점수

charles SCHWAB

미국 | 5-10년 |

미국 | 5-10년 |https://www.schwab.com/

공식 사이트

평점 지수

영향력

영향력

AAA

영향력 지수 NO.1

미국 9.97

미국 9.97 연락처

외환 규제

외환 규제

외환 거래 라이선스를 찾을 수 없습니다. 위험에 유의하시기 바랍니다.

- 해당 브로커는 유효한 외환 규제를 받고 있지 않습니다. 위험에 주의하세요!

기본 정보

미국

미국 charles SCHWAB 을(를) 본 사용자는 또다시 열람했습니다...

FXCM

GTCFX

STARTRADER

HANTEC MARKETS

검색 소스

캠페인 언어

시장 분석

캠페인 소재

웹사이트 감정

schwab.com

162.93.215.103schwab.com.hk

162.93.210.100tdameritrade.com

198.200.171.204tdameritrade.com.sg

198.200.171.26tdameritrade.com.hk

198.200.170.20

관계 계보

관련 회사

위키 Q&A

Does Charles Schwab have any cons?

As much as I appreciate the services offered by Charles Schwab, there are a few areas where I believe they could improve, especially when it comes to the Charles Schwab leverage options available. Schwab offers leverage of up to 2:1 for equities in margin accounts, meaning I can borrow up to 50% of the value of the securities I am trading. While this is typical for most brokers, some advanced traders, including myself, would appreciate a bit more flexibility, especially when trading higher-risk assets like options or futures. For someone like me who trades actively, this conservative approach can sometimes limit my ability to execute more aggressive strategies. Furthermore, Schwab is primarily focused on the U.S. market, and as such, investors looking for easy access to international markets may find this platform limiting. While Schwab does offer global accounts, their international trading options are somewhat restricted compared to brokers that are more focused on global diversification. Another drawback I encountered is that while Schwab offers great customer service, their thinkorswim® platform, which is geared toward advanced traders, can be quite complex for beginners. I recall feeling slightly overwhelmed by the sheer number of tools and features, which I didn’t initially know how to use effectively. For novice traders, this can be a bit intimidating and could potentially delay the learning curve. However, once I became familiar with it, thinkorswim® provided some of the most powerful trading tools I’ve ever used. In conclusion, while these cons are notable, I still find Schwab to be a great platform due to its overall reliability, excellent educational resources, and transparent fee structure.

Is Charles Schwab regulated? Is it safe and legit?

In my experience, Charles Schwab is a reliable and secure brokerage, despite its regulatory status with the SFC being revoked. Schwab operates under U.S. financial regulations, and it is a member of SIPC (Securities Investor Protection Corporation), which offers protection for customers' securities, up to $500,000, including $250,000 in cash. This SIPC protection gives me confidence that my assets are secure, and it provides peace of mind in case of unforeseen circumstances. Additionally, Schwab Bank is FDIC-insured, which means that any funds in my Schwab Bank accounts are covered up to $250,000 per depositor, further adding to the safety of my funds. Although the revocation of SFC regulation might seem concerning for non-U.S. investors, the extensive regulatory framework that Schwab adheres to within the United States ensures that I am well-protected as an investor. When I first registered and logged into my Charles Schwab account, I found that Schwab makes security a top priority, which reassured me. While the revoked status from SFC might limit Schwab's activities in some regions, its extensive regulatory background and customer protection mechanisms make it a trustworthy platform for me. Therefore, despite this revocation, I still feel comfortable with Schwab’s overall security and regulatory compliance.

Which payment methods does Charles Schwab support for deposits?

