Riepilogo dell'azienda

Informazioni generali

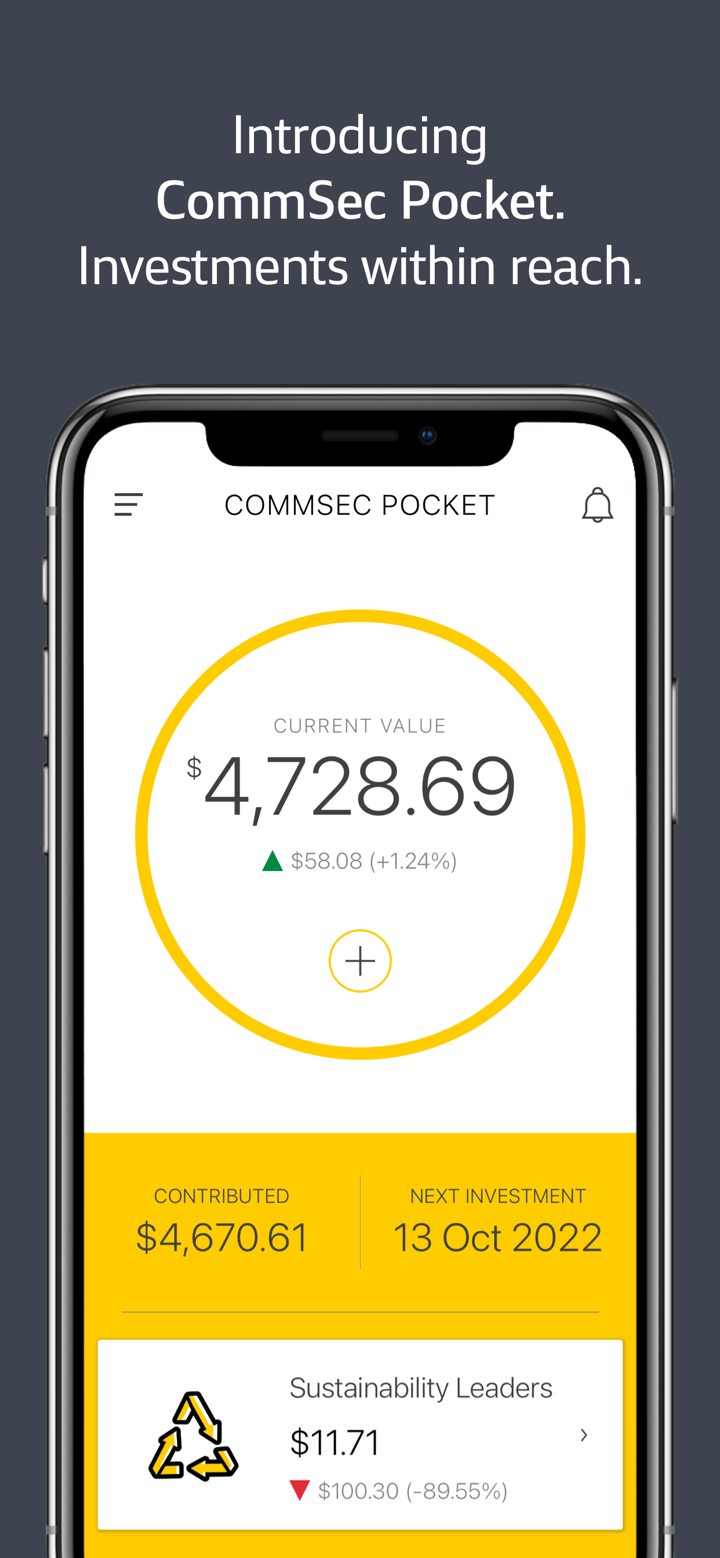

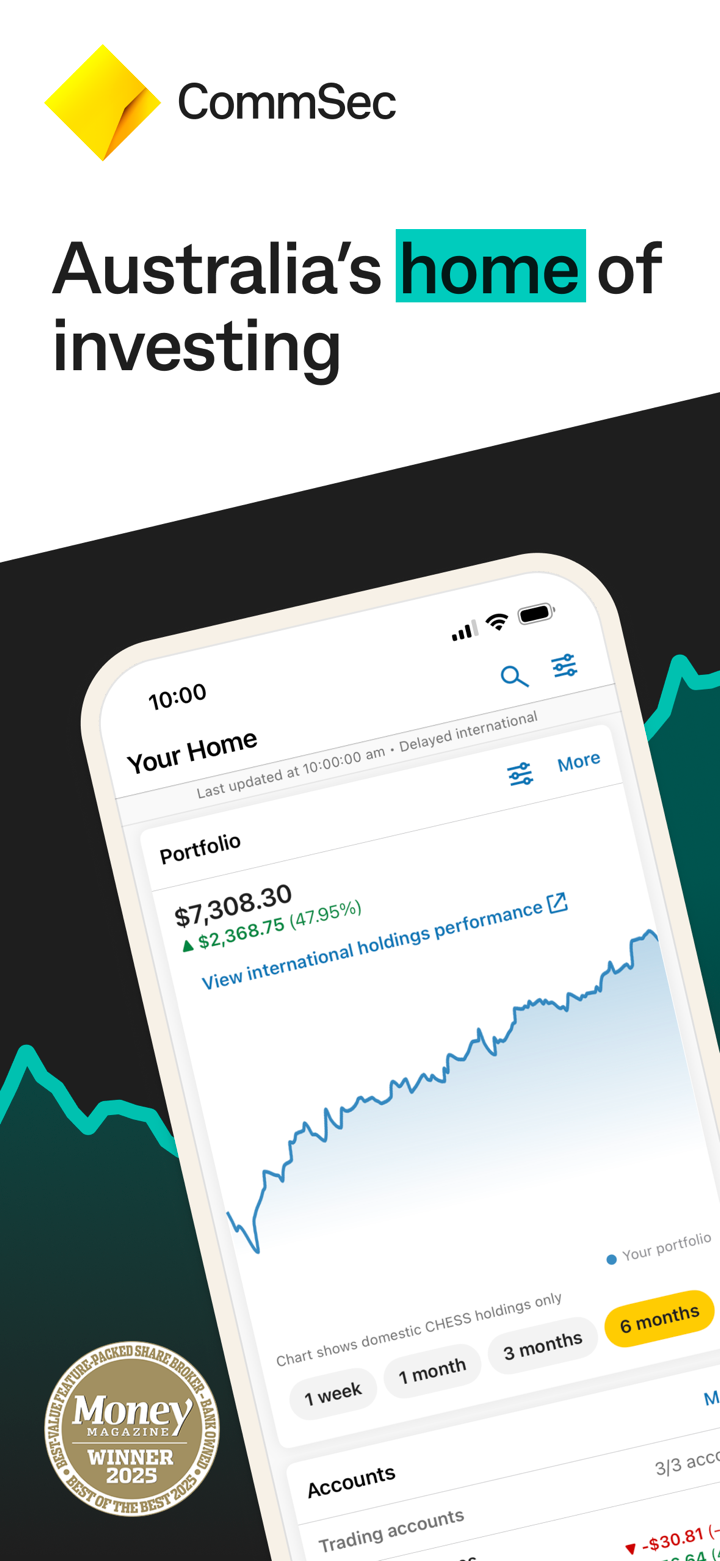

IL Commonwealth Bank of Australia (cba), o CommBank , è una banca multinazionale australiana con attività in Nuova Zelanda, Asia, Stati Uniti e Regno Unito. fornisce una varietà di servizi finanziari tra cui servizi bancari al dettaglio, aziendali e istituzionali, gestione di fondi, fondi pensione, assicurazioni, servizi di investimento e intermediazione. la banca del Commonwealth è la più grande società australiana quotata alla borsa valori australiana ad agosto 2015 con marchi tra cui Bankwest, Colonial First State Investments, Asb Bank (Nuova Zelanda), Commonwealth Securities (Commsec) e Commonwealth Insurance (Comminsure).

Le sue ex parti costitutive erano la Commonwealth Trading Bank of Australia, la Commonwealth Savings Bank of Australia e la Commonwealth Development Bank.

Fondata nel 1911 dal governo australiano e completamente privatizzata nel 1996, la Commonwealth Bank è una delle “quattro grandi” banche australiane, insieme alla National Australia Bank (NAB), ANZ e Westpac. La banca è stata quotata alla Borsa australiana nel 1991.

