Darren Ross

1-2年

Can you tell me the typical EUR/USD spread offered on an INVAST standard account?

As an independent trader with years of experience evaluating brokers, I always focus on transparency and regulatory credibility when examining a new platform. INVAST, regulated by the Japanese Financial Services Agency and operating for over 15 years, stands out for its adherence to local regulations and generally strong reputation in Japan. However, when I look specifically for information on the typical EUR/USD spread for a standard account, I cannot find explicit, up-to-date figures publicly disclosed by INVAST. The broker indicates that spreads are set by the Tokyo Financial Exchange, and user feedback often mentions “super narrow” spreads, which is usually a good sign. Even so, the lack of concrete numbers is a concern for me, especially since spread variability could impact real trading costs.

In my trading practice, I am wary of any broker that does not clearly publish its typical spreads for major pairs like EUR/USD, as this transparency is essential for informed decision-making. Given the information at hand, while spreads are reportedly tight, I cannot provide an exact typical value without further verification—something I personally require before committing meaningful capital. For anyone considering INVAST, I would recommend contacting their support directly for granular spread data and to confirm if real trading conditions meet your needs.

Broker Issues

Fees and Spreads

Abu00saeed

1-2年

What is the highest leverage provided by INVAST for major forex currencies, and how does this leverage differ for other asset classes?

