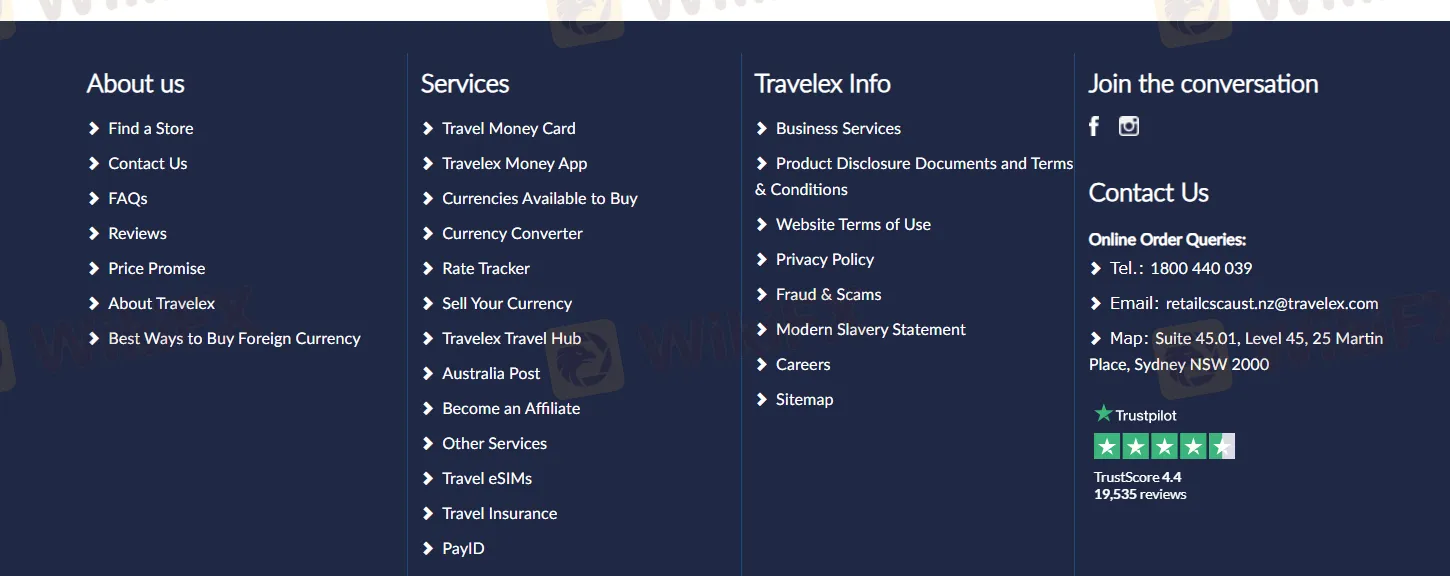

Perfil de la compañía

| Travelex Resumen de la reseña | |

| Establecido | 1976 |

| País/Región Registrada | Australia |

| Regulación | ASIC |

| Productos y Servicios | Divisas, tarjeta de viaje, seguro de viaje |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Travelex Money APP, Travelex web |

| Depósito Mínimo | AUD 100 |

| Soporte al Cliente | Soporte 24/7 |

| Tel: 1800 440 039 | |

| Email: retailcscaust.nz@travelex.com | |

| Dirección: Suite 45.01, Nivel 45, 25 Martin Place, Sydney NSW 2000 | |

| Facebook, Instagram | |

Información sobre Travelex

Travelex es un proveedor de servicios regulado de corretaje y servicios financieros de primera categoría, fundado en Australia en 1976. Ofrece productos y servicios para divisas, tarjetas de viaje y seguros de viaje.

Pros y Contras

| Pros | Contras |

| Largo tiempo de operación | Cobro de comisiones |

| Varios canales de contacto | |

| Bien regulado | |

| Diversas opciones de pago |

¿Es Travelex Legítimo?

