Buod ng kumpanya

| CommBank Buod ng Pagsusuri | ||

| Itinatag | 1911 | |

| Rehistradong Bansa/Rehiyon | Australia | |

| Regulasyon | Regulado | |

| Mga Produkto at Serbisyo | Retail banking, commercial banking, investment, insurance, superannuation, at iba pa. | |

| Platform ng Paggagalaw | Suporta sa Customer | +61 2 9999 3283 |

| 13 2221 | ||

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado | Limitadong internasyonal na mga produkto sa investment (Australian market). |

| Diversified financial services | Komplikadong mga istraktura ng bayad |

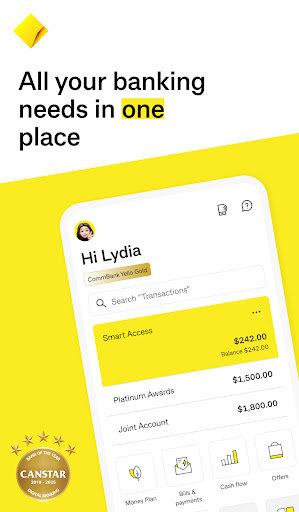

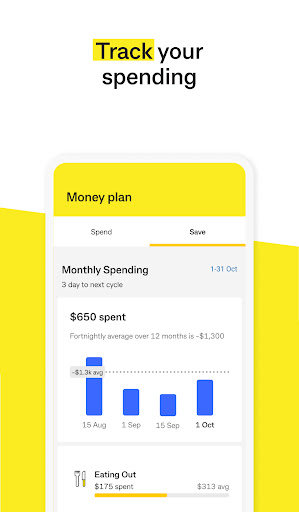

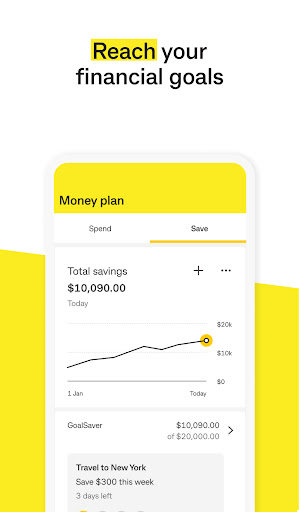

