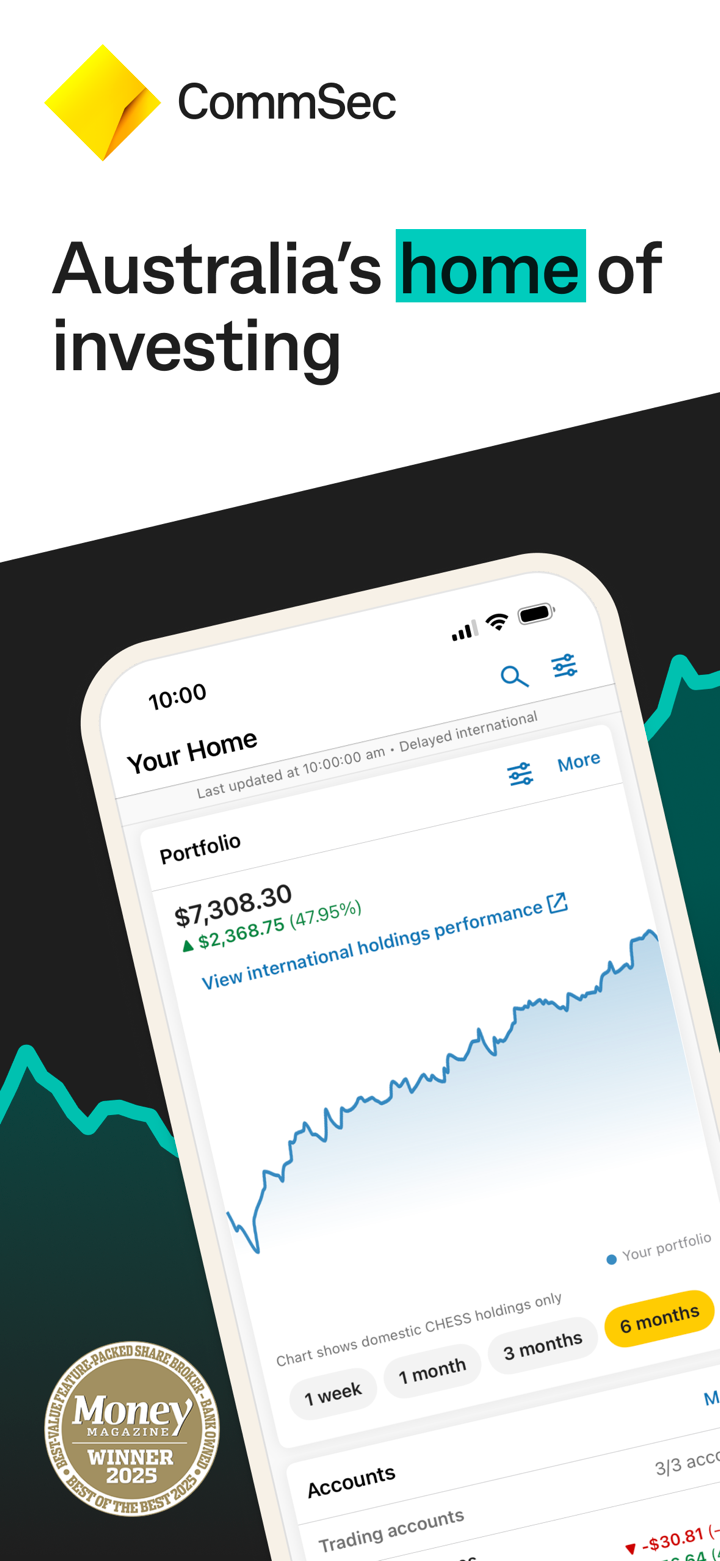

Profil perusahaan

| CommBank Ringkasan Ulasan | |

| Didirikan | 1911 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | Teregulasi |

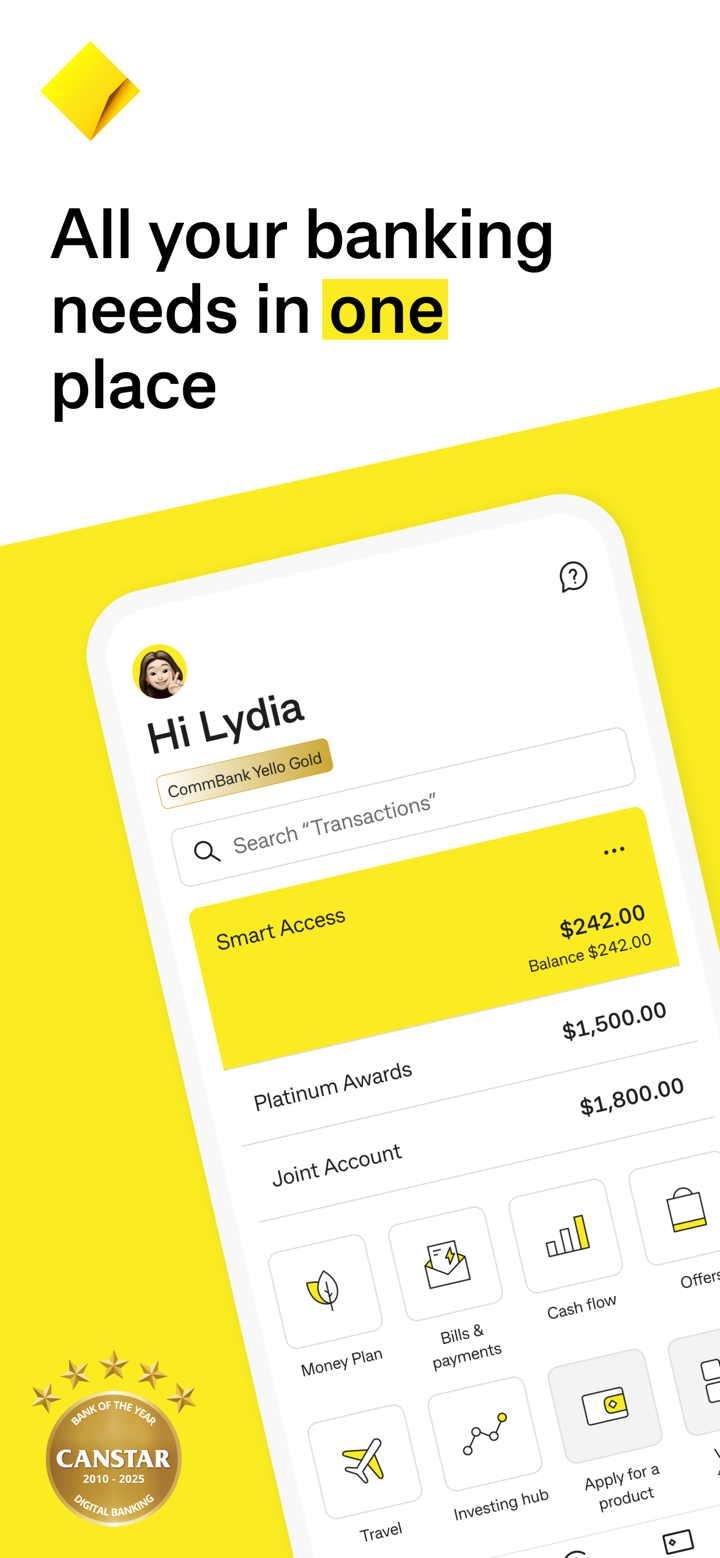

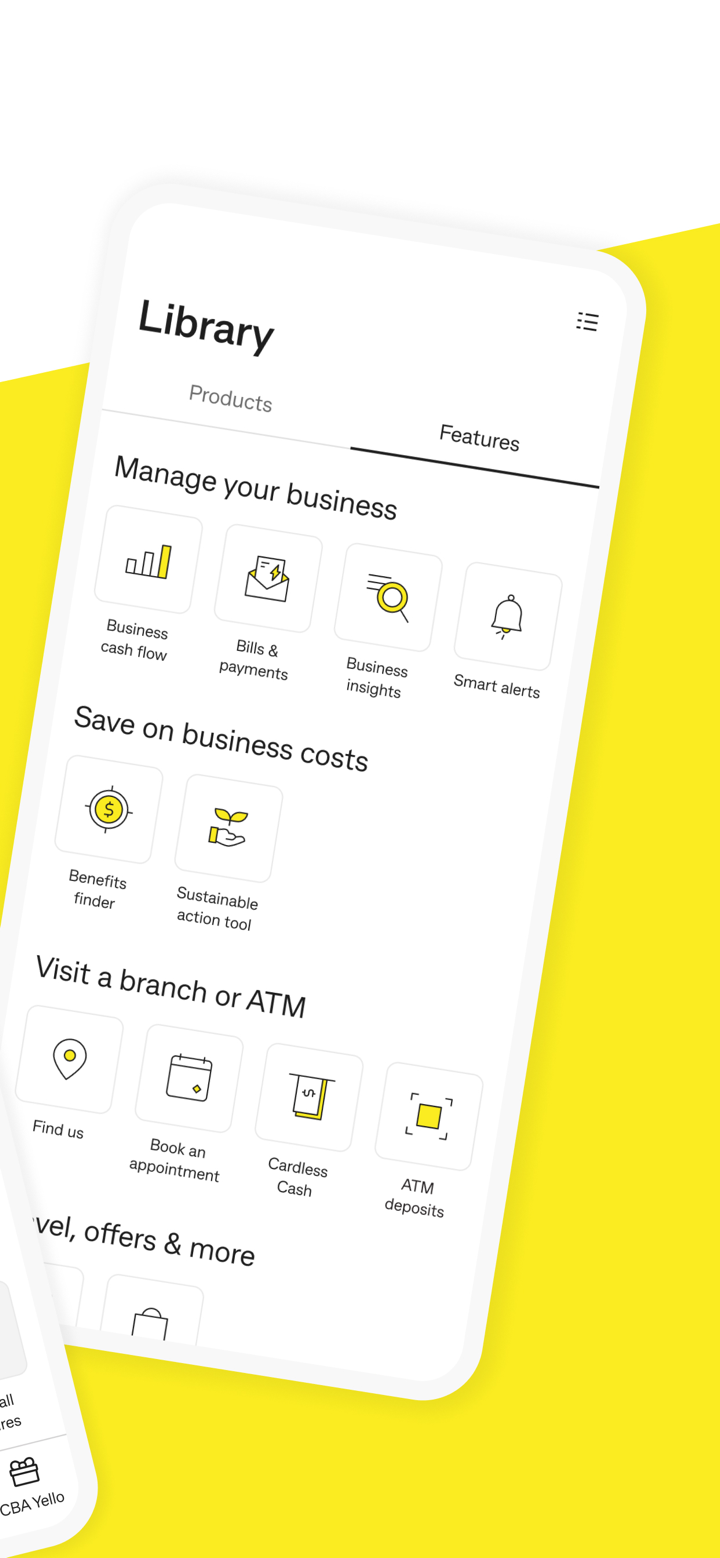

| Produk dan Layanan | Perbankan ritel, perbankan komersial, investasi, asuransi, superannuation, dll. |

