Eziol

1-2年

Is it possible to trade particular assets such as Gold (XAU/USD) and Crude Oil through S Broker?

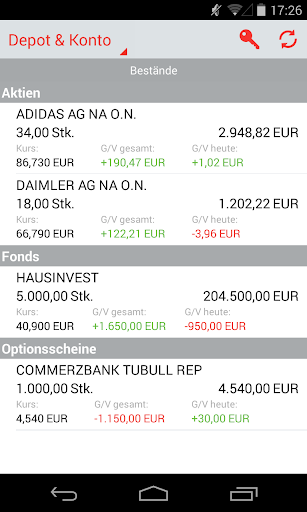

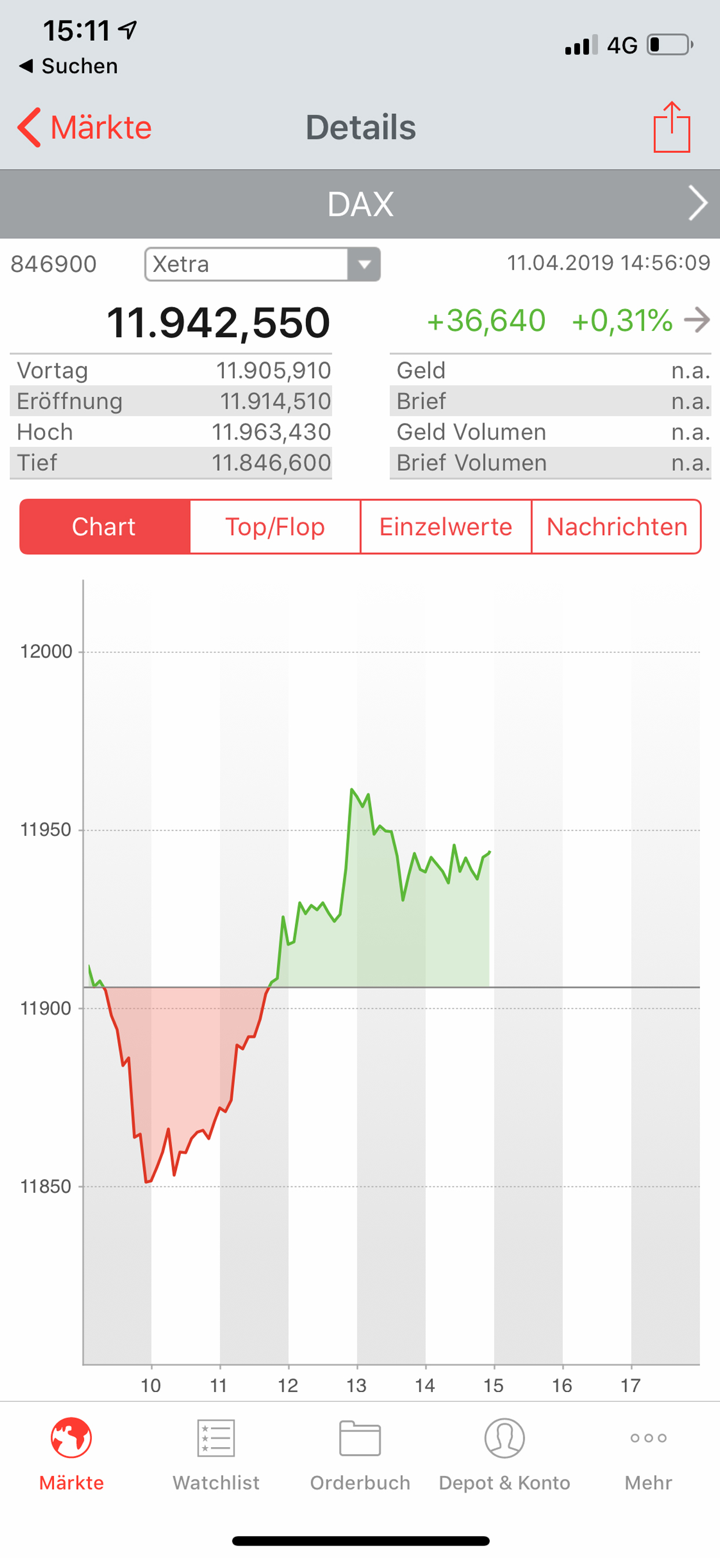

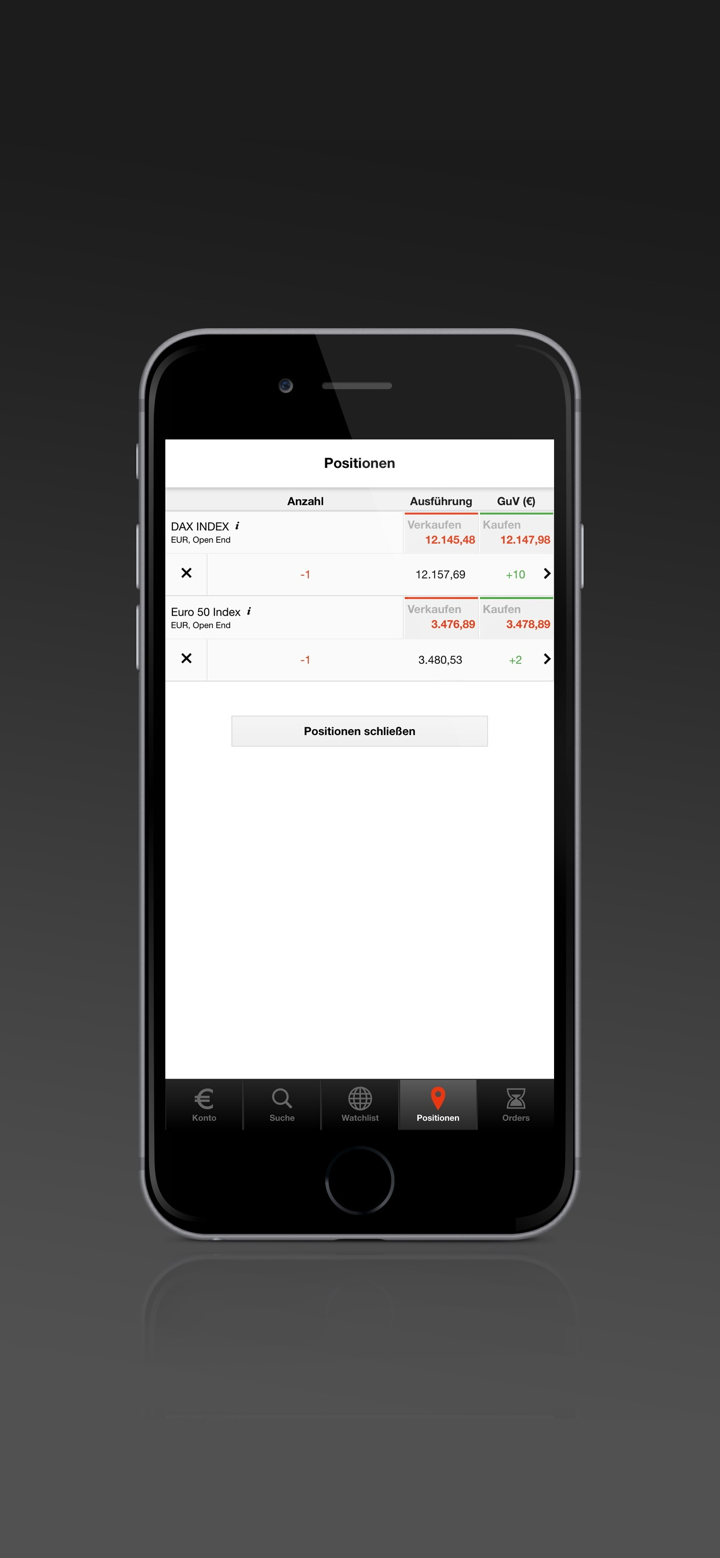

Based on my personal experience and the research I've done as a trader, I need to be very cautious when considering which assets are accessible through any brokerage. In the case of S Broker, their listed offering covers a fairly broad range: stocks, funds, ETFs, CFDs, bonds, and indices. However, based on the details I found, S Broker specifically does not provide trading in commodities—including popular instruments like Gold (XAU/USD) or Crude Oil. This is a notable limitation, particularly for traders, like myself, who consider commodity exposure to be an essential part of a diversified trading strategy.

In my own portfolio, the flexibility to trade commodities such as gold and crude oil can be critical, especially as these assets often behave differently from equities or bonds and may serve as hedges during volatile periods. Not having access to these instruments reduces my ability to manage risk and pursue particular trading setups.

Additionally, I always prioritize a broker’s regulatory standing for safety. S Broker appears unregulated by any recognized authority, which adds considerable risk. For those like me who require not only a wide range of markets but also strong oversight, this is a red flag that can’t be ignored. Ultimately, while S Broker might suit someone focused strictly on securities or ETFs in Germany, for trading Gold or Crude Oil directly—especially with a need for regulatory safeguards—I would look for a better-equipped and properly supervised broker.

Broker Issues

Account

Platform

Leverage

Instruments

joalund

1-2年

How much do you need to deposit at a minimum to start a live trading account with S Broker?

