회사 소개

| NINJA TRADER리뷰 요약 | |

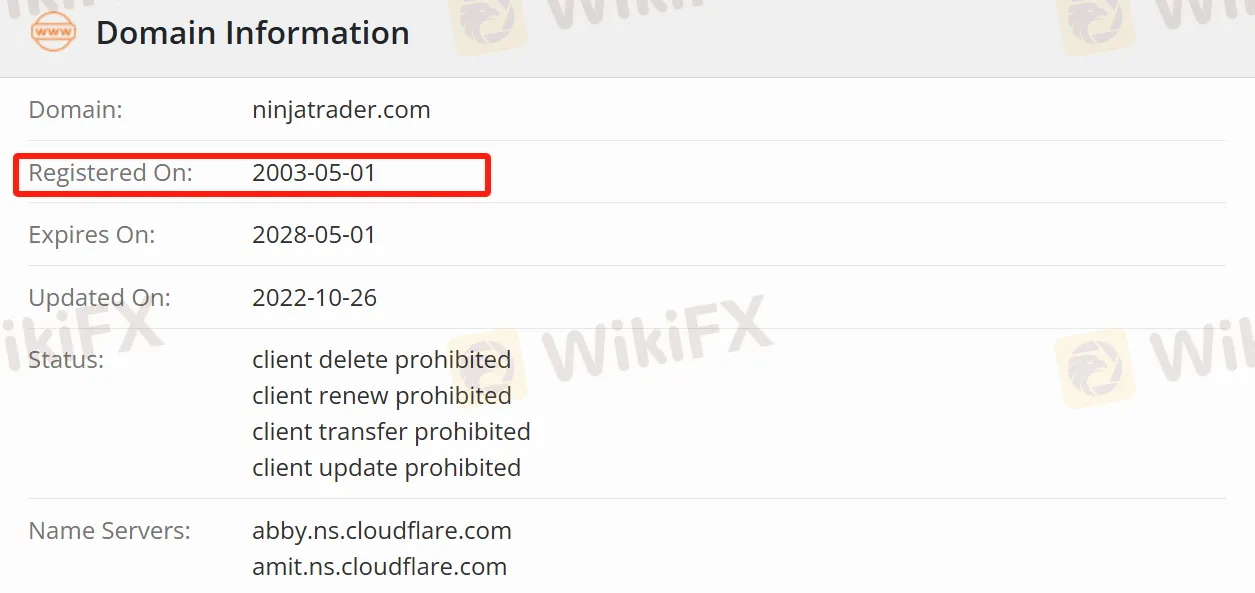

| 등록일 | 2003-05-01 |

| 등록 국가/지역 | 미국 |

| 규제 | 의심스러운 클론 |

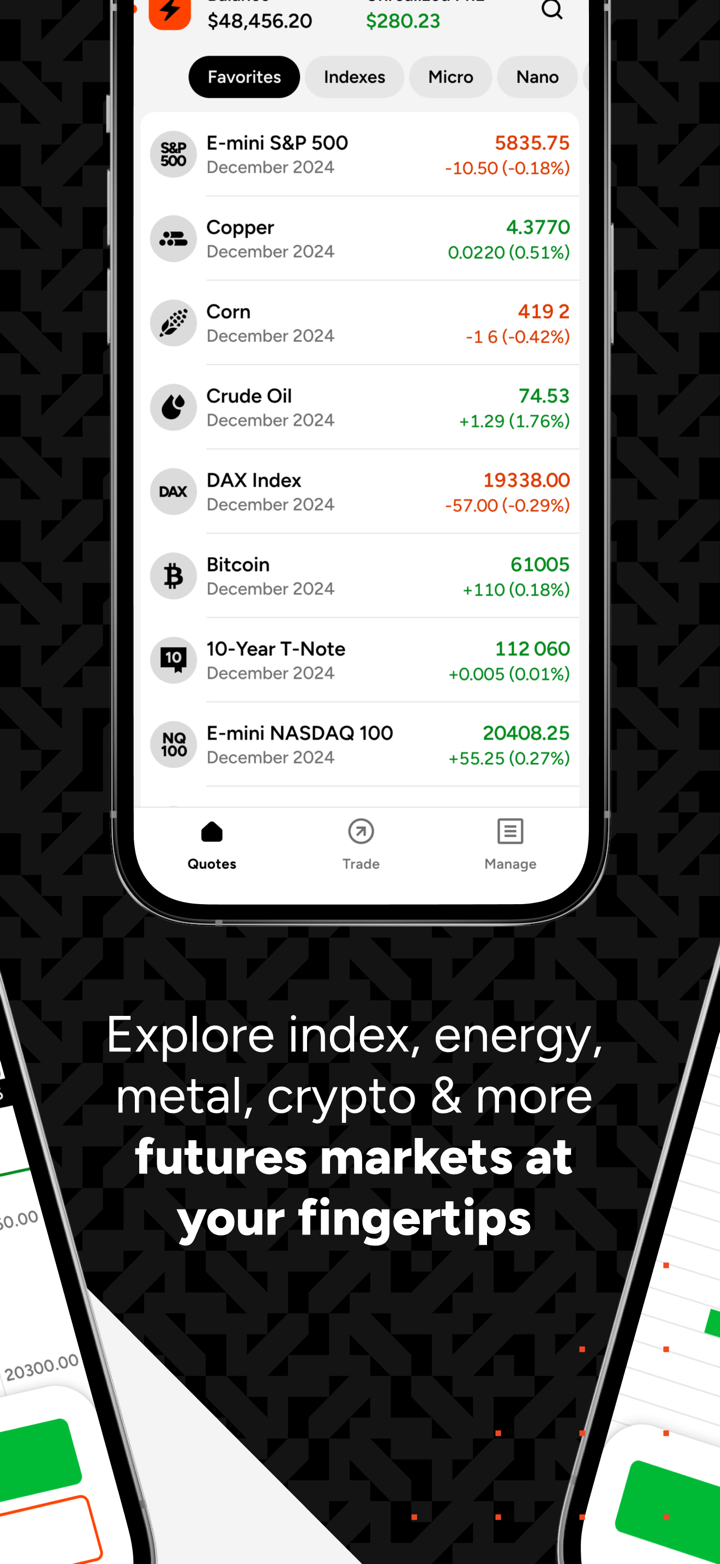

| 시장 상품 | 지수 선물 계약, 암호화폐 선물 계약, 금속 선물 계약 및 에너지 선물 계약 |

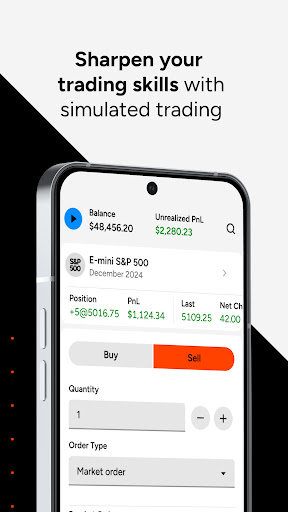

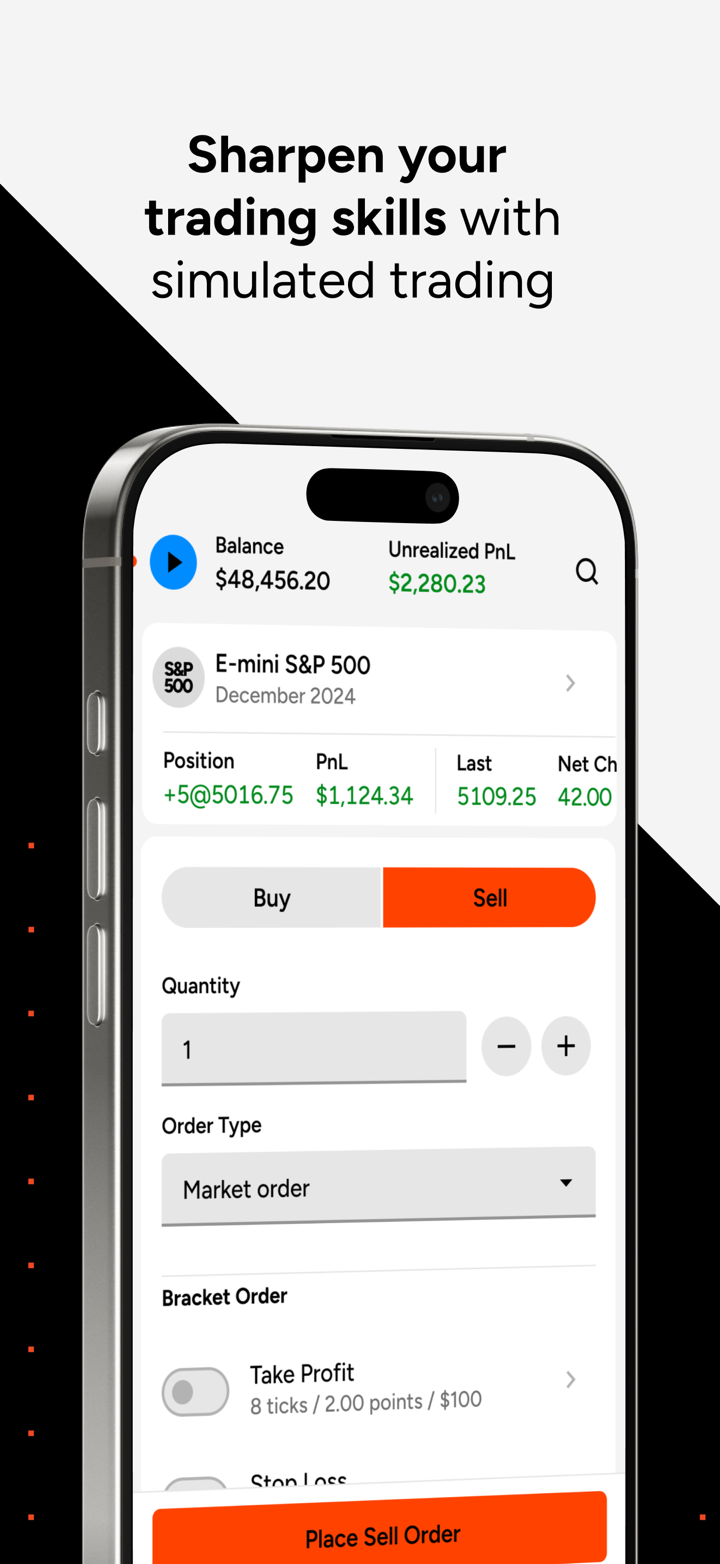

