基礎資訊

日本

日本天眼評分

日本

|

15-20年

|

日本

|

15-20年

| https://www.nomura.co.jp/

官方網址

評分指數

影響力

AAA

影響力指數 NO.1

日本 9.74

日本 9.74 監管資訊

監管資訊持牌機構:野村證券株式会社

監管證號:関東財務局長(金商)第142号

單核

1G

40G

1M*ADSL

日本

日本 nomuraholdings.com

nomuraholdings.com nomura.com

nomura.com

| NOMURA 評論摘要 | |

| 成立年份 | 1994 |

| 註冊國家/地區 | 日本 |

| 監管機構 | FSA |

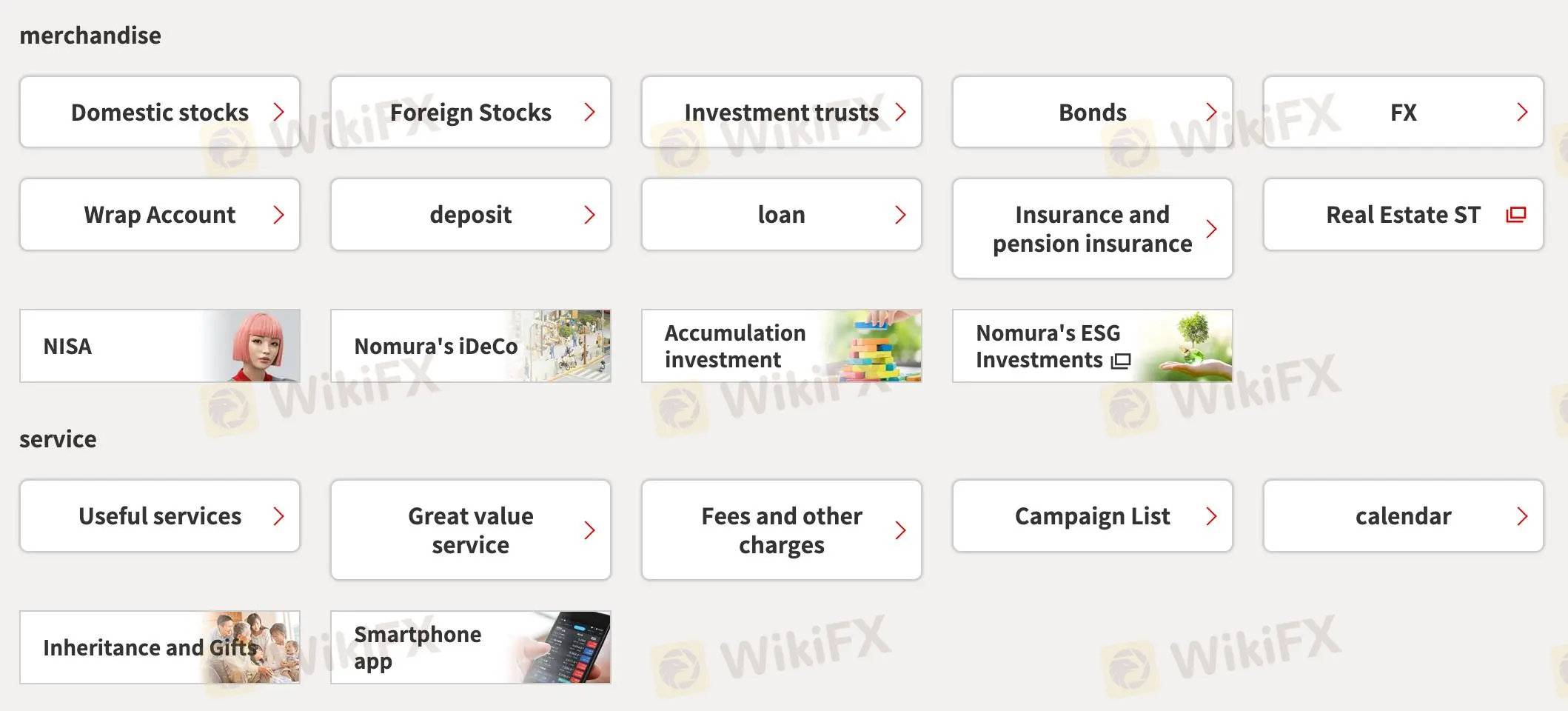