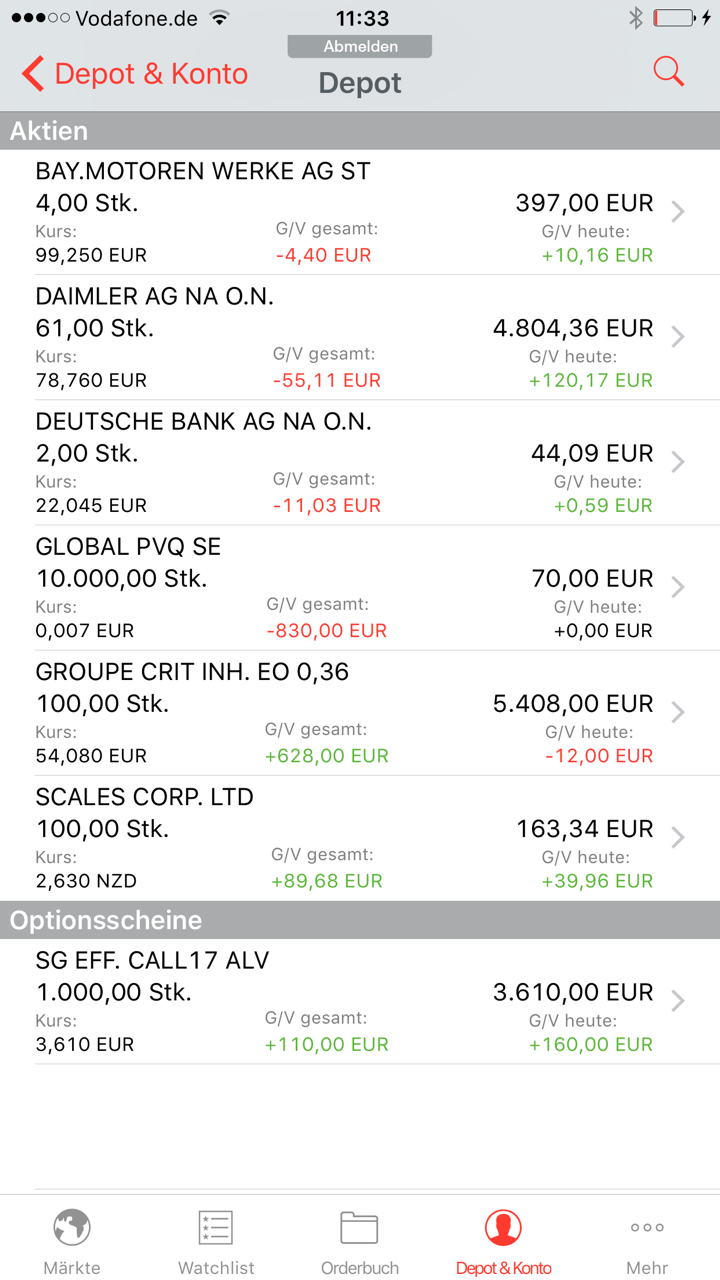

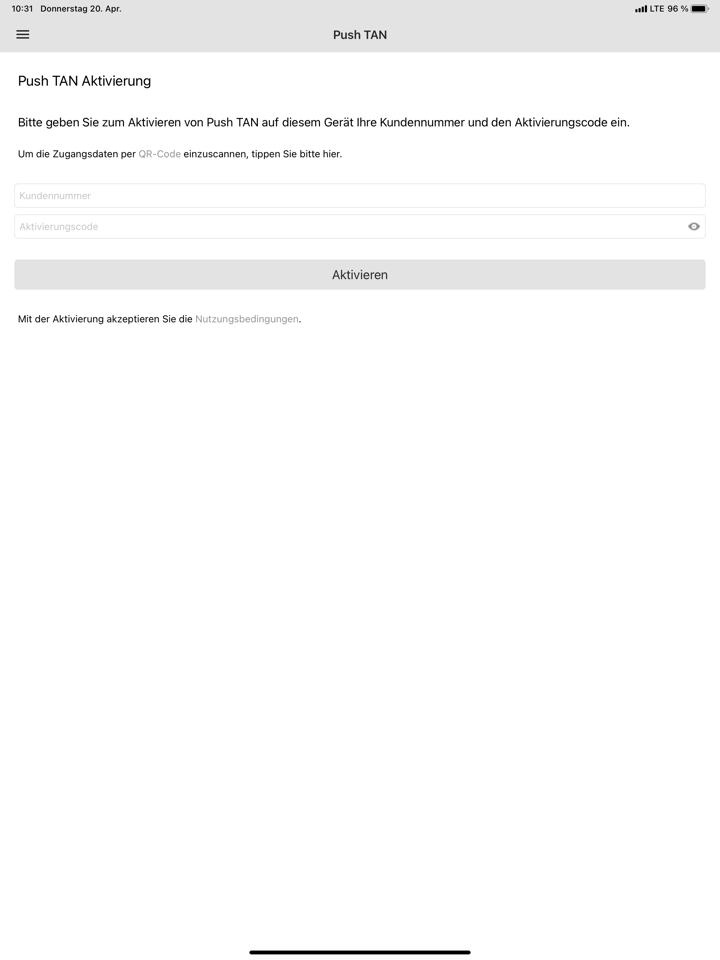

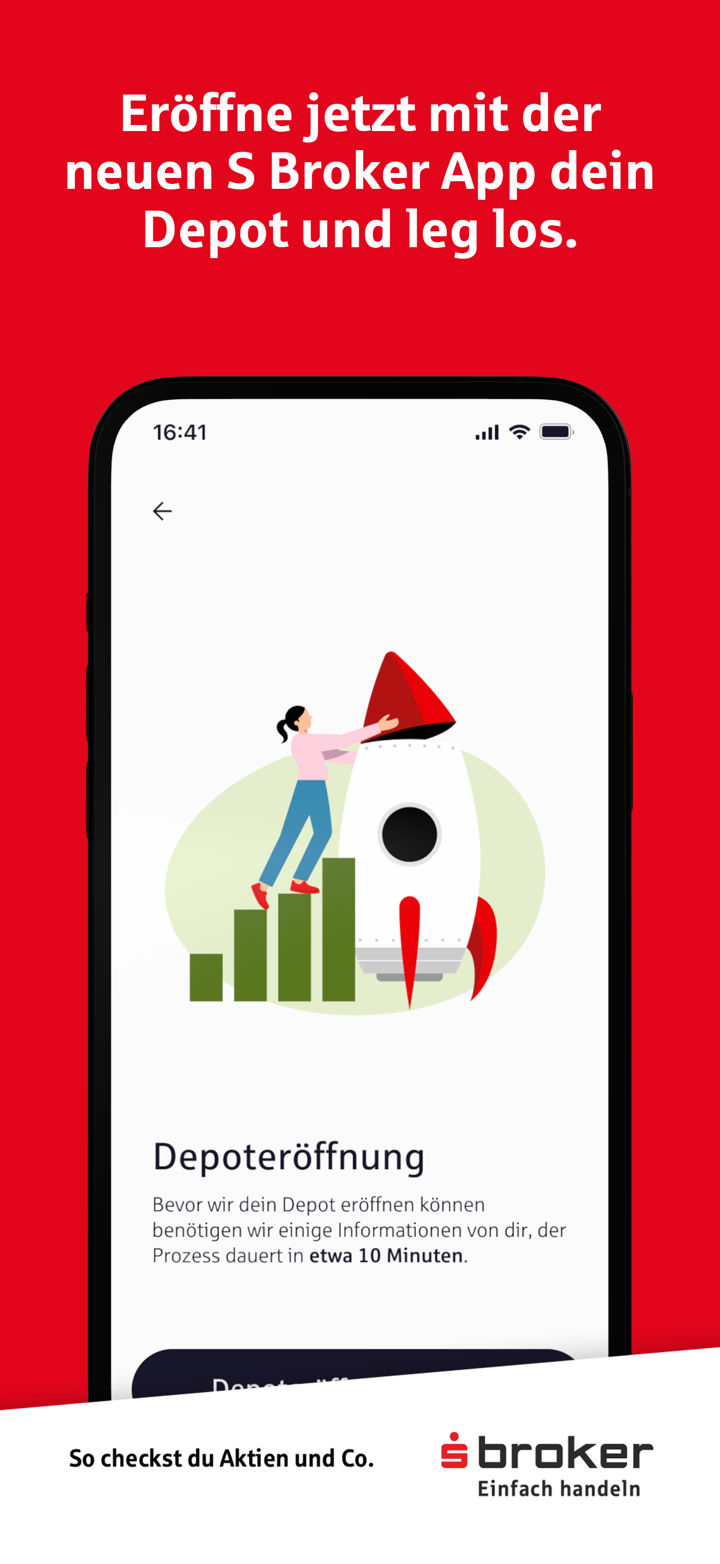

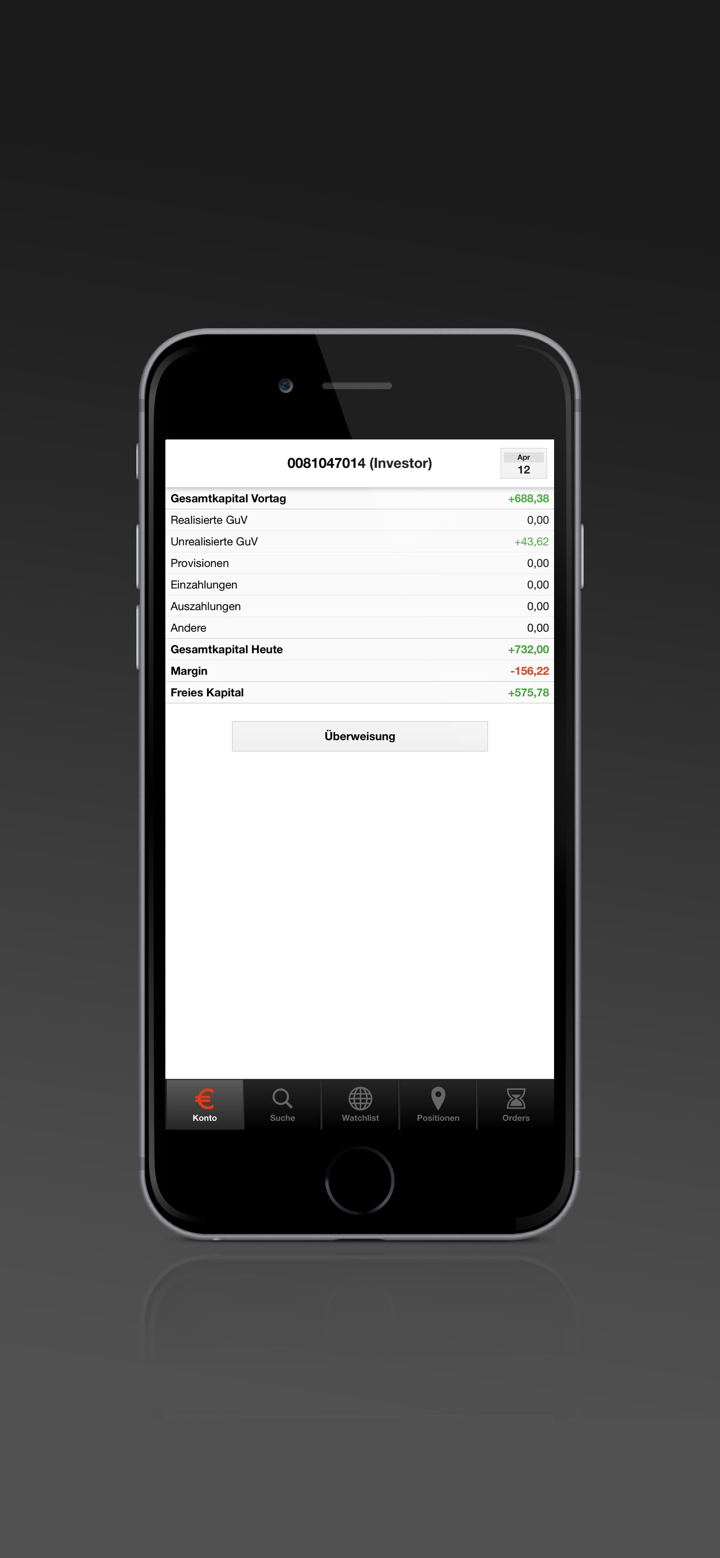

As an experienced trader, one of my first questions with any broker is the minimum deposit requirement, as it directly affects how accessible the platform is for different types of investors. With S Broker, my research shows there is no minimum deposit required to open a live trading account. For me, this provides some flexibility, especially if I want to start with a smaller amount and gradually build my exposure as I get more comfortable with their platform.

However, I always weigh this positive aspect against the bigger risks involved. In S Broker’s case, the lack of minimum deposit can be attractive for newcomers or those looking to test features without committing significant capital. But from my perspective, the absence of any regulatory oversight is a far more significant concern. In my experience, trading with an unregulated broker can jeopardize fund safety, as there is no official body ensuring the protection of clients’ interests.

So, while S Broker allows you to start with any amount, I personally would be very cautious. For me, financial safety and robust regulation take priority over low entry barriers, especially when my capital is at stake.

Broker Issues

Deposit

Withdrawal

QM Trader

1-2年

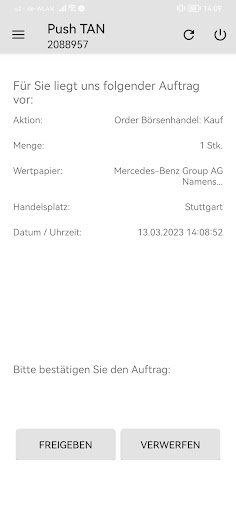

Can I trust S Broker as a reliable and secure platform for trading?