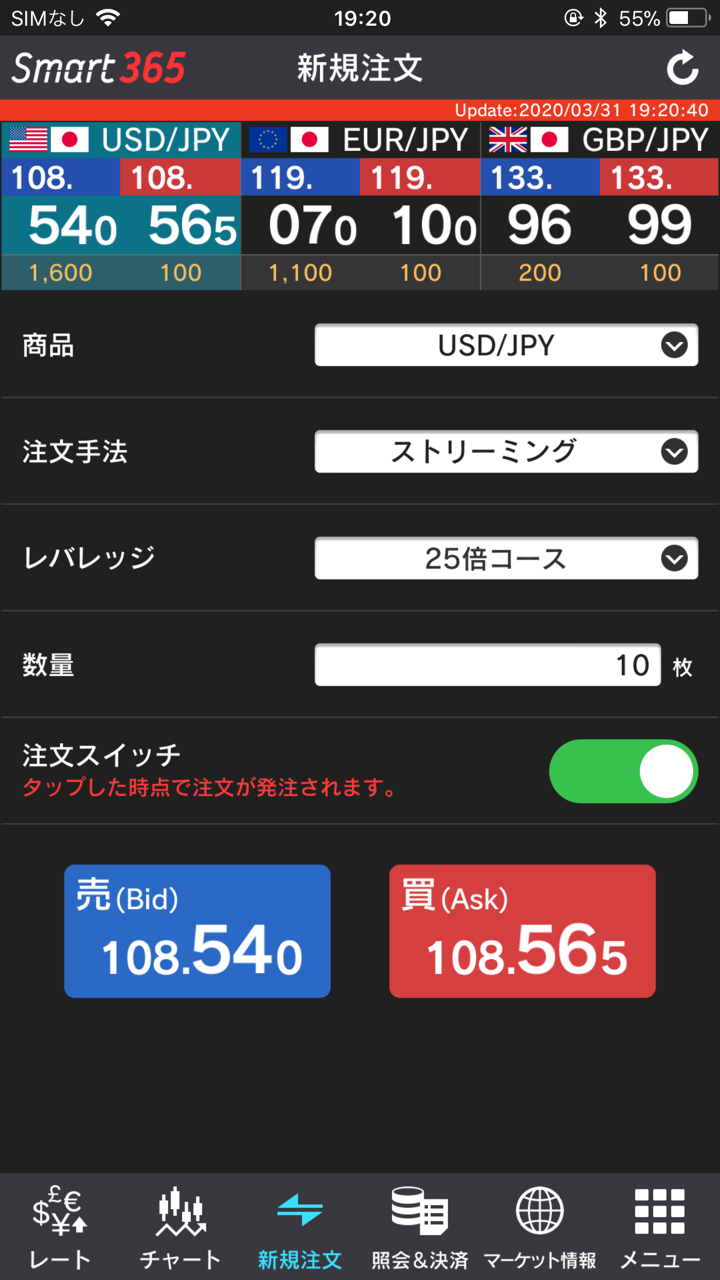

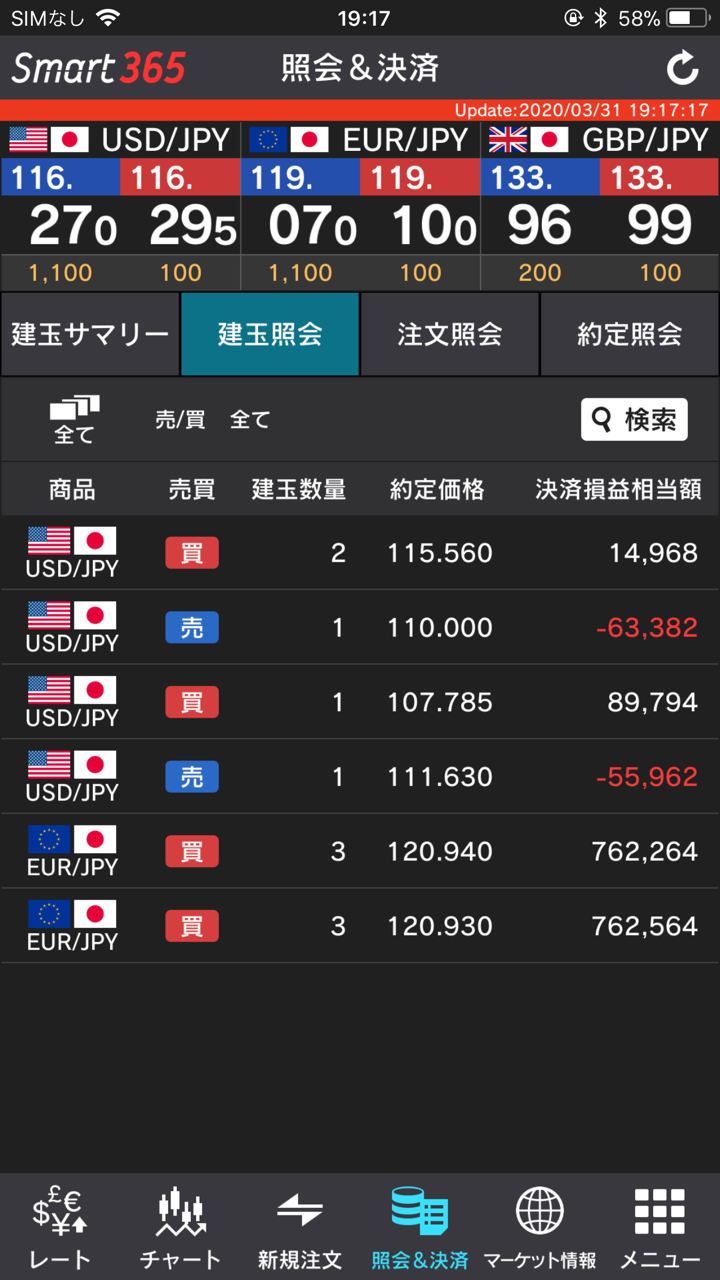

In my experience trading with INVAST, I found that the highest leverage INVAST offers for major forex currencies is 1:25 for personal accounts. This is fairly typical for brokers regulated in Japan, as the Financial Services Agency (FSA) sets strict leverage caps to help manage client risk. The broker also provides lower leverage options—such as 1:10, 1:5, and 1:1—which can be suitable for traders with different risk preferences or strategies.

