Perfil de la compañía

| au Kabucom SecuritiesResumen de la reseña | |

| Fundado | 1997 |

| País/Región registrado | Japón |

| Regulación | FSA |

| Productos y servicios | Acciones, Margen, Transacción (Sistema/General), Oferta Pública Inicial (IPO)/Venta de oferta pública (PO), ETF/ETN/REIT, ETF gratuito (Fondo cotizado en bolsa sin comisiones), Acciones pequeñas (Acciones de menos de una unidad), Oferta pública de adquisición (TOB), Fideicomiso de inversión, FX (Operaciones de margen de divisas), Operaciones de futuros/opciones, Bonos (Bonos extranjeros), MMF denominado en moneda extranjera, CFD (acciones 365) |

| Cuenta demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de trading | Aplicación Au Kabucom FX |

| Depósito mínimo | / |

| Soporte al cliente | Chat en vivo |

| Tel: 0120 390 390, 05003-6688-8888 | |

| Email: cs@kabu.com | |

| Redes sociales: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities es una empresa de corretaje en línea y es la empresa principal del Grupo Financiero Mitsubishi UFJ (Grupo MUFG) en servicios financieros en línea. El negocio se dedica al comercio, corretaje, oferta y venta de valores. Junto con otros servicios financieros, ofrece servicios de agencia bancaria y operaciones de margen de divisas.

Ventajas y desventajas

| Pros | Cons |

| Regulado por FSA | Información limitada sobre las condiciones de trading |

| Empresa establecida con una empresa matriz de buena reputación | |

| Varios productos y servicios de trading | |

| Soporte de chat en vivo |

¿Es au Kabucom Securities legítimo?

Sí, Au Kabucom está actualmente regulado por la Agencia de Servicios Financieros (FSA), con una licencia de forex minorista (No.61).

| País Regulado | Autoridad Reguladora | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Agencia de Servicios Financieros (FSA) | Regulado | au Kabucom Securities株式会社 | Licencia de Forex Minorista | 関東財務局長(金商)第61号 |

