Présentation de l'entreprise

| NOMURA Résumé de l'examen | |

| Fondé | 1994 |

| Pays/Région enregistré | Japon |

| Régulation | FSA |

| Instruments de marché | Actions nationales, Actions étrangères, Fonds d'investissement, Obligations, FX, Immobilier ST |

| Compte de démonstration | / |

| Effet de levier | 1:25 |

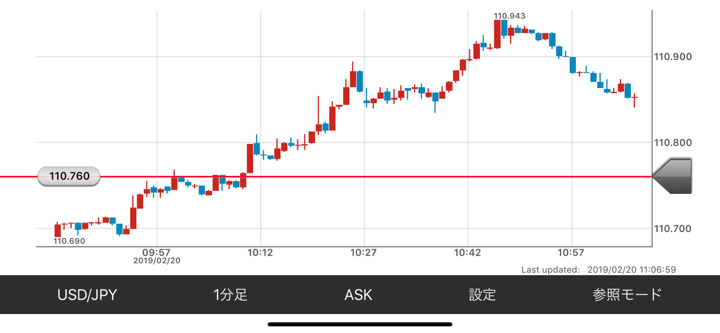

| Spread | USD/JPY: 2.8pips |

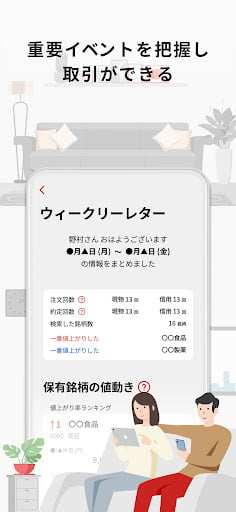

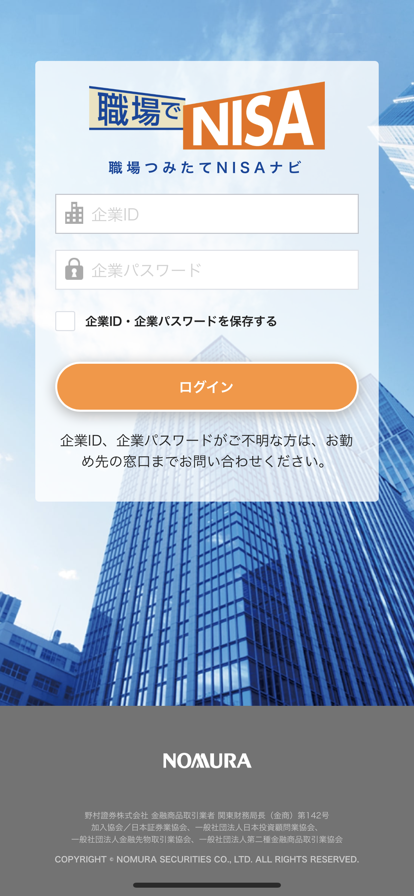

| Plateforme de trading | Application de gestion d'actifs Nomura ("NOMURA"), Application de gestion d'actifs ("OneStock"), Application Nomura FX |

| Dépôt minimum | / |

| Support client | - Numéro général : 0570-077-000 |

| - Alternatif : 042-303-8100 | |

NOMURA Informations

Nomura Securities propose des actions, des fonds d'investissement, du trading FX et de l'immobilier structuré. Ses systèmes de trading sophistiqués et son contrôle réglementaire rigoureux servent les clients particuliers et institutionnels. La structure des coûts de la société varie en fonction du canal de service, avec des tarifs en agence bien supérieurs à ceux en ligne.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par la FSA | Frais plus élevés pour les transactions en agence |

| Applications et plateformes de trading tout-en-un | Effet de levier limité par rapport aux concurrents |

| De nombreux instruments de trading | Pas de compte de démonstration disponible |

NOMURA est-il légitime ?

Oui, Nomura est réglementé. La FSA du Japon le supervise dans le cadre d'une licence de change au détail. Le numéro de licence est 関東財務局長(金商)第142号, avec une date d'effet du 2007-09-30.