Sí. Travelex está autorizado por la Comisión Australiana de Valores e Inversiones para ofrecer servicios. Su número de licencia es 000222444. La Comisión Australiana de Valores e Inversiones (ASIC) es un organismo gubernamental independiente de Australia que actúa como regulador corporativo de Australia, el cual fue establecido el 1 de julio de 1998 siguiendo recomendaciones de la Investigación Wallis.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión Australiana de Valores e Inversiones (ASIC) | Regulado | Travelex Limited | Creador de Mercado (MM) | 000222444 |

Productos y Servicios

| Productos y Servicios | Soportado |

| Moneda | ✔ |

| Tarjeta de Viaje | ✔ |

| Seguro de Viaje | ✔ |

Tarifas de Travelex

| Tipo de Tarifa | Cantidad |

| Tarifa Inicial de la Tarjeta (cobrada en el momento de la compra) | En línea: GRATIS a través de travelex.com.au o la Aplicación de Dinero de Travelex |

| En Tienda: GRATIS para cargas de moneda extranjera (las cargas de AUD incurren en una tarifa del 1.1% del monto o $15, lo que sea mayor) | |

| Tarifa de Recarga | En línea: GRATIS a través de travelex.com.au o la Aplicación de Dinero de Travelex |

| En Tienda: GRATIS para recargas de moneda extranjera (las recargas de AUD incurren en una tarifa del 1.1% del monto o $15, lo que sea mayor) | |

| BPAY: Las recargas no realizadas a través de travelex.com.au o la Aplicación de Dinero de Travelex incurren en una tarifa del 1% del monto | |

| Tarifa de Reemplazo de Tarjeta | ❌ |

| Tarifa de Retiro Internacional de Cajero Automático y EFTPOS (fuera de Australia) | GRATIS (Nota: algunos operadores de cajeros automáticos pueden cobrar sus propias tarifas o establecer sus propios límites) |

| Tarifa de Retiro de Cajero Automático y EFTPOS Nacional: cuando utiliza su tarjeta para hacer retiros o compras en Australia y tiene moneda AU$ en su tarjeta (para más detalles consulte la cláusula 9.4 de los Términos y Condiciones) | |

| Tarifa de Retiro de Efectivo en el Mostrador (donde se obtiene efectivo en el mostrador) | ❌ |

| Tarifa de Inactividad Mensual: Se cobra al inicio de cada mes si no ha realizado ninguna transacción en la tarjeta en los 12 meses anteriores a menos que su tarjeta se utilice nuevamente o se recargue. Esta tarifa se aplica cada mes hasta que la tarjeta se cierre o el saldo restante de la tarjeta sea menor que la tarifa de inactividad. | AU$4.00 por mes |

| Asistencia de Emergencia Global 24/7 | ❌ |

| Tarifa de Cierre/Retiro: Se cobra cuando cierra su tarjeta o retira fondos de su Fondo de Tarjeta. Esta tarifa es establecida y cobrada por Mastercard Prepagada. | AU$10.00 |

| Tasa de Cambio de Divisa a Divisa: Se aplica cuando mueve sus fondos de una moneda a otra. | A la tasa de cambio minorista aplicable determinada por nosotros. El corredor le notificará la tasa que se aplicará en el momento en que asigne sus fondos de una moneda a otra. |

| Tarifa de Conversión de Moneda: Se aplica cuando se realiza una compra o retiro de cajero automático en una moneda que no está cargada o es insuficiente para completar la transacción y el costo se asigna a la moneda utilizada para financiar la transacción. | GRATIS (La Tasa de Gasto se aplicará a las transacciones de cambio de divisas de acuerdo con los Términos y Condiciones) |

