Buod ng kumpanya

| Yuanta Buod ng Pagsusuri | |

| Itinatag | 1992 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC |

| Mga Kasangkapan sa Merkado | Stocks, derivatives, futures & options |

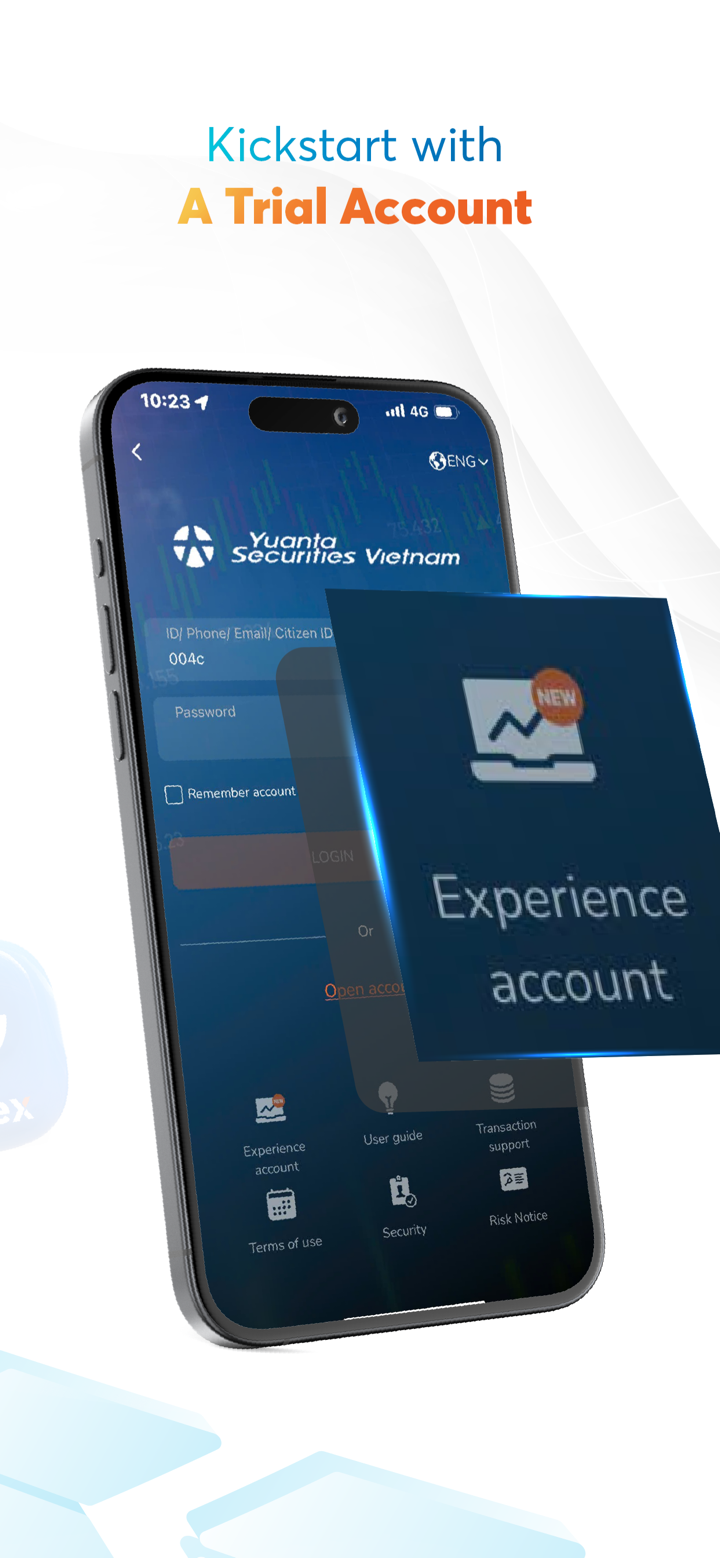

| Demo Account | ❌ |

| Platform ng Paggagalaw | eWinner, YSHK SP Trader |

| Minimum Deposit | / |

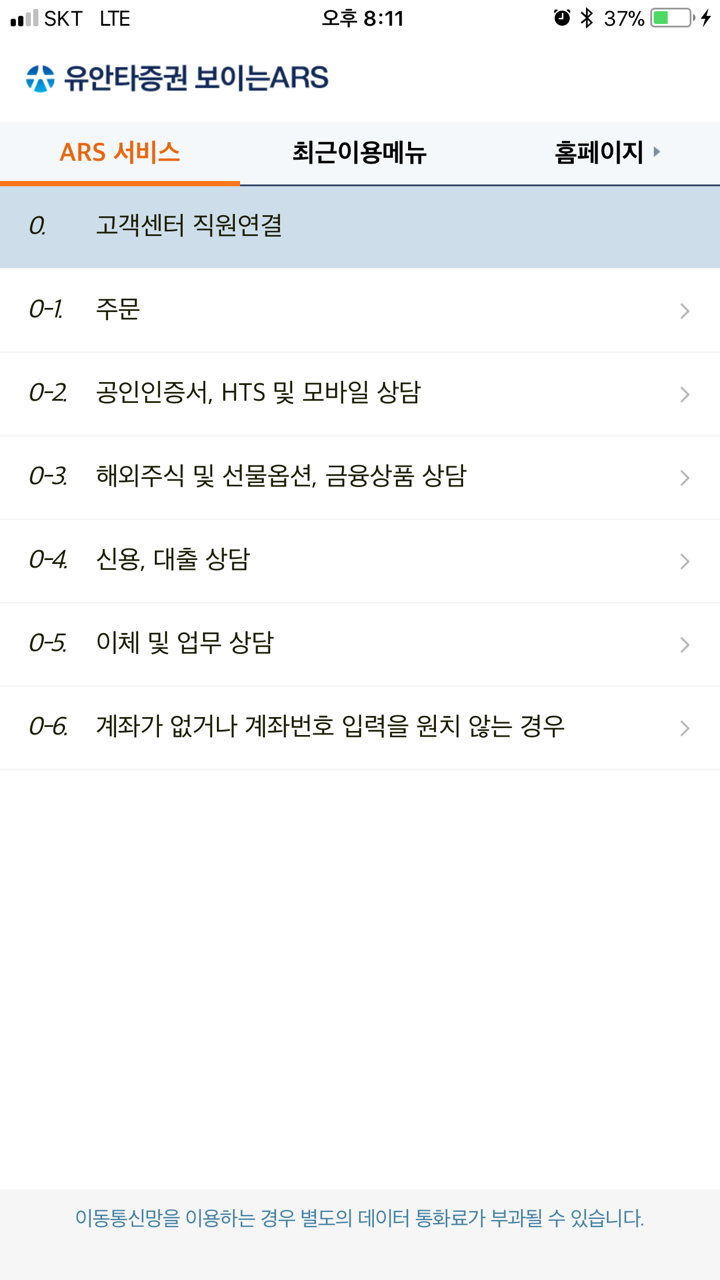

| Suporta sa Customer | Telepono: (852) 3555-7878 |

| Fax: (852) 3555-7889 | |

| Email: HK.services.brk@yuanta.com | |

Impormasyon Tungkol sa Yuanta

Itinatag noong 1992, pinamamahalaan ng Hong Kong Securities and Futures Commission ang Yuanta. Nagbibigay ang kumpanya ng iba't ibang kasangkapan sa pangangalakal kabilang ang mga stocks, futures, at derivatives. Bagaman wala itong demo account, tumutulong ito sa multi-platform trading gamit ang mga teknolohiyang nilikha sa loob at nagbibigay ng lokal na suporta sa pamamagitan ng telepono at email.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado ng Hong Kong SFC | Walang demo accounts |

| Suporta sa multi-market trading sa pamamagitan ng isang login | Maaaring mataas ang ilang bayad sa serbisyo (hal. nominee services) |

| Nag-aalok ng malawak na saklaw ng produkto: stocks, futures, options | Walang malinaw na itinakdang minimum deposit |

Tunay ba ang Yuanta?

Oo, ang Yuanta ay nireregula ng Securities and Futures Commission ng Hong Kong (SFC).

| Lisensiyadong Entidad | Regulated by | Regulated License | Kasalukuyang Kalagayan | Uri ng Lisensya | Numero ng Lisensya |

| Yuanta Securities (Hong Kong) Company Limited | Hong Kong, China | SFC | Regulated | Pakikitungo sa mga kontrata sa hinaharap | ABS015 |

| Yuanta Futures (HK) Co., Limited | Hong Kong, China | SFC | Regulated | Pakikitungo sa mga kontrata sa hinaharap | AXQ690 |

| Yuanta Asia Investment (Hong Kong) Limited | Hong Kong, China | SFC | Nag-exceed | Pakikitungo sa mga securities | ABZ023 |

