Basic Information

Ireland

IrelandScore

Ireland

|

15-20 years

|

Environment AAA

|

Ireland

|

15-20 years

|

Environment AAA

|https://www.avatrade.com?versionId=10301&tag=206585

Website

Rating Index

Environment

AAA

Average transaction speed (ms)

MT4/5

Full License

Ava-Demo

Capital Ratio

Perfect

Capital

Influence

AA

Influence index NO.1

France 7.31

France 7.31Speed:D

Slippage:AAA

Cost:A

Disconnected:AAA

Rollover:AAA

MT4/5 Identification

Full License

United Kingdom

United KingdomCapital Ratio

Perfect

Capital

Influence

AA

Influence index NO.1

France 7.31

France 7.31Single Core

1G

40G

1M*ADSL

Ireland

Ireland

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

| VPS Region | User | Products | Closing time |

|---|---|---|---|

| 982*** | GOLD | 12-16 03:22:39 | |

| 835*** | GOLD | 12-16 02:35:04 | |

| 648*** | CHINA_A50 | 12-03 05:54:36 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

| Quick AvaTrade Review Summary | |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

| Tradable Assets | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Min Deposit | $100 |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

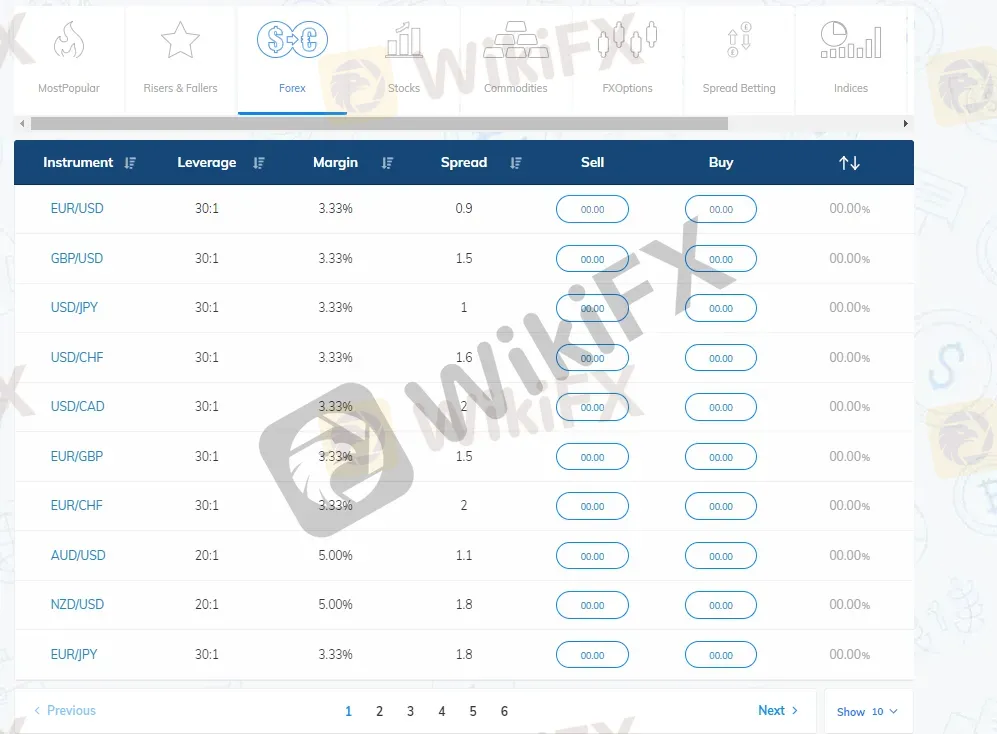

| EUR/USD Spread | 0.9 pips |

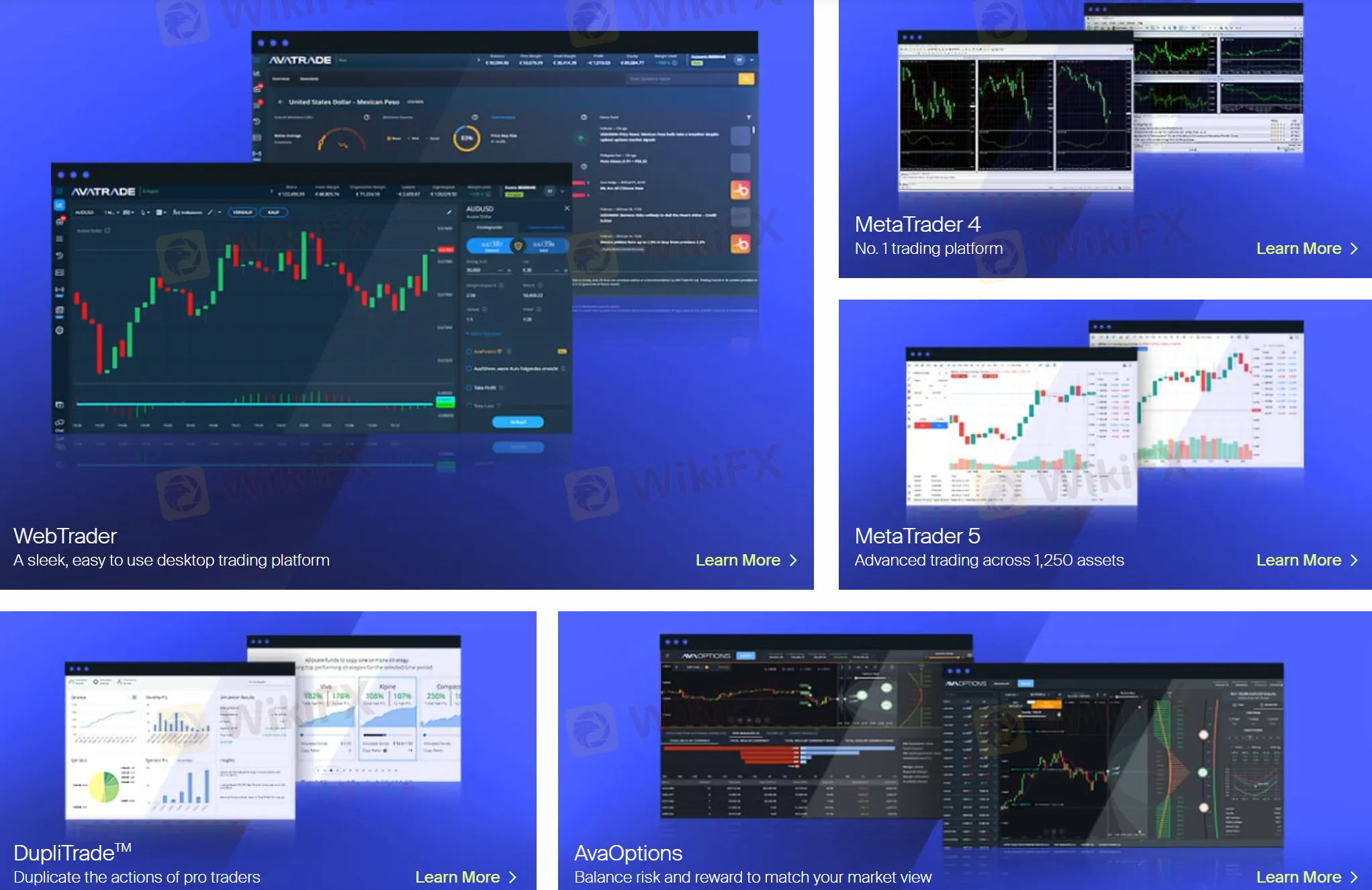

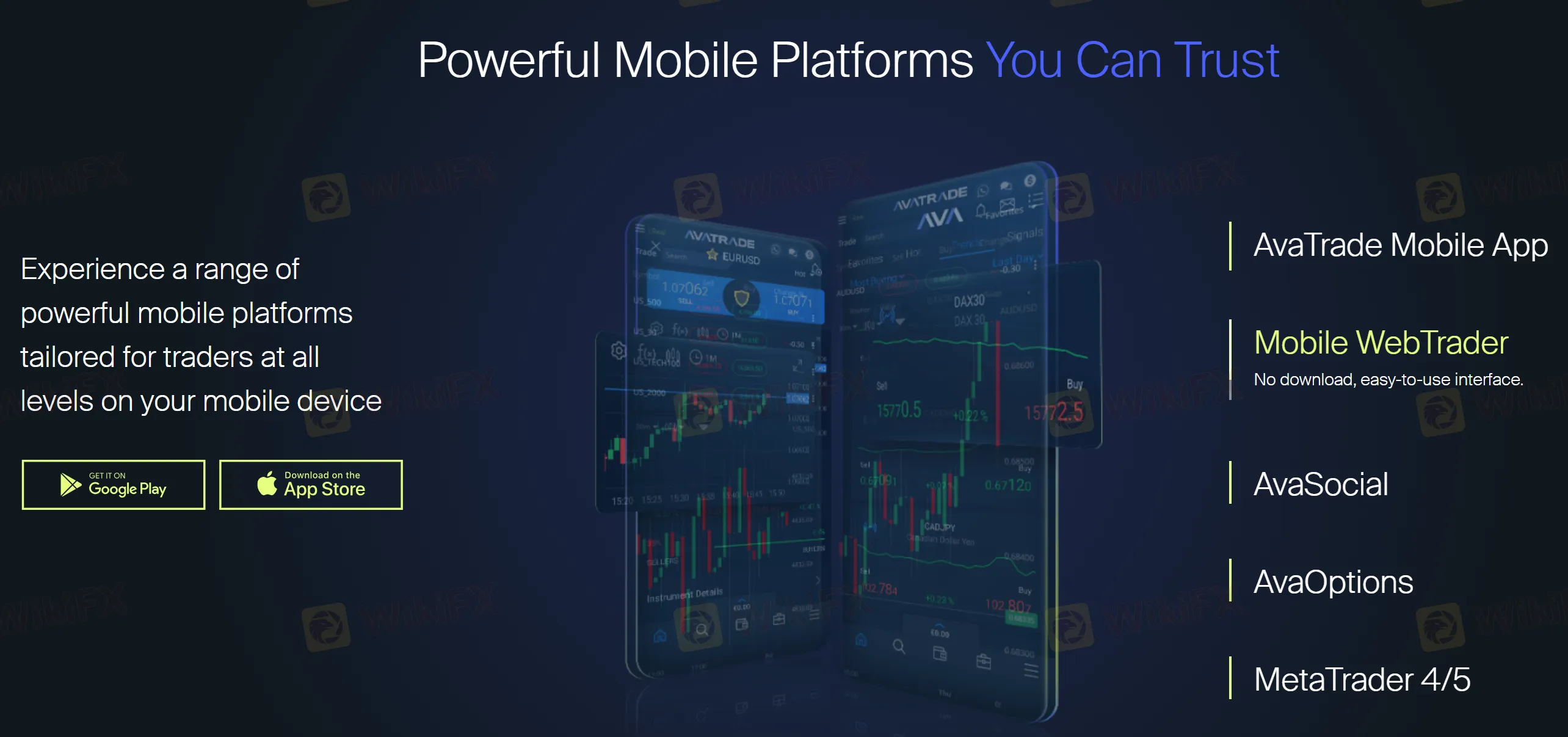

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

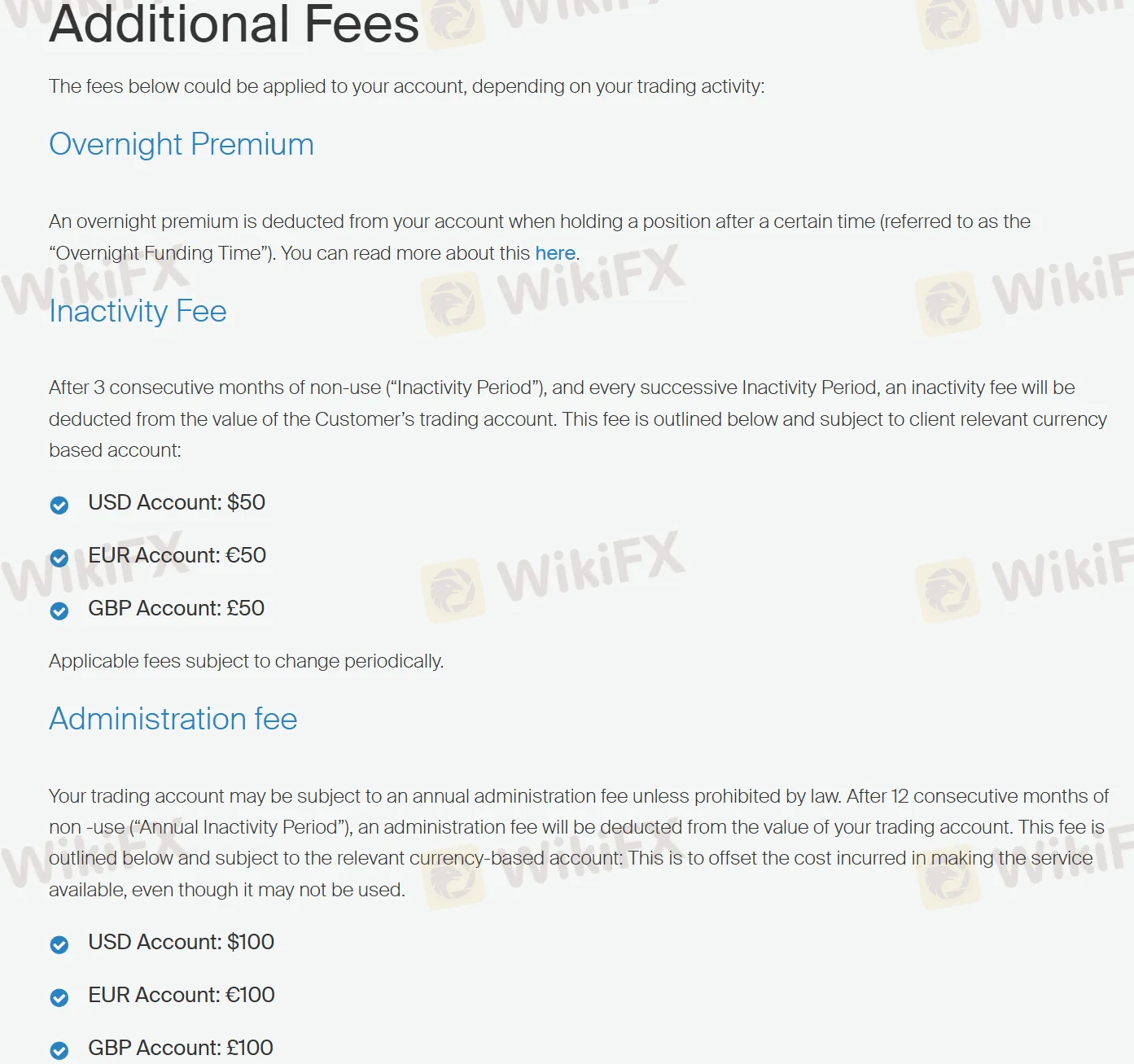