Struttura bancaria

Servizi bancari al dettaglio

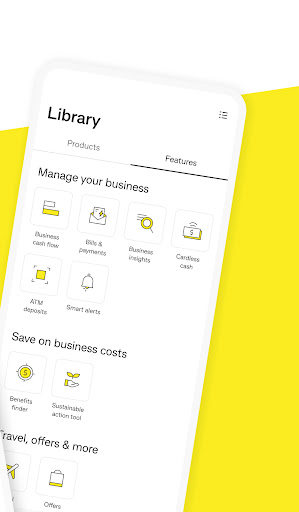

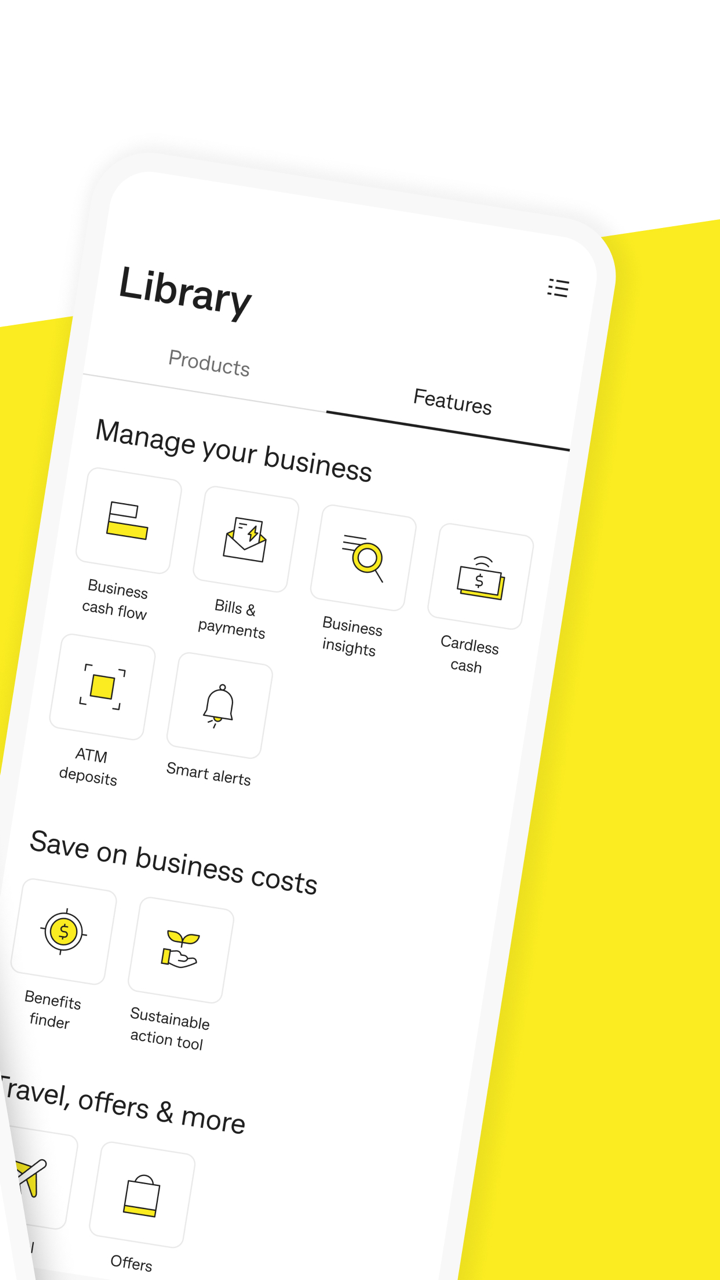

Questa divisione fornisce servizi finanziari a clienti privati e piccole imprese.

