Buod ng kumpanya

| KnightsbridgeFX Buod ng Pagsusuri | |

| Itinatag | 2009 |

| Rehistradong Bansa/Rehiyon | Canada |

| Regulasyon | Walang regulasyon |

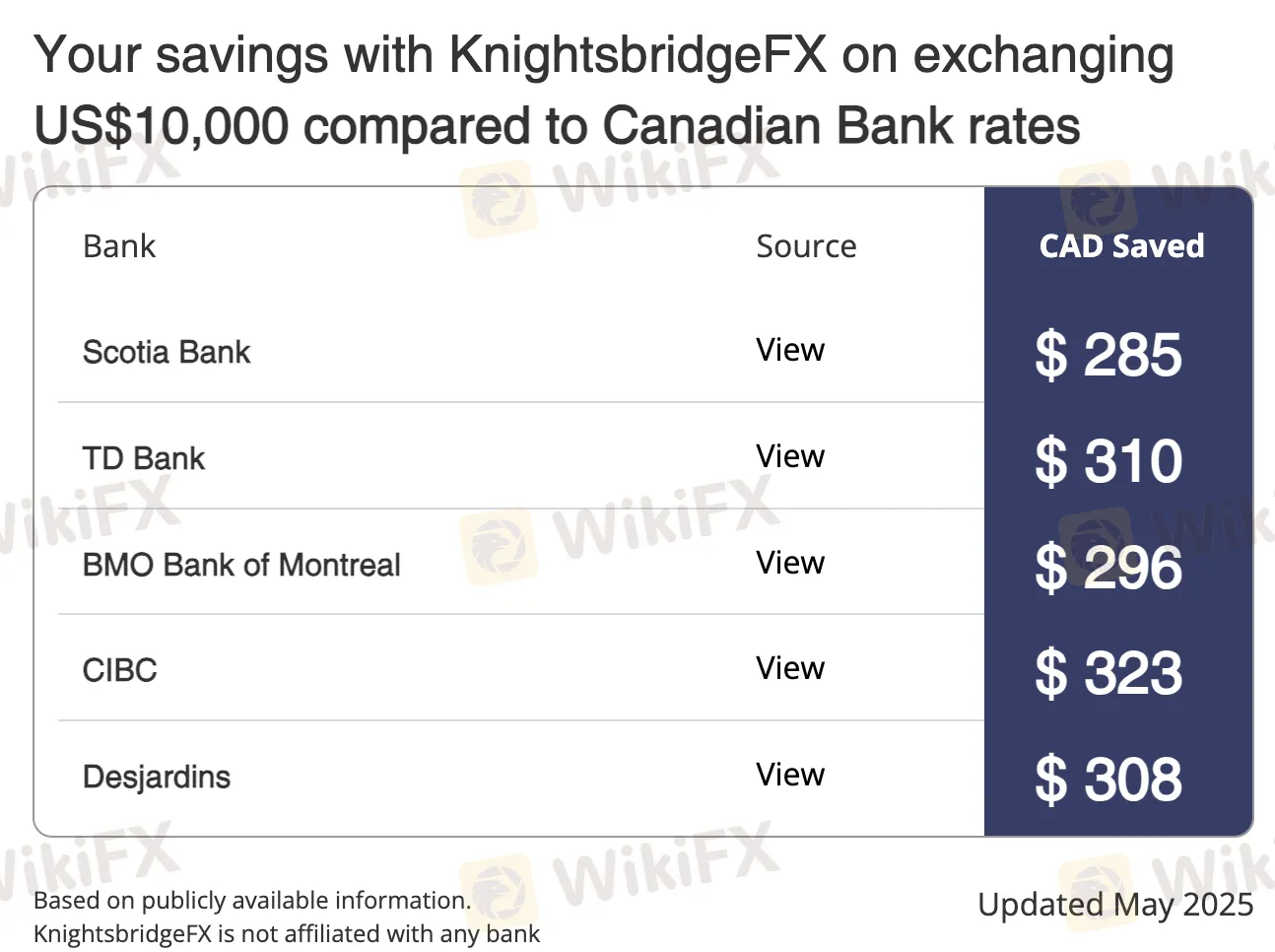

| Mga Serbisyo | Papalitan ng dayuhang pera para sa mga indibidwal at negosyo, mga rate na tinalo ang mga bangko |

| Minimum Deposit | $2,000 CAD |

| Suporta sa Customer | Toll-Free (Canada/USA): (877)-355-KBFX (5239) ext. 1 |

| Lokal: (416) 800-5552 / (416) 479-0834 | |

| Email: contact@knightsbridgefx.com | |

| Address: First Canadian Place, 100 King St W, Suite 5700, Toronto, ON, M5X 1C7 | |

