公司簡介

| KnightsbridgeFX 評論摘要 | |

| 成立年份 | 2009 |

| 註冊國家/地區 | 加拿大 |

| 監管 | 無監管 |

| 服務 | 為個人和企業提供外幣兌換服務,優於銀行匯率 |

| 最低存款 | $2,000 加幣 |

| 客戶支援 | 免費電話(加拿大/美國):(877)-355-KBFX (5239) 分機 1 |

| 本地:(416) 800-5552 / (416) 479-0834 | |

| 電郵:contact@knightsbridgefx.com | |

| 地址:First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

KnightsbridgeFX 資訊

KnightsbridgeFX 在加拿大並非受監管的金融服務公司。它未經加拿大投資業監管組織(IIROC)或任何省級監管機構許可。儘管是一家真正的貨幣兌換業務,但並未受到建立的金融機構的監管。

優缺點

| 優點 | 缺點 |

| 提供比加拿大主要銀行更優惠的匯率 | 無監管 |

| 大部分交易可提供當日轉帳 | |

| 無存款/提款費用 |

KnightsbridgeFX 是否合法?

KnightsbridgeFX 並非受監管 的金融服務提供者。它沒有從加拿大投資業監管組織(IIROC)或加拿大任何省級機構取得任何許可,而其註冊地點為加拿大。

根據WHOIS記錄,knightsbridgefx.com 域名於2009年6月11日註冊,最後更新日期為2023年6月7日,到期日為2029年6月11日。其狀態為“clientTransferProhibited”,表示該域名安全且活躍,受到保護,防止非法轉移或修改。