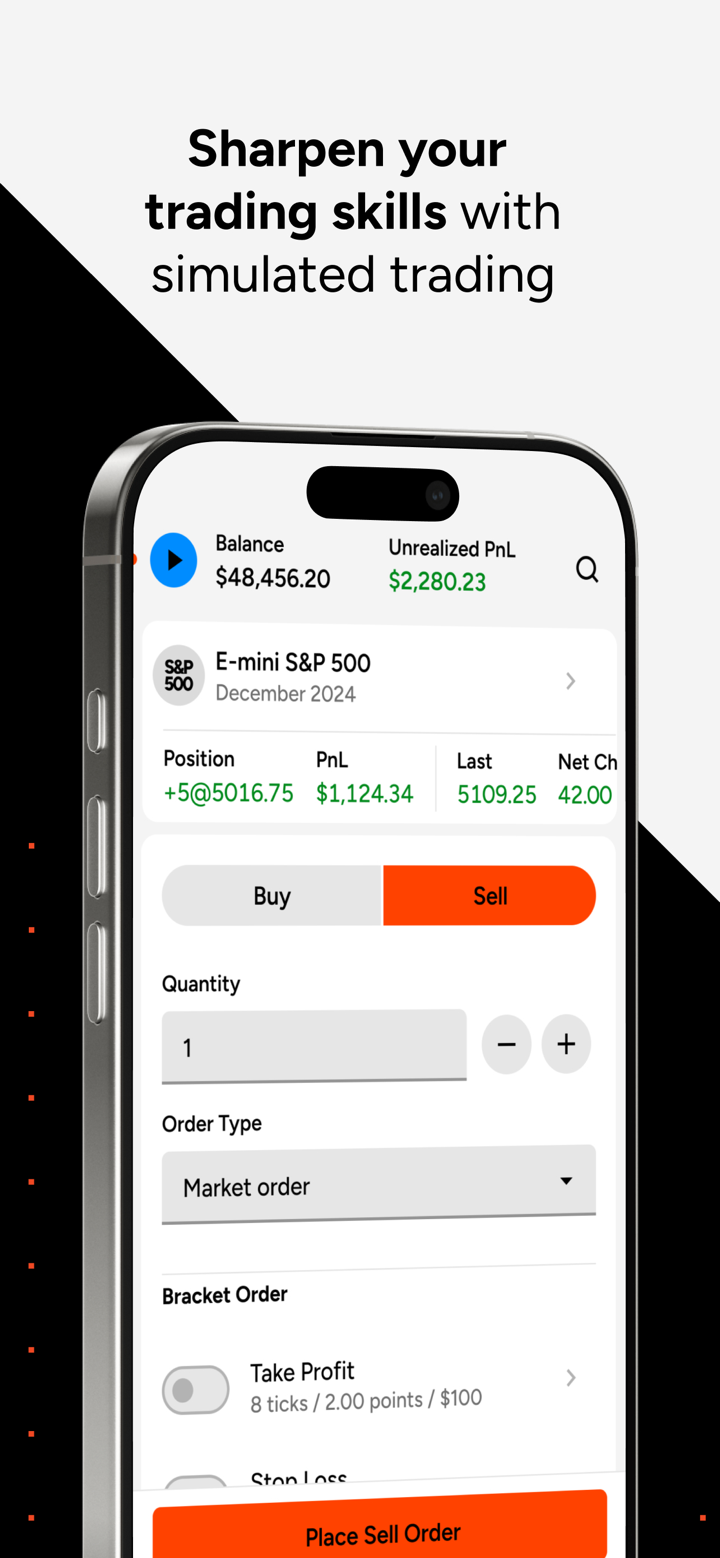

| 모의 거래 | ✅ |

| 거래 플랫폼 | NinjaTrader (데스크톱, 웹 및 모바일) |

| 최소 입금 | 없음 |

| 고객 지원 | 800-496-1683 |

| support@ninjatrader.com | |

| 실시간 채팅 | |

| 트위터, 페이스북, 유튜브, 링크드인, 인스타그램 | |

NINJA TRADER 정보

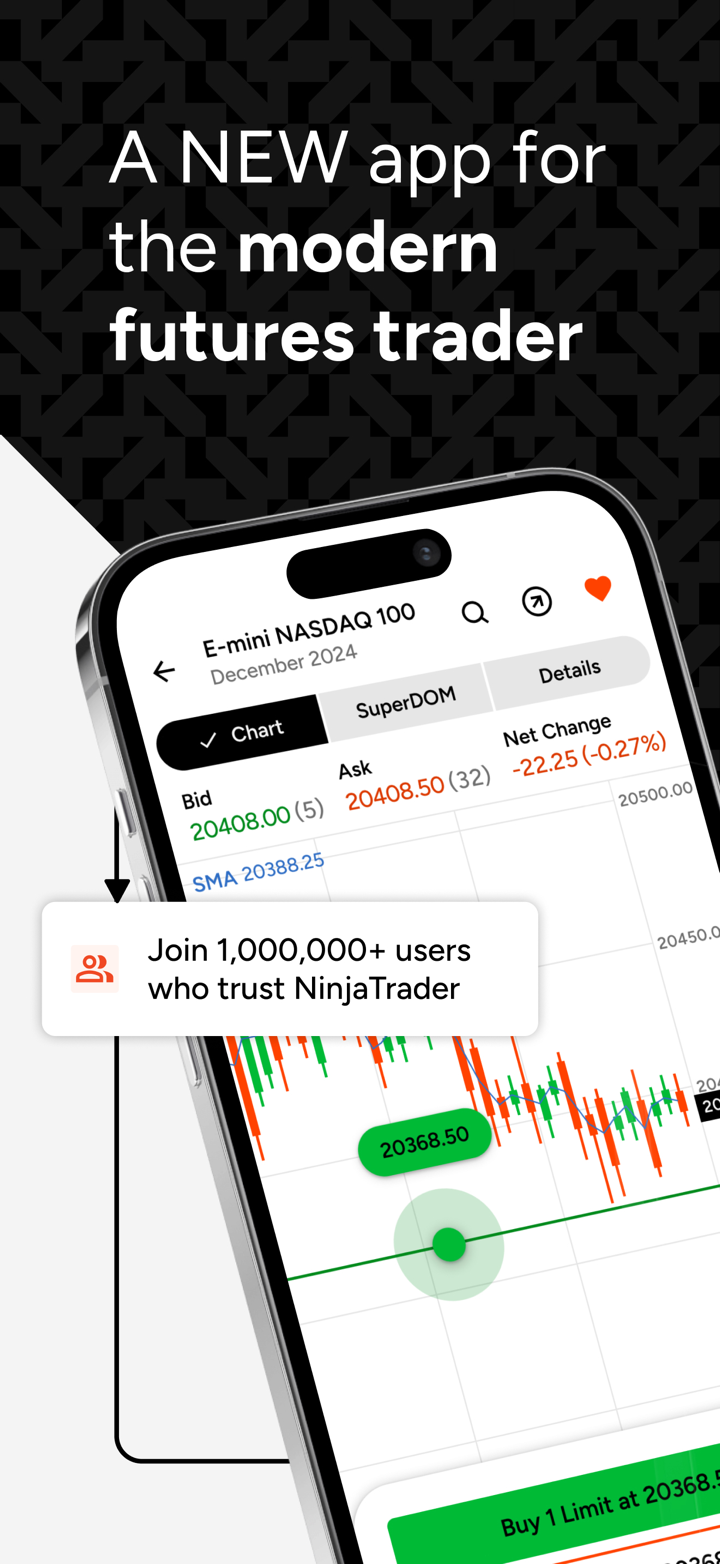

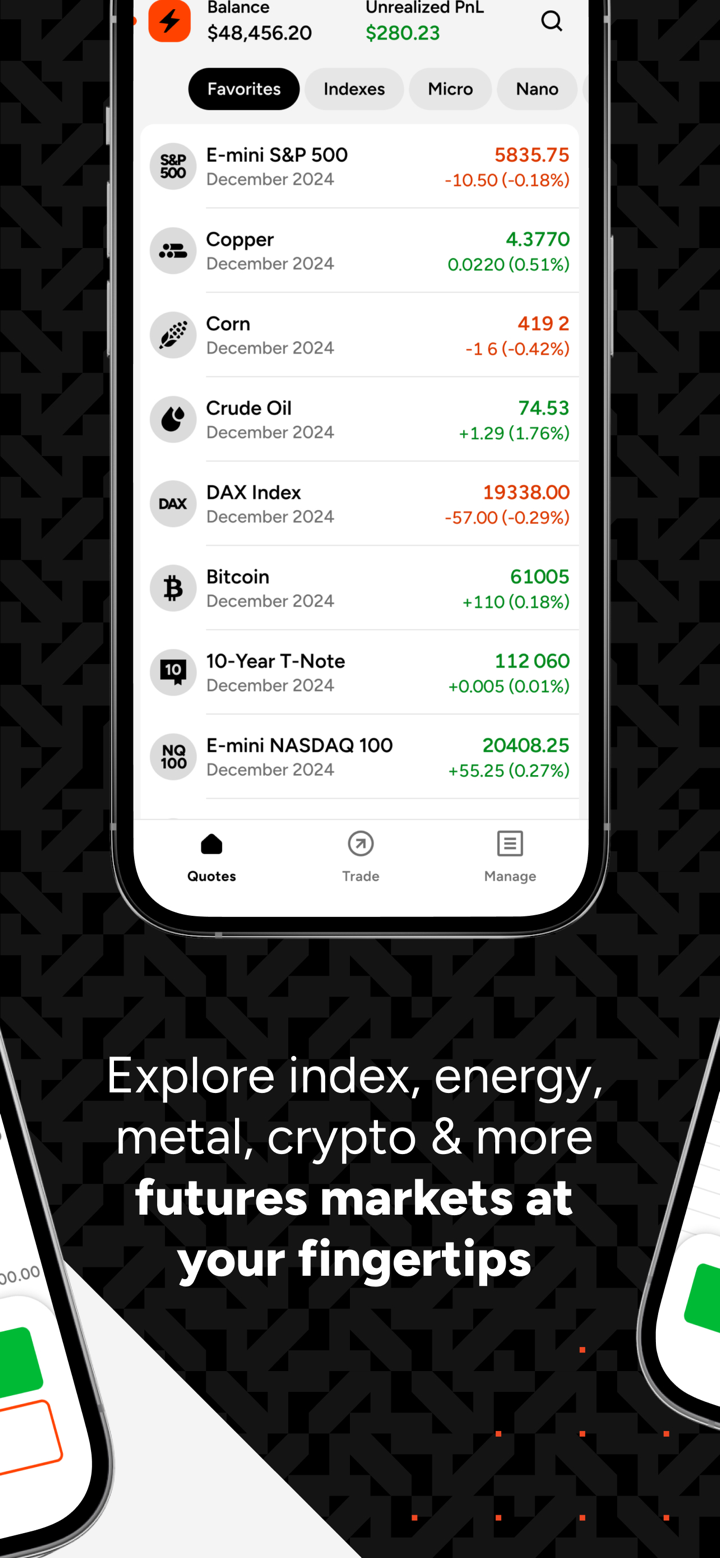

NinjaTrader는 선물 거래에 특화된 중개업체입니다. 최소 입금 요건이 없으며 낮은 마진과 수수료를 제공하며 멀티 디바이스 동기화 거래 플랫폼을 제공합니다. 이 플랫폼은 지수, 암호화폐, 금속 및 에너지와 같은 100개 이상의 선물 계약을 포함한 주요 글로벌 선물 시장을 지원합니다.

장단점

| 장점 | 단점 |

| 최소 입금 요건 없음 | 의심스러운 클론 |

| 소액 자금 트레이더에게 친숙함 | 계정 정보 불명확 |

| 멀티 터미널 통합 플랫폼 | 비교적 단일한 거래 종류 (선물만) |

| 무료 모의 훈련 | |

| 낮은 마진 ($50) | |

| 낮은 수수료 (계약당 $0.09) |

NINJA TRADER 합법적인가요?

