Perfil de la compañía

| MasterLink SecuritiesResumen de revisión | |

| Fundado | 1989 |

| País/Región registrado | Taiwán |

| Regulación | Regulado por Taipei Exchange |

| Instrumentos de mercado | Corretaje, Gestión de patrimonio, Suscripción, Registro y transferencia de acciones, Operaciones propietarias, Operaciones propietarias de futuros, Renta fija, Derivados, Asesoramiento de inversiones MasterLink Securities, MasterLink Futures, MasterLink Insurance Agency, MasterLink Venture Capital&MasterLink Venture Mana |

| Cuenta demo | No mencionado |

| Apalancamiento | Hasta 1:600 |

| Spread | Desde 0.5 pips |

| Plataforma de trading | MetaTrader 4 |

| Depósito mínimo | $100 |

| Soporte al cliente | Teléfono: +886-2-27313888 |

| Email: sylvia0704@masterlink.com.tw | |

Información de MasterLink Securities

MasterLink Securities tiene su sede en Taiwán y fue fundado en 1989. Este corredor ofrece Forex, CFDs, materias primas e índices. También proporciona un apalancamiento de hasta 1:600, spreads que van desde 0.5 pips hasta 1.5 pips y tres tipos de cuentas para elegir.

Pros y contras

| Pros | Contras |

| Ofrece varios activos de trading | Falta de soporte de chat en vivo |

| Proporciona tipos de cuentas | |

| Regulado por Taipei Exchange | |

| Ofrece un apalancamiento competitivo de 1:600 | |

| Proporciona la plataforma de trading MetaTrader 4 |

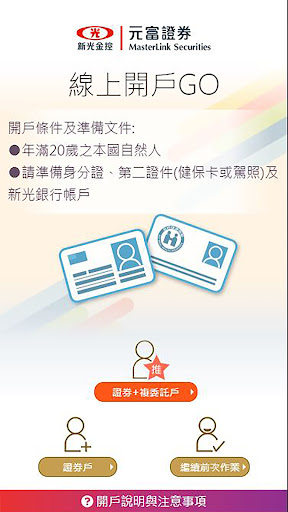

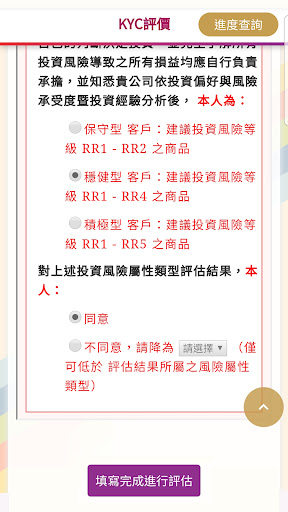

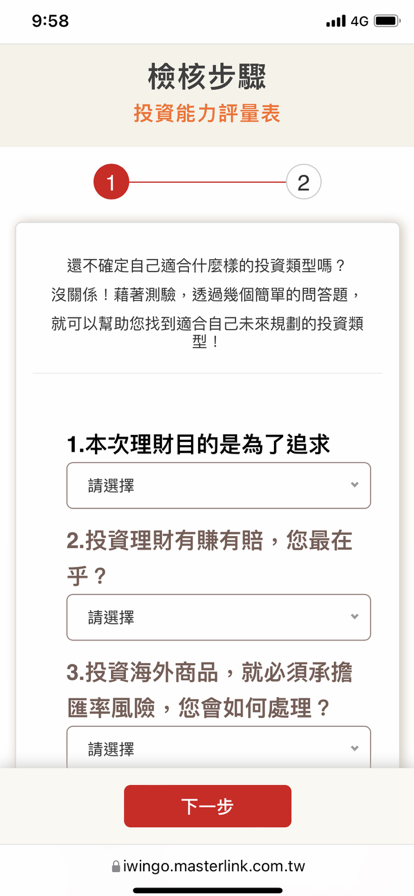

¿Es MasterLink Securities legítimo?

MasterLink Securities está regulado por Taipei Exchange. Su tipo de licencia es No Sharing.

