Şirket özeti

| au Kabucom Securitiesİnceleme Özeti | |

| Kuruluş Yılı | 1997 |

| Kayıtlı Ülke/Bölge | Japonya |

| Düzenleme | FSA |

| Ürünler ve Hizmetler | Hisse Senetleri, Marj, İşlem (Sistem/Genel), İlk Halka Arz (IPO)/Halka Arz Satışı (PO), ETF/ETN/REIT, Ücretsiz ETF (Komisyon İçermeyen Borsa Yatırım Fonu), Petit Paylar (Bir Birimden Daha Az Paylar), Teşvik Teklifi (TOB), Yatırım Fonu, Döviz (Forex Marj Ticareti), Vadeli/Seçenekli İşlemler, Tahviller (Yabancı Tahviller), Yabancı Para Cinsinden MMF, CFD (pay 365) |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

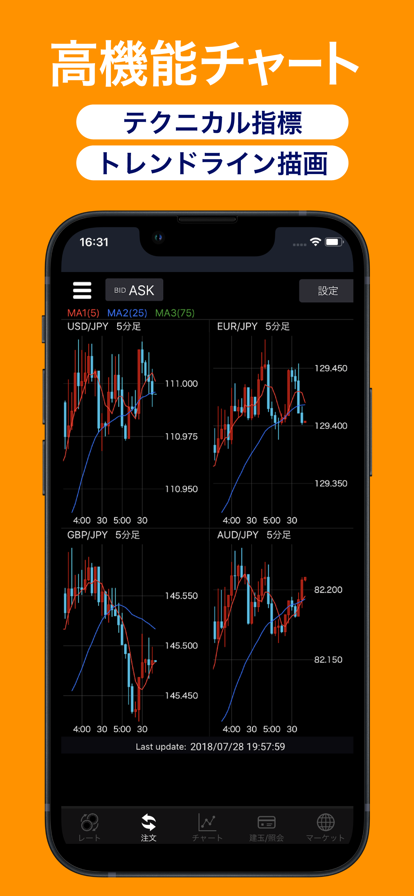

| İşlem Platformu | Au Kabucom FX uygulaması |

| Minimum Yatırım | / |

| Müşteri Desteği | Canlı sohbet |

| Tel: 0120 390 390, 05003-6688-8888 | |

| E-posta: cs@kabu.com | |

| Sosyal Medya: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities çevrimiçi bir aracı kurum şirketidir ve Mitsubishi UFJ Financial Group (MUFG Group) 'un çevrimiçi finansal hizmetlerinin çekirdek şirketidir. İş, menkul kıymet ticareti, aracılık, teklif ve satışla ilgilidir. Diğer finansal hizmetlerle birlikte, banka temsilciliği ve döviz marj ticareti sunmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| FSA tarafından düzenlenir | İşlem koşulları hakkında sınırlı bilgi |

| Saygın bir ana şirkete sahip kurumsal bir şirket | |

| Çeşitli ticaret ürünleri ve hizmetleri | |

| Canlı sohbet desteği |

au Kabucom Securities Güvenilir mi?

Evet, Au Kabucom şu anda Finansal Hizmetler Ajansı (FSA) tarafından düzenlenmektedir ve perakende forex lisansına sahiptir (No.61).

| Düzenlenen Ülke | Düzenleyici Kurum | Mevcut Durum | Düzenlenen Kuruluş | Lisans Türü | Lisans Numarası |

| Finansal Hizmetler Ajansı (FSA) | Düzenlenmiş | au Kabucom Securities株式会社 | Perakende Forex Lisansı | 関東財務局長(金商)第61号 |