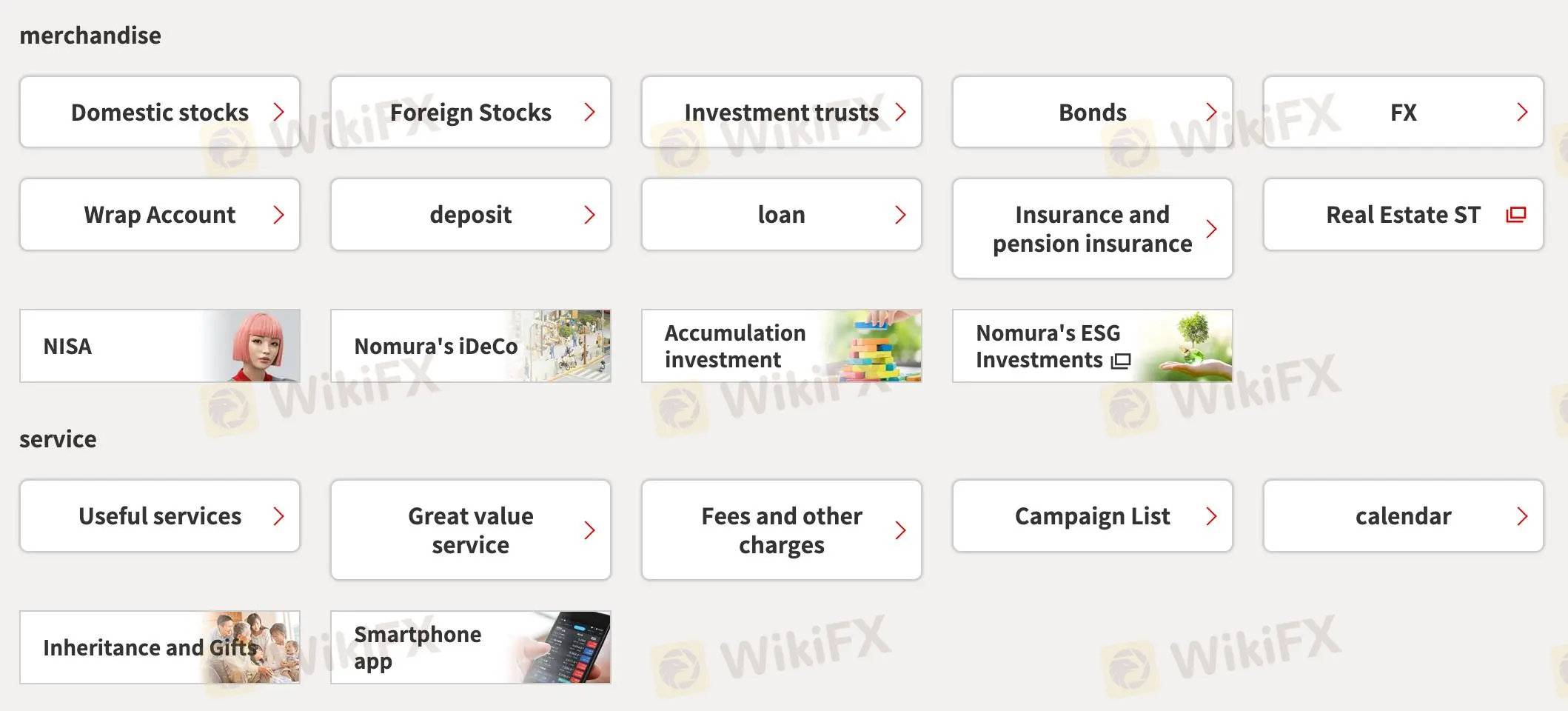

Services et produits

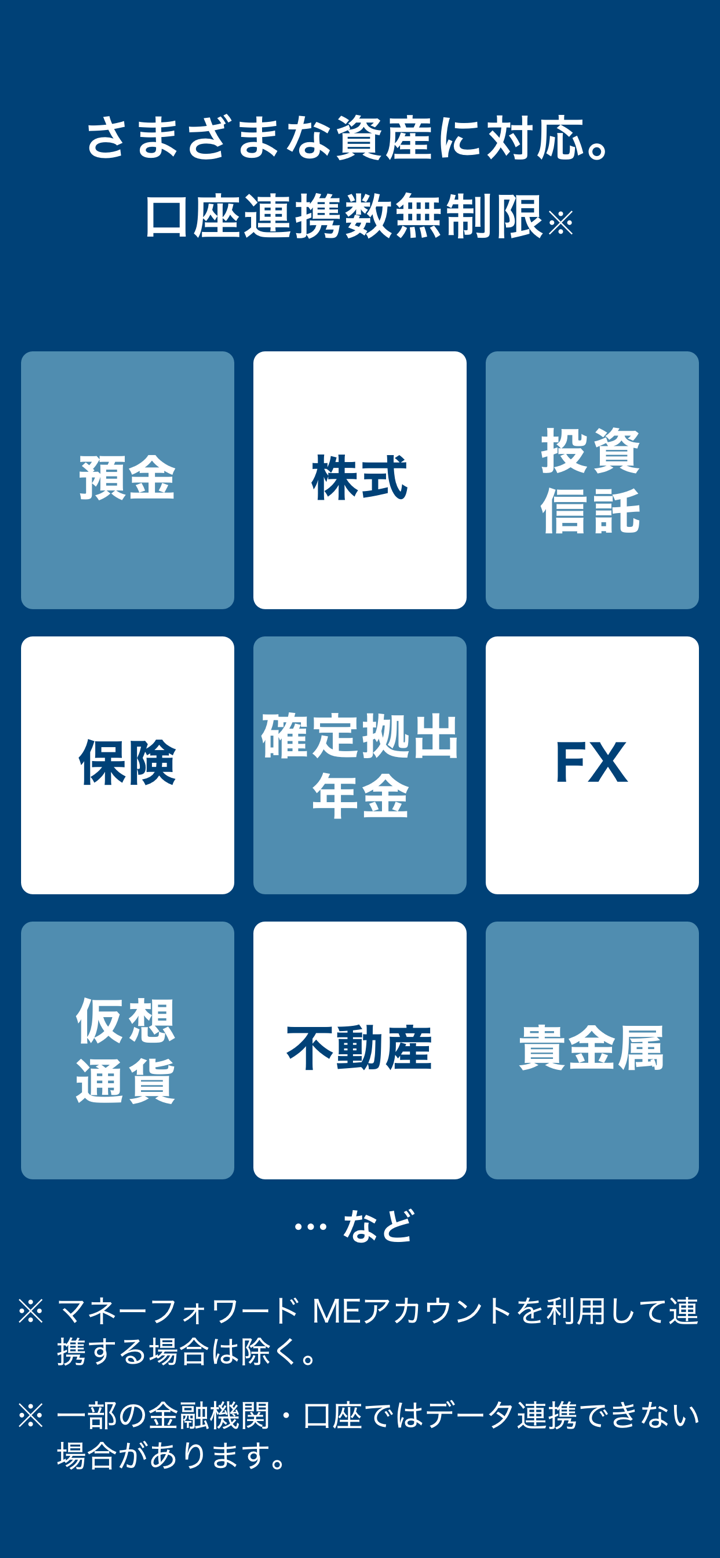

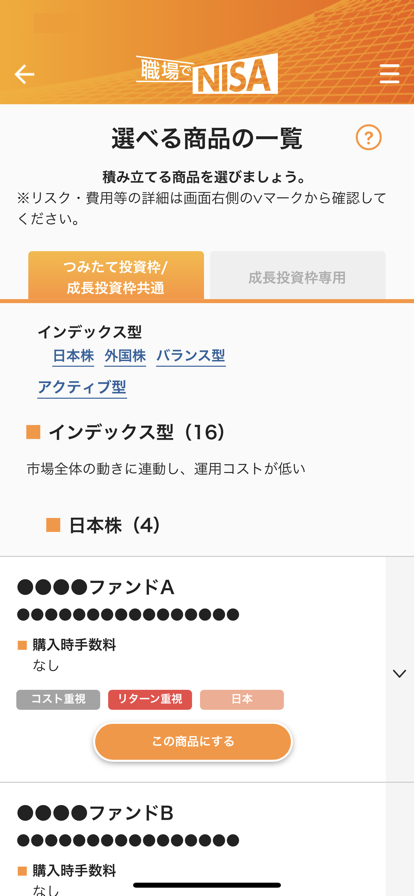

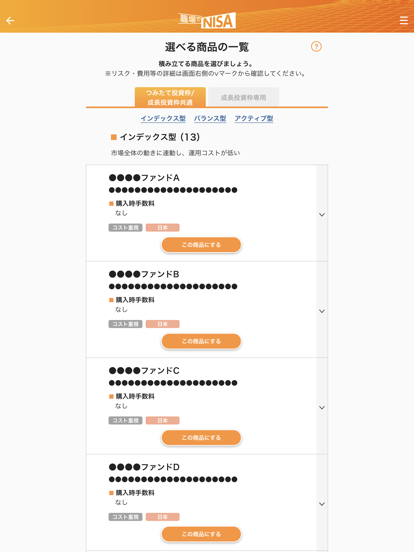

Le courtier propose des actions locales et étrangères, des fonds d'investissement, des obligations, du trading FX et des produits d'assurance parmi un large éventail de produits et services financiers. Ils fournissent des services de support, y compris des promotions de campagnes, des préparations de succession et une application smartphone.

