Company Summary

| INVASTReview Summary | |

| Founded | 2004 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Forex, ETFs |

| Demo Account | / |

| Leverage | Up to 1:25 |

| Spread | Various |

| Trading Platform | Click 365 |

| Minimum Deposit | / |

| Customer Support | Phone: 0120-659-274 |

| Contact Form | |

INVAST Information

Invast, headquartered in Tokyo, Japan, is a prominent financial services firm specializing in online trading. The company offers a range of services, including margin FX, CFDs, and automated trading solutions. INVAST currently operates under the Financial Services Agency (FSA).

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited market instrumets |

| Demo account unavailable | |

| Limited info on trading conditions |

Is INVAST Legit?

INVAST is regulated by the Financial Services Agency (FSA), holding a Retail Forex License (No.26).

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Financial Services Agency (FSA) | Regulated | INVAST Securities Co., Ltd | Retail Forex License | 関東財務局長(金商)第26号 |

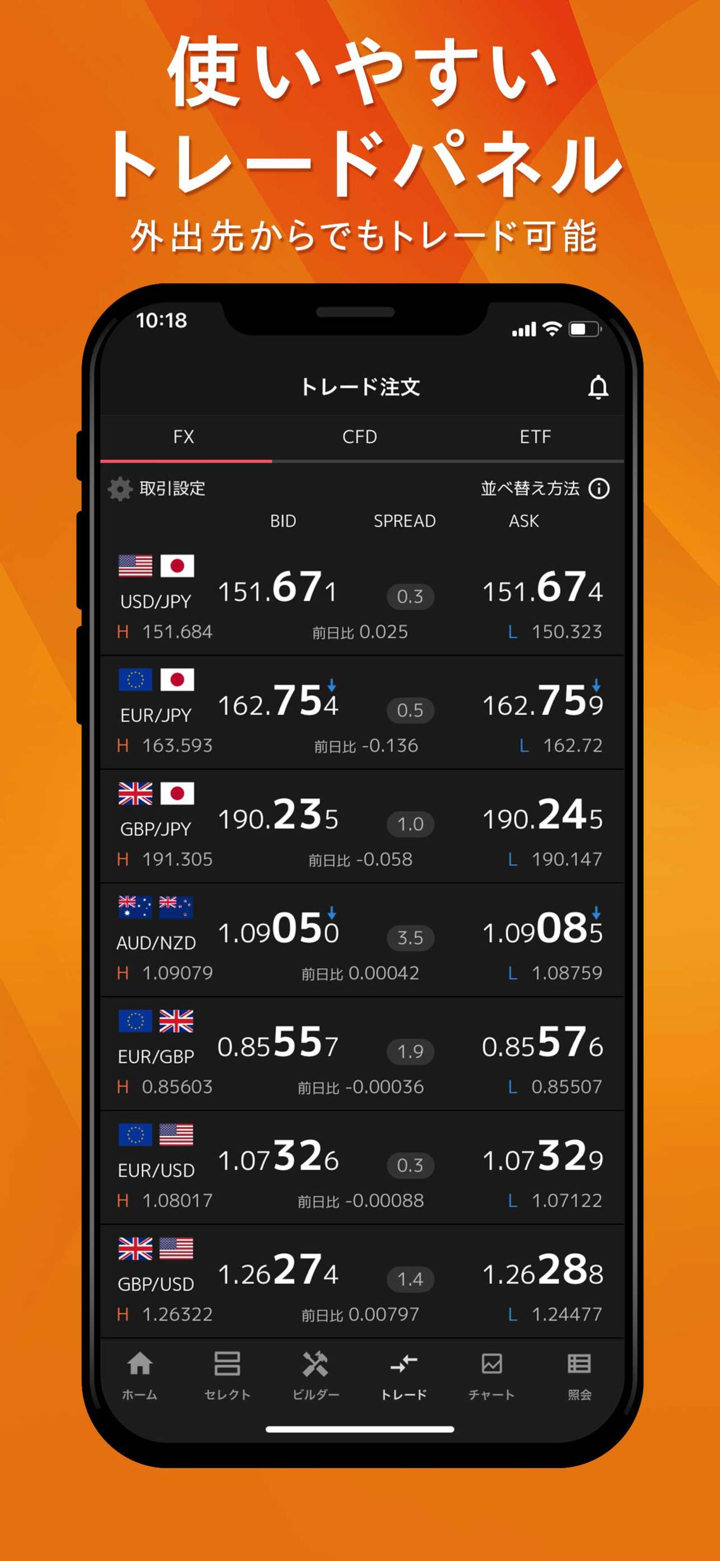

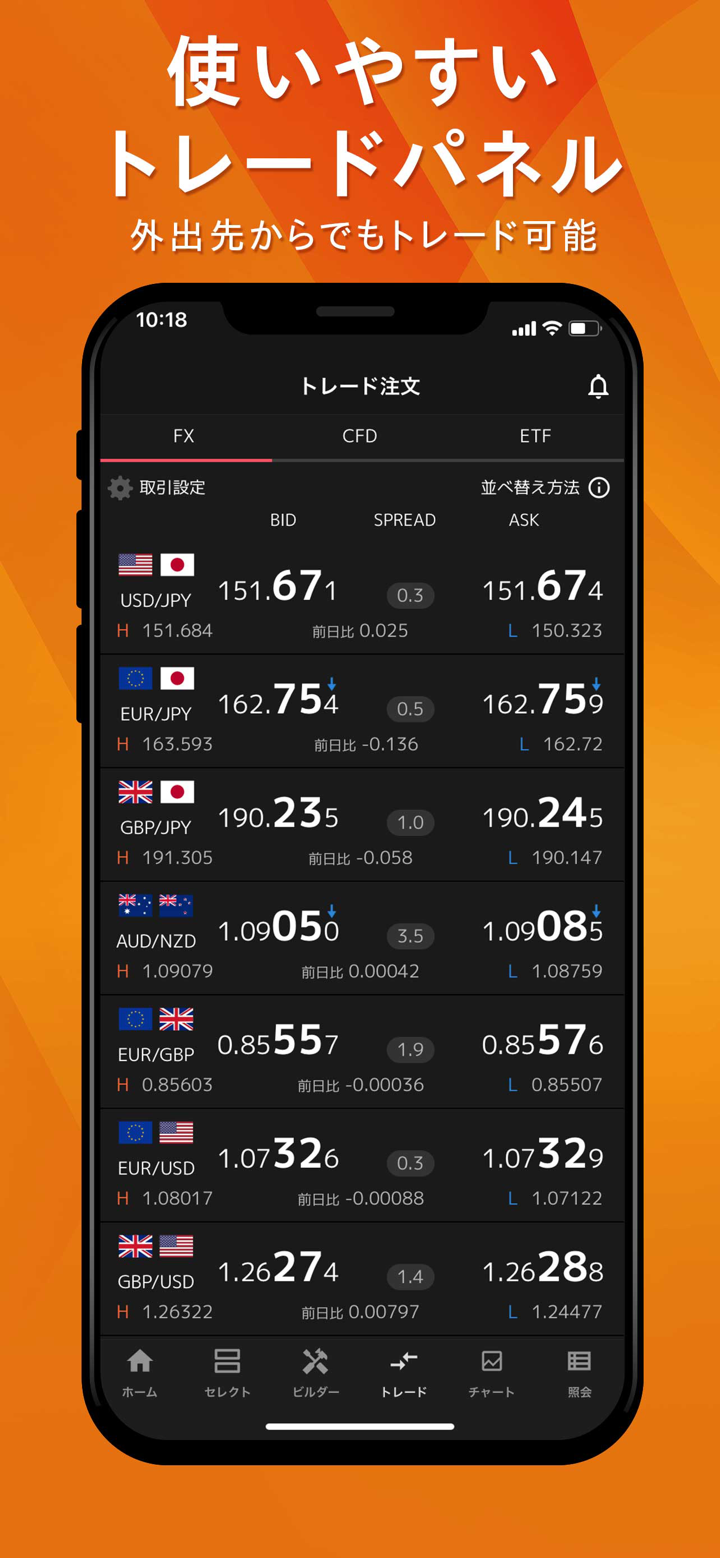

What Can I Trade on INVAST?