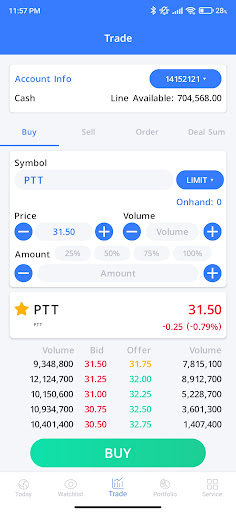

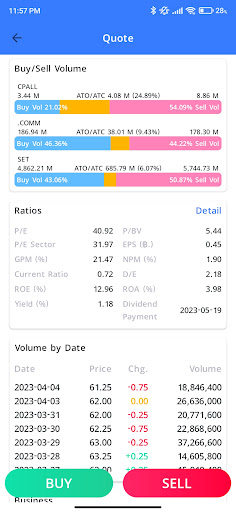

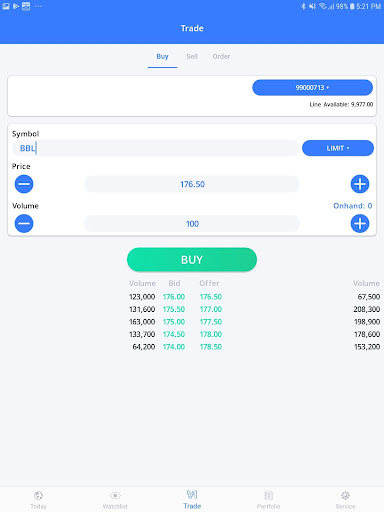

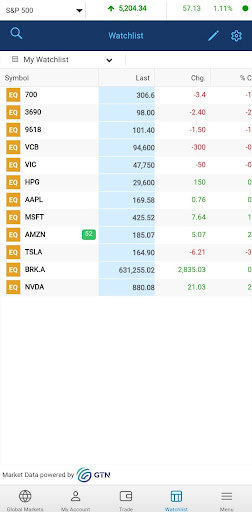

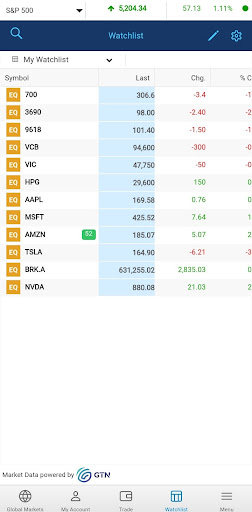

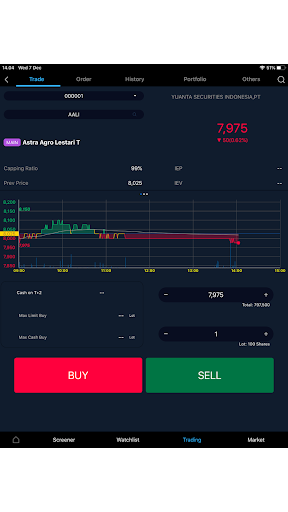

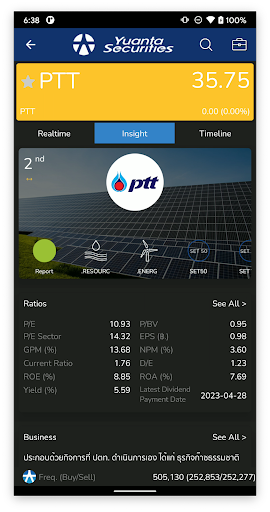

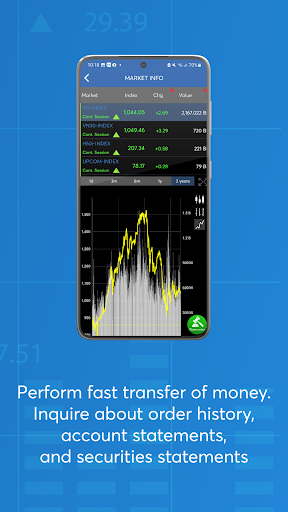

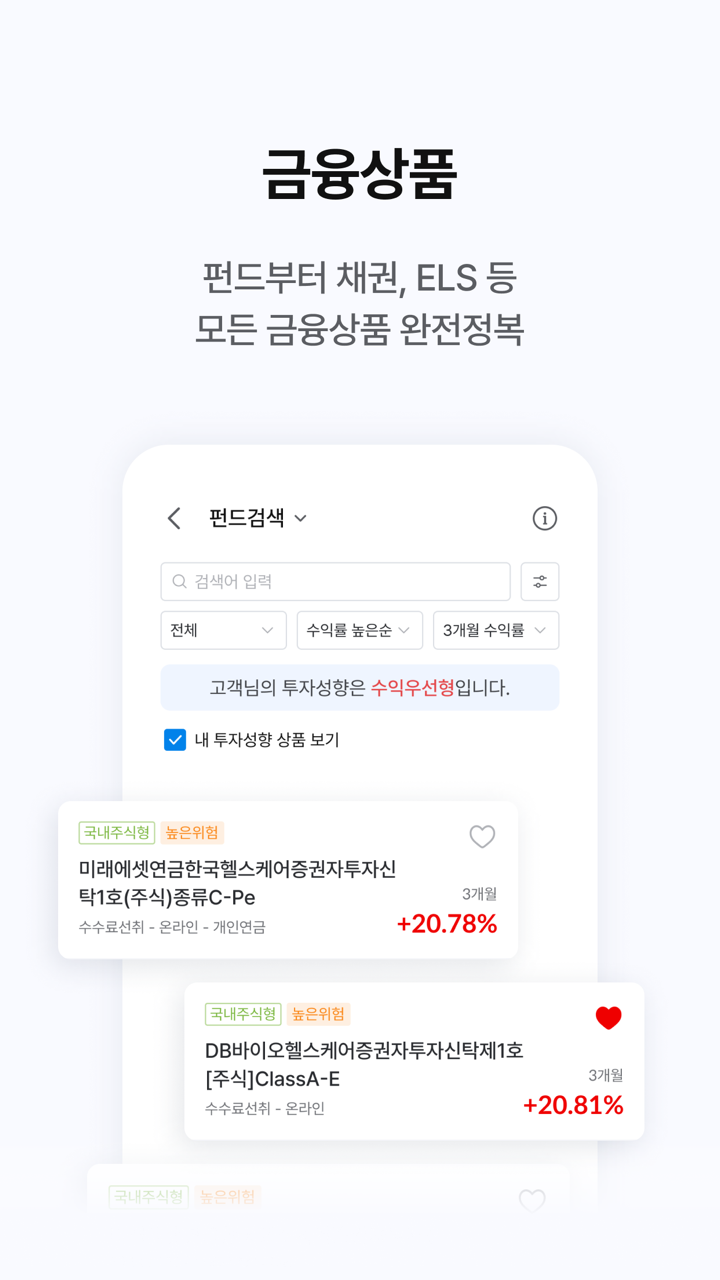

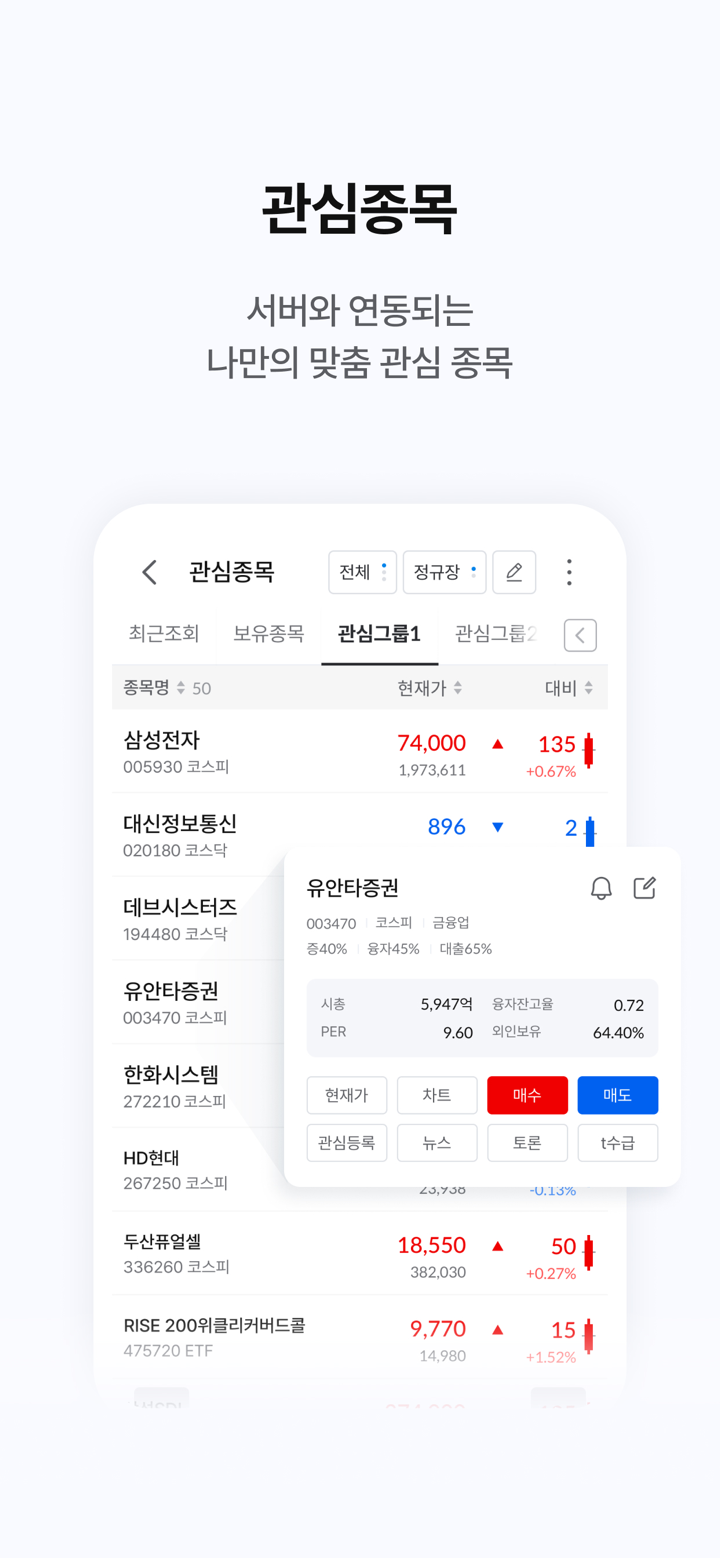

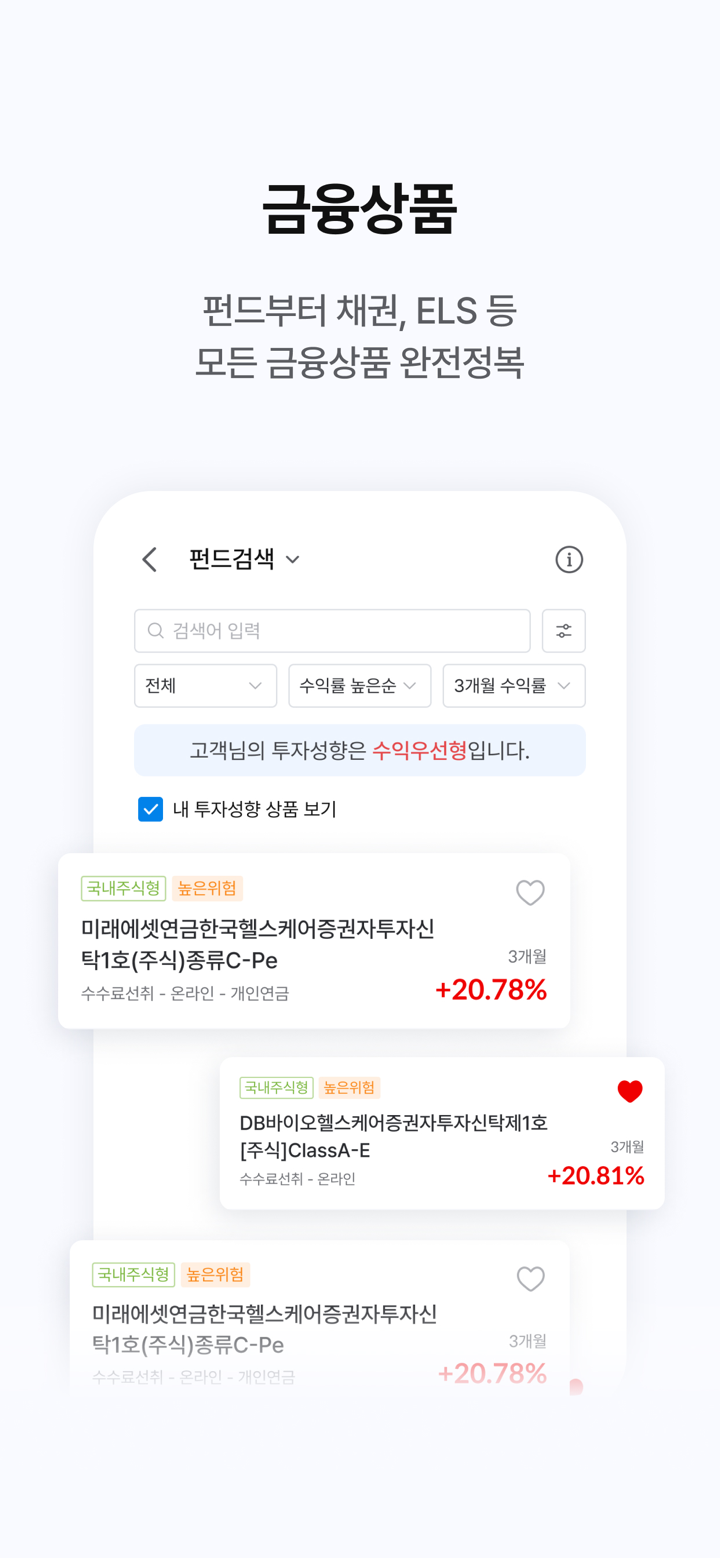

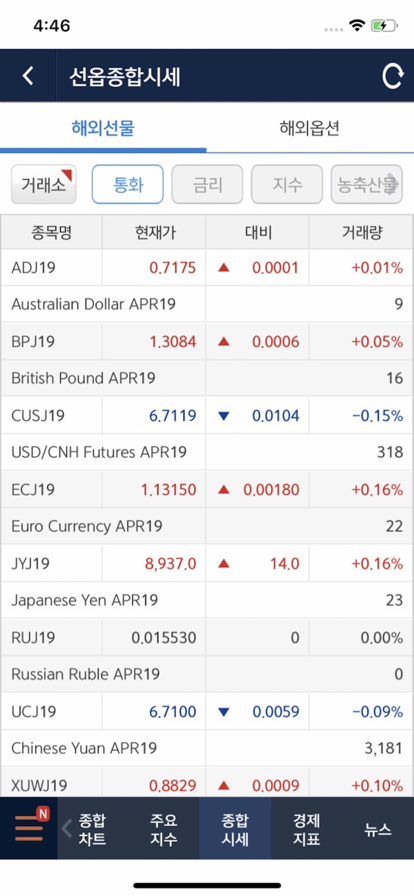

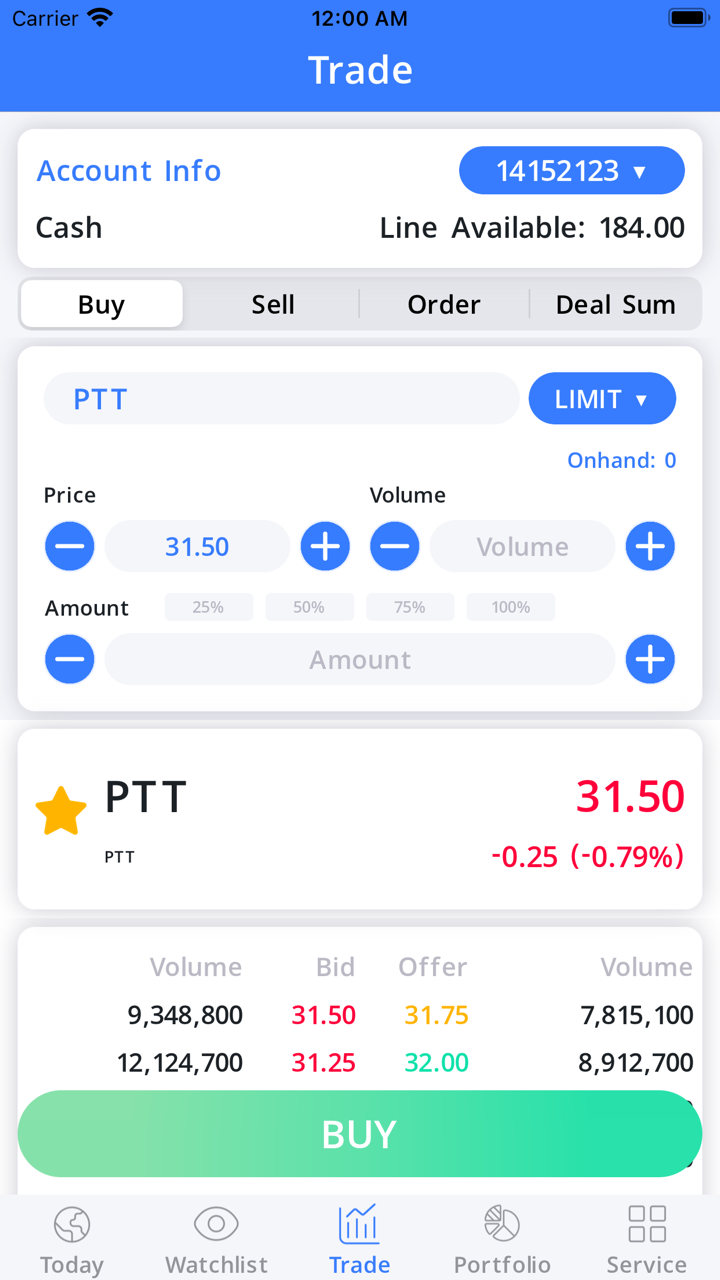

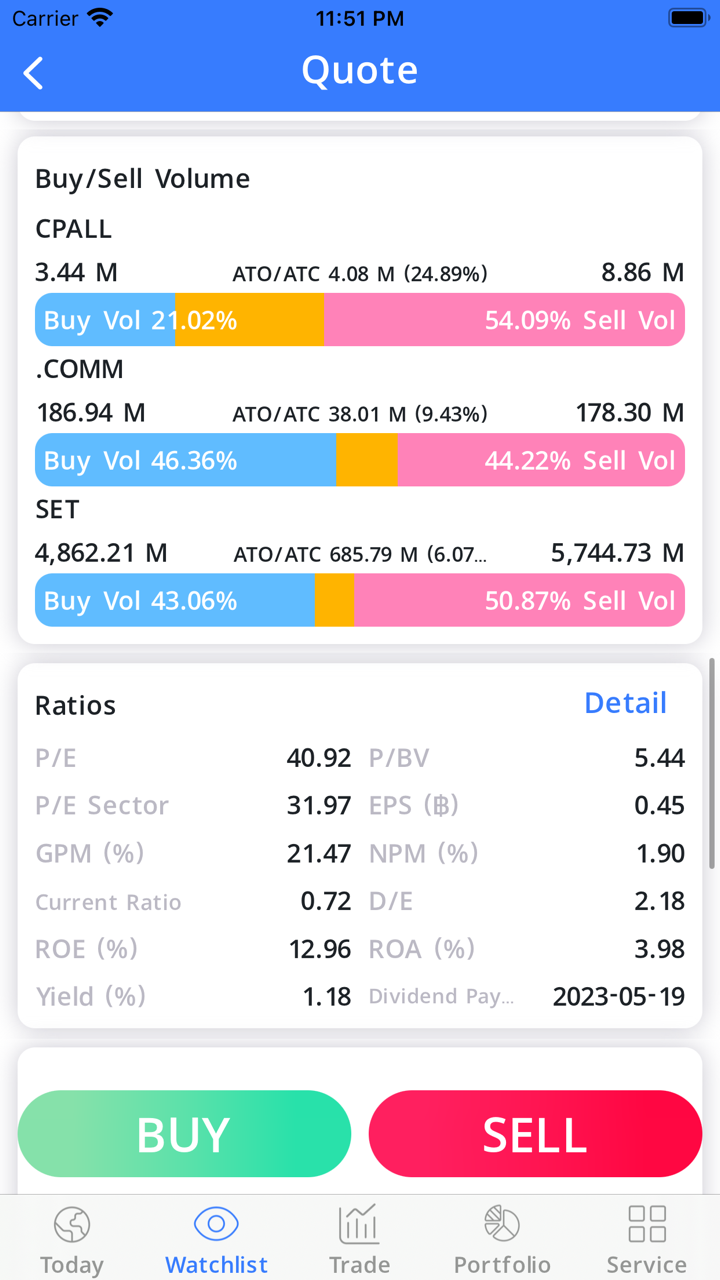

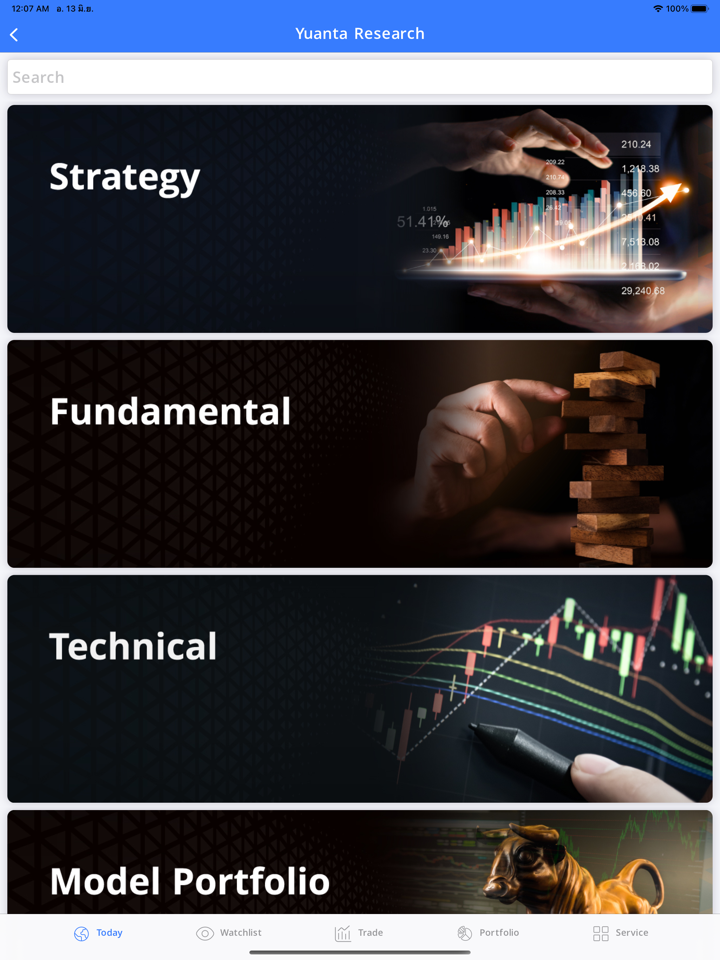

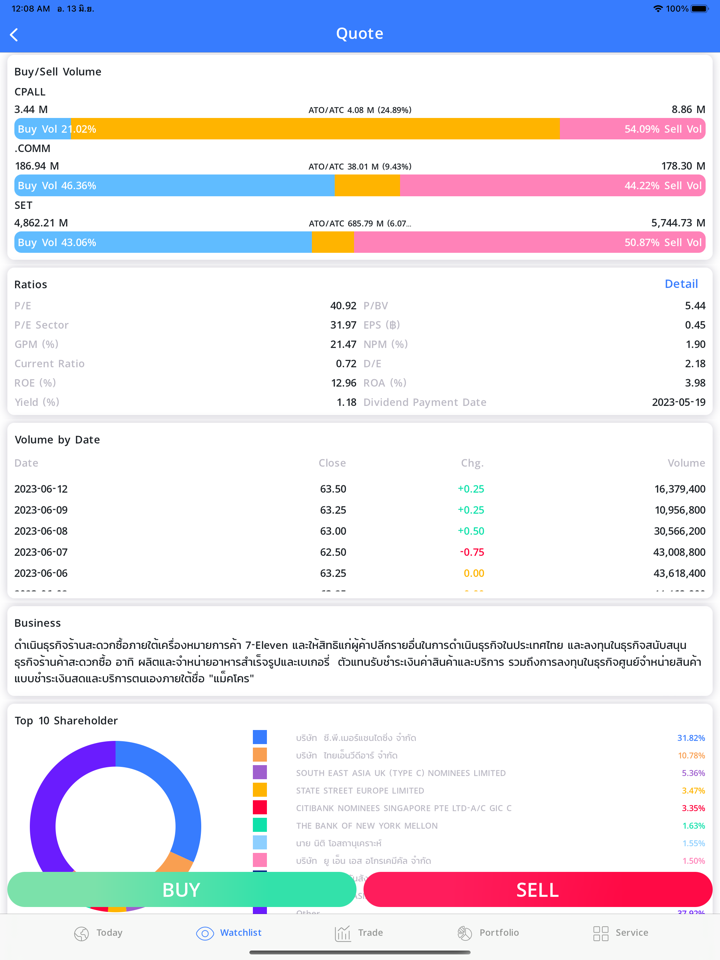

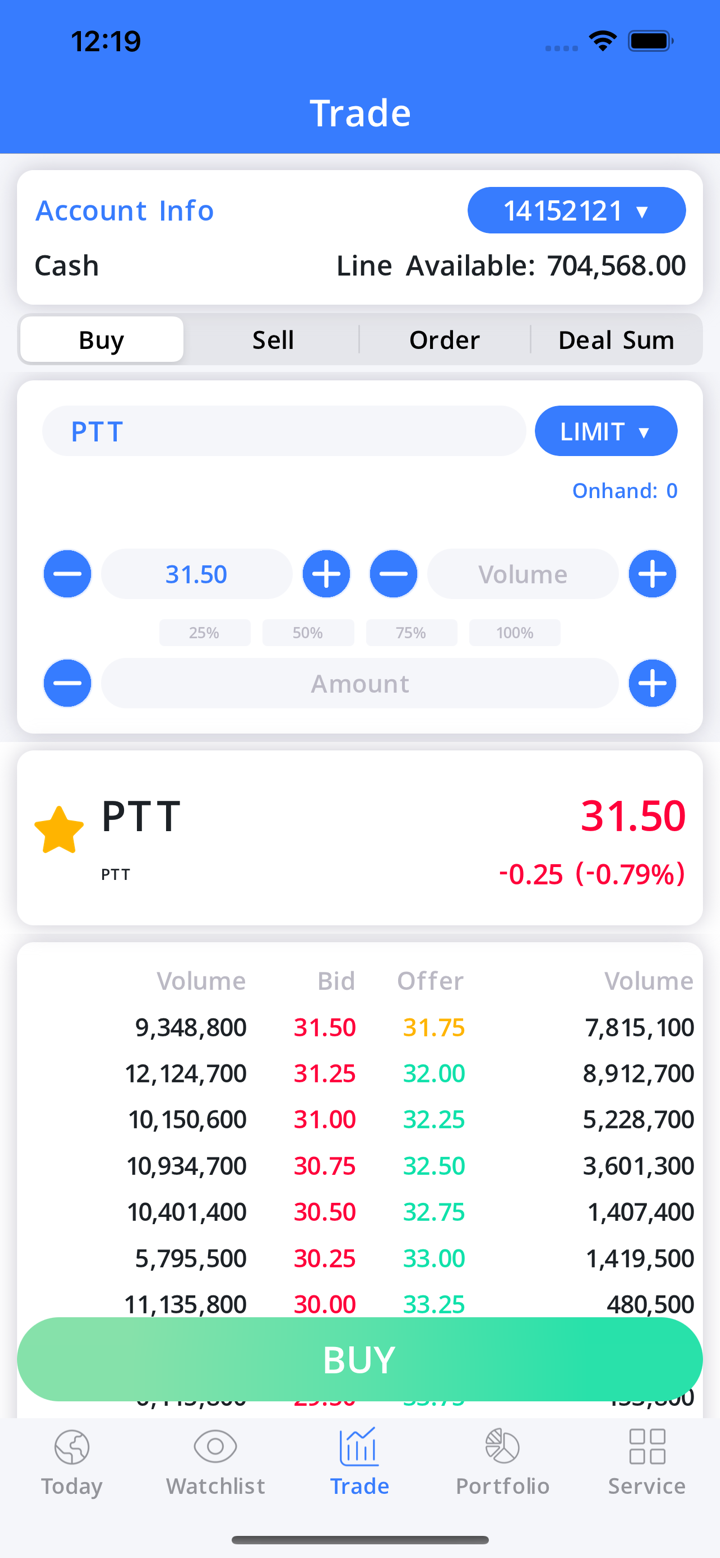

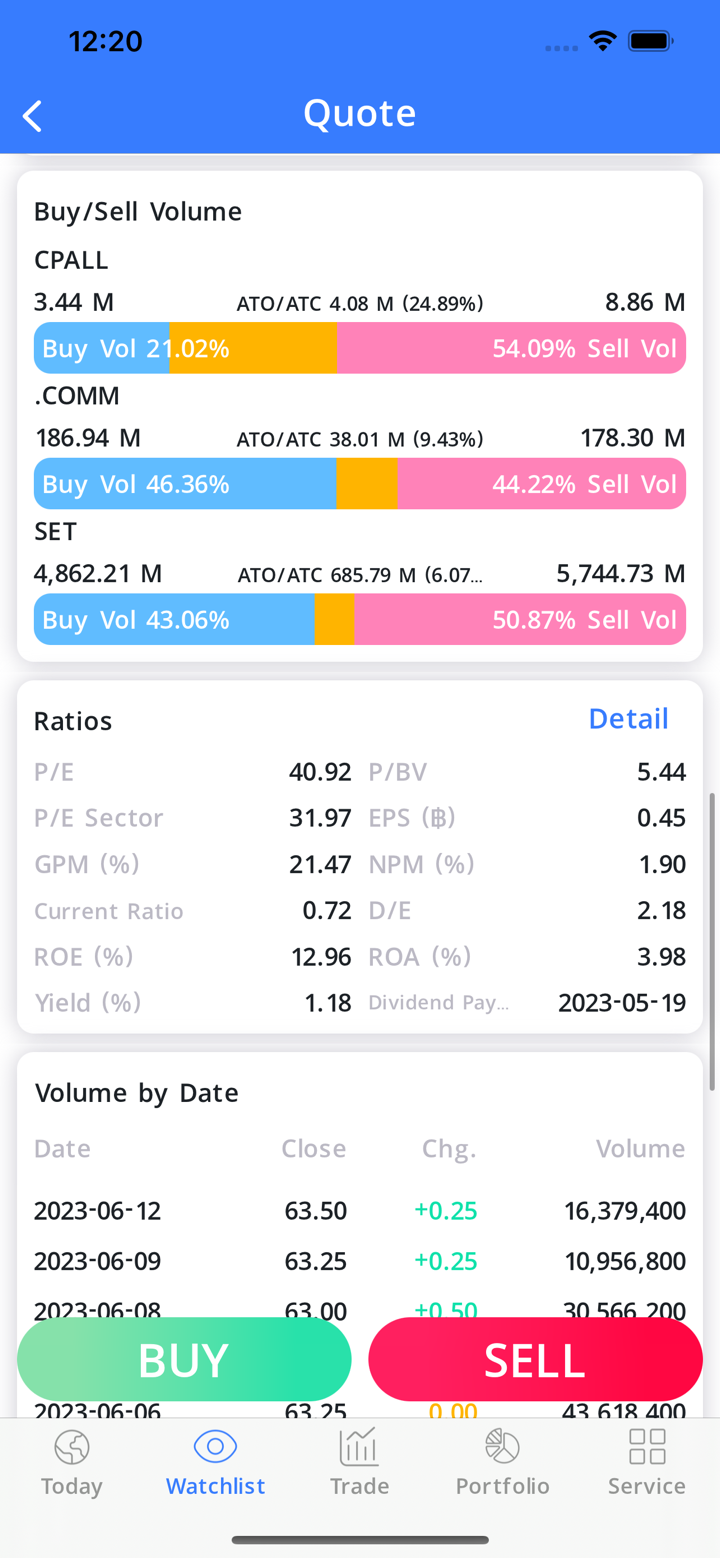

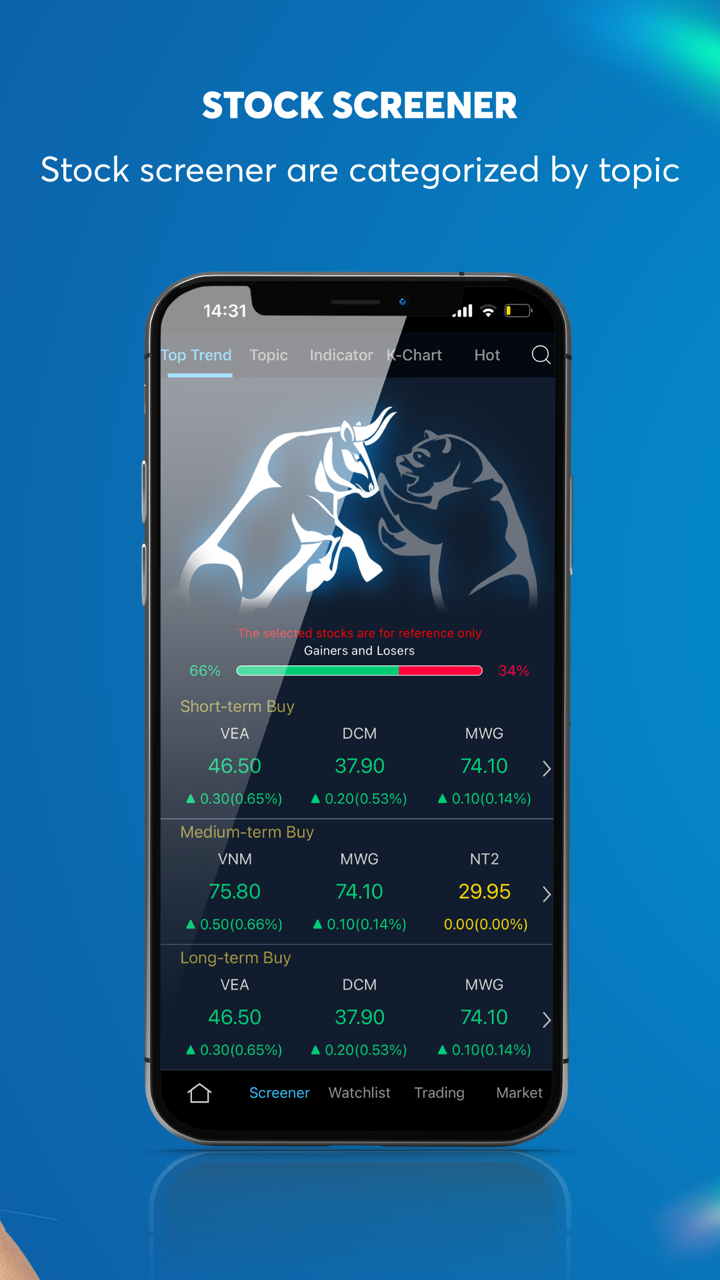

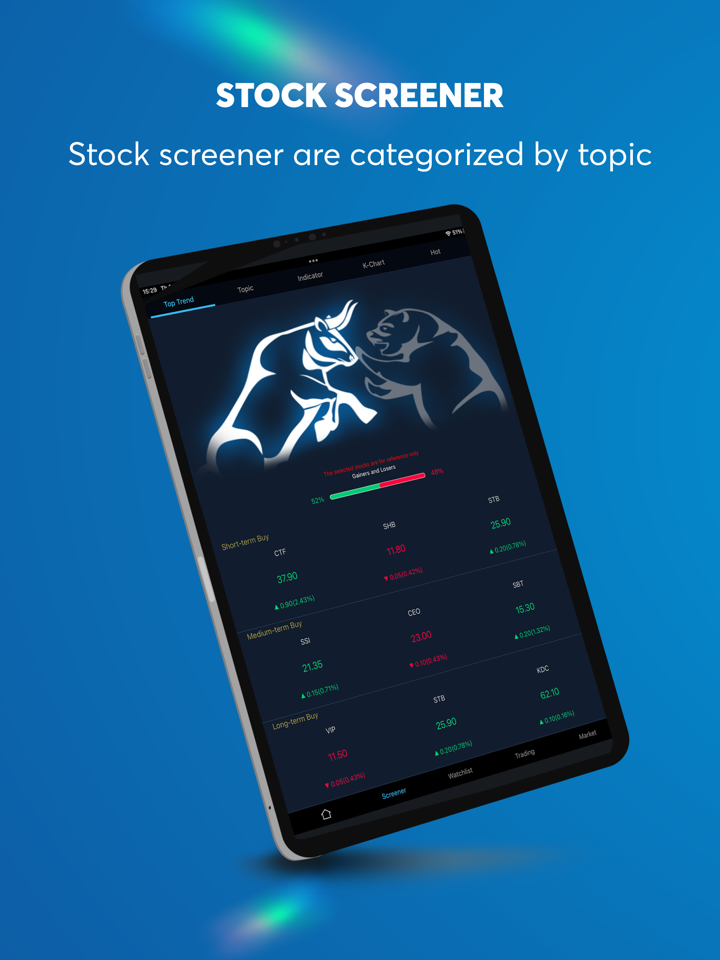

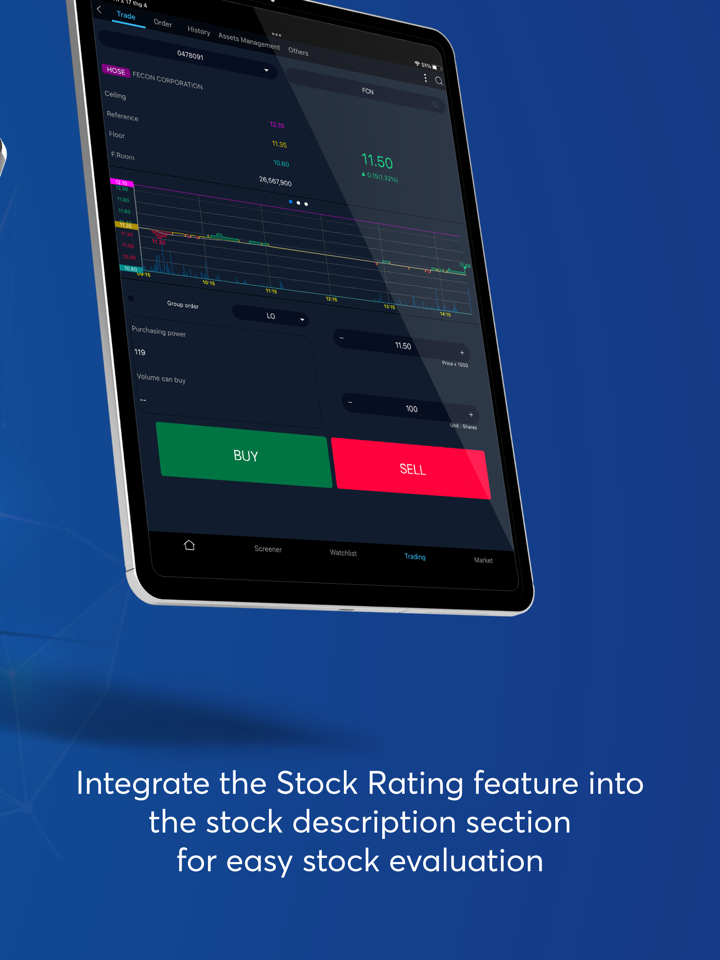

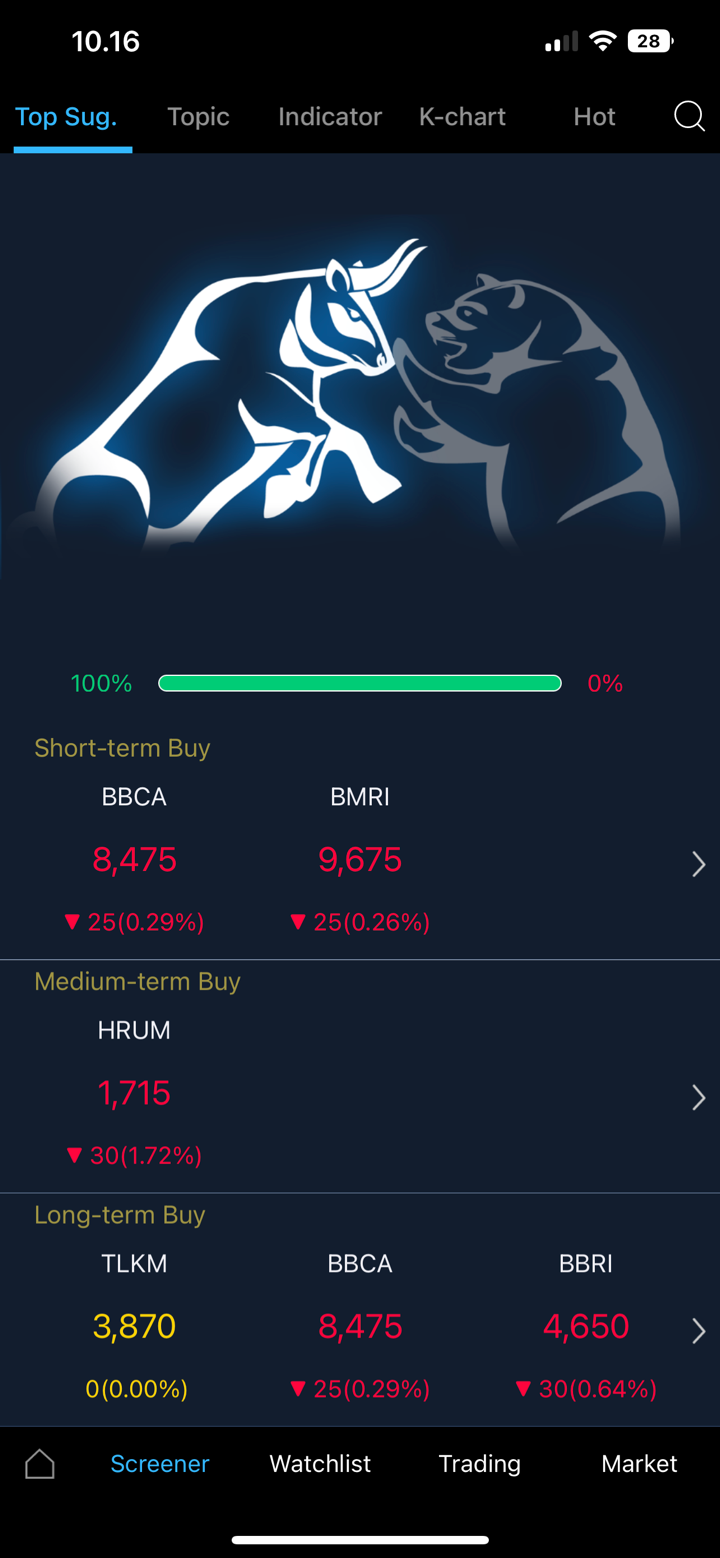

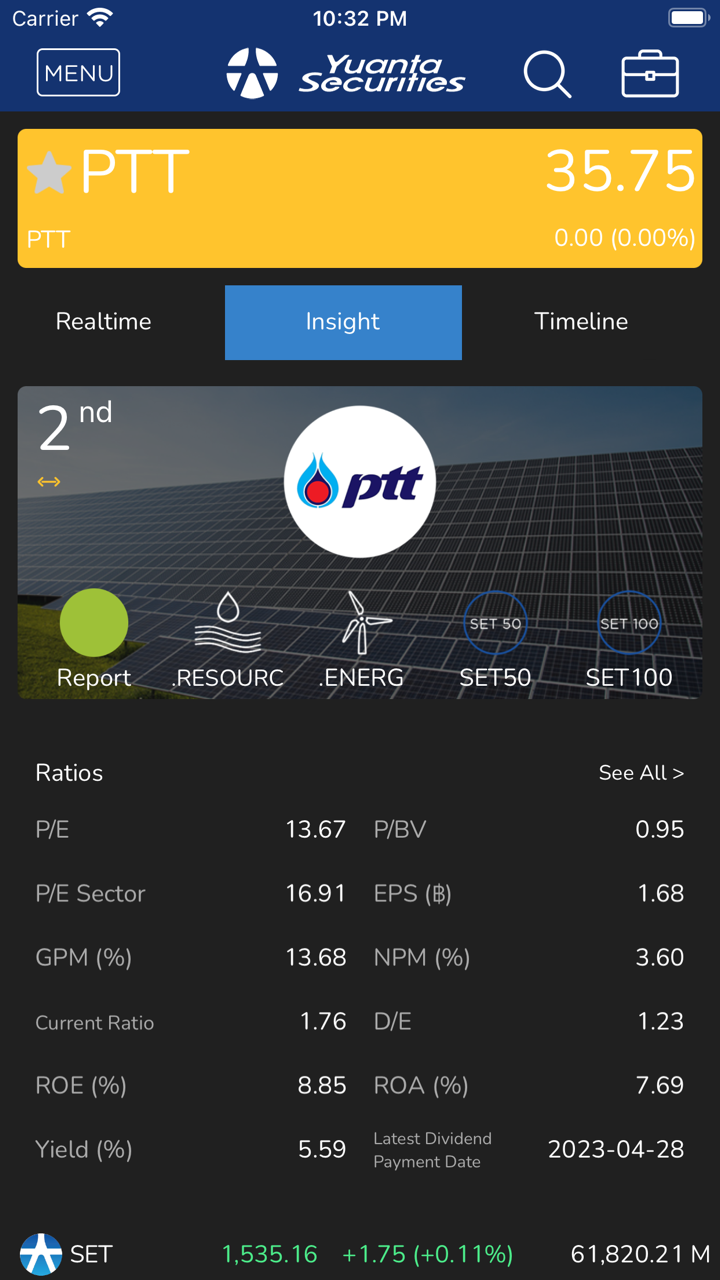

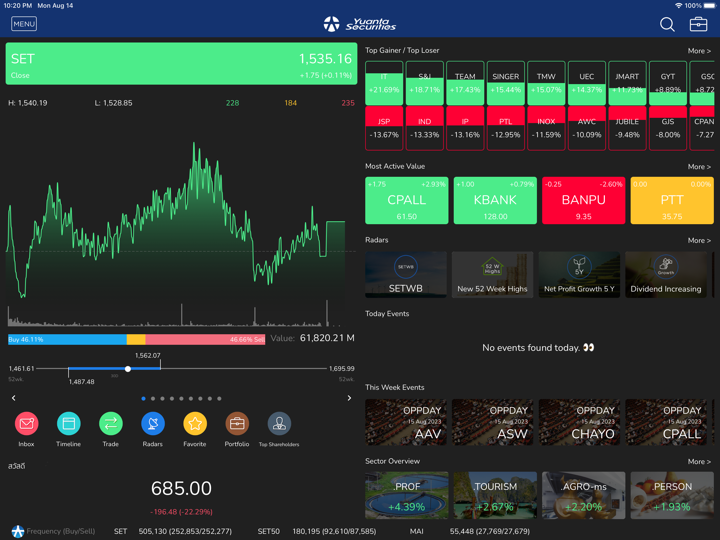

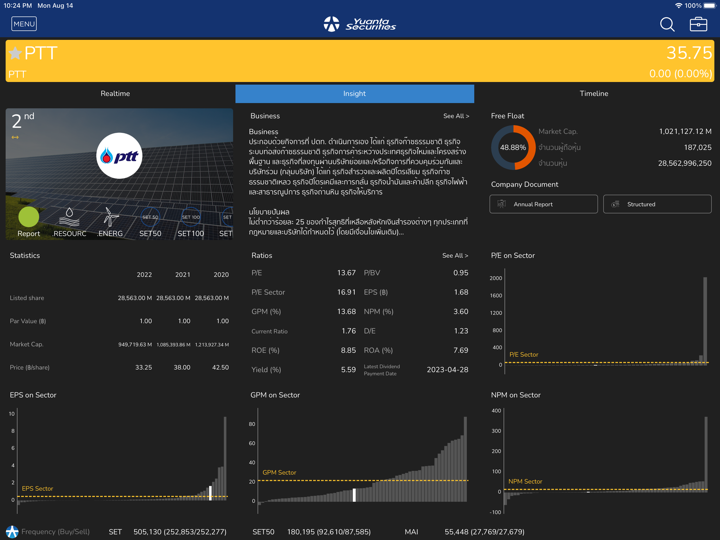

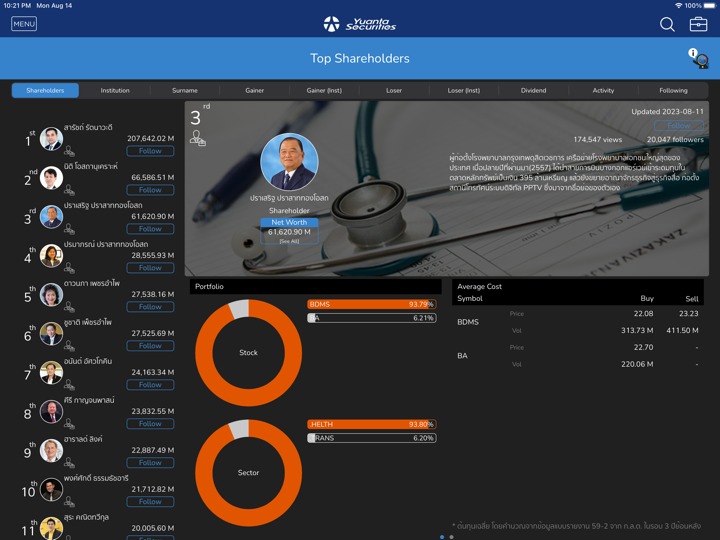

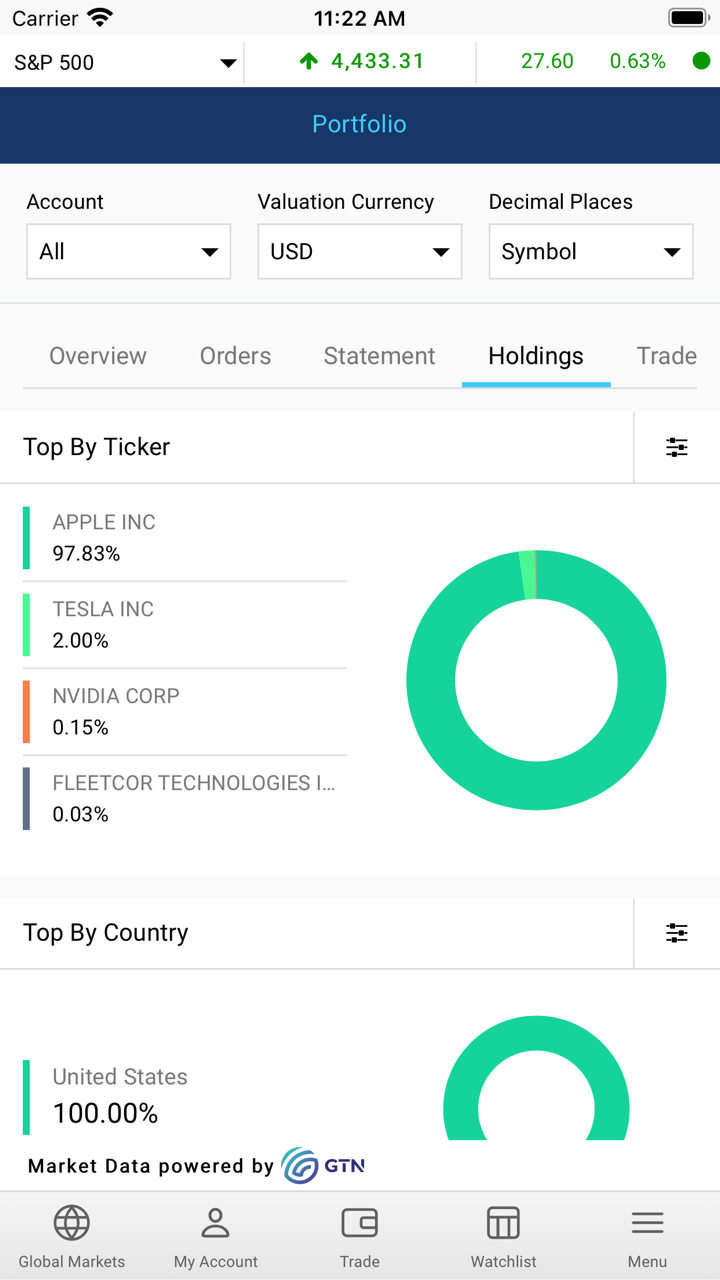

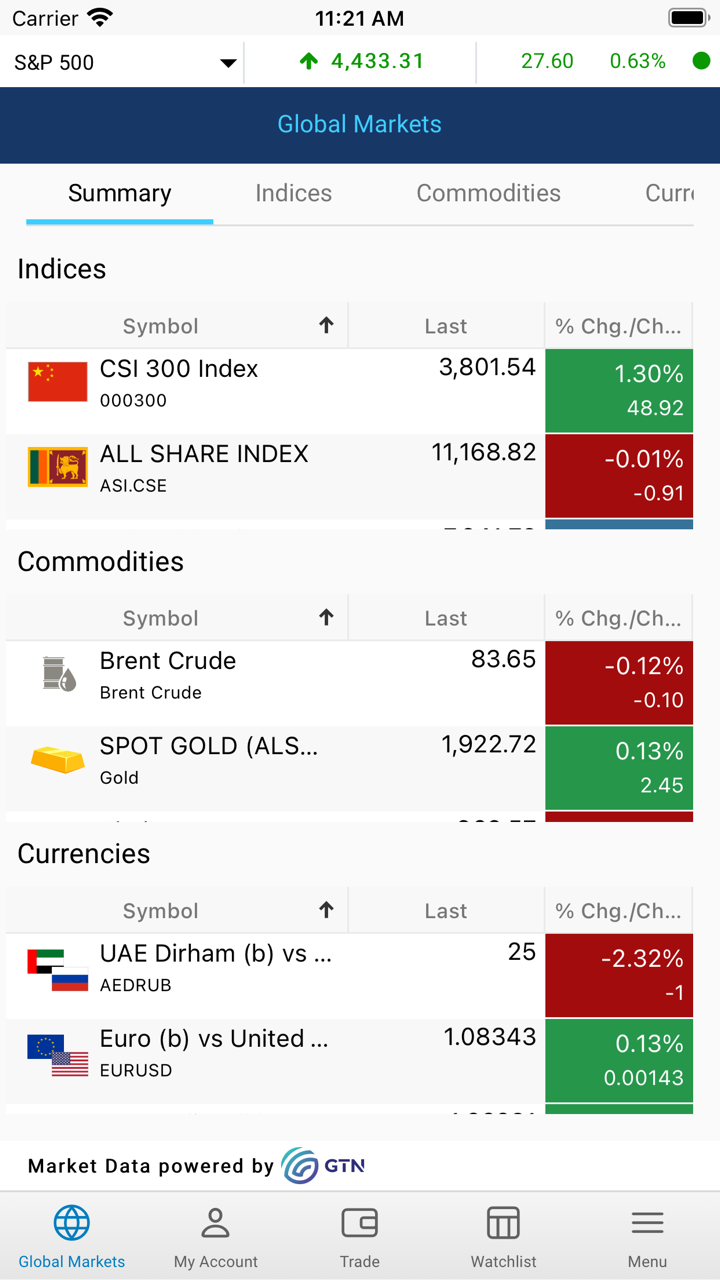

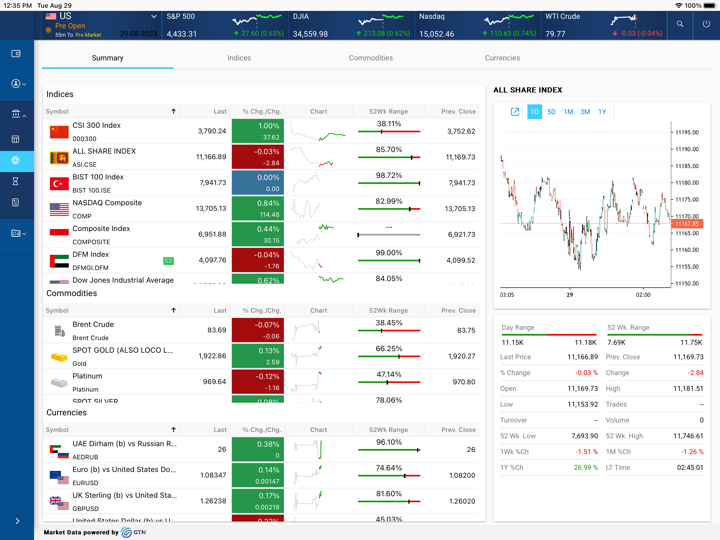

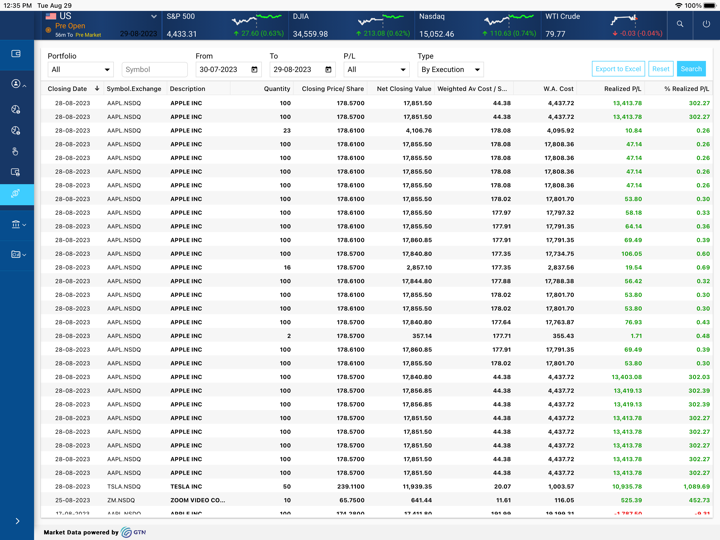

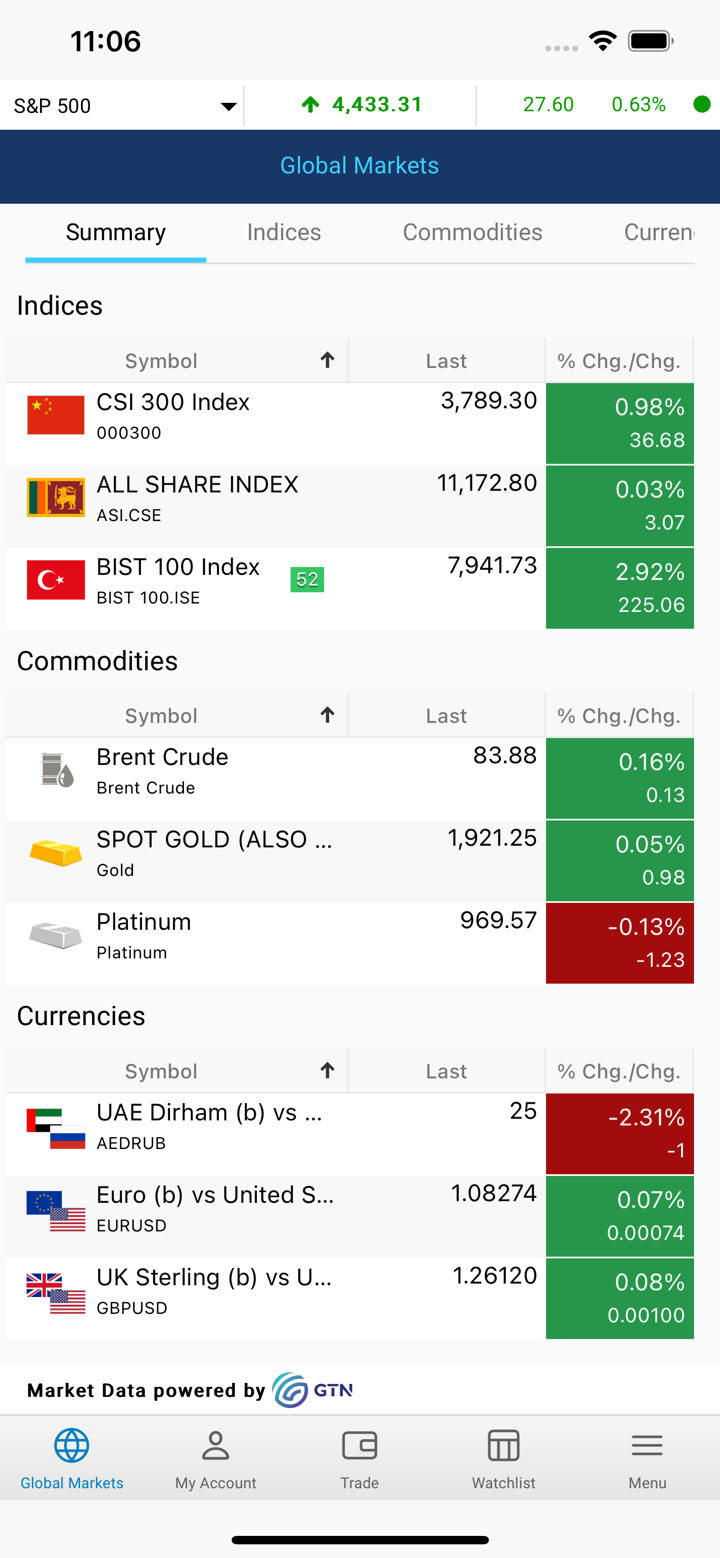

Ano ang Maaari Kong I-trade sa Yuanta?

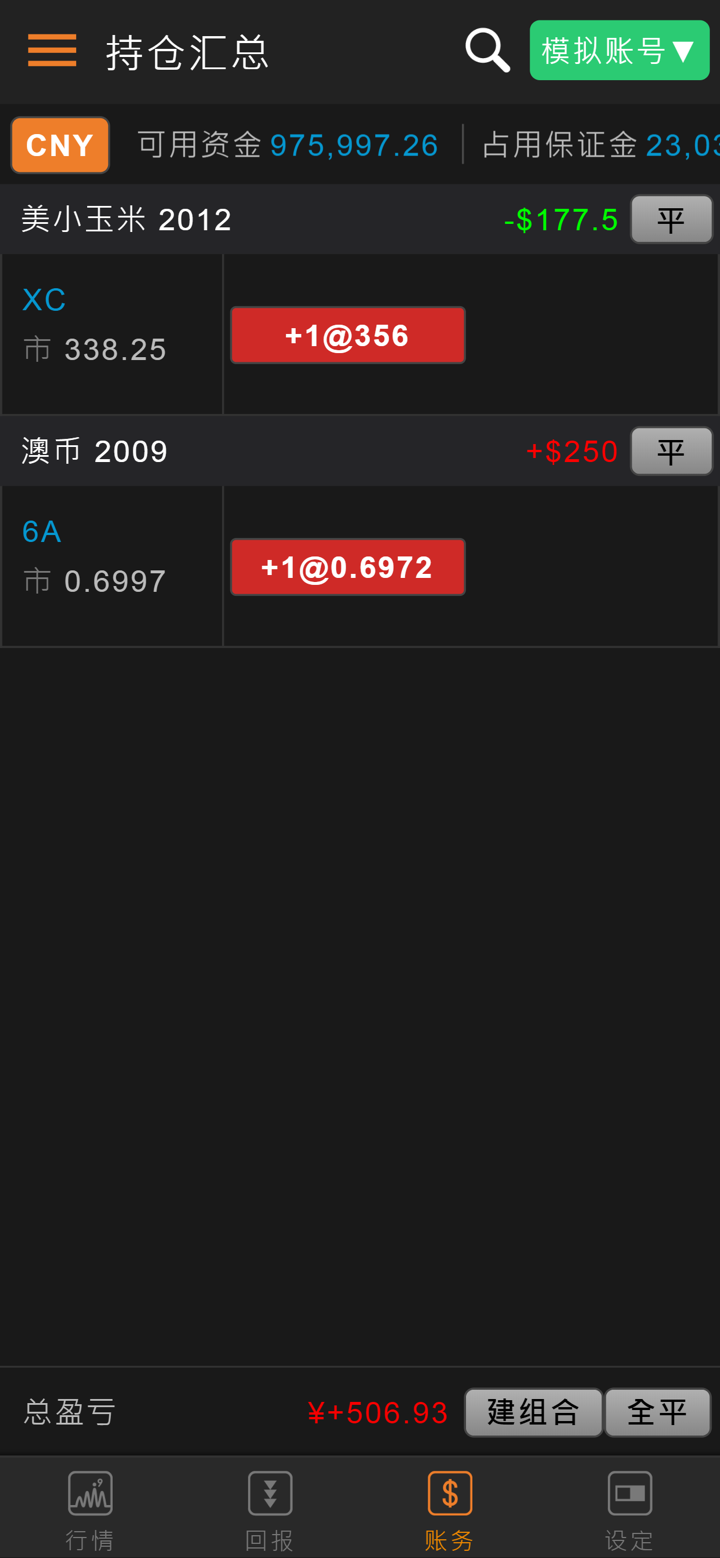

Pangunahing tumatalakay sa stock trading, derivative products, at futures & options, ang organisasyon ay nagbibigay ng malawak na hanay ng mga produkto at serbisyong pinansiyal.

| Mga Produkto sa Paghahalal | Mga Detalye |

| Stock Trading | HK Stocks, SH Stocks, SZ Stocks, Taiwan Stocks, US Stocks, China B Shares, Overseas Stocks |

| Derivative Products | Callable Bull / Bear Contracts, Derivative Warrants |

| Futures & Options | Futures, Options, Mga Detalye sa Paghahalal, Mga Tala ng Kontrata, Mga Kinakailangang Margin |

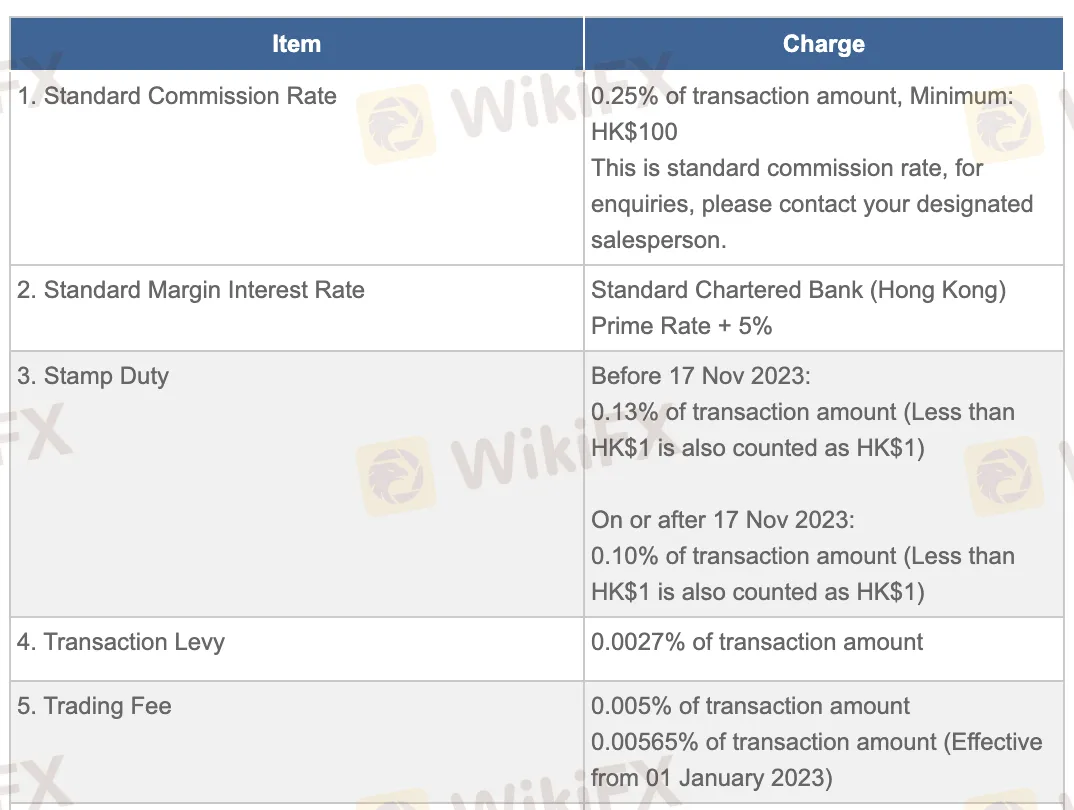

Mga Bayad ng Yuanta

Bagaman maaaring mataas ang ilang bayad sa administratibo at nominado na serbisyo, karaniwan naman ay nasa antas ng mga pamantayan ng industriya ang mga bayad ng Yuanta, na may mga standard na komisyon at interes na katulad ng mga pangunahing broker sa Hong Kong.

