회사 소개

| MasterLink Securities리뷰 요약 | |

| 설립 | 1989년 |

| 등록 국가/지역 | 대만 |

| 규제 | 타이페이 거래소 규제 |

| 시장 기구 | 중개, 자산 관리, 언더라이팅, 주식 등록 및 이전, 자체 거래, 선물 자체 거래, 고정 수입, 파생 상품, MasterLink Securities 투자 자문, MasterLink 선물, MasterLink 보험 대행사, MasterLink 벤처 캐피탈 및 MasterLink 벤처 Mana |

| 데모 계정 | 언급되지 않음 |

| 레버리지 | 최대 1:600 |

| 스프레드 | 0.5픽셀 이하 |

| 거래 플랫폼 | 메타트레이더 4 |

| 최소 입금액 | $100 |

| 고객 지원 | 전화: +886-2-27313888 |

| 이메일: sylvia0704@masterlink.com.tw | |

MasterLink Securities 정보

MasterLink Securities은 대만에 기반을 둔 1989년에 설립되었습니다. 이 브로커는 외환, CFD, 상품 및 지수를 제공합니다. 또한 최대 1:600의 레버리지, 0.5픽셀에서 1.5픽셀까지의 스프레드 및 선택할 수 있는 세 가지 계정 유형을 제공합니다.

장단점

| 장점 | 단점 |

| 다양한 거래 자산 제공 | 실시간 채팅 지원 부족 |

| 계정 유형 제공 | |

| 타이페이 거래소 규제 | |

| 경쟁력 있는 1:600의 레버리지 제공 | |

| 메타트레이더 4 거래 플랫폼 제공 |

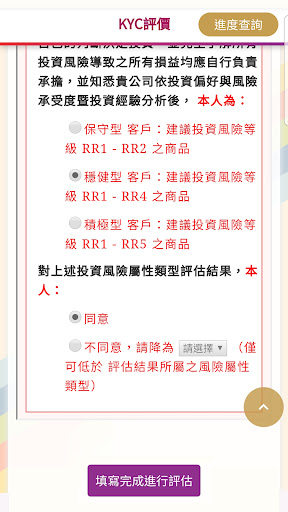

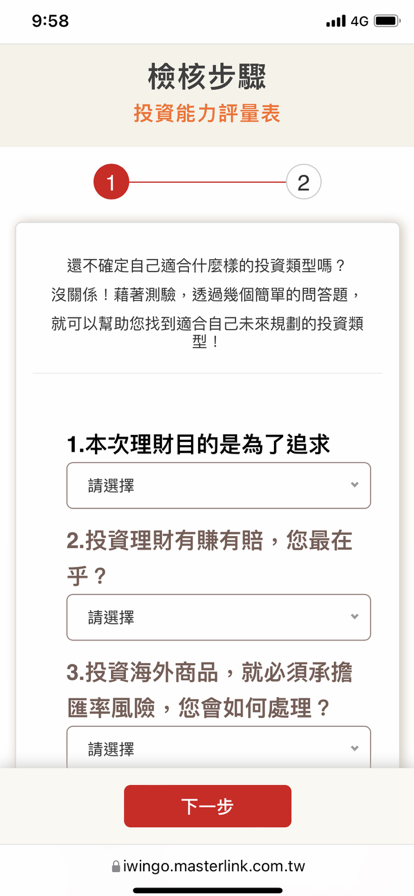

MasterLink Securities이 신뢰할 수 있는가?

MasterLink Securities은 타이페이 거래소에 의해 규제를 받고 있습니다. 라이선스 유형은 공유 없음입니다.