One of the reasons I continue using Charles Schwab is the variety of methods available for depositing funds. Schwab supports electronic funds transfers (EFT), which allow me to quickly transfer money from my bank account to Schwab. I also appreciate that Schwab accepts wire transfers and checks for deposits, giving me flexibility depending on my situation. I’ve personally used EFT for deposits, and it’s always been a smooth and fast process. Additionally, Schwab allows direct deposit, which is a great feature if I want to automate my contributions. Having the ability to easily deposit funds into my Schwab account ensures that I can invest whenever I want without worrying about the logistics of funding my account. Schwab’s deposit methods are reliable and easy to use, which is why I’ve never encountered any issues when adding funds to my account.

Can I know the details about Charles Schwab's fees?

One of the things I value about Charles Schwab is their transparency regarding fees. As a regular user of their services, I was relieved to discover that they offer commission-free trading for most online stocks, ETFs, and options. This was particularly appealing to me as an active trader, because avoiding commissions means I can keep more of my investment returns. However, I did notice that for options trades, Schwab charges a $0.65 fee per contract, which is fairly typical across the industry. I also encountered some mutual fund transaction fees, particularly for those outside Schwab's OneSource® program, which can go up to $74.95 per trade. Despite these exceptions, I find Schwab’s overall fee structure to be highly competitive. Additionally, Schwab does not charge account maintenance or inactivity fees, and the Charles Schwab minimum deposit requirement for most accounts is $0, which makes it very accessible. I also appreciate that Schwab provides detailed information on all fees upfront, so there are no surprises. I was able to easily find all the pricing details on their website, which helped me make an informed decision. The absence of hidden fees and the simplicity of their pricing structure makes Schwab an appealing option for me. Overall, I feel that Schwab’s fees are reasonable for the value it provides, and I haven’t encountered any unexpected charges.

사용자리뷰6

댓글을 달고 싶은 내용

입력해 주세요....