| 市場工具 | 國內股票、外國股票、投資信託、債券、外匯、房地產ST |

| 模擬帳戶 | / |

| 槓桿 | 1:25 |

| 點差 | USD/JPY: 2.8點 |

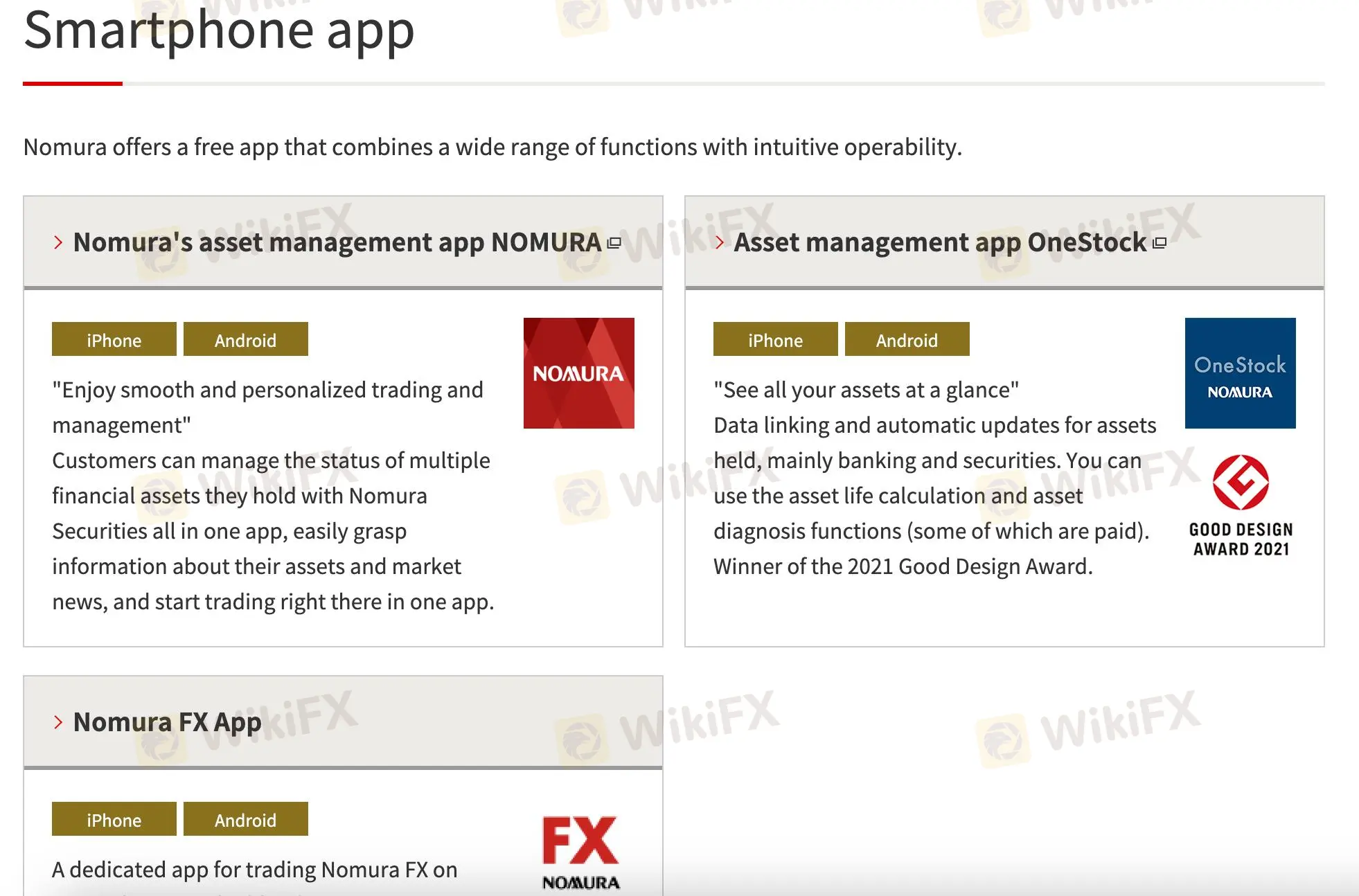

| 交易平台 | 野村資產管理應用程式("NOMURA")、資產管理應用程式(OneStock)、野村外匯應用程式 |

| 最低存款 | / |

| 客戶支援 | - 一般撥號:0570-077-000 |

| - 替代:042-303-8100 | |

野村證券提供股票、投資信託、外匯交易和結構化房地產。其先進的交易系統和嚴格的監管控制為零售和機構客戶提供服務。該公司的成本結構因服務渠道而異,分行的費率遠高於線上的費率。

