Interbank Trader

1-2年

Is Travelex a trustworthy and reliable broker for trading purposes?

In my experience as a forex trader, assessing brokers like Travelex requires careful scrutiny. Travelex has a long-standing presence—over 20 years—and is regulated by ASIC in Australia (license number 222444). Regulation by a reputable authority such as ASIC is a fundamental factor I consider when evaluating trustworthiness, as it indicates adherence to strict financial standards. However, Travelex’s business model focuses more on currency exchanges, travel cards, and travel insurance rather than conventional forex trading. For me, that’s a notable difference compared to brokers whose core services are online trading platforms with advanced tools.

The fee structure is transparent, but costs such as commission fees and potential inactivity charges should be factored in. While they offer a proprietary trading app and web platform, the absence of a demo account limits the ability to test their systems risk-free, which I personally value for gauging spreads, trade execution, and platform reliability. I also noticed that user feedback is mixed. Positive comments highlight their currency services, but there is concerning feedback about trading losses linked to third-party signal groups, which raises caution for anyone considering following trading signals or managed accounts.

In conclusion, while Travelex is a legitimate, regulated provider and may be reliable for currency exchange or travel-related financial products, I remain cautious about using them as a primary broker for active trading. I prioritize platforms designed specifically for trading with a stronger industry reputation in that domain. If trading is your main goal, careful consideration and due diligence are essential.

gnsrael

1-2年

Can you use Expert Advisors (EAs) for automated trading on Travelex’s platforms?