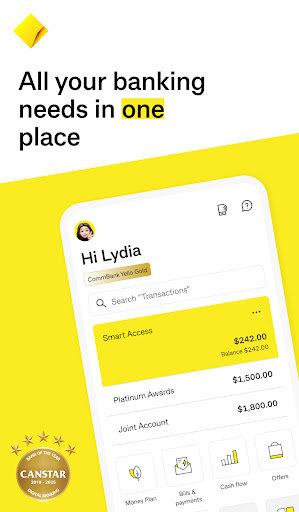

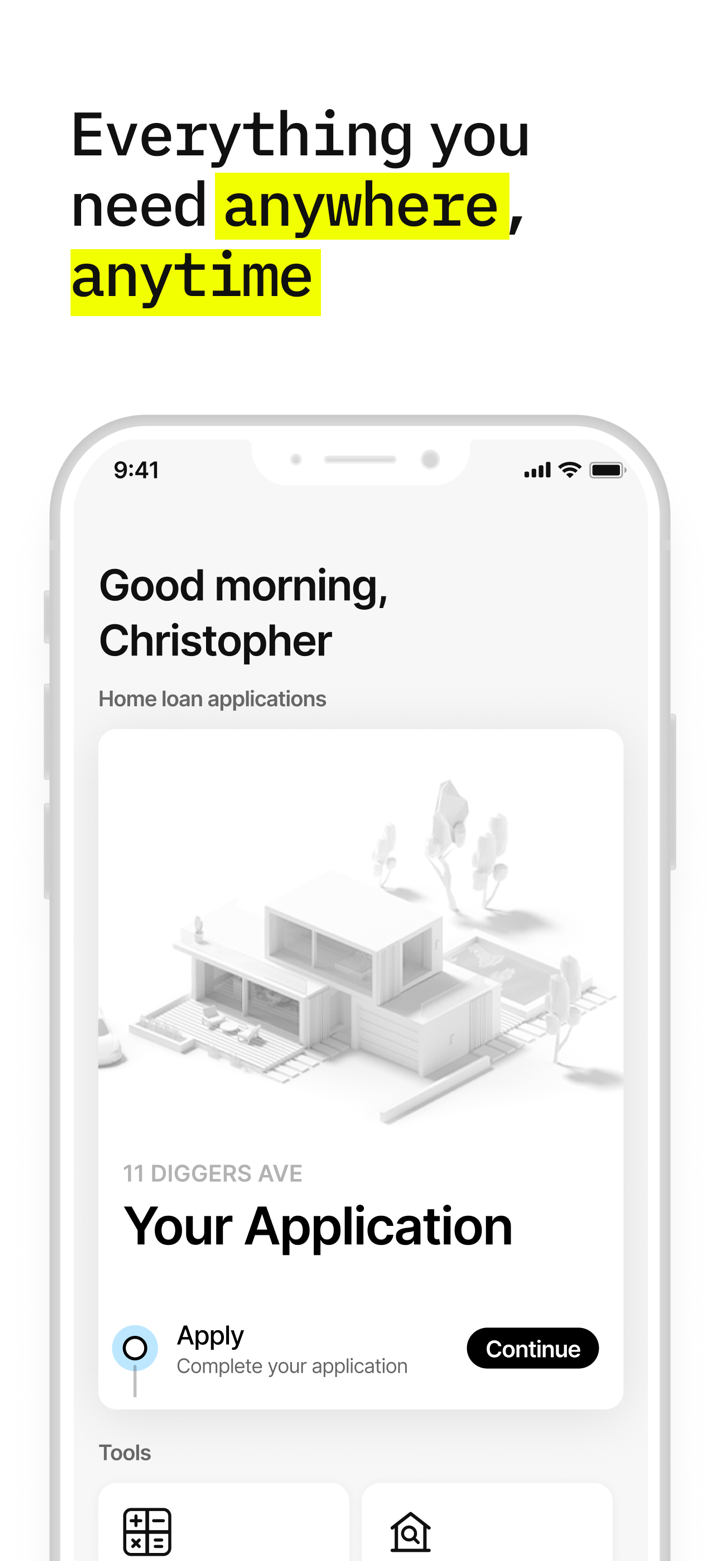

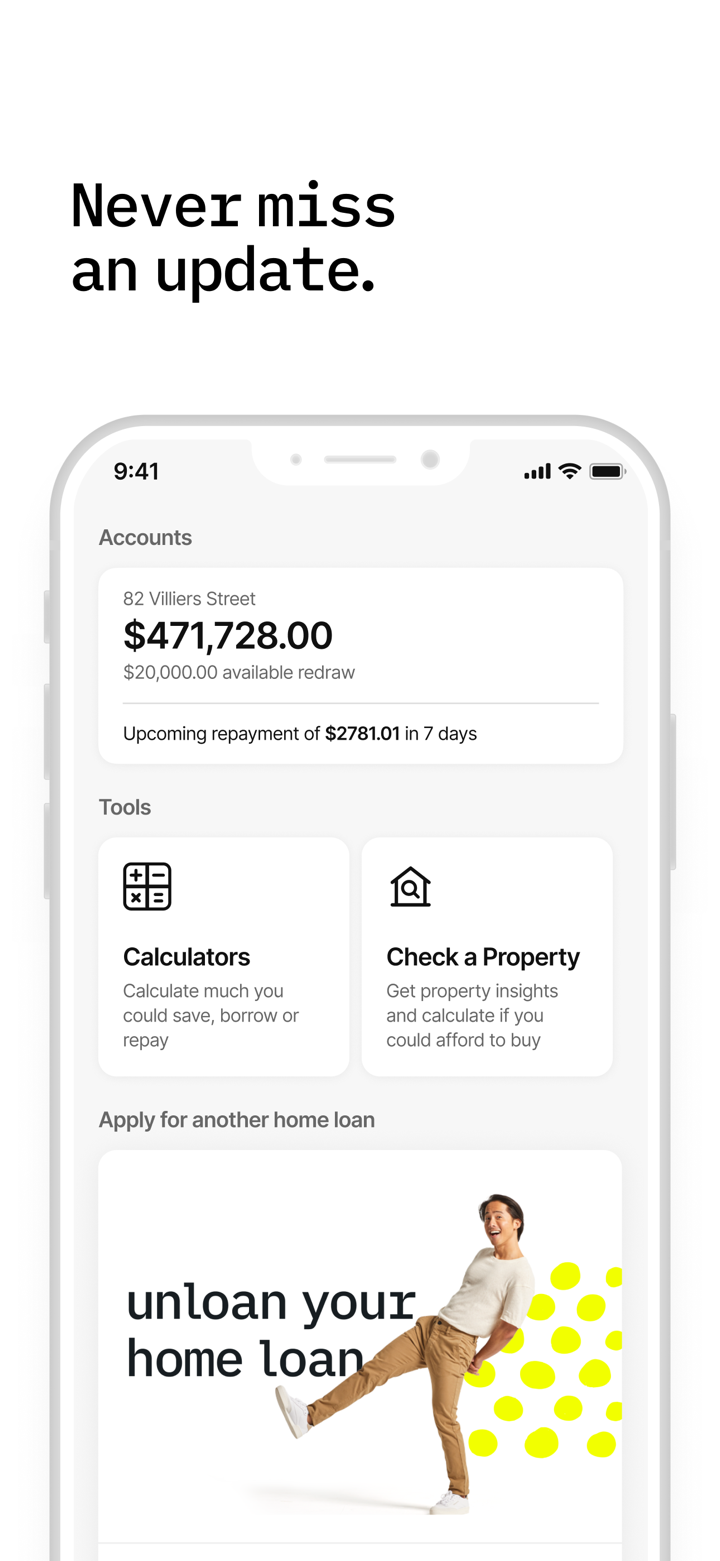

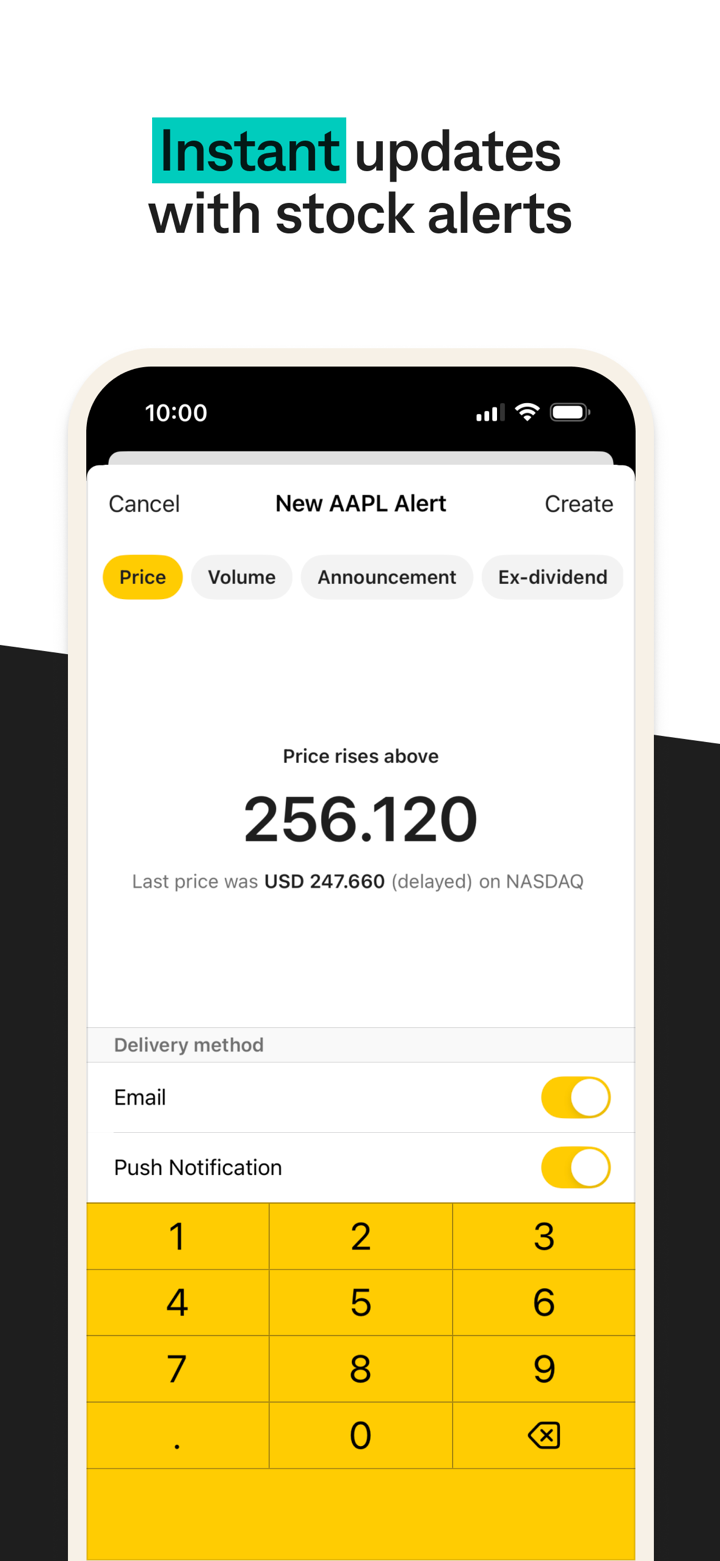

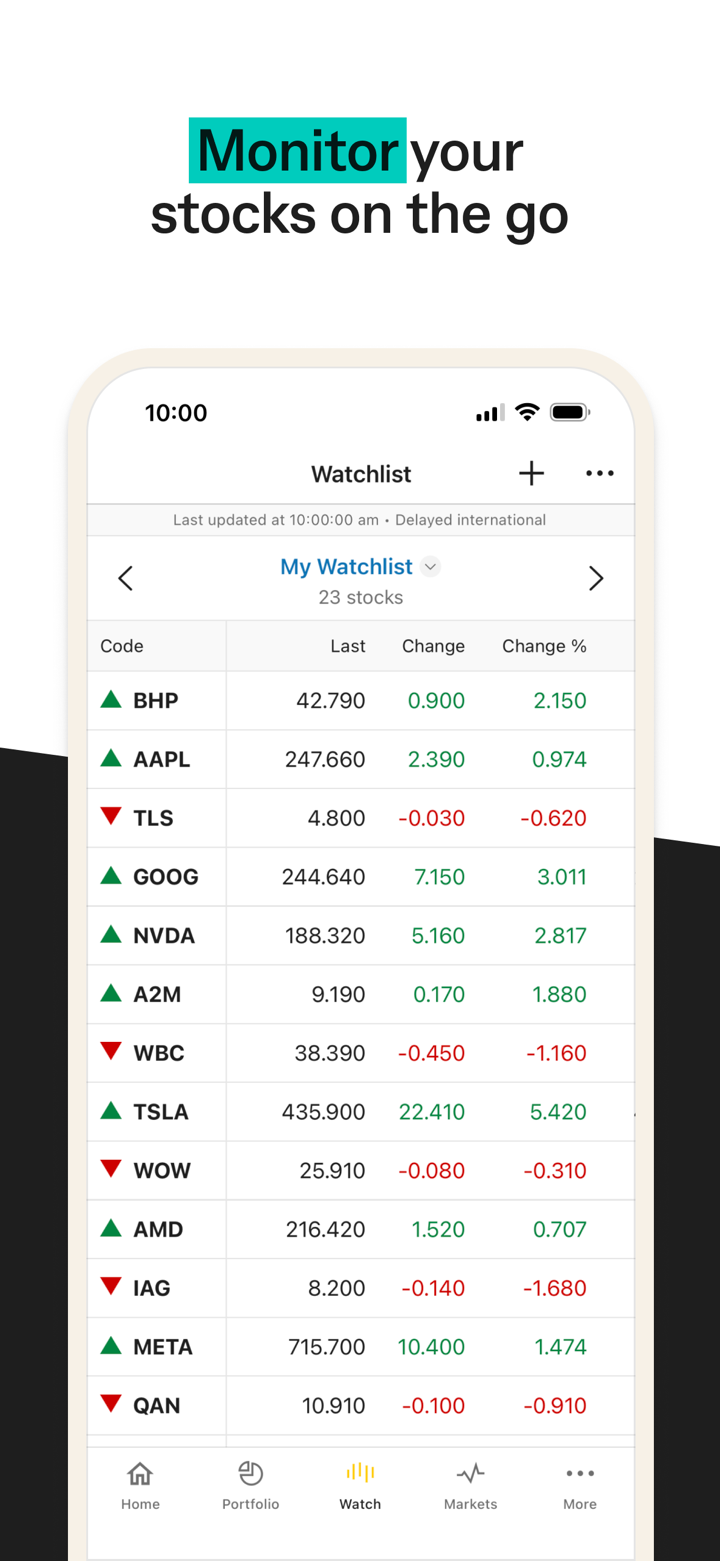

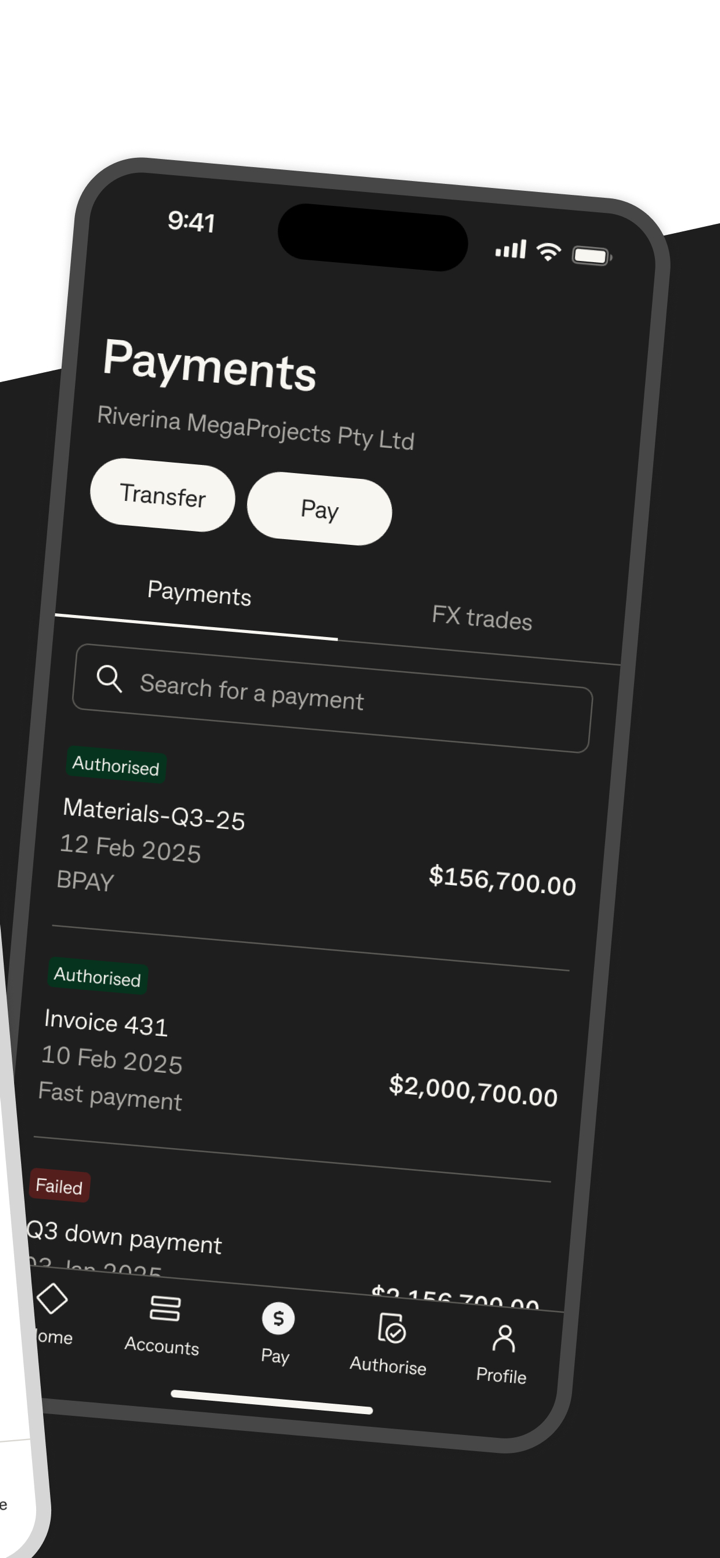

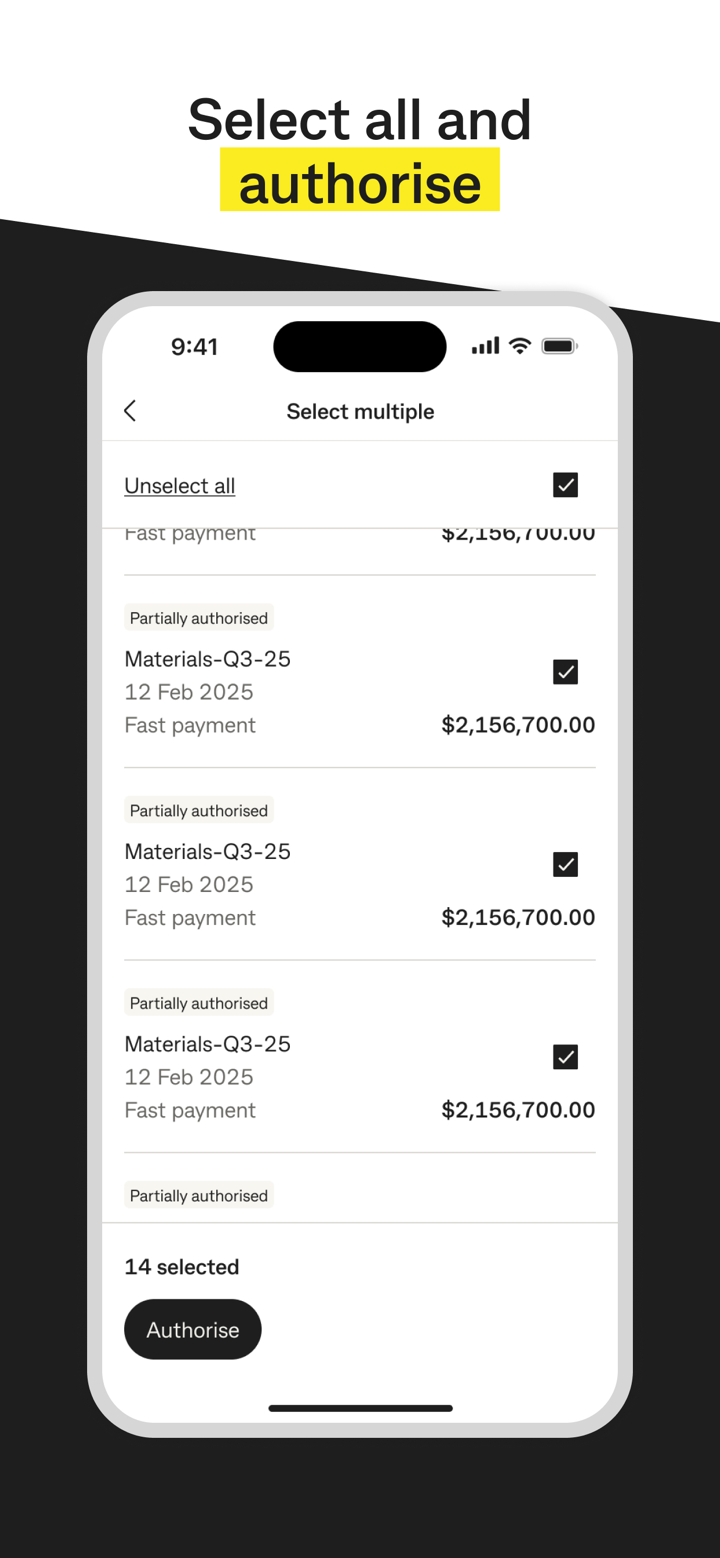

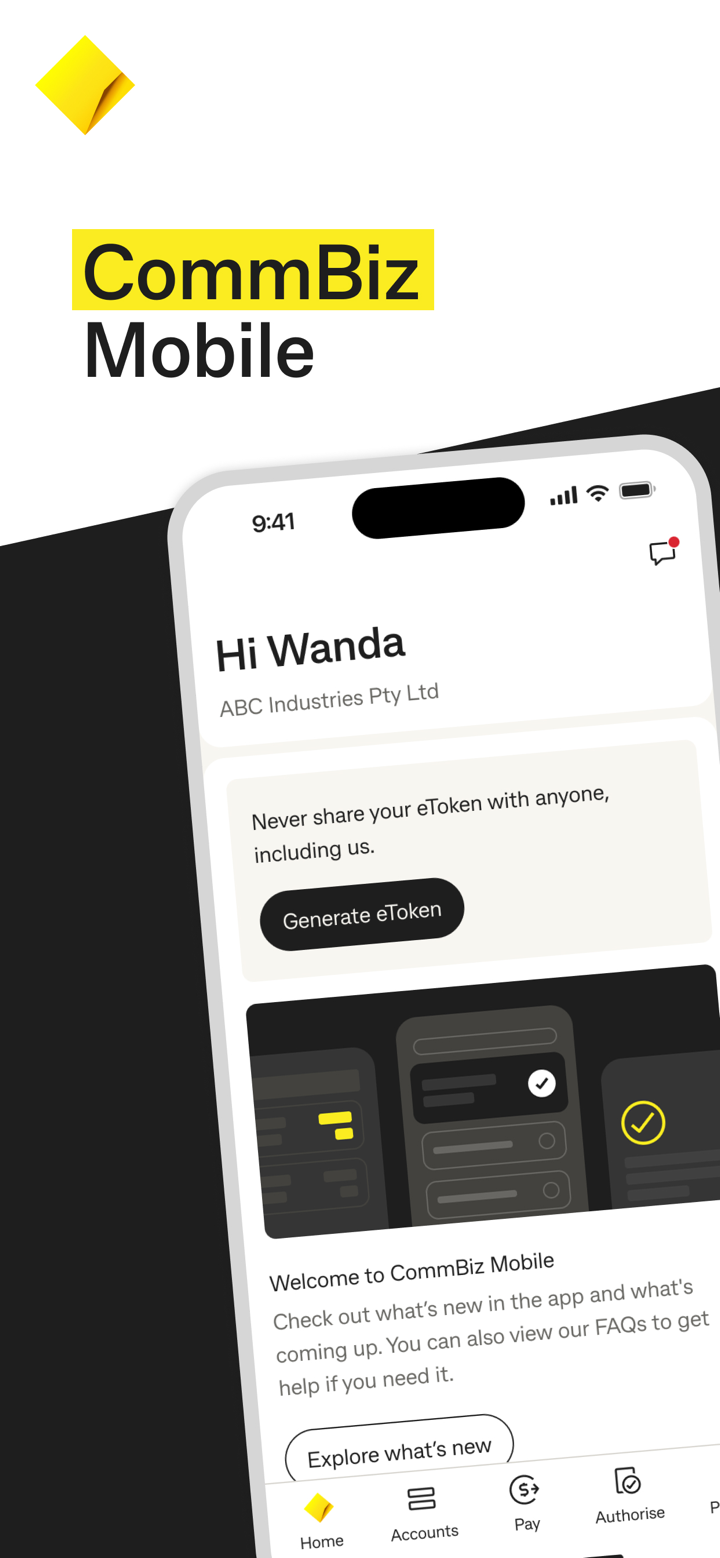

| Platform Perdagangan | Aplikasi CommBank, NetBank (Web), dan CommSec |

| Dukungan Pelanggan | +61 2 9999 3283 |

| 13 2221 | |

Pro dan Kontra

| Pro | Kontra |

| Teregulasi | Produk investasi internasional terbatas (pasar Australia). |

| Layanan keuangan yang beragam | Struktur biaya kompleks |

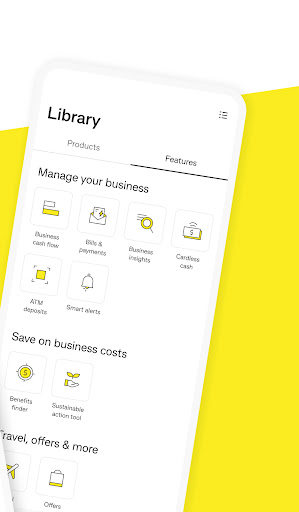

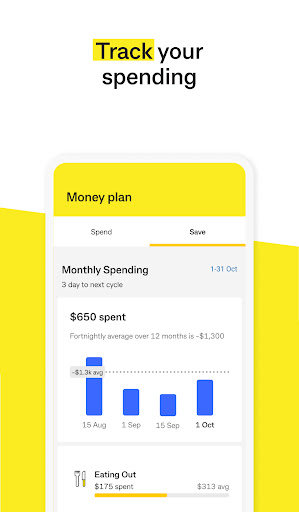

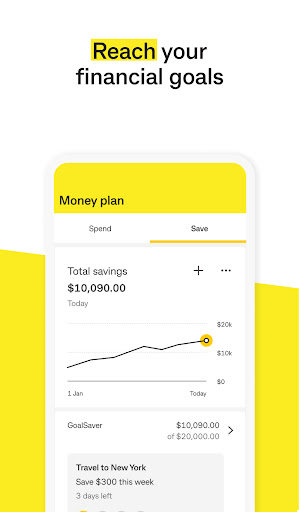

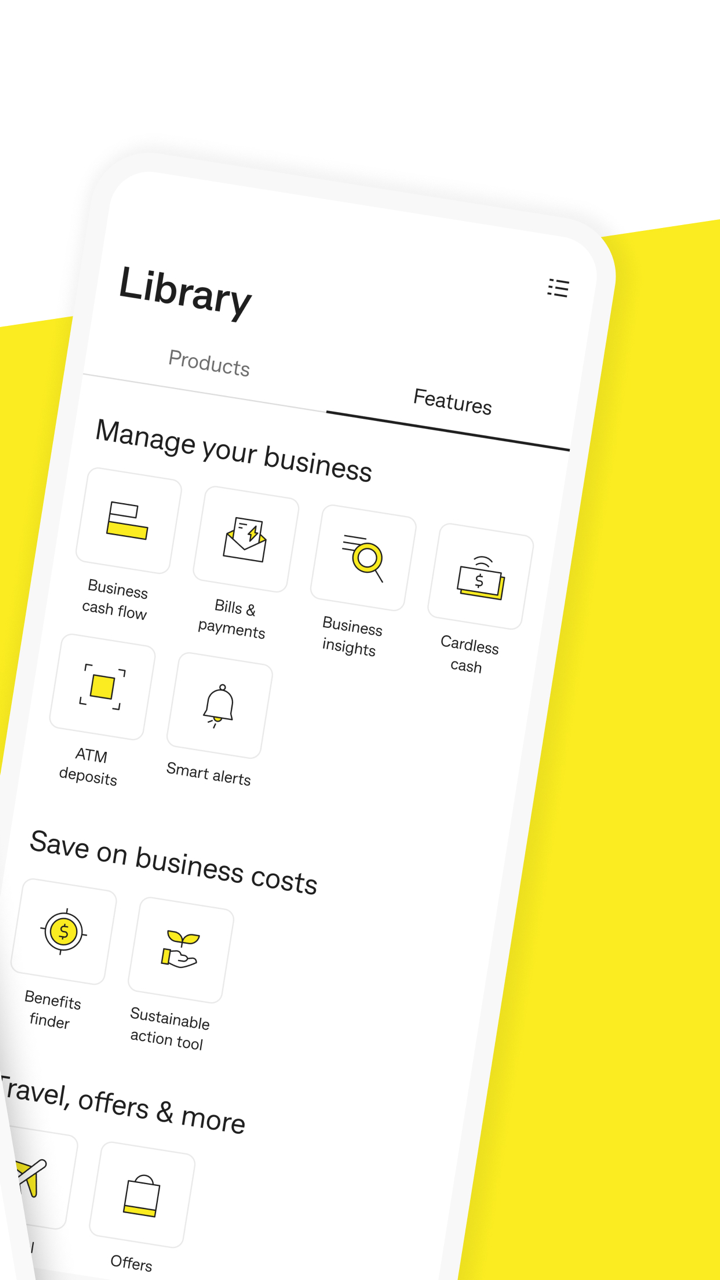