Servizio aziendale premium

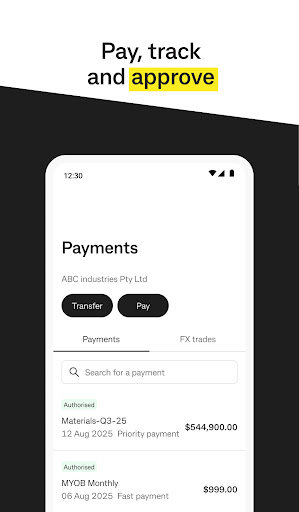

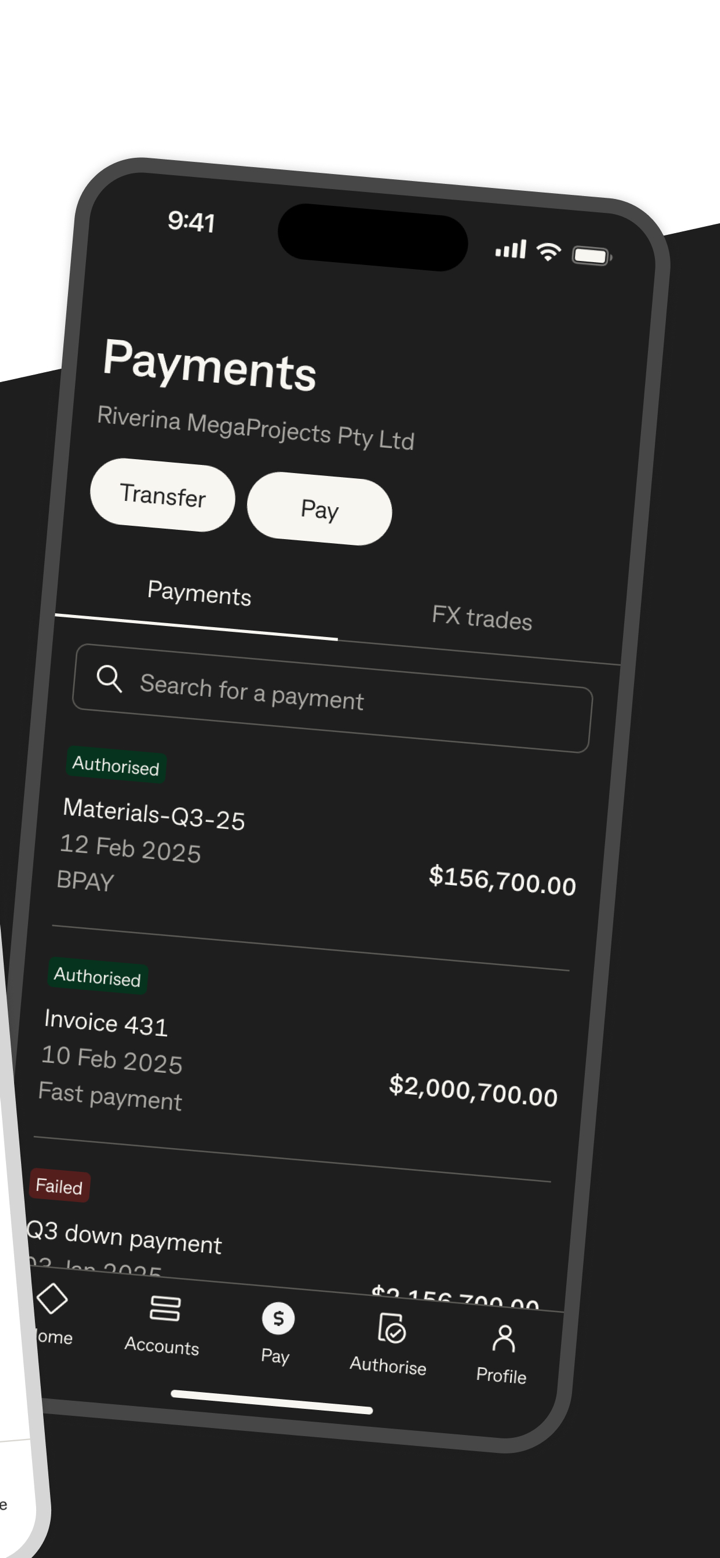

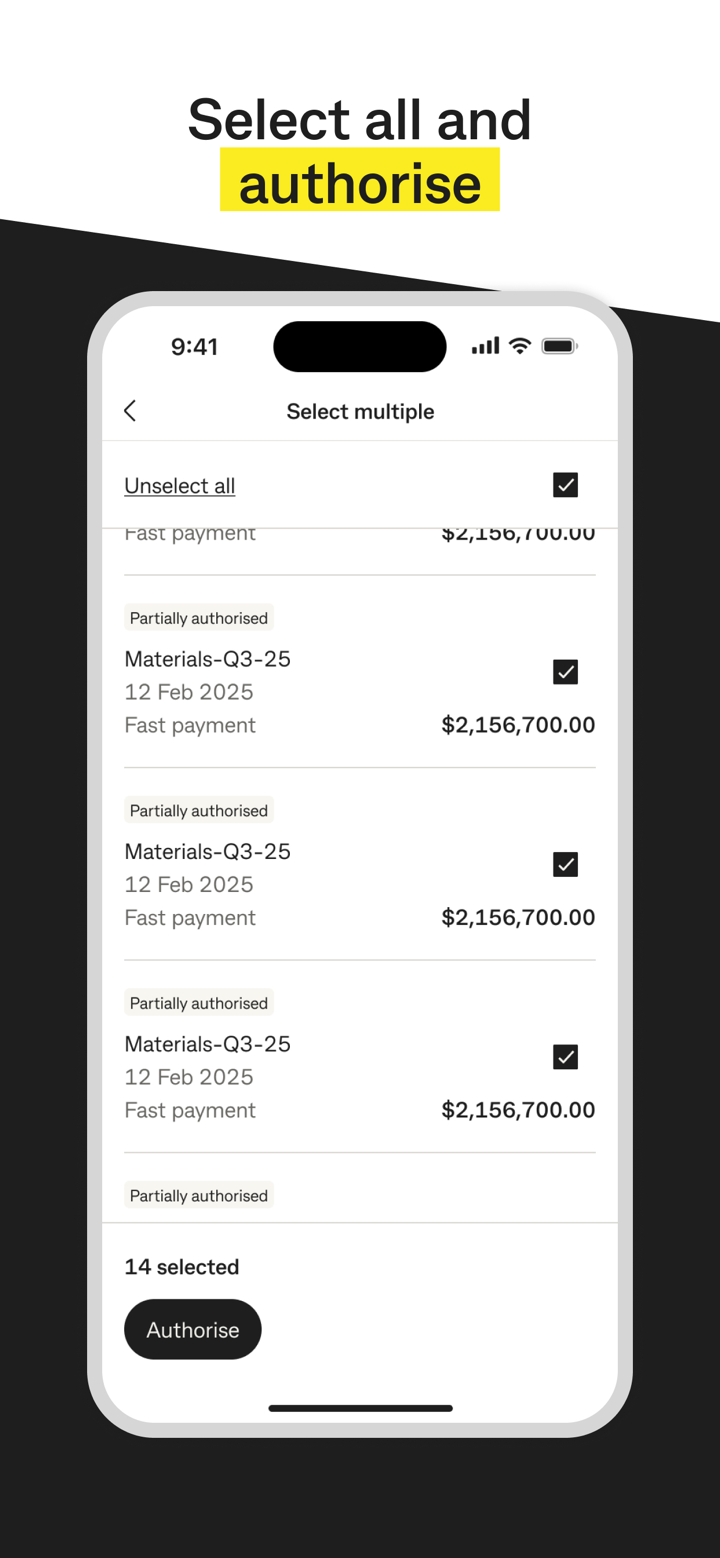

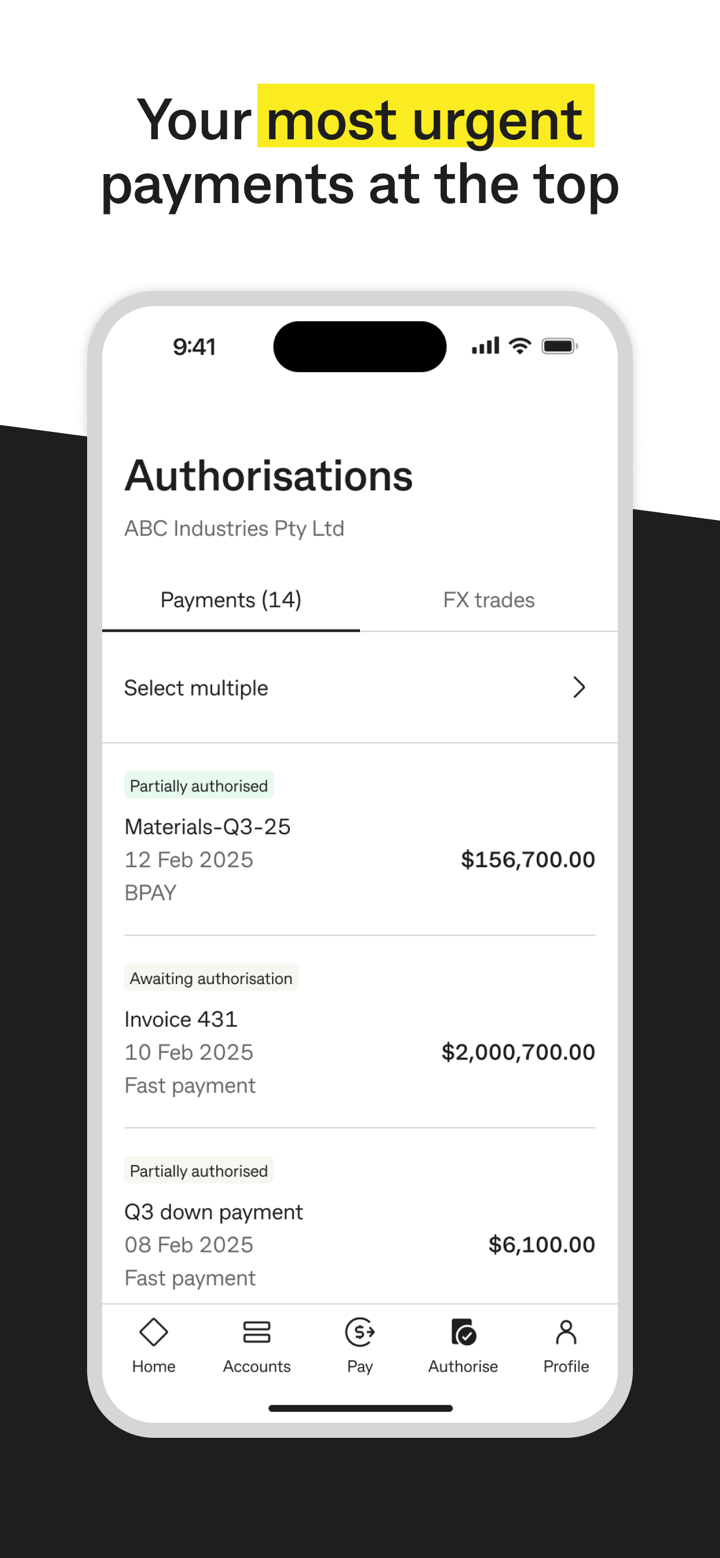

Premium Business Services è stata formalmente suddivisa in due dipartimenti nel 2009, Institutional Banking & Markets (IB&M) e Business & Private Banking (B&PB). IB&M comprende aree della banca che forniscono servizi a Clienti Istituzionali e Mercati Globali. B&PB comprende aree della banca che erogano servizi alla clientela Business e alla clientela Private Banking.