| Instruments de trading | Pris en charge |

| Actions nationales | ✔ |

| Actions étrangères | ✔ |

| Fonds d'investissement | ✔ |

| Obligations | ✔ |

| FX | ✔ |

| Produits immobiliers structurés (ST) | ✔ |

| Matières premières | ❌ |

| Crypto | ❌ |

| ETFs | ❌ |

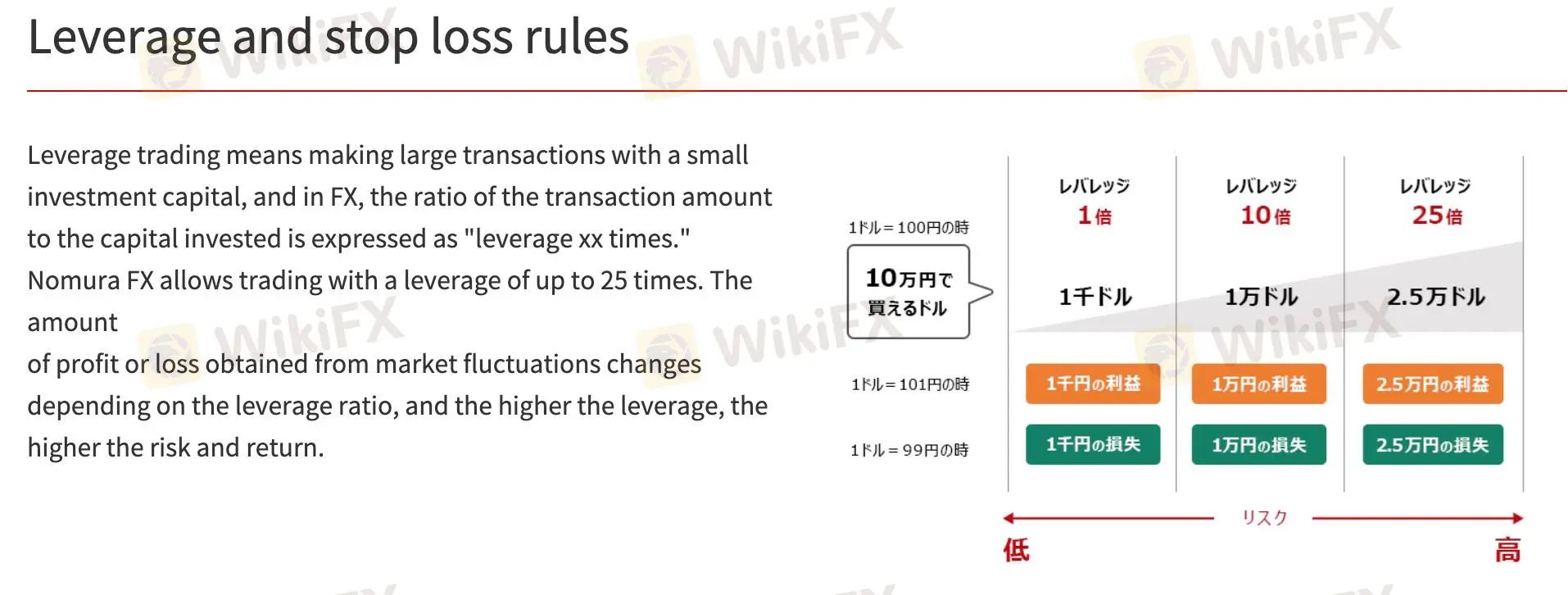

Effet de levier

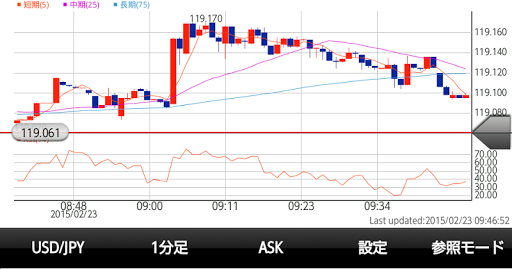

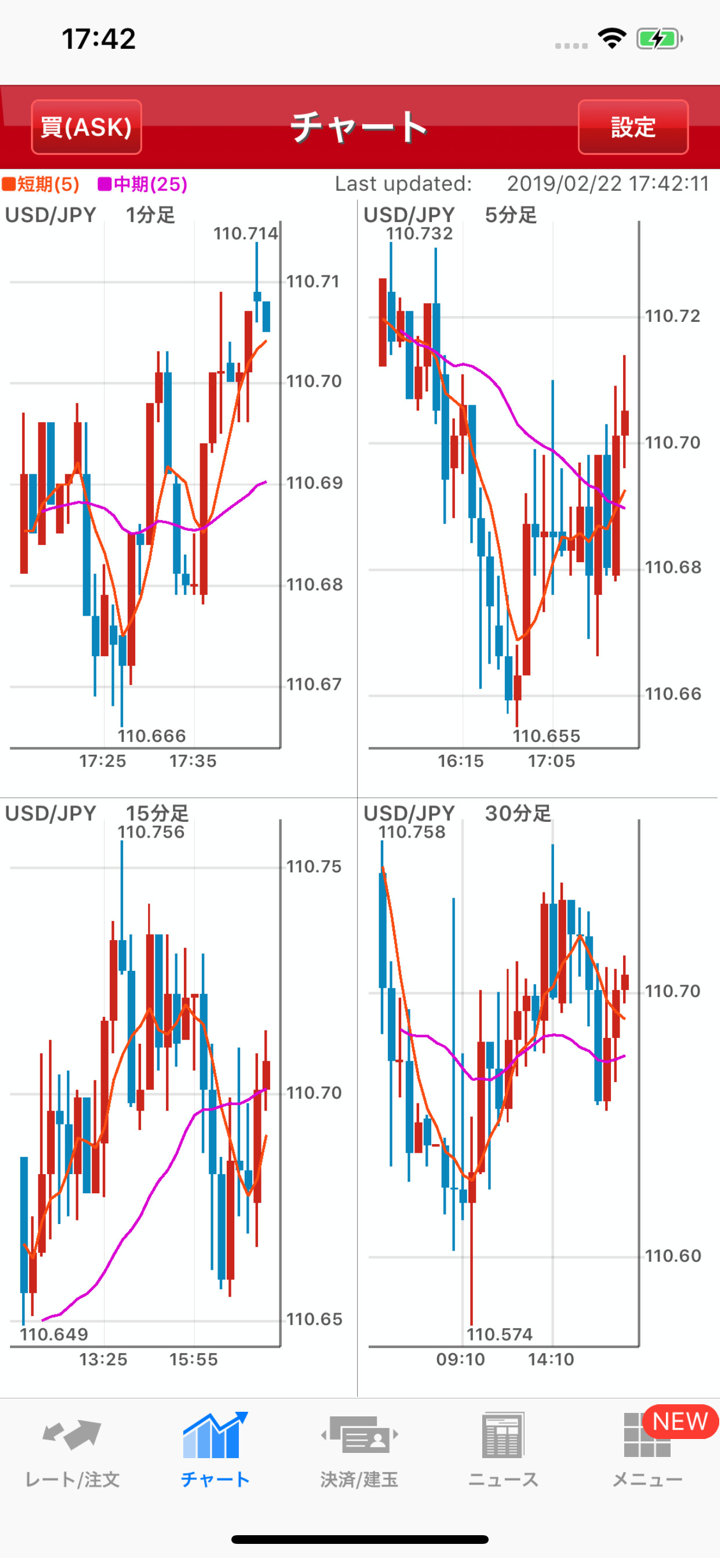

Nomura FX permet aux traders de réaliser des transactions plus importantes avec moins de liquidités grâce à un effet de levier de 25x. Un effet de levier élevé augmente les profits mais augmente également les pertes. Une "règle de coupure des pertes", qui clôture automatiquement les positions lorsque le "taux de maintenance de la marge" passe en dessous de 100%, réduit les risques chez Nomura FX. Les traders doivent être prudents car des changements soudains sur le marché peuvent entraîner des pertes supérieures aux liquidités déposées, même avec des stop-loss.