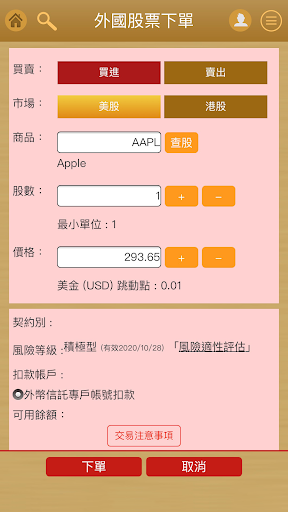

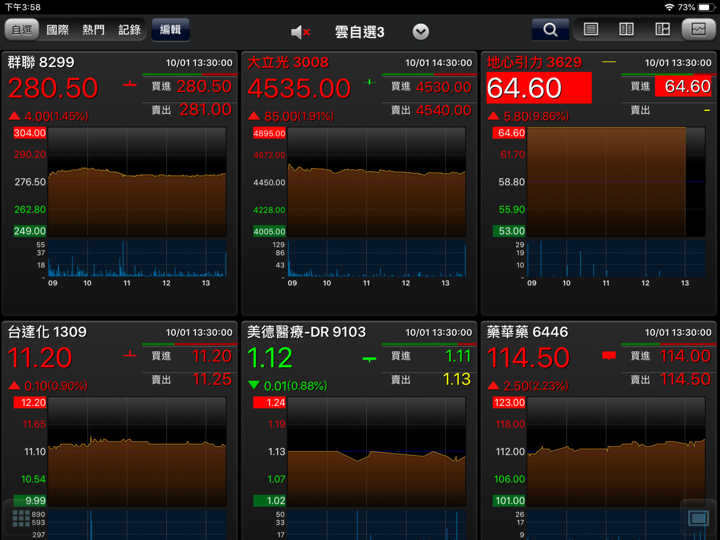

MasterLink Securities에서 무엇을 거래할 수 있나요?