| Item | Bayad |

| Standard Commission Rate | 0.25% ng halaga ng transaksyon, Minimum na HK$100 |

| Standard Margin Interest Rate | Prime Rate + 5% |

| Stamp Duty | 0.10% (pagkatapos ng 17 Nob 2023), 0.13% (bago), min HK$1 |

| Transaction Levy | 0.0027% ng halaga ng transaksyon |

| Trading Fee | 0.00565% ng halaga ng transaksyon (simula Ene 2023) |

| CCASS Fee | 0.002%, min HK$2, max HK$100 |

| Italian Financial Transaction Tax | 0.2% ng halaga ng transaksyon |

| FRC Transaction Levy | 0.00015% ng halaga ng transaksyon |

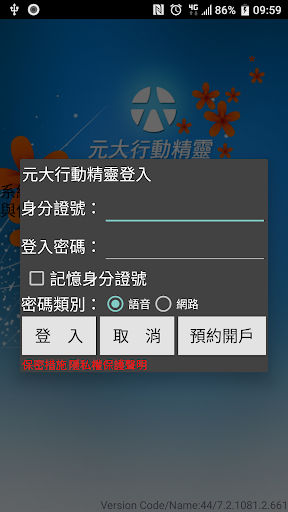

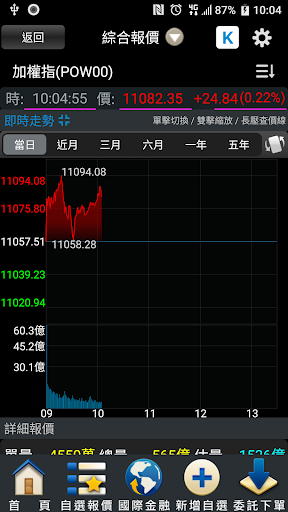

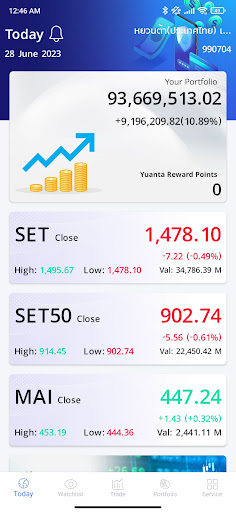

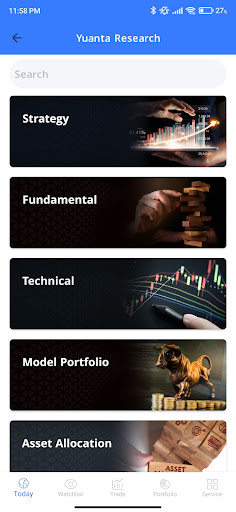

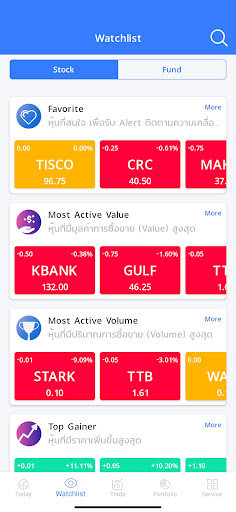

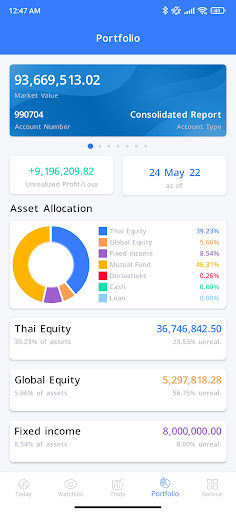

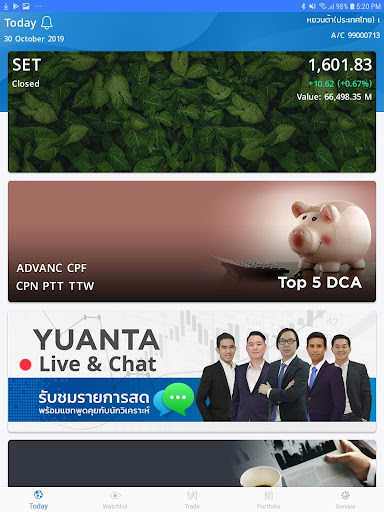

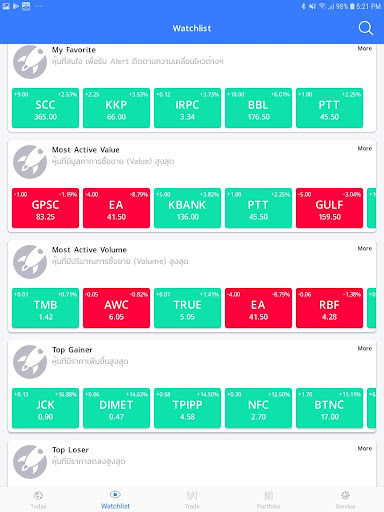

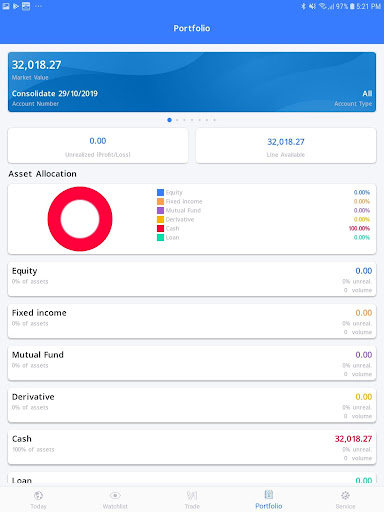

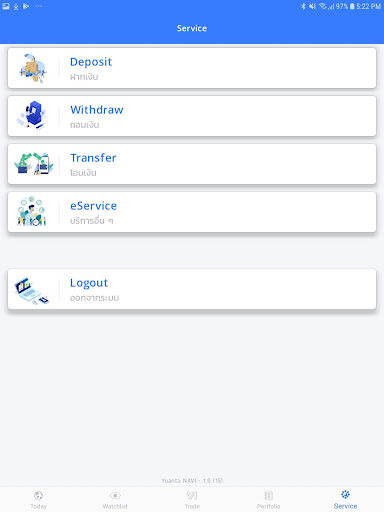

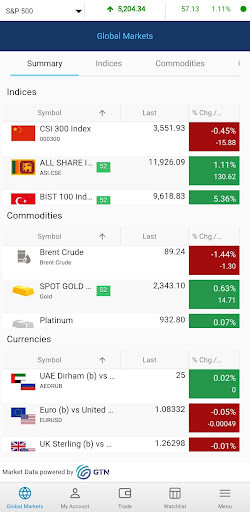

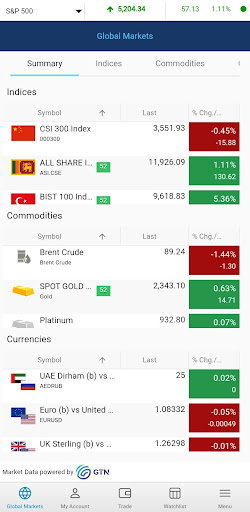

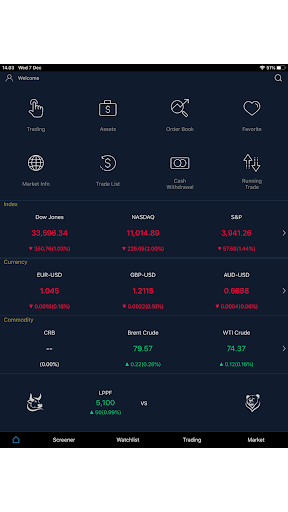

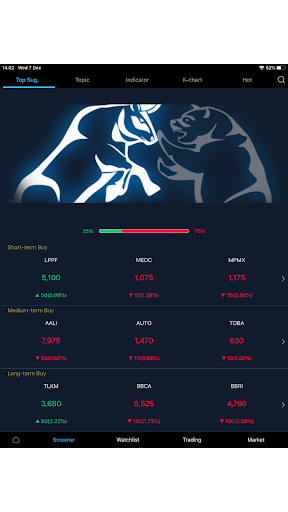

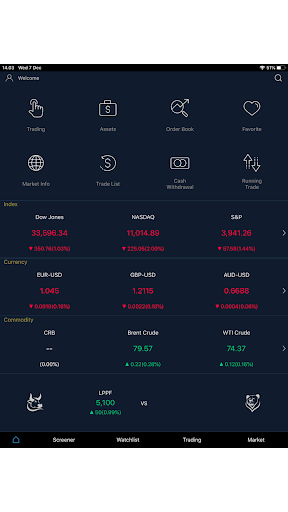

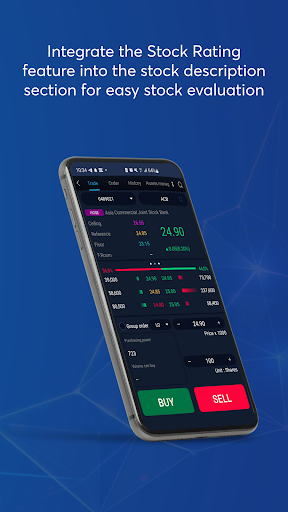