INVAST offers tradable products including forex and ETFs.

| Trading Asset | Available |

| forex | ✔ |

| ETFs | ✔ |

| commodities | ❌ |

| indices | ❌ |

| stocks | ❌ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

Account Type

INVAST offers both personal accounts and a corporate account.

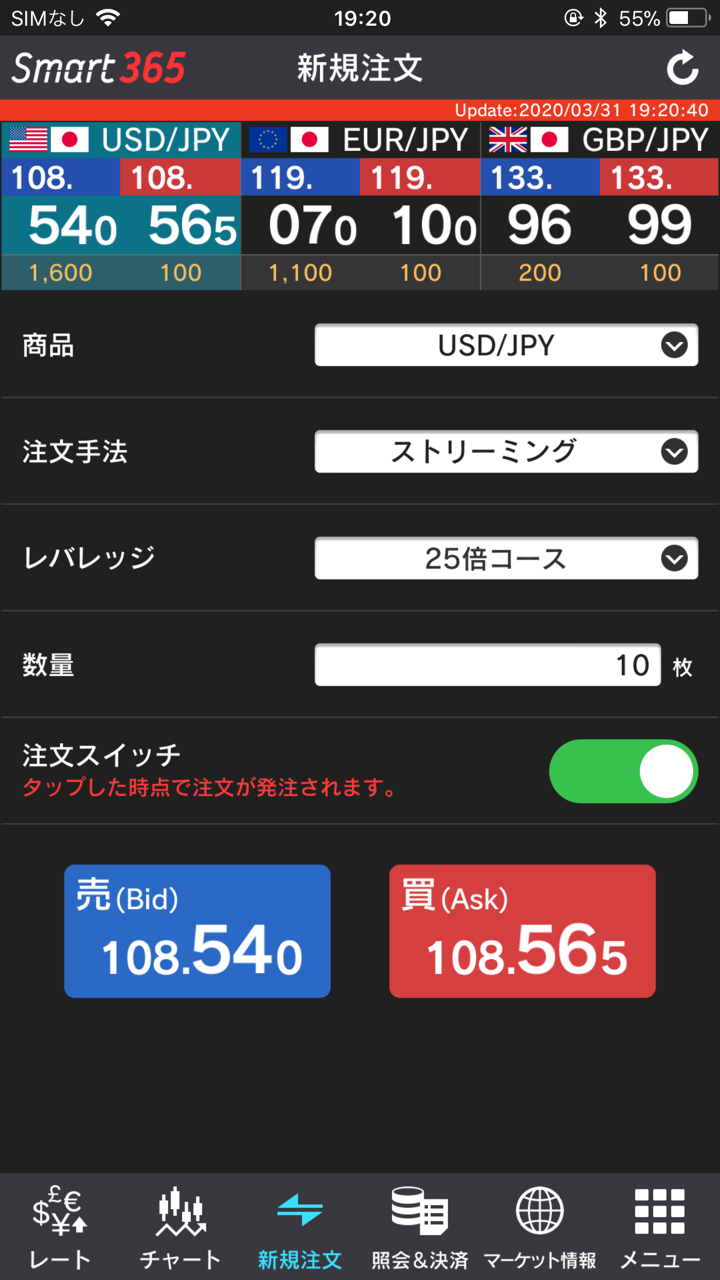

Leverage

INVAST offers various leverage rates.

Personal account leverage: 25x course, 10x course, 5x course, and 1x course.

There is only one corporate account: leverage course.

Fees

Spreads are determined by the Tokyo Financial Exchange.

For details, please visit the website of the Tokyo Financial Exchange.

Trading fees are usually JPY 330. But there are exceptions:

- More than 1,000 sheets: A reduced fee of JPY 88 applies if more than 1,000 sheets are traded in a month.

