Profil perusahaan

| Yuanta Ringkasan Ulasan | |

| Didirikan | 1992 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC |

| Instrumen Pasar | Saham, derivatif, futures & opsi |

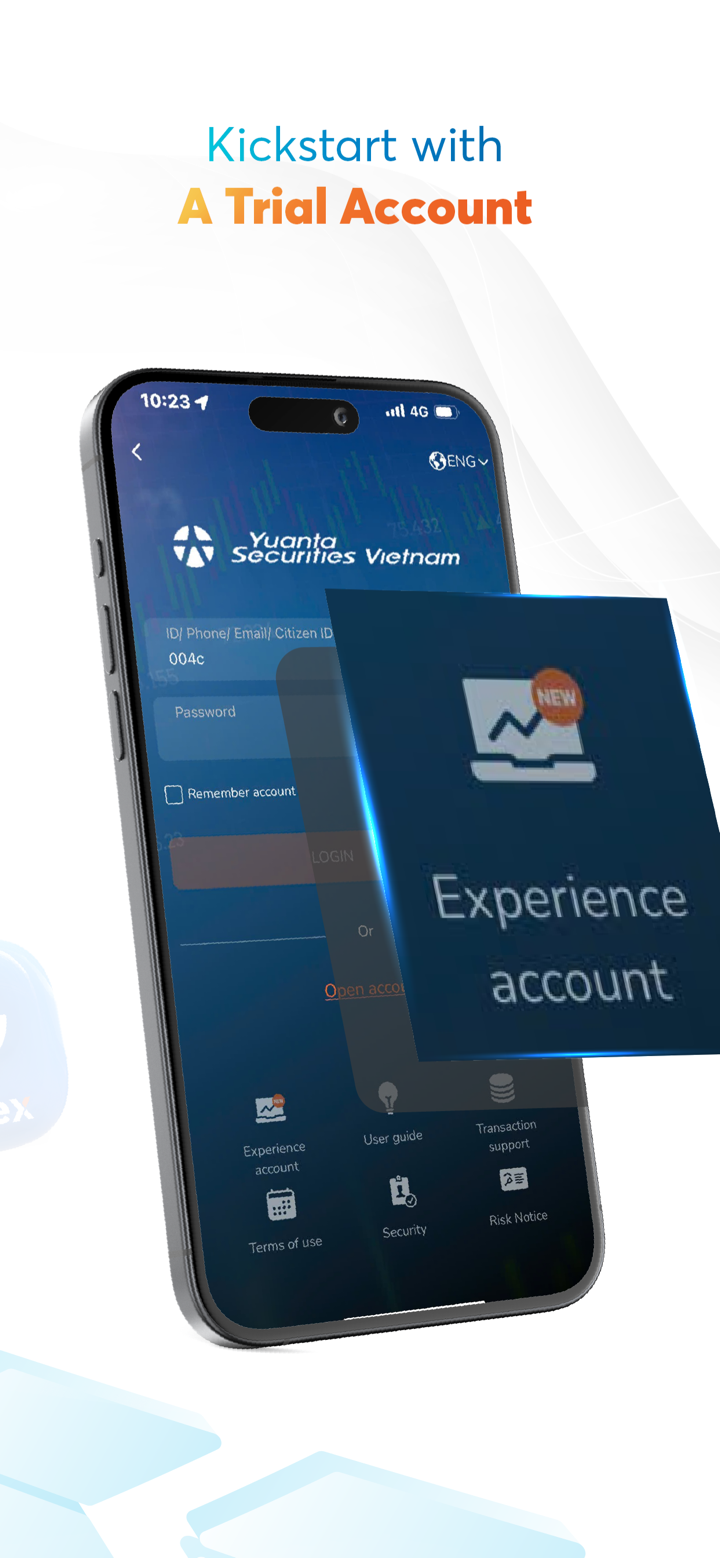

| Akun Demo | ❌ |

| Platform Perdagangan | eWinner, YSHK SP Trader |

| Deposit Minimum | / |

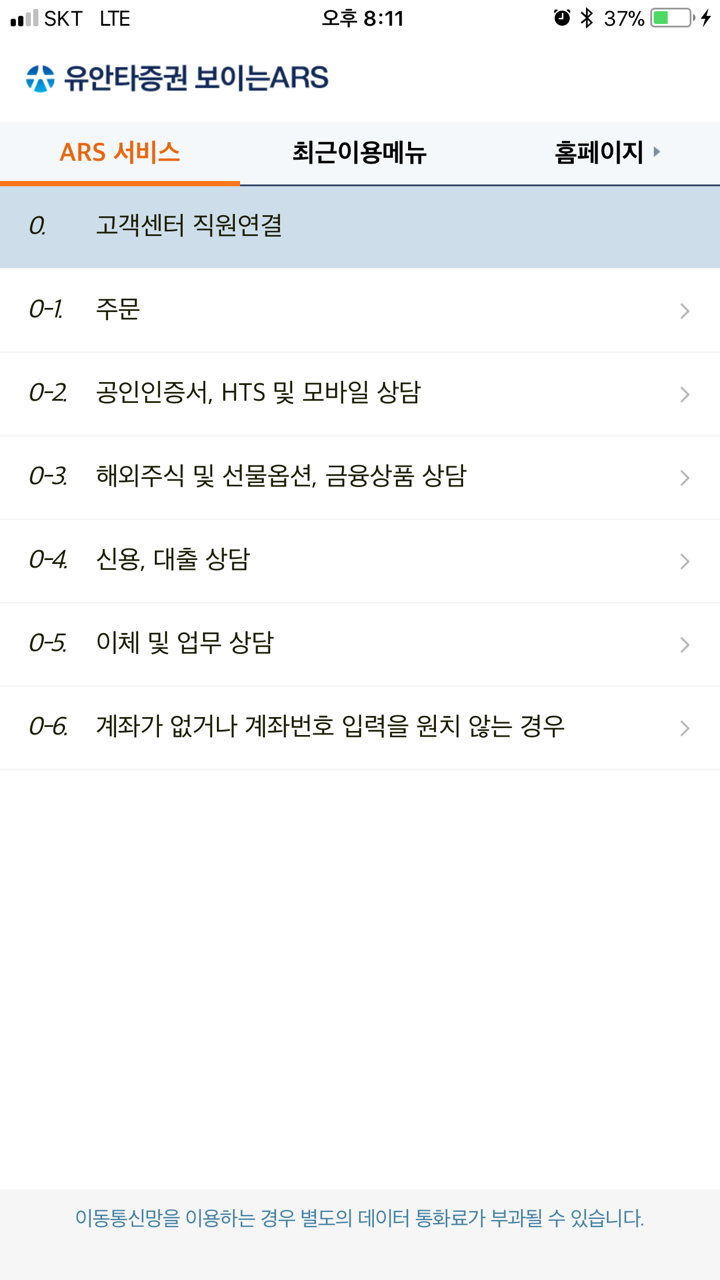

| Dukungan Pelanggan | Telepon: (852) 3555-7878 |

| Fax: (852) 3555-7889 | |

| Email: HK.services.brk@yuanta.com | |

Informasi Yuanta

Didirikan pada tahun 1992, Yuanta diatur oleh Komisi Sekuritas dan Futures Hong Kong. Perusahaan ini menyediakan berbagai alat perdagangan termasuk saham, futures, dan derivatif. Meskipun tidak memiliki akun demo, perusahaan ini membantu perdagangan multi-platform dengan teknologi ciptaan sendiri dan menyediakan dukungan lokal melalui telepon dan email.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh SFC Hong Kong | Tidak ada akun demo |

| Mendukung perdagangan multi-market melalui satu login | Beberapa biaya layanan (misalnya, layanan nominee) bisa tinggi |

| Menawarkan cakupan produk yang luas: saham, futures, opsi | Tidak ada deposit minimum yang jelas |

Apakah Yuanta Legal?

Ya, Yuanta diatur oleh Komisi Sekuritas dan Futures Hong Kong (SFC).

| Entitas Berlisensi | Diatur oleh | Lisensi Teratur | Status Saat Ini | Tipe Lisensi | No. Lisensi |

| Yuanta Securities (Hong Kong) Company Limited | Hong Kong, China | SFC | Diatur | Bertransaksi dalam kontrak futures | ABS015 |

| Yuanta Futures (HK) Co., Limited | Hong Kong, China | SFC | Diatur | Bertransaksi dalam kontrak futures | AXQ690 |

| Yuanta Asia Investment (Hong Kong) Limited | Hong Kong, China | SFC | Melampaui | Bertransaksi dalam sekuritas | ABZ023 |