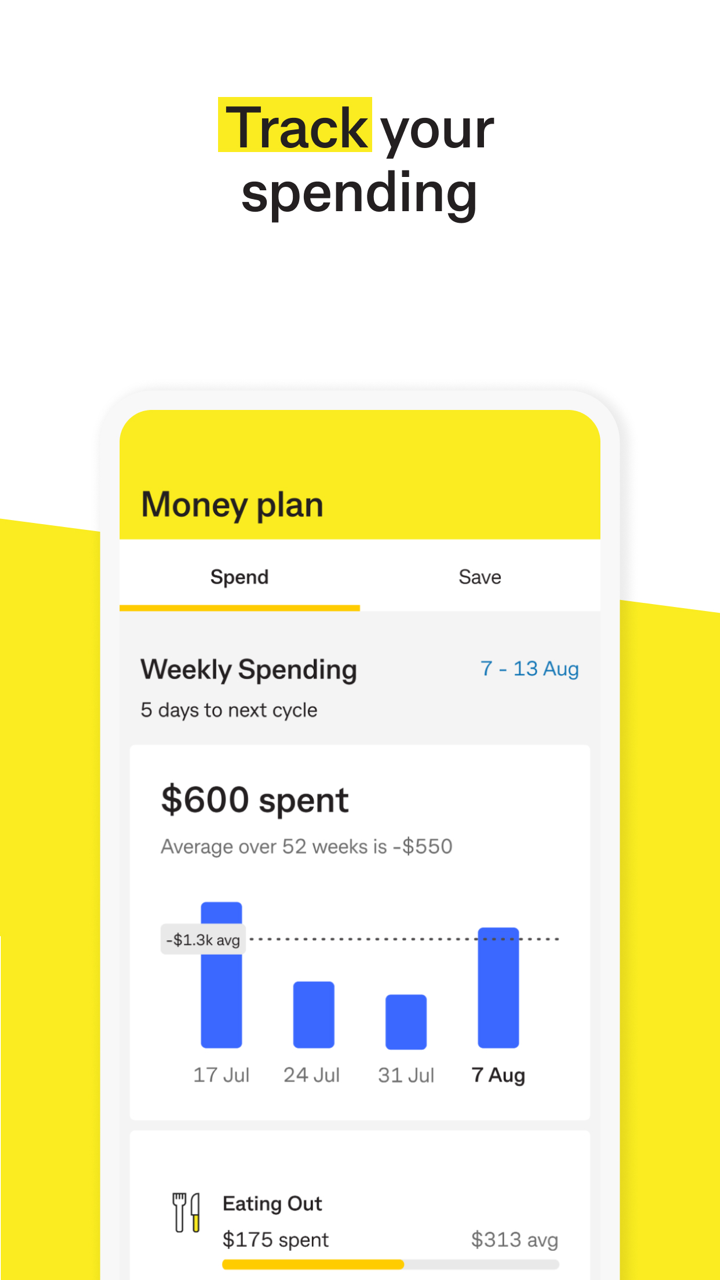

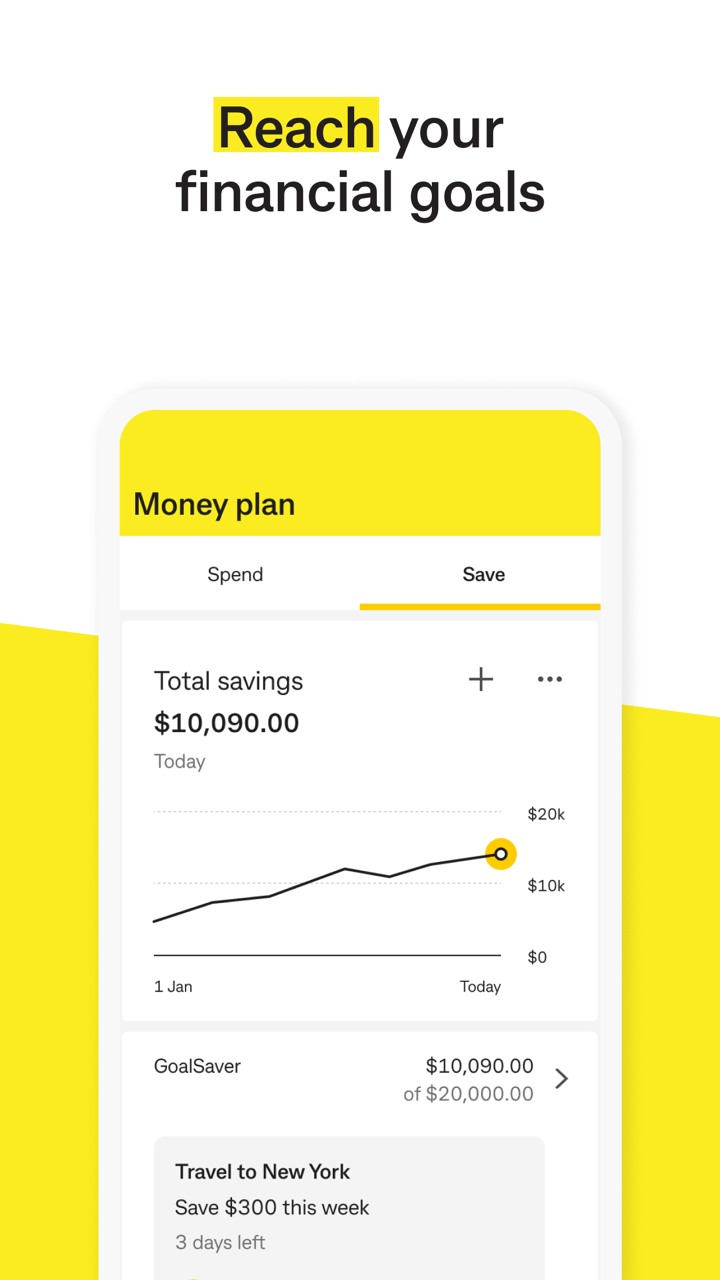

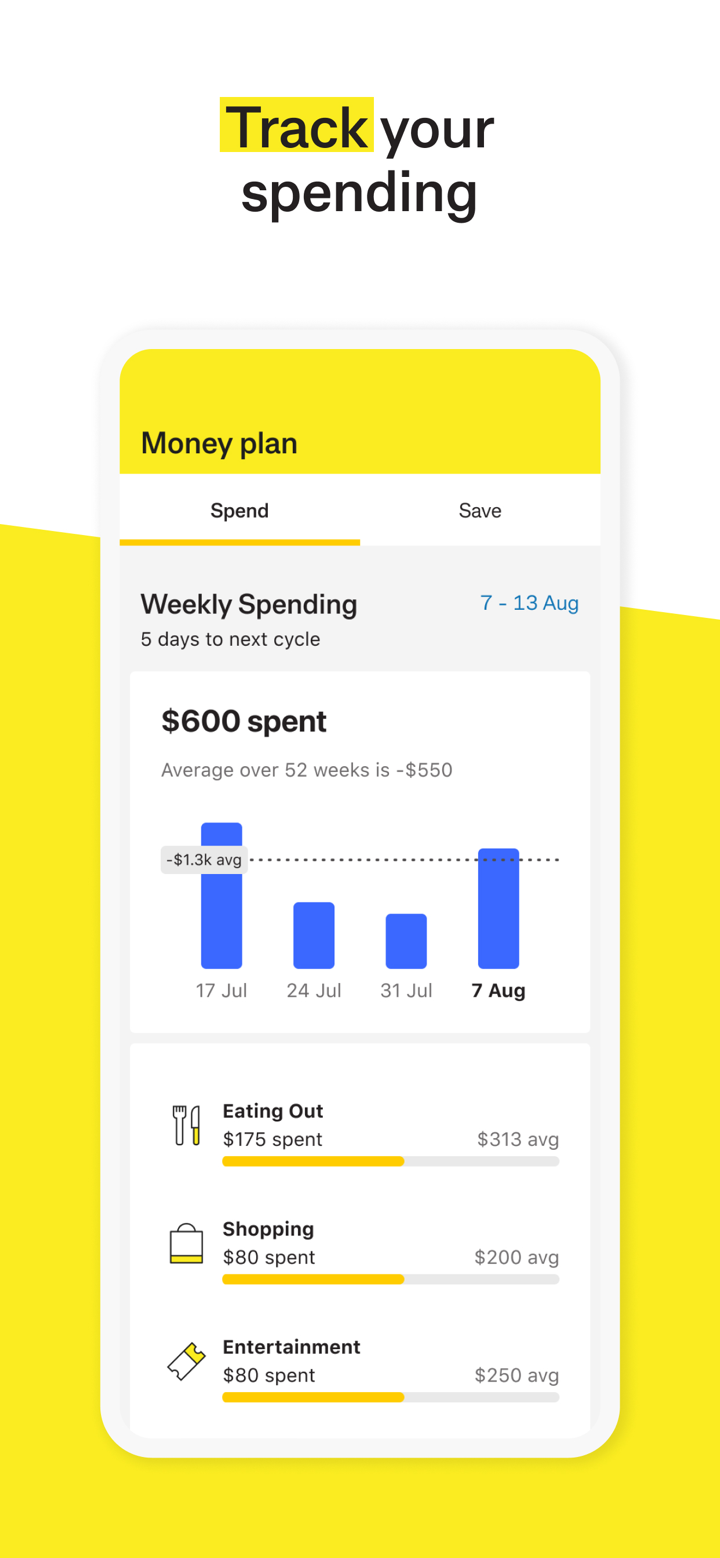

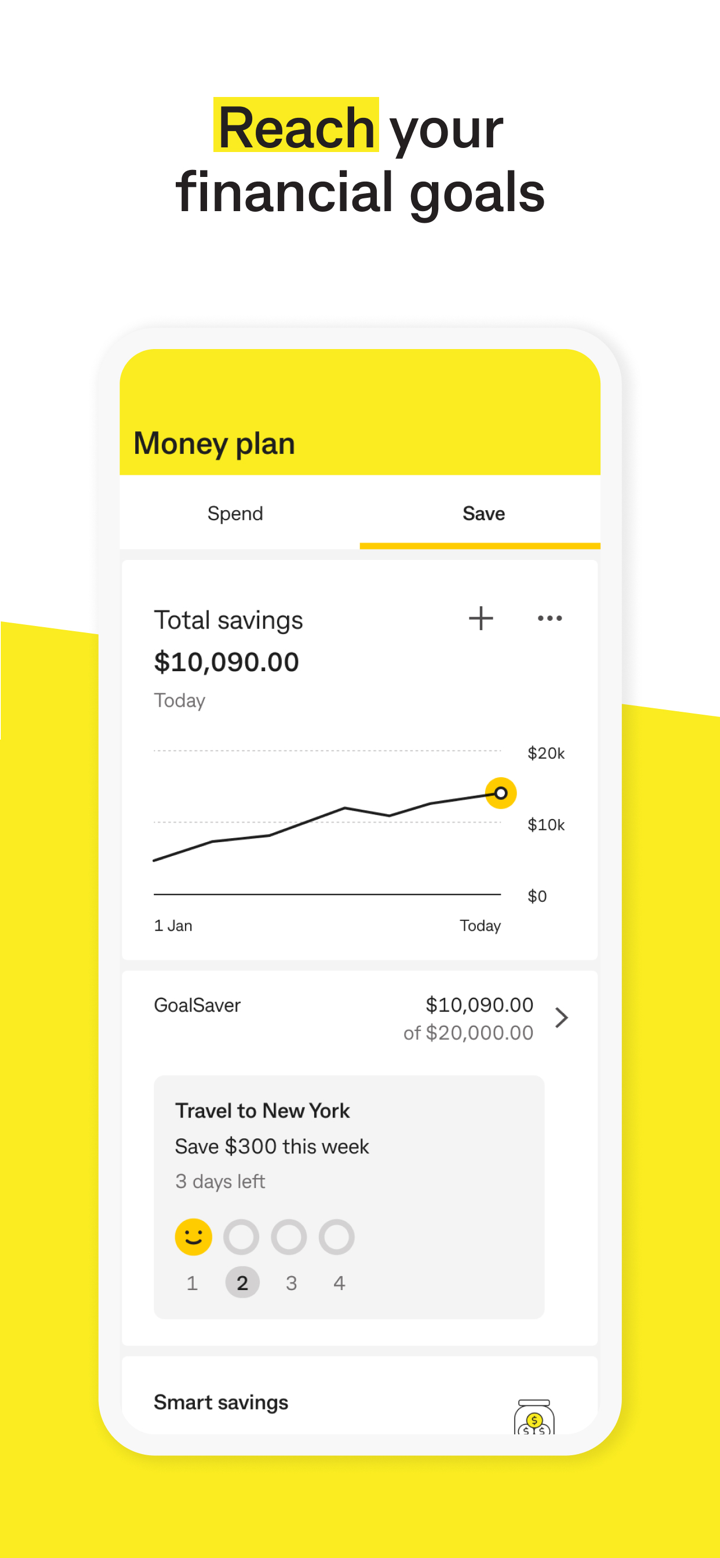

| Alat digital canggih (mis., aplikasi CommBank) | Pembatasan pada layanan luar negeri |

| Program loyalitas pelanggan |

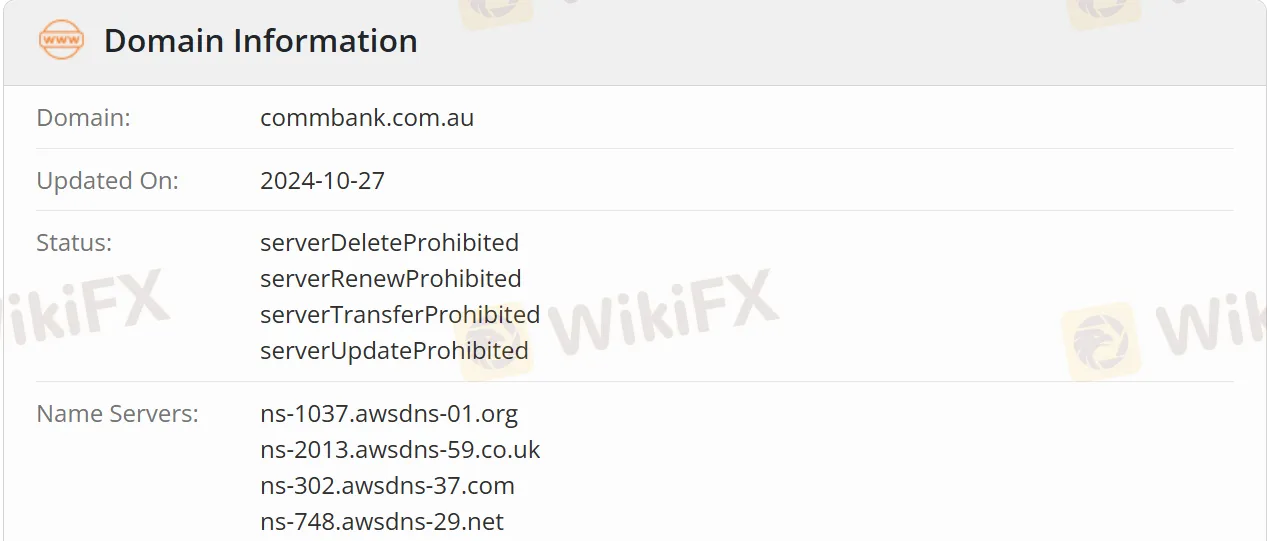

Apakah CommBank Legal?

CommBank adalah bank yang sudah lama berdiri dengan sejarah panjang di Australia. Bank ini diatur dengan ketat oleh APRA dan merupakan anggota Australian Financial Claims Scheme. Komisi Sekuritas dan Investasi Australia (ASIC) mengatur bank ini, dan nomor lisensinya adalah 000234945. Oleh karena itu, keamanan deposito terjamin.

Layanan Apa yang Ditawarkan oleh CommBank?

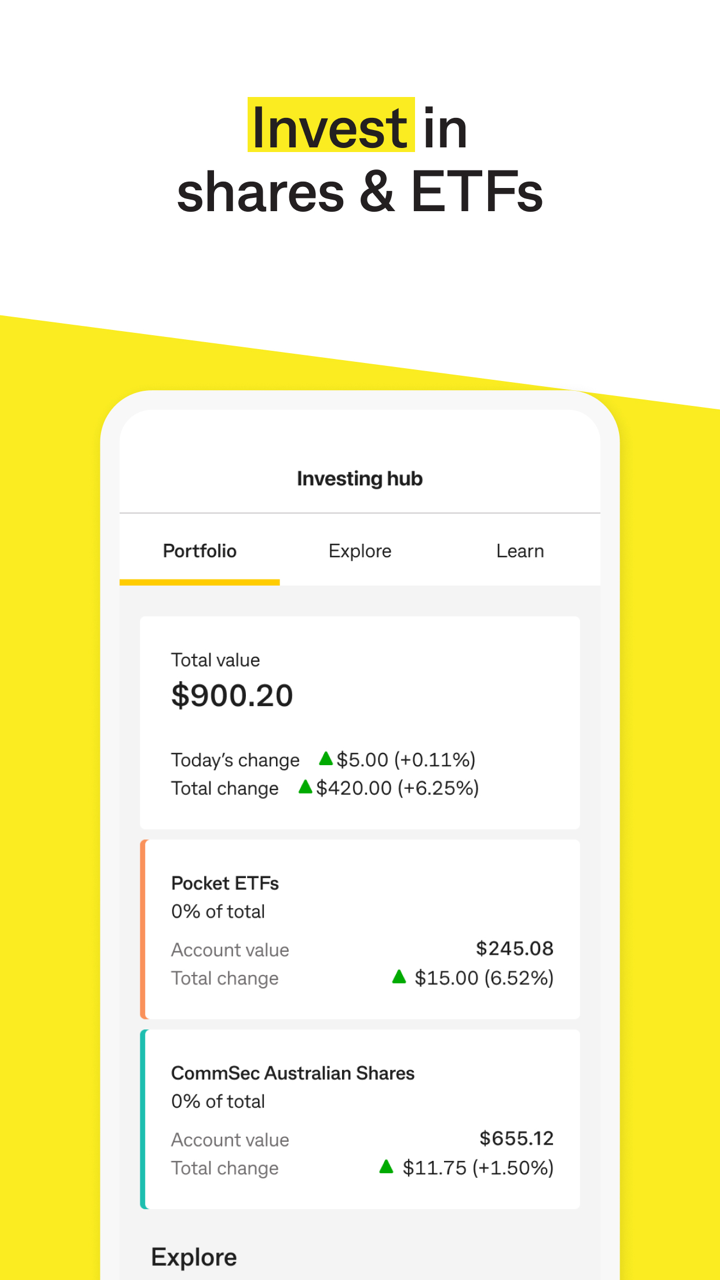

Jenis transaksi investasi meliputi empat kategori berikut:

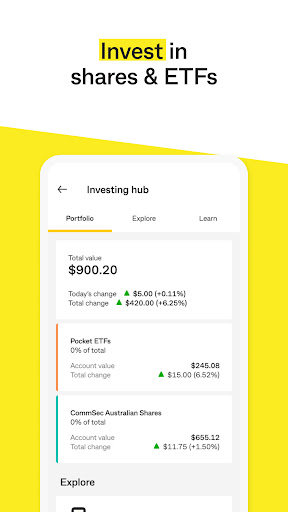

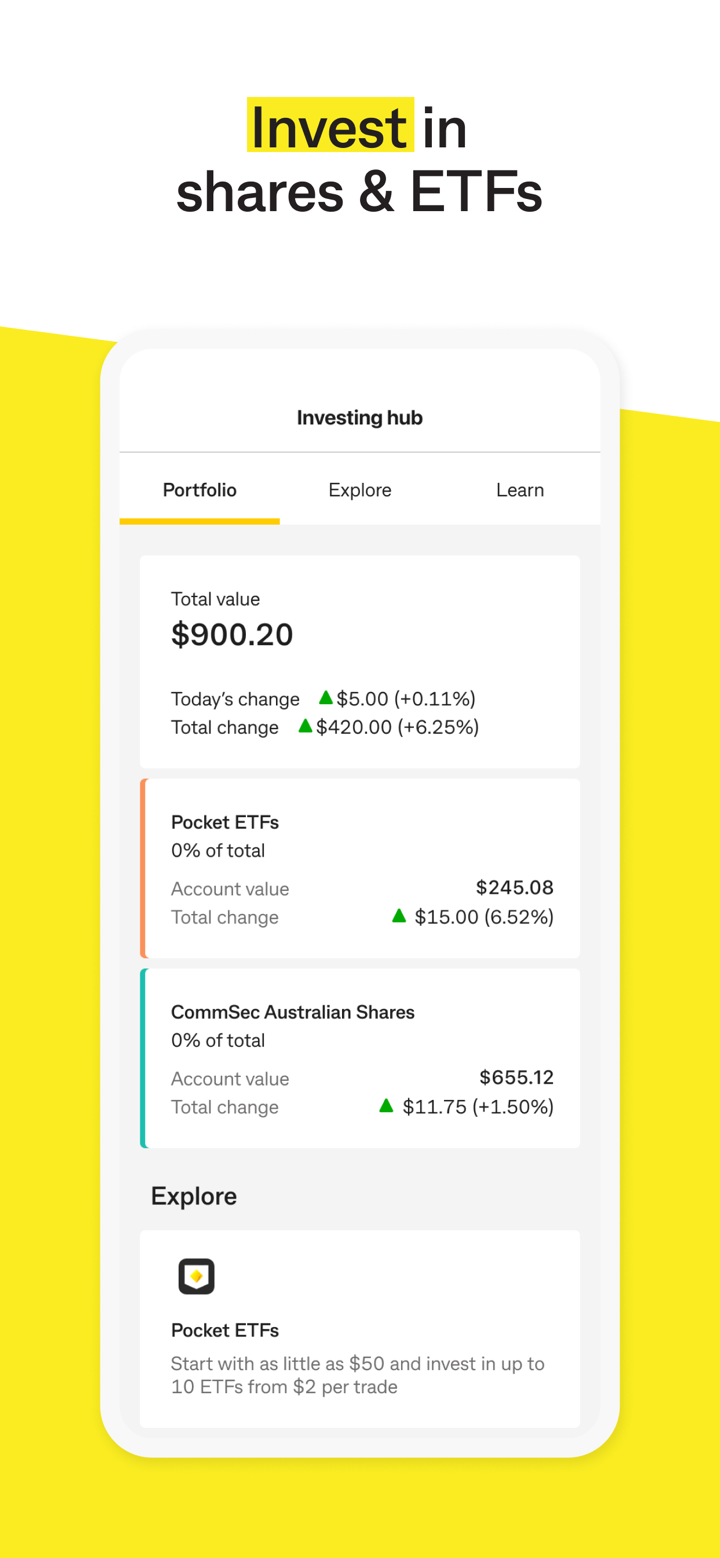

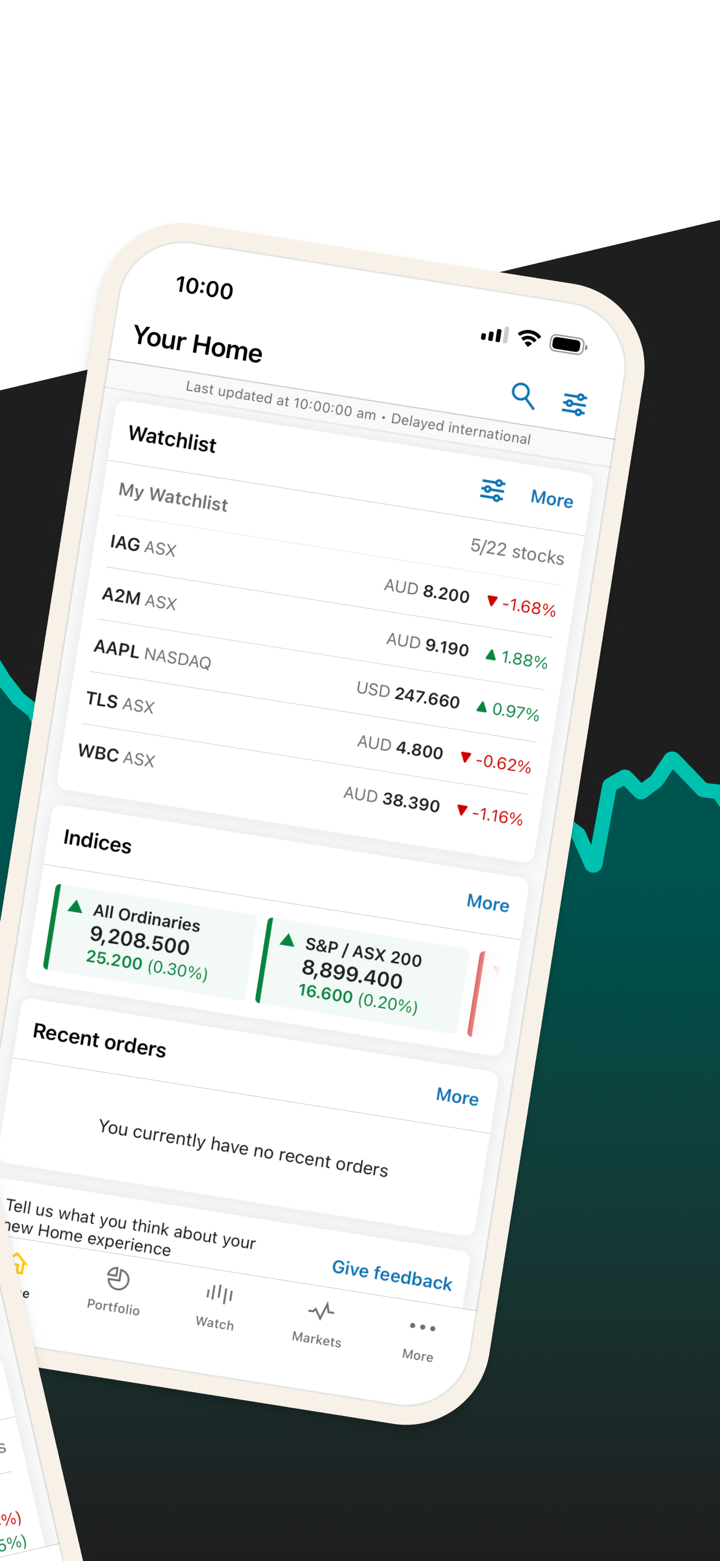

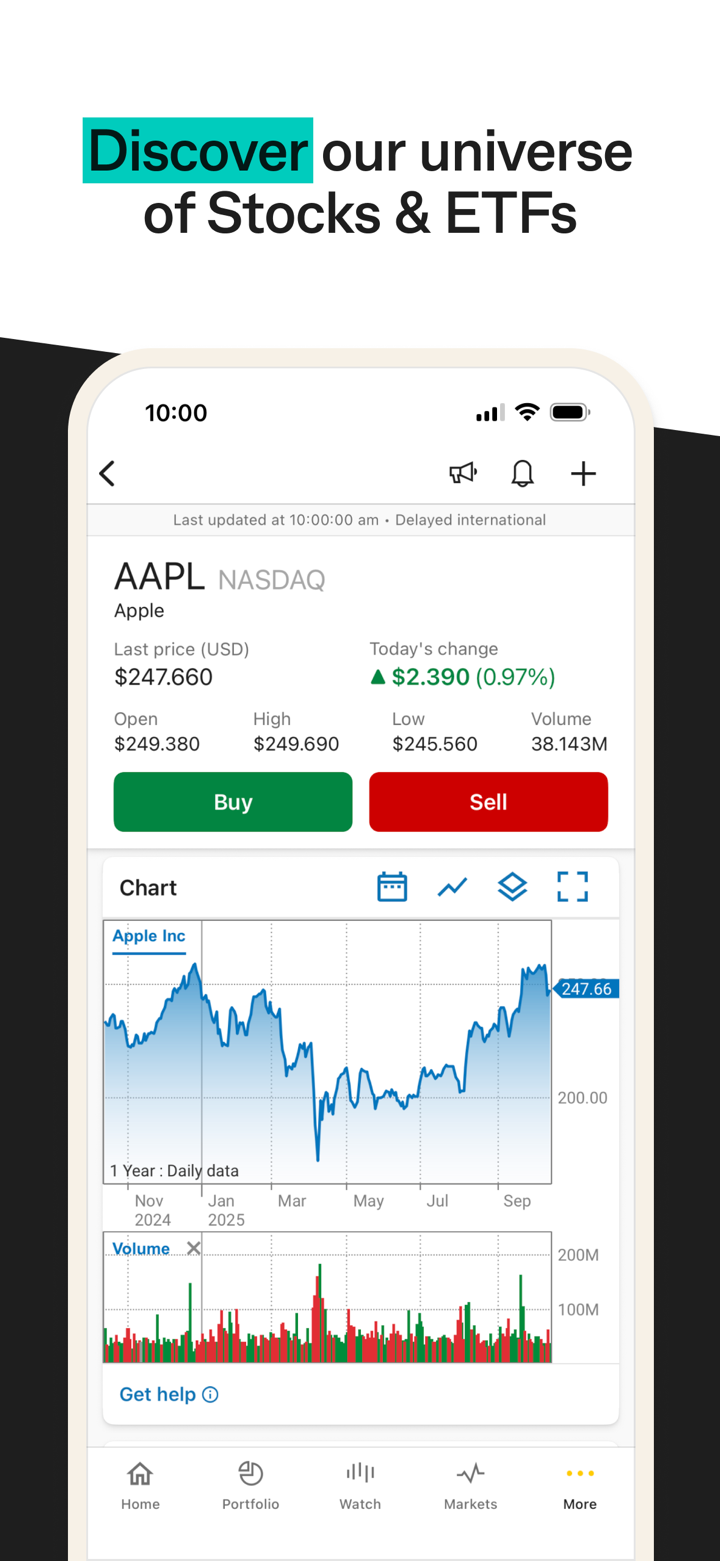

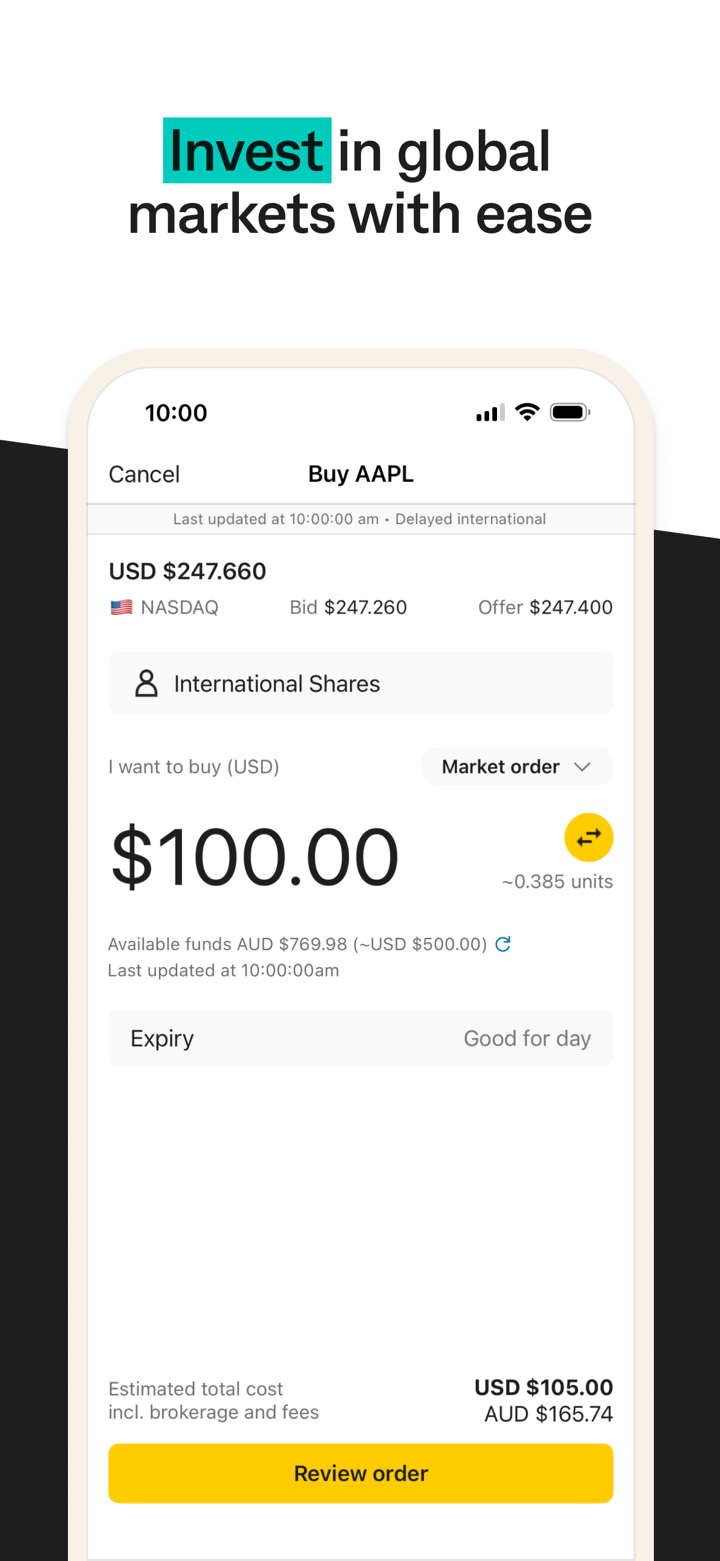

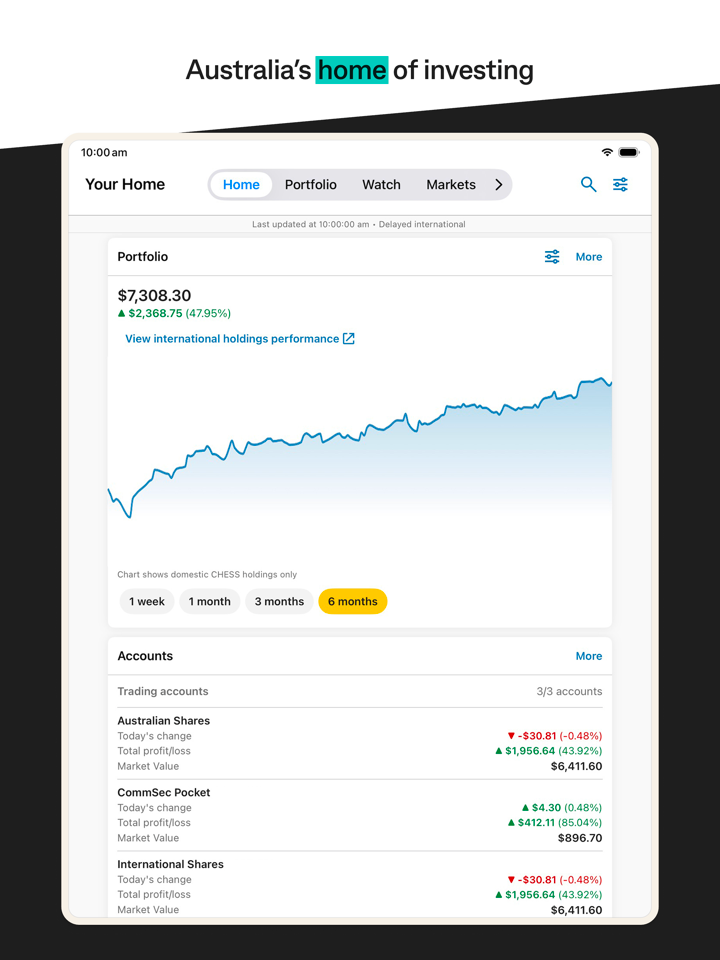

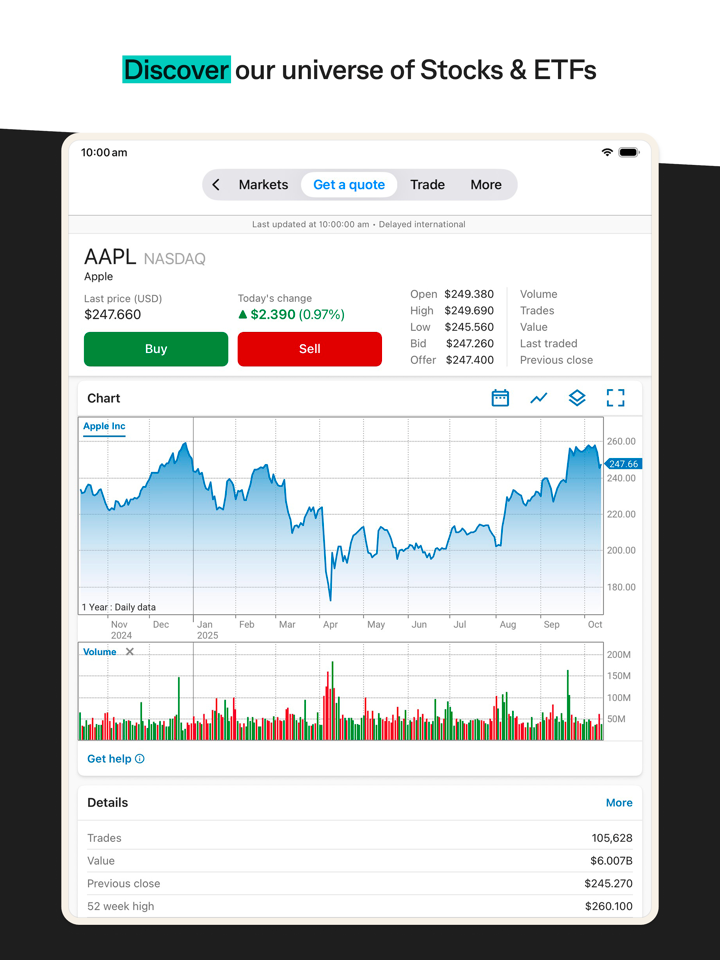

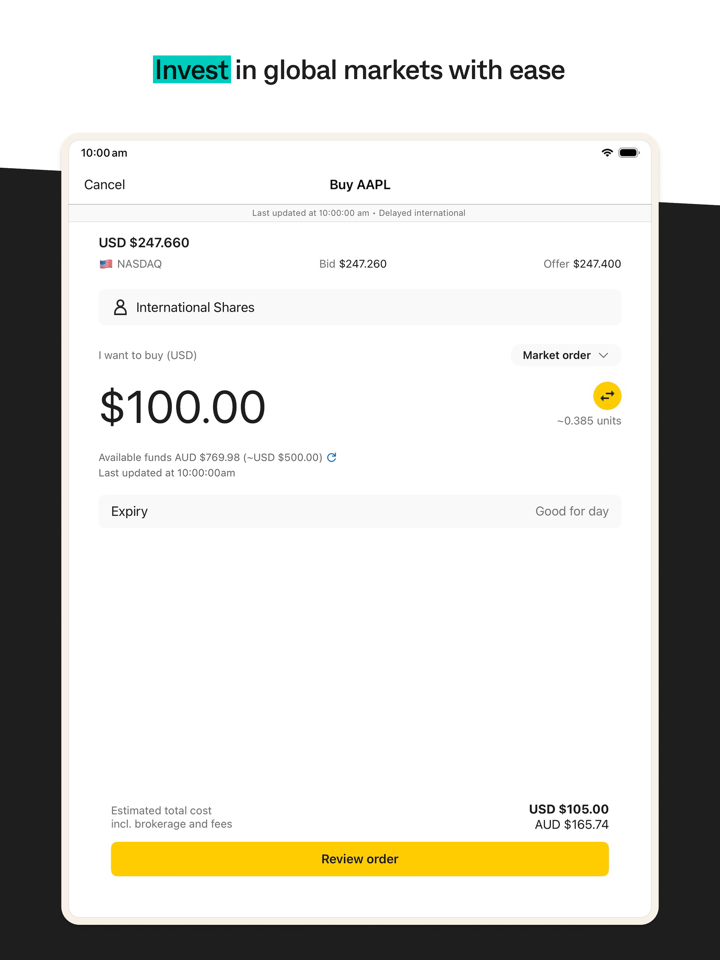

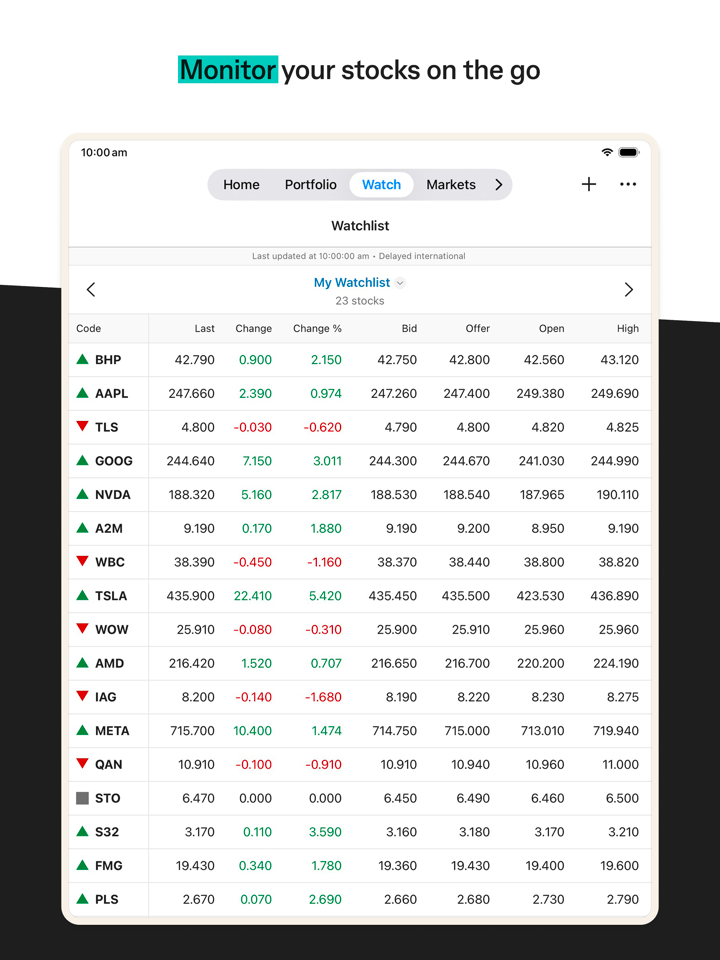

Saham Australia (ASX): Perdagangkan lebih dari 2.000 saham Australia melalui platform CommSec. Perdagangan pertama minimum adalah $500, dan perdagangan berikutnya dimulai dari $100.