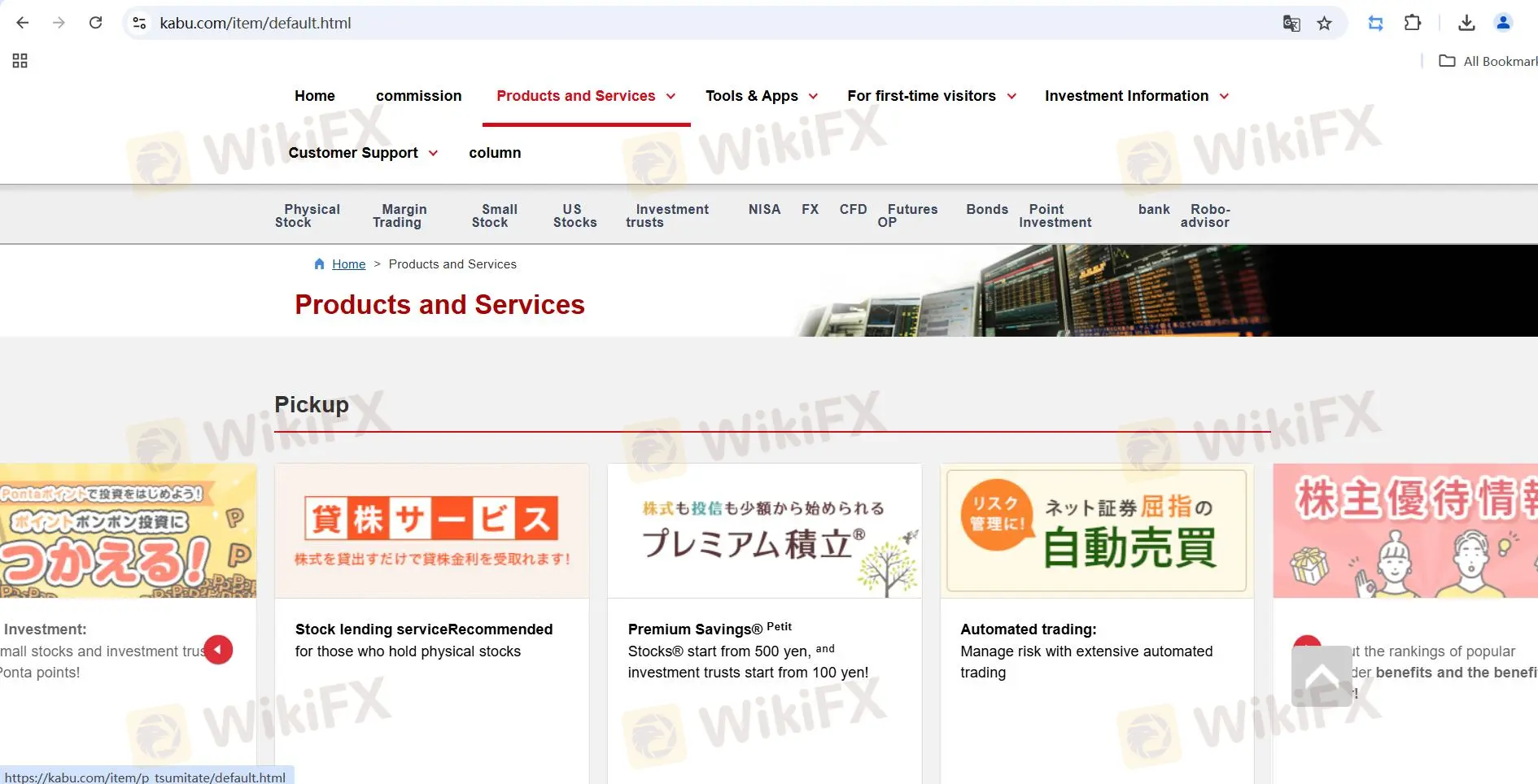

Ürünler ve Hizmetler

| Ürünler ve Hizmetler | Mevcut |

| Hisse Senetleri | ✔ |

| Marj İşlemi (Sistem/Genel) | ✔ |

| Halka Arz (IPO)/Halka Arz Satışı (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| Ücretsiz ETF (Komisyon İçermeyen Borsa Yatırım Fonu) | ✔ |

