Elio Matacena

1-2年

How do the different account types available at Cloudfutures compare to each other?

In my experience evaluating Cloudfutures, I found that the broker does not offer clearly differentiated account types in the way many international brokers do. Instead, Cloudfutures primarily focuses on futures trading and provides access through a suite of self-developed trading platforms. While this may appeal to traders who value platform variety, I noticed that the lack of demo accounts is a significant limitation. For me, testing strategies or platform functionalities without risking real funds is important, especially with less familiar software.

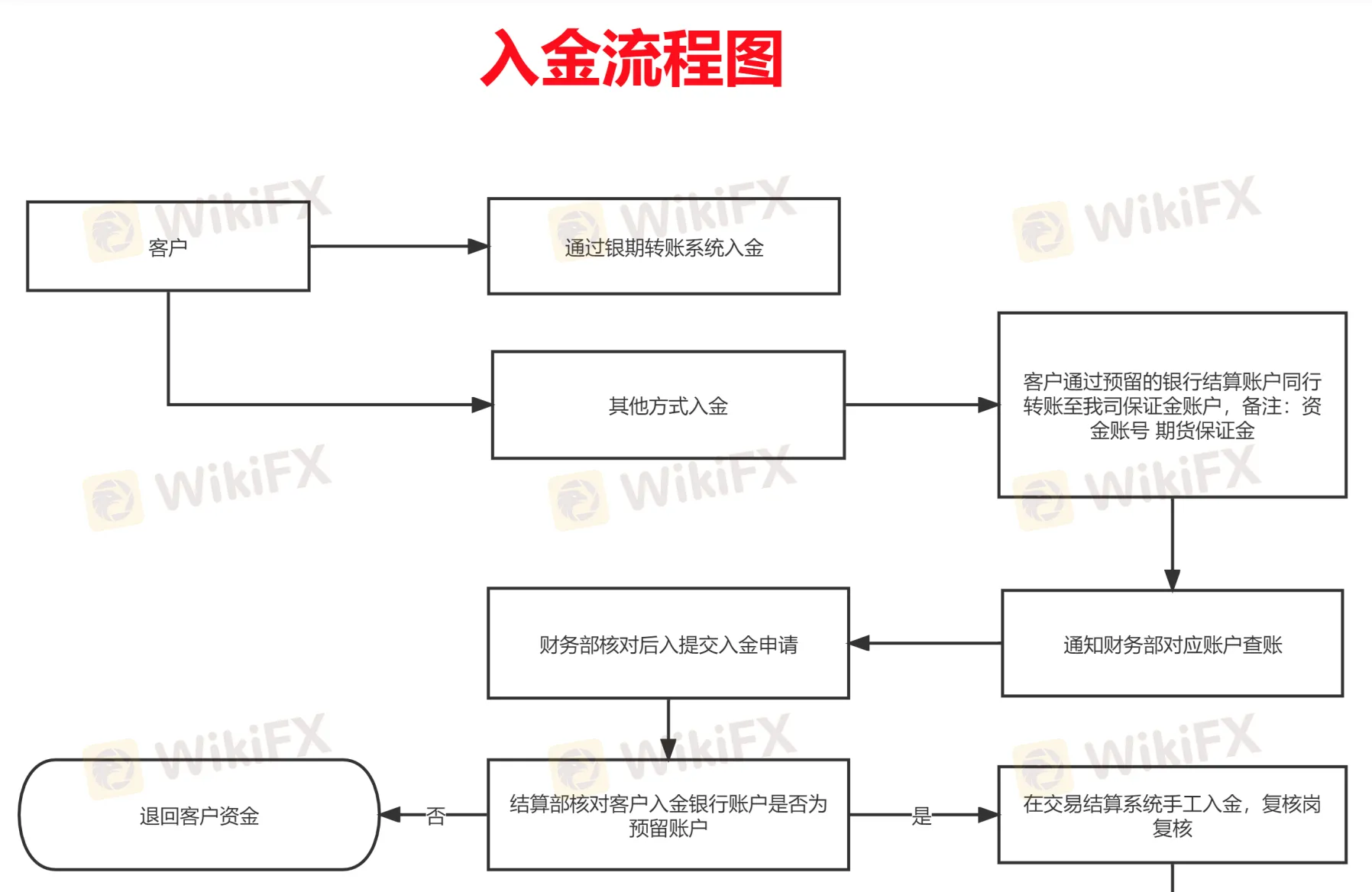

Another point that stood out to me was the general lack of transparency regarding account structures, minimum deposit requirements, and specific trading conditions. Unlike brokers that have standard, mini, or VIP accounts with different thresholds and benefits, Cloudfutures does not provide that granularity, making it harder to compare options or gauge suitability for various trader profiles. While they are regulated by the CFFEX in China, I always want to see clear, accessible details about fees, margin requirements, and withdrawal processes before making a commitment.