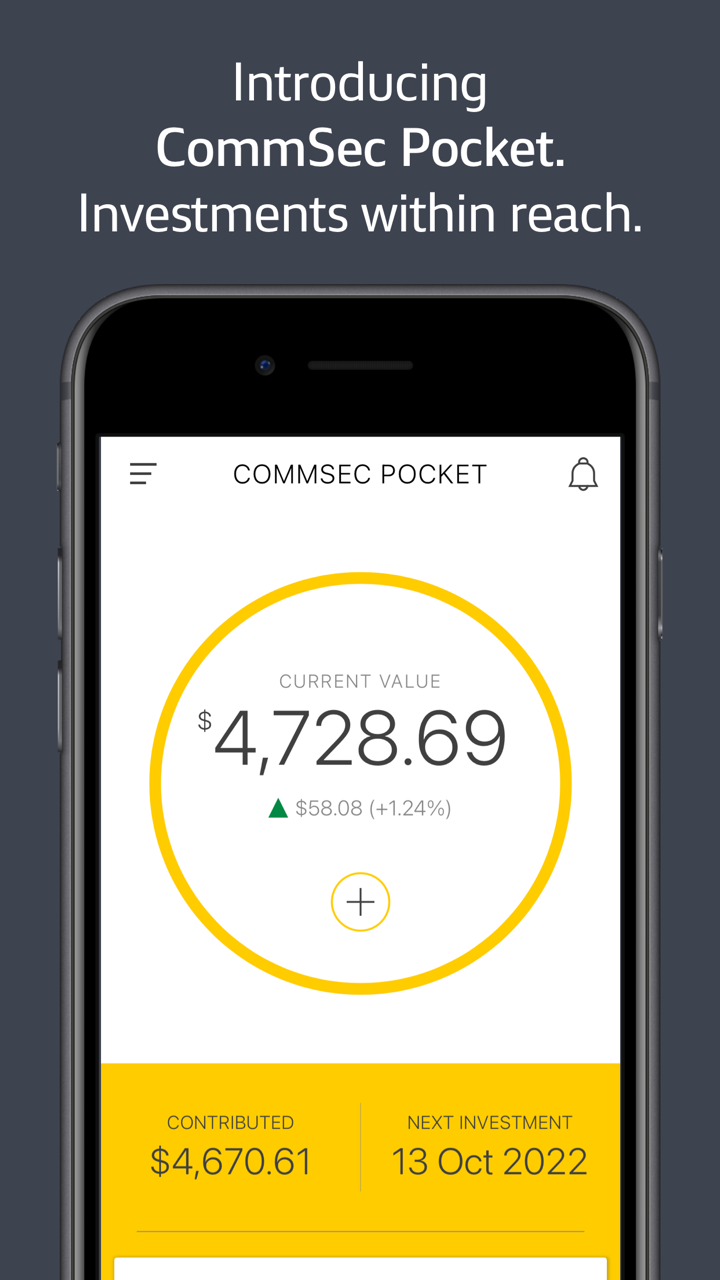

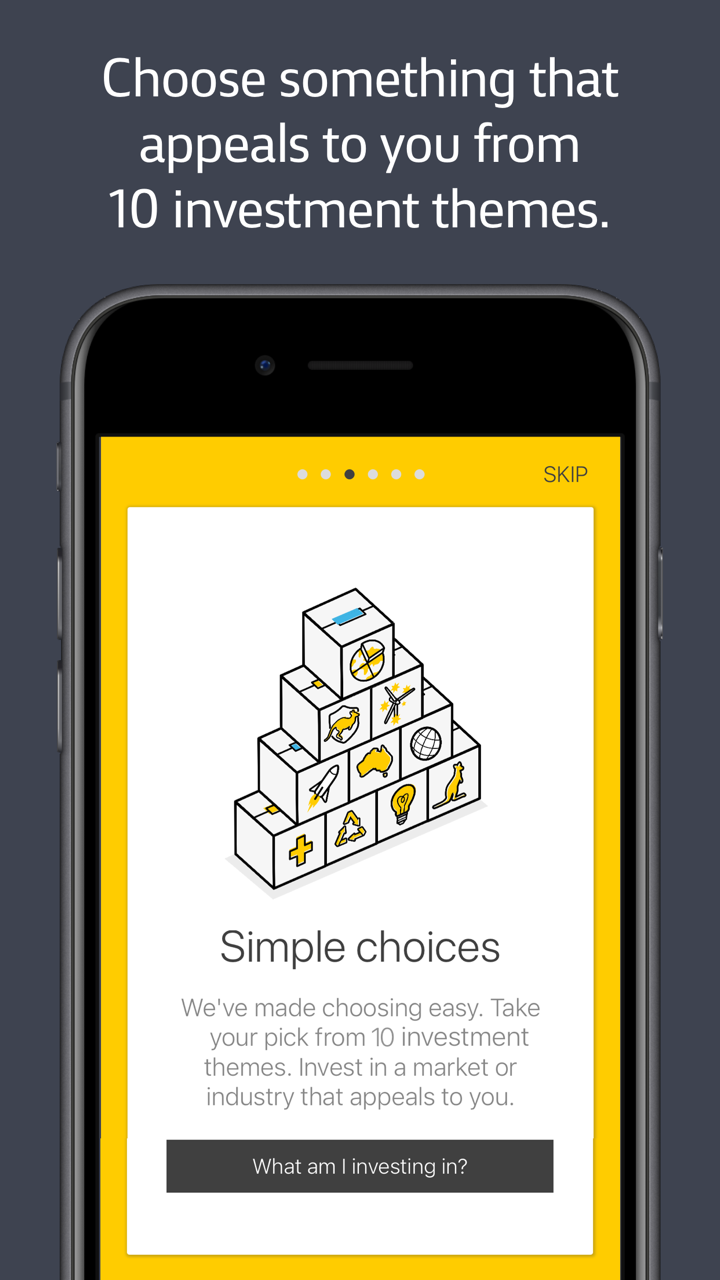

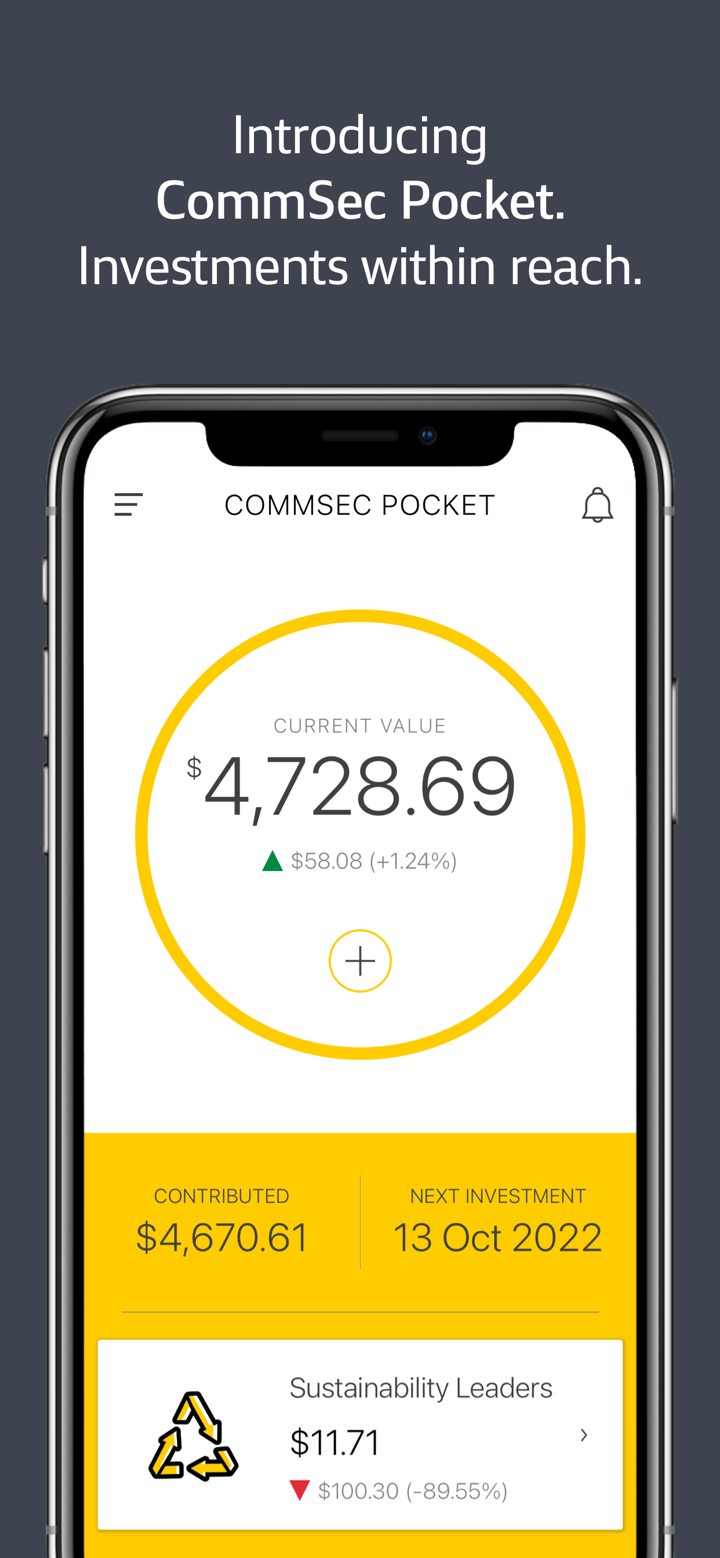

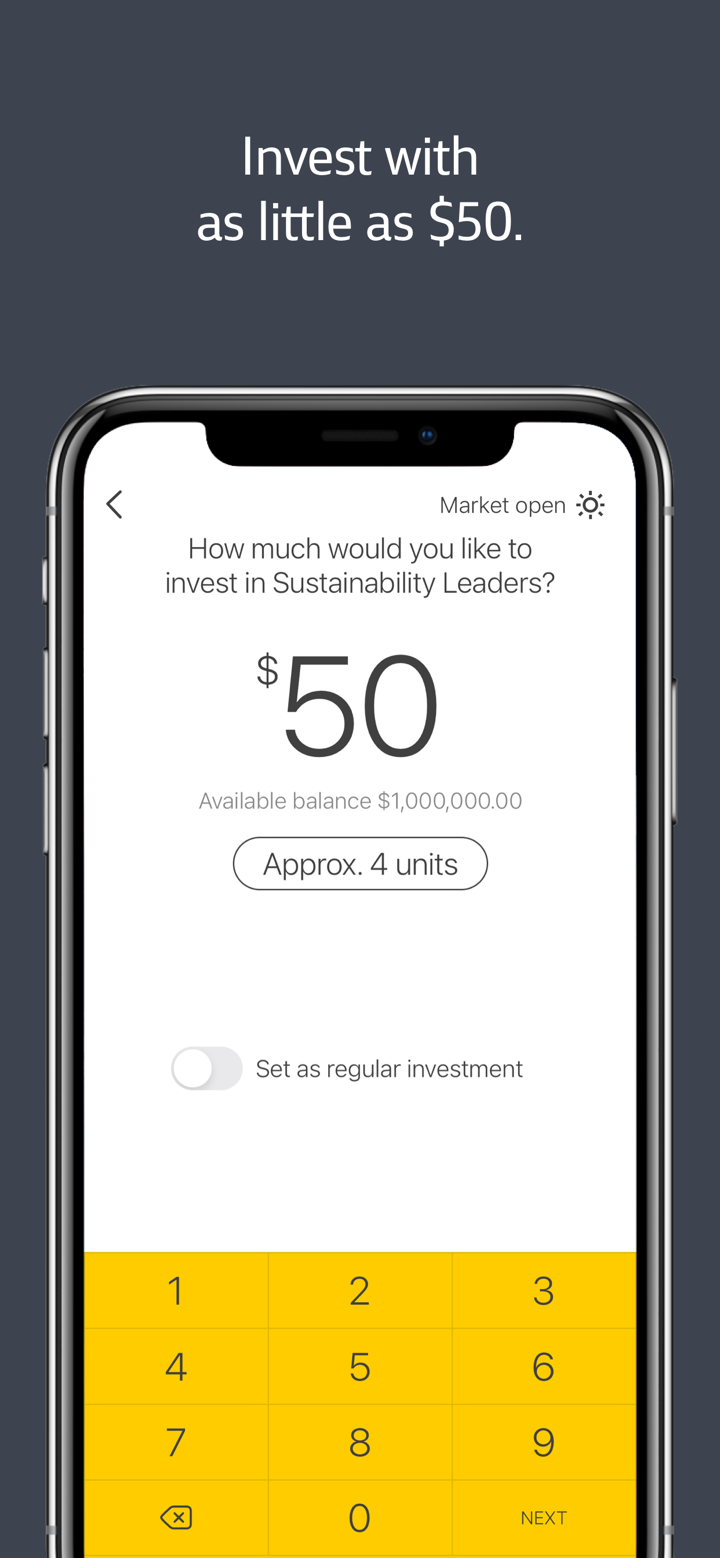

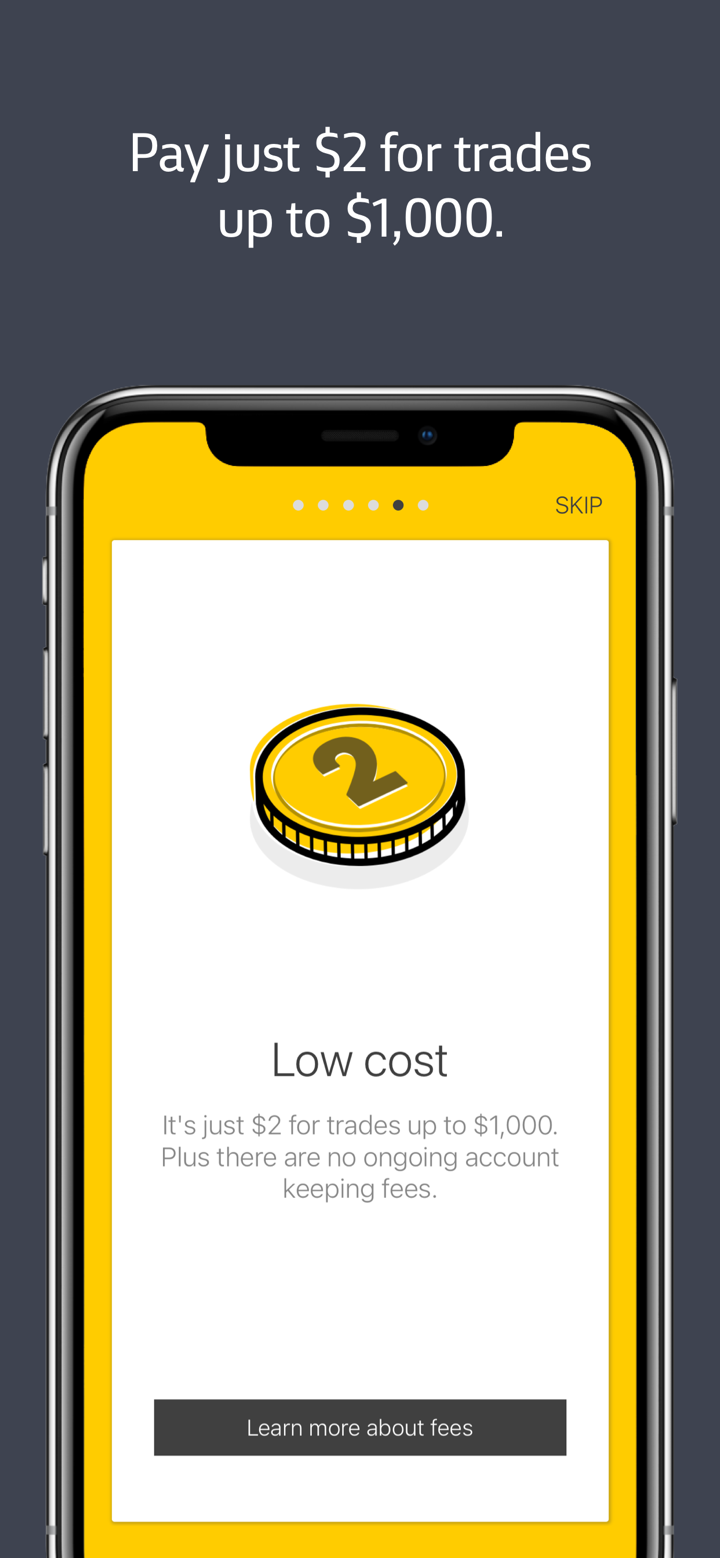

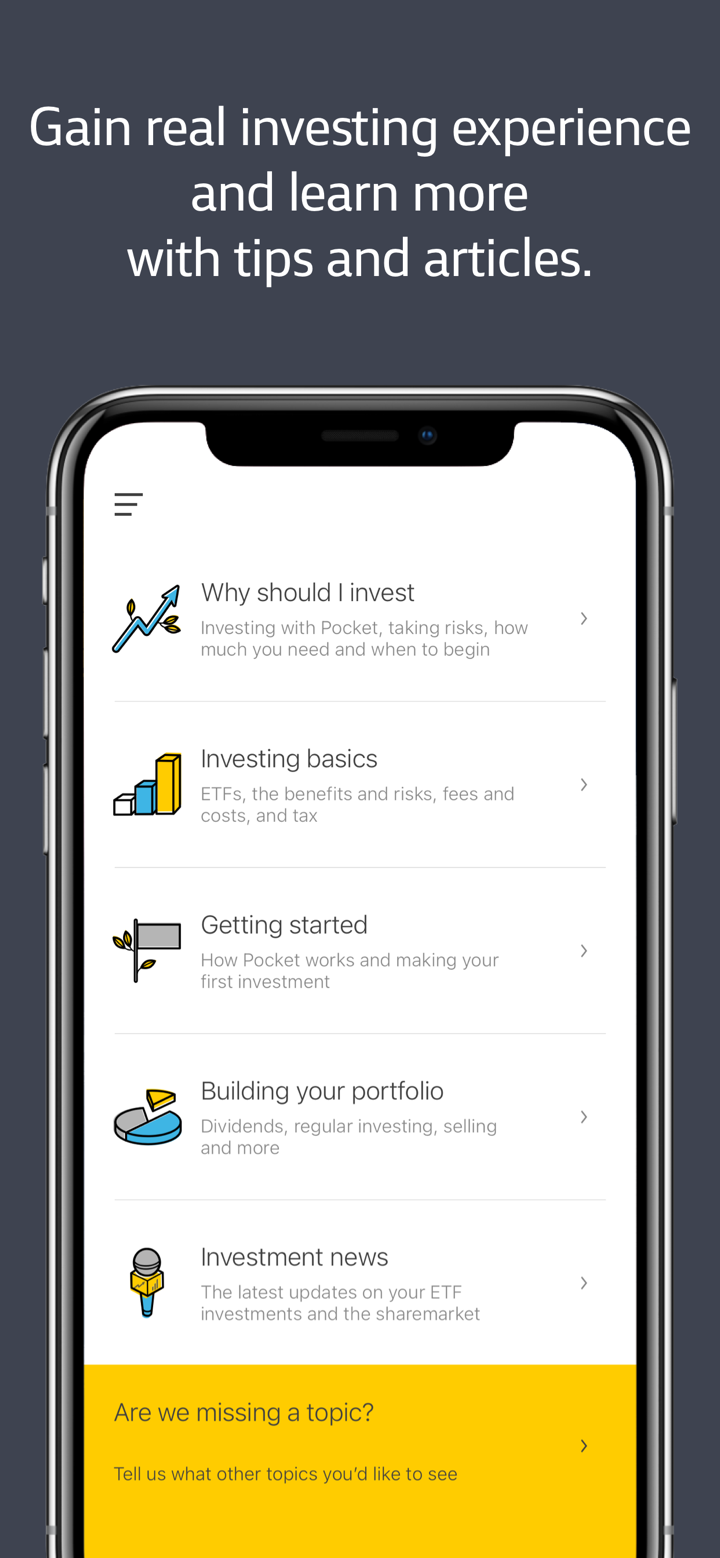

Dana yang Diperdagangkan di Bursa (ETF): Pocket ETF menawarkan 10+ ETF berbasis tema (mis., teknologi, perawatan kesehatan) dengan investasi minimum $50. Komisi adalah $2 per perdagangan (untuk perdagangan ≤ $1.000) atau 0,2% (untuk perdagangan > $1.000).

Superannuation: Disediakan oleh Colonial First State, produk seperti Essential Super memiliki biaya 15% lebih rendah dari rata-rata industri.

- Deposito Berjangka dan Rekening Tabungan: Tingkat bunga terbatas sebesar 4,05% ditawarkan untuk rekening investasi bisnis 9 bulan, sementara tingkat rekening tabungan biasa fluktuatif dengan pasar.