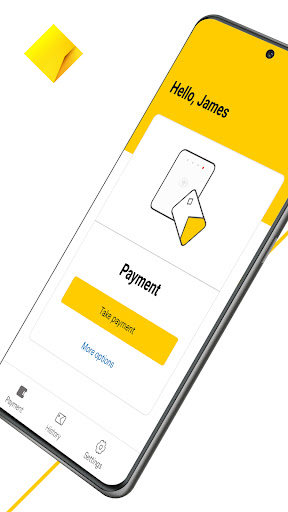

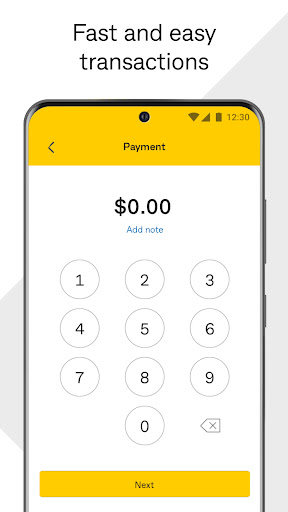

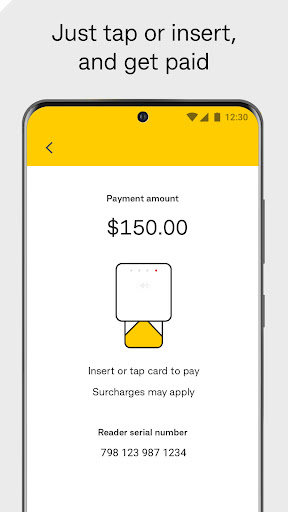

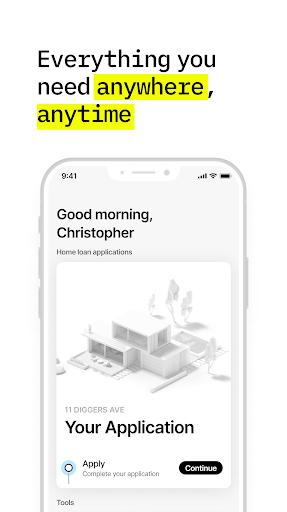

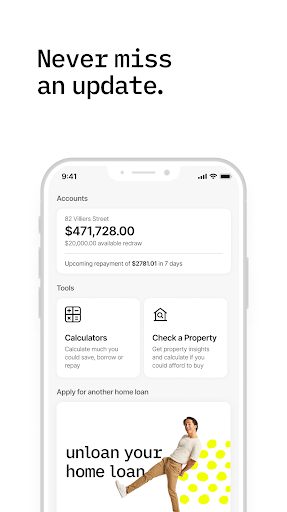

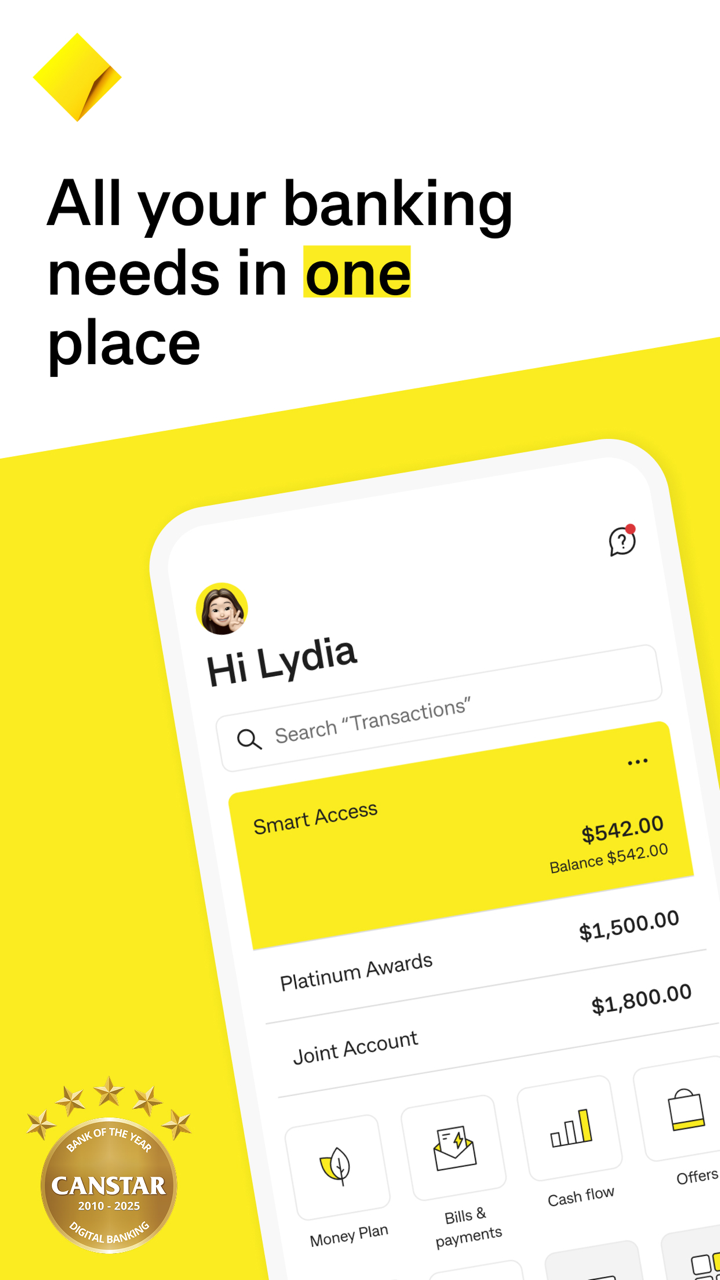

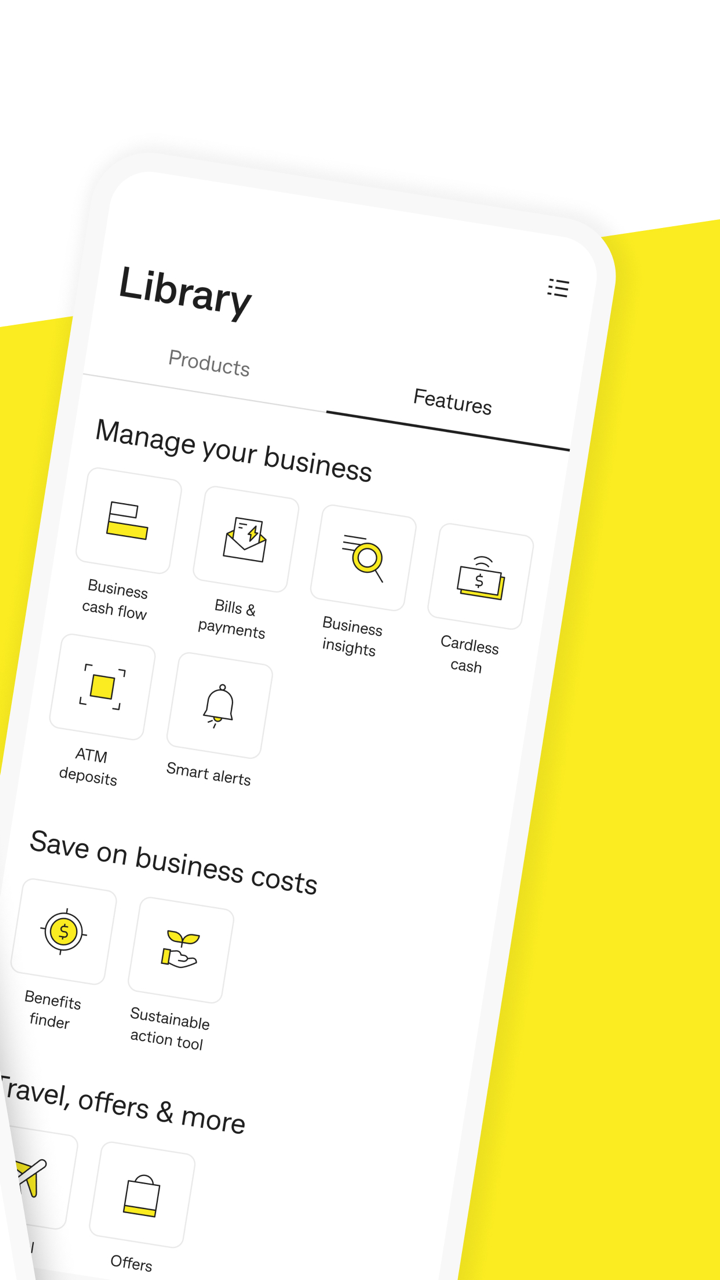

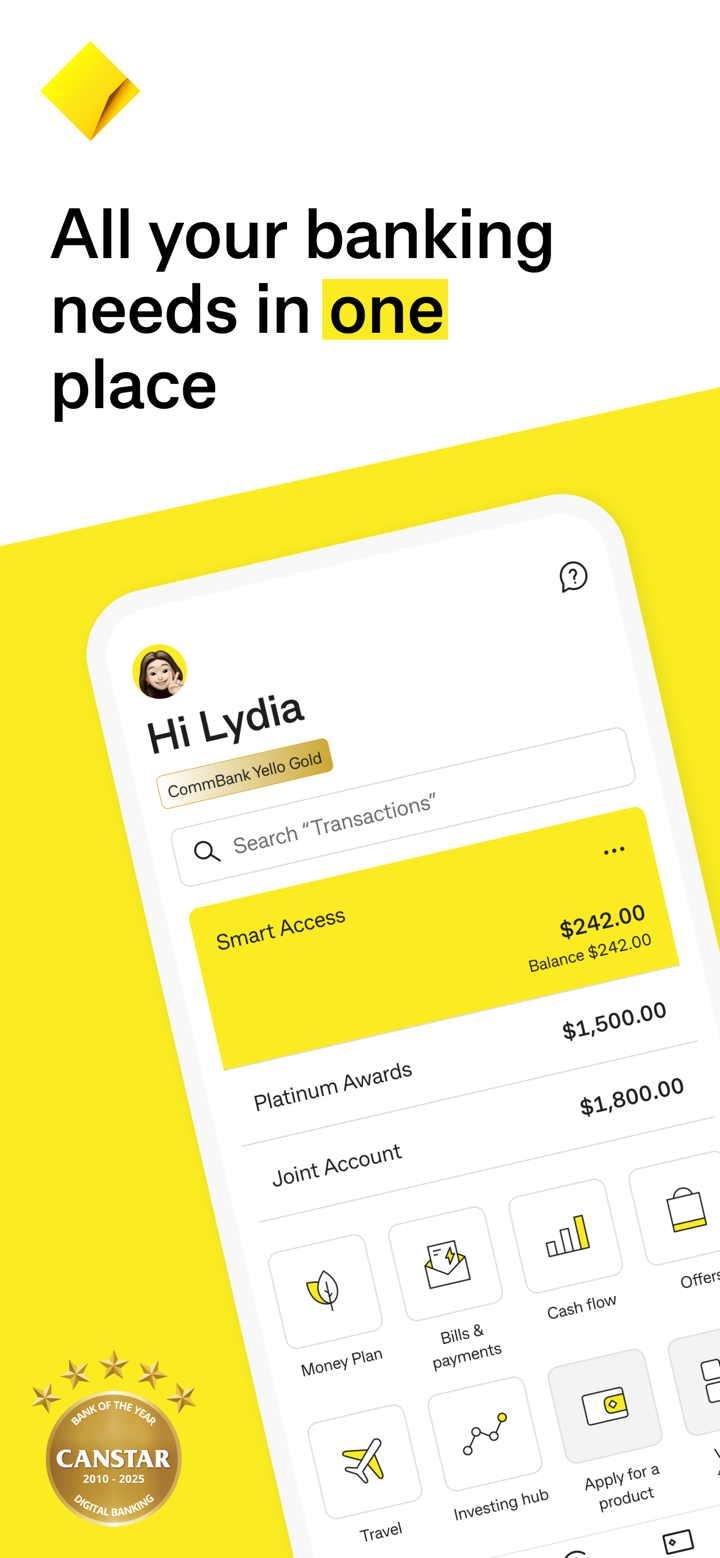

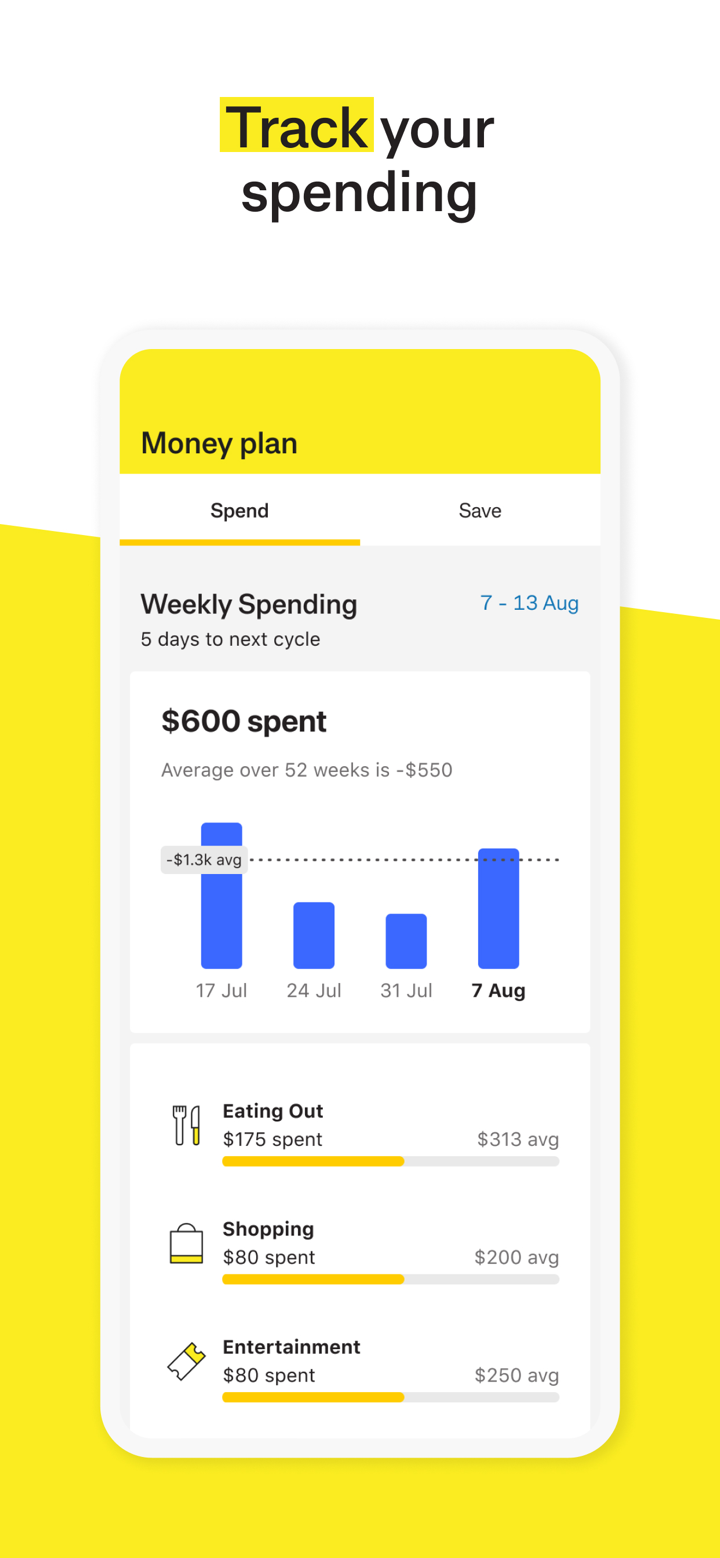

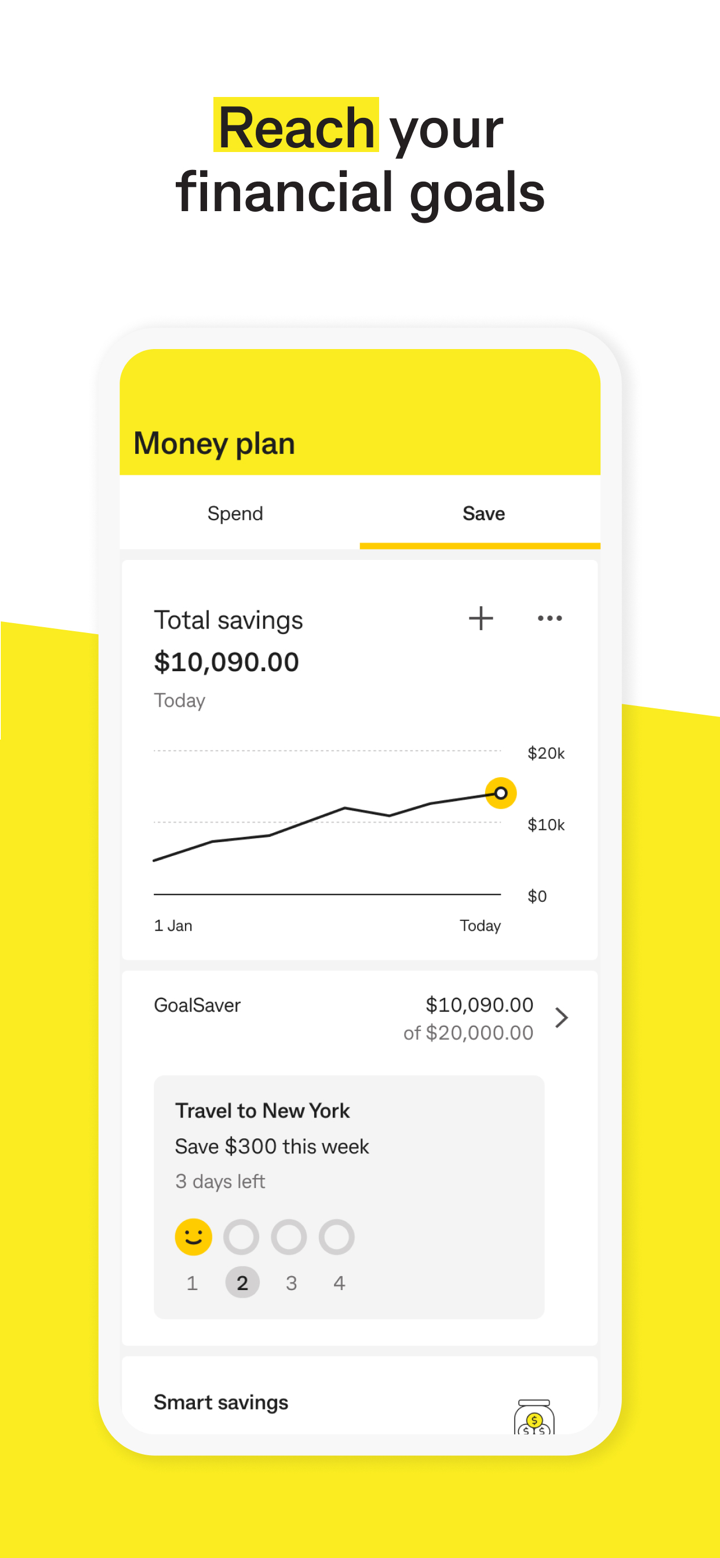

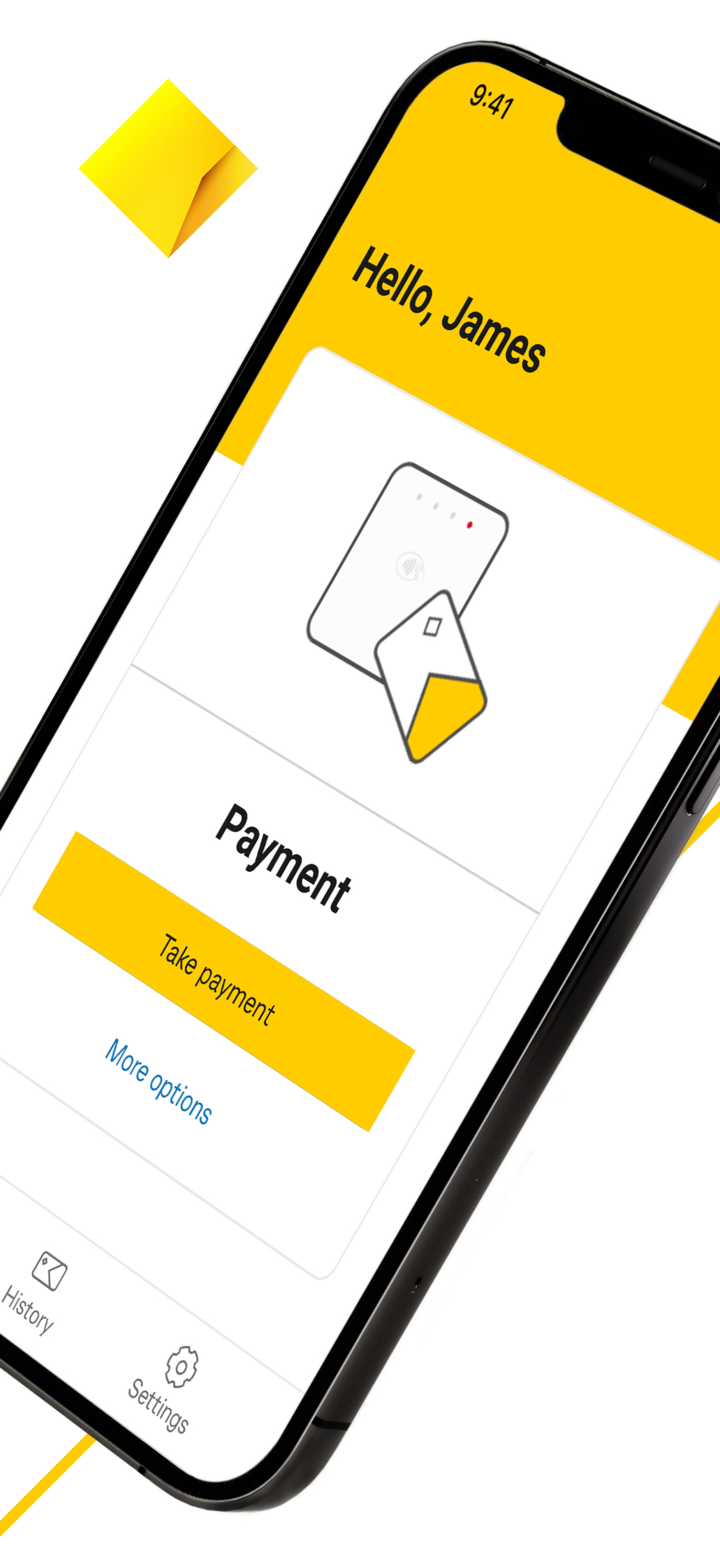

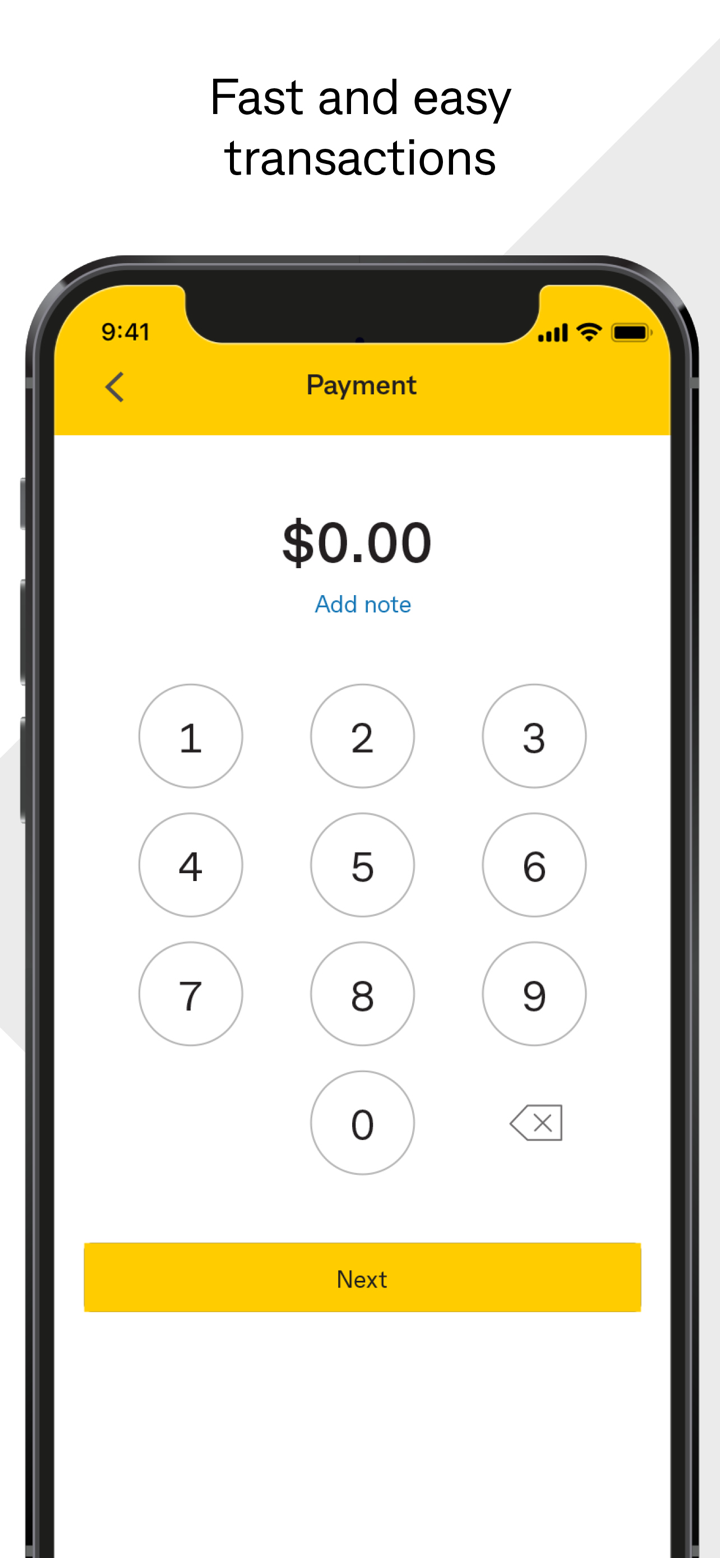

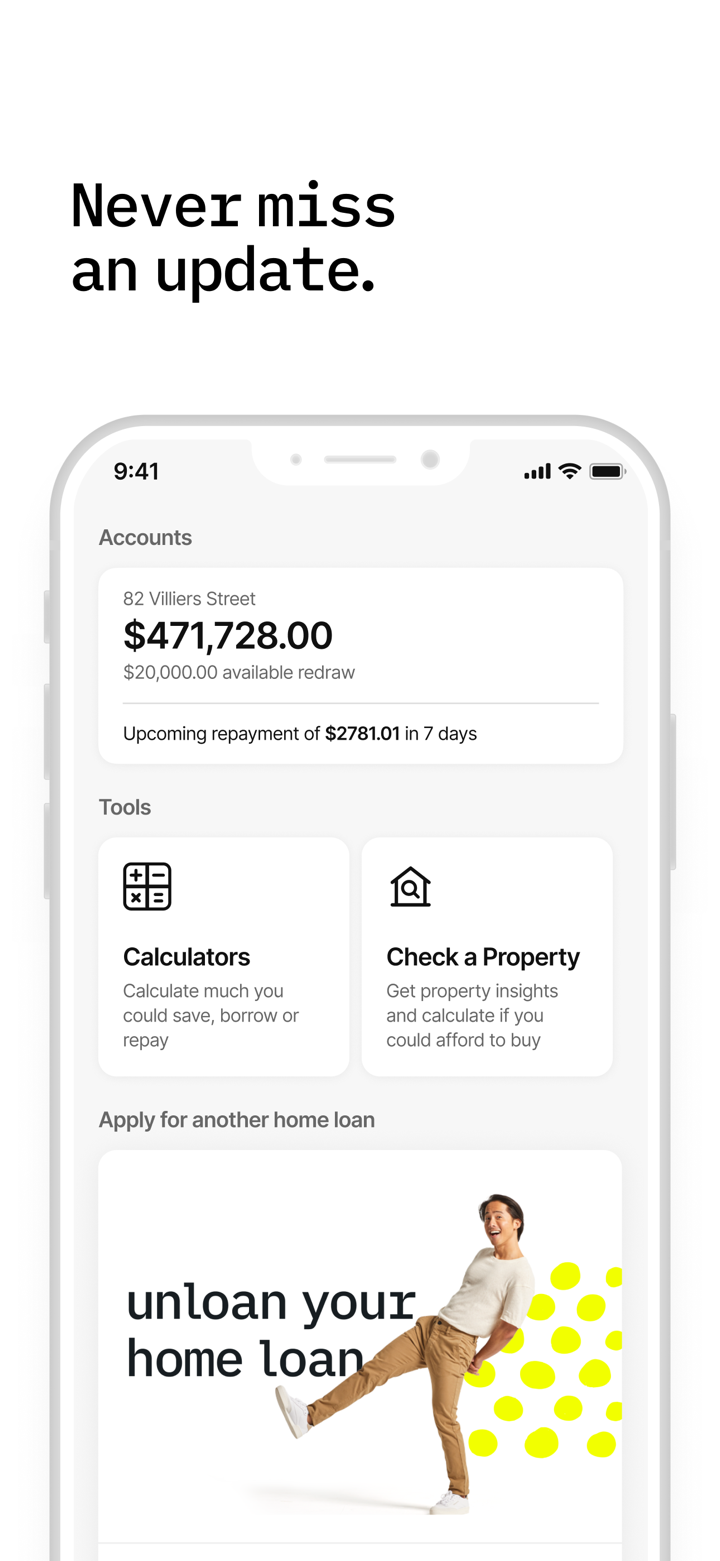

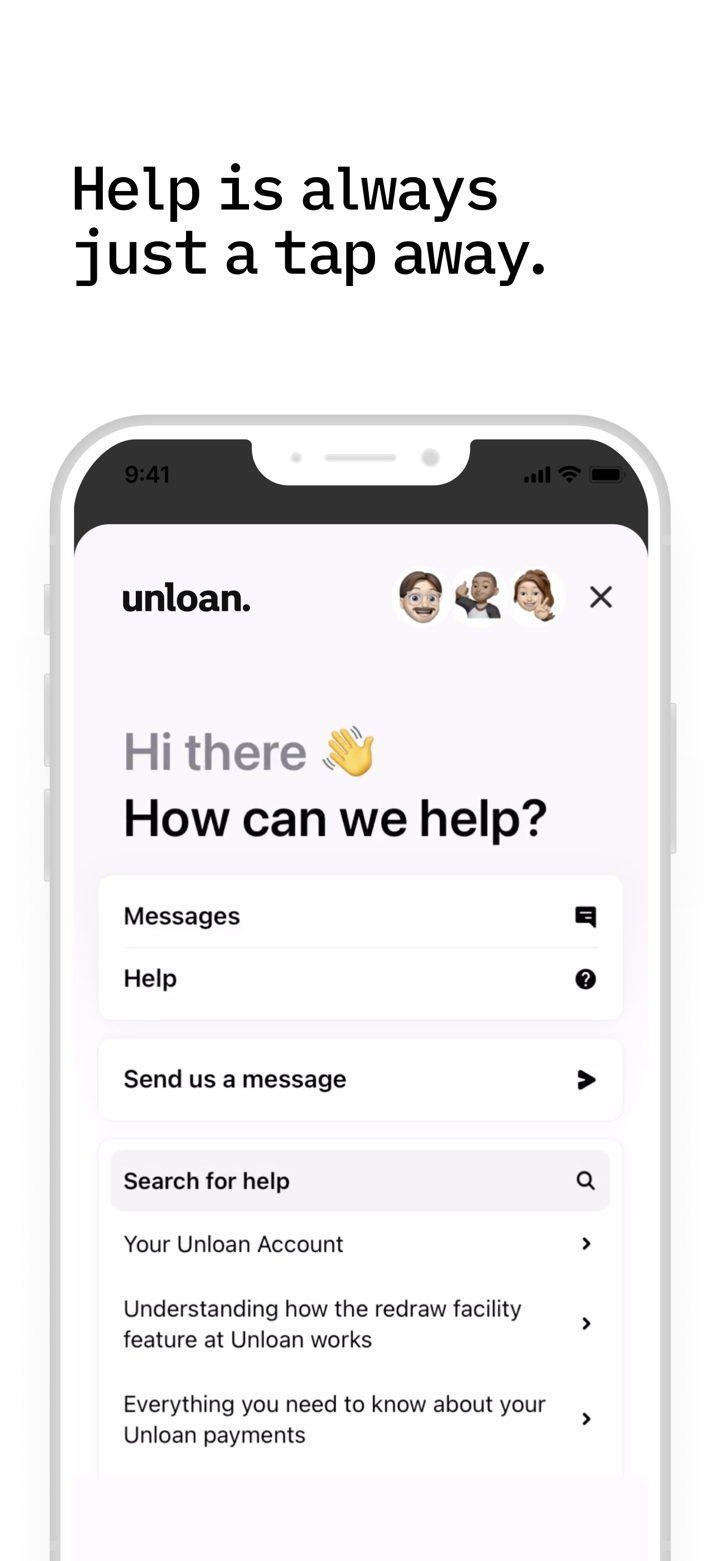

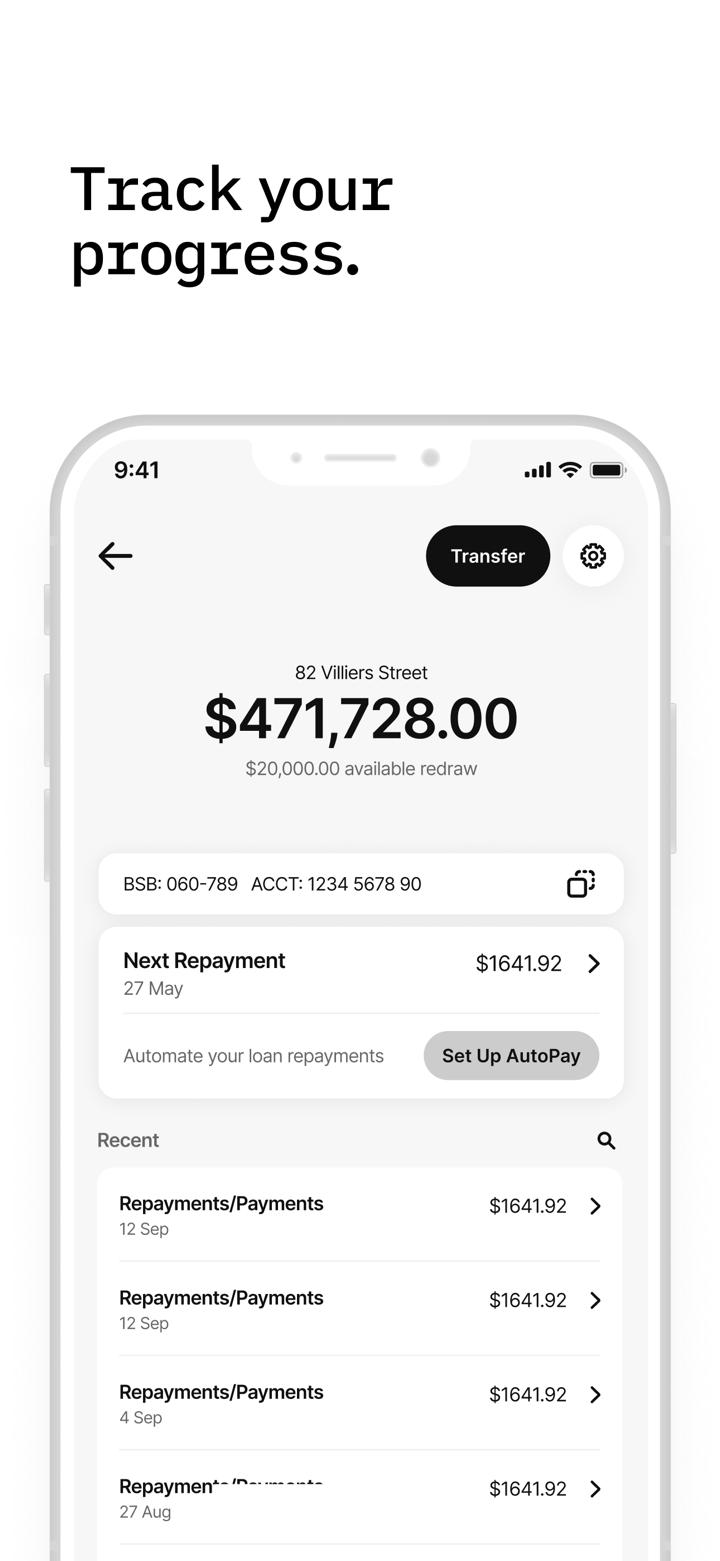

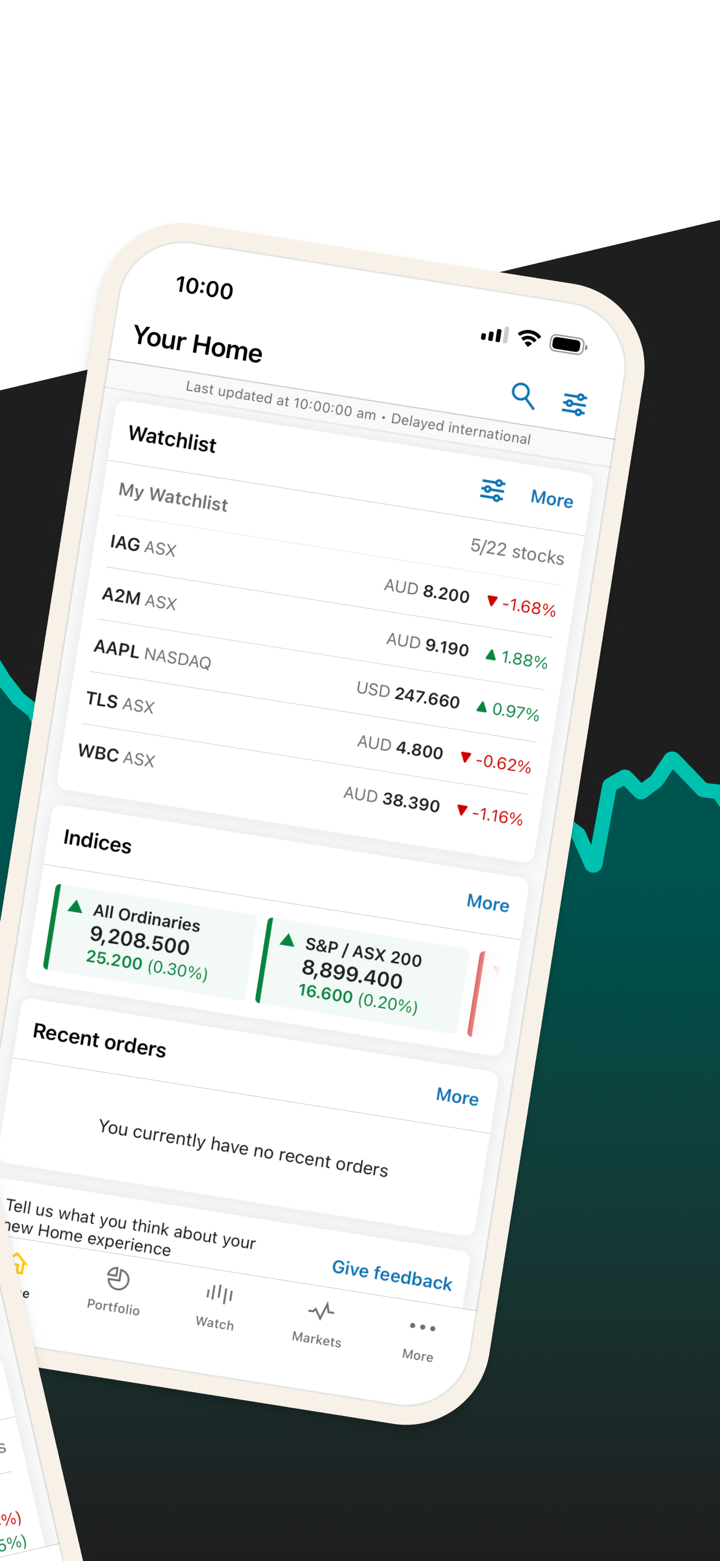

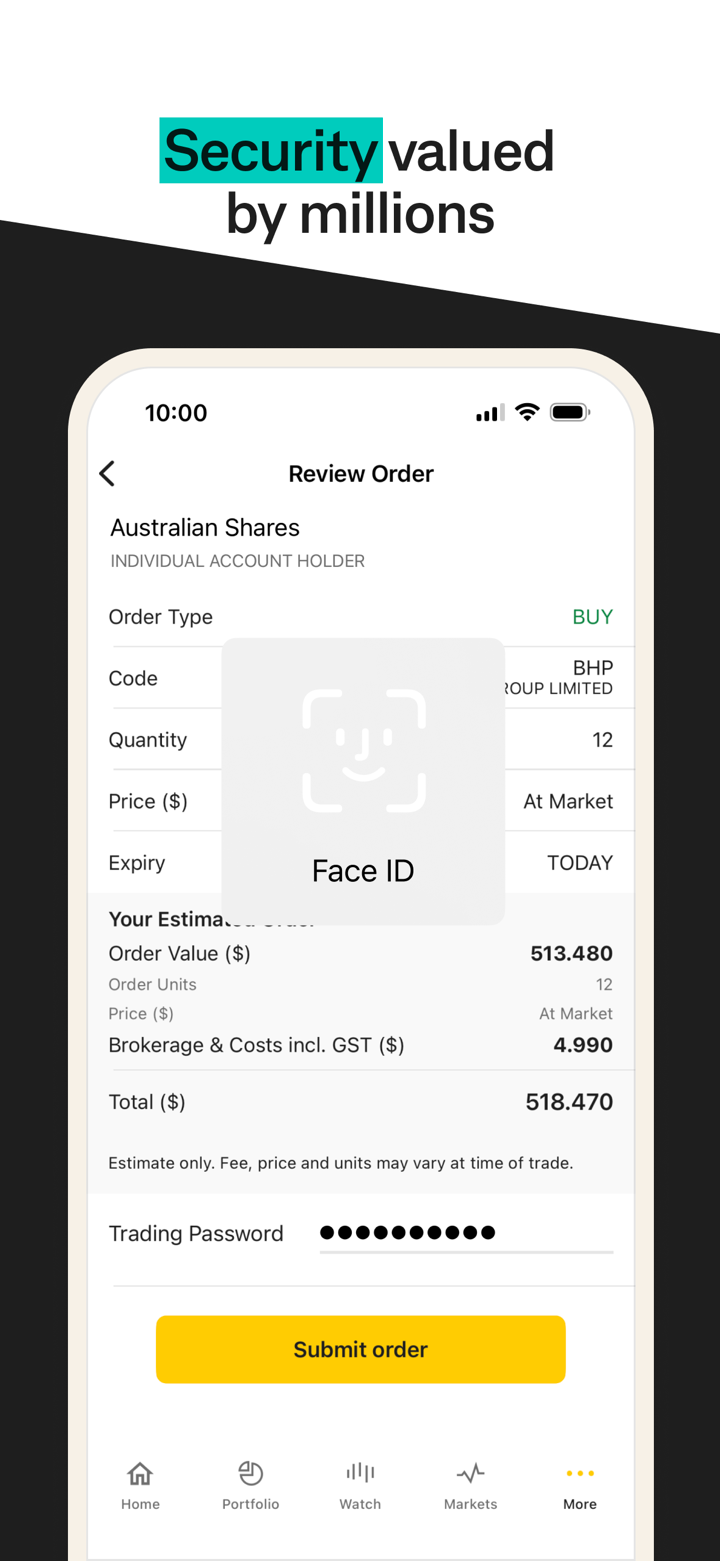

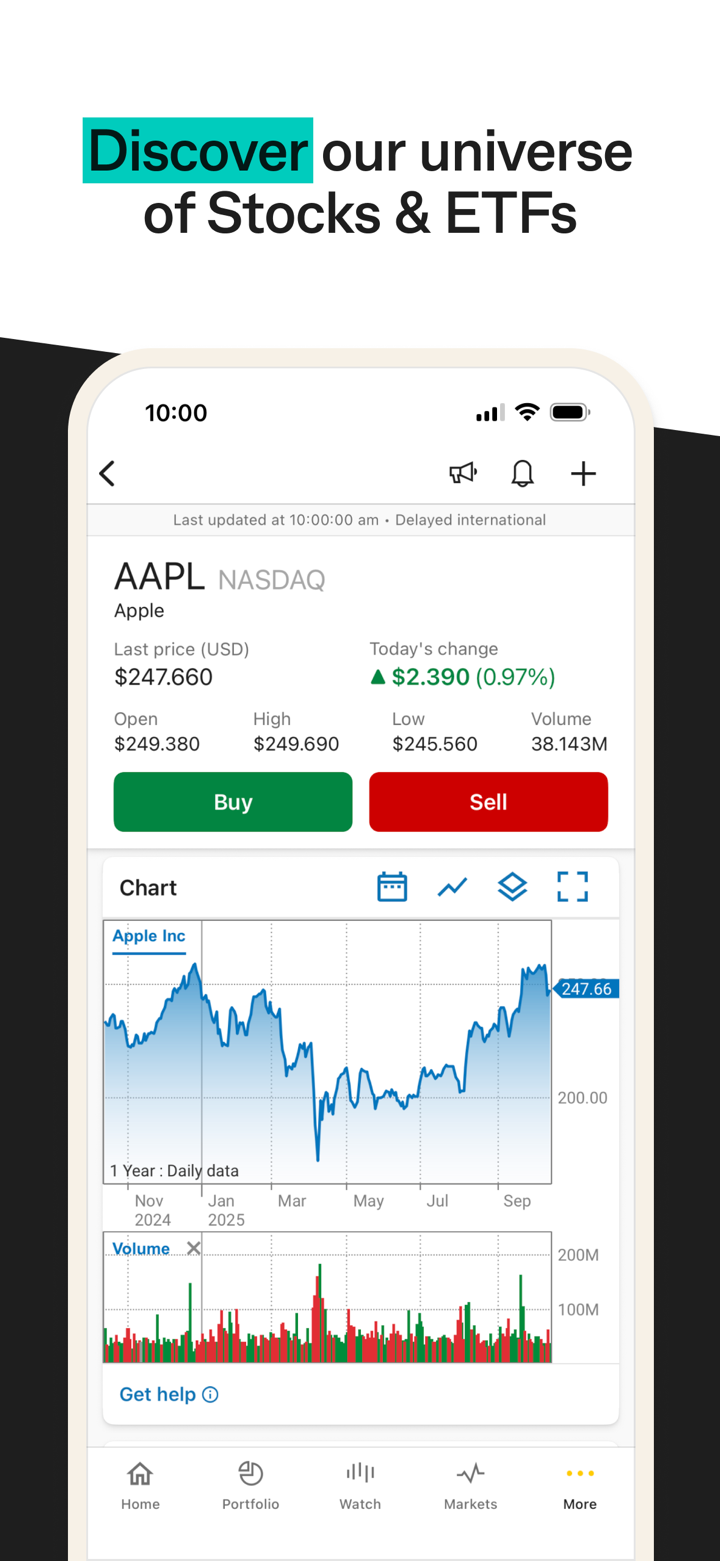