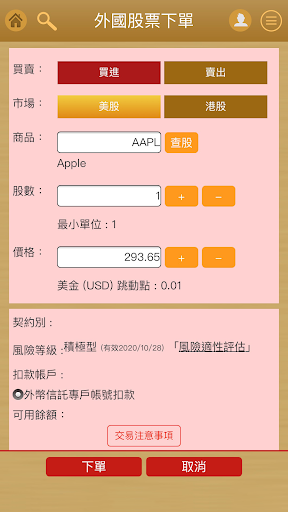

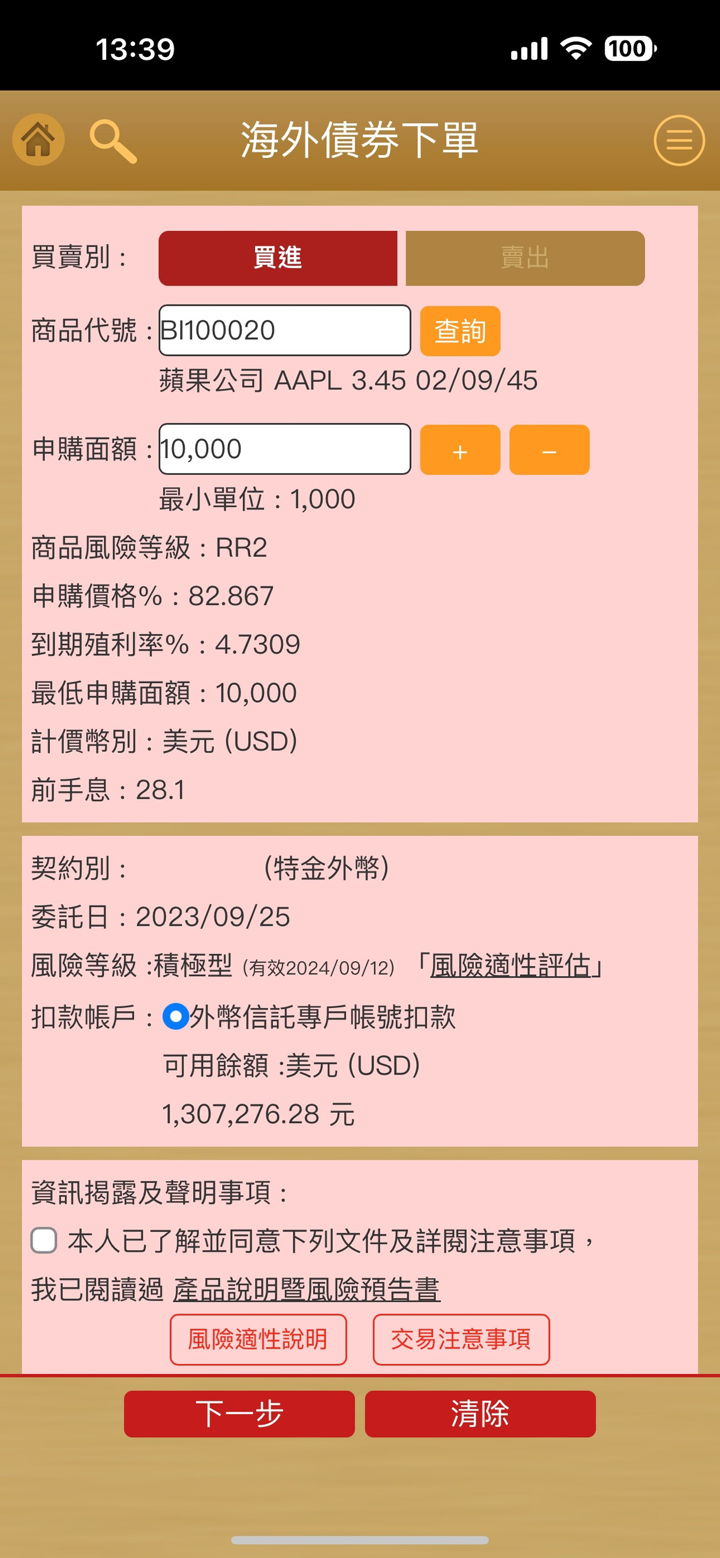

¿Qué puedo operar en MasterLink Securities?

