회사 소개

| Islamic Financial Securities 리뷰 요약 | |

| 설립 연도 | 2003 |

| 등록 국가/지역 | 카타르 |

| 규제 | 규제 없음 |

| 시장 상품 | 주식 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | 앱 |

| 최소 입금액 | / |

| 고객 지원 | 문의 양식 |

| 전화: +974 44498888 | |

| 팩스: +974 44498802 | |

| 이메일: info@wasata.qa | |

| 주소: 빌딩 No 48, Q03 Building, Al Kharaba South, Msheireb Downtown, Doha | |

| Facebook, Twitter, LinkedIn, Instagram | |

Islamic Financial Securities은 2003년에 설립된 카타르에 본사를 둔 규제되지 않은 금융 회사입니다. 자체 앱을 통해 주식 거래만 제공합니다. 또한 계정 세부 정보 및 거래 수수료에 대한 제한된 정보가 있습니다.

장단점

| 장점 | 단점 |

| 다양한 고객 지원 채널 | 규제 없음 |

| 단일 거래 상품 | |

| 계정에 대한 제한된 정보 | |

| 거래 수수료에 대한 제한된 정보 | |

| 데모 계정 없음 |

Islamic Financial Securities이 신뢰할 만한가요?

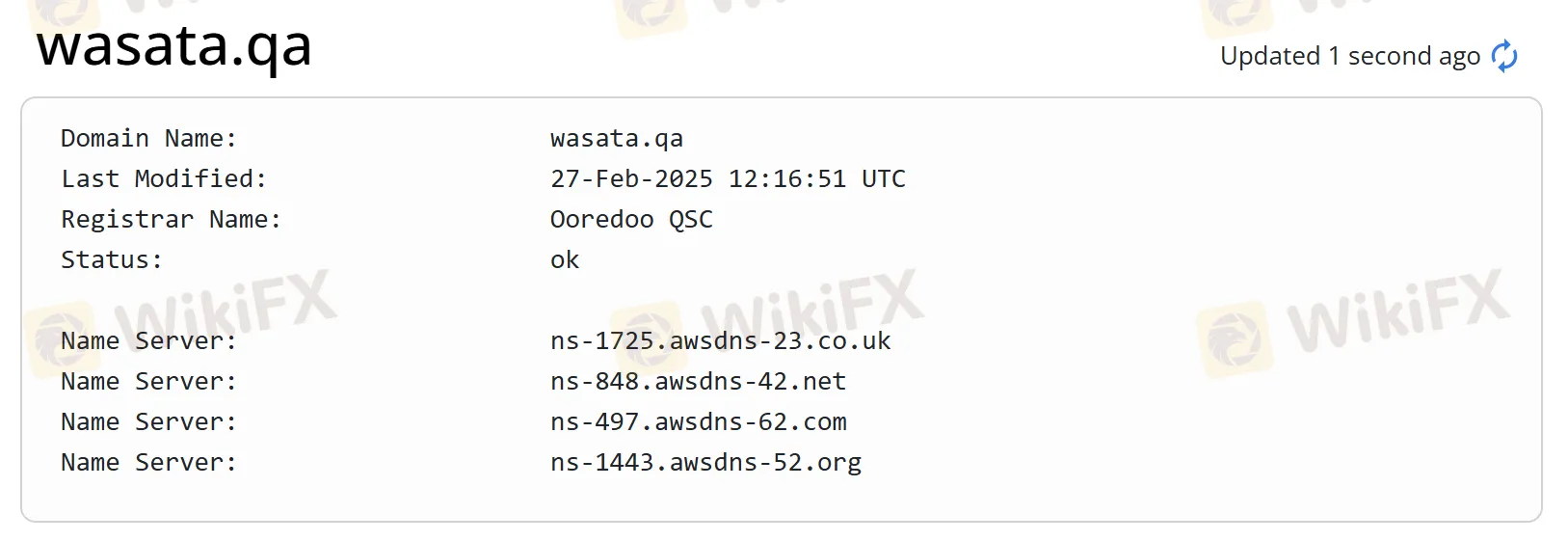

현재 Islamic Financial Securities은 유효한 규제가 없습니다. 또한 해당 도메인에 대한 정보가 제한적입니다. 규제된 기관을 찾는 것이 좋습니다.

Islamic Financial Securities에서 무엇을 거래할 수 있나요?

Islamic Financial Securities은(는) 주식 거래만을 제공하는 것으로 보입니다. 세부 정보에 대한 제한된 정보가 있습니다.

| 거래 가능한 상품 | 지원 |

| 주식 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

| 상장펀드 | ❌ |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| 앱 | ✔ | Google Play, App Store |