مقدمة عن الشركة

| Islamic Financial Securities ملخص المراجعة | |

| تأسست | ٢٠٠٣ |

| الدولة/المنطقة المسجلة | قطر |

| التنظيم | لا يوجد تنظيم |

| صكوك السوق | الأسهم |

| حساب تجريبي | ❌ |

| منصة التداول | تطبيق |

| الحد الأدنى للإيداع | / |

| دعم العملاء | نموذج الاتصال |

| الهاتف: +٩٧٤ ٤٤٤٩٨٨٨٨ | |

| الفاكس: +٩٧٤ ٤٤٤٩٨٨٠٢ | |

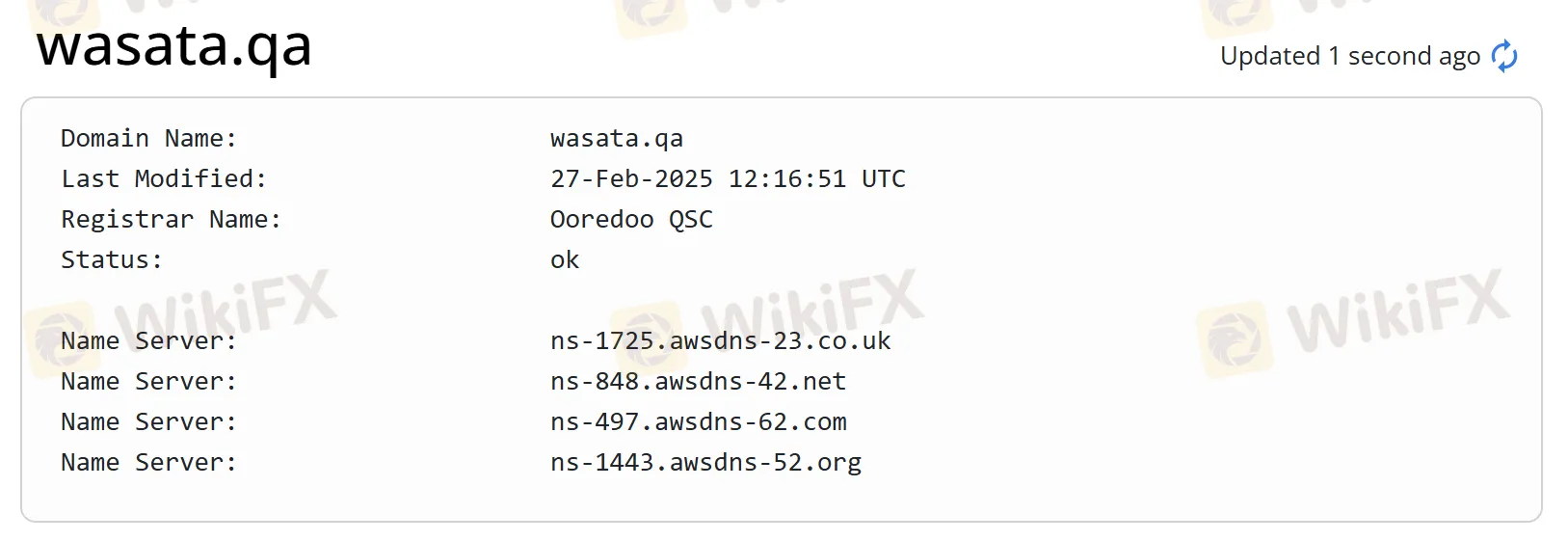

| البريد الإلكتروني: info@wasata.qa | |

| العنوان: بناية رقم ٤٨، بناية Q03، الخربة الجنوبية، مشيرب داونتاون، الدوحة | |

| فيسبوك، تويتر، لينكد إن، إنستجرام | |

Islamic Financial Securities هي شركة مالية غير منظمة تأسست في عام ٢٠٠٣ ومقرها في قطر. تقدم فقط تداول الأسهم من خلال تطبيقها الخاص الخاص. بالإضافة إلى ذلك، هناك معلومات محدودة متاحة بخصوص تفاصيل الحساب ورسوم التداول.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| قنوات دعم العملاء المتعددة | لا يوجد تنظيم |

| منتج تداول واحد | |

| معلومات محدودة عن الحسابات | |

| معلومات محدودة عن رسوم التداول | |

| لا توجد حسابات تجريبية |

هل Islamic Financial Securities شرعية؟

في الوقت الحالي، Islamic Financial Securities تفتقر إلى تنظيم صالح. علاوة على ذلك، هناك معلومات محدودة حول نطاقها. ننصحك بالبحث عن شركات أخرى منظمة.

ما الذي يمكنني التداول به على Islamic Financial Securities؟

يبدو أن Islamic Financial Securities يقدم فقط تداول الأسهم. هناك معلومات محدودة حول التفاصيل.

| الأدوات التجارية | مدعوم |

| الأسهم | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

| صناديق الاستثمار المشتركة | ❌ |

منصة التداول

| منصة التداول | مدعوم | الأجهزة المتاحة |

| تطبيق | ✔ | Google Play، App Store |