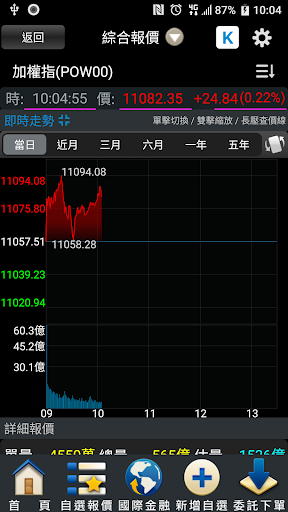

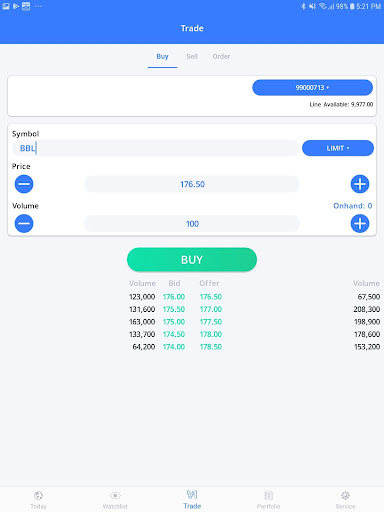

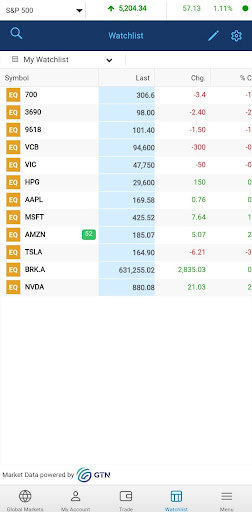

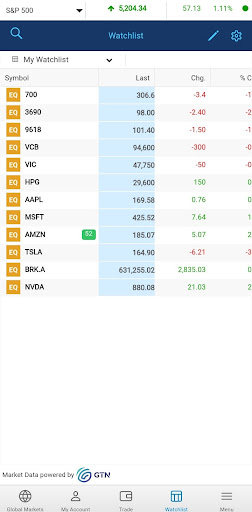

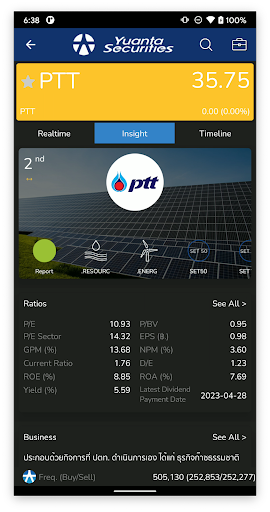

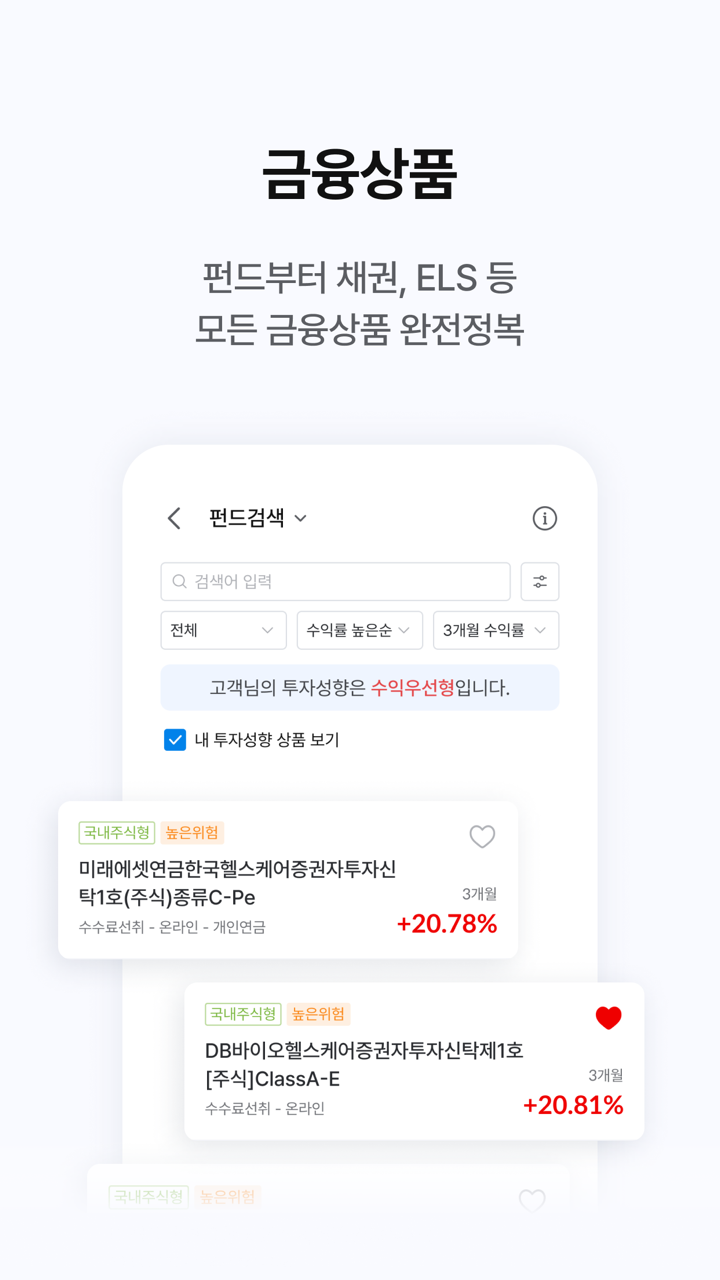

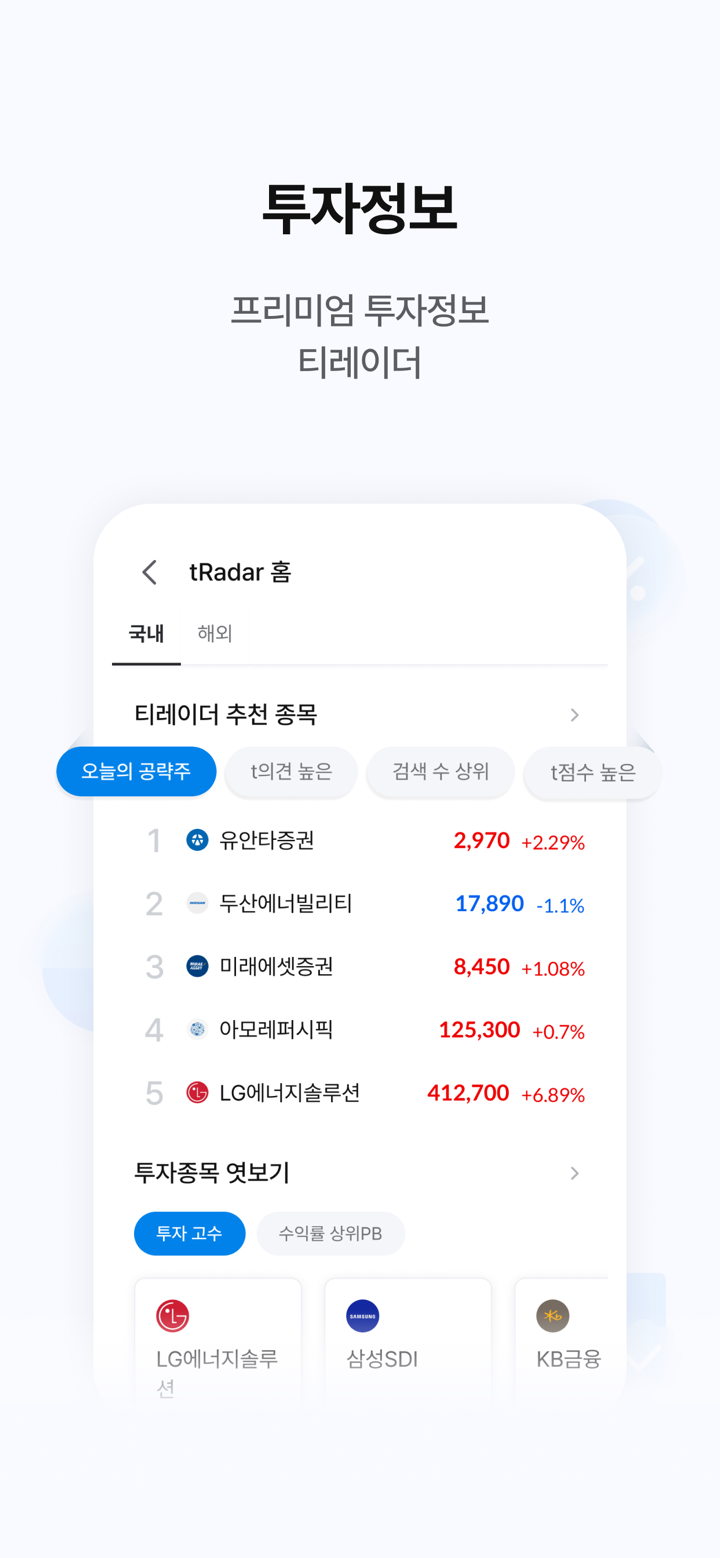

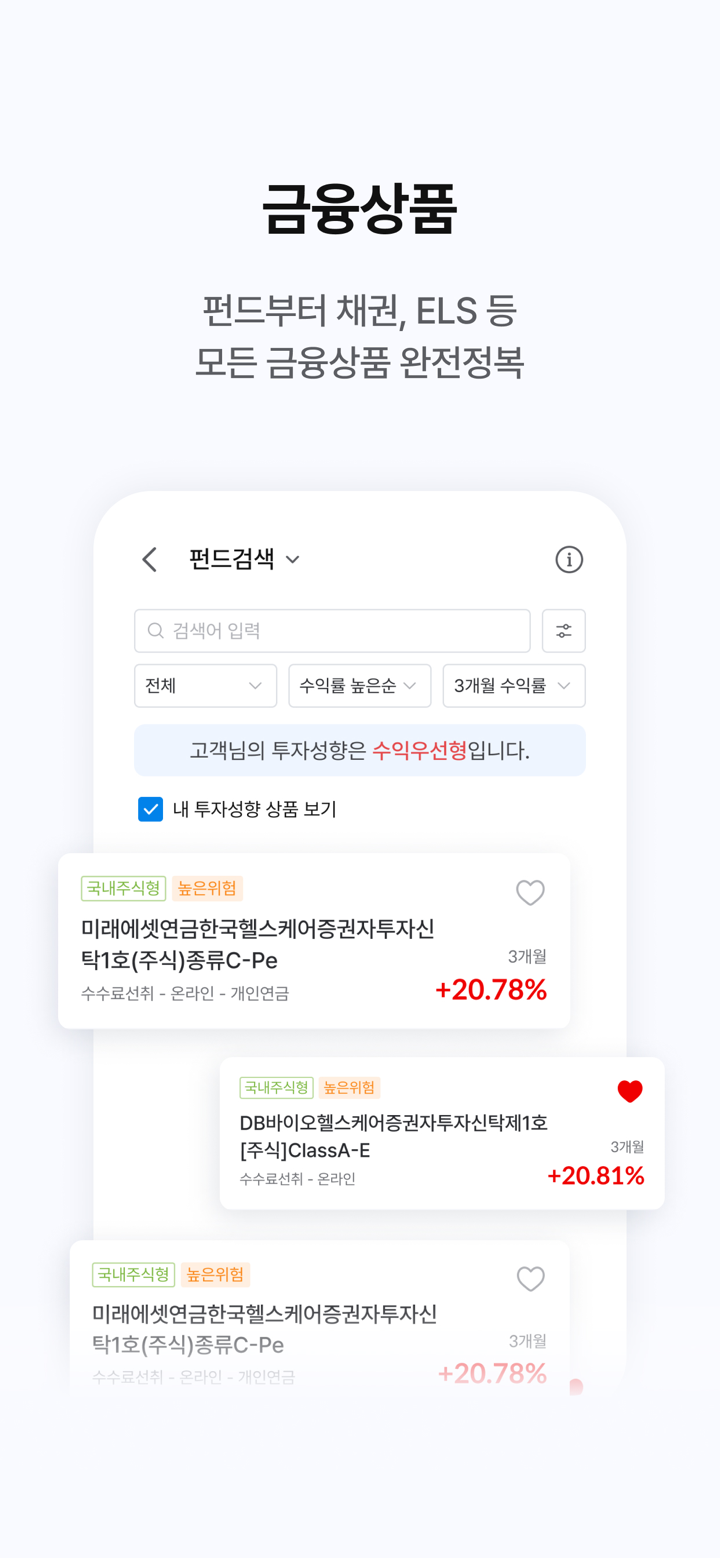

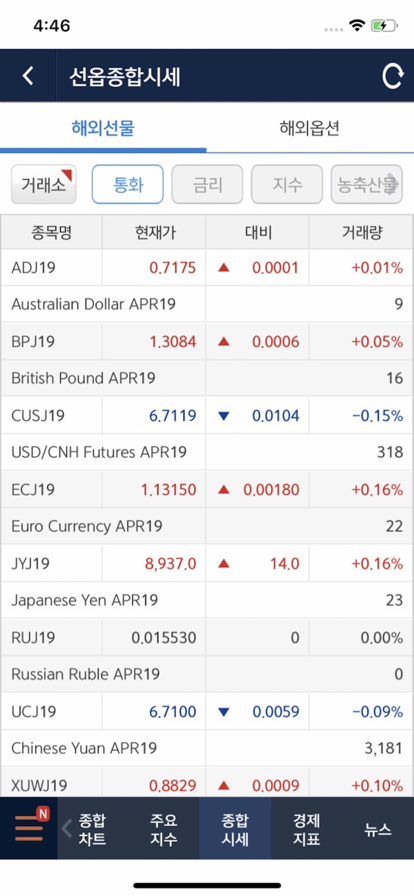

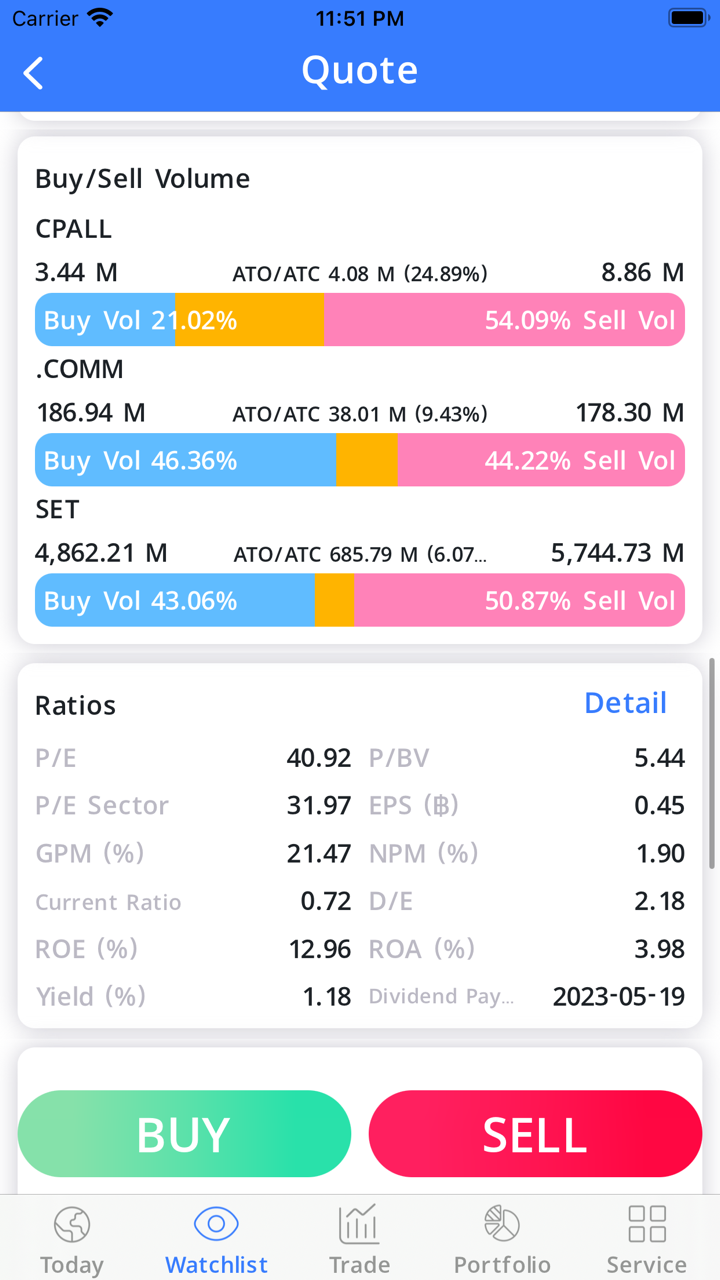

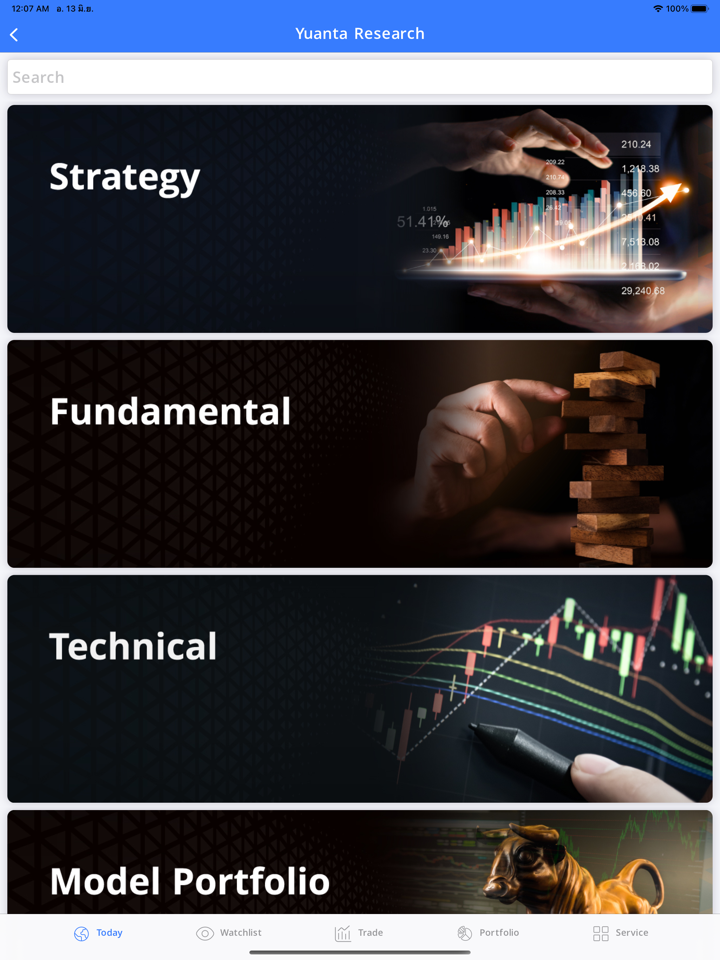

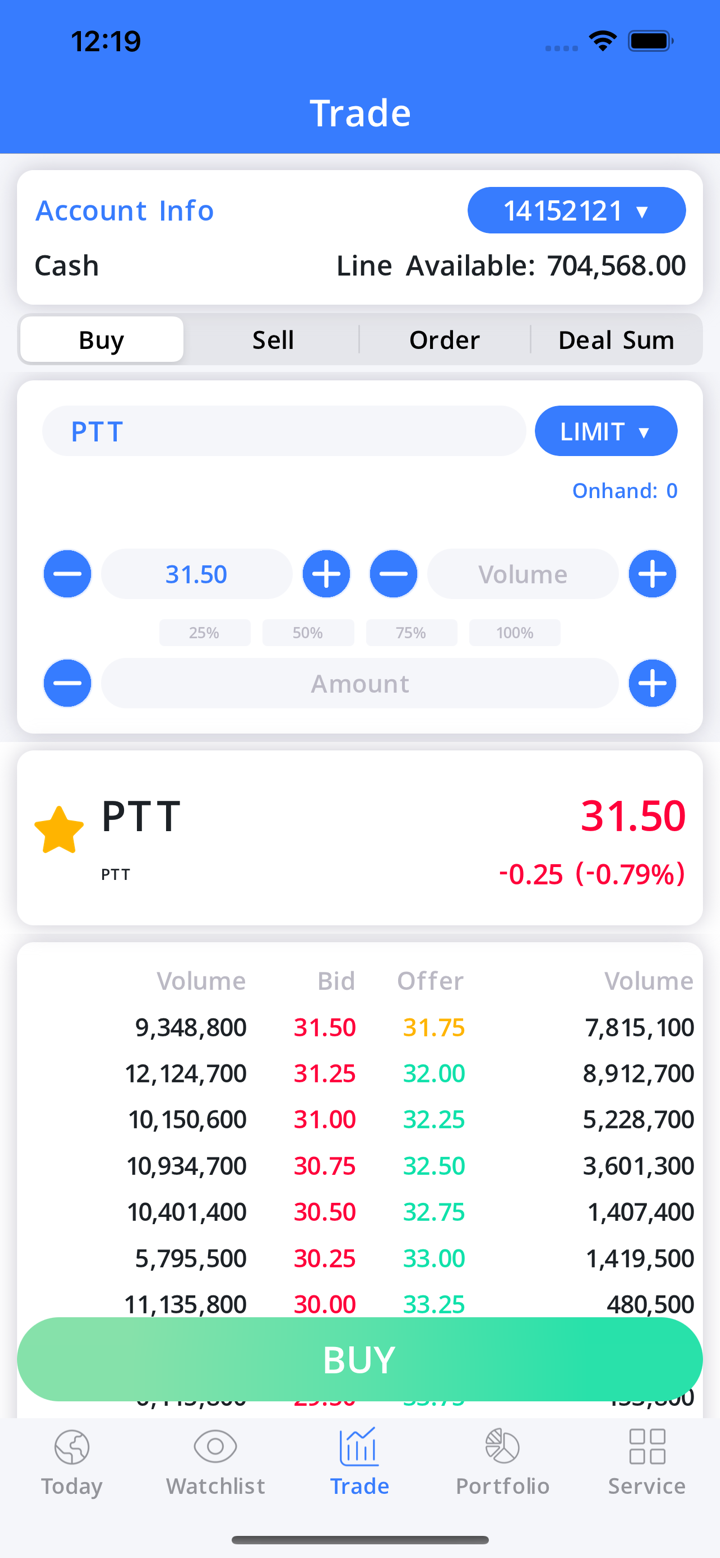

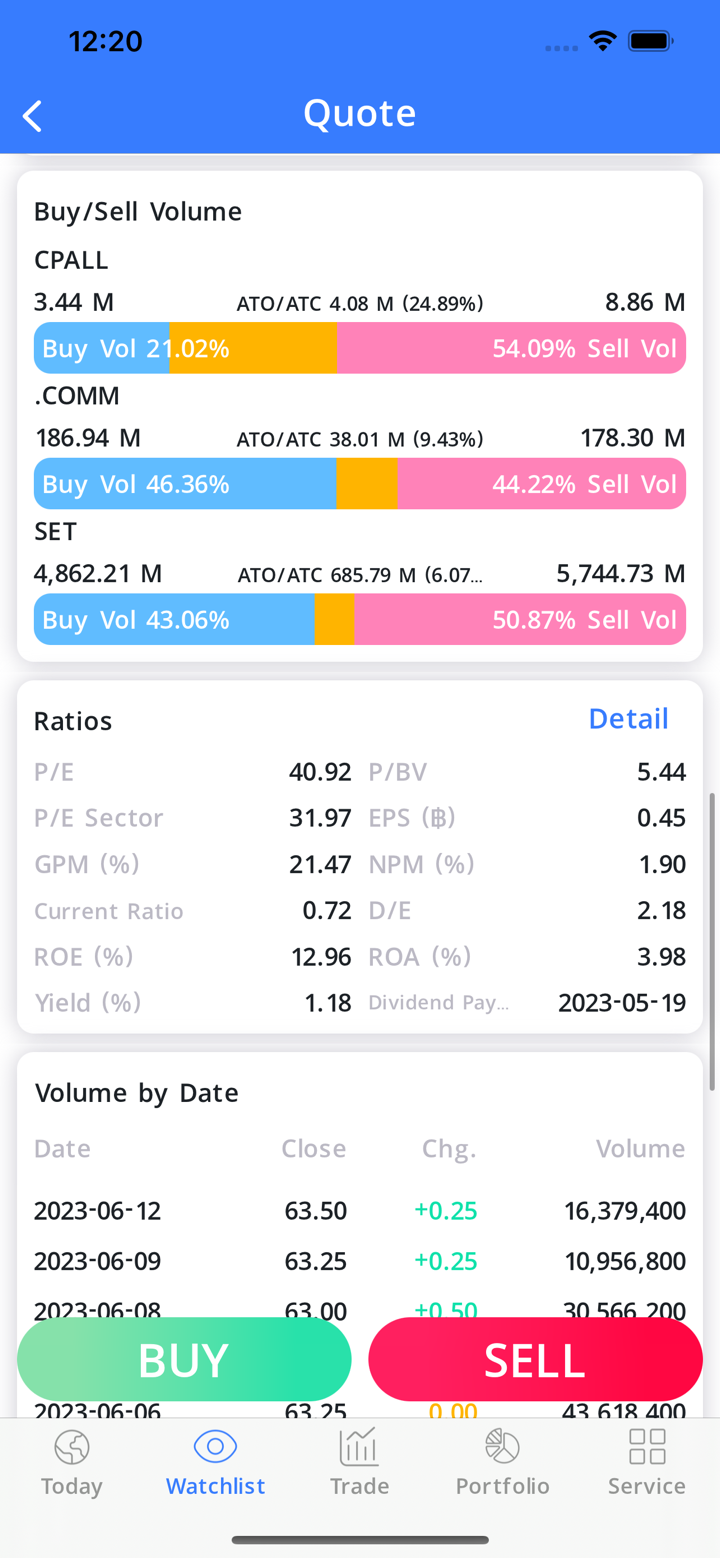

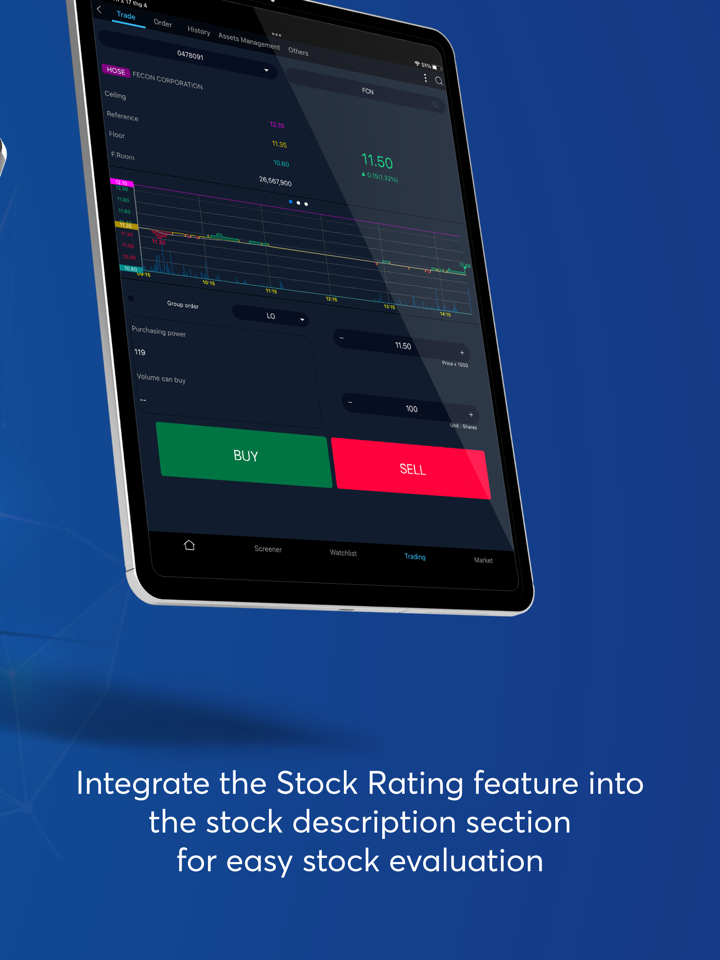

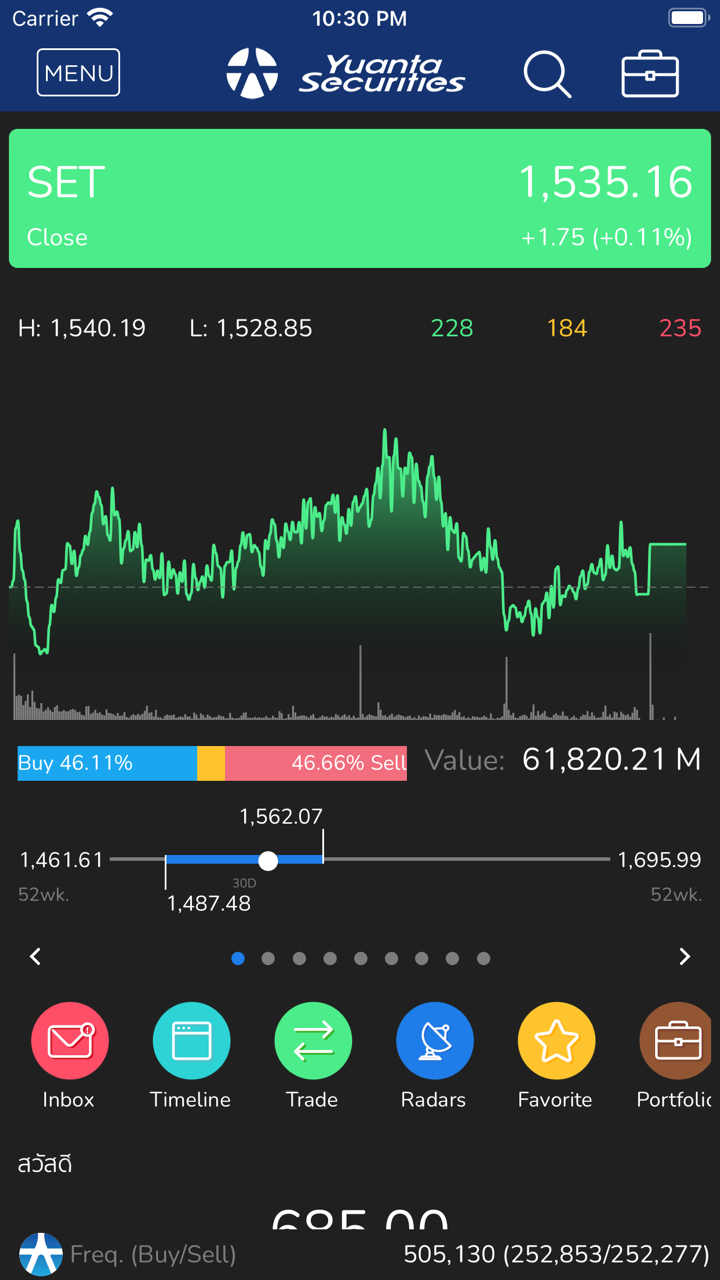

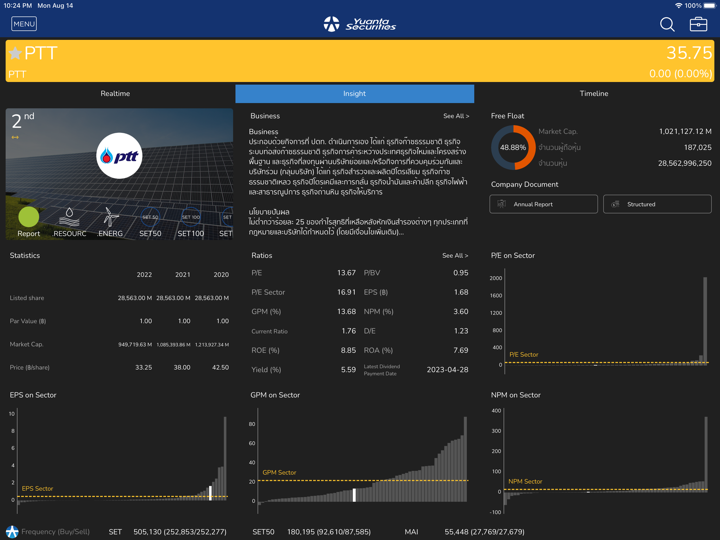

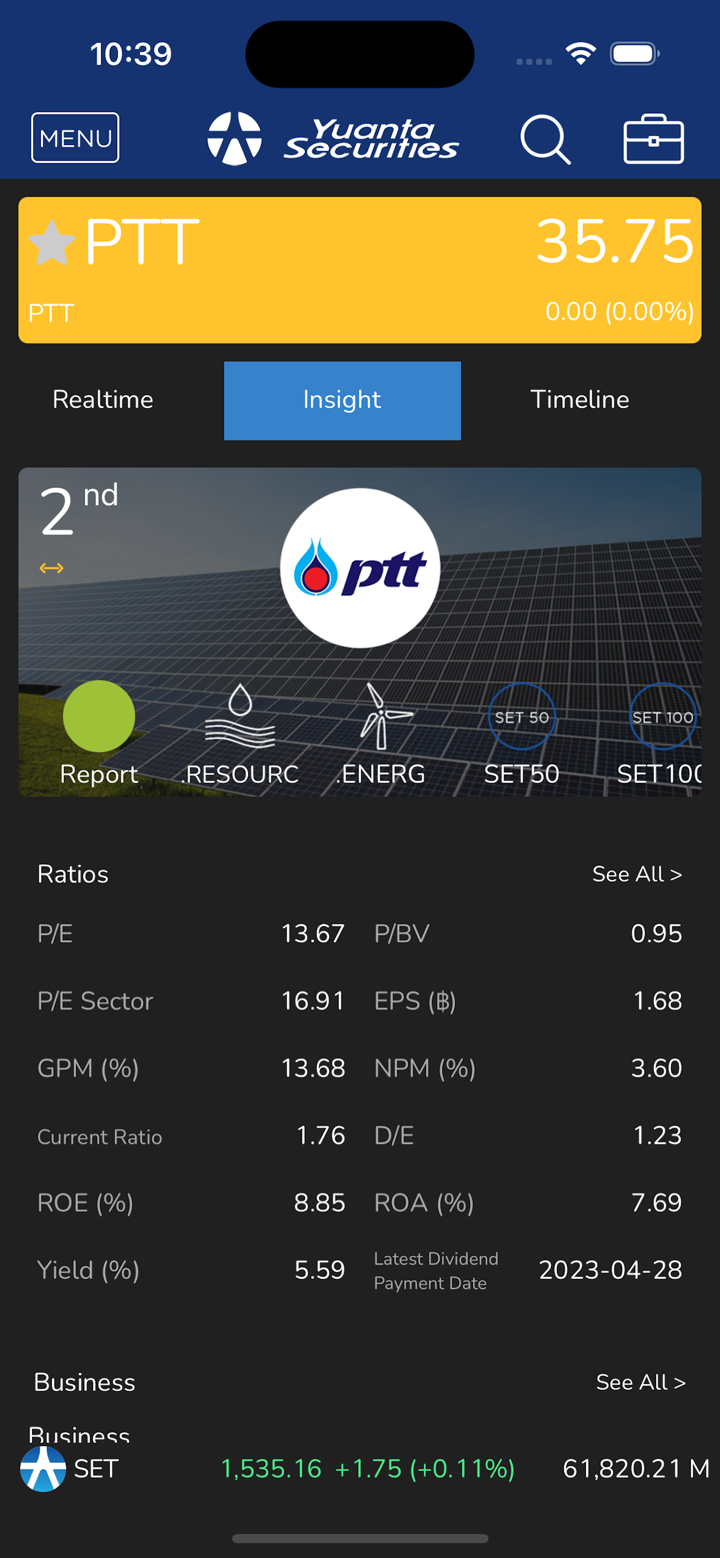

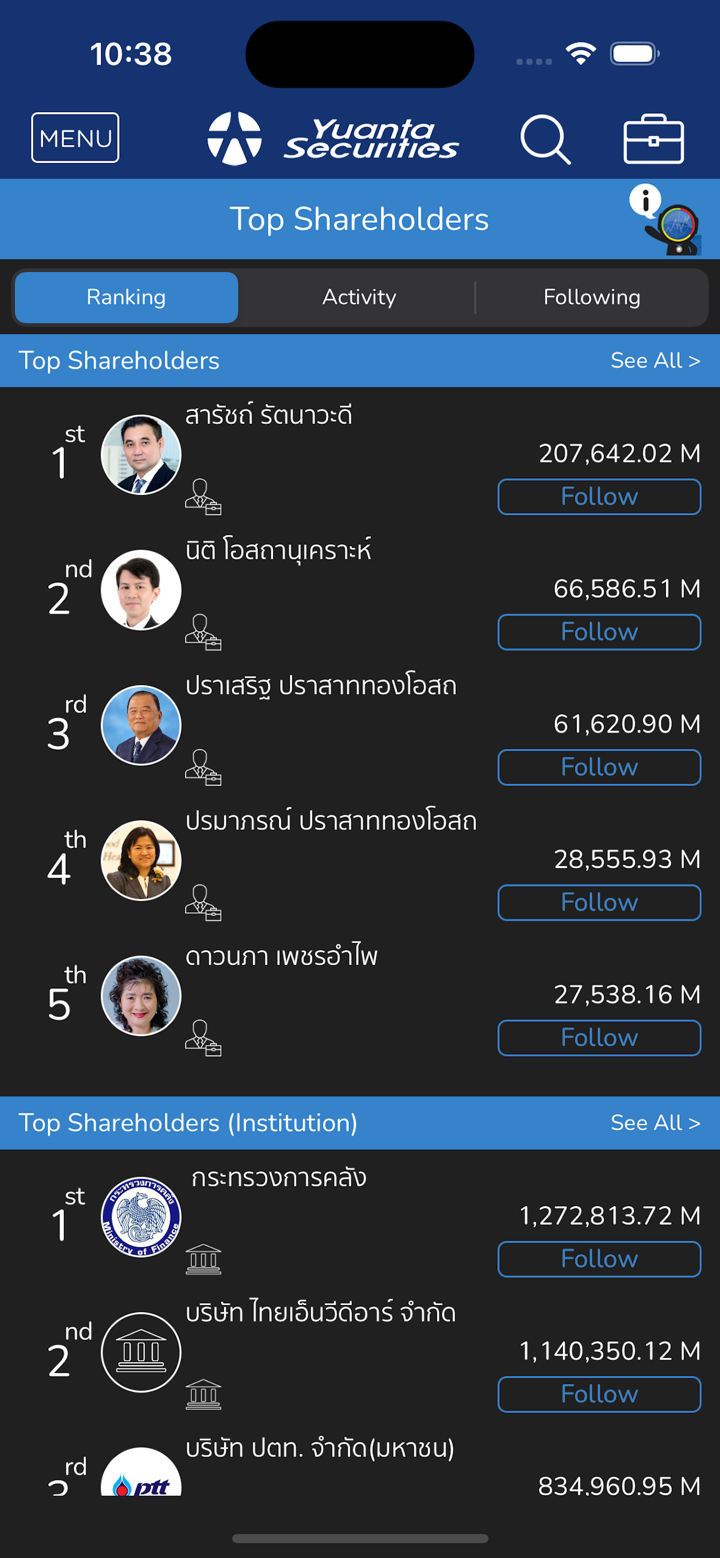

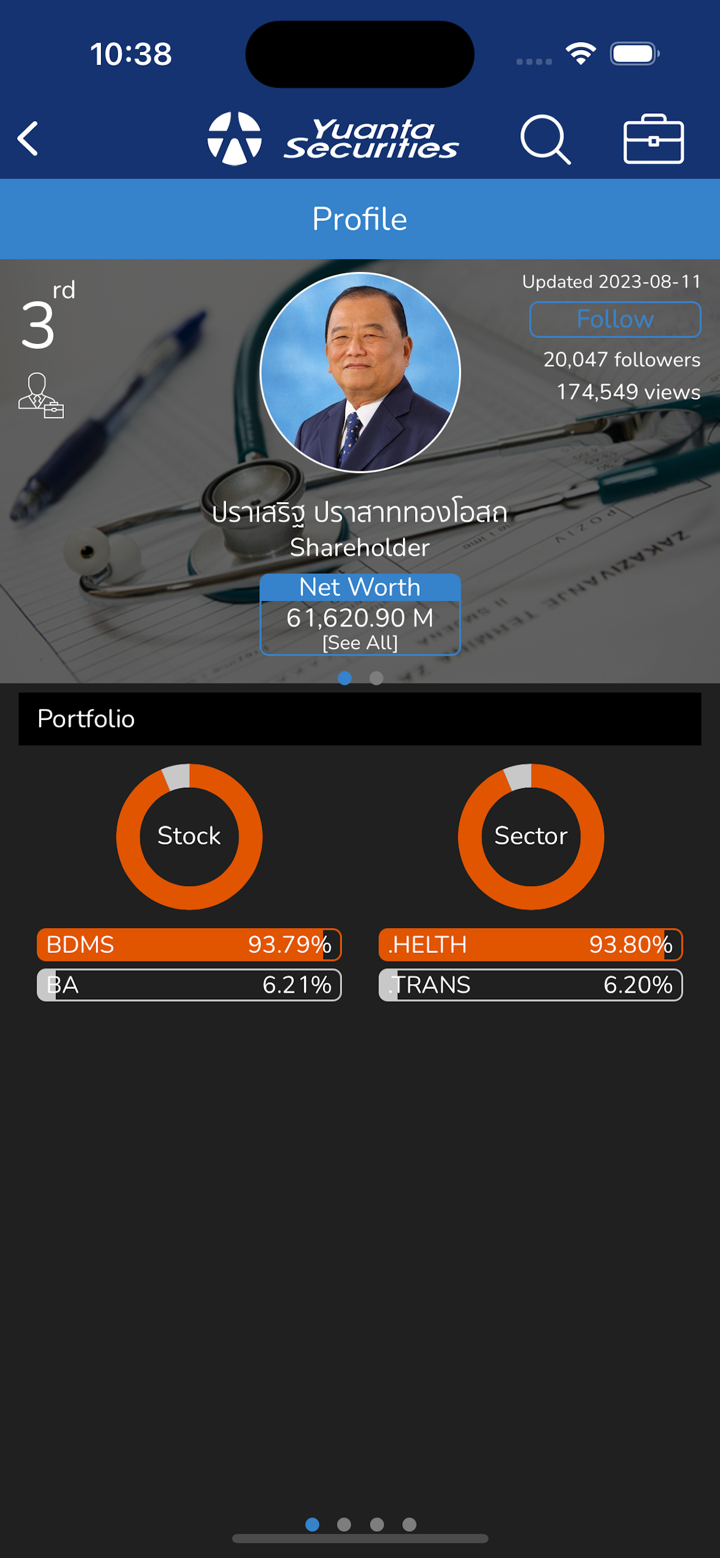

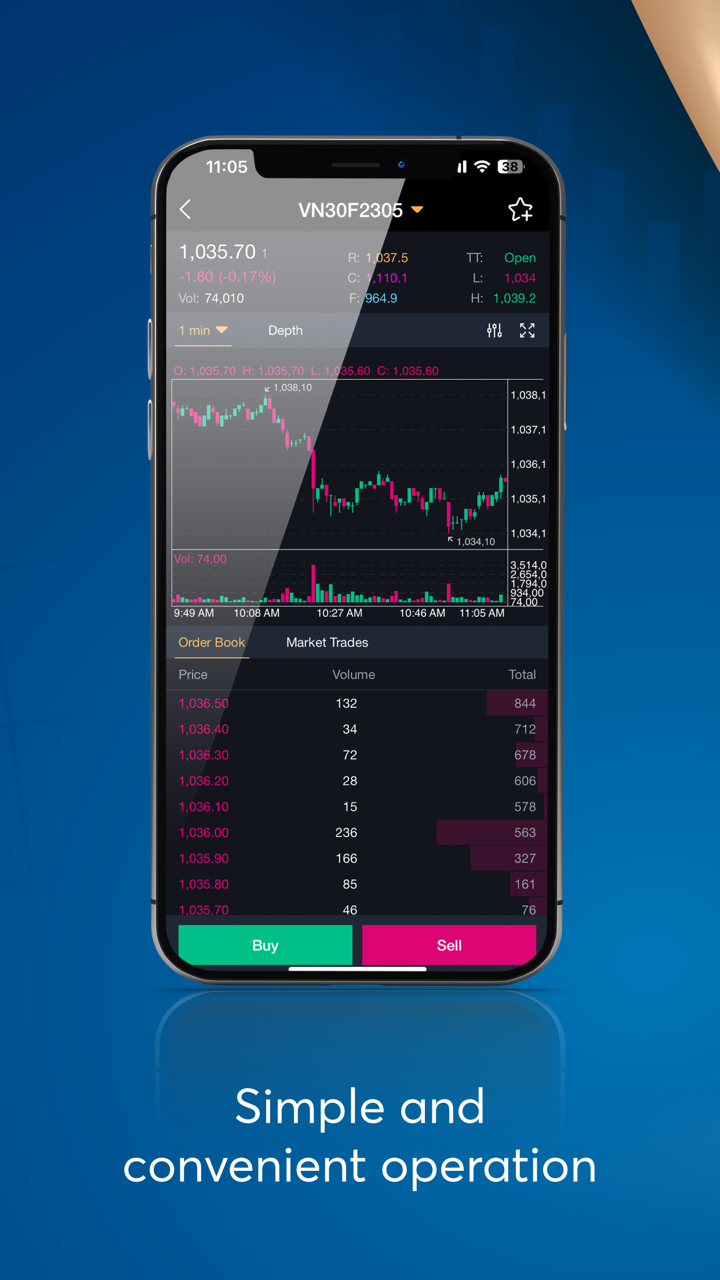

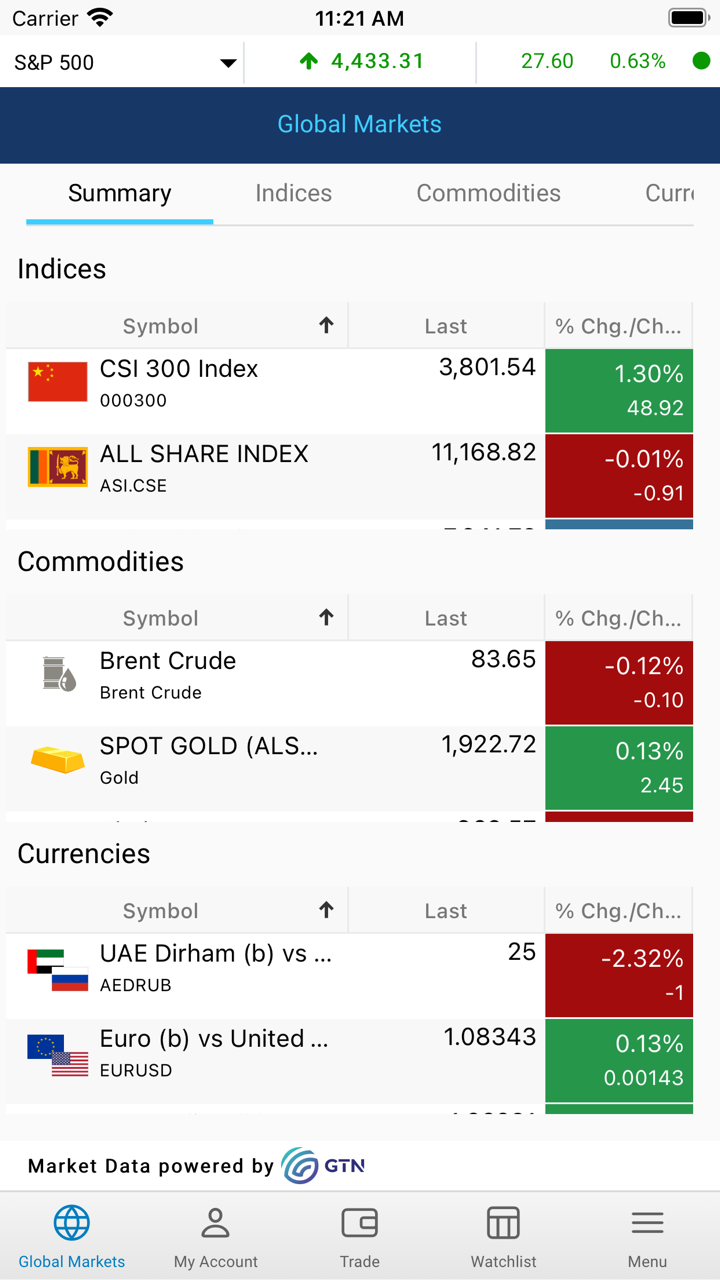

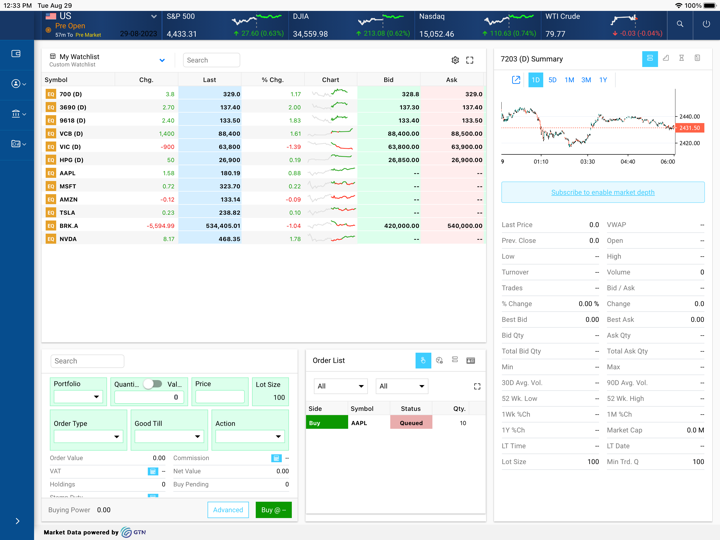

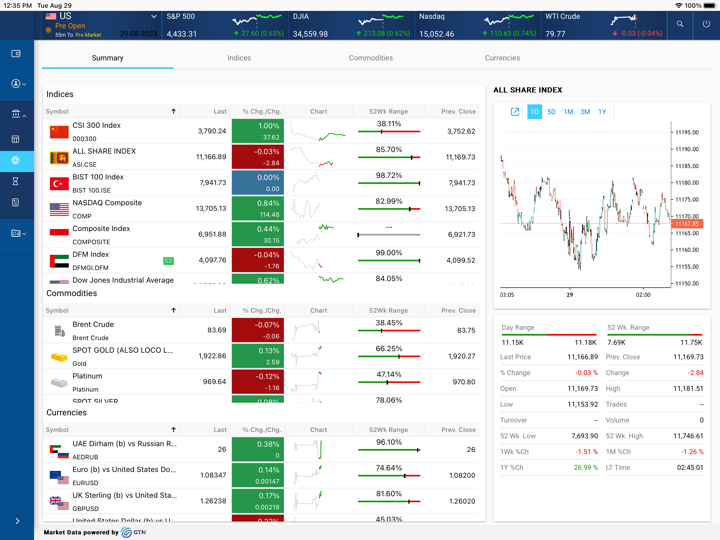

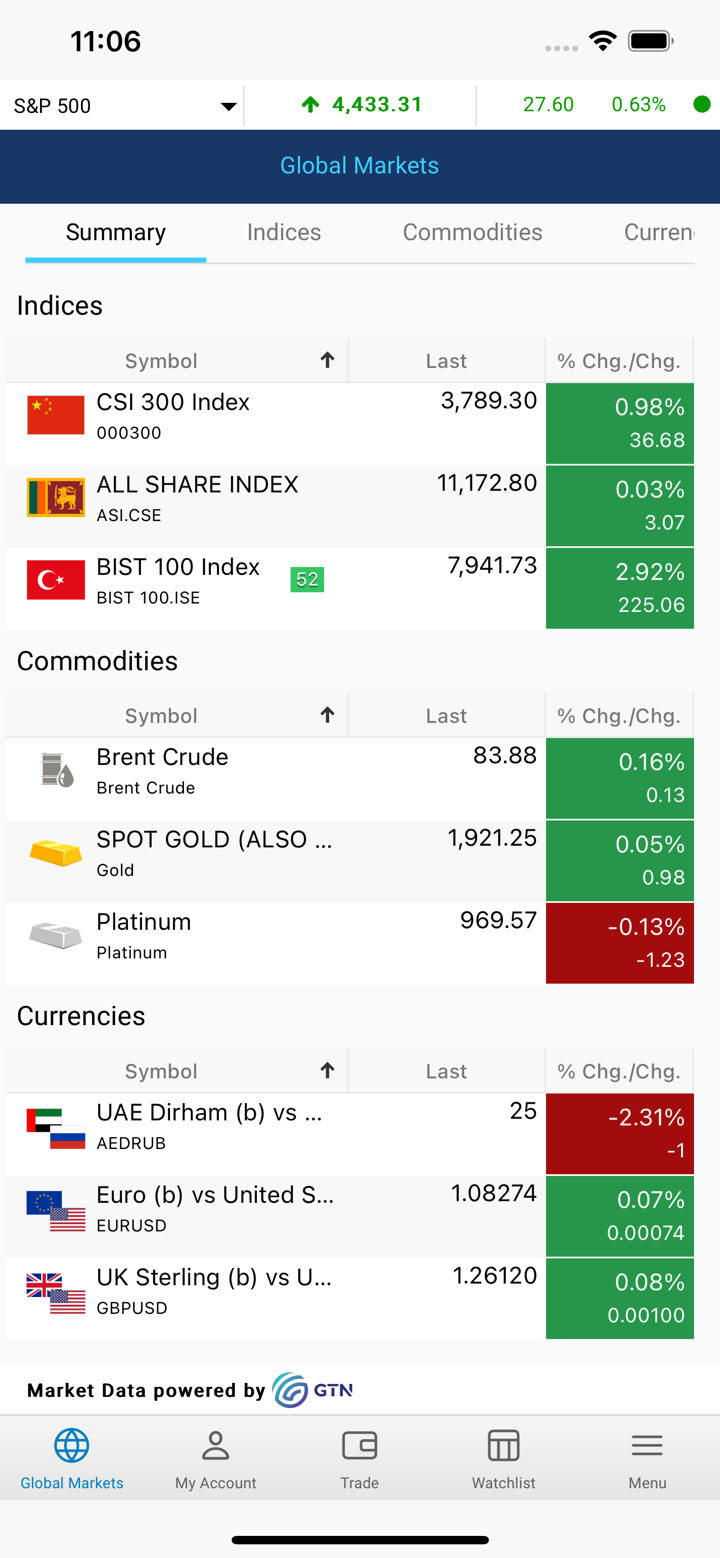

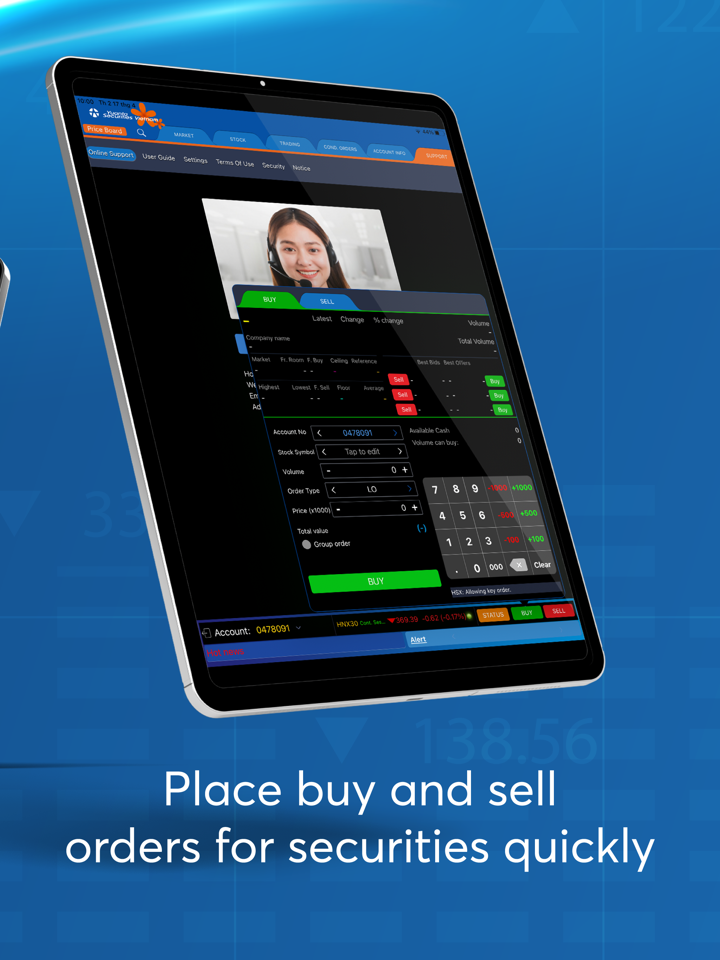

Apa yang Bisa Saya Perdagangkan di Yuanta?

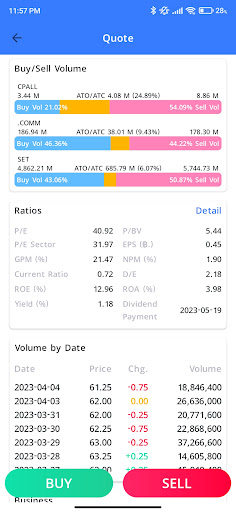

Secara utama mencakup perdagangan saham, produk derivatif, dan futures & options, organisasi ini menyediakan beragam produk dan layanan keuangan.

| Produk Perdagangan | Detail |

| Perdagangan Saham | Saham HK, Saham SH, Saham SZ, Saham Taiwan, Saham AS, Saham B China, Saham Luar Negeri |

| Produk Derivatif | Callable Bull / Bear Contracts, Waran Derivatif |

| Futures & Options | Futures, Options, Detail Perdagangan, Spesifikasi Kontrak, Persyaratan Margin |

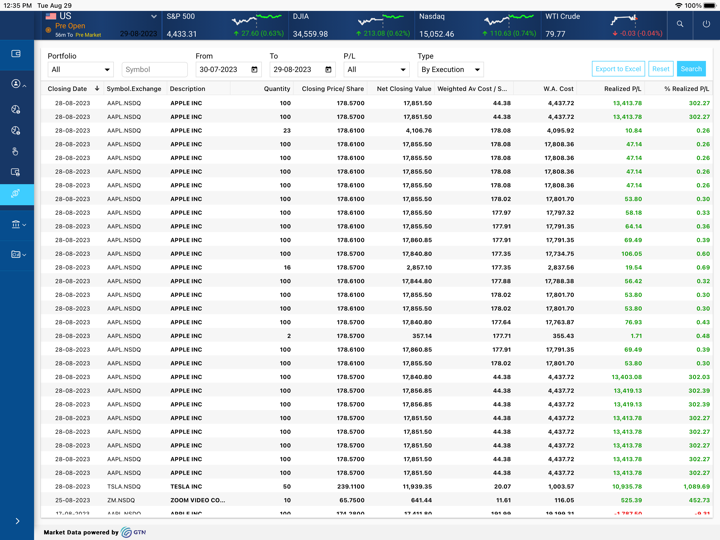

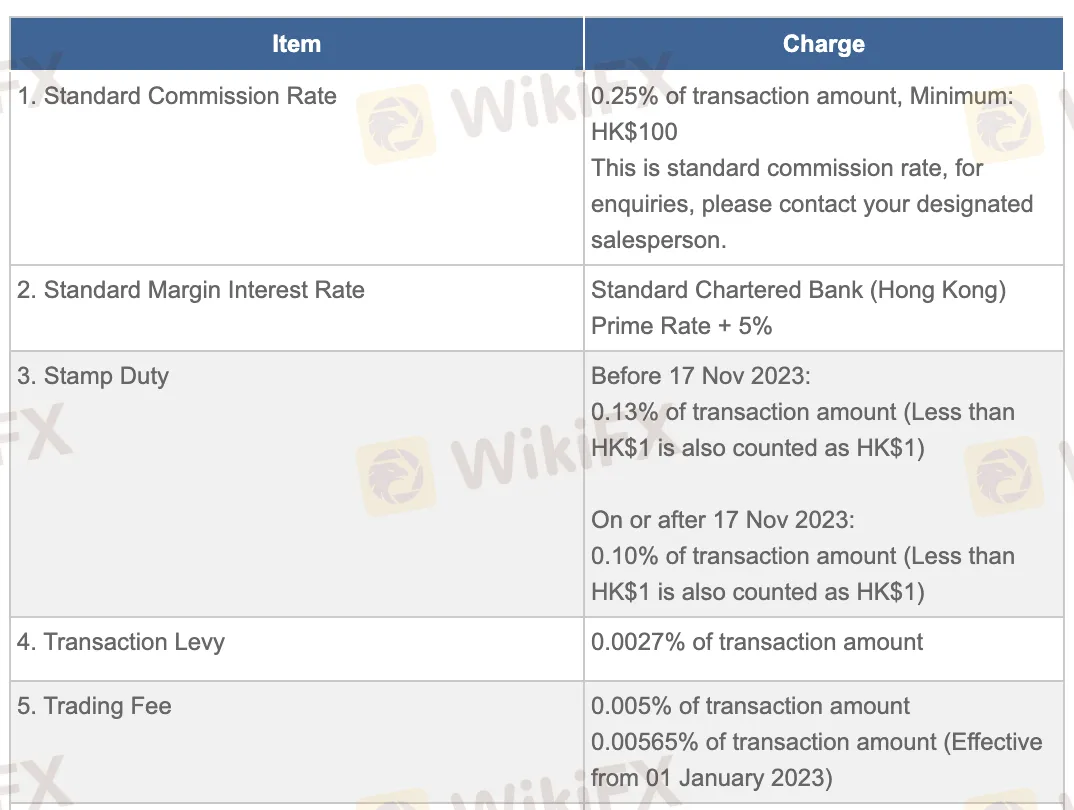

Biaya Yuanta

Meskipun beberapa biaya administrasi dan layanan penunjukan bisa sedikit tinggi, biaya Yuanta biasanya sejalan dengan standar industri, dengan tarif komisi dan bunga standar yang mirip dengan pialang utama Hong Kong.