KnightsbridgeFX 服務

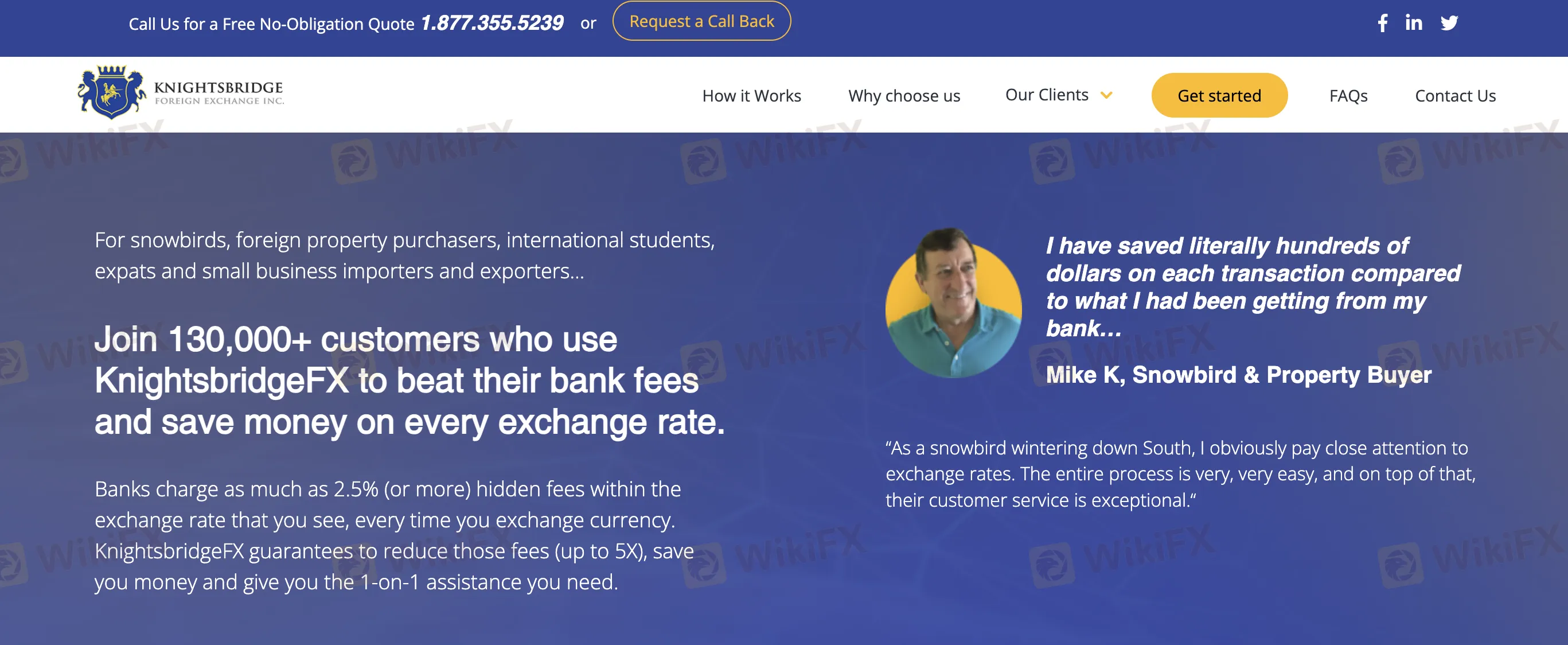

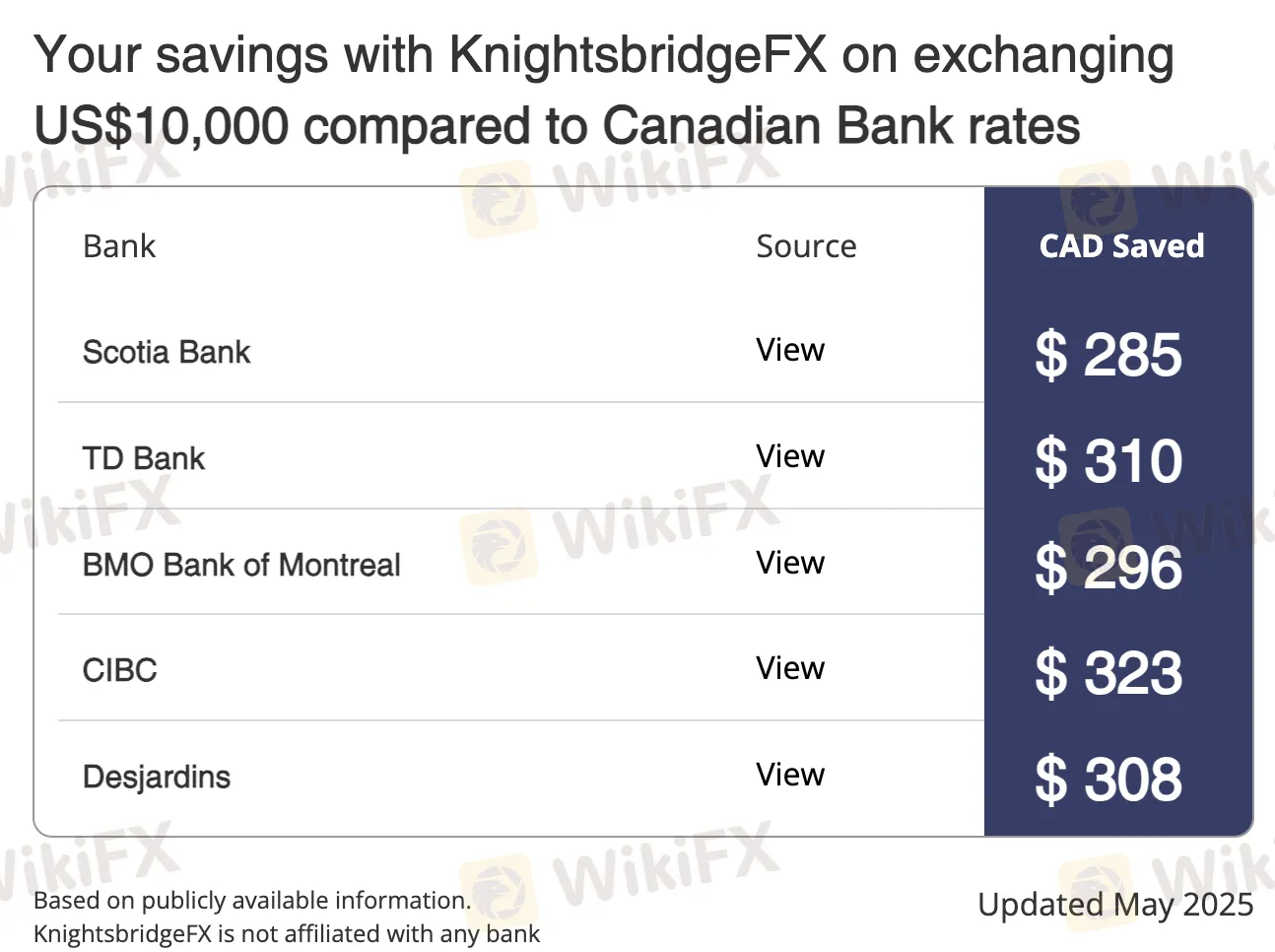

KnightsbridgeFX 是一家加拿大貨幣兌換公司,為個人和小型企業提供外幣兌換服務,專注於比銀行更優惠的匯率。它為過冬者、房地產買家、外籍人士、國際學生和進出口公司提供無隱藏費用、當日轉帳和個性化服務。

| 服務 | 支援 |

| 貨幣兌換(加幣/美元及其他外匯) | ✔ |

| 房地產貨幣轉帳 | ✔ |

| 學費及國際學生付款 | ✔ |

| 進出口企業外匯 | ✔ |

最低兌換金額

與 KnightsbridgeFX 進行交易的最低金額通常為每筆交易$2,000 加幣。儘管這是他們的基準水平,但他們承認根據情況有一定的靈活性。

存款和提款

KnightsbridgeFX不收取存款或提款費用。在國際匯款時,中間銀行和收款銀行可能收取費用。最低存款(交易金額)通常為$2,000 加幣,但他們可能會提供一些彈性。

| 付款方式 | 最低金額 | 費用 | 處理時間 |

| 帳單支付 | $2,000 加幣 | 0 | 當天(通常) |

| 電匯 | 當天或1個工作日 | ||

| EFT(電子資金轉帳) | 當天(通常) |