Given this, my approach would be quite cautious: the platforms seem robust and regulation is present, but the absence of transparent and differentiated account types leaves too many questions unanswered for my preference. I believe traders should seek comprehensive account information and consider the need for practice environments before opening a live account here.

Broker Issues

Cloud Wealth Futures 云财富期货 Leverage

Platform

Account

Instruments

WoodCrusher

1-2年

What major risks or drawbacks should I consider before using Cloudfutures?

As an experienced trader, I approach every new broker with a healthy dose of caution, especially when evaluating less familiar names like Cloudfutures. For me, the most significant risks revolve around their lack of transparency. While it’s notable that Cloudfutures is indeed regulated in China by CFFEX and has been operating for five to ten years, there’s very limited information available on key trading conditions such as deposit and withdrawal requirements, associated fees, or the exact nature of their order execution. This makes it difficult for me to fully assess the true cost or operational ease of using this broker.

Another issue that causes hesitation is the absence of a demo account. As someone who relies on practice environments to test platforms and strategies before committing real funds, this omission is a real drawback. Additionally, the range of available instruments is extremely narrow—Cloudfutures only offers futures trading, with no access to forex, commodities, indices, or other asset classes, which restricts diversification options.

Lastly, the limited customer support options and the “suspicious scope of business” label worry me. Without more robust channels for resolving potential disputes or clarifying uncertainties, I feel vulnerable if challenges arise. These factors collectively encourage me to be particularly conservative before funding a live account with Cloudfutures. For my risk management and peace of mind, brokers with greater transparency and broader product offerings are generally preferable.

Broker Issues

Cloud Wealth Futures 云财富期货 Regulation

Thanh Thao

1-2年

Is it possible to trade particular assets such as Gold (XAU/USD) and Crude Oil on Cloudfutures?

Based on my review of Cloudfutures, I could not find any support for trading Gold (XAU/USD), Crude Oil, or other commodity-based instruments. My examination of the available materials and official listings indicates that Cloudfutures operates as a futures broker regulated in China and holds a valid futures license with the China Financial Futures Exchange. However, they are explicitly focused on futures products and do not mention or offer forex, commodities, indices, stocks, cryptocurrencies, bonds, options, or ETFs. This is a crucial limitation: for traders like myself interested in gold or crude oil contracts—whether as spot or CFD products—Cloudfutures is not suitable, at least with the currently disclosed instruments.

Additionally, I need to point out the lack of transparent details on trading conditions and instruments, which leaves some ambiguity, but there is no direct evidence that they provide access to gold, oil, or similar markets. In my experience, when a broker’s public information and official disclosures do not reference a specific asset class, it is prudent to assume those instruments are unavailable. For gold and crude oil exposure, I would consider a broker that clearly states support for commodity trading to ensure my trading objectives are met and regulatory clarity is maintained.

Broker Issues

Cloud Wealth Futures 云财富期货 Account

Leverage

Instruments

Platform

J Forex Trader

1-2年

Based on your experience, what do you consider the three main benefits of using Cloudfutures?

From my experience analyzing brokers like Cloudfutures, I’ve learned to weigh regulatory status, platform choices, and operational transparency carefully. First, Cloudfutures is regulated by the China Financial Futures Exchange, which indicates it has obtained a proper futures license and demonstrates oversight by an official entity. For me, regulatory supervision is a critical factor in assessing any broker’s legitimacy and safety, as it usually requires compliance with specific standards in risk management and client protection.

Second, Cloudfutures supports a range of self-developed trading platforms, including desktop and mobile solutions. Having multiple trading platforms can be beneficial, especially for active futures traders who may have individual preferences for functionality, interface, or technical tools. I value platform diversity, as it allows me to adapt my trading style or switch devices without feeling limited by a broker’s technology.

Finally, the broker’s risk management index appears strong based on the metrics provided, which is usually a positive signal. In my view, robust risk management reduces the likelihood of systemic issues and gives traders a degree of confidence, especially when dealing with complex futures instruments. That being said, I remain cautious due to a lack of transparency in trading conditions and the absence of a demo account, factors which can pose their own risks. As with any broker, meticulous personal due diligence remains essential.

Broker Issues

Cloud Wealth Futures 云财富期货 Regulation