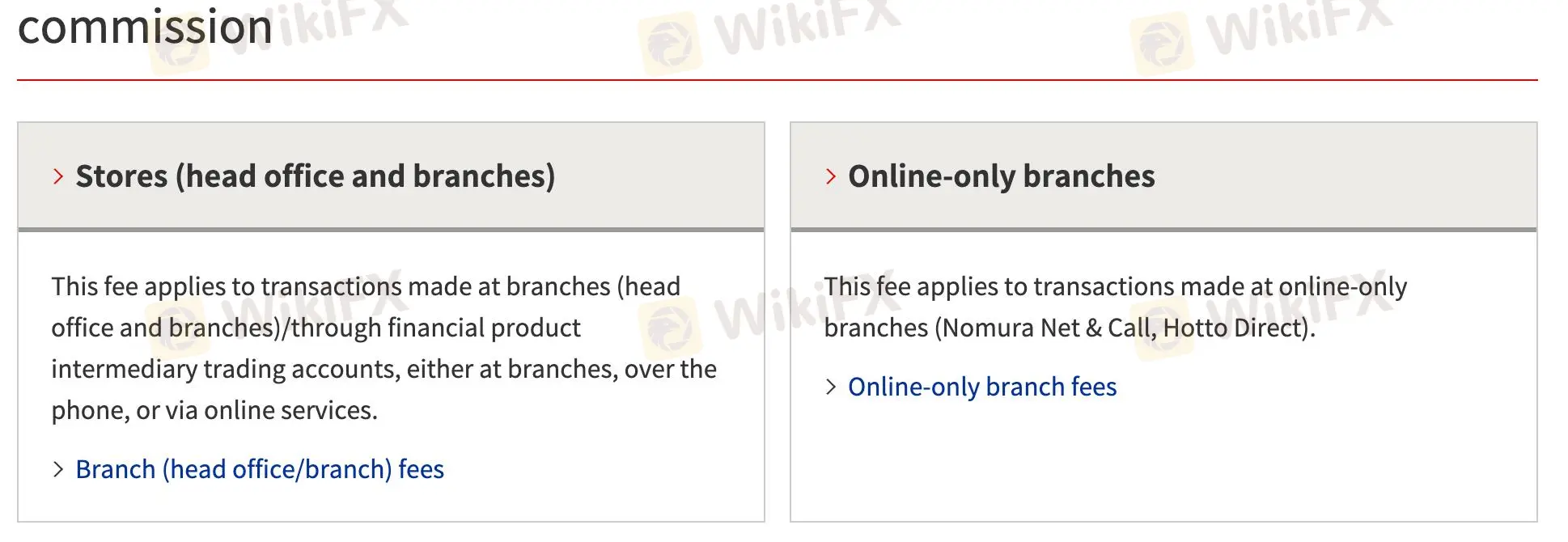

NOMURA Frais

Les tarifs de Nomura varient en fonction du service, avec des frais différents pour les transactions en agence et en ligne uniquement. Les agences physiques facturent beaucoup plus cher les transactions boursières nationales que les comptes internet.

| Type de frais | Montant |

| Transfert d'actions vers une autre société (<20 unités) | Frais de base : 550 yens + 550 yens/unité (minimum 1 100 yens). |

| Transfert d'actions vers une autre société (>20 unités) | Frais uniformes : 11 000 yens. |

| Achat supplémentaire d'actions | 330 yens par action. |

| Certificat de solde ou de transaction | Gratuit pour les transactions individuelles ; 1 000 yens pour les transactions multiples par compte. |

Pas de frais de transaction : Nomura FX ne facture pas de frais de transaction explicites mais tire ses revenus des écarts.