| 優點 | 缺點 |

| 受FSA監管 | 分行交易的手續費較高 |

| 全方位的交易應用程式和平台 | 與競爭對手相比,槓桿有限 |

| 眾多可交易的工具 | 無模擬帳戶可用 |

是的,野村受到監管。日本的FSA在零售外匯牌照下監管該公司。牌照號碼為関東財務局長(金商)第142号,有效日期為2007-09-30。

該經紀商提供本地和外國股票、投資信託、債券、外匯交易和保險產品等多種金融產品和服務。他們提供支援服務,包括活動促銷、遺產準備和智能手機應用程式。

| 可交易工具 | 支援 |

| 國內股票 | ✔ |

| 外國股票 | ✔ |

| 投資信託 | ✔ |

| 債券 | ✔ |

| 外匯 | ✔ |

| 房地產結構產品(ST) | ✔ |

| 大宗商品 | ❌ |

| 加密貨幣 | ❌ |

| ETF | ❌ |

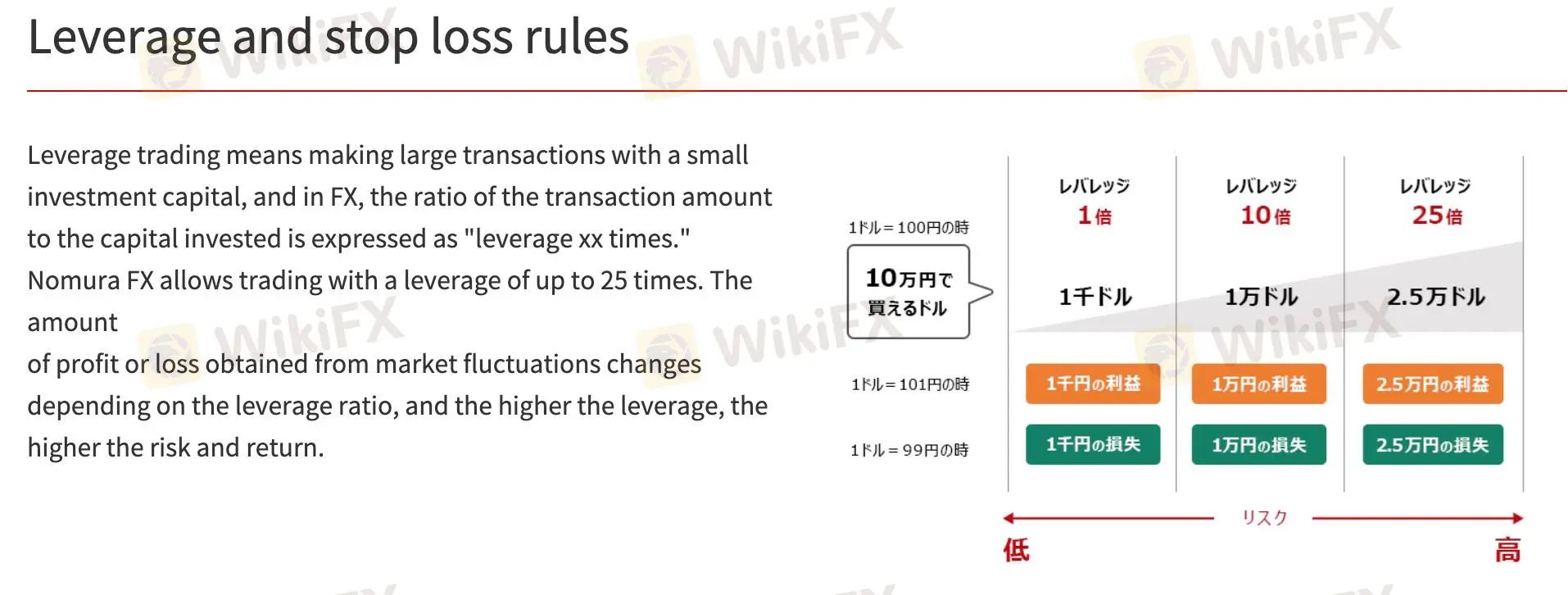

Nomura FX 允許交易者以25倍槓桿進行更大的交易,只需較少的現金。高槓桿可以增加利潤,但也會增加損失。Nomura FX 的「損失削減規則」在「保證金維持率」低於100%時自動平倉,降低風險。交易者應該謹慎,因為突然的市場變動可能導致損失超過存入現金,即使有止損訂單也是如此。