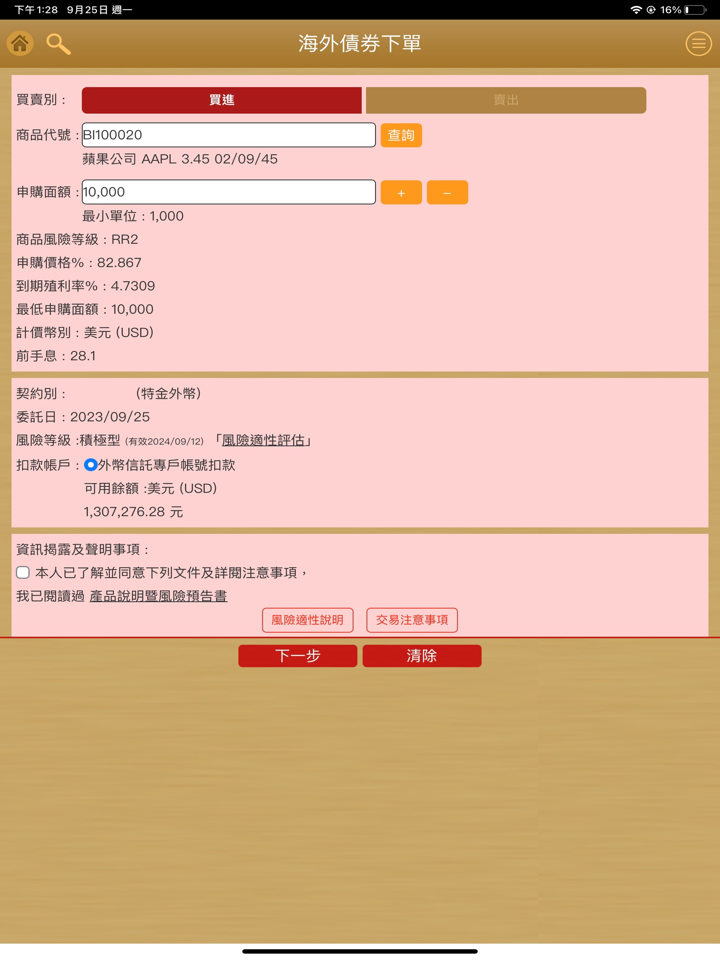

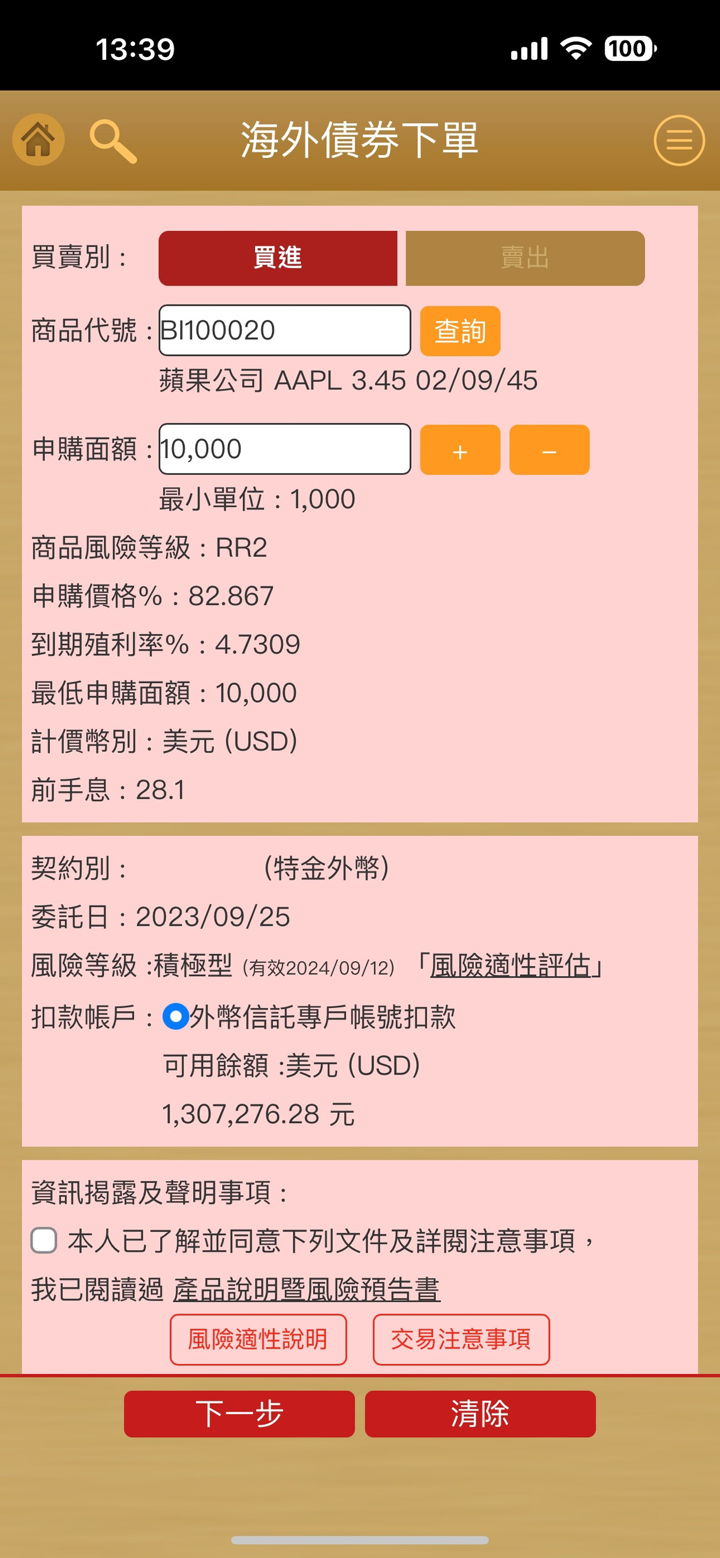

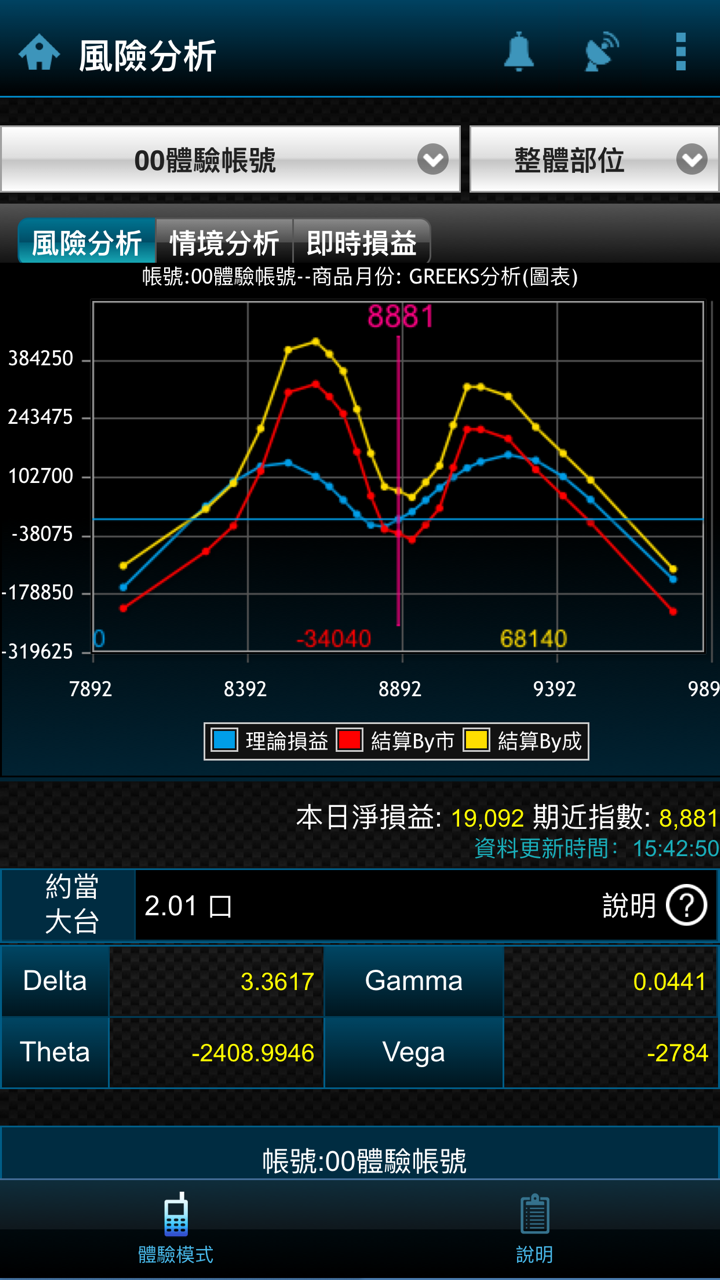