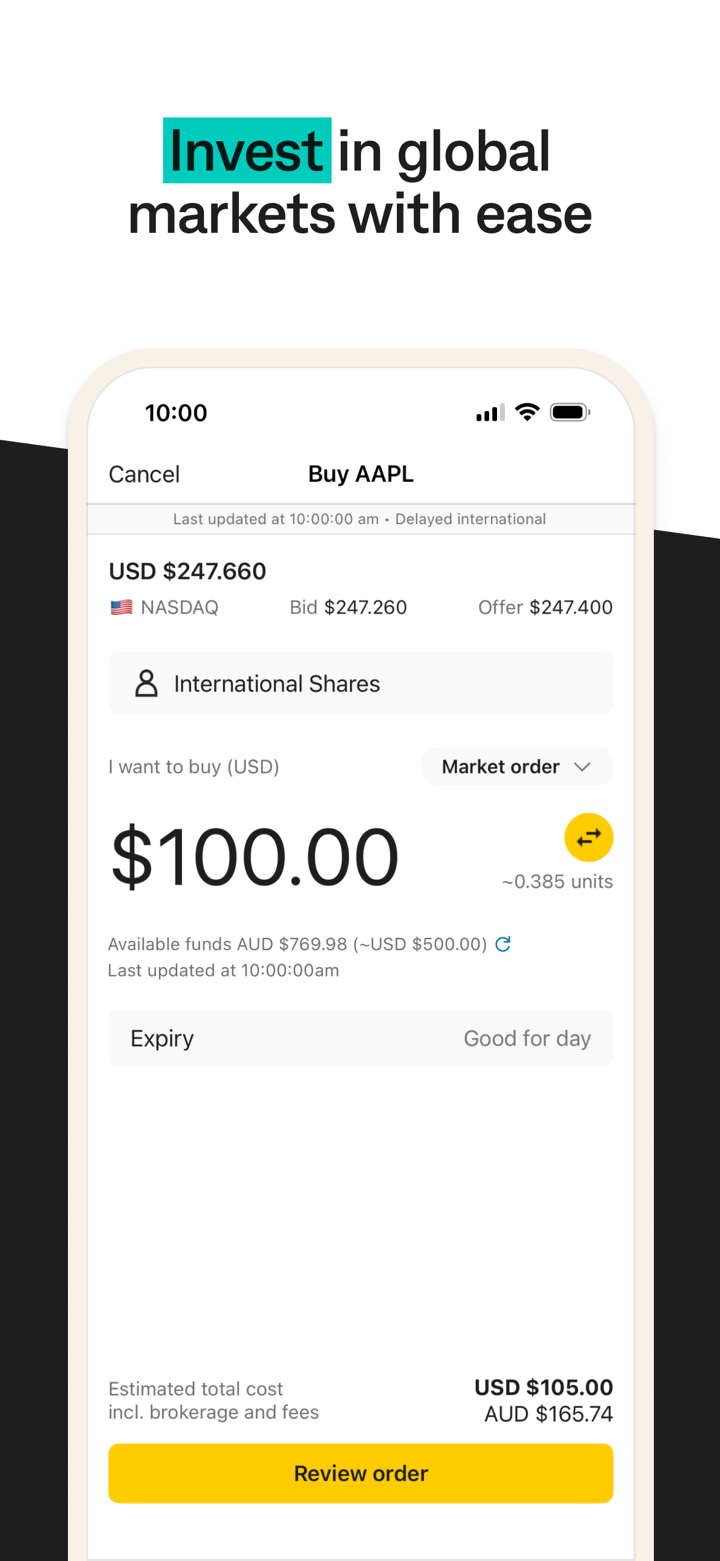

| Advanced digital tools (e.g., CommBank app) | Mga paghihigpit sa mga serbisyong internasyonal |

| Customer loyalty rewards program |

Tunay ba ang CommBank?

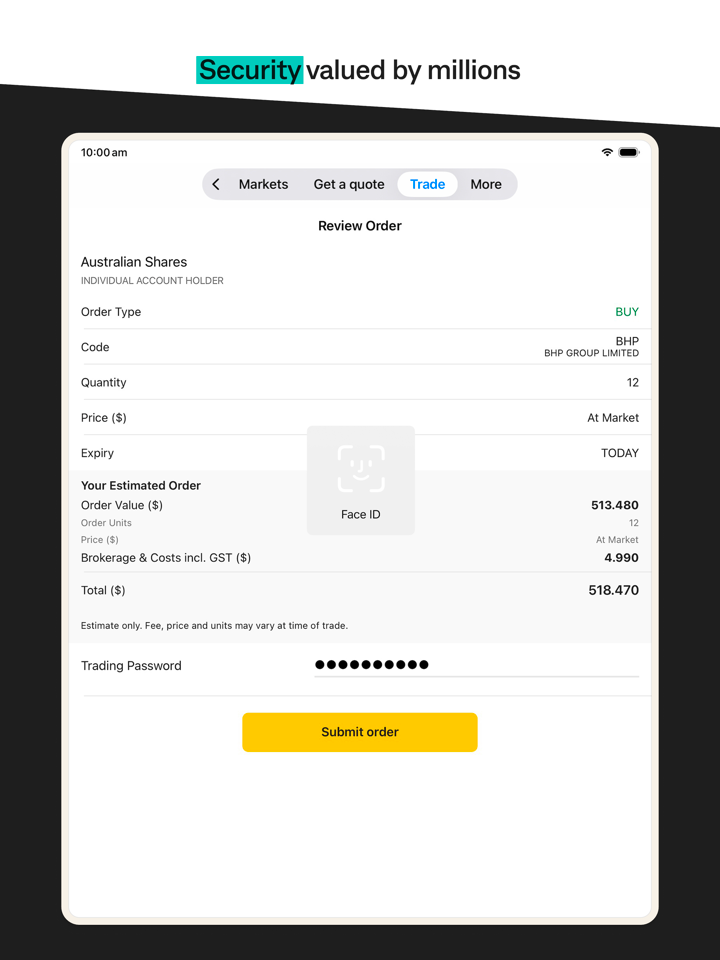

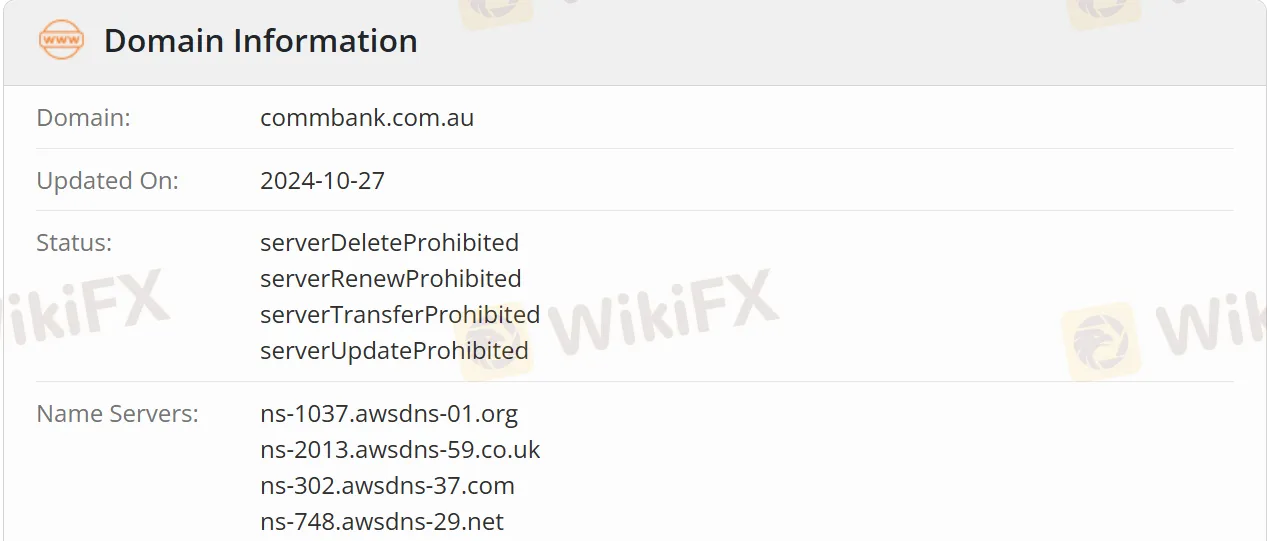

Ang CommBank ay isang matagal nang itinatag na bangko na may mahabang kasaysayan sa Australia. Striktong regulado ito ng APRA at miyembro ng Australian Financial Claims Scheme. Pinamamahalaan ng Australian Securities and Investments Commission (ASIC) ang bangko na ito, at ang numero ng lisensya nito ay 000234945. Kaya't garantisado ang seguridad ng deposito.

Anong mga Serbisyo ang Inaalok ng CommBank?

