公司简介

| 招商期货评论摘要 | |

| 成立时间 | 1993年 |

| 注册国家/地区 | 中国 |

| 监管机构 | CFFEX |

| 业务范围 | 商品期货经纪、期货投资咨询和资产管理 |

| 模拟账户 | 可用 |

| 交易软件 | 博易大师云交易版、快速新一代V3、招商博易App、E-Star App移动终端以及Flush Futures App适用于Android和iOS |

| 最低存款 | $1 |

| 客户支持 | 在线聊天、电话、电子邮件、传真和邮政编码 |

什么是招商期货?

中国招商期货有限公司成立于1993年,是中国招商证券有限公司的全资子公司。作为中国最早的全资期货公司之一,招商期货注册资本为359.8亿元人民币。该公司在中国金融期货交易所有限公司(CFFEX)的监管下运营,该交易所经中华人民共和国国务院和中国证监会批准设立。

招商期货提供一系列服务,包括商品期货经纪、金融期货经纪、期货投资咨询和资产管理。该公司致力于在国内提供一流的行情和交易软件,赢得了众多客户的好评。

如果您愿意,我们邀请您阅读即将发布的文章,我们将从各个角度对该经纪人进行全面评估。我们将提供结构良好且简洁的信息,以使您全面了解该经纪人的重要特点。在文章结束时,我们将提供简要摘要,以便您全面了解该经纪人的关键特征。

优点和缺点

| 优点 | 缺点 |

|

|

|

|

|

|

|

|

|

招商期货的优点:

- 多个交易平台和移动应用程序:招商期货提供多种交易平台和移动应用程序,为交易者提供灵活性和便利性,以便访问市场。

- 可用的模拟账户:招商期货提供模拟账户,允许交易者在投入真实资金之前练习和熟悉平台和市场条件。

- 可用的在线聊天:招商期货提供在线聊天支持,使客户能够轻松与支持团队进行实时沟通并寻求帮助。

- 多渠道支持联系:招商期货 提供多种渠道供客户联系支持团队,确保及时高效的客户服务。

- 受CFFEX监管:招商期货受CFFEX监管,CFFEX是一家专门从事金融衍生品交易的知名交易所。

招商期货的缺点:

- 资金选项有限:招商期货的资金选项有限,这对一些偏好更广泛的支付方式的交易者来说可能有限制。

- 没有社交媒体存在:招商期货在社交媒体平台上没有存在,这可能限制了潜在客户通过这些渠道获取信息或更新的可访问性和可见性。

招商期货是安全的还是骗局?

招商期货是一家受中国金融期货交易所有限责任公司(CFFEX)监管的经纪公司,该公司已获得中华人民共和国国务院和中国证券监督管理委员会(CSRC)的批准。CFFEX是一家合法的交易所,专门提供金融期货、期权和衍生品的交易和结算服务。凭借良好的运营记录和积极的客户反馈,招商期货可以被认为是一家可靠和值得信赖的经纪商。然而,投资者必须认识到所有投资都存在固有风险,重要的是在做出任何投资决策之前进行彻底的研究并考虑所有可用的选择。

业务范围

招商期货的业务范围包括:

- 商品期货经纪:招商期货为交易商品期货合约提供服务。这涉及到在各种商品上进行期货合约的买卖,如金属、能源、农业等。

-金融期货经纪:招商期货提供金融期货合约交易服务。这包括促进股票指数、利率、货币和债券等金融工具的期货合约交易。

- 期货投资咨询:招商期货为对期货投资感兴趣的个人和机构提供咨询服务。他们提供建议、市场分析和推荐,帮助客户在期货市场上做出明智的投资决策。

- 资产管理:招商期货还提供资产管理服务,他们代表客户管理投资组合和投资基金。这包括做出投资决策,执行交易,并监控所管理资产的表现。

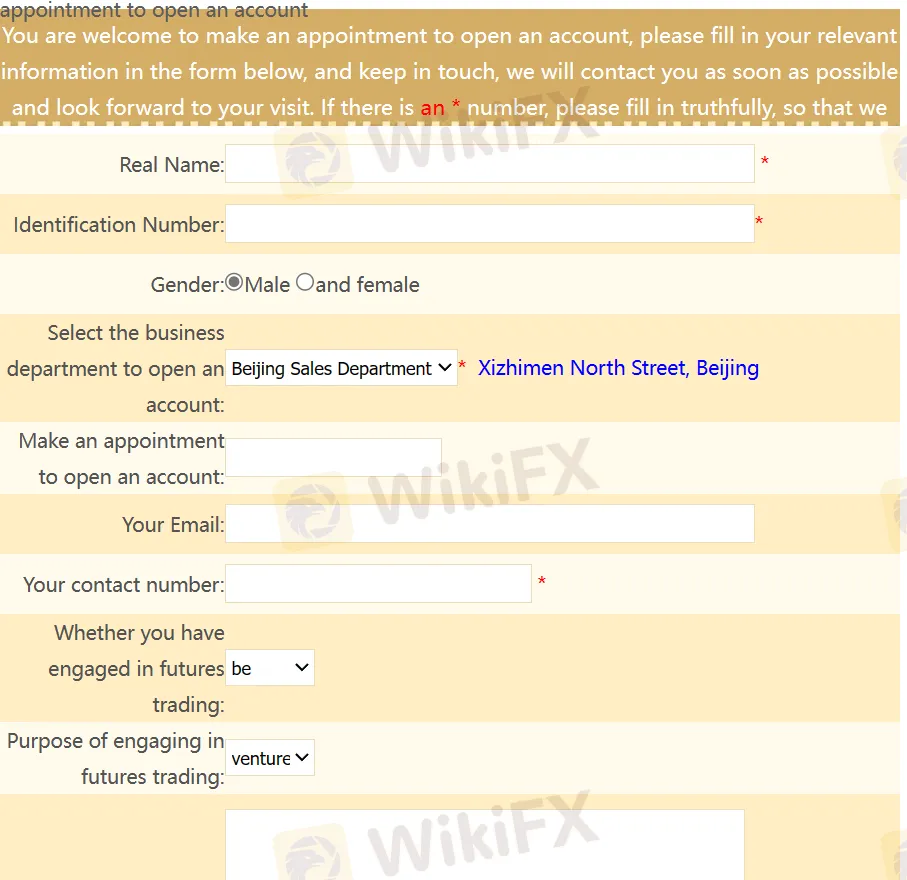

账户

要开设一个账户,交易者可以访问该网站并预约开户。他们需要在下面的表格中填写相关信息,并保持联系,以便工作人员尽快与他们联系。

招商期货还为那些想在使用真实资金进行交易之前练习和熟悉平台的交易者提供模拟账户。模拟账户模拟真实市场条件,允许交易者使用虚拟资金进行交易。

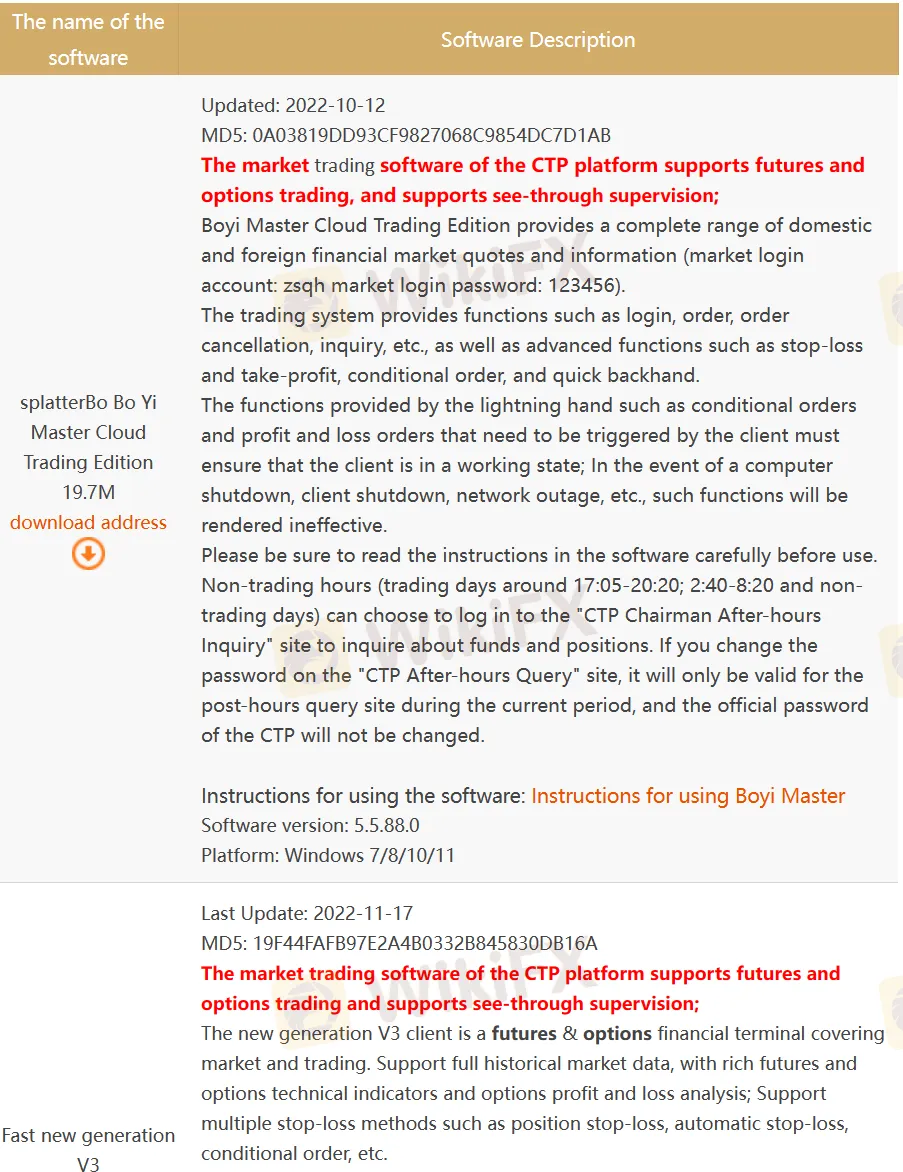

交易软件

中国招商期货为客户提供国内一流的行情和交易软件。投资者可以根据自身情况选择最合适的行情和交易方式。在下载和使用在线交易软件之前,请确保您当前的环境符合在线交易的要求,包括稳定安全的计算机或电子终端设备,没有木马、病毒或其他恶意程序,以及可靠顺畅的网络连接。

可用的软件选项包括博易大师云交易版、快速新一代V3、招商博易App、E-Star App移动终端以及安卓和iOS的Flush Futures App。

存款和取款

中国招商期货(招商期货)为交易者提供了几种存取资金的方式。这些方式包括银期转账、网银转账和柜台存取。

对于希望使用银行期货转账存入资金的人来说,这个过程相对简单。每次存款的最低限额为¥1,而最高限额由银行规定。交易者可以发起银行对银行的转账,将资金存入他们的交易账户。一旦资金到账,交易者可以查看他们的余额并开始交易。

另外,通过网上银行转账存入资金也是一种选择。交易者可以通过网上银行平台将资金从他们的银行账户转入他们的招商期货交易账户。这个选项可能对那些喜欢在线管理所有财务的交易者很有吸引力。

最后,交易者可以选择使用银行柜台存取资金。为此,交易者需要前往支持招商期货的银行,并提供完成交易所需的必要细节。一旦资金存入,交易者可以查看余额并开始交易。

在提款方面,交易者可以通过期货到银行转账的方式从他们的交易账户中提取资金。累计每日最高提款限额为300万元人民币,单笔转账限额为300万元人民币。此外,交易者每天最多可以提款三次。这些限制确保了一个安全和受监管的环境,供交易者进行他们的金融交易。

