Profil perusahaan

| SMBC Nikko Ringkasan Ulasan | |

| Dibentuk | 2010 |

| Negara/Daerah Terdaftar | Jepang |

| Produk & Layanan Keuangan | Konsultasi pengelolaan aset, solusi M&A dan pembiayaan, layanan riset |

| Regulasi | FSA |

| Dukungan Pelanggan | Telepon, Alamat |

Informasi SMBC Nikko

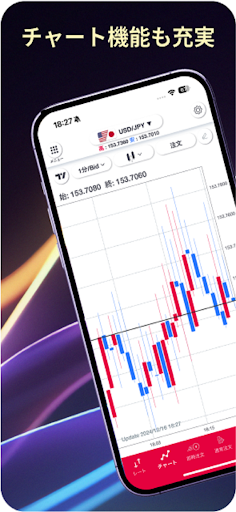

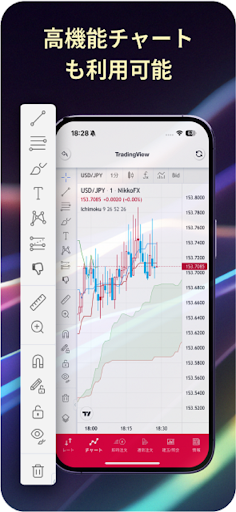

Diatur oleh FSA dan sekarang bagian dari Grup SMBC, SMBC Nikko adalah broker layanan lengkap yang berfokus pada peningkatan penawaran klien mereka. Prioritas strategis mereka termasuk mengembangkan pengelolaan aset di Jepang dan memperluas kehadiran global mereka dengan produk keuangan berkualitas tinggi untuk menjadi pialang efek pilihan. Namun, banyak informasi, termasuk biaya perdagangan, deposit, dan penarikan, tidak disediakan di situs web resmi mereka.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

|

|

|

|

SMBC Nikko Legal?

SMBC Nikko memiliki Lisensi Forex Ritel yang diatur oleh Financial Services Agency (FSA) di Jepang dengan nomor lisensi 関東財務局長(金商)第2251号.

Produk & Layanan Keuangan

SMBC Nikko melacak sejarahnya kembali ke tahun 1918 dan telah berkembang menjadi bagian dari Grup SMBC. Sebagai broker layanan lengkap, mereka fokus pada meningkatkan kualitas dan jangkauan layanan mereka untuk mendukung klien, dengan memanfaatkan kemampuan kelompok perusahaan yang lebih luas. Mereka memprioritaskan pengelolaan aset di Jepang, memperkuat operasi global, termasuk M&A lintas batas dan pembiayaan luar negeri, dan mengembangkan produk kelas atas, dengan tujuan menjadi pialang efek pilihan bagi pelanggan mereka.

Pendidikan

SMBC Nikko secara aktif mempromosikan pendidikan keuangan dan ekonomi sebagai bagian dari misinya sebagai perusahaan jasa keuangan. Komitmen ini ditunjukkan melalui inisiatif seperti Nikko Family Exciting Experience Day, di mana siswa muda dan keluarga mereka belajar tentang ekonomi. Selain itu, perusahaan menawarkan kunjungan dan seminar untuk siswa dan orang dewasa untuk memperdalam pemahaman mereka tentang keuangan dan perusahaan efek, termasuk tur ke Bursa Saham Tokyo.