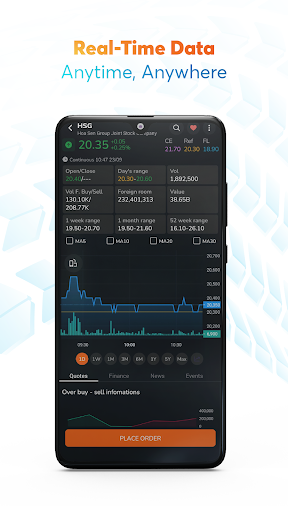

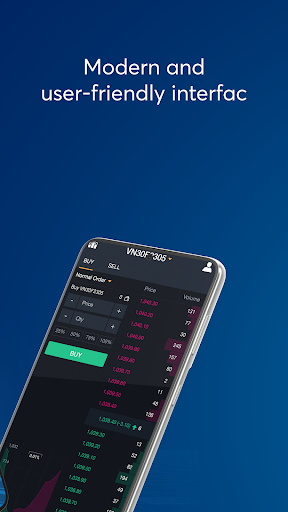

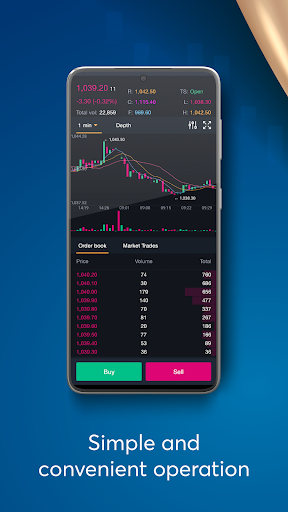

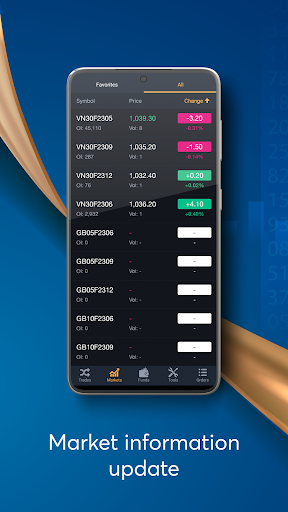

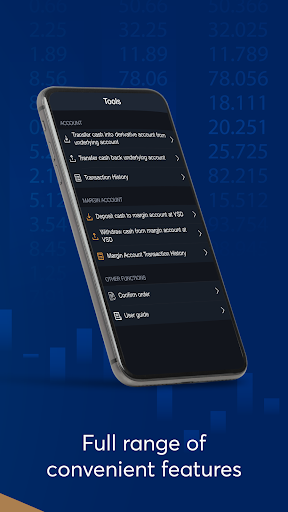

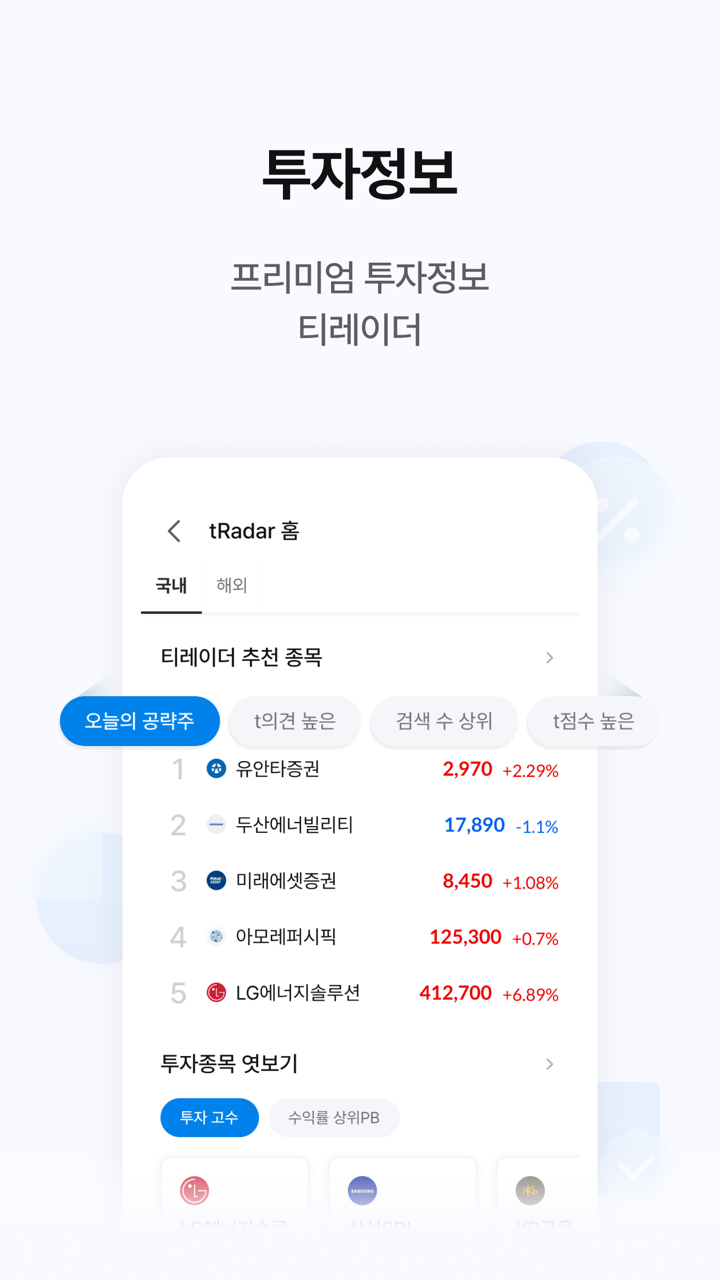

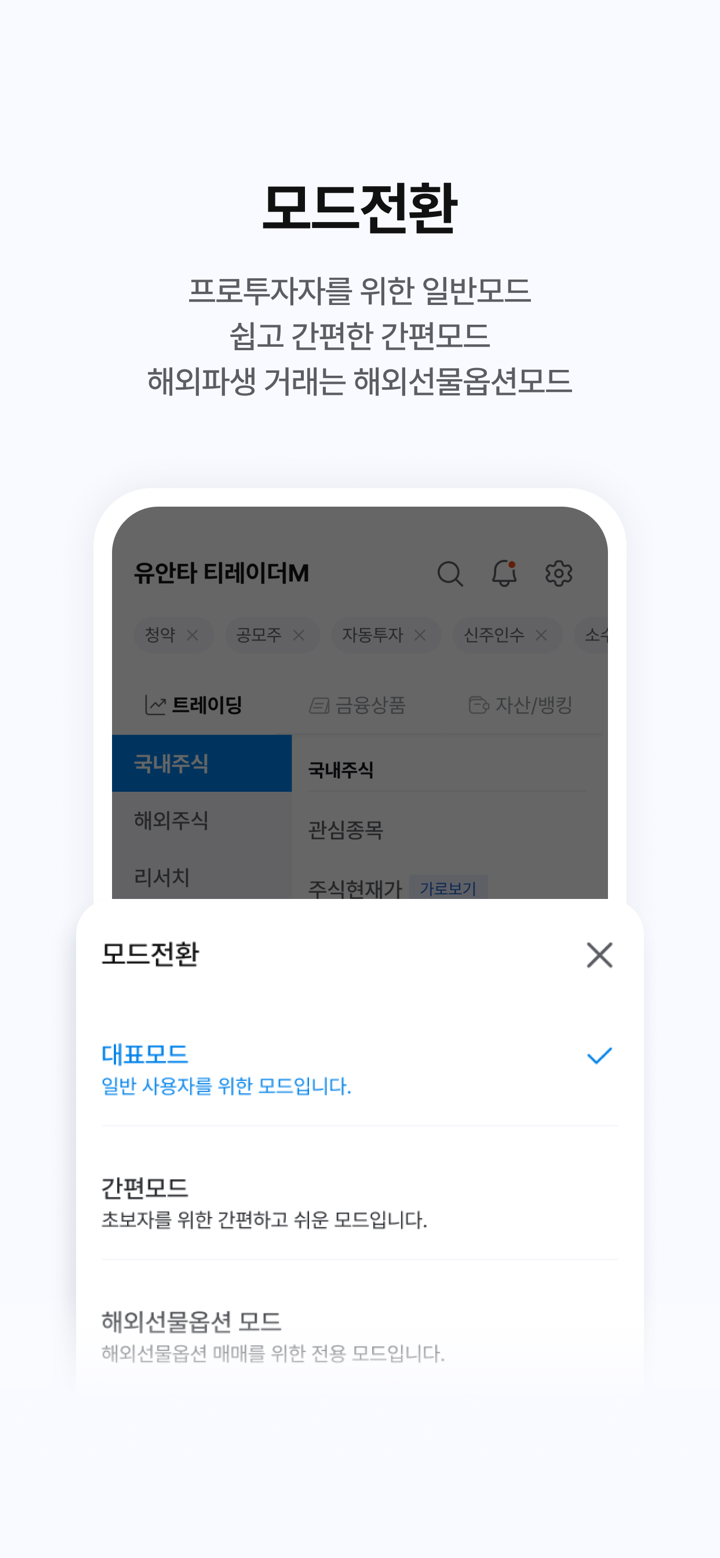

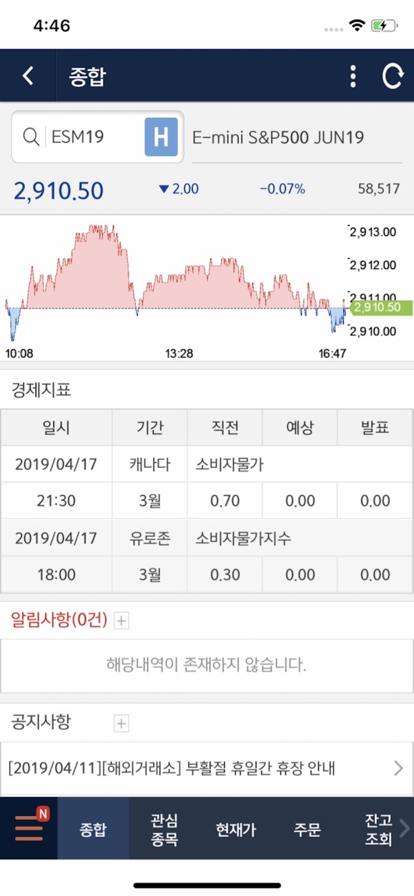

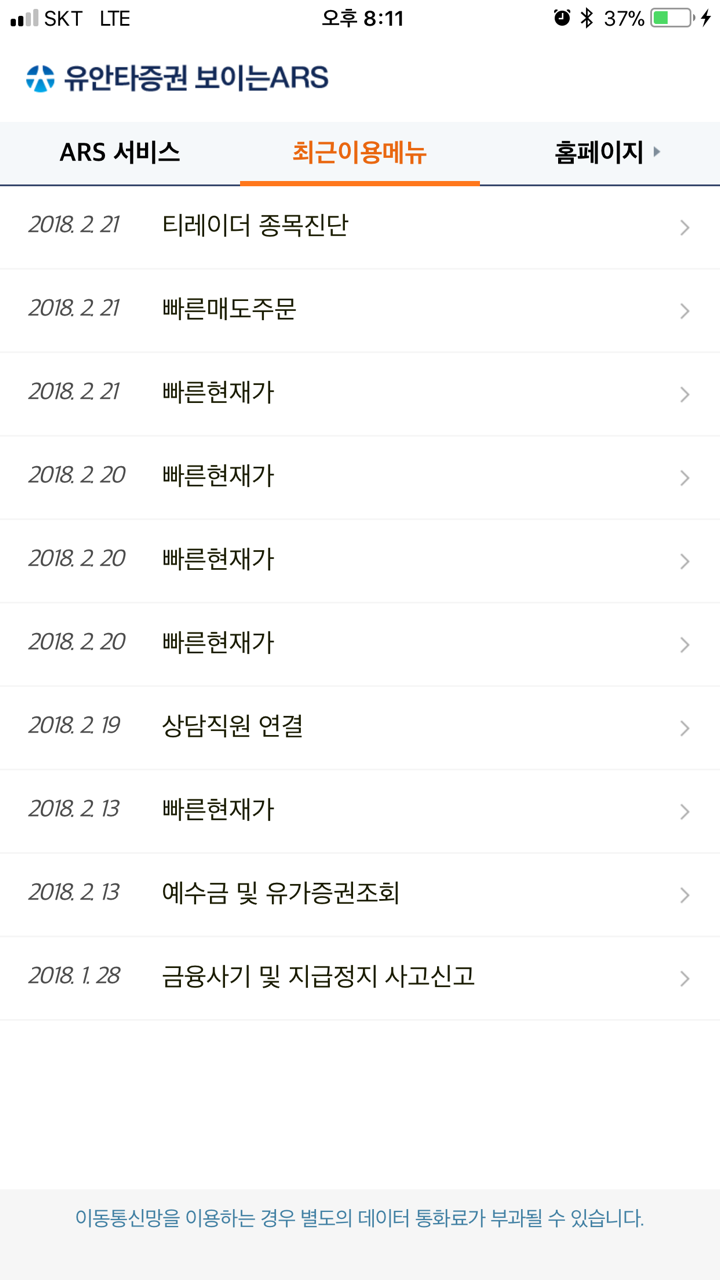

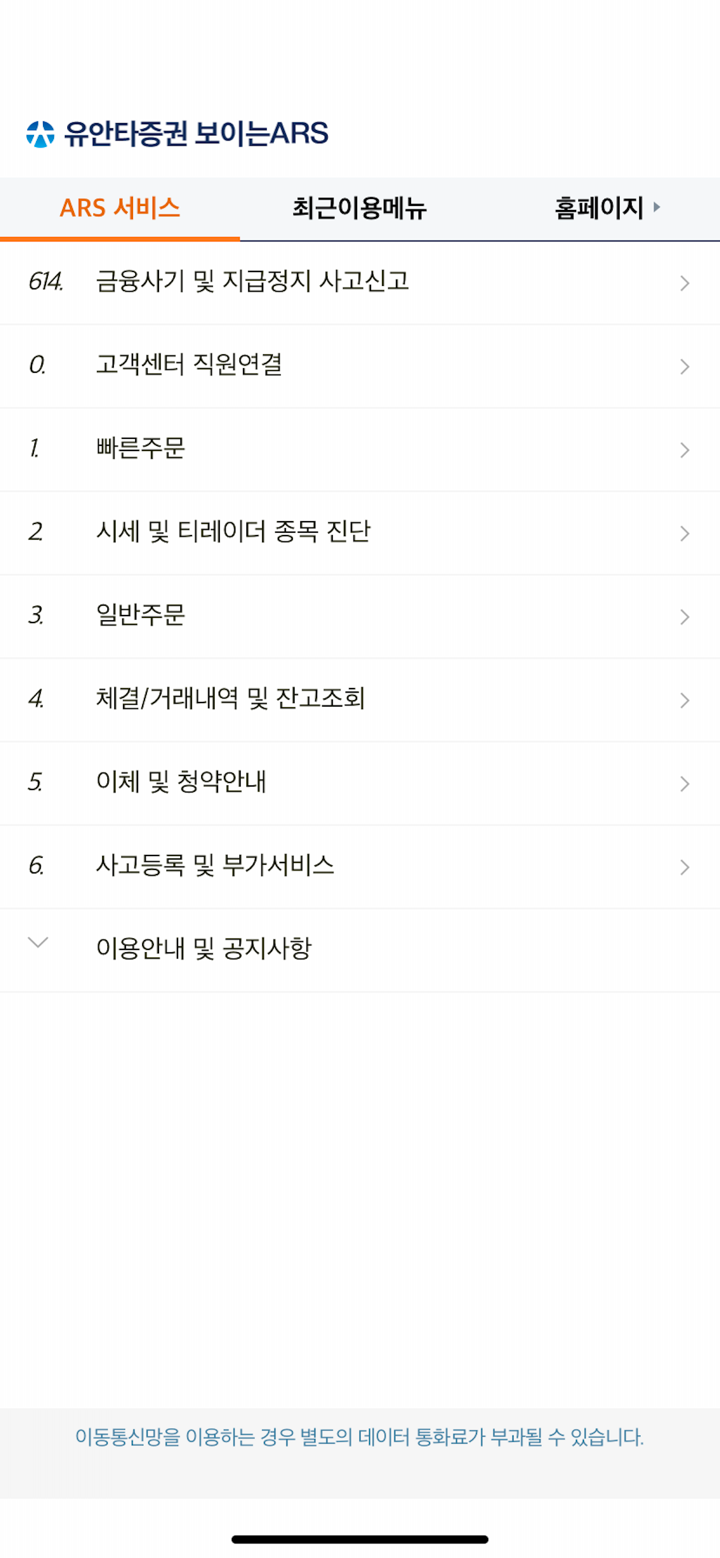

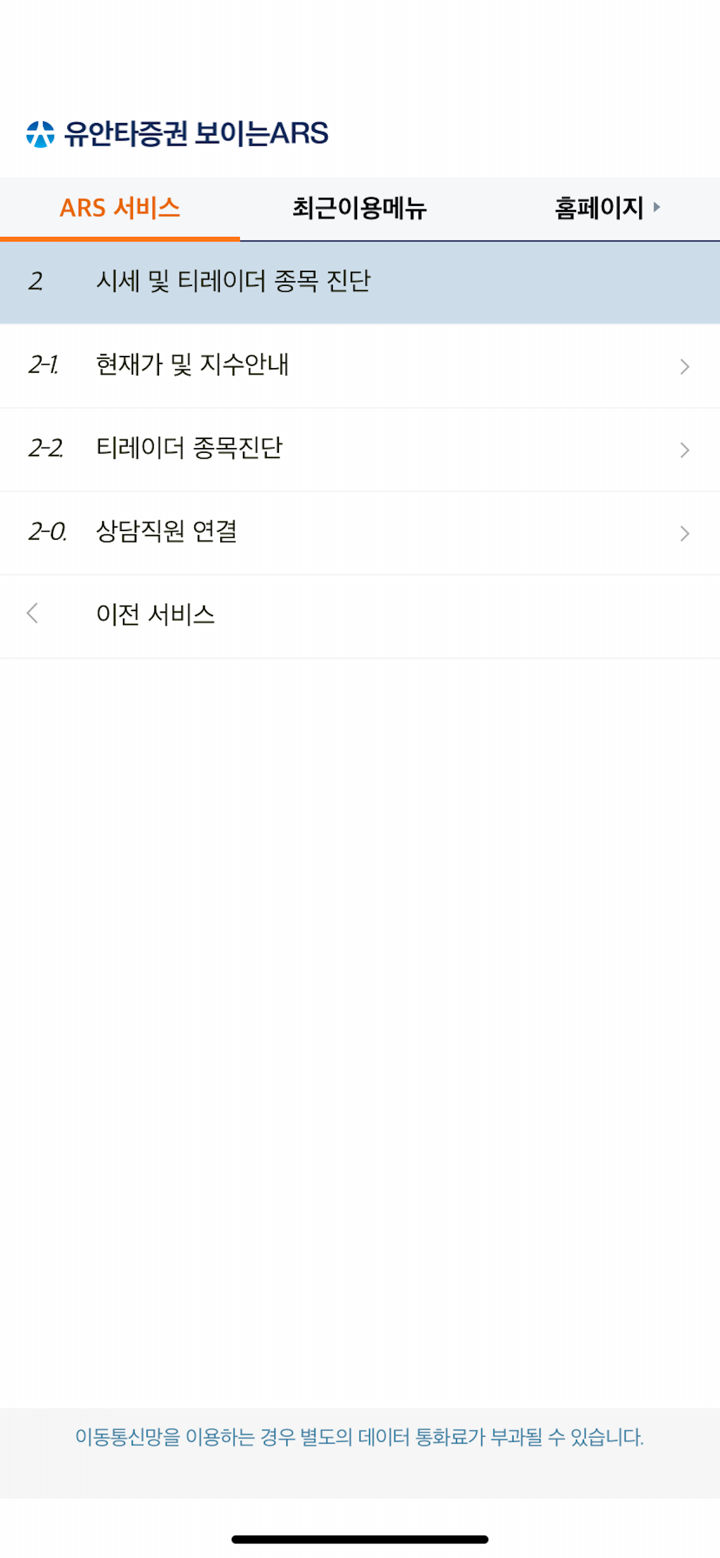

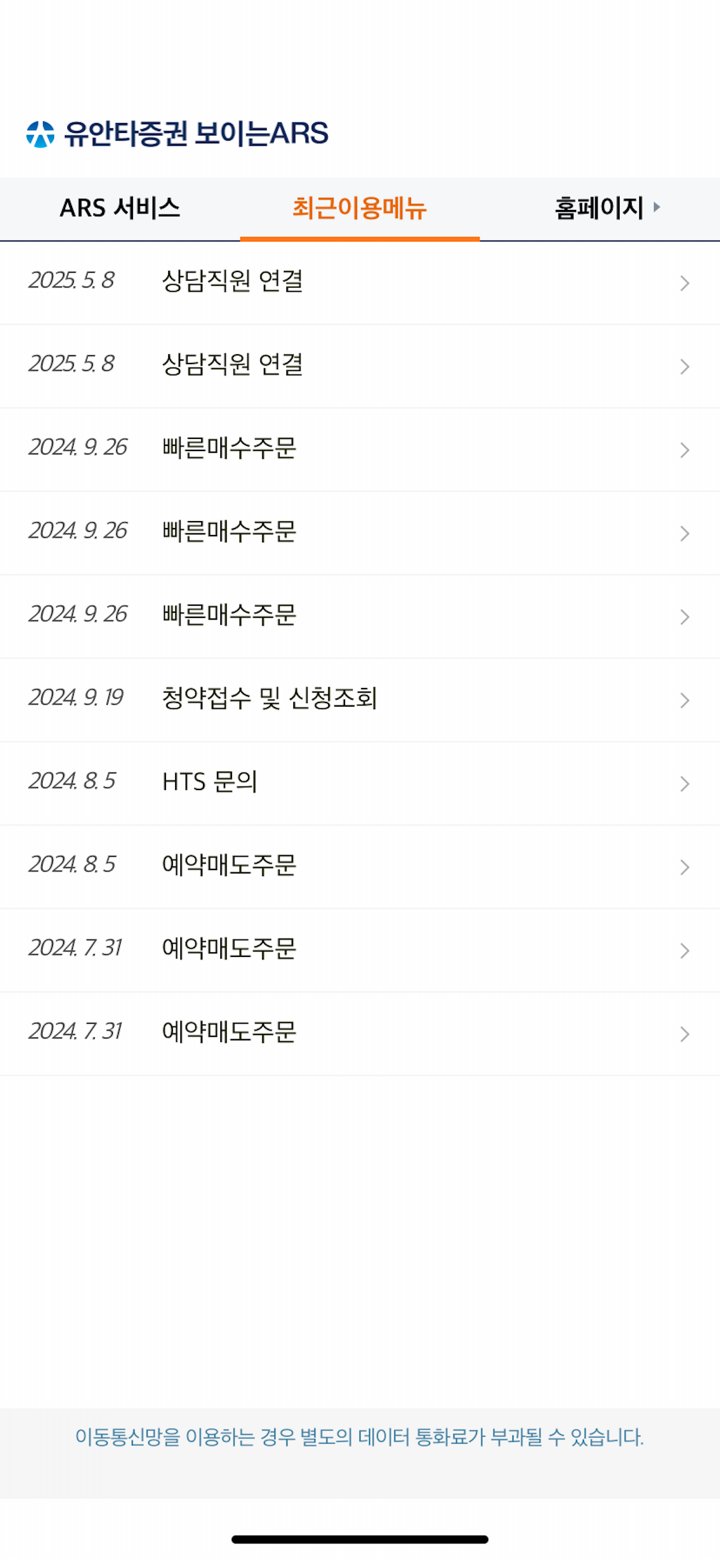

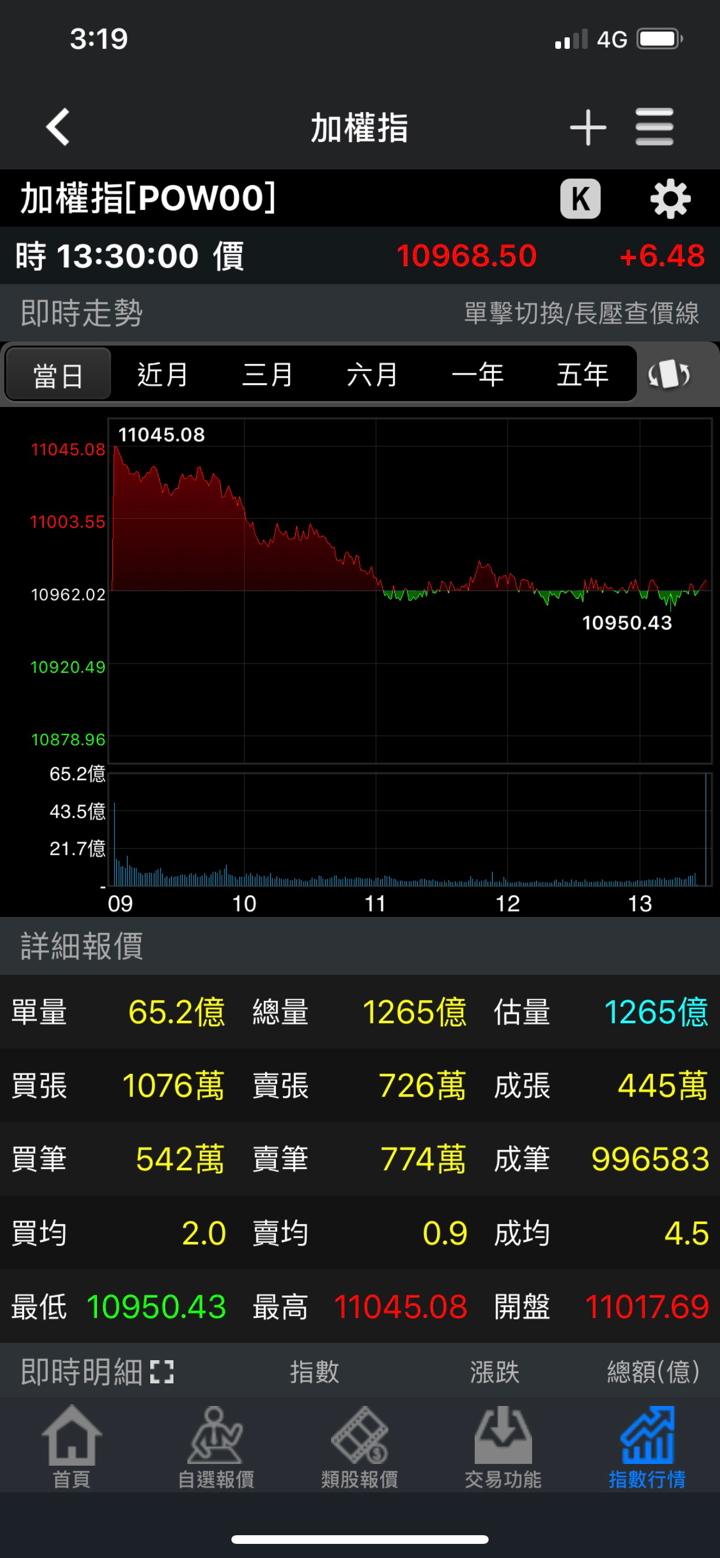

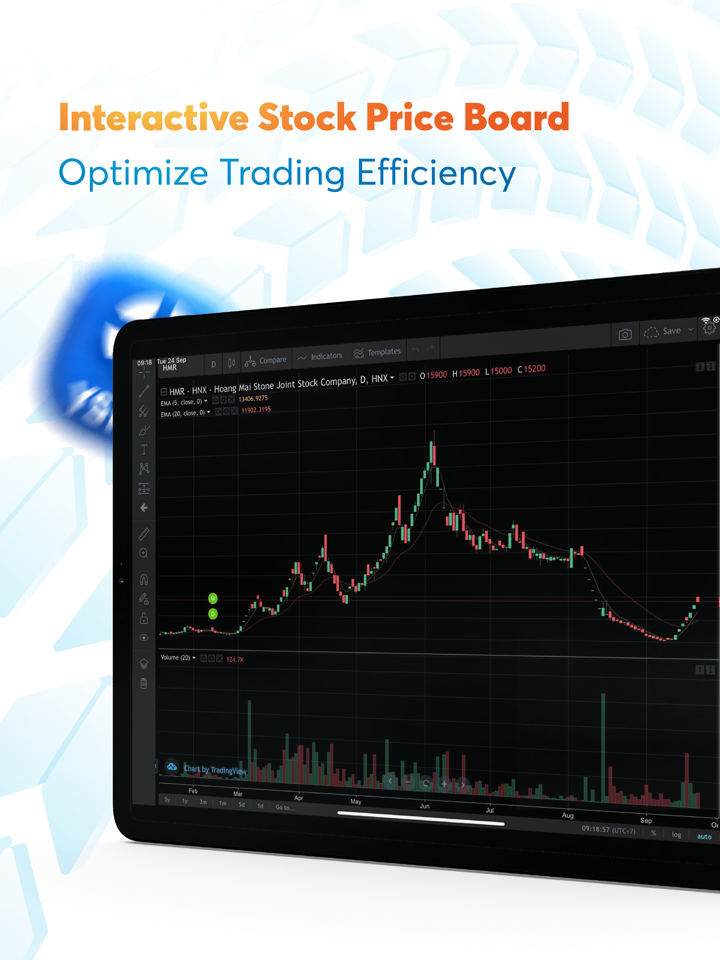

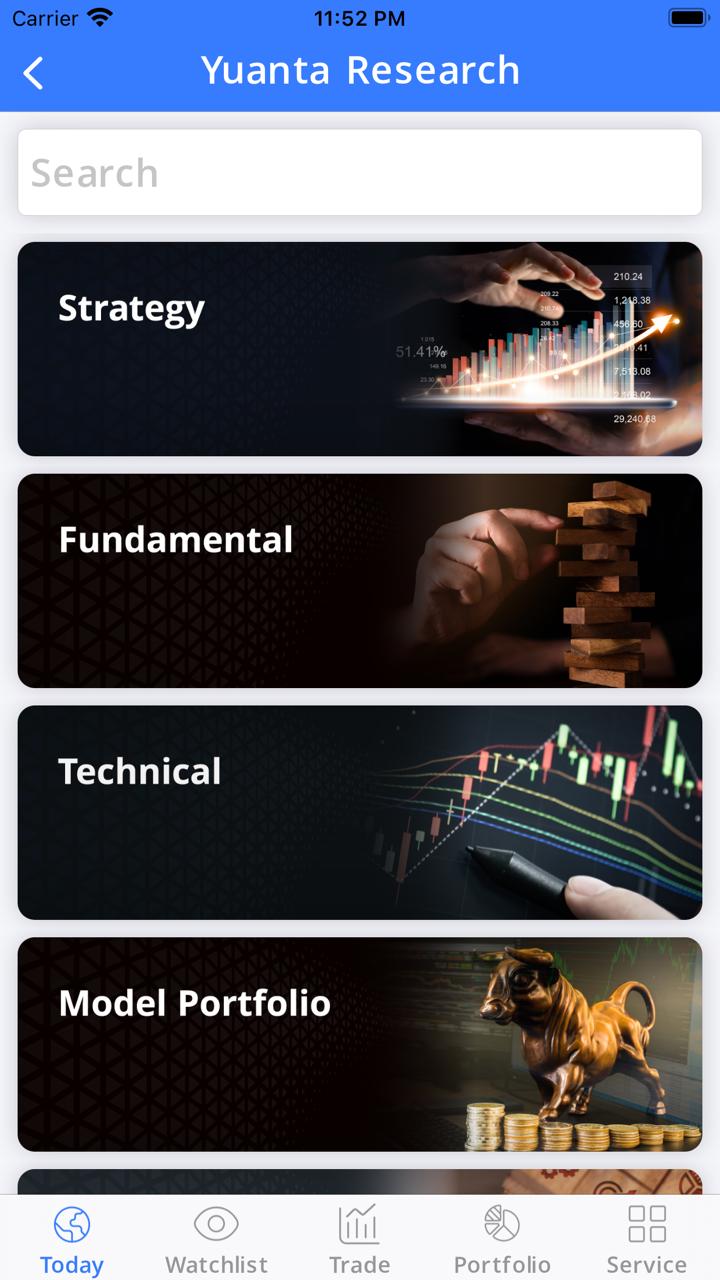

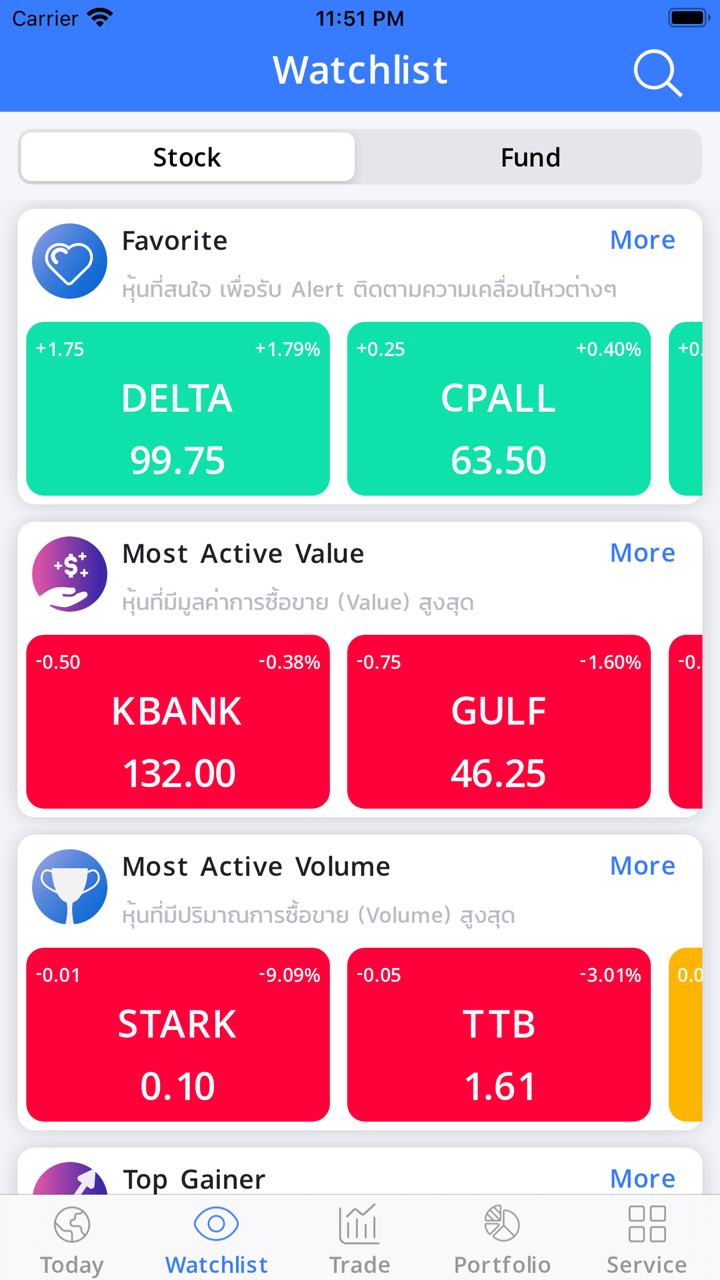

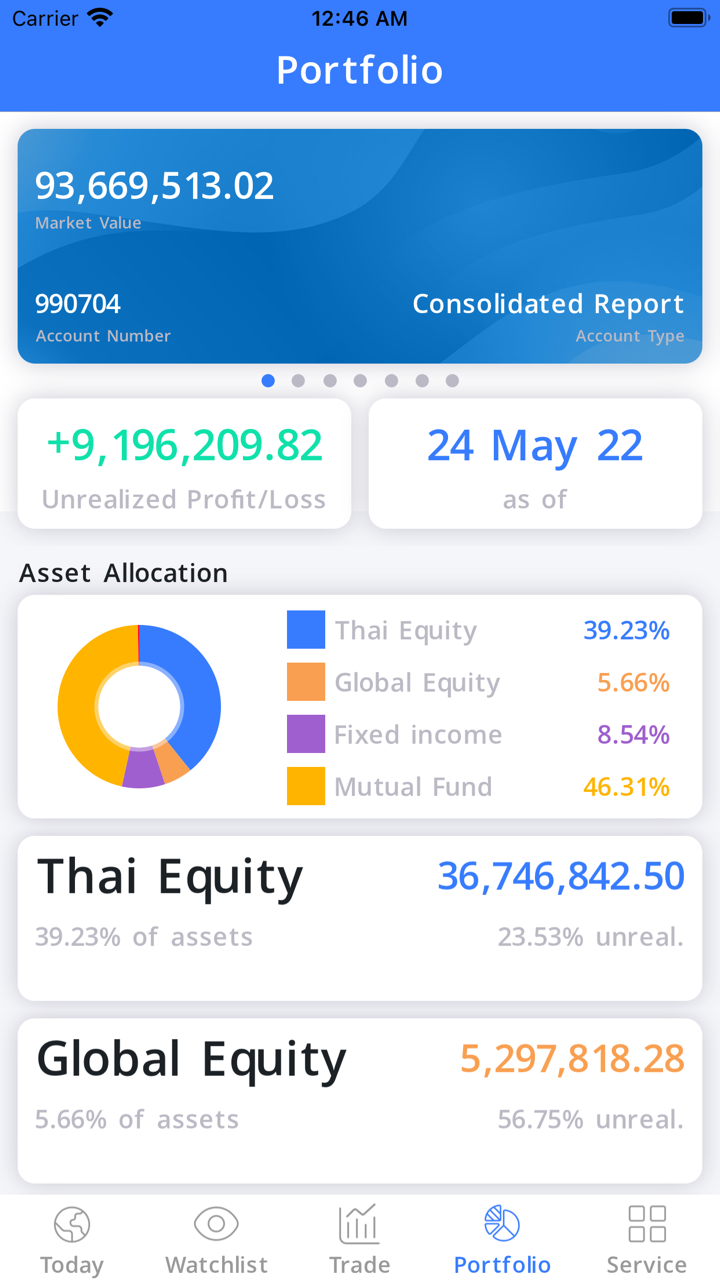

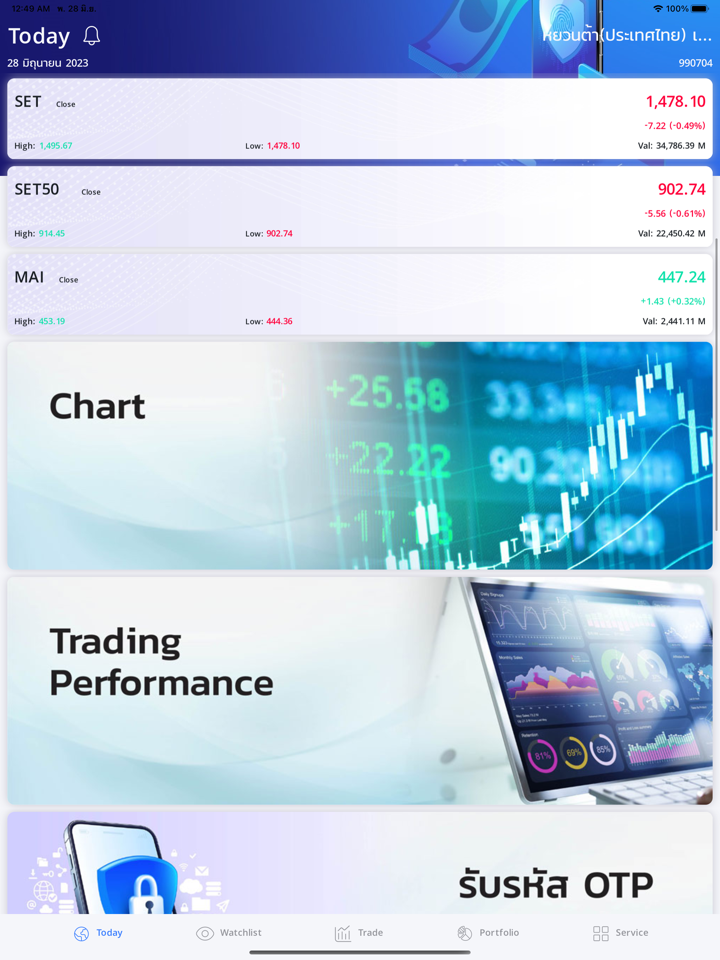

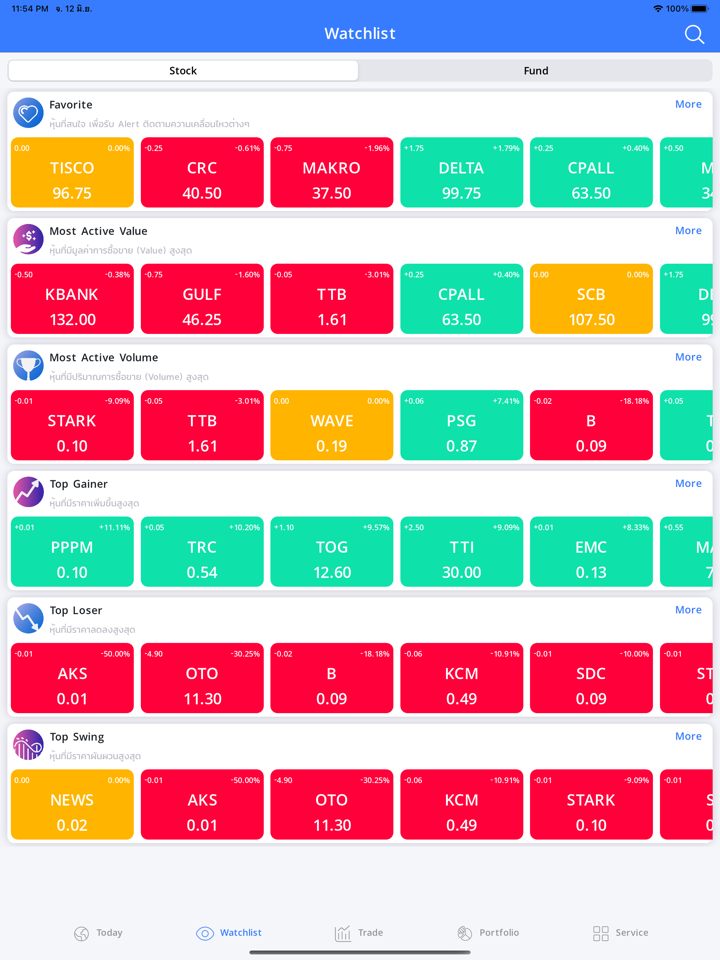

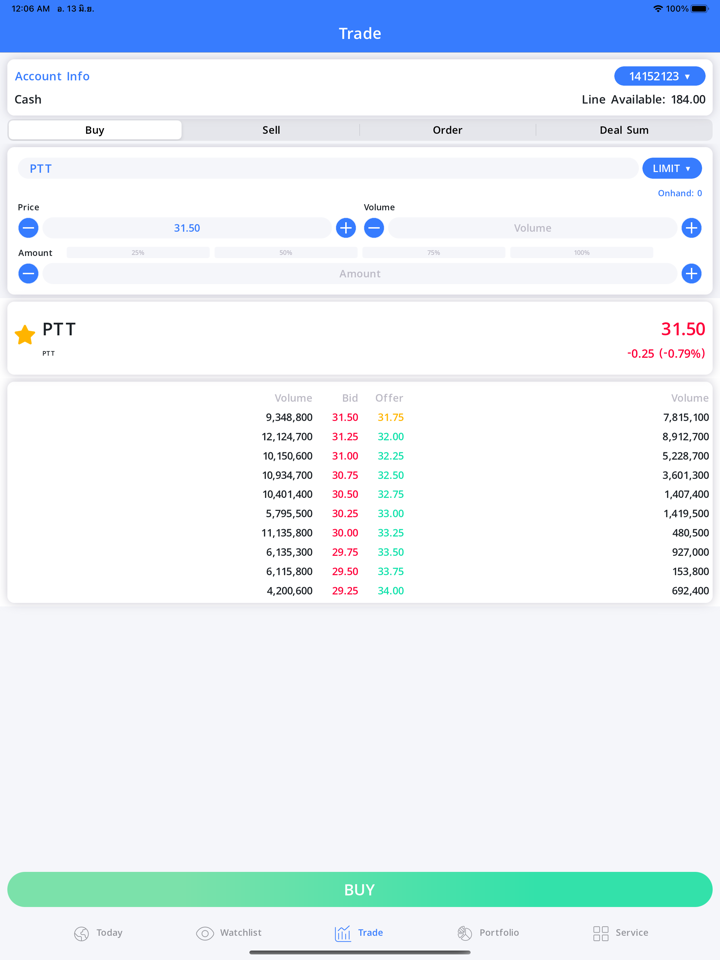

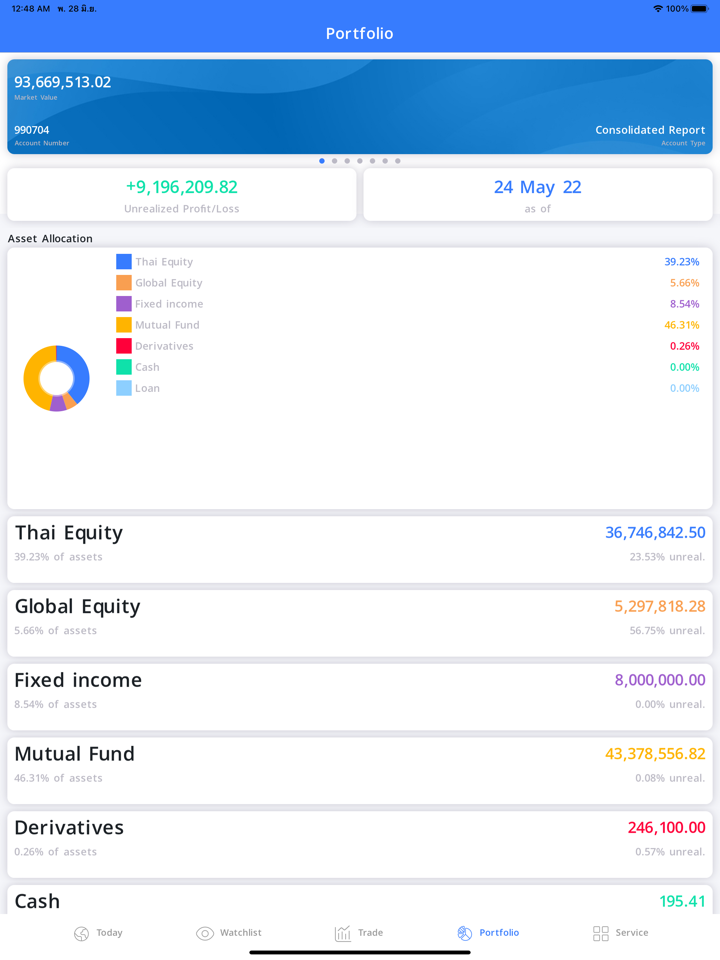

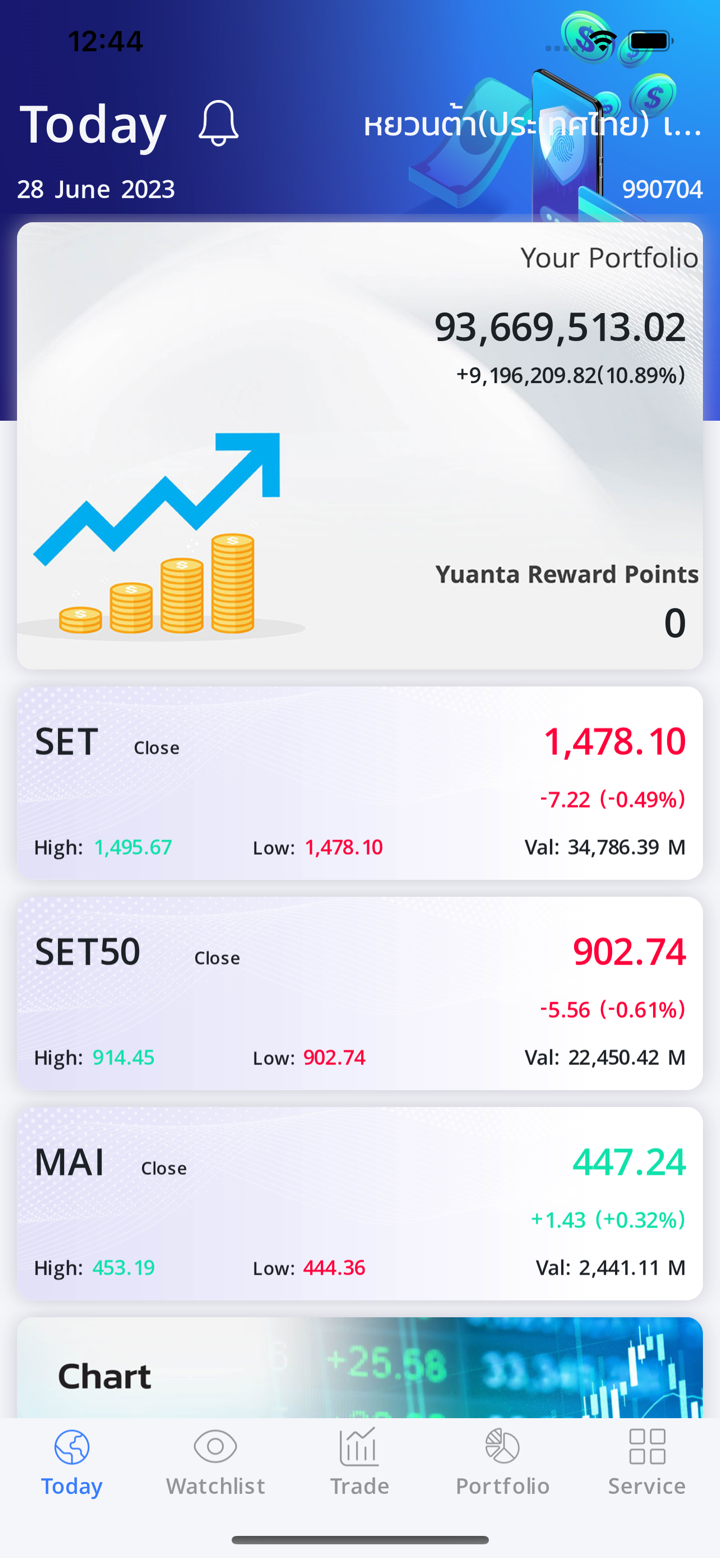

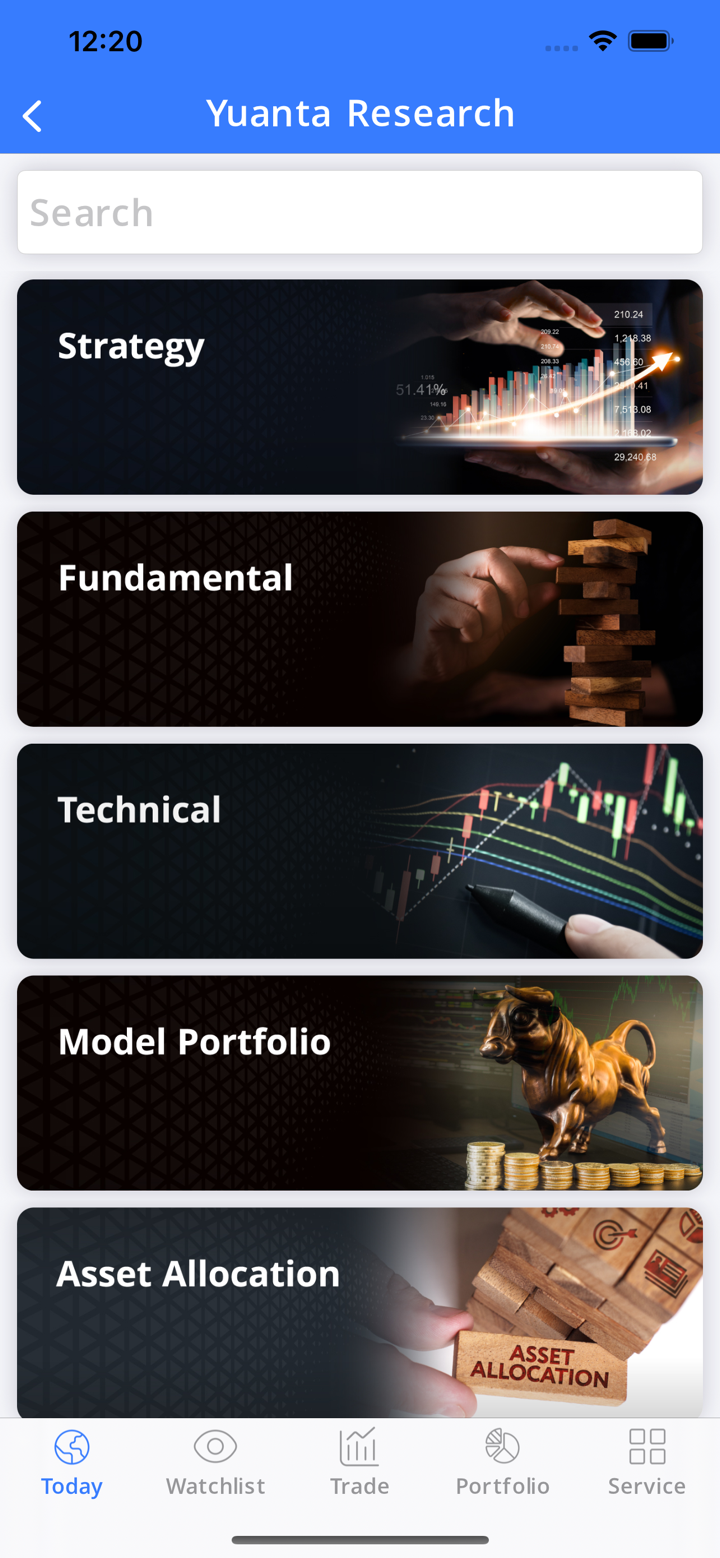

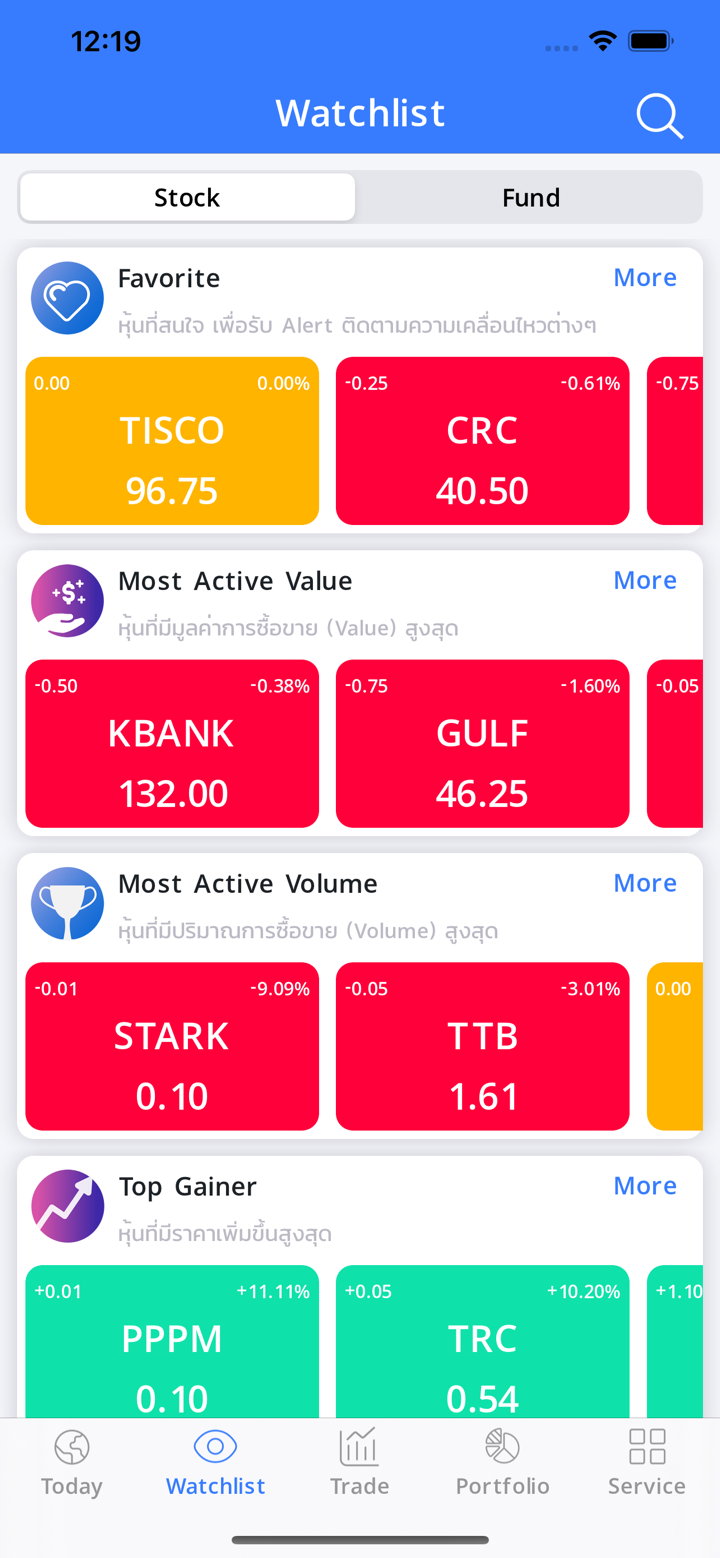

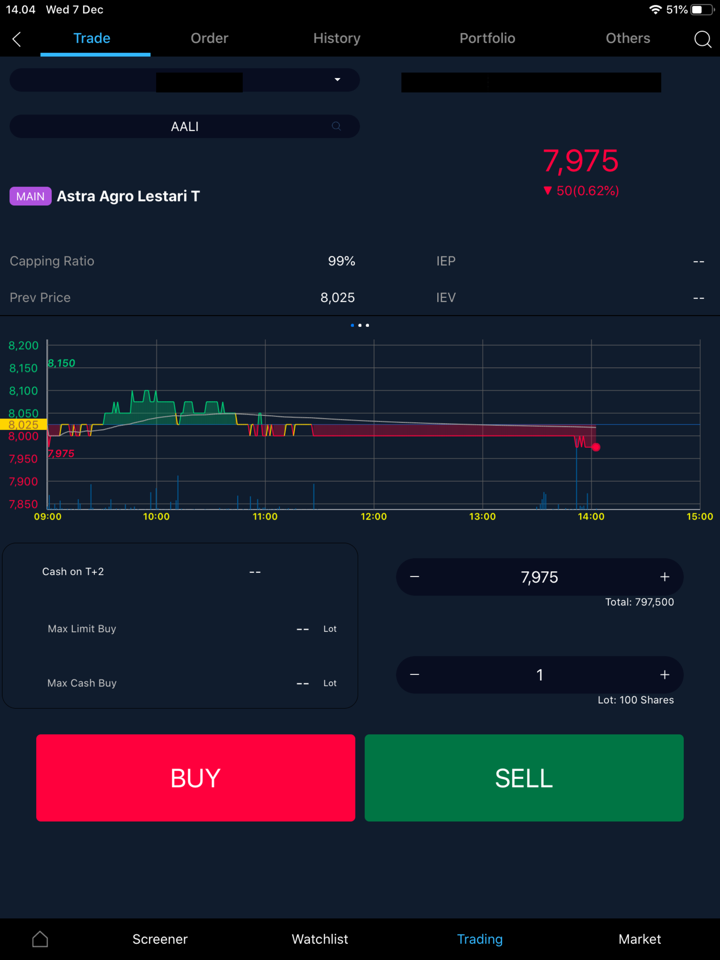

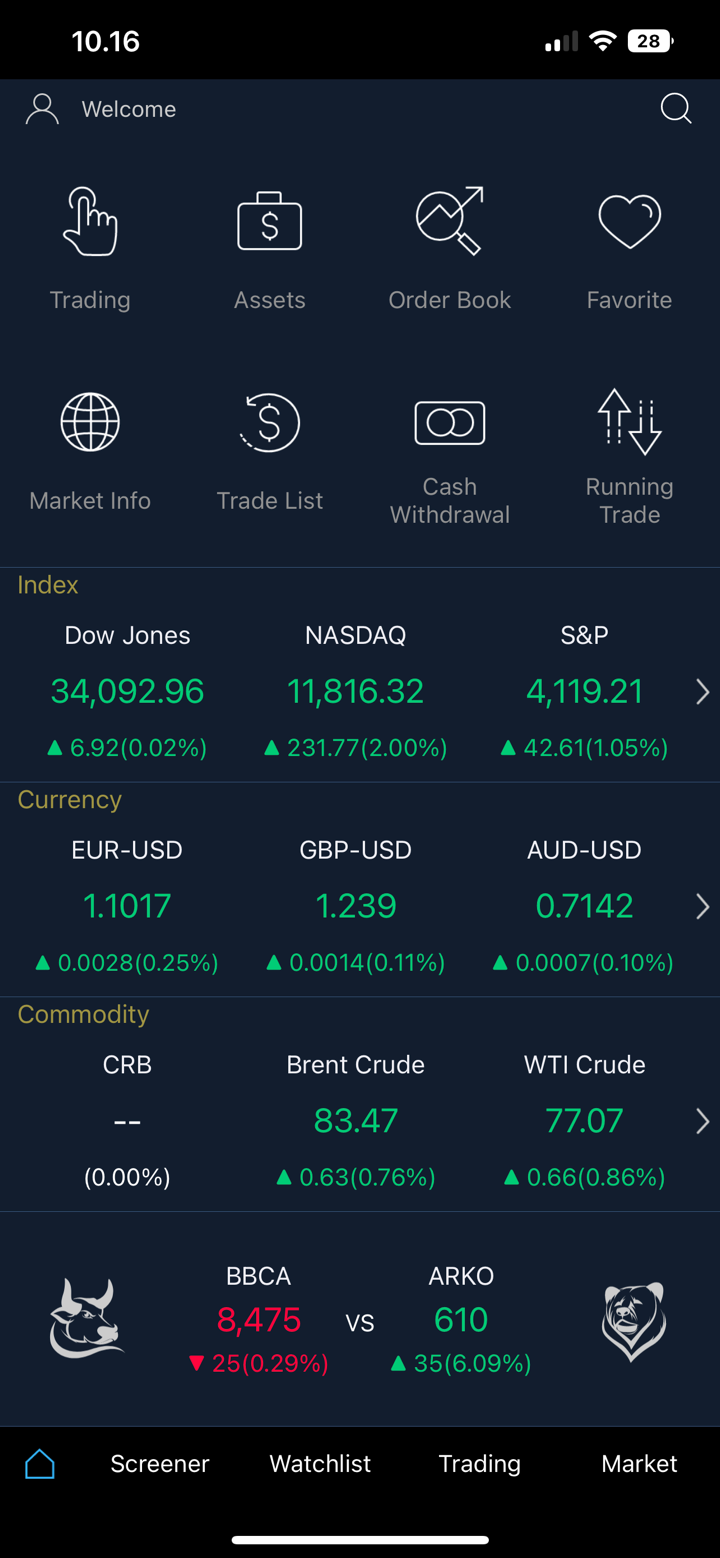

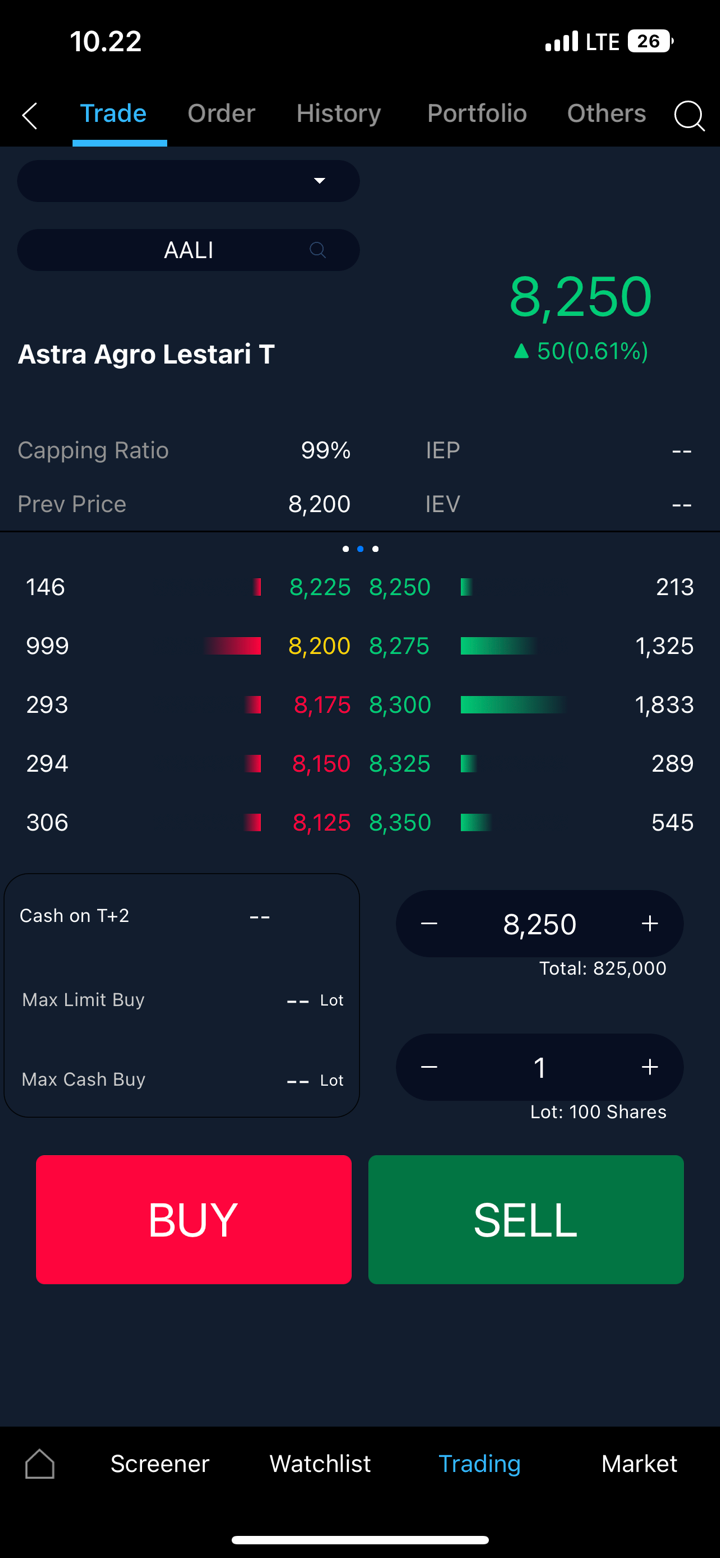

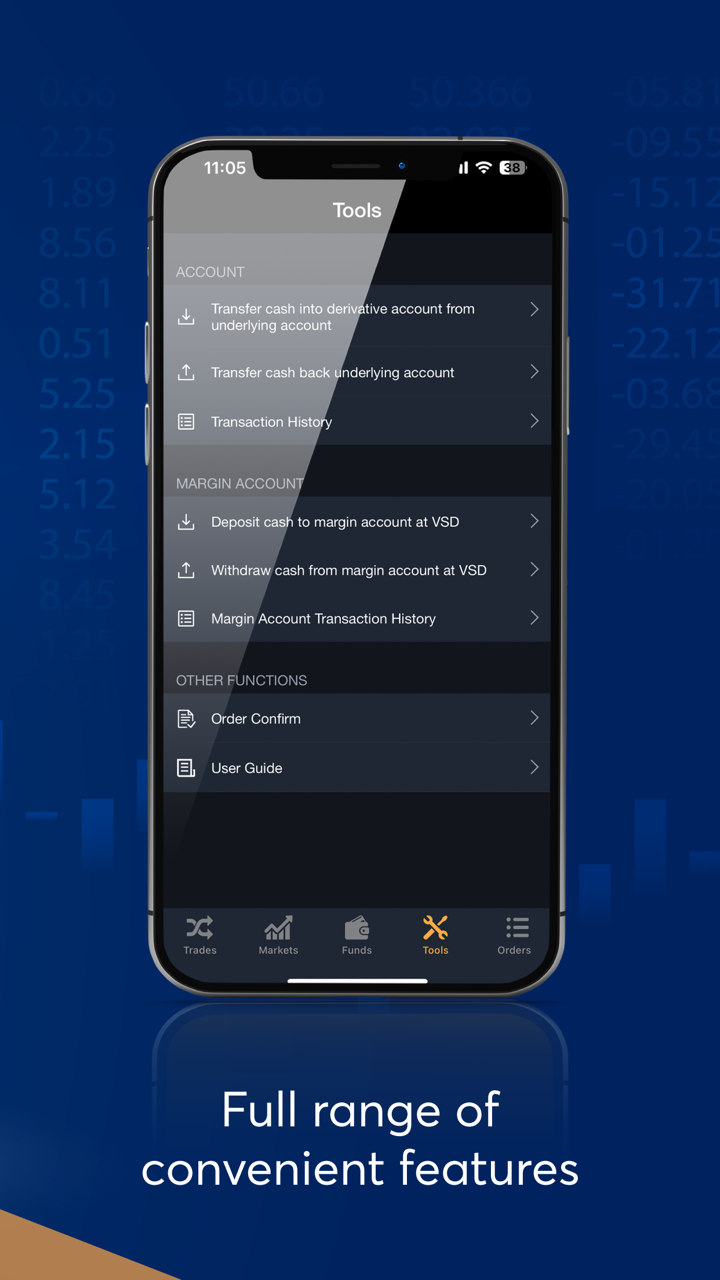

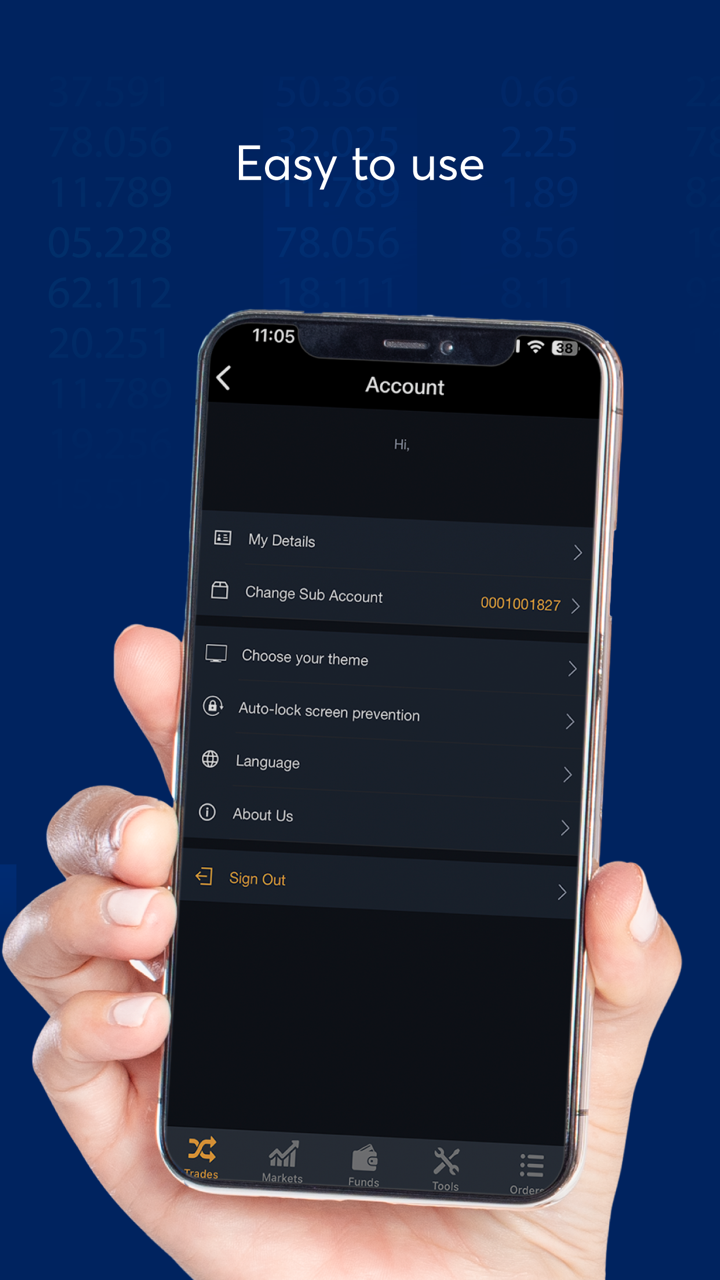