| Item | Biaya |

| Tarif Komisi Standar | 0,25% dari jumlah transaksi, Minimum HK$100 |

| Tarif Bunga Margin Standar | Prime Rate + 5% |

| Pajak Capai | 0,10% (setelah 17 Nov 2023), 0,13% (sebelumnya), min HK$1 |

| Levy Transaksi | 0,0027% dari jumlah transaksi |

| Biaya Perdagangan | 0,00565% dari jumlah transaksi (sejak Jan 2023) |

| Biaya CCASS | 0,002%, min HK$2, maks HK$100 |

| Pajak Transaksi Keuangan Italia | 0,2% dari jumlah transaksi |

| Levy Transaksi FRC | 0,00015% dari jumlah transaksi |

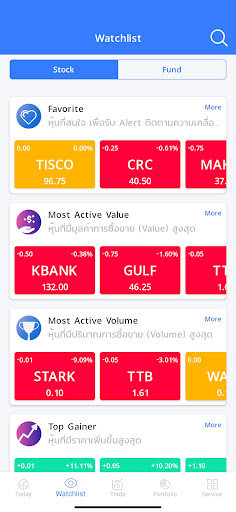

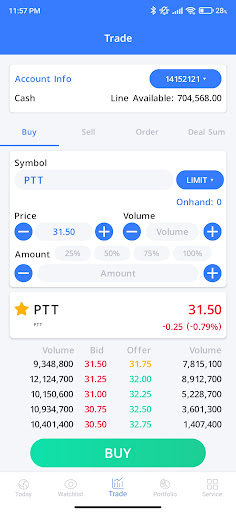

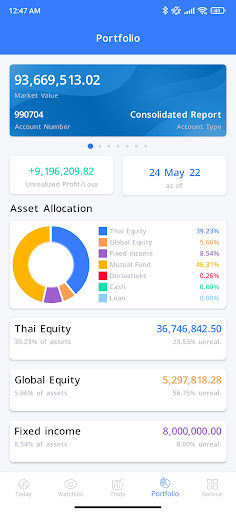

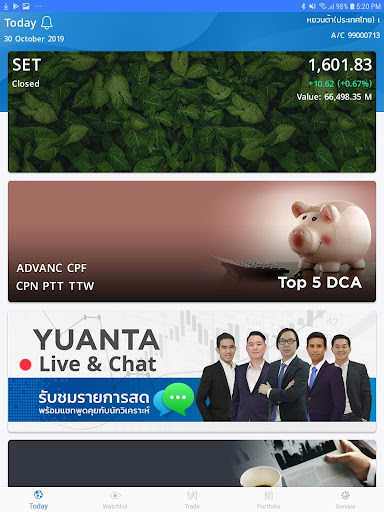

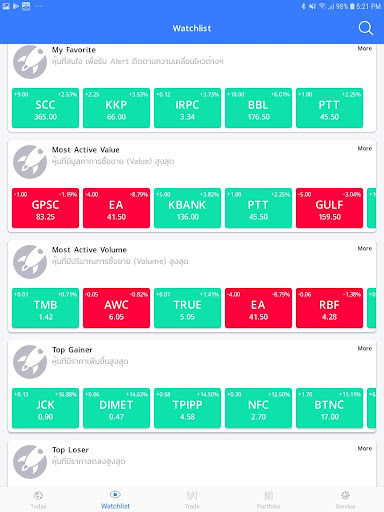

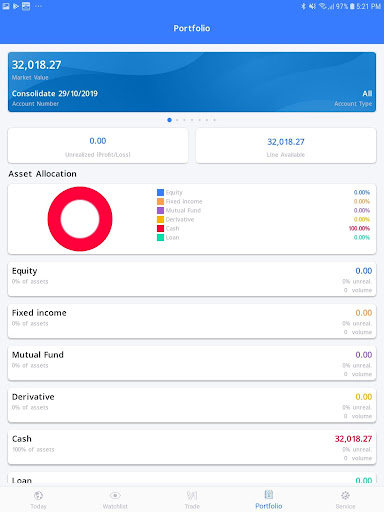

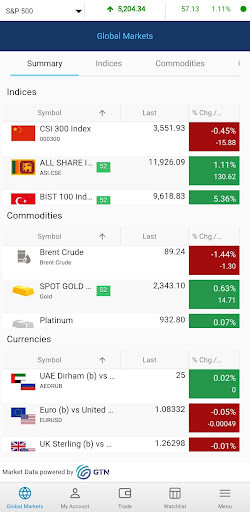

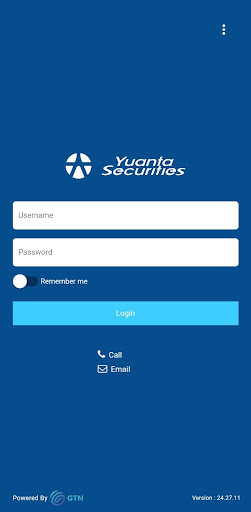

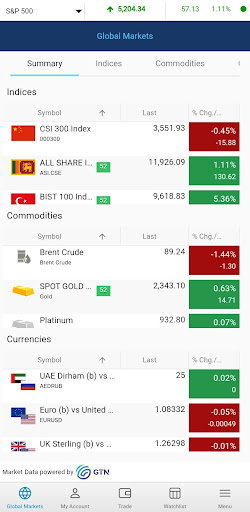

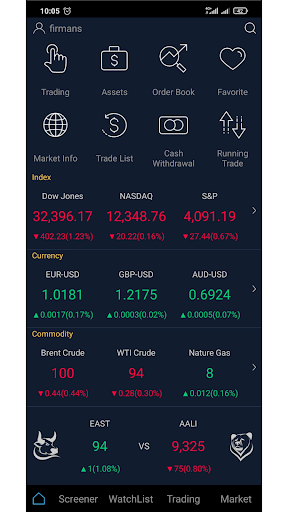

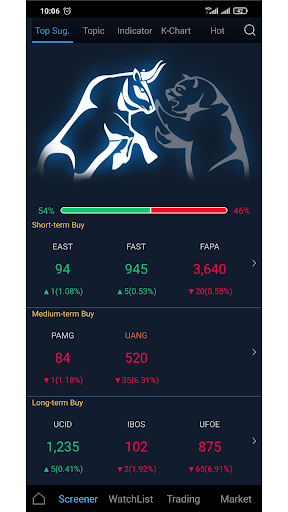

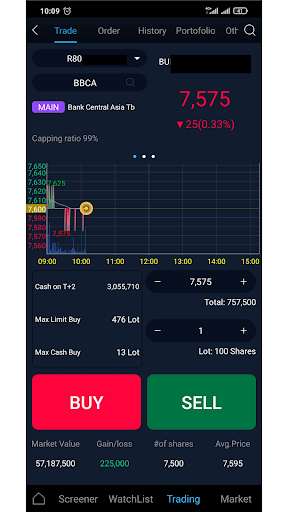

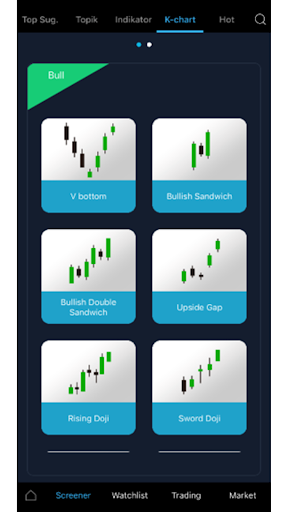

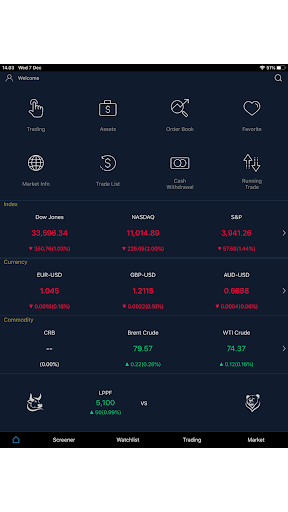

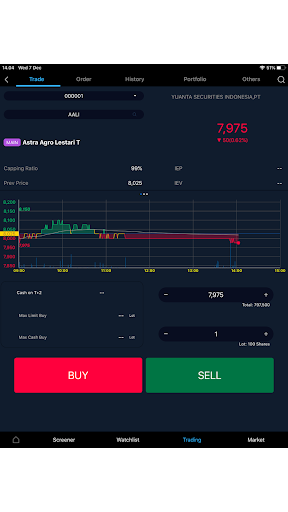

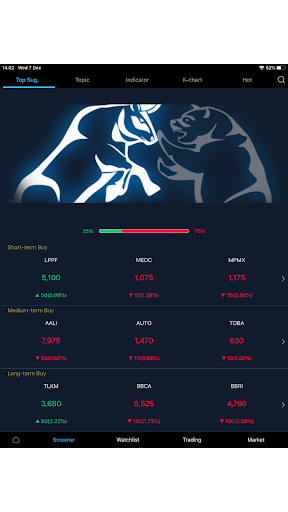