Gestione patrimoniale

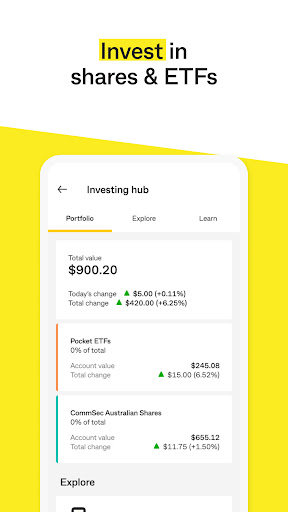

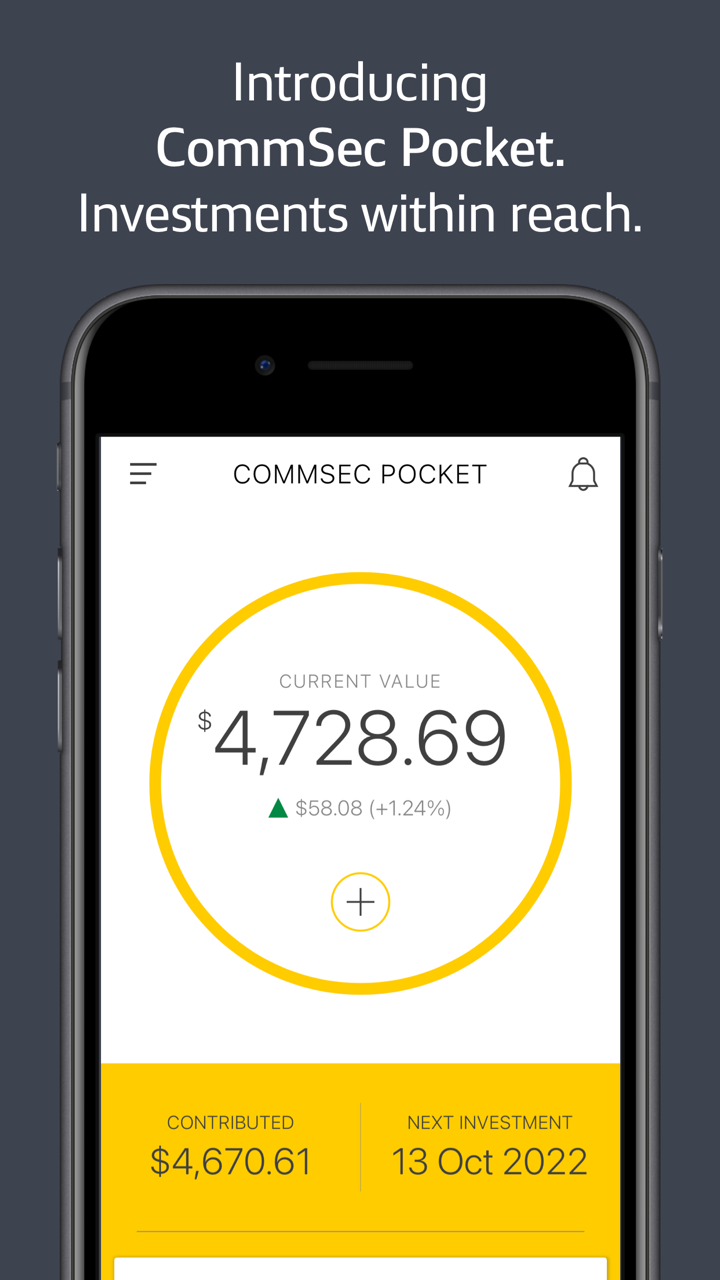

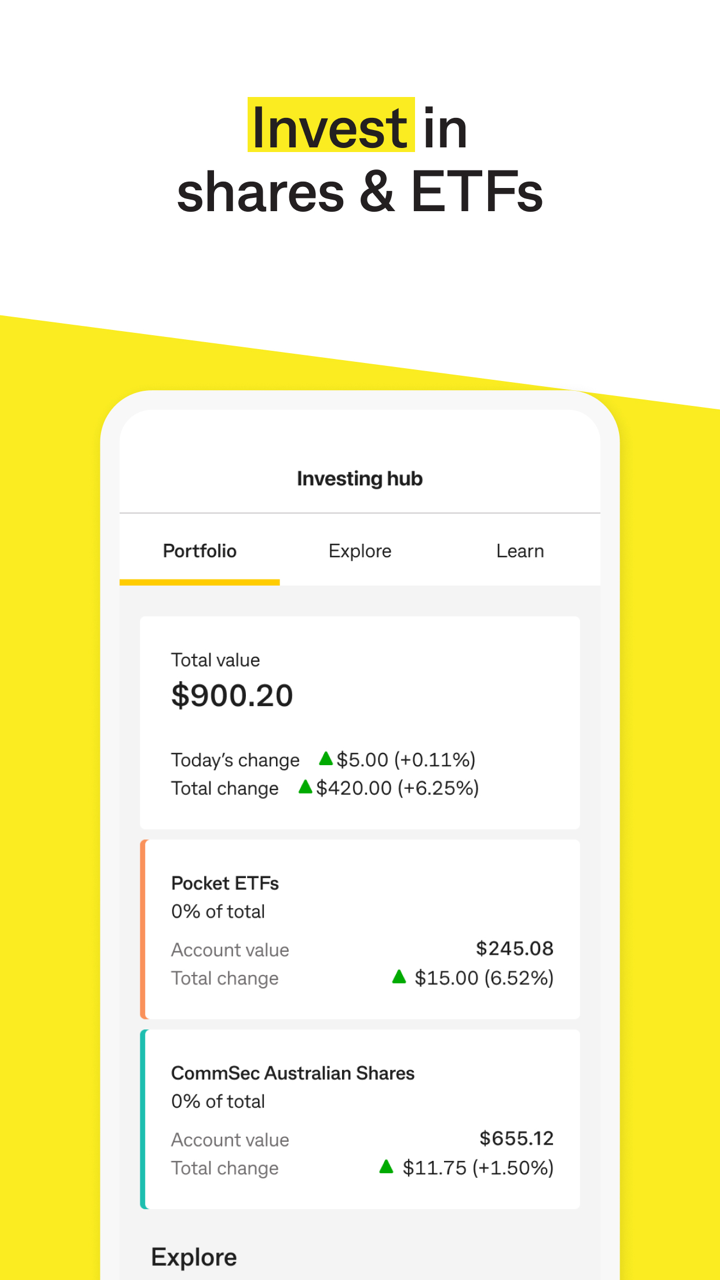

Wealth Management riunisce la piattaforma di gestione dei fondi di Gruppo, i fondi master, la pensione, il supporto alle imprese di consulenza assicurativa e finanziaria. Colonial First State, Colonial First State Global Asset Management e CommInsure fanno tutti parte di Wealth Management. A CBA è stata concessa un'autorità MySuper, che le consente di continuare a ricevere il contributo pensionistico predefinito dal 1° gennaio 2014.