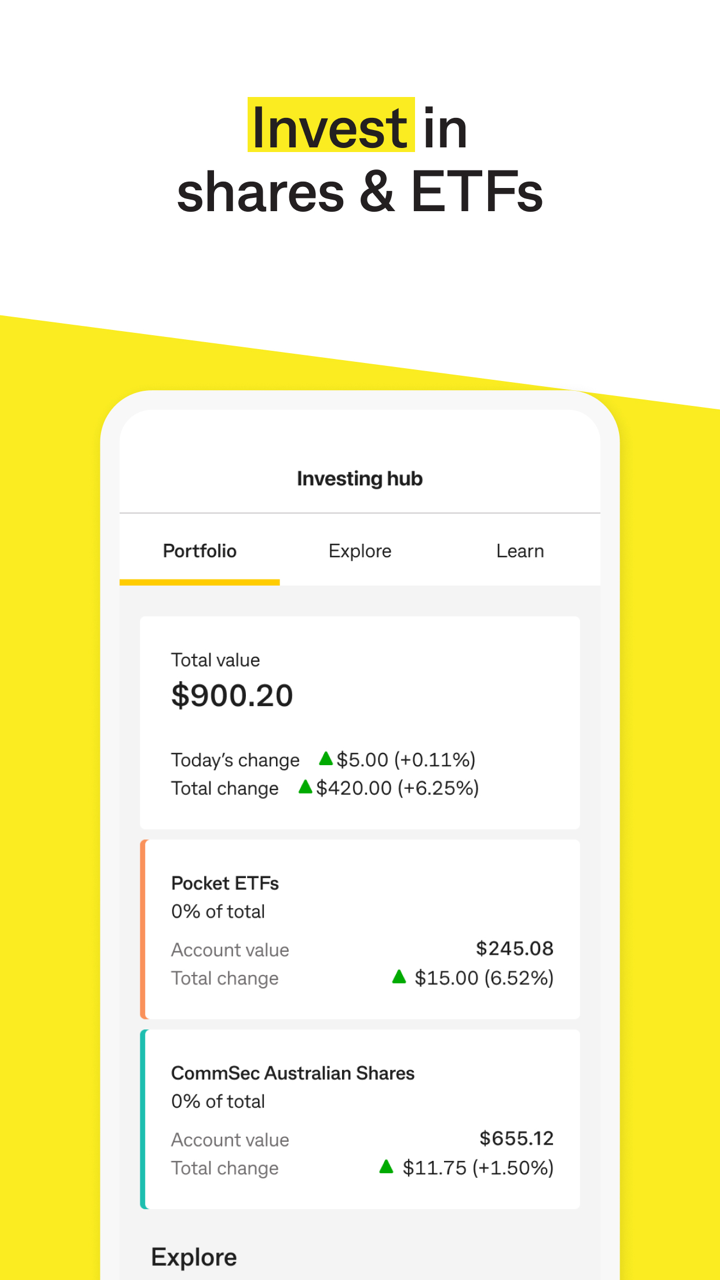

Ang mga uri ng transaksyon sa investment ay kinabibilangan ng sumusunod na apat na kategorya:

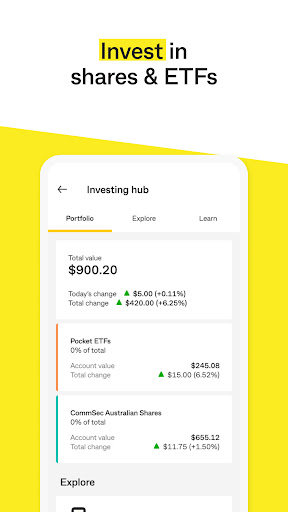

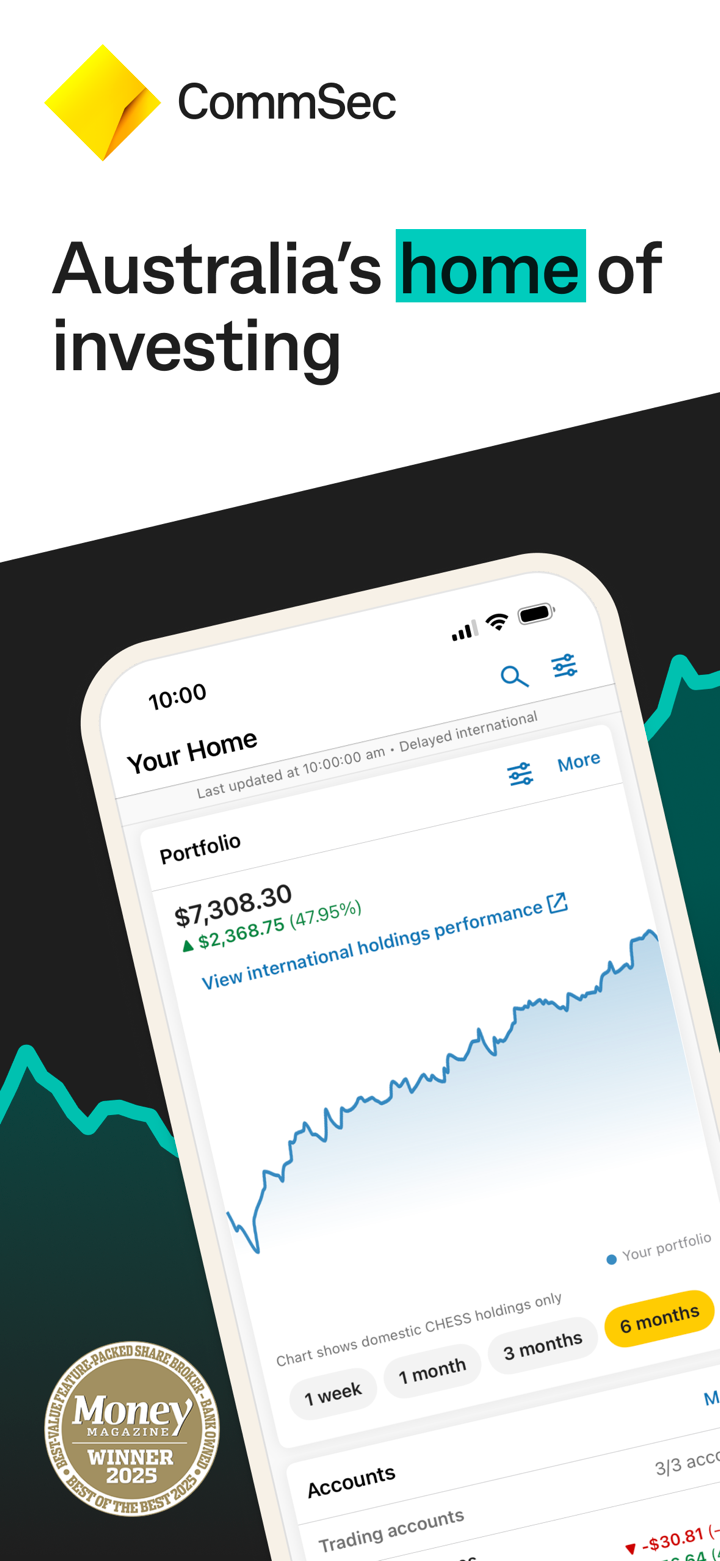

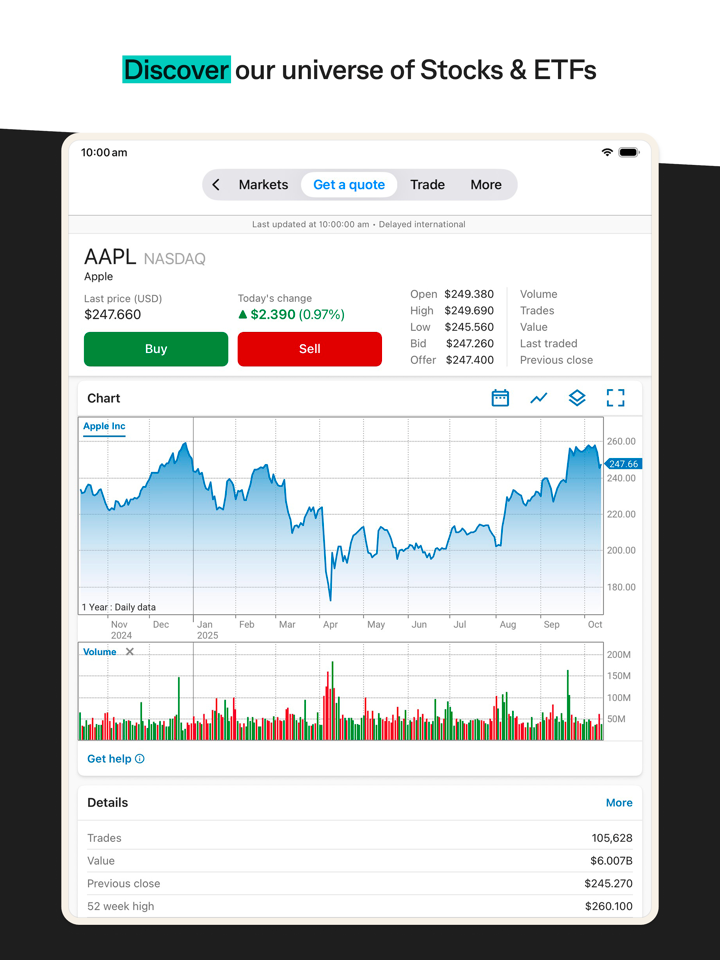

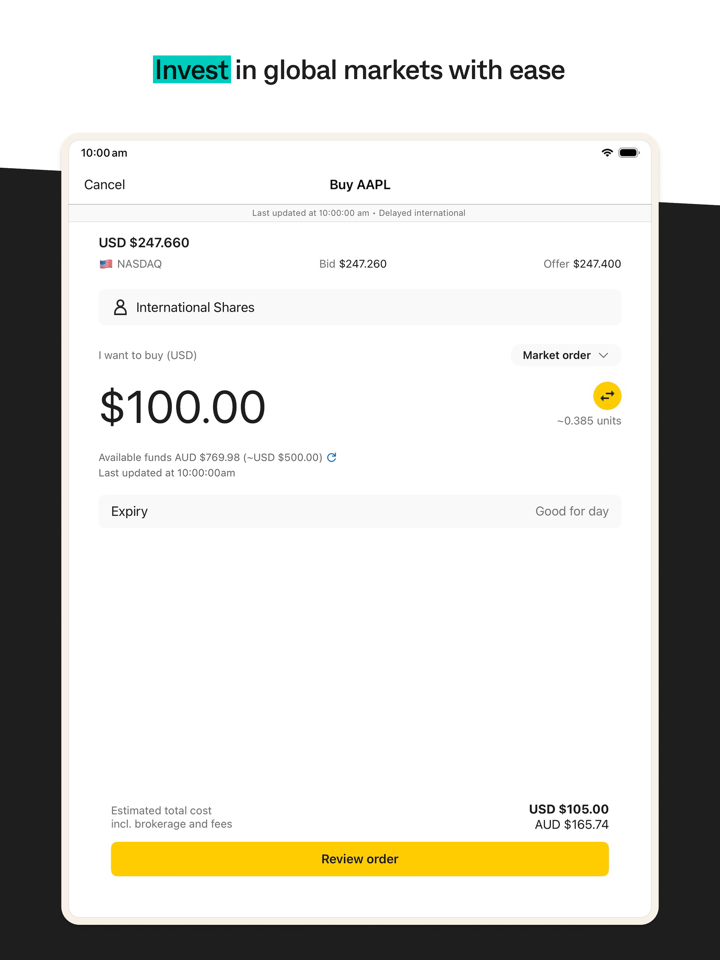

Australian Stocks (ASX): Mag-trade ng higit sa 2,000 Australian stocks sa pamamagitan ng platform ng CommSec. Ang minimum na unang trade ay $500, at ang mga sumunod na trades ay nagsisimula sa $100.

