Buod ng kumpanya

| S Broker Buod ng Pagsusuri | ||

| Itinatag | 1999 | |

| Rehistradong Bansa/Rehiyon | Alemanya | |

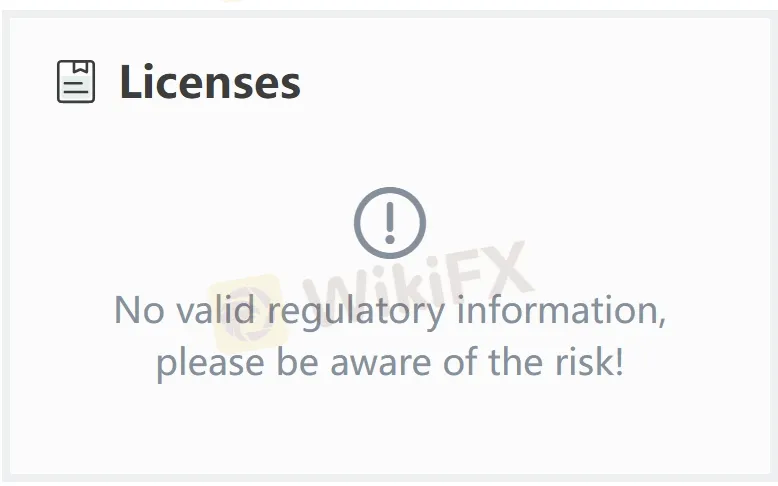

| Regulasyon | Walang regulasyon | |

| Mga Kasangkapan sa Merkado | Mga Stock, pondo, ETFs, CFDs, bonds, mga index, atbp. | |

| Platform ng Paggawa ng Kalakalan | Minimum na Deposito | 0 |

| Suporta sa Customer | Live chat | |

| Tel: 0611 2044-1912; 0611 2044-1911; 0611 2044-1944 | ||

| Email: service@sbroker.de | ||

| FAQ, Instagram, YouTube, LinkedIn, Facebook, atbp. | ||

| Address: S Broker AG & Co. KG, Customer Service, P.O. Box 90 01 50, 39133 Magdeburg | ||

Impormasyon Tungkol sa S Broker

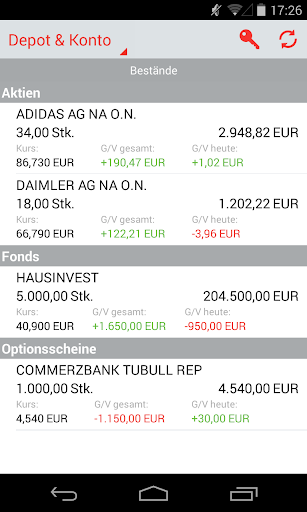

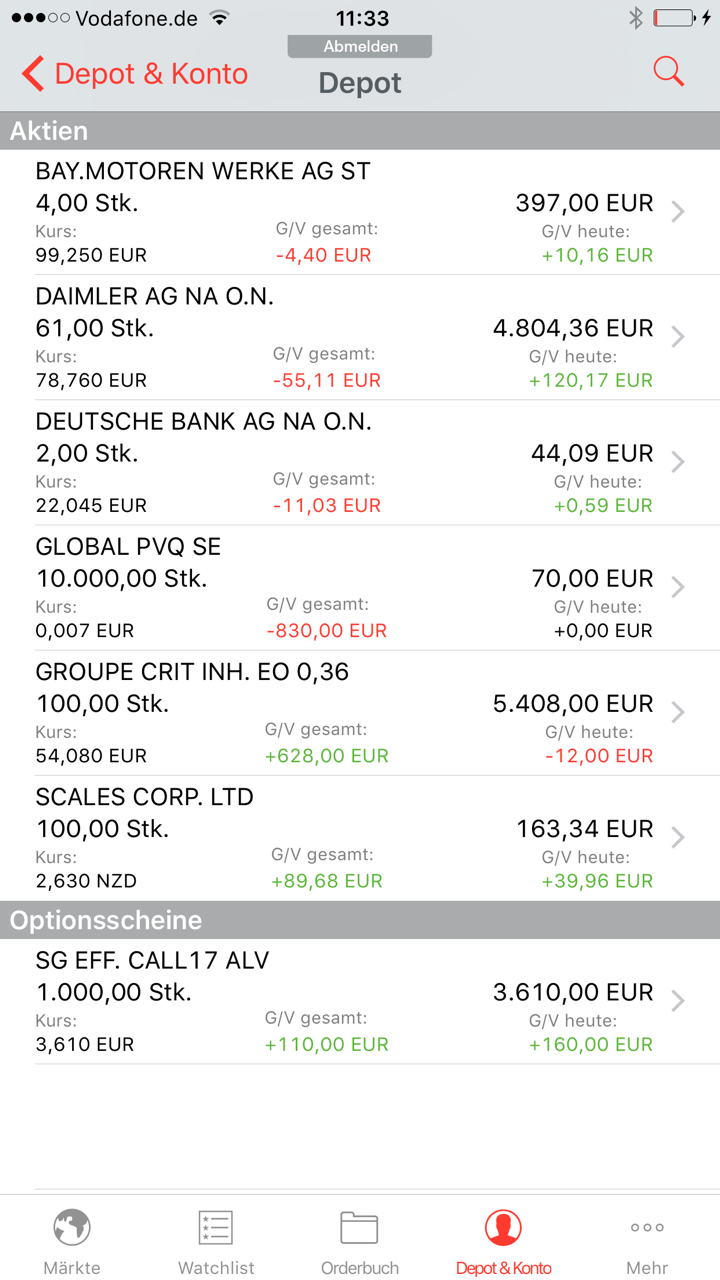

S Broker ay isang kumpanya ng kalakalan ng mga seguridad na unang itinatag noong 1999 sa Alemanya. Ang kumpanya ngayon ay nag-aalok ng mga produkto sa kalakalan kabilang ang ngunit hindi limitado sa mga stock, pondo, ETFs, CFDs, bonds, mga leverage na produkto tulad ng mga index, atbp. Nag-aalok ito ng dalawang account sa kalakalan nang walang anumang kinakailangang minimum na deposito.

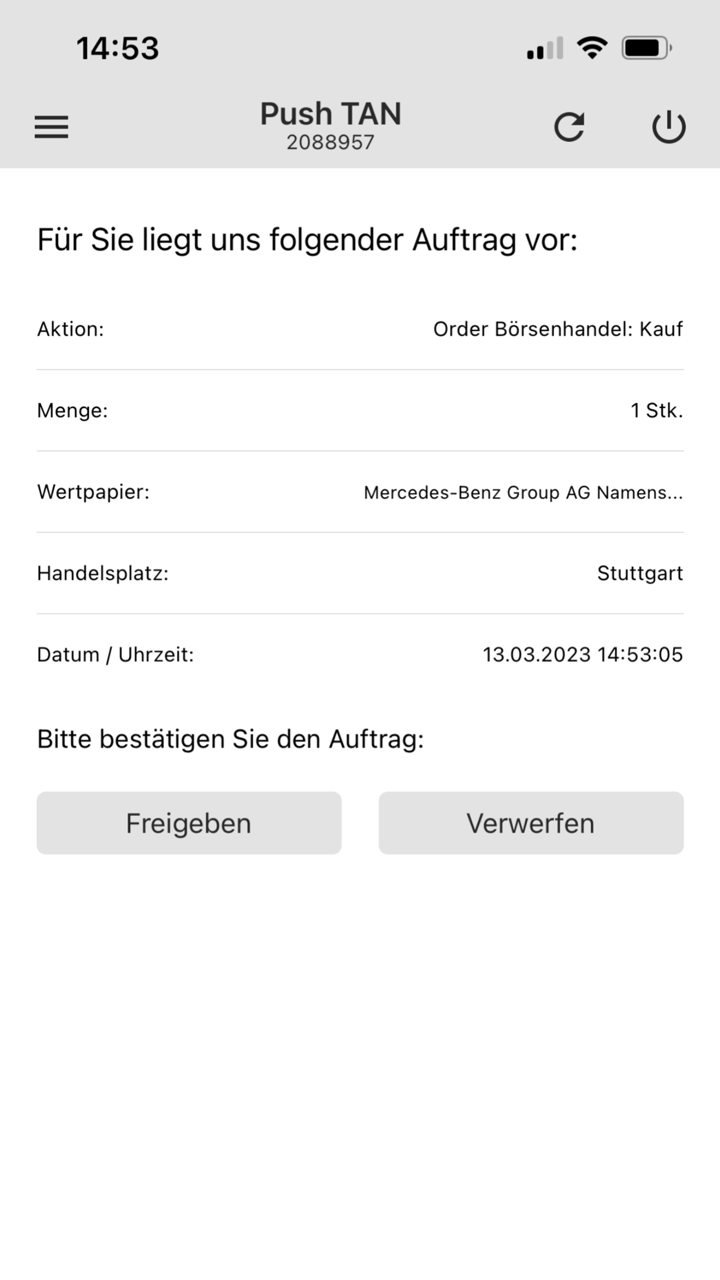

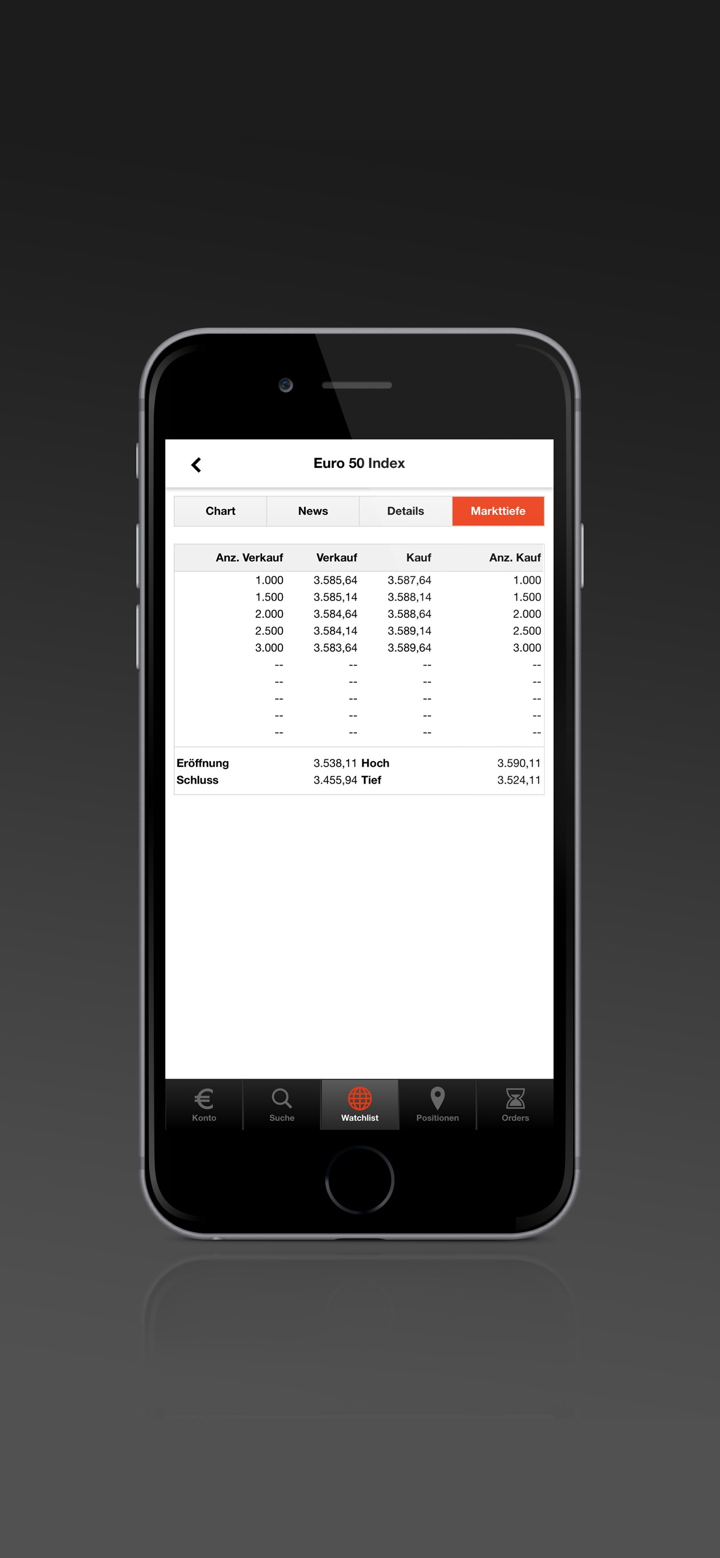

Upang maisagawa ang mga kalakalan, binuo ng kumpanya ang kanilang sariling S Broker Mobile App, espesyal para sa kanilang mga gumagamit.

Gayunpaman, ang broker sa kasalukuyan ay hindi lubos na nairegulahan ng anumang opisyal na awtoridad, na nagbabaon sa kanyang kredibilidad at pagtitiwala.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Maraming taon ng karanasan sa industriya | Walang regulasyon |

| Iba't ibang mga produkto sa kalakalan | |

| Walang minimum na deposito |

Tunay ba ang S Broker?

Ang pinakamahalagang salik sa pagmamatimbang ng kaligtasan ng isang plataporma ng brokerage ay kung ito ay pormal na nairegula. Ang S Broker ay isang di nairegulahang broker, na nangangahulugang ang kaligtasan ng pondo ng mga gumagamit at mga aktibidad sa kalakalan ay hindi epektibong pinoprotektahan. Dapat piliin ng mga mamumuhunan ang S Broker nang may pag-iingat.