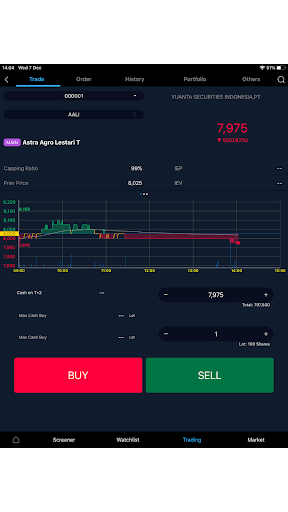

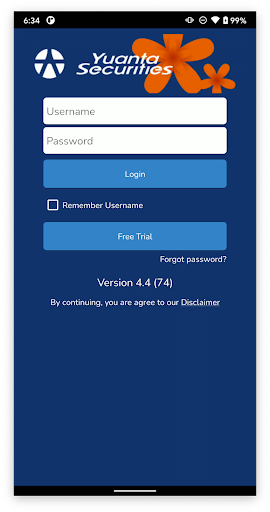

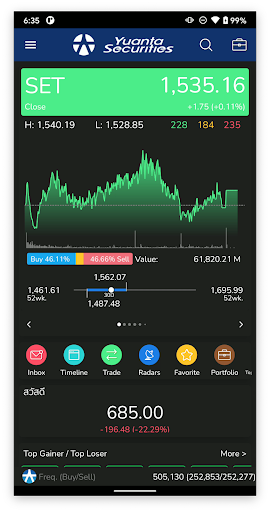

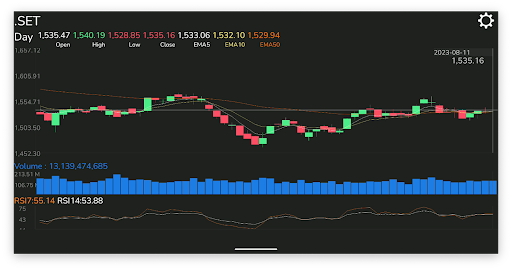

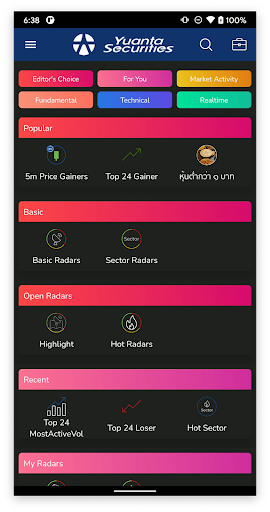

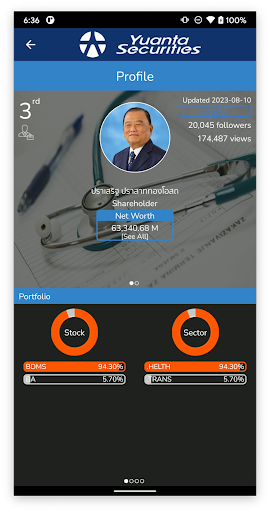

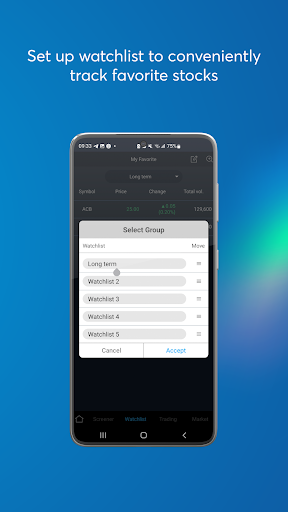

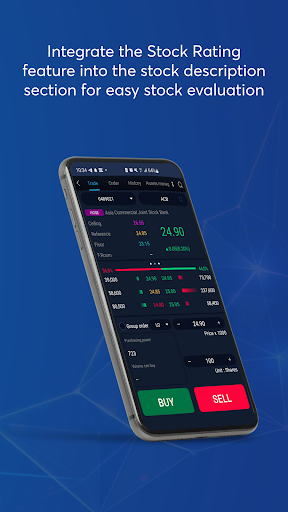

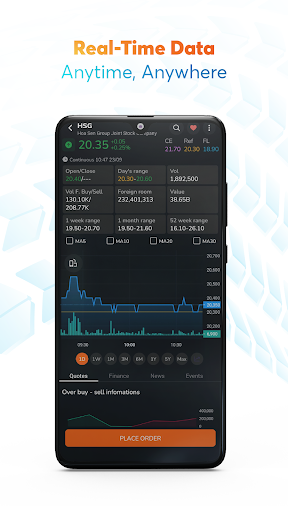

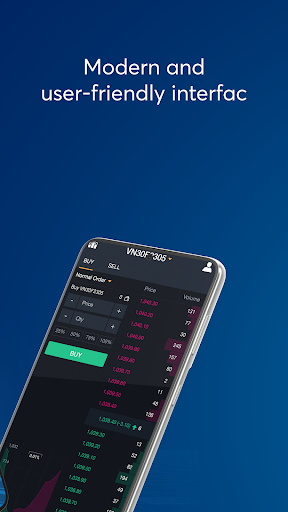

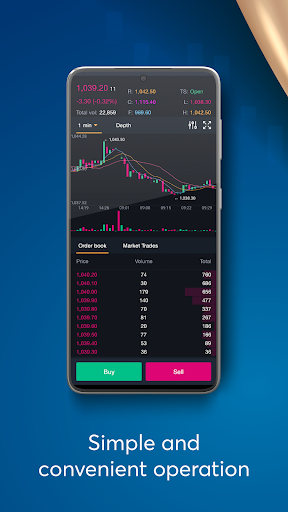

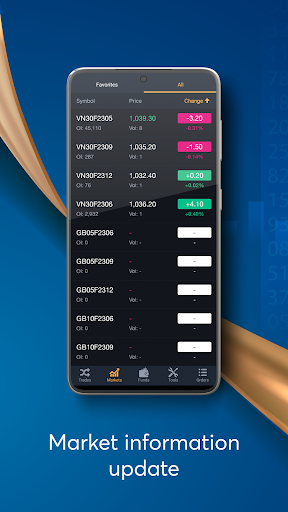

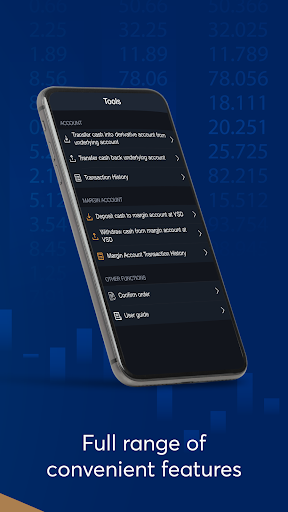

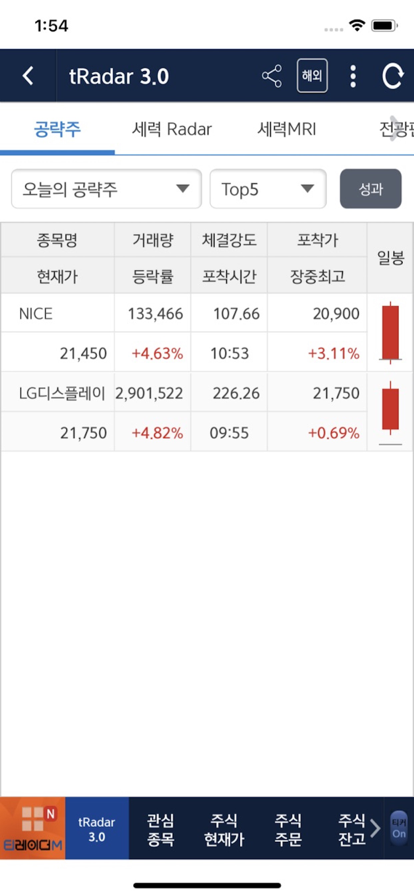

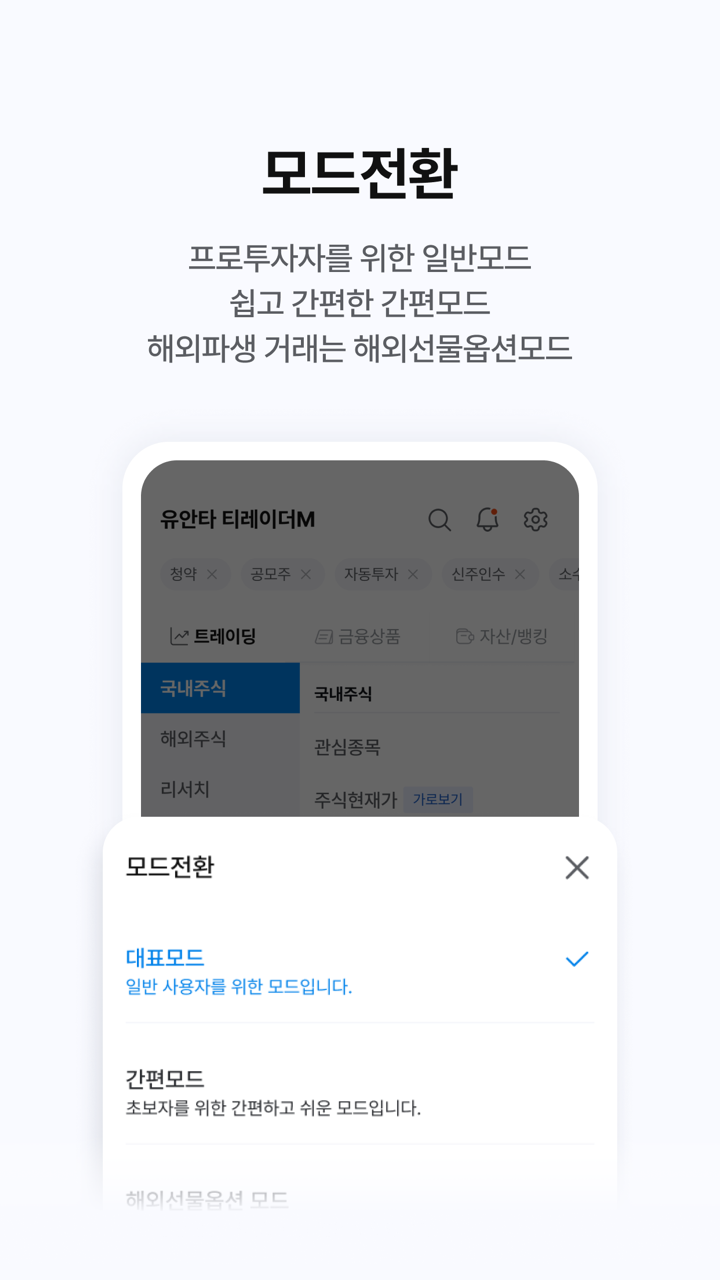

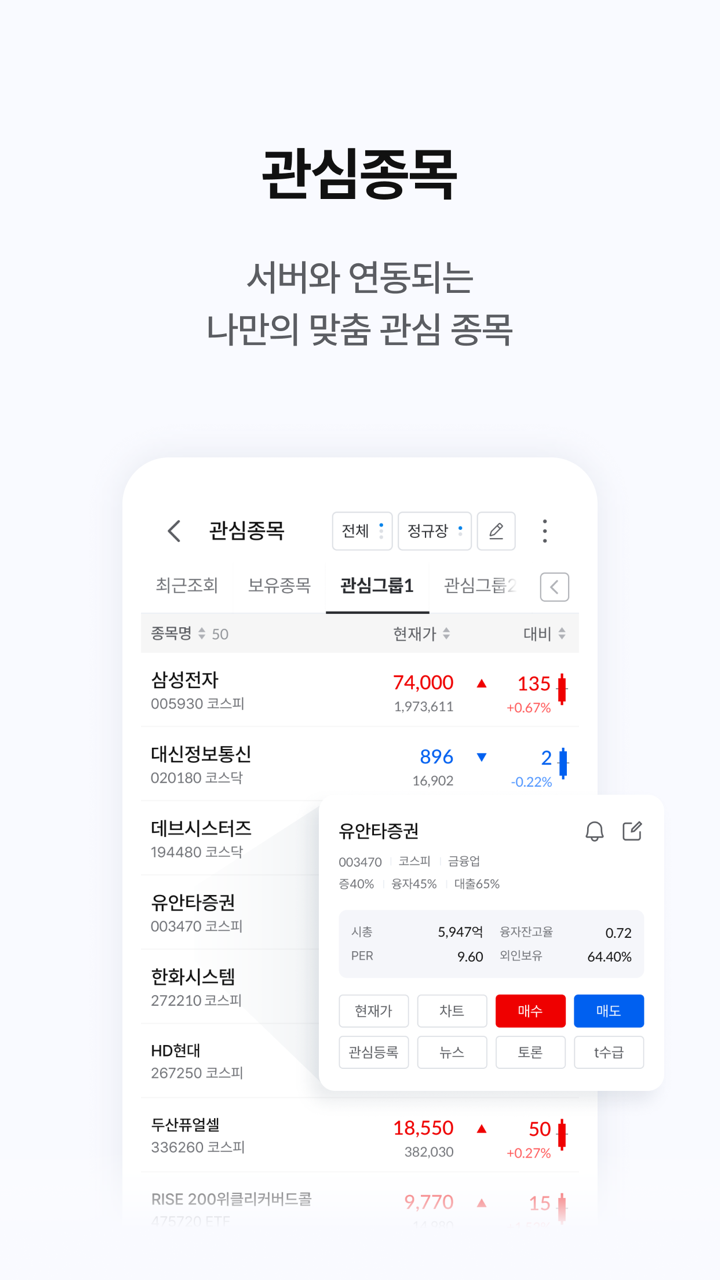

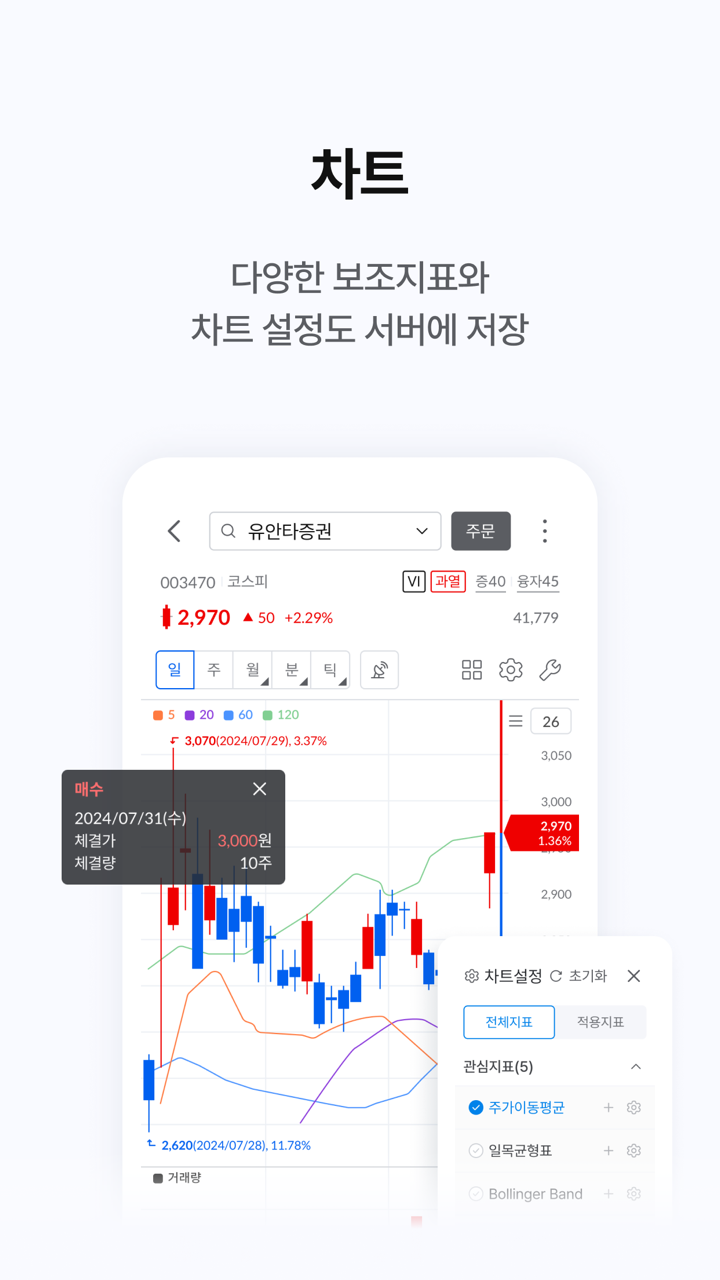

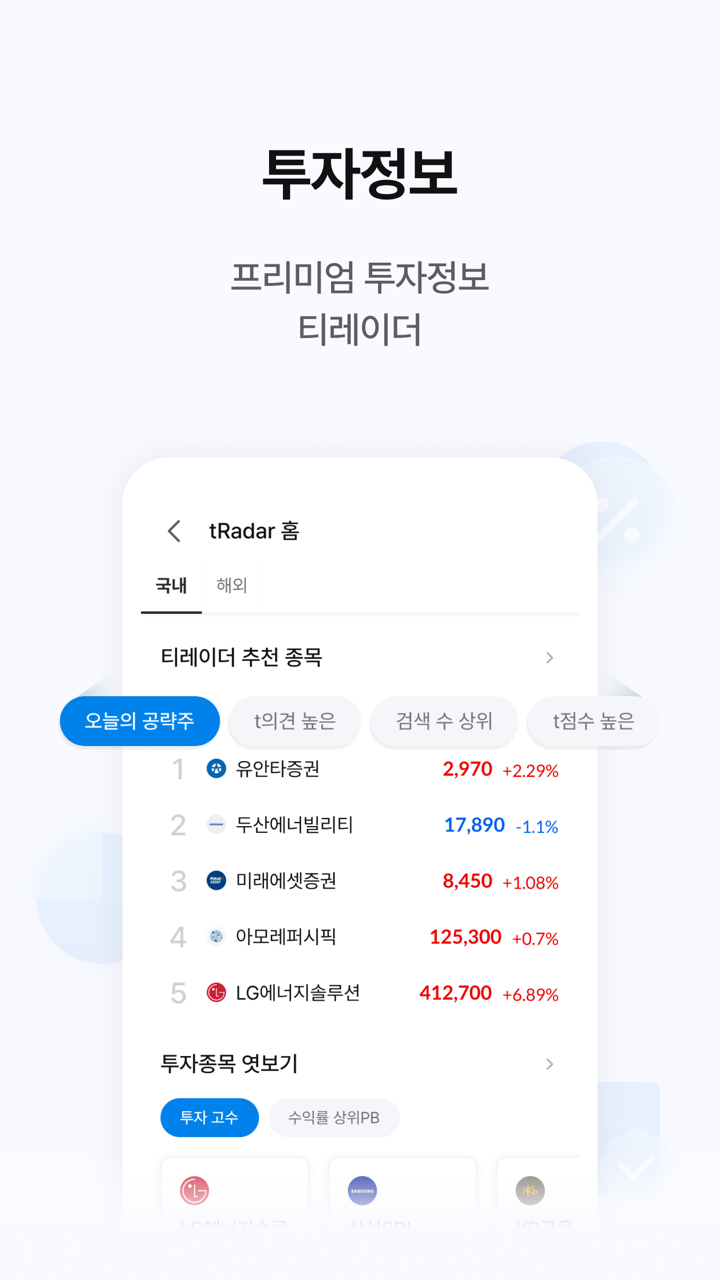

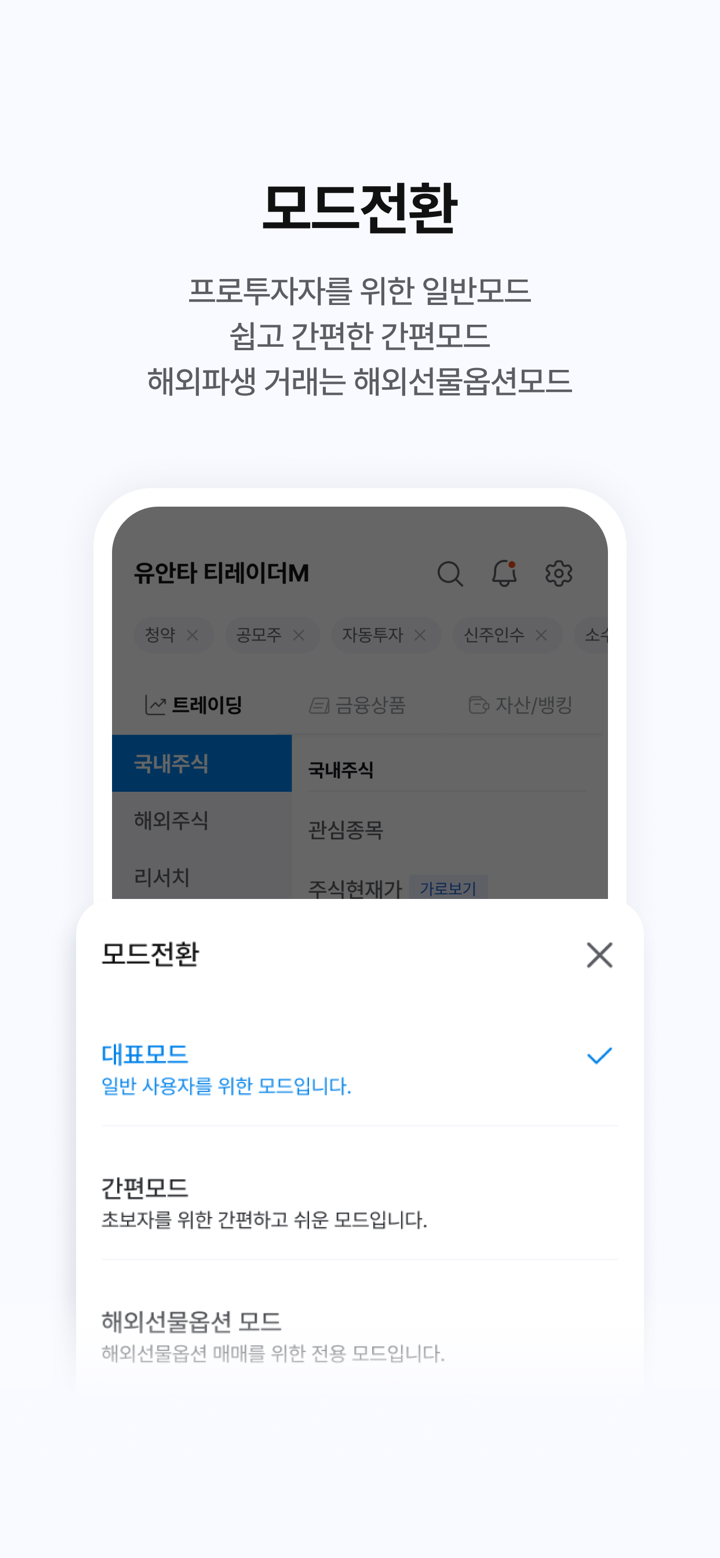

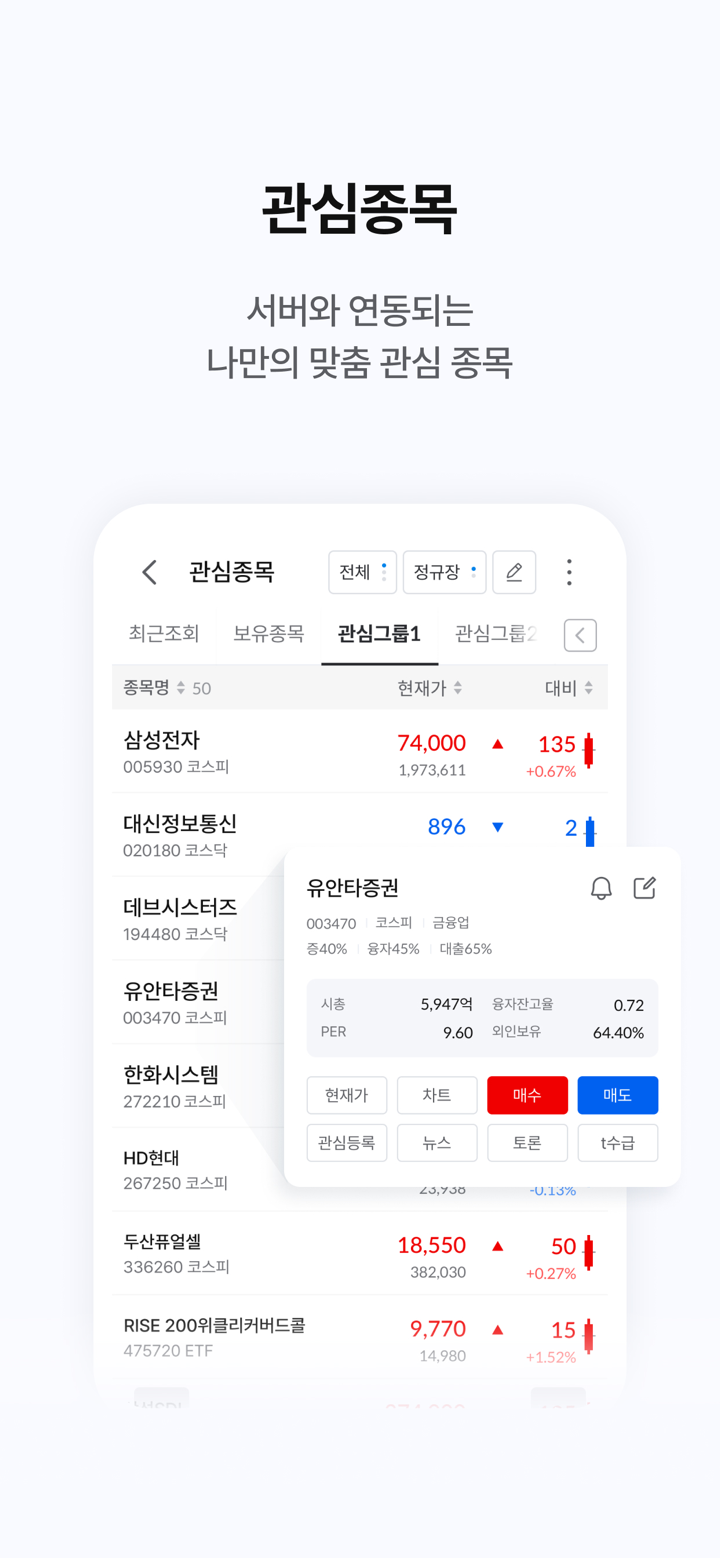

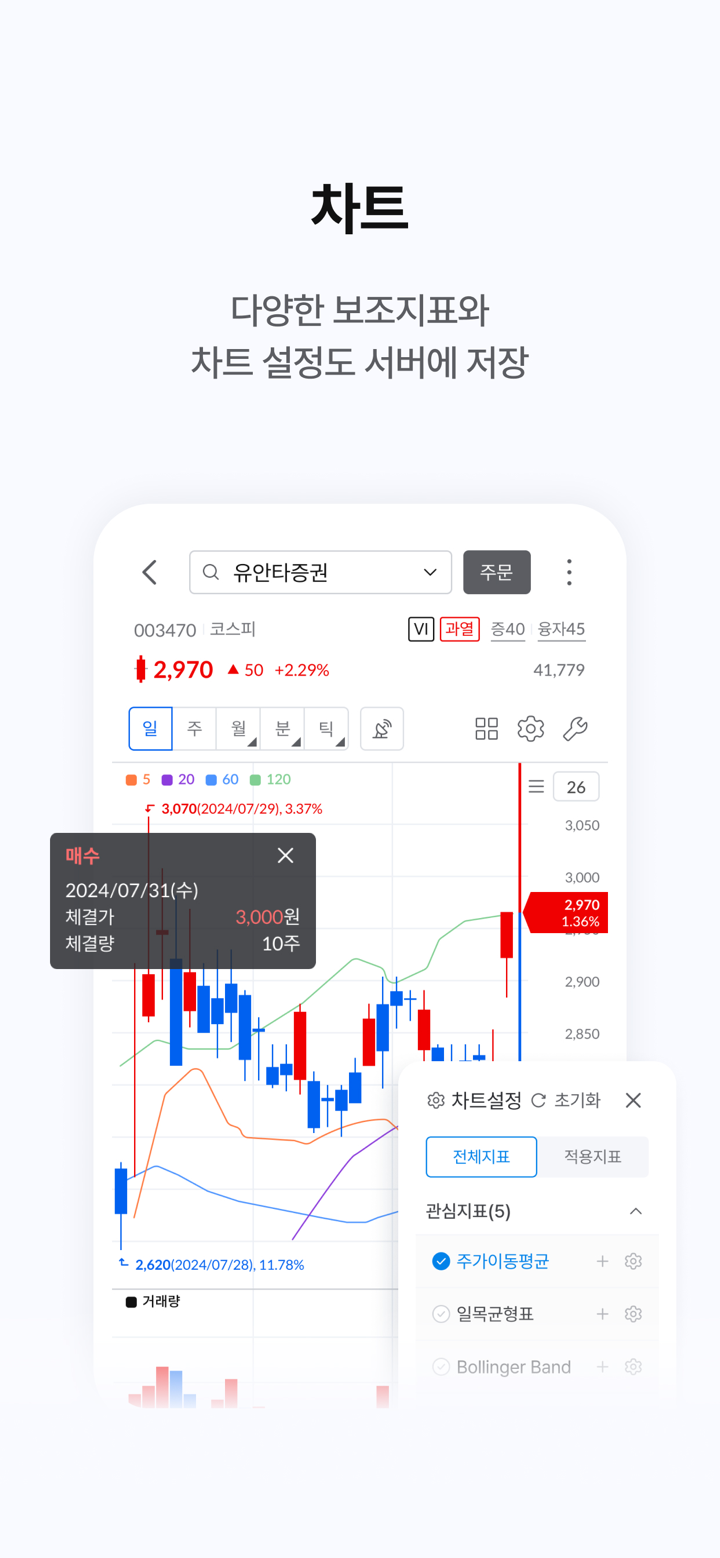

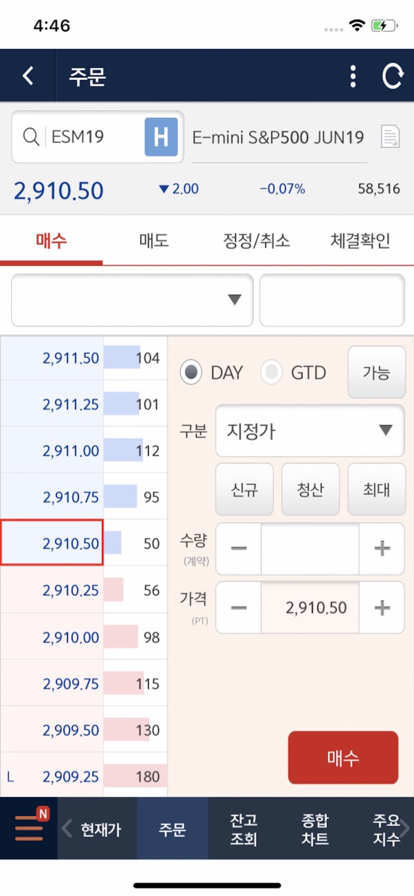

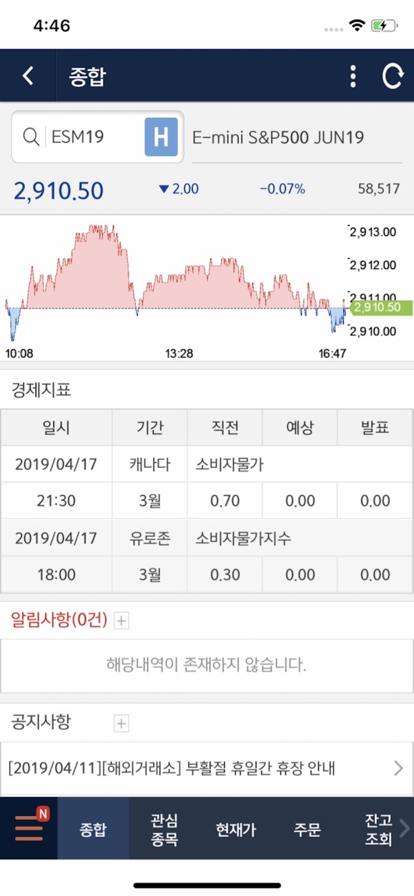

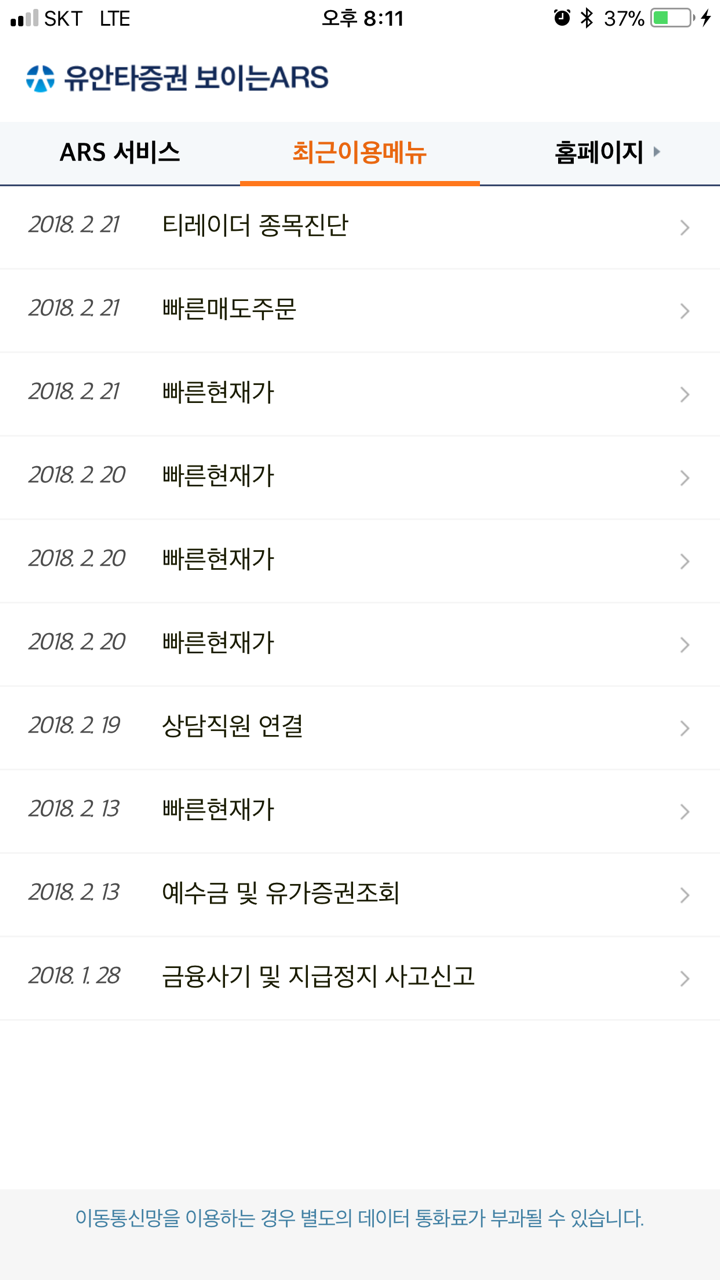

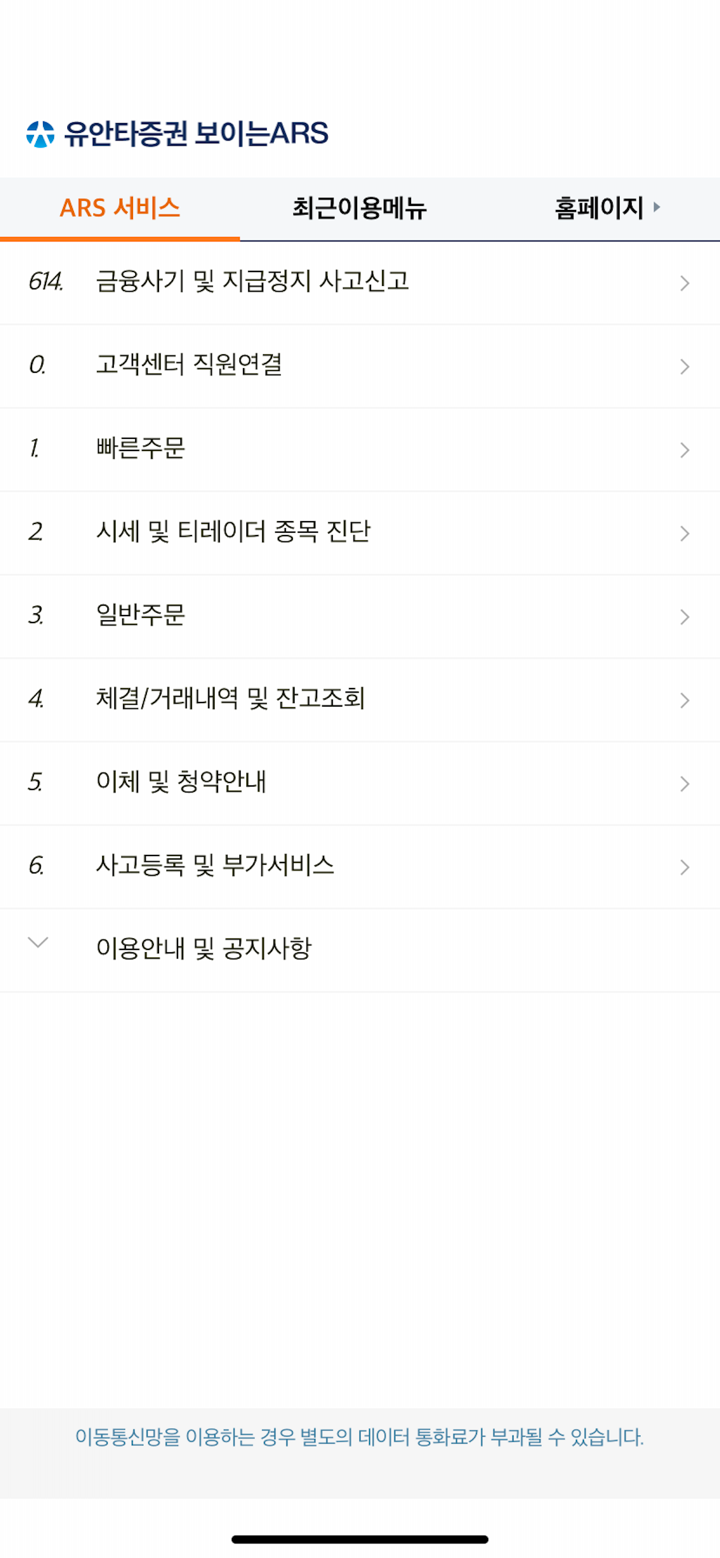

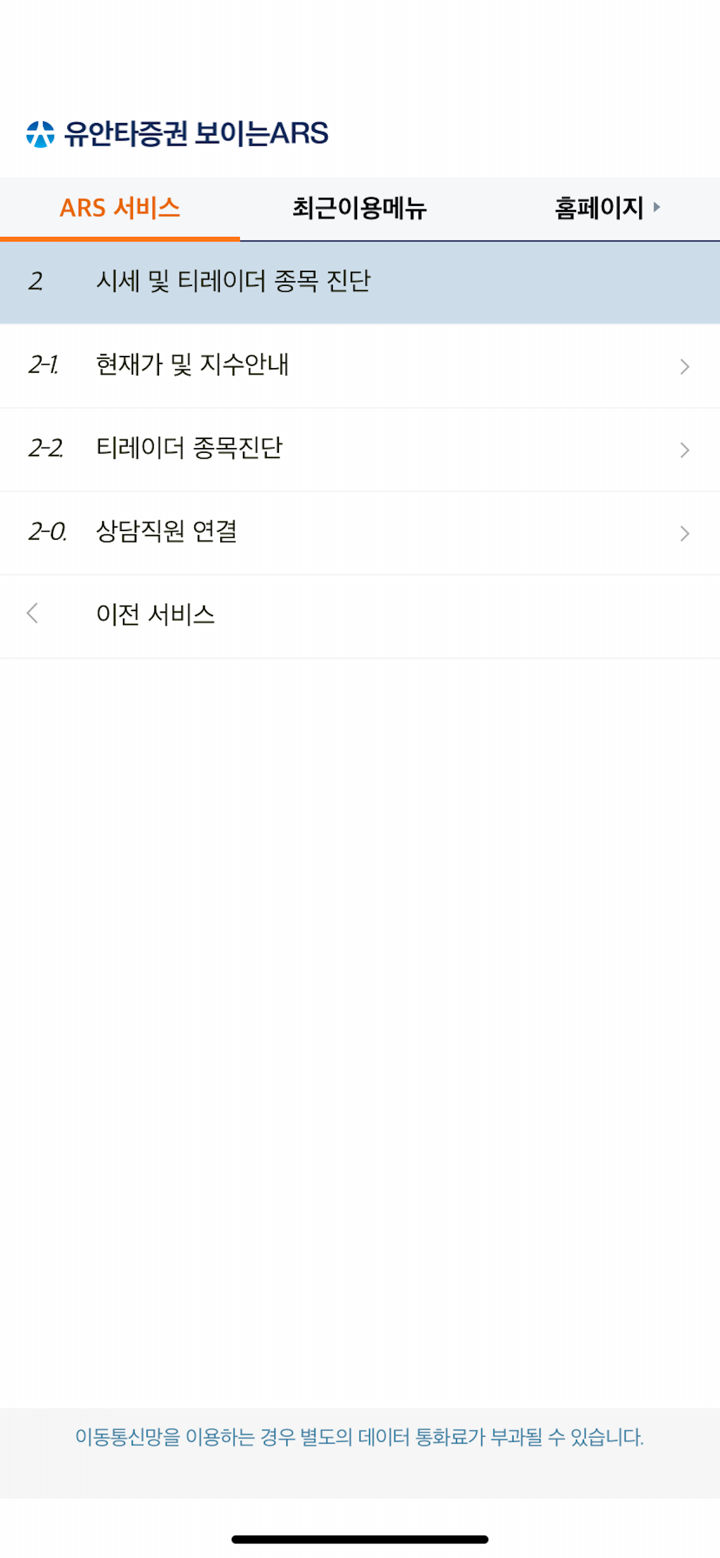

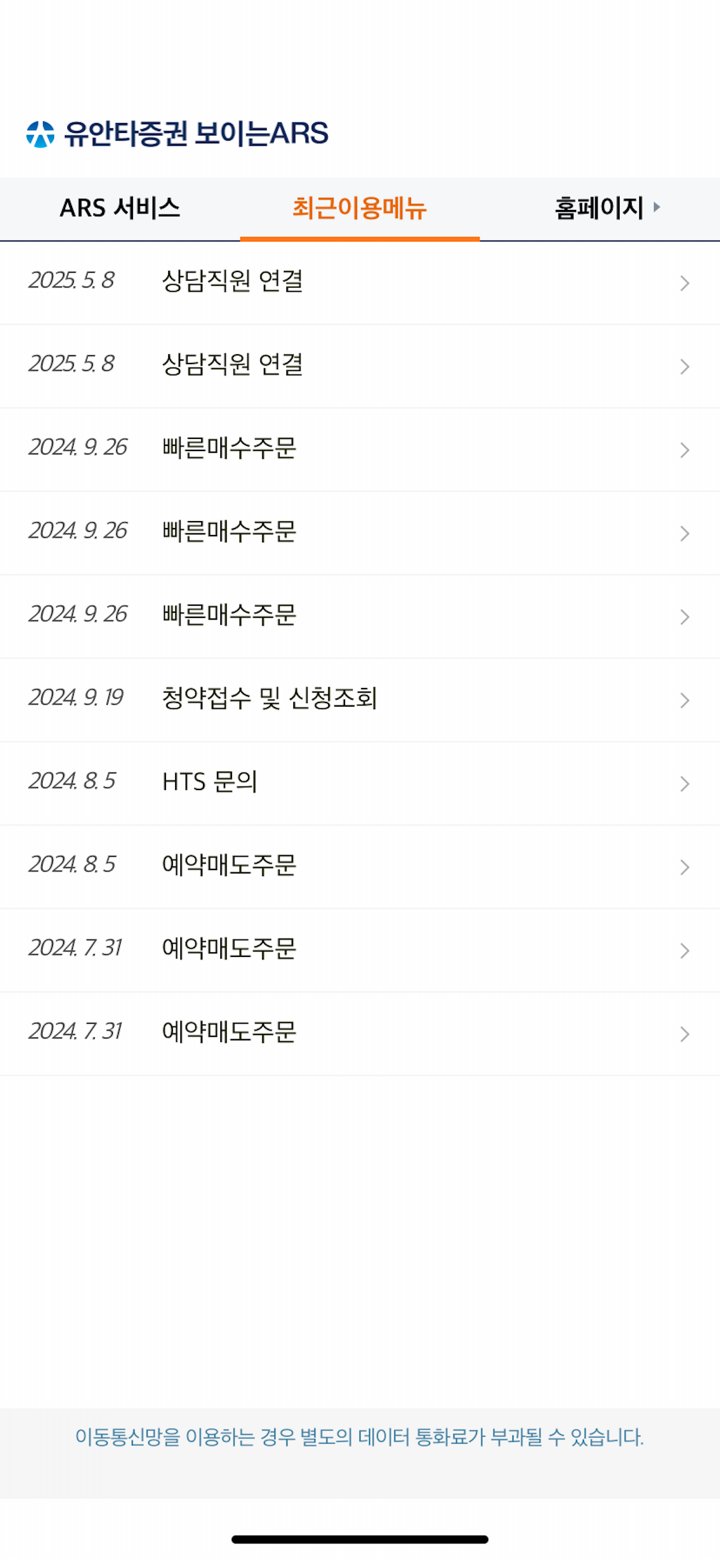

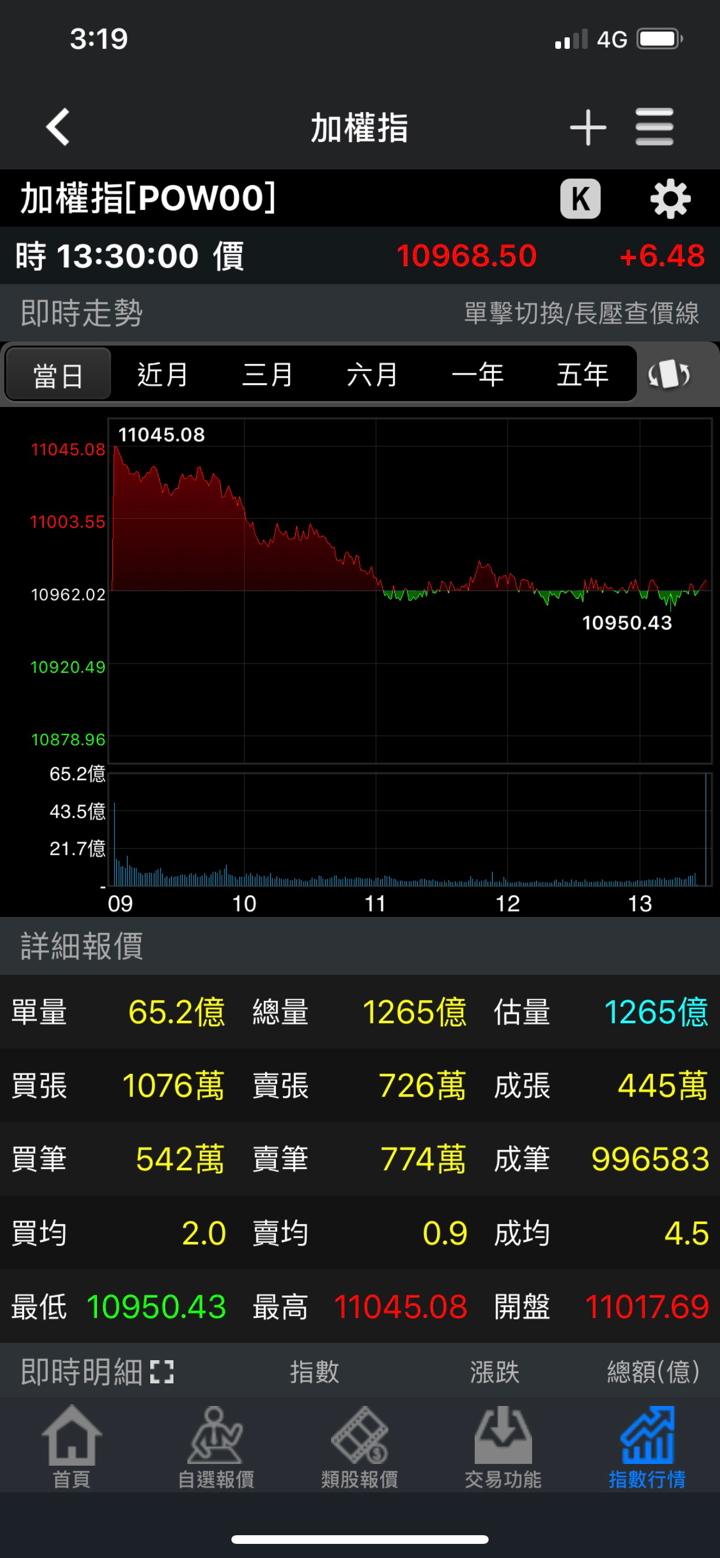

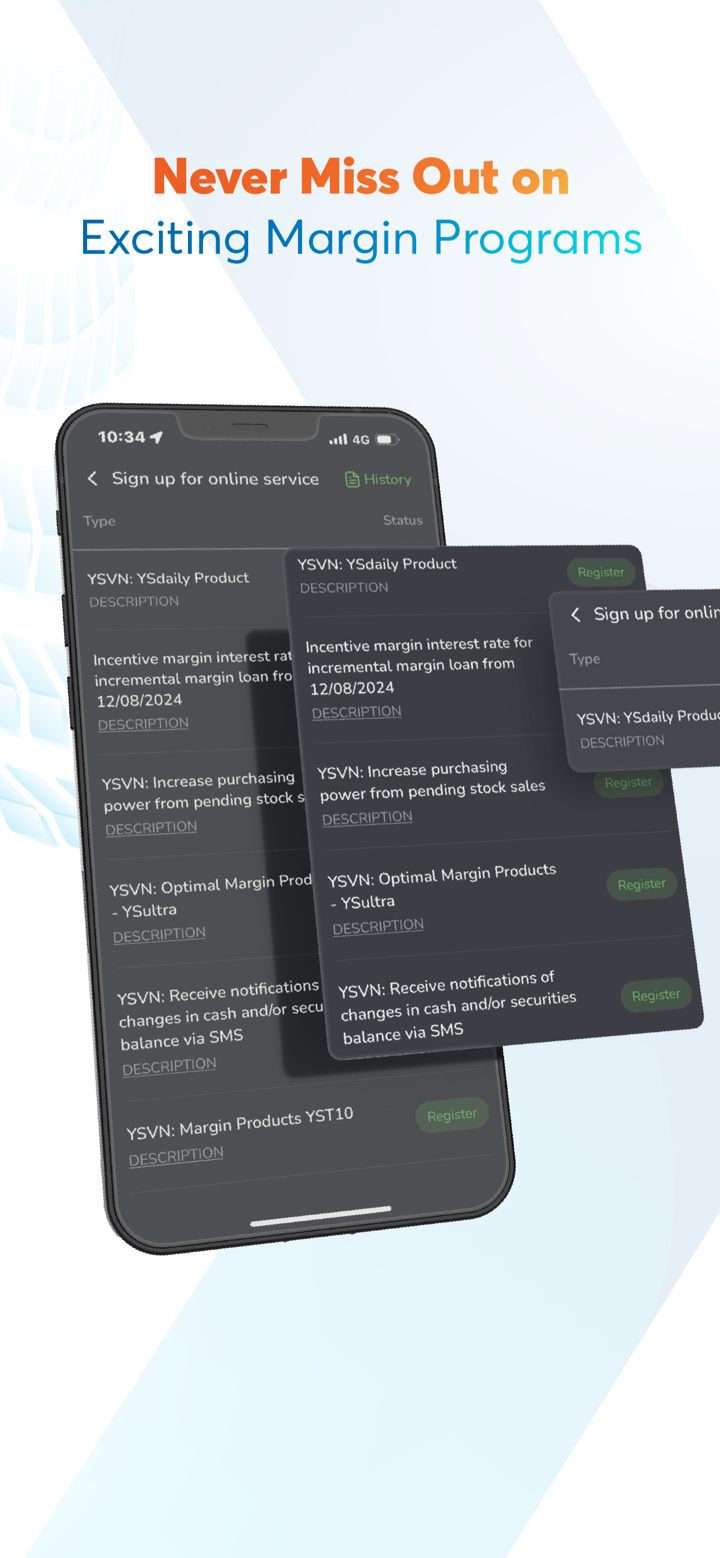