| Inactivity Fee | $/€/£50 after 3 consecutive months of non-use |

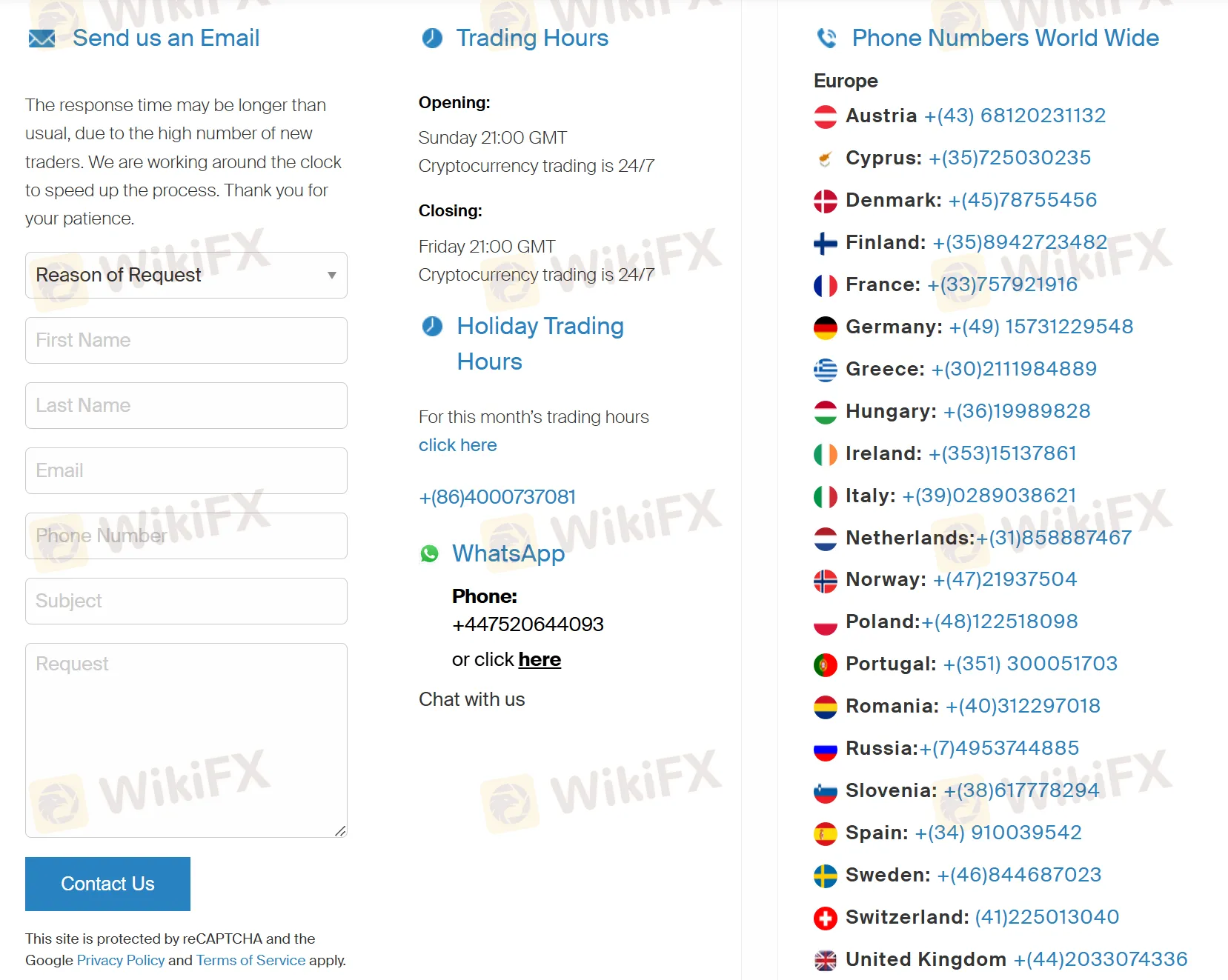

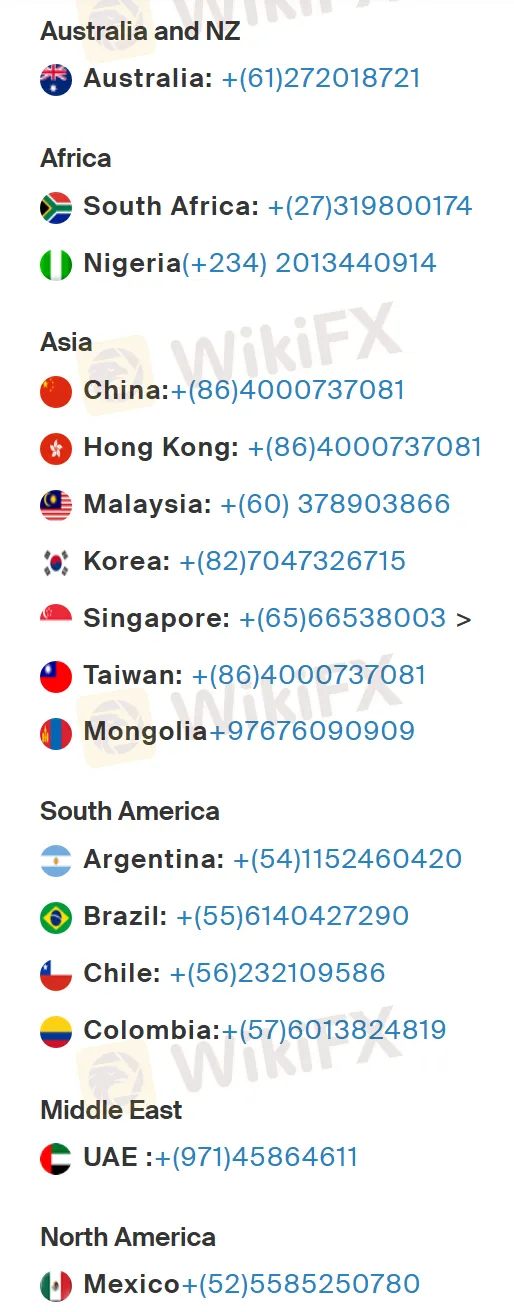

| Customer Support | Live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

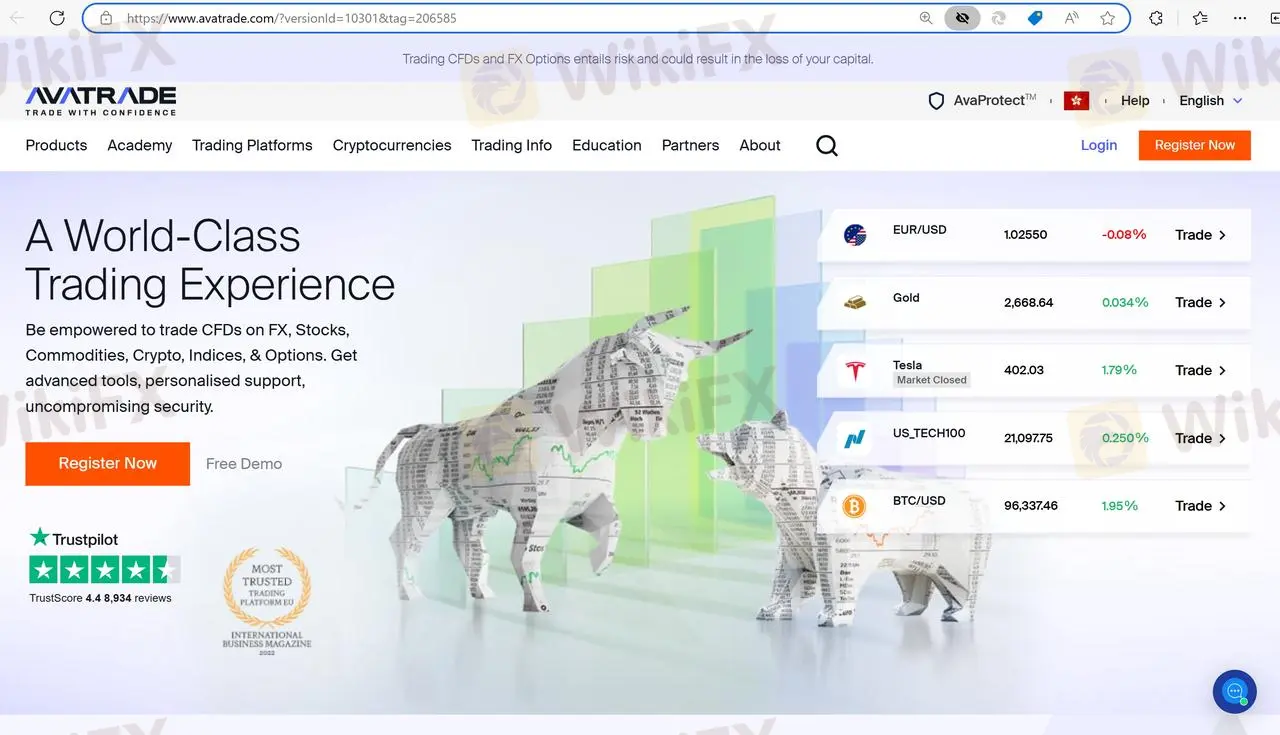

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, FSA, FFAJ, ADGM, CBI, and FSCA.

As a market maker broker, Avatrade offers a range of tradable assets including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options. The broker provides clients with access to multiple trading platforms, including AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, and DupliTrade.

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you.