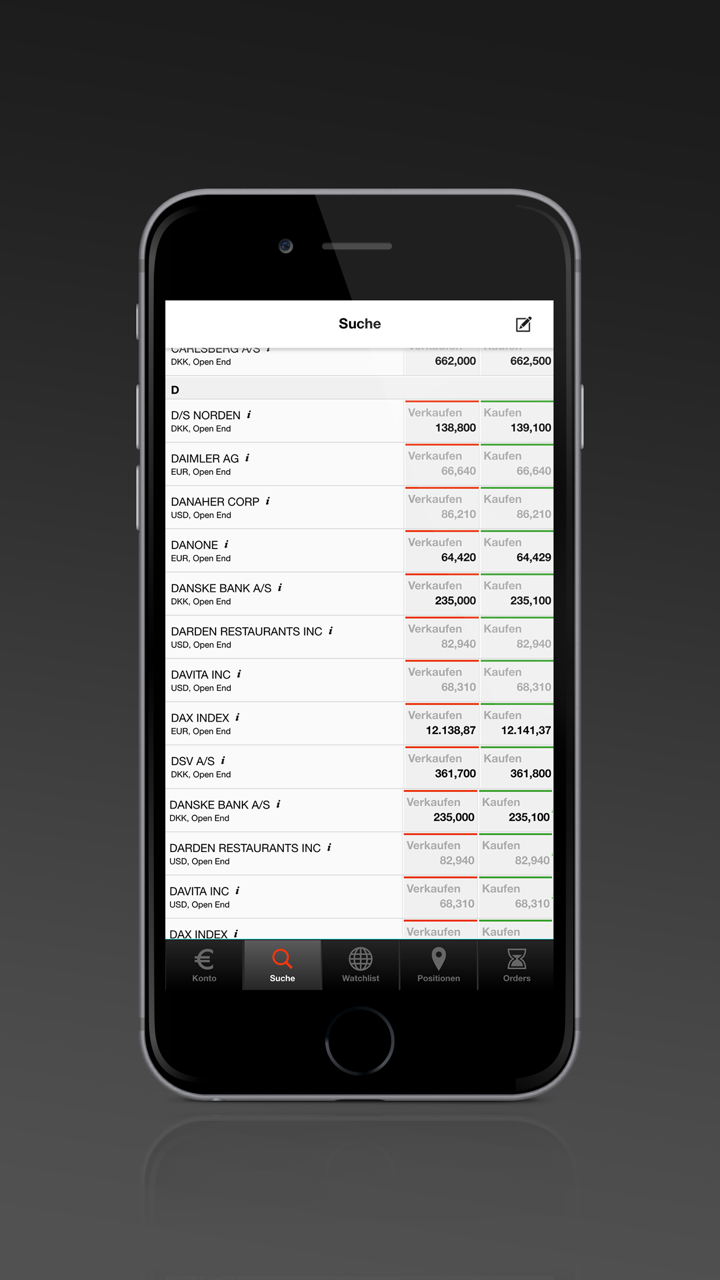

Ano ang Maaari Kong Itrade sa S Broker?

| Mga Kasangkapan sa Kalakalan | Supported |

| Stocks | ✔ |

| Funds | ✔ |

| ETFs | ✔ |

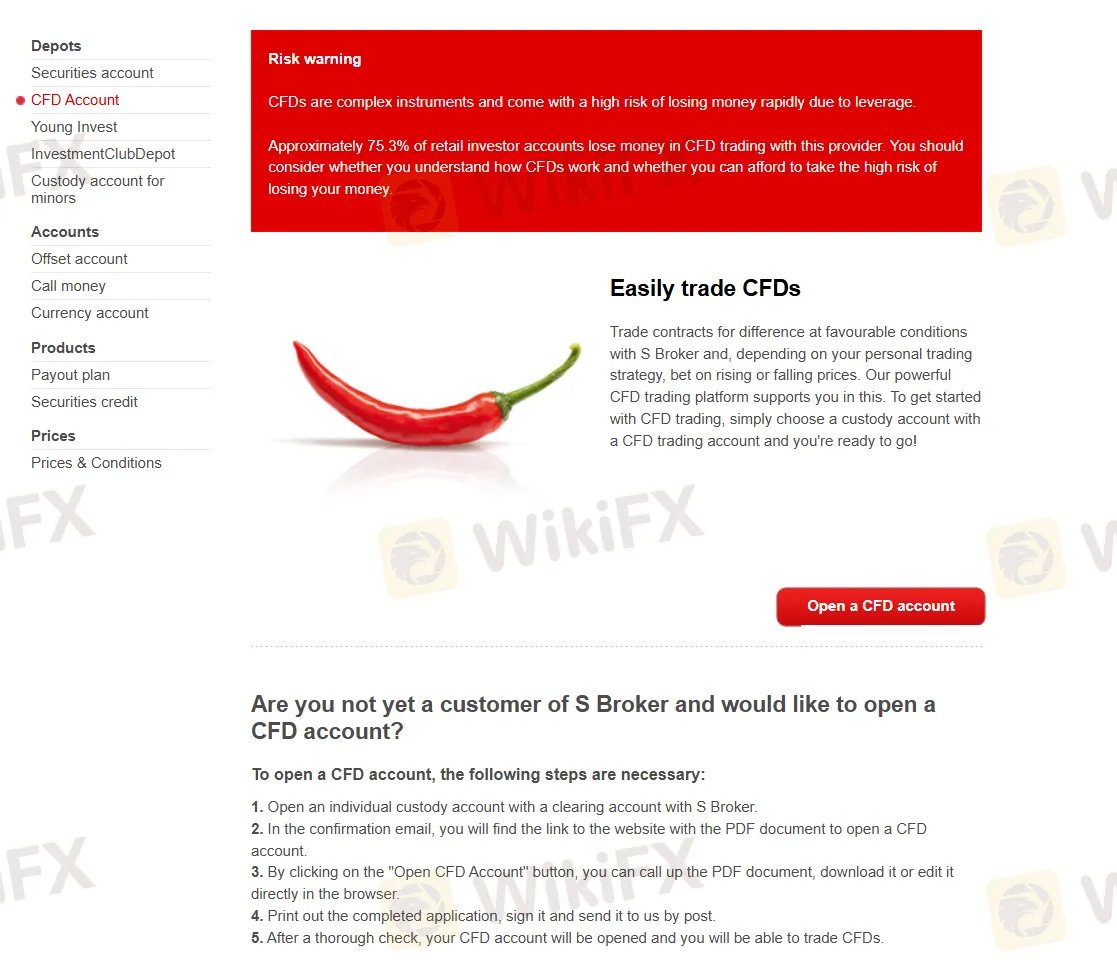

| CFDs | ✔ |

| Bonds | ✔ |

| Indexes | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

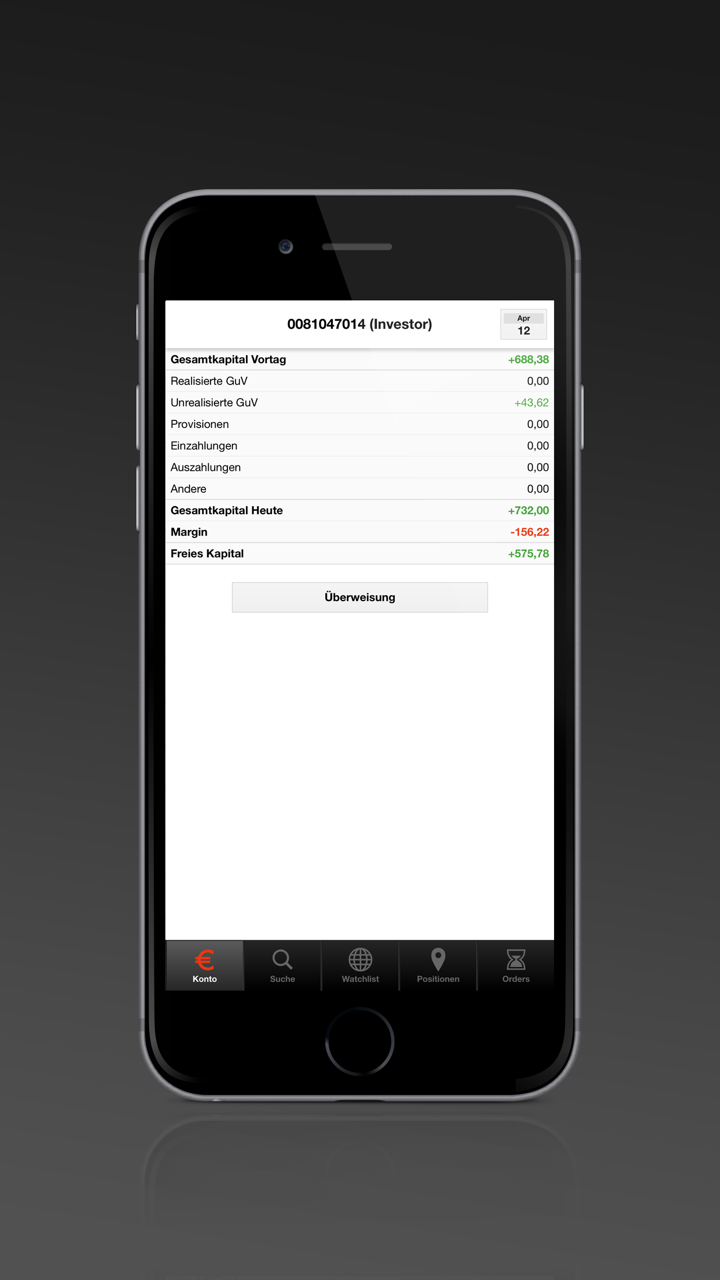

Uri ng Account

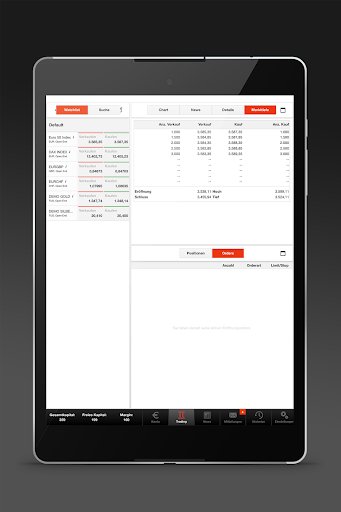

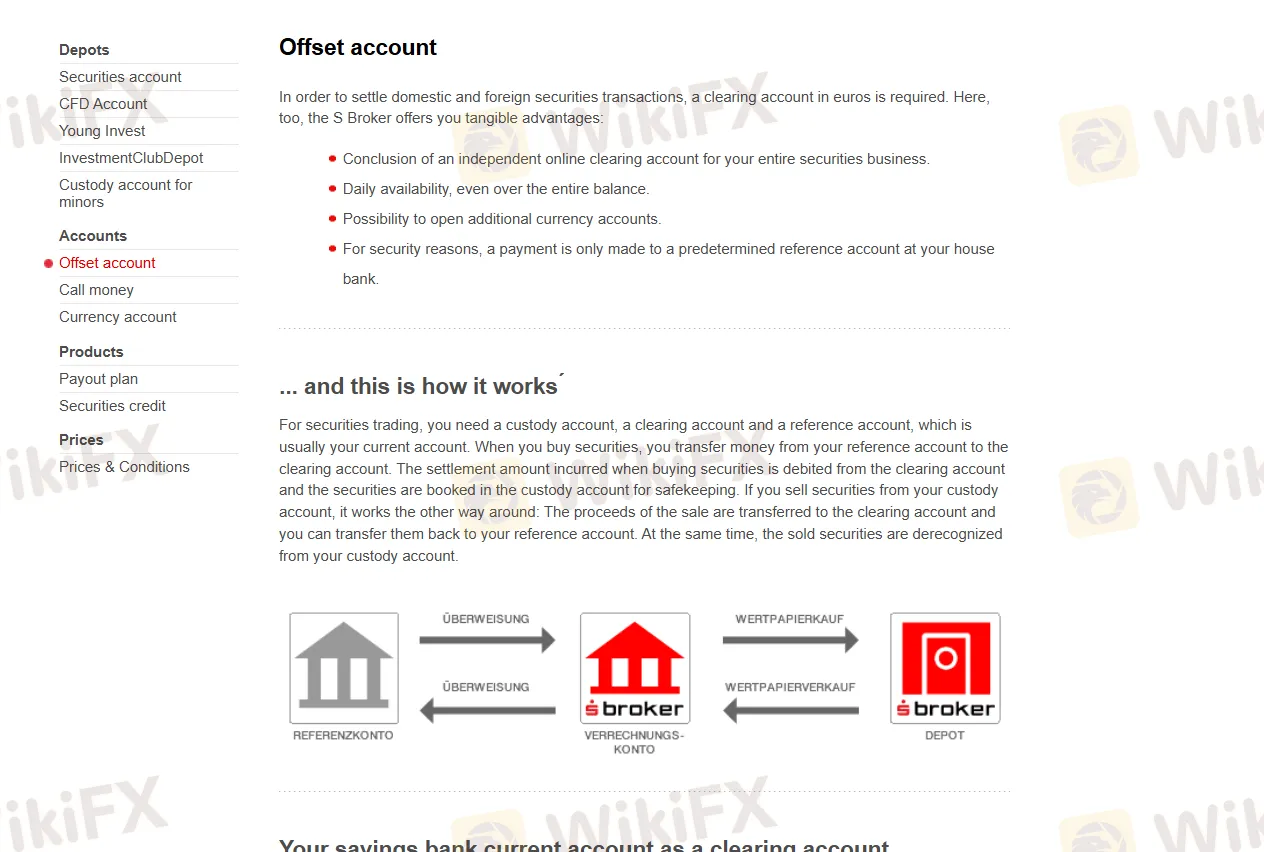

S Broker nag-aalok ng tatlong uri ng account para sa iba't ibang produkto: CFD account, securities account, offset account at currency account.

Walang minimum deposit requirements para magbukas ng account sa kumpanya.