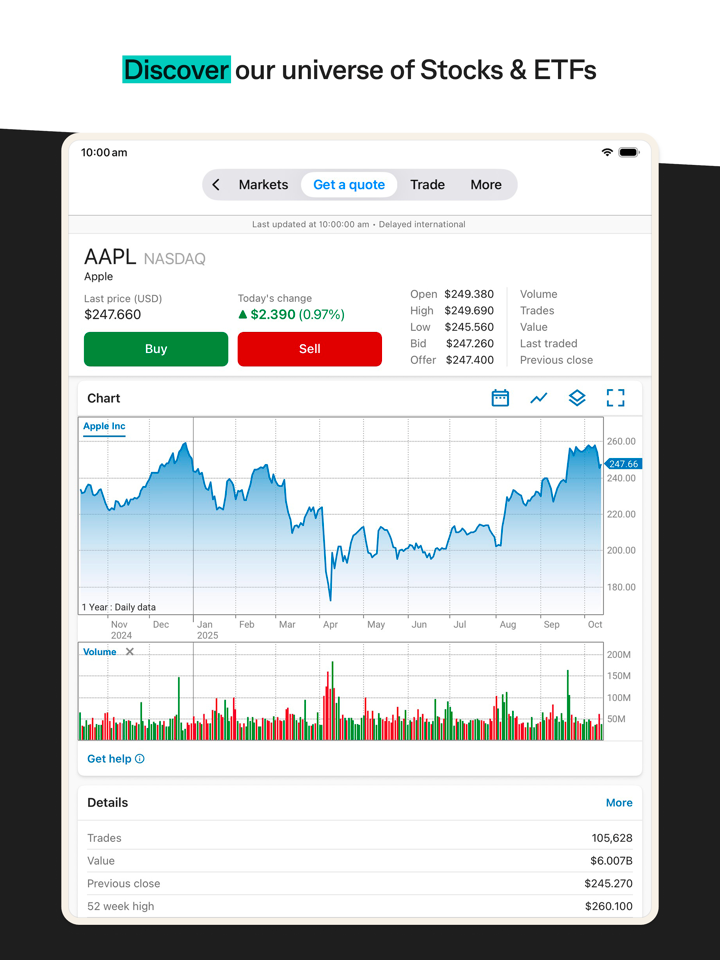

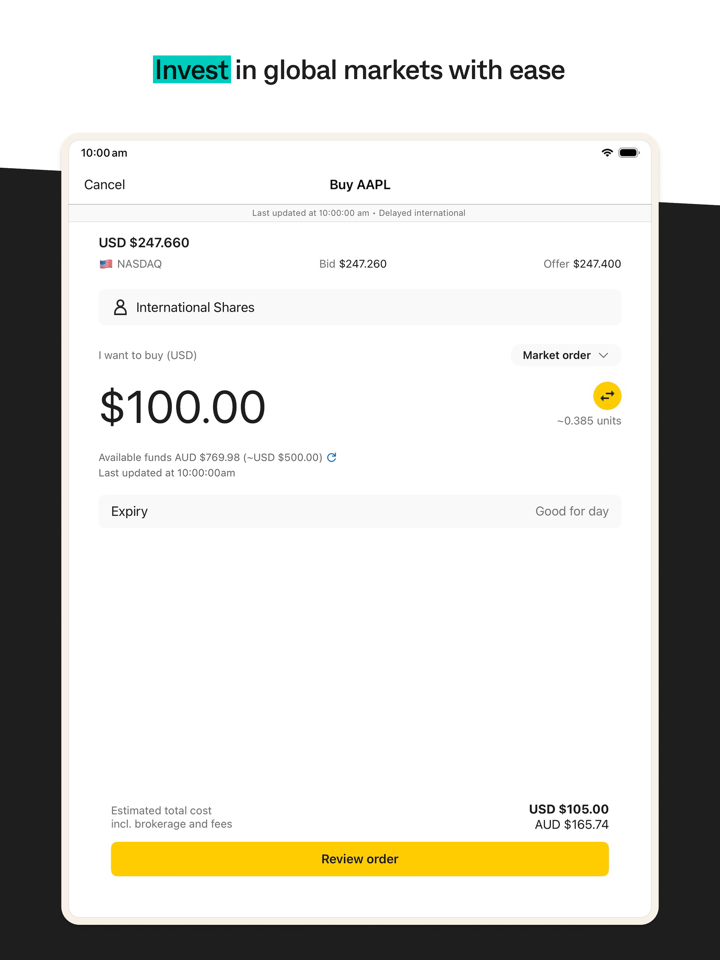

prodotti e servizi

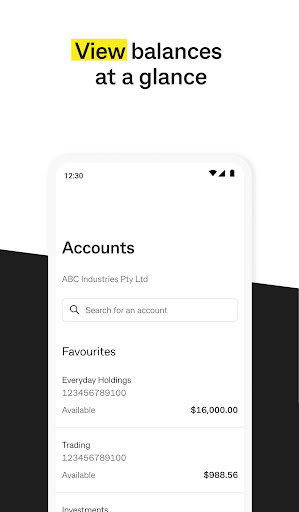

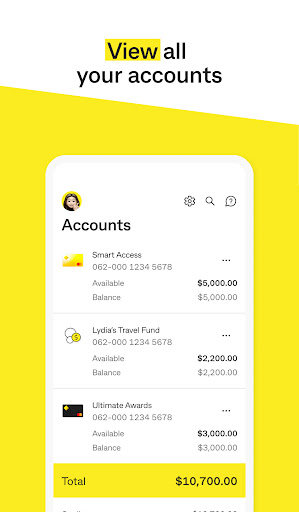

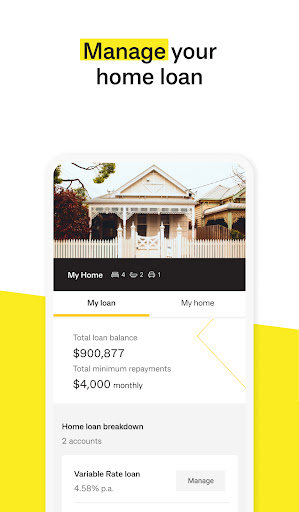

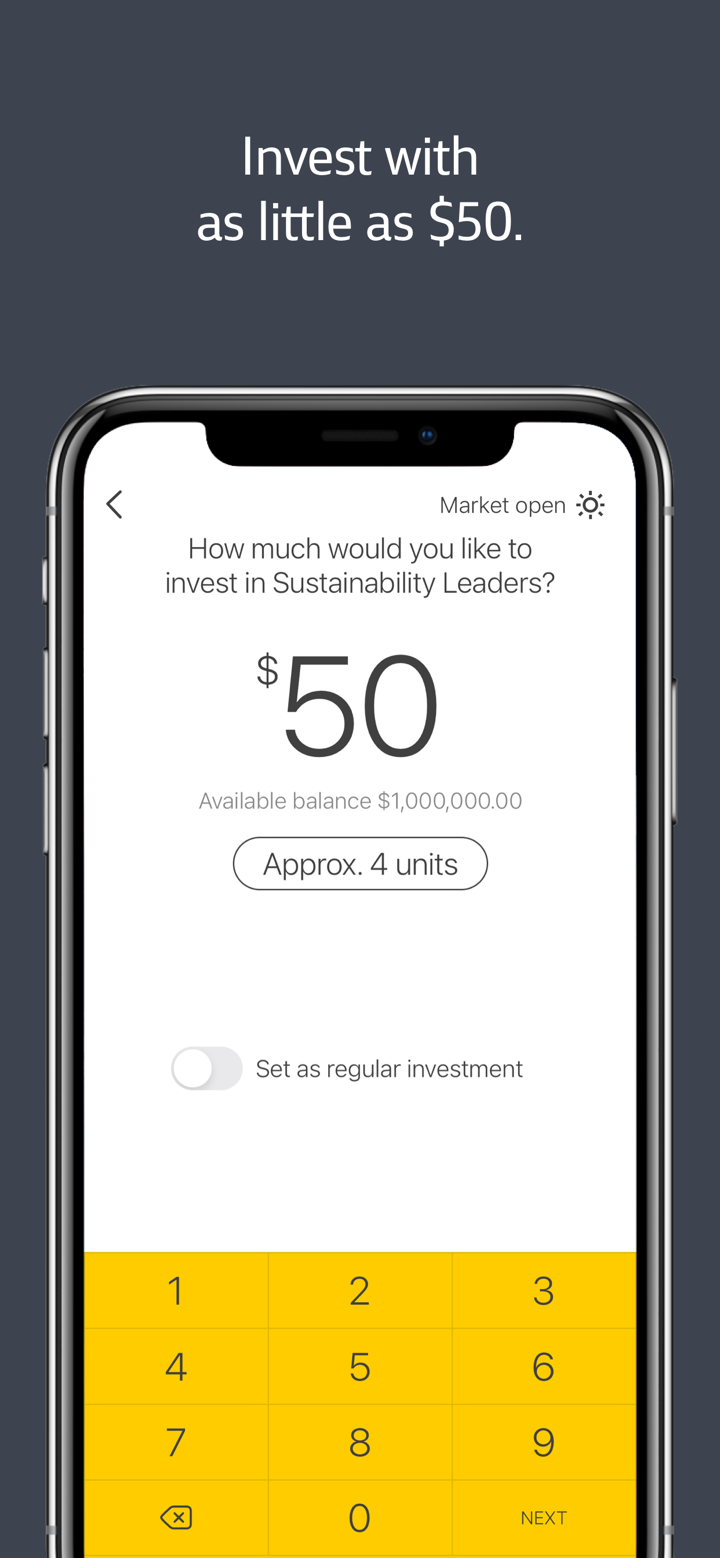

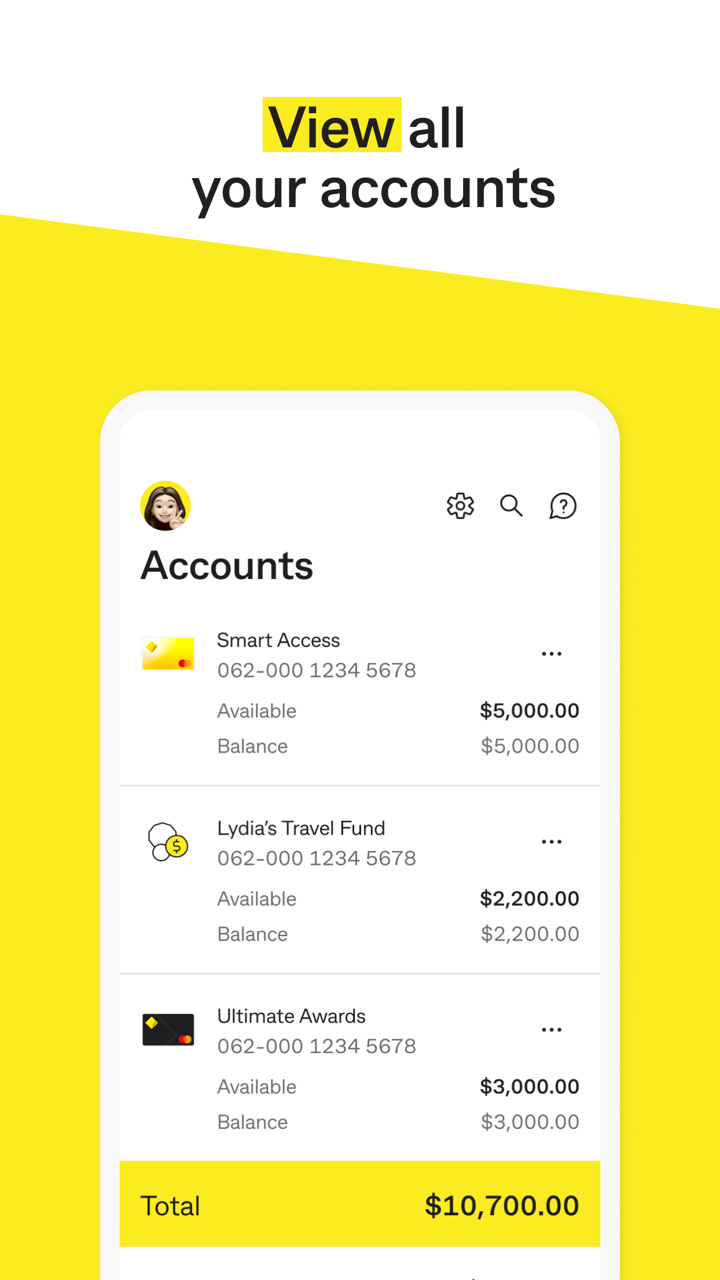

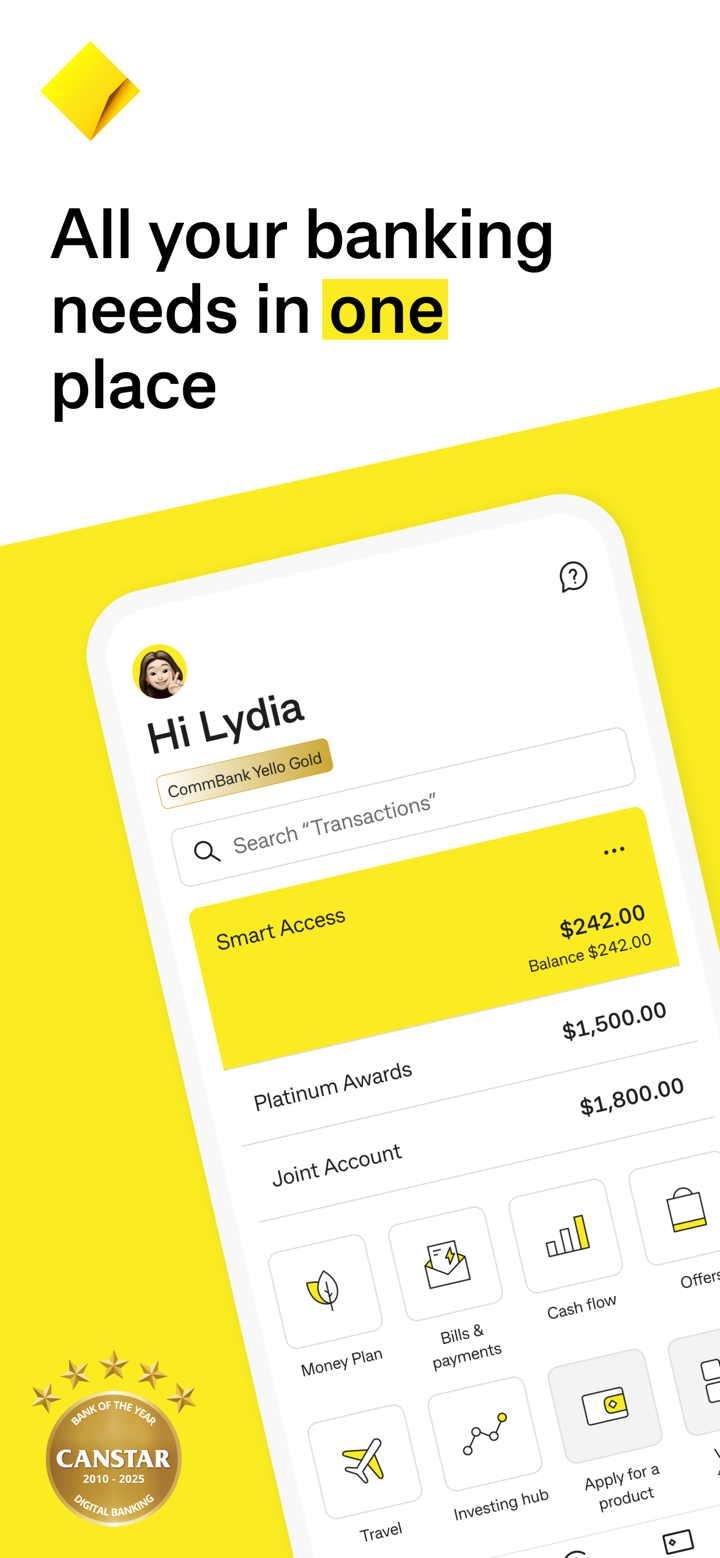