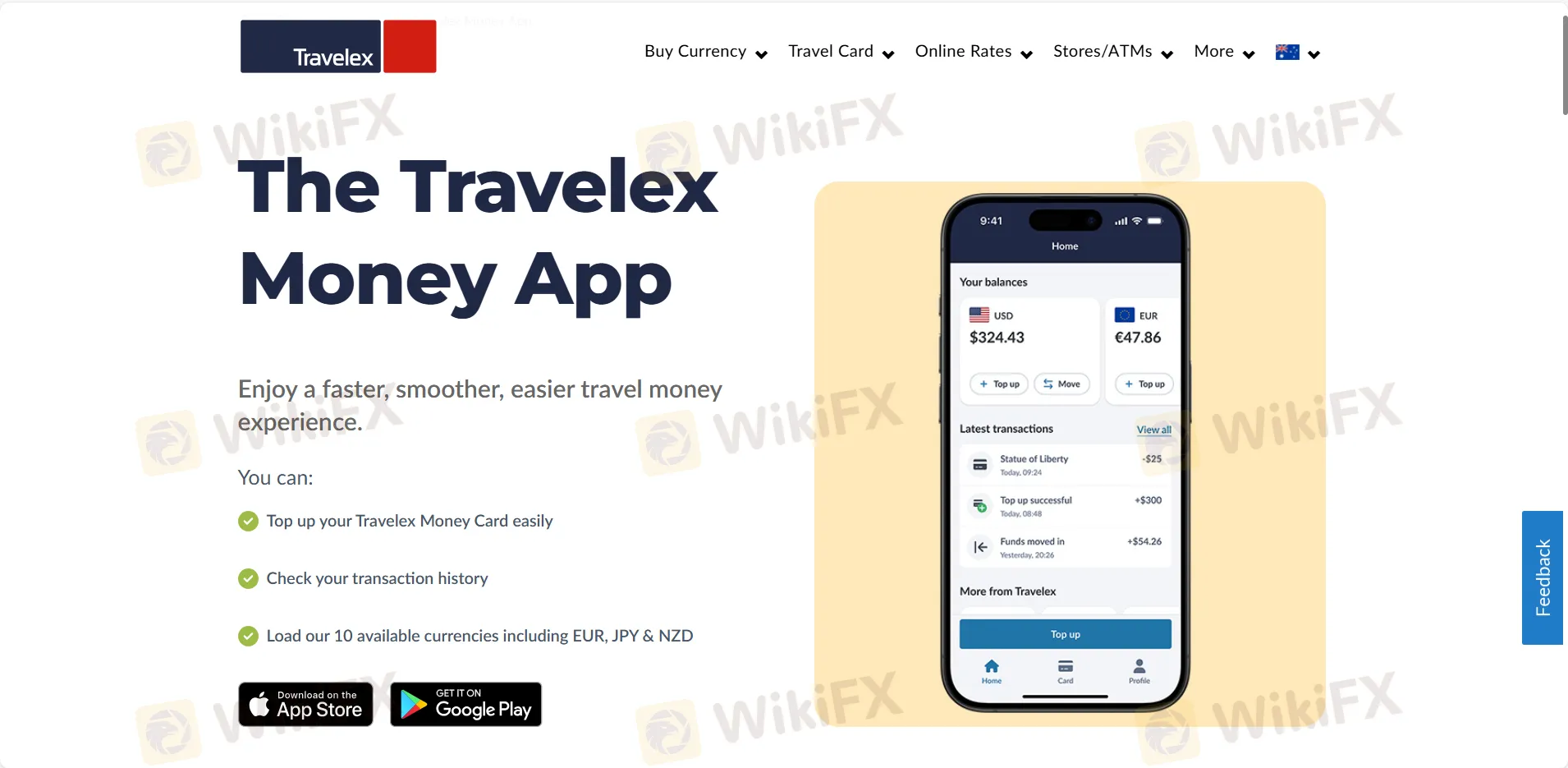

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles |

| La Aplicación de Dinero de Travelex | ✔ | Móvil |

| Travelex web | ✔ | PC, portátil, tableta |

Depósito y Retiro

Travelex acepta pagos realizados a través de Mastercard, VISA, BPAY, Pay ID, GPay y ApplePay.

| Monto mínimo | AU$350 o su equivalente en moneda, en línea y a través de la aplicación |

| AU$100 o su equivalente en moneda en tienda | |

| Monto máximo | AU$50.000 o su equivalente en moneda |