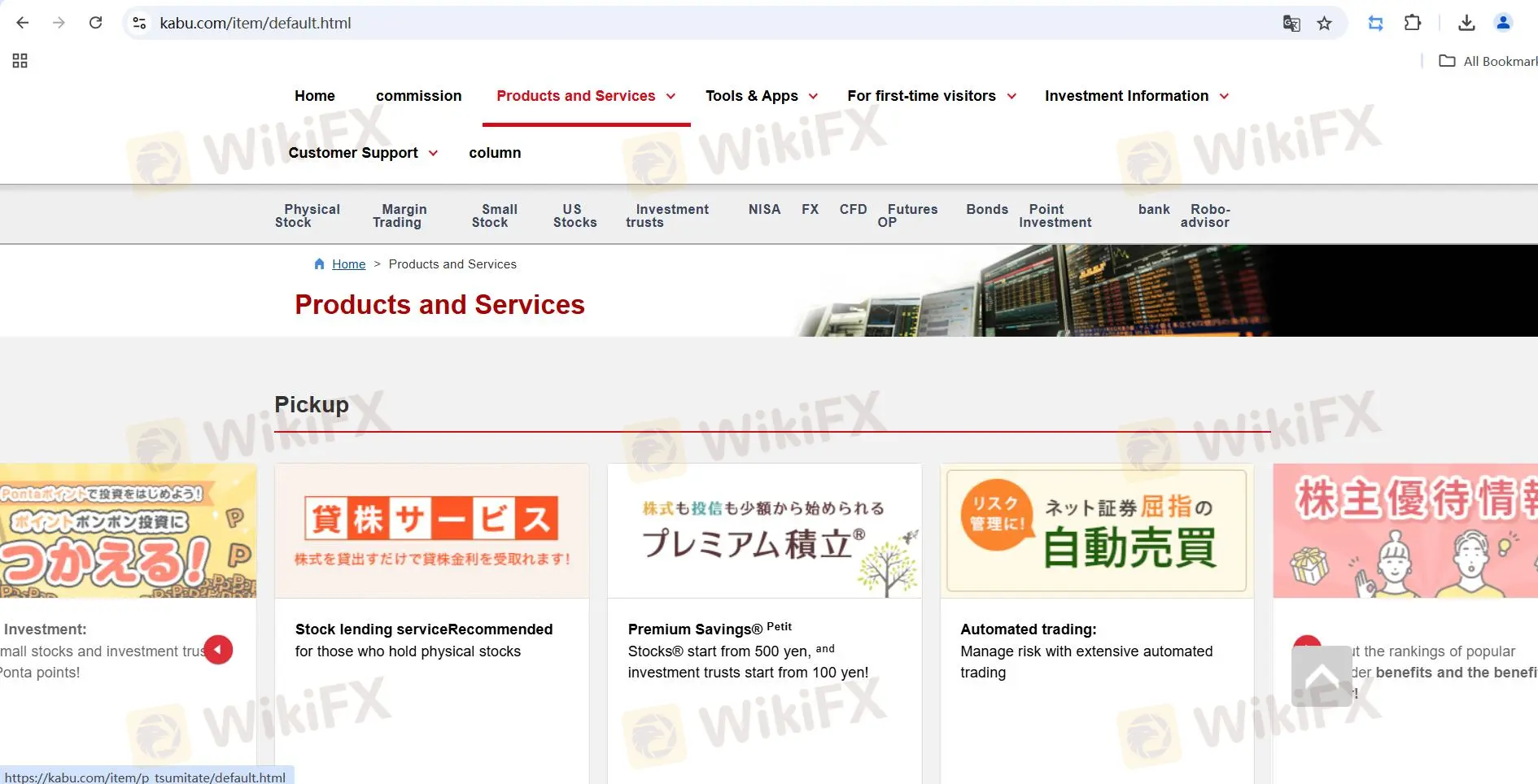

Productos y Servicios

| Productos y Servicios | Disponibles |

| Acciones | ✔ |

| Transacción de Margen (Sistema/General) | ✔ |

| Oferta Pública Inicial (IPO)/Venta de Oferta Pública (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| ETF Gratuito (Fondo Cotizado en Bolsa sin Comisiones) | ✔ |

| Acciones Pequeñas (Acciones de Menos de una Unidad) | ✔ |

| Oferta Pública de Adquisición (TOB) | ✔ |

| Fideicomiso de Inversión | ✔ |

| FX (Operaciones de Margen de Forex) | ✔ |

| Operaciones de Futuros/Opciones | ✔ |

| Bonos (Bonos Extranjeros) | ✔ |

| Fondos Mutuos en Moneda Extranjera | ✔ |

| CFD (Share 365) | ✔ |

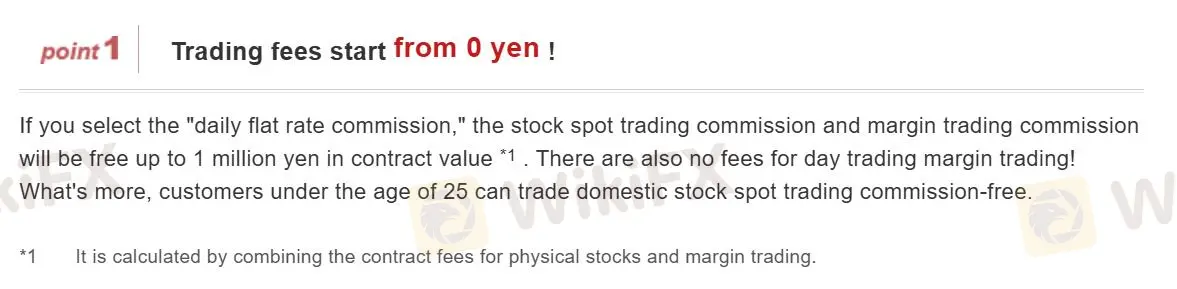

Tarifas

au Kabucom Securities ofrece operaciones de forex sin comisiones, donde el costo de las operaciones se incorpora en los spreads.

Sin embargo, Au Kabucom cobra por transacciones que involucran otros productos. Aquí está la comisión de operaciones de acciones, por ejemplo.

Comisión de operaciones de acciones (excluyendo Petit (Kabu®) y Acumulación Premium (Petit (Kabu® )))

| Precio del Contrato (JPY) | Comisión Física (impuestos incluidos) | Plan Preferencial de Gran Volumen |

| 0 yenes a 50,000 yenes o menos | 55 yenes | ❌ |

| Más de 50,000 yenes a menos de 100,000 yenes | 99 yenes | |

| Más de 100,000 yenes a menos de 200,000 yenes | 115 yenes | |

| Más de 200,000 yenes a menos de 500,000 yenes | 275 yenes | |

| Más de 500,000 yenes a menos de 1,000,000 yenes | 535 yenes | |

| Más de 1 millón de yenes | Monto del contrato × 0.099% (impuestos incluidos) + 99 yenes [Máximo: 4,059 yenes] |

Nota:

- Las tarifas mencionadas anteriormente se aplicarán independientemente de las condiciones de ejecución (orden de mercado, orden límite, operaciones automatizadas, etc.).

- Si un cálculo (cálculo de tarifas o cálculo de impuestos de consumo) resulta en una parte fraccionaria, se redondeará hacia abajo.

- Para transacciones por teléfono, se agregará una tarifa de operador de 2,200 yenes (impuestos incluidos) por separado.

- Las tarifas para comprar y vender derechos de adquisición de acciones son las mismas que las tarifas para comprar y vender acciones físicas mencionadas anteriormente.

