公司簡介

| au Kabucom Securities評論摘要 | |

| 成立年份 | 1997 |

| 註冊國家/地區 | 日本 |

| 監管機構 | FSA |

| 產品與服務 | 股票、保證金、交易(系統/一般)、首次公開募股(IPO)/公開發售(PO)、ETF/ETN/REIT、免佣金交易所交易基金、小股份(少於一單位的股份)、要約收購(TOB)、投資信託、外匯保證金交易(FX)、期貨/期權交易、債券(外國債券)、以外幣計價的貨幣市場基金、CFD(股票365) |

| 模擬帳戶 | / |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | Au Kabucom FX app |

| 最低存款 | / |

| 客戶支援 | 在線聊天 |

| 電話:0120 390 390,05003-6688-8888 | |

| 電子郵件:cs@kabu.com | |

| 社交媒體:Twitter,Facebook,Instagram,Line,YouTube | |

au Kabucom Securities 是一家網上券商公司,是三菱UFJ金融集團(MUFG集團)網上金融服務的核心公司。該業務涉及證券交易、經紀、發行和銷售。除了其他金融服務外,它還提供銀行代理和外匯保證金交易。

優點和缺點

| 優點 | 缺點 |

| 受FSA監管 | 交易條件的信息有限 |

| 成立多年的公司,具有聲譽良好的母公司 | |

| 多種交易產品和服務 | |

| 在線聊天支援 |

au Kabucom Securities是否合法?