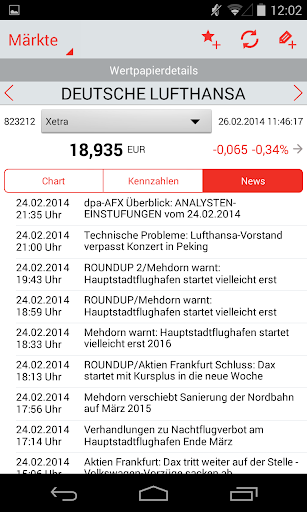

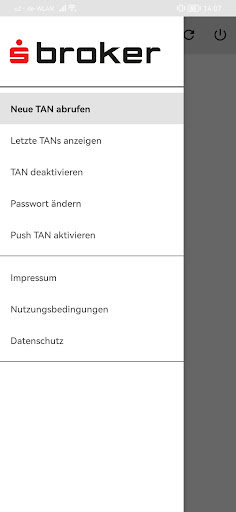

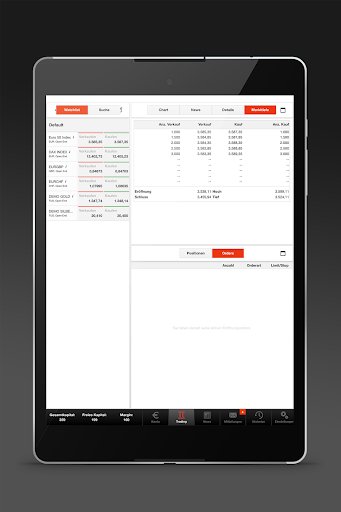

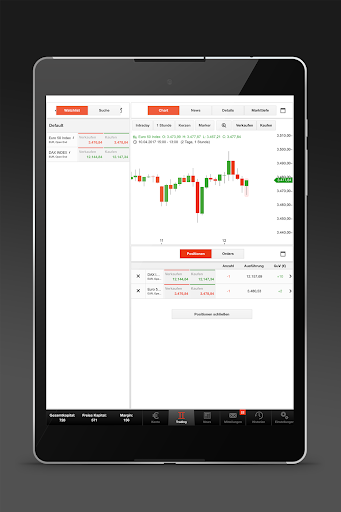

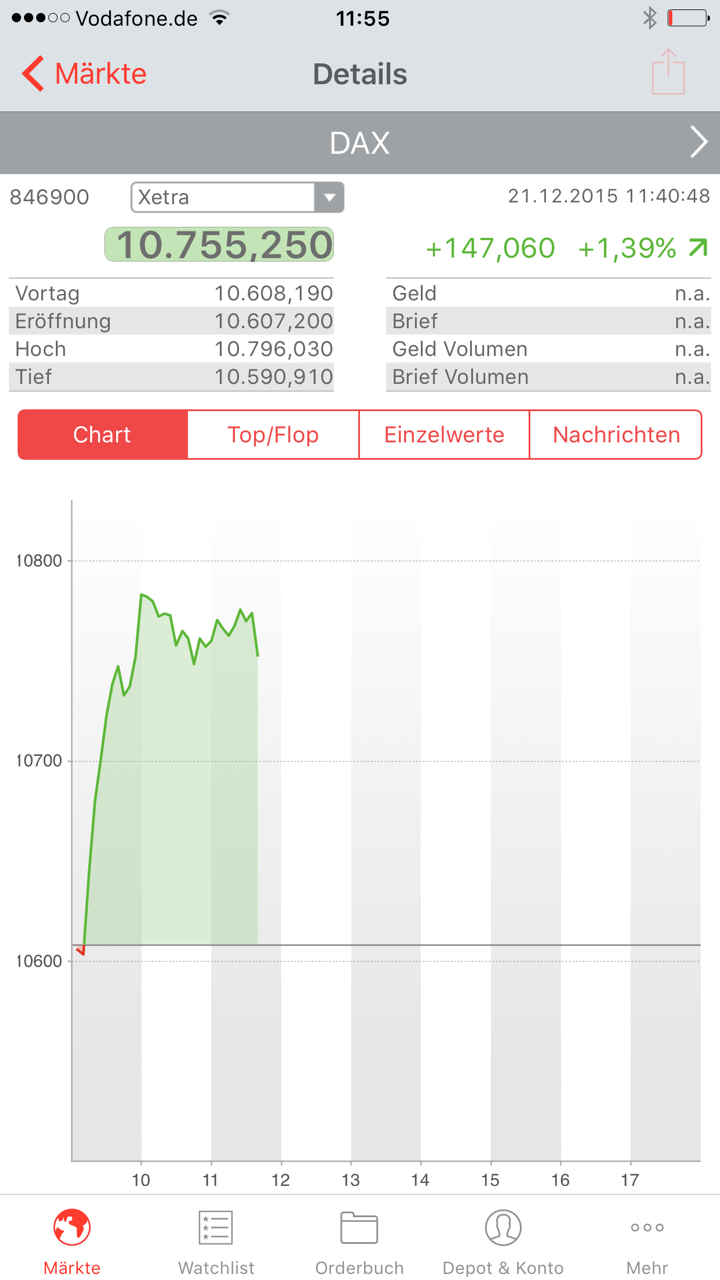

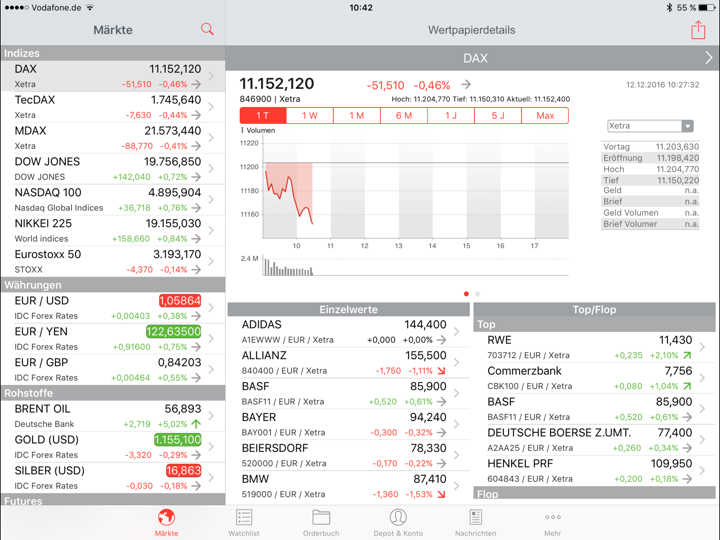

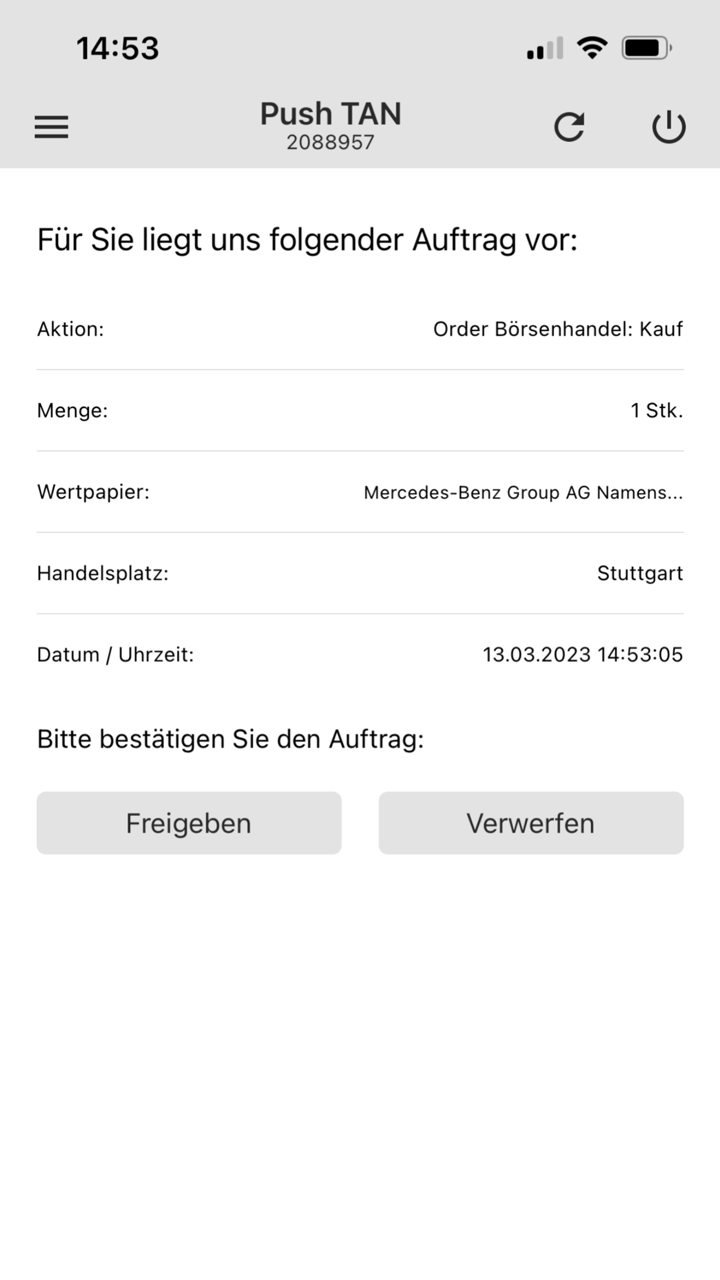

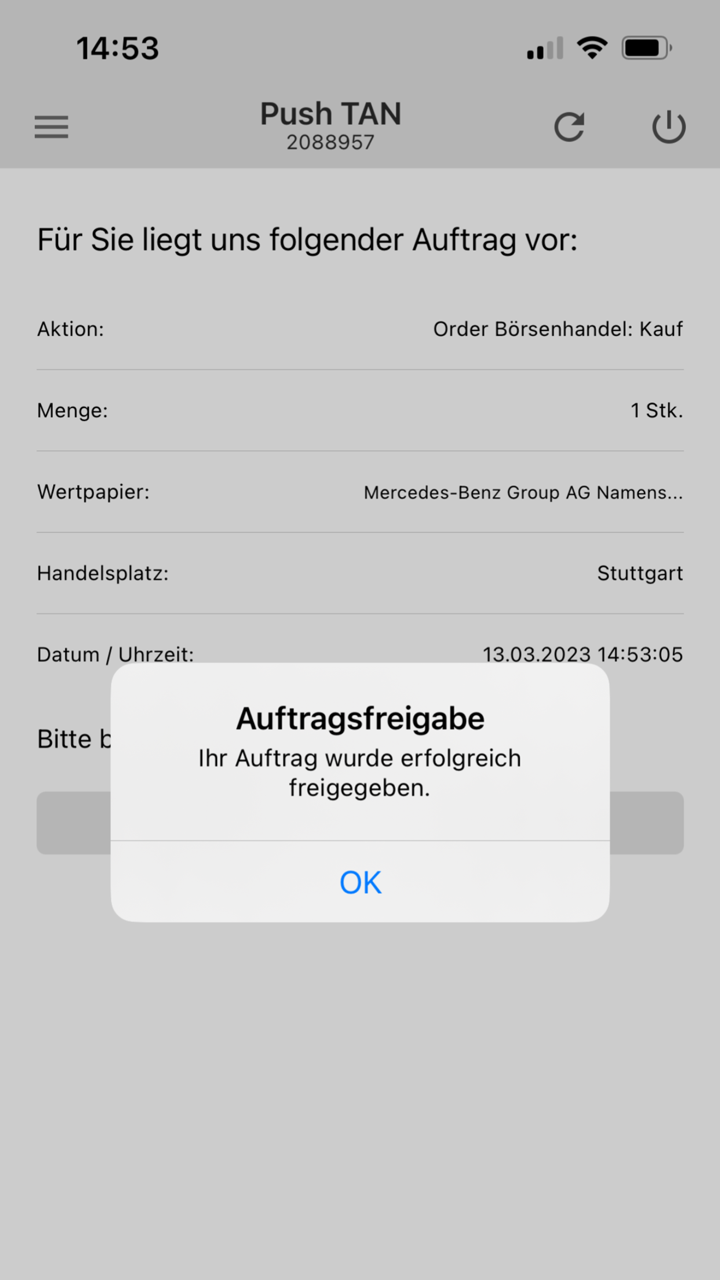

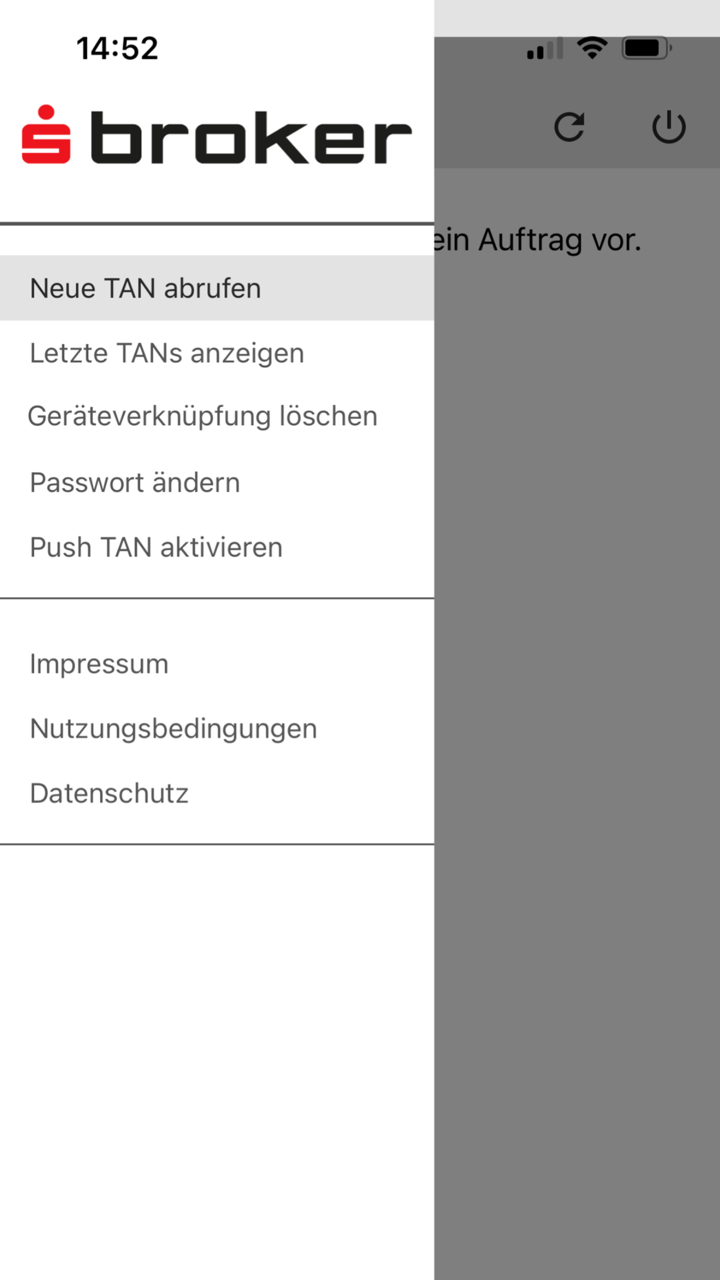

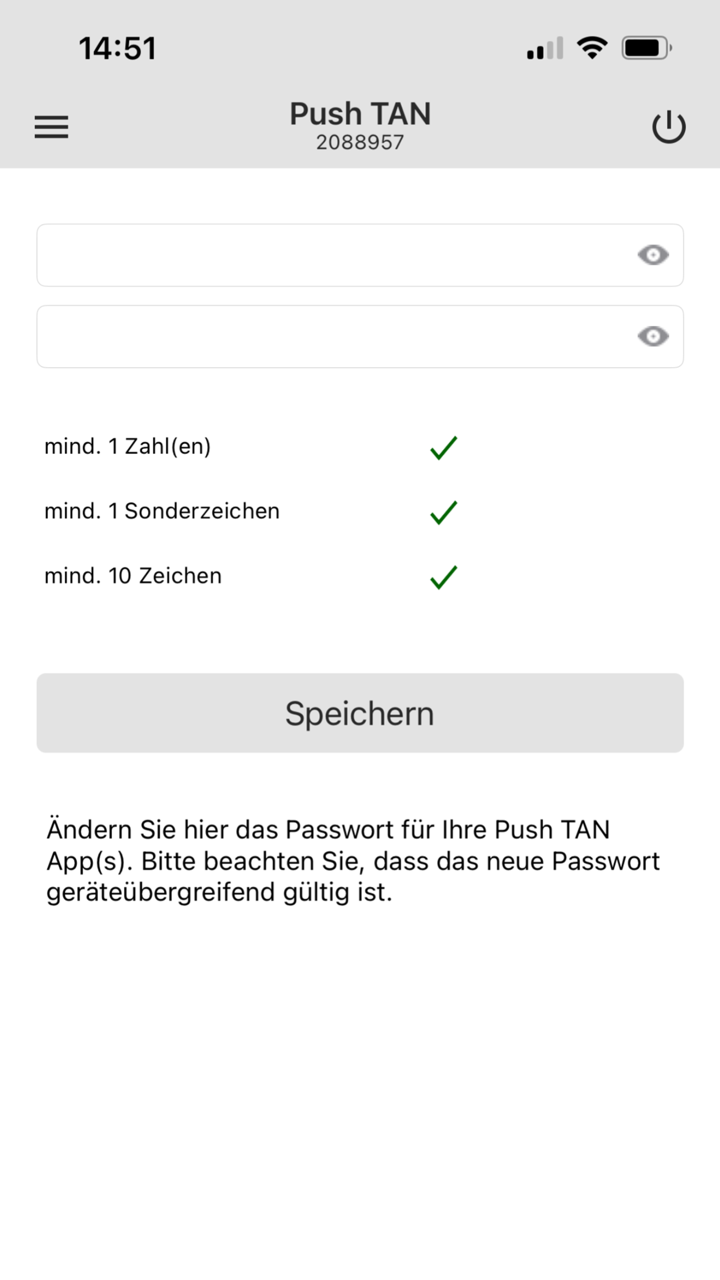

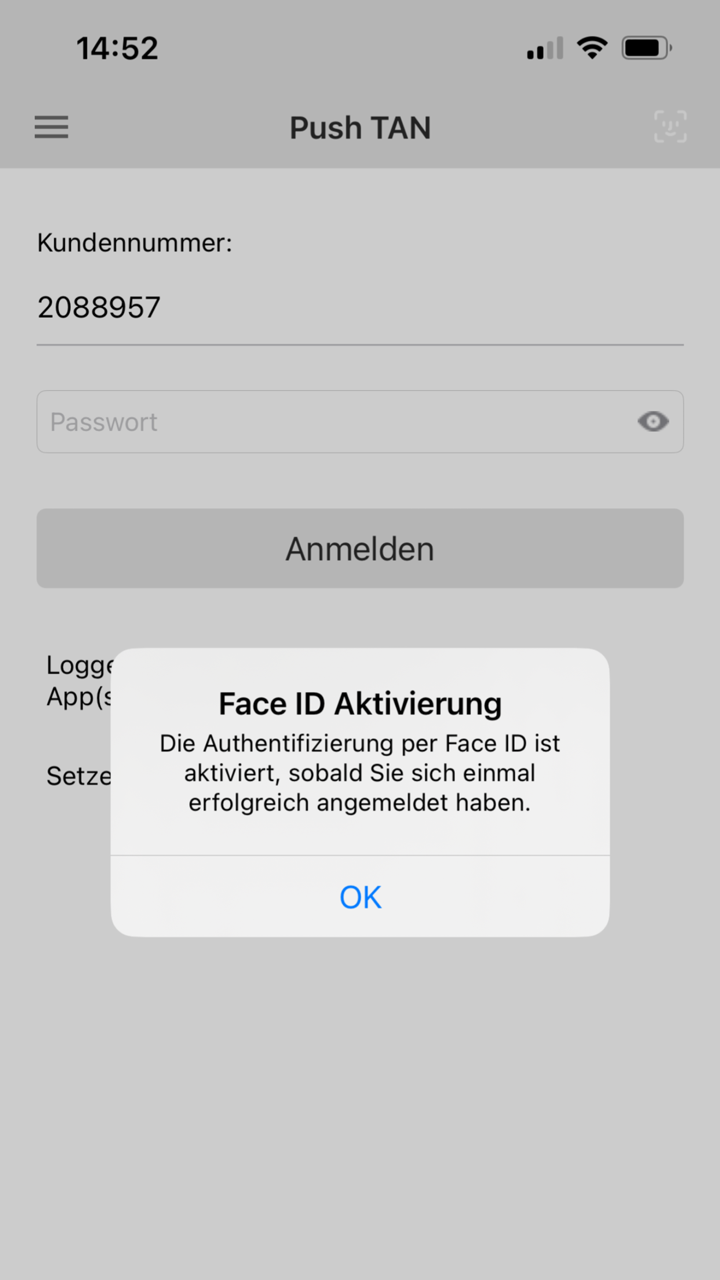