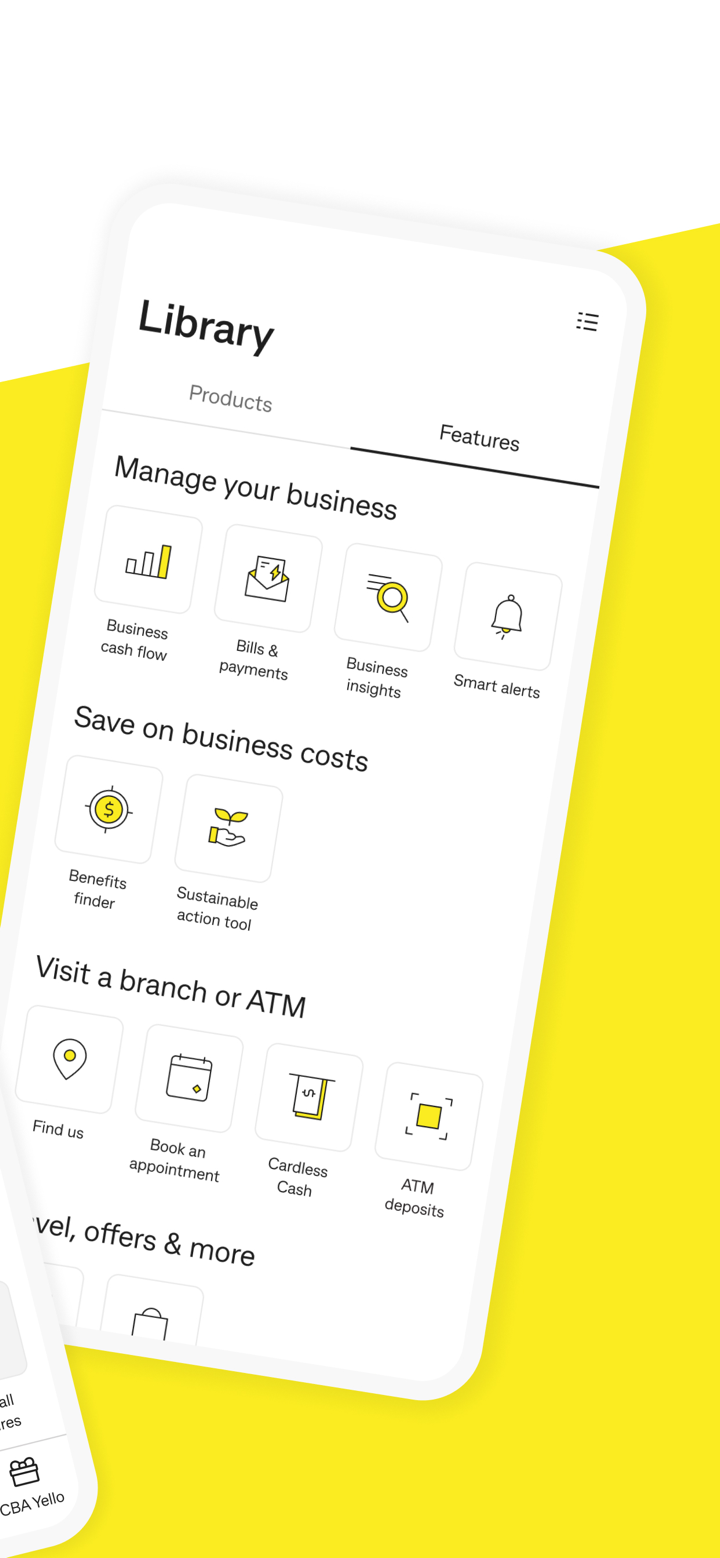

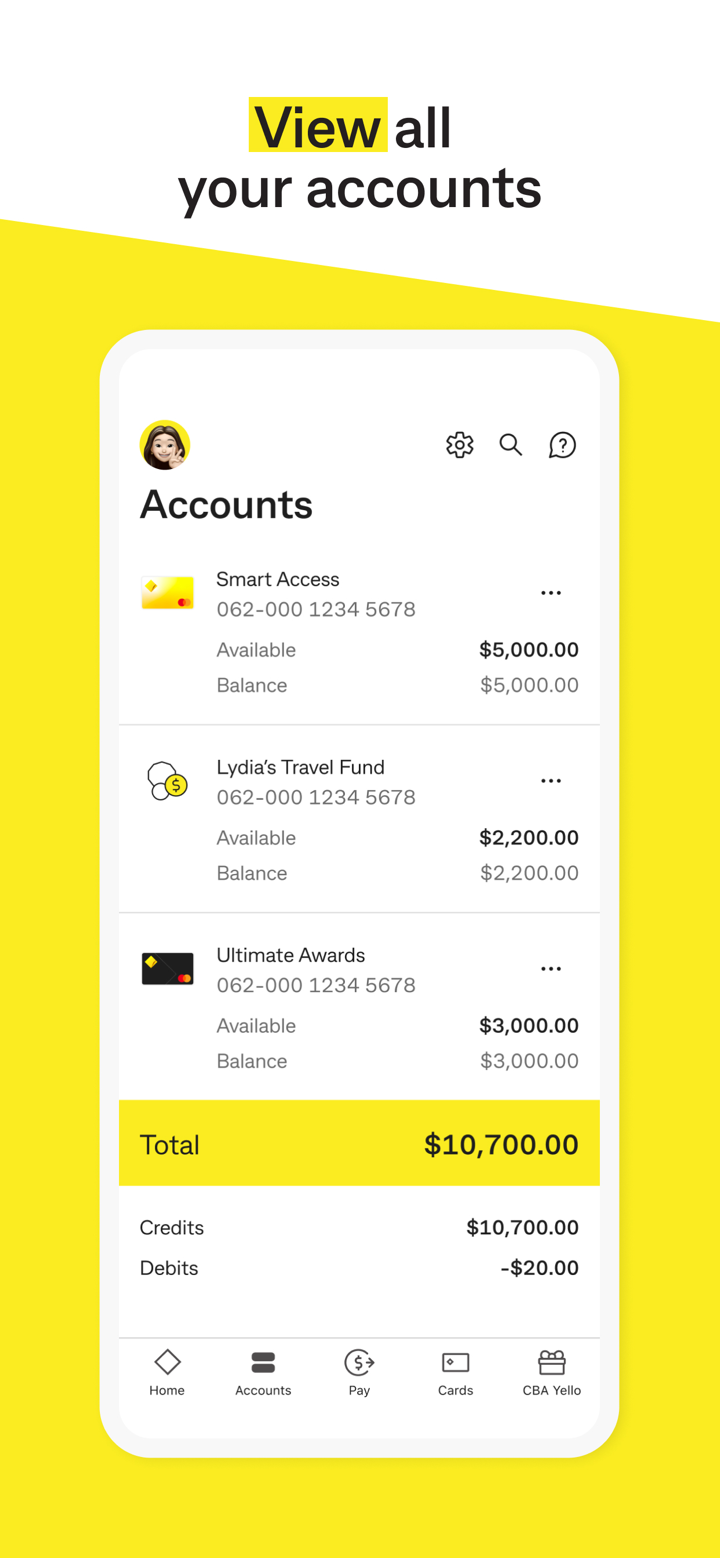

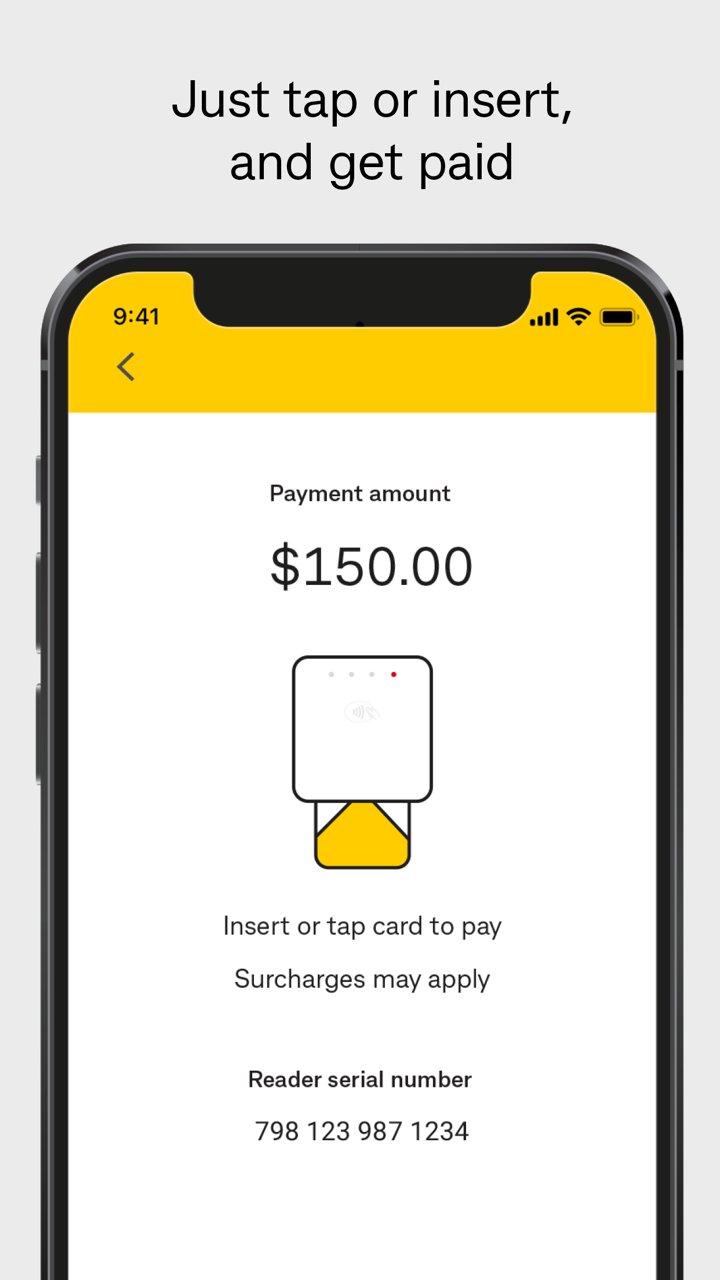

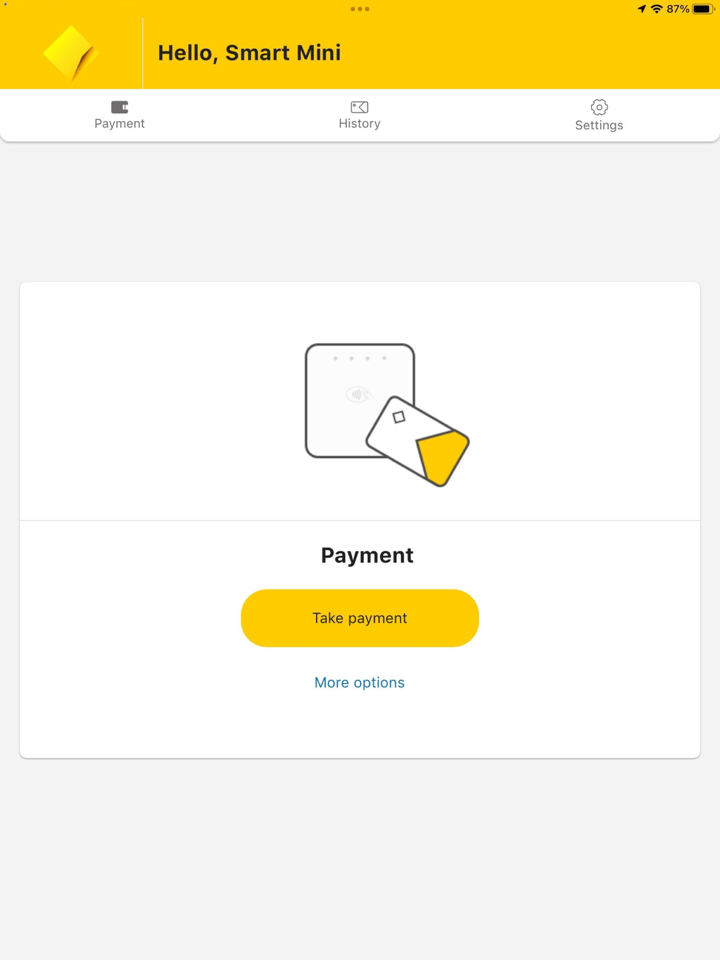

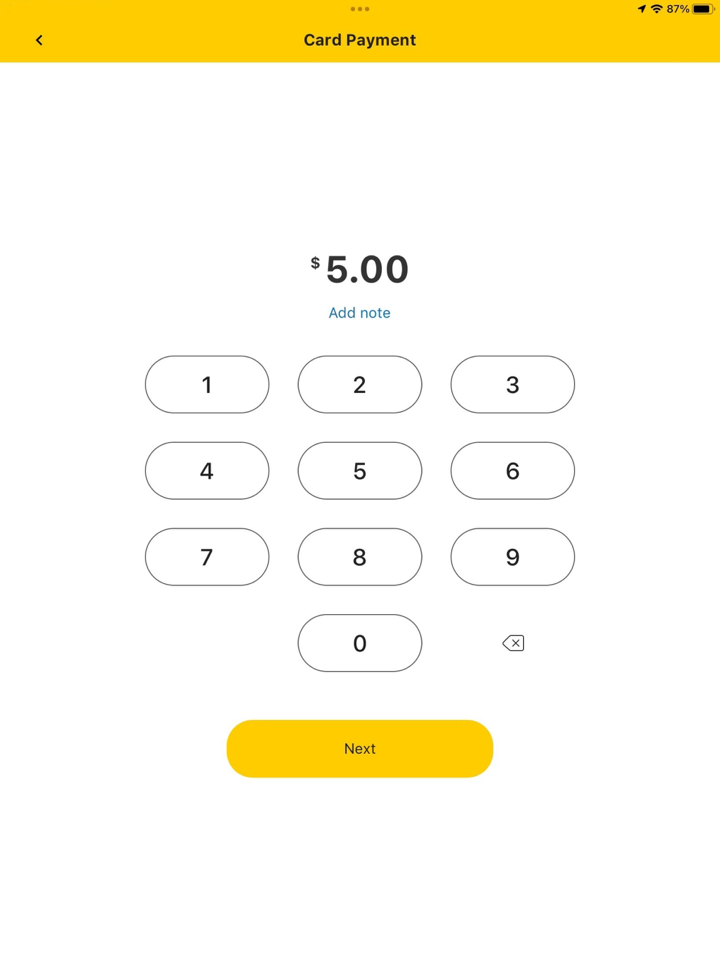

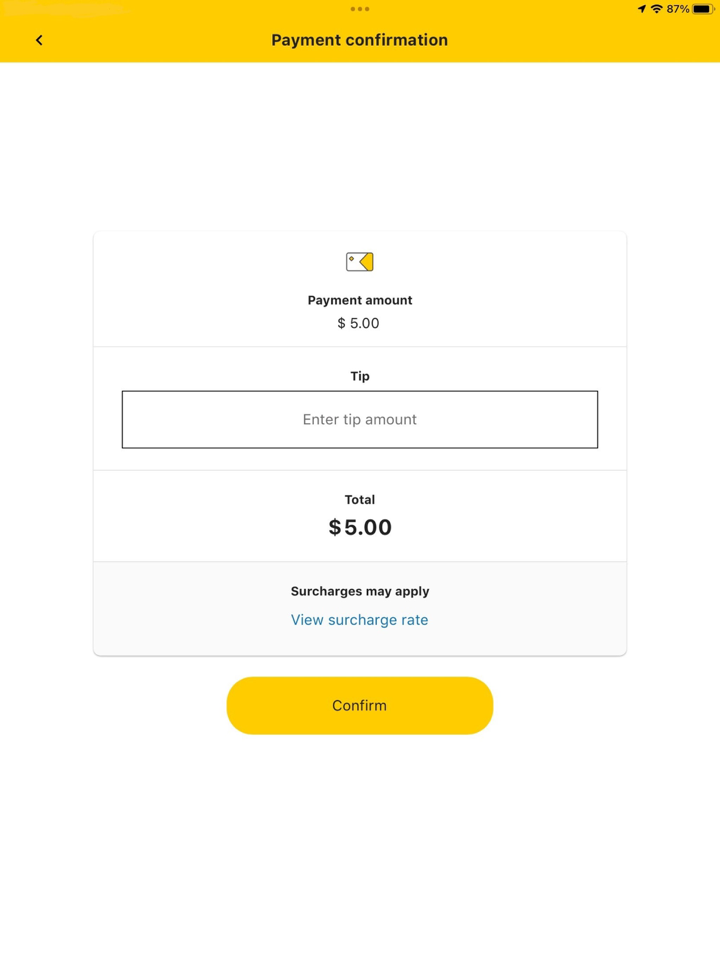

La Commonwealth Bank è la più grande banca al dettaglio d'Australia e offre ai clienti una