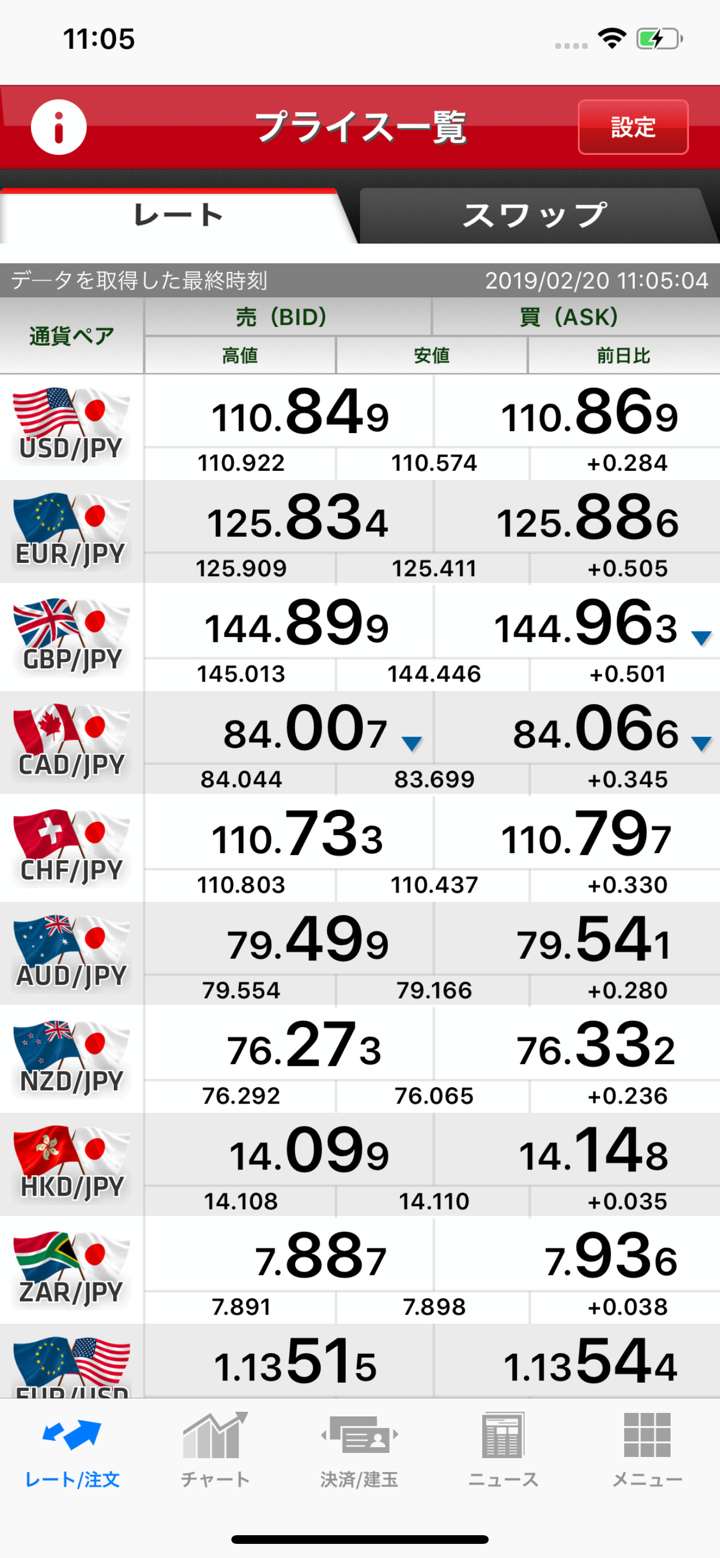

Taux de swap : Les traders peuvent gagner ou payer des points de swap en fonction de la différence de taux d'intérêt entre les devises échangées. Les points de swap fluctuent en fonction des conditions du marché.

Conversion de devises : Pour les transactions en devises autres que le yen, des écarts supplémentaires pour la conversion en yen peuvent s'appliquer.

| Paire de devises | Écart (pips) |

| USD/JPY | 2,8 |

| EUR/JPY | 5,3 |

| GBP/JPY | 6,9 |

| AUD/JPY | 4,9 |

| EUR/USD | 2,9 |

Plateforme de trading

| Plateforme de trading | Prise en charge | Appareils disponibles | Convient à quel type de traders |

