Buod ng kumpanya

| au Kabucom SecuritiesPangkalahatang Pagsusuri | |

| Itinatag | 1997 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto at Serbisyo | Stocks, Margin, Transaksyon (System/General), Initial Public Offering (IPO)/Public offering sale (PO), ETF/ETN/REIT, Libreng ETF (Commission-Free Exchange Traded Fund), Petit Shares (Shares LessThan One Unit), Tender Offer (TOB), Investment Trust, FX (Forex Margin Trading), Futures/Options Trading, Bonds (Foreign Bonds), Foreign Currency Denominated MMF, CFD (share 365) |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Plataporma ng Pagkalakalan | Au Kabucom FX app |

| Min Deposit | / |

| Suporta sa Customer | Live chat |

| Tel: 0120 390 390, 05003-6688-8888 | |

| Email: cs@kabu.com | |

| Social Media: Twitter, Facebook. Instagram, Line, YouTube | |

Ang au Kabucom Securities ay isang online brokerage company at ang pangunahing kumpanya ng Mitsubishi UFJ Financial Group (MUFG Group) sa online na mga serbisyong pinansyal. Ang negosyo ay kasama sa mga kalakalan ng mga seguridad, brokerage, alok, at pagbebenta. Kasama sa iba pang mga serbisyong pinansyal, nag-aalok ito ng bank agency at foreign exchange margin trading.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulasyon ng FSA | Limitadong impormasyon sa mga kondisyon ng kalakalan |

| Itinatag na kumpanya na may reputableng magulang na kumpanya | |

| Iba't ibang mga produkto at serbisyo sa kalakalan | |

| Suporta sa live chat |

Ang au Kabucom Securities ay Legit?

Oo, ang Au Kabucom ay kasalukuyang regulado ng Financial Services Agency (FSA), na may retail forex license (No.61).

| Regulated Country | Regulated Authority | Kasalukuyang Katayuan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| Financial Services Agency (FSA) | Regulado | au Kabucom Securities株式会社 | Retail Forex License | 関東財務局長(金商)第61号 |

