基礎資訊

越南

越南

天眼評分

越南

|

5-10年

|

越南

|

5-10年

| https://www.vps.com.vn/default.aspx

官方網址

評分指數

影響力

A

影響力指數 NO.1

越南 8.86

越南 8.86 監管資訊

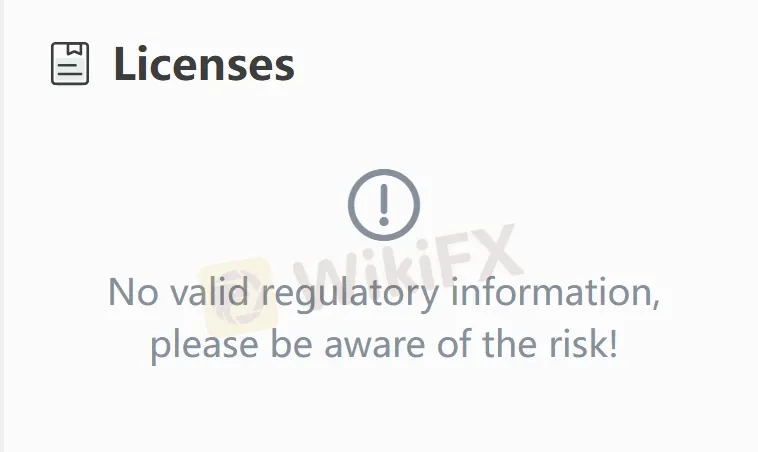

監管資訊暫未查證到有效監管資訊,請注意風險!

越南

越南 vps.com.vn

vps.com.vn 越南

越南| VPS 評論摘要 | |

| 成立年份 | 2006 |

| 註冊國家/地區 | 越南 |

| 監管 | 未受監管 |

| 交易平台 | VPS SmartOne、SmartPRO和SmartEasy |

| 客戶支援 | 電話:1900 6457 |

| 電子郵件:hotrokhachhang@vps.com.vn | |

| 地址:越南河內市海濱區65號,胡志明市第1區勒萊街76號3樓,岘港市澈海區潘秋貞街112號 | |

| 社交媒體:Facebook、Linkedin、Zalo、Youtube和TIKTOK | |

VPS於2006年由VPS證券在越南成立。它提供一些產品和服務,如零售銷售和經紀(增長投資、靈活累積、金融服務、金融和生活方式工具和交易平台)、機構銷售和經紀以及投資銀行業務。然而,它未受監管。

| 優點 | 缺點 |

| 多種產品和服務 | 未受監管 |

| 缺乏透明度 |

不,VPS未受任何金融機構監管。它不需要遵守任何監管規定。交易者應當注意資金風險。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| SmartOne | ✔ | 移動設備 | 經驗豐富的交易者 |

| SmartPRO | ✔ | ||

| SmartEasy | ✔ | ||

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

Speaking from my experience as a forex trader, evaluating VPS highlighted a few advantages alongside significant cautions. VPS offers a wide range of securities and trading products, such as flexible accumulation options and multiple investment services, which for me is helpful when seeking diversified exposure in one place. Their dedicated platforms—SmartOne, SmartPRO, and SmartEasy—appear user-friendly and suitable for both experienced traders and beginners, enhancing accessibility to various instruments beyond forex, like investment banking and retail brokerage. However, a crucial consideration for me is the platform’s regulatory status—it operates without oversight from recognized financial authorities. This fact alone means that, regardless of its product range or platform features, I must remain vigilant about the safety of my funds and data. The fee structure isn’t transparently detailed. I’ve read scattered feedback: some users praise certain services, like swift card delivery with zero annual fee, yet others raise concerns about account renewals and possible charges that feel unclear. This lack of clarity on potential costs and risks compels me to approach VPS with extra caution. Ultimately, while the variety of instruments is attractive, the absence of regulatory protection and transparency in fee structures means I cannot simply overlook the potential risks to capital and trust. For me, prudence outweighs convenience when evaluating a broker like VPS.

