公司簡介

| eex 評論摘要 | |

| 成立年份 | 1995 |

| 註冊國家/地區 | 德國 |

| 監管 | 未受監管 |

| 市場工具 | 電力、天然氣、貨運和農產品 |

| 客戶支援 | technology@eex.com |

| +49 341 2156-466 | |

eex 資訊

eex,即歐洲能源交易所,是一家專門為金融投資提供安全可靠的商品市場的全球能源交易所。eex提供多種產品,包括電力、天然氣、貨運和農產品。然而,該公司並未受到任何金融監管機構的監管。

優點與缺點

| 優點 | 缺點 |

|

|

|

|

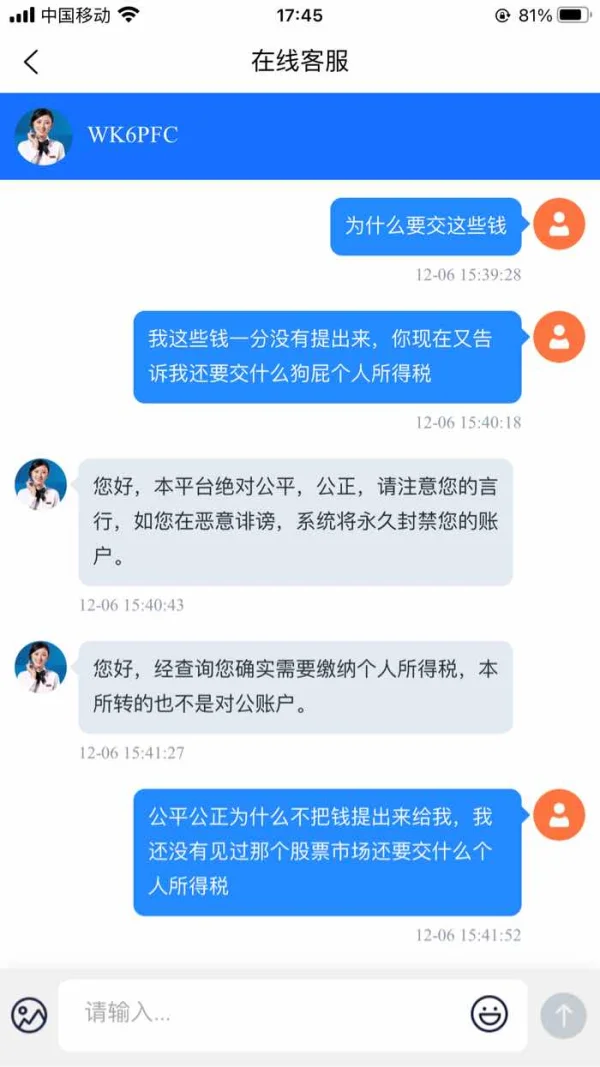

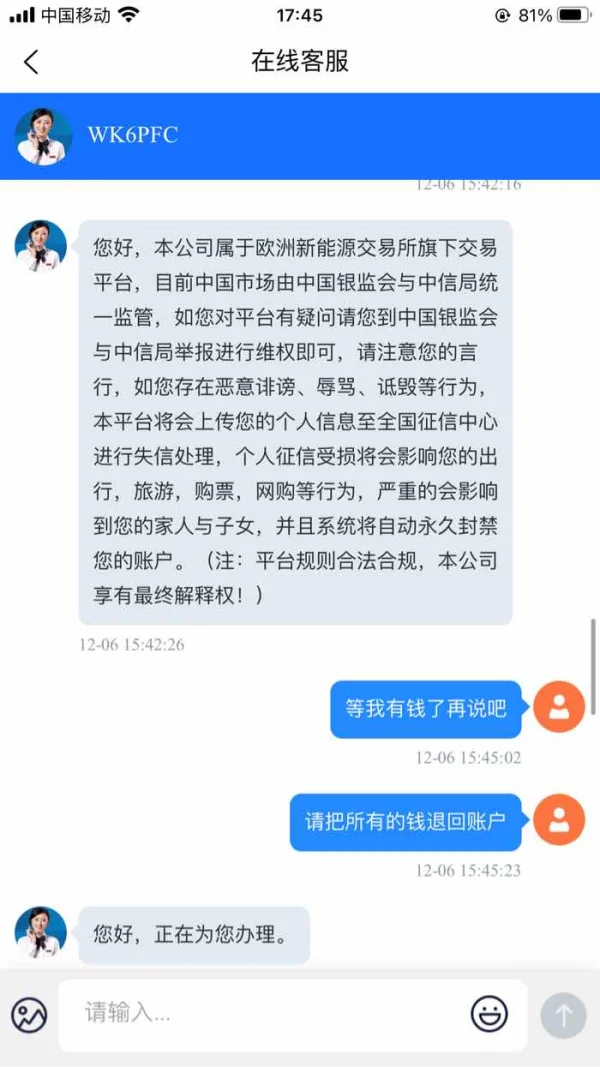