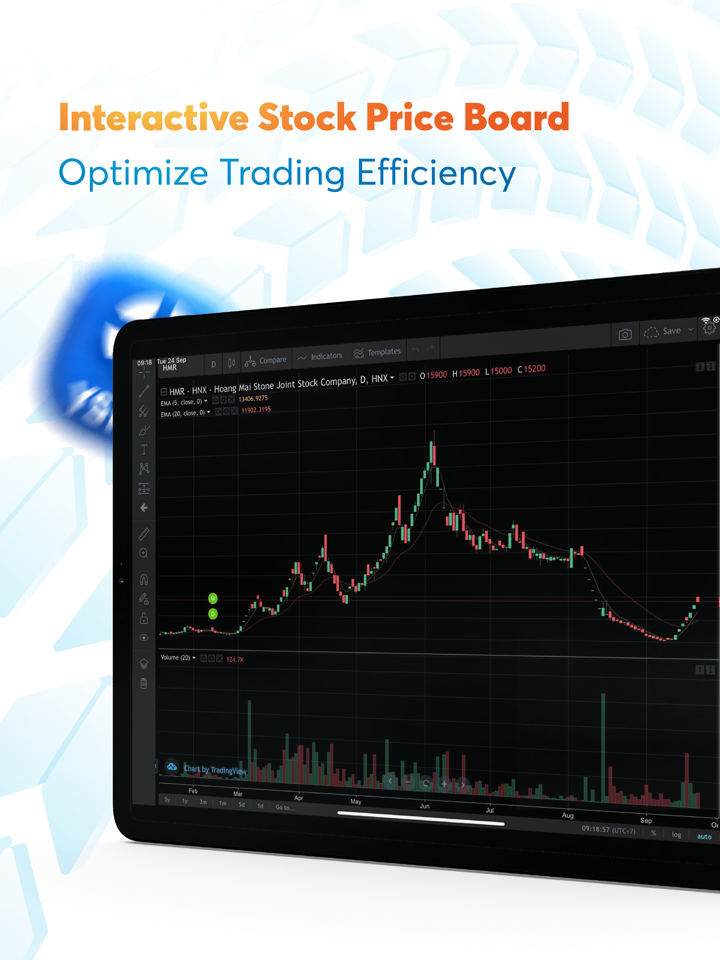

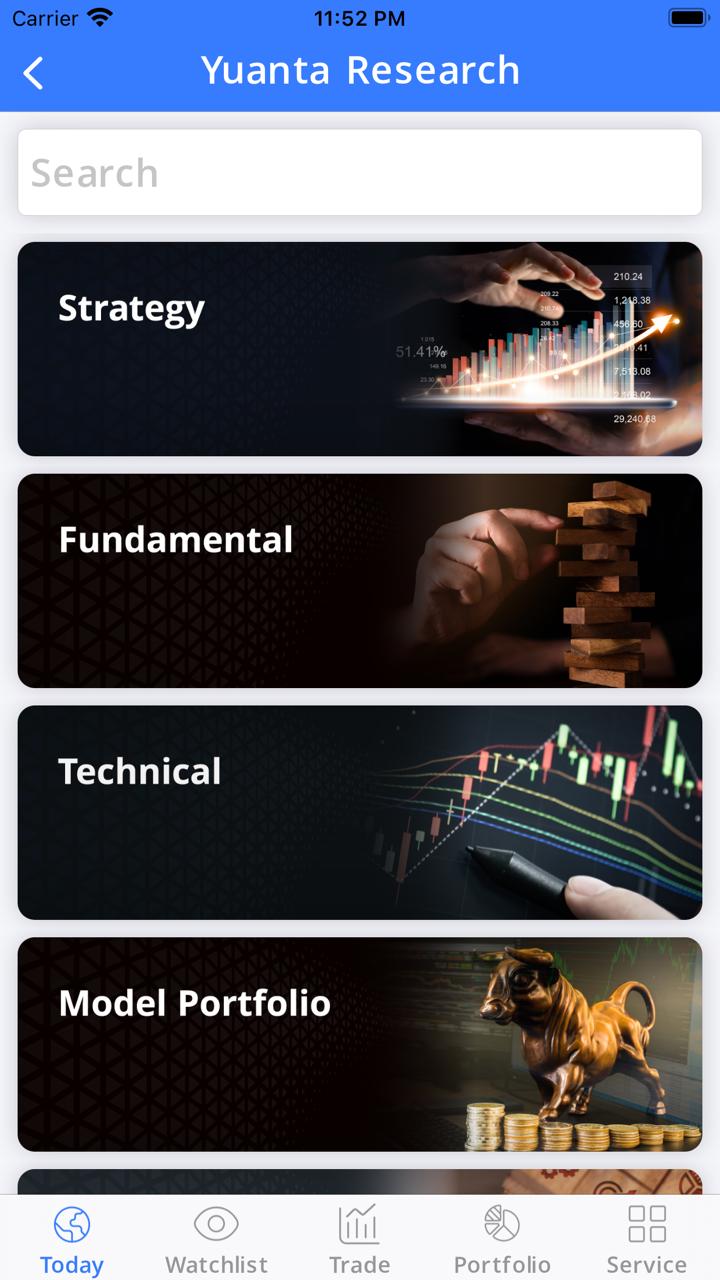

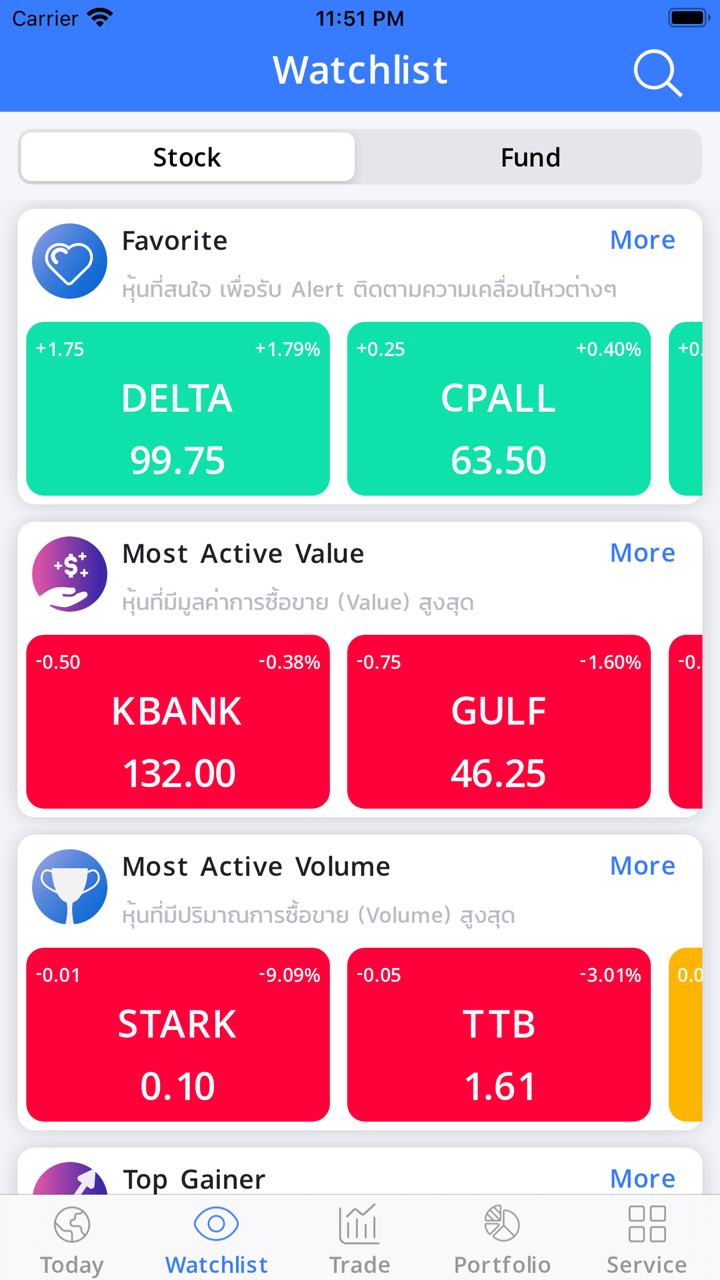

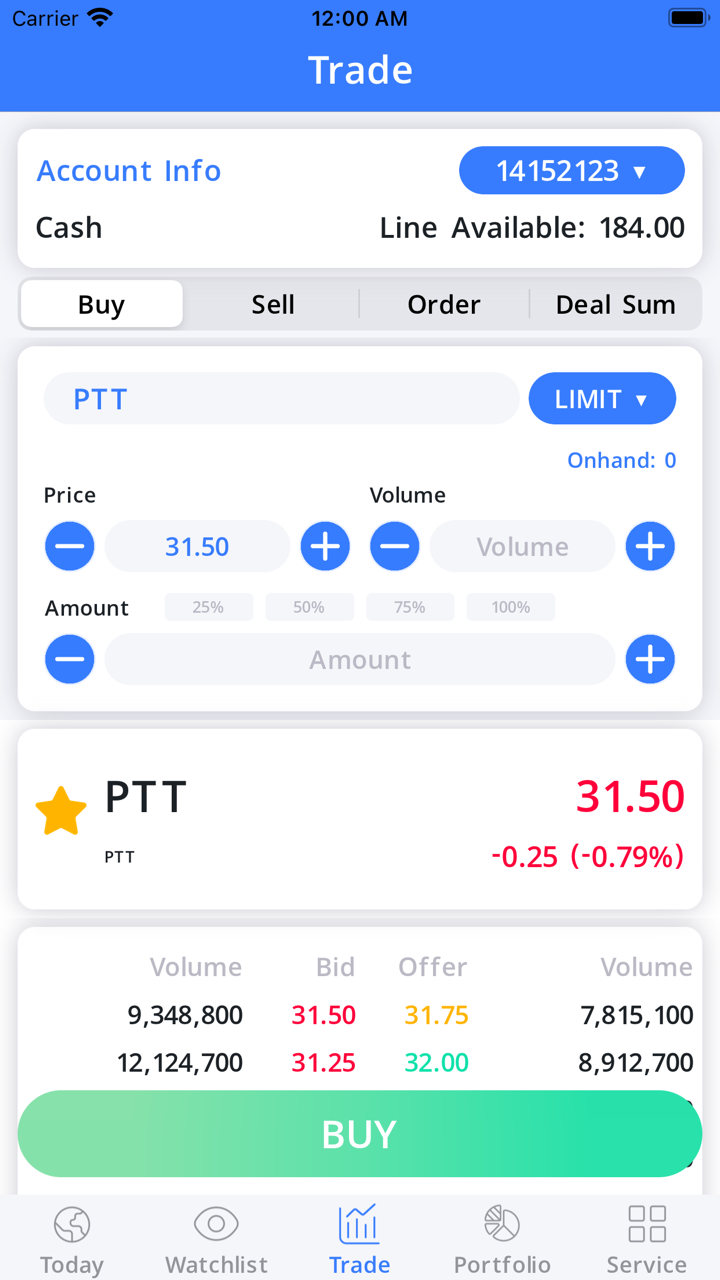

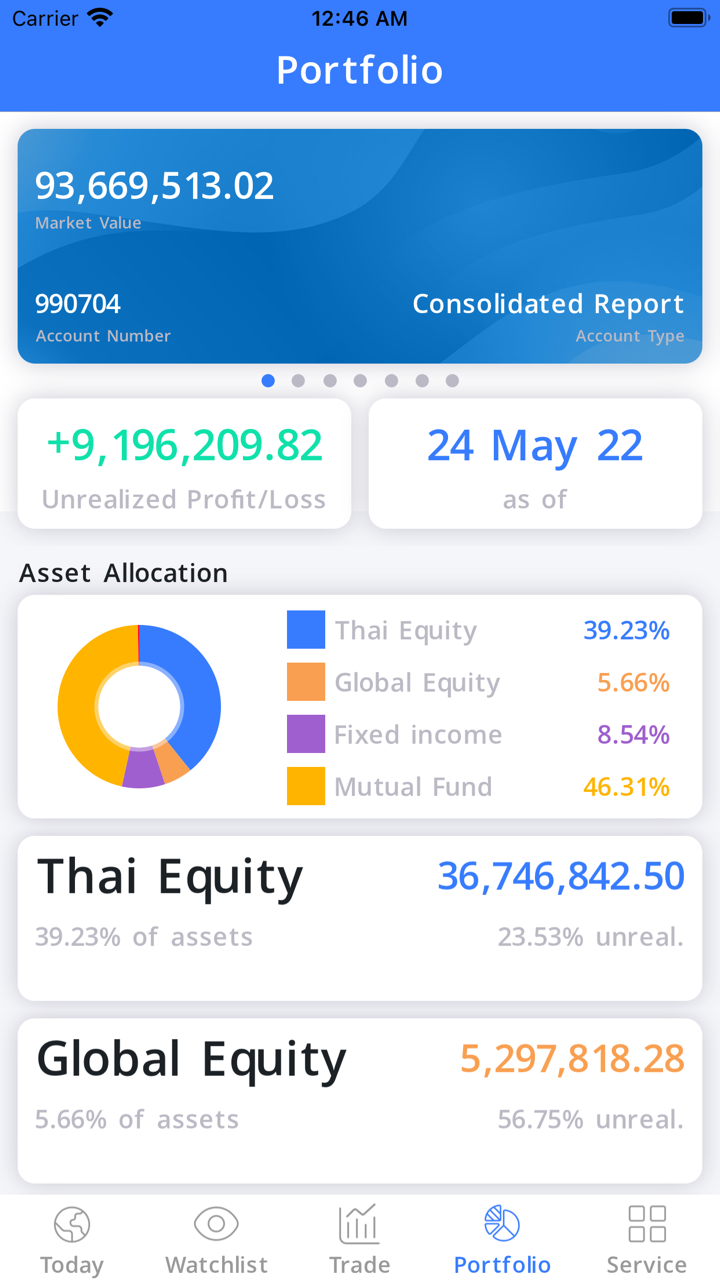

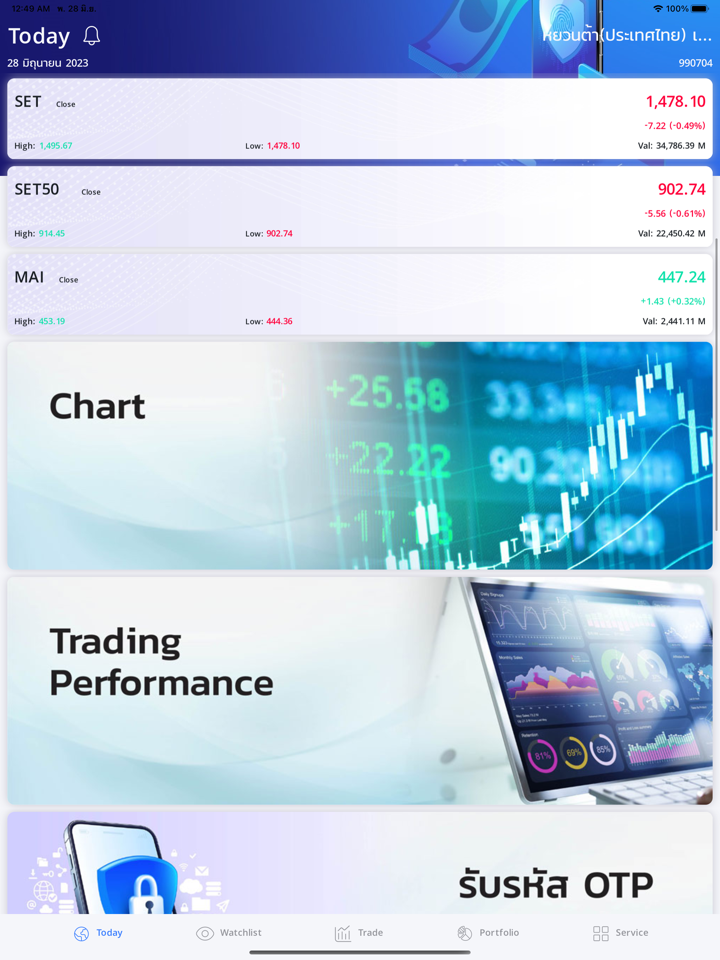

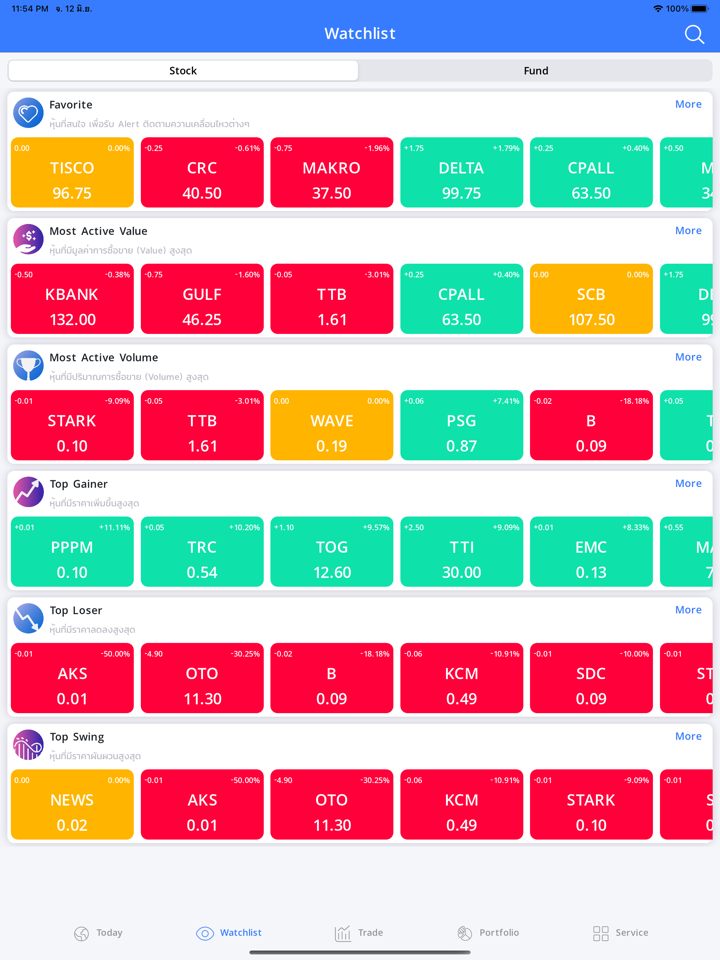

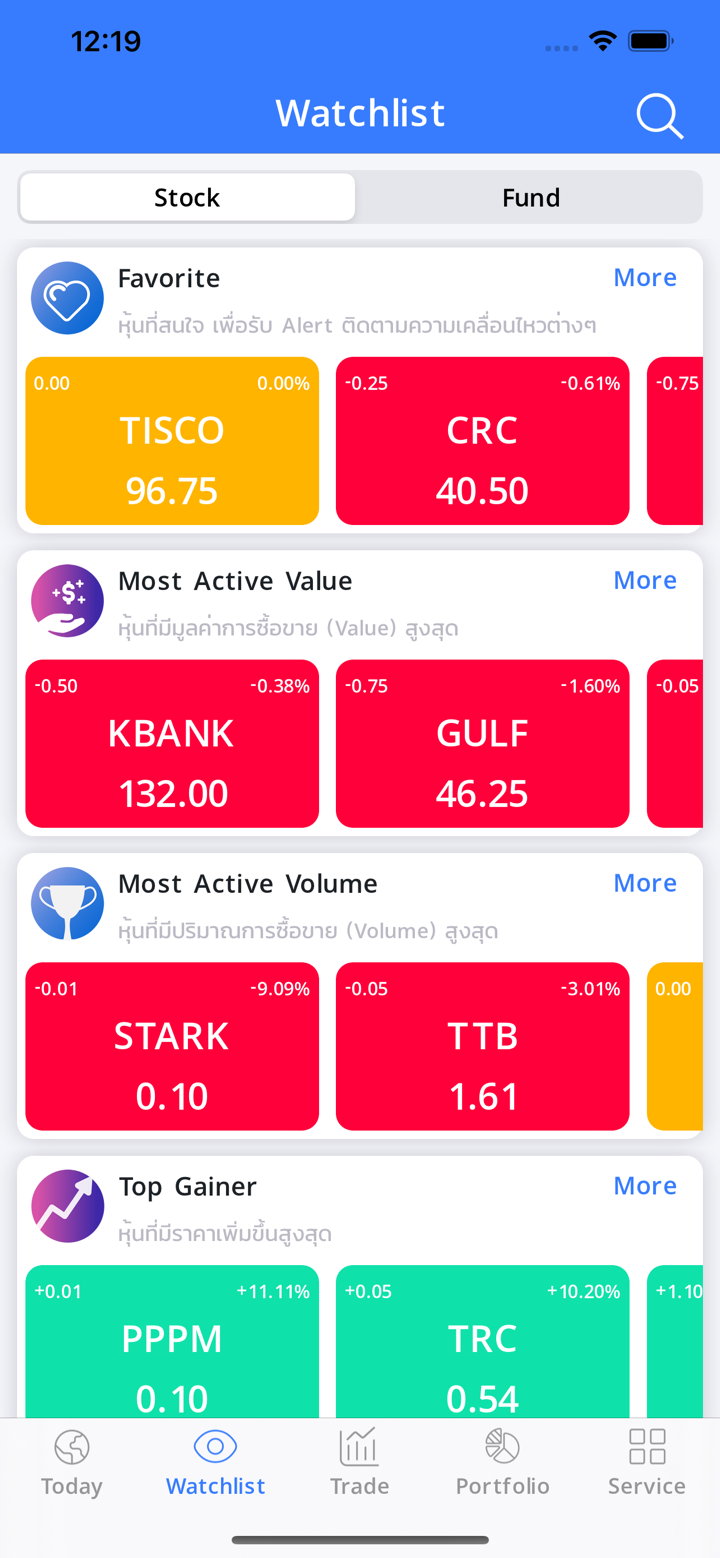

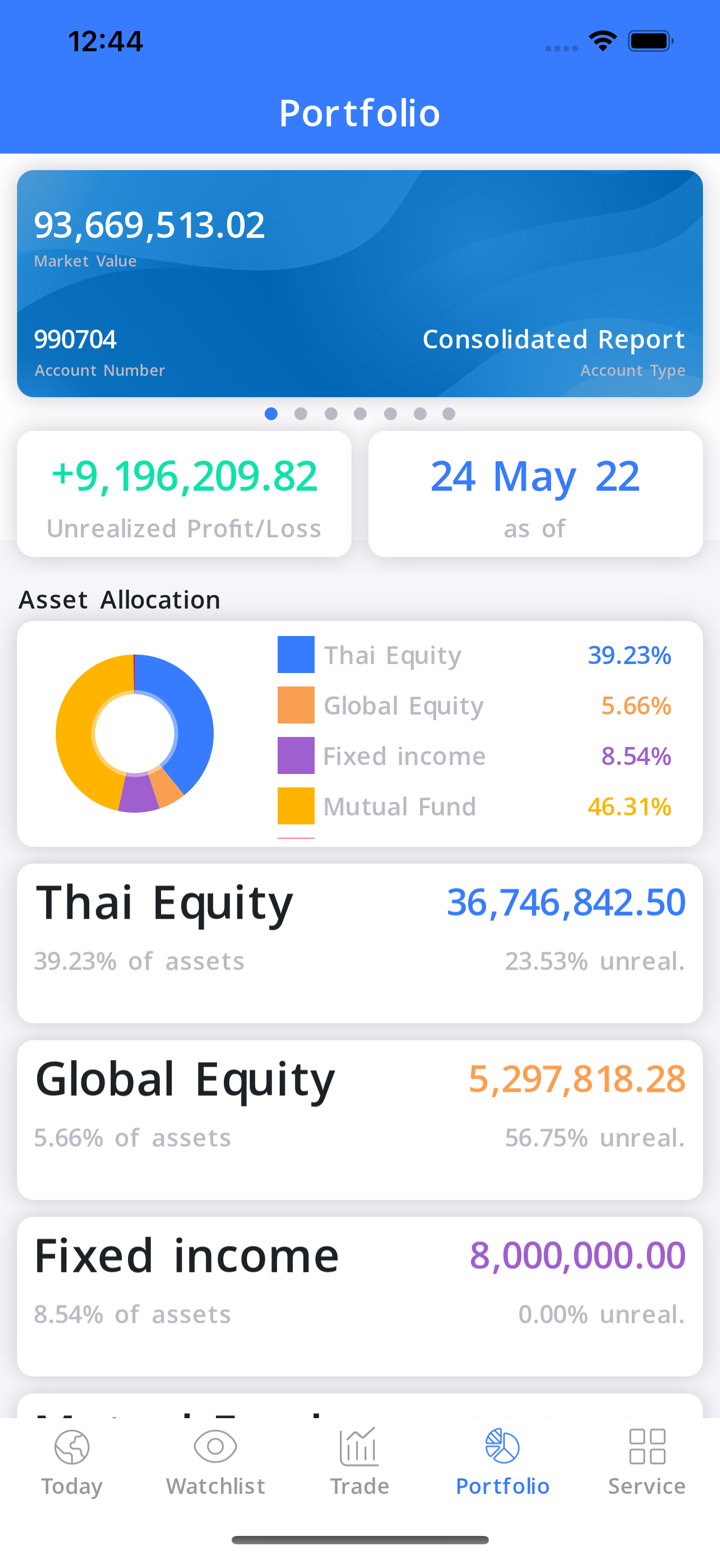

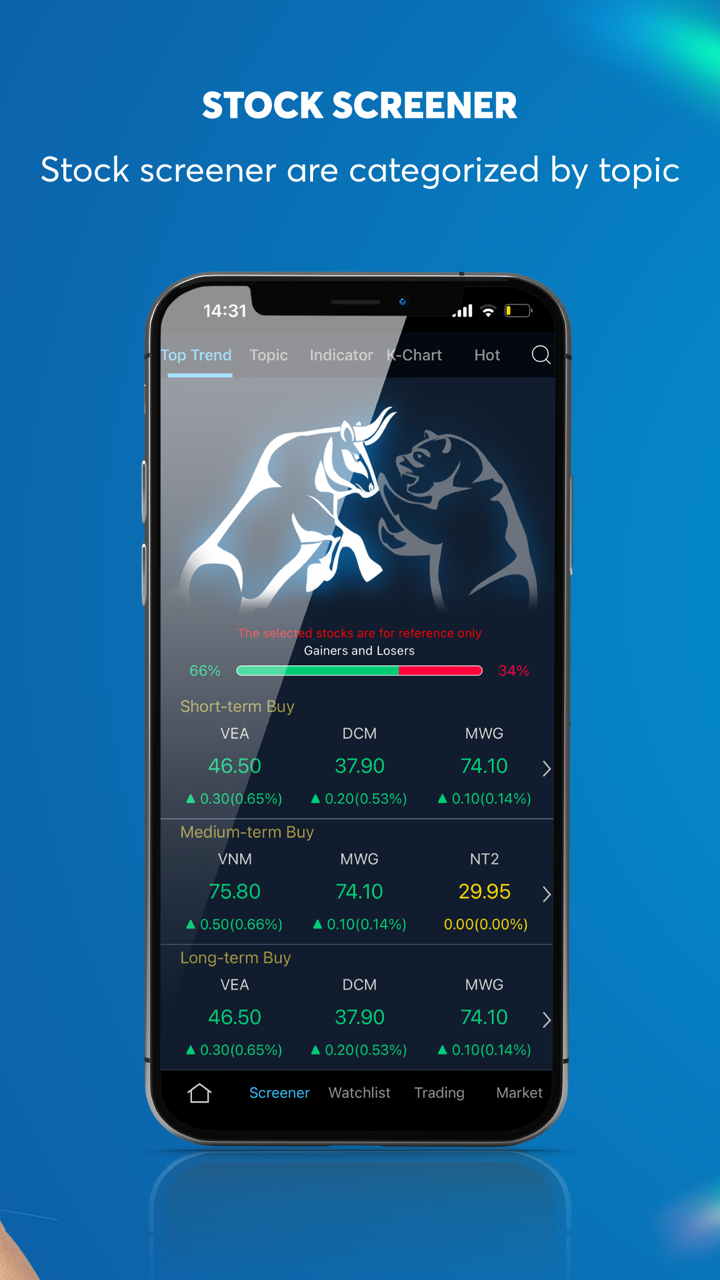

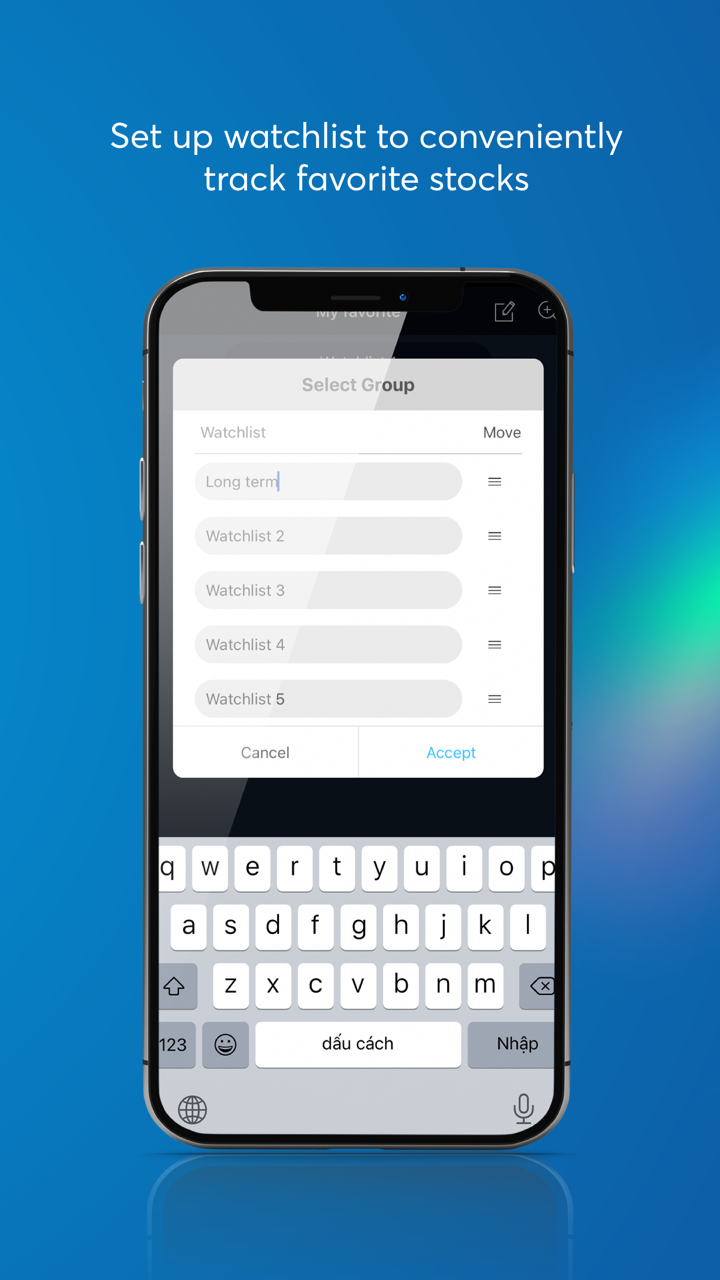

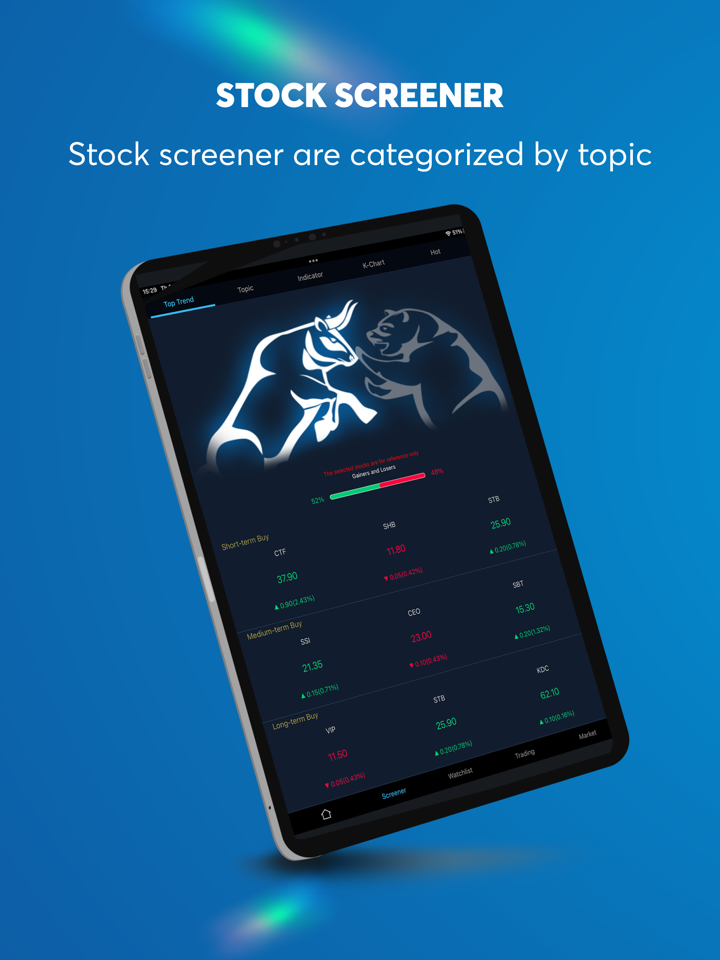

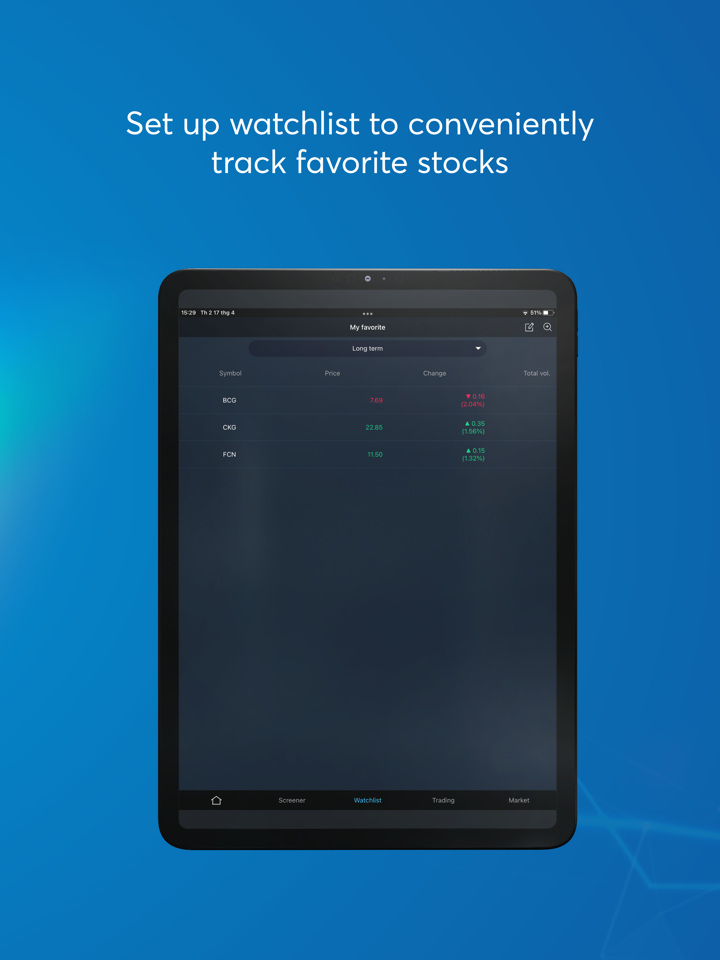

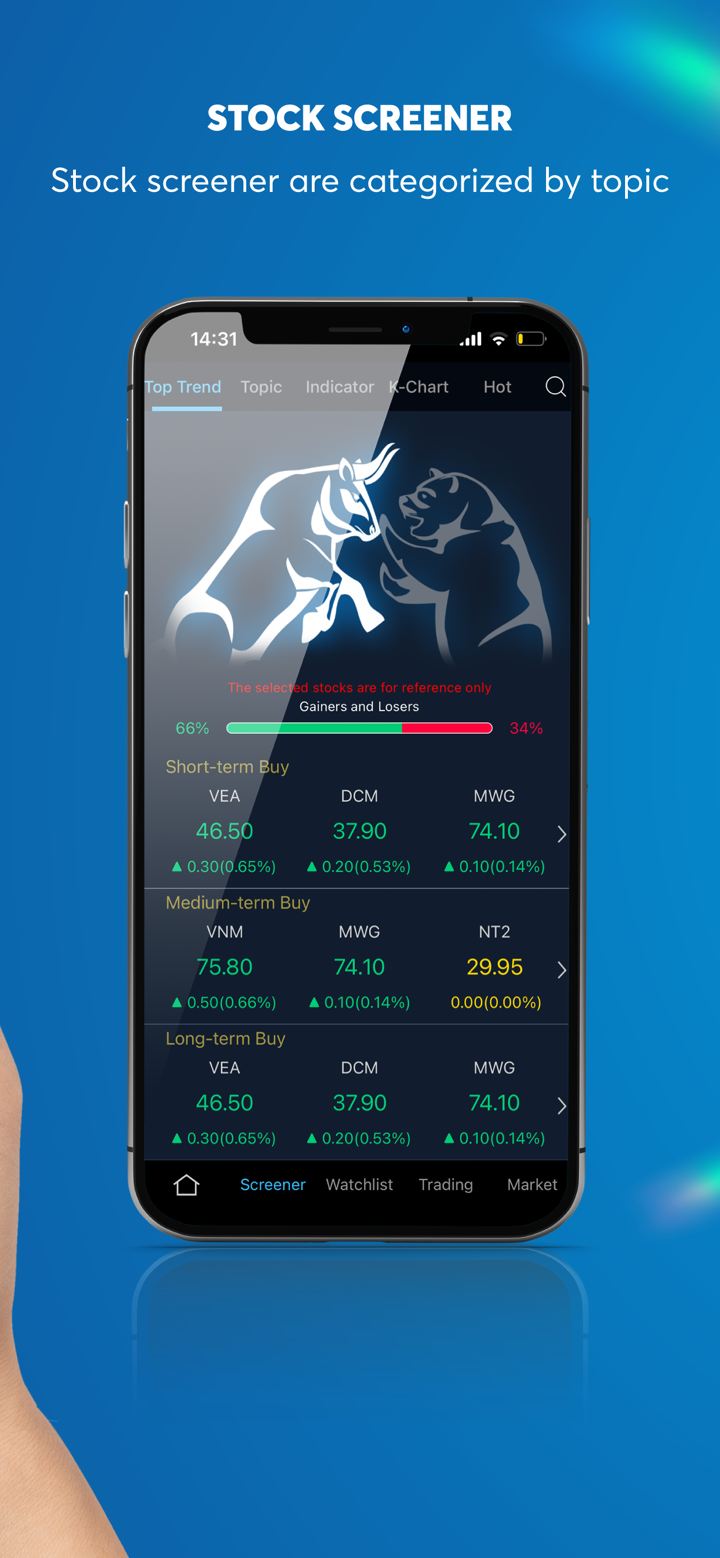

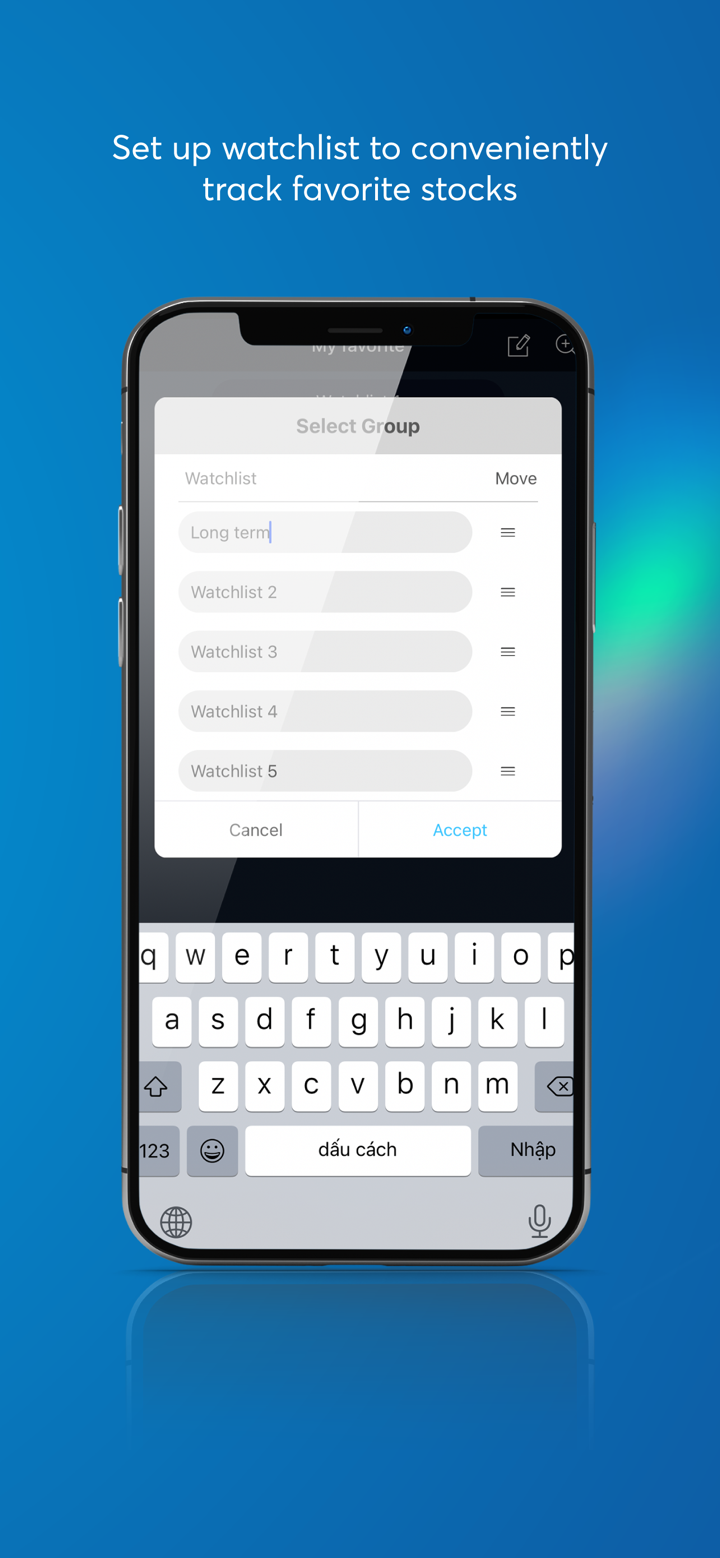

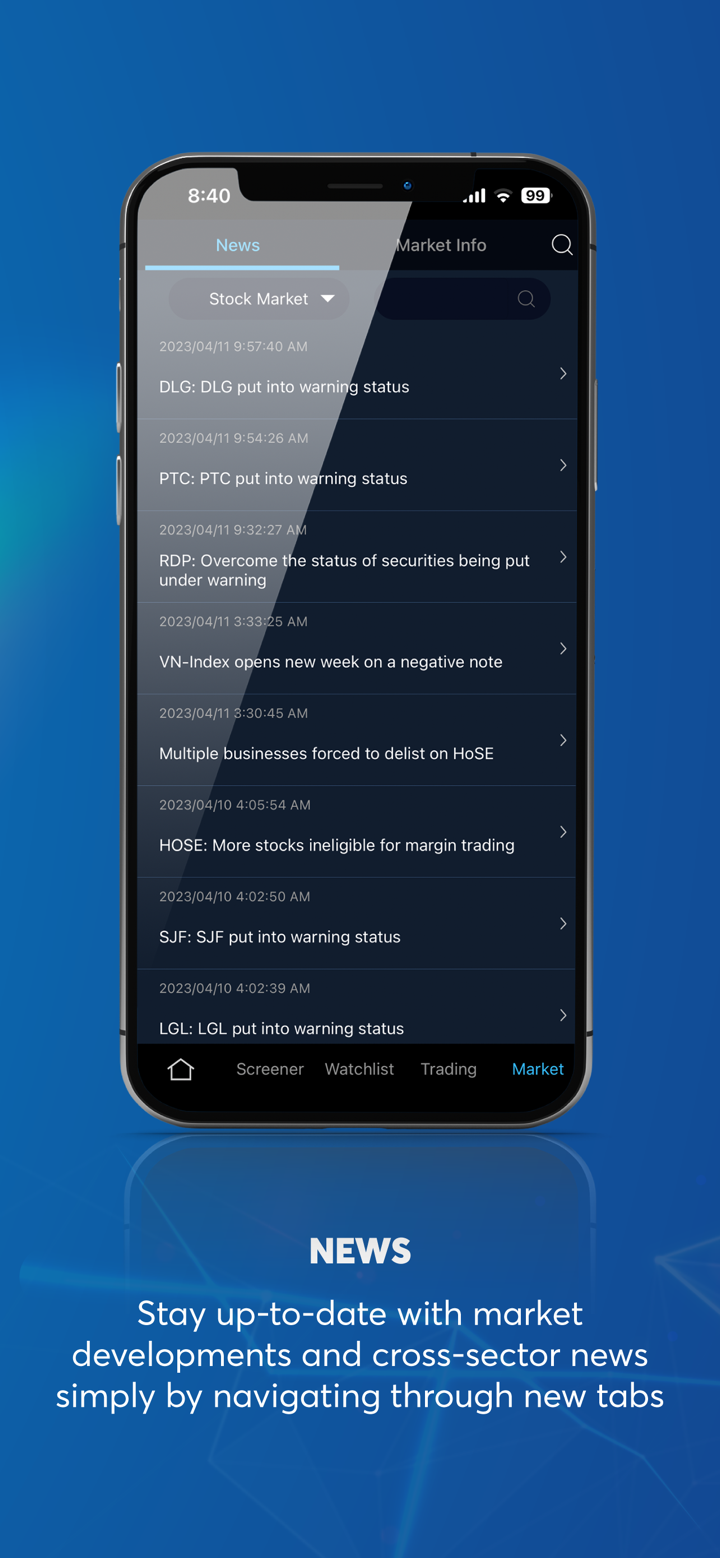

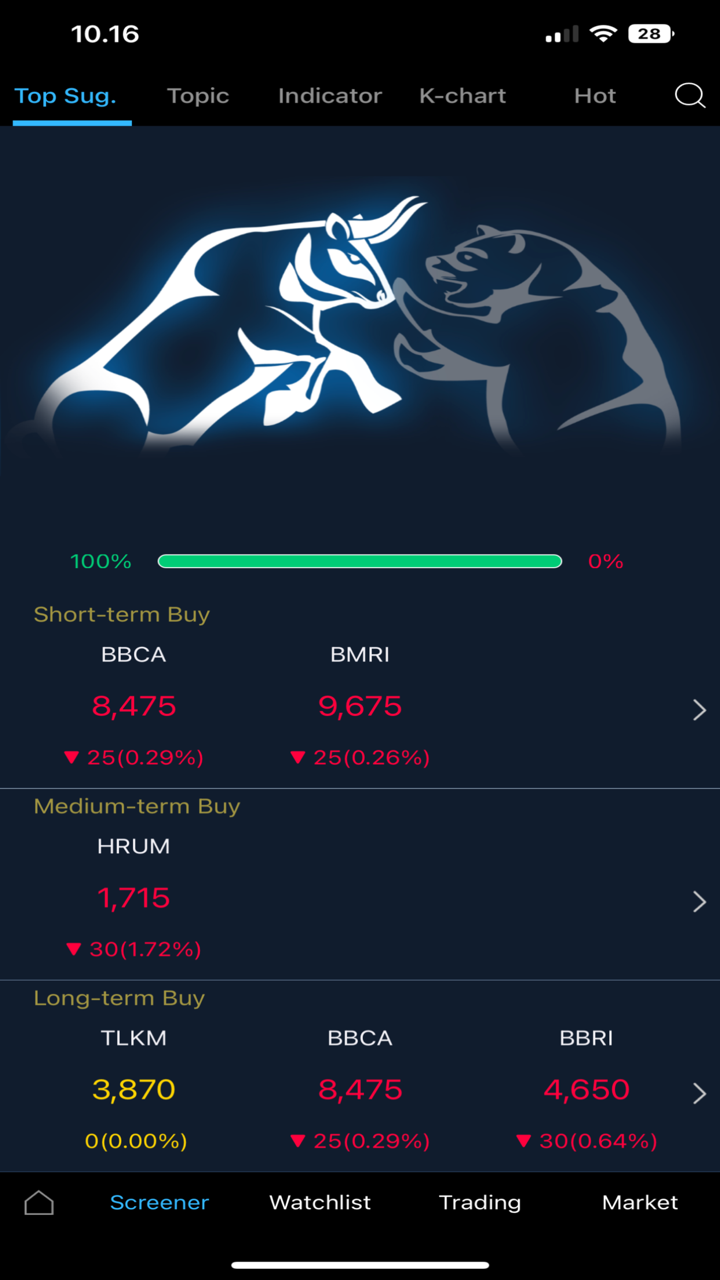

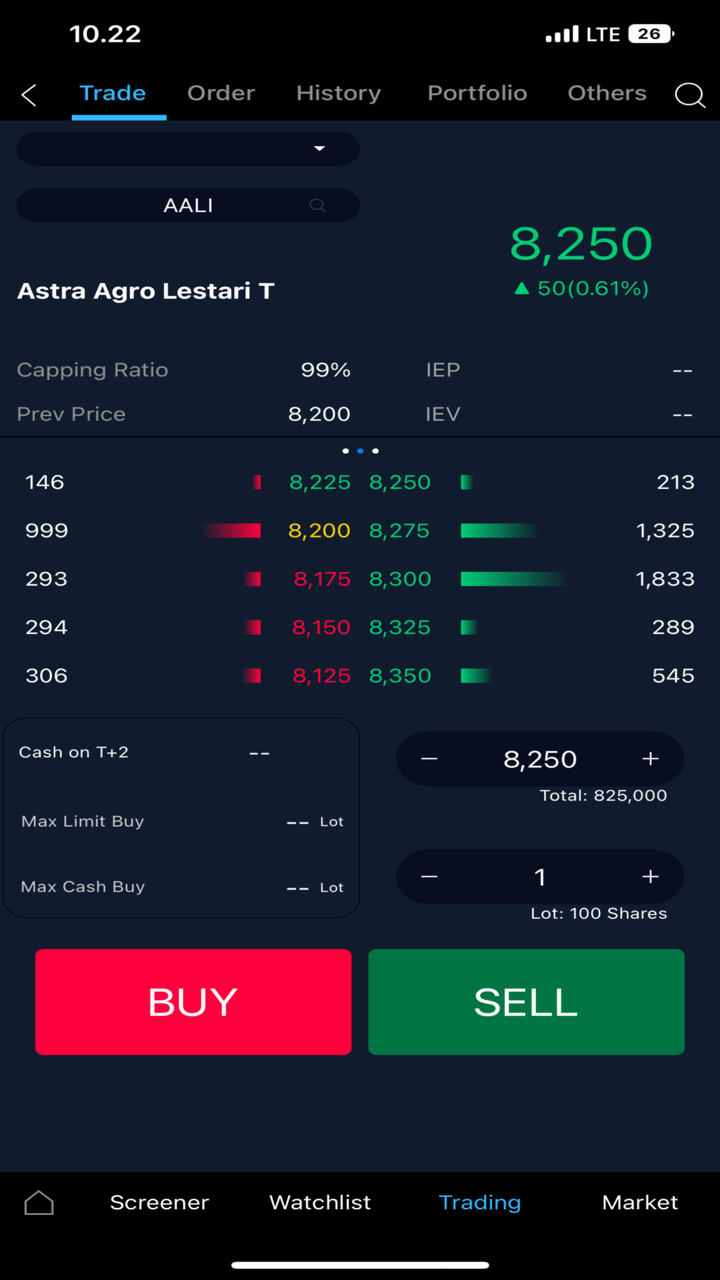

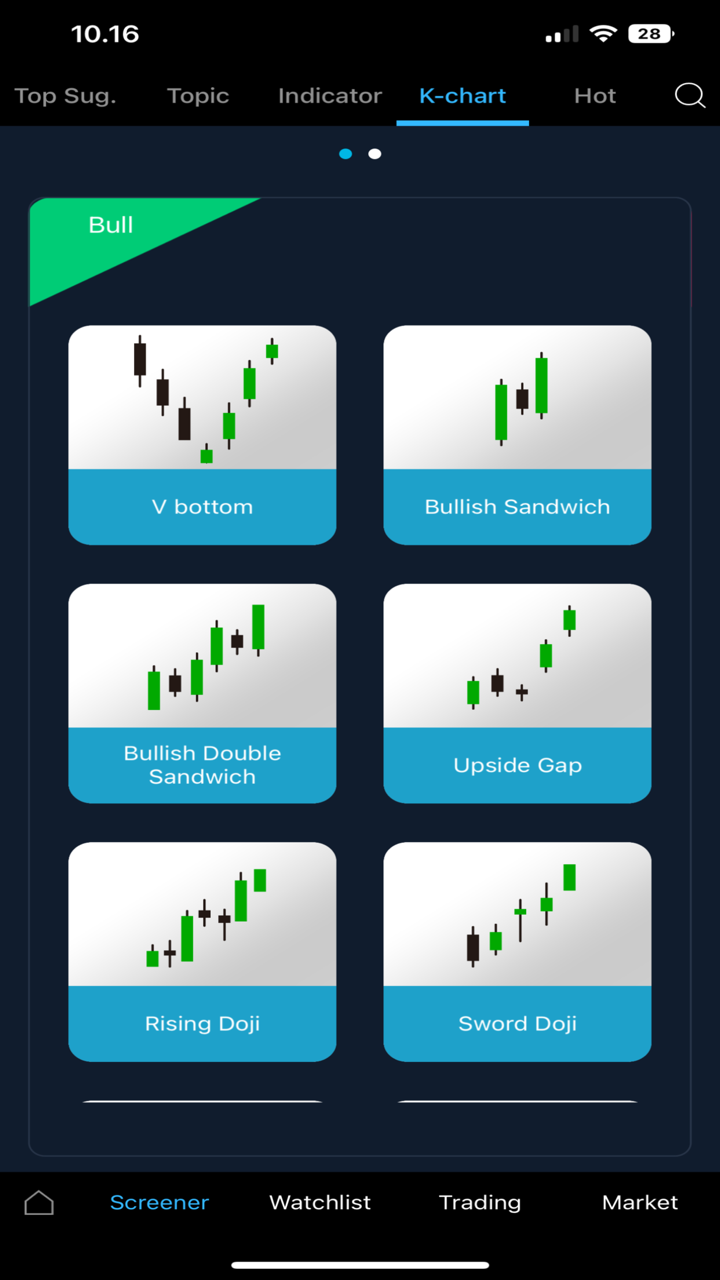

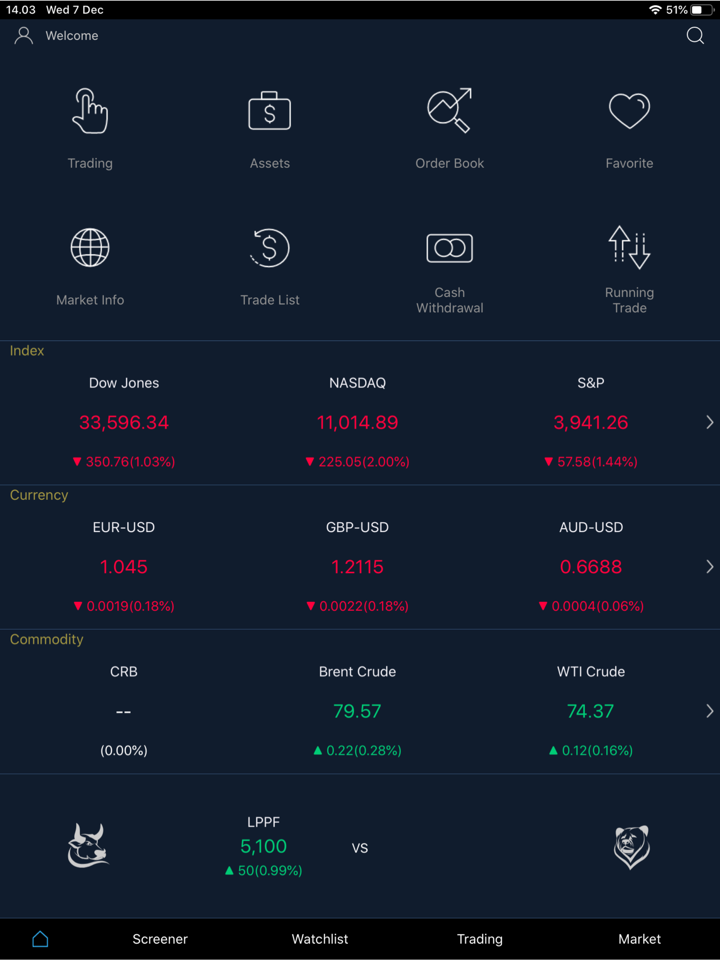

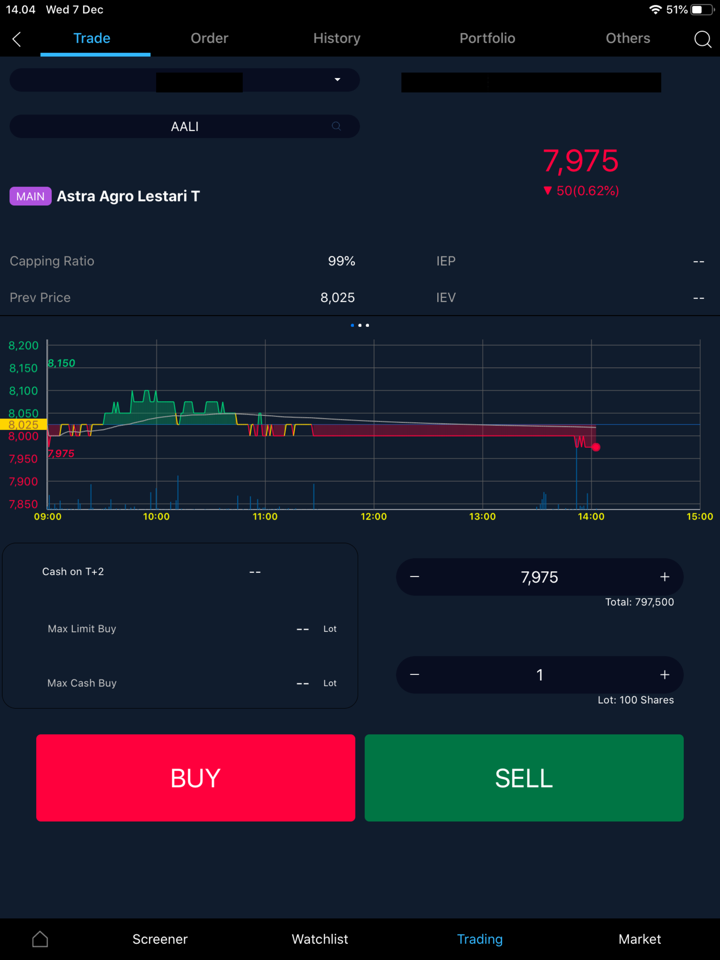

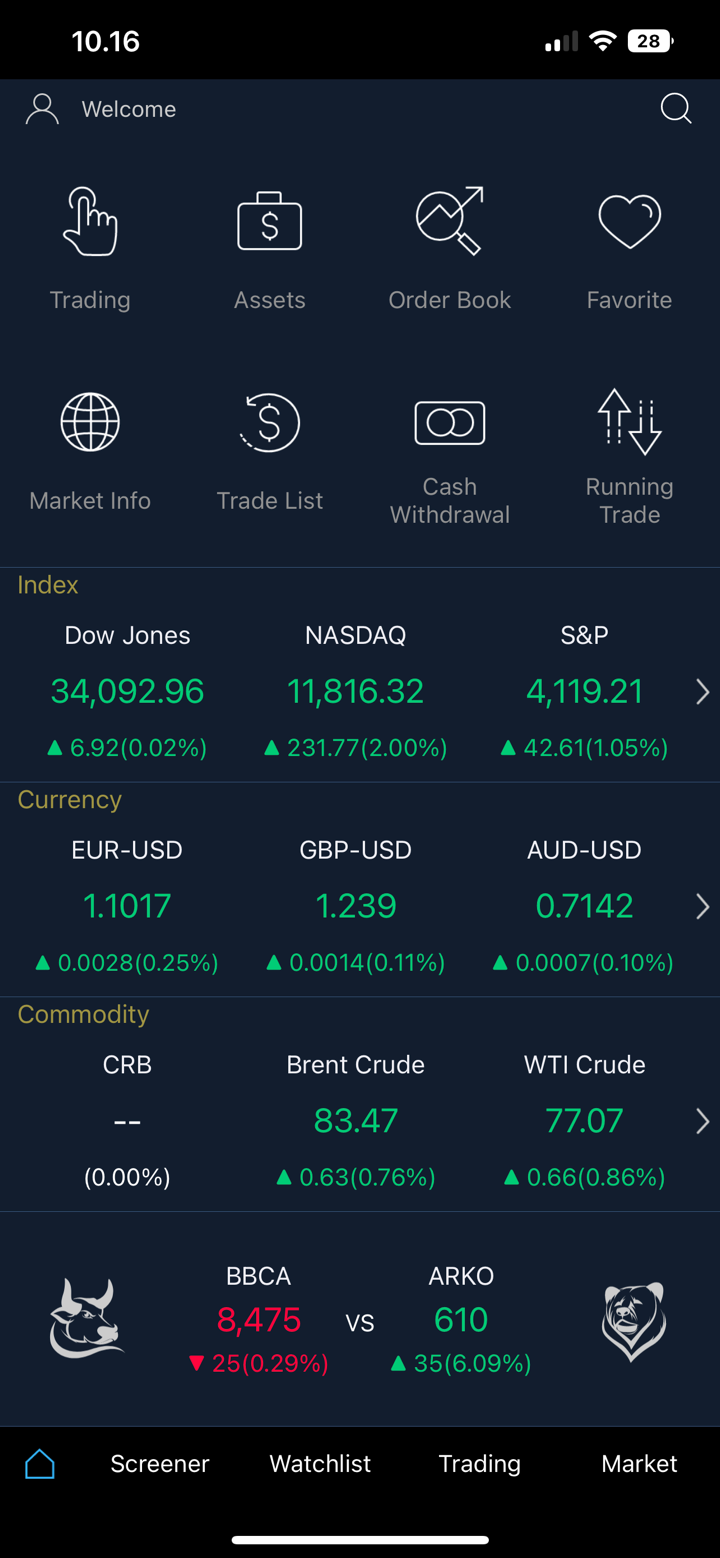

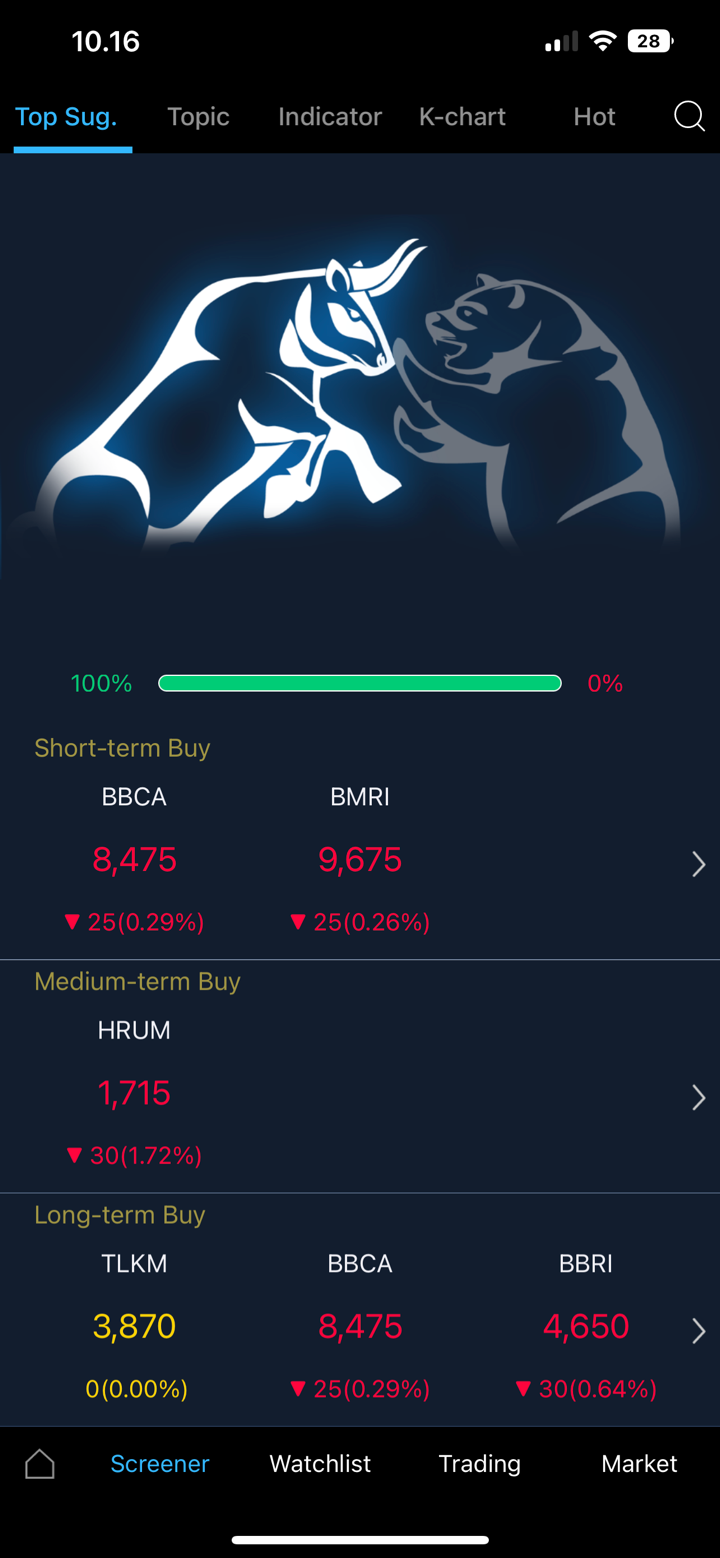

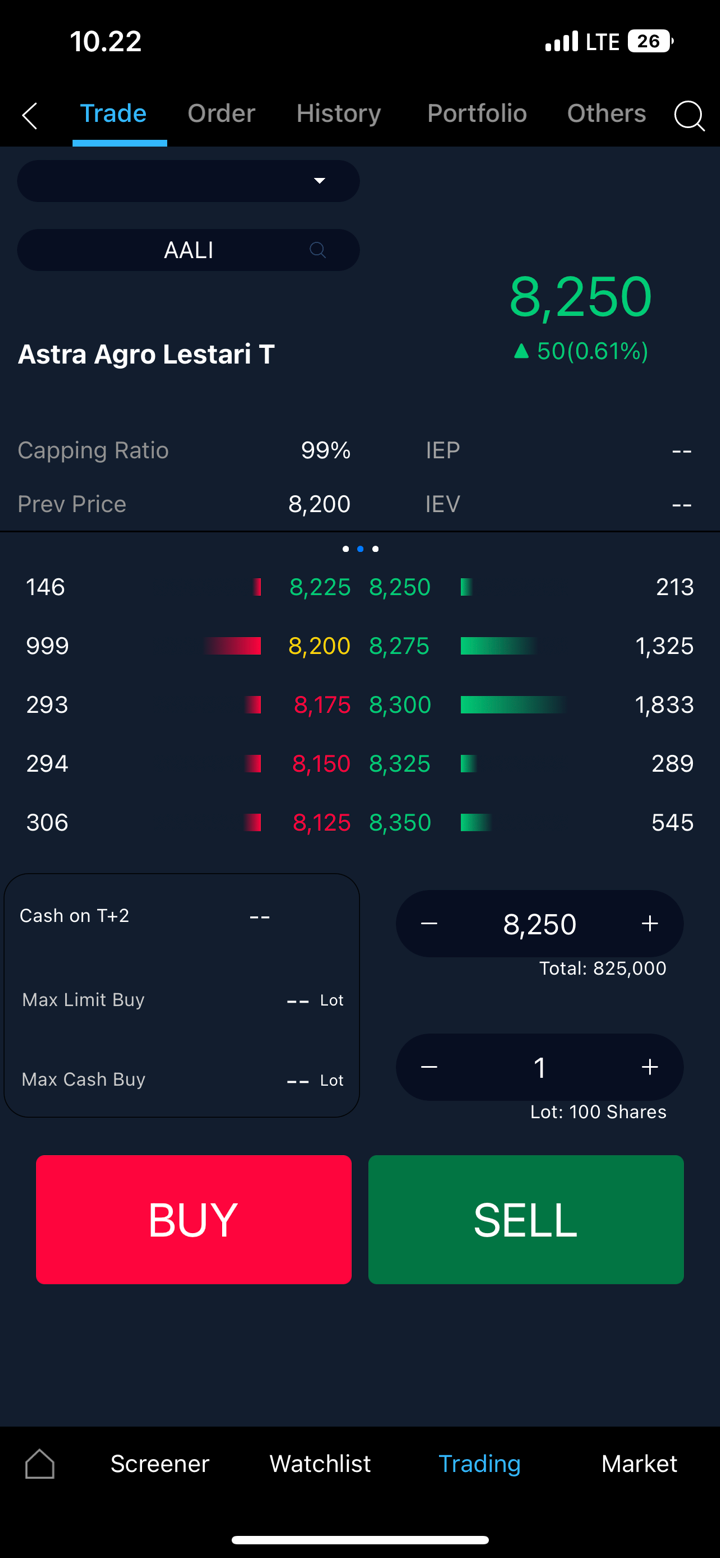

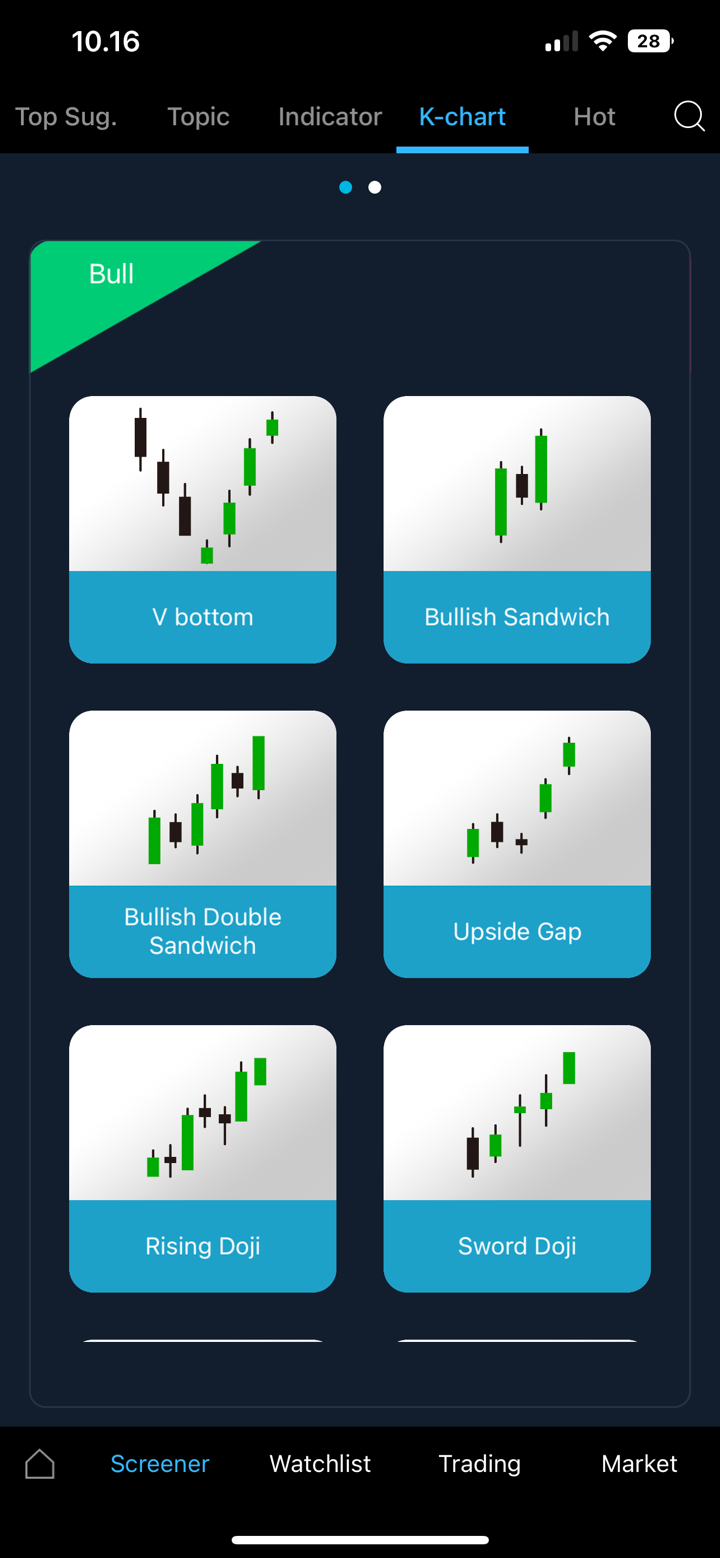

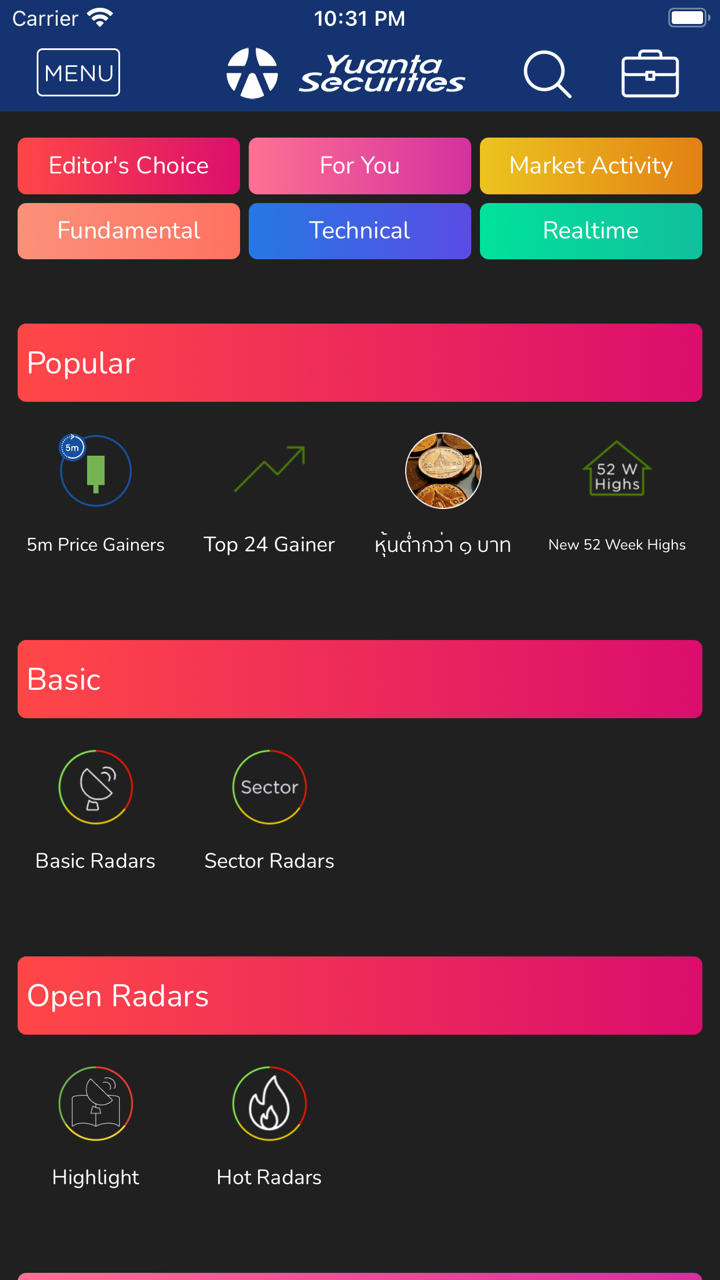

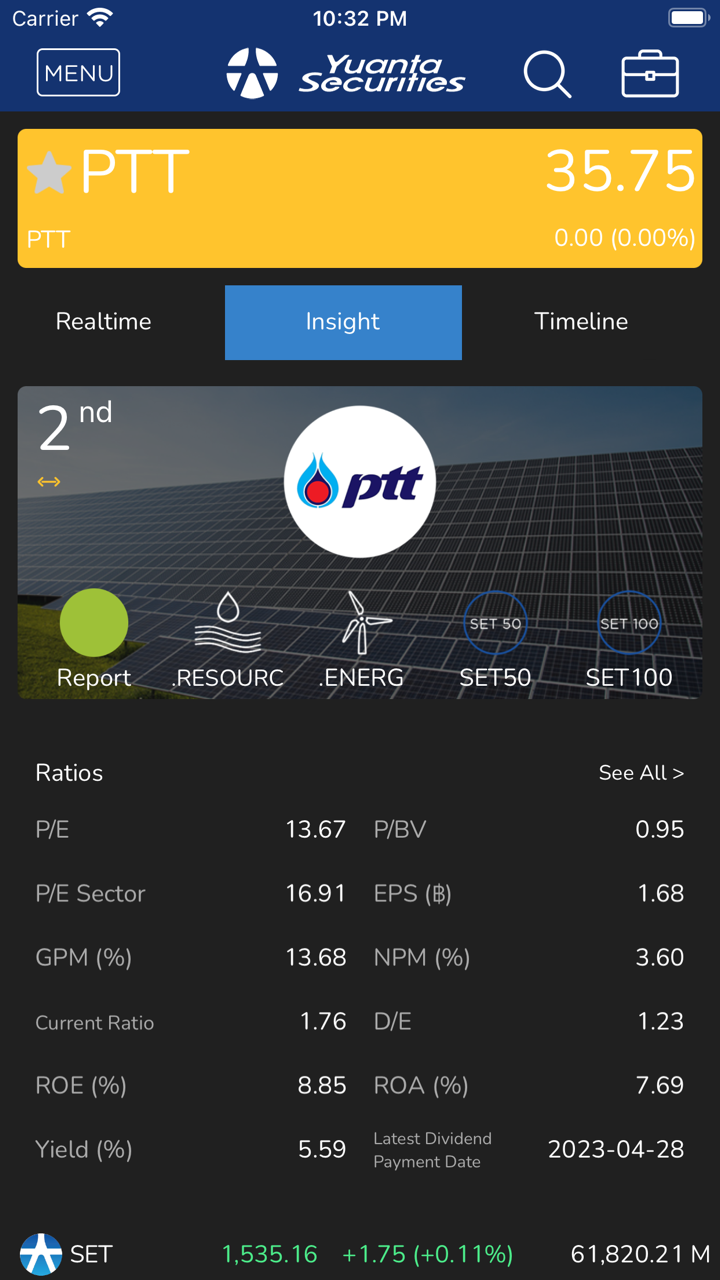

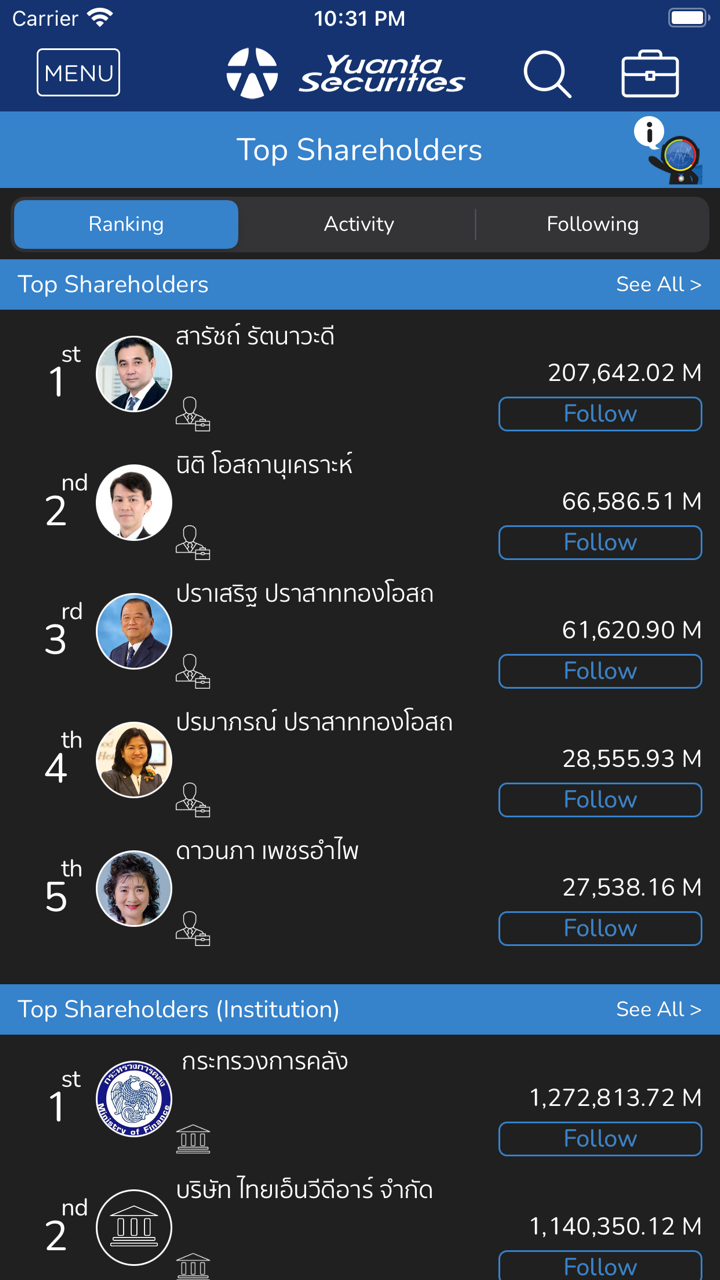