| Küçük Paylar (Bir Birimden Daha Az Paylar) | ✔ |

| Tender Teklifi (TOB) | ✔ |

| Yatırım Fonu | ✔ |

| FX (Forex Marj İşlemi) | ✔ |

| Vadeli İşlemler/Opsiyon İşlemleri | ✔ |

| Tahviller (Yabancı Tahviller) | ✔ |

| Yabancı Para Cinsinden MMF | ✔ |

| CFD (Pay 365) | ✔ |

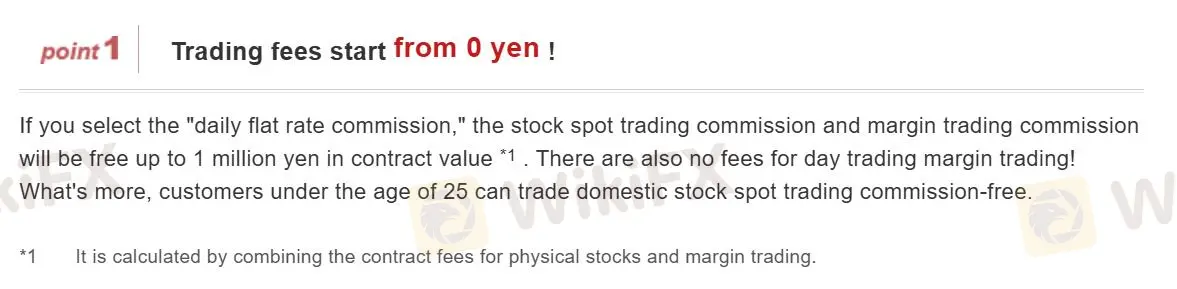

Ücretler

au Kabucom Securities, işlem maliyetinin spreadlere dahil edildiği komisyon ücretsiz forex ticareti sunmaktadır.

Ancak, Au Kabucom diğer ürünleri içeren işlemler için ücret talep etmektedir. İşte örneğin hisse senedi işlem komisyonu.

Hisse senedi işlem komisyonu (Petit (Kabu®) ve Premium Birikim (Petit (Kabu® )) hariç)

| Sözleşme Fiyatı (JPY) | Fiziksel Ücret (vergi dahil) | Yüksek Hacim Tercihli Planı |

| 0 yen veya daha az | 55 yen | ❌ |

| 50,000 yen üzeri 100,000 yen altı | 99 yen | |

| 100,000 yen üzeri 200,000 yen altı | 115 yen | |

| 200,000 yen üzeri 500,000 yen altı | 275 yen | |

| 500,000 yen üzeri 1,000,000 yen altı | 535 yen | |

| 1 milyon yen üzeri | Sözleşme tutarı × 0.099% (vergi dahil) + 99 yen [Maksimum: 4,059 yen] |

Not:

- Yukarıdaki ücretler, yürütme koşullarından bağımsız olarak uygulanacaktır (piyasa emri, limit emri, otomatik ticaret vb.).

- Bir hesaplama (ücret hesaplama veya tüketim vergisi hesaplama) kesirli bir kısım sonucunda ise aşağı yuvarlanacaktır.

- Telefonla yapılan işlemler için, ayrıca 2.200 yen (vergi dahil) operatör ücreti eklenir.

- Hisse edinim haklarının alım satım ücretleri, yukarıda belirtilen fiziksel hisse senetleri alım satım ücretleriyle aynıdır.

- NISA (vergisiz küçük ölçekli yatırım) hesabı içindeki işlemler için herhangi bir ücret yoktur.

- Fiyat aralığının üst sınırı (durma yüksek) belirli bir süreli emir nedeniyle değişirse ve mevcut miktar yetersiz kalırsa, emir zorla iptal edilecektir.

Ticaret Platformu

Au Kabucom Securities, hem PC hem de mobil platformda kullanılabilen bir au Kabucom uygulaması sunmaktadır.

| Ticaret Platformu | Desteklenen | Kullanılabilir Cihazlar | Uygun |

| Au Kabucom FX uygulaması | ✔ | Masaüstü, Mobil | / |

| MT5 | ❌ | / | Deneyimli işlemciler |

| MT4 | ❌ | / | Yeni başlayanlar |