Based on my experience reviewing brokers, the ability to evaluate the maximum leverage they offer is a crucial part of my due diligence process. Unfortunately, VPS does not appear to provide clear or public information regarding the specific maximum leverage available for major forex pairs or other asset classes. This is important because, in my trading approach, understanding a broker’s leverage policy is essential to assessing both potential flexibility and the risks I might face. The lack of published leverage details is closely tied to a broader issue I noticed: VPS is not regulated by any recognized financial authority and carries a high-risk designation for traders. In my view, a broker’s unwillingness or inability to transparently disclose core trading conditions such as leverage raises significant concerns for anyone considering using their platform. In regulated trading environments, maximum leverage for major forex pairs and other products is clearly defined and enforced – which is a safety net I personally value. Without this information or regulatory oversight, I cannot comfortably calculate my risk exposures or compare VPS to more transparent, regulated alternatives. For these reasons, I would proceed very cautiously, as the lack of clarity on leverage policies directly impacts decision-making for risk management and overall trading strategy.

As an experienced forex trader, I understand how important reliable withdrawals are for anyone trusting their funds to a broker. With VPS, I have concerns that stem from their lack of regulatory oversight. According to the available details, VPS operates without any license from recognized financial authorities, which, for me, raises caution regarding not just withdrawals, but the overall handling of client funds. In my experience, regulated brokers typically offer clear policies and predictable withdrawal timeframes—often ranging from one to five business days, depending on method and verification processes. However, since VPS is not regulated and there’s a lack of transparent procedural information, I personally would approach the withdrawal timeline with heightened caution. There’s no published commitment from VPS about how quickly they process payouts, and this ambiguity means there could be a greater risk of delays or unexpected issues. I also noticed a user expressing frustration about account conditions and renewal requirements, which, while not specifically about withdrawal speed, indicate potential complications in account management. For me, the absence of both regulatory obligations and user consensus on withdrawal efficiency are red flags. If fast and predictable withdrawals are essential to your trading routine, my experience would advise looking for brokers that publish clear, auditable processes under regulatory oversight.

As someone who has spent years in the trading world, I am always particularly cautious when evaluating a broker, especially one like VPS. Based on my direct experience navigating their offering, VPS primarily presents itself as a multi-asset platform with an apparent focus on the broader securities market rather than pure forex. My evaluation of their services shows that VPS provides access to a range of trading instruments. These include growth investments and various brokerage products, which likely means access to stocks and related financial instruments. However, there is no explicit mention of forex, indices, cryptocurrencies, or commodities as separate, dedicated products on their available platforms. For me, the lack of clear information about specific asset classes—especially forex and commodities—raises flags around product transparency. This is reinforced by the fact that VPS is not regulated by any recognized authority. Unregulated brokers can, and sometimes do, offer a broad swath of assets, but without strict oversight, I cannot confirm what is fully available—or that client rights are adequately protected. While some user feedback highlights strengths in their trading platform and the range of securities offered, I find it necessary to stress that if your goal is to trade forex, indices, or cryptocurrencies, you should seek further detailed confirmation directly from VPS. Their absence of an MT4/MT5 platform is also noteworthy for dedicated forex traders. Personally, without independent, regulated confirmation of the exact products available, I remain extremely cautious and would recommend thorough due diligence before committing funds or trading with VPS, especially for forex or other specialized asset classes.

請輸入...

chengaohuan

中國

为什么我账号已经登入vps了,并且月月都是有交易,续费显示条件不足,零交易!!无法续费,那不是骗钱我充金币??

爆料

Chen Miyagi

新加坡

服務很好,我很快就收到了我的信用卡。順便說一下,沒有年費。

好評

A&~

越南

對於他們強大的交易平台和可用的證券範圍印象深刻。審計和財務公告始終清晰及時。只是希望客戶服務在高峰時段能更加反應迅速。

好評

王川岷

南非

到目前為止沒問題。我知道無法從中賺錢的不良經紀人每天都支持響應,平台經常凍結。我在這裡沒有註意到這樣的問題。

好評