Xxpro

1-2年

Is C&S a regulated company, and if so, which financial regulators oversee it?

Based on my direct experience researching brokers for my own trading needs, I can confirm that C&S is not a regulated company. According to all the information I’ve found, C&S does not hold any valid regulatory licenses from trusted financial authorities. As someone who values the safety of my trading capital, this is a critical red flag. Regulation is important because it imposes accountability, ensures basic operational standards, and offers an avenue for recourse in case problems arise with things like withdrawals or trade disputes.

In my own due diligence process, I always look for brokers that are overseen by reputable regulators—such as the Australian Securities and Investments Commission (ASIC) or the Financial Conduct Authority (FCA) in the UK—because it gives me greater confidence that my interests as a trader are protected to some reasonable degree. With C&S, I could find no evidence of supervision by any such bodies. In fact, various risk indicators—including a clearly stated lack of regulation—lead me to take a very cautious and conservative stance toward entrusting funds to a broker like this. For me, trading with an unregulated provider introduces a level of risk that simply isn’t justified by any potential benefits they might offer.

qirhost

1-2年

Could you give a comprehensive overview of the fees charged by C&S, detailing their commissions as well as their spreads?

As an experienced forex trader, I place a strong emphasis on the transparency and reliability of a broker’s fee structure before committing any funds. In my assessment of C&S, I encountered significant gaps in crucial information about their commissions and spreads. According to the data available, C&S does not provide clear or official disclosure regarding their trading fees, including the types of spreads (fixed or variable) or any commission arrangement for trading commodities.

The absence of a demo account also prevented me from trialing the platform firsthand to evaluate real trading costs. What raises further concern for me is that C&S operates without any formal regulation, which directly affects their accountability around fee transparency. Typically, in regulated environments, brokers are required to openly disclose their fee schedules to ensure clients can accurately calculate and manage costs. Without this oversight, I have no independent means to verify whether C&S’s fee structure is competitive or fair in practice.

From a risk-management perspective, trading with a broker where fee details are ambiguous presents a notable disadvantage. In my professional judgment, especially for those starting out or concerned about cost structures, the lack of reliable, published information about commissions and spreads at C&S is a major red flag. I always advise prioritizing brokers who are forthcoming about their costs, as hidden or poorly explained fees can seriously impact trading outcomes and overall trust.

Broker Issues

Fees and Spreads

schlaepfi

1-2年

Do C&S’s ECN or raw spread accounts charge a commission per lot traded?

Based on my careful review of C&S, I found a number of notable gaps that directly impact my ability to answer questions with certainty from a trader's perspective. As an experienced forex trader, I prioritize brokers with clear, transparent account conditions—especially regarding commissions and spreads. Unfortunately, C&S does not provide information about ECN or raw spread account types, nor do they disclose details on whether any commission per lot is charged. In fact, it appears commodities are their only offering, with no mention of forex trading or other standard products that usually indicate the existence of ECN or raw spread accounts.

Furthermore, C&S operates entirely unregulated and is flagged for high potential risk, which magnifies my caution. From my experience, when key cost structures such as commissions are not explicitly documented, and with no regulatory oversight, there is an increased risk of hidden or unfavorable trading conditions. The absence of a demo account further limits any practical way for me to test or verify their fee structures safely before funding an account. For anyone, especially those newer to online trading, I would strongly urge extreme caution or consider more transparent, regulated alternatives. For me, the lack of disclosed commission information is, in itself, a major red flag.

Broker Issues

Fees and Spreads

Shoofar

1-2年

What's the lowest single withdrawal amount allowed from my C&S account?

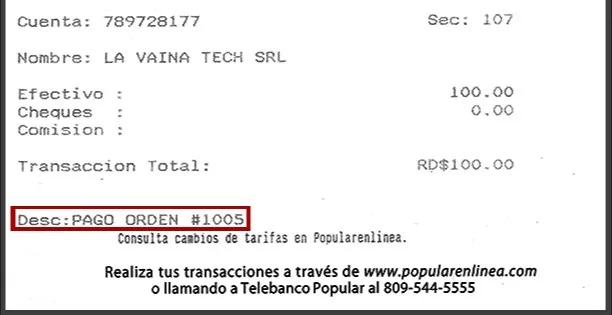

As someone who prioritizes safety and transparency in all my trading relationships, I always look for brokers with clear and accessible information about their account operations, especially regarding withdrawals. With C&S, I encountered a significant problem: there is no official information provided about the minimum withdrawal amount. This lack of essential details about basic account transactions immediately raised concerns for me. In my trading experience, reputable brokers nearly always state such policies upfront.

My approach is always cautious—especially with brokers that are unregulated and have limited transparency about their business practices. C&S is registered in Argentina and has operated for several years, but based on the current information, their lack of regulation and straightforward customer support channels worries me, especially since other users have noted poor customer service and even unresolved losses. Without published details on withdrawal terms, I honestly can’t recommend trusting funds to a platform where standard procedures—like minimum withdrawal amounts—aren’t disclosed. For any trader, especially when real money is involved, being able to easily access and withdraw funds is non-negotiable, and the absence of this information is a significant red flag for me.

Broker Issues

Deposit

Withdrawal