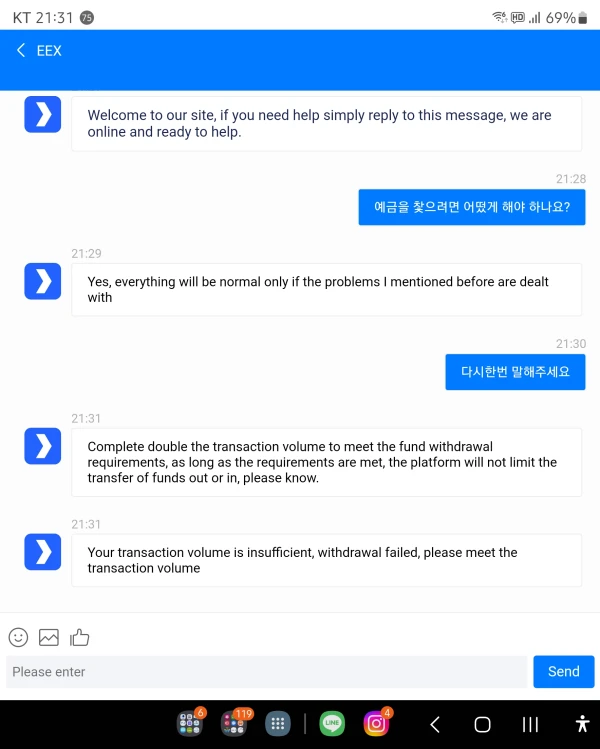

公司简介

| eex 评论摘要 | |

| 成立时间 | 1995 |

| 注册国家/地区 | 德国 |

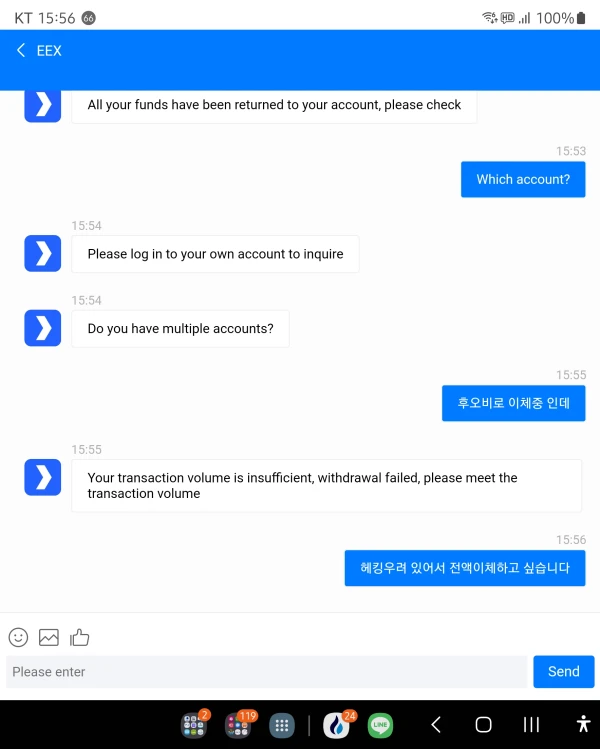

| 监管 | 未受监管 |

| 市场工具 | 电力、天然气矿工费、货运和农产品 |

| 客户支持 | technology@eex.com |

| +49 341 2156-466 | |

eex 信息

eex,即欧洲能源交易所,是一家专门为金融投资提供安全可靠的大宗商品市场的全球能源交易所。eex提供多种产品,包括电力、天然气、货运和农产品。然而,该公司未受任何金融机构监管。

优点和缺点

| 优点 | 缺点 |

|

|

|

|

eex 是否合法?

eex 是一家未受监管的经纪商。WHOIS搜索显示,eex.com域名于1995年12月15日注册。

市场工具

EEX提供多种交易工具和各种资产类别供金融投资使用。其中包括:

- 电力:交易电力合约(即期、期货)。

- 天然气矿工费:交易天然气合约(现货、期货)。

- 排放配额:交易二氧化碳排放许可证。

- 货运:交易航运费率对冲合约。

- 农产品:交易小麦、玉米、油菜籽和土豆合约。

费用

- ACER REMIT 费用:根据报告需求和市场细分的不同而变化的费用,用于支付ACER/EU委员会指南规定的REMIT报告成本。

- ACER报告处理费用:每个市场细分(矿工费、电力、EPEX)固定年费120欧元,用于EEX的REMIT报告服务。