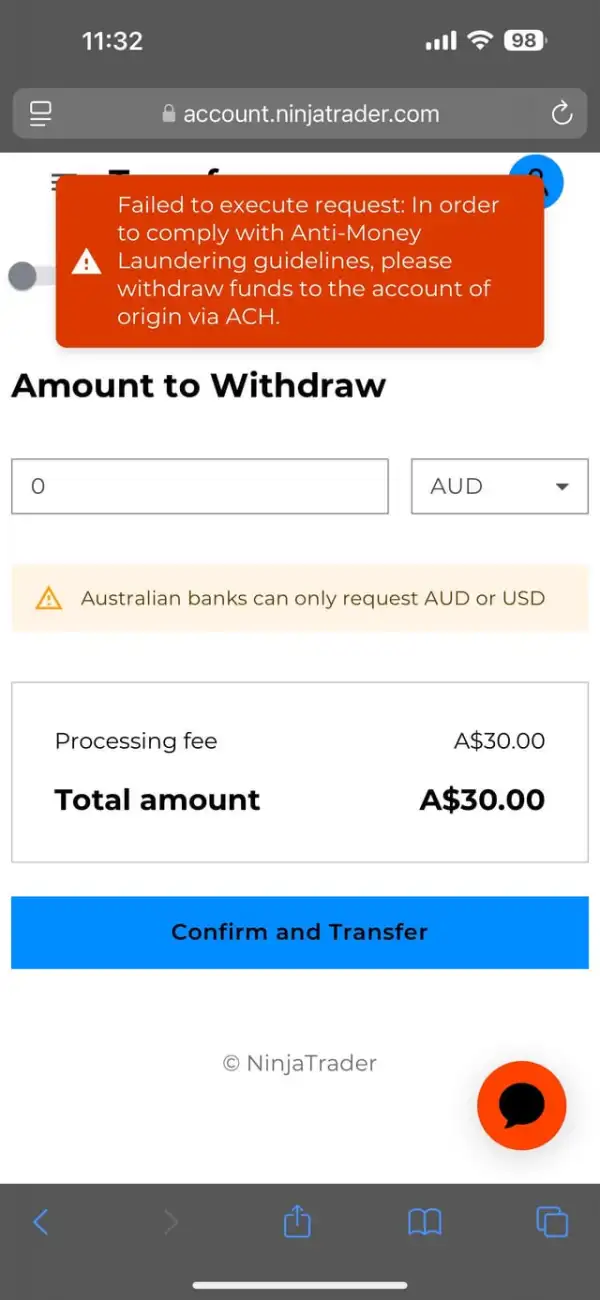

NinjaTrader는 미국의 국가 선물 협회(NFA)에 의해 규제되는 준수 중개업체이지만 규제 상태는 "의심스러운 클론"으로 나와 있습니다. 거래 활동에 엄격한 규제를 갖춘 중개업체를 우선적으로 선택하는 것이 좋습니다.

NINJA TRADER에서 무엇을 거래할 수 있나요?

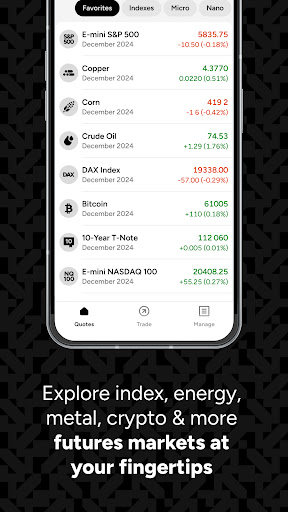

NinjaTrader는 지수, 암호화폐, 금속 및 에너지와 같은 100개 이상의 선물 계약을 거래할 수 있습니다.

| 거래 가능한 상품 | 지원됨 |

| 지수 선물 계약 | ✔ |

| 암호화폐 선물 계약 | ✔ |

| 금속 선물 계약 | ✔ |

| 에너지 선물 계약 | ✔ |

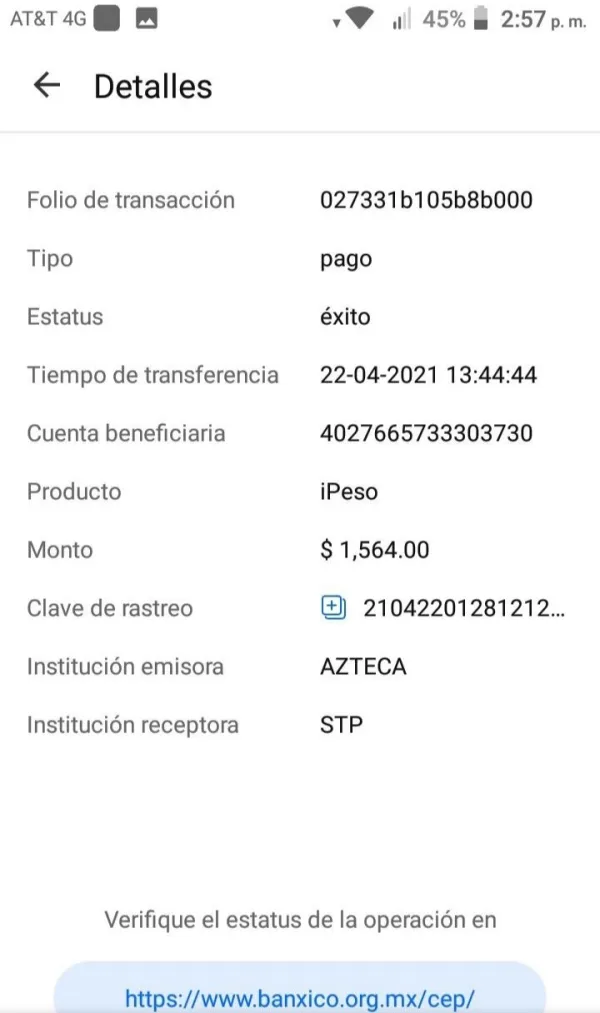

NINJA TRADER 수수료

거래자들은 이 선물 브로커와 최소 입금액 없이 거래를 시작할 수 있으며, 데이 트레이딩 마진은 $50이며, 미니 계약 당 수수료는 $0.09로 매우 낮습니다. 인기 있는 선물 시장은 마진만 $500이 필요합니다.

가격 요금제

| 무료 | 월간 | 평생 |

| 거래할 때마다 월간 수수료 없이 지불 | 거래당 수수료를 줄이세요 | 최저 수수료 및 주문 흐름 + 추가 기능 포함 |

| $0.35 / 미니$1.29 / 표준측면 당 수수료 | $0.25 / 미니$0.99 / 표준측면 당 수수료 | $0.09 / 미니$0.59 / 표준측면 당 수수료 |