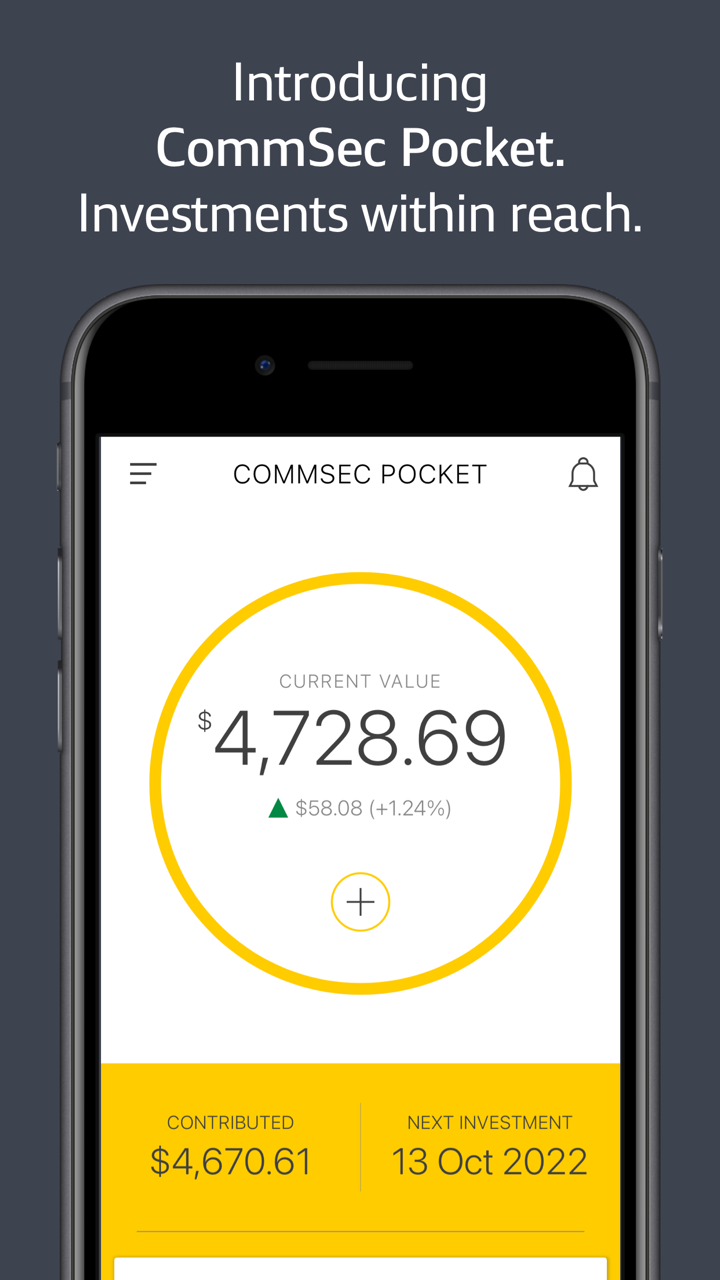

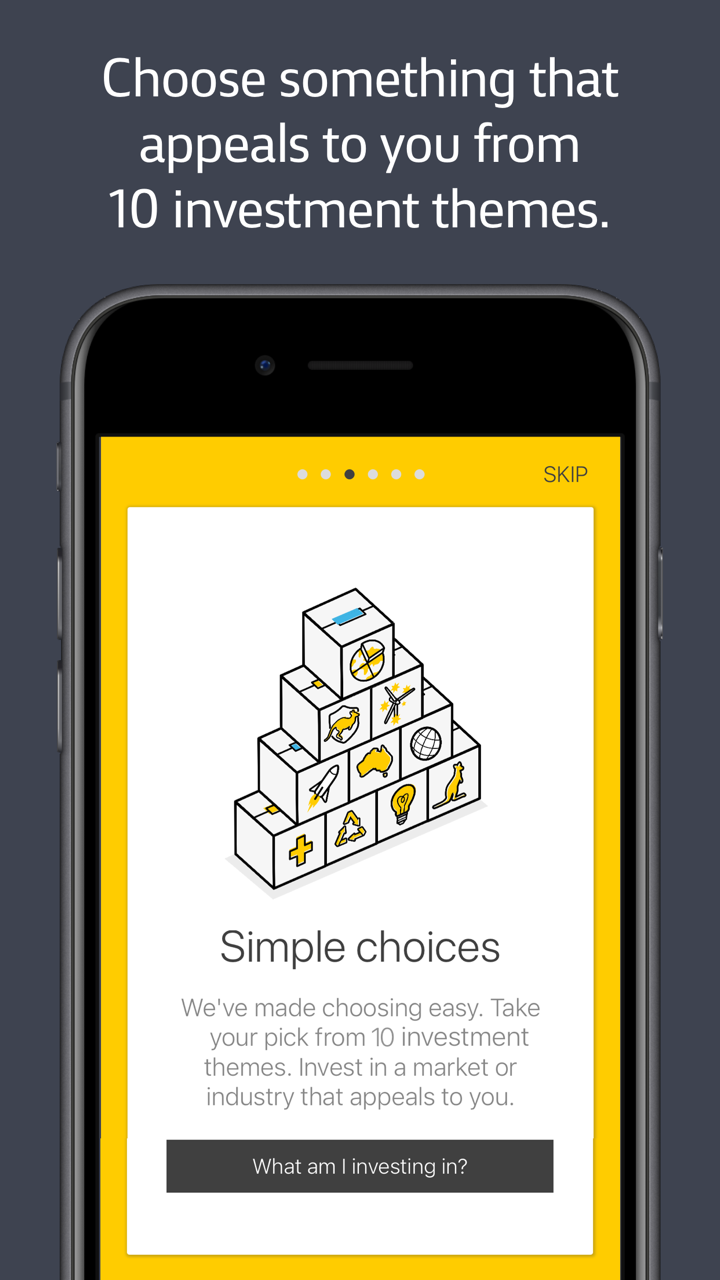

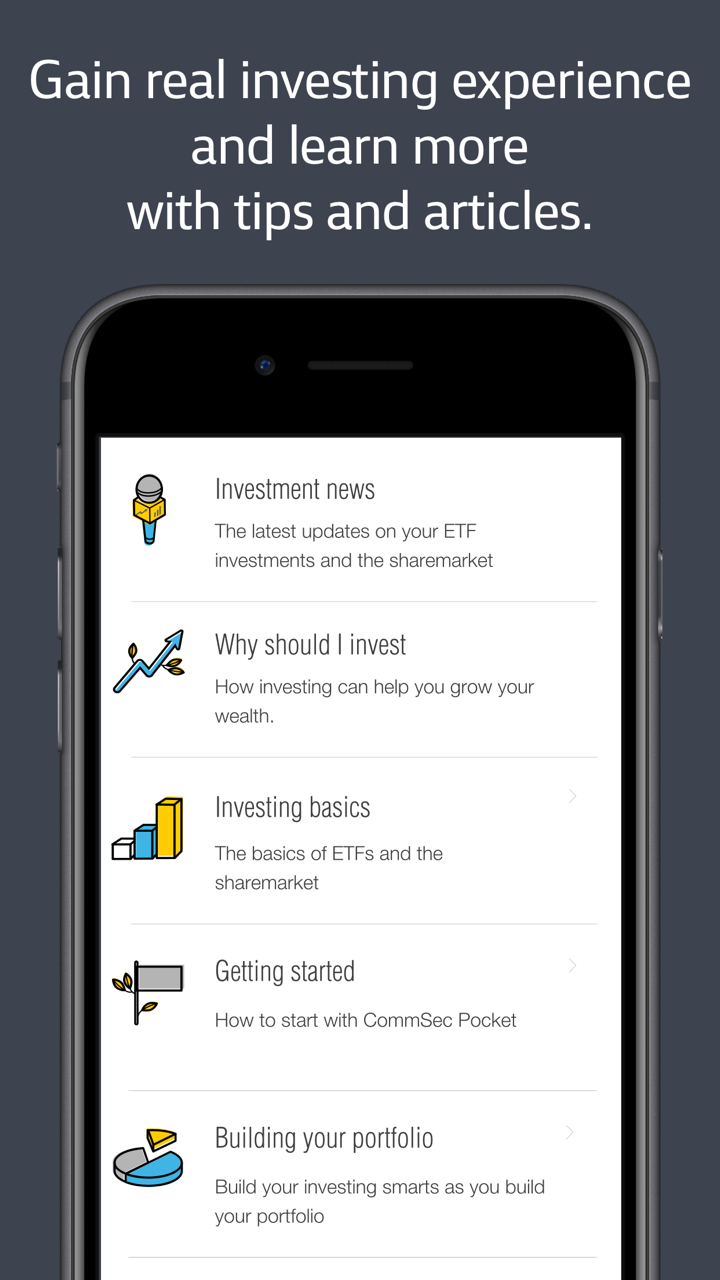

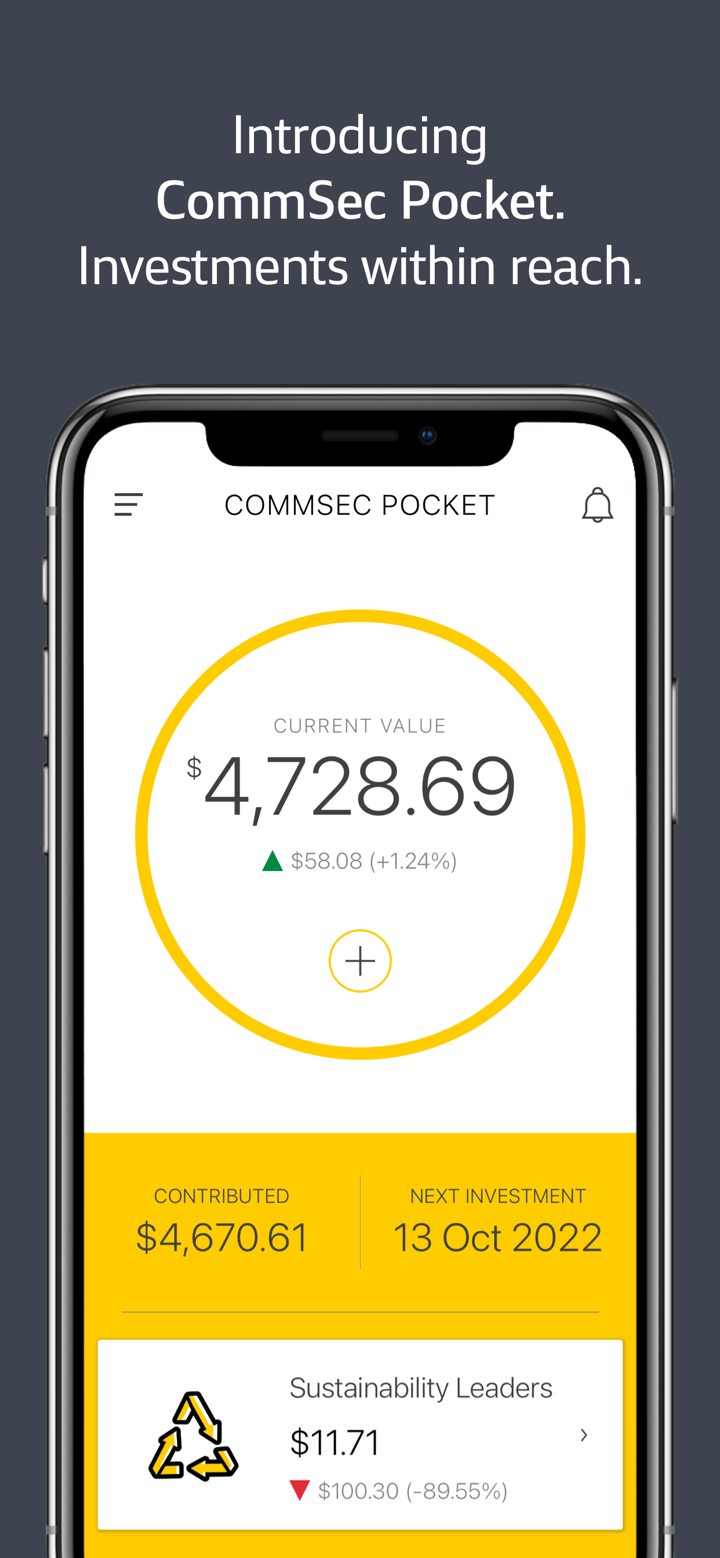

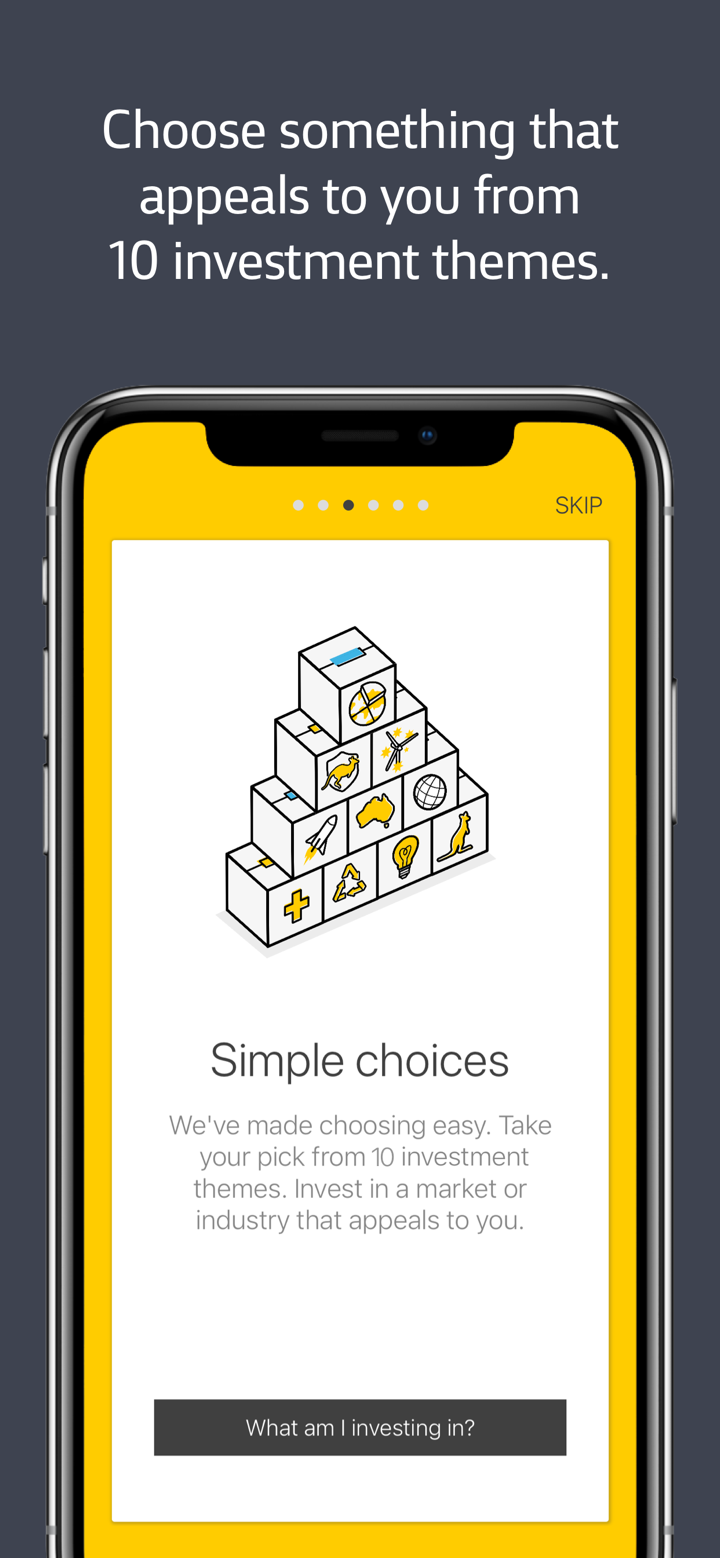

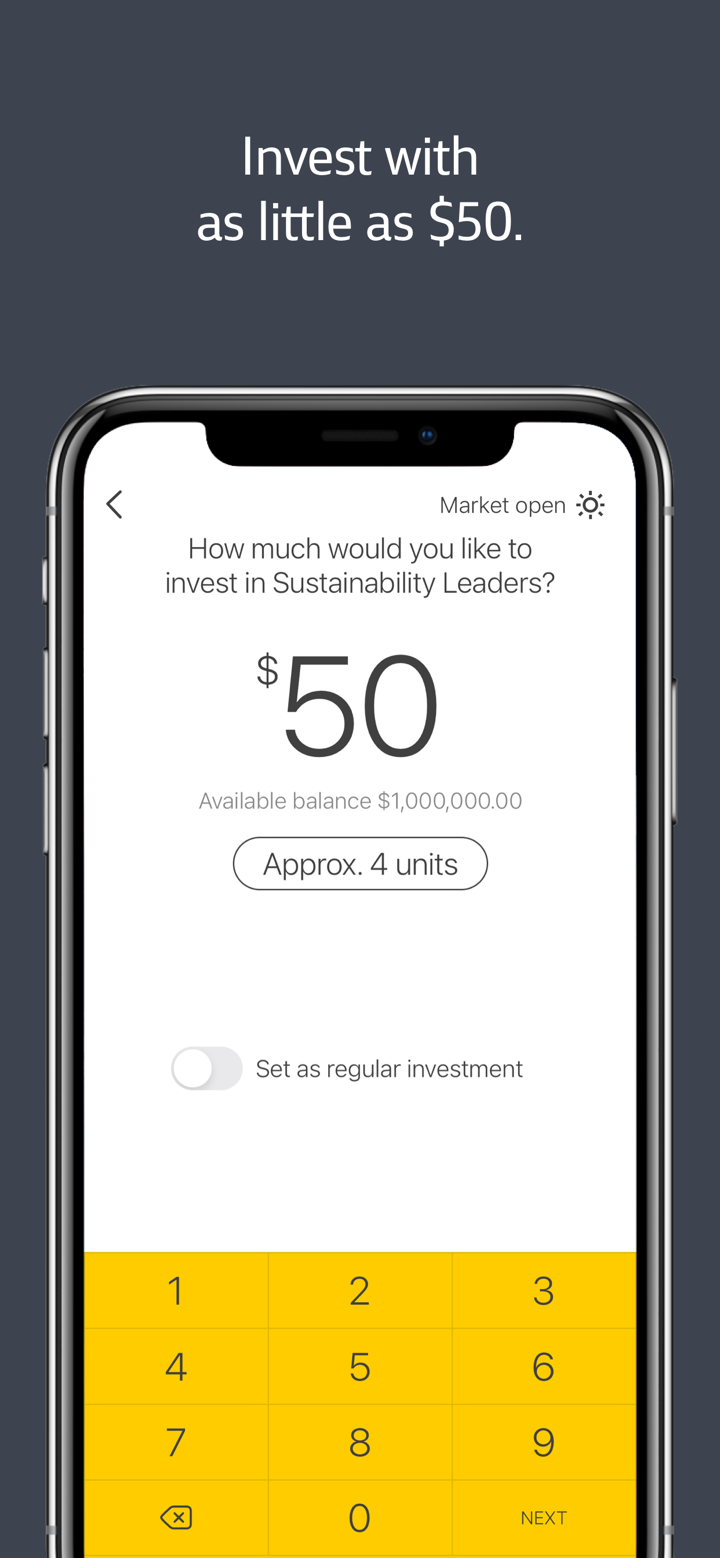

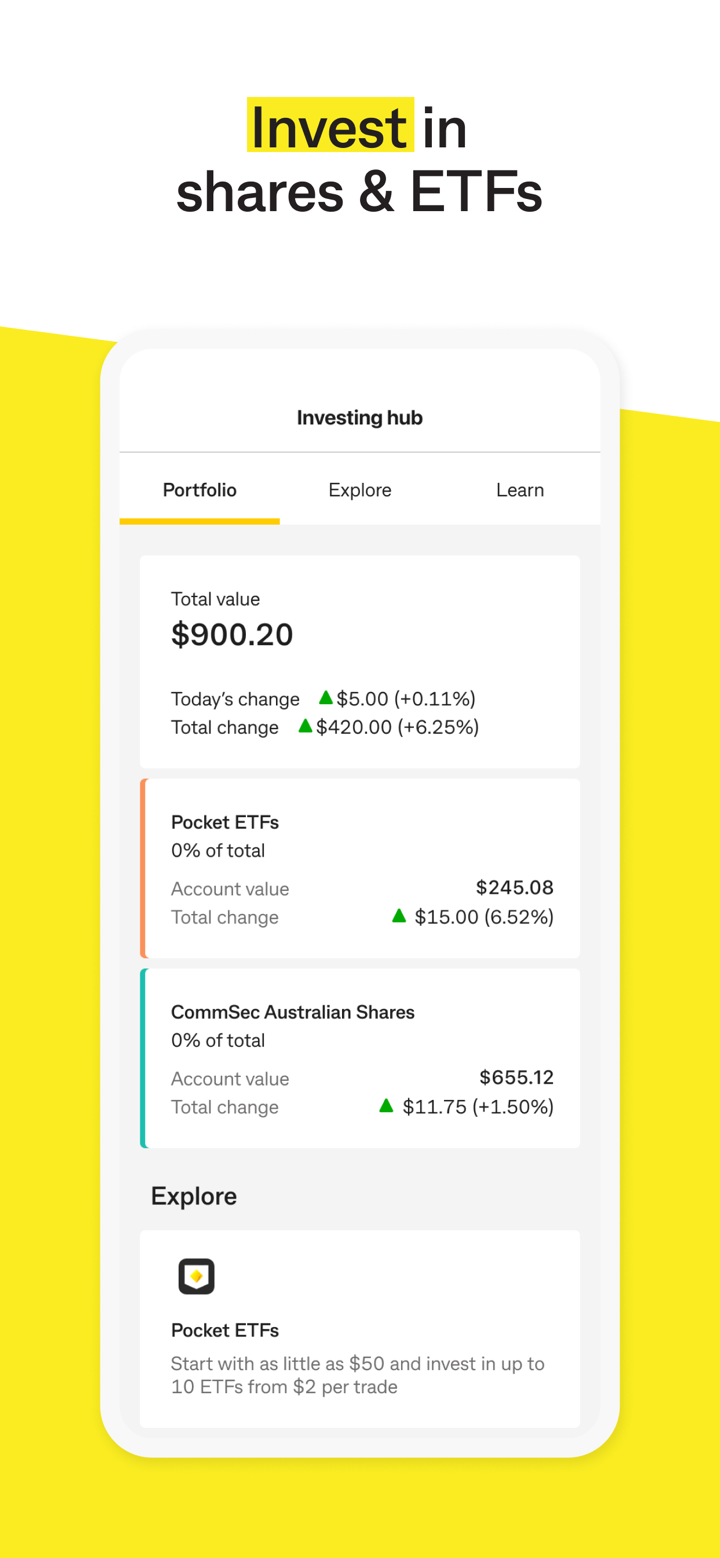

Exchange-Traded Funds (ETFs): Ang Pocket ETFs ay nag-aalok ng 10+ na tema ng ETFs (hal. teknolohiya, pangangalagang pangkalusugan) na may minimum na investment na $50. Ang komisyon ay $2 bawat trade (para sa trades ≤ $1,000) o 0.2% (para sa trades > $1,000).

Superannuation: Ibinibigay ng Colonial First State, ang mga produkto tulad ng Essential Super ay may mga bayad na 15% mas mababa kaysa sa average ng industriya.

- Term Deposits at Savings Accounts: Inaalok ang limitadong interest rate na 4.05% para sa 9-buwan na business investment accounts, habang ang mga rate ng karaniwang savings account ay nagbabago ayon sa merkado.