| Pros | Cons |

| Regulated by reputable financial authorities | Single account option |

| Competitive spreads | Inactivity fee and administration feecharged |

| Multiple trading platforms | |

| Rich and free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

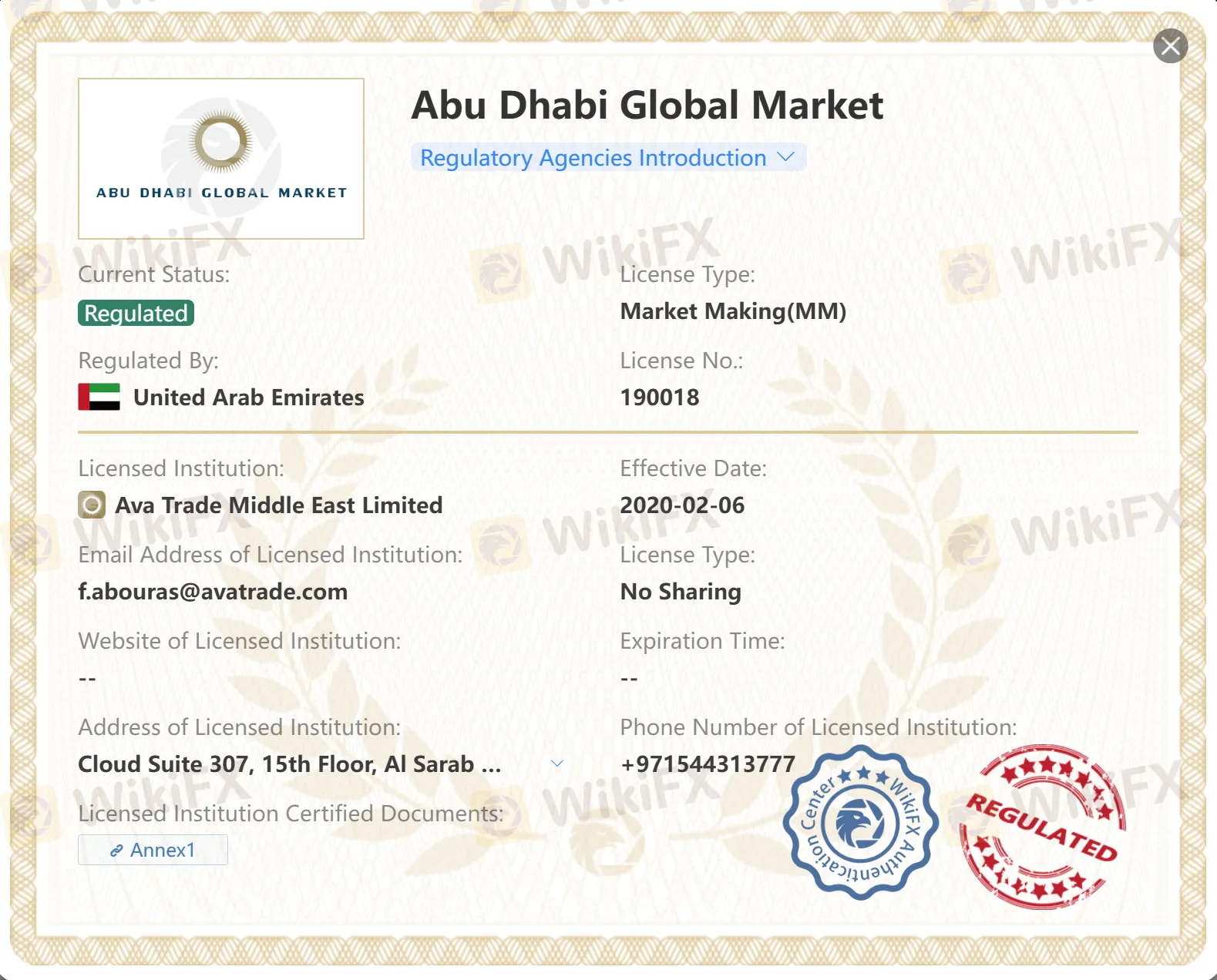

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), and the Financial Sector Conduct Authority of South Africa (FSCA). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

Avatrade offers a wide range of trading instruments across various markets, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options.

| Asset Class | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Crypto CFD | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| FX Options | ✔ |

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, HFM and XM have a minimum deposit requirement of $0 and $5, respectively.

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.

Non-trading fees are the fees that a broker charges for activities other than trading. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker. Avatrade charges inactivity fee and administration fee. You can find detailed info in the table below:

| Fee Type | Amount | Detail |

| Inactivity Fee | $/€/£50 | Charged after 3 consecutive months of non-use (“Inactivity Period”) |

| Administration Fee | $/€/£100 | Charged fter 12 consecutive months of non -use (“Annual Inactivity Period”) |

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

Avatrade accepts MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, and Boleto. The minimum deposit requirement is 100 USD, EUR, GBP or AUD. Deposit and withdrawal processing time very by the method you choose. You can find more detailed info in the screenshot below or directly visit this link: https://www.avatrade.com/about-avatrade/avatrade-withdrawals-deposits