客户服务

招商期货提供在线聊天。通过在线聊天,客户可以快速得到问题的答案,并获得帮助解决任何问题。这是一个方便和有效的沟通渠道,可以提高客户满意度并增加销售额。

客户可以通过以下提供的信息访问他们的办公室或与客户服务热线联系:

电话: 95565-9-2/0755-95565-9-2

电子邮件: zsqh@cmschina.com.cn

传真:0755-82763130

邮政编码: 518048

地址:深圳市福田区福华路17号招商证券大厦111层和16层

结论

总之,招商期货有限公司是一家期货公司,专注于商品和金融期货经纪、期货投资咨询和资产管理。该公司受CFFEX监管。凭借其致力于提供一流的行情和交易软件,招商期货得到了许多客户的好评,并在期货市场中确立了领先地位。总体而言,招商期货遵守政府法规,使其成为投资者和交易者的可靠和安全选择。

常见问题(FAQ)

| 问题 1: | 招商期货是否受监管? |

| 答案 1: | 是的。它受CFFEX监管。 |

| 问题 2: | 如何联系招商期货的客户支持团队? |

| 答案 2: | 您可以通过电话:95565-9-2/0755-95565-9-2,电子邮件:zsqh@cmschina.com.cn,传真:0755-82763130和邮政编码:518048与我们联系。 |

| 问题 3: | 招商期货是否提供模拟账户? |

| 答案 3: | 是的。 |

| 问题 4: | 招商期货是否提供行业领先的MT4和MT5? |

| 答案 4: | 不提供。相反,它提供了博易大师云交易版、快速新一代V3、招商博易App、E-Star App移动终端以及Flush Futures App(适用于Android和iOS)。 |

| 问题 5: | 招商期货是否适合初学者? |

| 答案 5: | 是的。它是初学者的不错选择,因为它受到良好的监管,并在行业中拥有多年的经验。此外,它提供多种交易软件选择和超低最低存款金额。 |

风险警示

在线交易涉及重大风险,您可能会损失所有投资资本。它并不适合所有交易者或投资者。请确保您理解所涉风险,并注意由于公司服务和政策的不断更新,本评论中提供的信息可能会发生变化。

此外,生成此评论的日期也可能是需要考虑的重要因素,因为信息可能已经发生变化。因此,在做出任何决定或采取任何行动之前,建议读者始终直接与公司核实更新的信息。对于使用本评论中提供的信息所产生的责任,完全由读者承担。