Impormasyon Tungkol sa KnightsbridgeFX

Ang KnightsbridgeFX ay hindi isang reguladong kumpanya ng serbisyong pinansyal sa Canada. Ito ay hindi lisensyado ng IIROC o ng mga regulator ng lalawigan. Bagaman ito ay isang tunay na negosyo ng palitan ng pera, hindi ito regulado ng mga itinatag na ahensiyang pinansyal.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Nag-aalok ng mas magandang mga rate ng palitan kaysa sa mga pangunahing bangko sa Canada | Walang regulasyon |

| Magagamit ang parehong-araw na paglilipat para sa karamihan ng mga transaksyon | |

| Walang bayad sa deposito/pag-withdraw |

Tunay ba ang KnightsbridgeFX?

Ang KnightsbridgeFX ay hindi isang reguladong tagapagbigay ng serbisyong pinansyal. Hindi ito mayroong anumang lisensya mula sa Investment Industry Regulatory Organization of Canada (IIROC) o anumang mga awtoridad ng lalawigan sa Canada, kung saan ito rehistrado.

Ayon sa mga rekord ng WHOIS, ang domain na knightsbridgefx.com ay nirehistro noong Hunyo 11, 2009, huling na-update noong Hunyo 7, 2023, at mag-e-expire sa Hunyo 11, 2029. Ang kanyang status ay "clientTransferProhibited", na nangangahulugang ang domain ay ligtas at buhay, na pinoprotektahan mula sa ilegal na paglilipat o pagbabago.