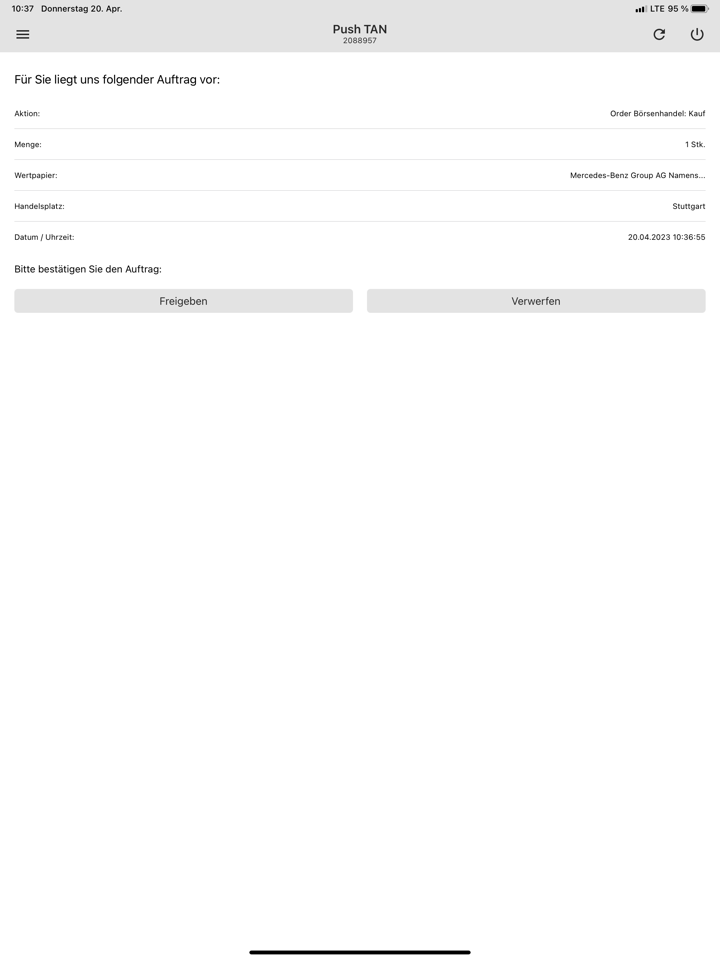

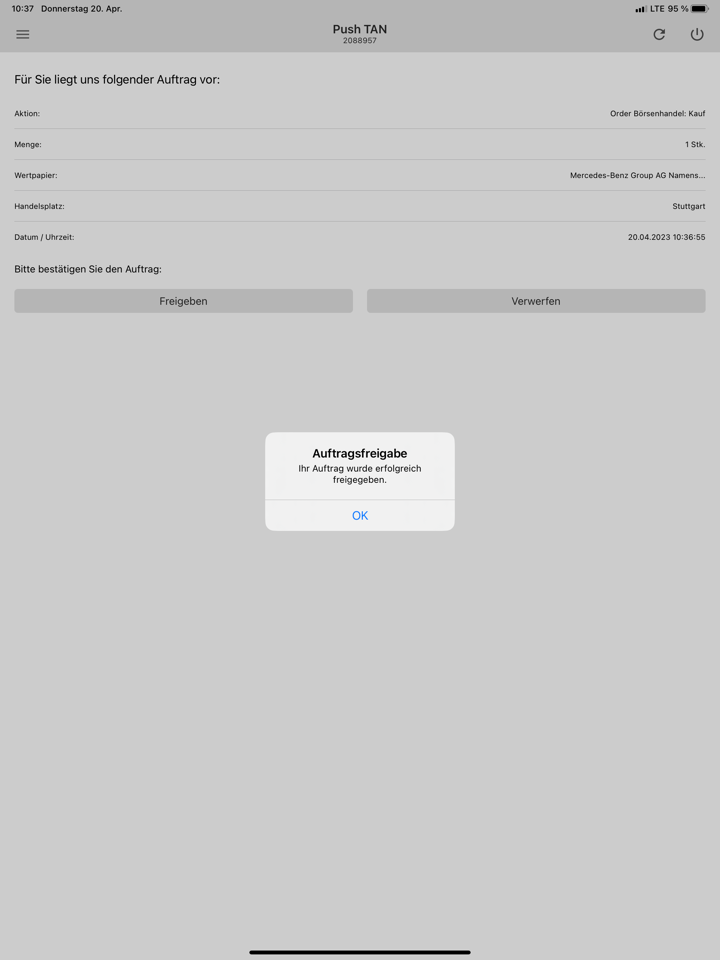

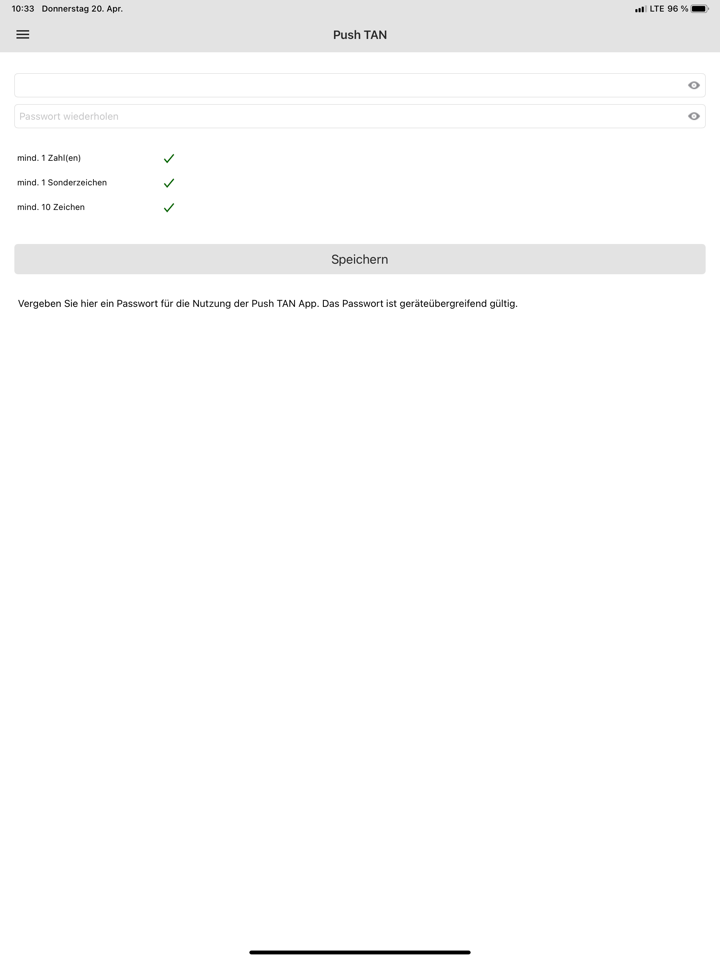

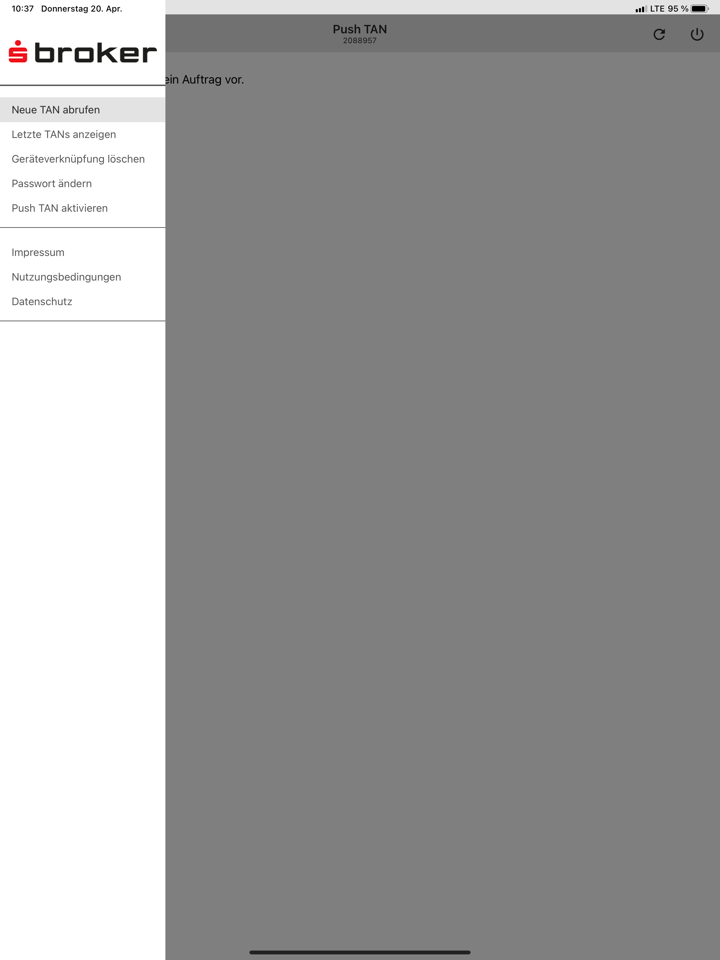

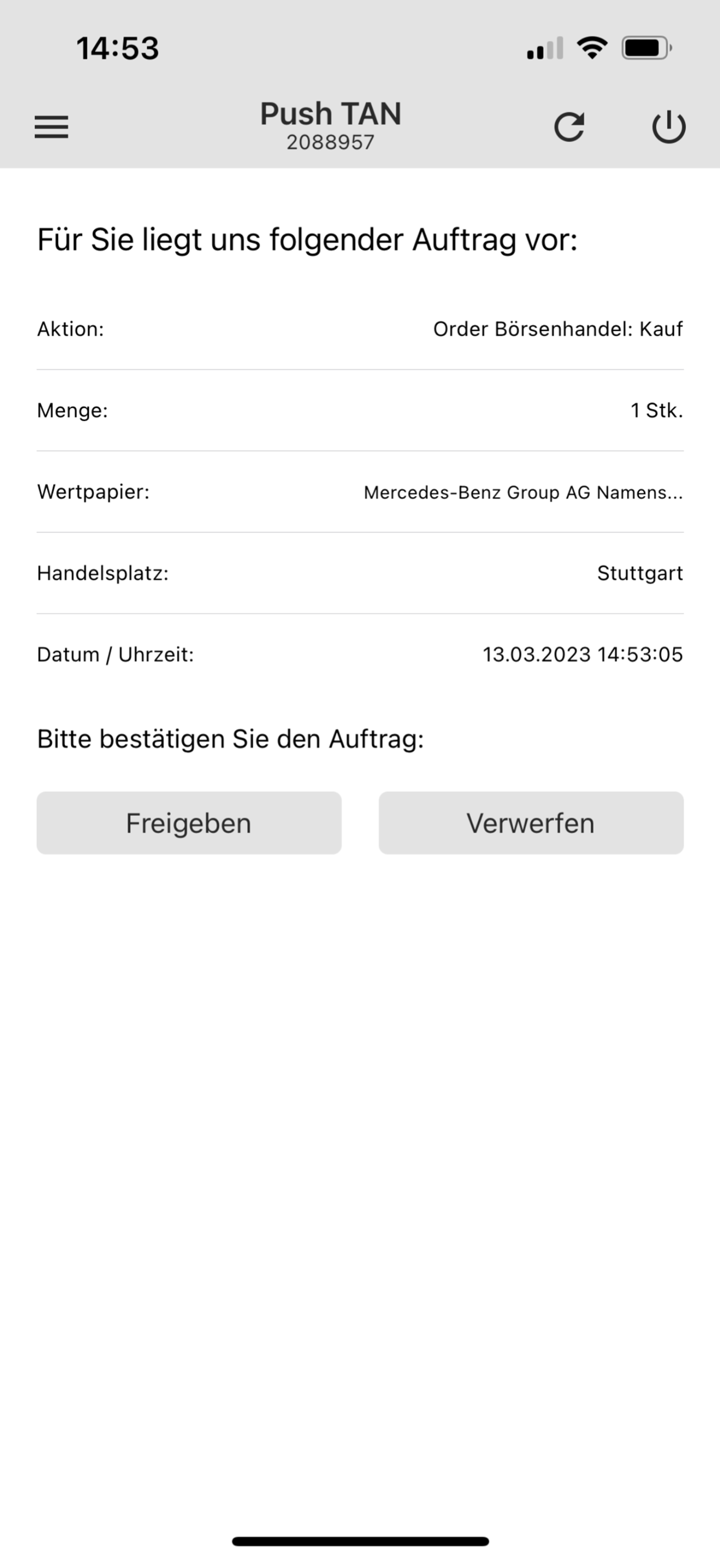

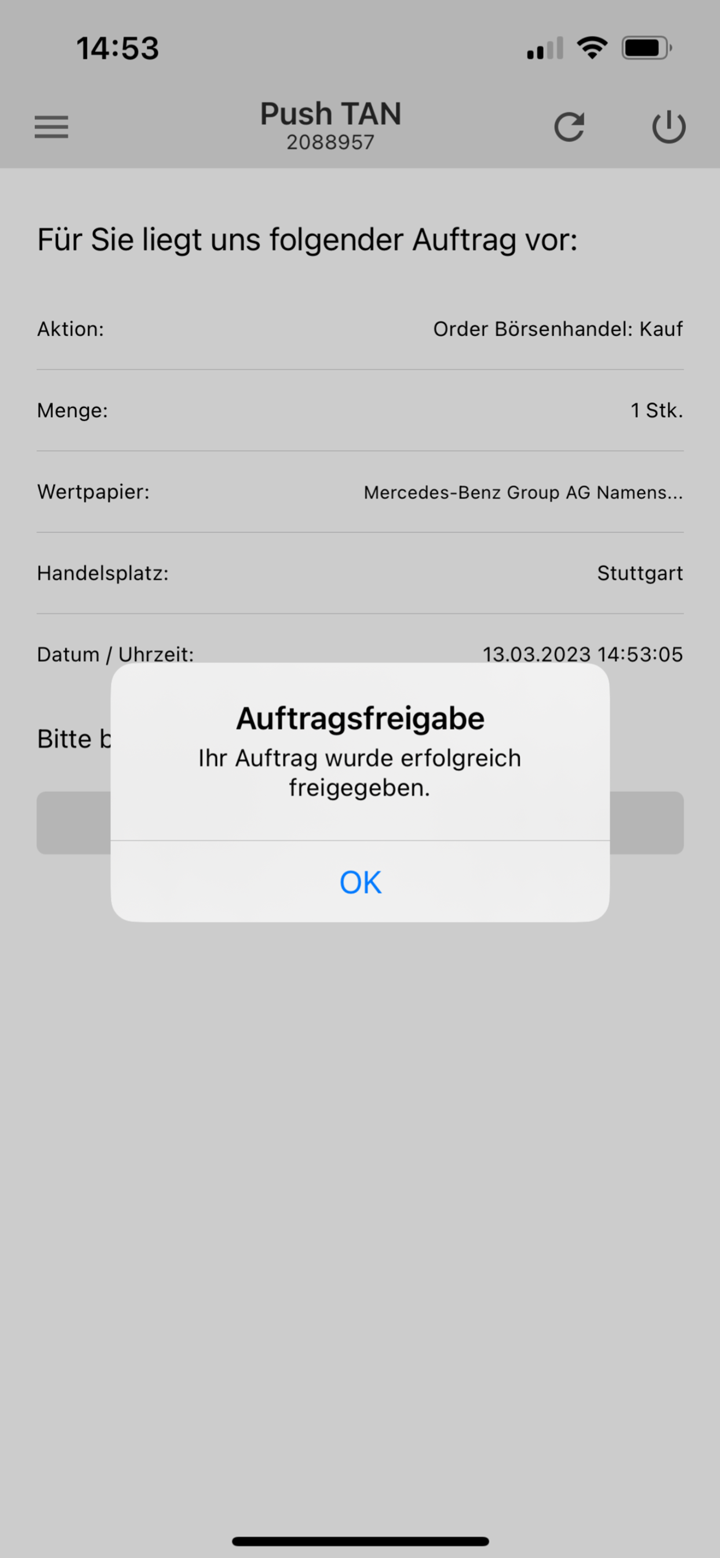

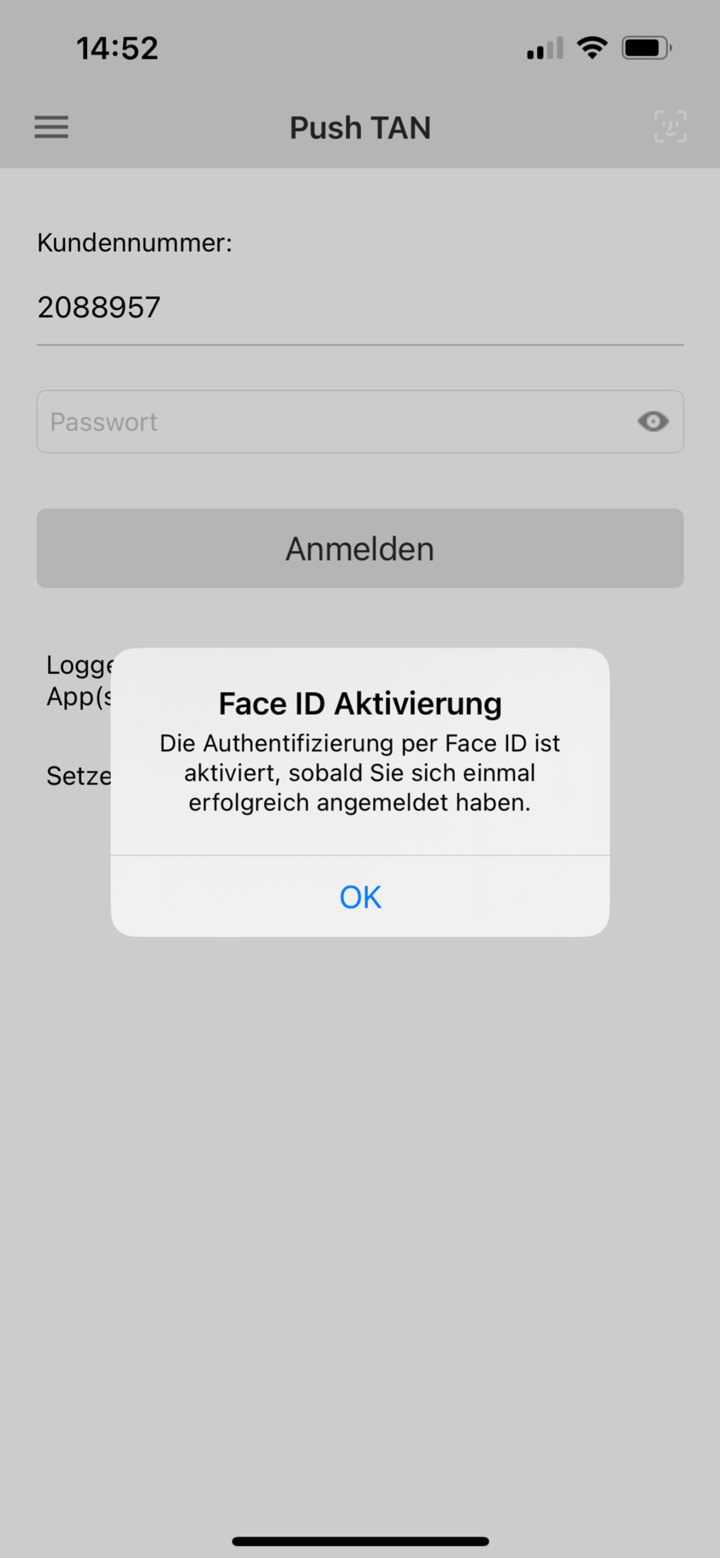

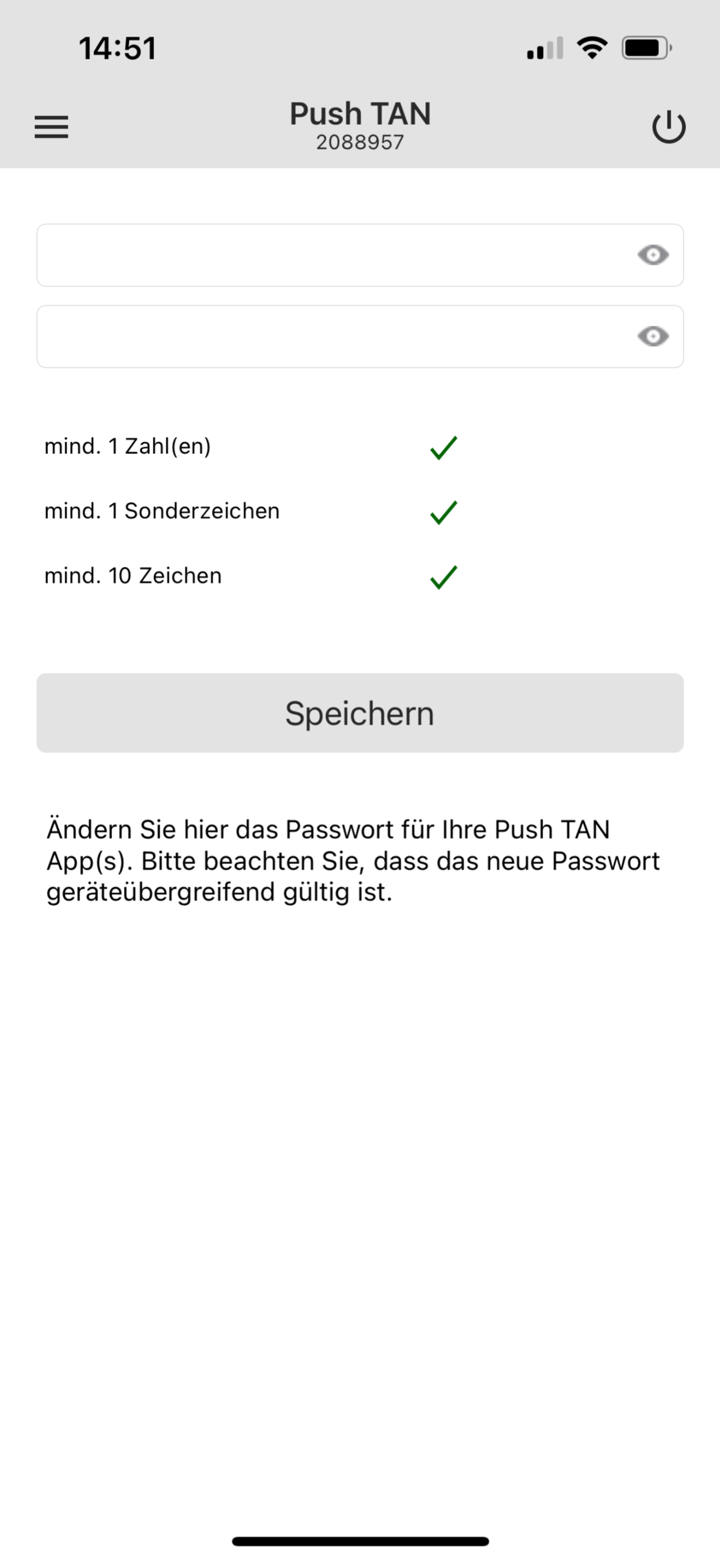

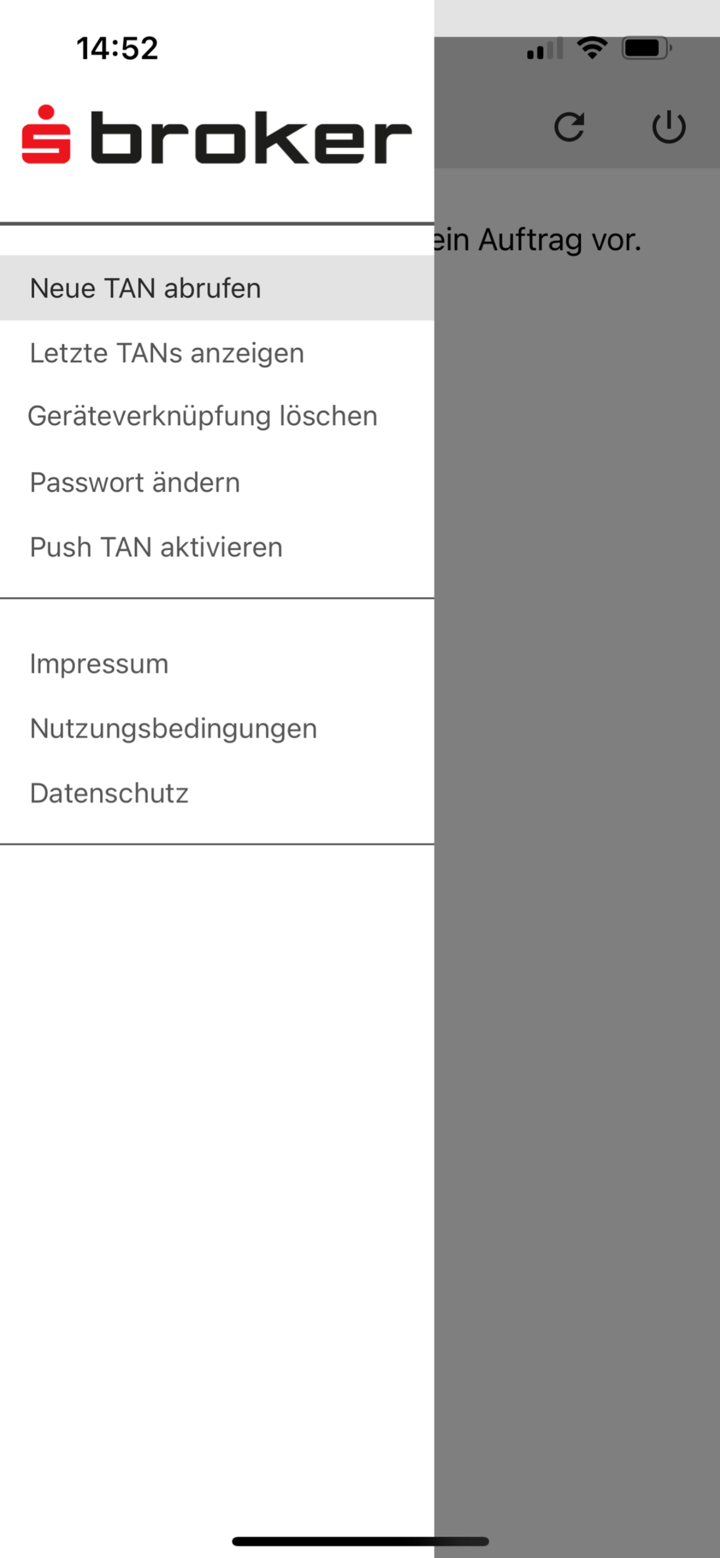

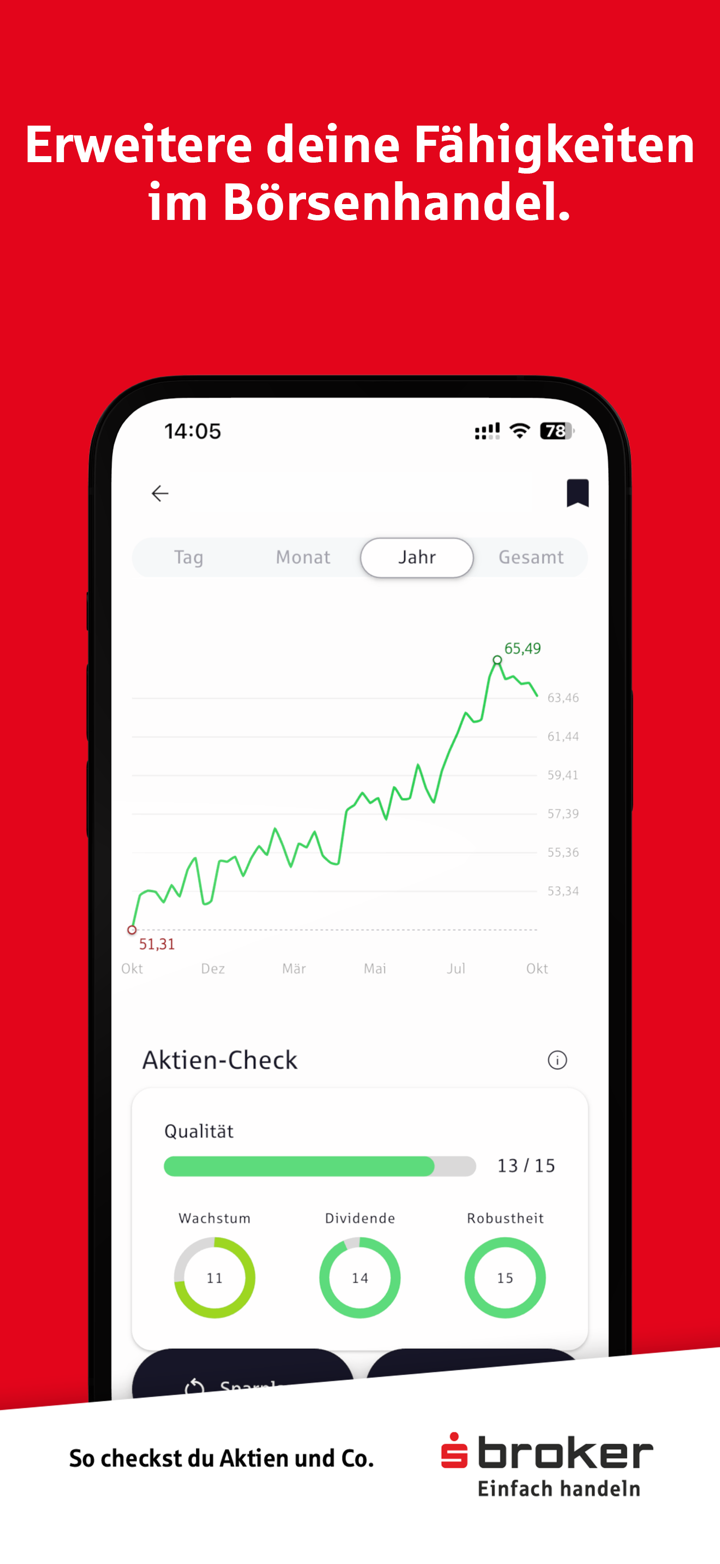

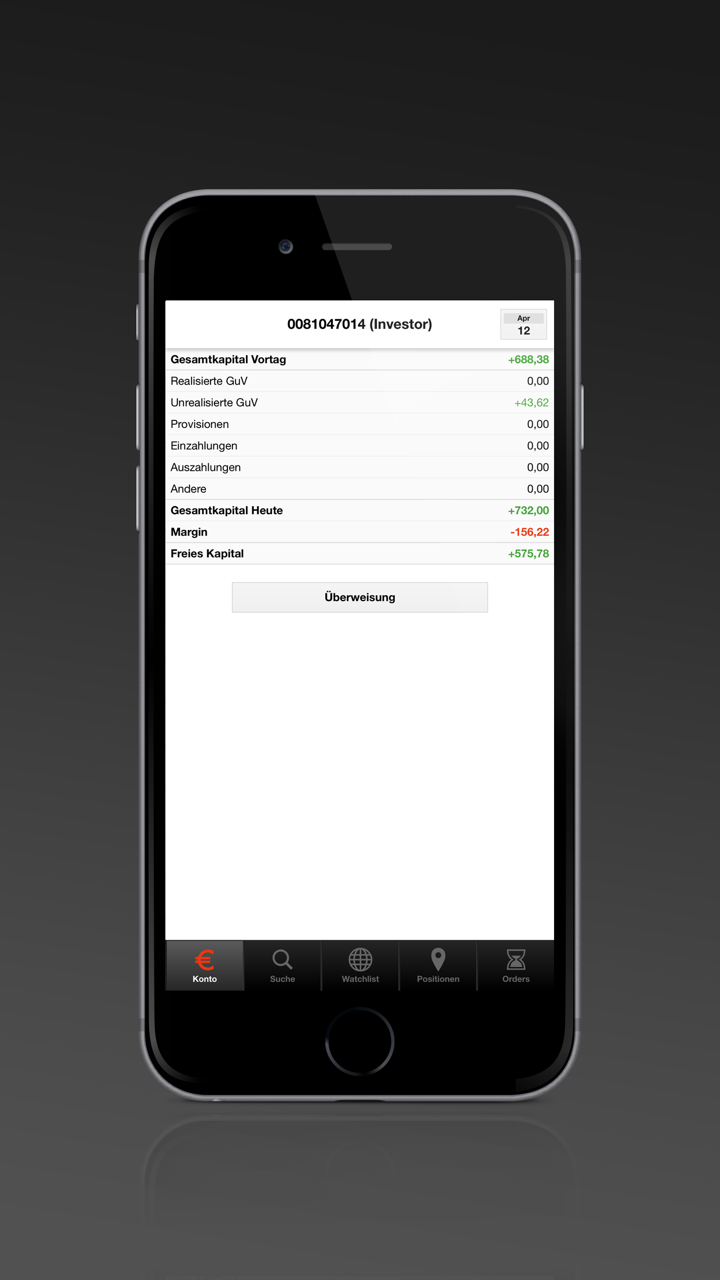