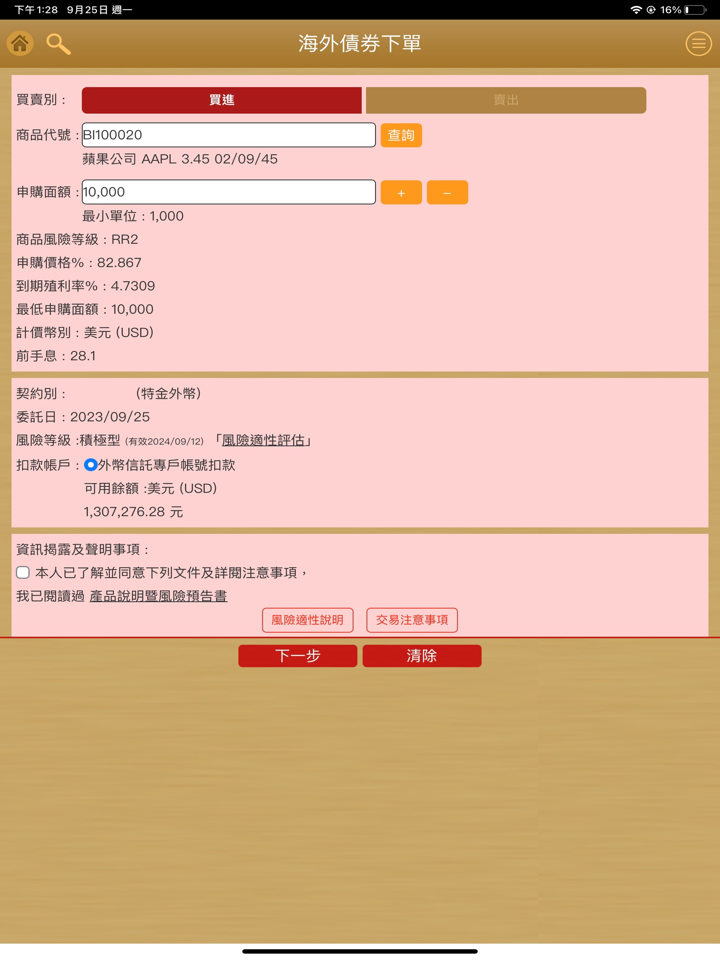

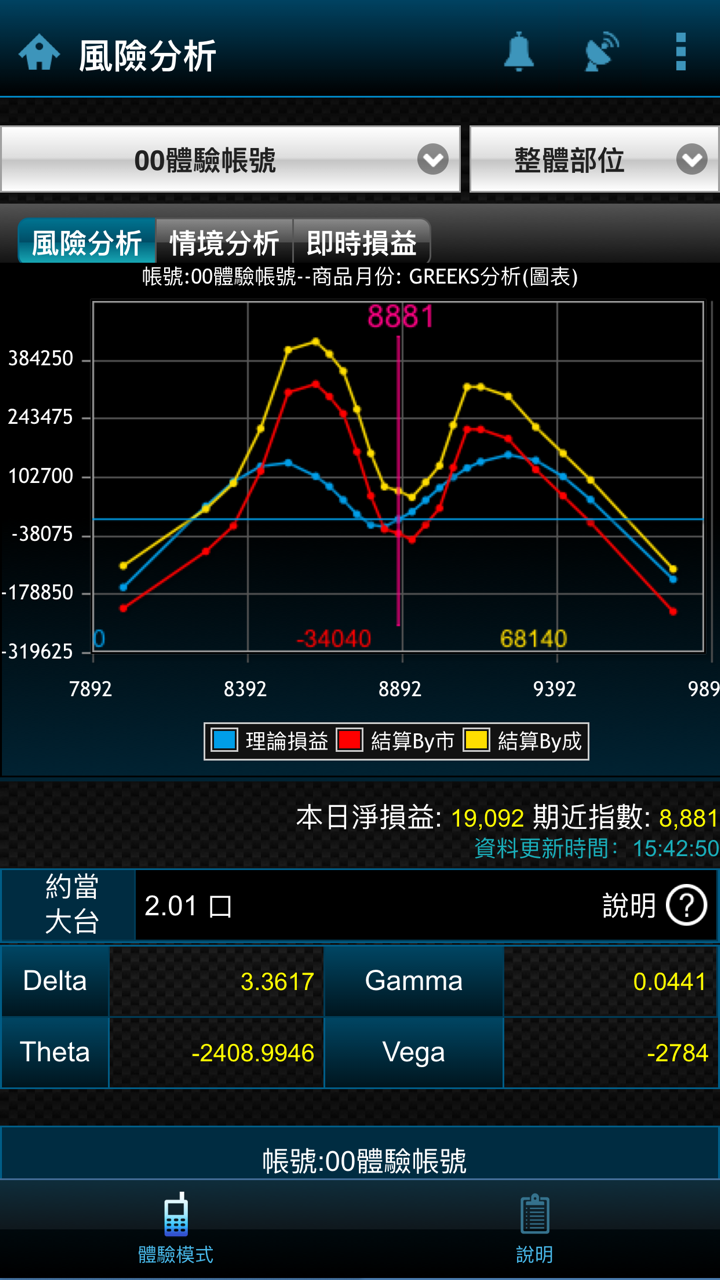

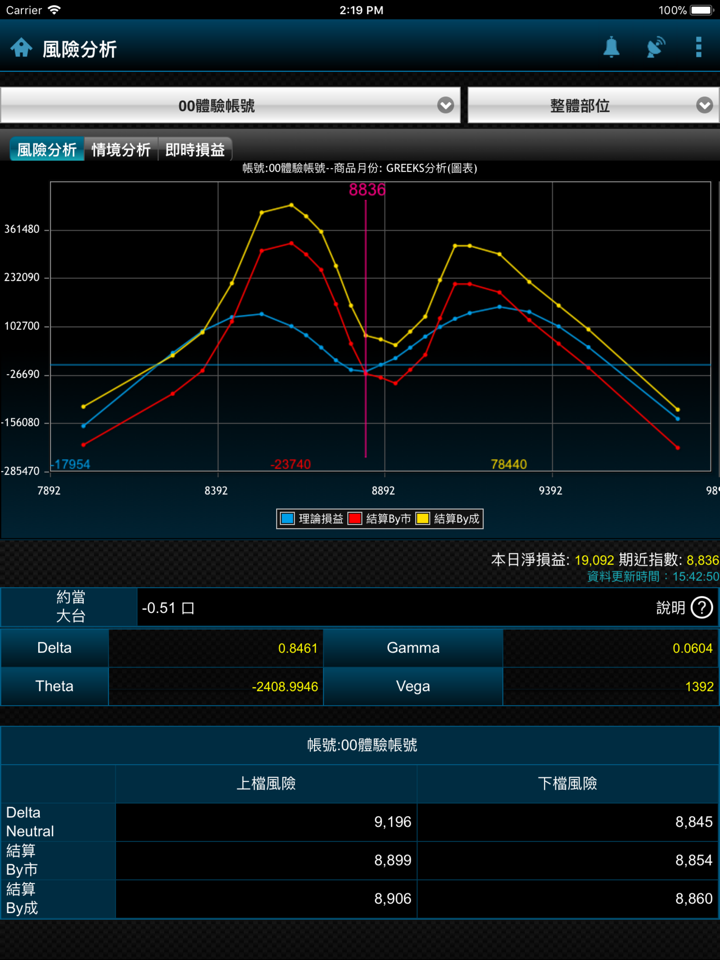

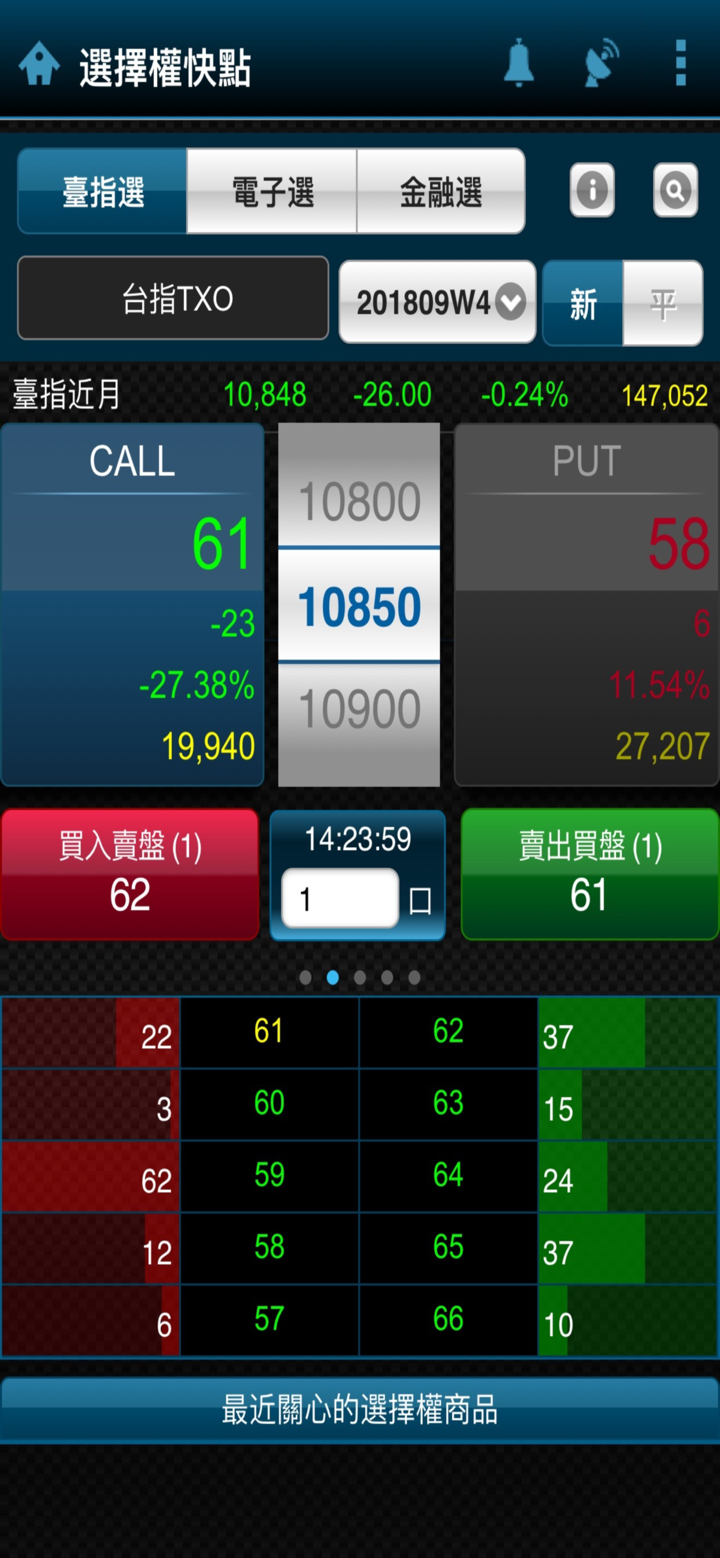

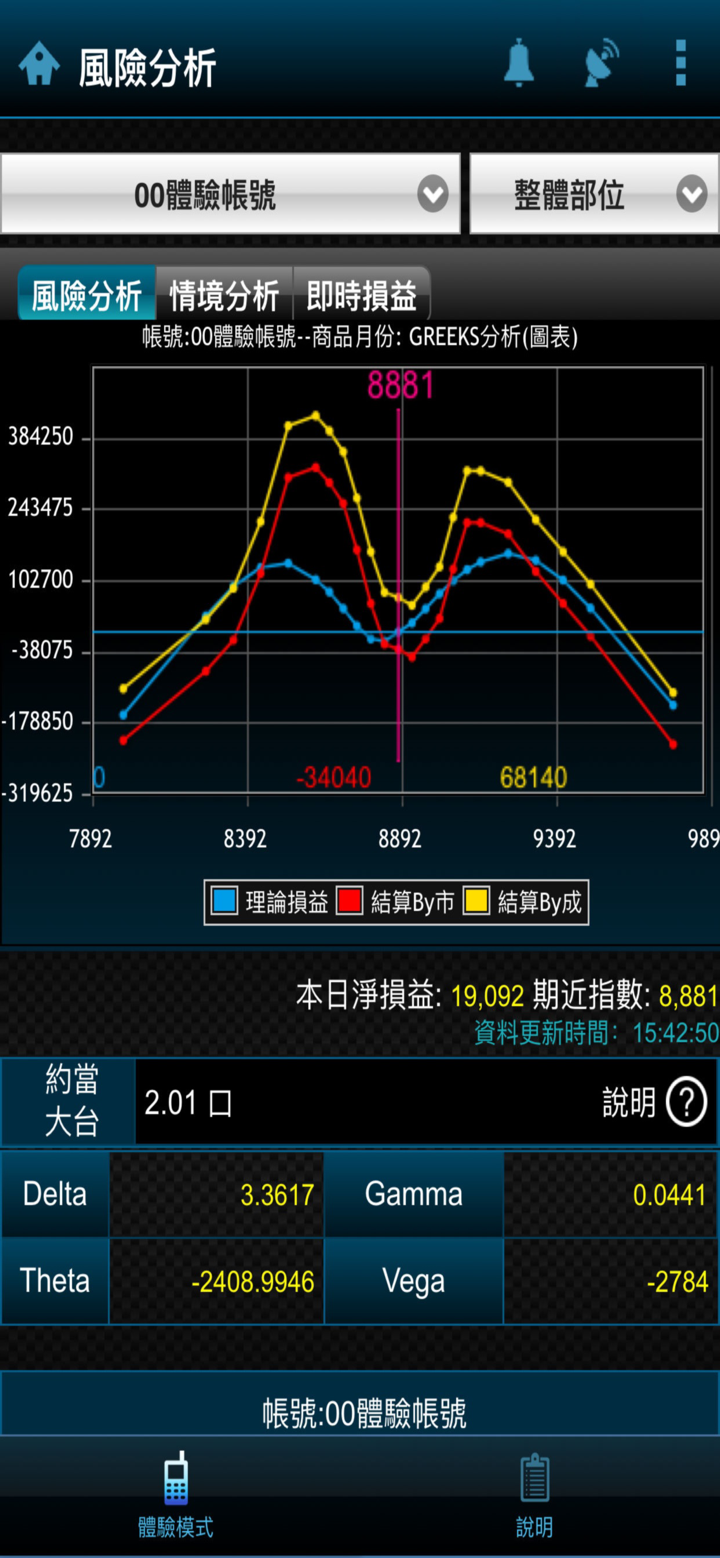

MasterLink Securities ofrece corretaje, gestión de patrimonio, suscripción, registro y transferencia de acciones, operaciones propietarias, operaciones propietarias de futuros, renta fija, derivados, asesoramiento de inversiones MasterLink Securities, MasterLink Futures, MasterLink Insurance Agency, MasterLink Venture Capital&MasterLink Venture Mana, incluyendo forex, CFDs sobre índices y materias primas, materias primas y trading de índices.