Mga Serbisyo ng KnightsbridgeFX

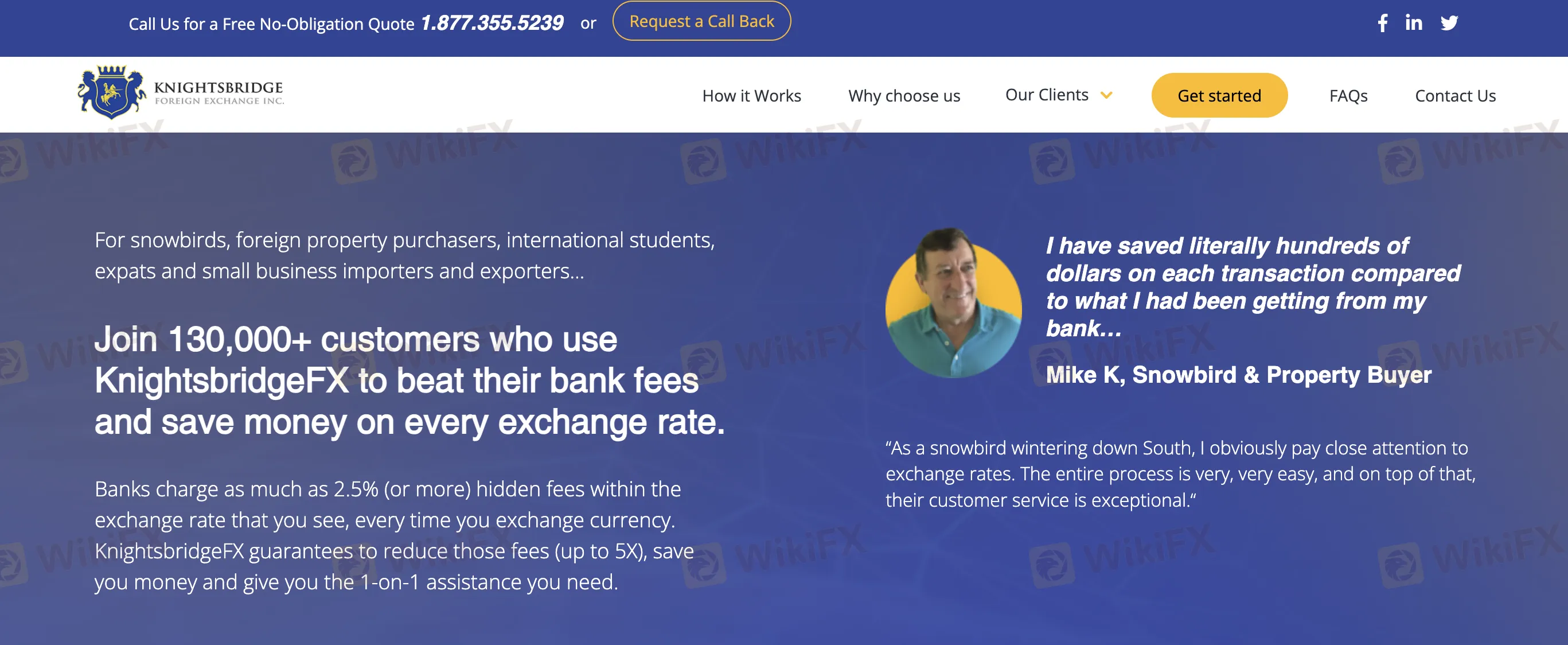

Ang KnightsbridgeFX ay isang kumpanya ng palitan ng pera sa Canada na nagbibigay ng mga serbisyong palitan ng dayuhang pera sa mga indibidwal at maliit na negosyo, na may pokus sa mas magandang mga rate ng palitan kaysa sa mga bangko. Ito ay inilalapat sa mga snowbird, mga bumibili ng real estate, mga expat, mga internasyonal na mag-aaral, at mga kumpanya ng import/export, nag-aalok ng walang nakatagong bayad, parehong-araw na paglilipat, at personalisadong serbisyo.

| Mga Serbisyo | Supported |

| Palitan ng Pera (CAD/USD at iba pang FX) | ✔ |

| Transaksyon ng Pera sa Real Estate | ✔ |

| Pagbabayad sa Tuition at Internasyonal na Mag-aaral | ✔ |

| Business FX para sa Import/Export | ✔ |

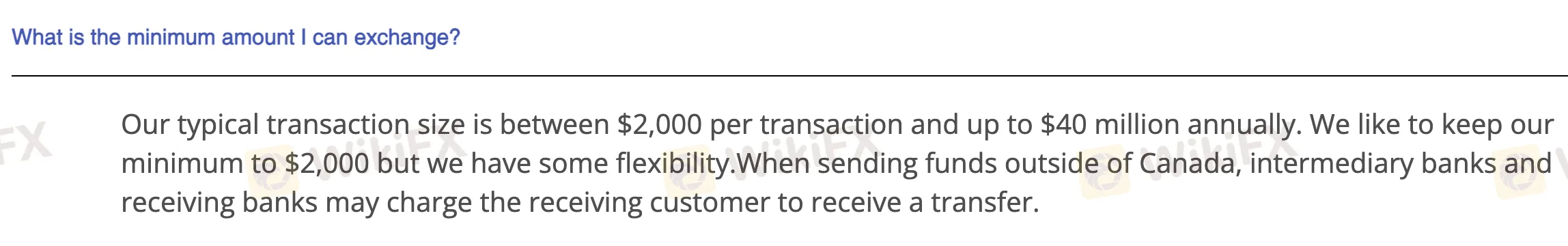

Minimum Halagang Pinalitan

Ang minimum na halaga na maaaring ipalit sa KnightsbridgeFX ay karaniwang $2,000 CAD bawat transaksyon. Bagaman ito ang kanilang batayang antas, kinikilala nila na mayroong kaunting kakayahang baguhin batay sa kalagayan.

Deposito at Pag-Atas

Ang KnightsbridgeFX ay hindi naniningil ng bayad para sa mga deposito o pag-atraso. Maaaring may bayad na ipinapataw ng mga intermediate at receiving banks kapag nagpapadala ng mga bayad sa pandaigdigang paraan. Karaniwan ang minimum na deposito (halaga ng palitan) ay $2,000 CAD, ngunit maaaring magbigay sila ng kaunting pagbibigay-sa-leeg.

| Pamamaraan ng Pagbabayad | Minimum na Halaga | Mga Bayad | Oras ng Paghahatid |

| Pagbabayad sa Bill | $2,000 CAD | 0 | Parehong araw (karaniwan) |

| Wire Transfer | Parehong araw o 1 araw na pang-negosyo | ||

| EFT (Electronic Funds Transfer) | Parehong araw (karaniwan) |