Plataforma ng Paggawa ng Kalakalan

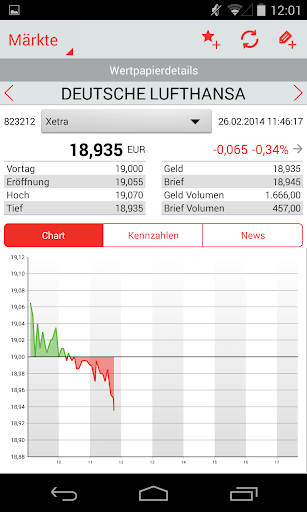

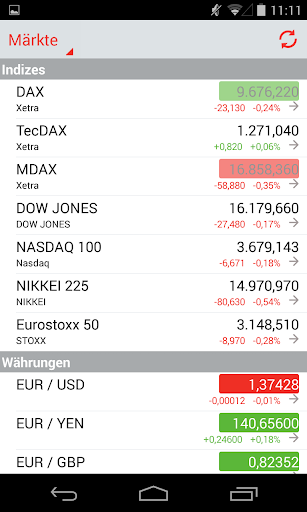

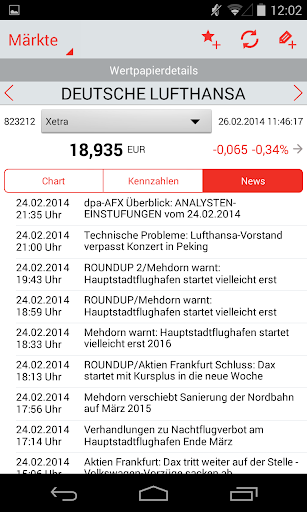

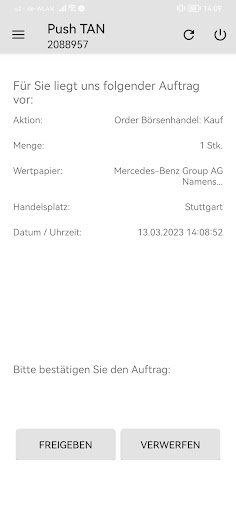

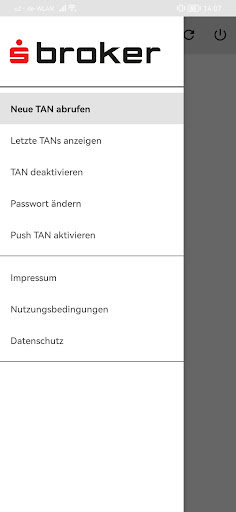

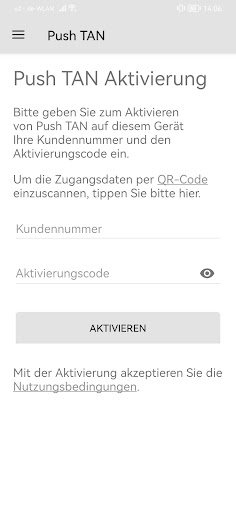

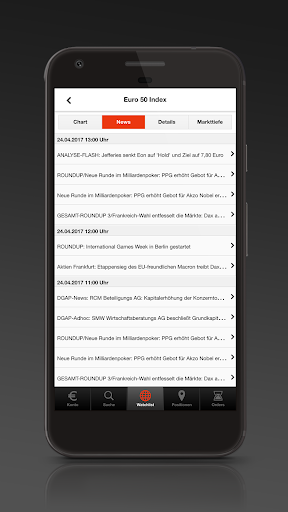

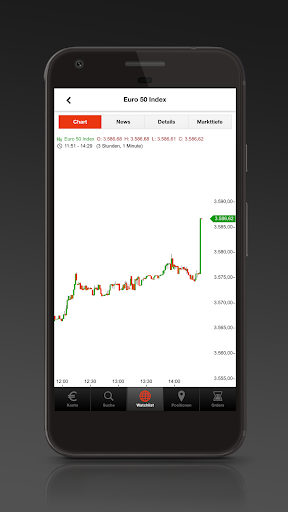