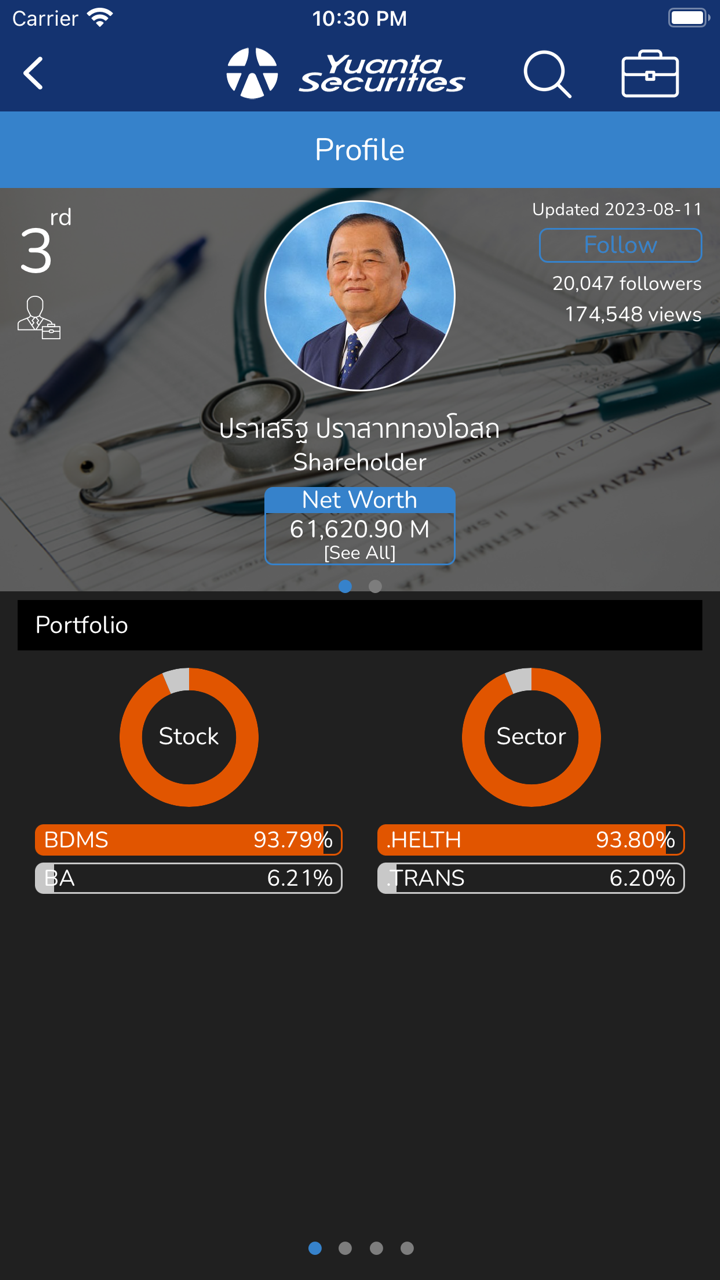

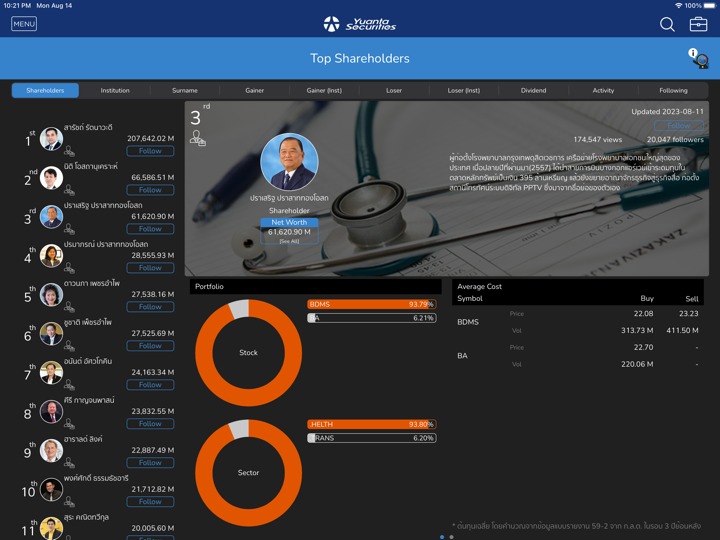

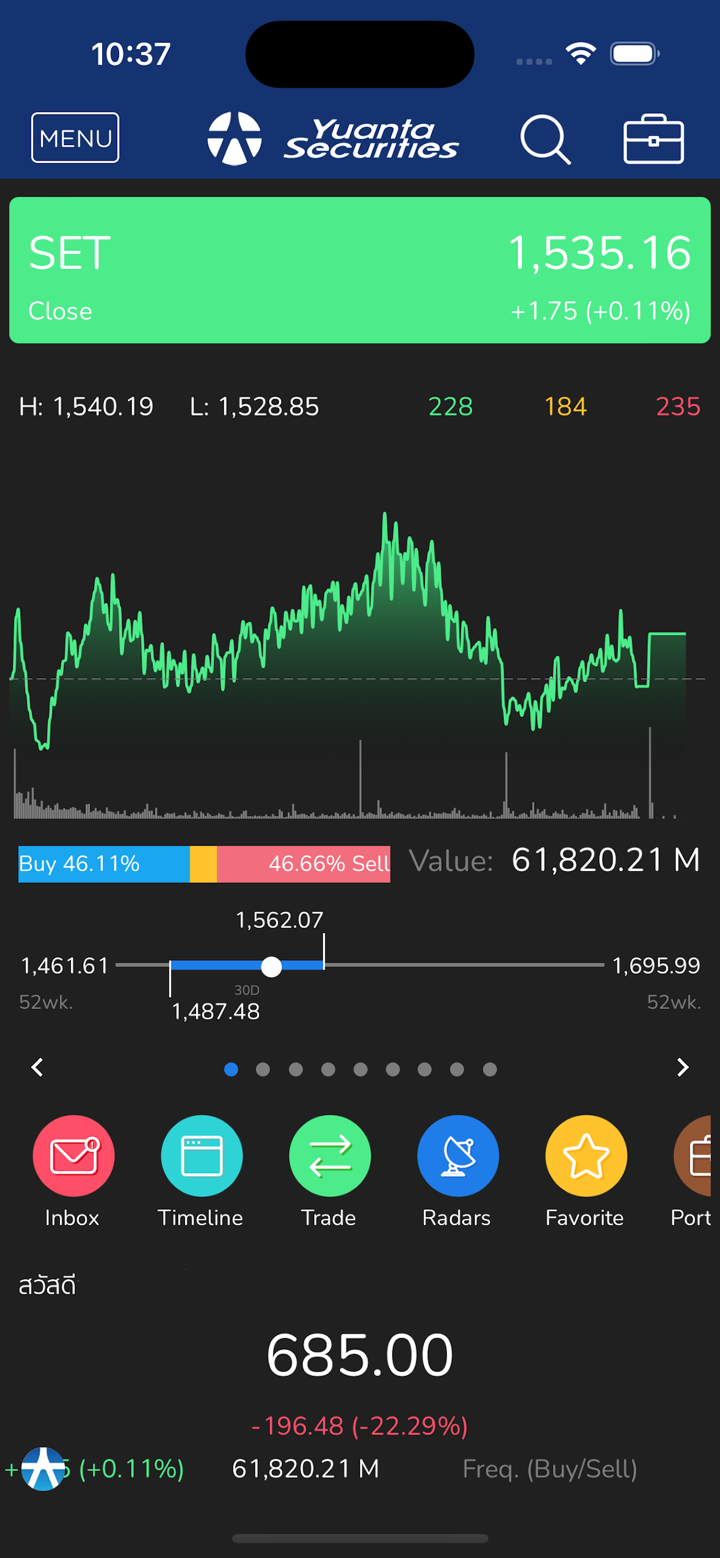

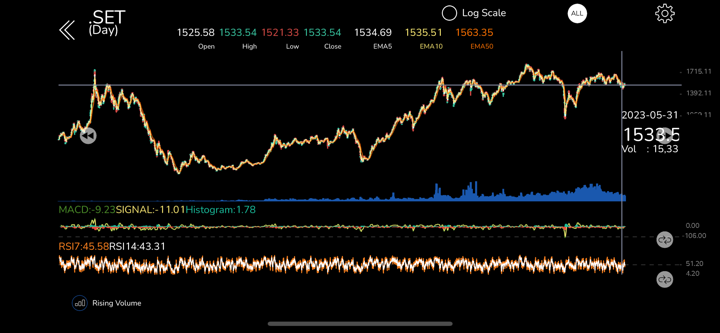

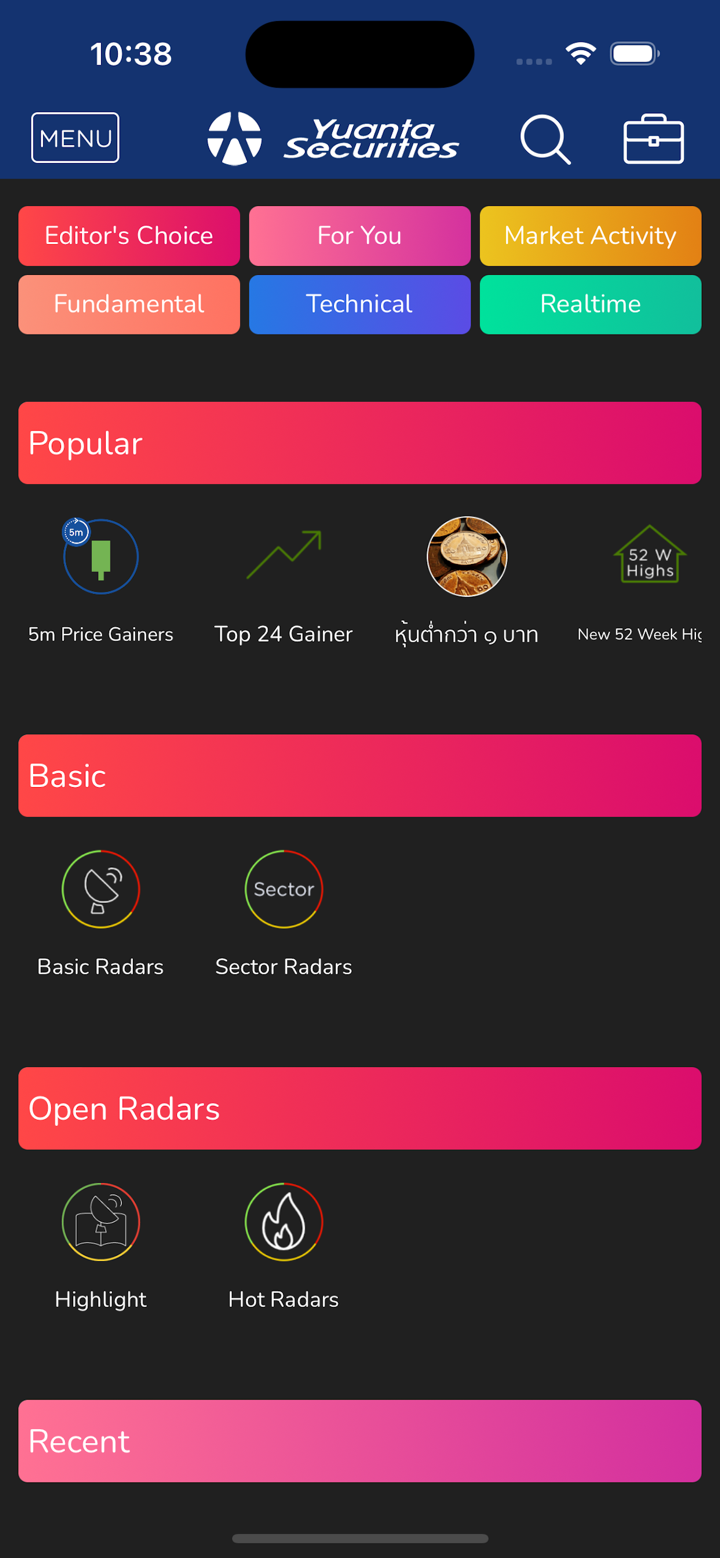

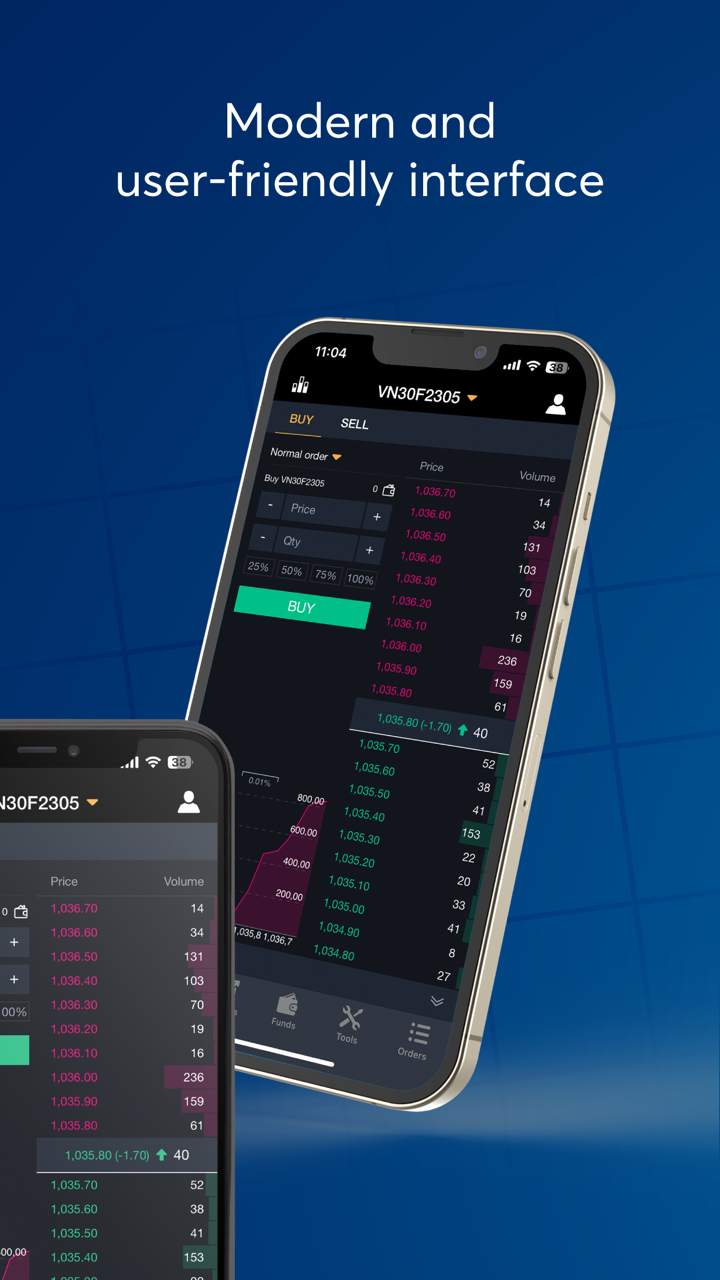

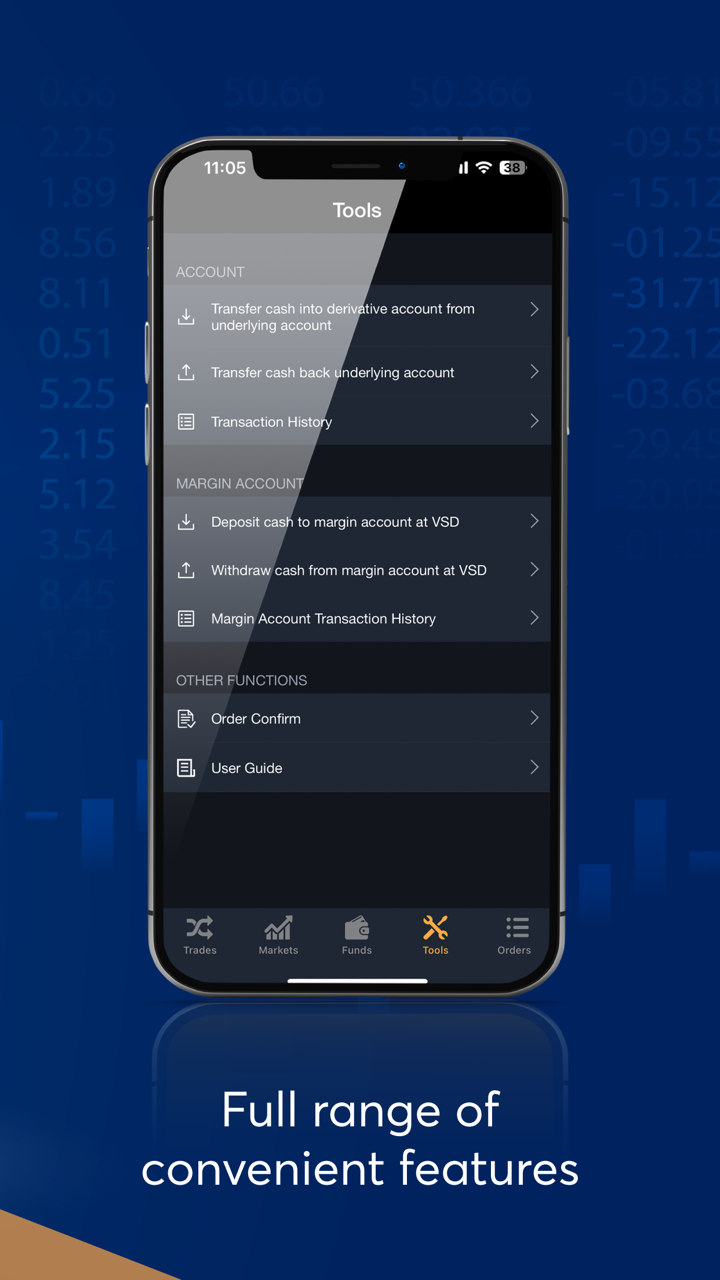

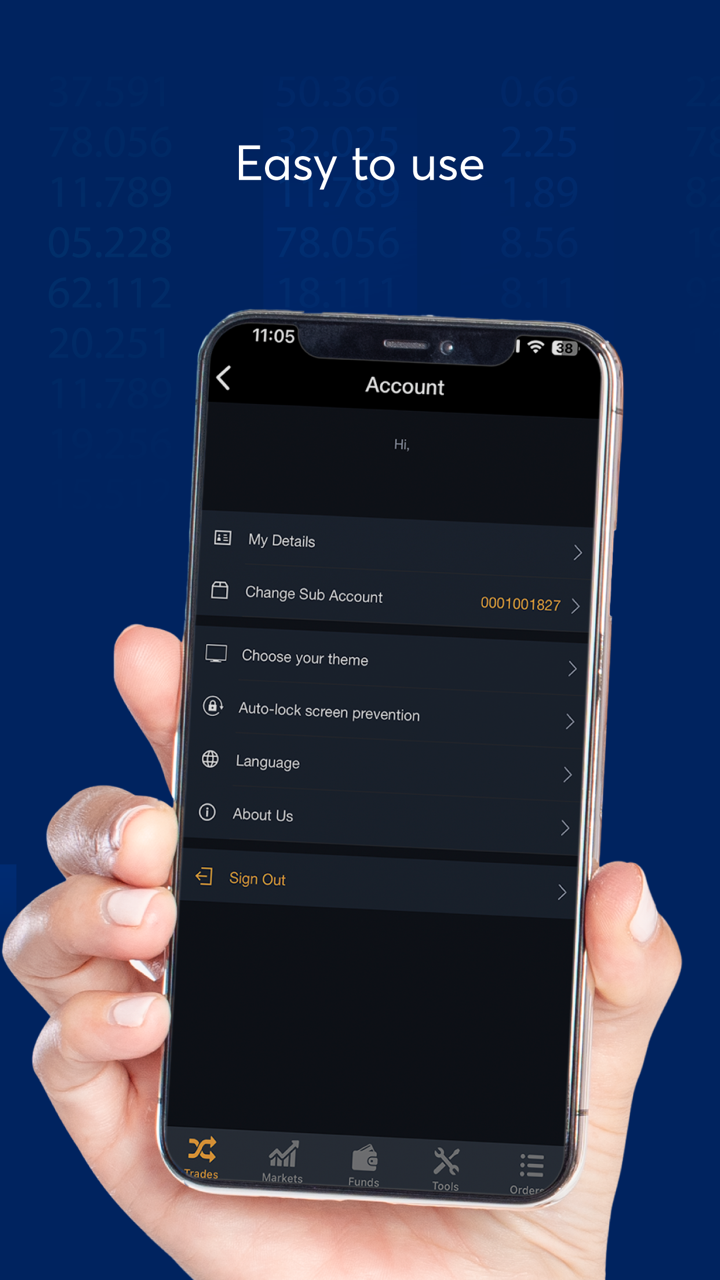

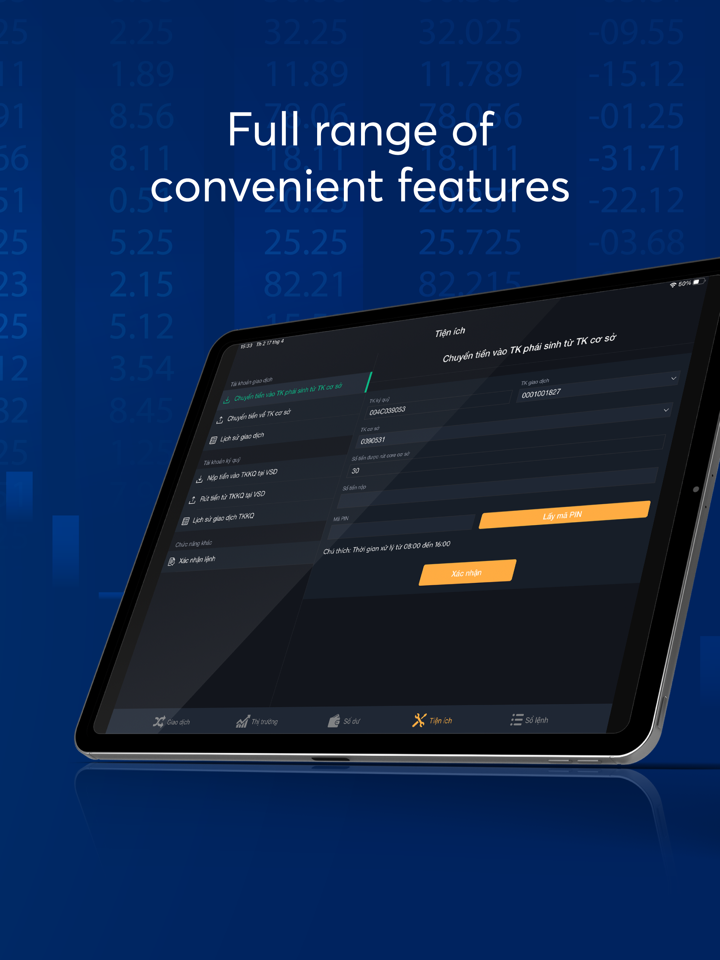

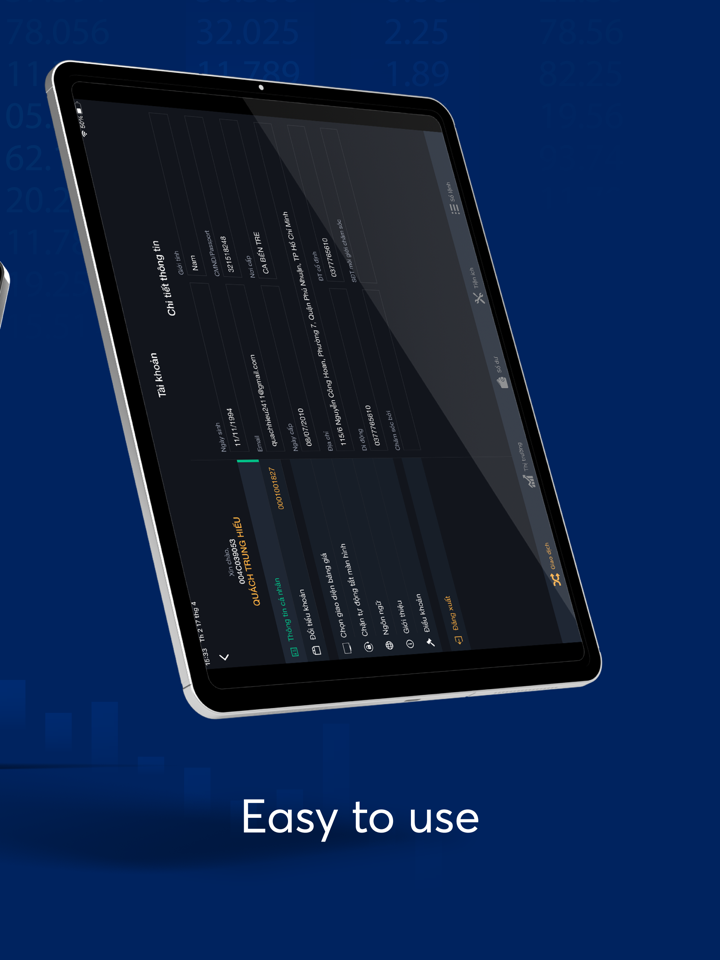

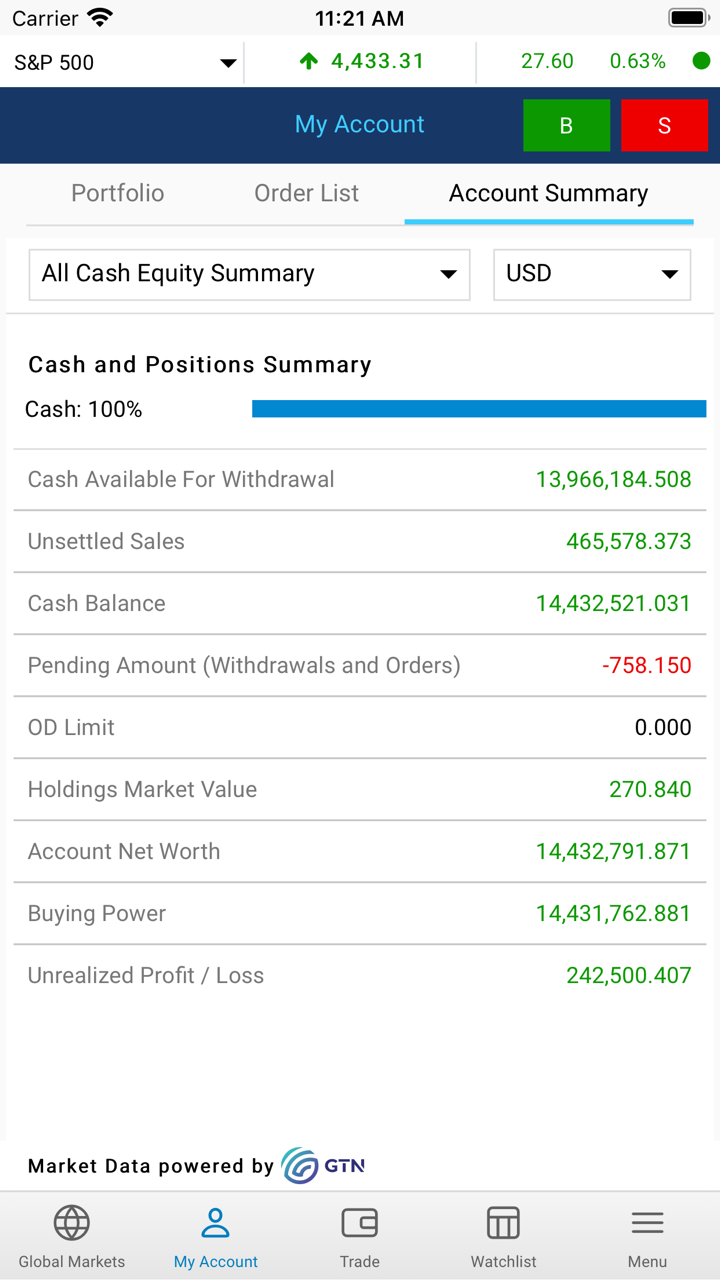

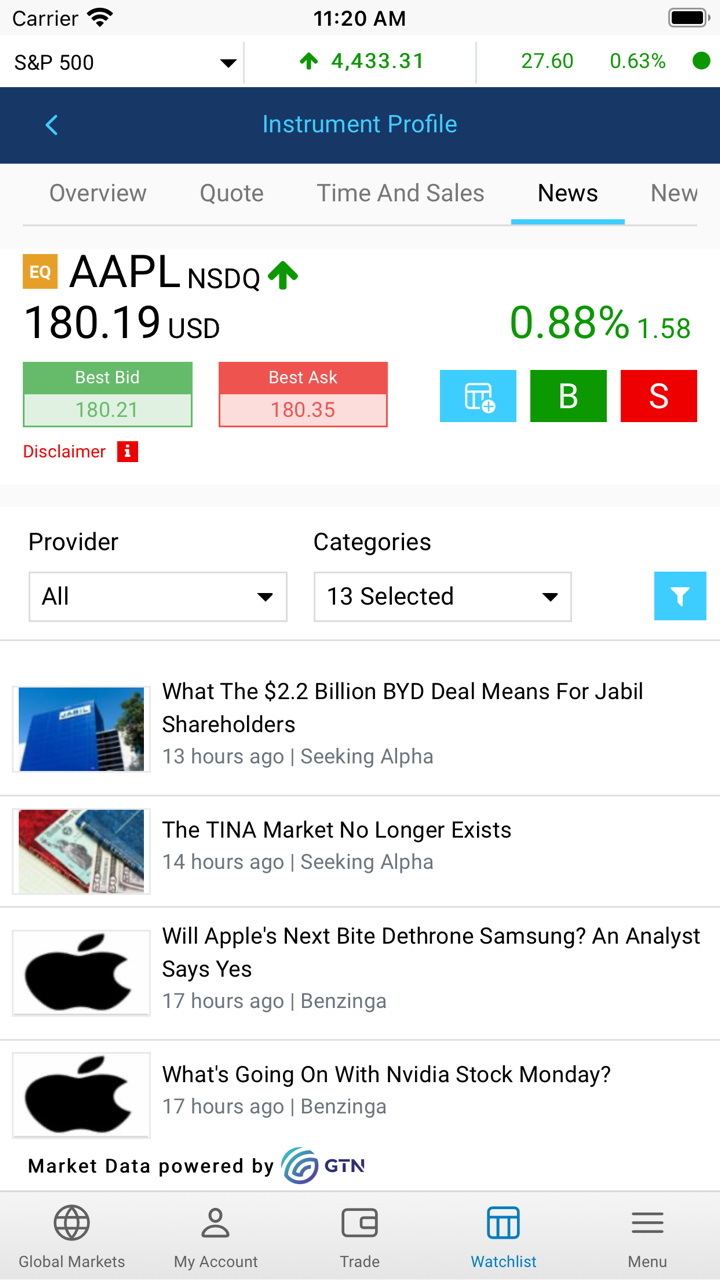

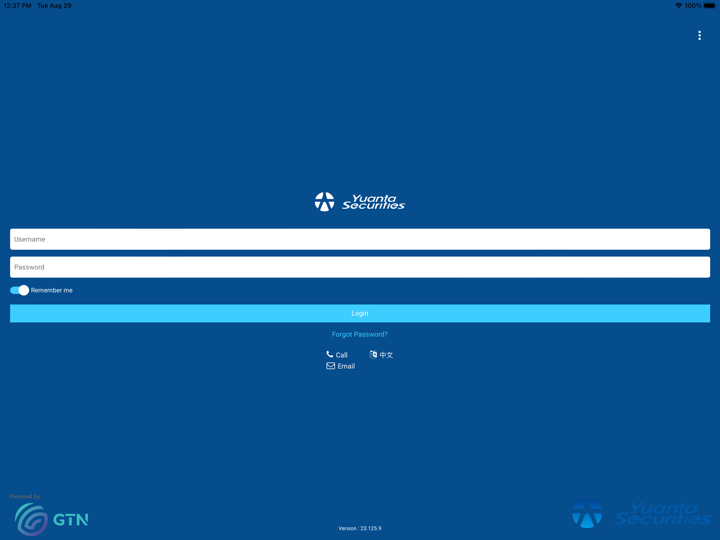

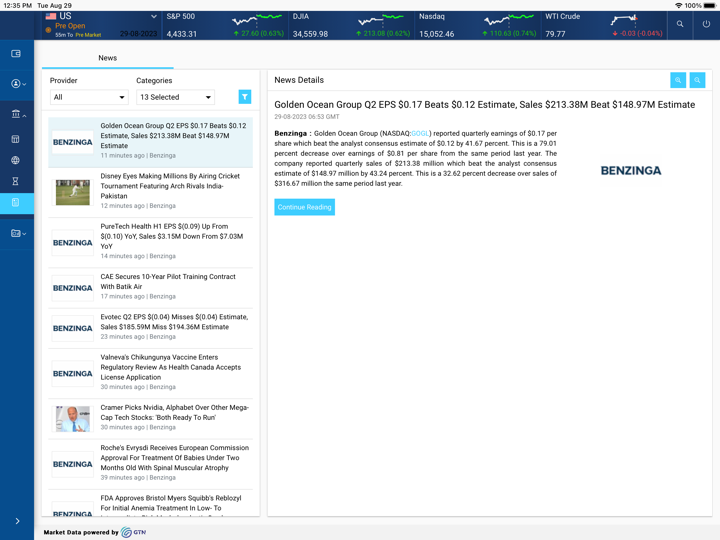

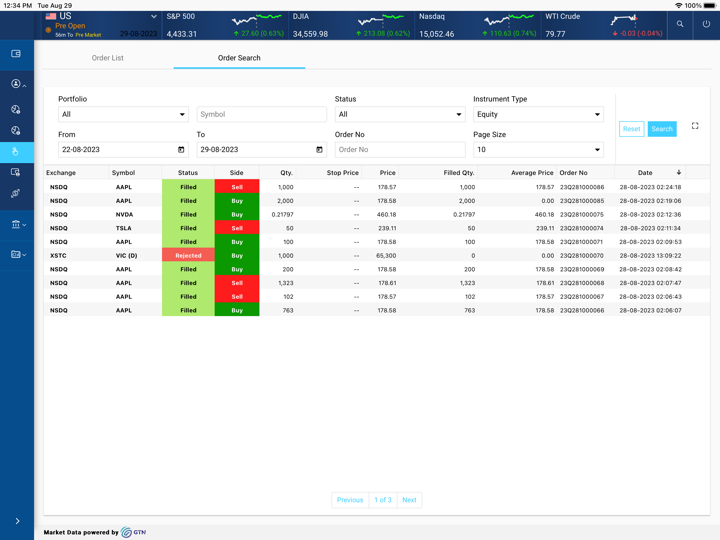

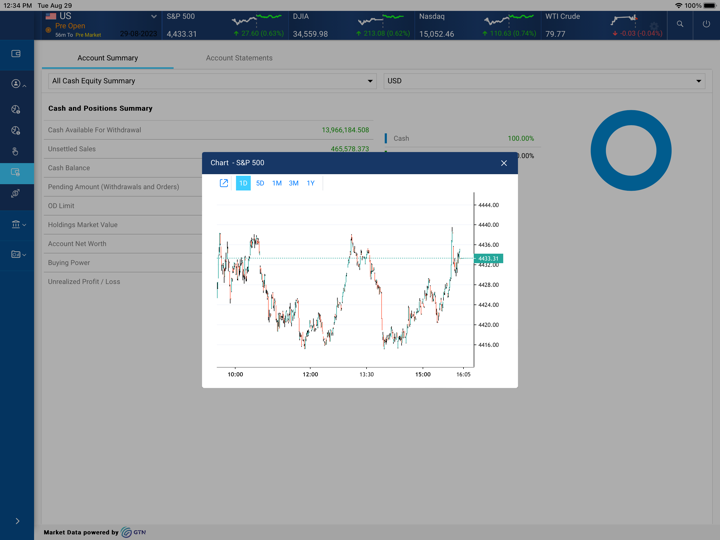

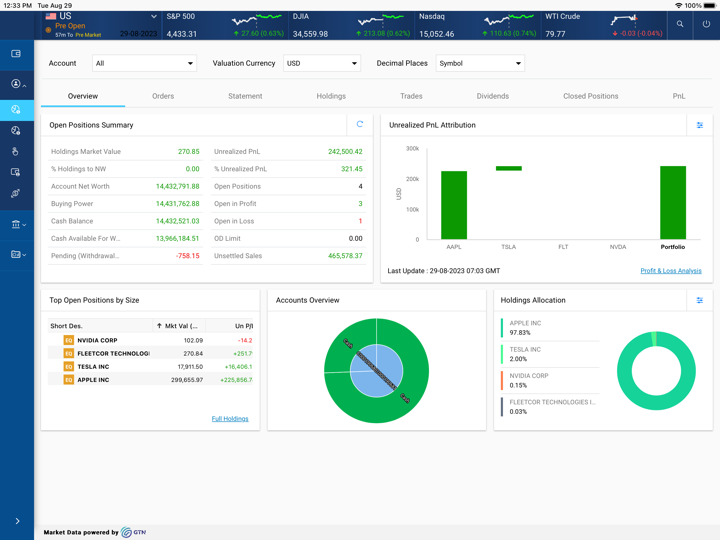

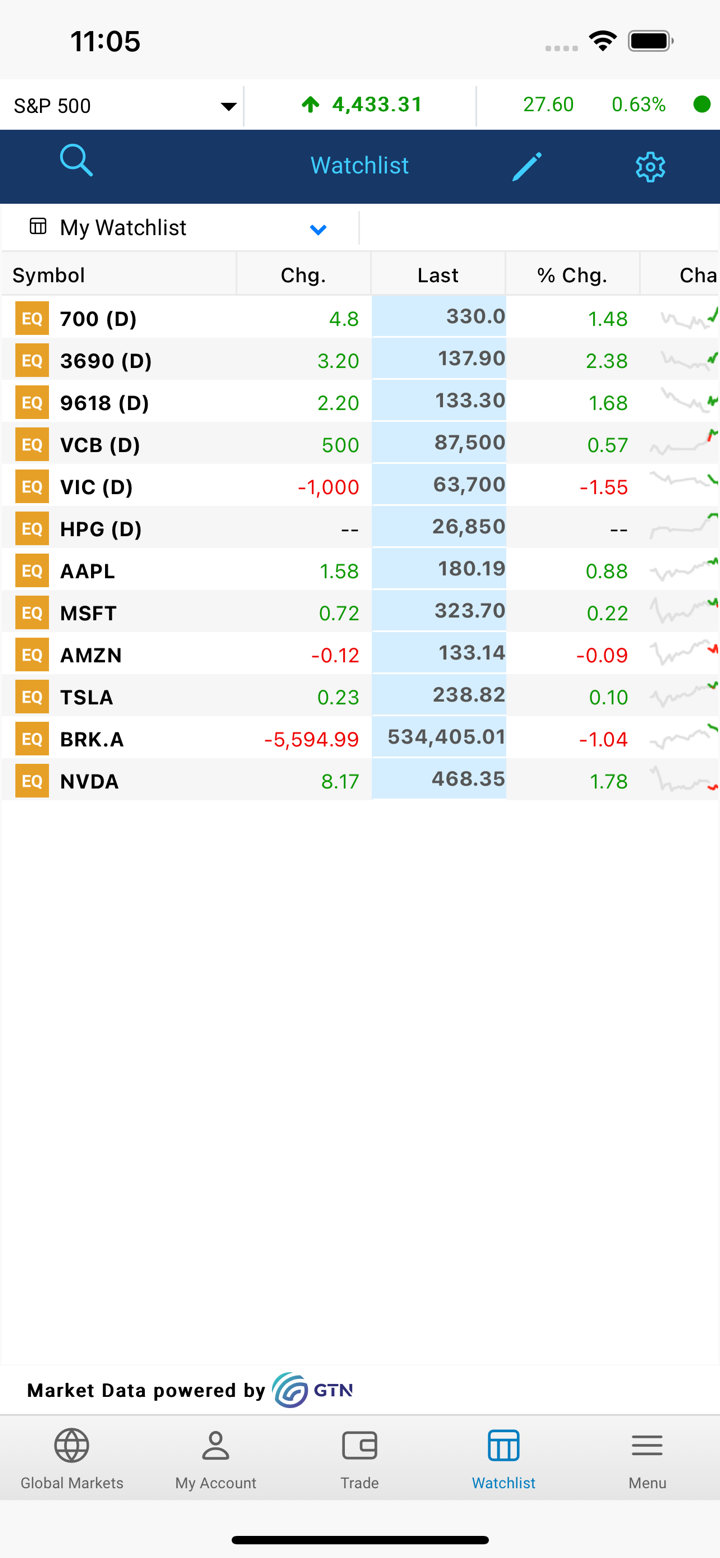

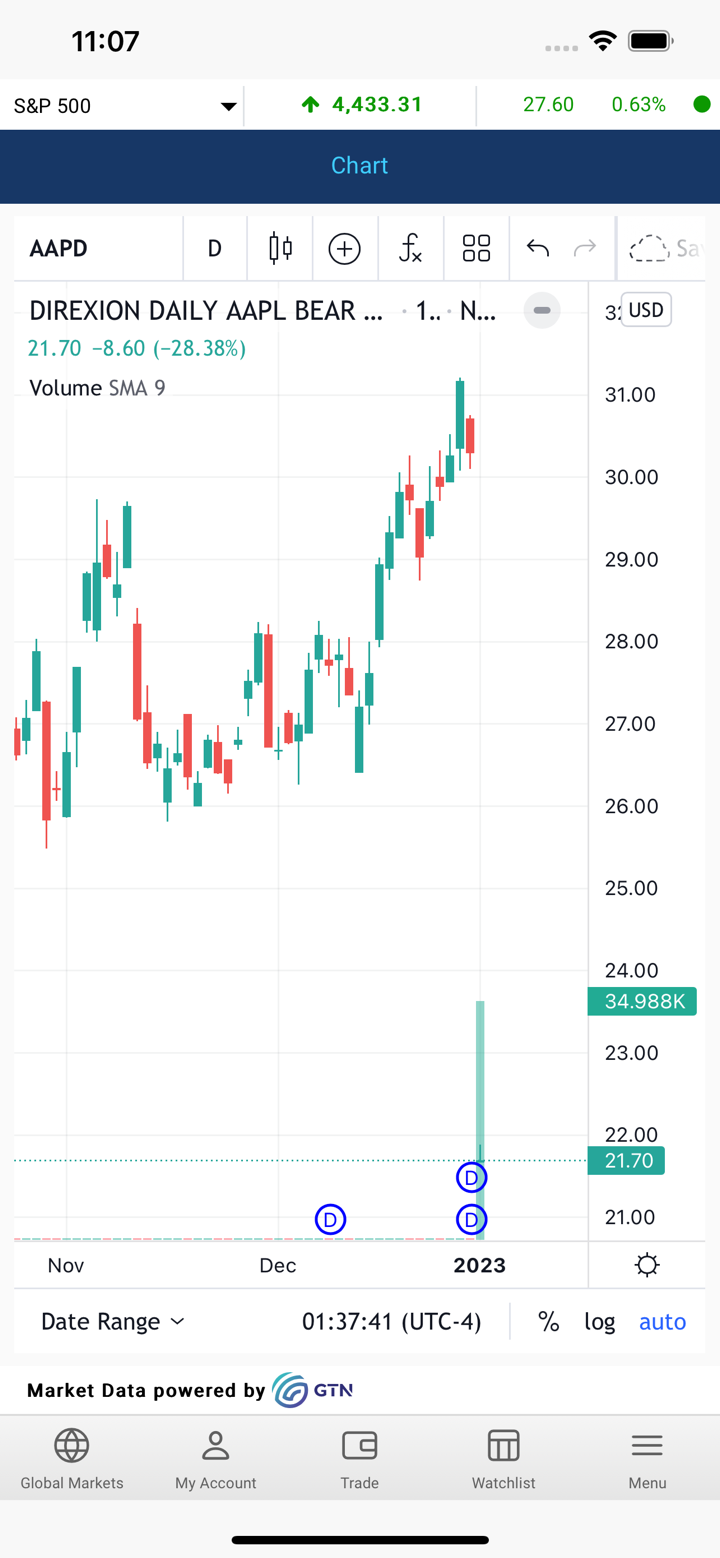

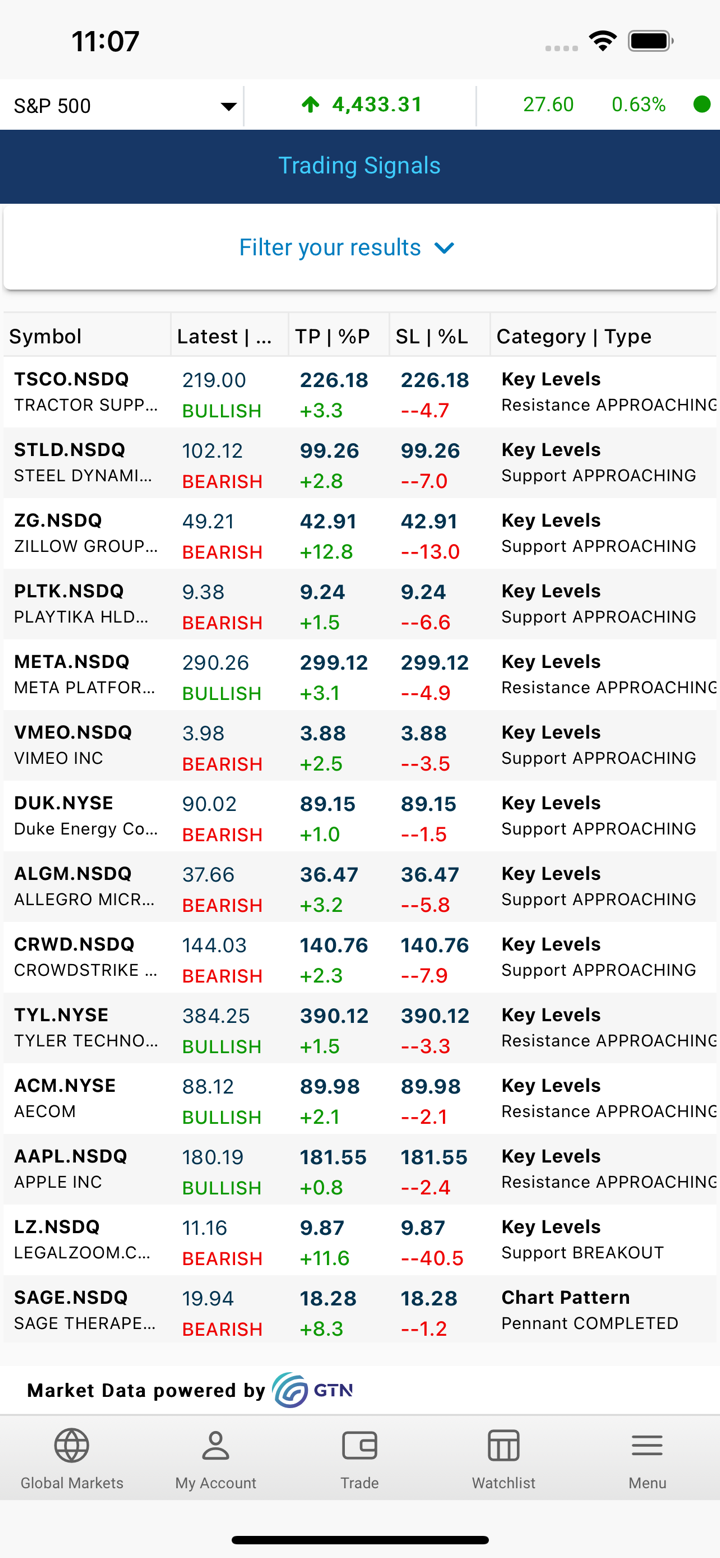

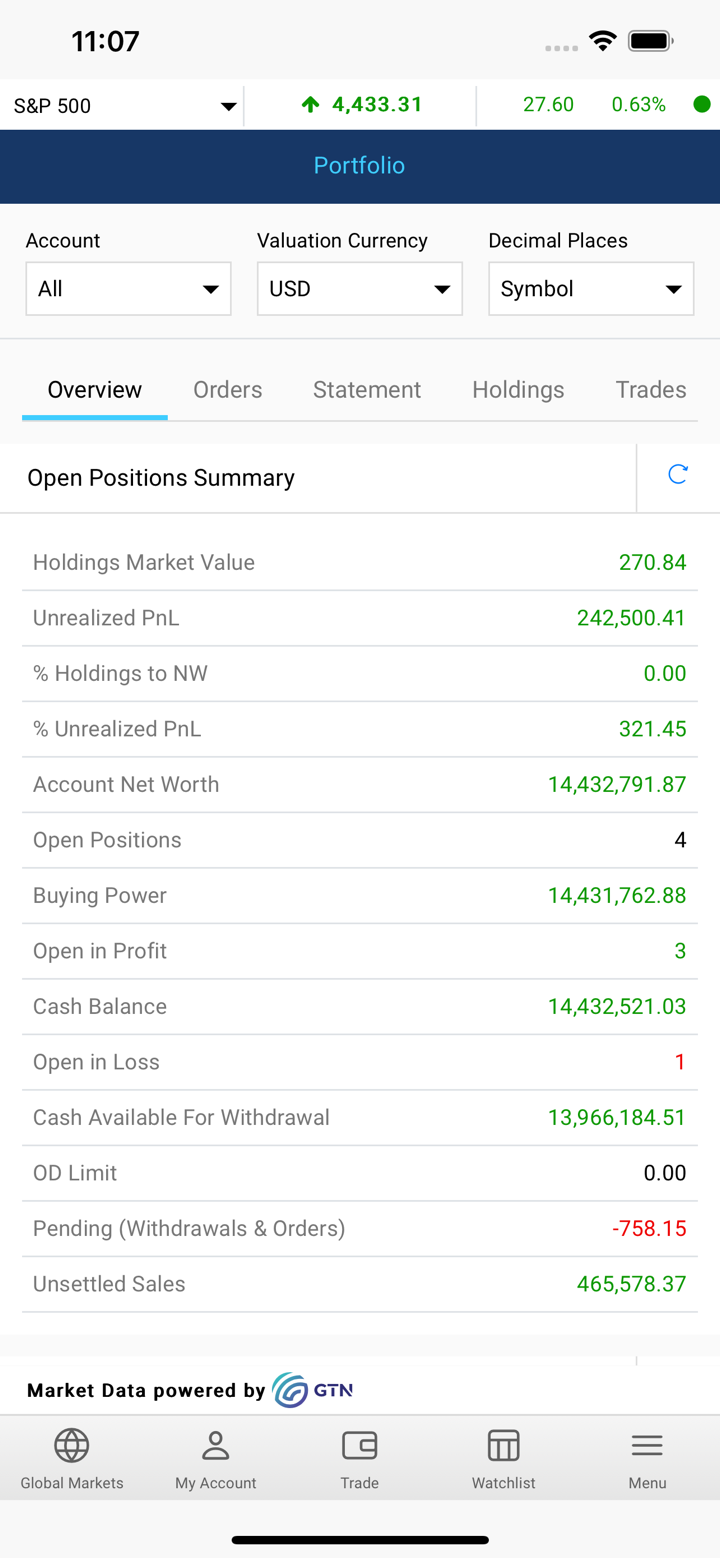

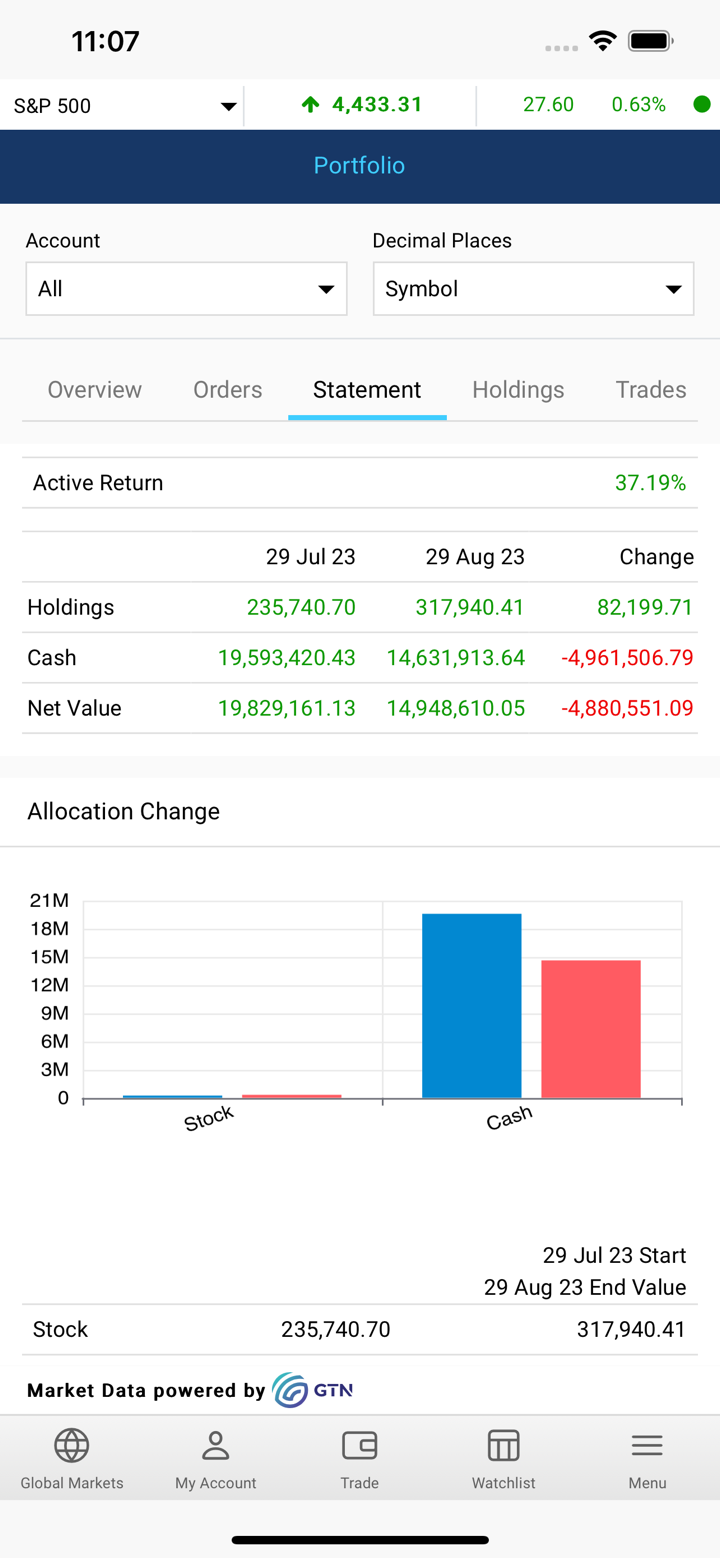

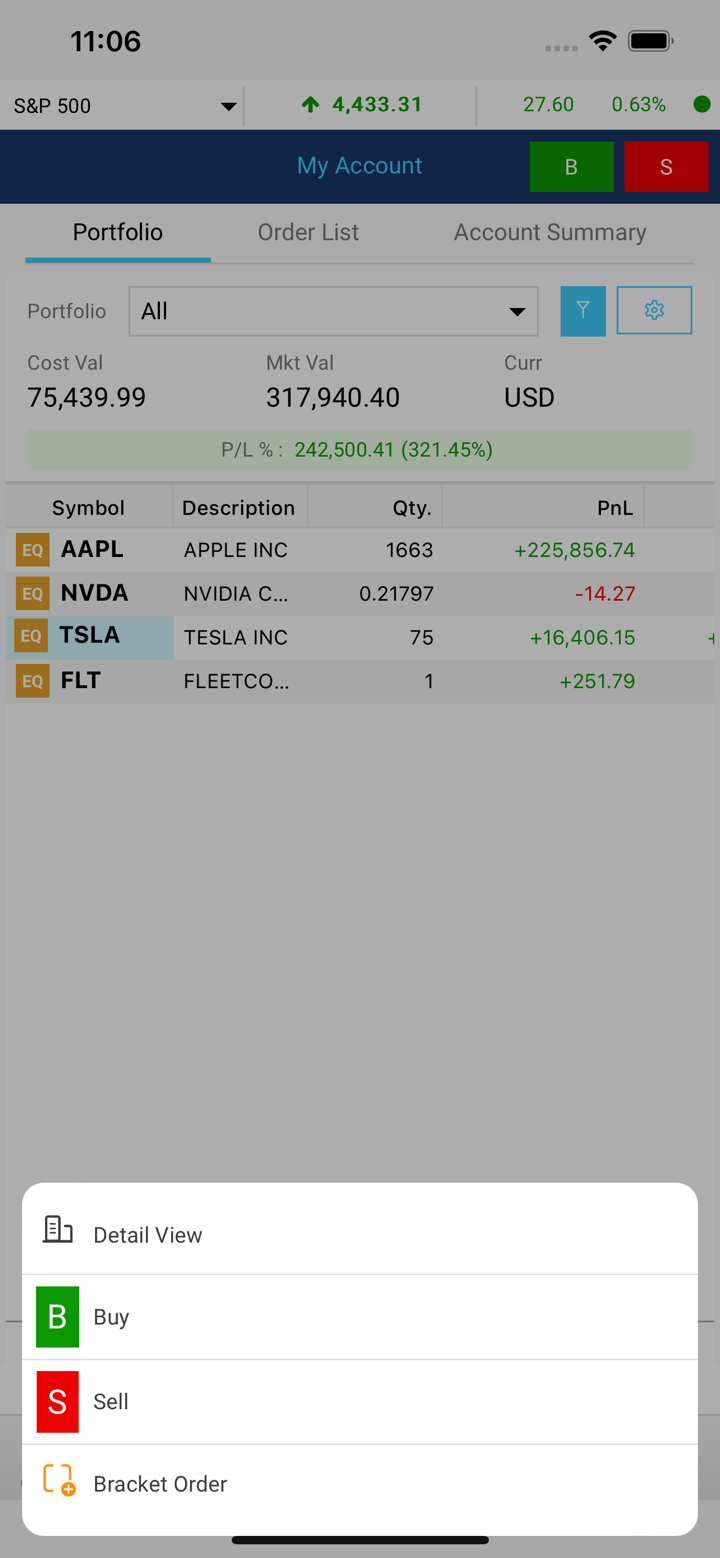

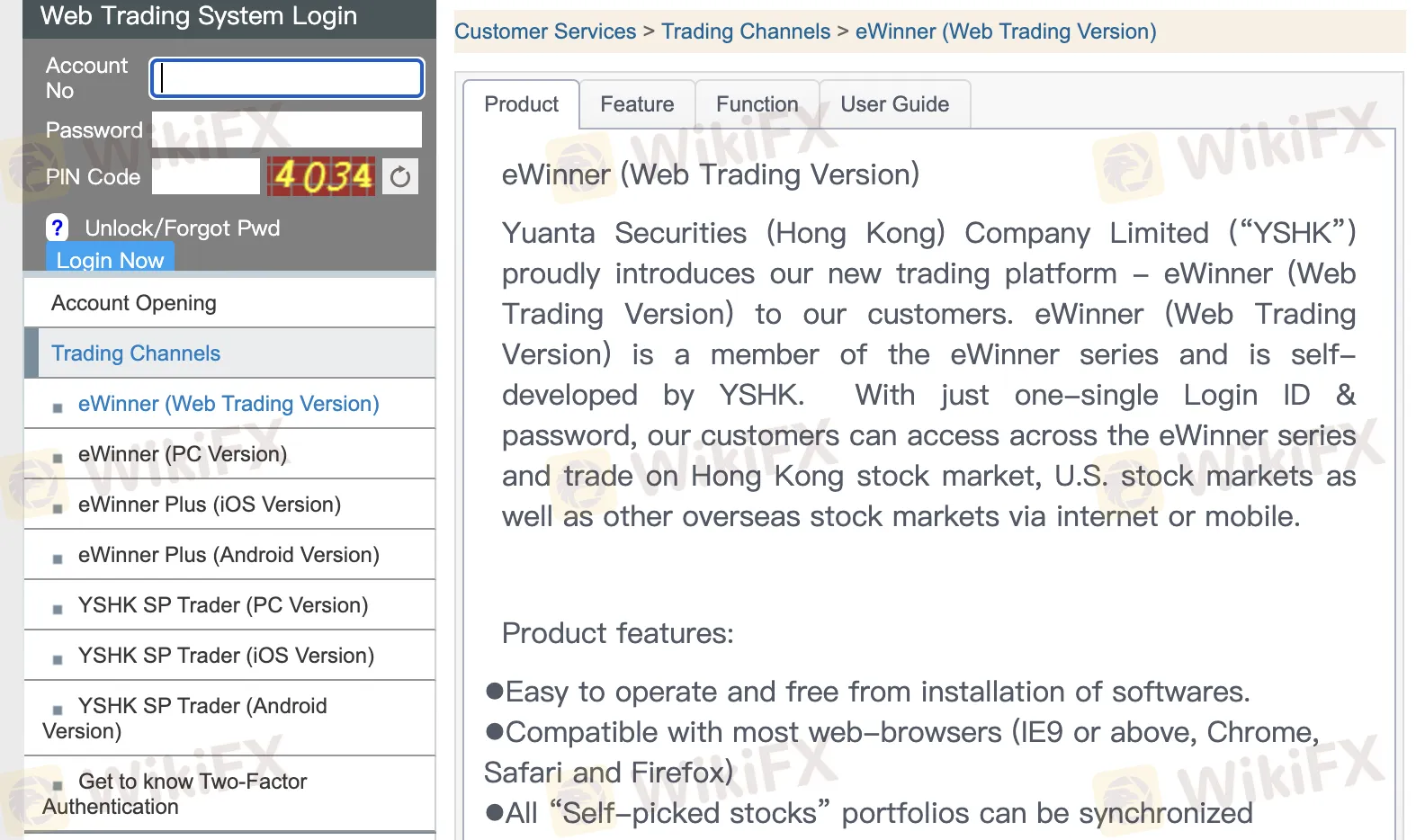

Platform Perdagangan

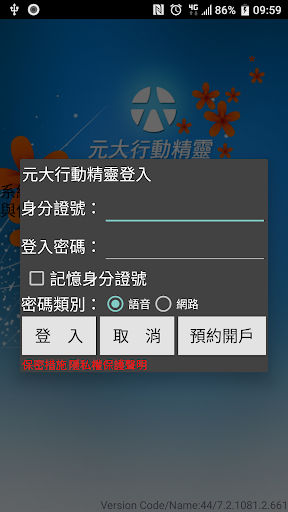

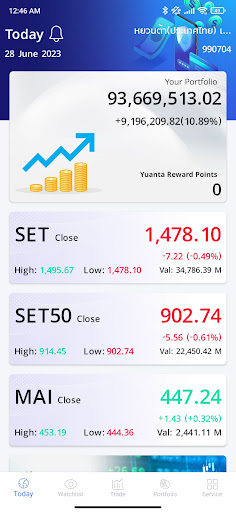

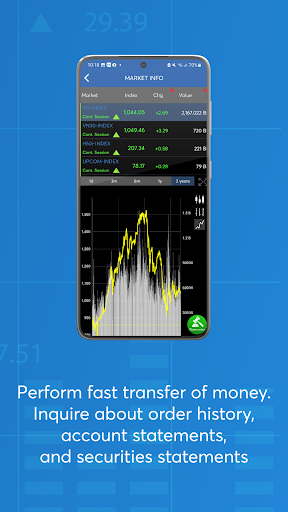

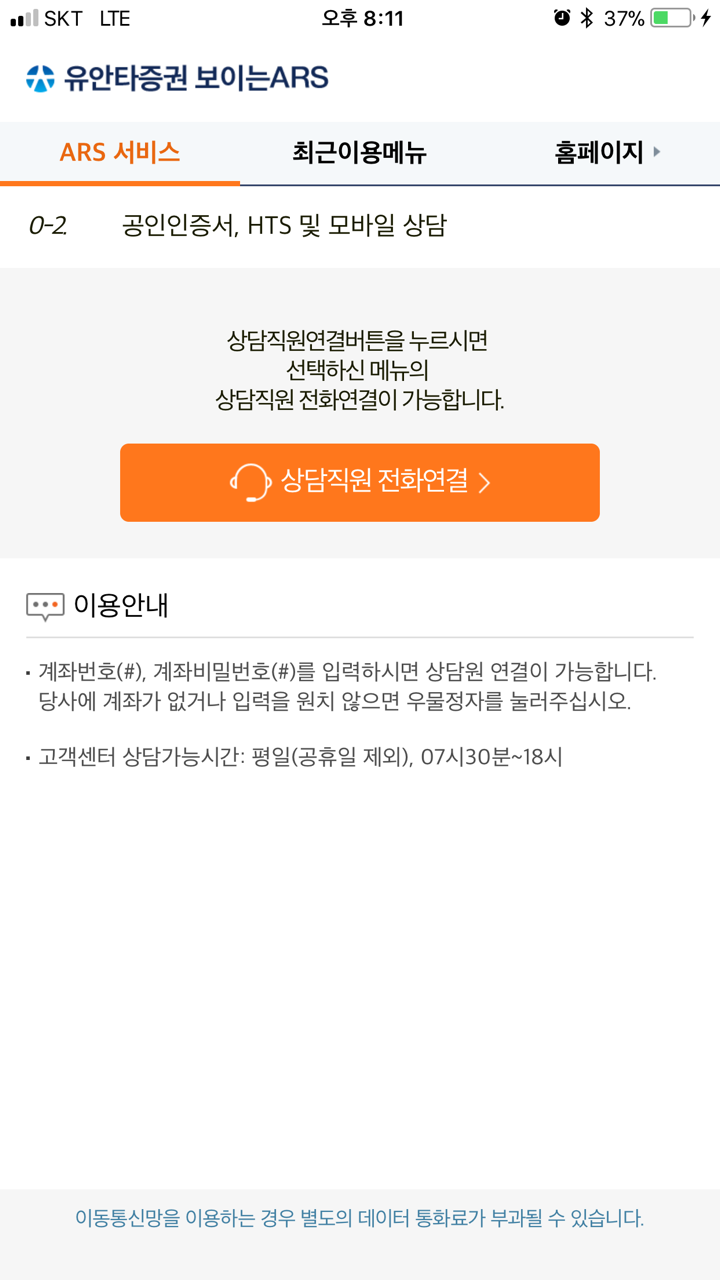