| Instrumentos negociables | Soportado |

| Forex | ✔ |

| Materias primas | ✔ |

| Cripto | ❌ |

| CFD | ✔ |

| Futuros | ✔ |

| Acciones | ✔ |

| Índices | ✔ |

| Opciones | ❌ |

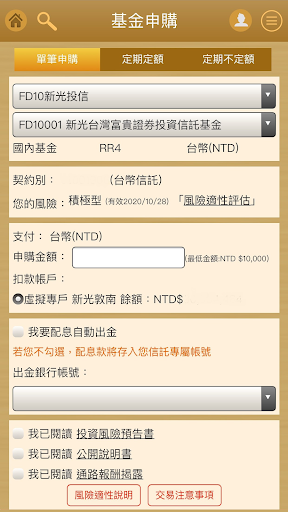

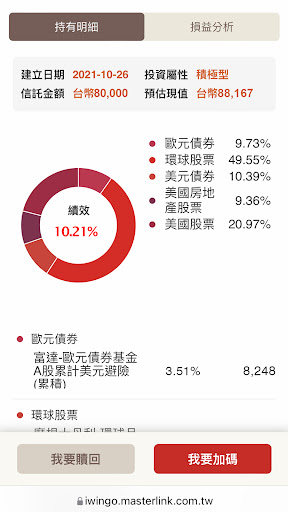

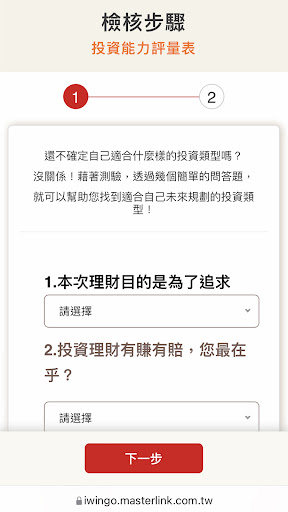

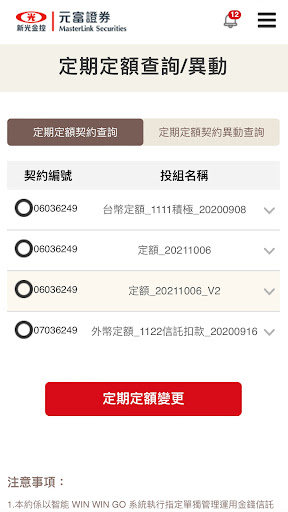

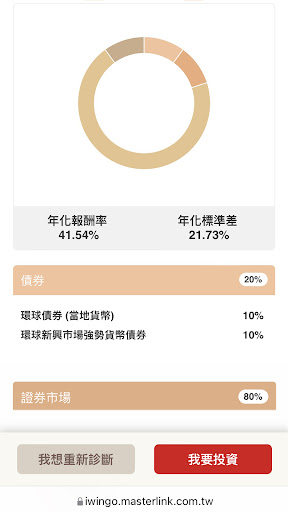

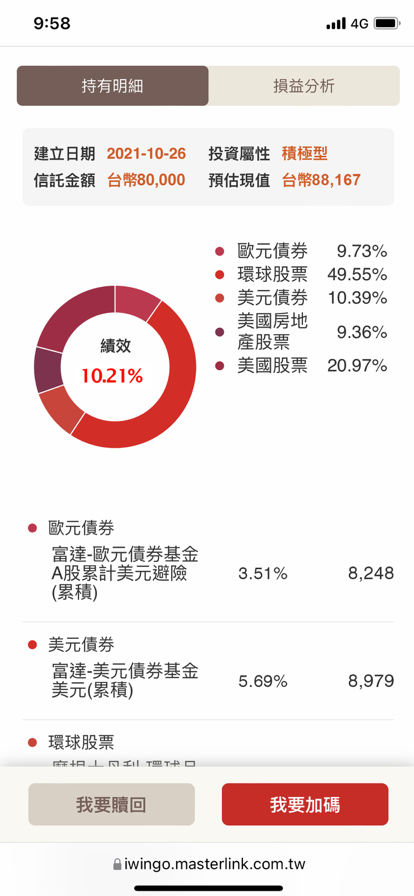

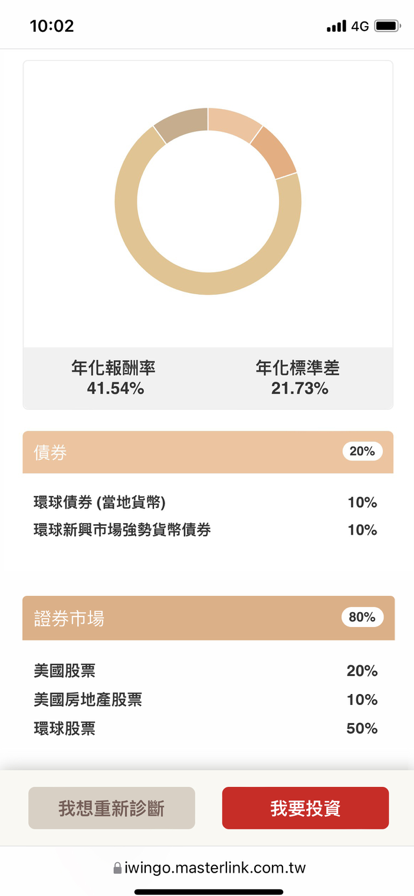

Tipos de cuenta

MasterLink Securities ofrece tres tipos de cuentas, incluyendo cuentas Estándar, Oro y Platino.

Cuenta Estándar:

La cuenta Estándar ofrece un depósito mínimo de $100, también ofrece spreads de 1.5 pips y comisiones cero. Además, ofrece un apalancamiento de hasta 1:600.

Cuenta Oro:

La cuenta Oro requiere un depósito mínimo de $500 y ofrece spreads más ajustados de 1.0 pips sin comisiones. También ofrece un apalancamiento de hasta 1:600.

Cuenta Platino:

La cuenta Platino ofrece un depósito mínimo de $1,000, y sus spreads comienzan desde 0.5 pips. Al igual que los otros tipos de cuenta, ofrece un apalancamiento de hasta 1:600.

| Característica | Estándar | Oro | Platino |

| Apalancamiento | Hasta 1:600 | Hasta 1:600 | Hasta 1:600 |

| Spreads | A partir de 1.5 pips | A partir de 1.0 pips | A partir de 0.5 pips |

| Comisiones | Ninguna | Ninguna | Ninguna |

| Depósito Mínimo | $100 | $500 | $1,000 |

| Herramientas de Trading | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

Apalancamiento

El apalancamiento máximo ofrecido por MasterLink Securities es de hasta 1:600. Esto significa que los traders pueden controlar posiciones en el mercado hasta 600 veces el monto de su capital de trading.

MasterLink Securities Comisiones

En una cuenta estándar, los traders pueden beneficiarse de un spread de los pares de divisas principales tan bajo como 1.5 puntos.

En las cuentas Oro, el spread comienza desde 1.0 pips.

En la cuenta Platino, el spread de los pares de divisas principales comienza desde 0.5 pips.

Y todas las cuentas no requieren comisiones.