gamma di prodotti e servizi, inclusi prestiti, carte di credito, transazioni e conti di risparmio. Ha la più grande rete di filiali e bancomat.

NetBank

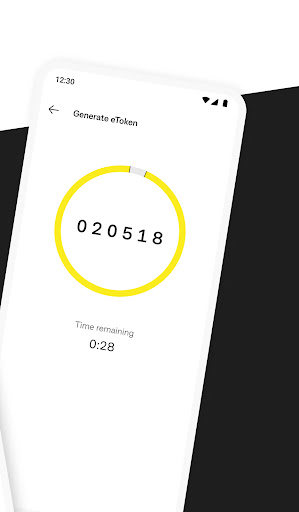

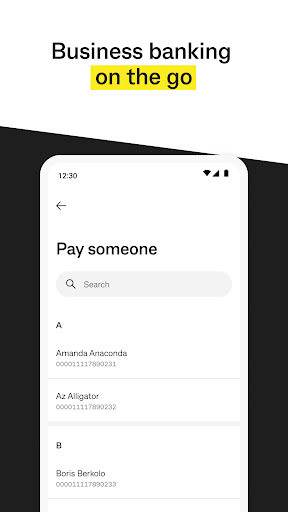

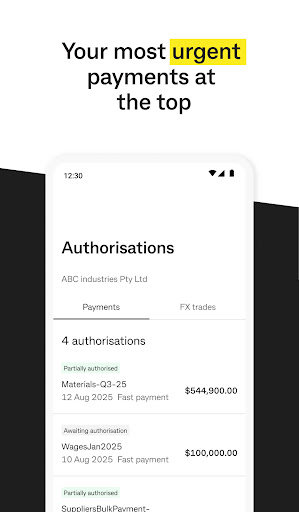

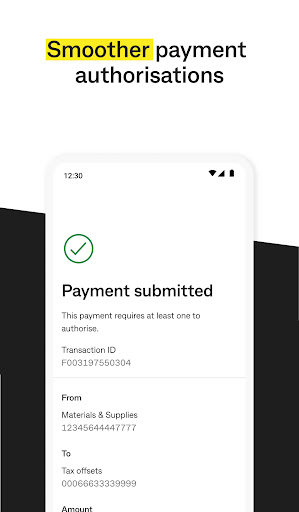

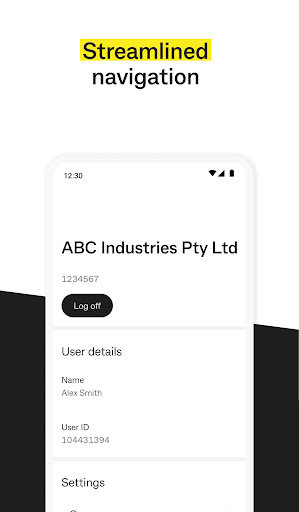