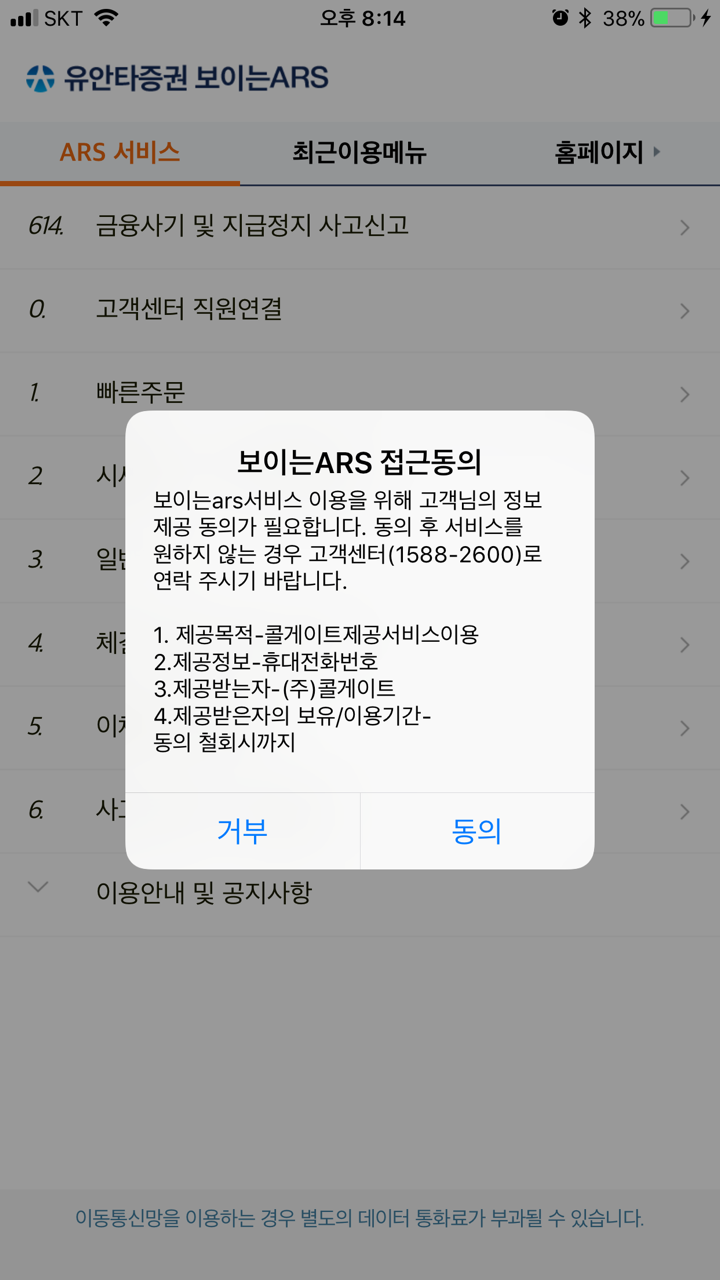

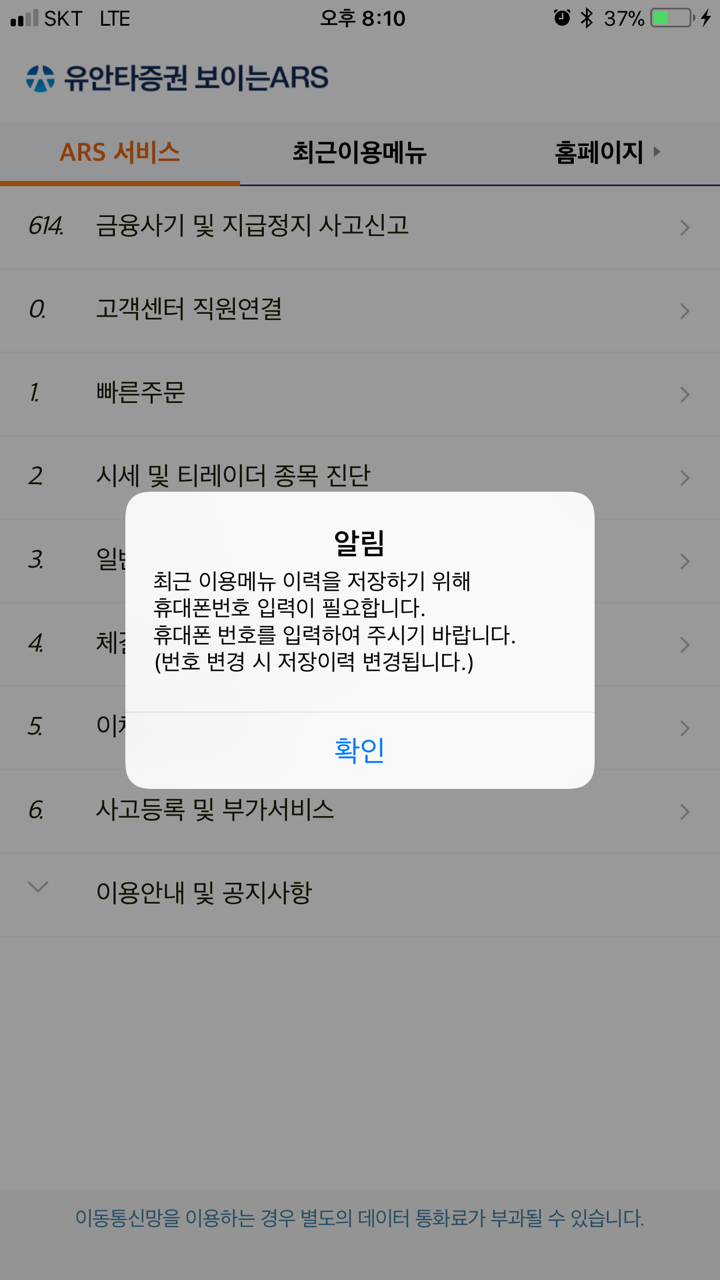

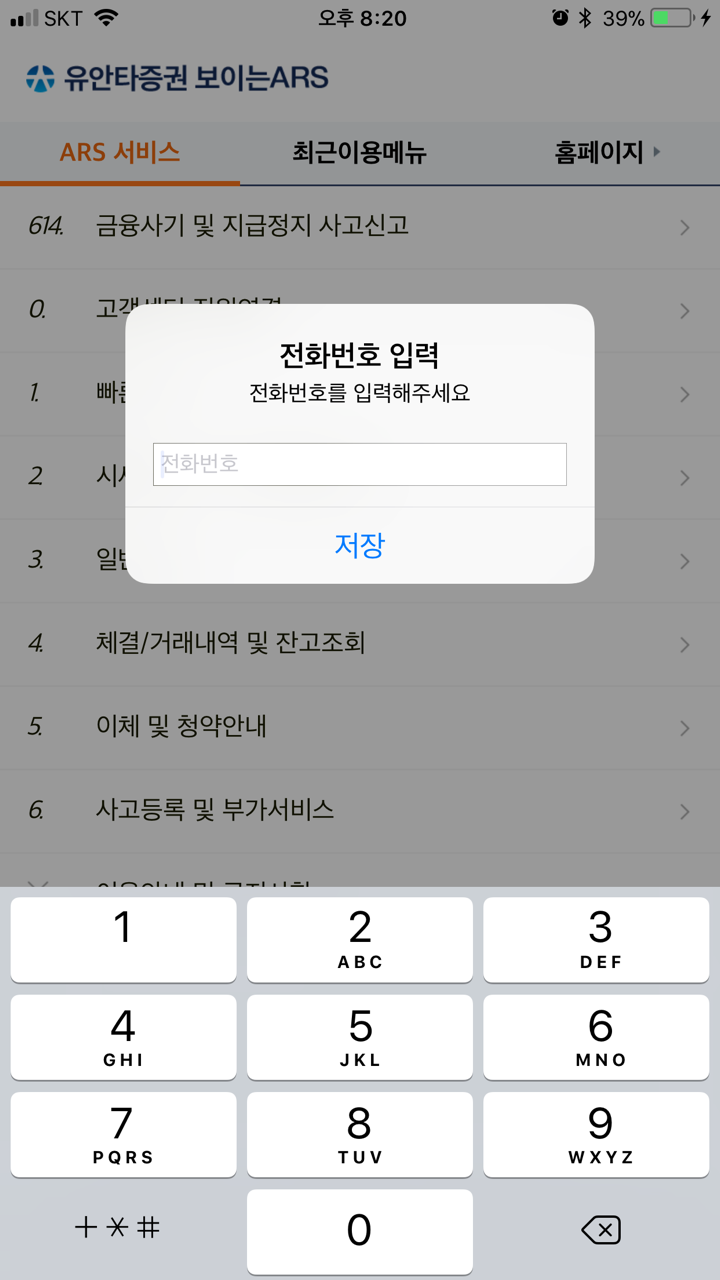

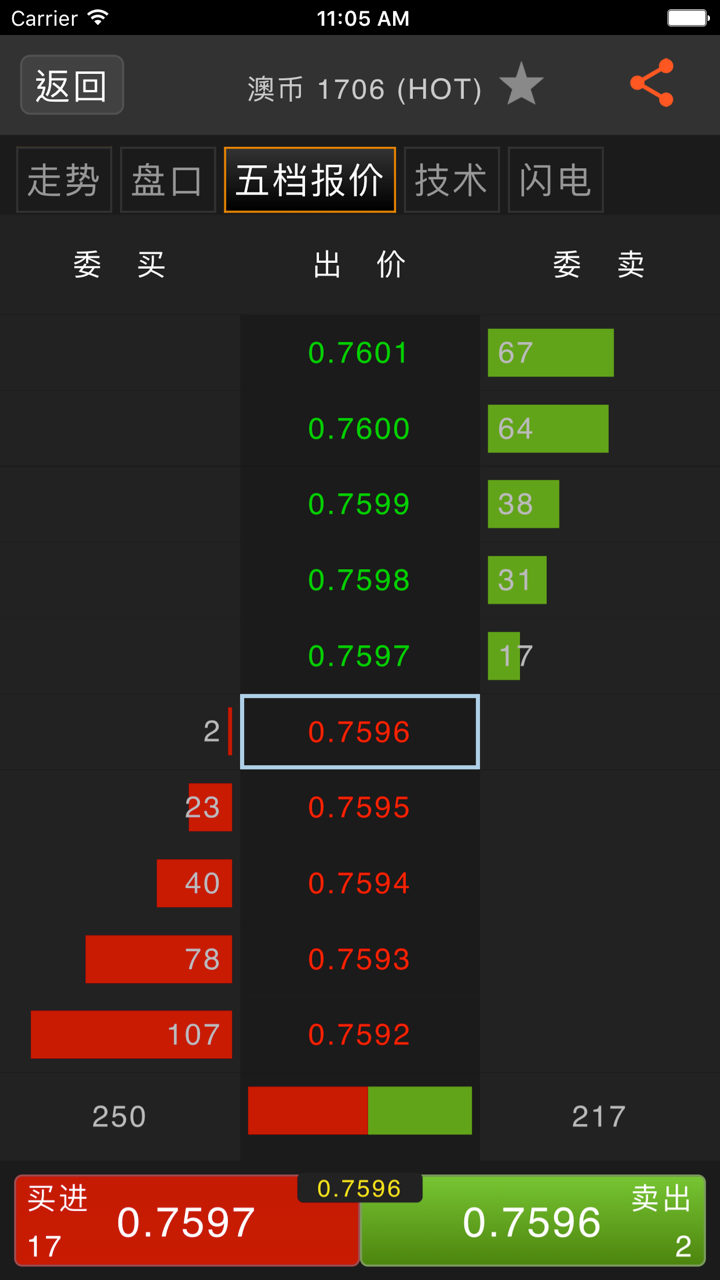

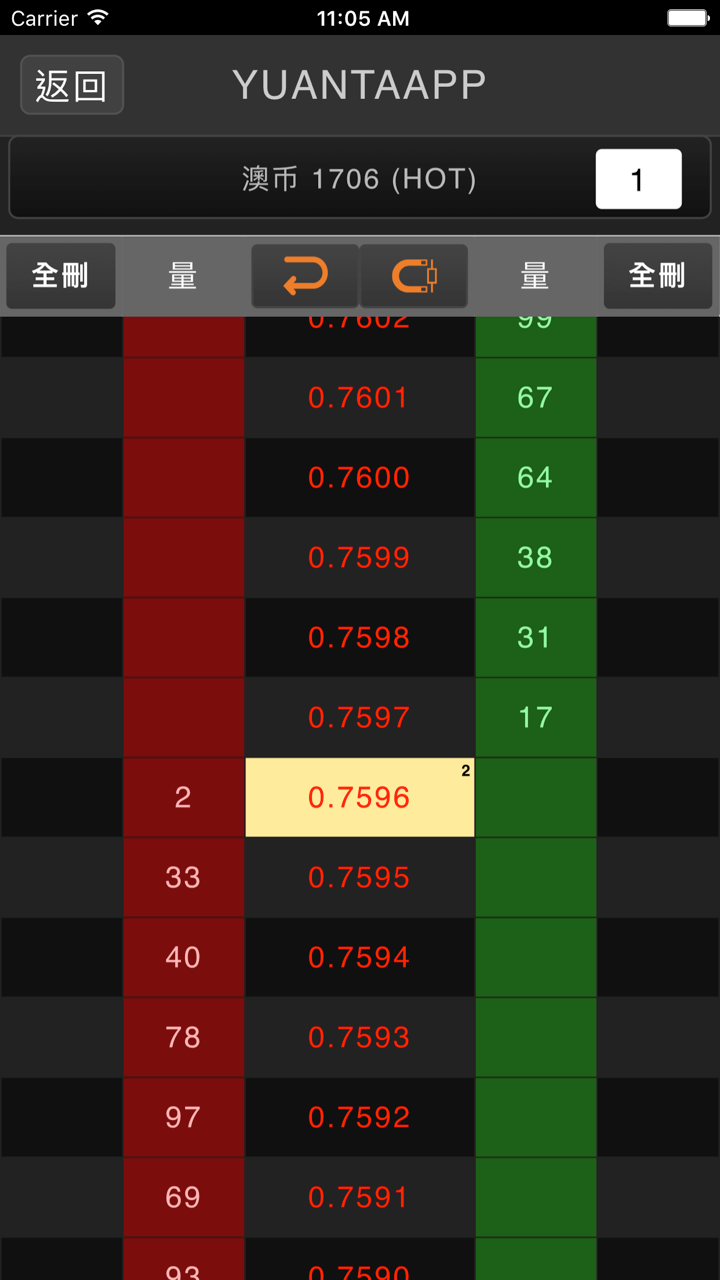

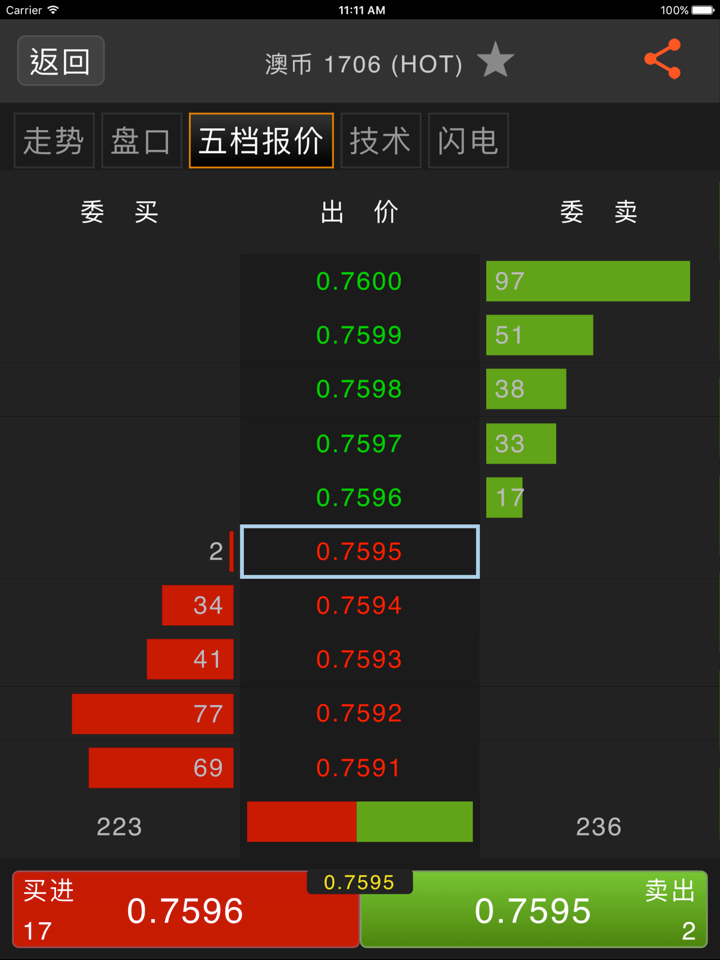

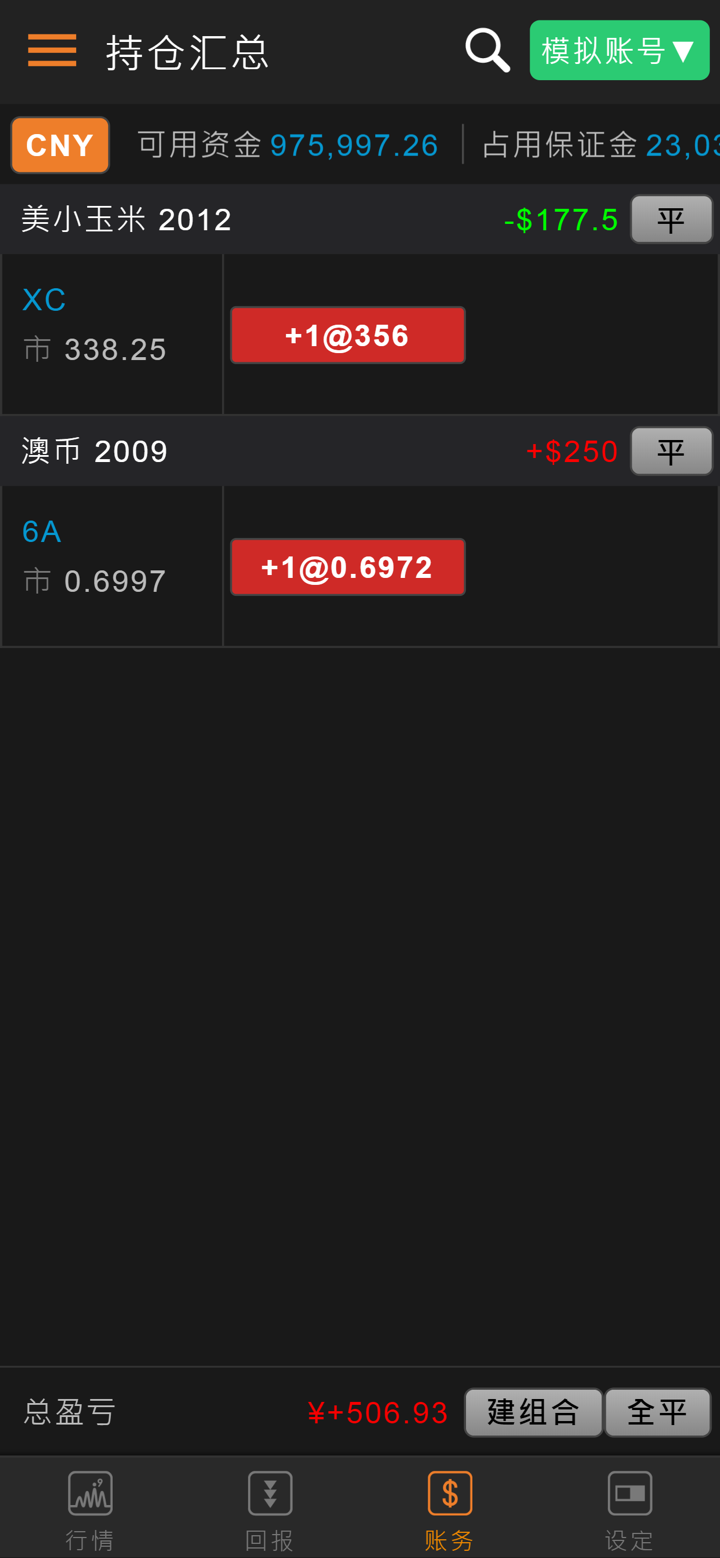

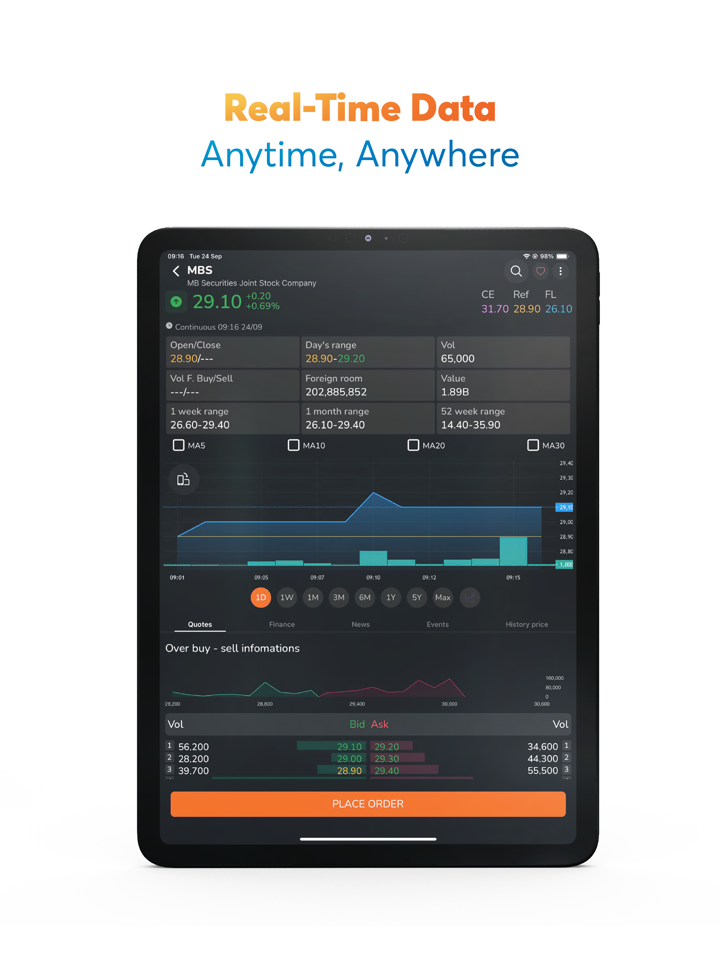

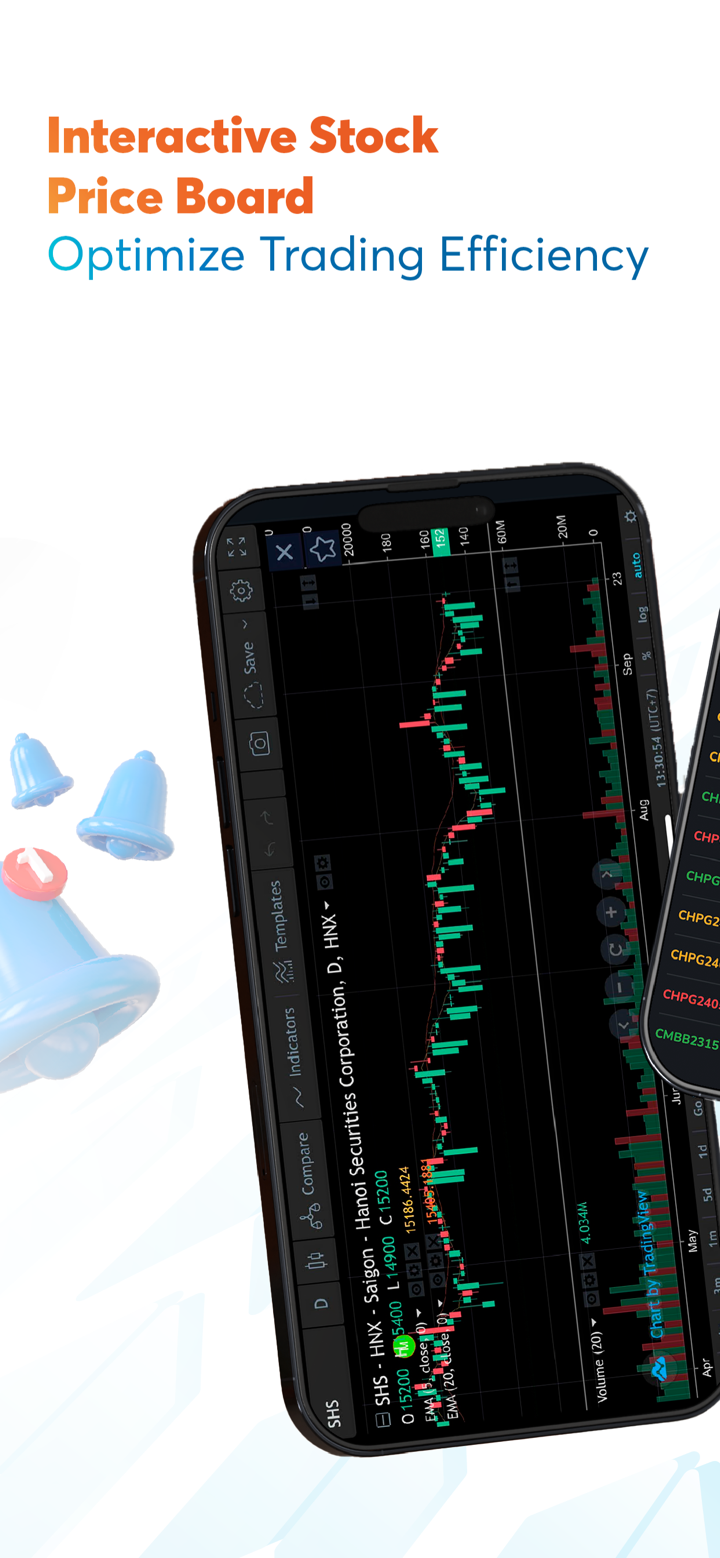

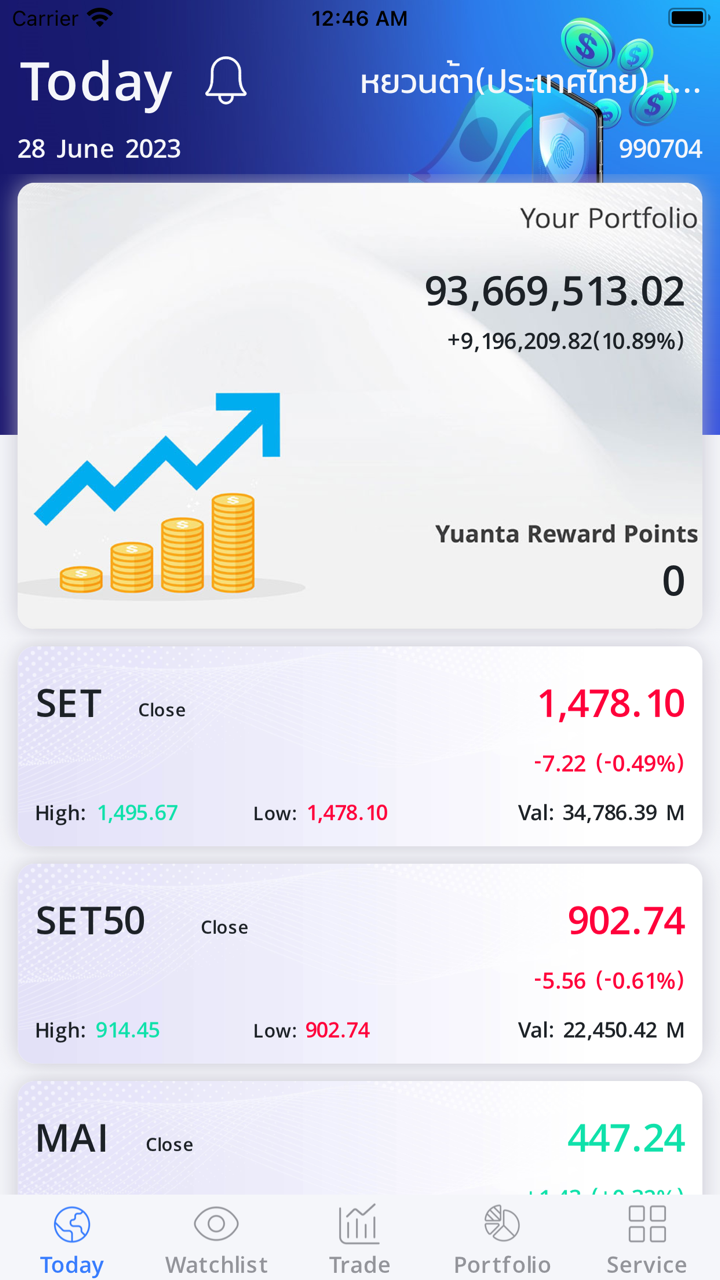

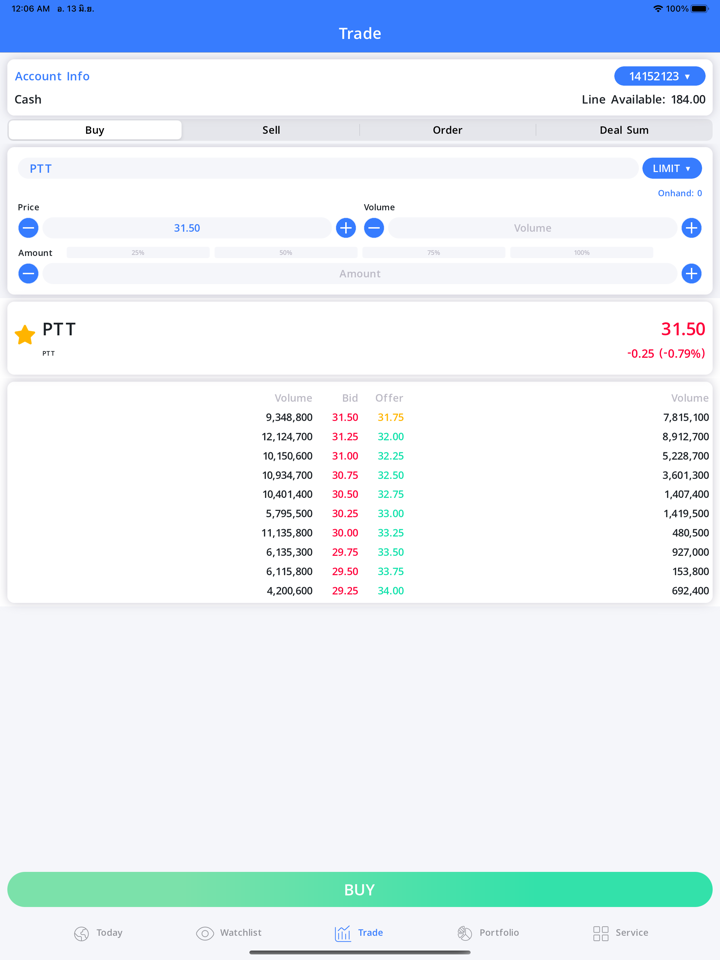

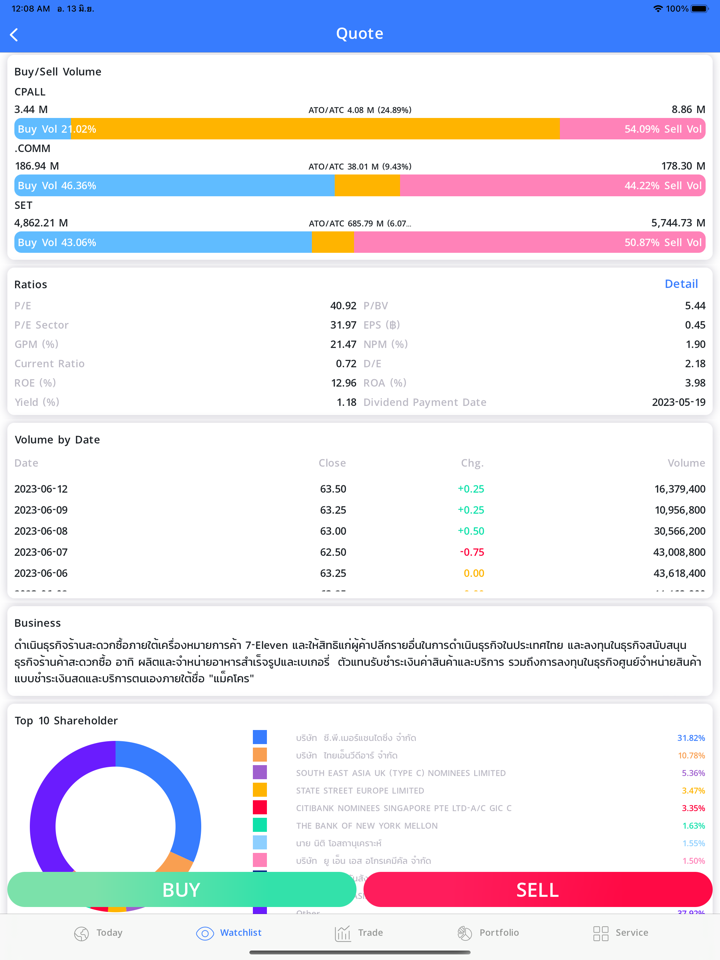

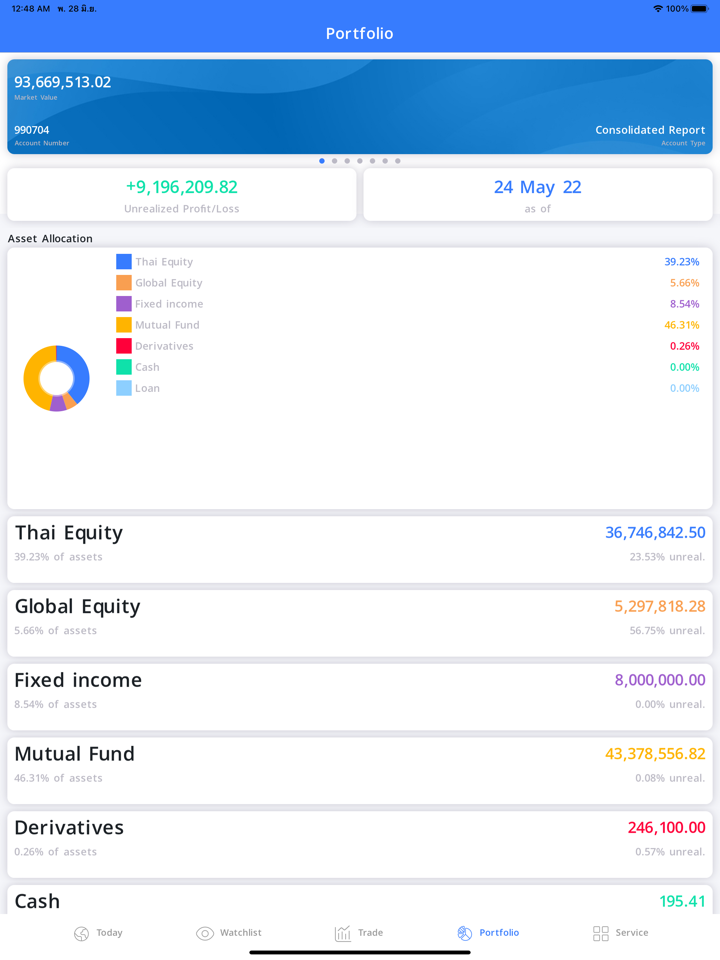

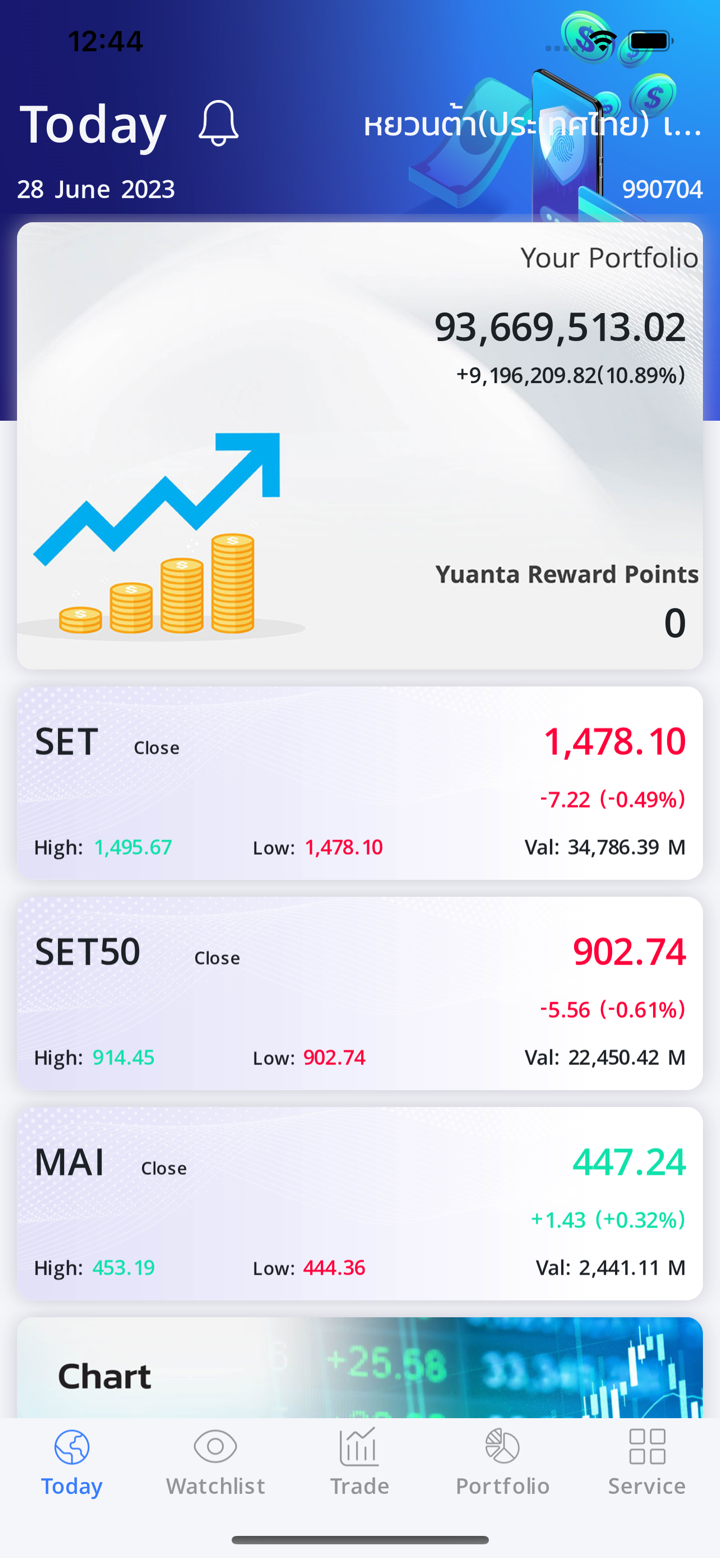

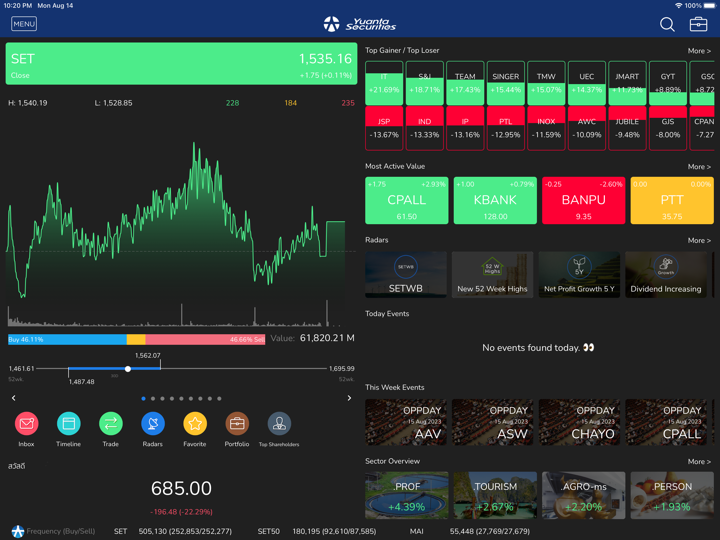

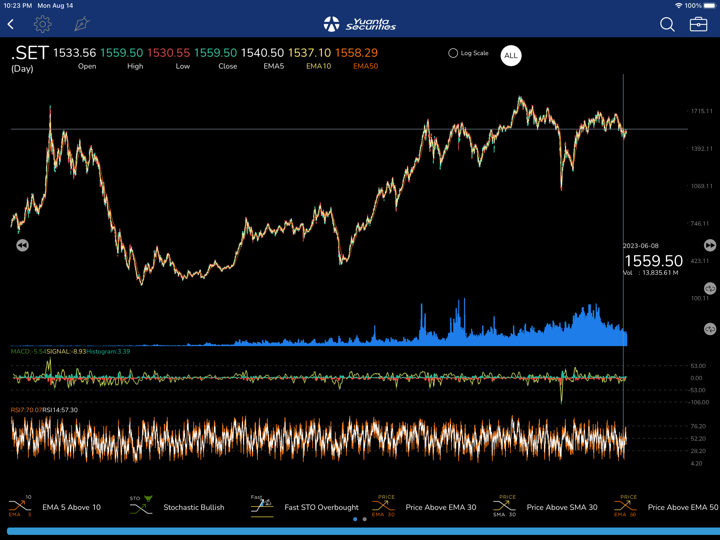

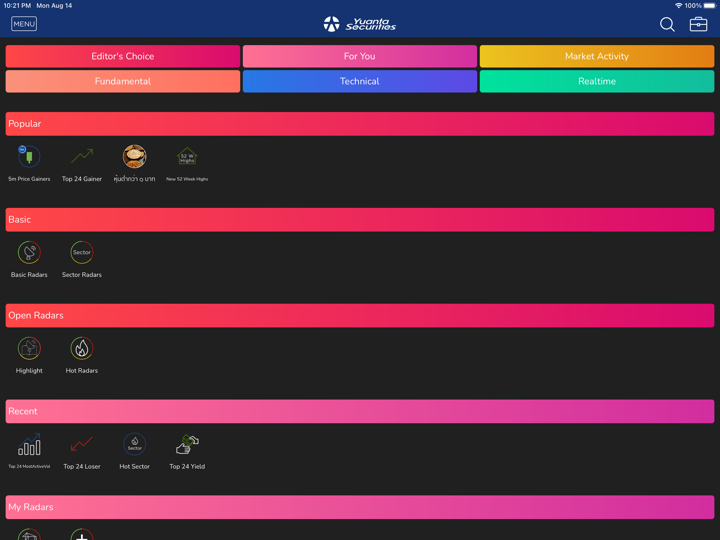

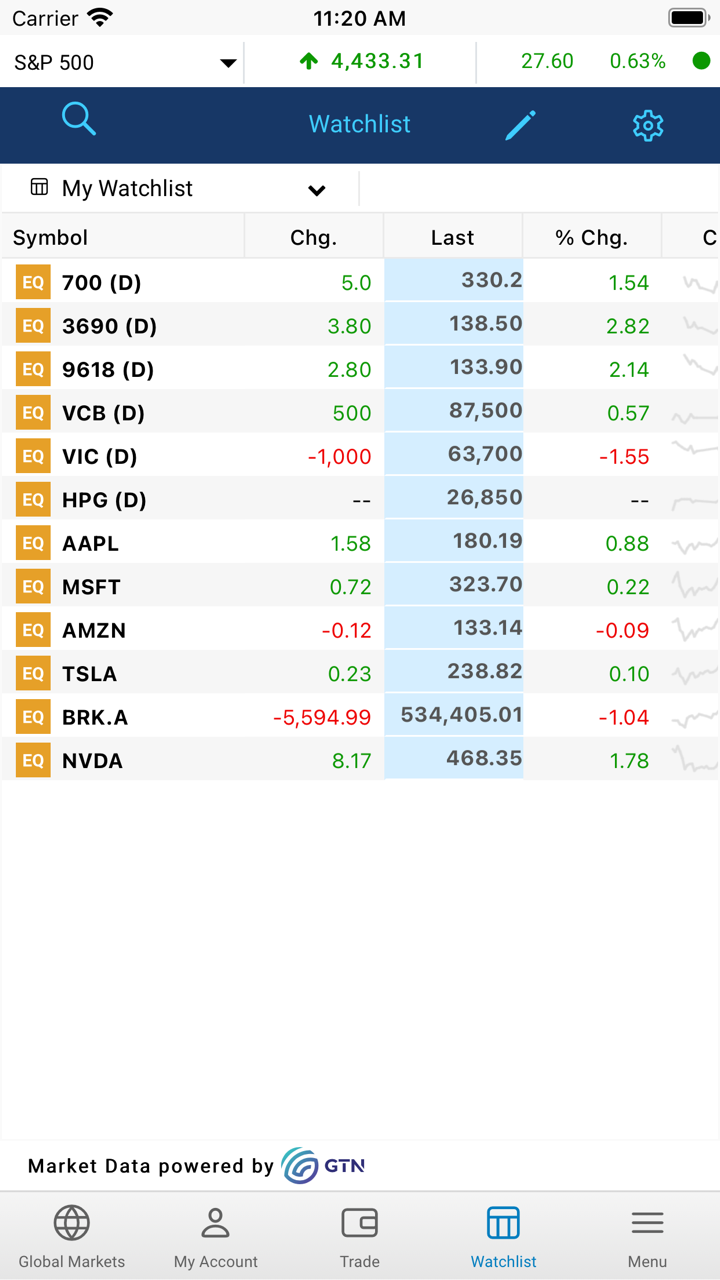

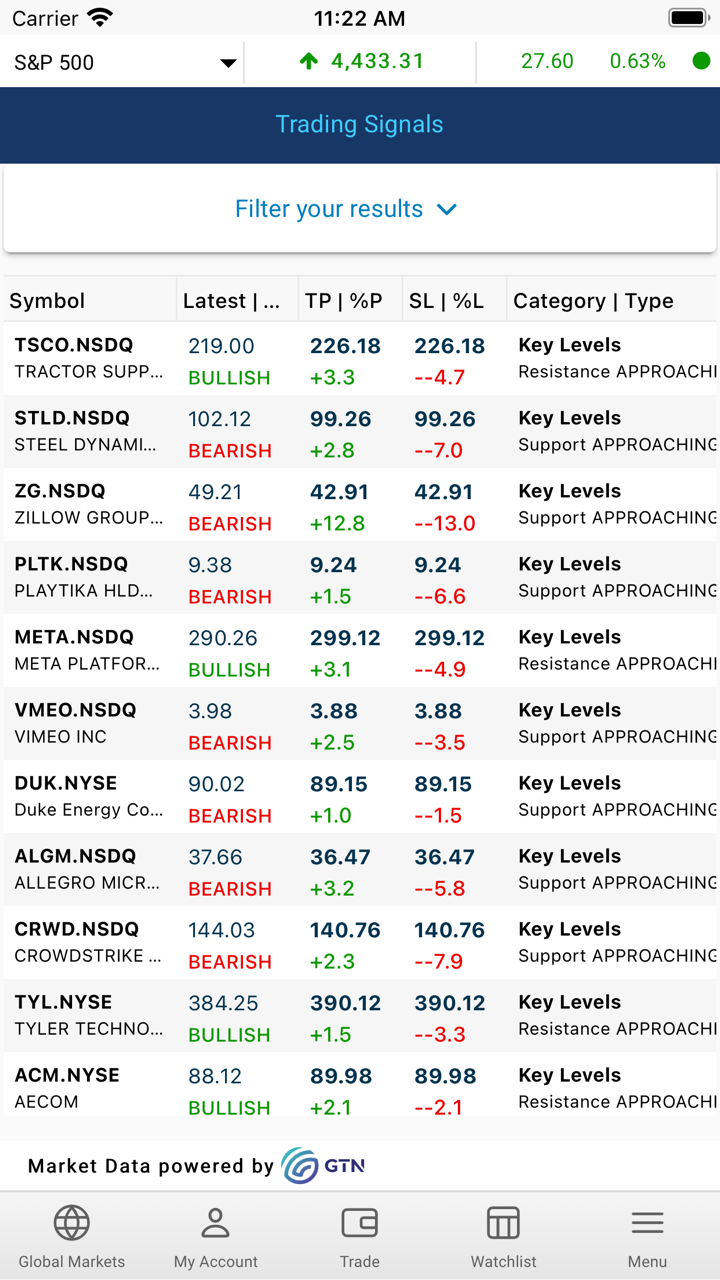

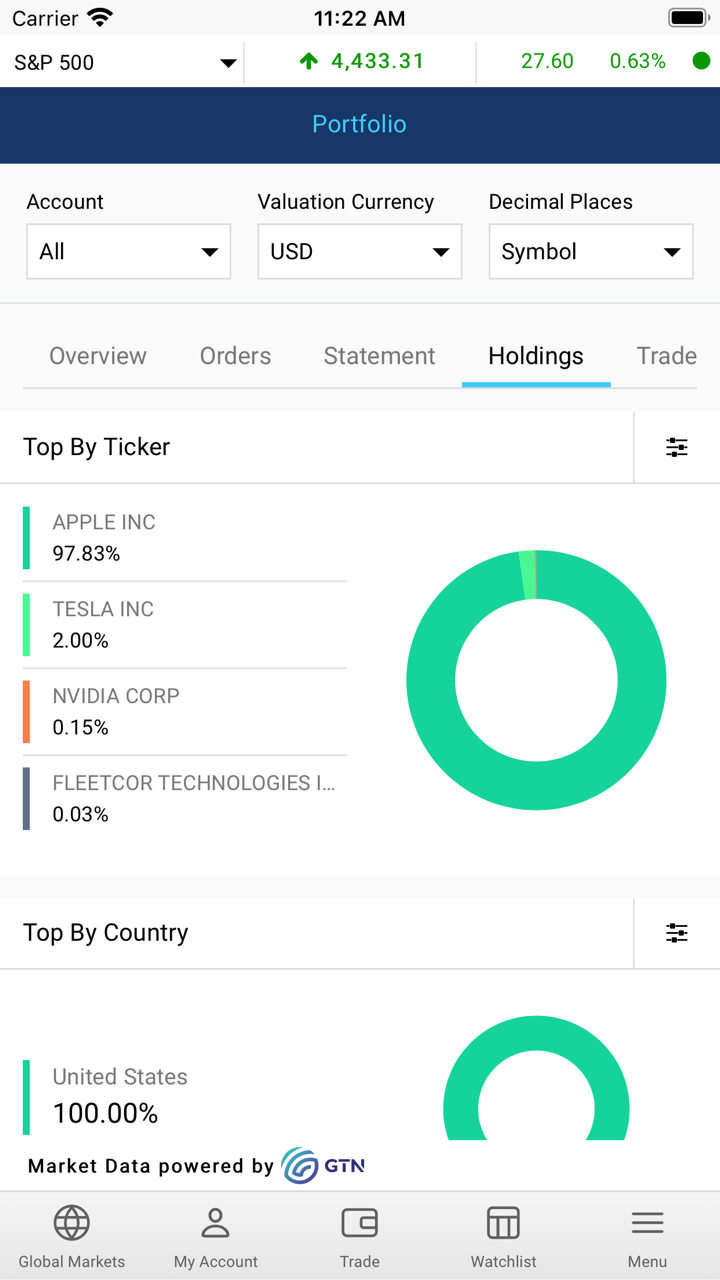

Yuanta menawarkan rangkaian platform perdagangan di bawah merek eWinner dan YSHK SP Trader, dirancang untuk pengguna desktop dan mobile.

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| eWinner | ✔ | Web, PC, iOS, Android |

| YSHK SP Trader | ✔ | PC, iOS, Android |

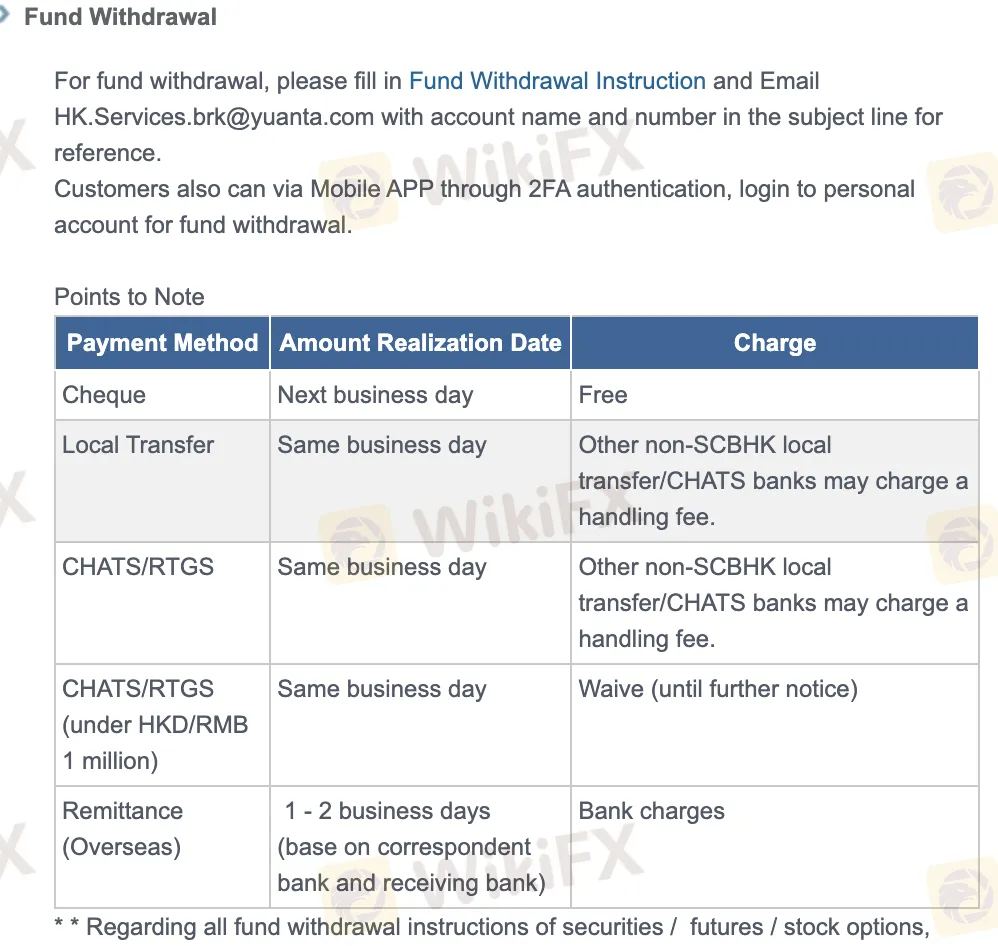

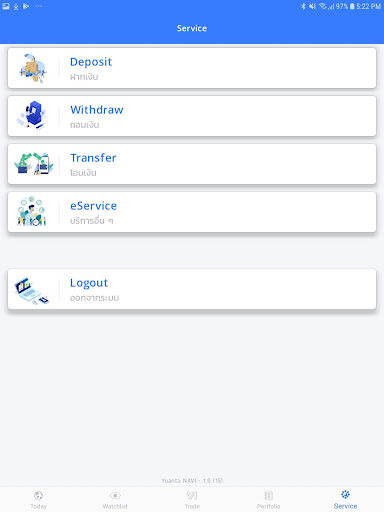

Deposit dan Penarikan