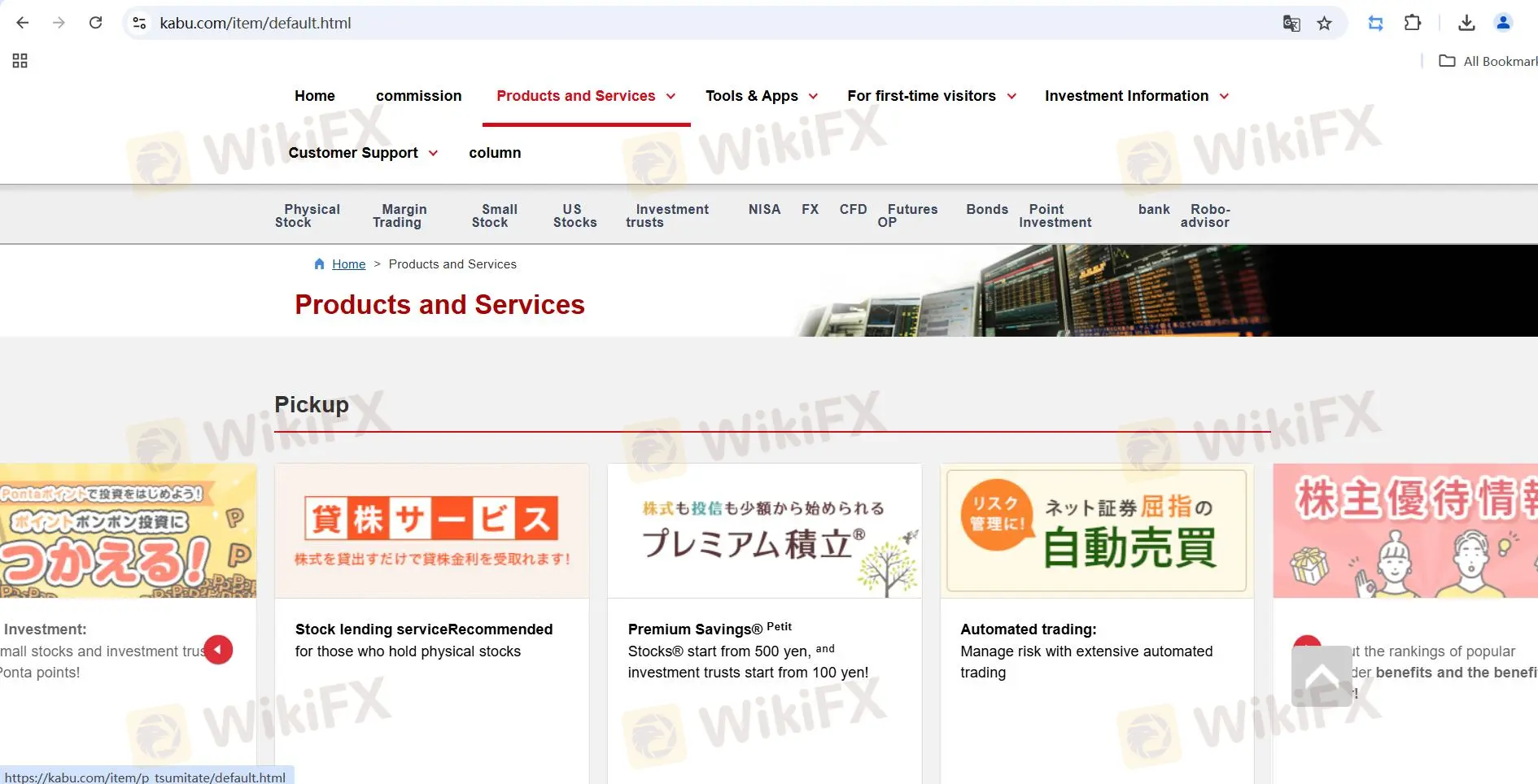

Mga Produkto at Serbisyo

| Mga Produkto at Serbisyo | Magagamit |

| Stocks | ✔ |

| Margin Transaction (System/General) | ✔ |

| Initial Public Offering (IPO)/Public Offering Sale (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| Free ETF (Commission-Free Exchange Traded Fund) | ✔ |

| Petit Shares (Shares Less Than One Unit) | ✔ |

| Tender Offer (TOB) | ✔ |

| Investment Trust | ✔ |

| FX (Forex Margin Trading) | ✔ |

| Futures/Options Trading | ✔ |

| Bonds (Foreign Bonds) | ✔ |

| Foreign Currency Denominated MMF | ✔ |

| CFD (Share 365) | ✔ |

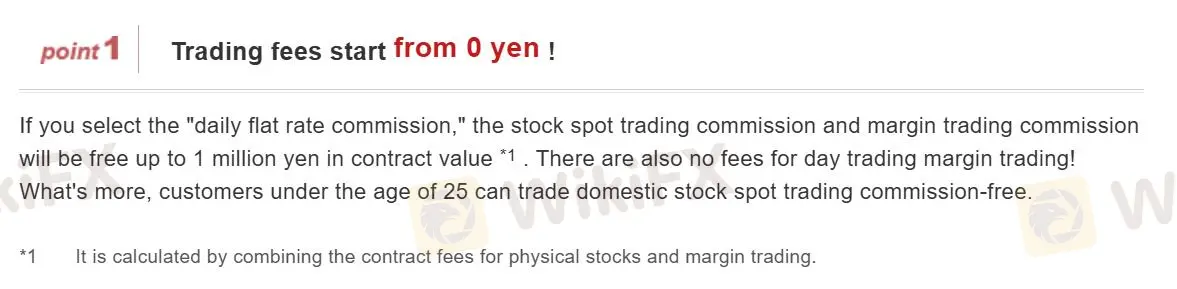

Mga Bayarin

Ang au Kabucom Securities ay nag-aalok ng walang bayad na komisyon sa forex trading, kung saan ang gastos sa trading ay kasama sa mga spreads.