평가 6

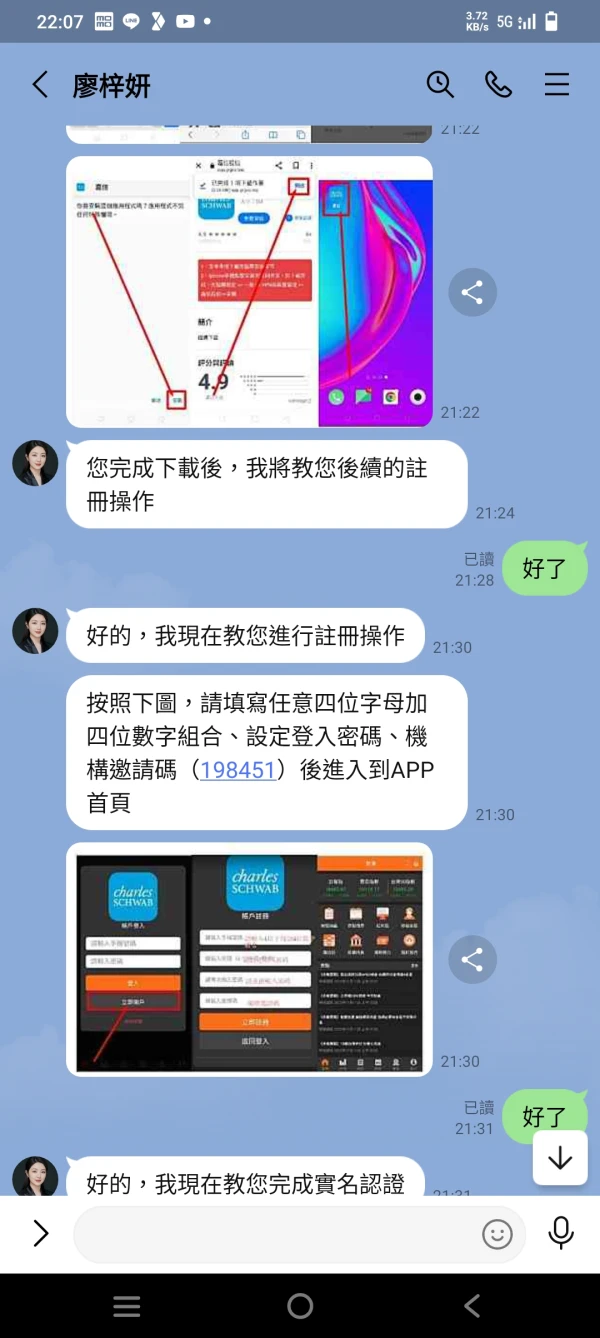

王爺爺

대만

본 증권투자신탁은 HSBC와 동일한 방식을 사용합니다. 먼저 추첨을 통해 20,000위안을 주고, 그 다음에는 100,000위안을 투자하라고 합니다. 외국인 투자자들이 사흘 만에 투자액을 15만 달러 늘렸다. 교장선생님이 있어도 27만이면 운영을 따라갈 수 있습니다. 이 3일 동안의 수입은 귀하의 것입니다. 3일이 지나면 17만 원을 전액 투자하고 원금과 3일간의 영업이익만 남게 됩니다. 처음에는 소액 출금이 허용되며, 점차적으로 출금이 허용되지 않습니다. 마지막으로 합의해서 이익금의 절반을 먼저 송금해 달라고 한 뒤 원금과 이익금을 송금해 줍니다. 위의 내용이 새로운 사기 수법입니다. 나처럼 속는 사람이 없기를 바랍니다.

신고

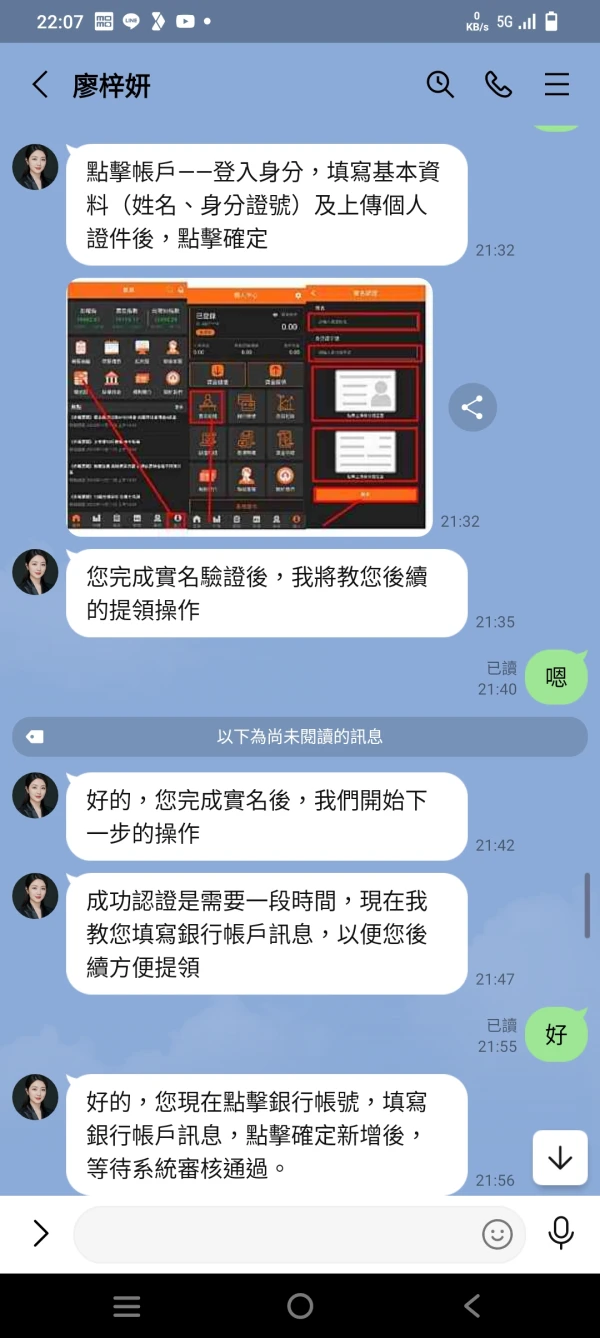

kang Rona

인도네시아

자금 인출과 관련하여 도움을 줄 수 있는 사람이 있나요? 사기가 아닐까 걱정되고.. CE에서 돈도 많이 투자했는데.. 인출금액의 15% 세금을 내야하는데..