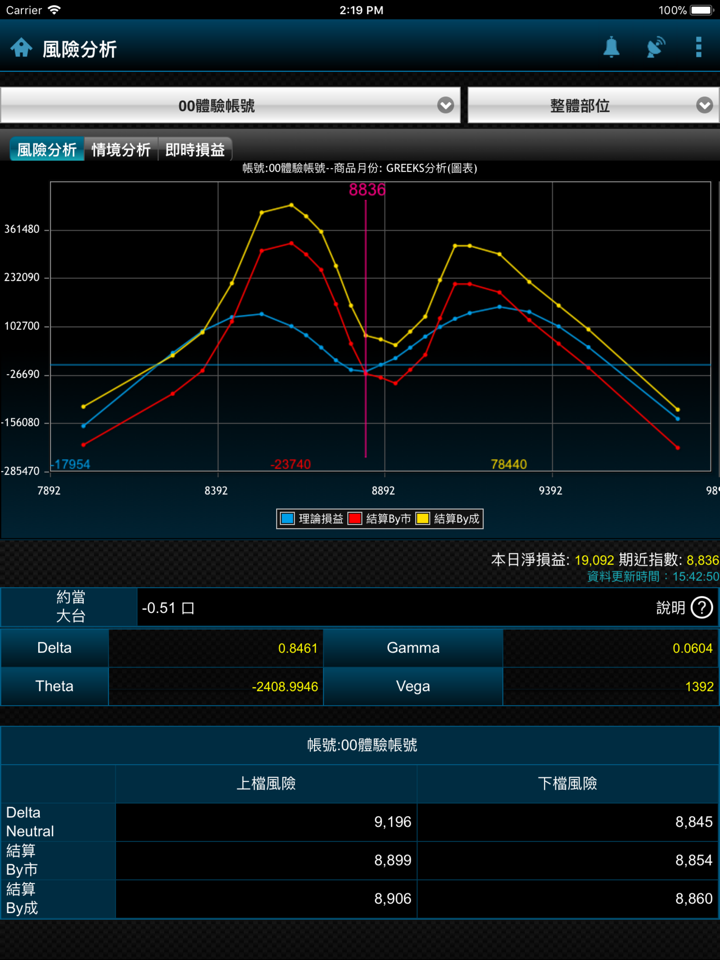

MasterLink Securities은 외환, 지수 및 상품에 대한 CFD, 상품 및 지수 거래를 포함한 중개, 자산 관리, 언더라이팅, 주식 등록 및 이전, 자체 거래, 선물 자체 거래, 고정 수입, 파생 상품, MasterLink Securities 투자 자문, MasterLink 선물, MasterLink 보험 대행사, MasterLink 벤처 캐피탈 및 MasterLink 벤처 Mana을 제공합니다.