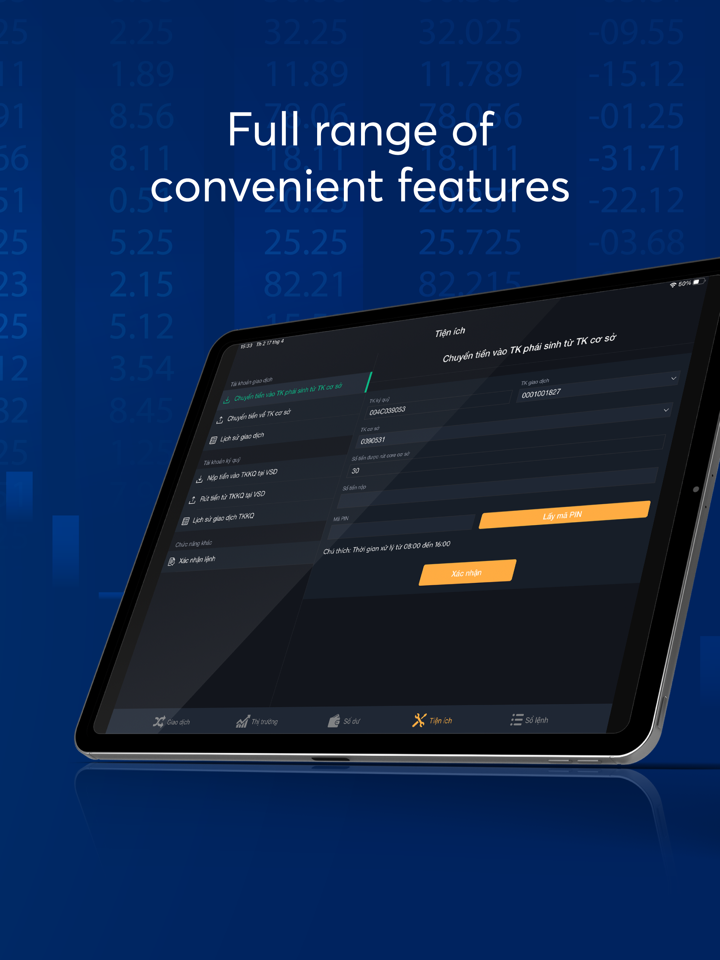

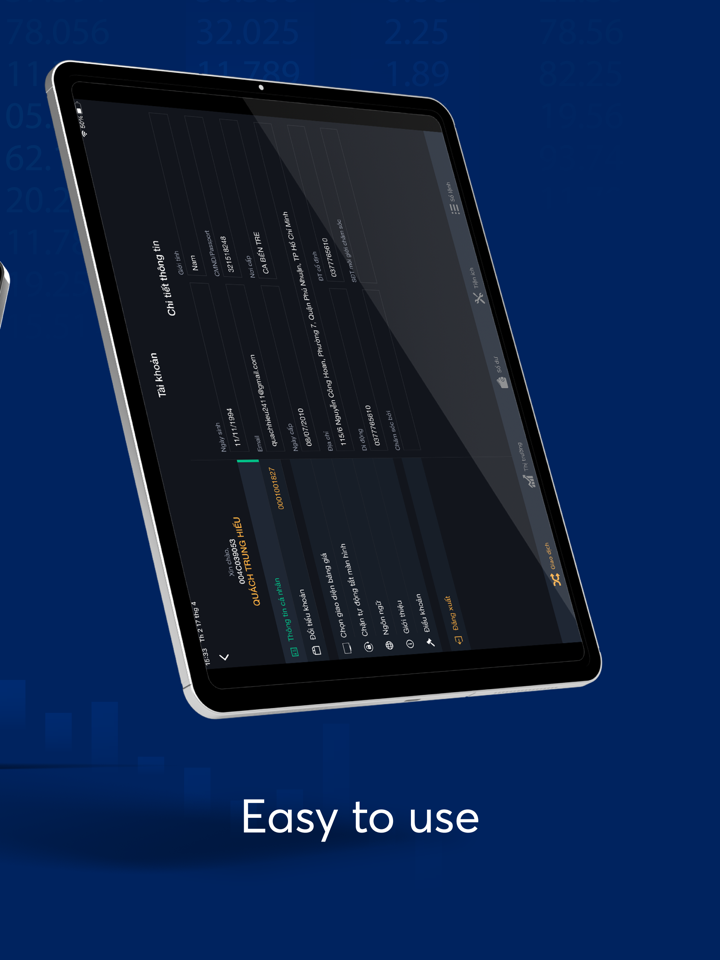

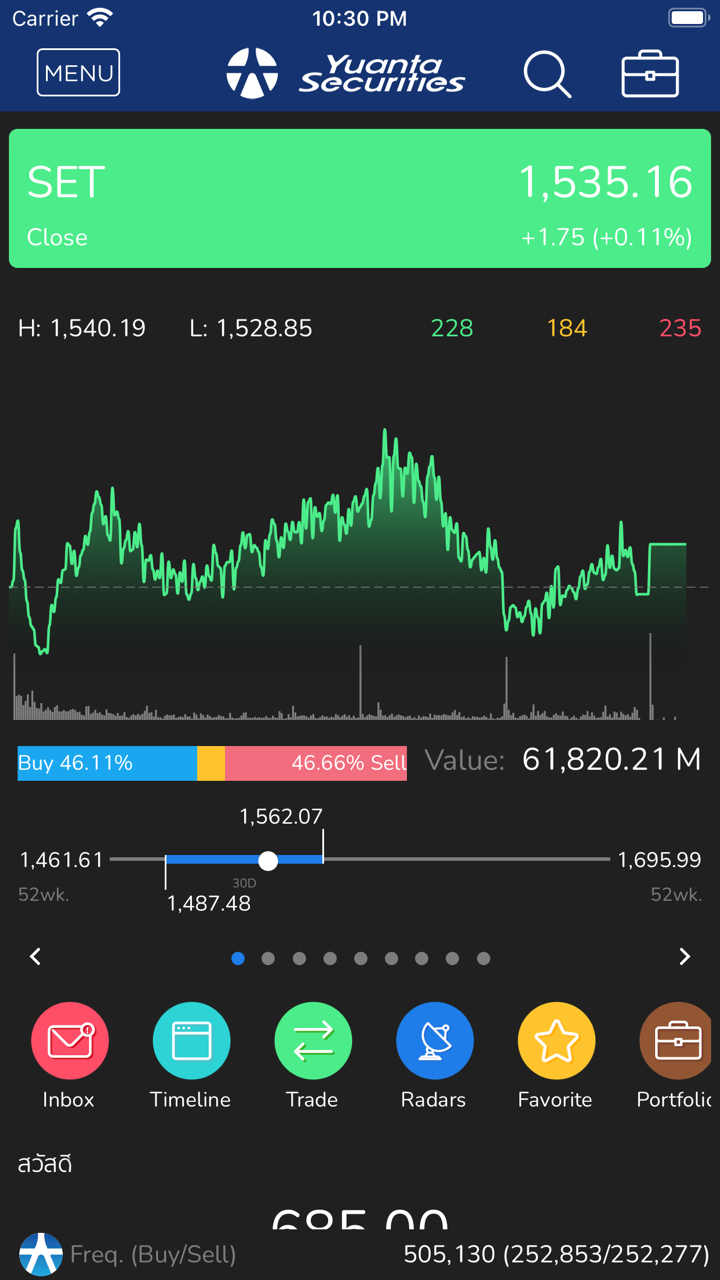

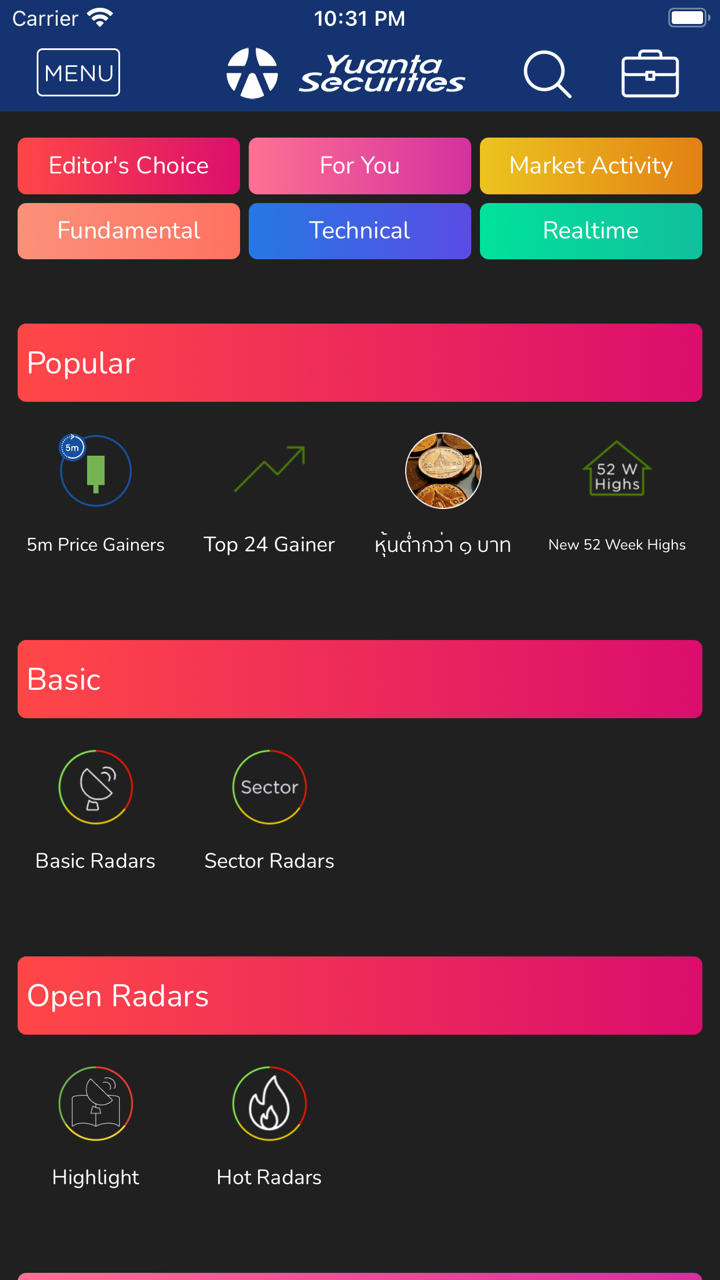

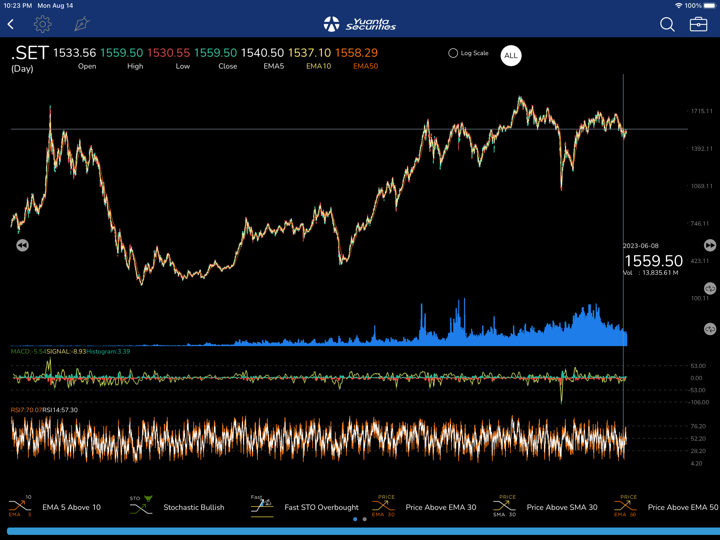

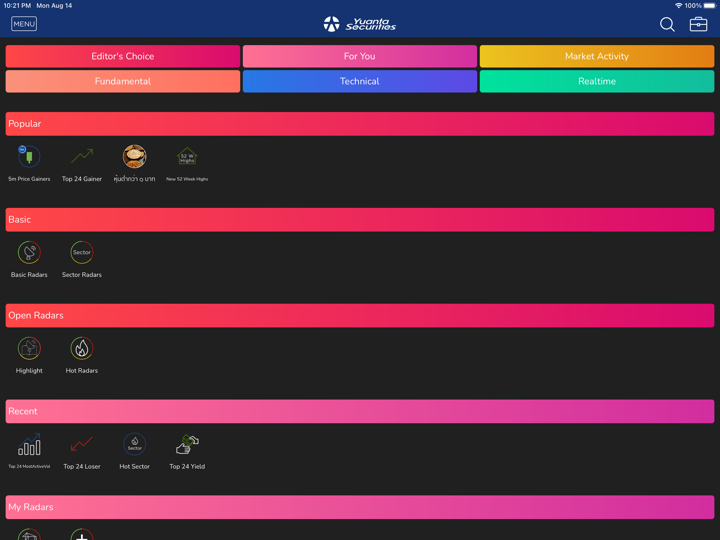

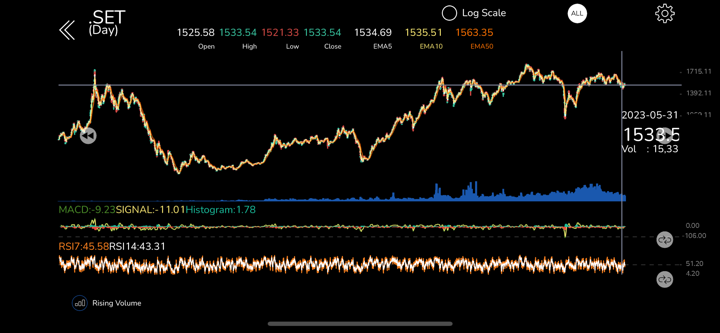

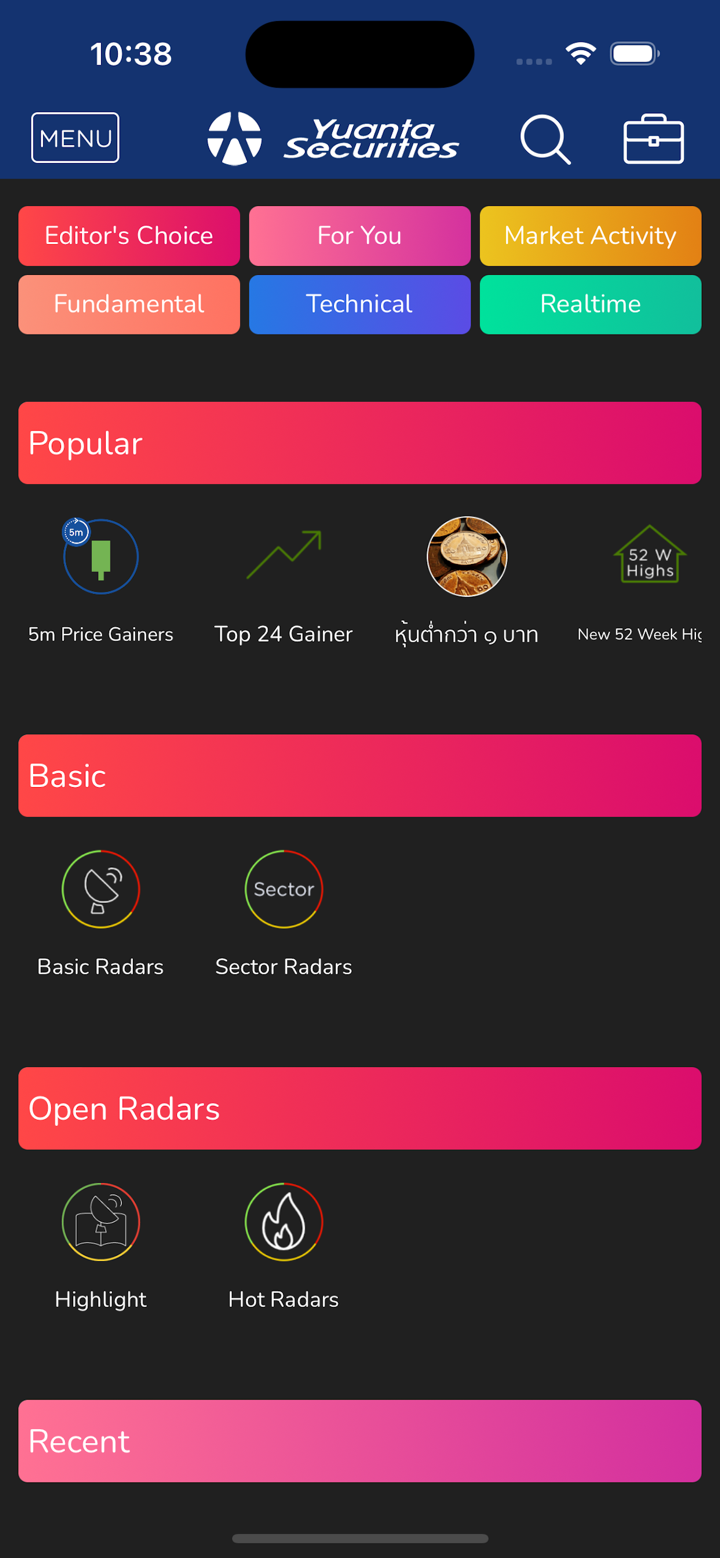

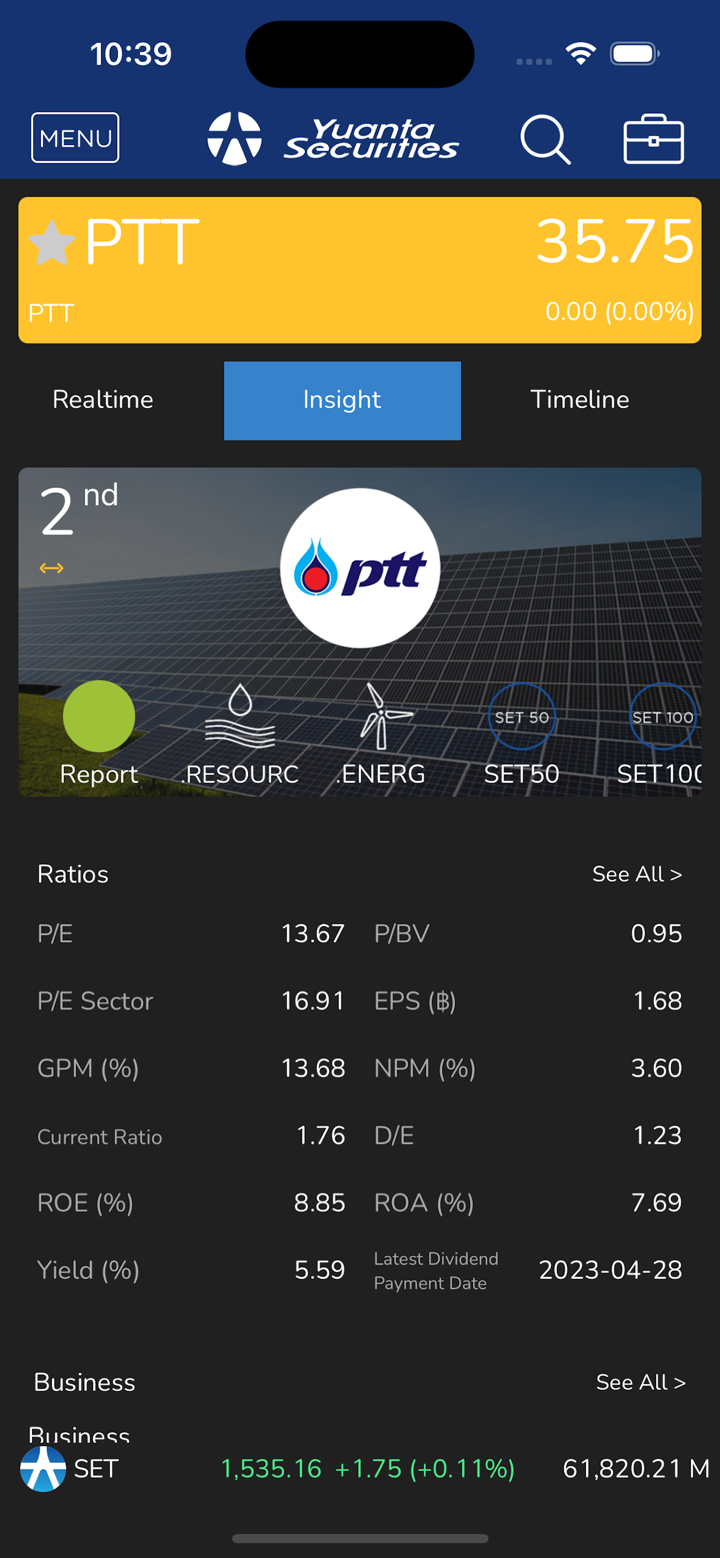

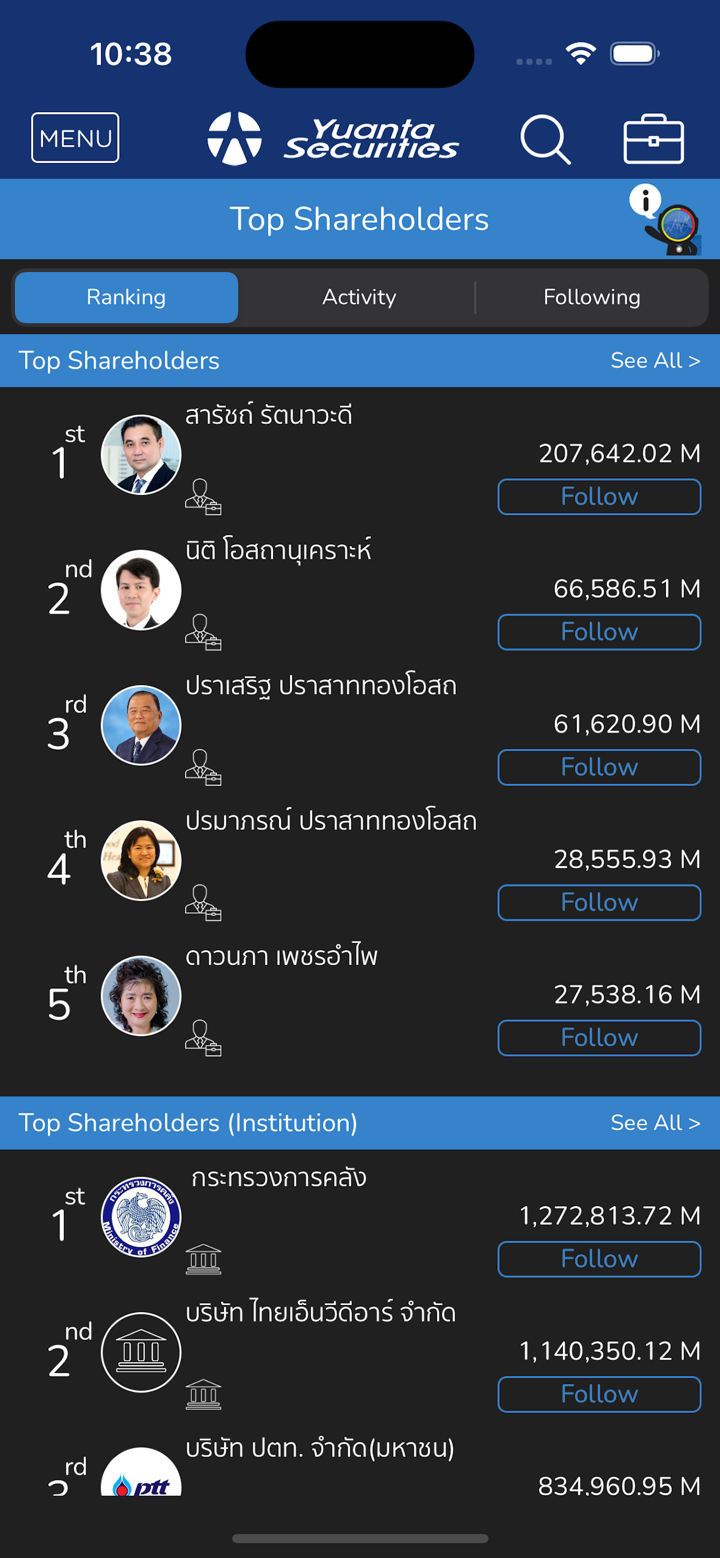

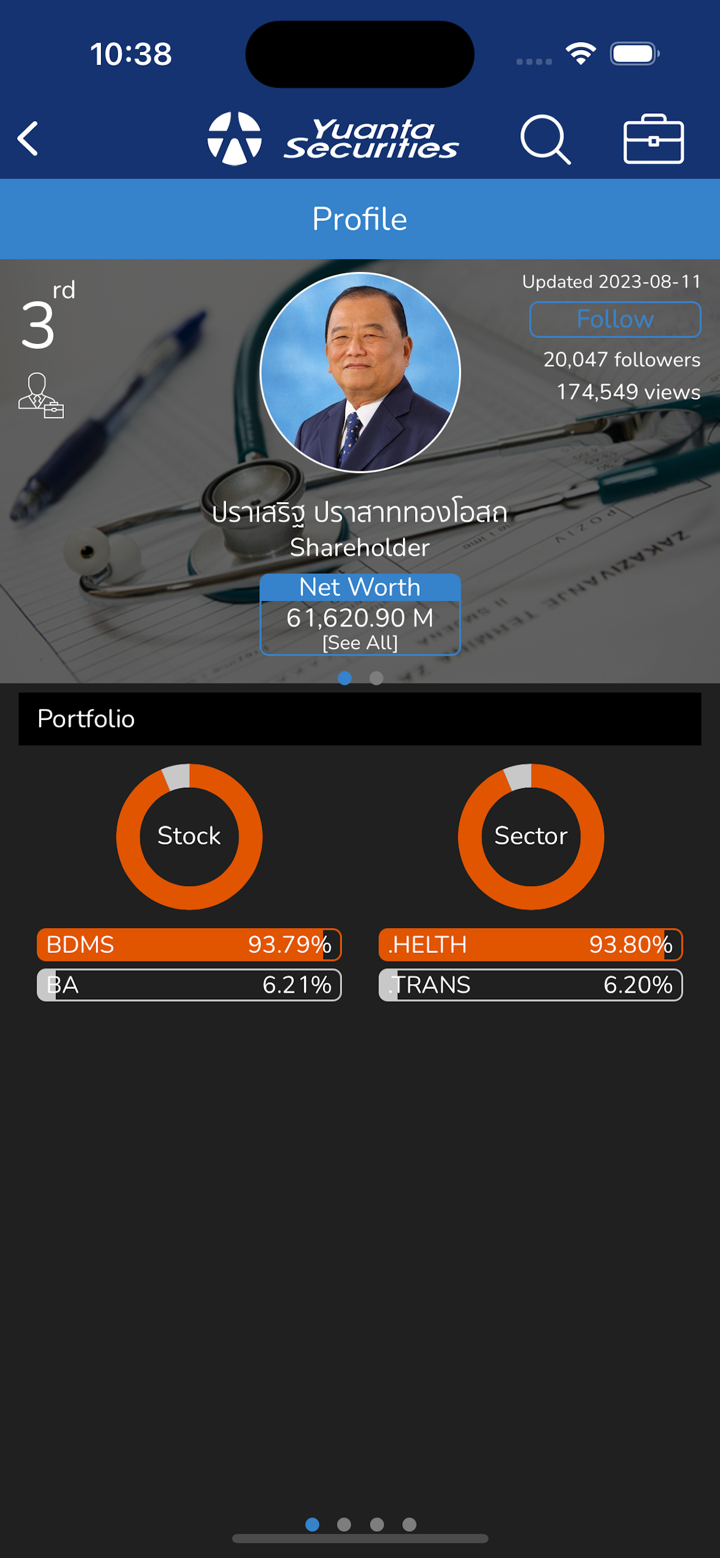

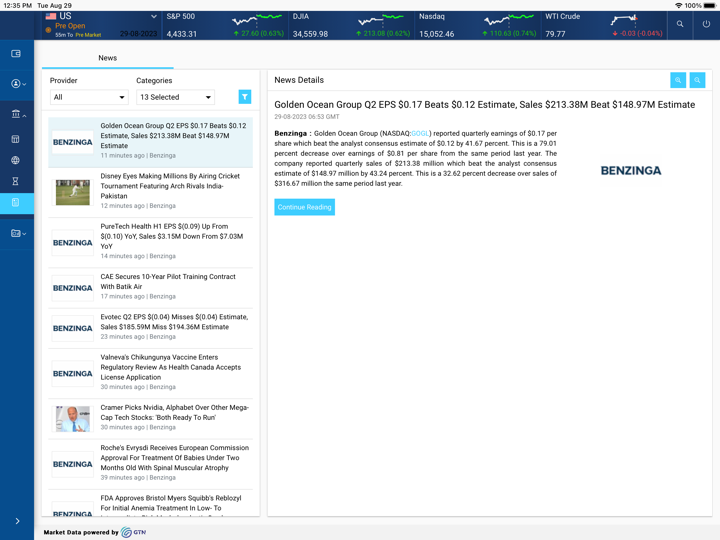

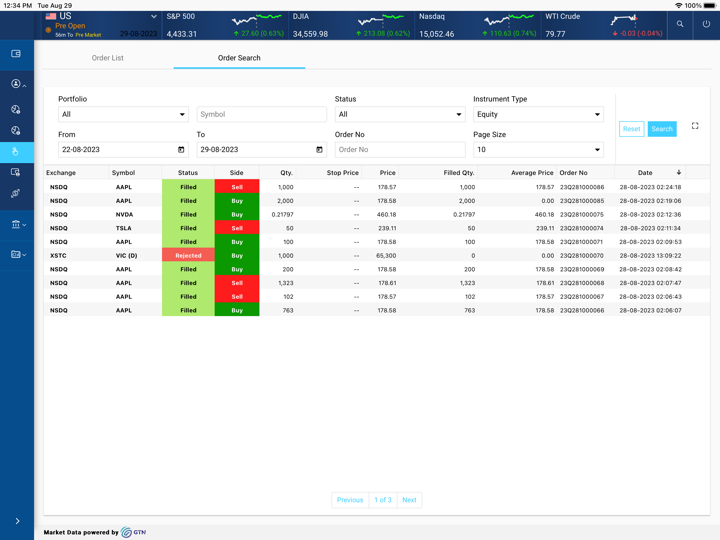

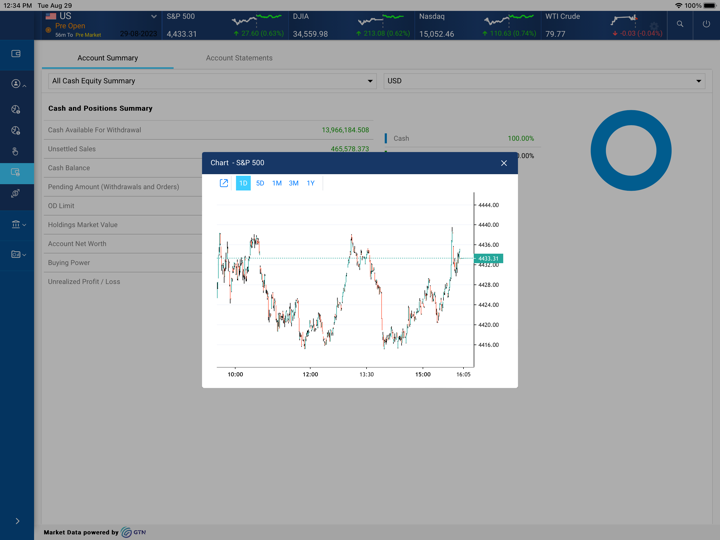

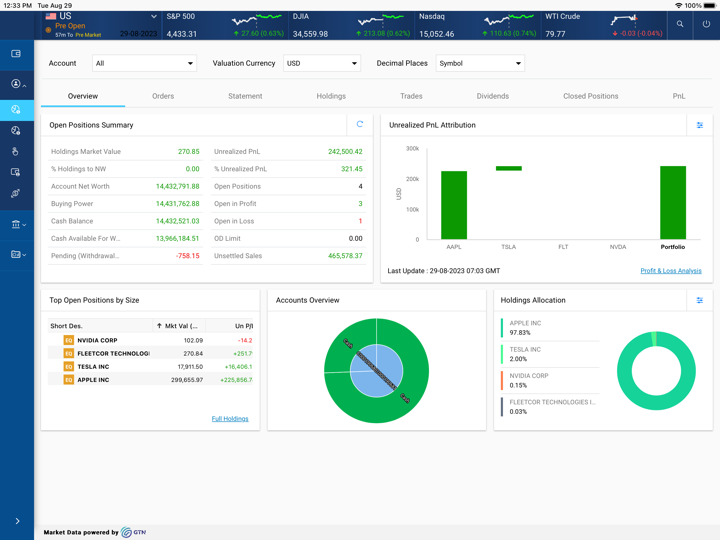

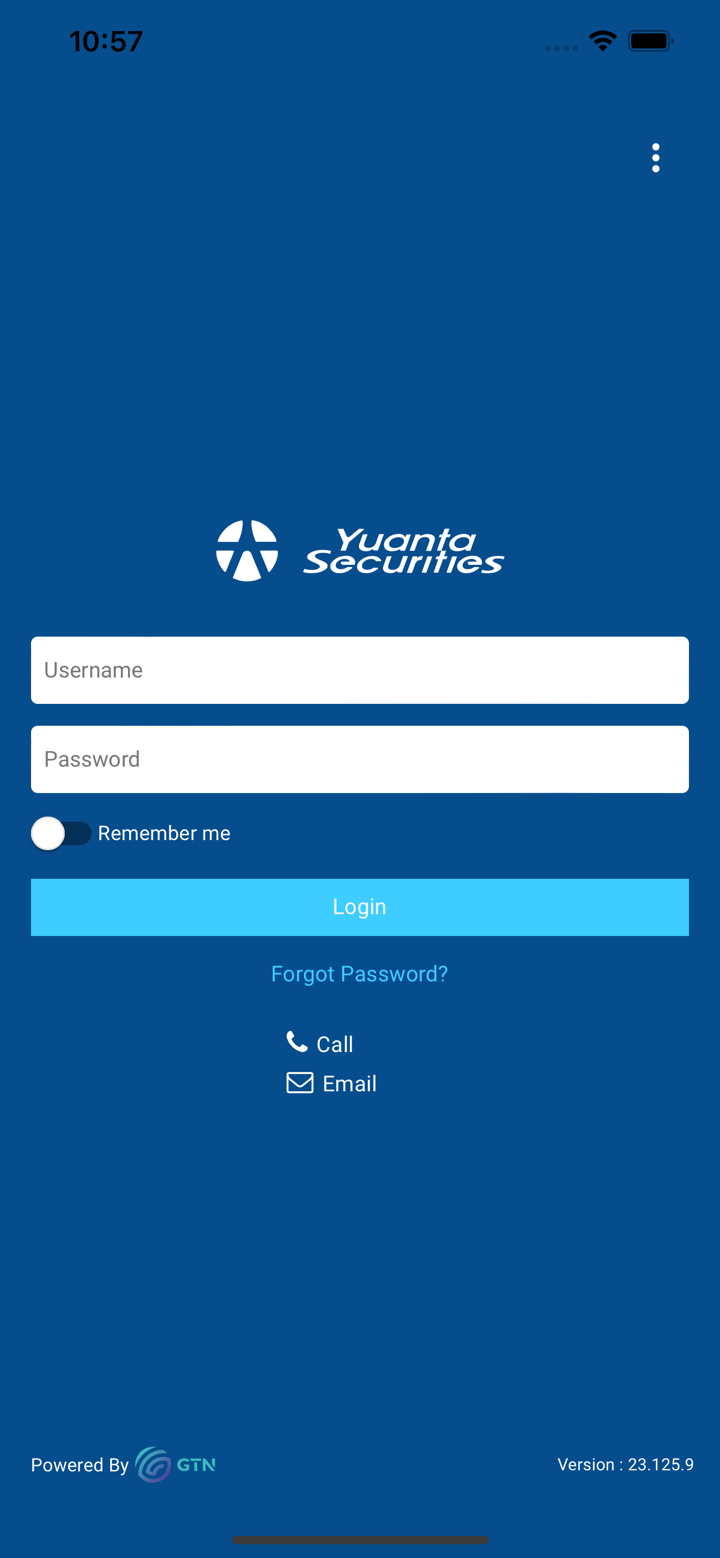

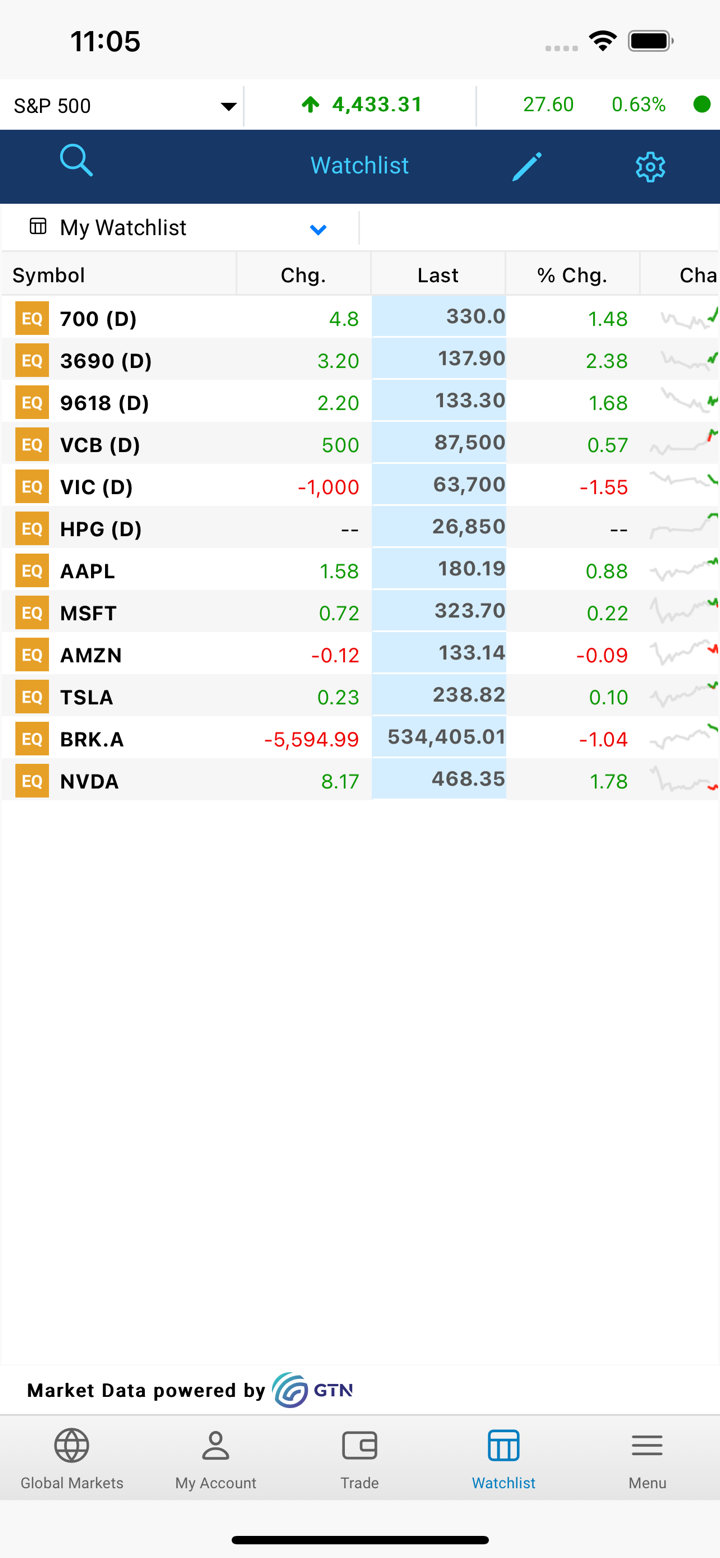

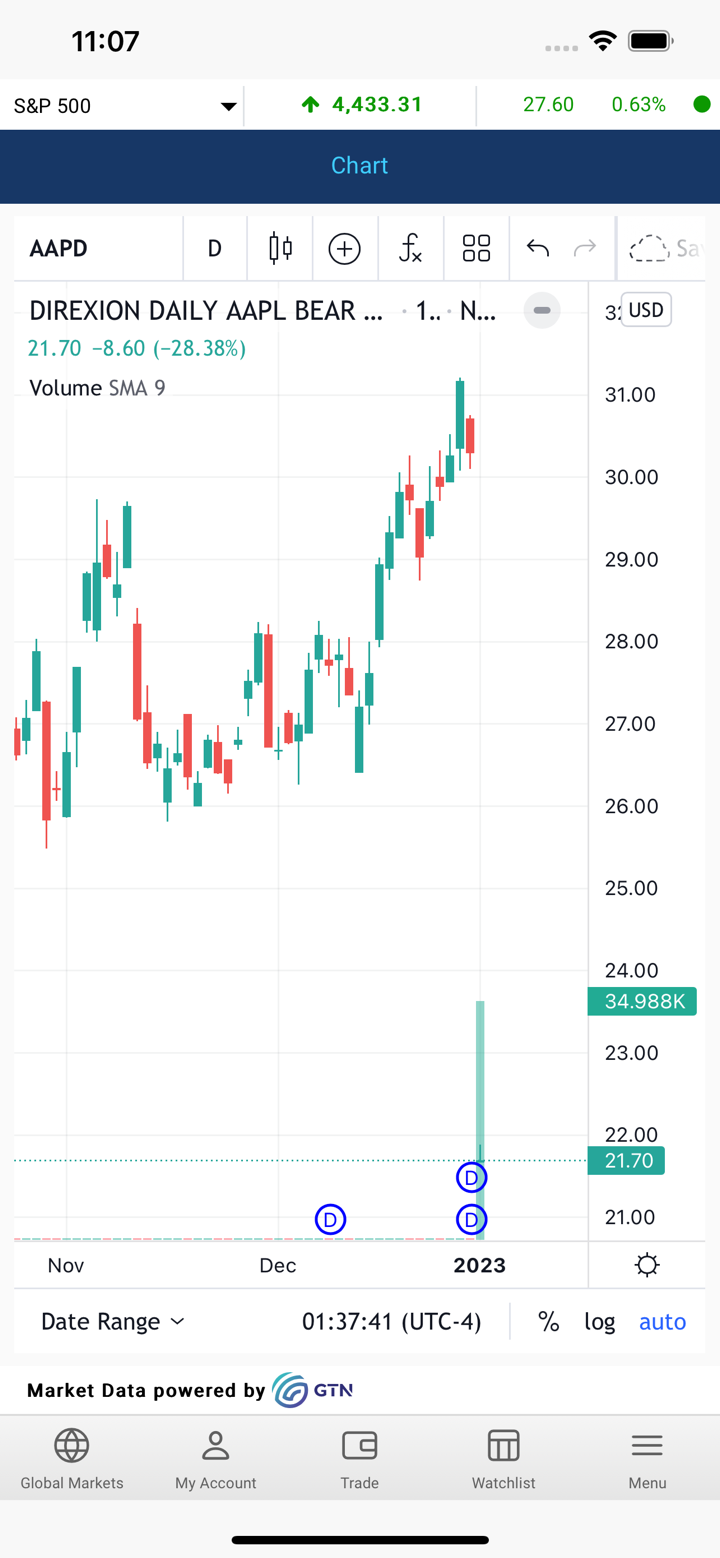

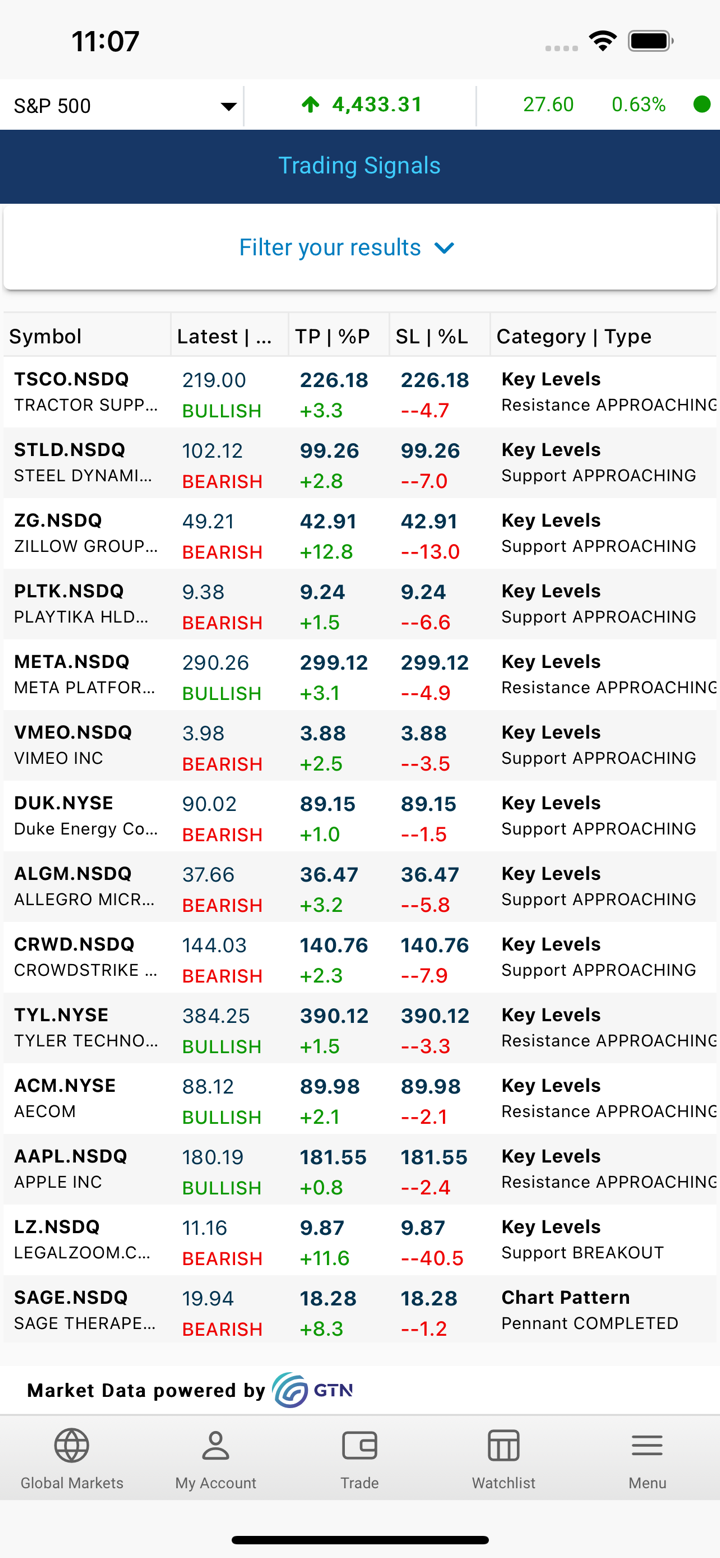

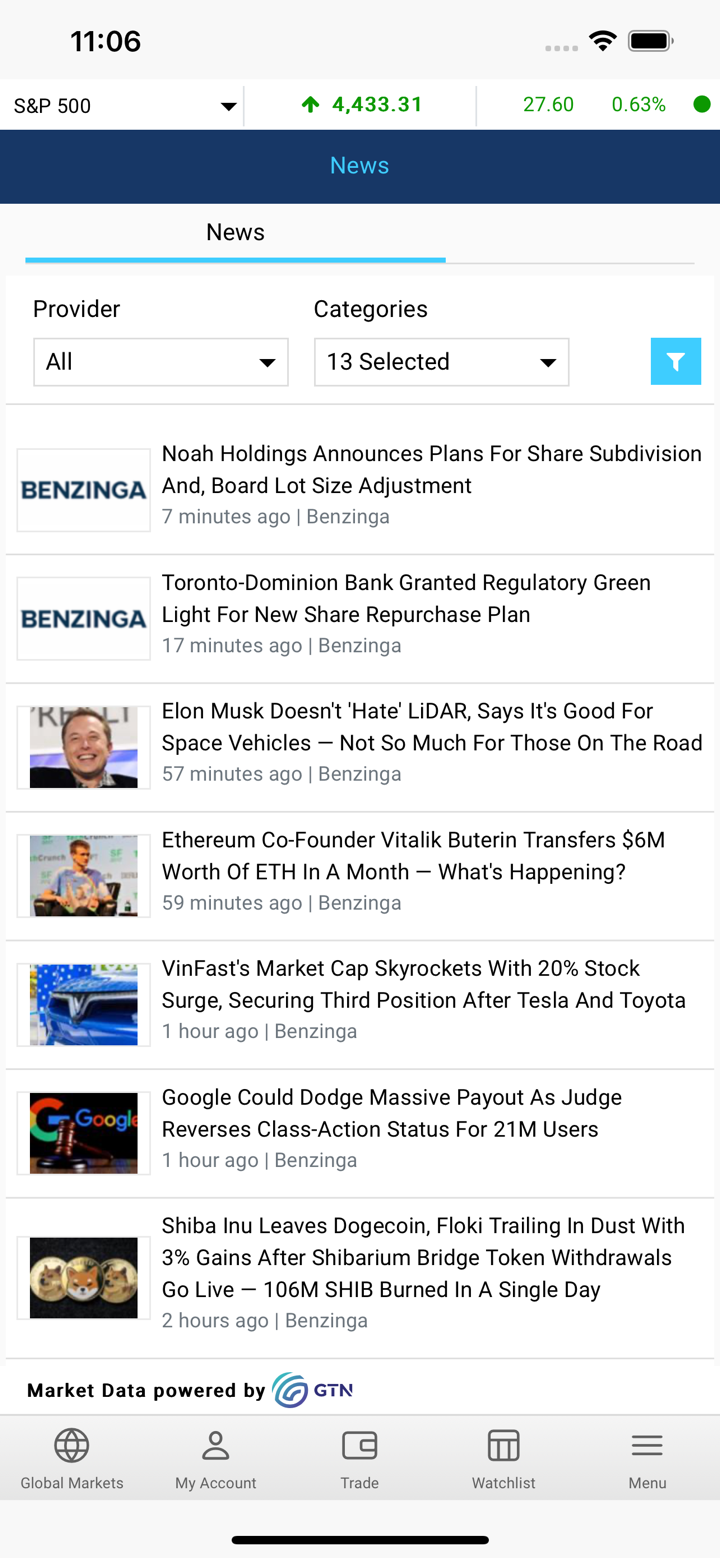

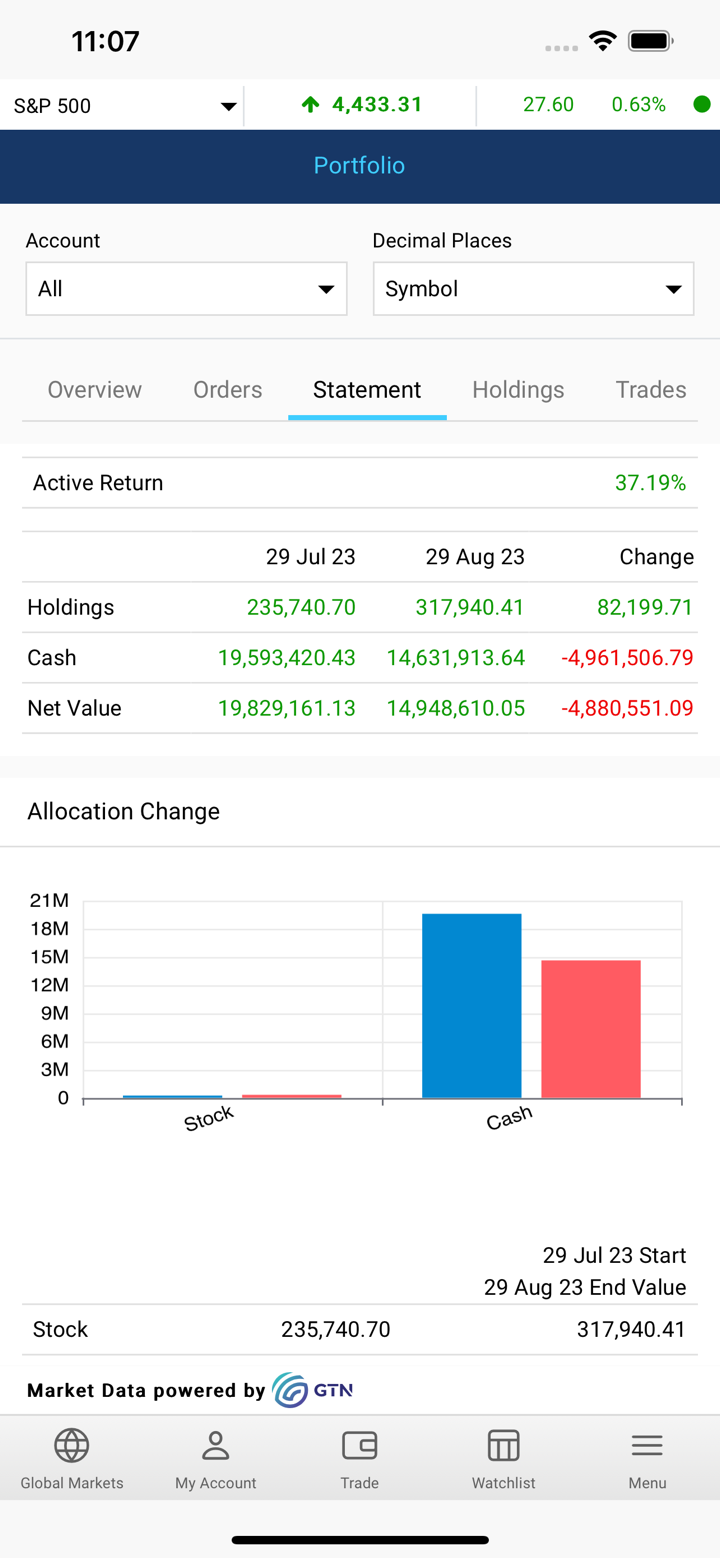

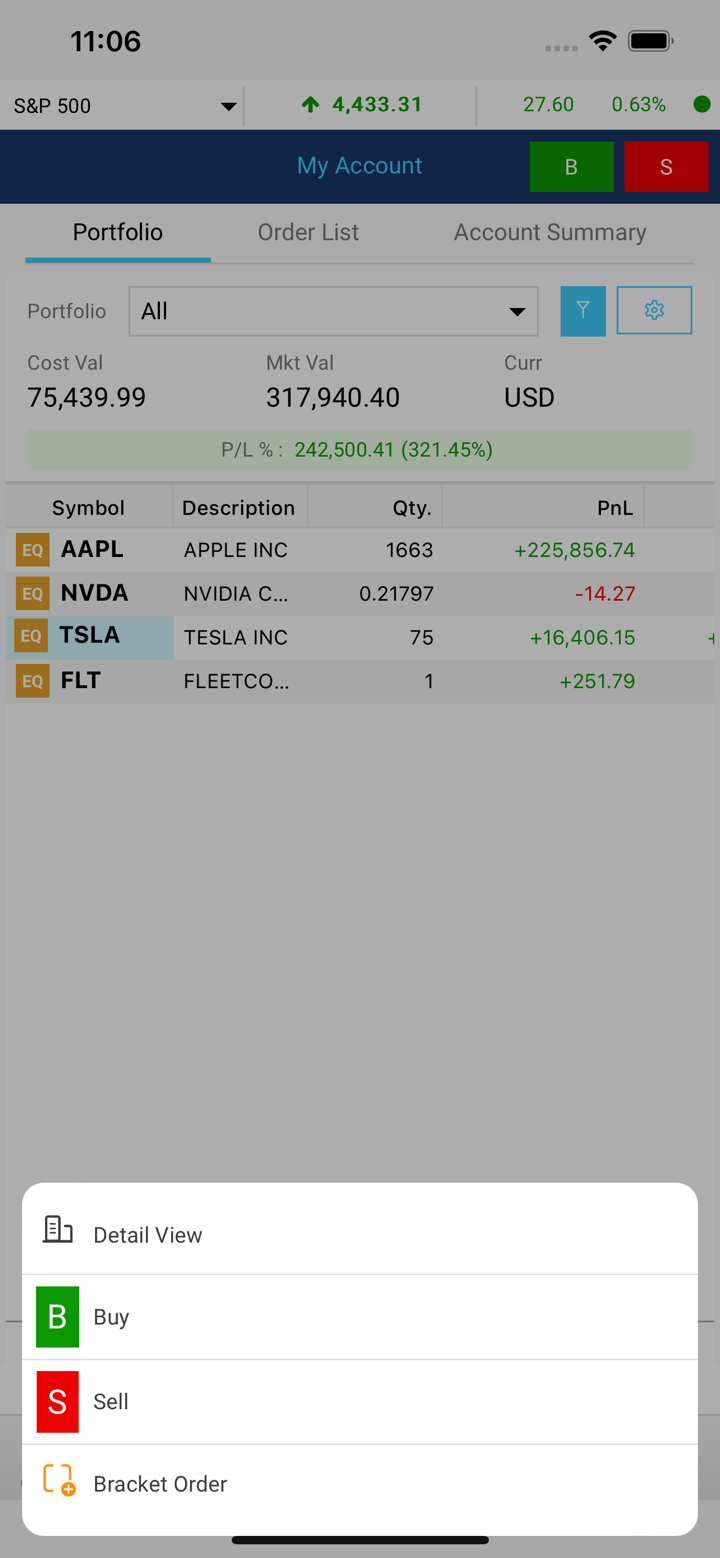

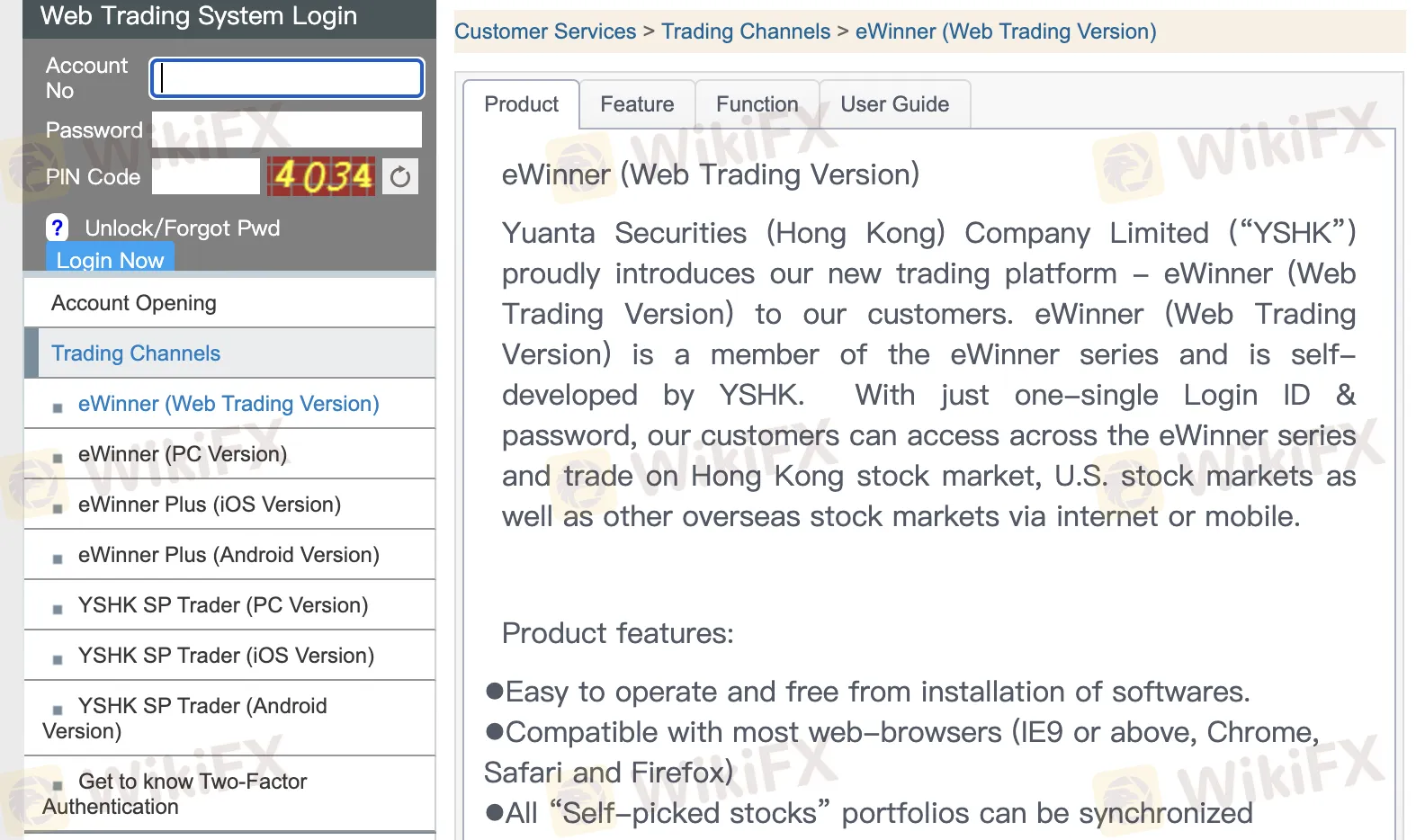

Plataporma ng Paghahalal

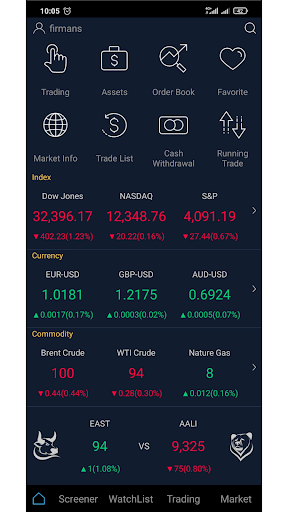

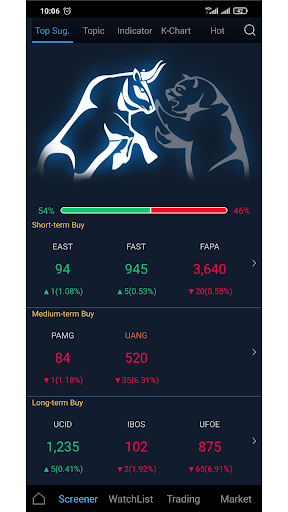

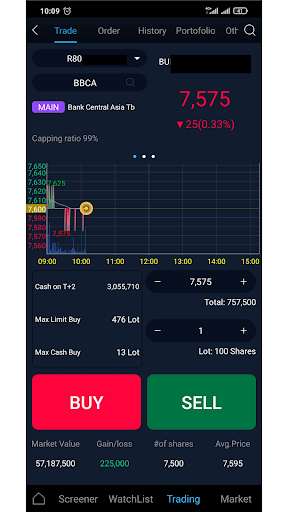

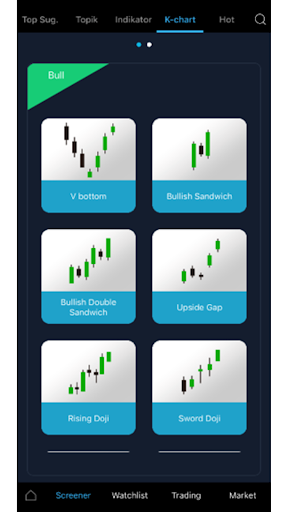

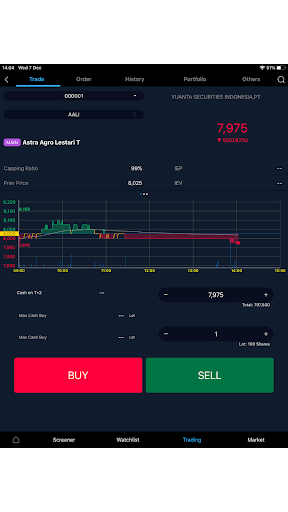