It’s important to highlight that the leverage is specifically structured for forex trading, as INVAST’s available asset classes are quite limited. Beyond forex, the only other notable products are ETFs, and there is no indication from the available information that the same leverage rates apply. In my observations, non-forex products like ETFs generally have lower or different leverage regulations in Japan, but INVAST’s documentation does not clearly specify the leverage for ETFs. There are no offerings for other asset classes like commodities, indices, stocks, or cryptocurrencies with INVAST, which means leverage options are simply not available for those markets on this platform. For me, this restriction emphasizes the need for traders to carefully consider their instrument choices, especially if high leverage is central to their trading style. Personally, I view INVAST's leverage caps as aligned with prudent risk management in a highly regulated environment.

Broker Issues

Account

Instruments

Leverage

Platform

QM Trader

1-2年

What are the primary advantages and disadvantages of trading with INVAST?

Having traded with a variety of brokers over my career, I approach any new platform with care, and INVAST stands out for a few key reasons. For me, one of the most significant advantages is its long-standing regulation by Japan’s Financial Services Agency (FSA). This level of oversight gives me confidence that the broker operates to a high standard of transparency and compliance, which is especially important for safeguarding client funds. I also appreciate that INVAST has been in operation for around 15-20 years; in forex, longevity often reflects stability and sustainable business practices.