신고

Gerhard Van Wyk

남아프리카 공화국

저는 5월 4일에 가입했습니다. 그들이 수수료를 요구할 때마다 지불금에 대해 거짓말을 할 때마다. 그들은 단어에 매우 매끄럽습니다.

신고

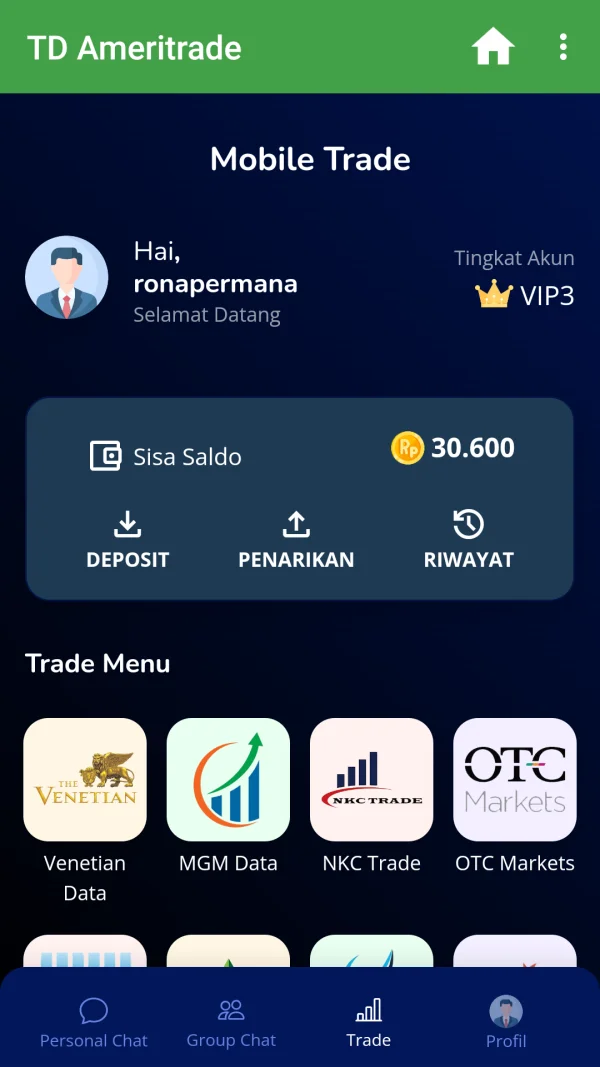

Đỗ Văn Ngọc

호주

TD Ameritrade의 웹사이트는 매우 전문적으로 보이지만 전체 웹사이트를 검색했는데 규제 라이선스에 대한 정보를 찾을 수 없었습니다. 회사가 엄격하게 규제된다면 고객의 신뢰를 얻기 위해 큰 소리로 말해야겠죠?

좋은 평가

♔

홍콩

TD Ameritrade로 계좌를 개설하는 데 $25,000의 비용이 듭니다. 그래서 당분간 거래를 생각하지 않습니다. 이 회사가 어떻게 되고 있는지 보기 위해 기다리고 또 볼 수 있게 되었습니다.

중간 평가

墨香

아르헨티나

사실 저는 TD A의 거래 경험을 좋아합니다. 거의 2년 동안 외환 거래를 해왔지만 지속적으로 또는 집중적으로 거래한 것은 아닙니다. 경험이 많다고 말할 수는 없지만 TDA의 조건과 서비스는 나에게 만족스러운. 나는 여전히 정상적으로 인출할 수 있기 때문에 wikifx가 규제되지 않는다고 말하는 이유를 이해할 수 없습니다.

좋은 평가