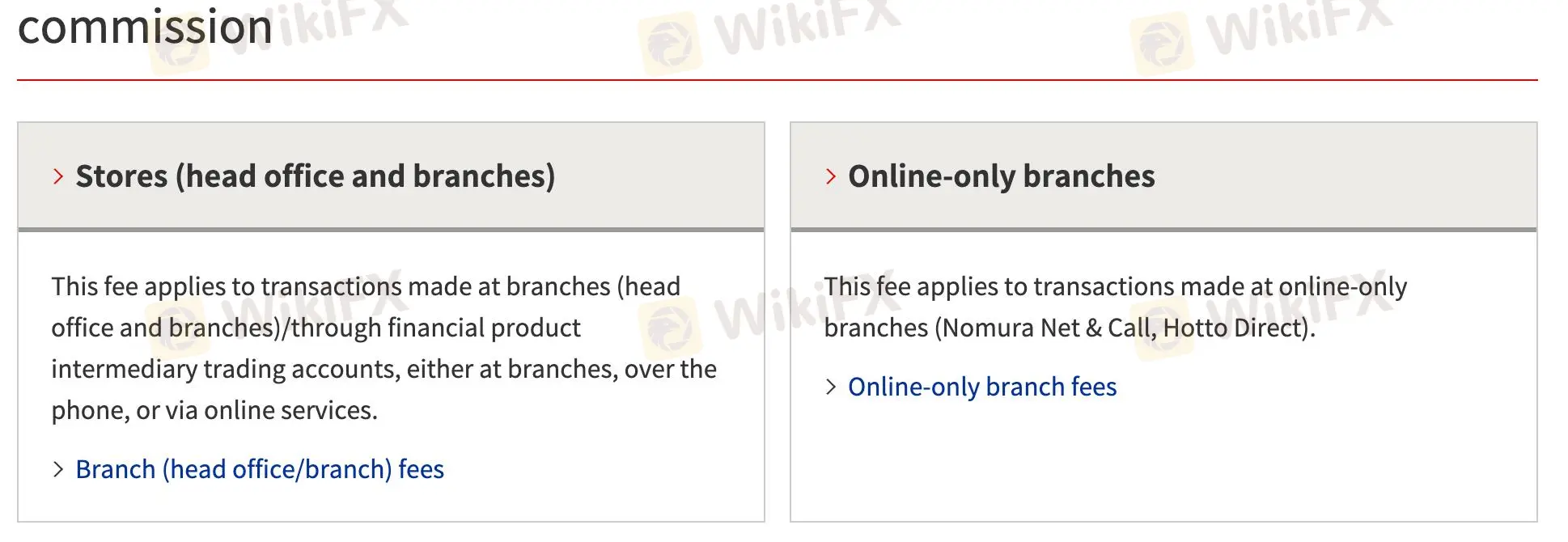

Nomura 的費率因服務而異,分行和網上交易的費用不同。實體分行對國內股票交易收取的費用遠高於網上帳戶。

| 費用類型 | 收費 |

| 股票轉移到另一家公司(<20股) | 基本費用:550日元 + 550日元/股(最低1,100日元)。 |

| 股票轉移到另一家公司(>20股) | 統一費用:11,000日元。 |

| 額外購買股票 | 每股330日元。 |

| 餘額或交易證明 | 個別交易免費;每個帳戶多次交易收取1,000日元。 |

無交易費用:Nomura FX 不收取明確的交易費用,而是從點差中獲得收入。

掉期利率:交易者可能根據交易貨幣之間的利率差異而賺取或支付掉期點數。掉期點數根據市場條件波動。

貨幣轉換:對於非日元貨幣交易,可能需要額外的日元轉換點差。

| 貨幣對 | 點差(點) |

| 美元/日元 | 2.8 |

| 歐元/日元 | 5.3 |

| 英鎊/日元 | 6.9 |

| 澳元/日元 | 4.9 |

| 歐元/美元 | 2.9 |

| 交易平台 | 支援 | 可用設備 | 適合何種交易者 |

| Nomura 資產管理應用程式「NOMURA」 | ✔ | iPhone、Android | 管理多種金融資產並尋求個性化交易工具的交易者和投資者。 |

| 資產管理應用程式「OneStock」 | ✔ | iPhone、Android | 希望瞭解其資產概況並具有額外功能(如資產診斷)的投資者。 |

| Nomura FX 應用程式 | ✔ | iPhone、Android | 偏好在移動設備上進行交易並具有直觀和專注操作的外匯交易者。 |

野村證券股份有限公司(Nomura Securities Co.,Ltd.)成立於2001年5月7日,是野村控股有限公司(Nomura Holdings, Inc.)的全資子公司。野村證券是一家金融服務集團和全球投資銀行,主要從事證券業務。野村證券總部設在日本東京,在香港、倫敦和紐約設有區域總部。它通過五個業務部門運作:零售(在日本)、全球市場、投資銀行、商業銀行和資產管理。野村證券由日本金融廳(FSA)監管,監管證號為6010001074037。更多外匯訊息,請上外匯天眼。

Based on my research and experience, one challenge I’ve faced with NOMURA is a lack of transparency about specific deposit and withdrawal methods. While the broker is highly regulated by the Japanese FSA and offers a long-standing, reputable business structure, direct details regarding whether they accept credit cards, PayPal, Skrill, or cryptocurrencies are not openly advertised or specified within their readily available resources. In practice, Japanese brokers, especially those serving mainly domestic clients like NOMURA, tend to facilitate transfers primarily via Japanese bank accounts and in-person branch services instead of international e-wallets or crypto options. This approach aligns with local financial regulations intended to minimize fraud and maintain a high compliance standard. As someone who often seeks flexibility, I find the lack of explicit support for international payment methods to be a limiting factor if you are a non-resident or expect diverse deposit and withdrawal channels. If ease and speed of transactions via PayPal, Skrill, or crypto are vital for your trading flow, NOMURA may not meet these expectations; instead, it appears best suited for Japan-based traders accustomed to local banking infrastructure. Until NOMURA provides clearer information or expanded payment options, I would proceed cautiously, ensuring all my transactions could be managed comfortably through Japanese banking channels. This conservative stance helps safeguard against potential misunderstandings, delays, or difficulties, especially for international clients.