Yuanta tidak mengenakan biaya deposit atau penarikan secara langsung, namun bank pihak ketiga dapat memberlakukan biaya tergantung pada metode (terutama untuk CHATS/RTGS dan pengiriman luar negeri). Tidak ada jumlah deposit minimum tertentu yang disebutkan dalam kebijakan.

| Metode Pembayaran | Biaya (Yuanta) | Waktu Pemrosesan | Catatan |

| Deposit Cek | 0 | Hari kerja berikutnya | Salinan cek & struk dengan info akun diperlukan |

| Transfer Bank Lokal | 0 (melalui SCBHK), yang lain mungkin mengenakan biaya | Hari kerja yang sama | Transfer SCBHK gratis; non-SCBHK/CHATS mungkin dikenakan biaya |

| CHATS/RTGS | Dikecualikan di bawah HKD/RMB 1 juta (sementara) | Jumlah yang lebih besar mungkin dikenakan biaya pihak ketiga | |

| Pengiriman Luar Negeri | Yuanta: 0; Biaya bank berlaku | 1–2 hari kerja (tergantung pada bank koresponden) | Detail bank lengkap dan SWIFT diperlukan per mata uang |

| Aplikasi Seluler (2FA) | 0 | Hari yang sama (jika sebelum batas waktu) | Penarikan melalui aplikasi seluler memerlukan otentikasi |

| Instruksi Email | 0 | Diproses pada hari kerja yang sama atau berikutnya | Harus email dengan nama akun & nomor sebelum batas waktu (5:00pm HKT) |