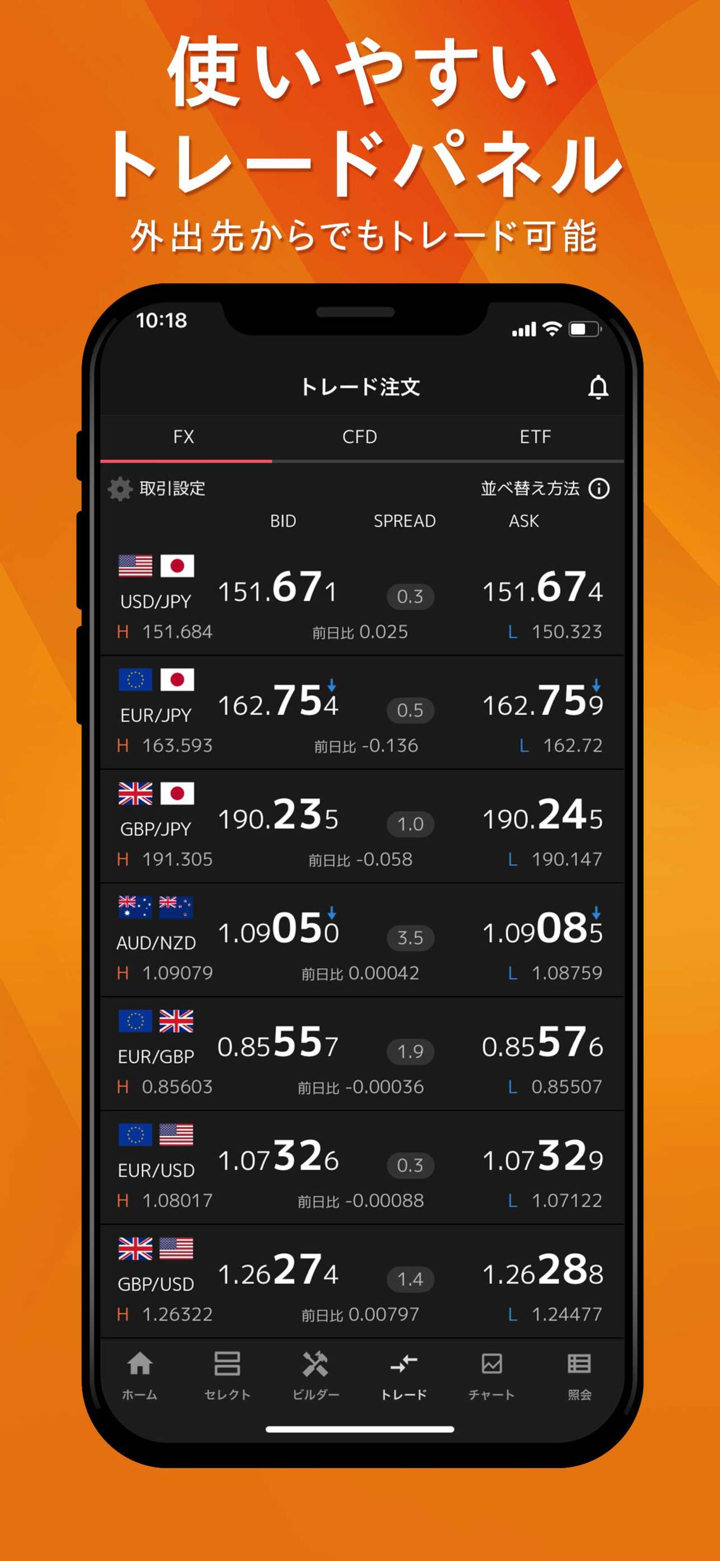

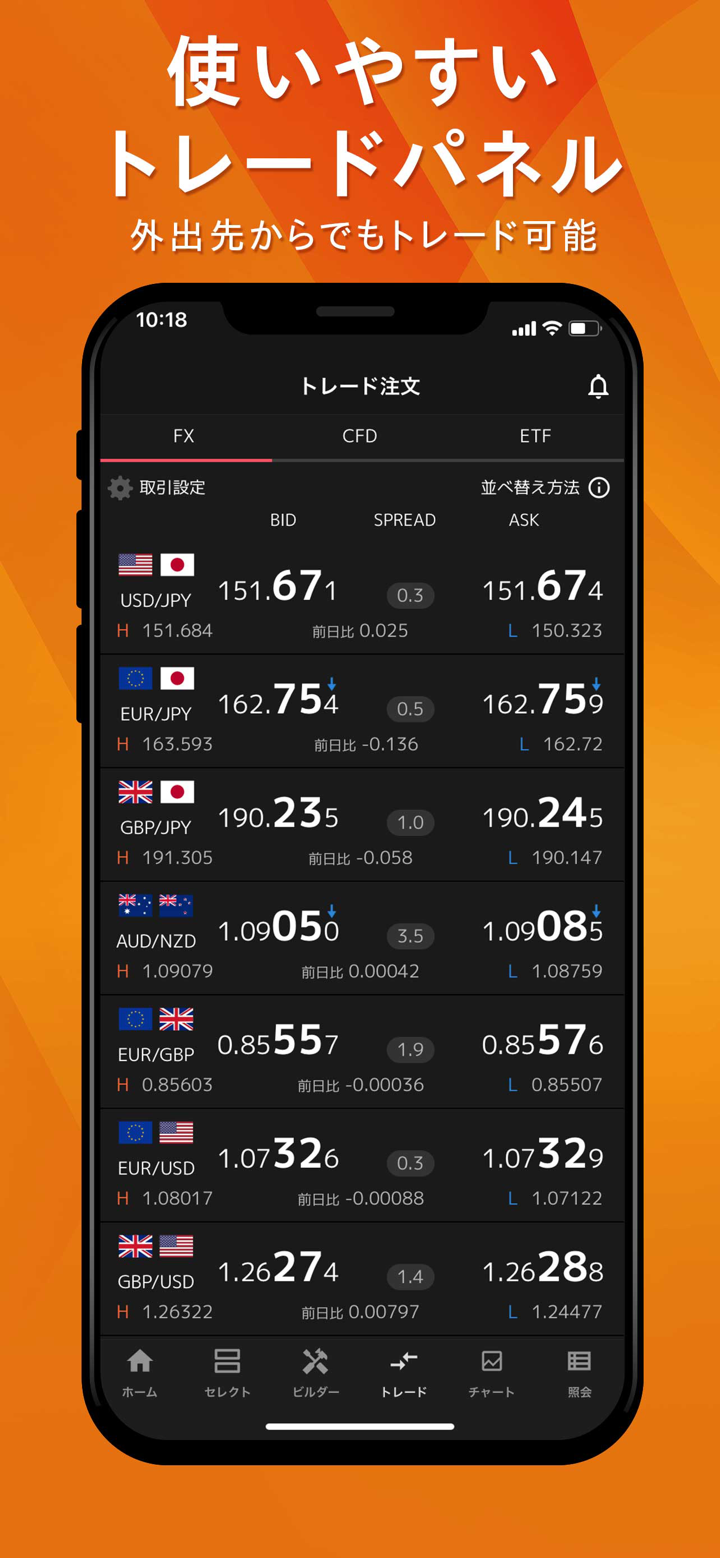

Trading conditions are relatively clear: leverage is capped at 1:25 for personal accounts, adhering to Japanese regulatory norms, which I view as prudent risk management. The Click 365 proprietary platform is tailored for the Japanese market and is known for its robust functionality, though it is not MT4/MT5 compatible, which might not meet all traders' preferences. Spreads are determined by the Tokyo Financial Exchange, and trading fees are transparent, with discounts available for high-volume traders—something I always look for as this can affect long-term profitability.

However, I see notable drawbacks. The product range is quite narrow, limited mainly to forex and ETFs. This restriction means if, like me, you want to diversify into commodities, indices, or cryptocurrencies, you’re out of luck. Additionally, no demo account is available, which hinders the ability to test strategies risk-free before committing funds. The experience can be hampered if you’re not proficient in Japanese, as the support and platform seem primarily targeted at local users. Finally, data updates feel a bit slow, and the proprietary platform, while stable, lacks some advanced analytics tools I’ve come to rely on elsewhere.

In summary, trading with INVAST gives me confidence due to its regulatory strength and operational transparency, but the limited instruments and platform restrictions make it less versatile than some global peers. I believe it’s best suited for those focused on forex and ETFs within a tightly regulated environment, but not ideal if you are seeking broad asset variety or advanced platform features.

Davis Wu

1-2年

Are there any payment methods with INVAST that allow for instant withdrawals?