| Layanan | Didukung |

| Saham Australia (ASX) | ✔ |

| Dana yang Diperdagangkan di Bursa (ETF) | ✔ |

| Superannuation | ✔ |

| Deposito Berjangka dan Rekening Tabungan | ✔ |

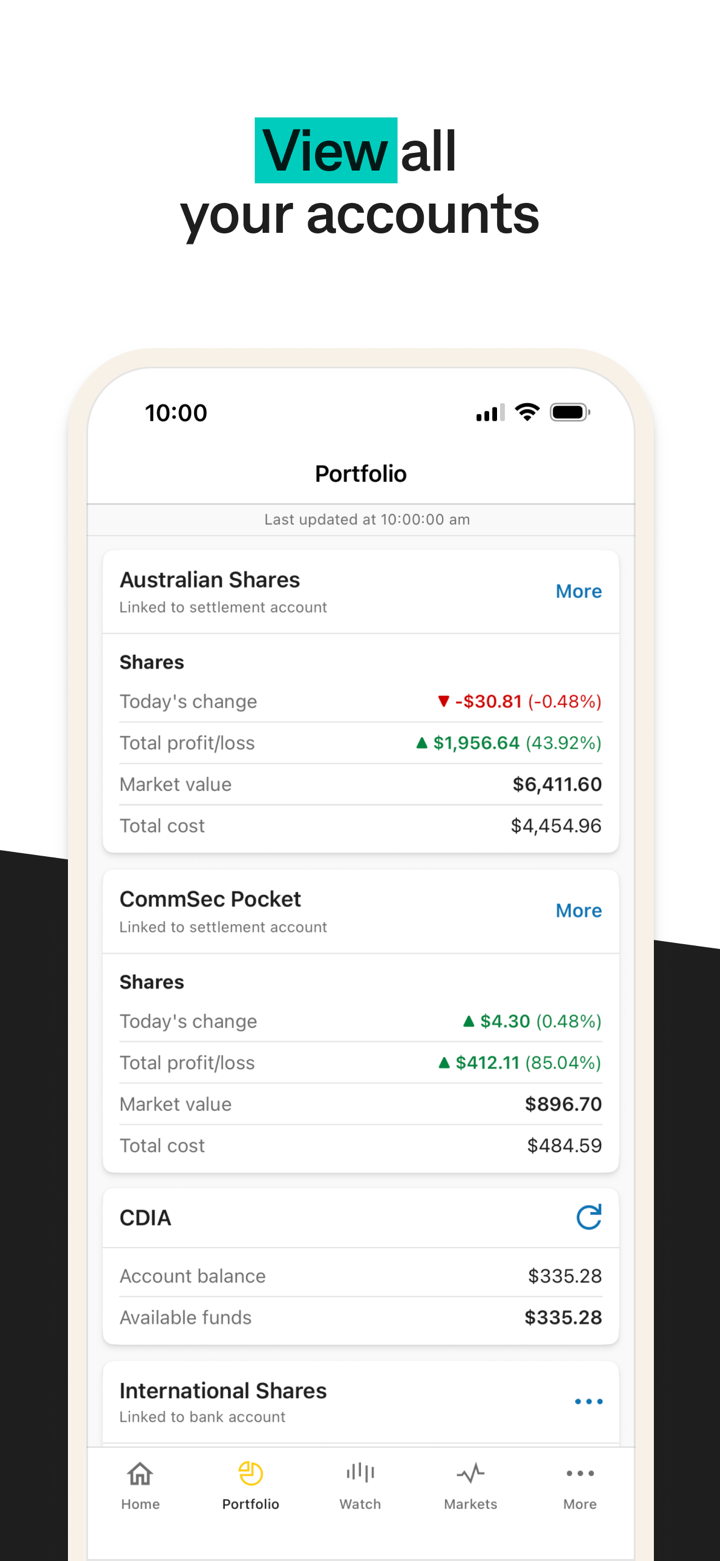

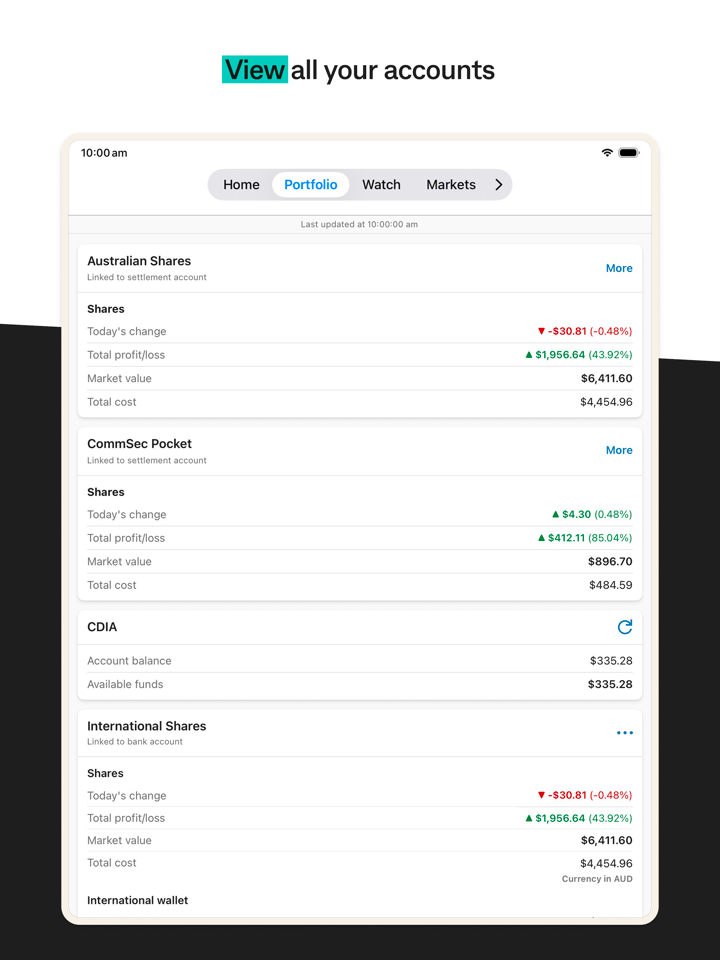

Jenis Akun

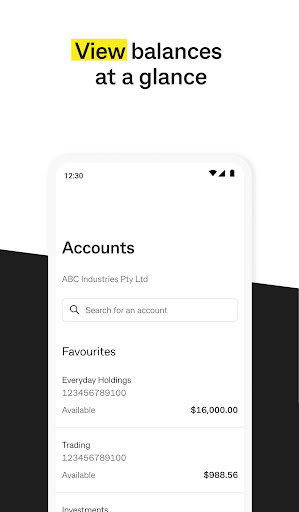

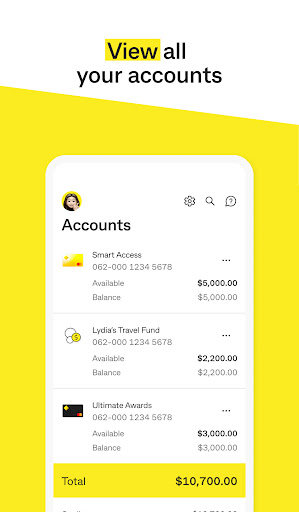

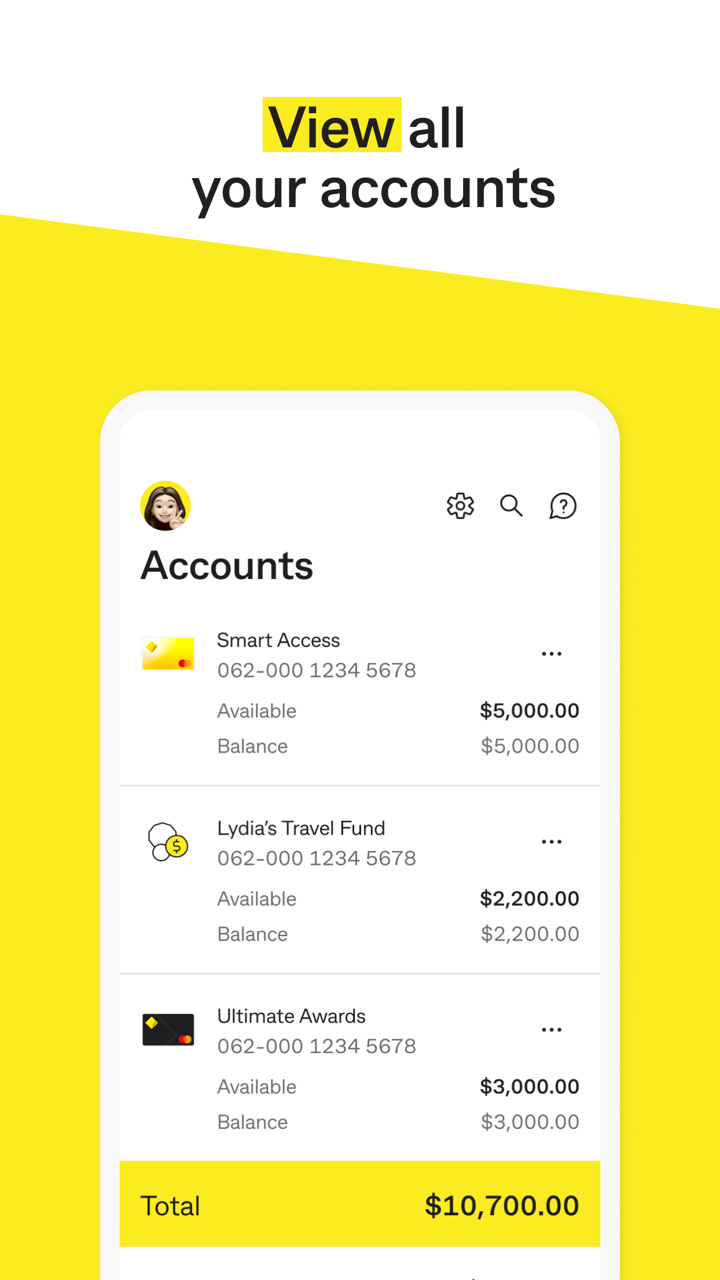

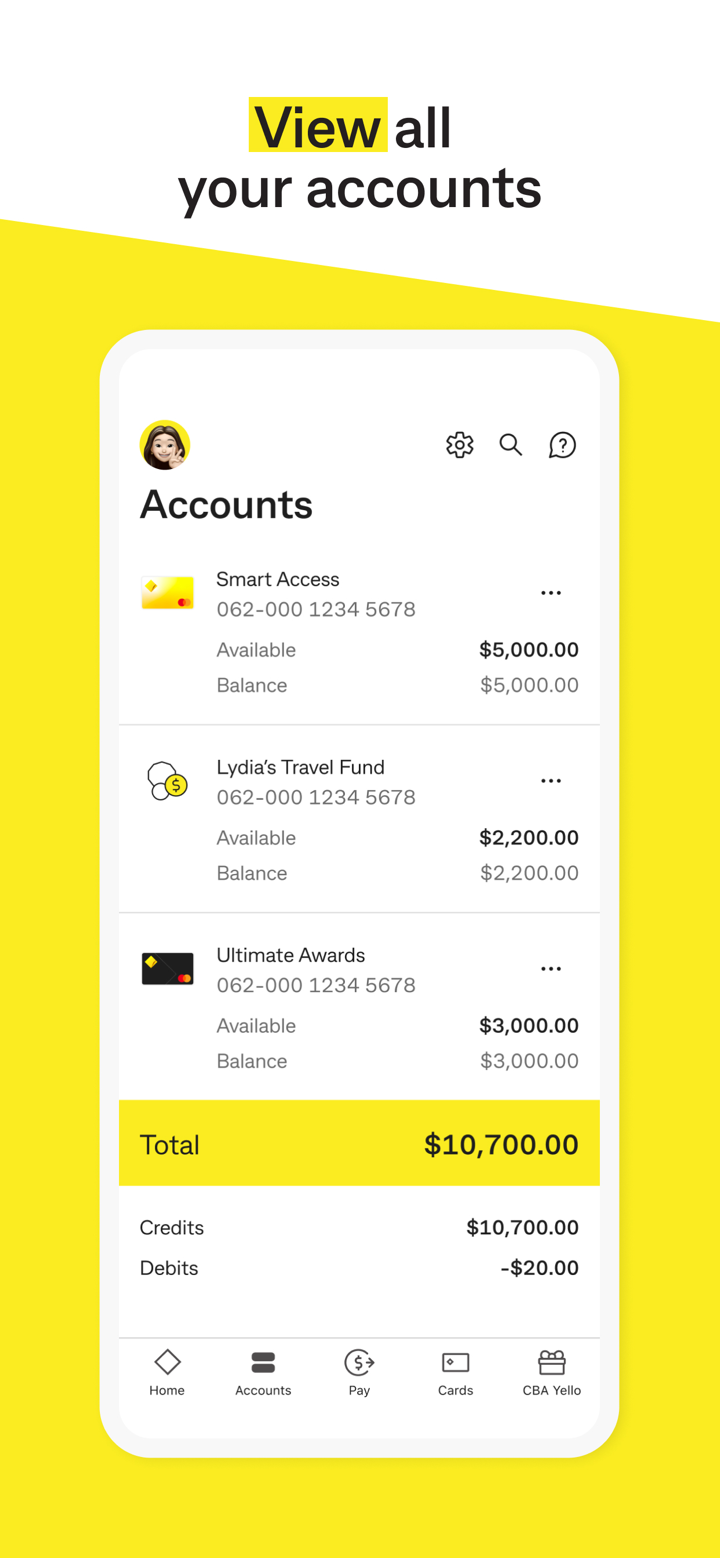

Akun Pribadi

| Jenis Akun | Nama Akun | Fitur Utama |

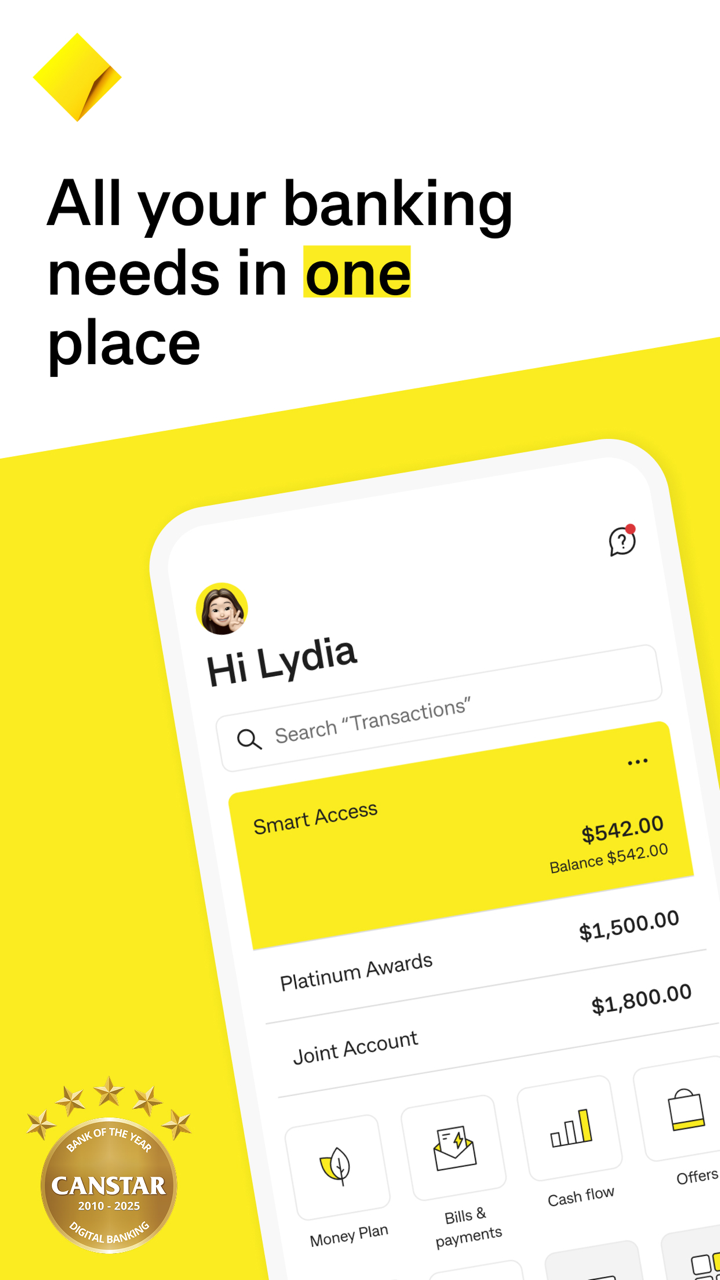

| Akun Transaksi Sehari-hari | Smart Access | • Tidak ada biaya bulanan• Mendukung transfer cepat melalui PayID• Penarikan uang tanpa kartu |

| Everyday Offset | • Terhubung dengan pinjaman rumah, saldo akun dapat mengurangi bunga | |

| Akun Tabungan | NetBank Saver | • Tingkat bunga fleksibel• Cocok untuk tabungan jangka pendek |

| Deposit Berjangka | • Tingkat bunga tetap• Jangka waktu deposit mulai dari 3 bulan hingga 5 tahun | |

| Akun Investasi | Akun Perdagangan Saham CommSec | • Untuk perdagangan saham Australia• Memerlukan keterhubungan dengan CDIA (Akun Manajemen Tunai) |

| Akun Pocket | • Berfokus pada perdagangan ETF• Investasi minimum $50 |

Akun Bisnis

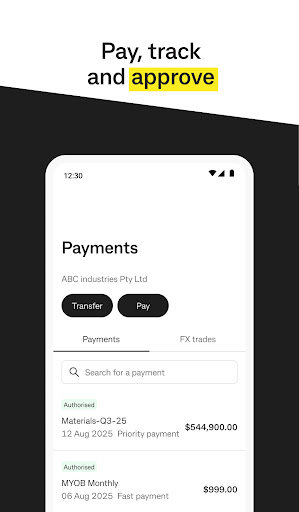

CommBank menawarkan Akun Transaksi Bisnis yang cocok untuk bisnis kecil, dengan biaya bulanan $0 dan memerlukan verifikasi ASIC. Selain itu, pengguna dapat memilih akun pinjaman bisnis seperti Pinjaman Bisnis yang Lebih Baik (pinjaman kecil tanpa agunan) dan pembiayaan kendaraan dan peralatan.

CommBank Biaya

| Jenis Layanan | Item | Standar Biaya |

| Akun Transaksi | Biaya Bulanan Akun Dasar | Sebagian besar tidak memiliki biaya bulanan |

| Transfer lintas batas | $15–$25 per transaksi | |

| Biaya Konversi Valuta Asing | 1%–3% | |

| Perdagangan Investasi | Komisi Perdagangan Saham Australia | $10–$29.95 per transaksi |

| Komisi Perdagangan ETF | ≤ $1,000: $2 per transaksi; > $1,000: 0.2% | |

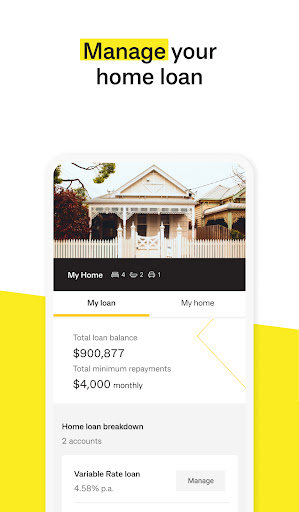

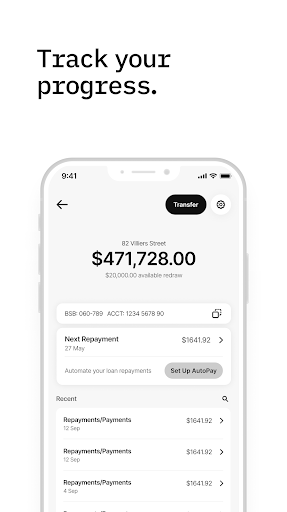

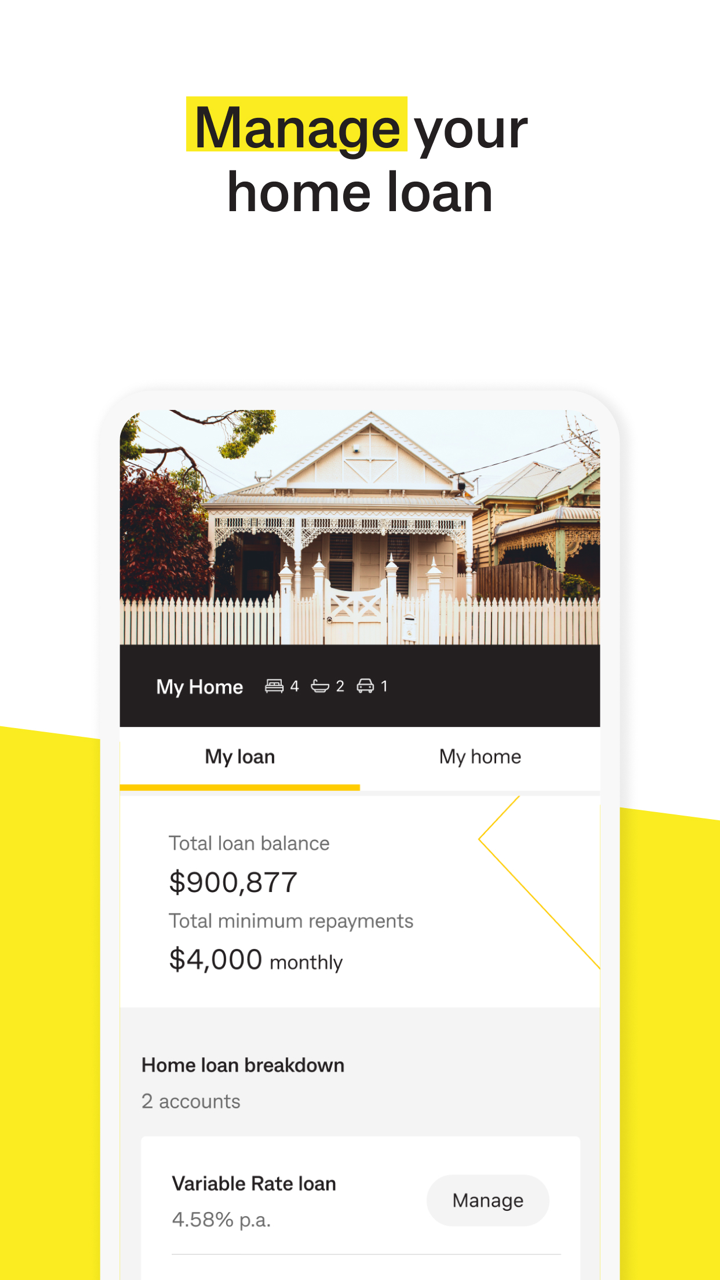

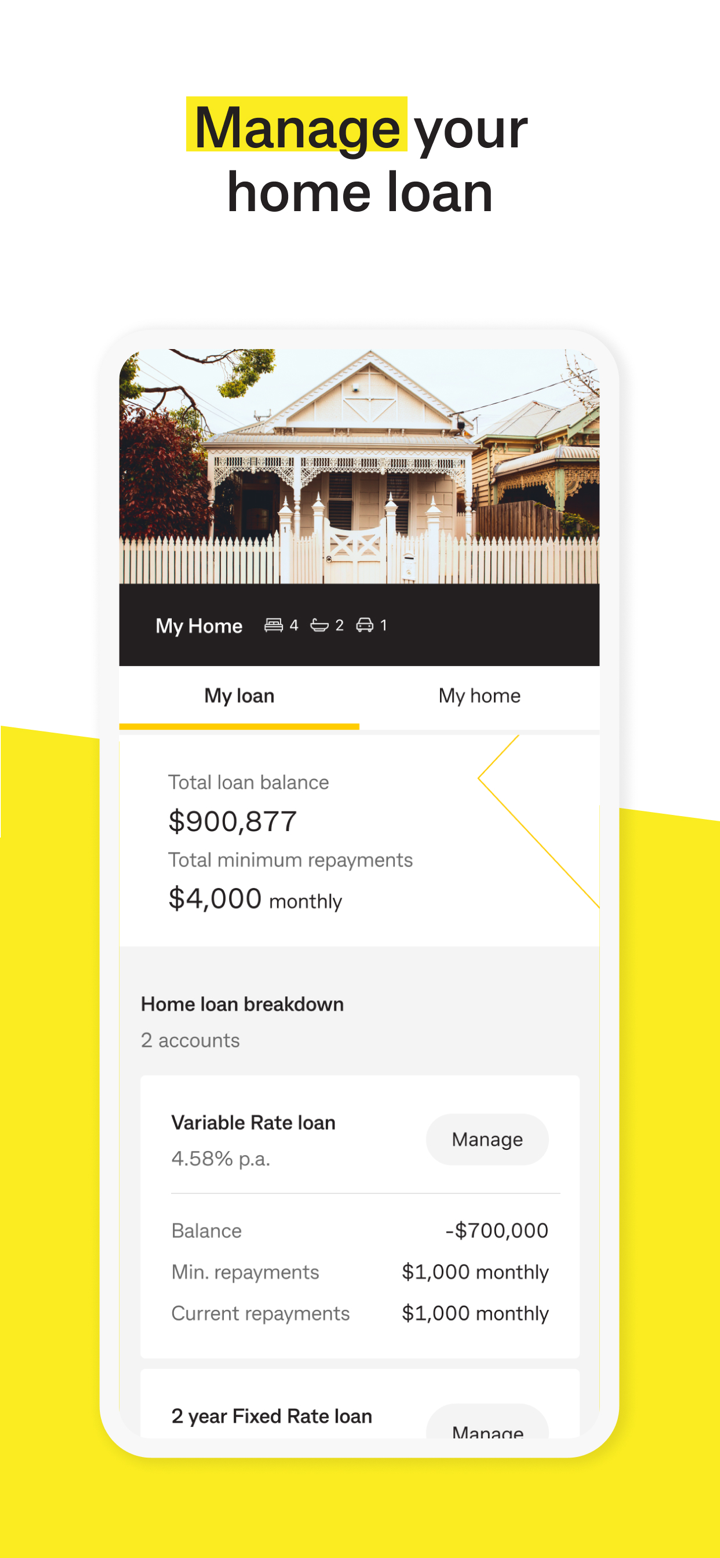

| Pinjaman Rumah | Biaya Aplikasi Pinjaman Rumah | $495–$995 |

| Biaya Refinancing | Sekitar $395 | |

| Biaya Tahunan Paket Kekayaan | $395 (termasuk diskon suku bunga pinjaman rumah) | |

| Asuransi | Asuransi Hewan Peliharaan (Penawaran Tahun Pertama) | 2 bulan pertama gratis |

| Asuransi Hewan Peliharaan (Biaya Bulanan Berikutnya) | $20–$80 |

Leverage

Untuk CommBank leverage pinjaman rumah, jumlah pinjaman maksimum dapat mencapai 80% dari nilai properti (LVR ≤ 80%).