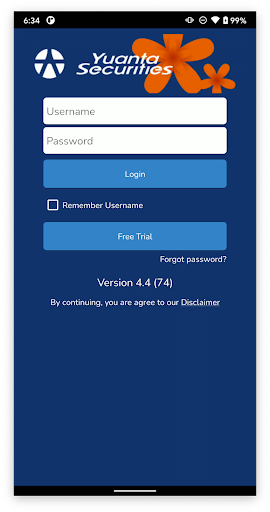

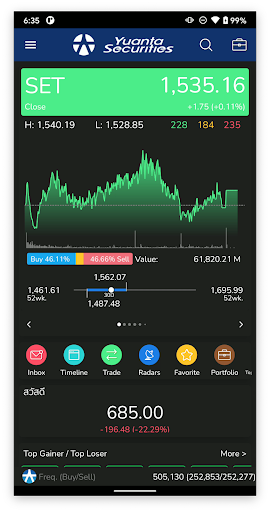

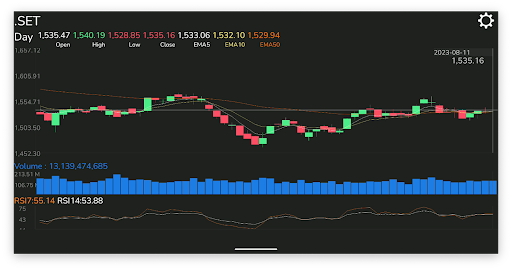

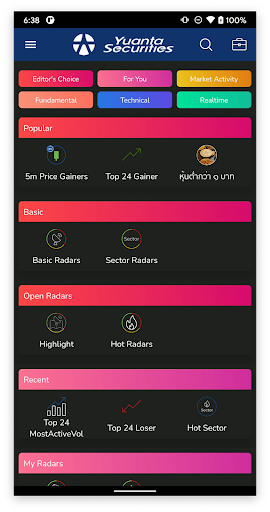

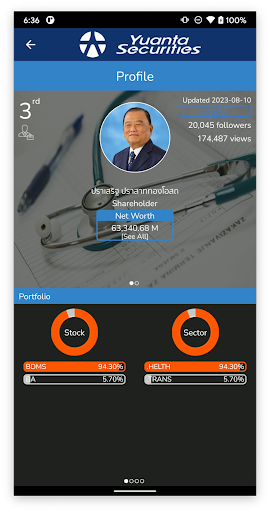

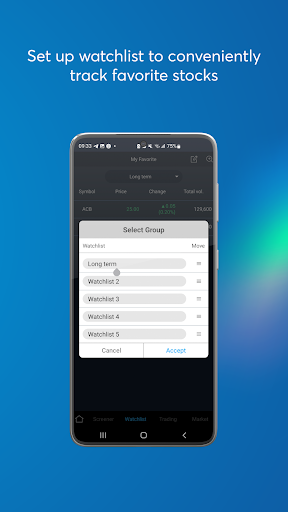

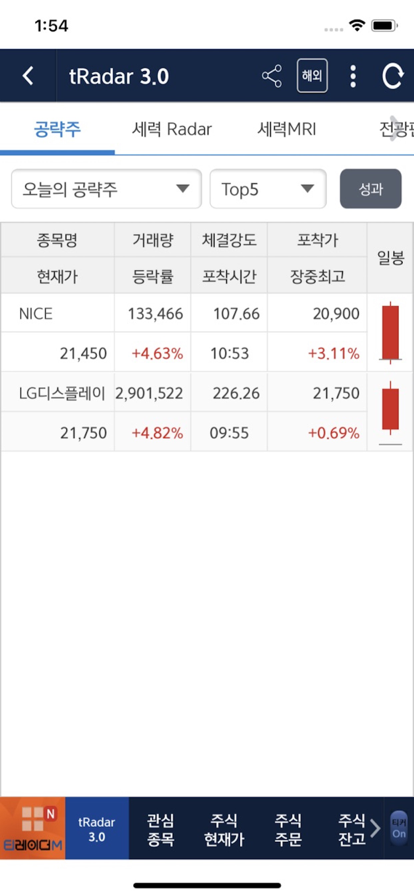

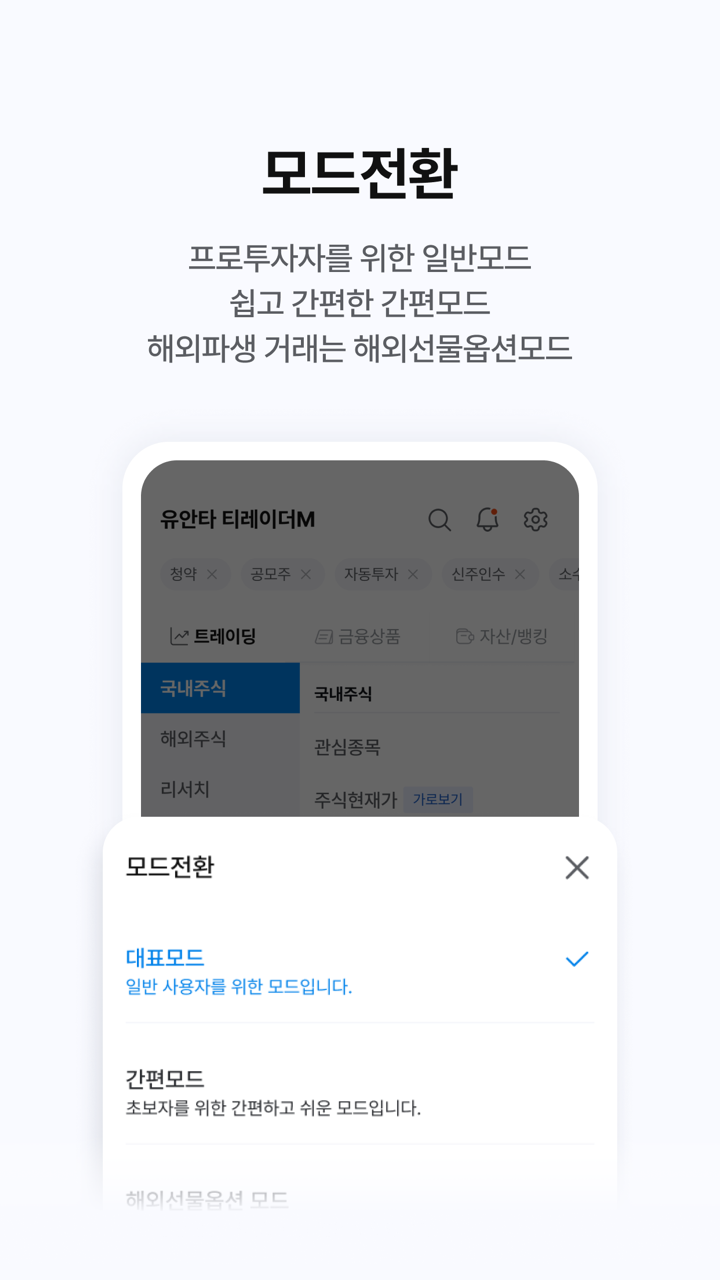

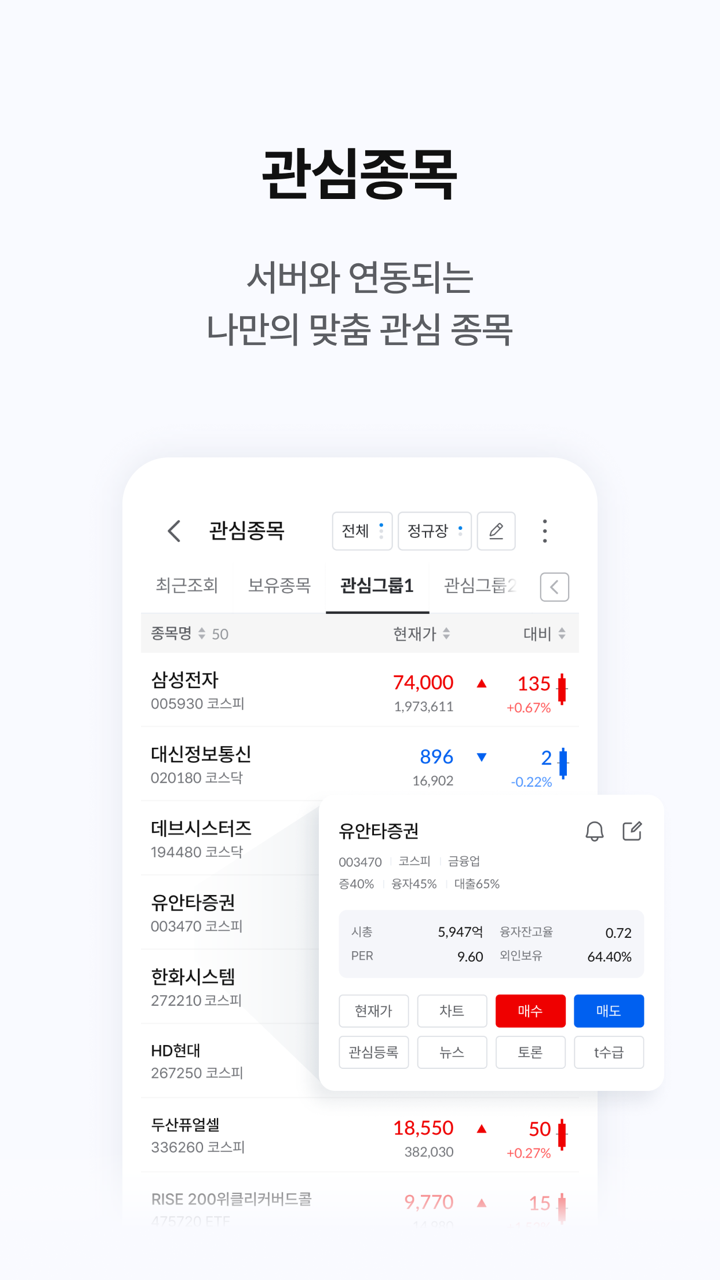

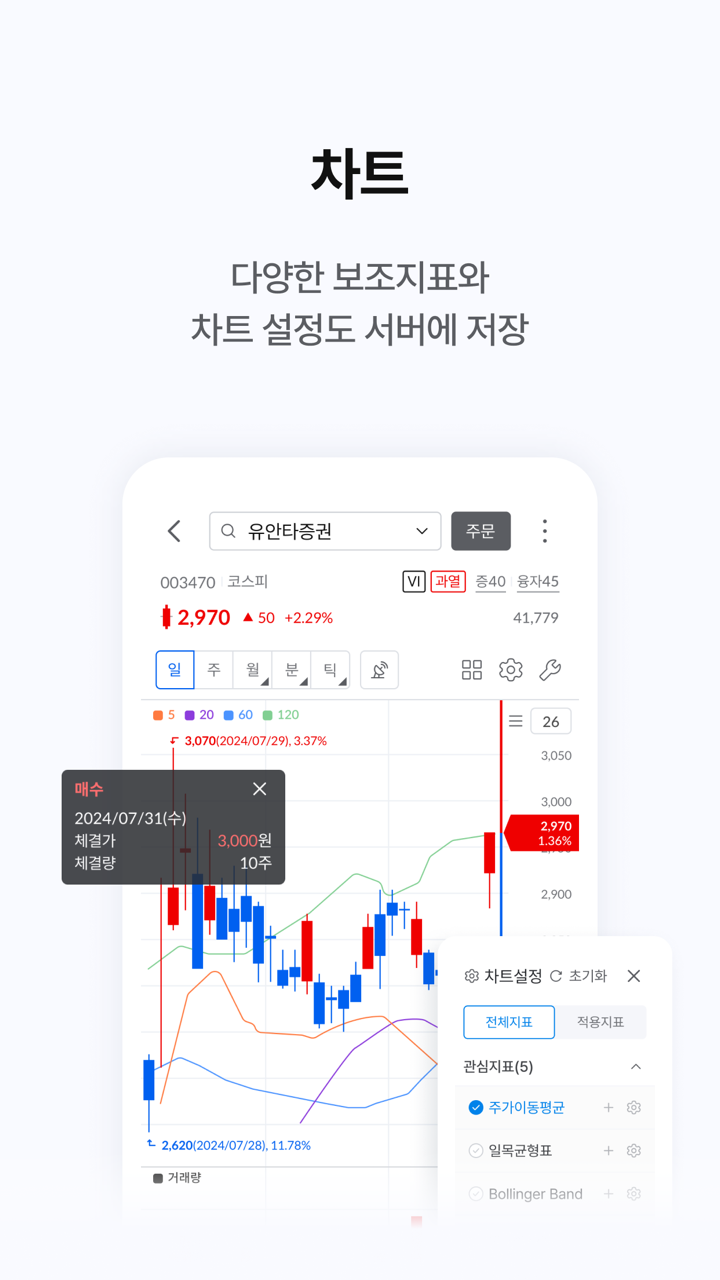

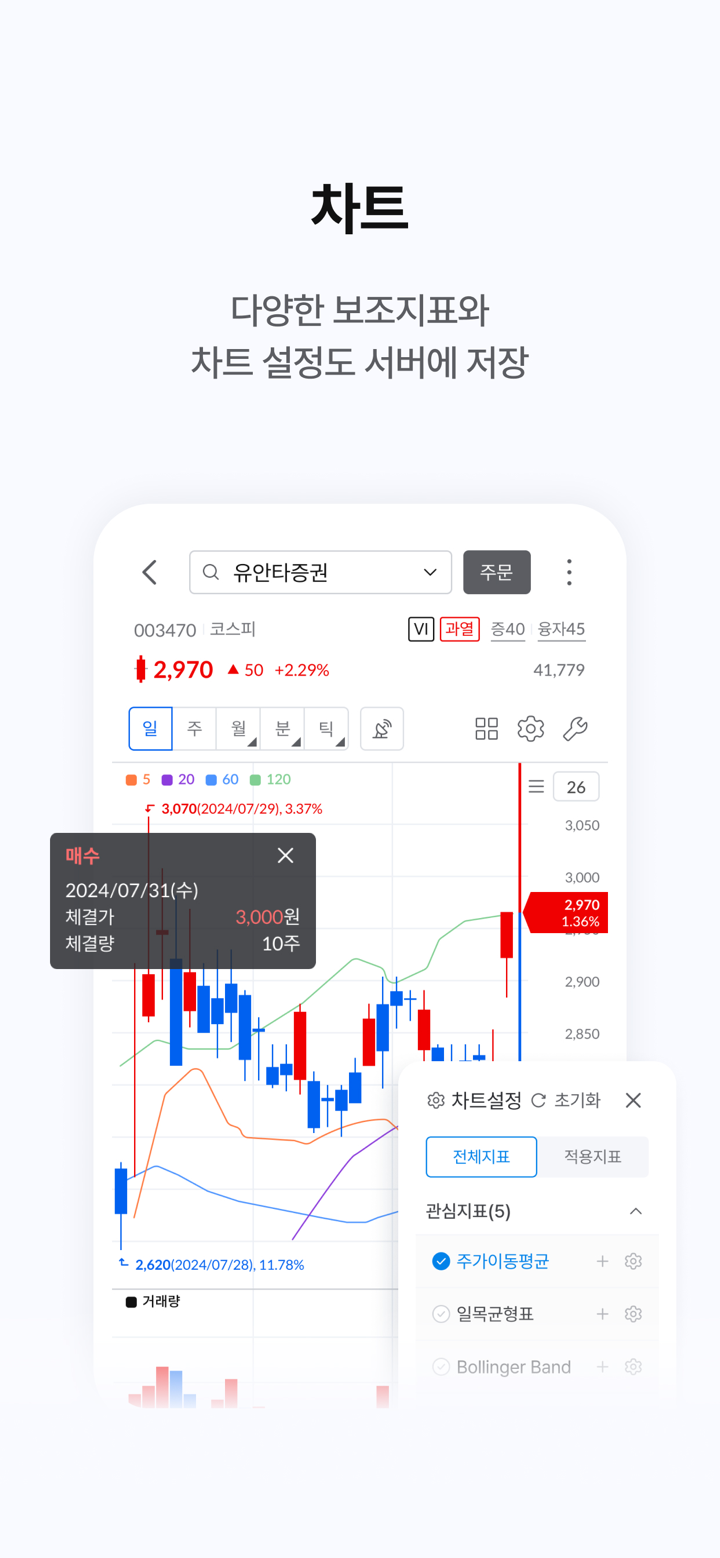

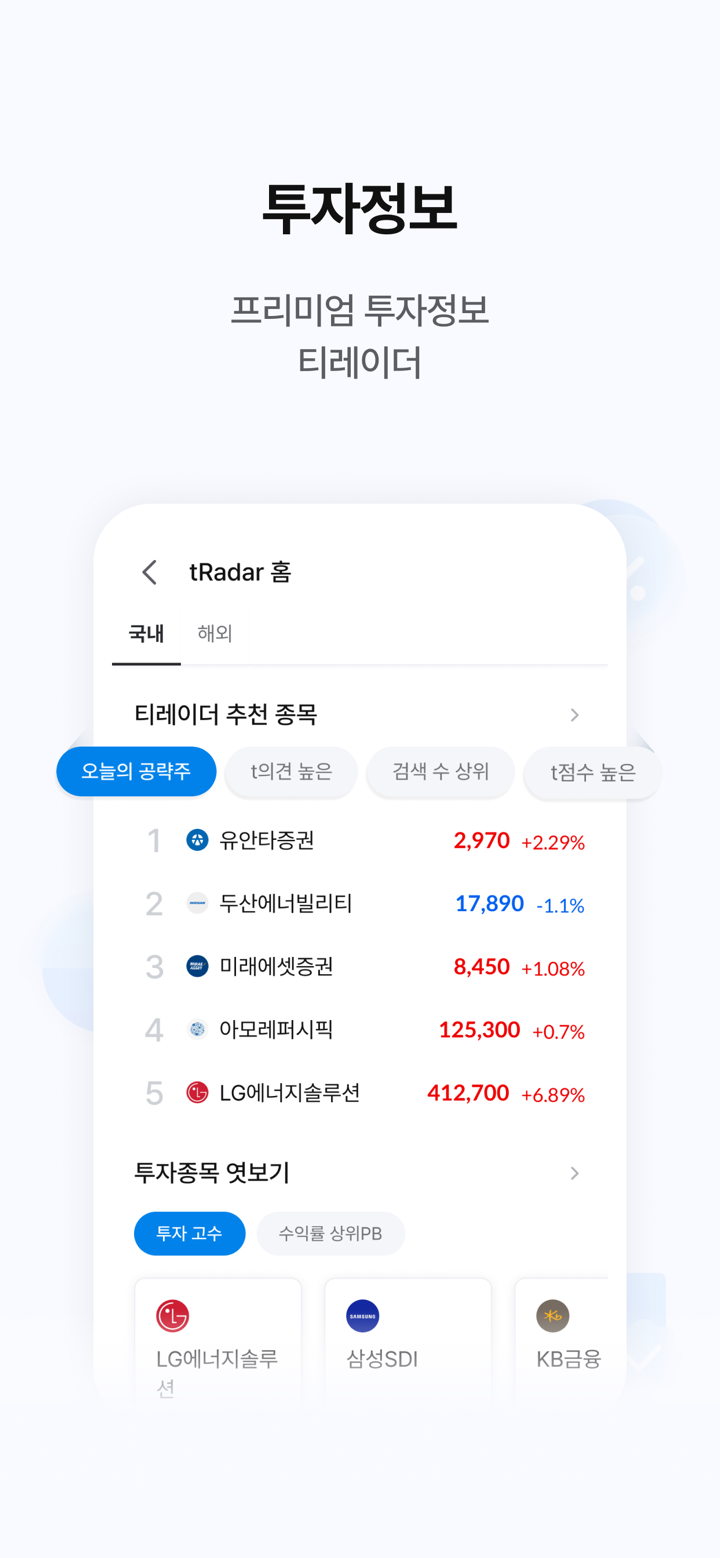

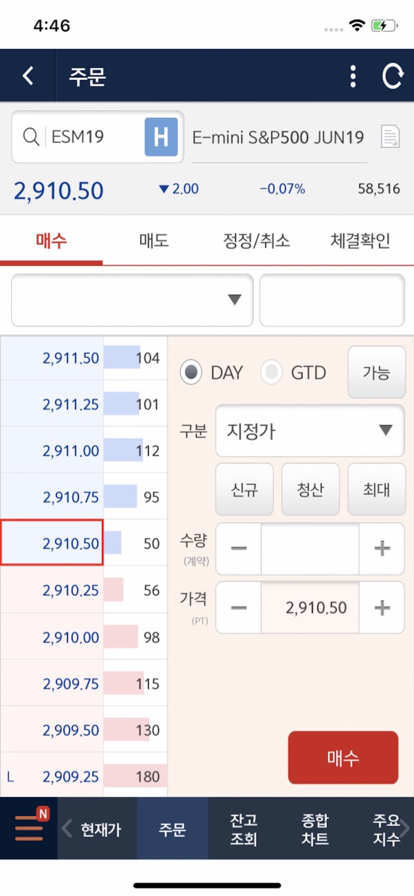

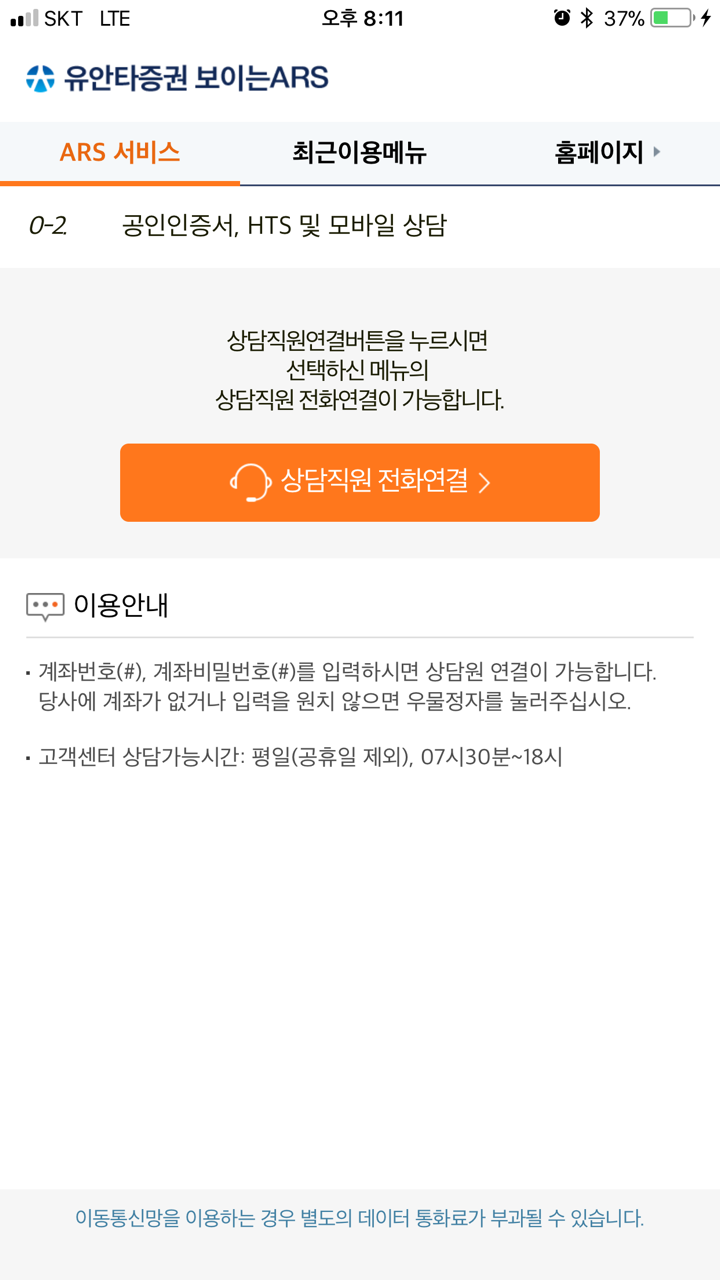

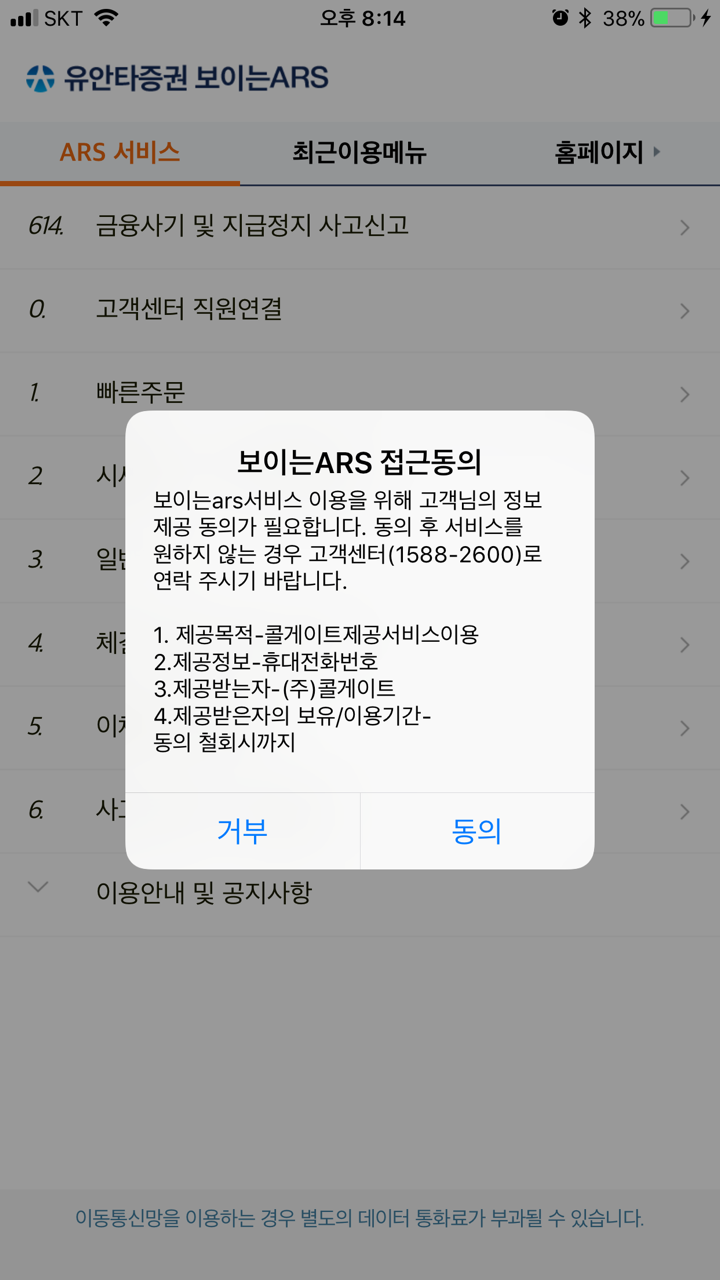

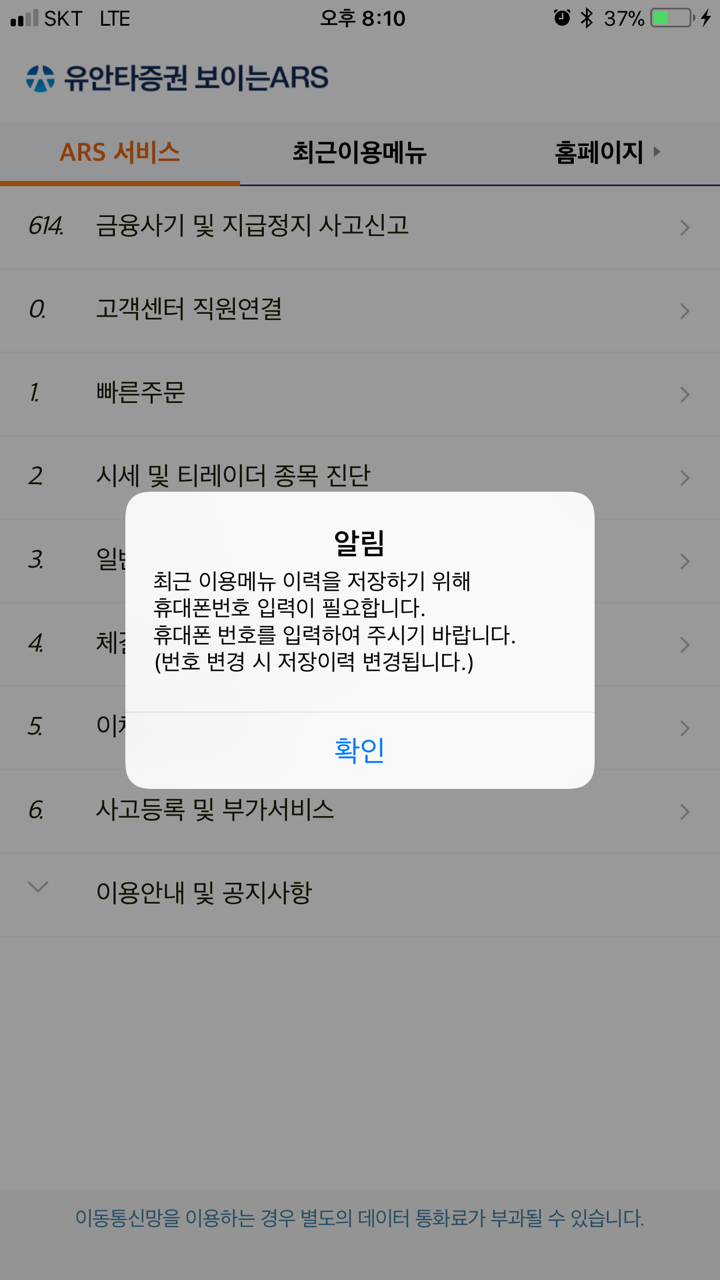

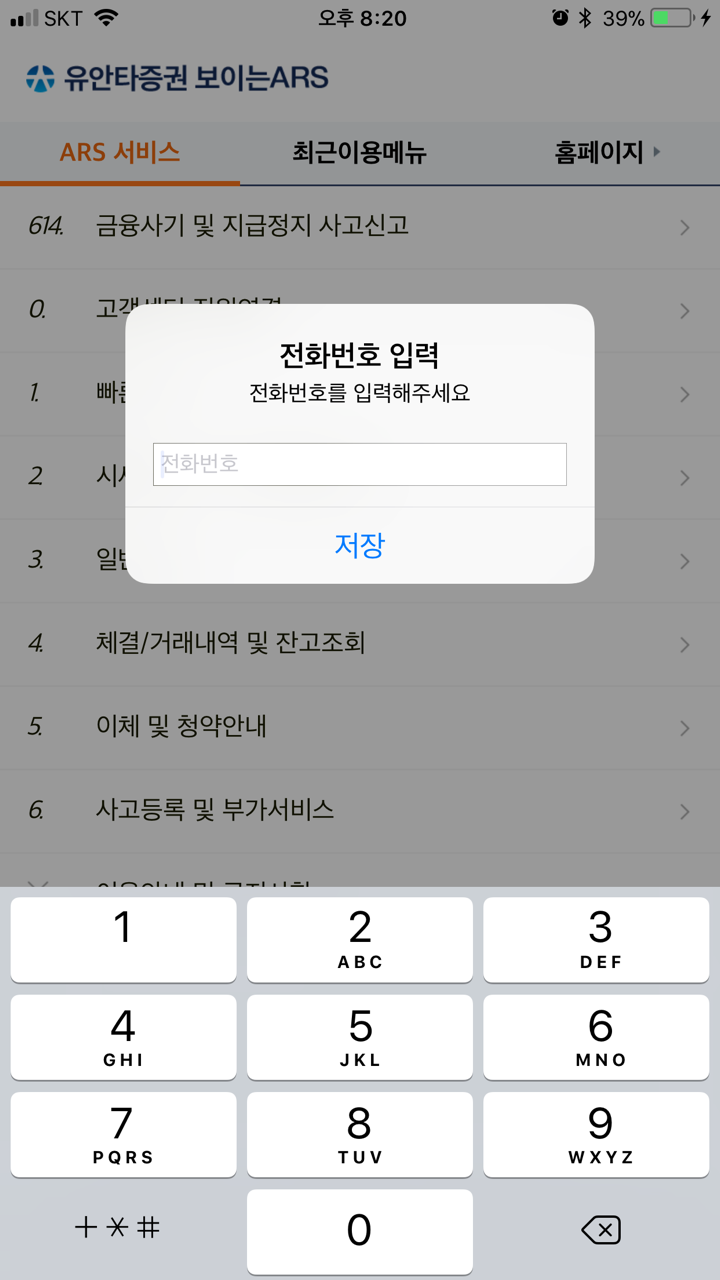

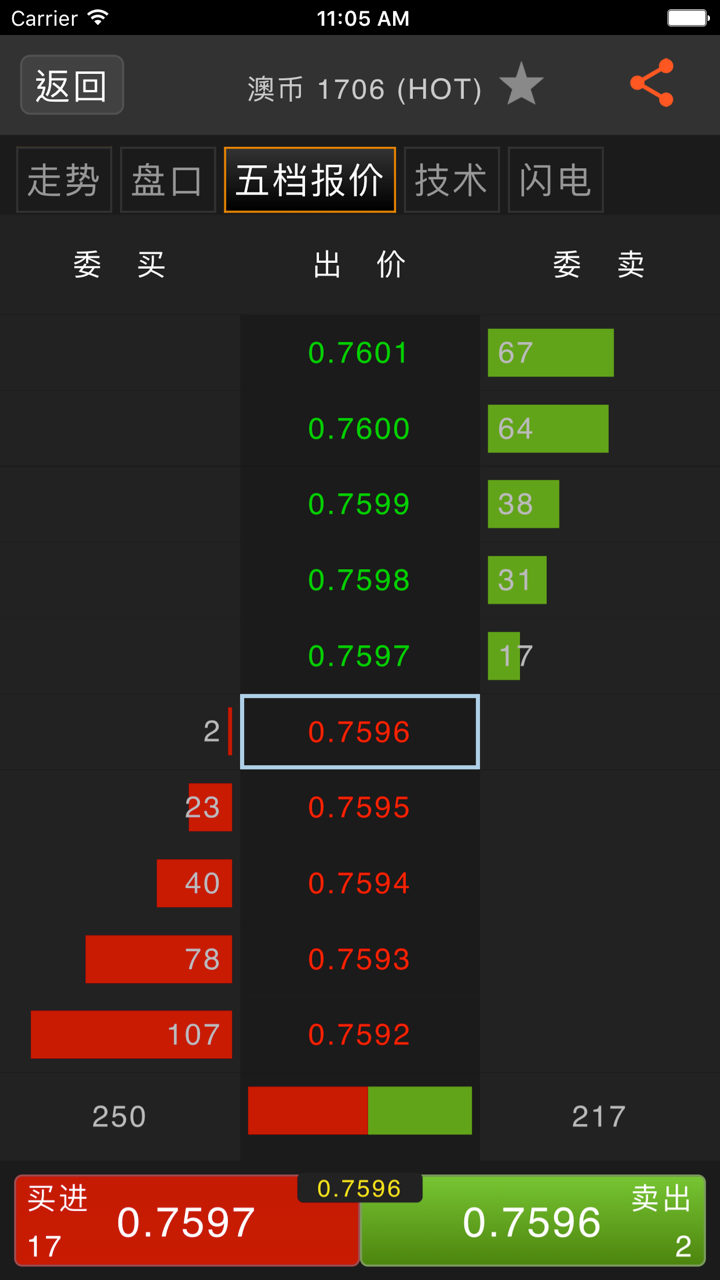

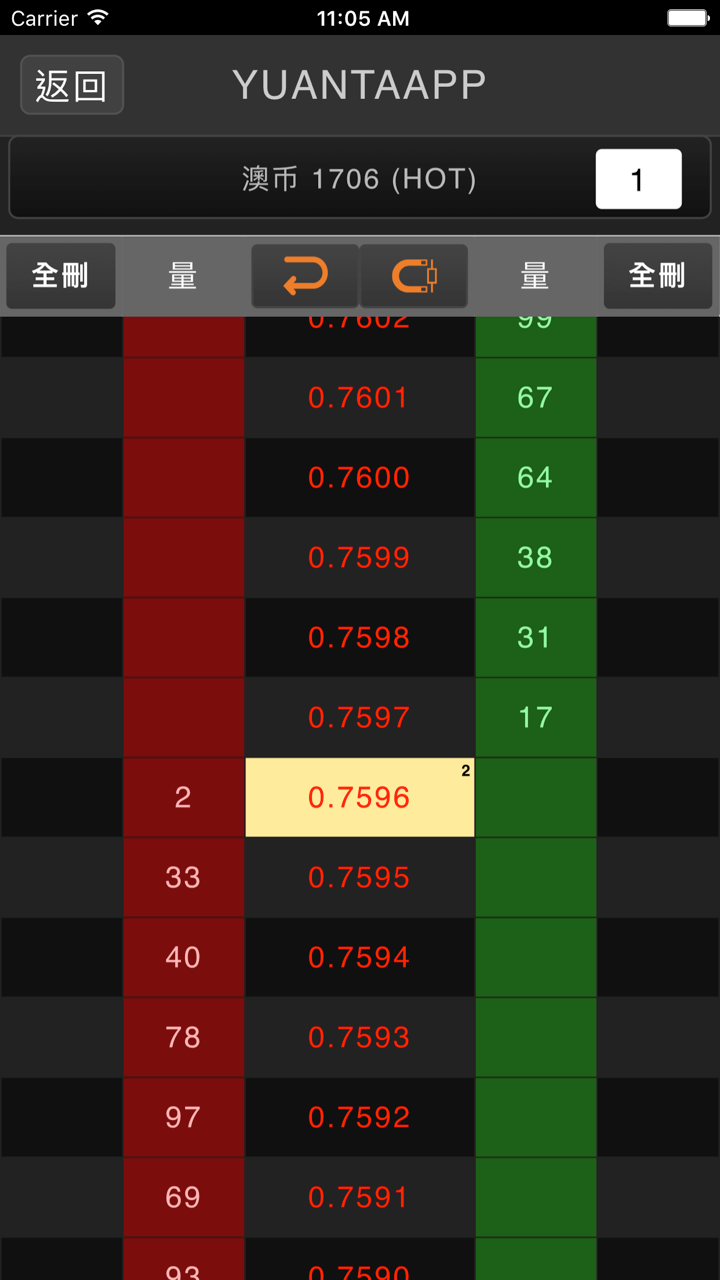

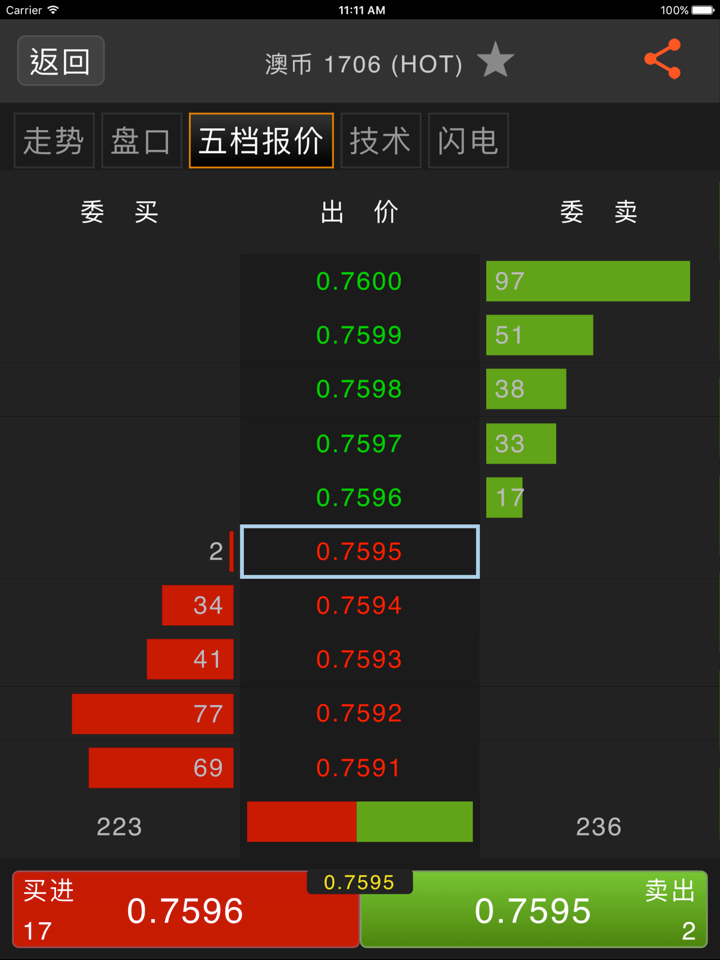

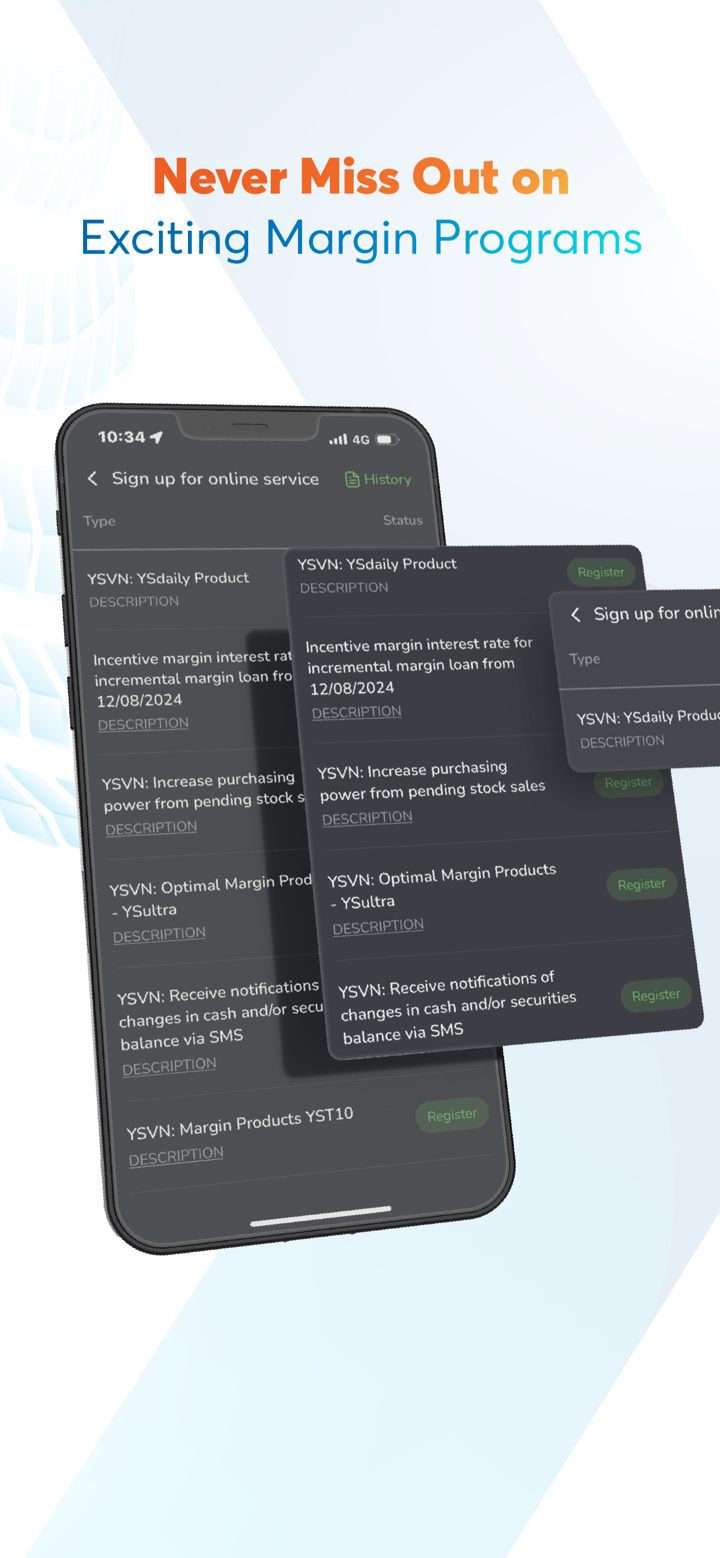

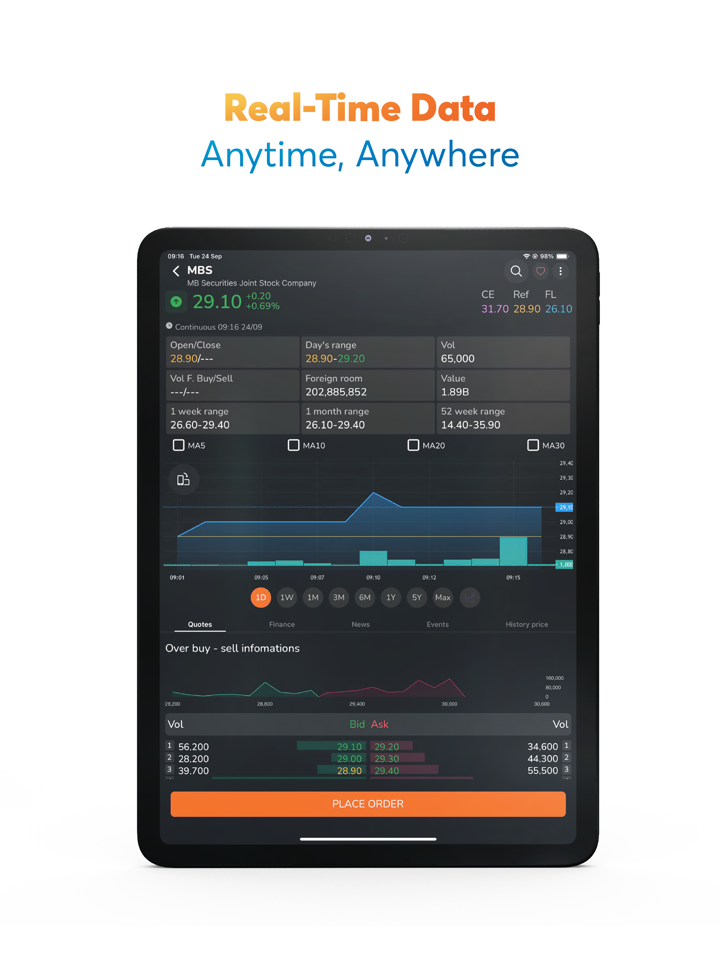

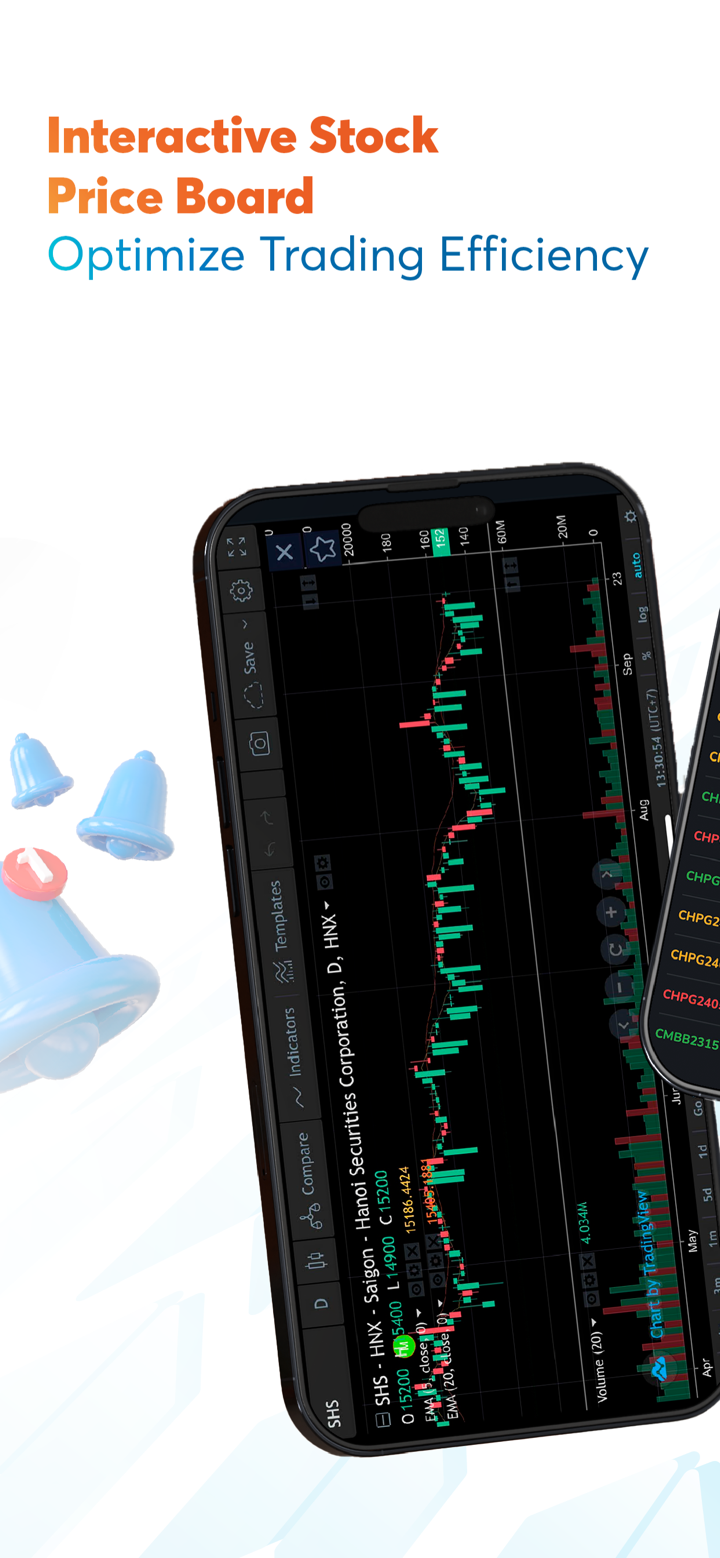

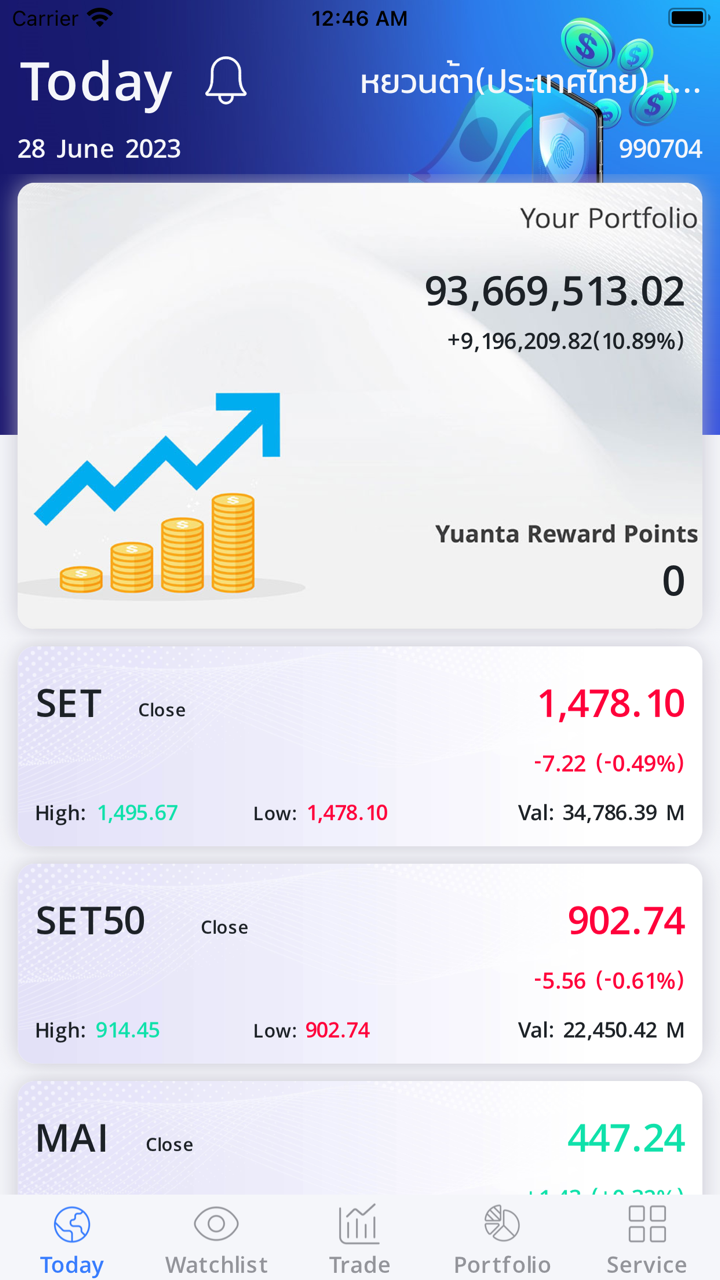

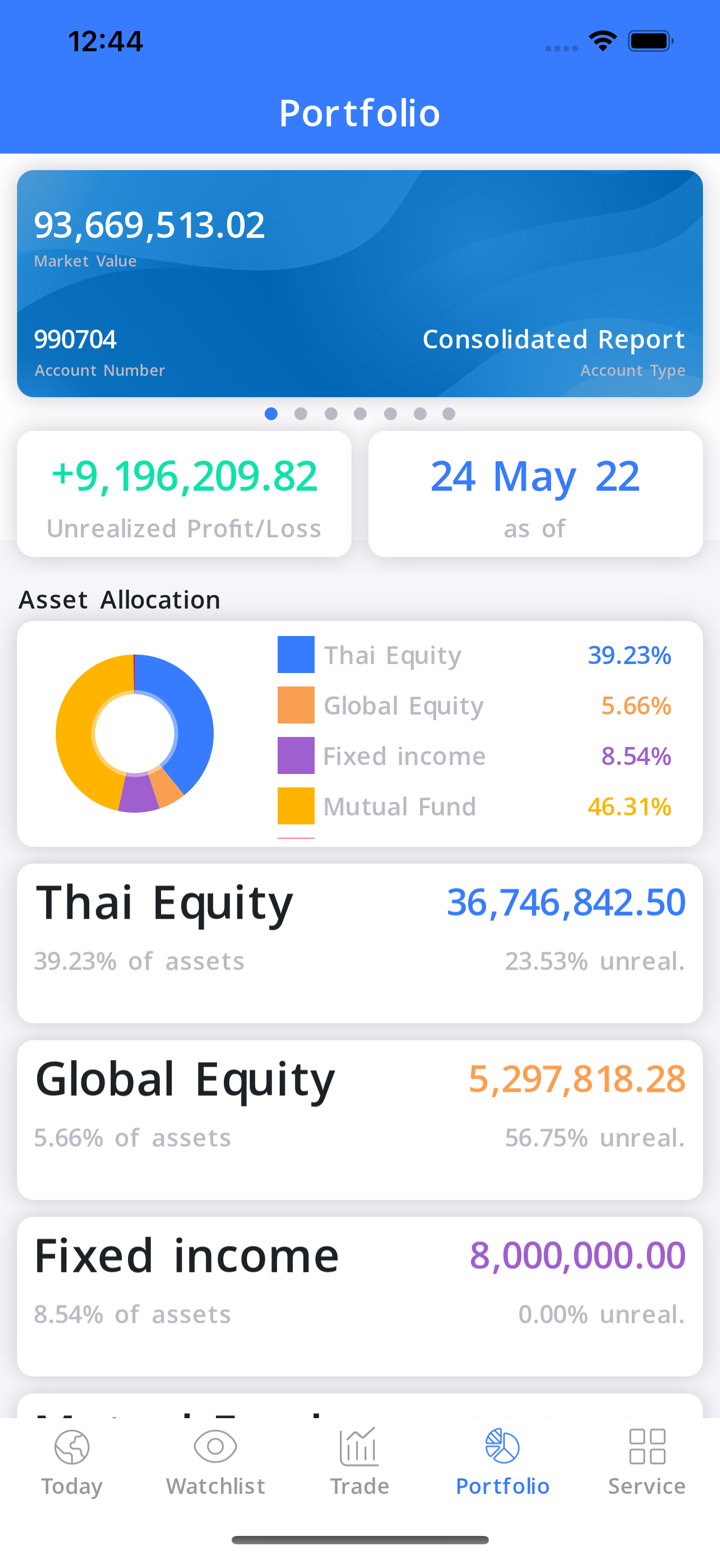

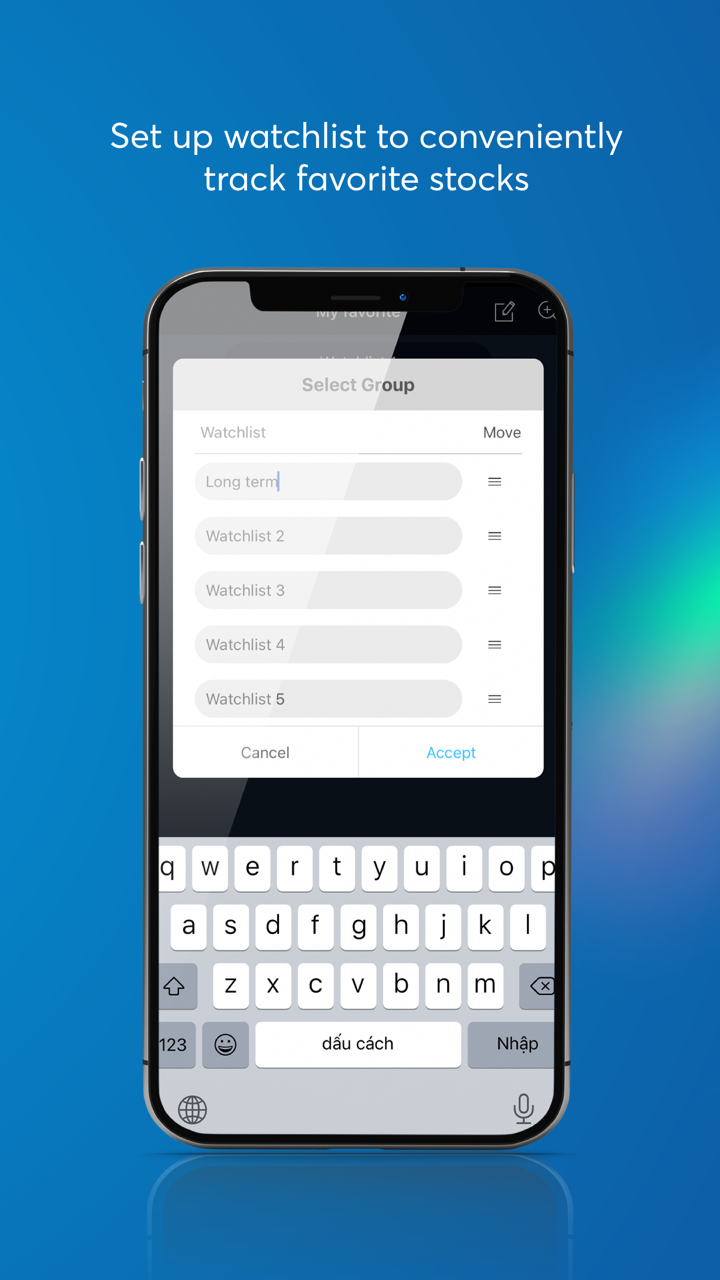

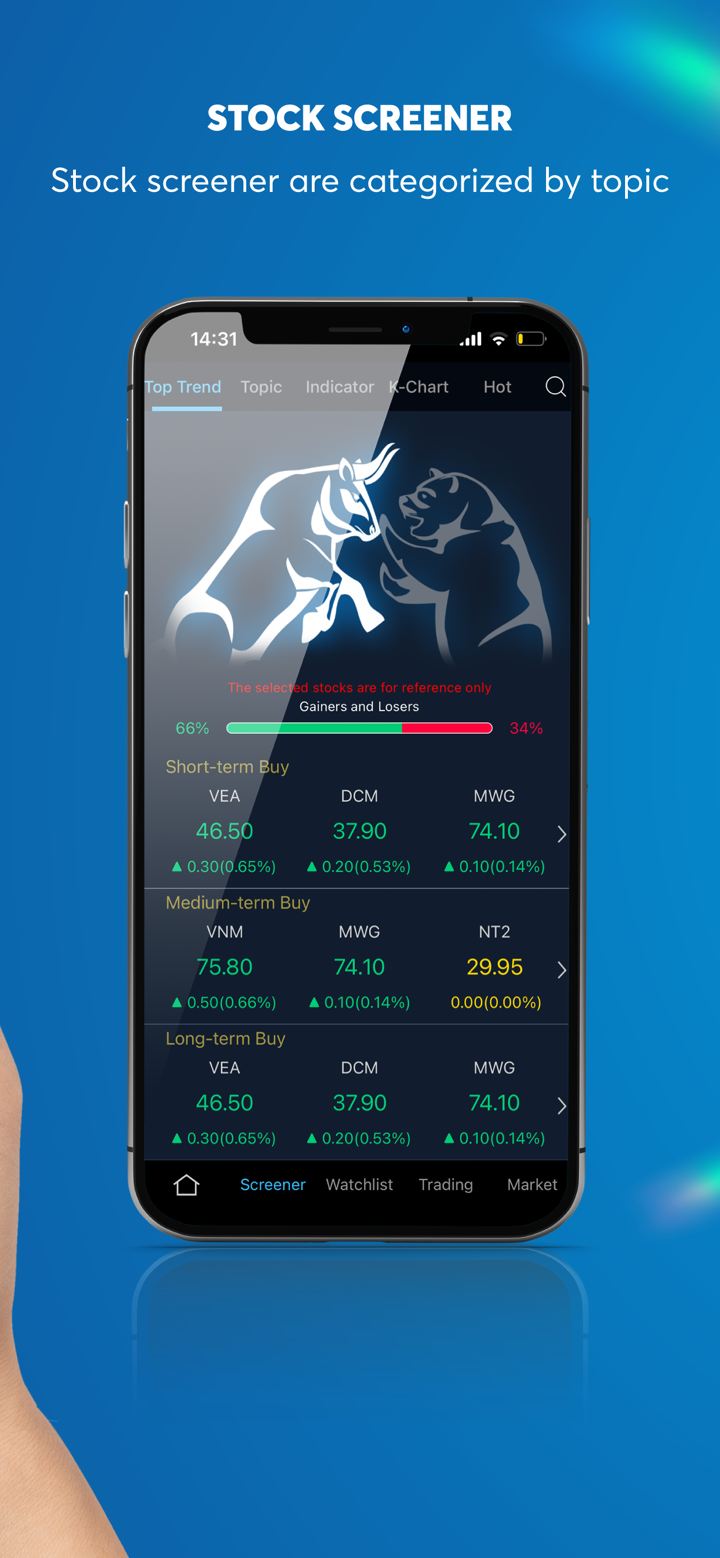

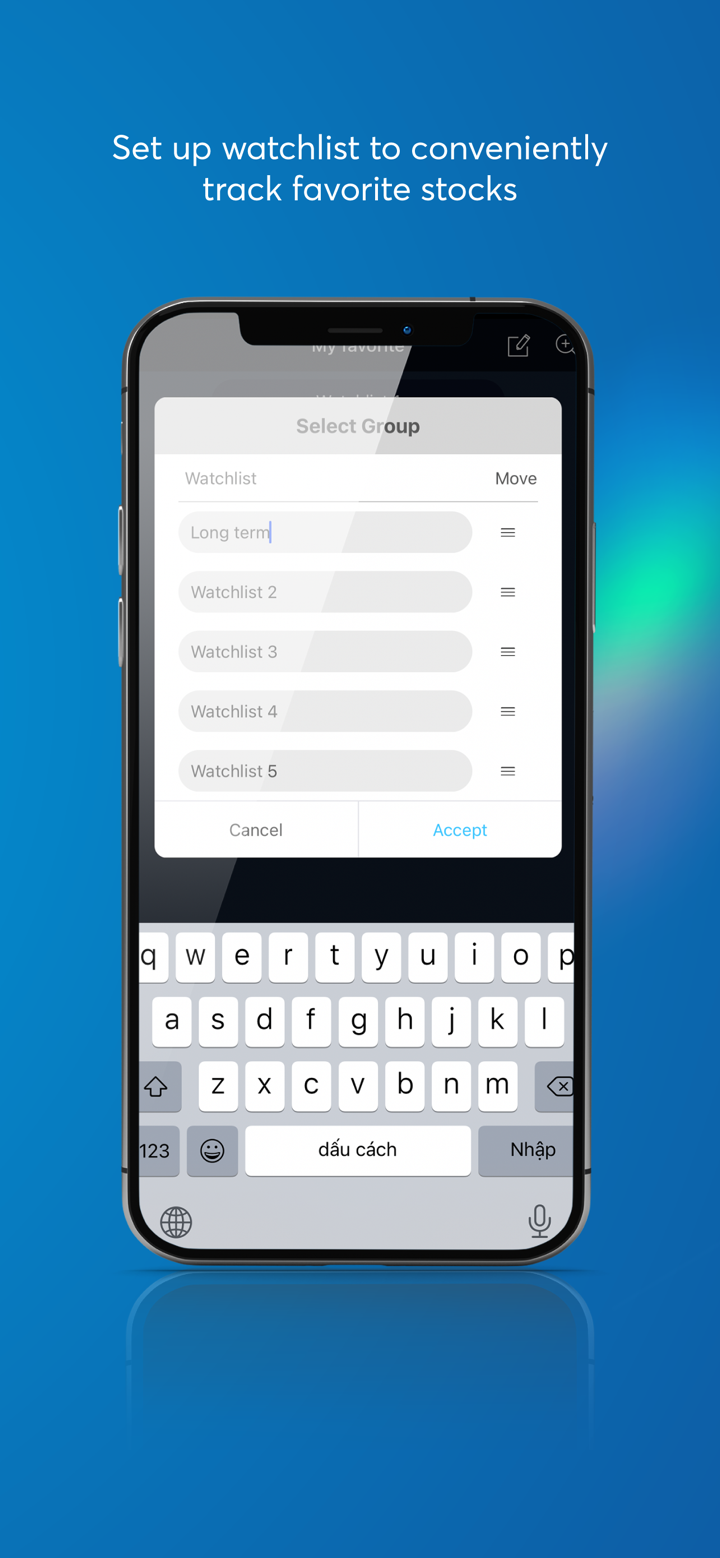

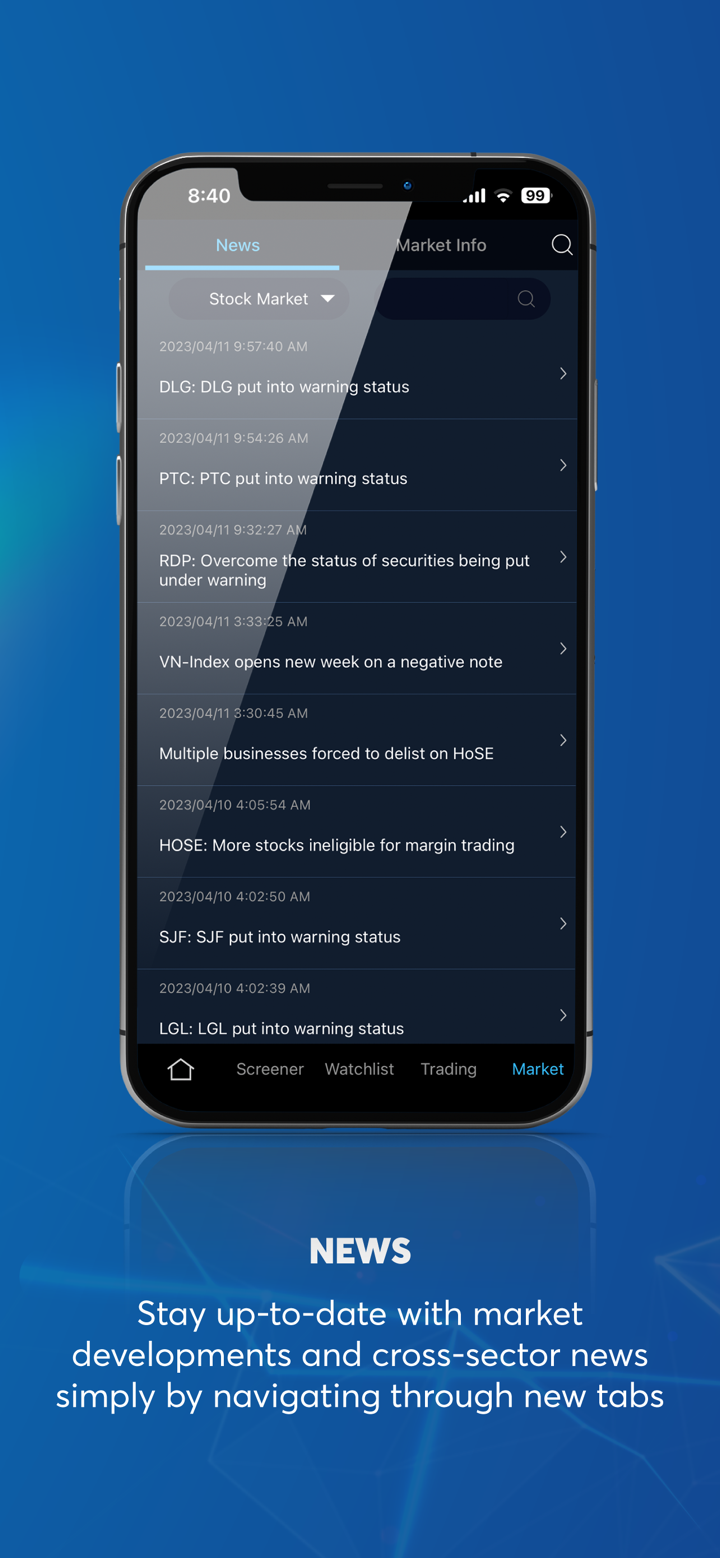