是的,Au Kabucom目前受到金融服务机构(FSA)的监管,持有零售外汇牌照(No.61)。

| 监管国家 | 监管机构 | 当前状态 | 受监管实体 | 牌照类型 | 牌照号码 |

| 金融服务机构(FSA) | 受监管 | au Kabucom Securities株式会社 | 零售外汇牌照 | 関東財務局長(金商)第61号 |

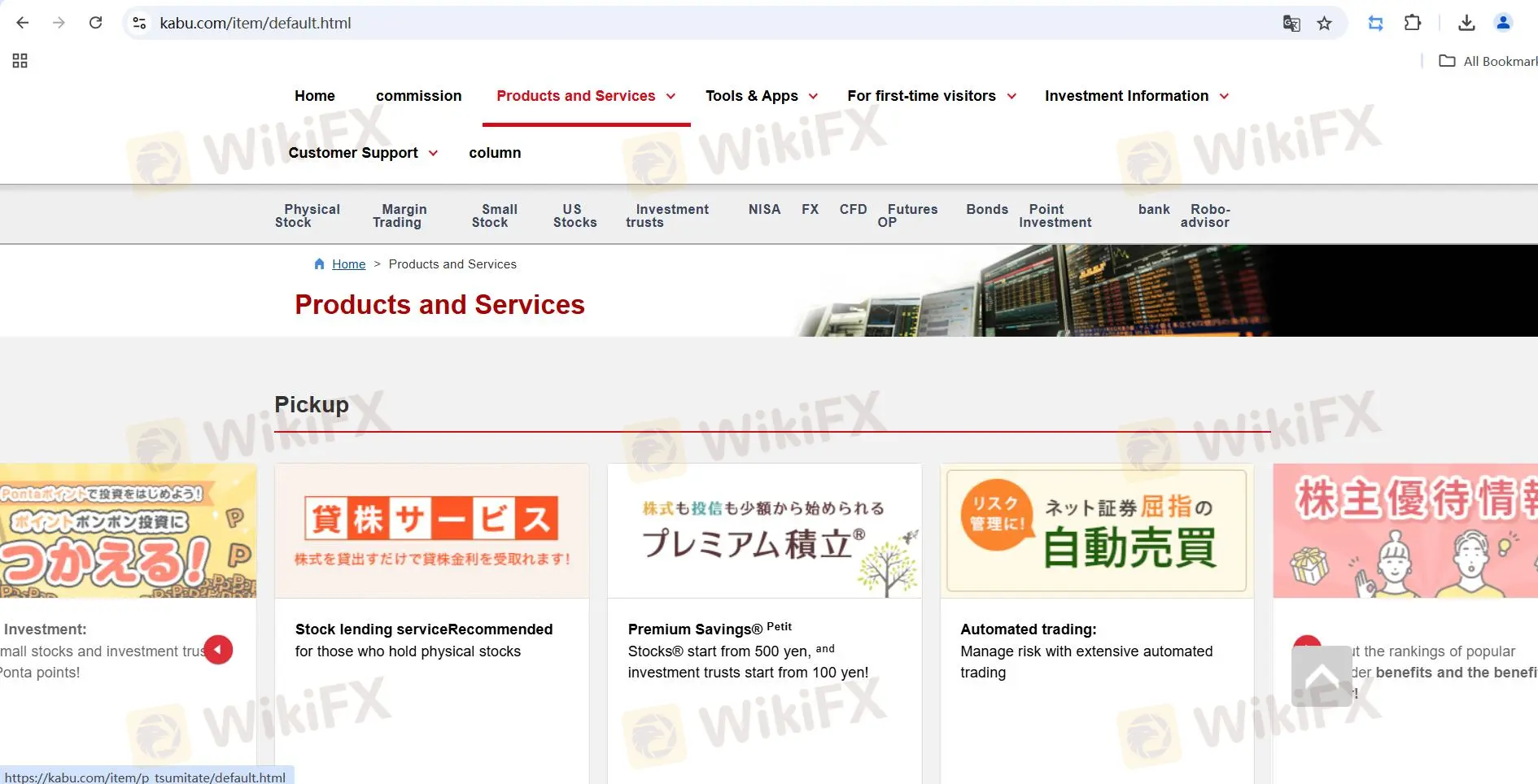

产品与服务

| 产品与服务 | 可用 |

| 股票 | ✔ |

| 保证金交易(系统/一般) | ✔ |

| 首次公开募股(IPO)/公开发售(PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| 免佣金ETF(免佣金交易所交易基金) | ✔ |

| 小股份(少于一单位的股份) | ✔ |

| 要约收购(TOB) | ✔ |

| 投资信托 | ✔ |

| 外汇(外汇保证金交易) | ✔ |

| 期货/期权交易 | ✔ |

| 债券(外国债券) | ✔ |

| 以外币计价的MMF | ✔ |

| CFD(股票365) | ✔ |

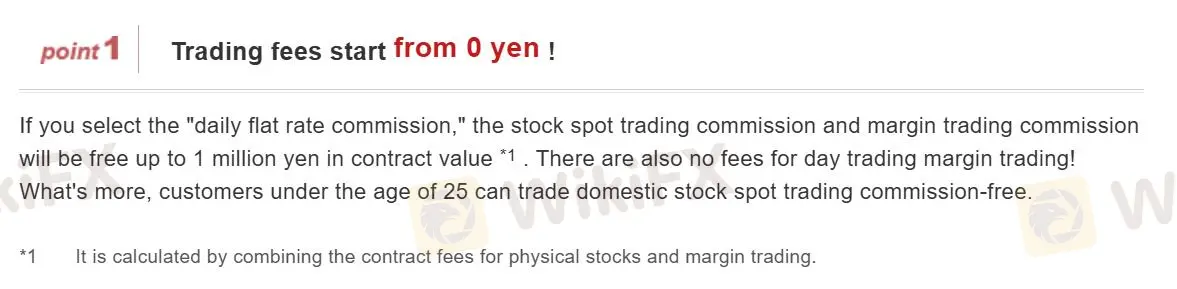

费用

au Kabucom Securities提供免佣金的外汇交易,交易成本已包含在点差中。

然而,Au Kabucom对涉及其他产品的交易收取费用。以下是股票交易佣金的例子。

股票交易佣金(不包括Petit(Kabu®)和Premium Accumulation(Petit(Kabu®)))

| 合同价格(日元) | 实物费用(含税) | 大宗优惠计划 |

| 0日元至50,000日元或以下 | 55日元 | ❌ |

| 超过50,000日元至100,000日元以下 | 99日元 | |

| 超过100,000日元至200,000日元以下 | 115日元 | |

| 超过200,000日元至500,000日元以下 | 275日元 | |

| 超过500,000日元至1,000,000日元以下 | 535日元 | |

| 超过1,000,000日元 | 合同金额×0.099%(含税)+ 99日元[最高:4,059日元] |

注意:

- 以上費用將不論執行條件(市價單、限價單、自動交易等)而收取。

- 如果計算(費用計算或消費稅計算)結果有小數部分,將向下取整。

- 電話交易將另外收取2,200日元(含稅)的操作員費用。

- 買賣股權證的費用與上述實物股票的買賣費用相同。

- NISA(免稅小型投資)帳戶內的交易不收取任何費用。

- 如果因為期間指定訂單導致價格範圍上限(停止高點)變動且可用數量不足,訂單將被強制取消。

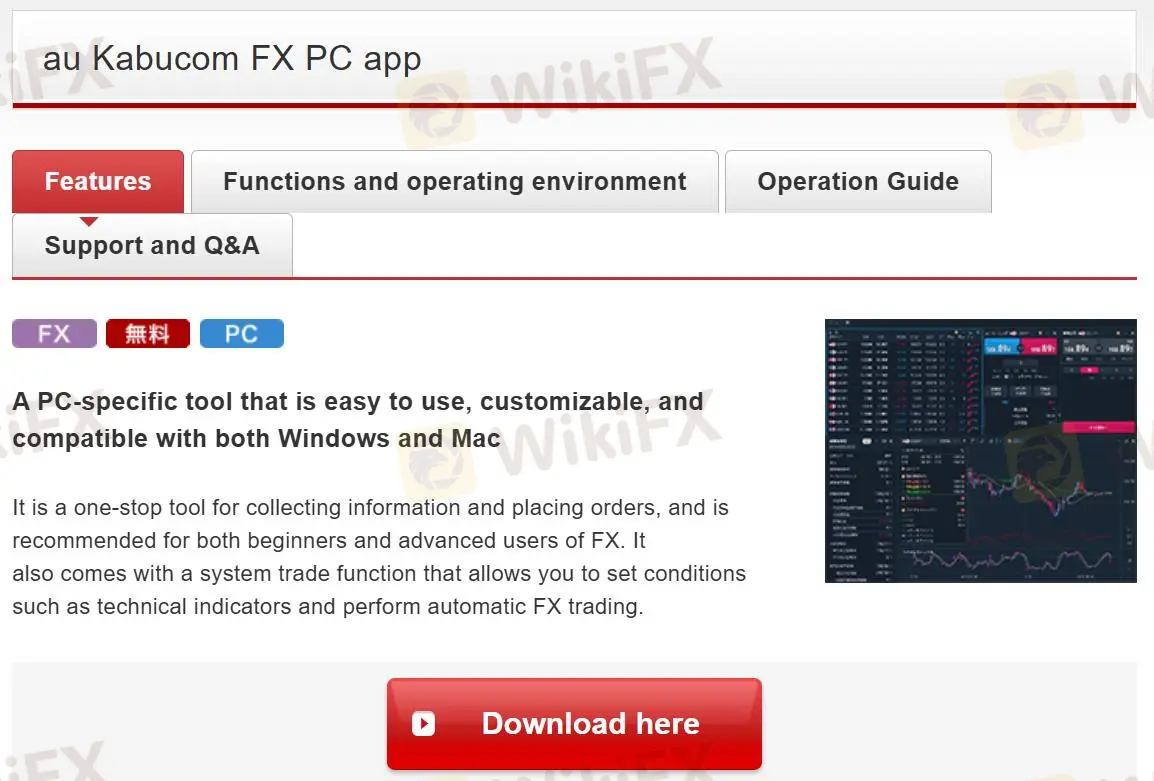

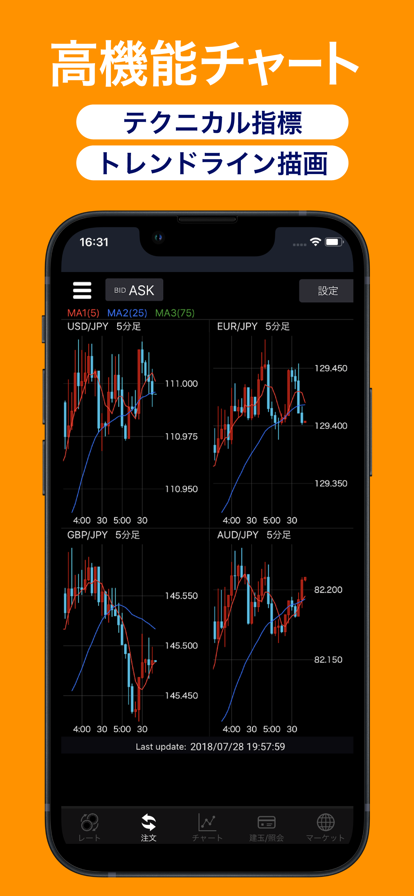

交易平台

Au Kabucom Securities 提供了一款可在 PC 和移動平台上使用的 au Kabucom 應用程式。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| Au Kabucom FX 應用程式 | ✔ | 桌面、移動設備 | / |

| MT5 | ❌ | / | 經驗豐富的交易者 |

| MT4 | ❌ | / | 初學者 |