| $0 (월간 요금 없음) | $99 매월 | $1,499 (일시 금액 지불) |

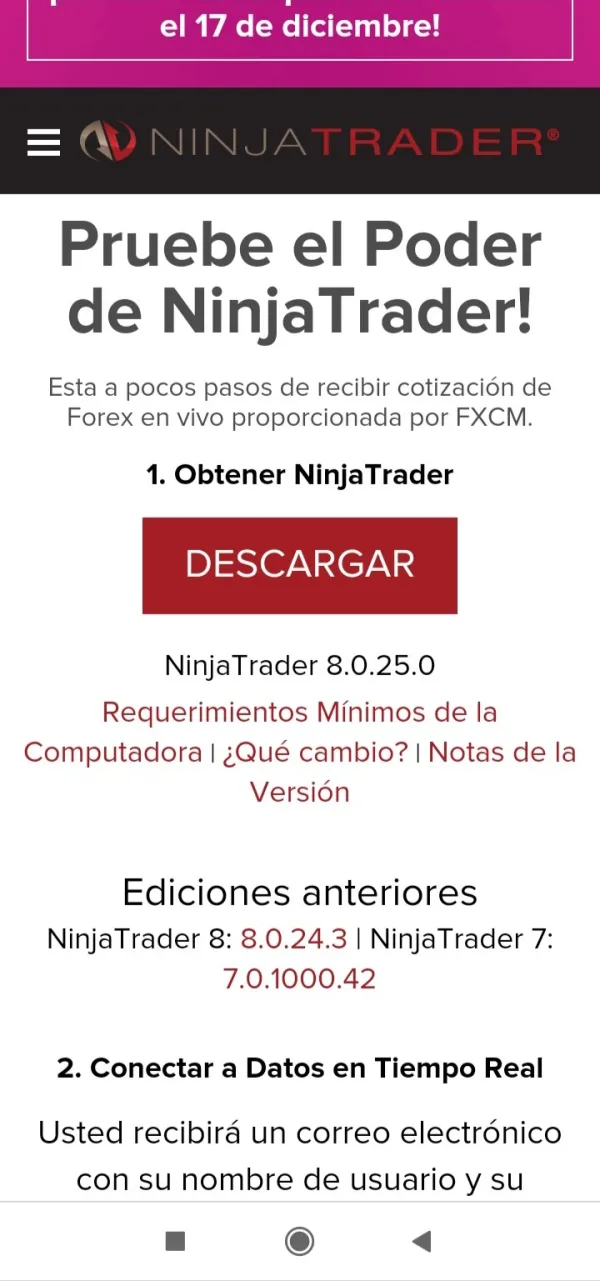

거래 플랫폼

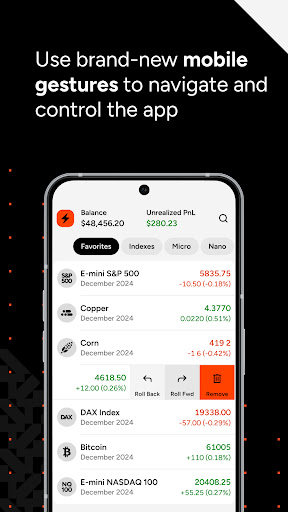

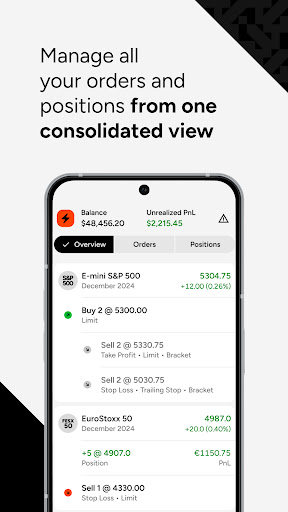