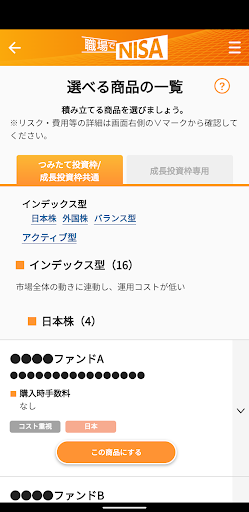

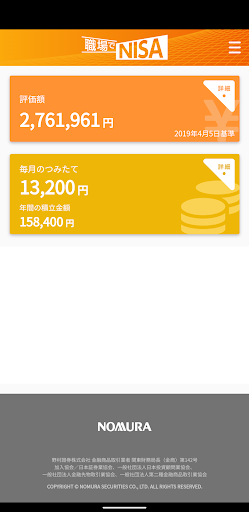

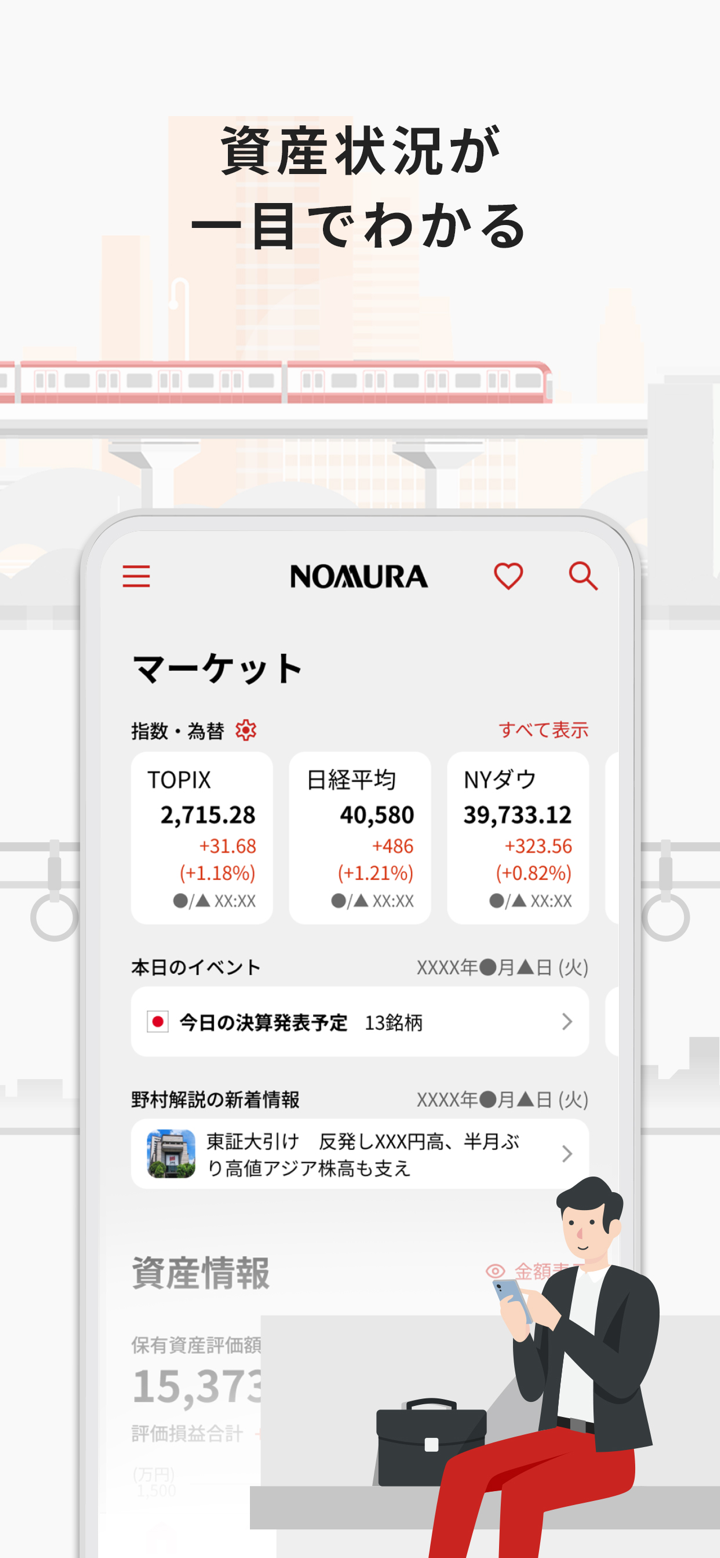

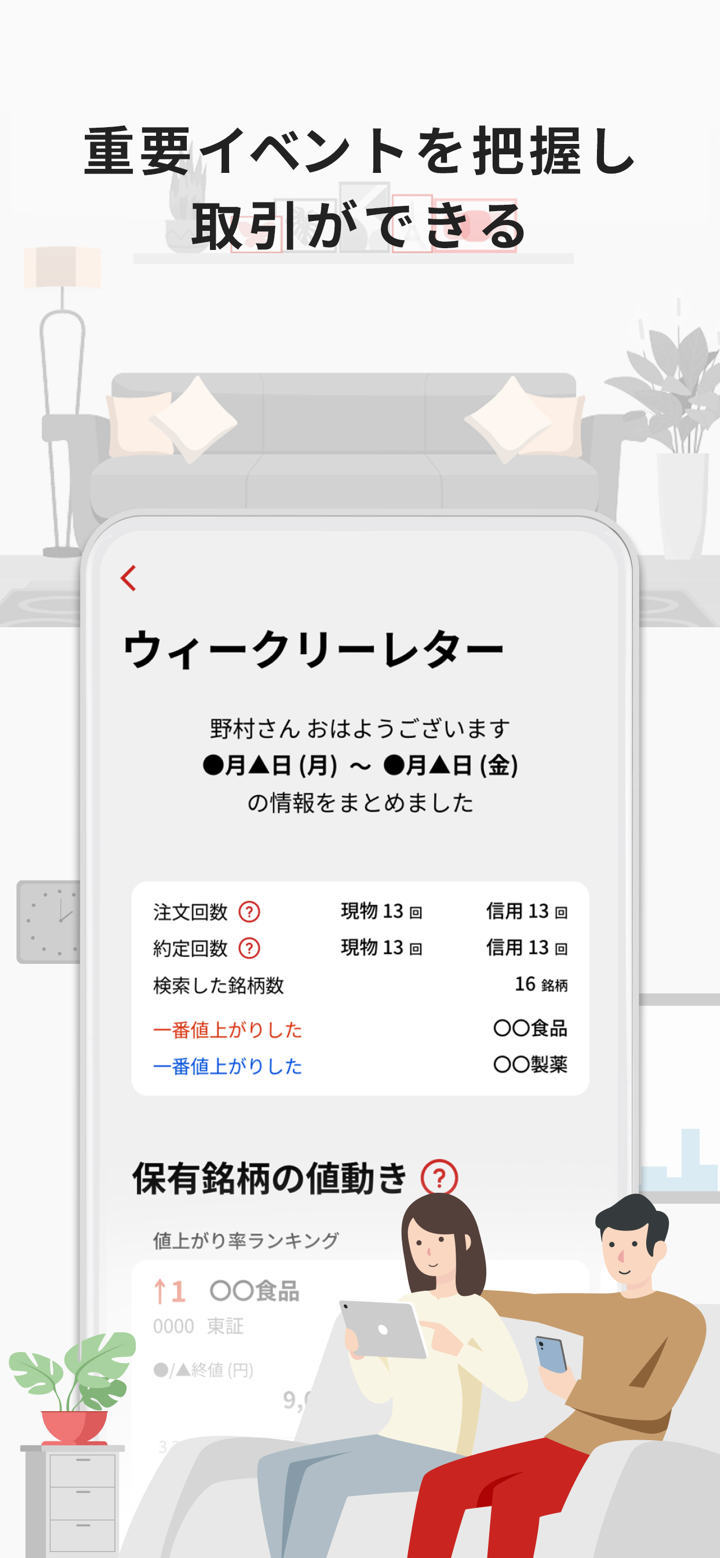

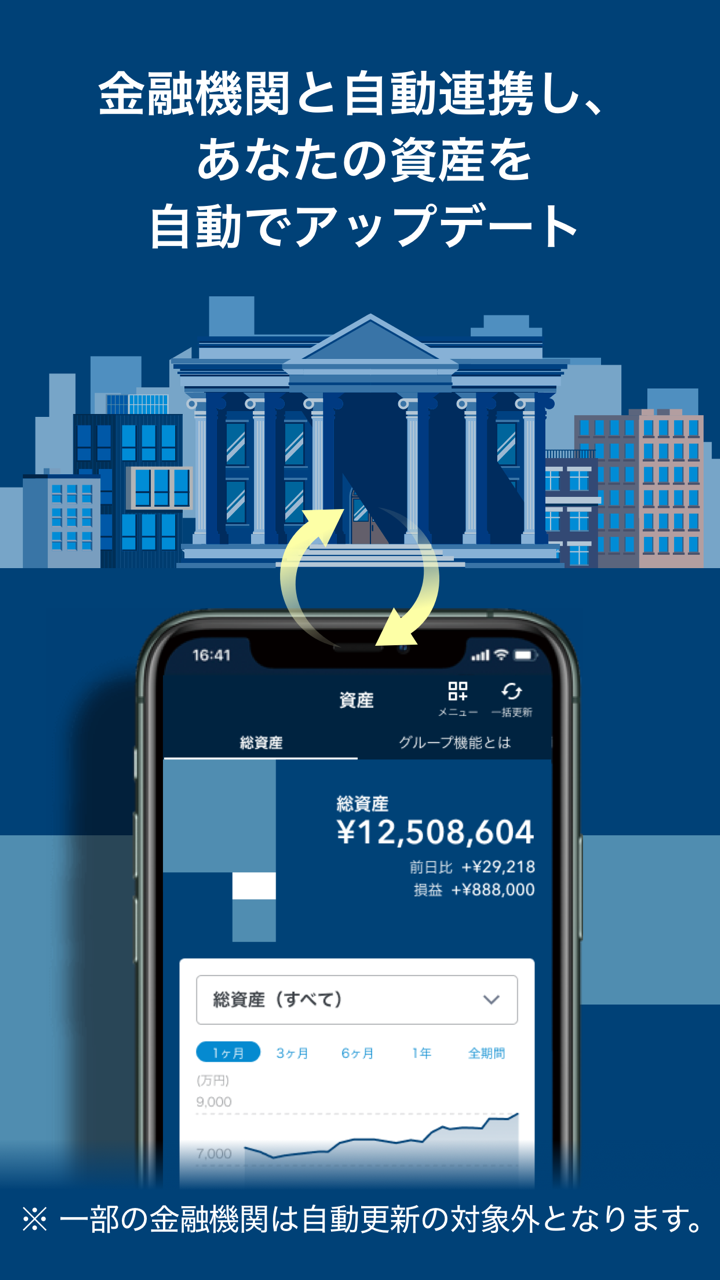

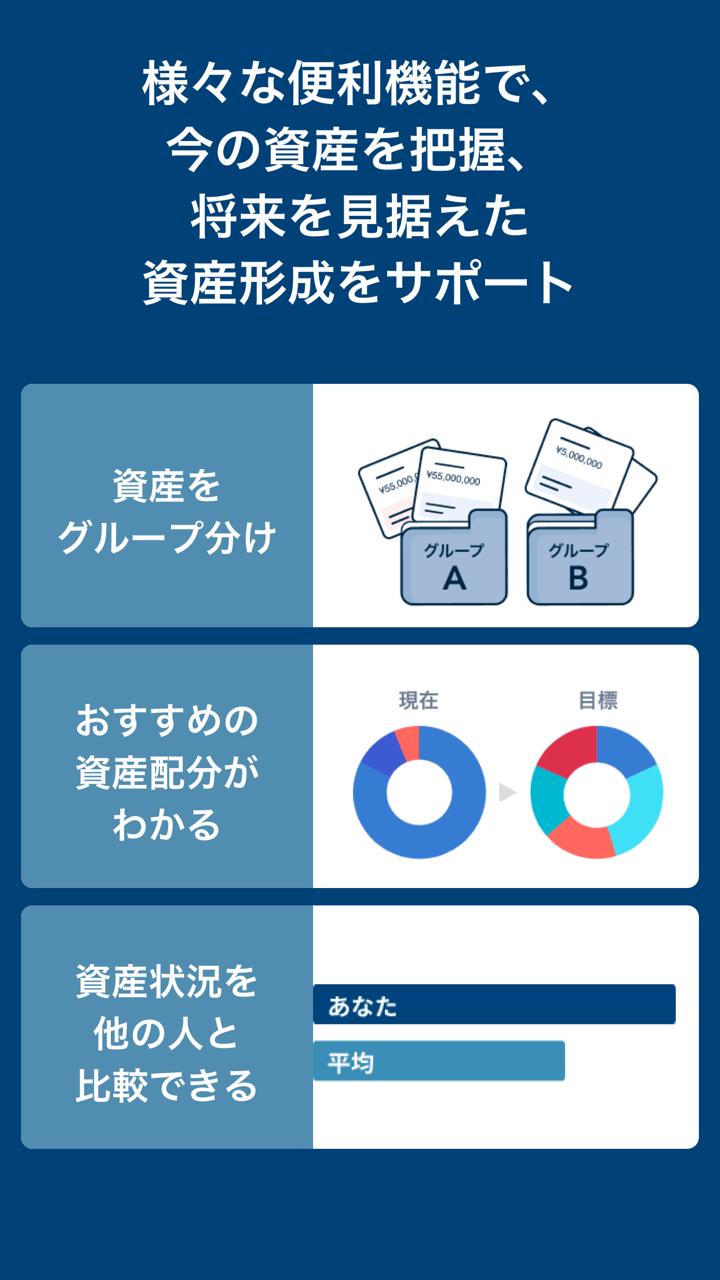

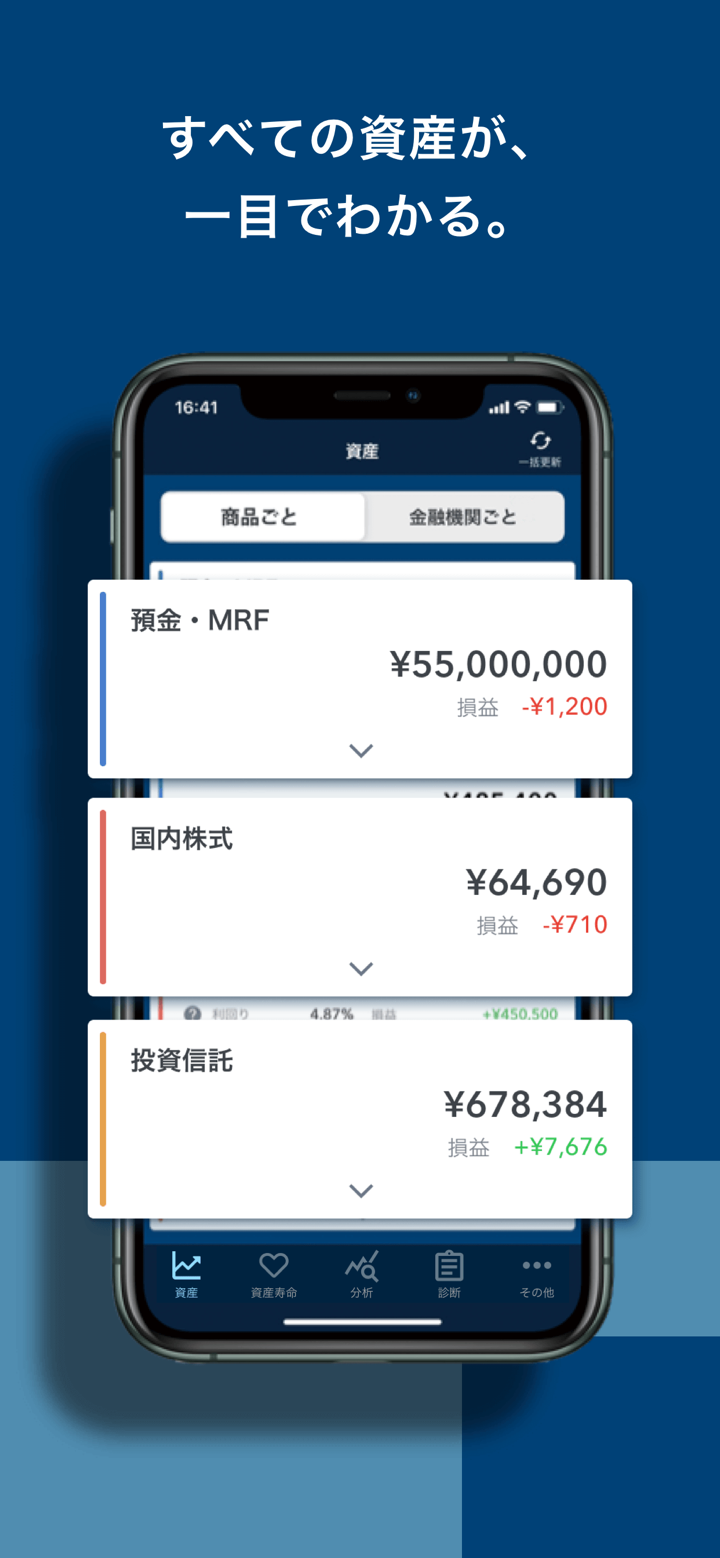