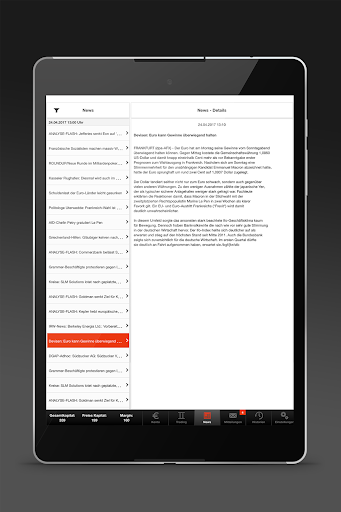

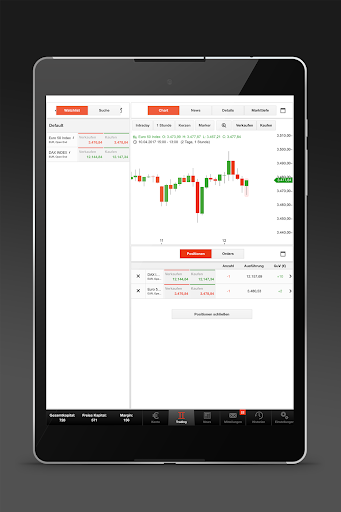

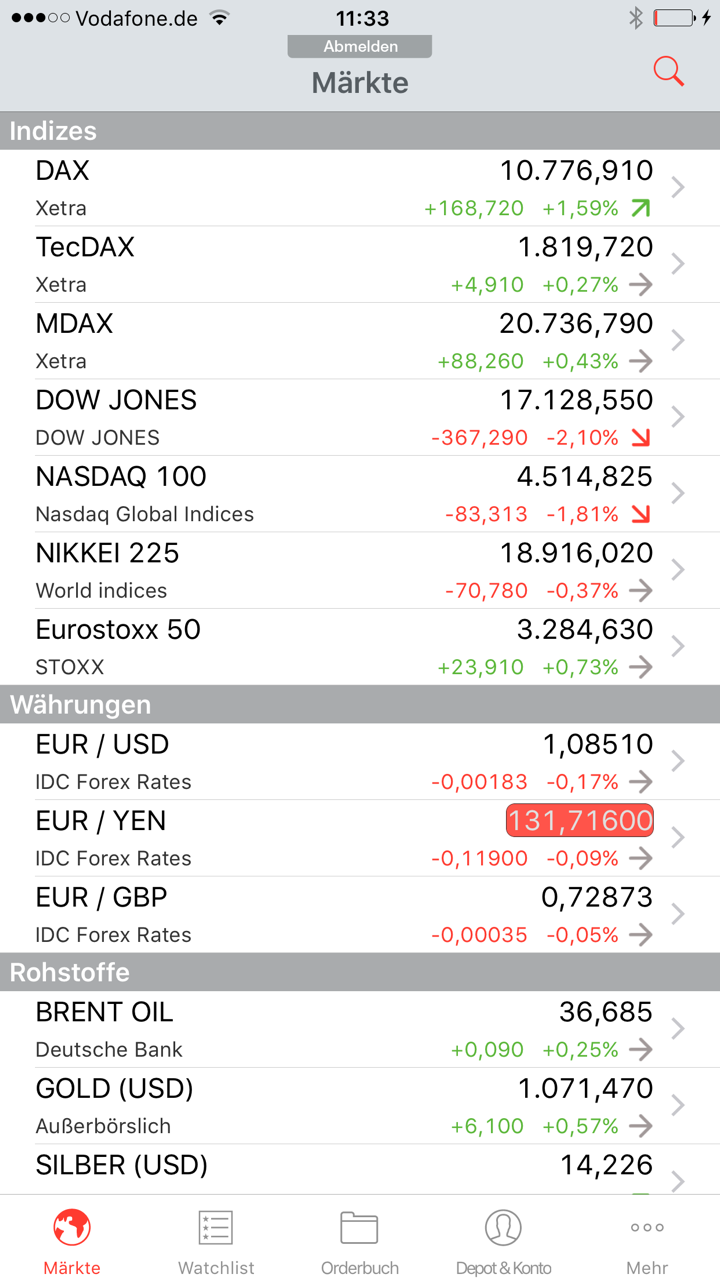

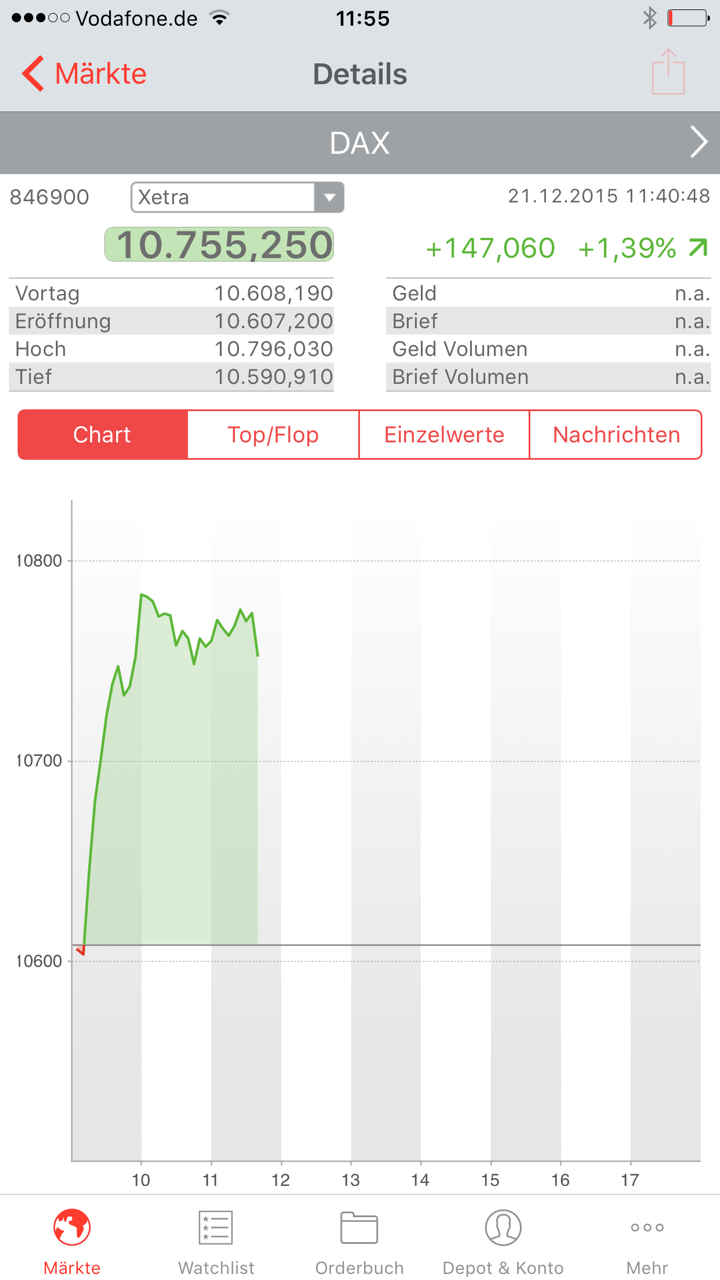

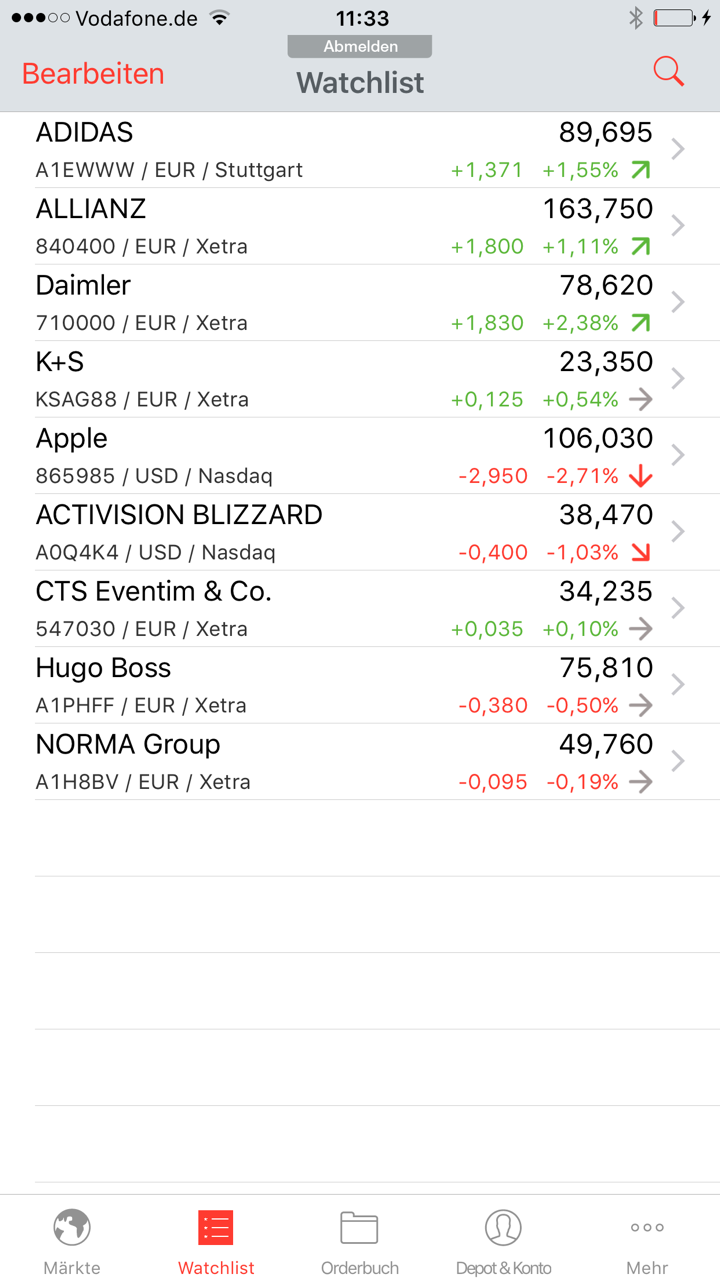

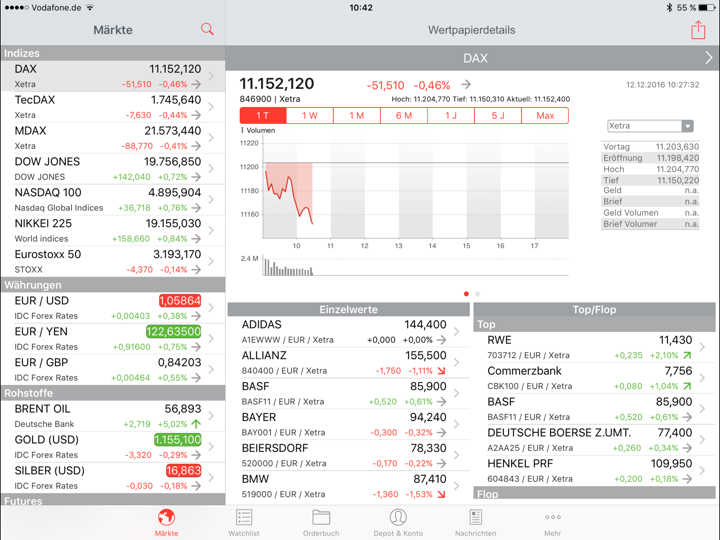

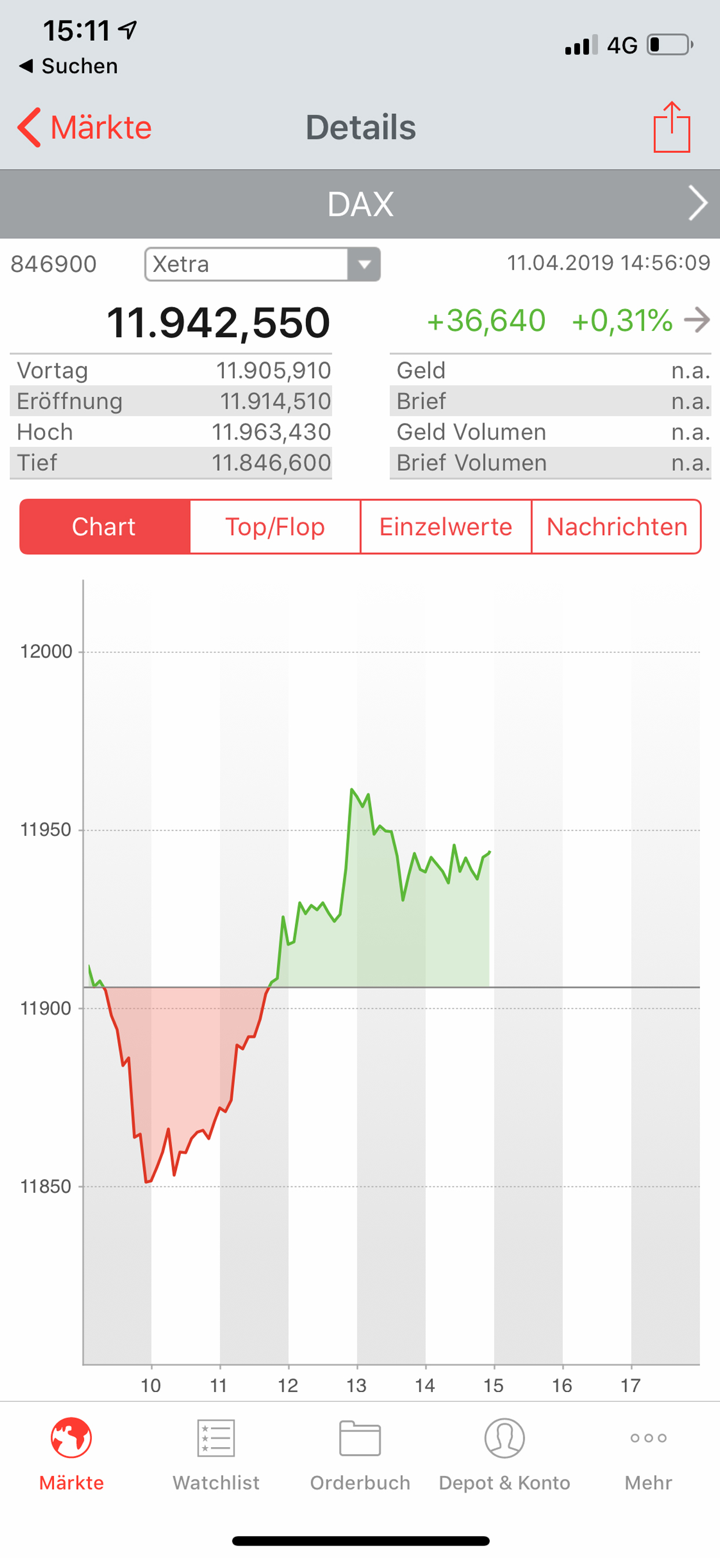

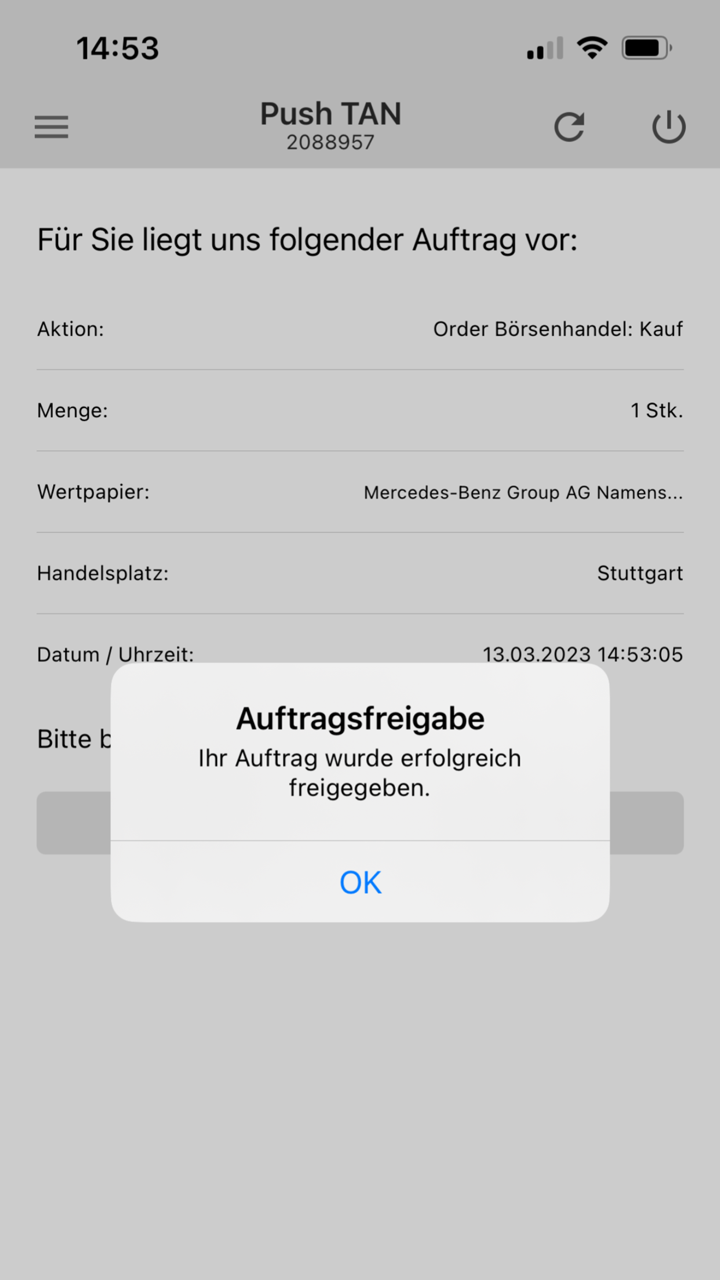

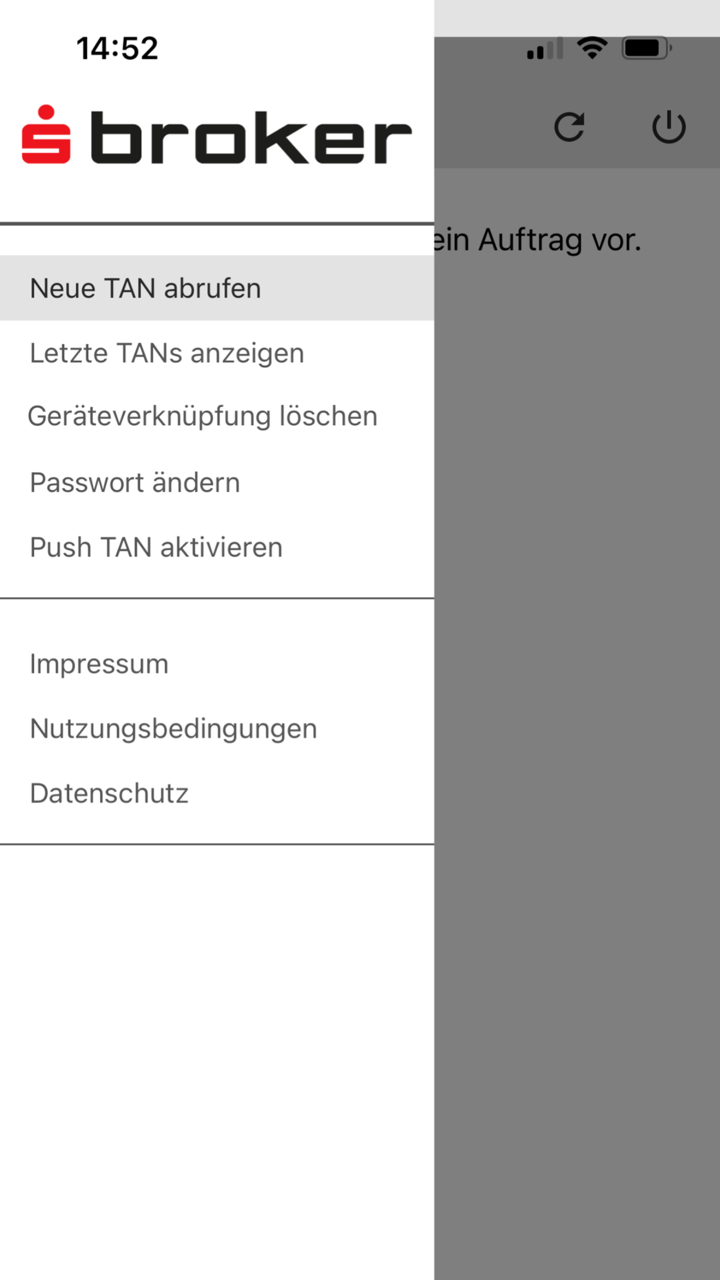