| 거래 가능한 기구 | 지원됨 |

| 외환 | ✔ |

| 상품 | ✔ |

| 암호화폐 | ❌ |

| CFD | ✔ |

| 선물 | ✔ |

| 주식 | ✔ |

| 지수 | ✔ |

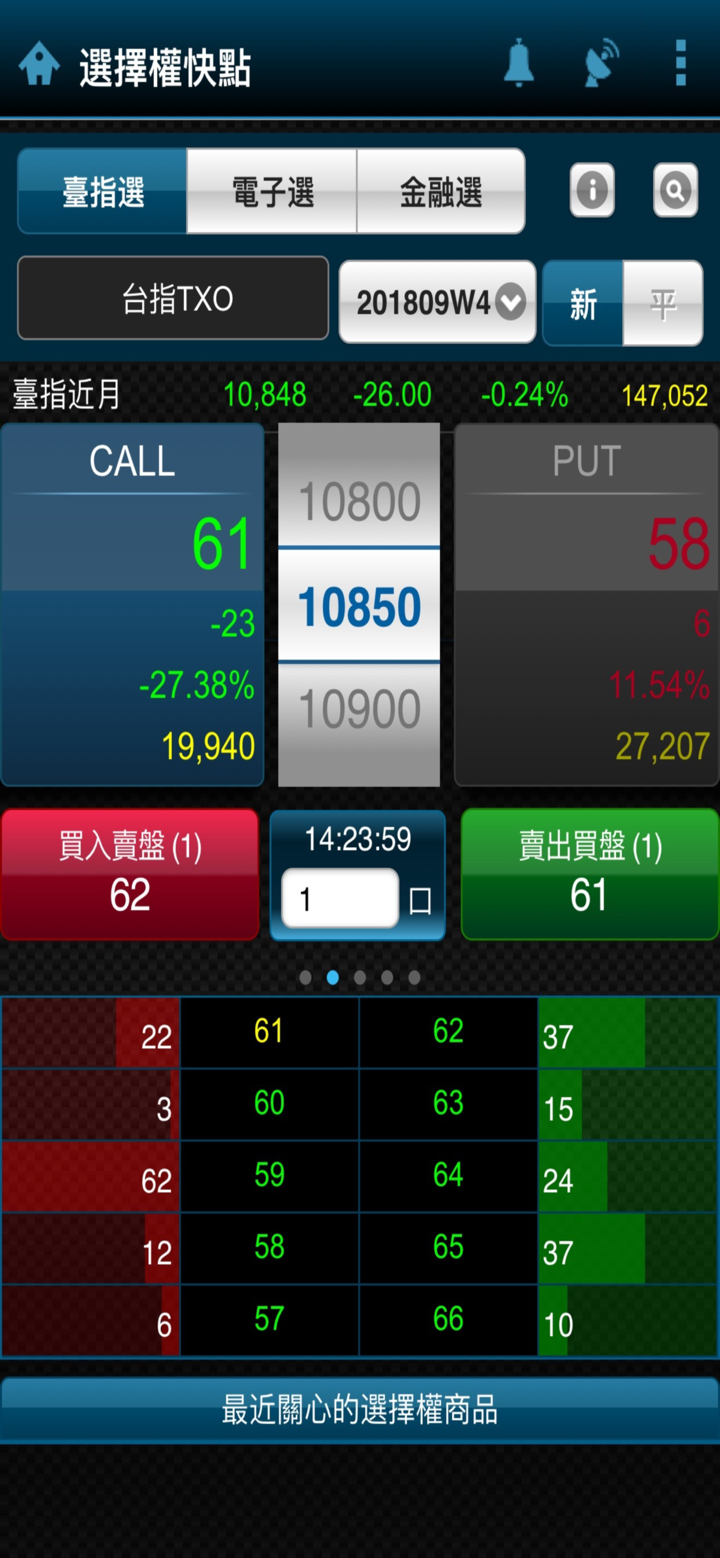

| 옵션 | ❌ |

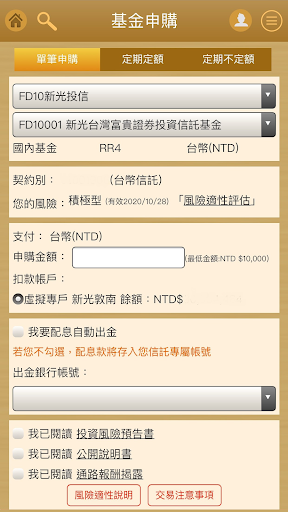

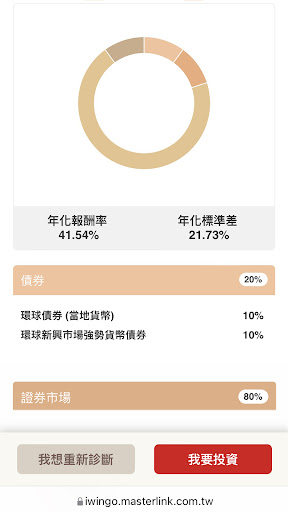

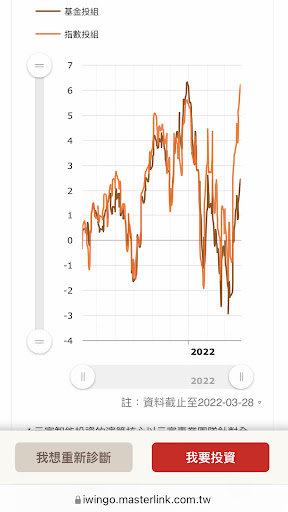

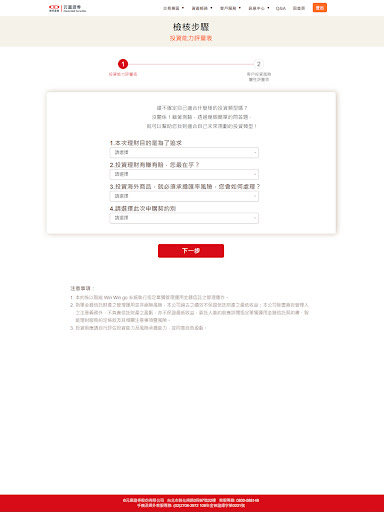

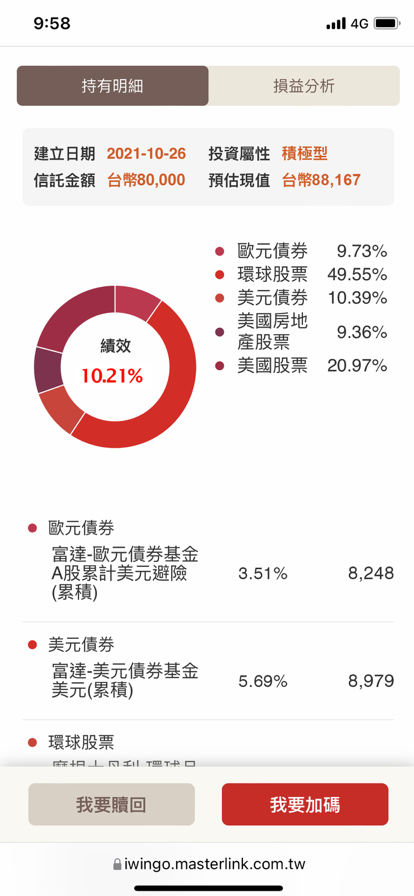

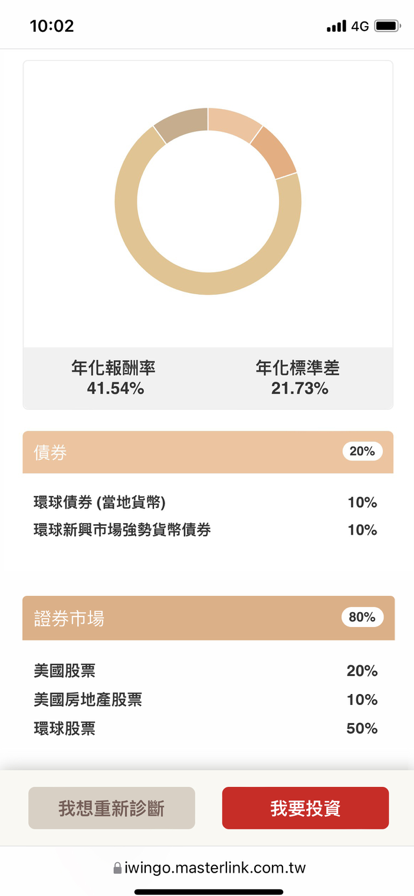

계정 유형

MasterLink Securities는 표준, 골드 및 플래티넘 계정을 포함한 세 가지 계정 유형을 제공합니다.

표준 계정:

표준 계정은 최소 입금액이 $100이며, 1.5 픽셀의 스프레드와 수수료가 없습니다. 또한 최대 1:600의 레버리지를 제공합니다.

골드 계정:

골드 계정은 최소 입금액이 $500이며, 1.0 픽셀의 더 좁은 스프레드와 수수료가 없습니다. 또한 최대 1:600의 레버리지를 제공합니다.

