Présentation de l'entreprise

| CloudfuturesRésumé de l'examen | |

| Fondé | 2019 |

| Pays/Région enregistré | Chine |

| Régulation | CFFE |

| Instruments de marché | Futures |

| Compte de démonstration | ❌ |

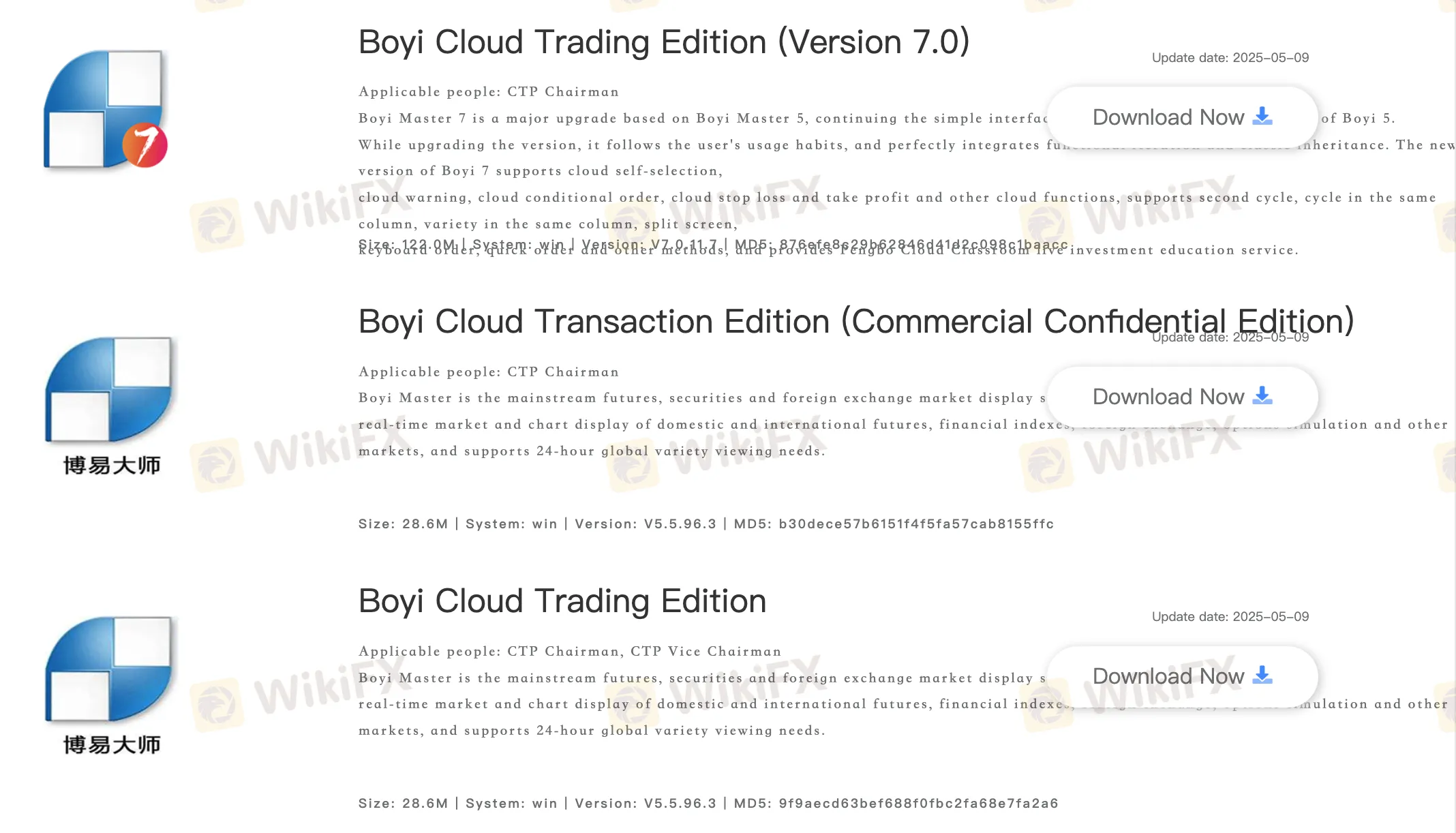

| Plateforme de trading | Boyi Cloud Trading Edition (Version 7.0), Boyi Cloud Transaction Edition (Commercial Confidential Edition), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Commercial Confidential Version), Quick Issue V3 (Commercial Confidential Version), Fast Issue V2, Quick Issue V3, etc. |

| Support client | Tél : 4001119992 |

| Email : YCFQH@cloudfutures.cn | |

Informations sur Cloudfutures

Cloudfutures est un courtier réglementé, offrant des services de trading sur contrats à terme sur différentes plateformes de trading. Le courtier ne propose pas de comptes de démonstration et peu d'informations sur les conditions de trading. Comme peu d'informations sont fournies, il y a un manque de transparence du site web.