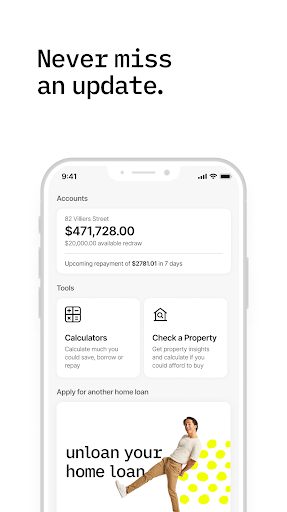

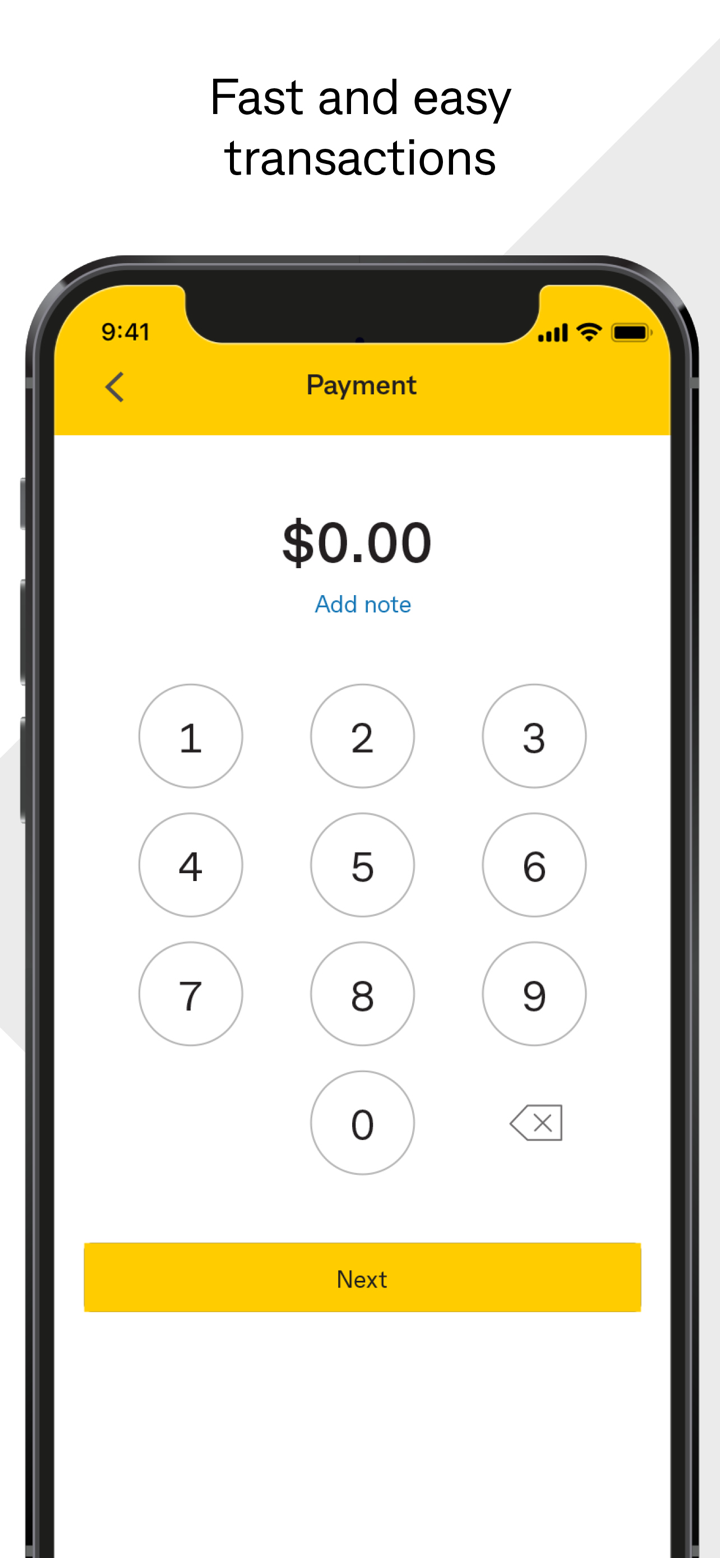

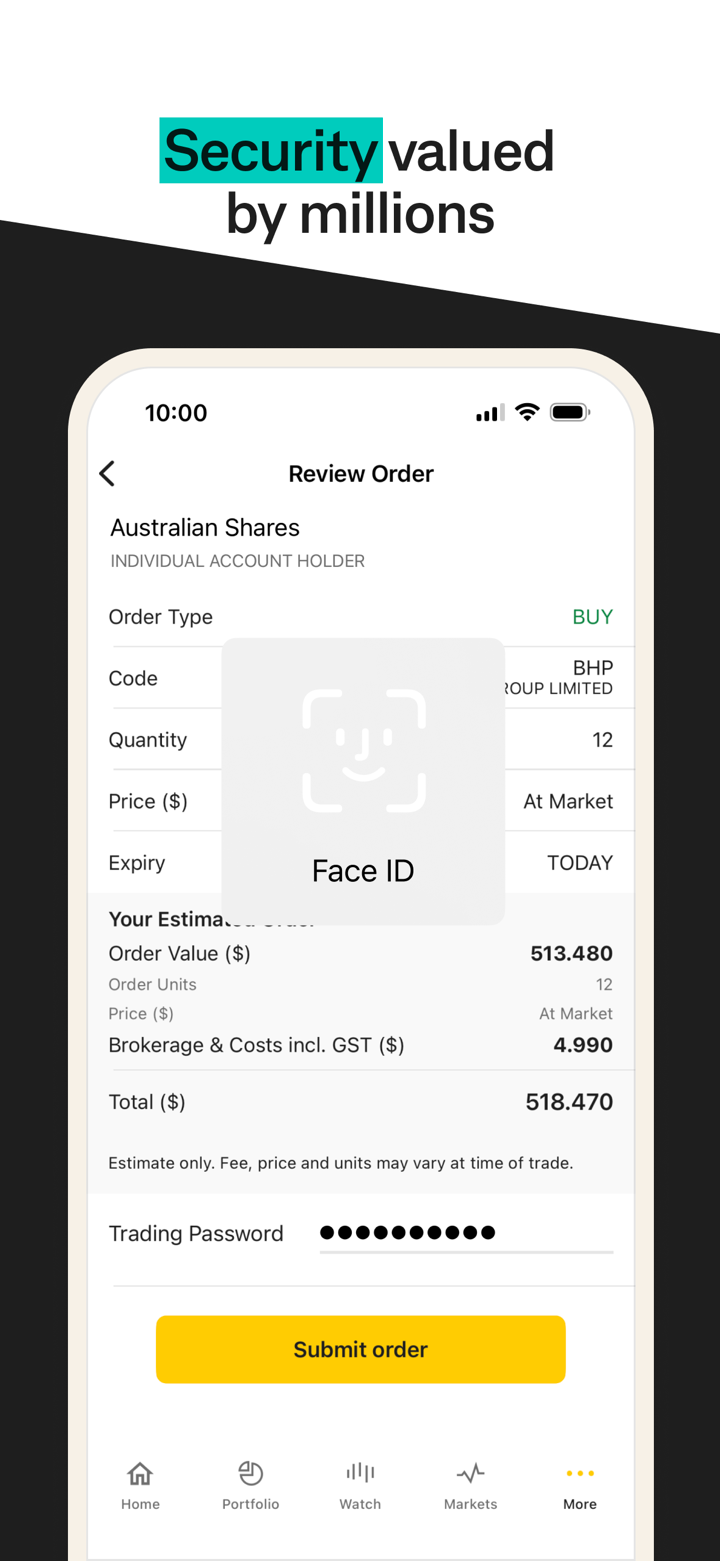

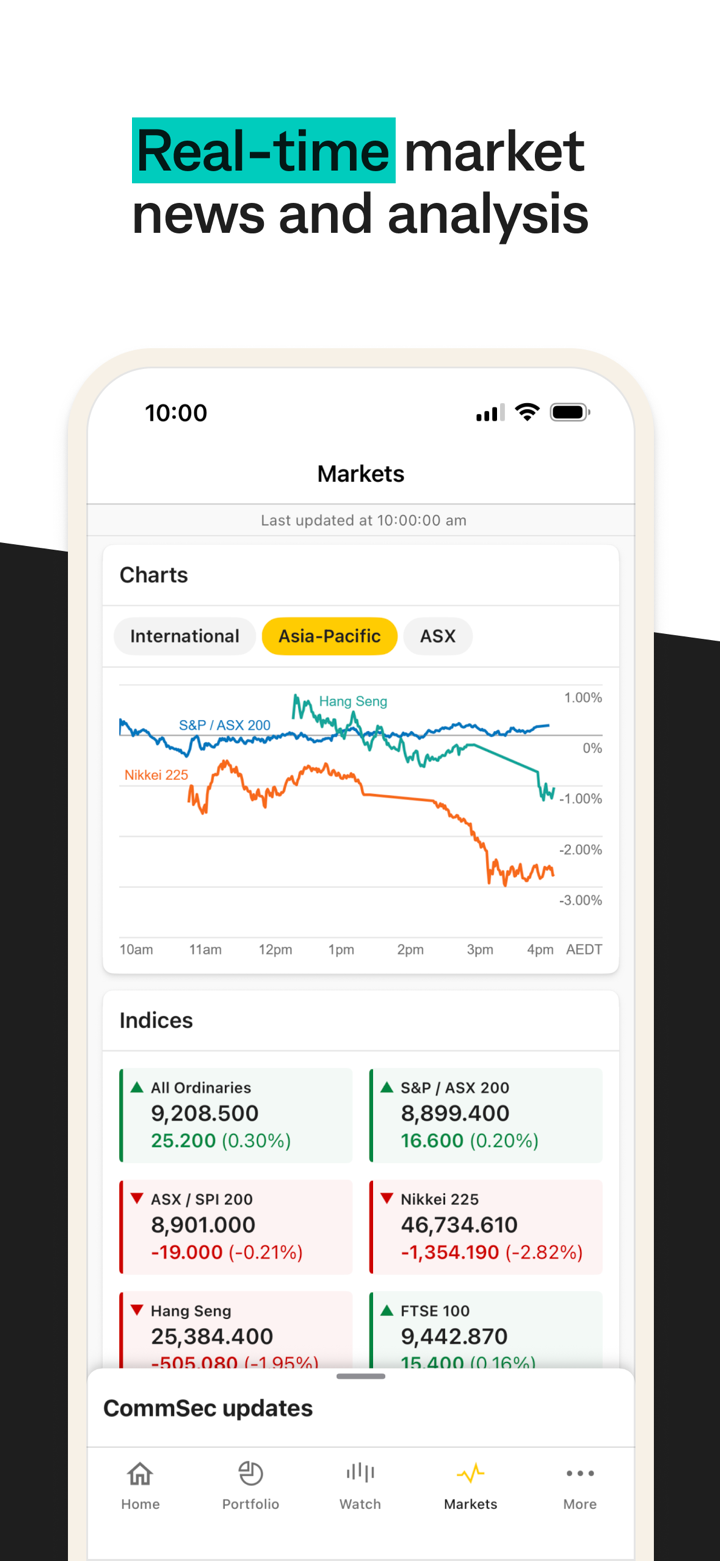

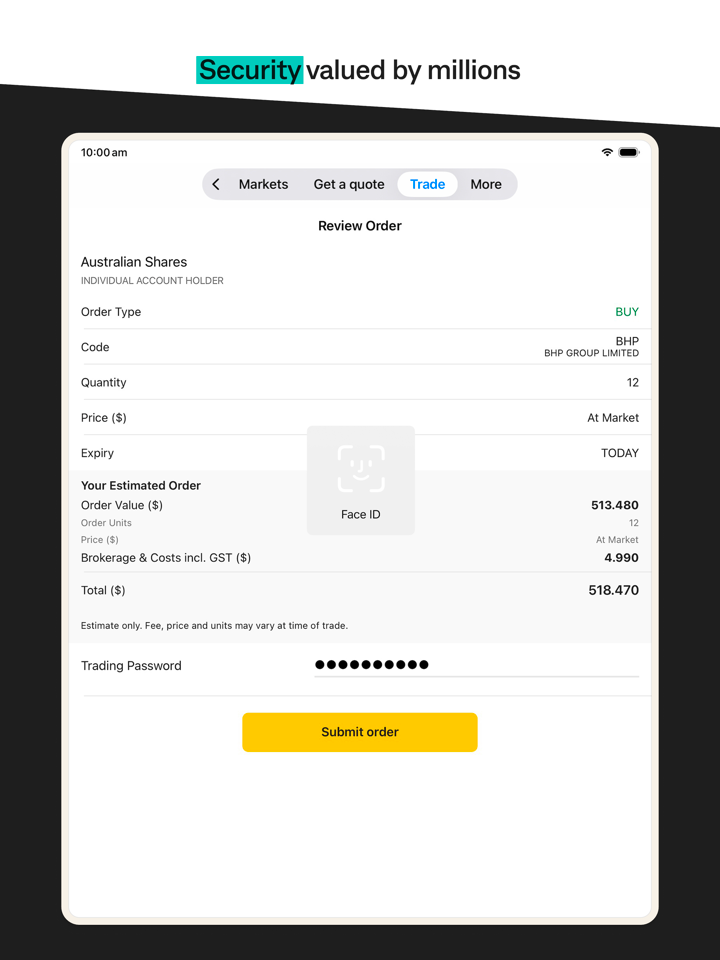

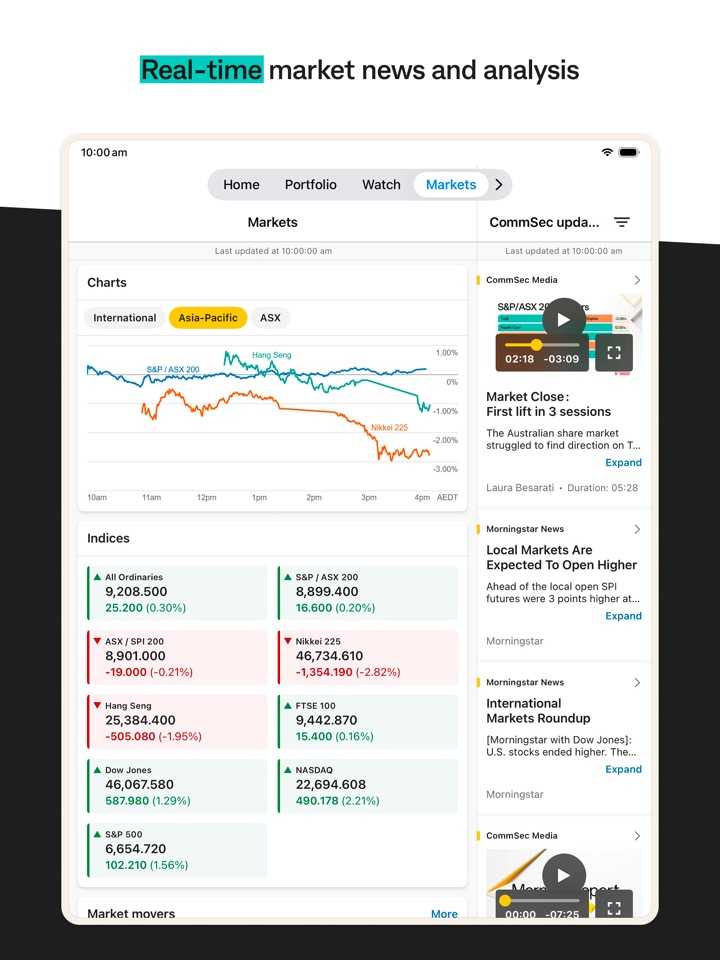

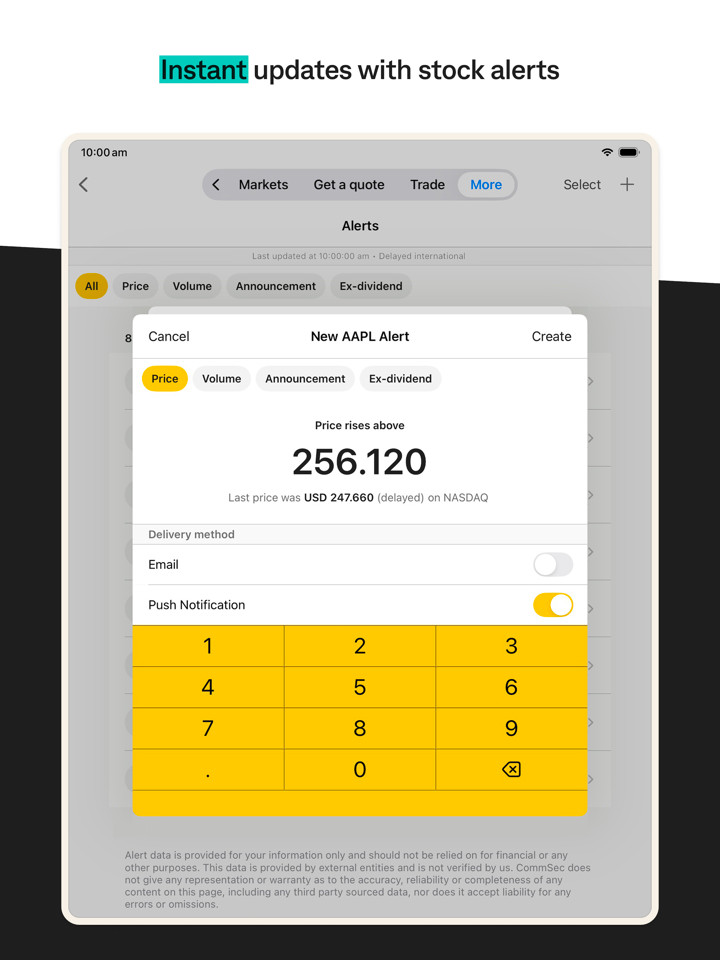

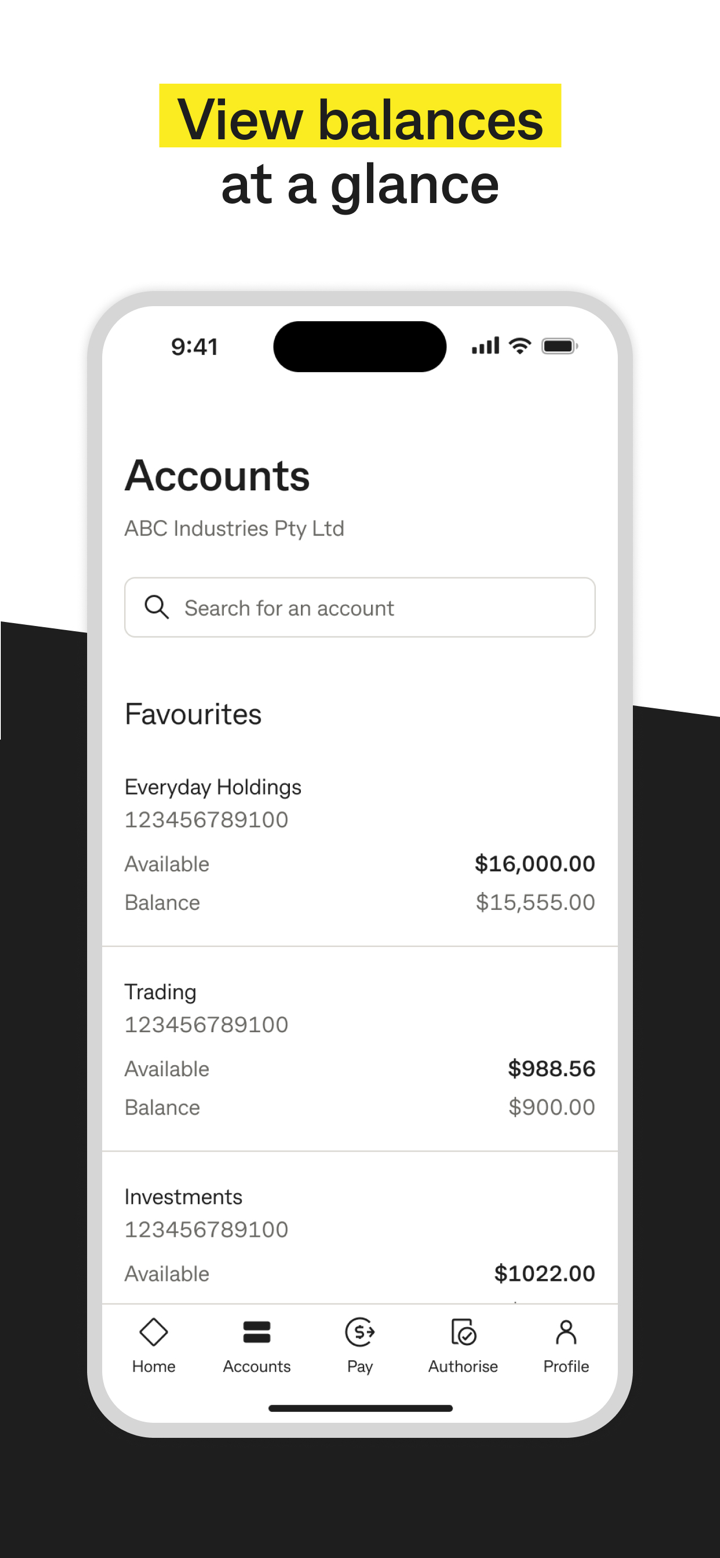

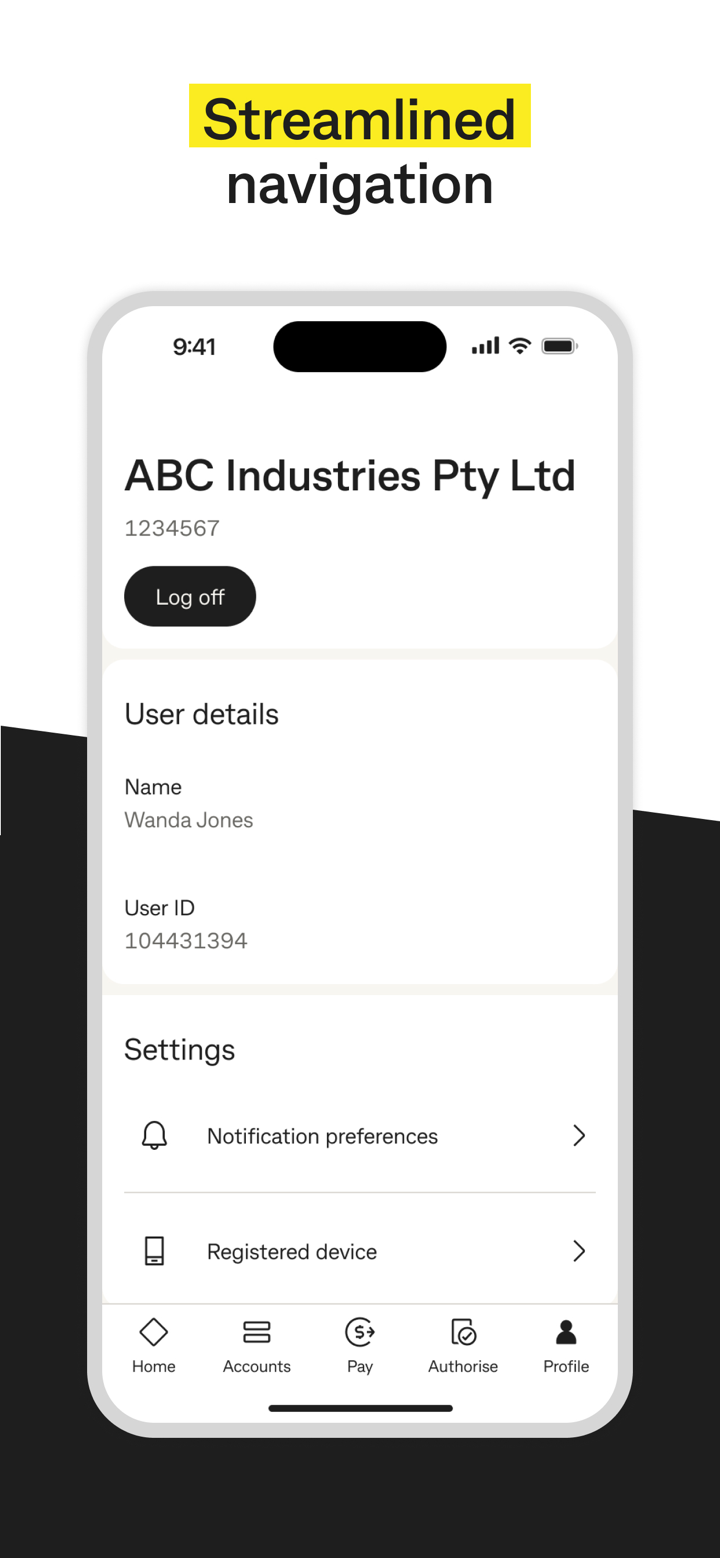

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia |

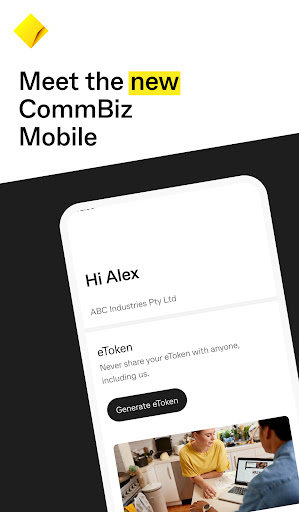

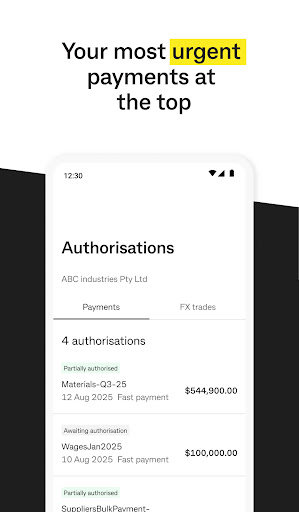

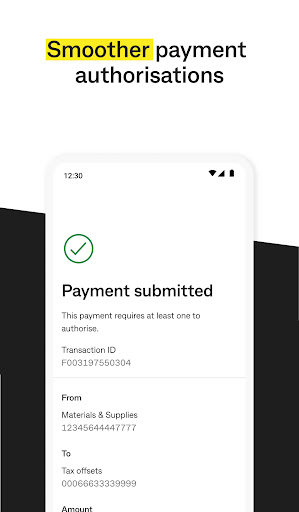

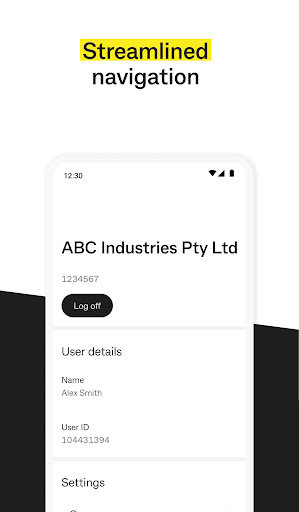

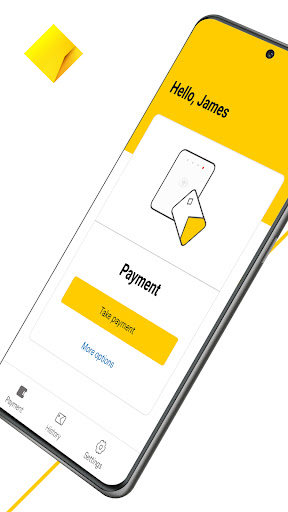

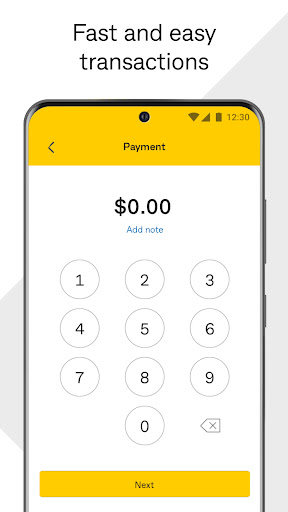

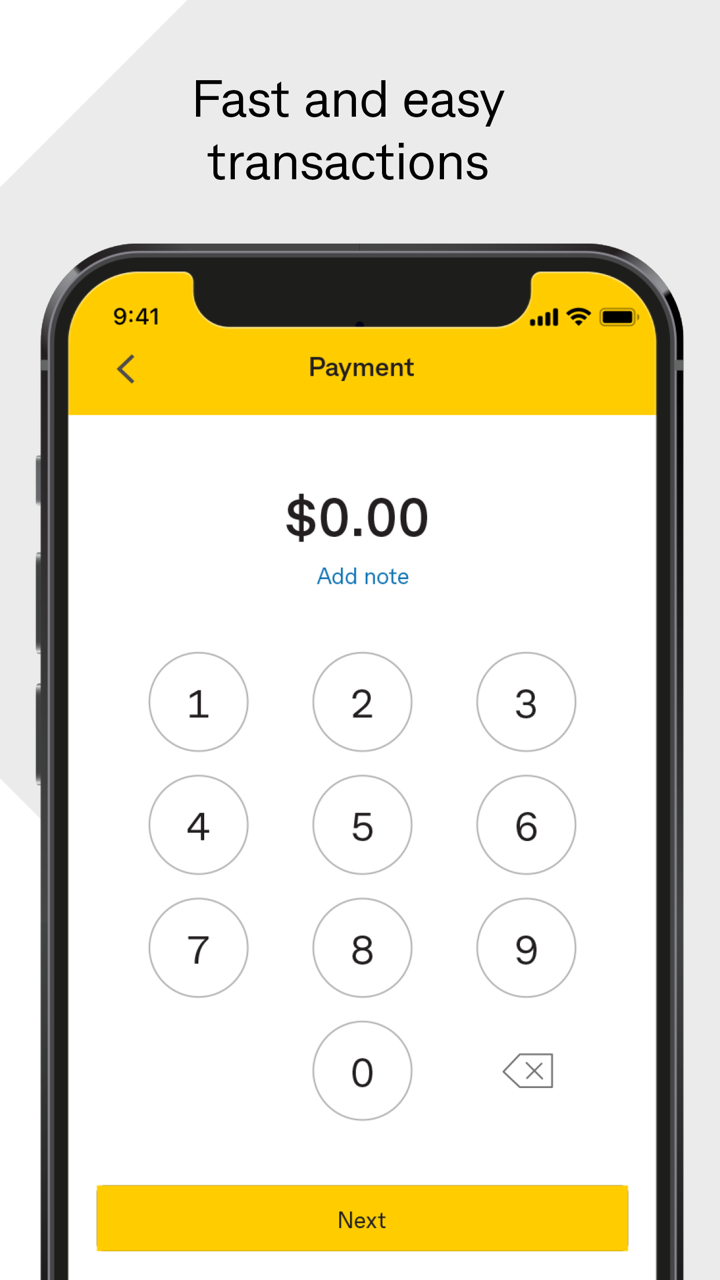

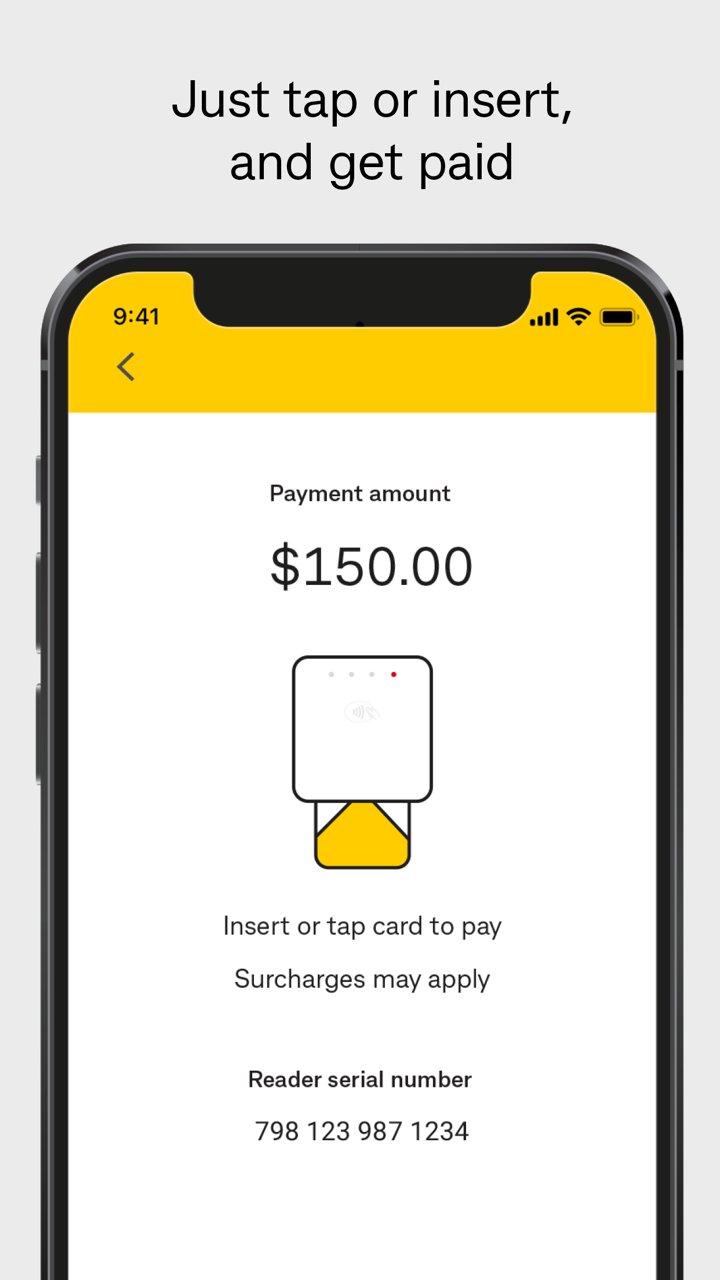

| Aplikasi CommBank | ✔ | - |

| NetBank | ✔ | Web |

| CommSec | ✔ | - |

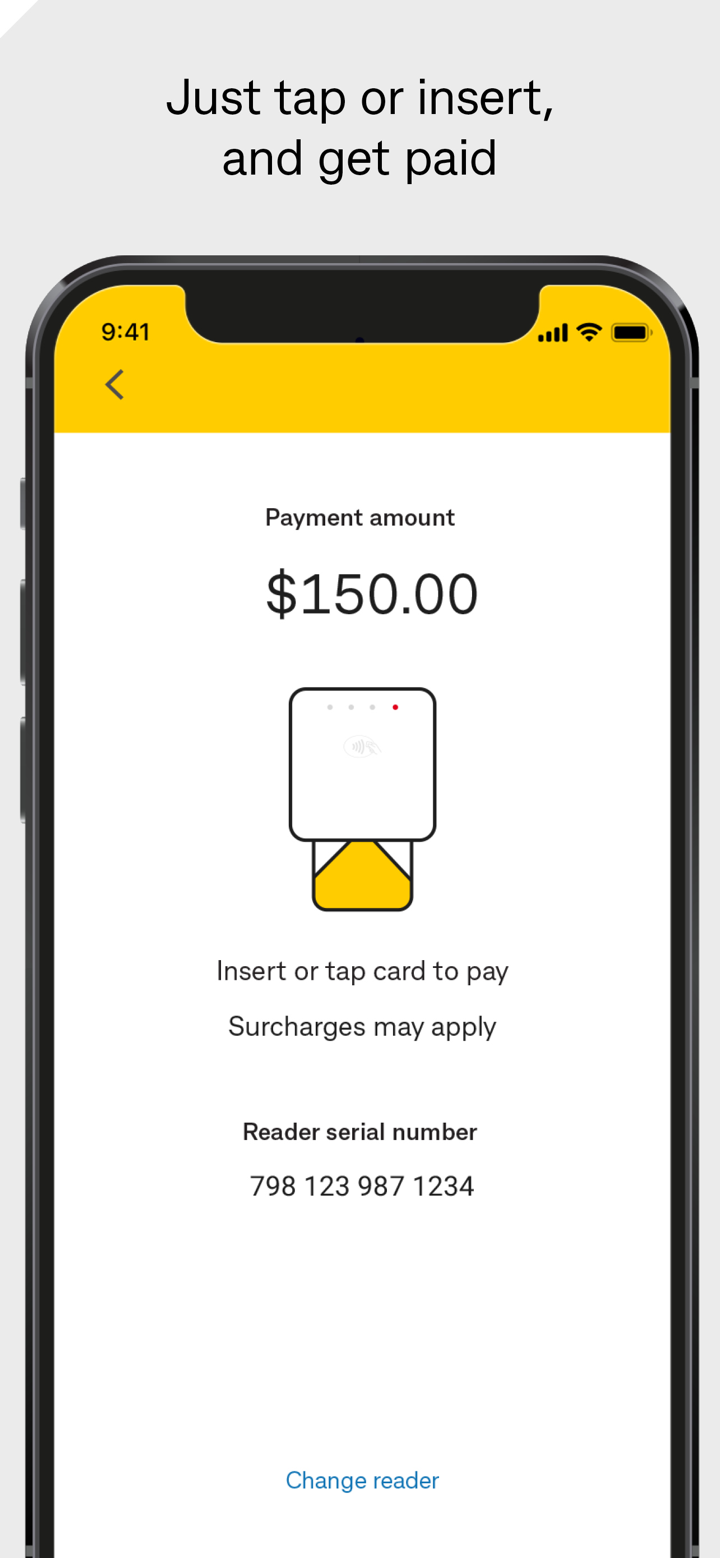

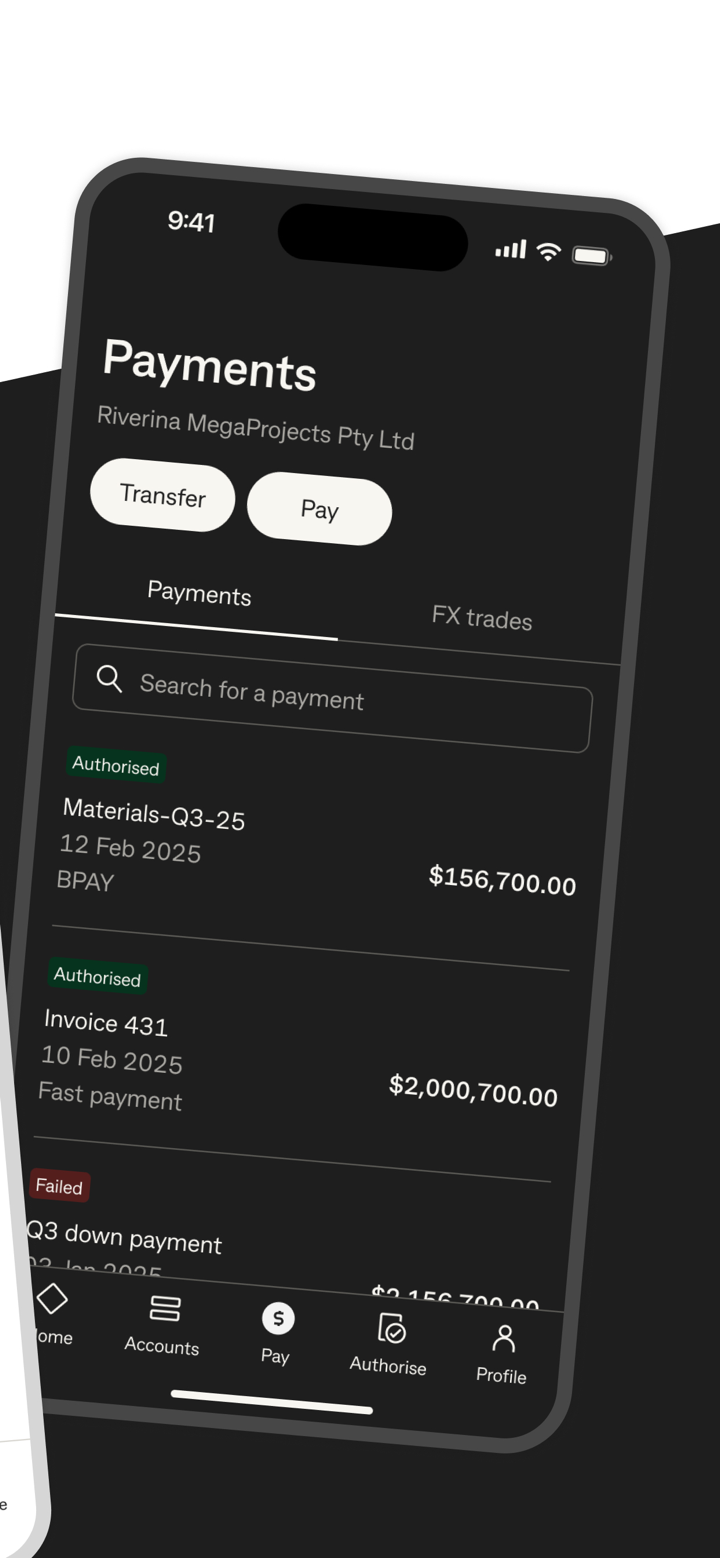

Deposit dan Penarikan

| Kategori | Metode | Detail |

| Deposit | Transfer Bank | Mendukung transfer lokal/internasional; Kode SWIFT diperlukan untuk transfer internasional: CBAUAT22. |

| Deposit ATM | Deposit uang tunai/cek gratis di ATM CommBank di Australia | |