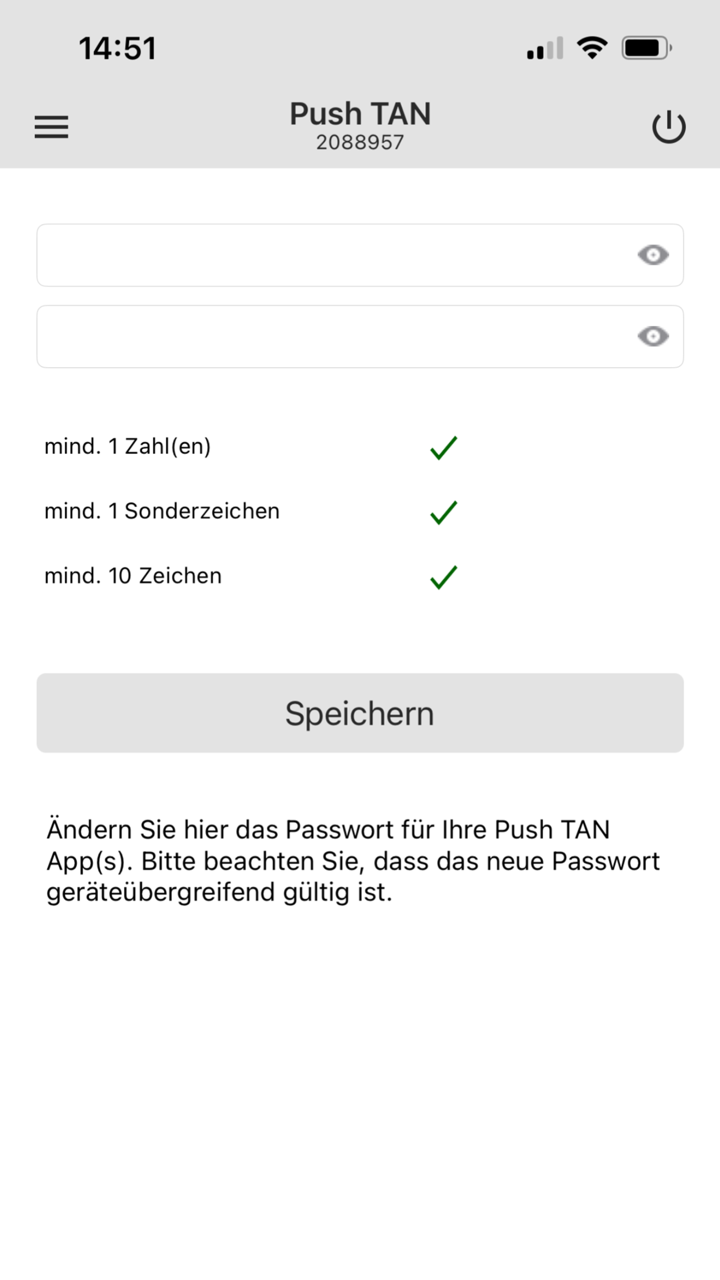

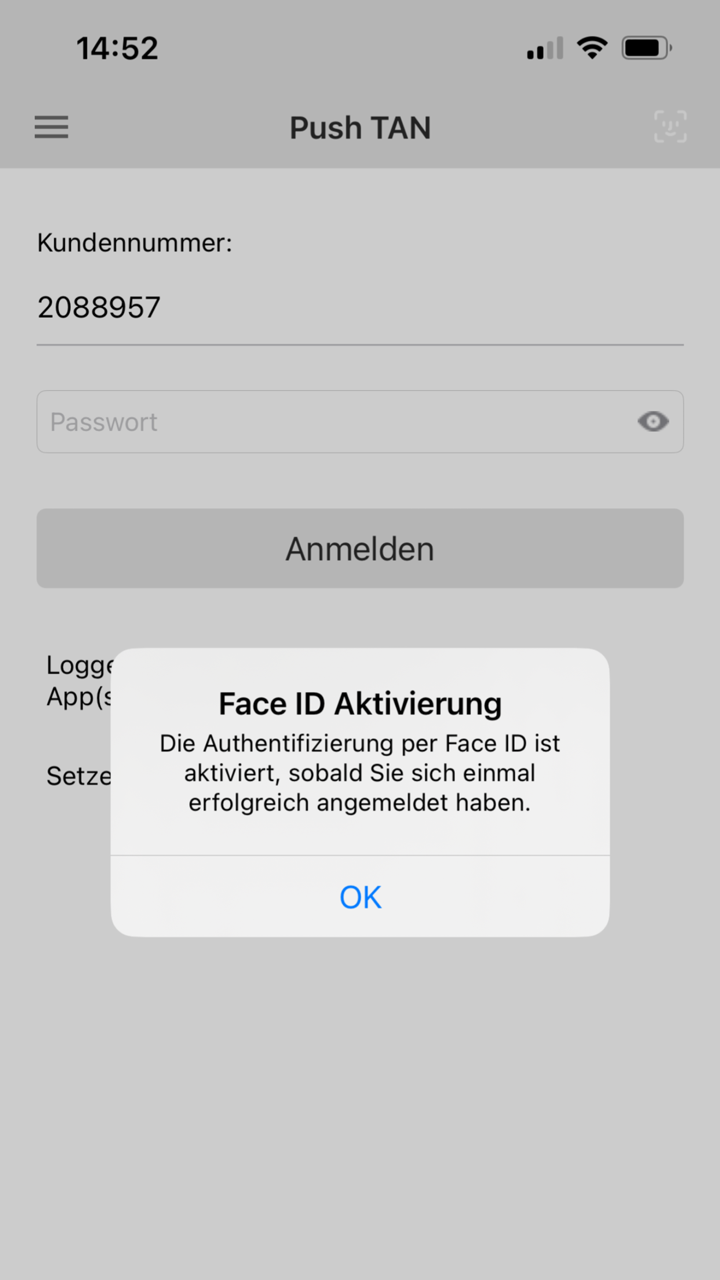

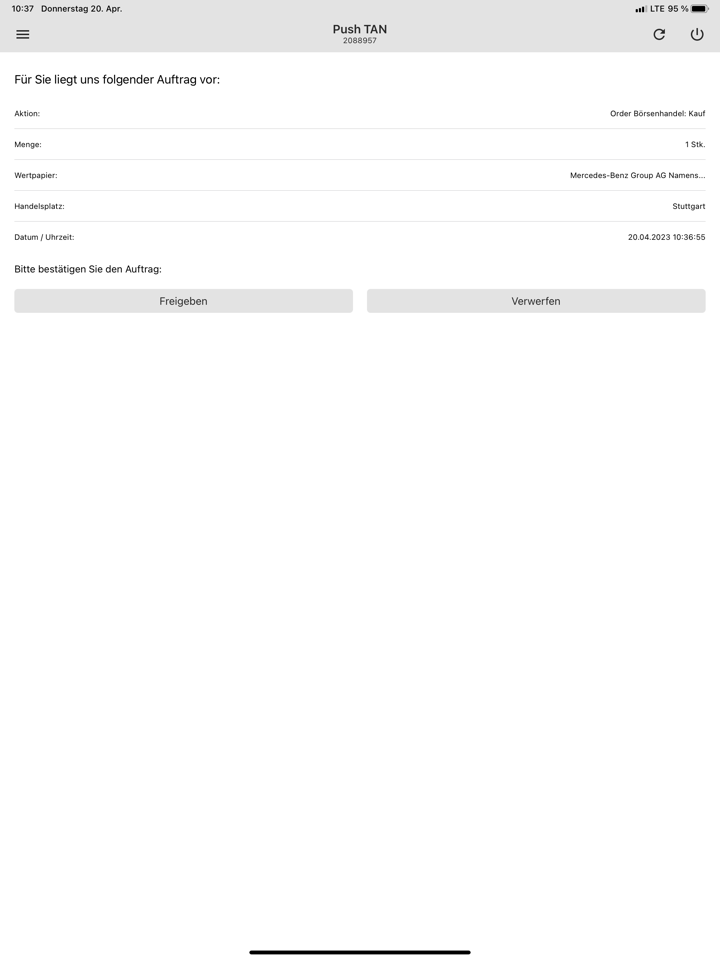

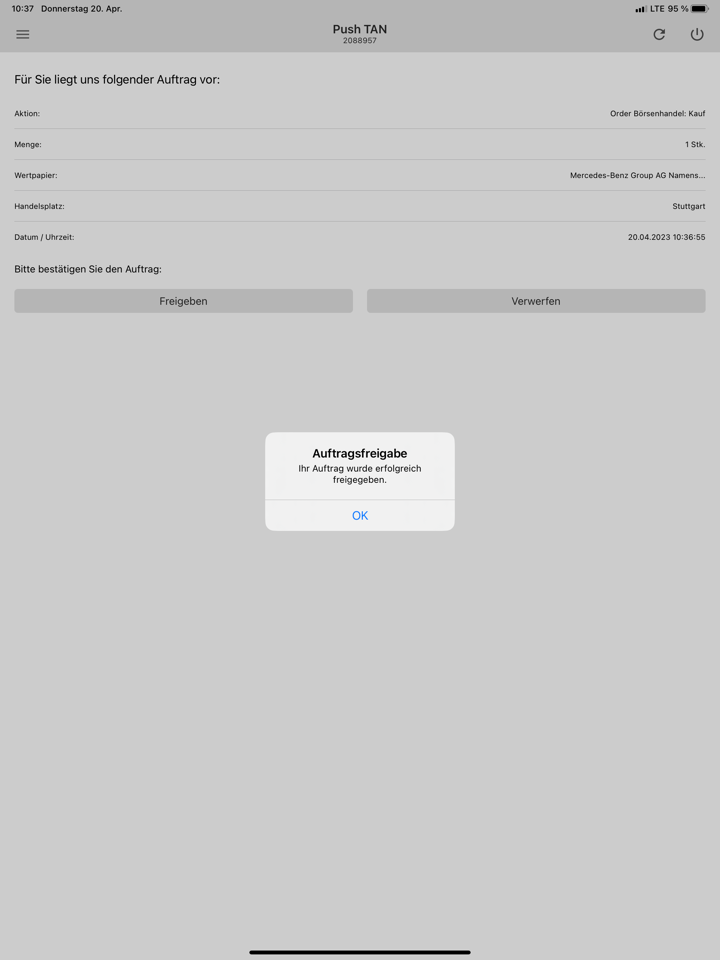

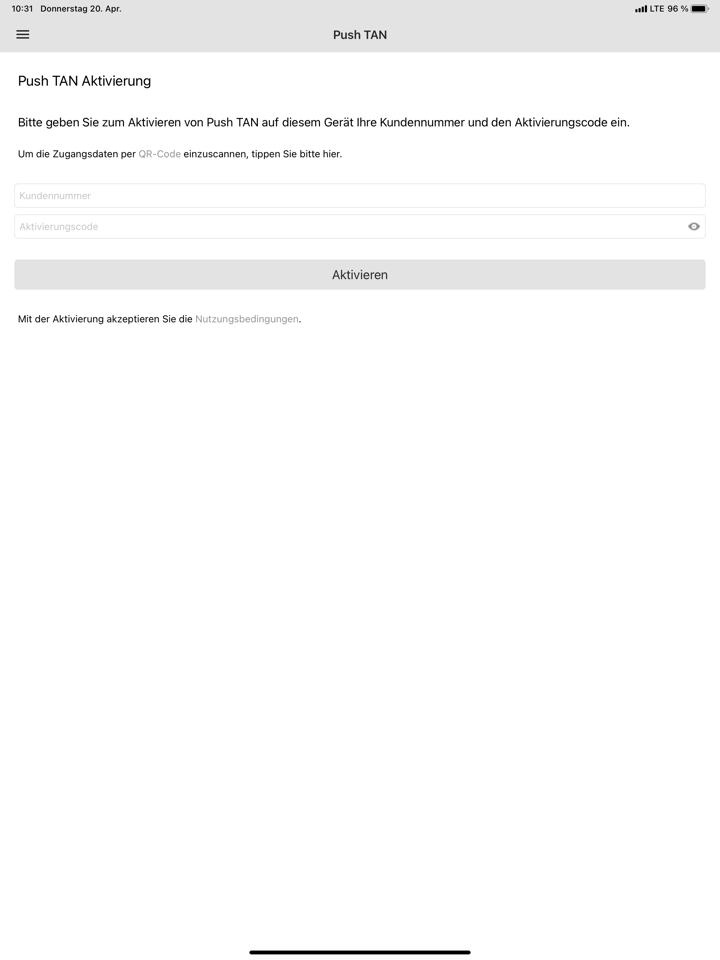

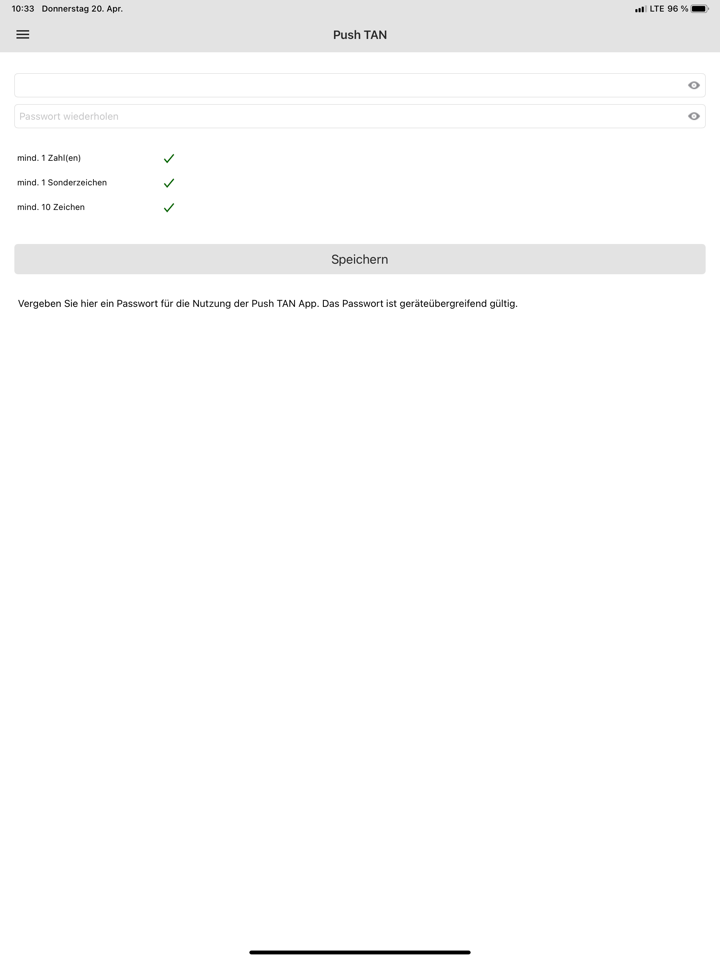

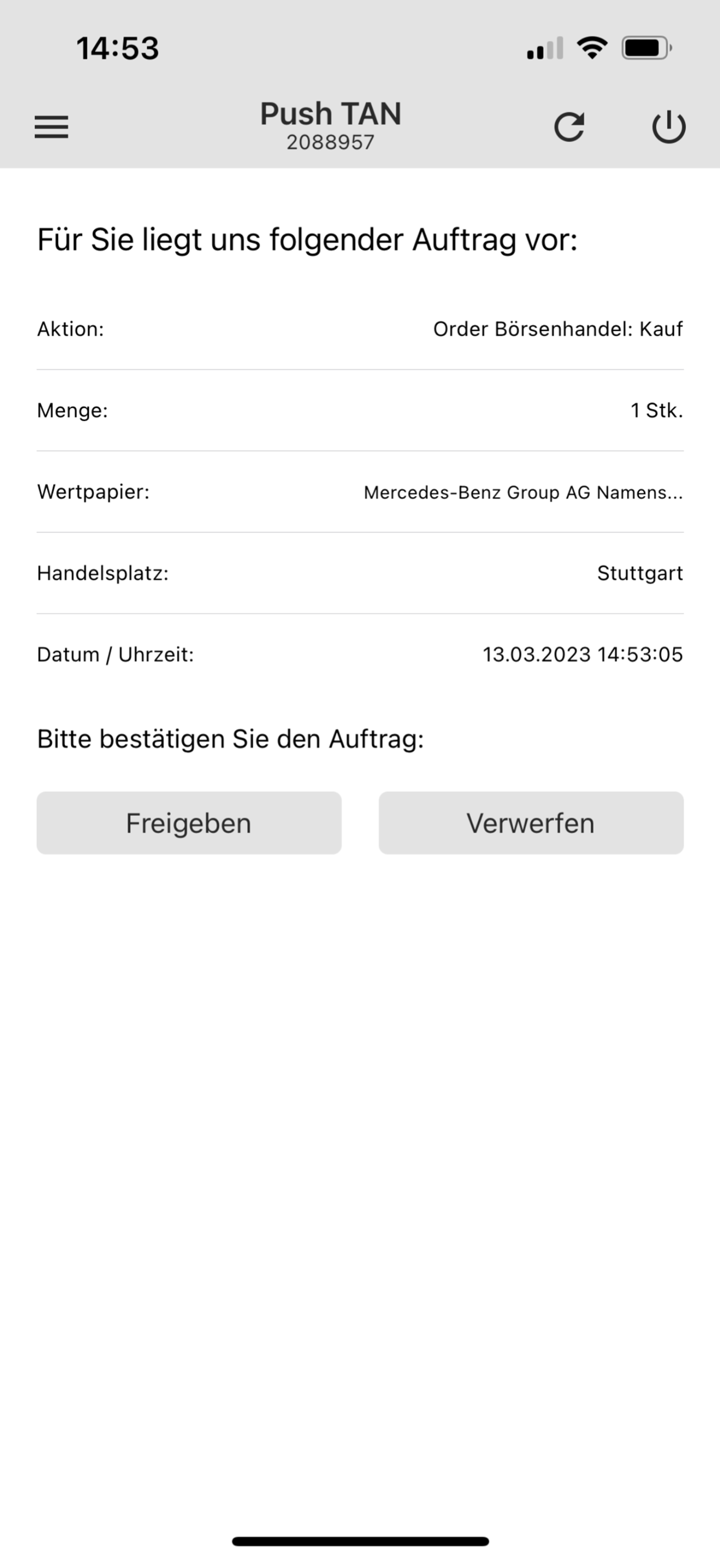

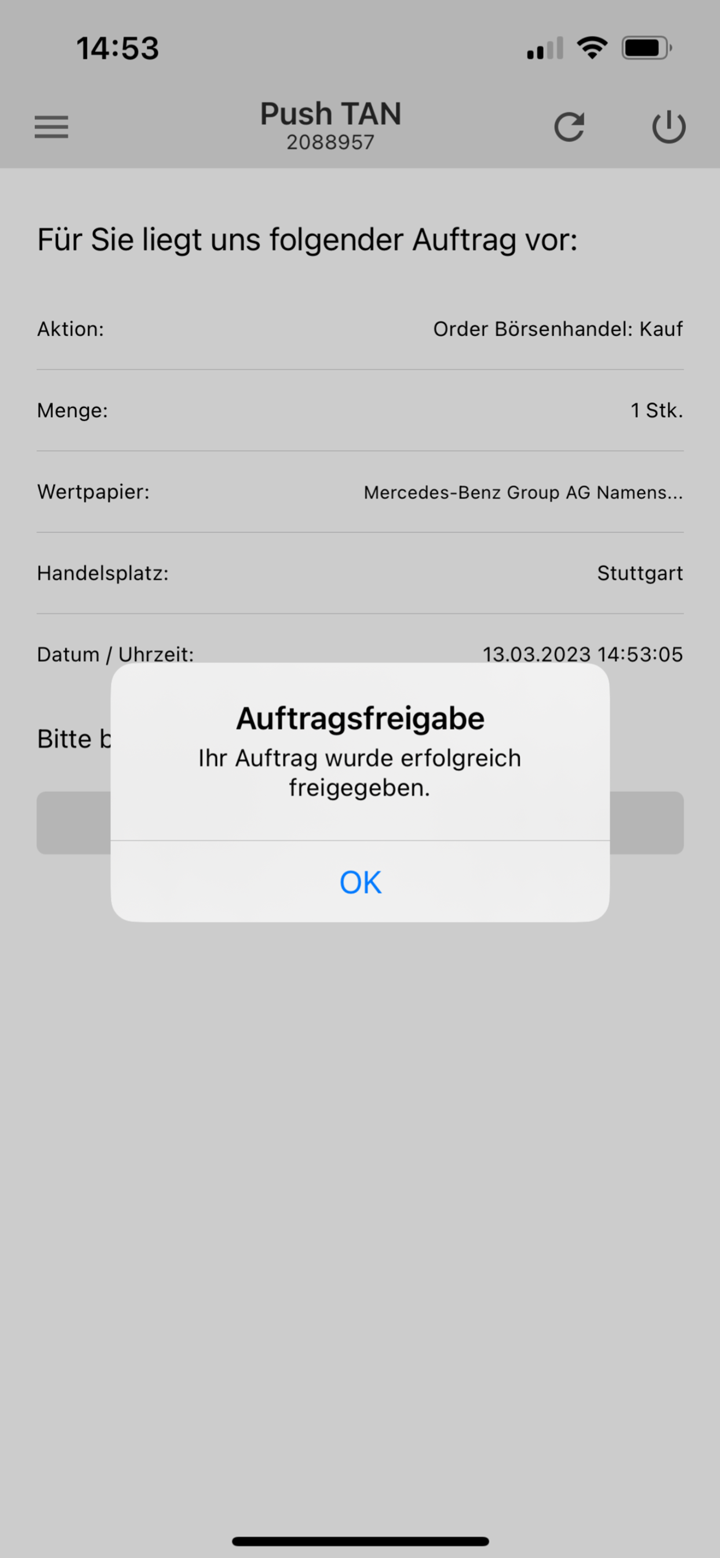

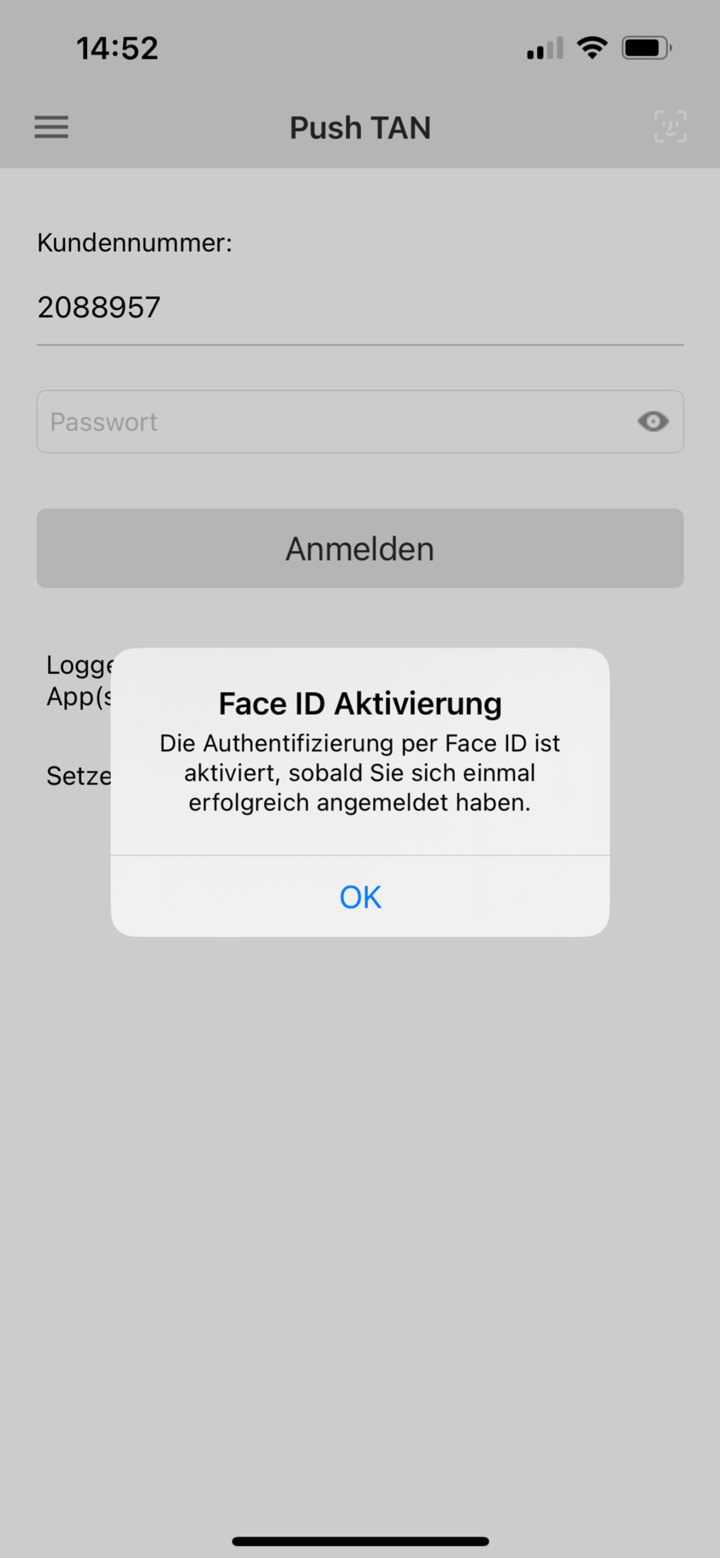

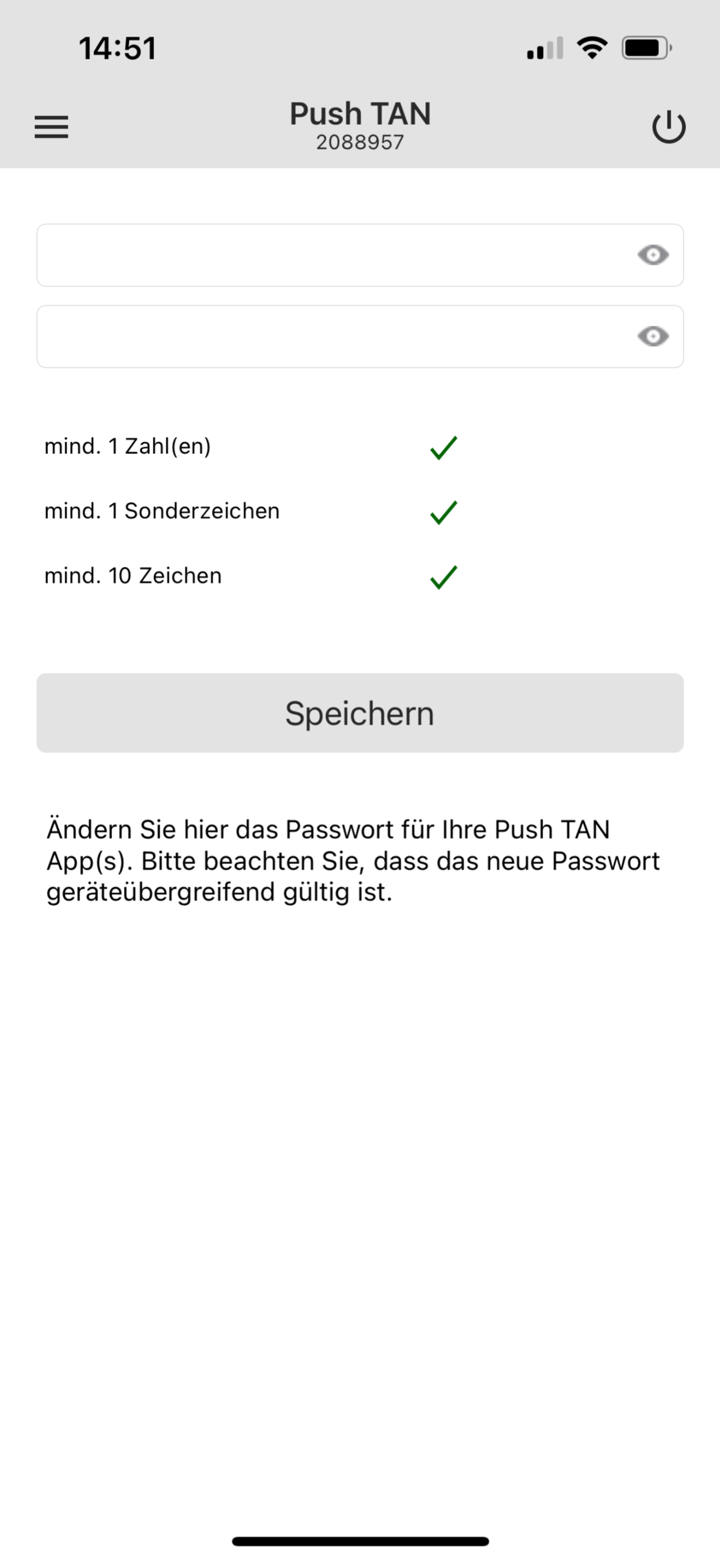