Avantages et inconvénients

| Avantages | Inconvénients |

| Diverses plateformes de trading | Pas de comptes de démonstration |

| Bien réglementé | Peu de canaux de contact |

| Manque de transparence |

Cloudfutures est-il légitime ?

Oui. Cloudfutures est autorisé par le CFFEX à offrir des services.

| Pays réglementé | Régulateur | Statut actuel | Entité réglementée | Type de licence | Numéro de licence |

| Bourse des contrats à terme financiers de Chine | Réglementé | 云财富期货有限公司 | Licence de contrats à terme | 0240 |

Sur quoi puis-je trader sur Cloudfutures ?

Cloudfutures propose le trading sur les contrats à terme.

| Instruments négociables | Pris en charge |

| Contrats à terme | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Plateforme de trading

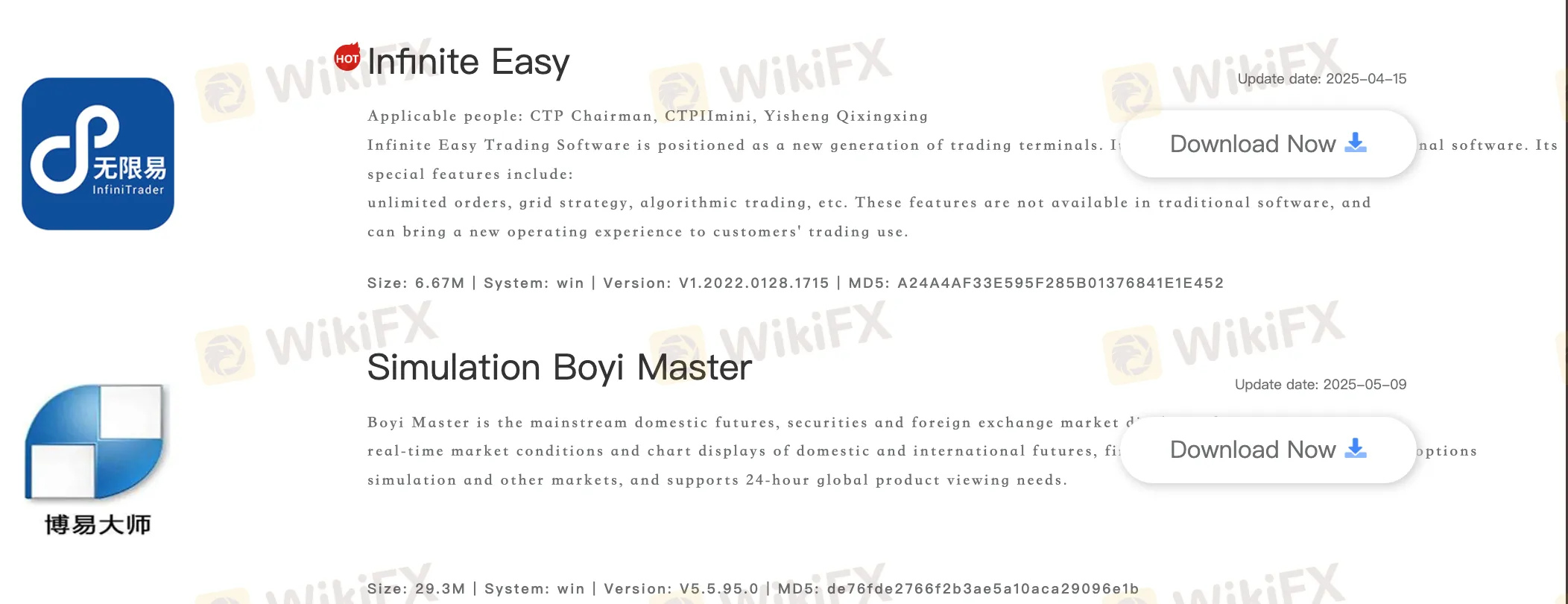

Le courtier propose différentes plateformes de trading, y compris Boyi Cloud Trading Edition (Version 7.0), Boyi Cloud Transaction Edition (Commercial Confidential Edition), Boyi Cloud Trading Edition, Panlifang Cloud Wealth Special Edition, Quick Issue V2 (Commercial Confidential Version), Quick Issue V3 (Commercial Confidential Version), Fast Issue V2, Quick Issue V3, Fast Issue V2, Quick Issue V3, Winshun Cloud Trading Software (wh6), Cloud Wealth Futures, Travel, Disk Cube, Cloud Wealth Polestar 9.5, Cloud Wealth Polestar 9.5 MacOS, Cloud Wealth Polestar 8.5, Infinite Easy et Simulation Boyi Master.

Appareils disponibles : bureau et mobile.