| Mga Serbisyo | Supported |

| Australian Stocks (ASX) | ✔ |

| Exchange-Traded Funds (ETFs) | ✔ |

| Superannuation | ✔ |

| Term Deposits at Savings Accounts | ✔ |

Uri ng Account

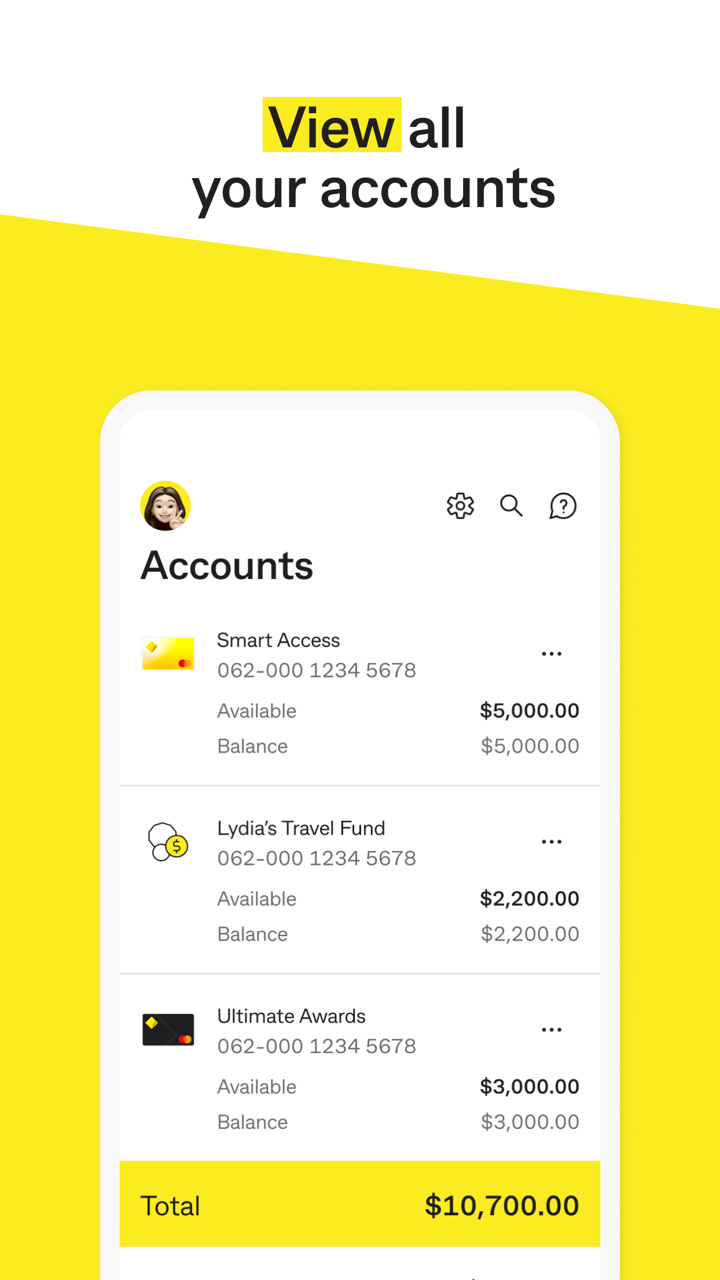

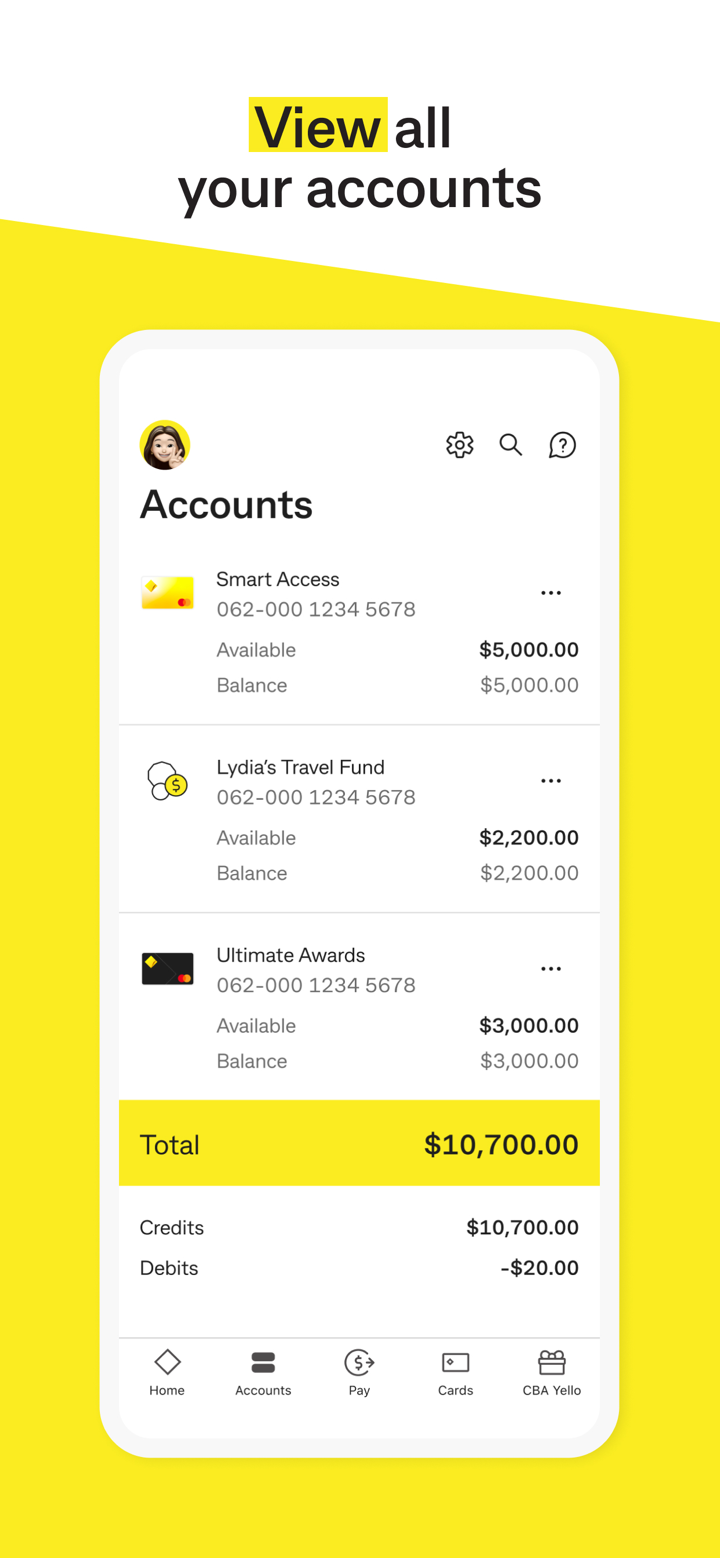

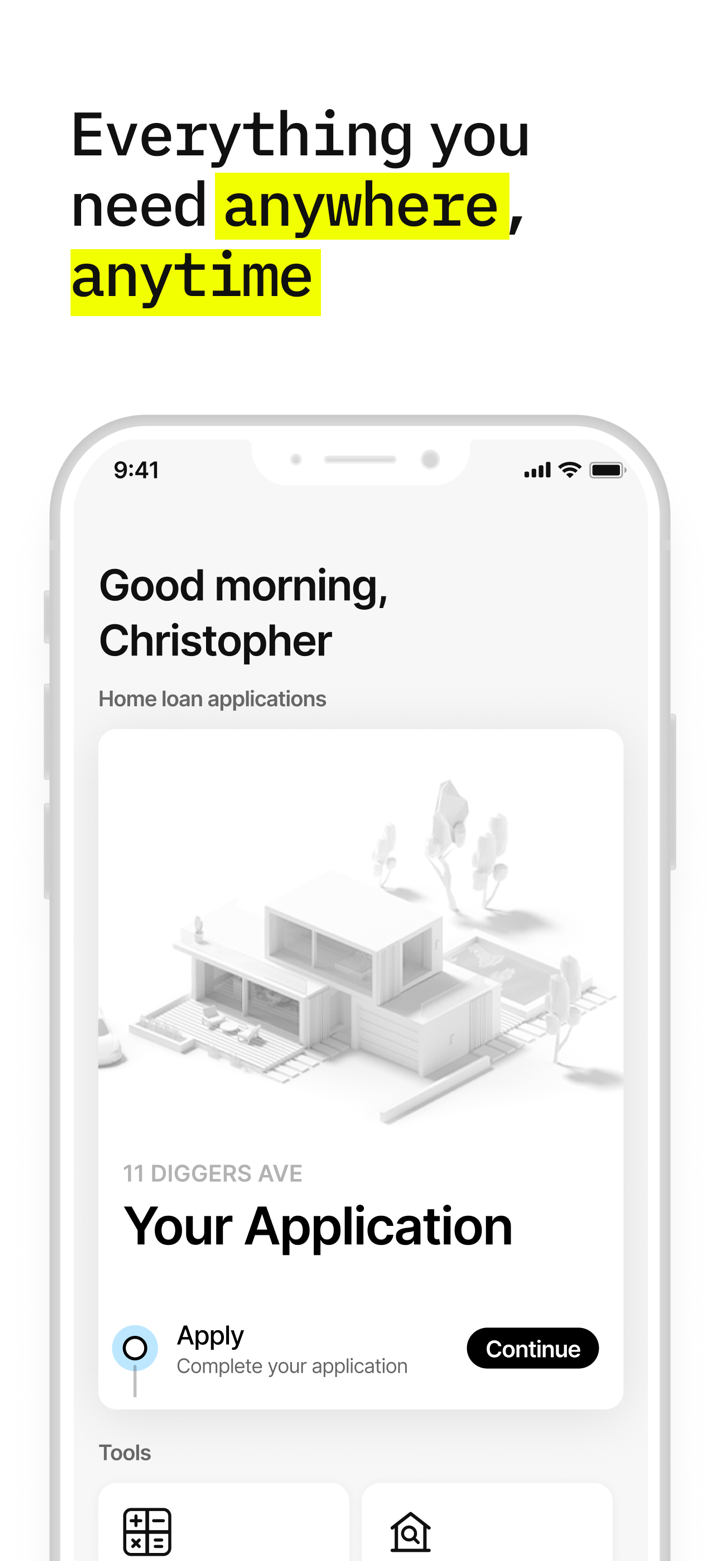

Mga Personal na Account

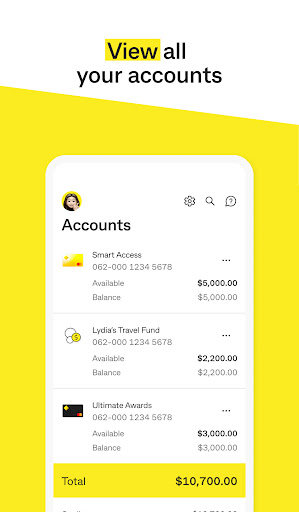

| Uri ng Account | Pangalan ng Account | Mga Pangunahing Tampok |

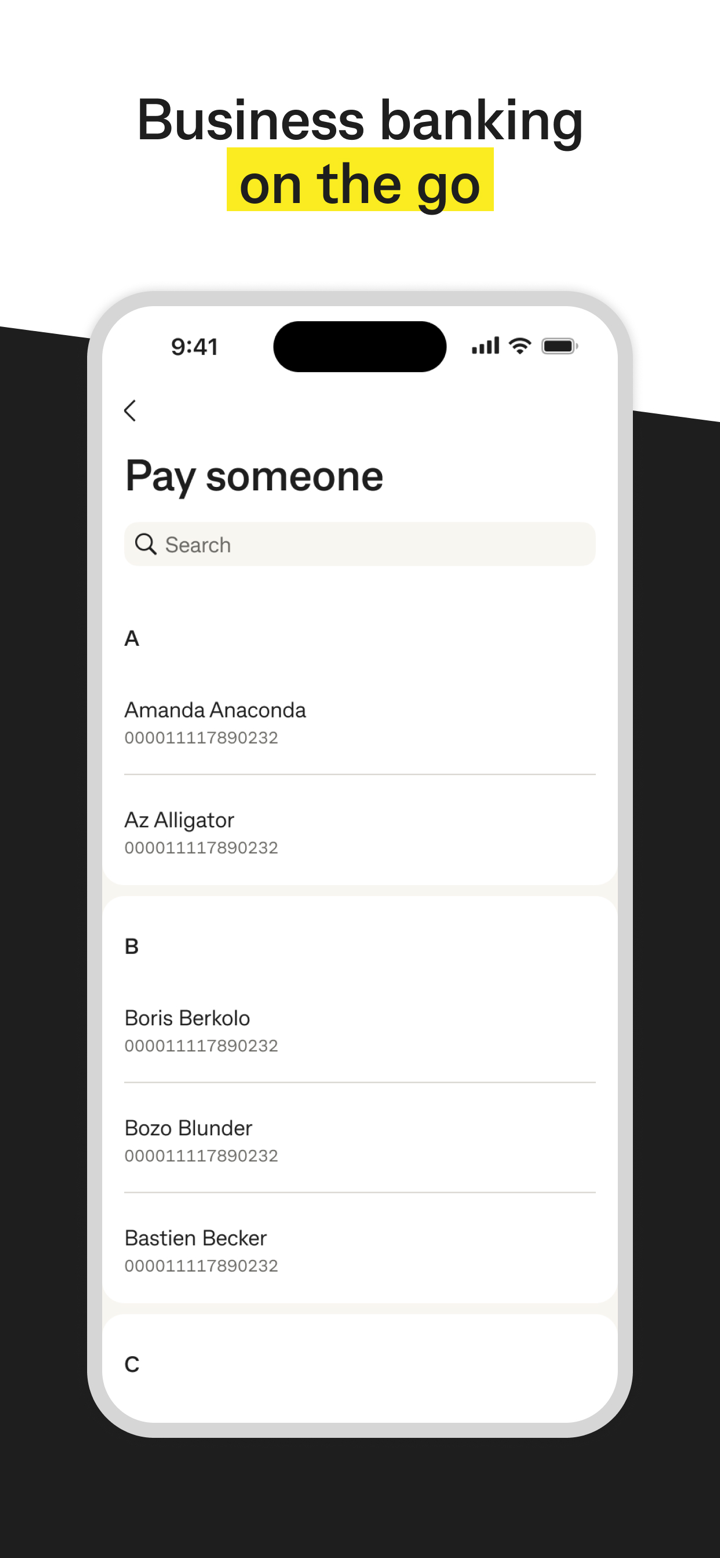

| Everyday Transaction Account | Smart Access | • Walang buwanang bayad• Sumusuporta sa mabilis na paglipat gamit ang PayID• Cardless cash withdrawal |

| Everyday Offset | • Konektado sa home loans, maaaring i-offset ang interes ng account balance | |

| Savings Account | NetBank Saver | • Mabibilis na interes rate• Angkop para sa maikling termino ng pag-iipon |

| Term Deposit | • Fixed na interes rate• Mga termino ng deposito mula 3 buwan hanggang 5 taon | |

| Investment Account | CommSec Share Trading Account | • Para sa pag-trade ng Australian stocks• Kinakailangan ang pag-link sa CDIA (Cash Management Account) |

| Pocket Account | • Nakatuon sa ETF trading• Minimum na investment na $50 |

Mga Negosyo Account

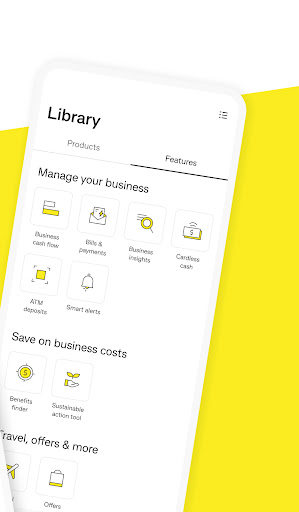

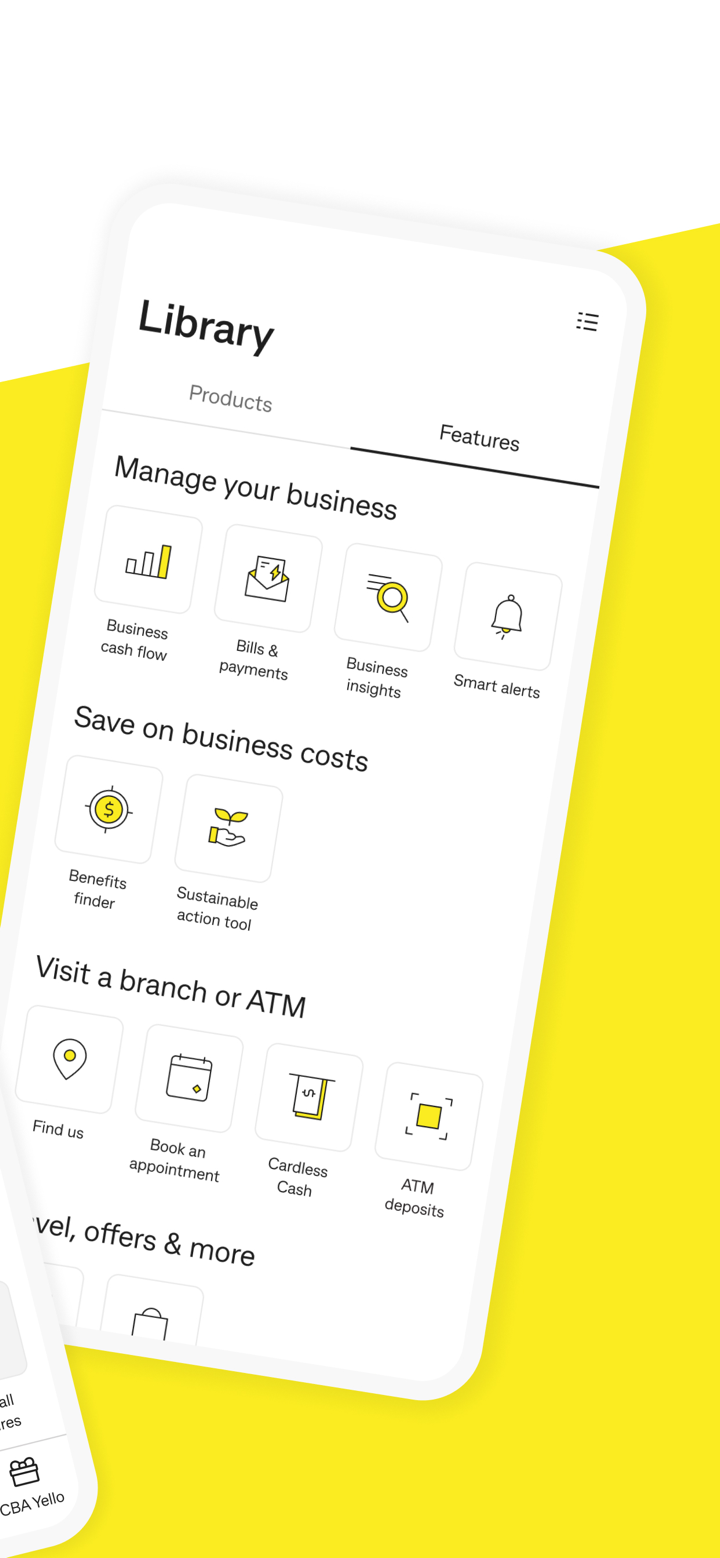

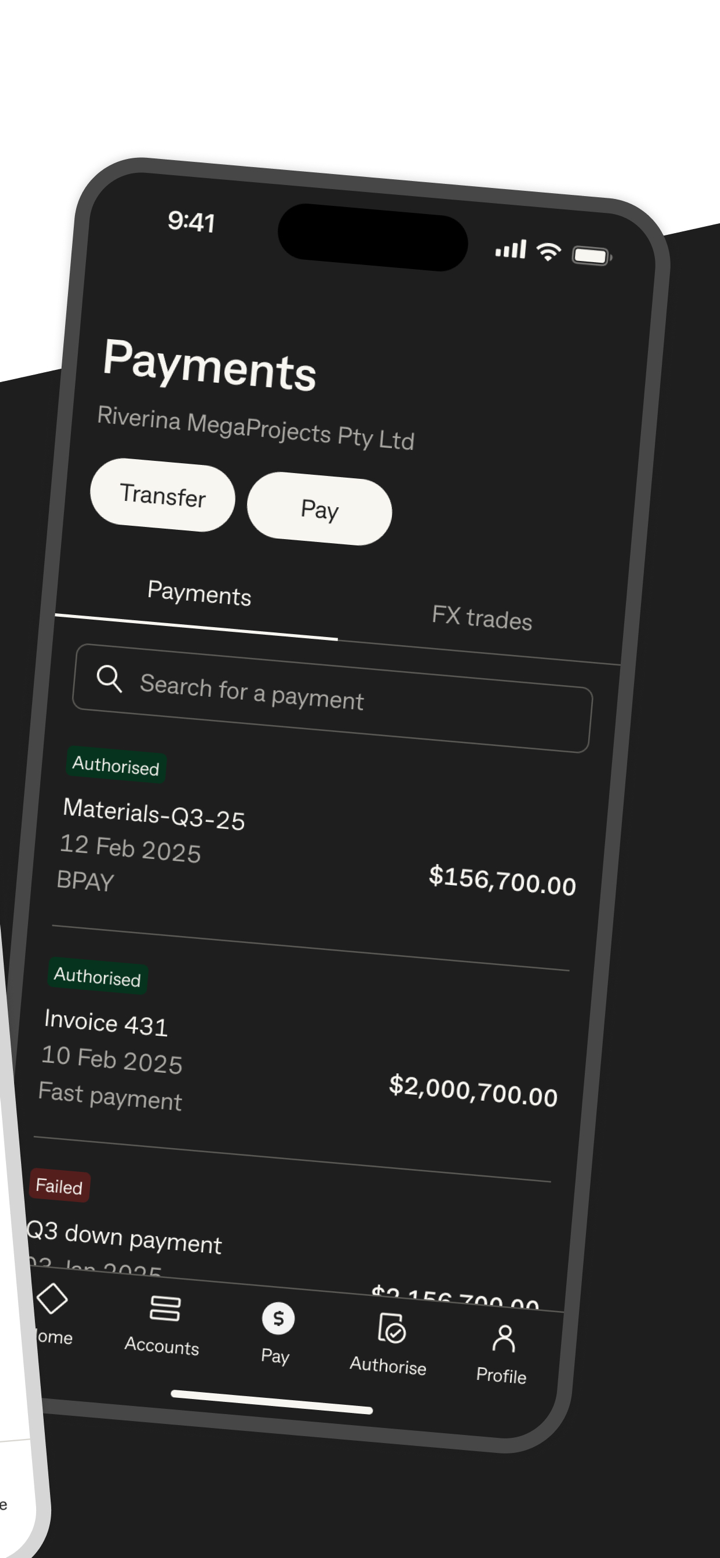

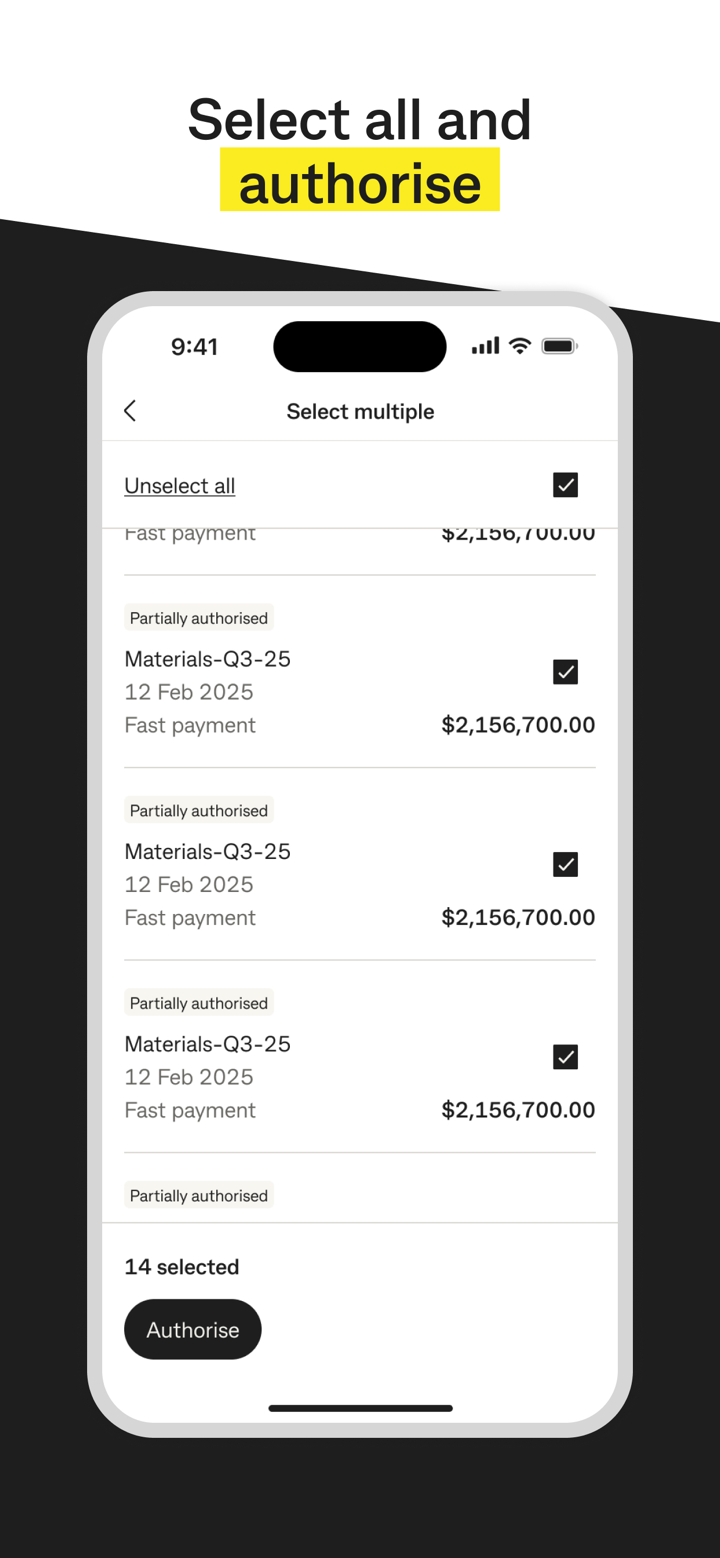

CommBank ay nag-aalok ng Business Transaction Account na angkop para sa mga maliit na negosyo, may $0 buwanang bayad at nangangailangan ng ASIC verification. Bukod dito, maaaring pumili ang mga user ng mga business loan accounts tulad ng Better Business Loan (unsecured small loan) at vehicle at equipment financing.