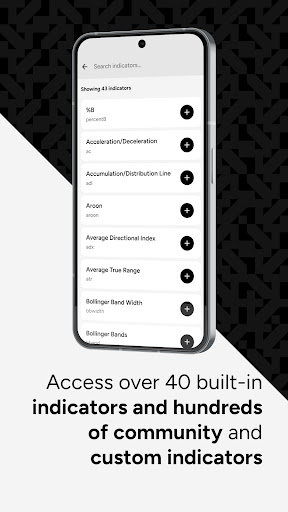

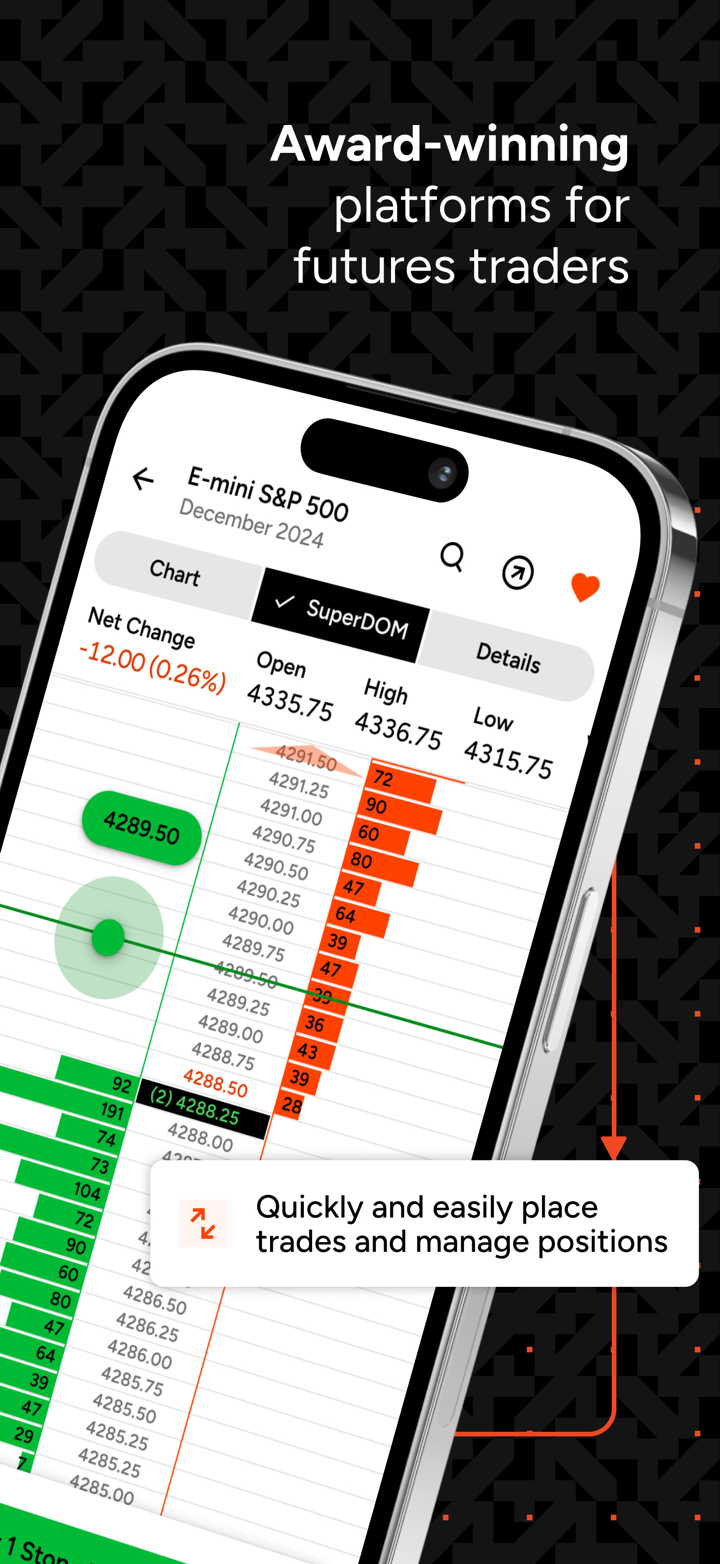

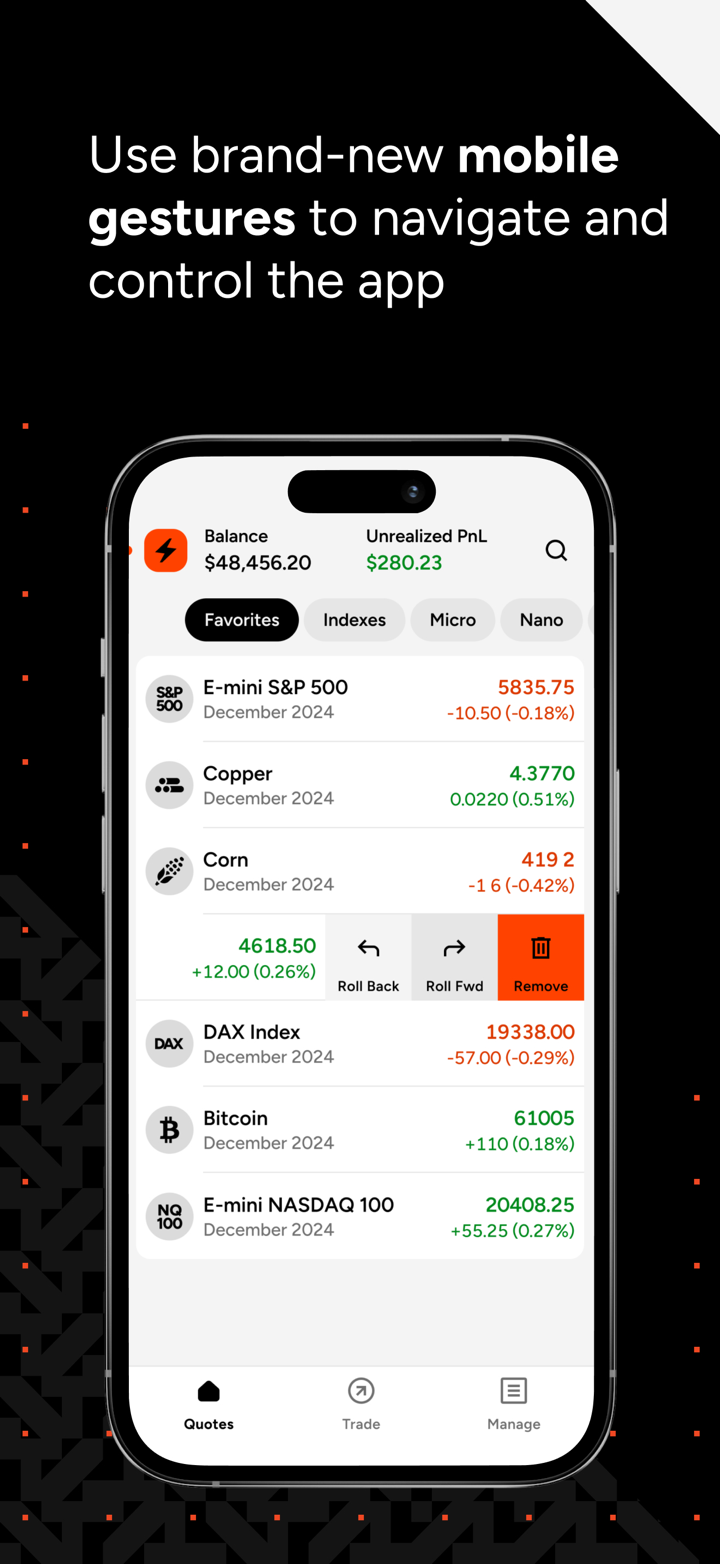

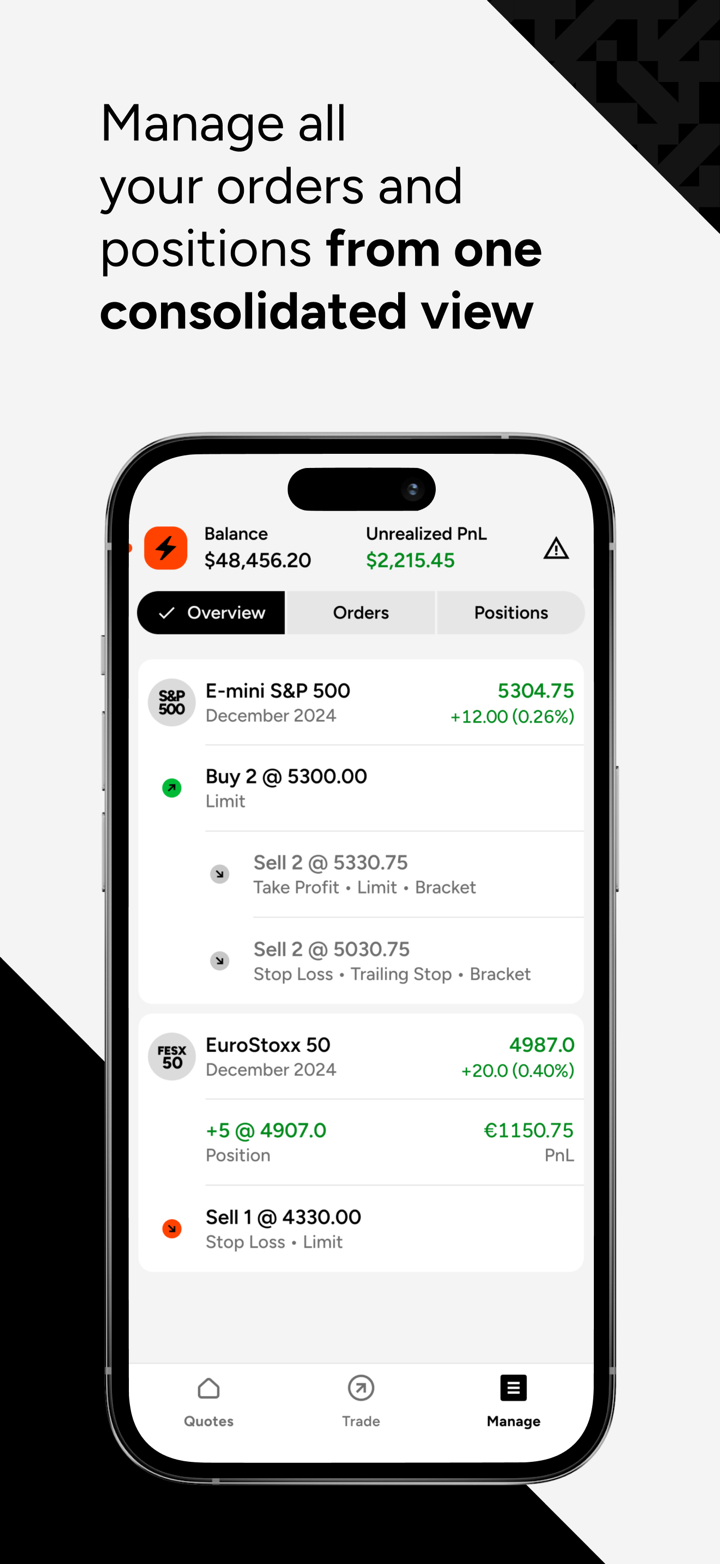

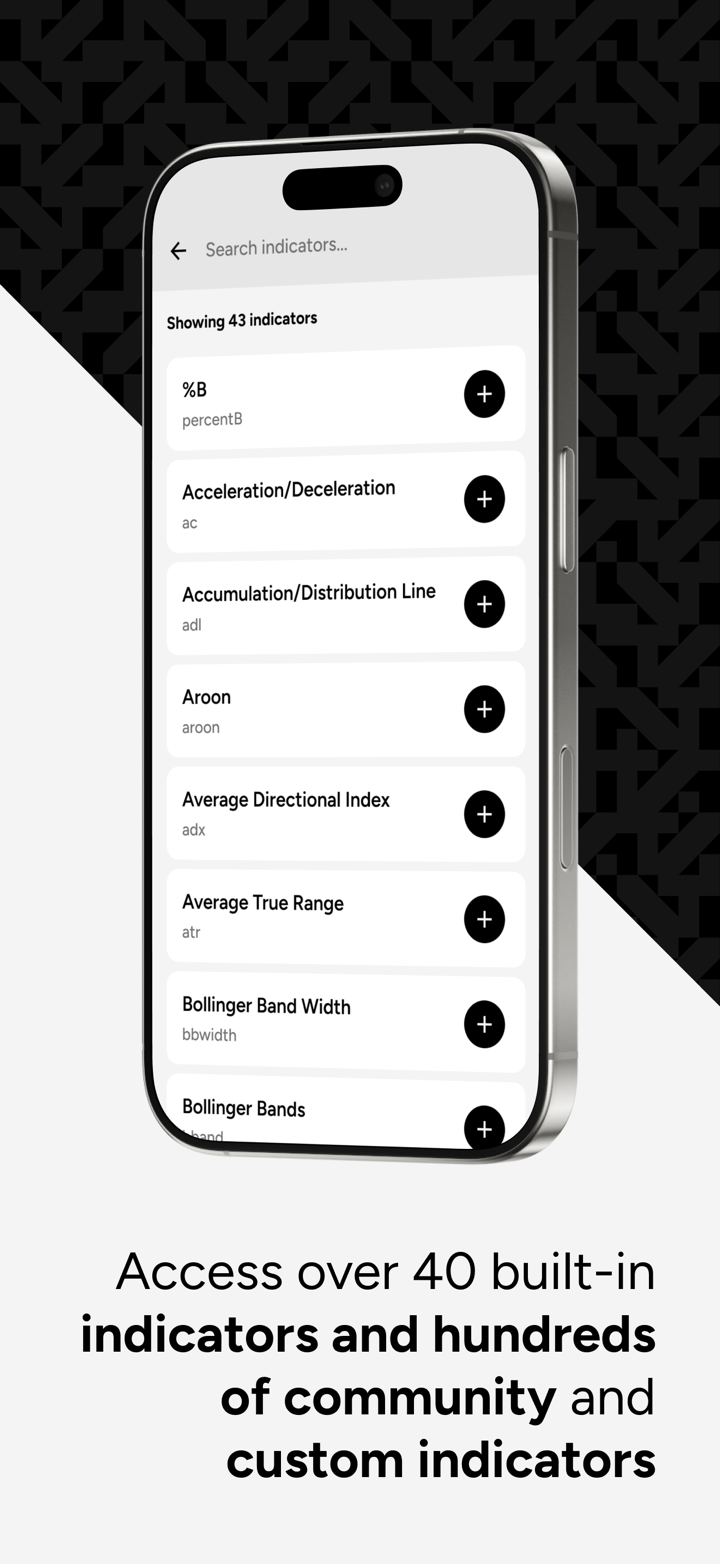