Based on my experience and a close look at the available information about INVAST, I have not encountered any indication that they offer instant withdrawal methods. INVAST primarily supports deposits through bank counter, ATM, and online banking options, with fees for deposits generally waived when using their instant deposit service. However, when it comes to withdrawals, the fees are covered by INVAST itself, which is a positive for overall costs, but there is no mention of instant withdrawal options—such as e-wallets or similar rapid transfer mechanisms—which some international brokers provide.

For me, prompt withdrawals are crucial for risk management and trading flexibility, so I paid particular attention to these details. INVAST's process, being bank-centric, likely involves normal banking timelines, and the platform does not currently support electronic payment solutions that might enable quicker transfers. This can mean standard processing times, potentially one to several business days, depending on banking hours and holidays. While the withdrawal process appears reliable and without extra charges, those with a strong preference for instant access to funds might find this limitation noteworthy. I always emphasize thoroughly considering your own operational needs before deciding on a broker, as speed and convenience in funding methods can significantly impact your trading efficiency.

Broker Issues

Deposit

Withdrawal

FX3196354740

香港

感觉还不错,出金速度快,开户简单快捷,操作也方便,就是数据更新有点慢,品种有限,因为不是内地平台,和客服沟通也不是那么方便,但客服还是很有耐心,还是比较靠谱的。

好评

周红玉

香港

我给这个地方 5 颗星。也推荐给大家。如果您在这个地方开始交易,您肯定会赚到大钱。目前市场上没有其他类似的平台。我对这个地方没有任何抱怨。每当我向这里的客户服务人员寻求支持时,我都会得到支持。

好评

FX1182046228

香港

點差超級窄,出入金速度也非常快,雖然可選方式還是稍微少了些,希望保持現在的然後再繼續改進啦,要是可以支持電子支付就更好了,這樣交易就更加方便啦!

好评

杰出青年

香港

這個日本的公司看著還可以啊,可惜我不懂日語而且感覺和本地的公司交易會好一點。香港有沒有類似的公司呢?有沒有匯友來推薦一下啦

好评