CommBank Mga Bayad

| Uri ng Serbisyo | Item | Standard ng Bayad |

| Mga Account ng Transaksyon | Basic Account Monthly Fee | Karamihan ay walang buwanang bayad |

| Cross-border Transfer | $15–$25 bawat transaksyon | |

| Foreign Exchange Conversion Fee | 1%–3% | |

| Investment Trading | Australian Stock Trading Commission | $10–$29.95 bawat transaksyon |

| ETF Trading Commission | ≤ $1,000: $2 bawat transaksyon; > $1,000: 0.2% | |

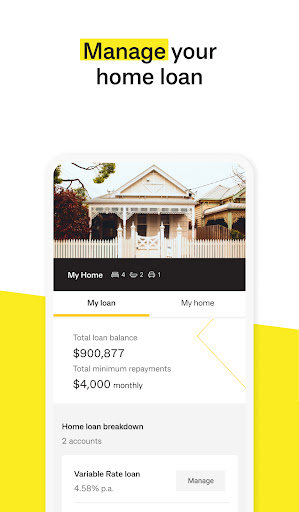

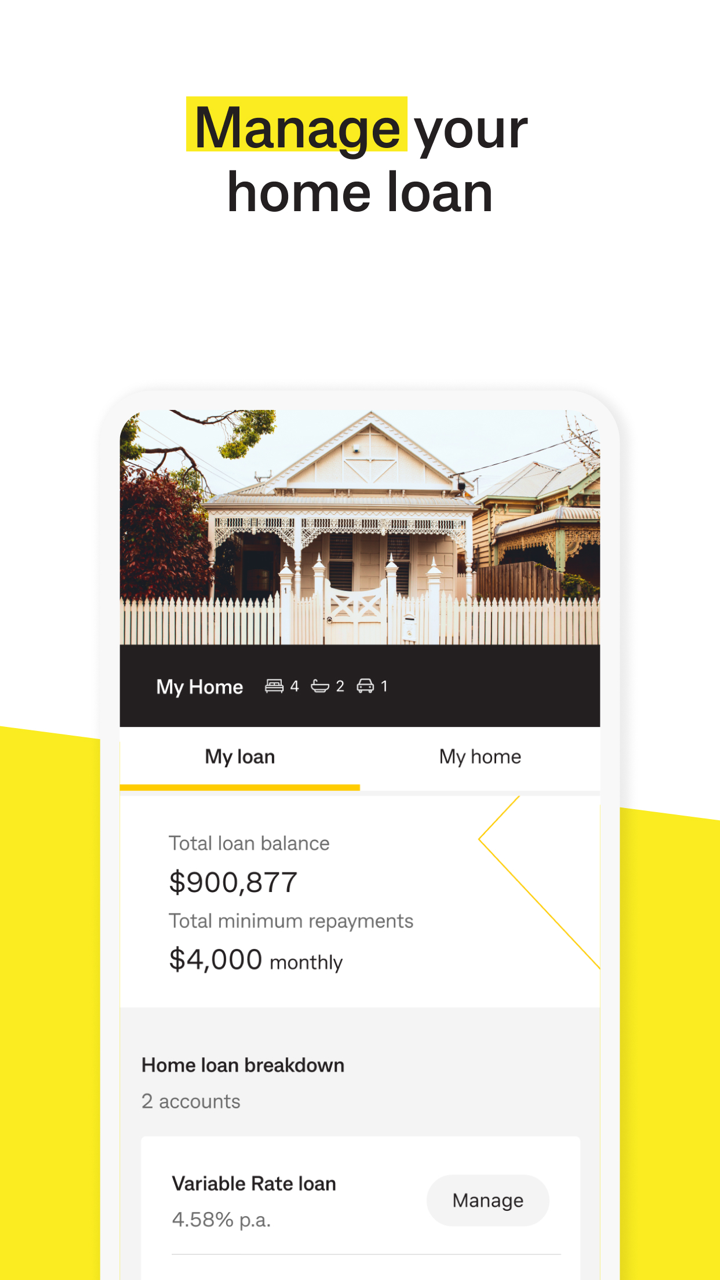

| Home Loans | Home Loan Application Fee | $495–$995 |

| Refinance Fee | Humigit-kumulang $395 | |

| Wealth Package Annual Fee | $395 (kasama ang diskwento sa home loan rate) | |

| Insurance | Pet Insurance (First-Year Offer) | Unang 2 buwan libre |

| Pet Insurance (Kasunod na Buwanang Bayad) | $20–$80 |

Leverage

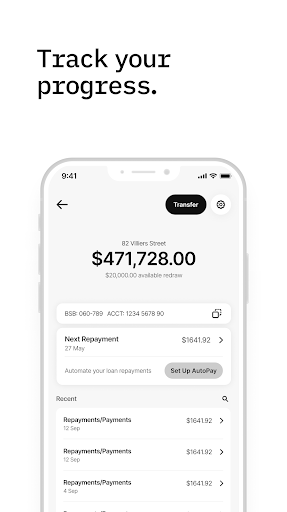

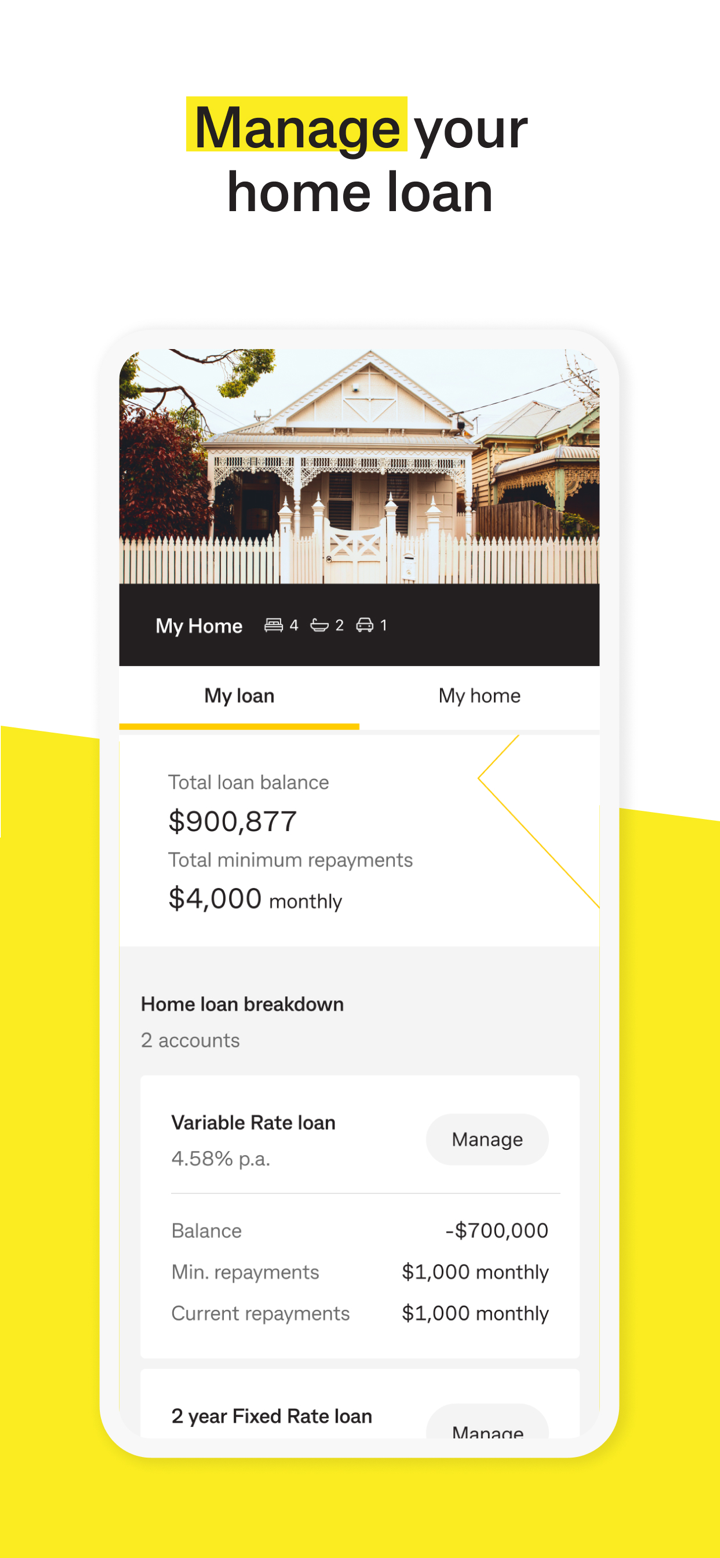

Para sa leverage sa home loan ng CommBank, ang maximum loan amount ay maaaring maging 80% ng halaga ng property (LVR ≤ 80%).