플래티넘 계정:

플래티넘 계정은 최소 입금액이 $1,000이며, 0.5 픽셀부터 시작하는 스프레드를 제공합니다. 다른 계정 유형과 마찬가지로 최대 1:600의 레버리지를 제공합니다.

| 특징 | 표준 | 골드 | 플래티넘 |

| 레버리지 | 최대 1:600 | 최대 1:600 | 최대 1:600 |

| 스프레드 | 1.5 픽셀부터 시작 | 1.0 픽셀부터 시작 | 0.5 픽셀부터 시작 |

| 수수료 | 없음 | 없음 | 없음 |

| 최소 입금액 | $100 | $500 | $1,000 |

| 거래 도구 | 메타트레이더 4 | 메타트레이더 4 | 메타트레이더 4 |

레버리지

MasterLink Securities가 제공하는 최대 레버리지는 최대 1:600입니다. 이는 트레이더가 거래 자본의 600배까지 시장에서 포지션을 제어할 수 있음을 의미합니다.

MasterLink Securities 수수료

표준 계정에서는 주요 통화 쌍의 스프레드를 최소 1.5 포인트로 이용할 수 있습니다.

골드 계정에서는 스프레드가 1.0 픽셀부터 시작됩니다.

플래티넘 계정에서는 주요 통화 쌍의 스프레드가 0.5 픽셀부터 시작됩니다.

모든 계정은 수수료가 없습니다.