- No hay tarifas para transacciones dentro de una cuenta NISA (inversión de pequeña escala libre de impuestos).

- Si el límite superior del rango de precios (alto de parada) cambia debido a una orden especificada por período y la cantidad disponible es insuficiente, la orden se cancelará de forma forzada.

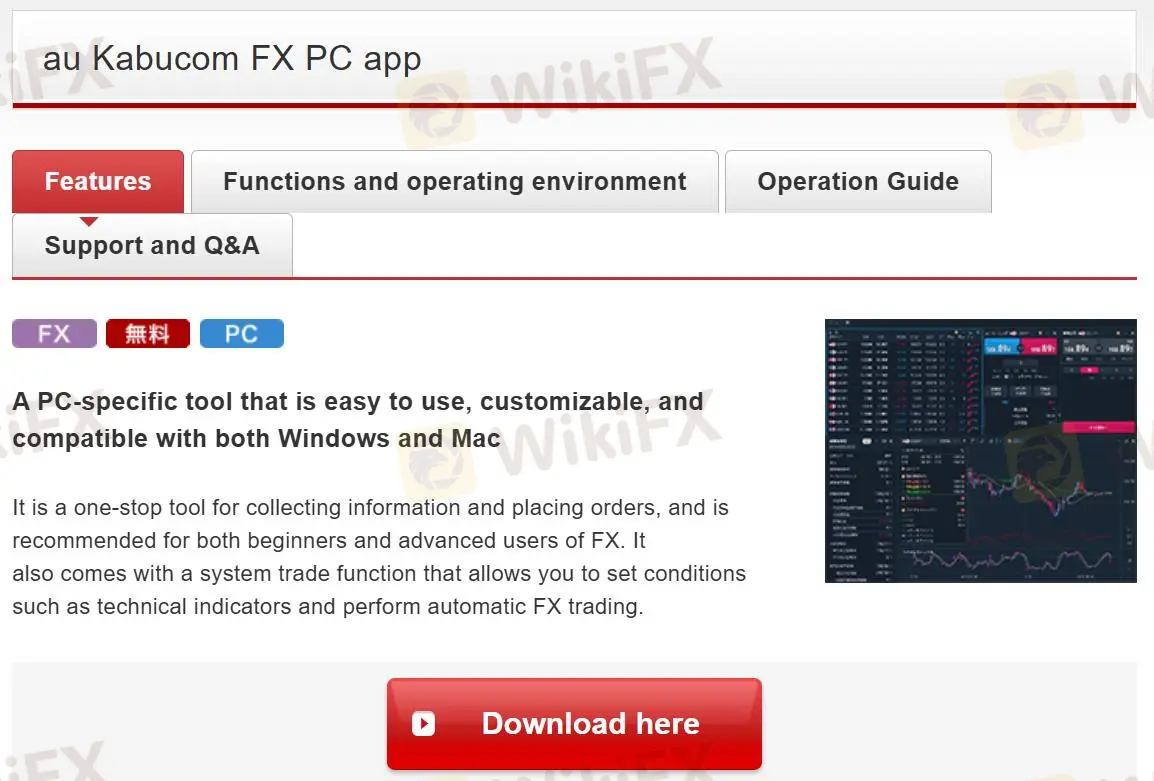

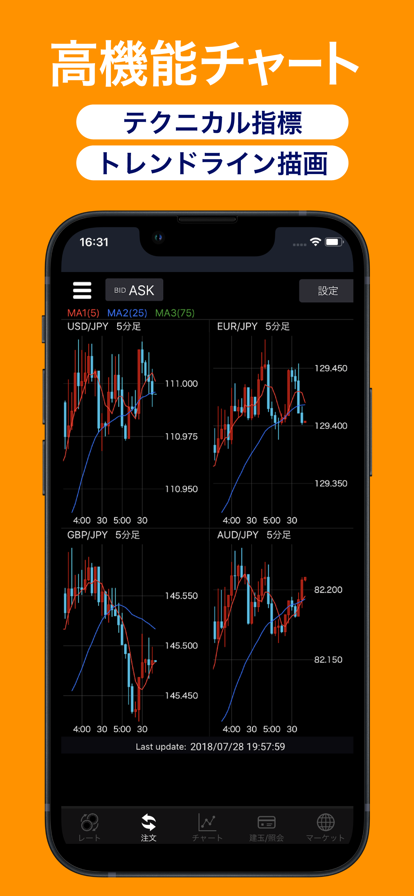

Plataforma de Trading

Au Kabucom Securities ofrece una aplicación Au Kabucom que está disponible tanto en PC como en dispositivos móviles.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Aplicación Au Kabucom FX | ✔ | Escritorio, Móvil | / |

| MT5 | ❌ | / | Traders experimentados |

| MT4 | ❌ | / | Principiantes |