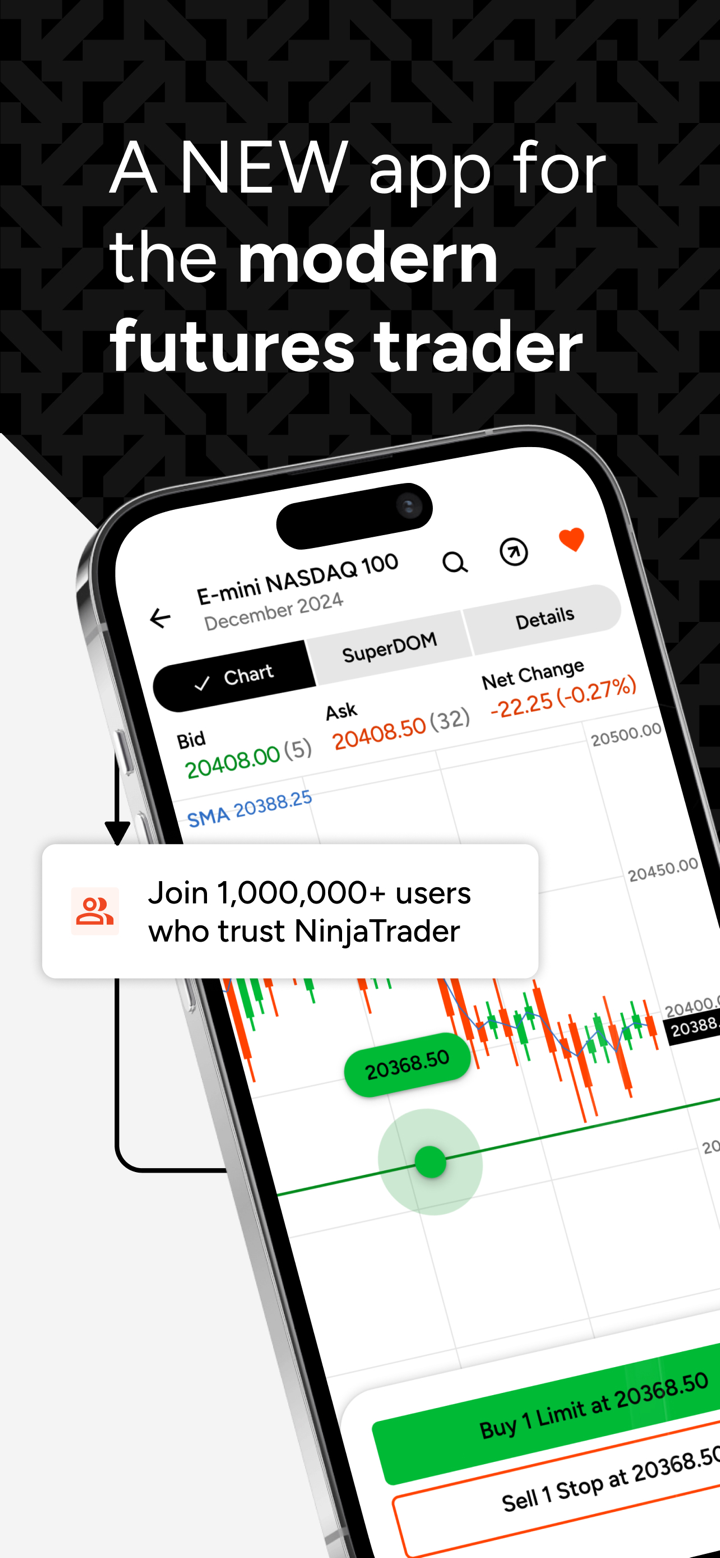

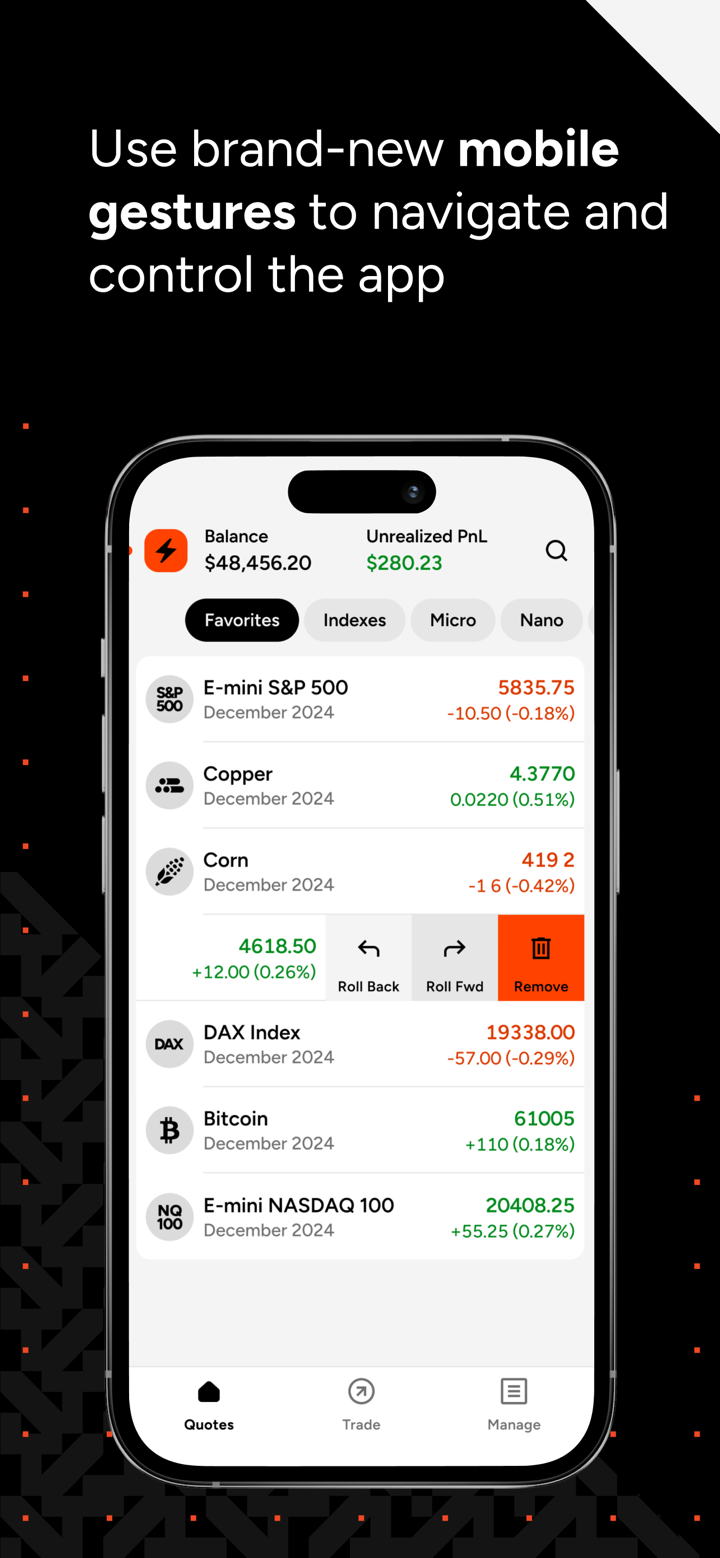

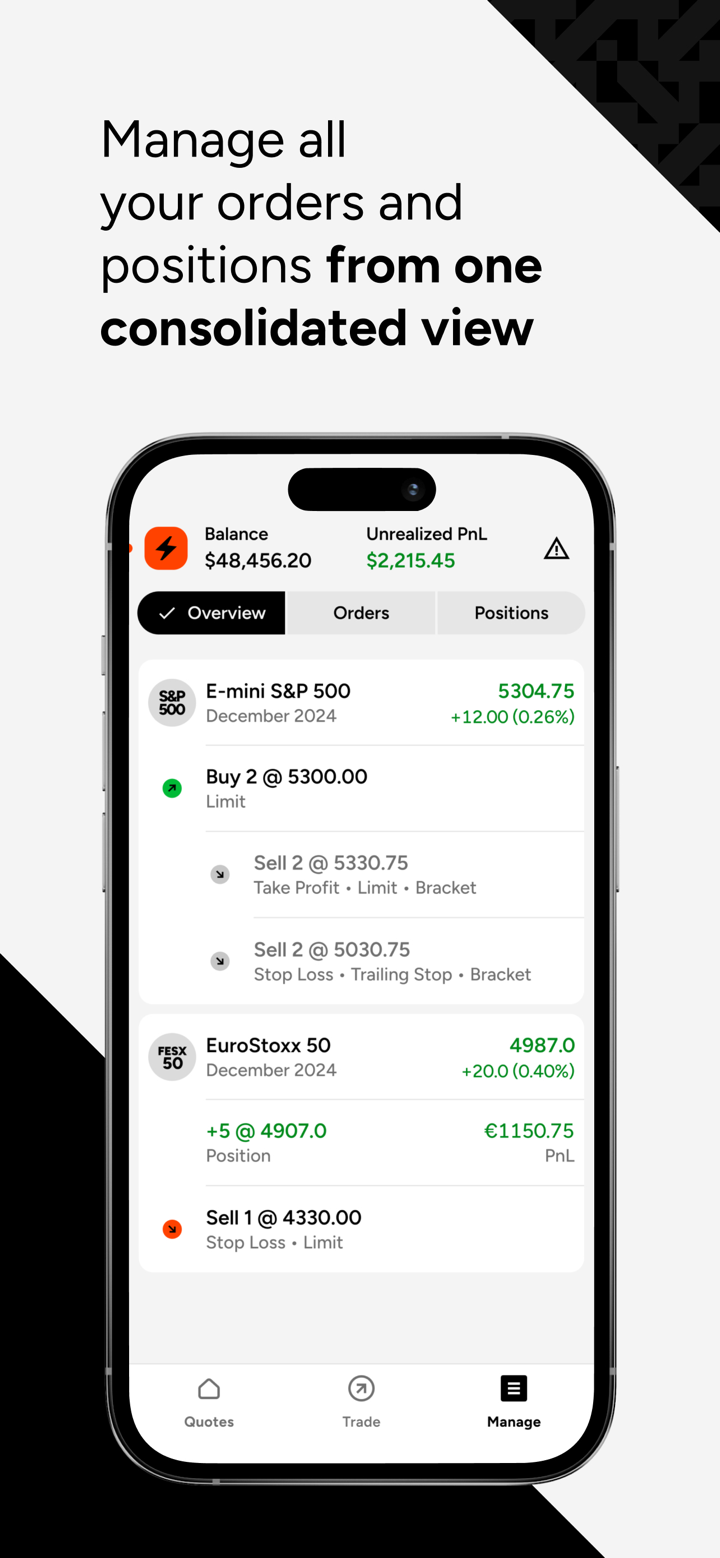

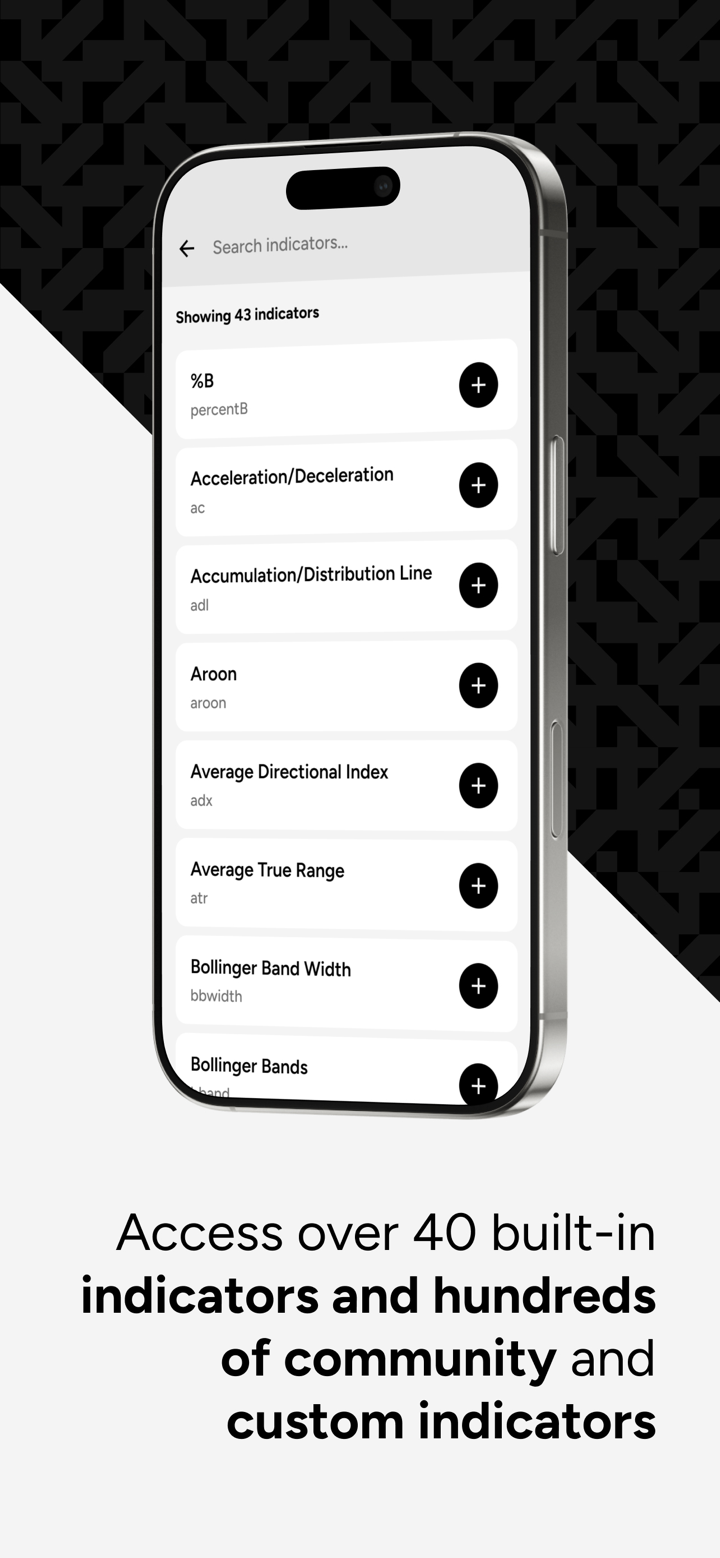

NinjaTrader는 데스크톱, 웹, 모바일(iOS/iPhone) 세 터미널에서 통합된 거래 플랫폼을 제공합니다. 초보자와 숙련된 선물 거래자 모두에게 적합합니다.

| 거래 플랫폼 | 지원됨 | 사용 가능한 장치 | 적합한 대상 |

| NinjaTrader | ✔ | 데스크톱, 웹, 모바일(iOS/iPhone) | 초보자와 숙련된 선물 거래자 |