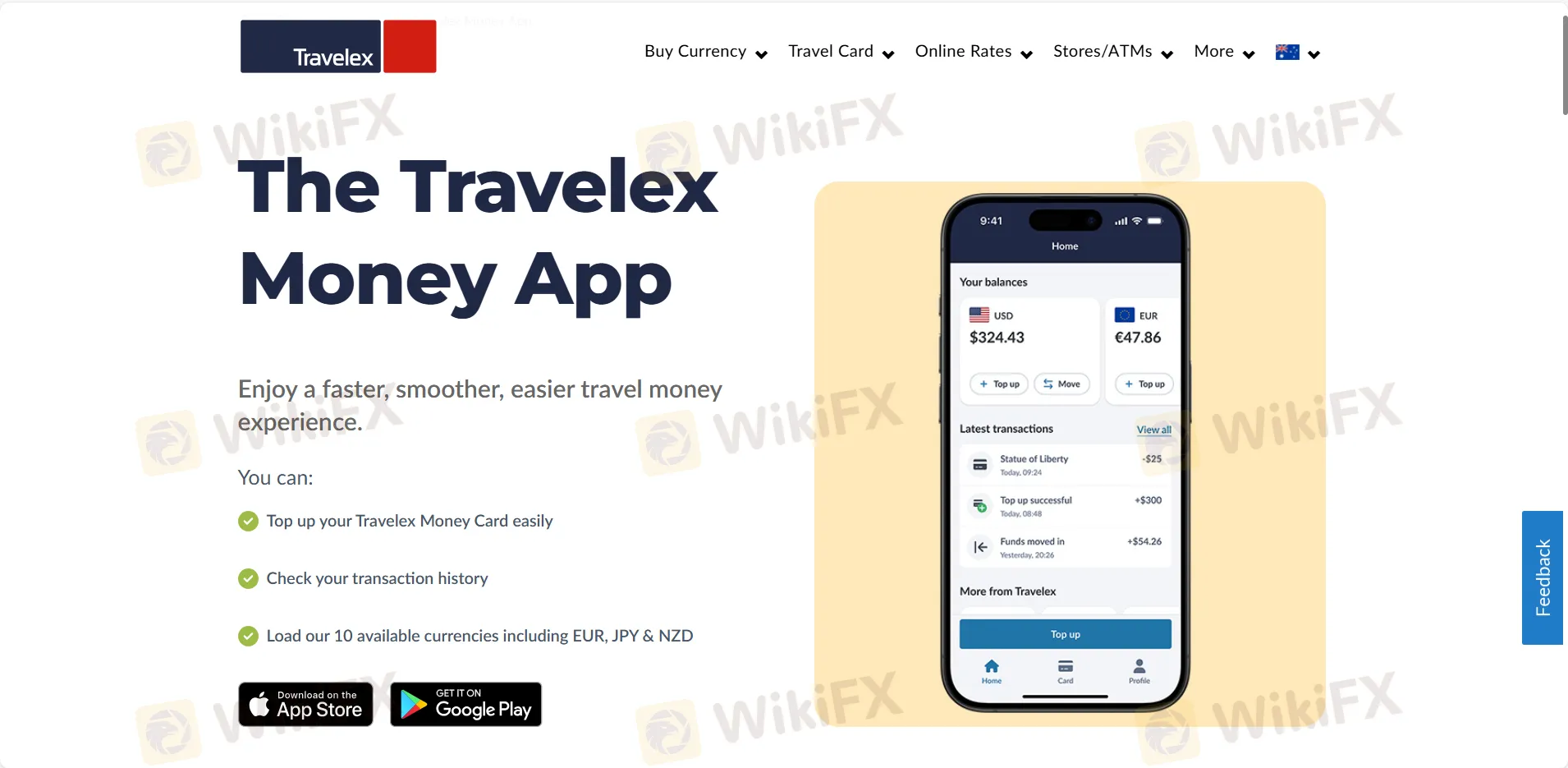

In my experience as a long-time forex trader, the ability to use Expert Advisors (EAs) for automated trading is an essential consideration. Based on my review of Travelex, their current platform offerings do not appear to support EAs or automated trading as commonly understood in the forex industry. Travelex primarily provides financial services related to currency exchange, travel cards, and travel insurance, and its trading platforms consist of the Travelex Money APP and the Travelex web interface. These are geared toward currency services rather than advanced trading features.

Traditional EA functionality is typically available on platforms like MetaTrader 4 or MetaTrader 5, which are purpose-built for algorithmic and automated trading. Travelex does not advertise support for MT4, MT5, or any similar trading software that would allow users to deploy EAs. This makes sense, considering the company's primary clientele seeks straightforward currency solutions for travel and payments rather than speculative trading or algorithmic strategies.

While Travelex is regulated by ASIC and has operated in Australia for over 20 years, it is important for anyone considering automated trading to recognize the broker’s platform limitations. For my style of trading, which often relies on automated tools, this would not be suitable. For anyone requiring EA support, I would suggest looking at brokers who clearly offer MetaTrader or similar environments. As always, aligning your choice of broker with your trading objectives and tools is a crucial aspect of responsible trading.