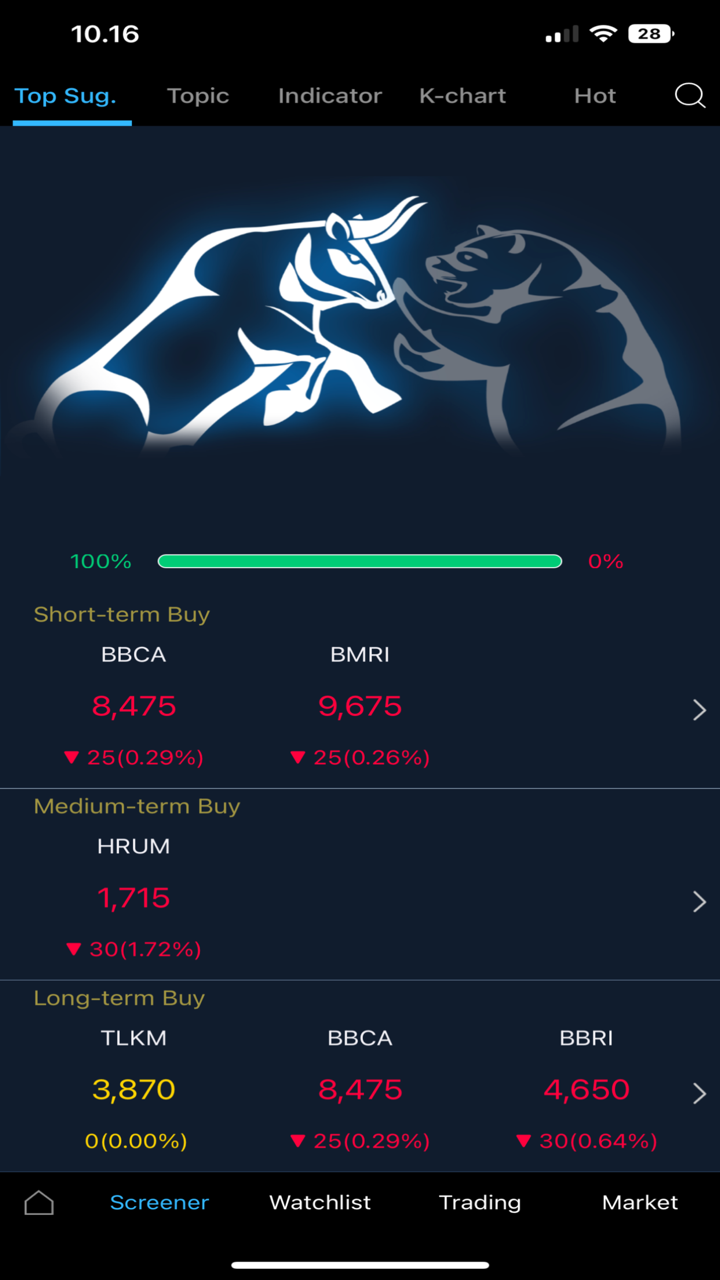

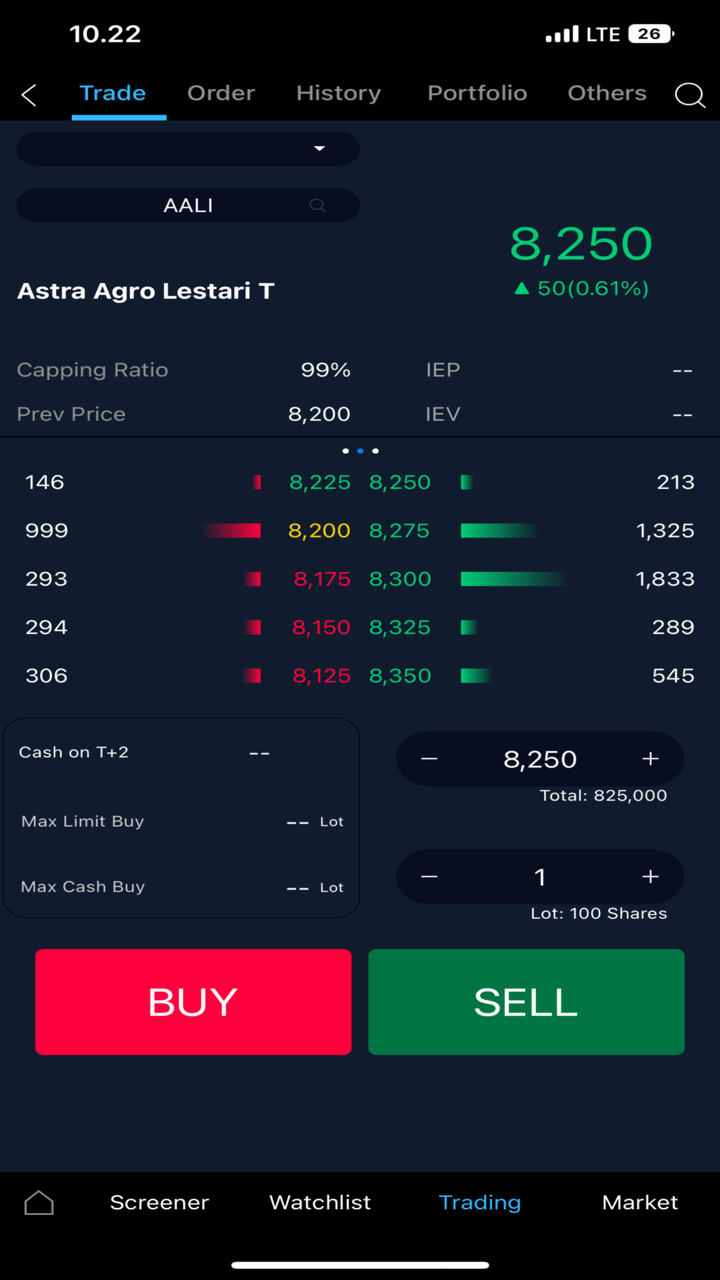

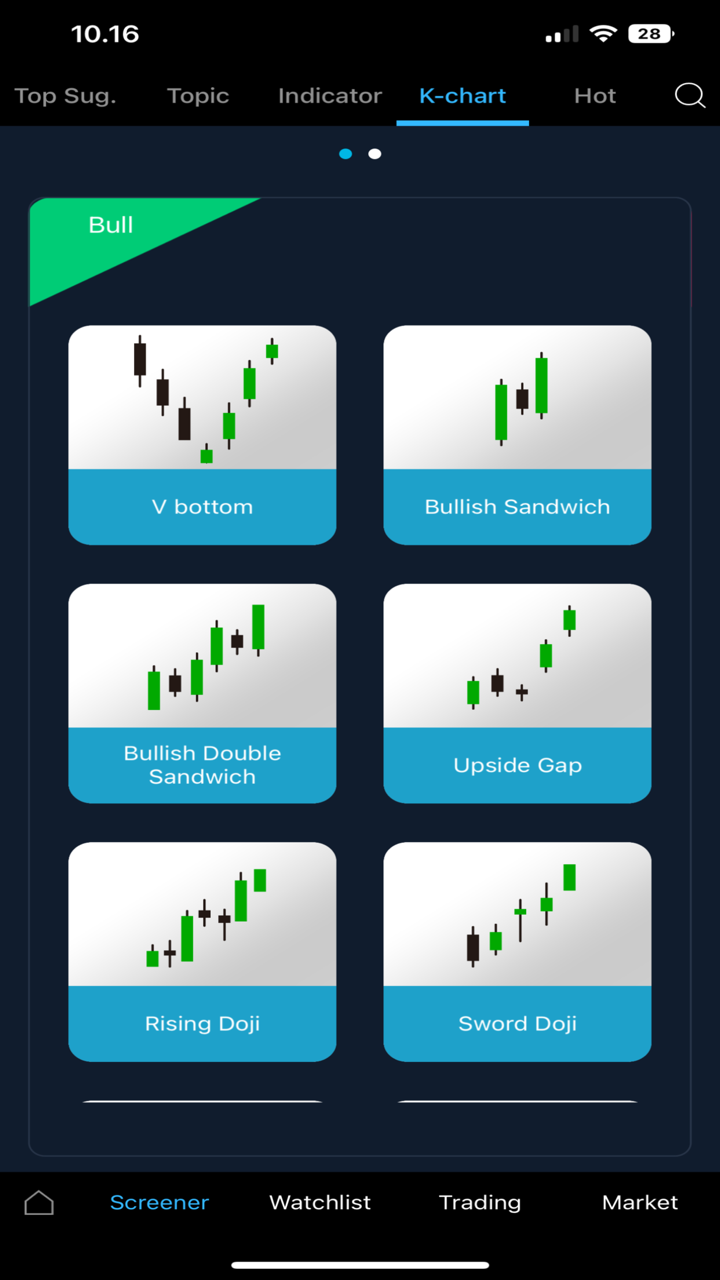

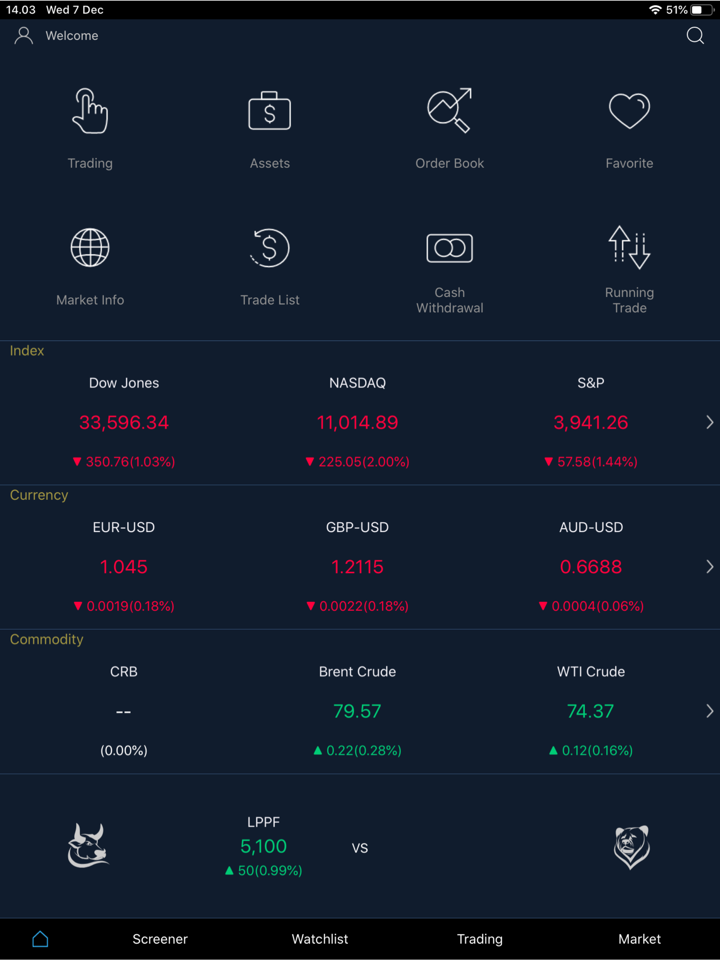

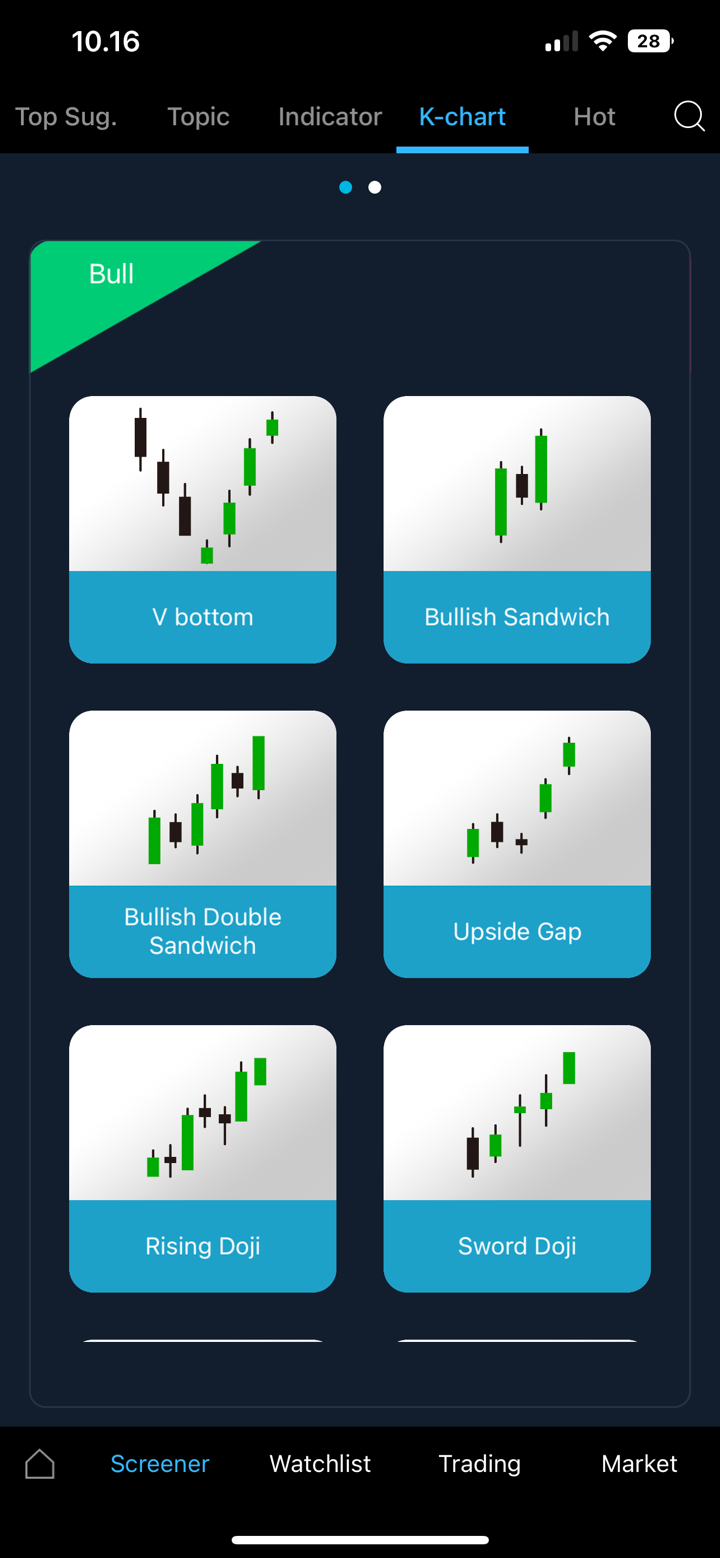

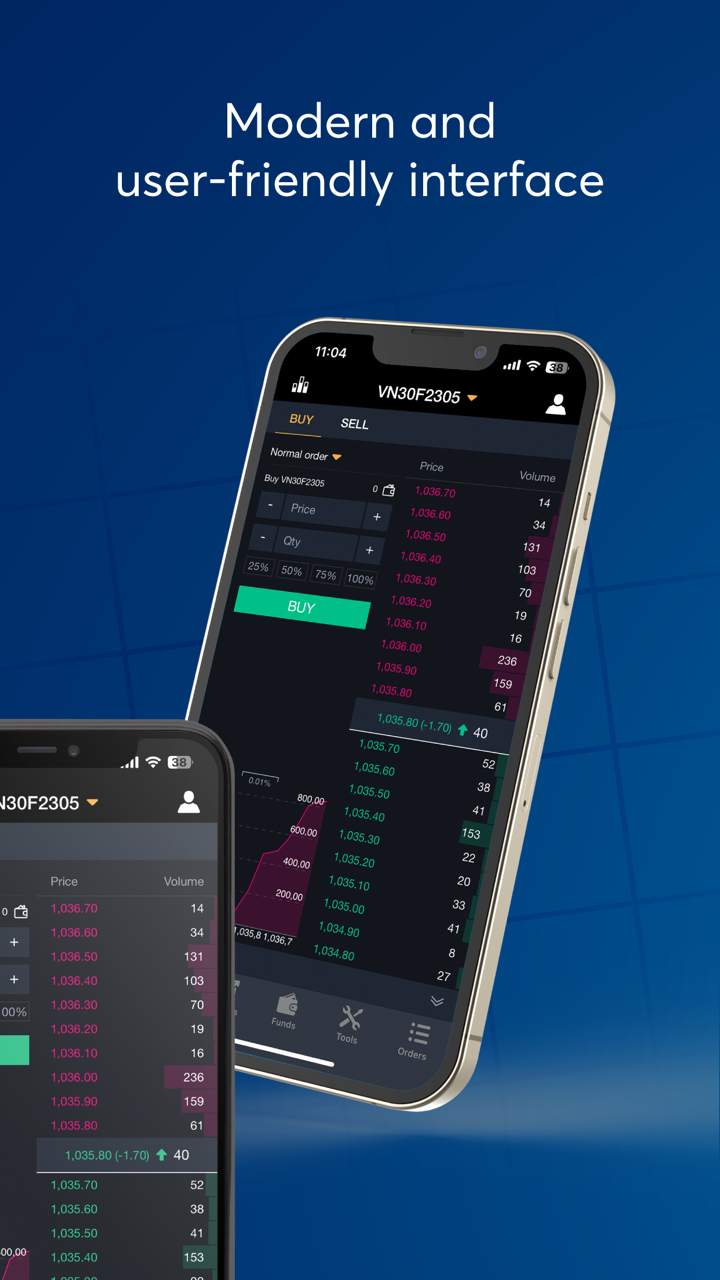

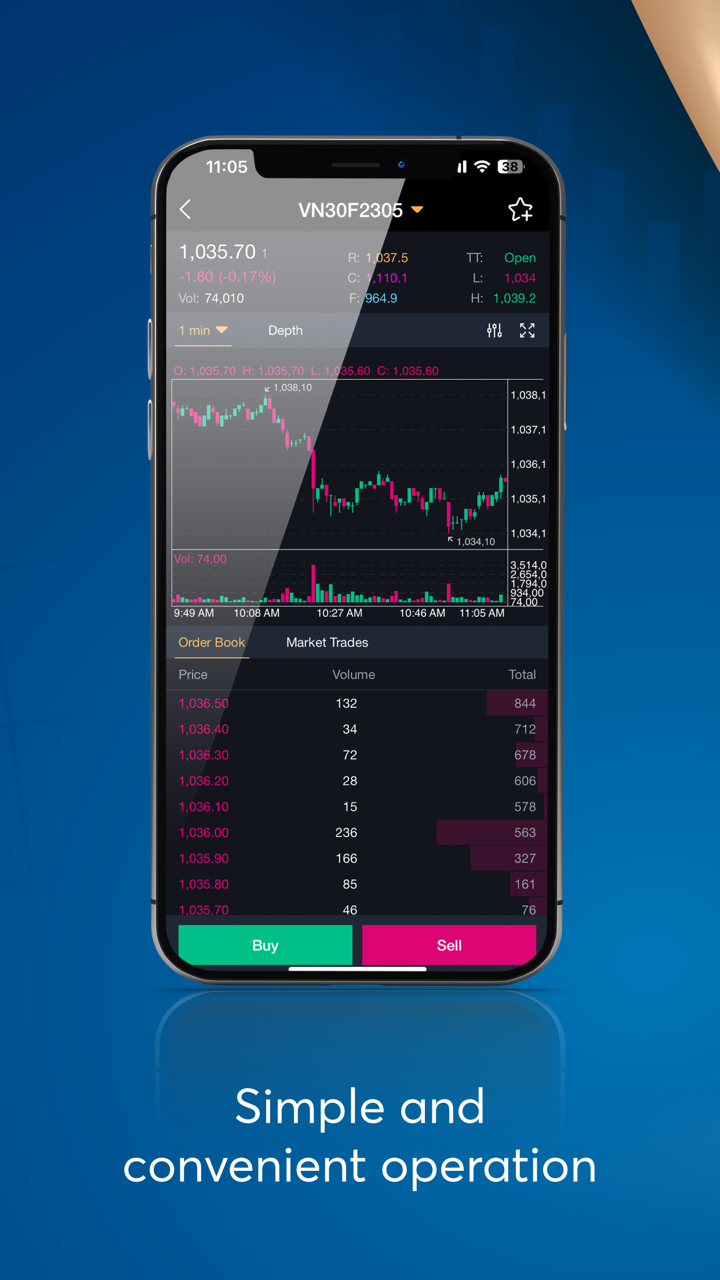

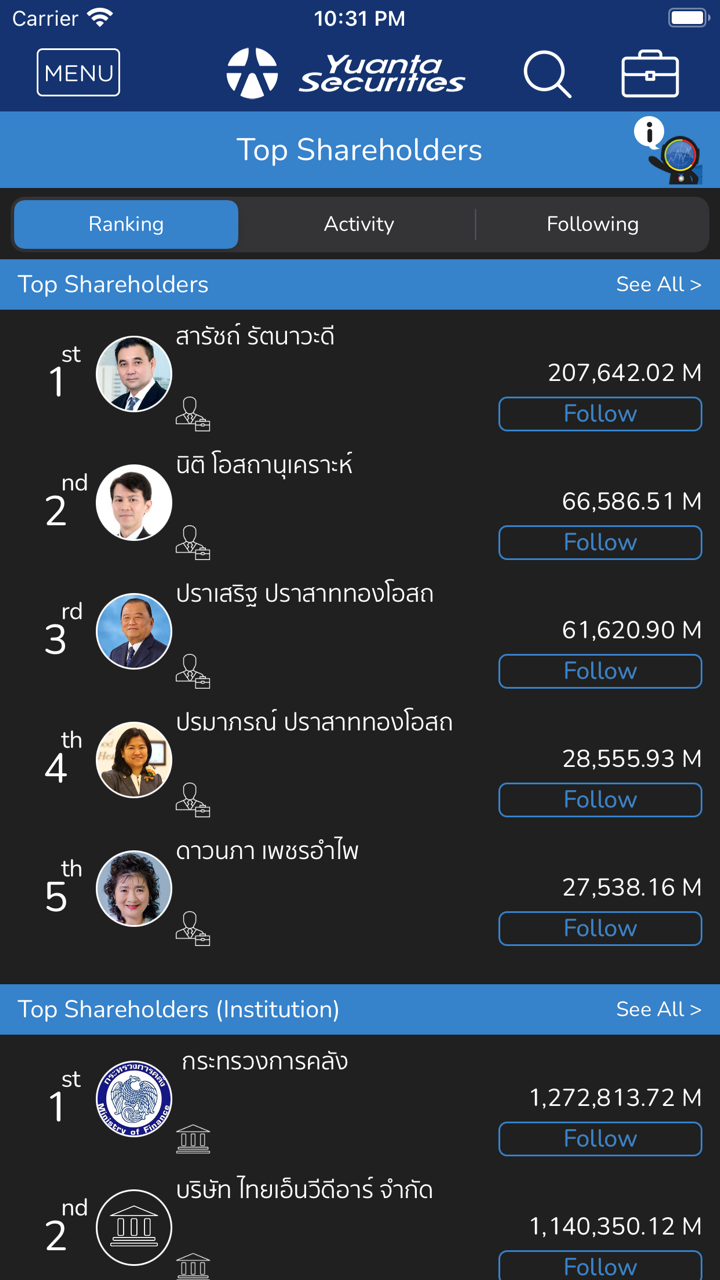

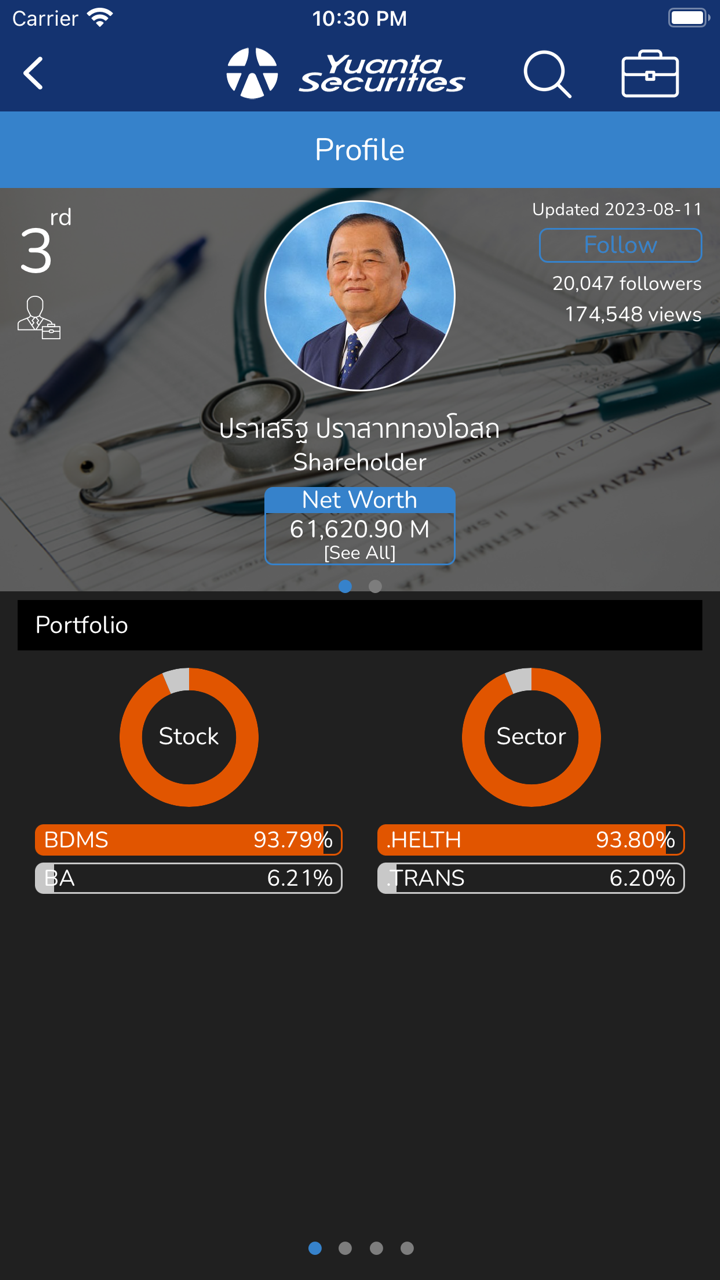

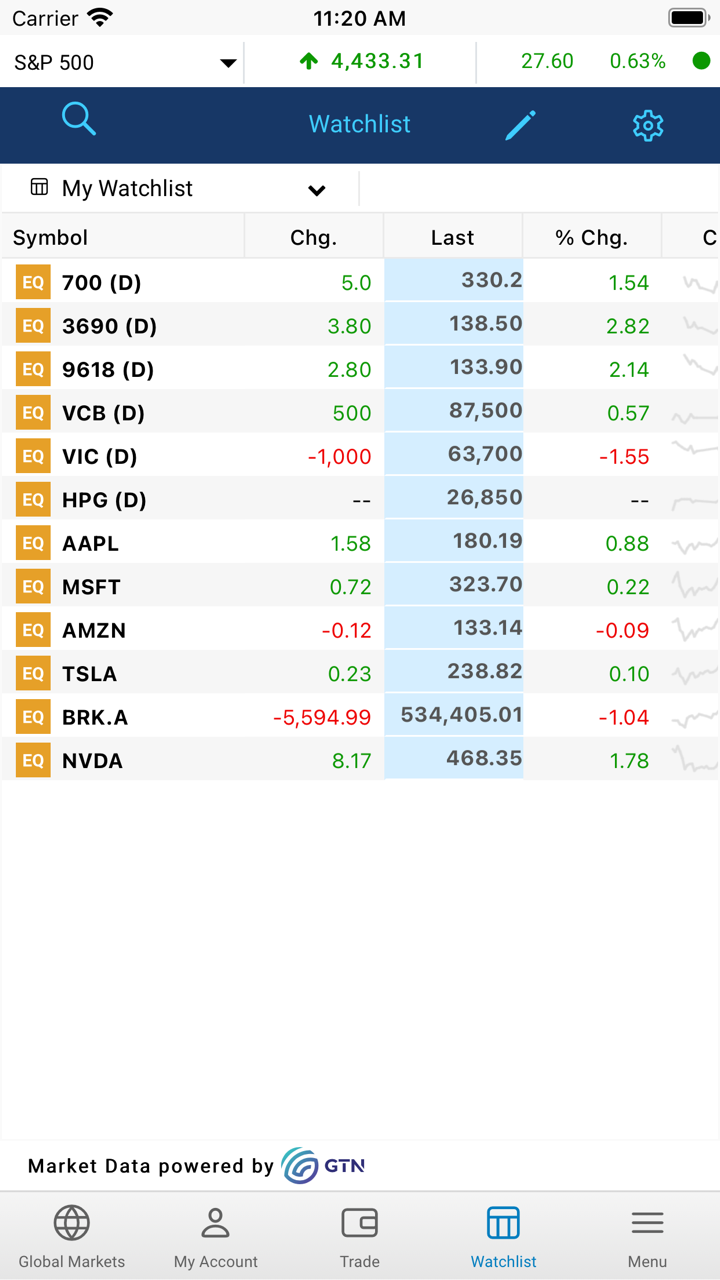

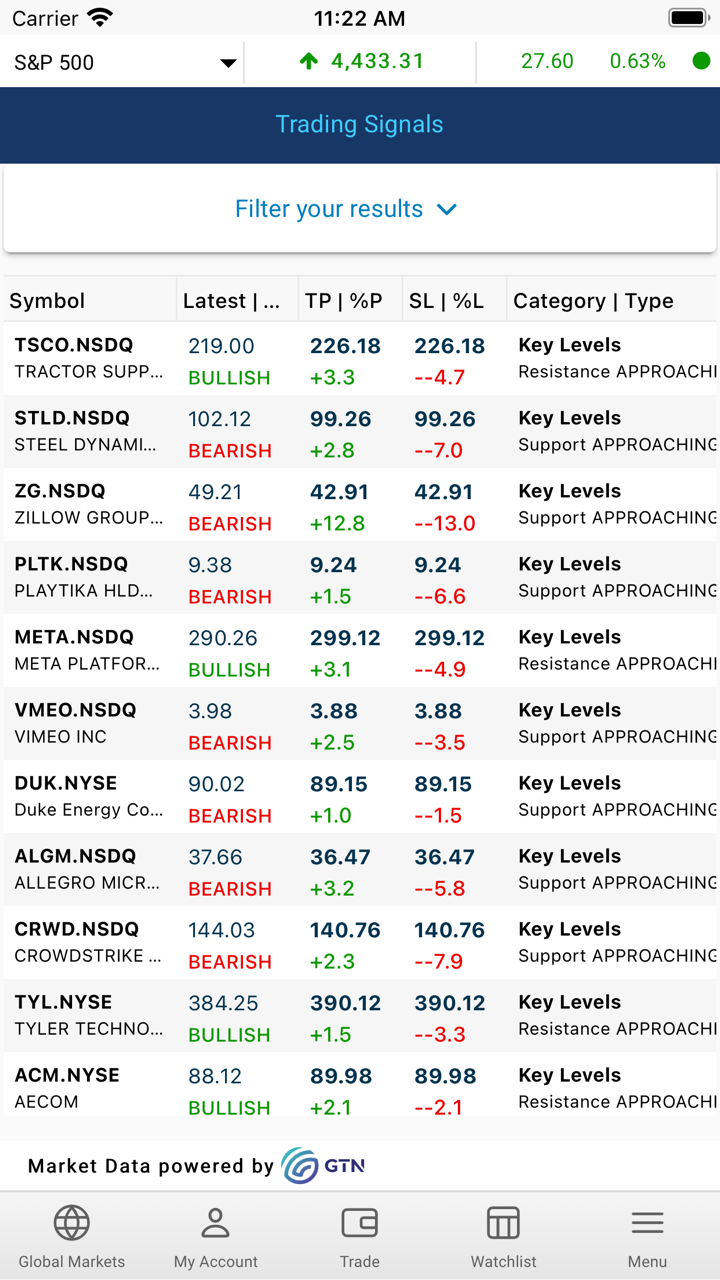

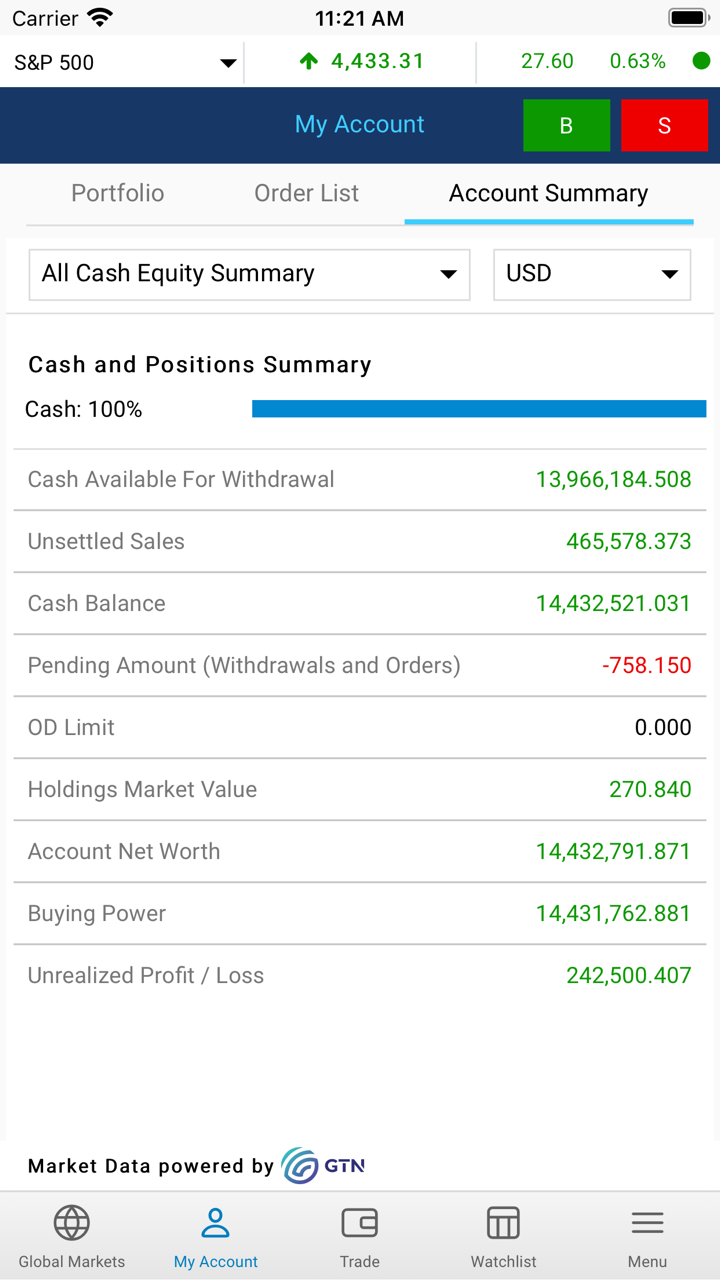

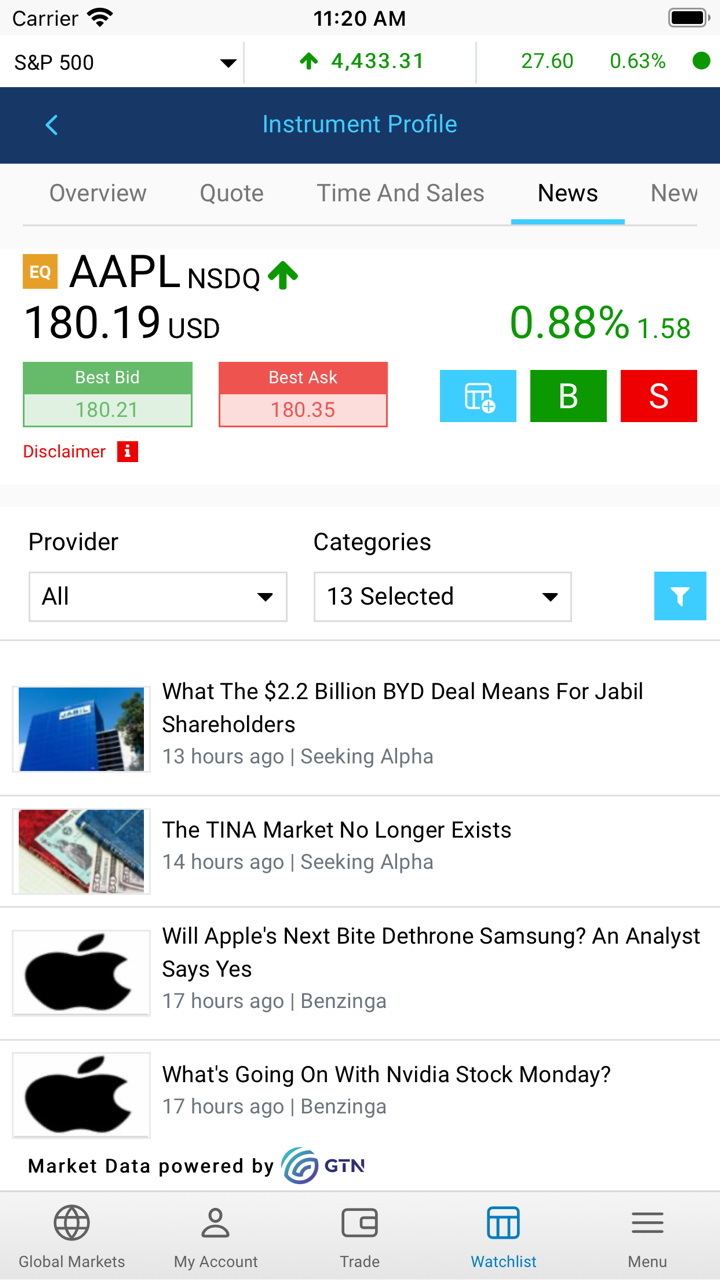

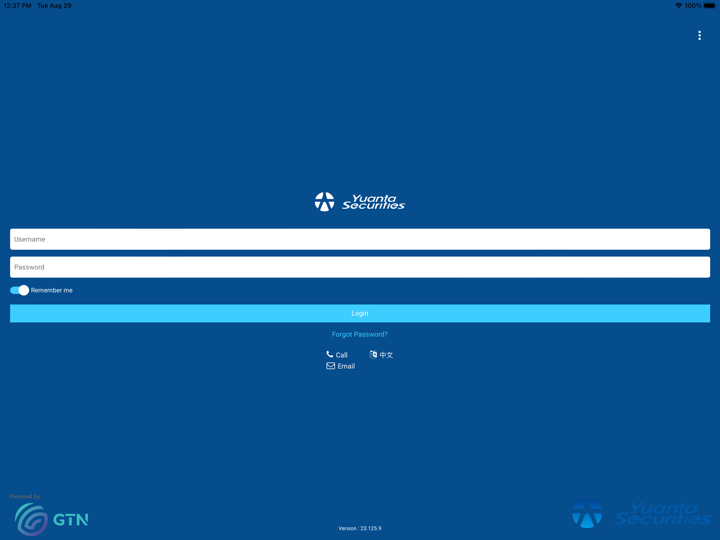

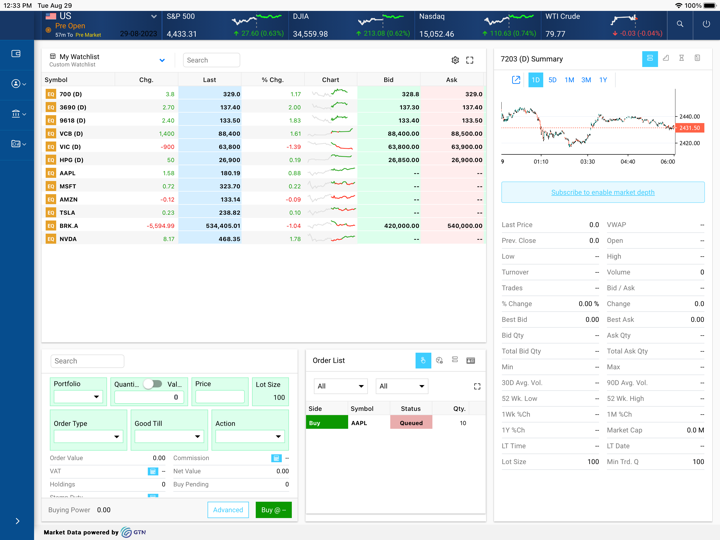

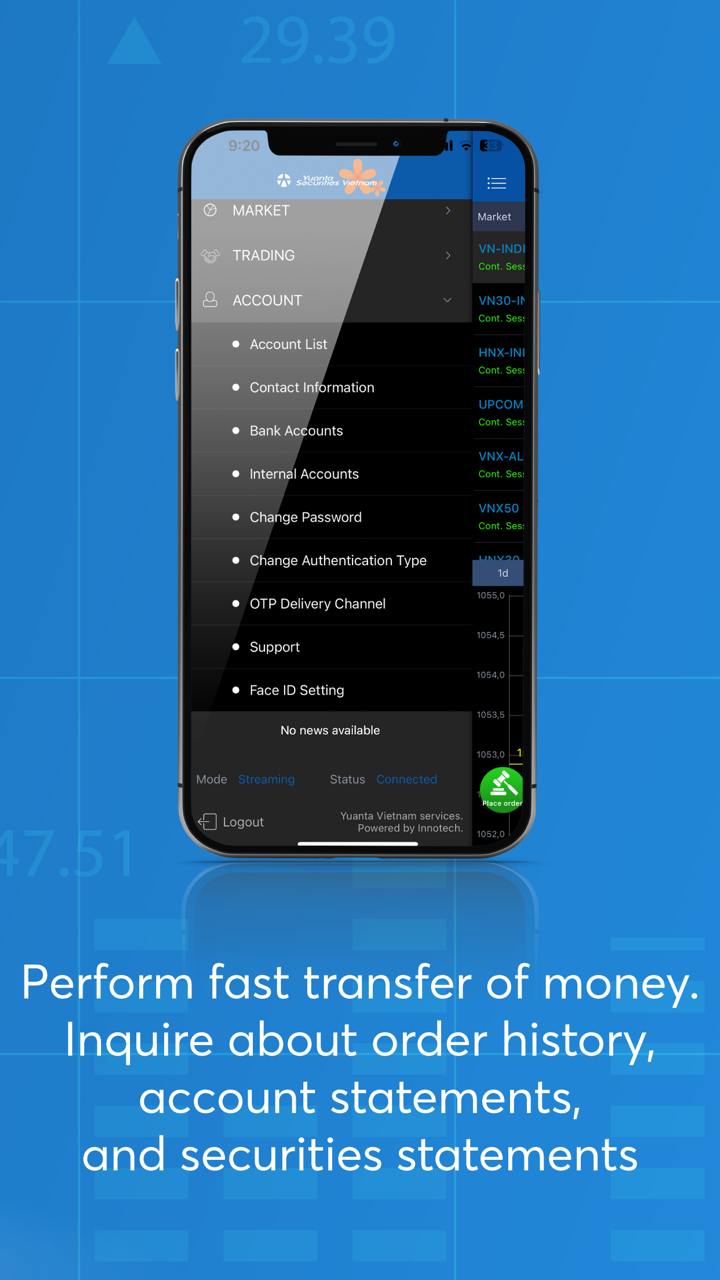

Nag-aalok ang Yuanta ng isang hanay ng mga plataporma ng paghahalal sa ilalim ng mga tatak na eWinner at YSHK SP Trader, na idinisenyo para sa mga gumagamit ng desktop at mobile.

| Plataporma ng Paghahalal | Supported | Available Devices |

| eWinner | ✔ | Web, PC, iOS, Android |

| YSHK SP Trader | ✔ | PC, iOS, Android |

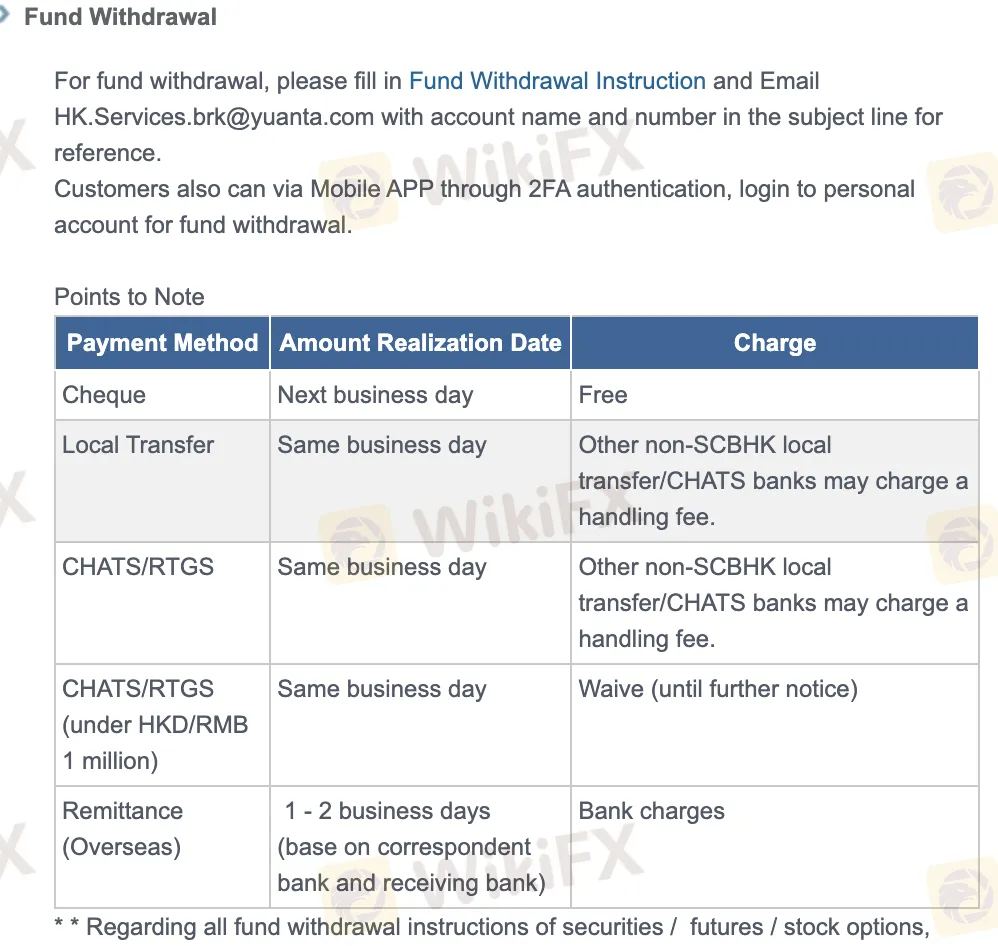

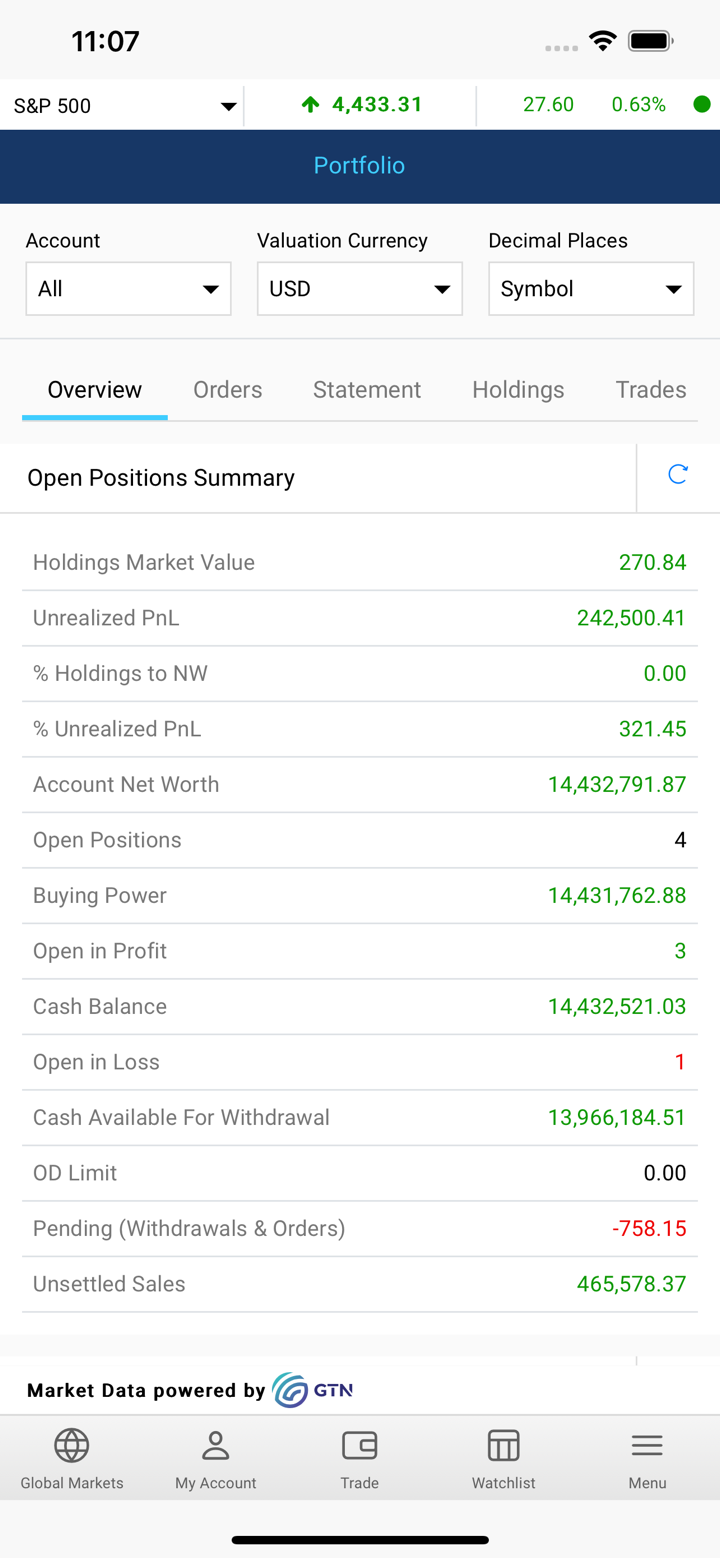

Deposito at Pag-atras