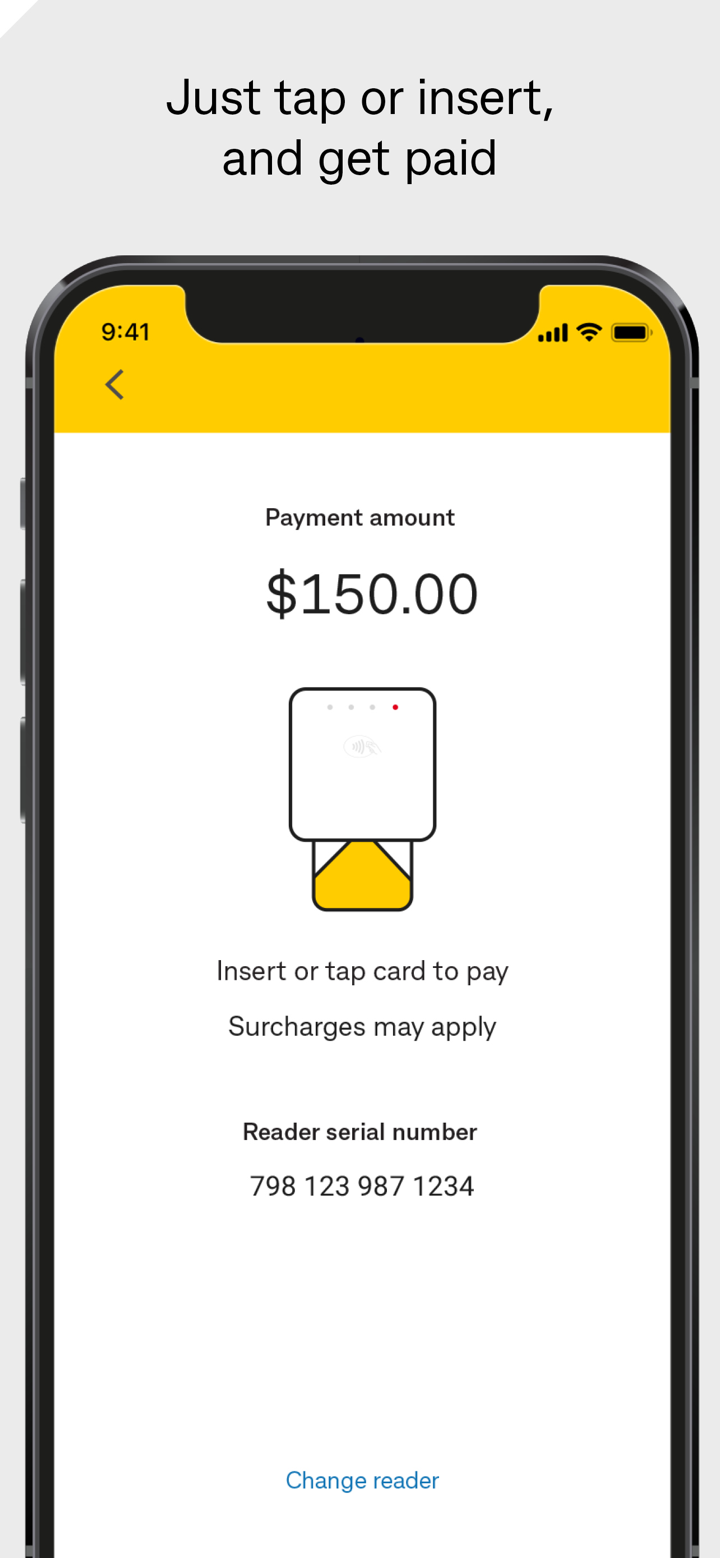

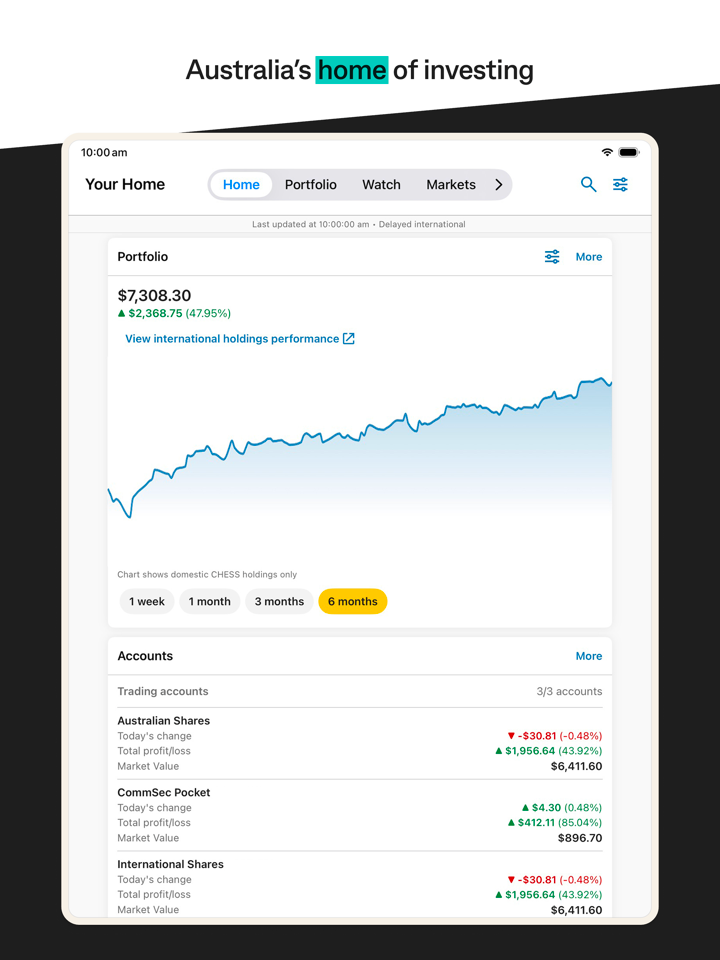

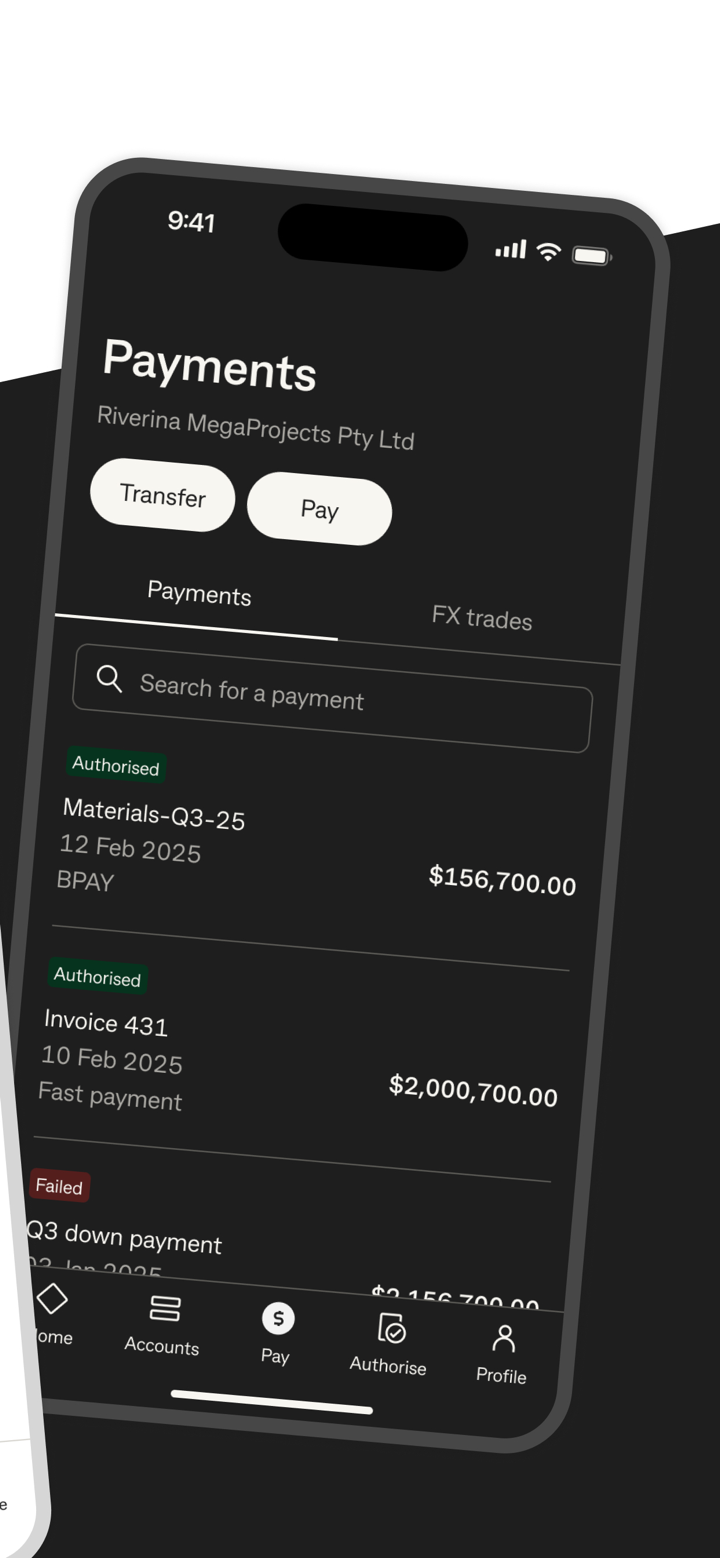

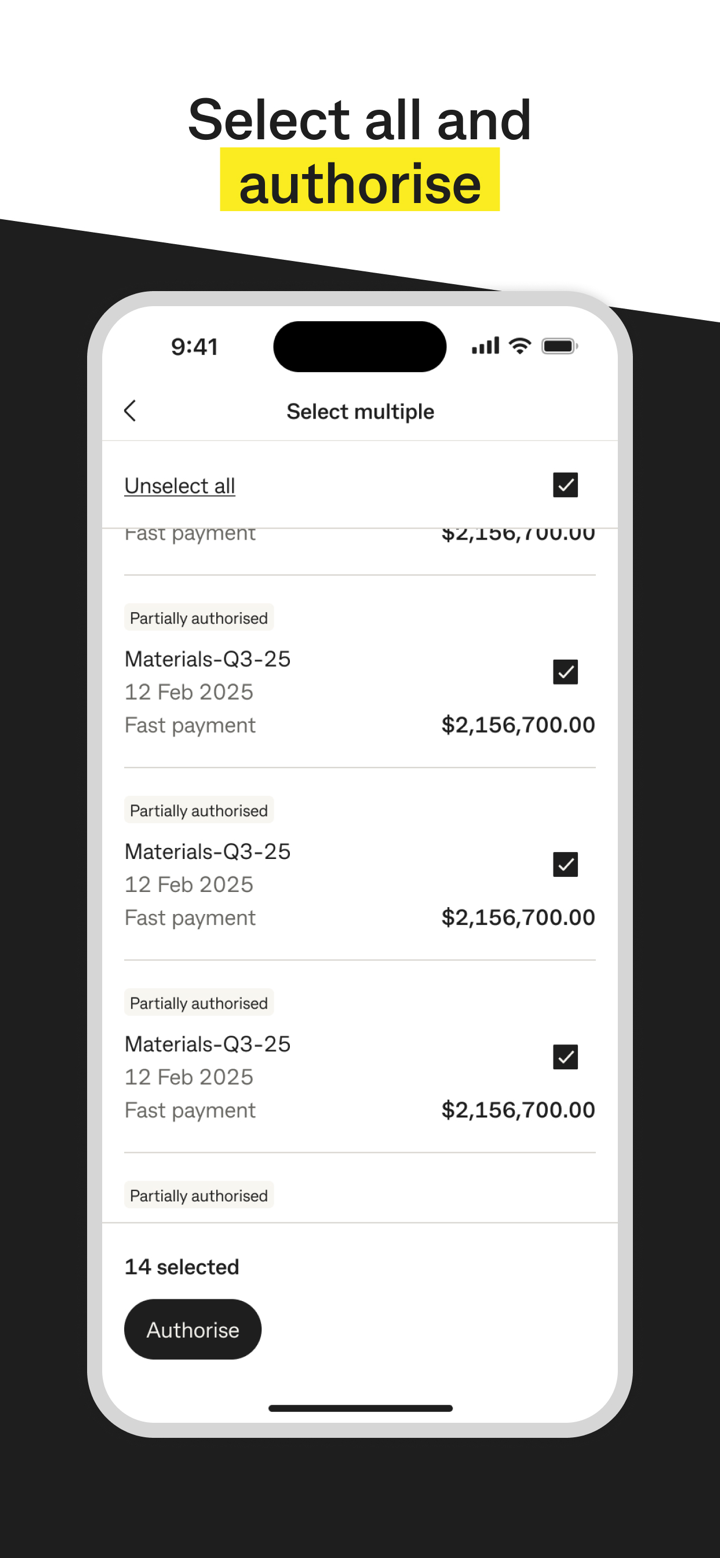

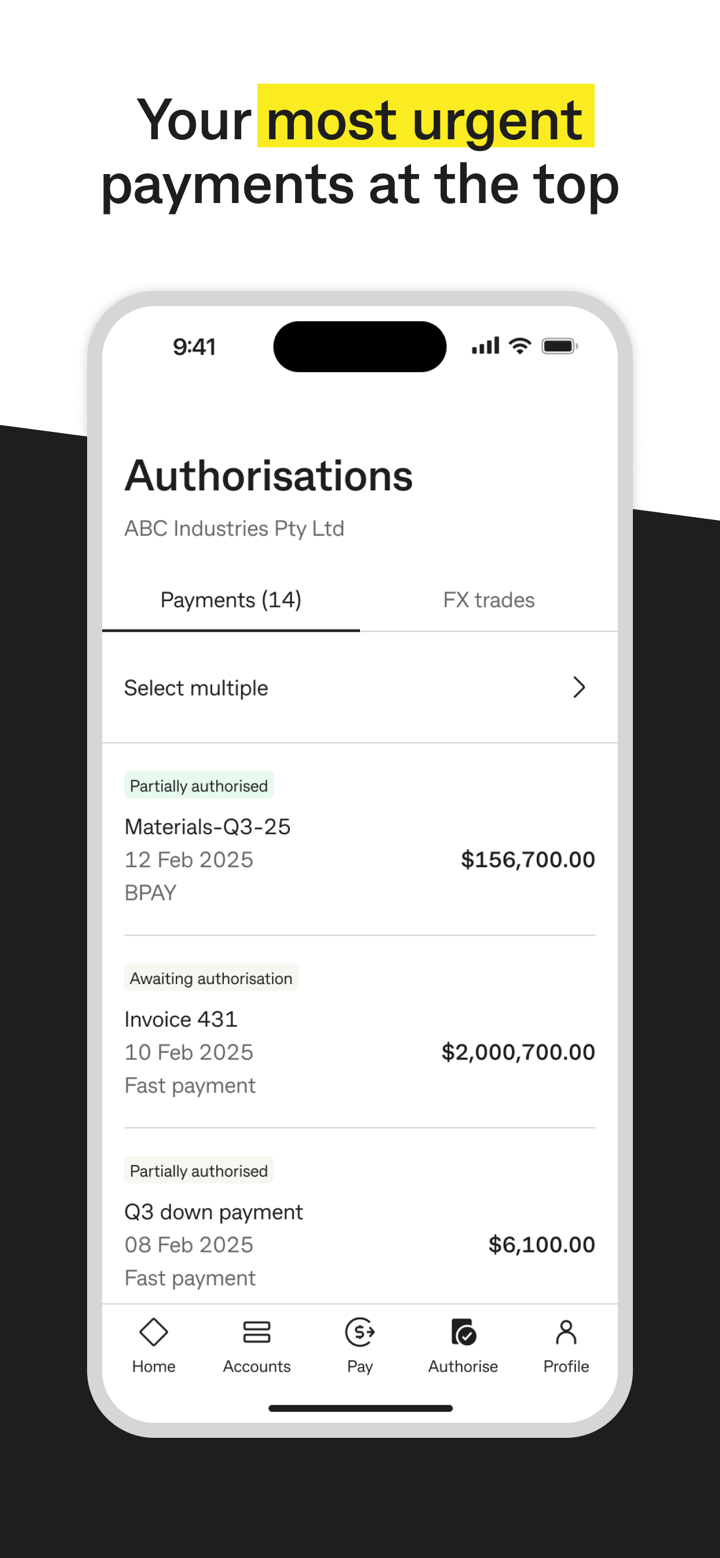

Plataforma ng Paghahalal

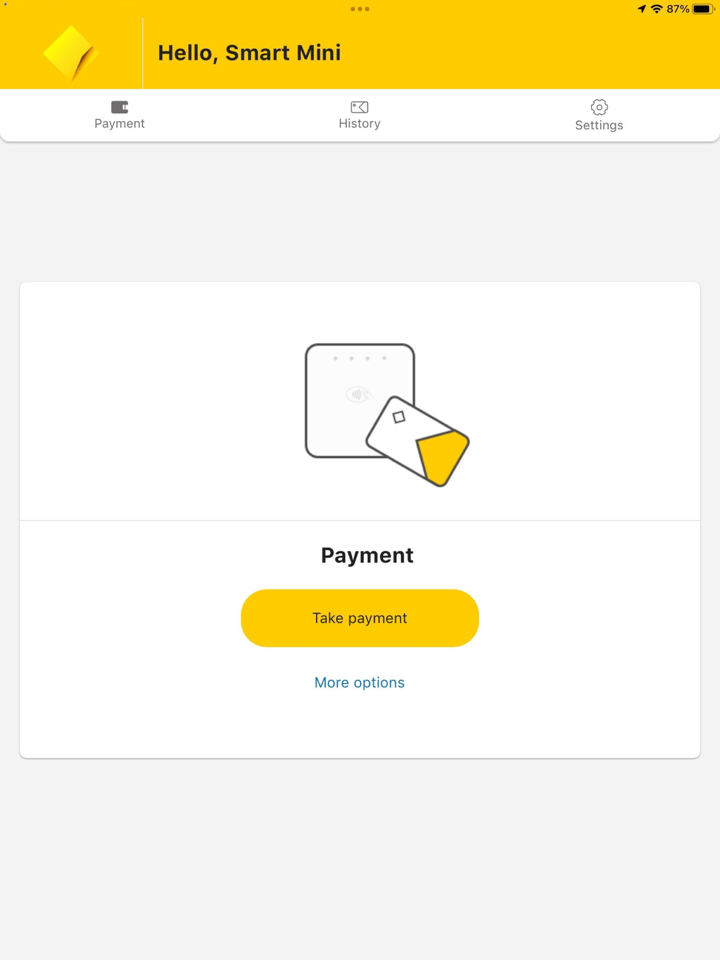

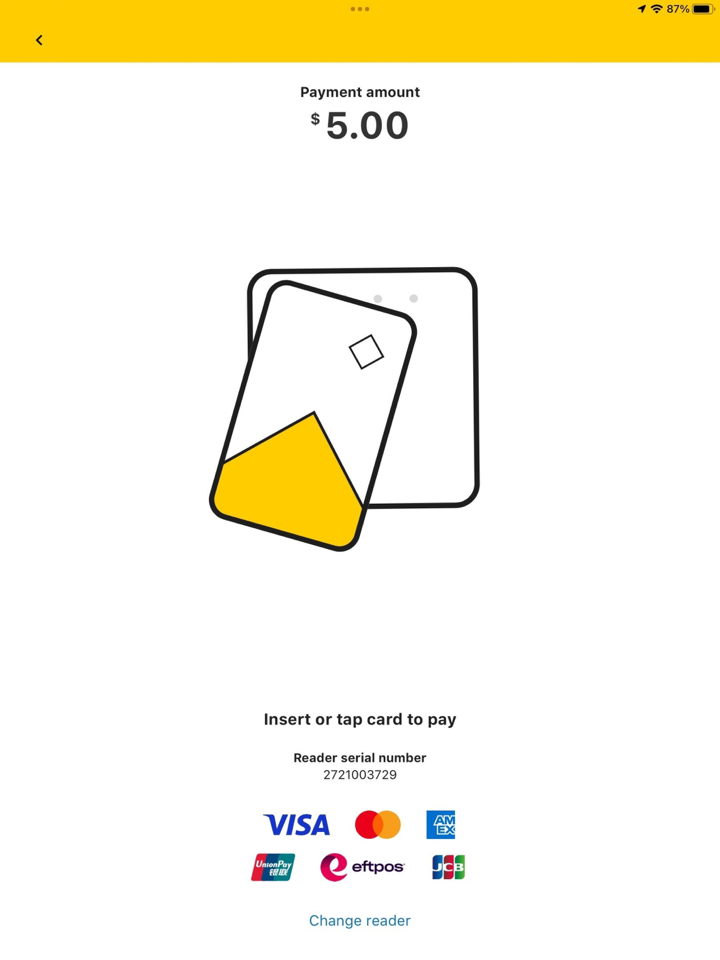

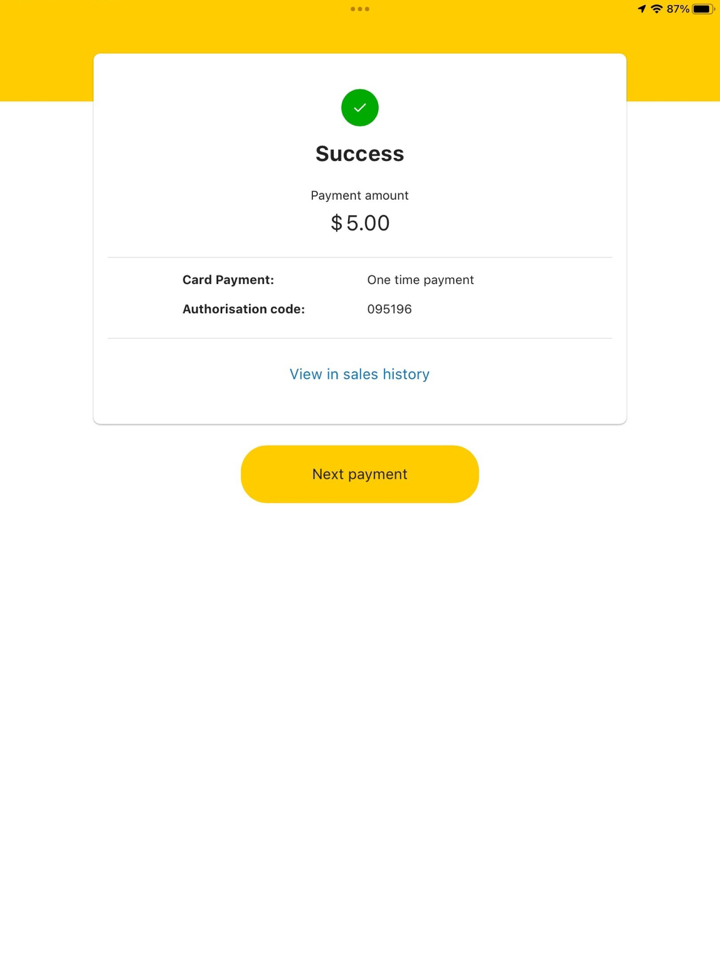

| Plataforma ng Paghahalal | Supported | Available Devices |

| ✔ | - | |

| NetBank | ✔ | Web |

| CommSec | ✔ | - |

Deposito at Pag-Atas

| Kategorya | Paraan | Mga Detalye |

| Deposito | Bank Transfer | Suporta sa lokal/internasyonal na mga transfer; Kinakailangan ang SWIFT code para sa internasyonal na mga transfer: CBAUAT22. |

| ATM Deposit | Libreng cash/check deposits sa mga ATM ng CommBank sa loob ng Australia | |

| Direct Salary Deposit | Pinapayagan ang mga employer na direkta na magdeposito ng sahod; Kwalipikasyon para sa mga rewards sa ilang mga account (hal. Smart Awards credit card points) | |

| Pag-Atas | ATM Withdrawal | Access sa Australian dollars o lokal na currency sa Mastercard ATMs sa buong mundo; Bayad para sa pag-atas sa ibang bansa: $5 bawat transaksyon + bayad sa currency conversion |

| Transfer sa Linked Accounts | Libreng real-time transfers sa iba pang mga account ng CommBank o third-party accounts (nangangailangan ng PayID/BSB number) |

Bonus

Ang mga bagong customer rewards ng CommBank ay kasama ang: pagbubukas ng itinakdang account para sa transaksyon at pagkumpleto ng mga transaksyon upang makatanggap ng $200 cash bonus (limited-time offer); ang mga bagong customer ng home loan ay maaaring mag-enjoy ng $699 na discount sa conveyancing (via the Home-in service).

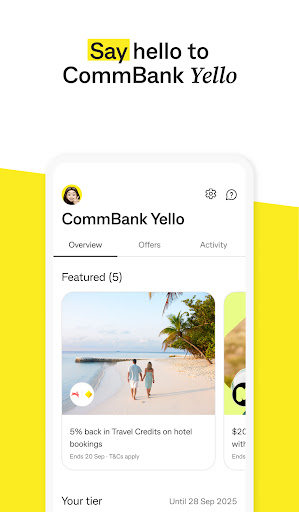

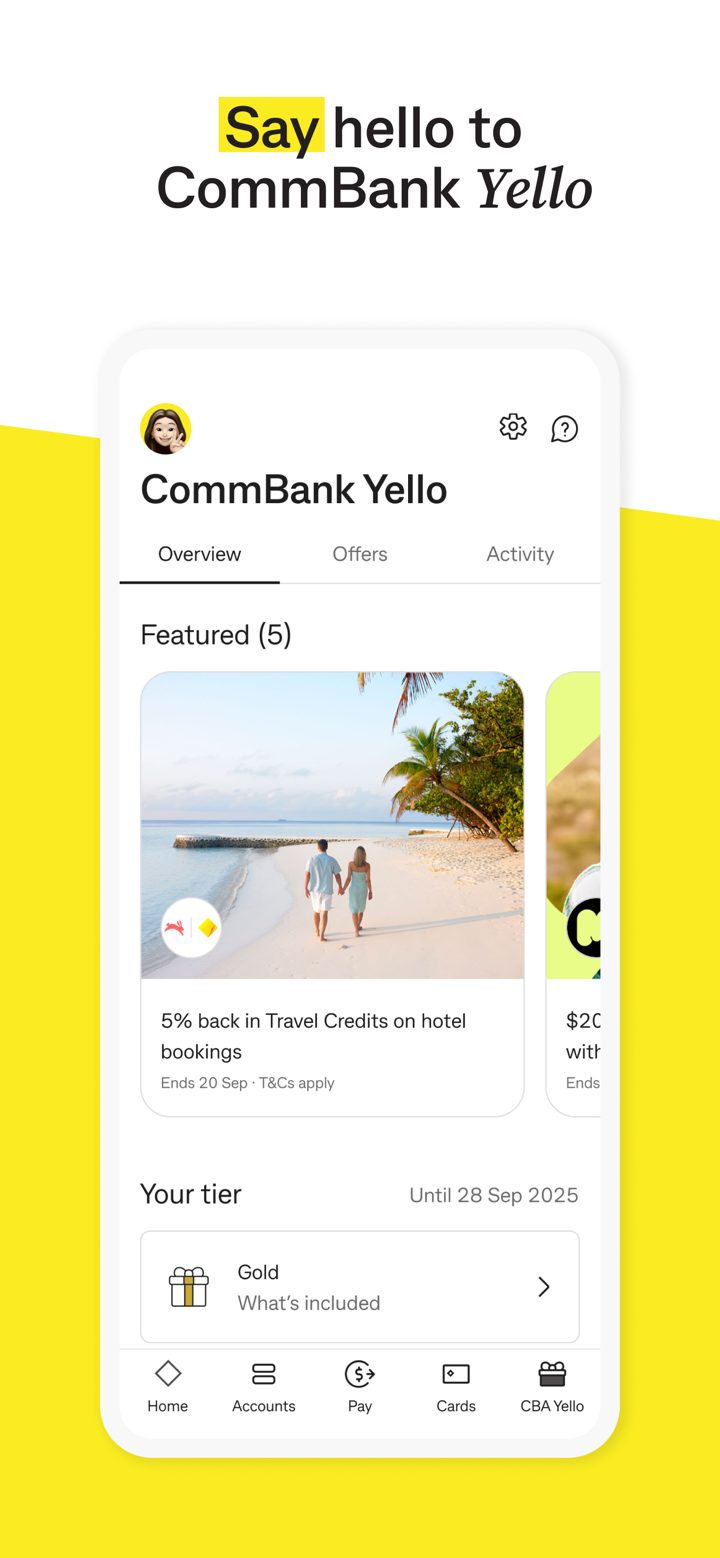

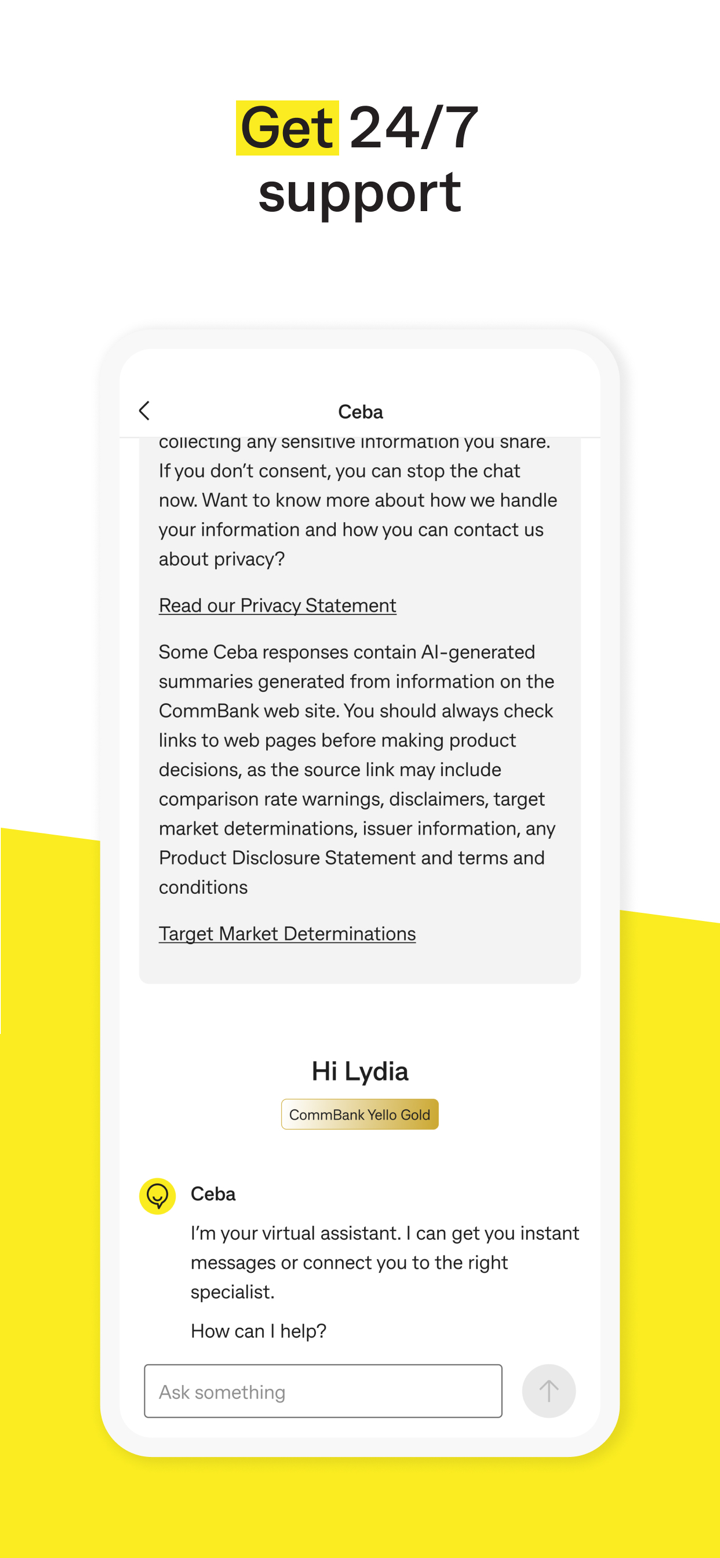

Bukod dito, maaaring mag-access ang mga investor sa loyalty rewards tulad ng CommBank Yello program, na nag-aalok ng points, cashback (hal. hanggang sa $40 buwanang cashback sa home loans), at mga discount sa serbisyo. Ang paggastos sa credit card ay nag-aaccumulate ng CommBank Awards points, na maaaring ma-redeem para sa gift cards o Qantas frequent flyer miles.