- More than 3,000 sheets: An even further reduced fee (or no fee) applies if more than 3,000 sheets are traded in a month.

| 1 sheet (tax included) | usually | Volume Discount (Monthly Transaction Meter) | |||

| More than 1,000 sheets | More than 3,000 sheets | ||||

| Normal one-way fee | JPY 330 | JPY 88 | JPY 0 | ||

Plus, accrued fee will be deducted from the margin deposit amount at the end of trading on the 1st.

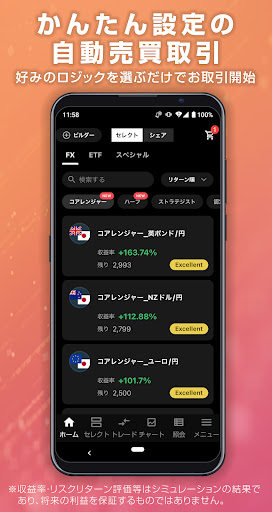

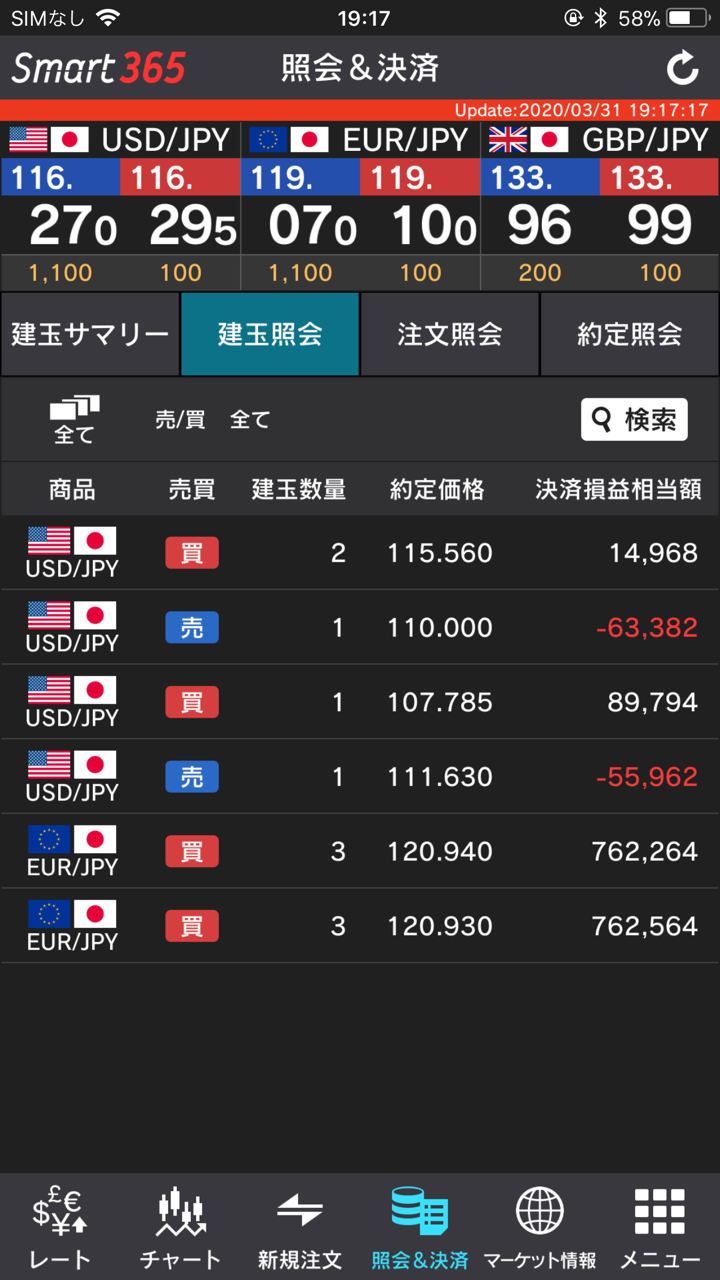

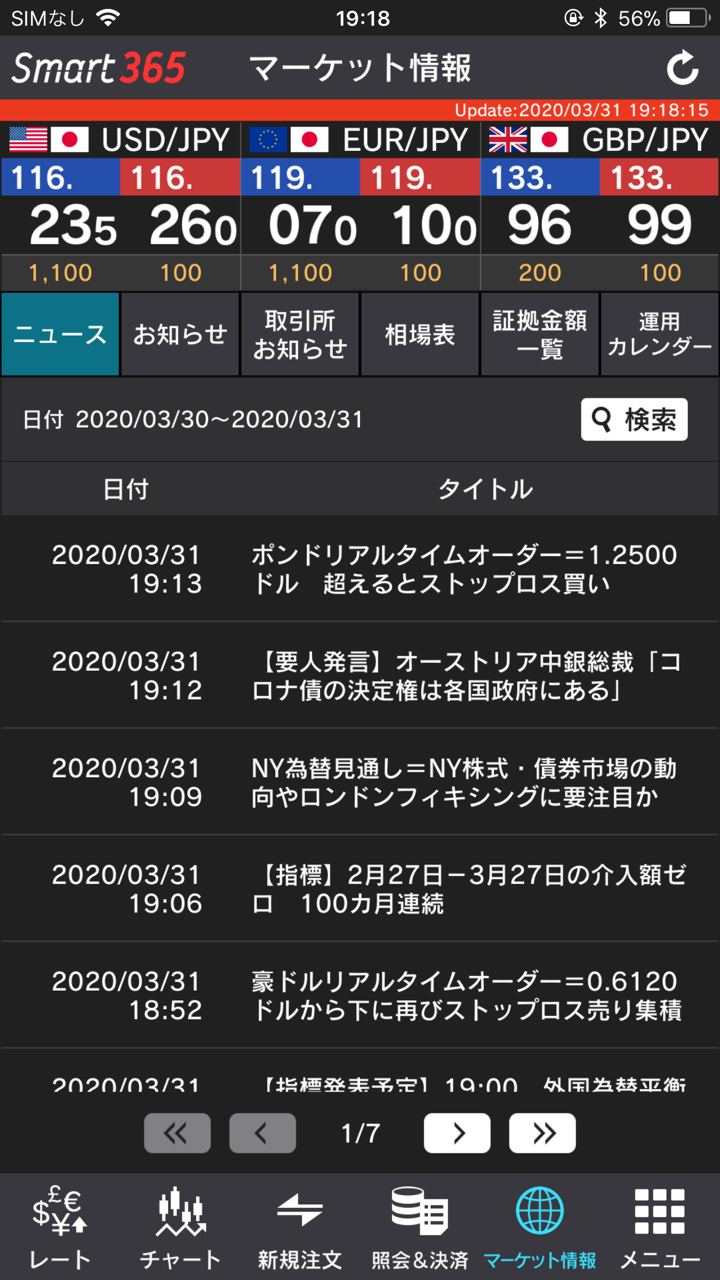

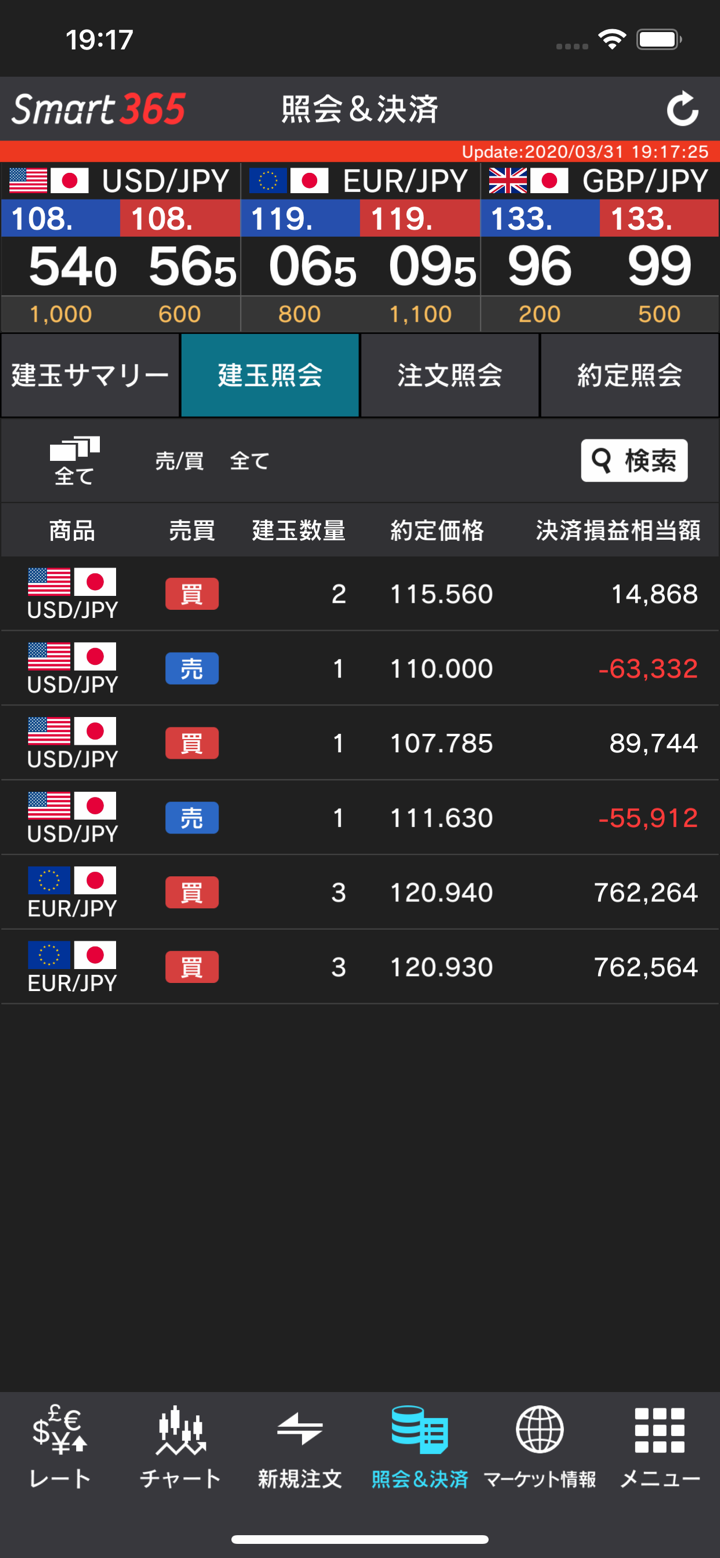

Trading Platform

Click 365 is Invast Securities' proprietary online trading platform designed for Japanese retail investors.

| Trading Platform | Supported | Available Devices | Suitable for |

| Click 365 | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Traders can make a deposit through a bank counter, ATM, or online banking.