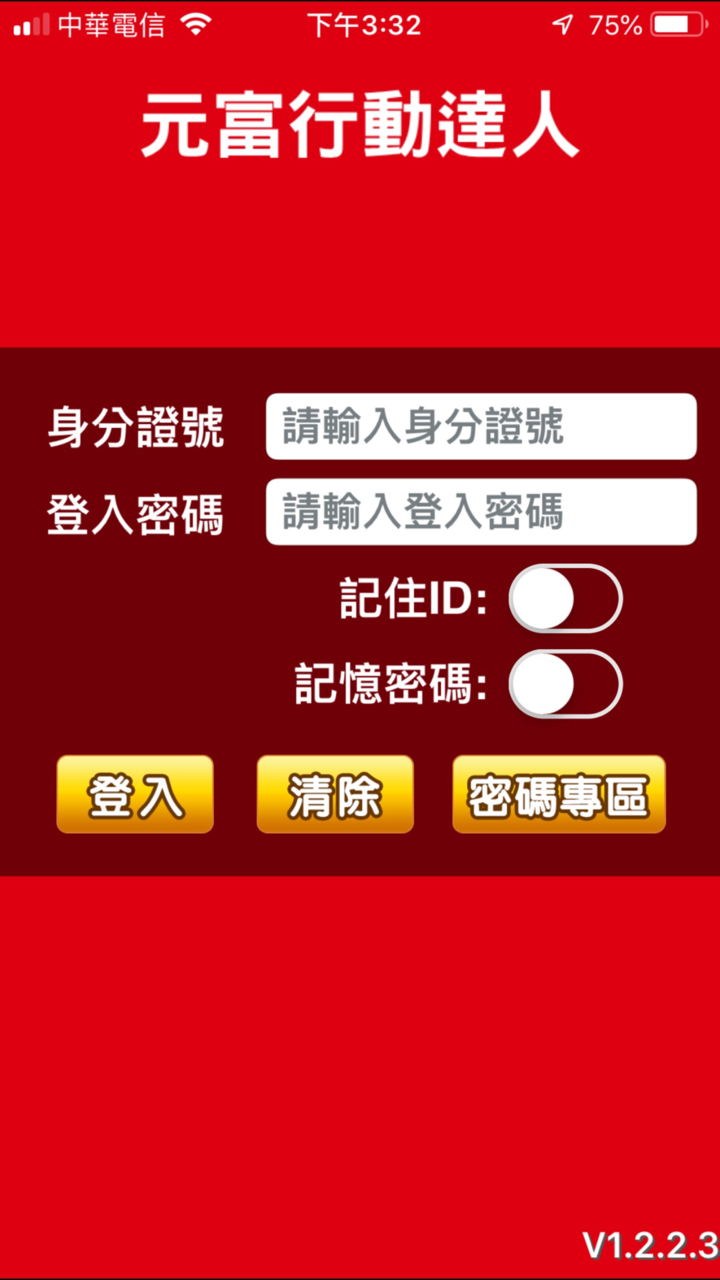

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 기기 | 어떤 투자자에게 적합한가 |

| 메타트레이더 4 | ✔ | Windows, MAC, IOS 및 Android | 모든 경험 수준의 투자자 |

| 메타트레이더 5 | ❌ | ||

| 웹 트레이더 | ❌ |

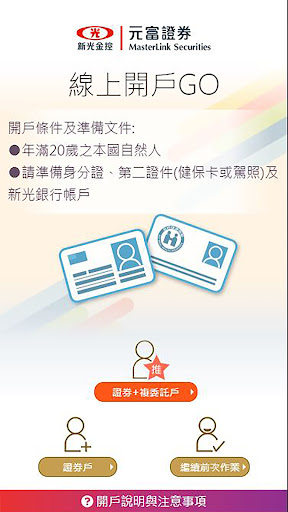

입출금

MasterLink Securities와의 거래 계정을 개설하기 위해 필요한 최소 입금액은 표준 계정의 경우 $100, 골드 계정의 경우 $500, 플래티넘 계정의 경우 $1,000입니다.