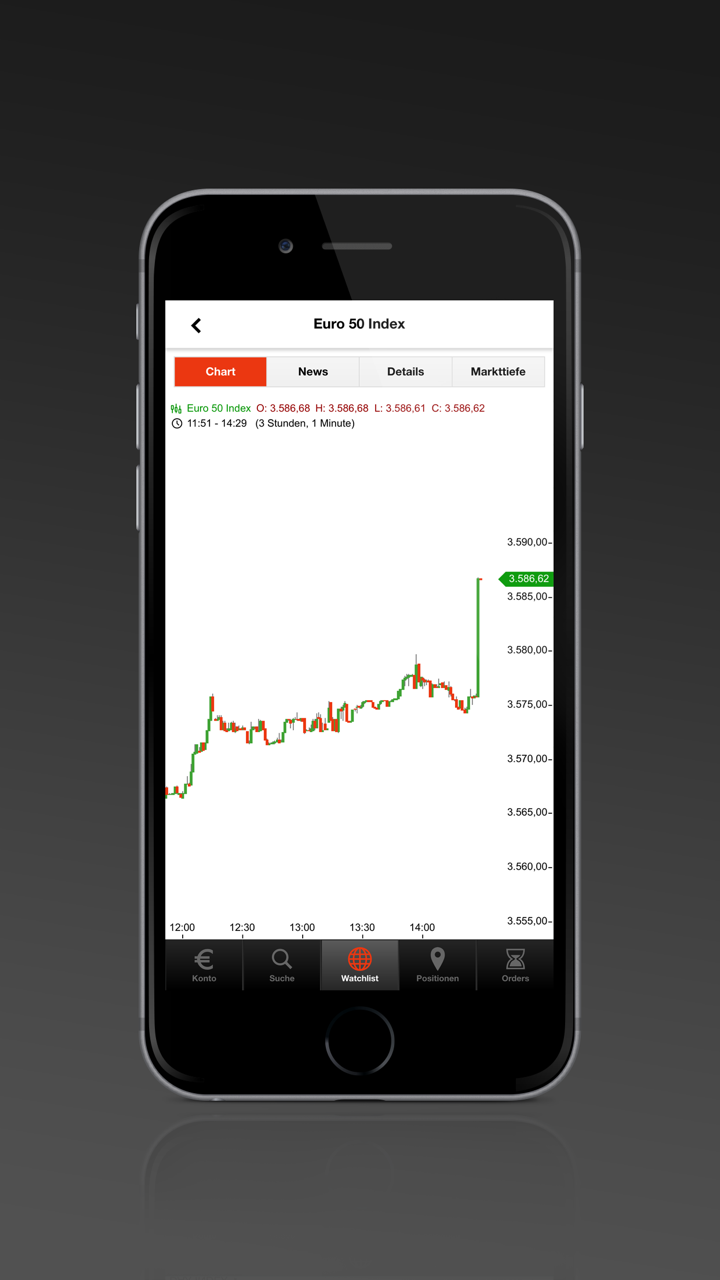

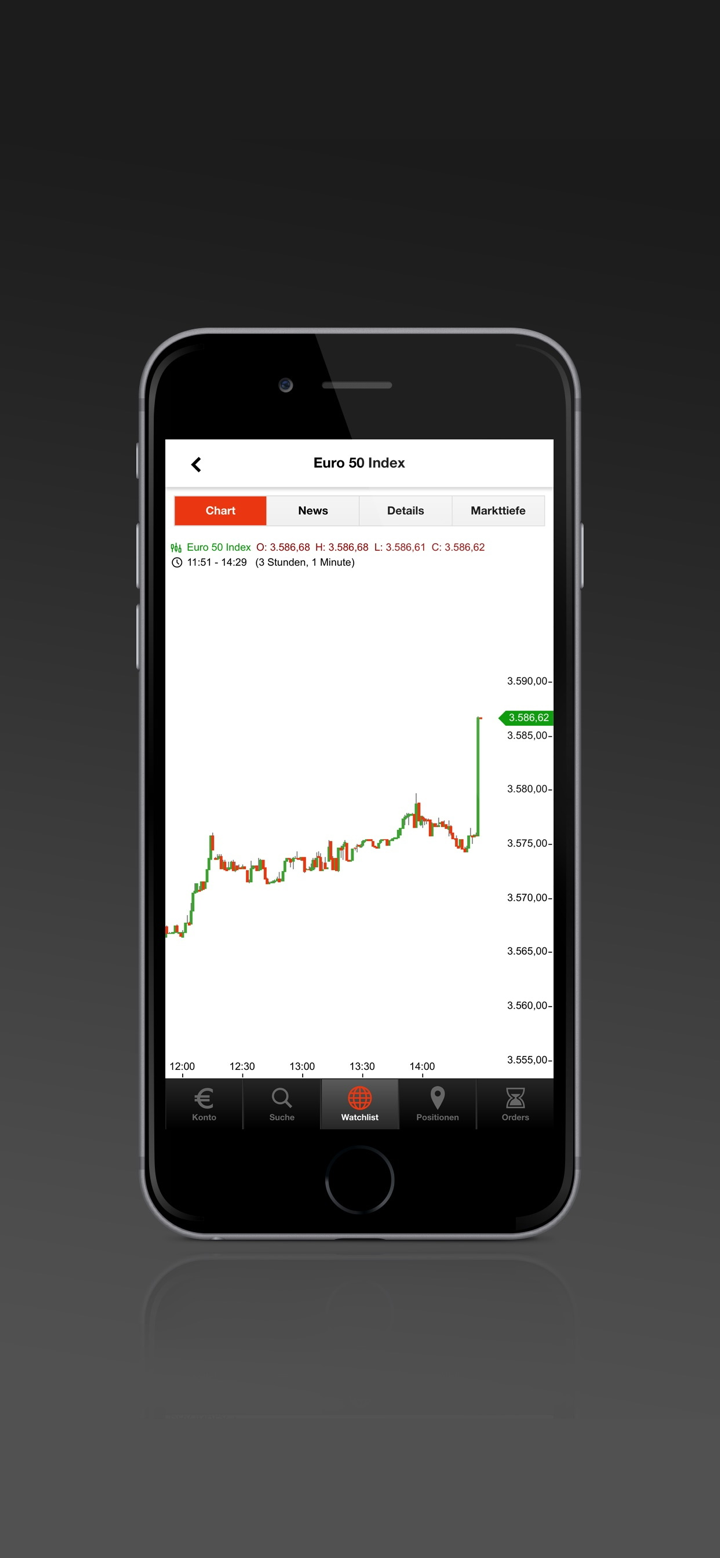

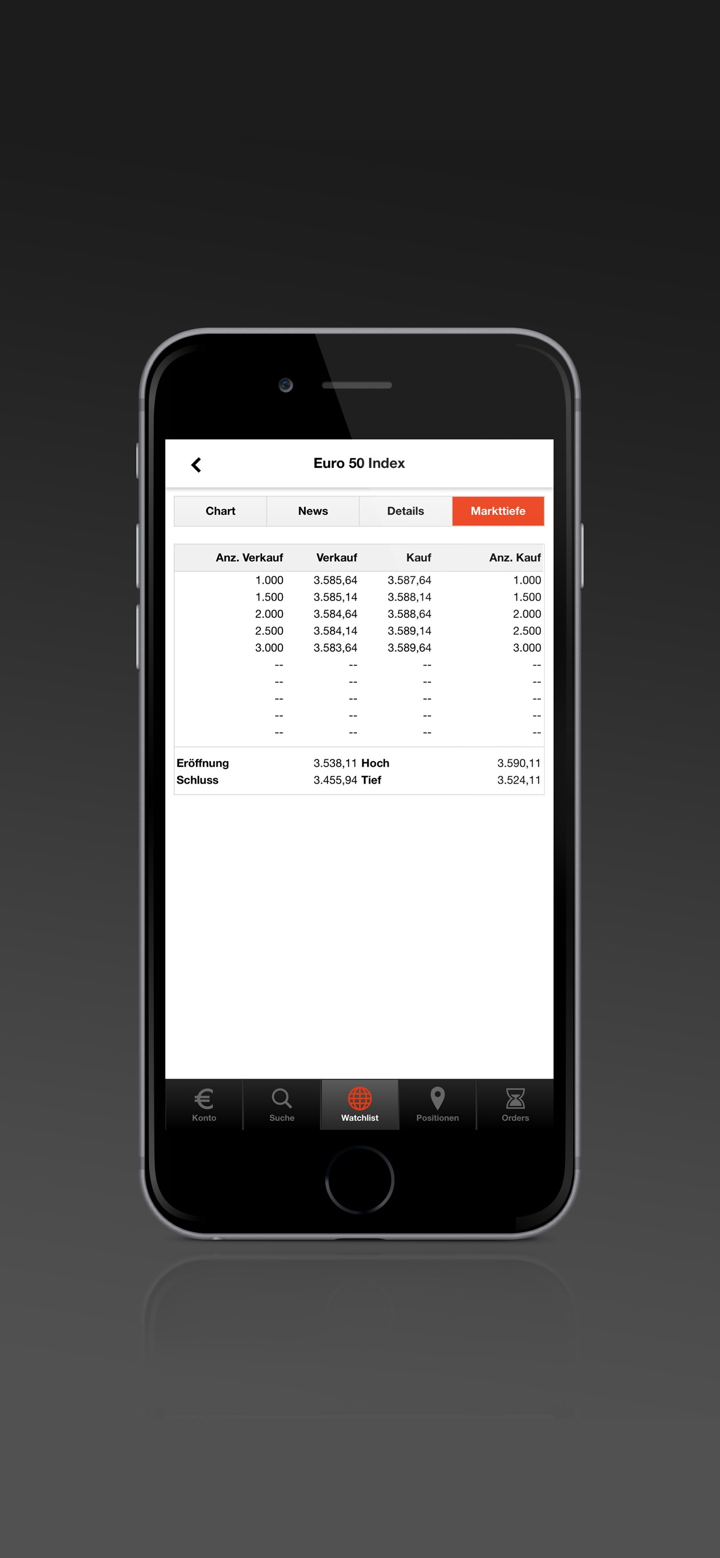

As an experienced trader, I always prioritize broker transparency and strong regulatory oversight when choosing a platform for trading. In my own due diligence on S Broker, several concerns stood out that have impacted my perception of its reliability and security. While S Broker has operated for over five years and offers a wide range of financial products such as stocks, ETFs, funds, CFDs, and bonds, I find the absence of valid regulation particularly troubling. There is no indication that S Broker is overseen by any recognized financial authority, which is a fundamental red flag for me. In my years of trading, unregulated platforms expose clients to unnecessary risks—particularly concerning fund protection and dispute resolution—because there's no external watchdog to ensure fair practices.