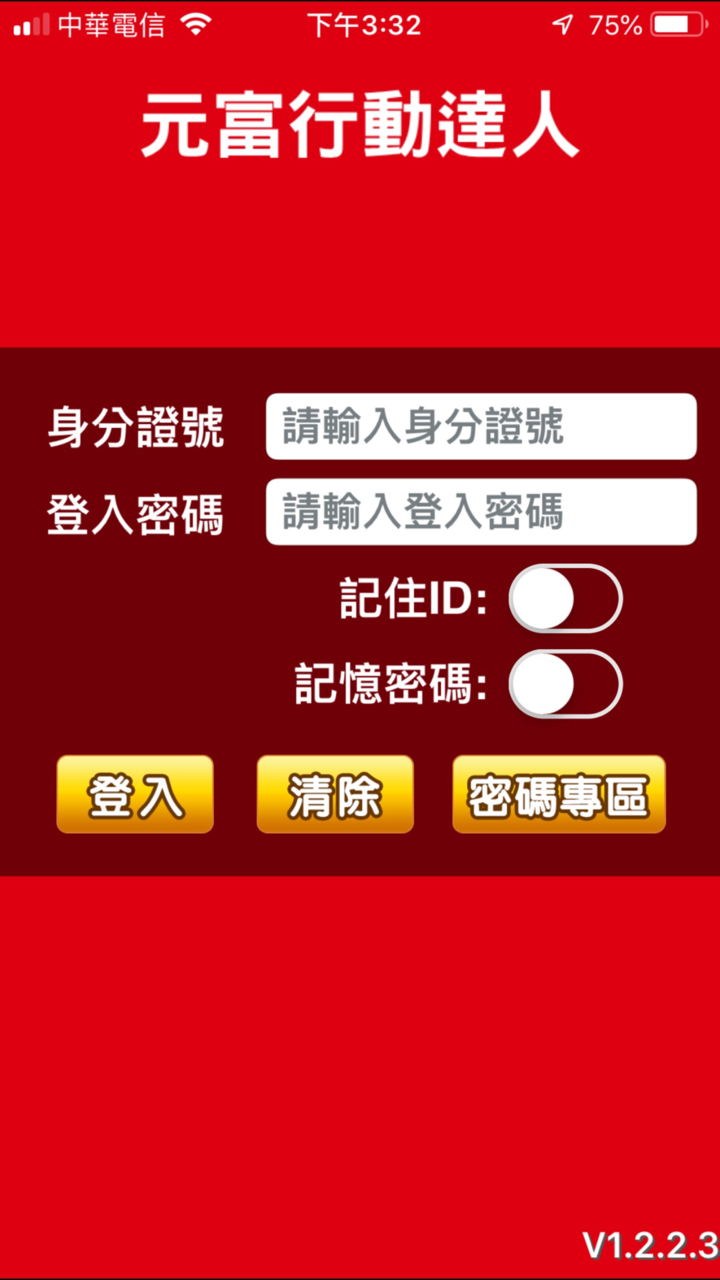

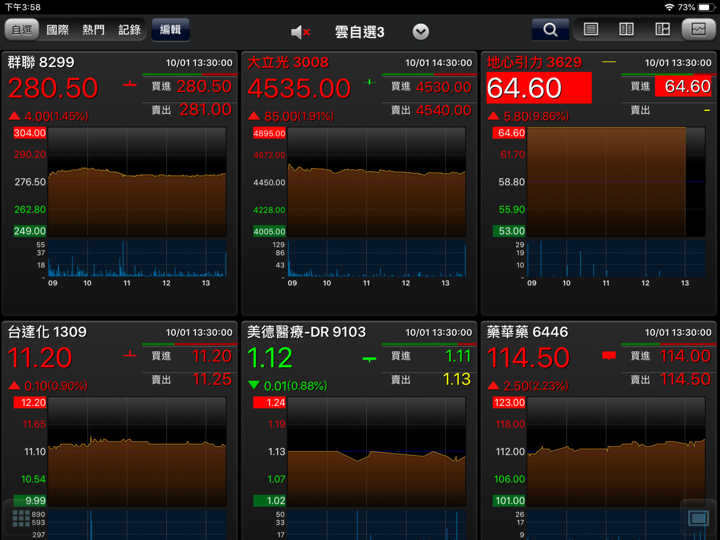

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para qué tipo de inversor |

| MetaTrader 4 | ✔ | Windows, MAC, IOS y Android | Inversores de todos los niveles de experiencia |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

Depósito y Retiro

El monto mínimo de depósito requerido para abrir una cuenta de trading con MasterLink Securities es de $100 para cuentas estándar, $500 para cuentas Oro y $1,000 para cuentas Platino.