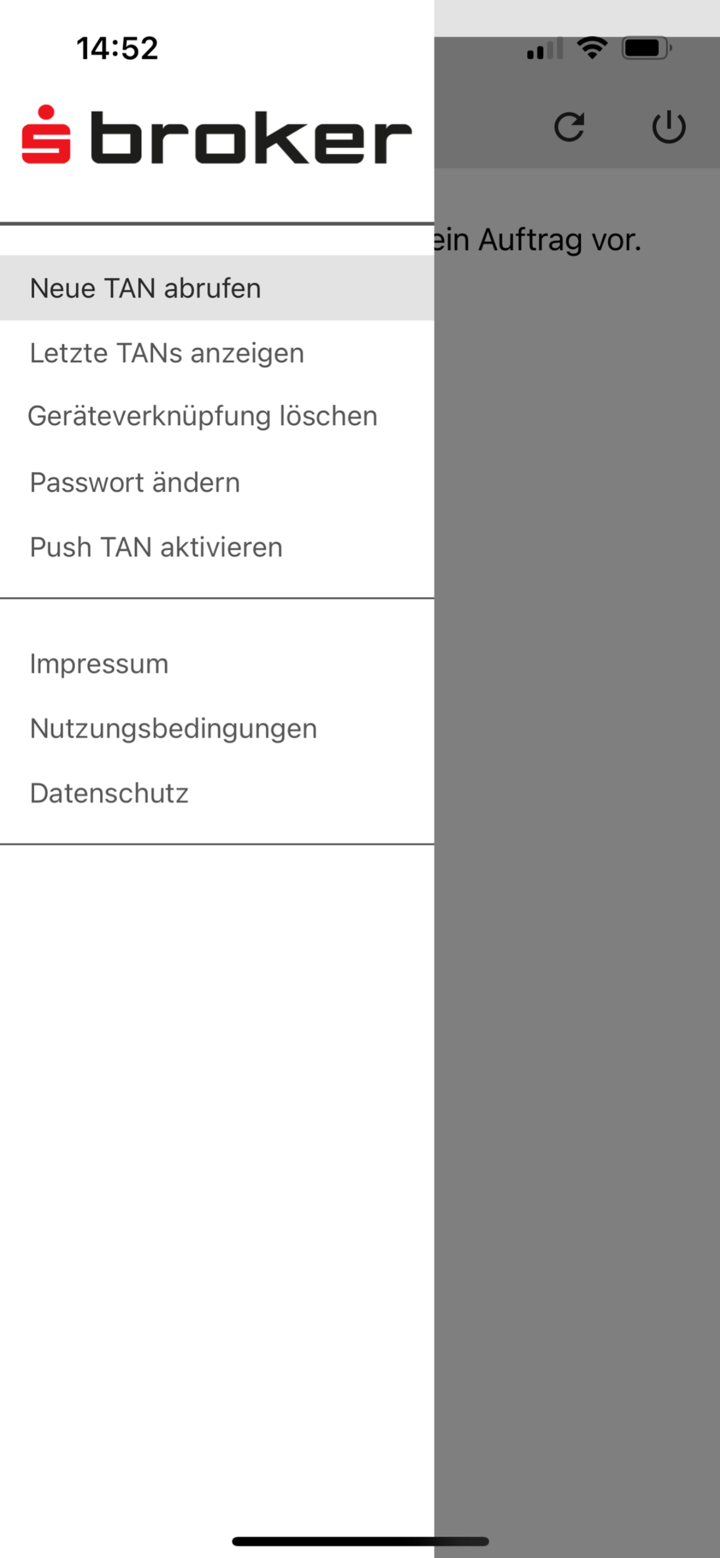

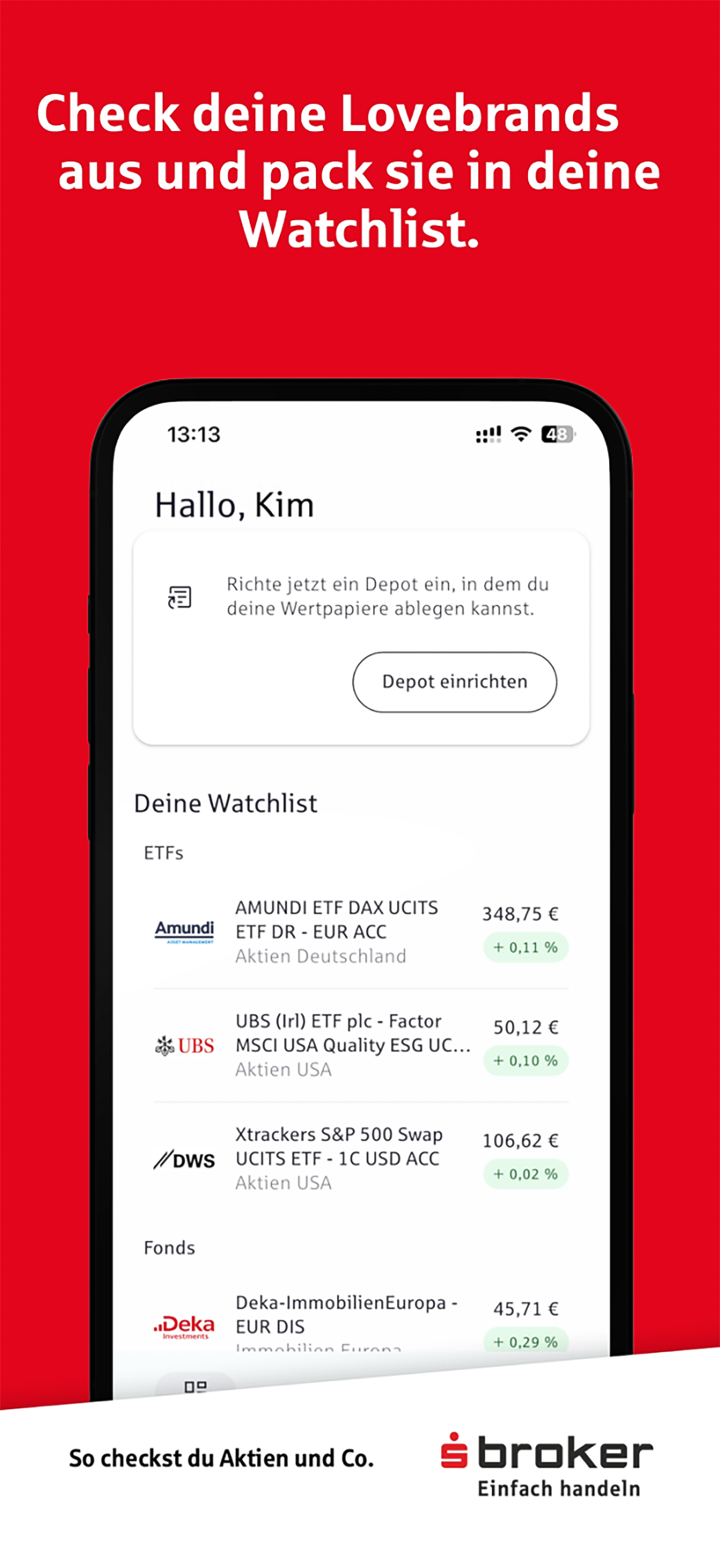

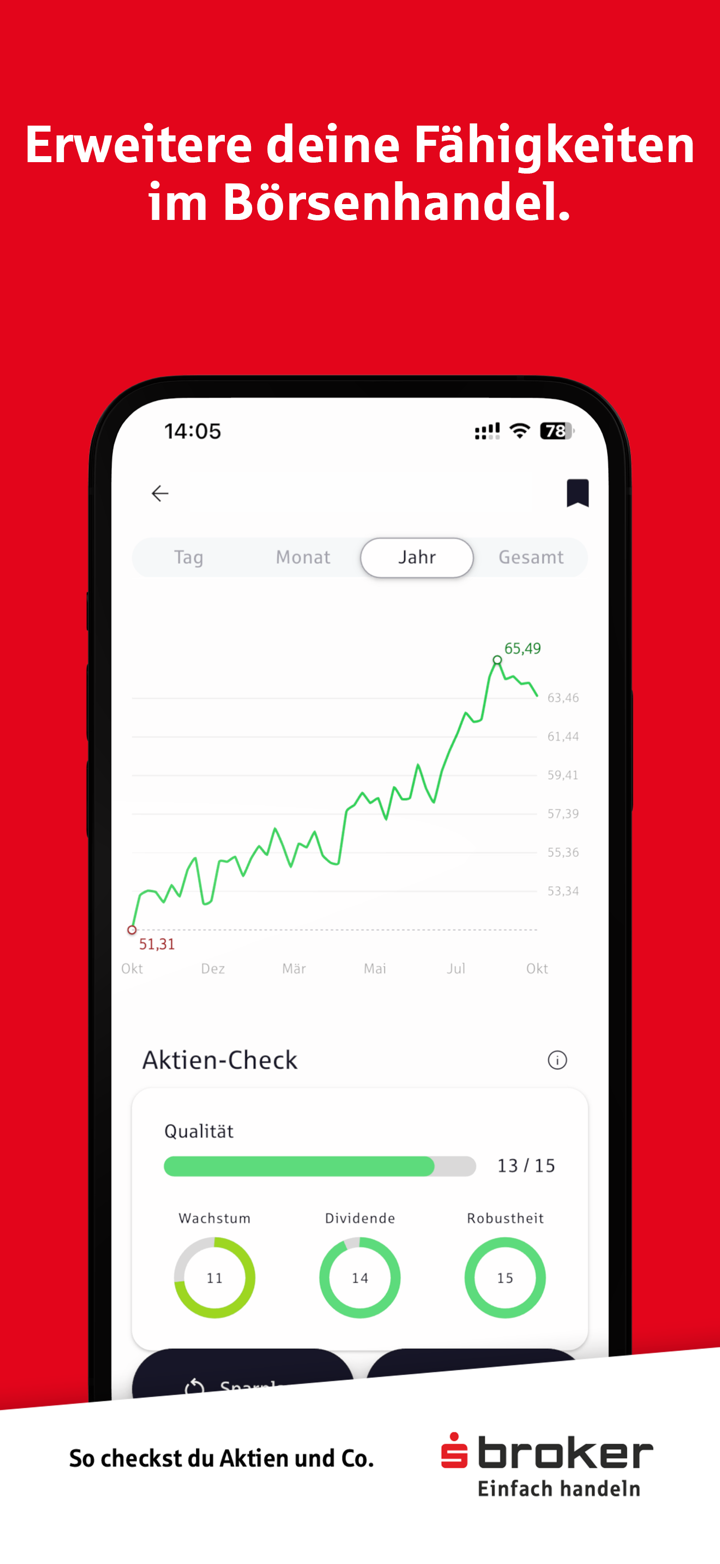

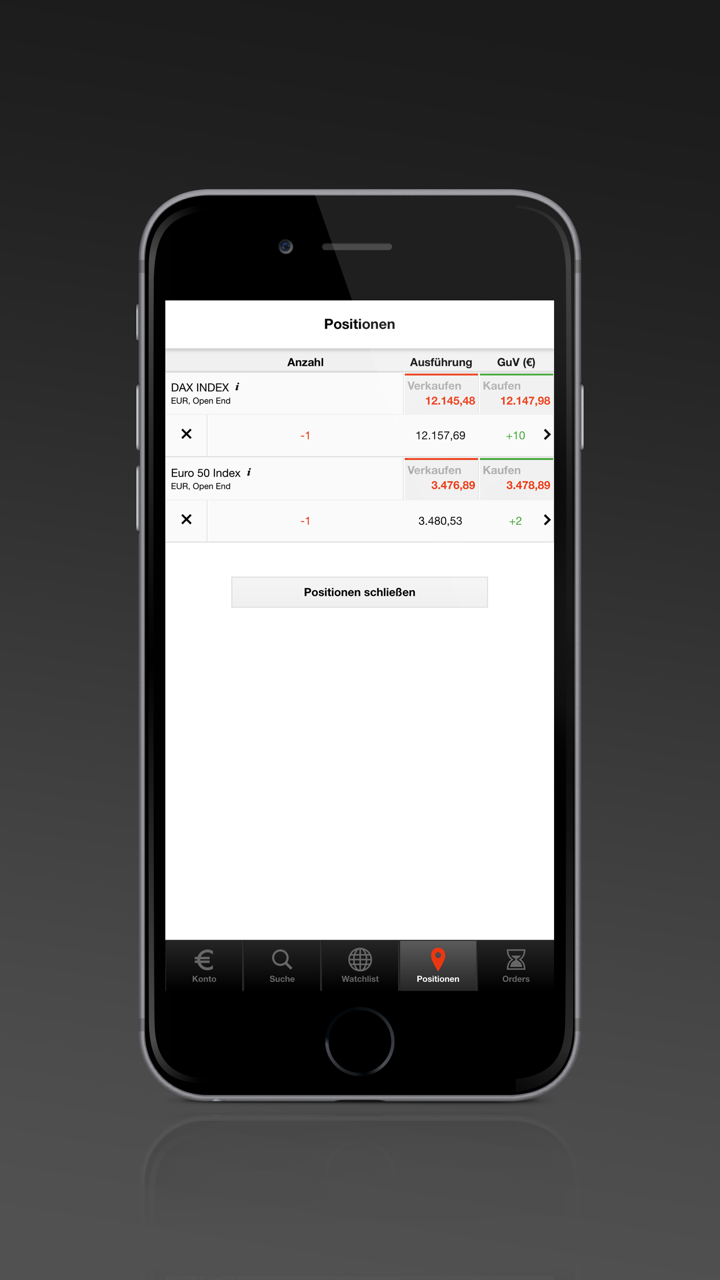

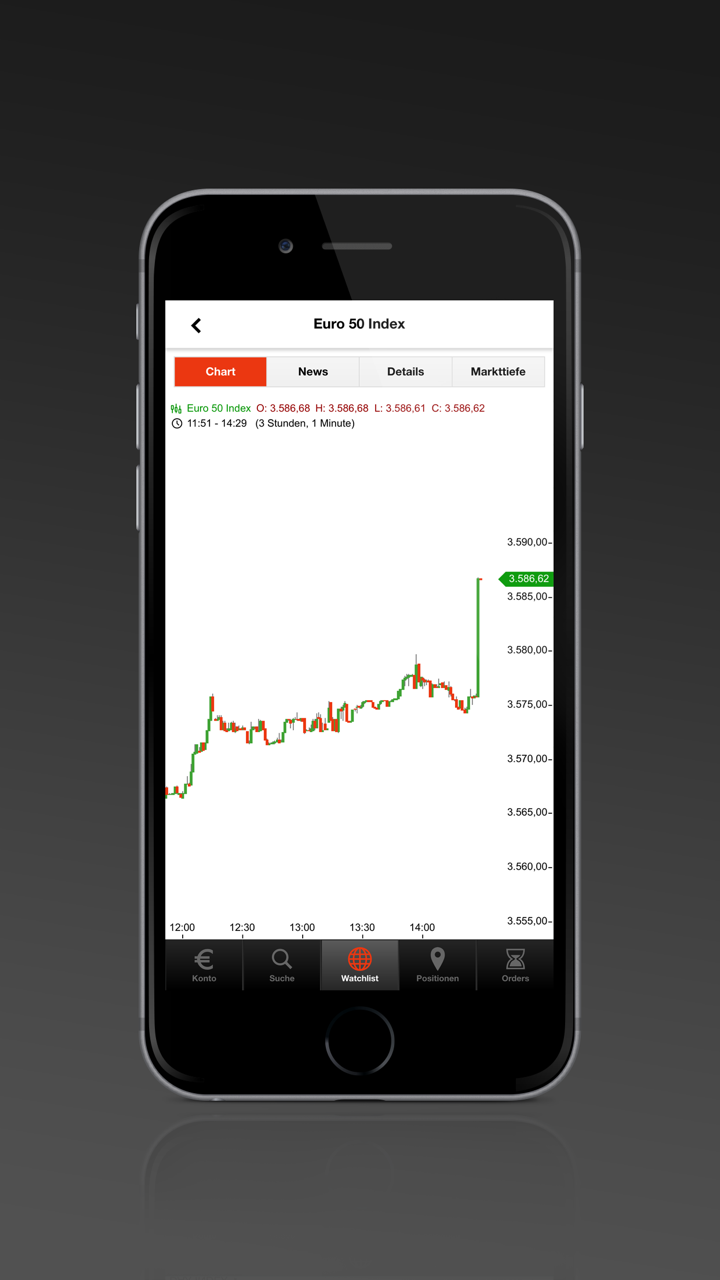

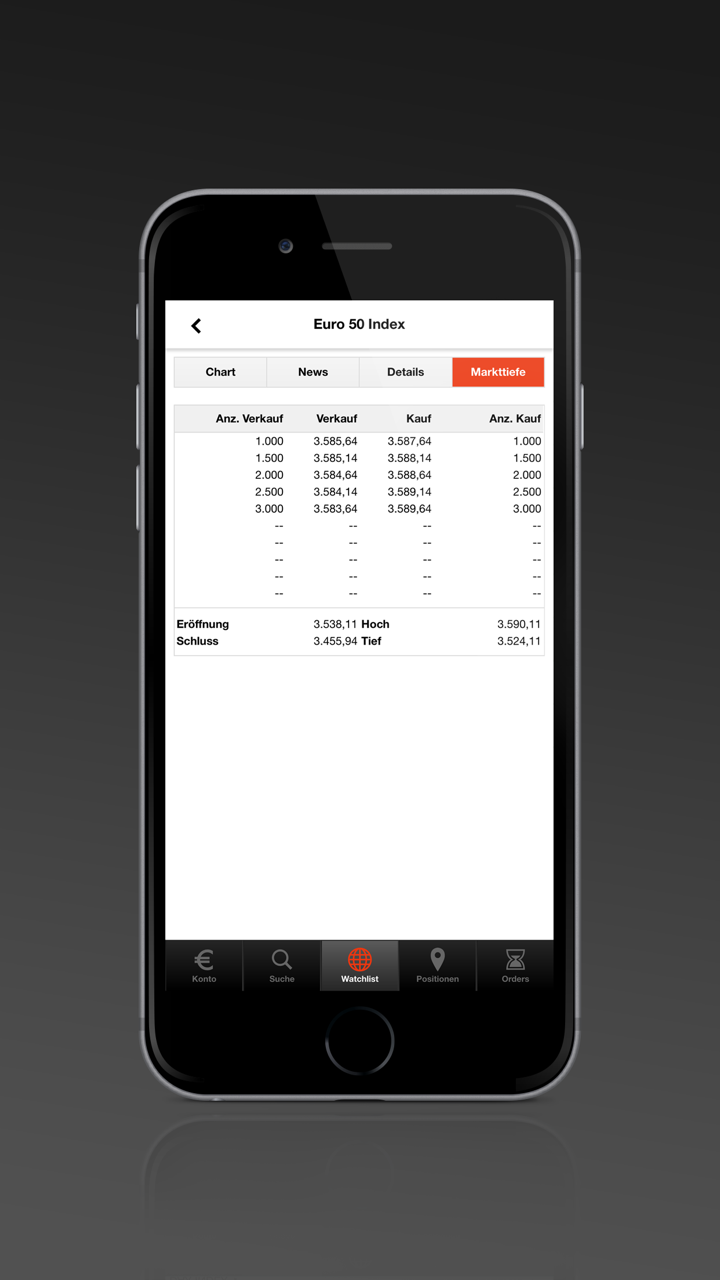

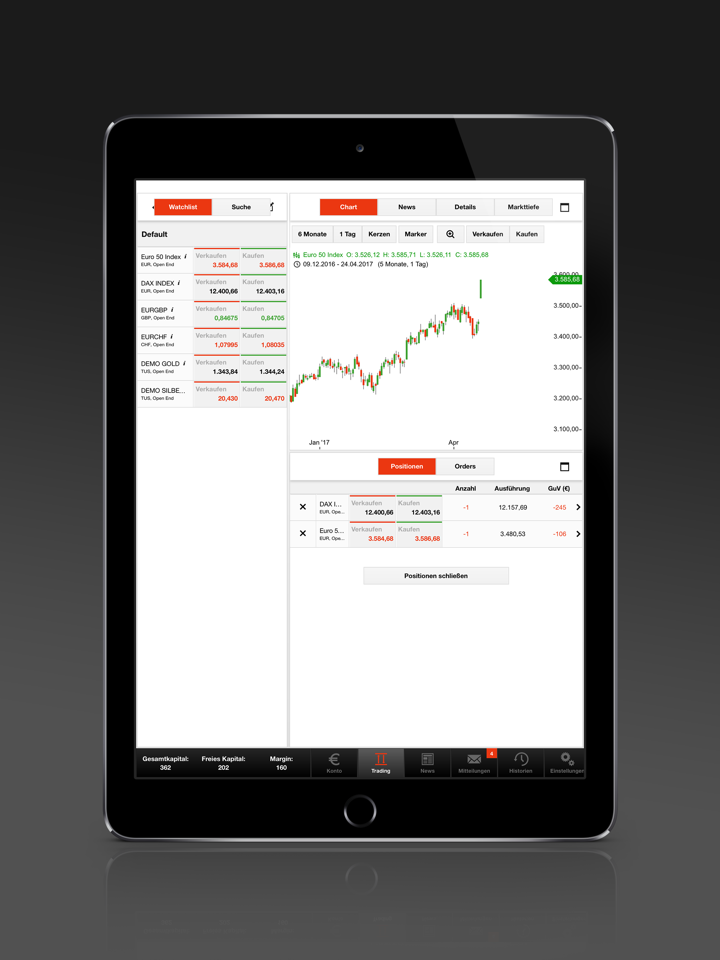

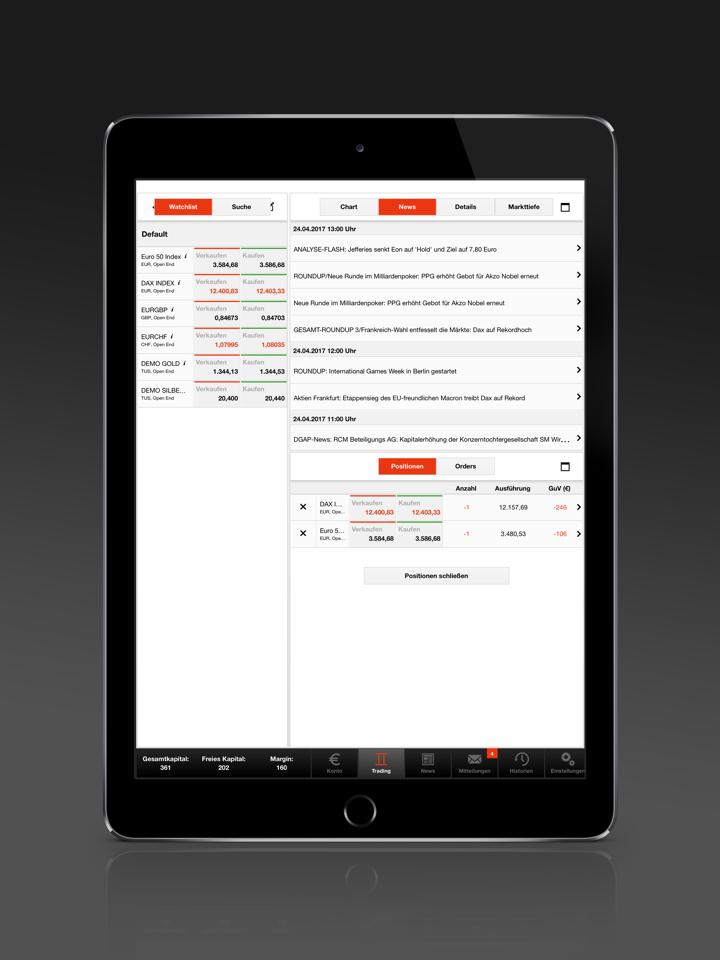

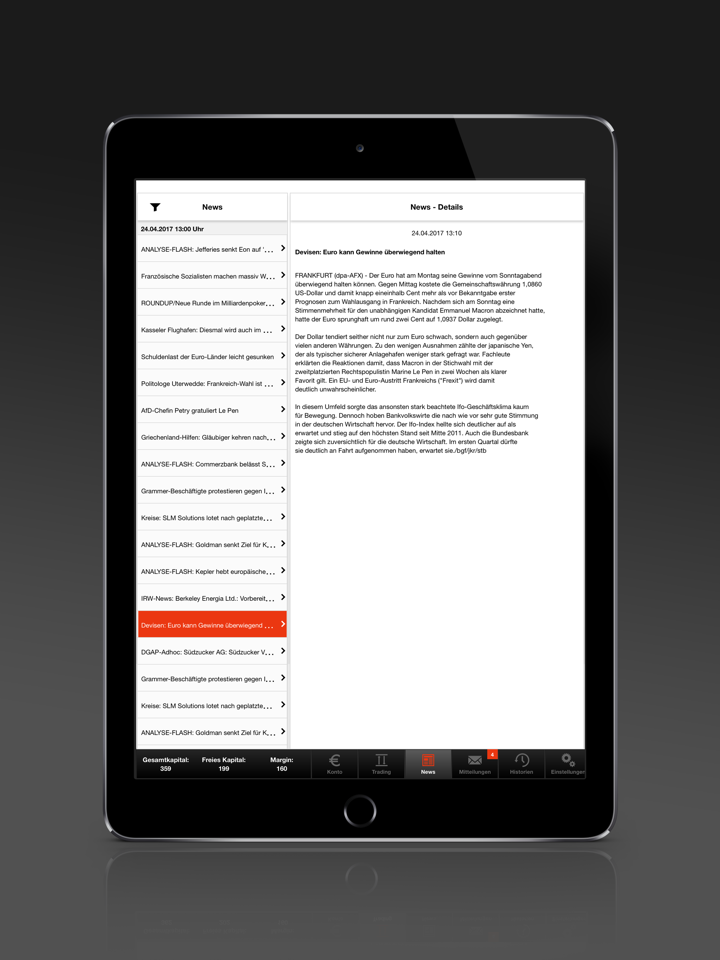