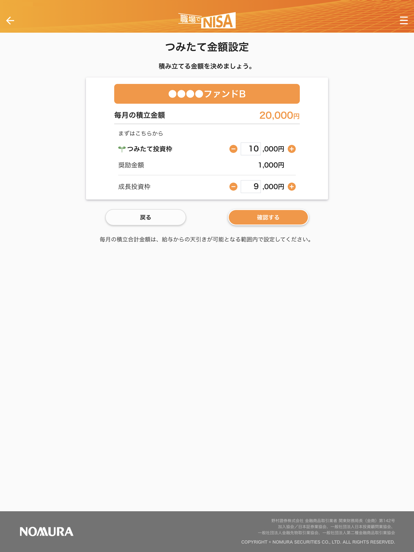

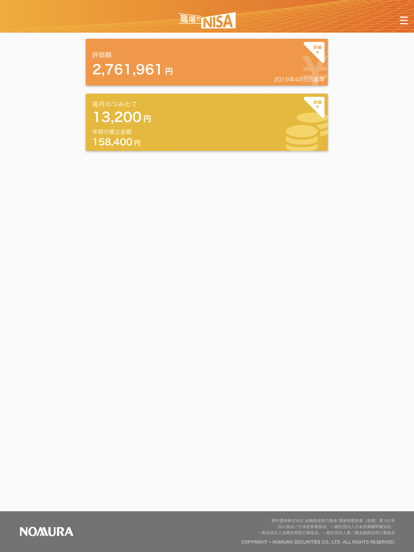

| Application de gestion d'actifs Nomura "NOMURA" | ✔ | iPhone, Android | Traders et investisseurs gérant plusieurs actifs financiers et recherchant des outils de trading personnalisés. |