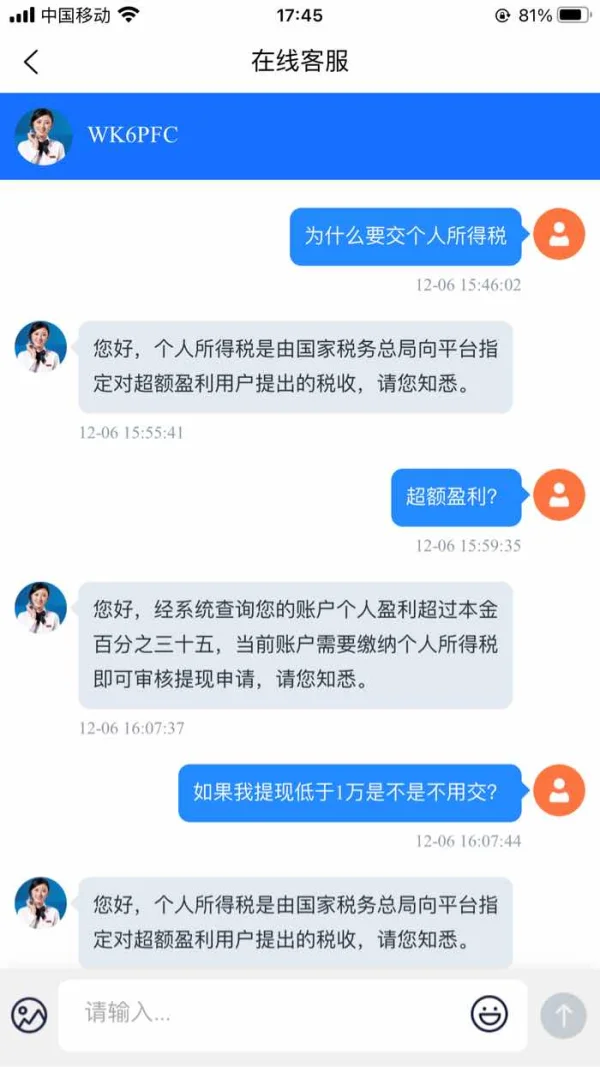

eex 是否合法?

eex 是一家未受監管的經紀商。WHOIS搜索顯示,eex.com 域名於1995年12月15日註冊。

市場工具

EEX 提供多種交易工具和各種金融投資資產類別。這些包括:

- 電力:交易電力合約(即期、期貨)。

- 天然氣:交易天然氣合約(現貨、期貨)。

- 排放配額:交易二氧化碳排放許可證。

- 貨運:交易航運利率對沖合約。

- 農產品:交易小麥、玉米、油菜籽和馬鈴薯合約。

費用

- ACER REMIT 費用:根據 ACER/EU 委員會指南,根據報告需求和市場部門的不同而變化的通過費用,用於支付 REMIT 報告成本。

- ACER 報告處理費用:每個市場部門(天然氣、電力、EPEX)固定年費 120 歐元,用於 EEX 的 REMIT 報告服務。