Broker Issues

Account

Platform

Instruments

Leverage

seejay

1-2年

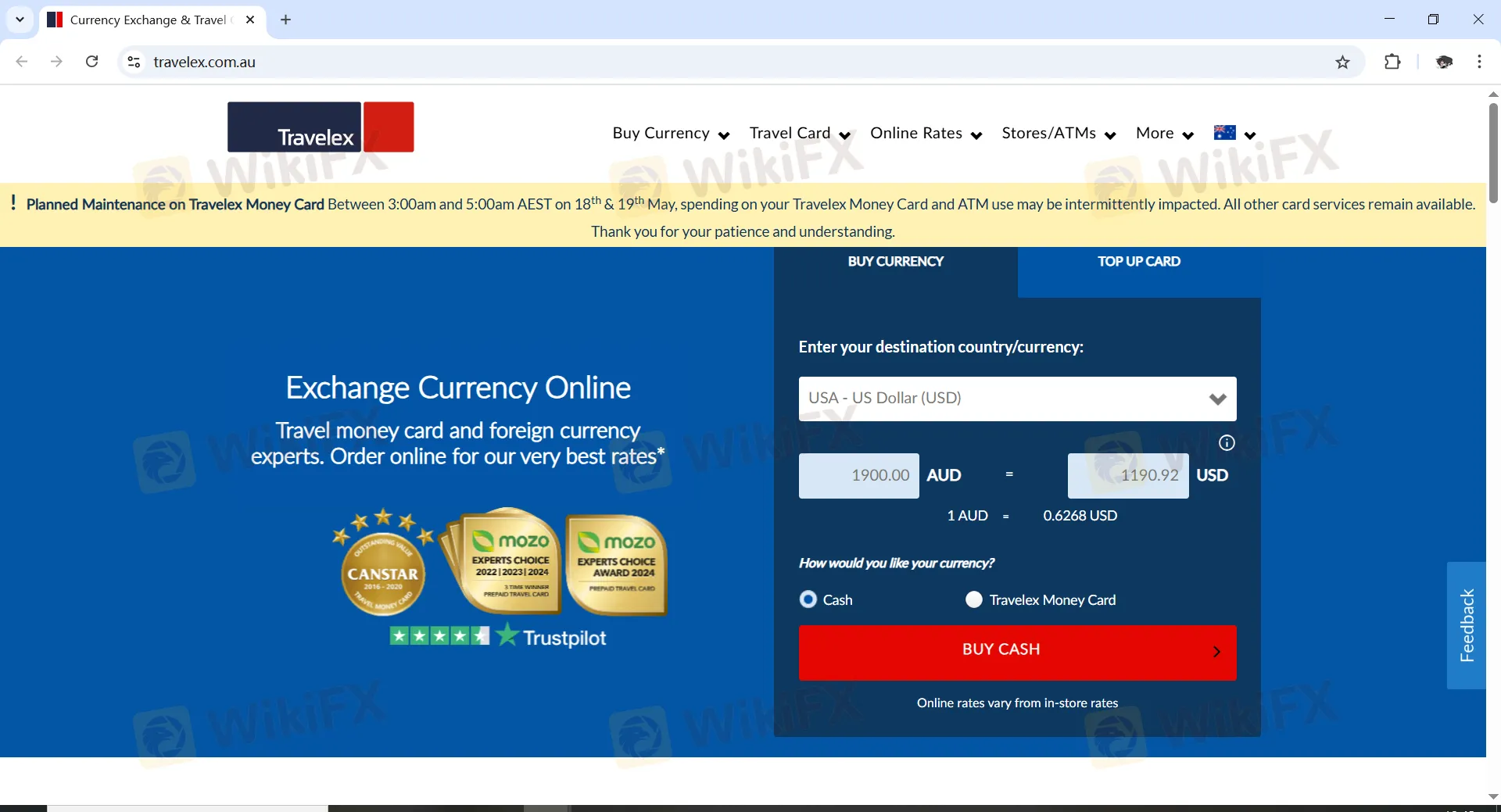

Can you outline the particular advantages of Travelex in terms of its available trading instruments and how its fees are structured?

In my experience as a trader who values both security and clarity, Travelex stands out primarily for its longevity and its regulatory oversight under ASIC, which gives me some reassurance about their operational standards. When it comes to trading instruments, Travelex is fairly specialized; its primary offerings include currency exchange, travel cards, and travel insurance. It's important to note that, unlike many brokers that provide access to a broad range of CFDs or forex pairs for speculative trading, Travelex’s focus is on serving practical currency needs, which may suit those seeking straightforward access to foreign currencies rather than leveraged trading.

Examining the fee structure, I appreciate that Travelex is transparent, though traders should be attentive. Online transactions and top-ups through their main platforms are typically free, which is convenient for frequent travelers or those transacting in foreign currencies. However, there are notable costs: top-ups and loads made in-store with AUD, or via BPAY, incur fees, and there's a monthly inactivity fee if an account goes unused for a year. The currency conversion rate is set at the prevailing retail rate, so it's prudent to compare this rate at the time of any currency swap. While there are no fees for international ATM withdrawals (apart from potential operator charges), users need to be mindful of closure fees and the risk that less active periods will erode their balance.

Overall, Travelex’s advantages lie in its regulated, practical currency products with clear—but not always low—fees, making it best suited for travelers or individuals with currency exchange needs, rather than those seeking a conventional multi-asset trading environment. I approach it as a supplementary service rather than a core trading platform for my portfolio.

Davis Wu

1-2年

Which trading platforms are offered by Travelex? Do they support MT4, MT5, or cTrader?

In my personal experience evaluating Travelex, I've found that their trading platforms are quite distinct from what many traditional forex traders might expect. Travelex offers two main platforms: the Travelex Money App and their web-based interface, accessible on PCs, laptops, tablets, and mobile devices. Notably, they do not offer support for MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. For me, the absence of MT4 and MT5 is a significant consideration, as these are widely used platforms favored by many traders for their charting tools, automated trading, and active online communities.

Instead, Travelex is primarily tailored towards currency exchange, travel cards, and related services, which influences the design and function of their proprietary platforms. Their systems seem optimized for currency handling and travel-related financial products rather than active speculative trading. In my view, this makes Travelex less suitable for those who rely on advanced trading strategies or automation typically enabled by MT4, MT5, or cTrader. For anyone used to the flexibility and depth of established forex trading platforms, this limitation is important to keep in mind and may affect your trading choices. As always, I recommend considering your individual trading needs and platform preferences with care before committing funds.

Broker Issues

Instruments

Account

Platform

Leverage