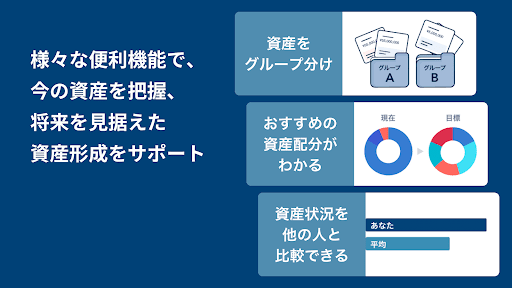

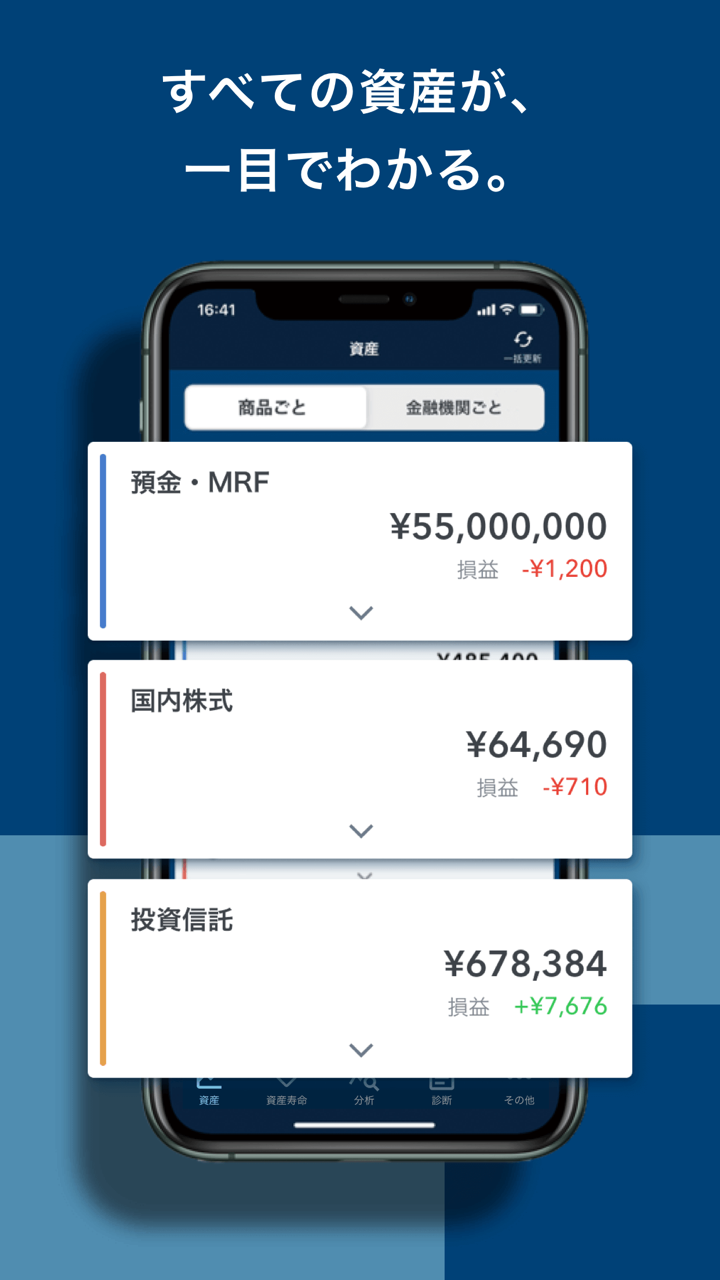

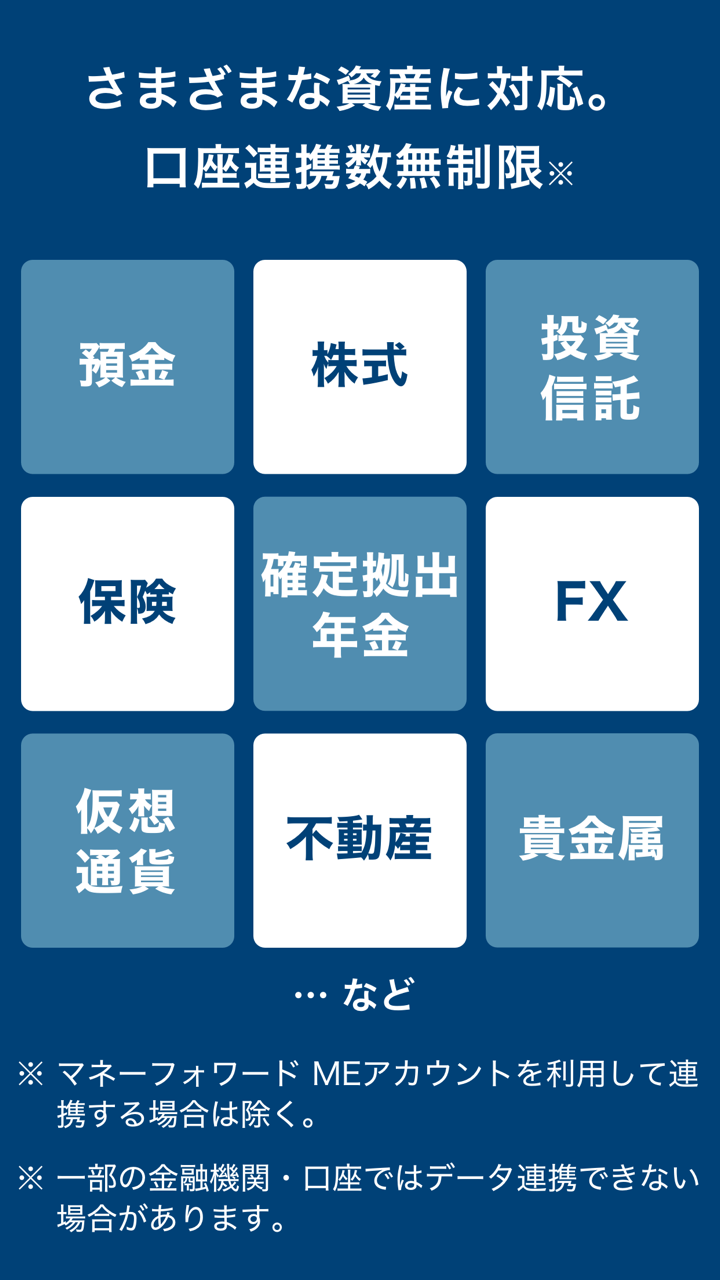

| Application de gestion d'actifs "OneStock" | ✔ | iPhone, Android | Investisseurs souhaitant une vue d'ensemble de leurs actifs, avec des fonctionnalités supplémentaires telles que le diagnostic des actifs. |

| Application Nomura FX | ✔ | iPhone, Android | Traders Forex qui préfèrent trader sur des appareils mobiles avec des opérations intuitives et ciblées. |