Based on my experience testing NOMURA as a forex and securities broker, I found that their range of trading instruments focuses primarily on traditional asset classes. Through NOMURA, I am able to access domestic and foreign stocks, investment trusts, bonds, foreign exchange (FX), and structured real estate products. However, instruments like commodities, cryptocurrencies, and exchange-traded funds (ETFs) are not available on their platform. This selection reflects NOMURA’s roots as a well-established, regulated Japanese financial institution, emphasizing assets typical of the local market and mainstream global securities. For me, the absence of cryptocurrencies and commodities means the platform isn’t suitable if I’m looking for exposure to those riskier or alternative markets. However, if I’m focusing on equity, FX, or fixed income trading with an added layer of regulatory scrutiny, NOMURA can be appropriate. The broker’s asset coverage is best suited for traders and investors who value regulatory oversight and a more conservative lineup, rather than those seeking broader diversification into newer or higher-volatility products. This limitation is important for anyone considering long-term strategy or portfolio construction and should be taken into account based on individual trading objectives.

Based on my thorough review of NOMURA and drawing from my experience in the forex industry, I must take a conservative approach when considering the use of Expert Advisors (EAs) for automated trading with this broker. NOMURA primarily offers its own self-developed mobile trading apps, such as the Nomura Asset Management App, OneStock, and Nomura FX App, which are well-suited for account management and manual FX trading. From what I observed, there is no explicit support or mention of third-party platforms like MetaTrader 4 or 5—popular choices for running EAs—in NOMURA’s current offering. The focus of NOMURA appears to be on providing a secure, regulated environment for Japanese clients, emphasizing a degree of risk control, robust in-house platforms, and service to both retail and institutional investors. While these factors can instill confidence in the broker’s overall legitimacy and risk management, they also suggest a limited degree of platform flexibility. In my experience, proprietary apps rarely support the kind of custom script or automated strategy deployment that EAs require. Given these factors, I would advise anyone seeking to use EAs with NOMURA to proceed with caution. Unless official support for MetaTrader or a comparable desktop platform is confirmed directly by the broker, it would be prudent to assume that Expert Advisors are not currently an option here. As always, verifying platform capabilities and restrictions with NOMURA’s customer support before committing any strategy is essential for minimizing unexpected issues in live trading.

Reflecting on my direct experience with NOMURA, I've found that their trading platform lineup is distinctly focused on proprietary, Japan-centric solutions rather than offering globally popular platforms like MT4, MT5, or cTrader. Personally, this had a significant impact on my workflow choices, as I usually appreciate the algorithmic trading and third-party tool integrations that MT4 and MT5 facilitate. With NOMURA, the core platforms include the Nomura Asset Management App (“NOMURA”), Asset Management App (“OneStock”), and a dedicated Nomura FX App. These are solid, well-developed applications that run smoothly on iPhone and Android devices. The apps cater to traders looking for clean interfaces and are especially convenient for managing diverse financial assets or engaging in FX trades from a mobile device. However, the absence of MT4, MT5, or cTrader means that if you rely on robust automated strategies, custom indicators, or established trading EA ecosystems, NOMURA’s platforms won’t be able to meet those specific needs. For me, the selection somewhat limits advanced technical analysis and automations compared to global competitors who provide those platforms. If your trading depends on mobile functionality, comprehensive asset management, and regulatory oversight, the custom NOMURA apps have practical merits. Still, for those preferring global industry standards or desktop-based trading, it's important to acknowledge these limitations before making a decision. Ultimately, their platform choice underscores their focus on a local, regulated offering rather than a global, all-purpose suite.

請輸入...