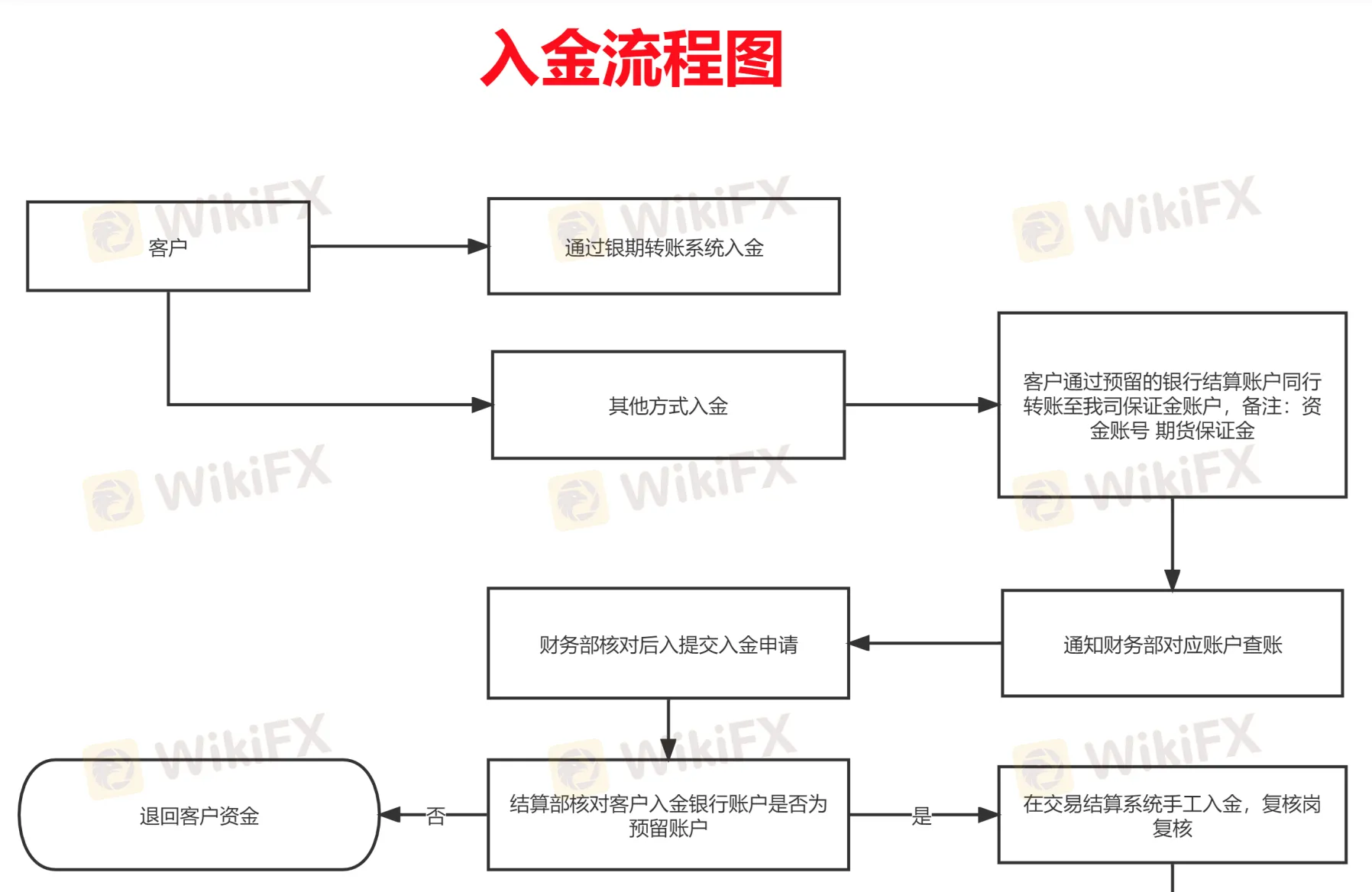

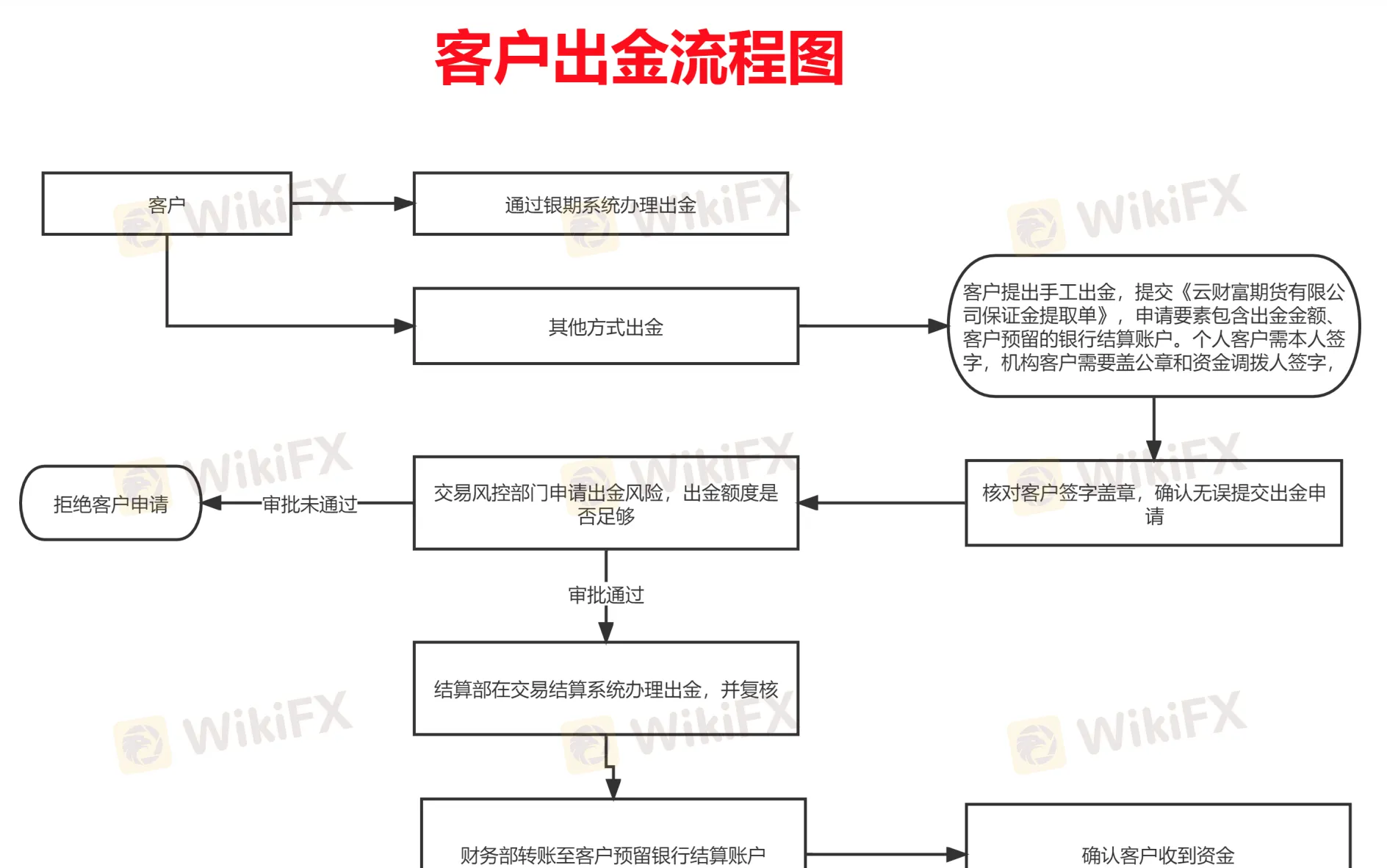

Dépôt et retrait

Aucun montant minimum de dépôt ou de retrait défini et aucun frais spécifié. Le site Web montre uniquement un processus de dépôt et de retrait.