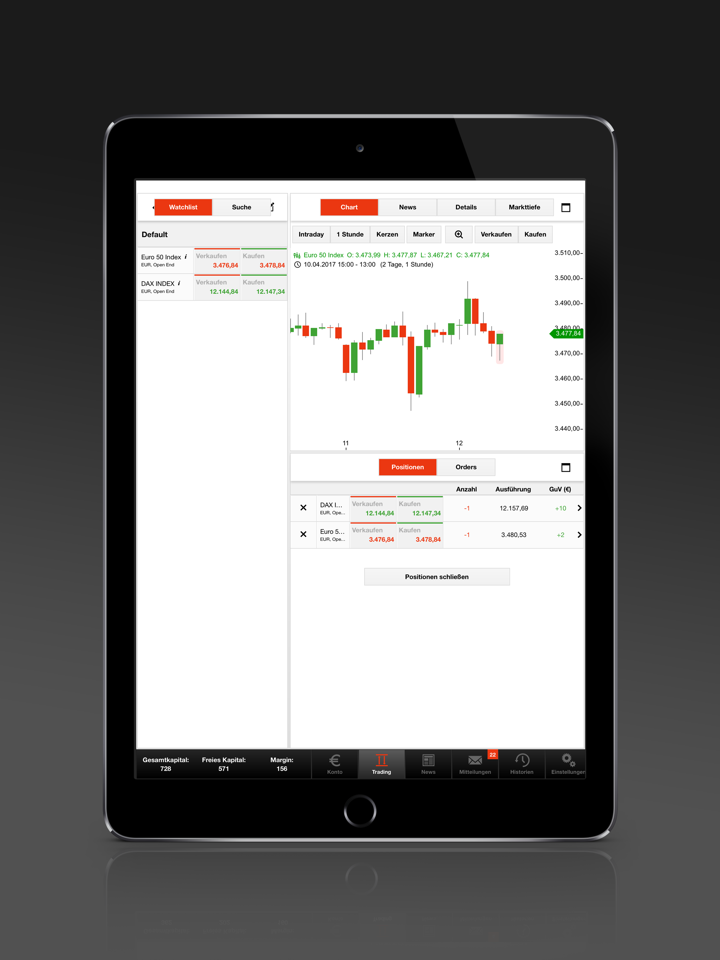

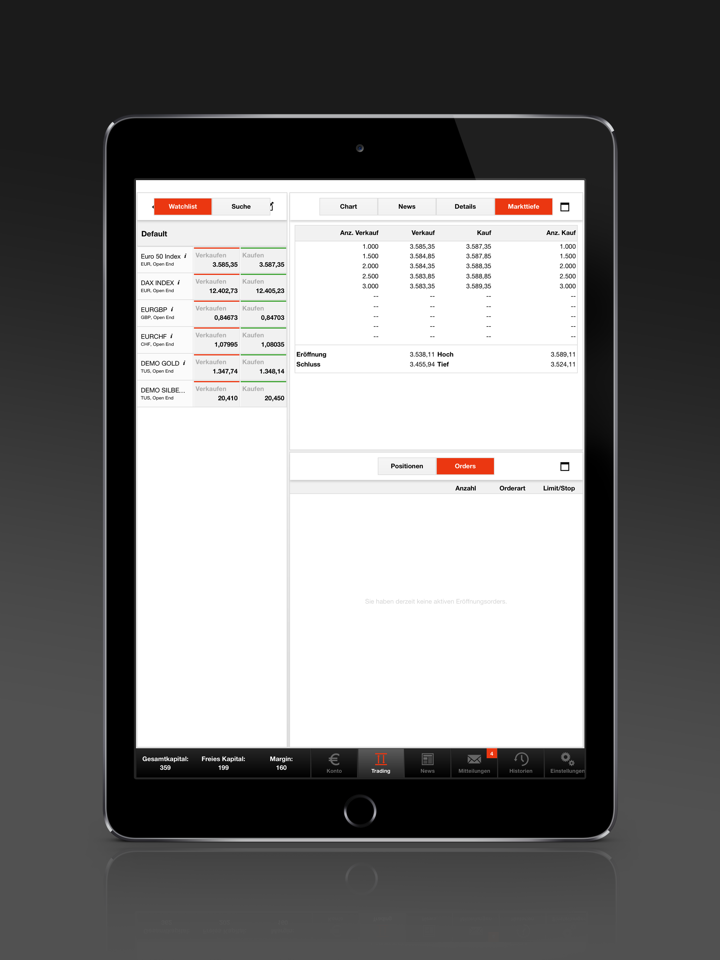

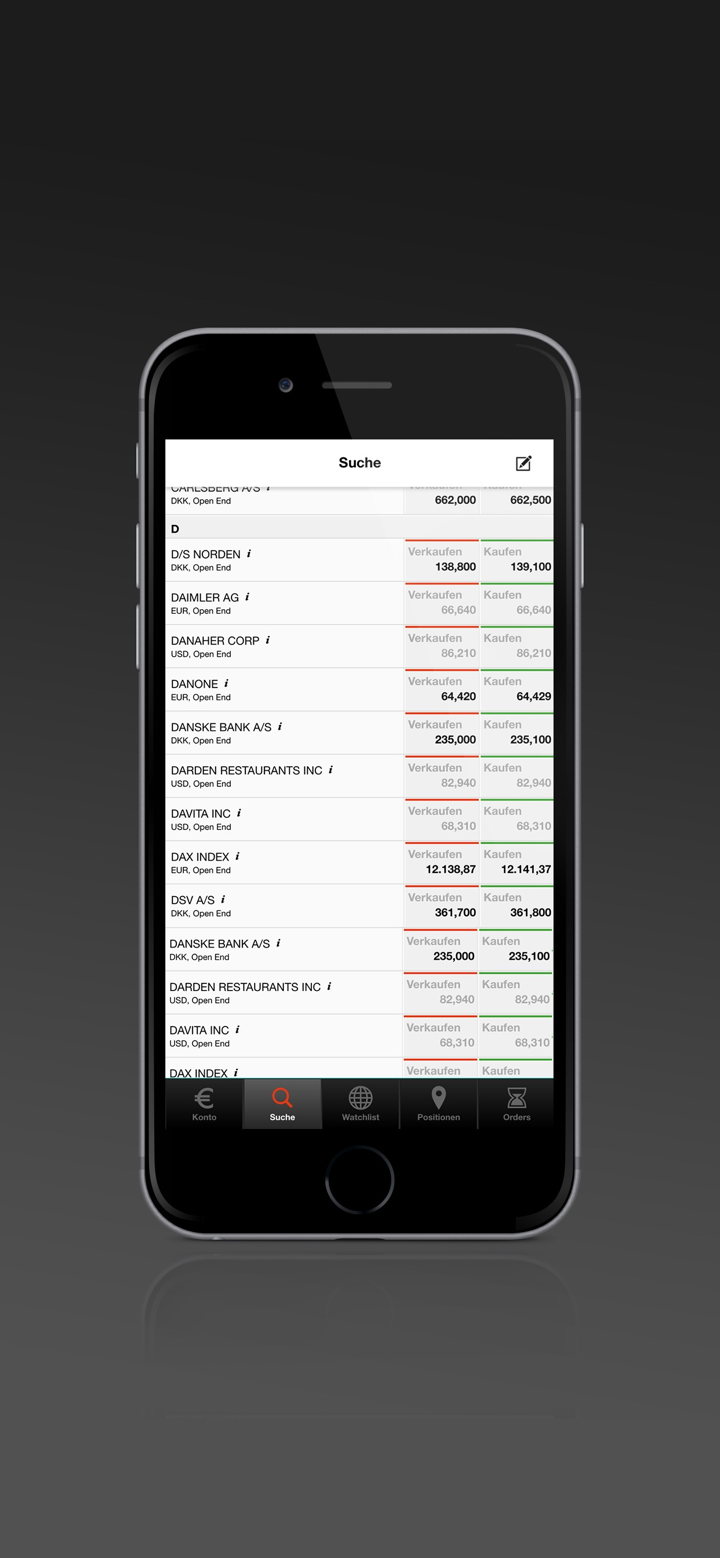

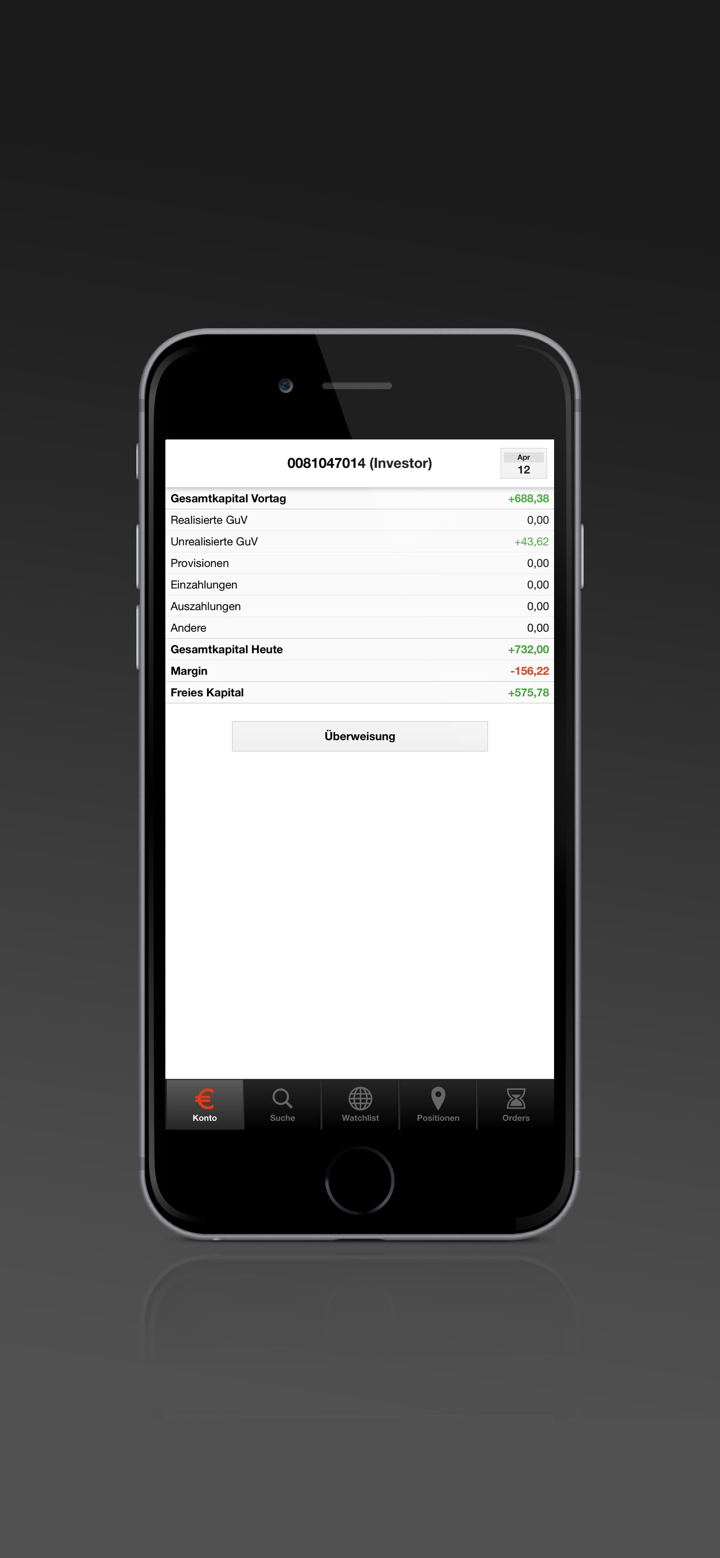

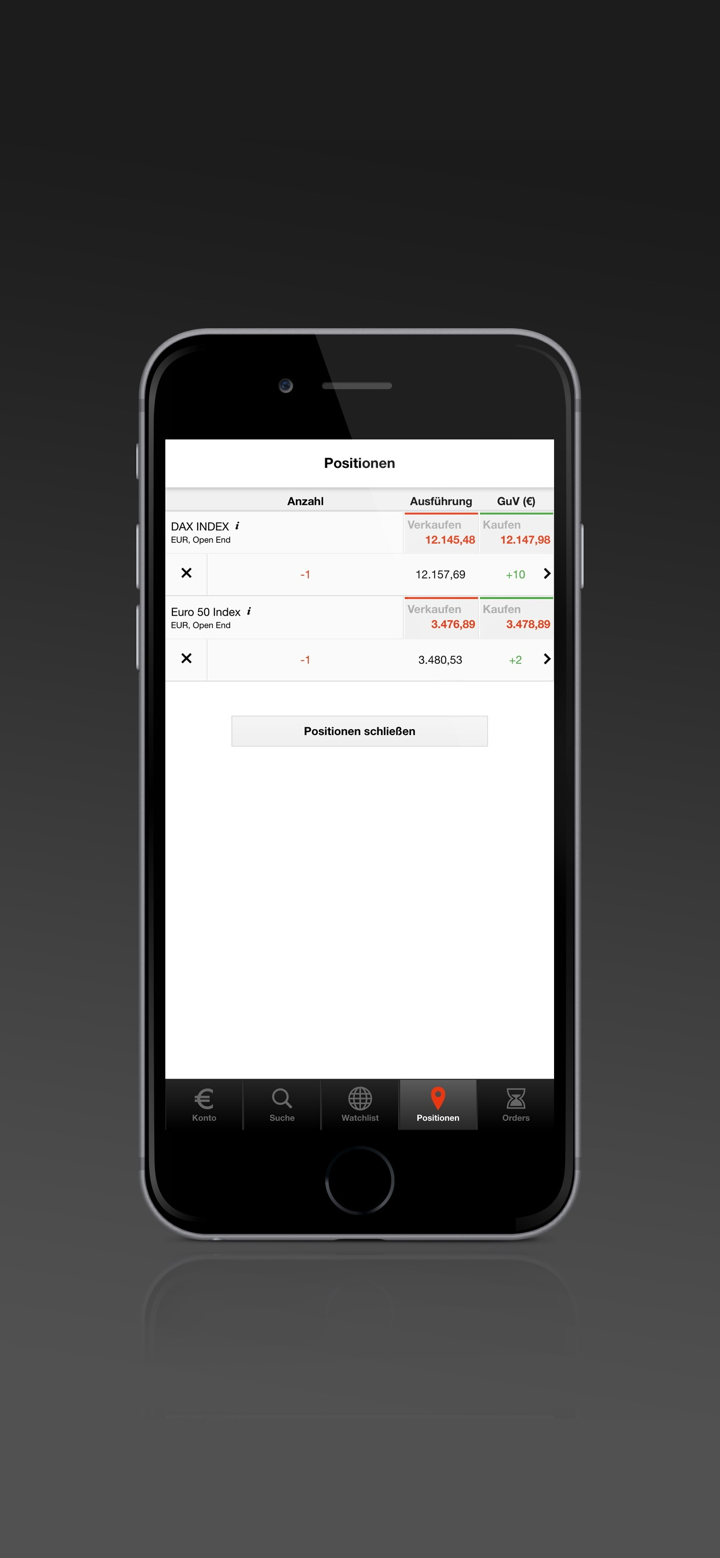

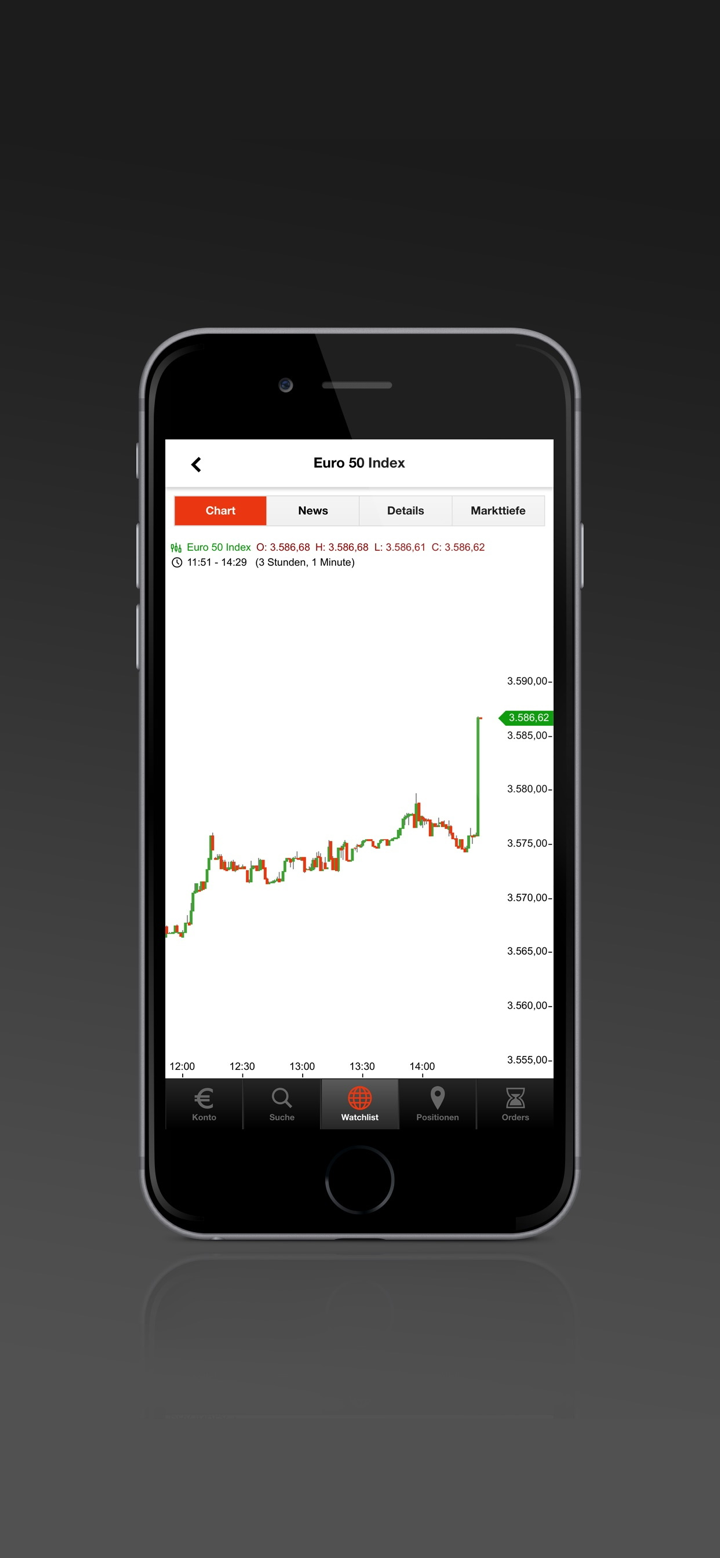

S Broker nag-aalok ng sariling trading platform na tinatawag na “S Broker App”, magagamit sa parehong iOS at Android platforms. Ito ay ginawang pasadya para sa kanilang mga gumagamit, may access sa pinakabagong market data, balita, indices & quotes, watchlist, at iba pa.

| Plataforma ng Paggawa ng Kalakalan | Supported | Magagamit na Devices | Angkop para sa |

| S Broker Mobile App | ✔ | iOS/Android | S Broker users |

| MT4 | ❌ | / | Mga Beginners |

| MT5 | ❌ | / | Mga Experienced traders |