Ang Yuanta ay hindi nagpapataw ng direktang bayad sa deposito o pag-atras, ngunit maaaring magpataw ng bayad ang mga bangko ng third-party depende sa paraan (lalo na para sa CHATS/RTGS at overseas remittance). Walang partikular na minimum na halaga ng deposito na binanggit sa patakaran.

| Pamamaraan ng Pagbabayad | Mga Bayad (Yuanta) | Oras ng Paghahatid | Mga Tala |

| Cheque Deposit | 0 | Kinabukasan na araw ng negosyo | Kopya ng cheque at resibo na may impormasyon ng account ang kinakailangan |

| Local Bank Transfer | 0 (via SCBHK), maaaring may bayad ang iba | Sa parehong araw ng negosyo | Libre ang paglilipat sa SCBHK; maaaring may bayad ang non-SCBHK/CHATS |

| CHATS/RTGS | Walang bayad sa ilalim ng HKD/RMB 1 milyon (panandalian) | Maaaring magpataw ng bayad ang mas malalaking halaga mula sa third-party | |

| Overseas Remittance | Yuanta: 0; May bayad ang bangko | 1–2 araw ng negosyo (depende sa correspondent bank) | Kumpletong detalye ng bangko at SWIFT ang kinakailangan bawat currency |

| Mobile App (2FA) | 0 | Sa parehong araw (kung bago ang cutoff) | Ang pag-atras sa pamamagitan ng mobile app ay nangangailangan ng autentikasyon |

| Tagubilin sa Email | 0 | Naiproseso sa parehong araw o sa susunod na araw ng negosyo | Kailangang mag-email ng pangalan ng account at numero bago ang cutoff (5:00pm HKT) |