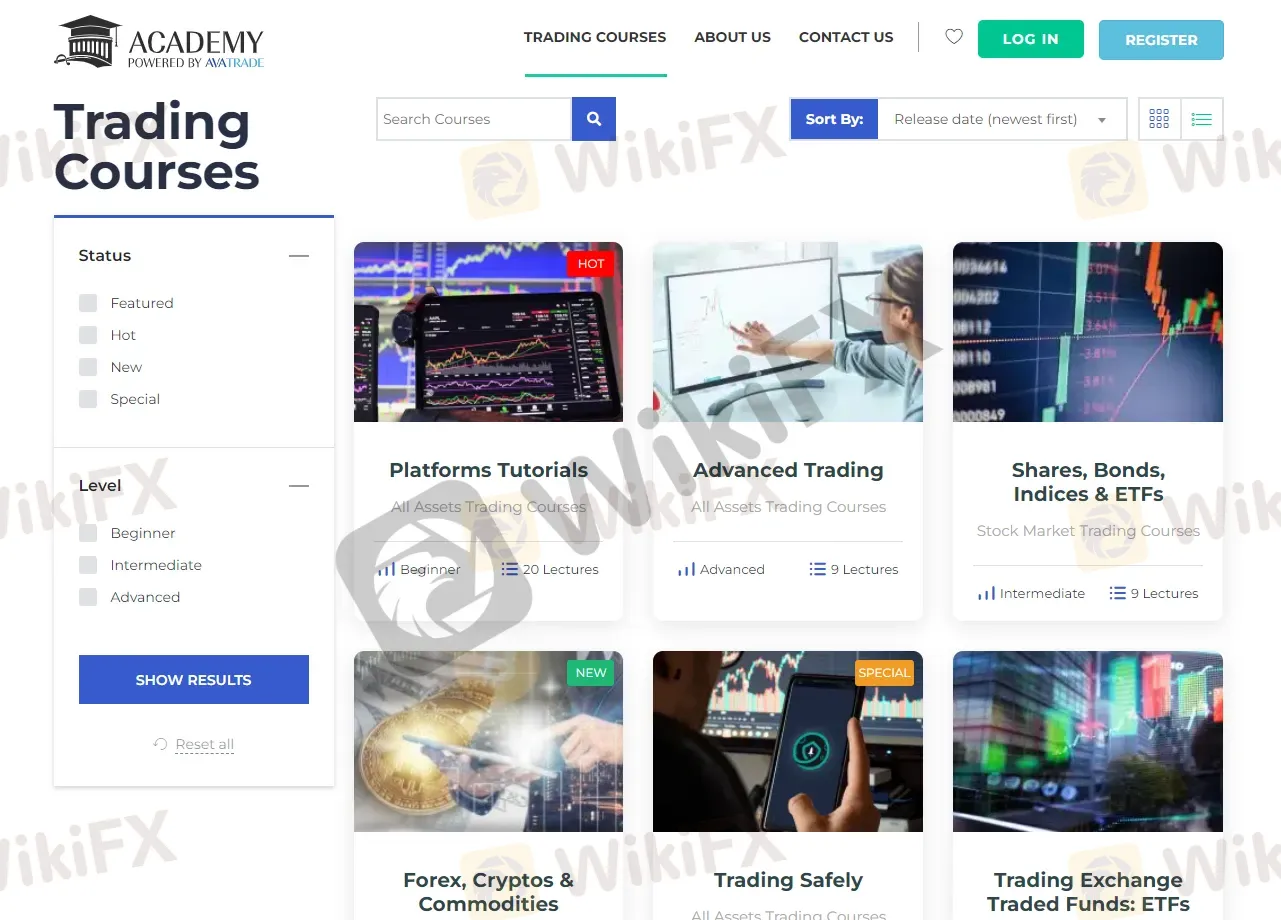

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, etc. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management. Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter.

Avatrade offers customer supportthrough multiple channels, including live chat, contact form, WhatsApp: +447520644093, phone (vary by the region), and email. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and demo accounts for traders to practice their strategies. However, there are some downsides to consider, such as higher inactivity fees and limited account options.

Is Avatrade regulated?

Yes, Avatrade is regulated by multiple reputable authorities, including ASIC (Australia), FSA (Japan), FFAJ (Japan), ADGM (UAE), CBI (Ireland), and FSCA (South Africa).

Does Avatrade offer demo accounts?

Yes.

What is the minimum deposit requirement for Avatrade?

The minimum deposit requirement for Avatrade is $100.

Does Avatrade charge inactivity fee?

Yes. After 3 consecutive months of non-use (“Inactivity Period”), and every successive Inactivity Period, an inactivity fee will be deducted from the value of the Customers trading account. This fee is outlined below and subject to client relevant currency based account:

2025 SkyLine Thailand

2025 SkyLine Thailand

AvaTrade signs a multi-year Red Bull Racing partnership from 2025, adding branding on cars and kits, F1 Academy support, and podcast title rights.

If you're trading online and not using all the tools available, you might be leaving money on the table. AvaTrade, is one of the world’s leading forex and CFD brokers, offers powerful features designed to enhance your trading experience. In this article, we’ll explore 6 powerful AvaTrade features that you should be using right now to level up your trading game.

Zvika Barinboim to take control of Forex Trading Broker AvaTrade in a $500M deal, boosting the Forex Trading Platform’s global reach. Regulatory approval pending.

Novice or experienced traders often look for a shortcut to make money in trading, and Copy Trading is the key. Copy trading is becoming increasingly popular in the forex community. If you're not familiar with it, this article could be your path to success."

When evaluating online trading platforms, it’s essential to compare brokers like XM and AvaTrade to determine which aligns best with your trading needs. Below is a comprehensive comparison based on key factors such as regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates.

AvaTrade launches enhanced automated trading solutions, featuring AvaSocial and DupliTrade for seamless, emotion-free trading. Explore cutting-edge tools today!

The EUR/USD spread starts from 0.9 pips.

The minimal deposit is 100 USD.

Avatrade offers a 21-day demo account for traders who want to practice their trading skills or test the trading platform without risking real money, which can be renewed according to their requirements.

All transactions conducted in AvaTrade are subject to the following potential fees: spread, overnight interest, expiration extension, and inactive fees.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now