- Fees forDeposits Fees for depositing money into your trading account will be waived if you use the instant deposit service.

If you do not use the instant deposit service and make a regular transfer, you will be responsible for the transfer fee of each financial institution.

- Fees for Withdrawals Fees for withdrawals from your trading account will be borne by Invast Securities (free of charge for you).

FX3196354740

Hong Kong

It feels pretty good, the withdrawal speed is fast, the account opening is simple and quick, the operation is also convenient, but the data update is a bit slow, the variety is limited, because it is not a domestic platform, and the communication with customer service is not so convenient, but the customer service is still very patient, and it is relatively reliable.

Positive

周红玉

Hong Kong

I give this place 5 stars. And also recommend it to all. You will for sure make huge money if you start trading at this place. There is no other platform like this in the market currently. I have no complaints about this place. I have received support whenever I sought from the customer service crew here.

Positive

FX1182046228

Hong Kong

The spread is super narrow, and the deposit and withdrawal speed is also very fast. Although the options are still a little less, I hope to keep the current one and continue to improve. It would be even better if it can support electronic payment, so that the transaction will be more convenient!

Positive

杰出青年

Hong Kong

This Japanese company looks okay, but unfortunately I don't understand Japanese and I feel that it would be better to do business with a local company. Are there any similar companies in Hong Kong? Do you have any Hui friends to recommend?

Positive