Gayunpaman, may bayad ang Au Kabucom para sa mga transaksyon na may kinalaman sa iba pang mga produkto. Narito ang bayad sa stock trading, halimbawa.

Bayad sa stock trading (maliban sa Petit (Kabu®) at Premium Accumulation (Petit (Kabu® )))

| Halaga ng Kontrata (JPY) | Physical Fee (kasama ang buwis) | Large-Volume Preferential Plan |

| 0 yen hanggang 50,000 yen o mas mababa | 55 yen | ❌ |

| Higit sa 50,000 yen hanggang sa ilalim ng 100,000 yen | 99 yen | |

| Higit sa 100,000 yen hanggang sa ilalim ng 200,000 yen | 115 yen | |

| Higit sa 200,000 yen hanggang sa ilalim ng 500,000 yen | 275 yen | |

| Higit sa 500,000 yen hanggang sa ilalim ng 1,000,000 yen | 535 yen | |

| Higit sa 1 milyong yen | Halaga ng kontrata × 0.099% (kasama ang buwis) + 99 yen [Maximum: 4,059 yen] |

Note:

- Ang mga bayarin sa itaas ay ipapataw kahit sa anong kondisyon ng pagpapatupad (market order, limit order, automated trading, atbp.).

- Kung ang pagkalkula (pagkalkula ng bayarin o pagkalkula ng buwis sa pagkonsumo) ay nagresulta sa isang bahagi na hindi buo, ito ay bababaan.

- Para sa mga transaksyon sa telepono, may dagdag na bayad na 2,200 yen (kasama ang buwis) na ipapataw nang hiwalay.

- Ang mga bayarin para sa pagbili at pagbebenta ng mga karapatan sa pagbili ng stock ay pareho sa mga bayarin para sa pagbili at pagbebenta ng pisikal na mga shares na nabanggit sa itaas.

- Walang bayad para sa mga transaksyon sa loob ng isang NISA (tax-free small-scale investment) account.

- Kung ang itaas na limitasyon ng saklaw ng presyo (stop high) ay nagbabago dahil sa isang order na may itinakdang panahon at ang available na halaga ay kulang, ang order ay mapipilitang kanselahin.

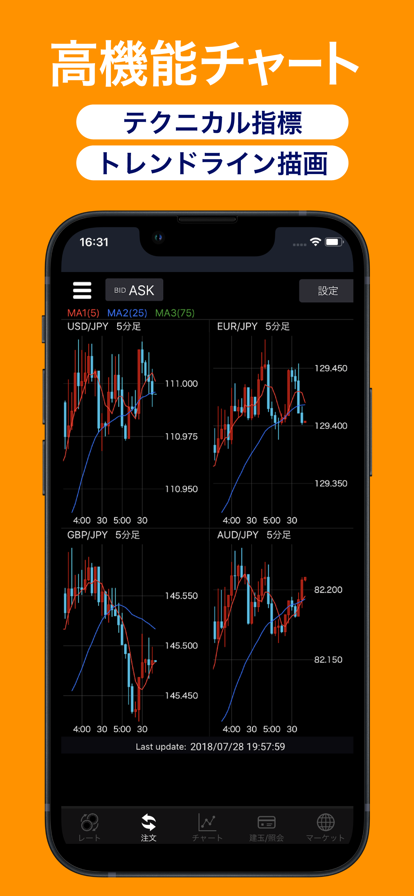

Plataforma ng Pagtitinda

Ang Au Kabucom Securities ay nag-aalok ng Au Kabucom app na available sa parehong PC at mobile platform.

| Plataforma ng Pagtitinda | Supported | Available Devices | Suitable for |

| Au Kabucom FX app | ✔ | Desktop, Mobile | / |

| MT5 | ❌ | / | Mga karanasan na mga mangangalakal |

| MT4 | ❌ | / | Mga nagsisimula |