| Deposit Gaji Langsung | Memungkinkan pengusaha untuk mendepositkan gaji secara langsung; Kelayakan hadiah untuk akun tertentu (misalnya, poin kartu kredit Smart Awards) | |

| Penarikan | Penarikan ATM | Akses dolar Australia atau mata uang lokal di ATM Mastercard di seluruh dunia; Biaya penarikan luar negeri: $5 per transaksi + biaya konversi mata uang |

| Transfer ke Rekening Terhubung | Transfer real-time gratis ke rekening CommBank lainnya atau rekening pihak ketiga (memerlukan nomor PayID/BSB) |

Bonus

Hadiah pelanggan baru CommBank termasuk: membuka rekening transaksi yang ditunjuk dan menyelesaikan transaksi untuk menerima bonus tunai $200 (penawaran terbatas); pelanggan pinjaman rumah baru dapat menikmati diskon konveyansi $699 (melalui layanan Home-in).

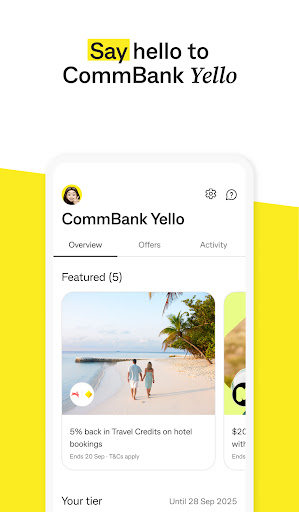

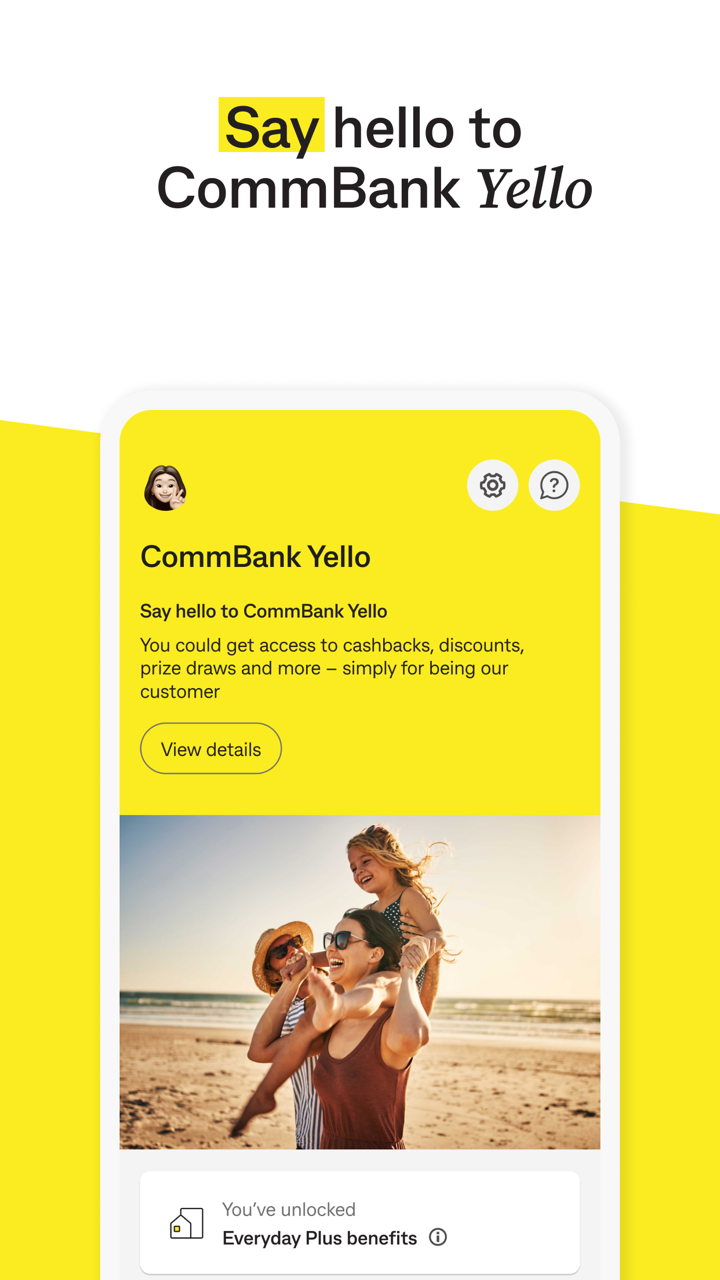

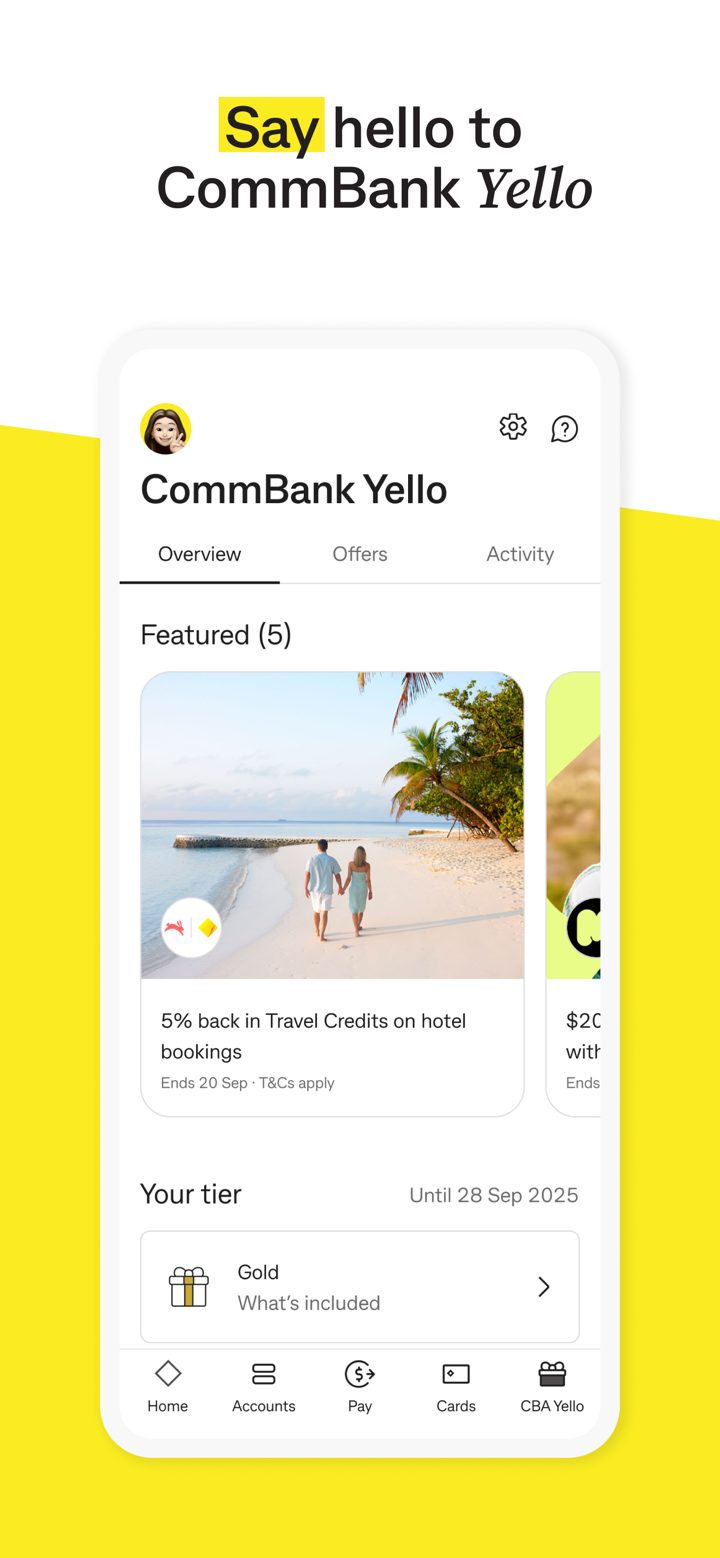

Selain itu, investor dapat mengakses hadiah loyalitas seperti program CommBank Yello, yang menawarkan poin, cashback (misalnya, hingga $40 cashback bulanan pada pinjaman rumah), dan diskon layanan. Pengeluaran kartu kredit mengumpulkan poin CommBank Awards, yang dapat ditukarkan dengan kartu hadiah atau mil penerbangan sering terbang Qantas.