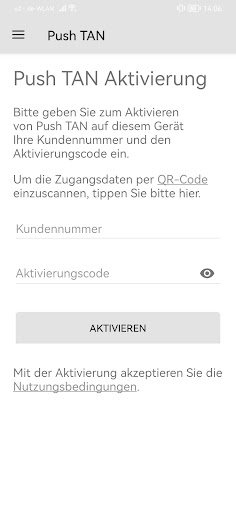

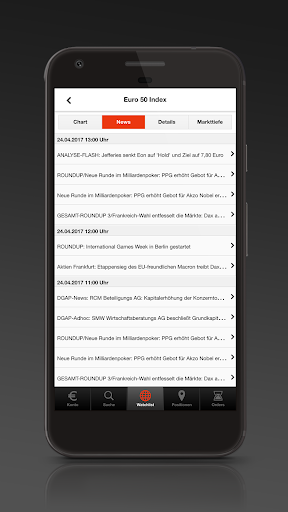

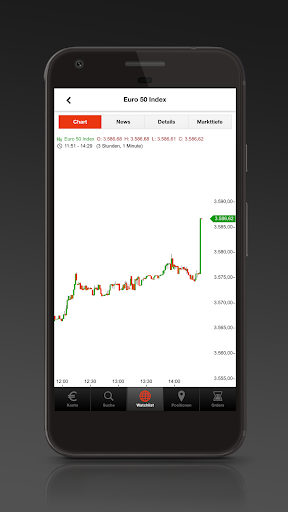

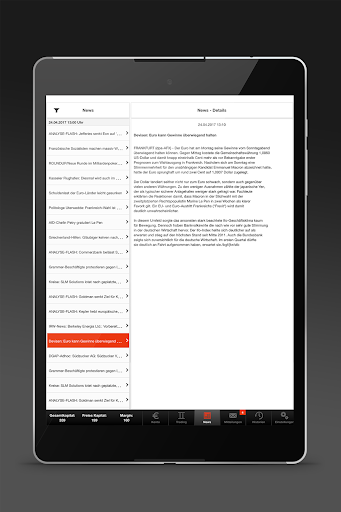

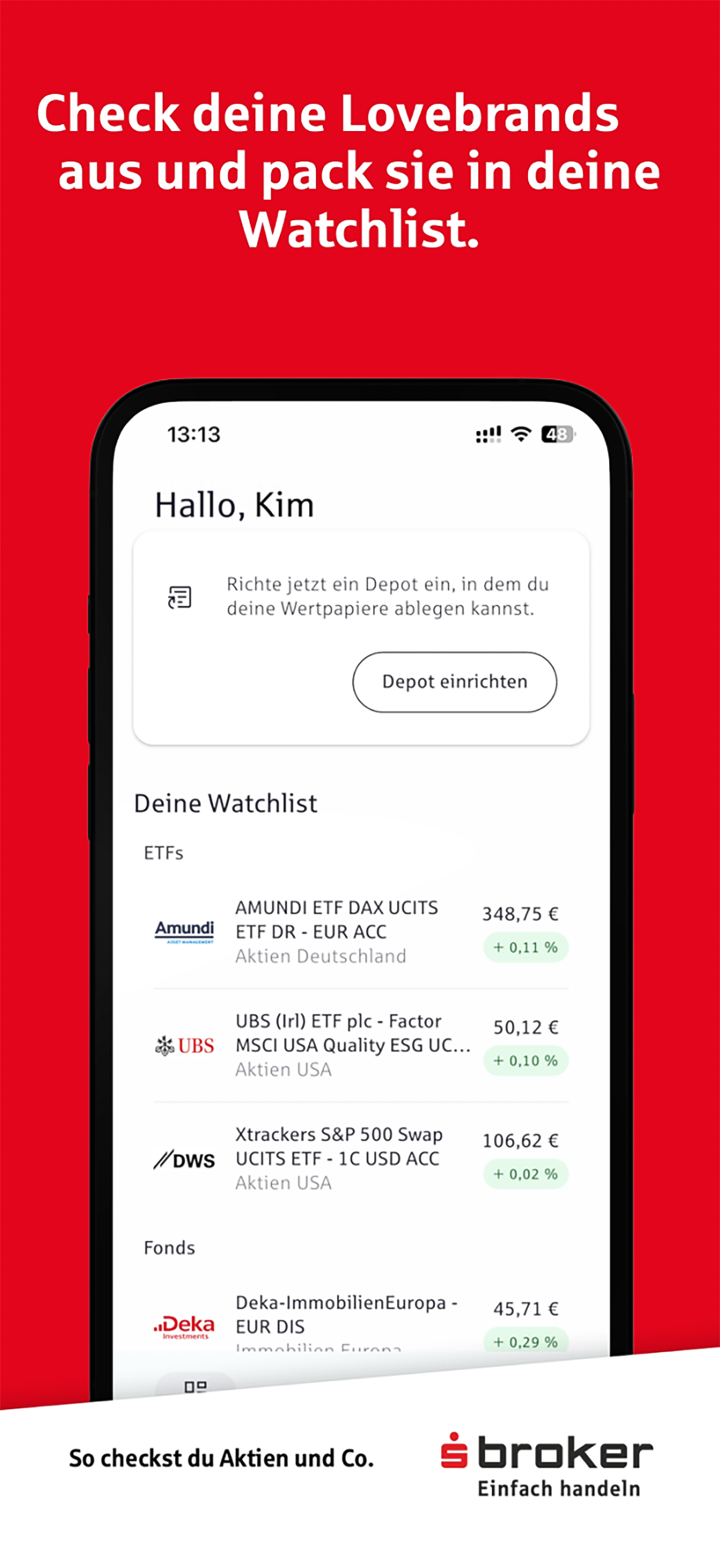

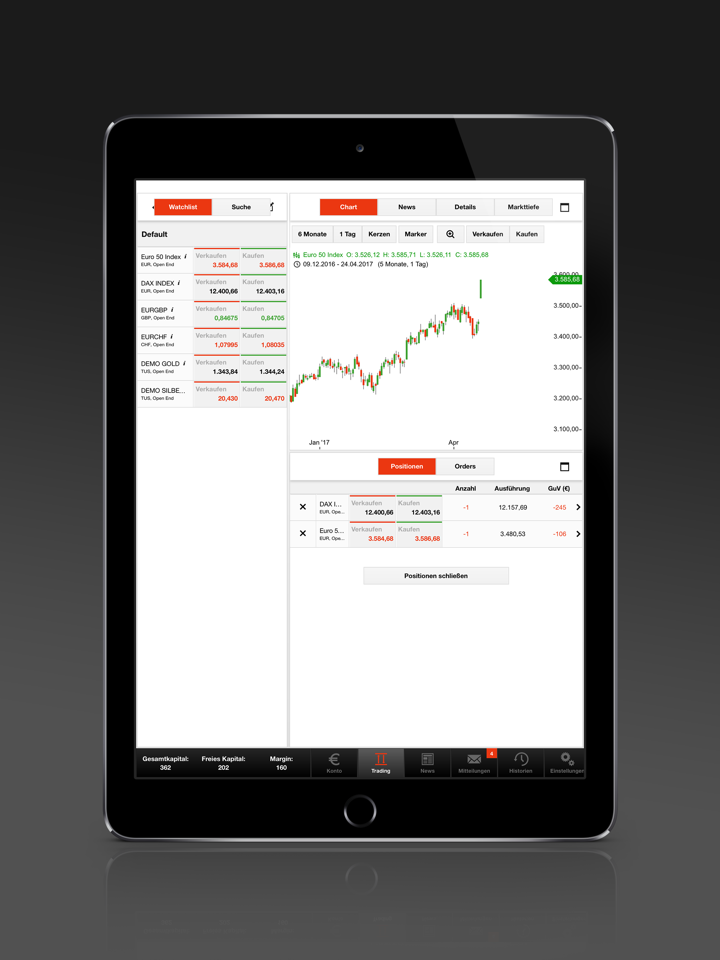

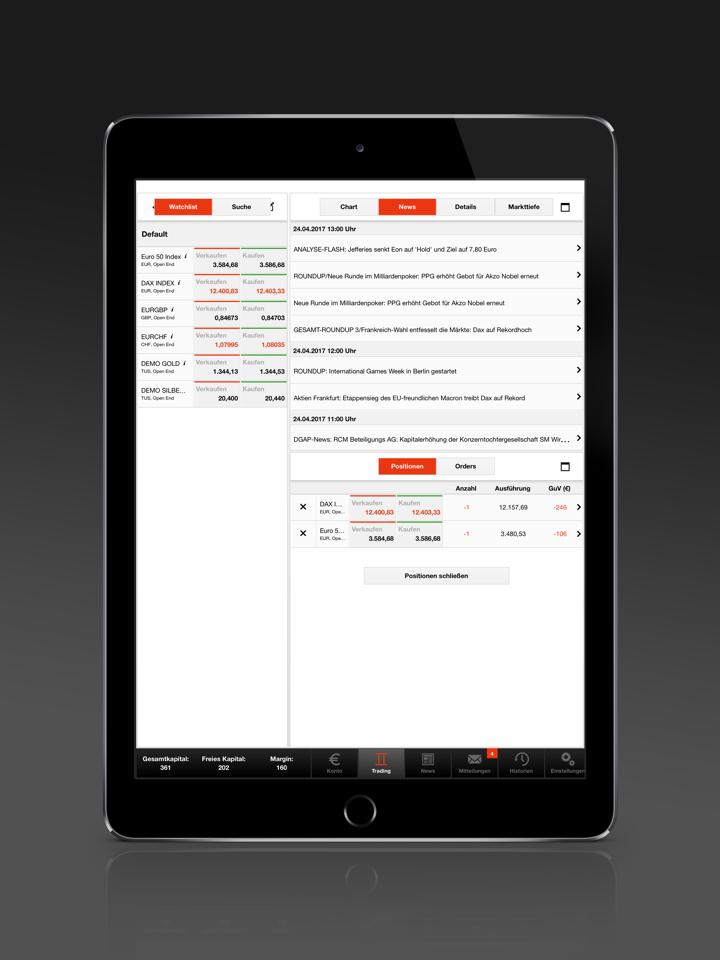

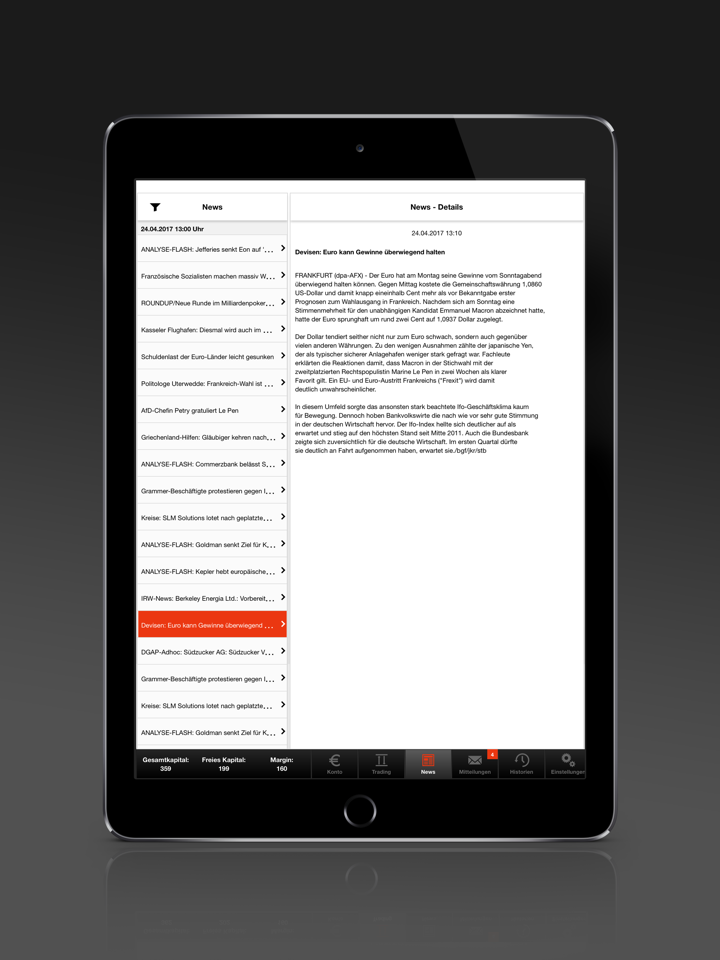

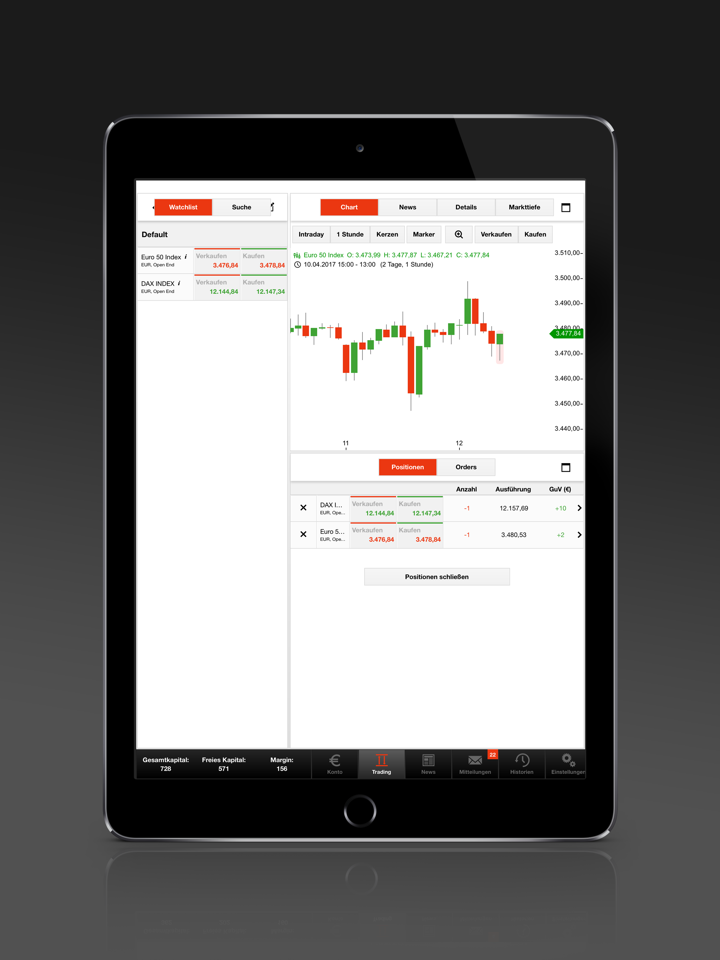

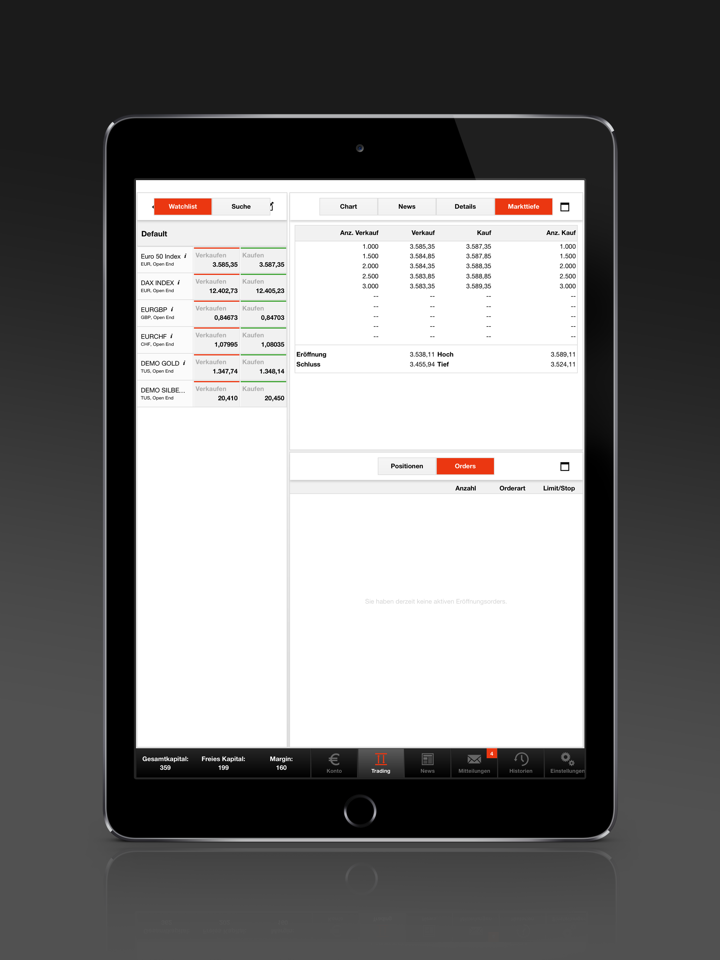

Although S Broker appears to cater to users through its proprietary mobile app and does not require a minimum deposit, these features do not substitute for the reassurance that comes with recognized regulation. The lack of licenses and the platform's own designation as high risk only reinforce my caution. For traders like myself who value longevity and a range of products, it's tempting to explore, but the fundamental question of accountability cannot be overlooked. Based on my experience, I would approach S Broker with significant caution and would not consider it fully trustworthy or secure for personal trading unless meaningful regulatory measures are put in place.

sinopi

1-2年

Which types of trading instruments does S Broker offer, such as stocks, forex, indices, cryptocurrencies, or commodities?

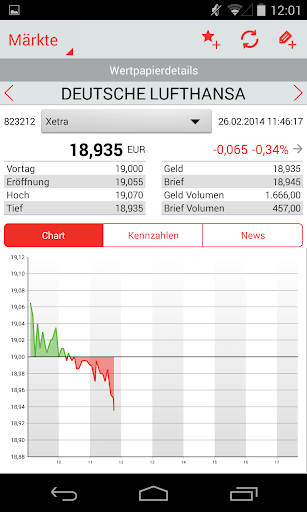

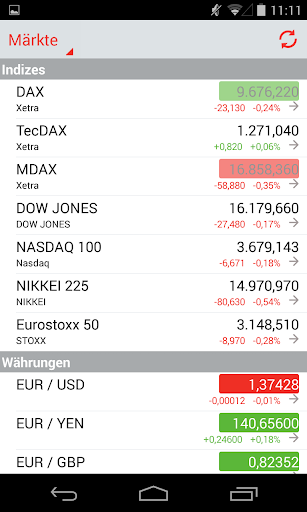

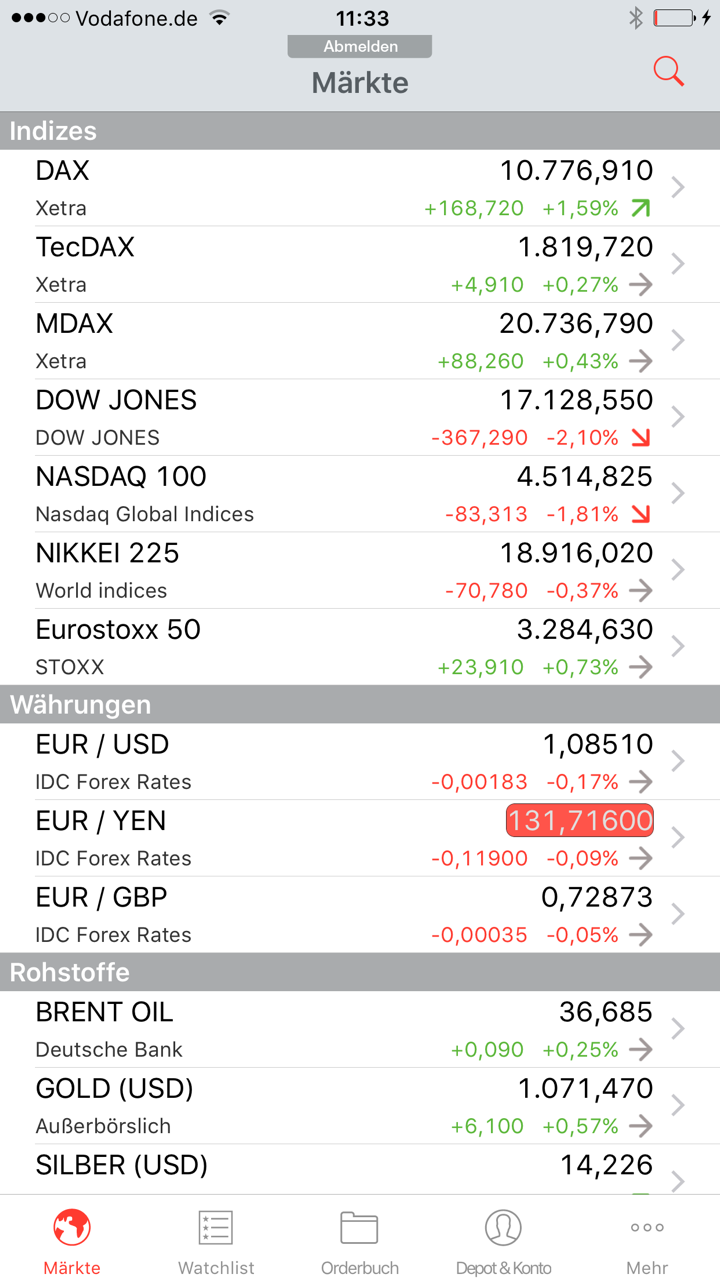

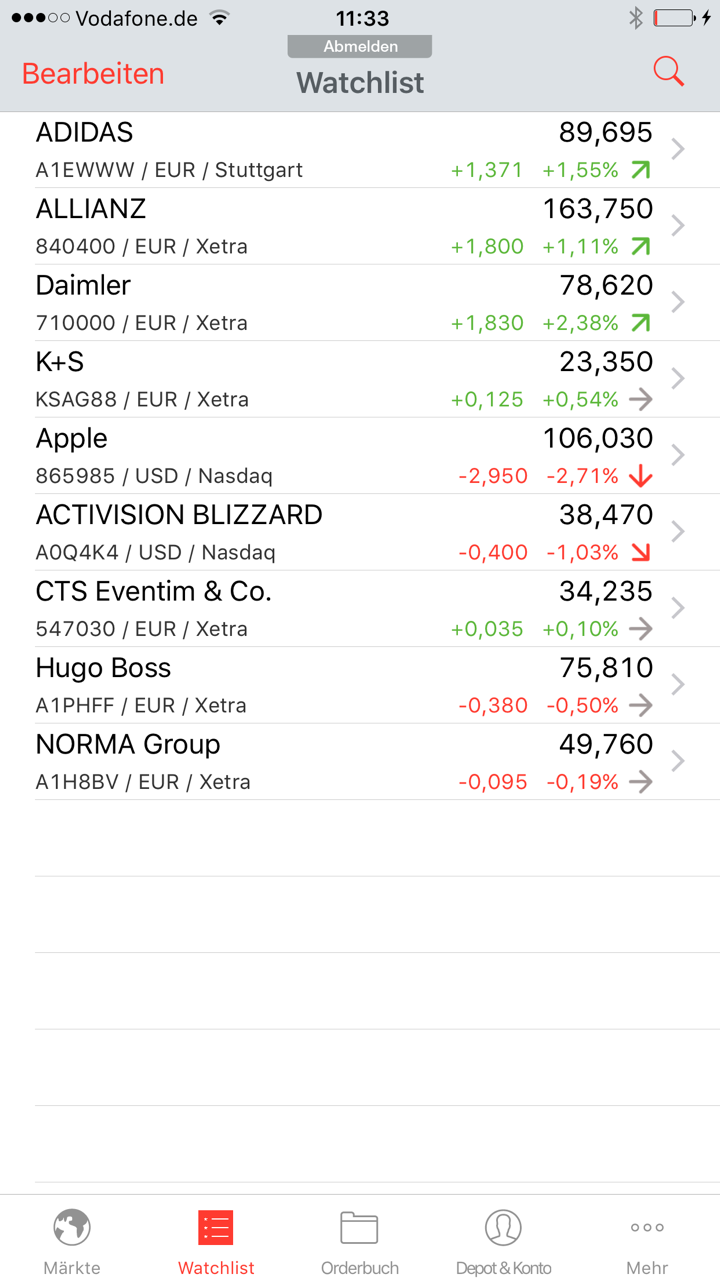

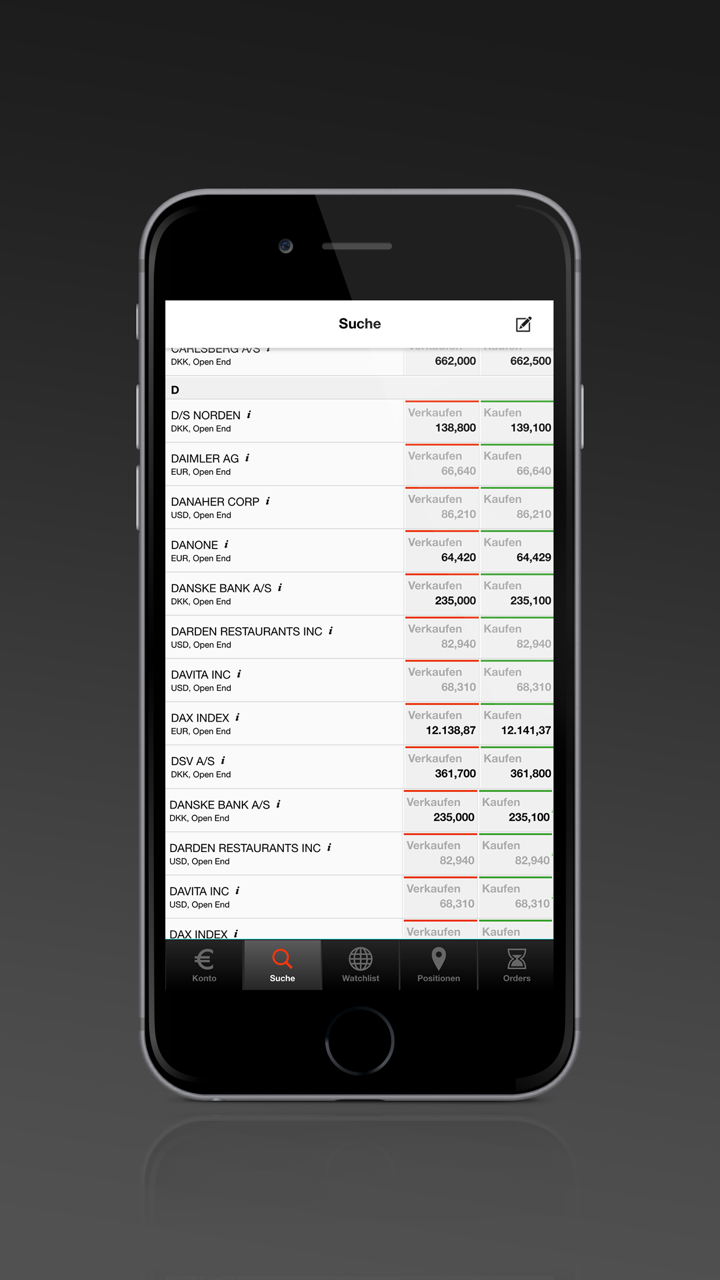

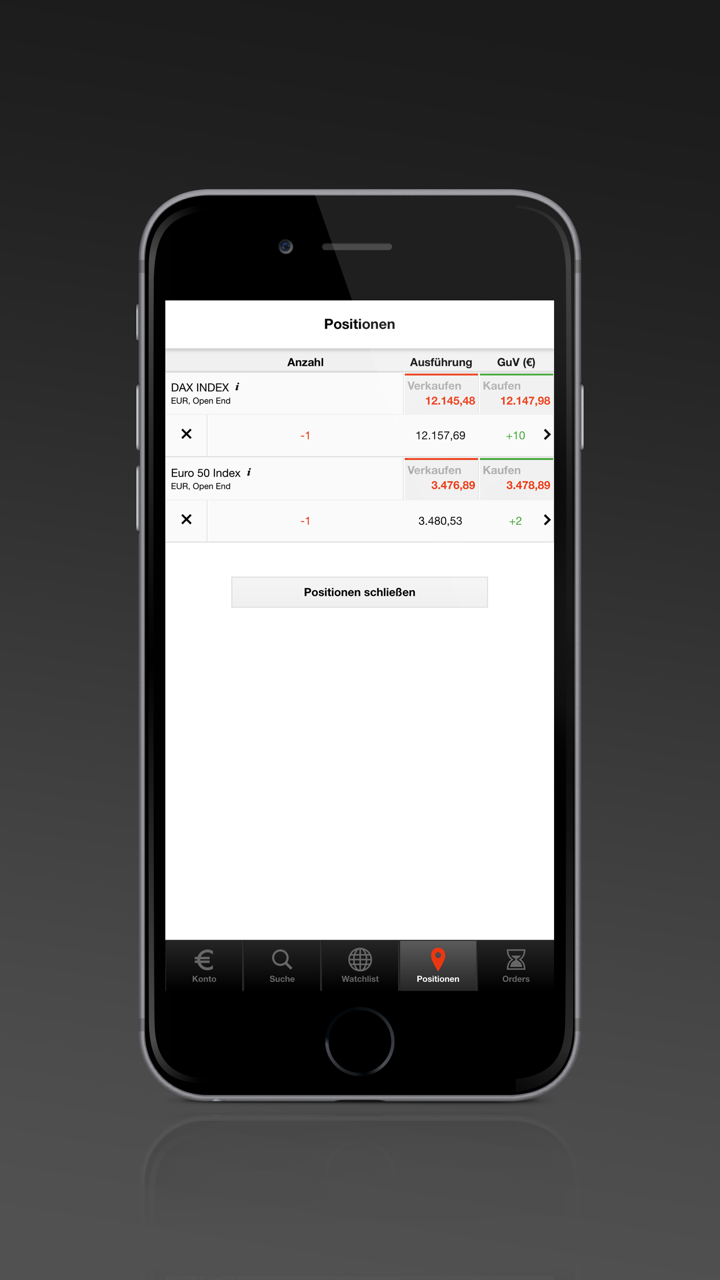

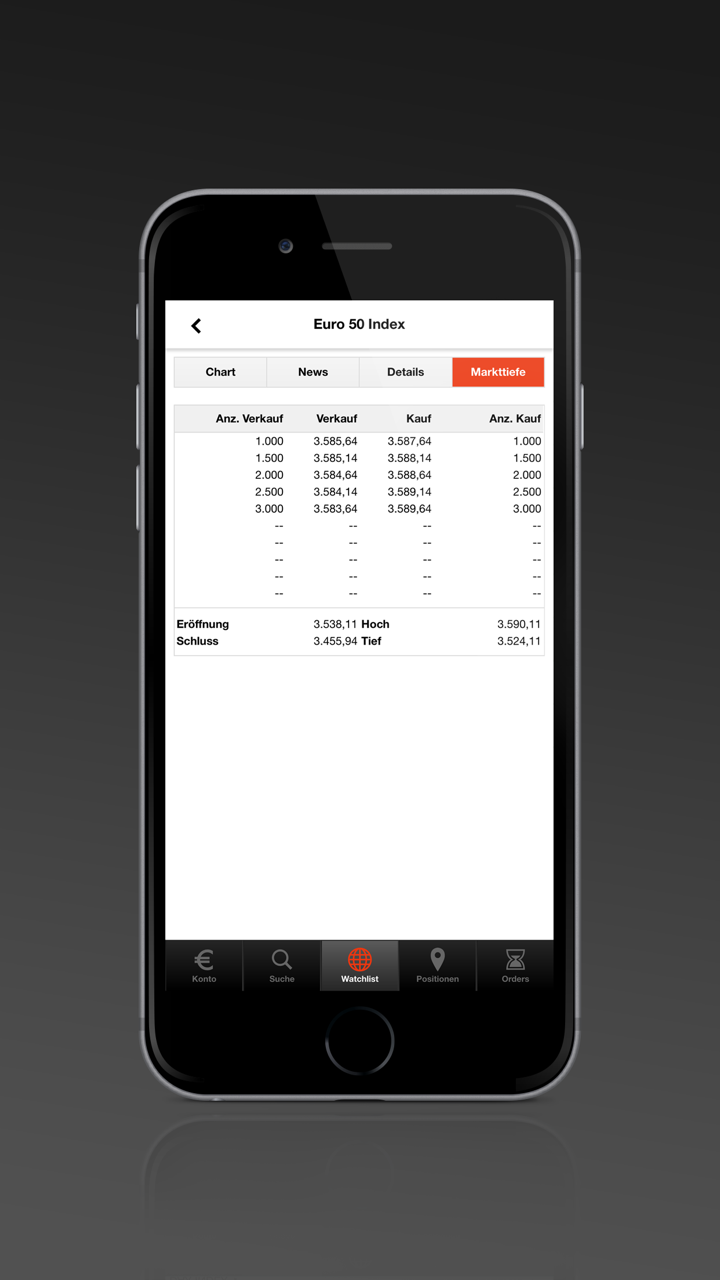

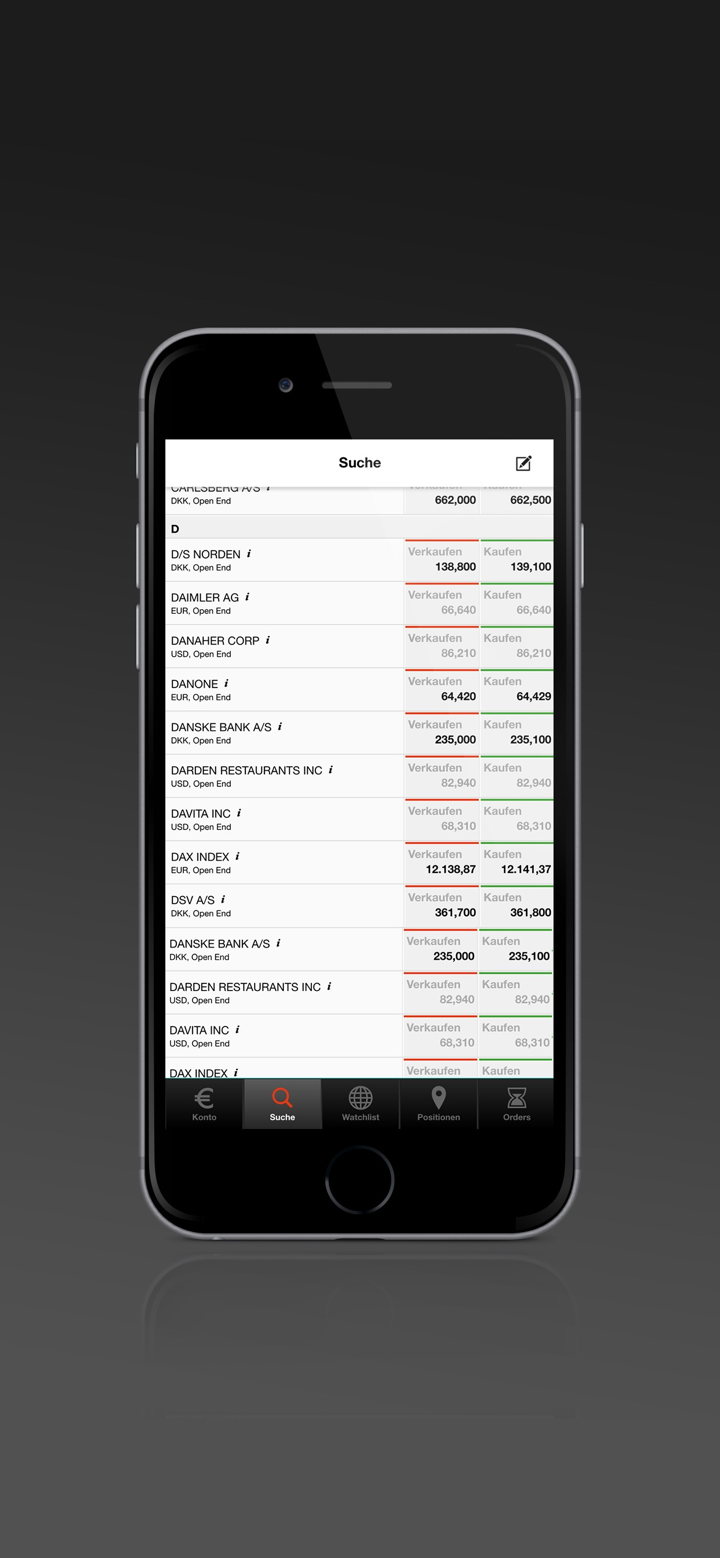

In my personal experience evaluating brokers, one of my priorities is understanding exactly which instruments are available for trading—this directly impacts both my strategies and risk exposure. With S Broker, I found that their selection is primarily centered around traditional financial products. Specifically, S Broker supports trading in stocks, funds, ETFs, CFDs, bonds, and indices. For me, this breadth means there’s decent coverage of major asset classes typically seen in European trading environments, and it can suit investors looking to build diversified portfolios using conventional securities and some derivative products. However, it’s important to note S Broker does not offer forex, commodities, cryptocurrencies, or options trading. The absence of these instruments can be limiting, especially for traders accustomed to high-liquidity and 24-hour markets like forex or those seeking alternatives like gold or bitcoin for hedging purposes.

Given the lack of regulatory oversight highlighted in my research, I would personally approach S Broker with caution, prioritizing capital protection and risk assessment before considering any trades. Ultimately, while S Broker’s offerings may satisfy straightforward securities trading, those requiring comprehensive multi-asset access or more advanced product suites might find the platform unsuitable for their needs. For me, this limitation is a decisive factor in broker selection.

Broker Issues

Platform

Account

Instruments

Leverage