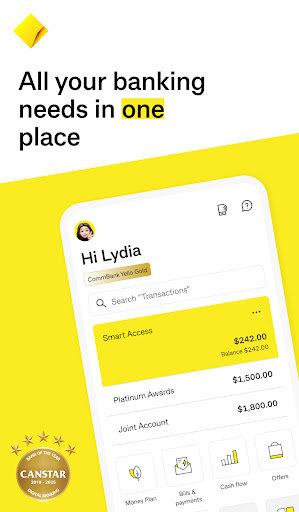

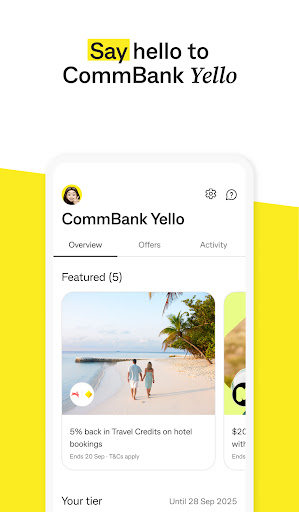

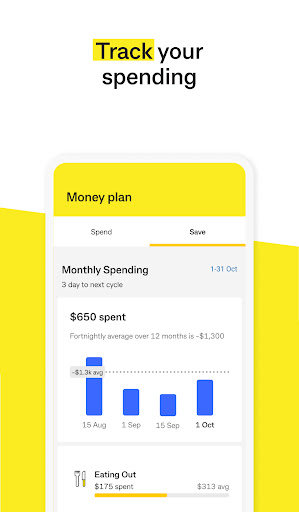

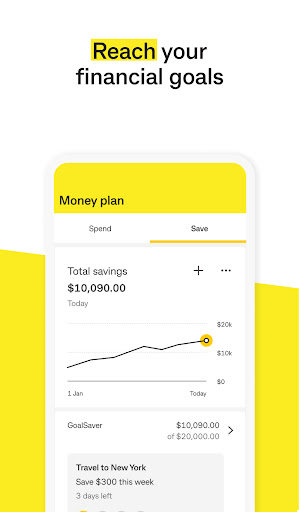

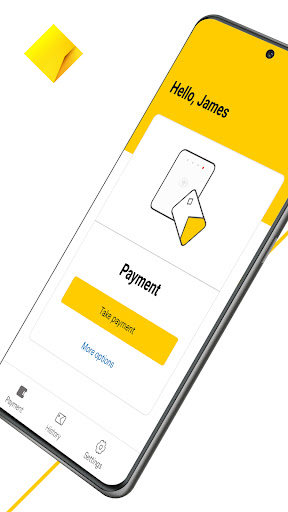

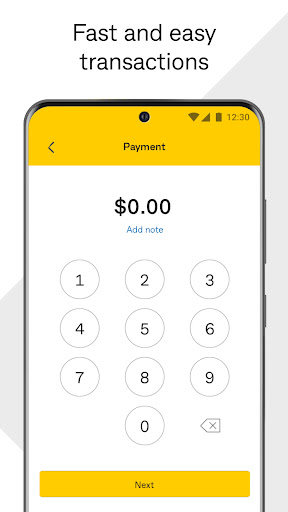

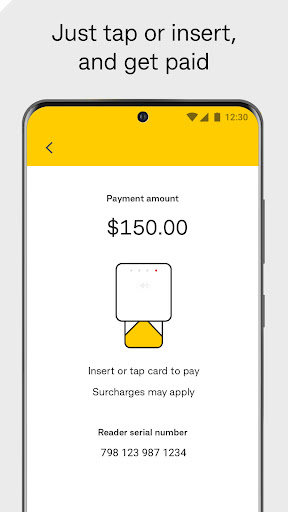

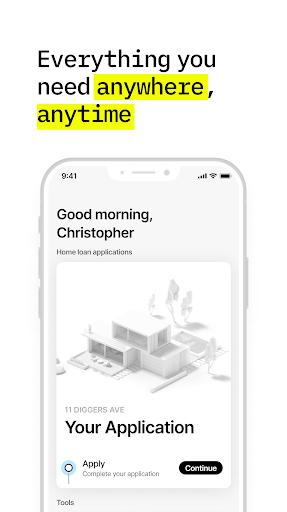

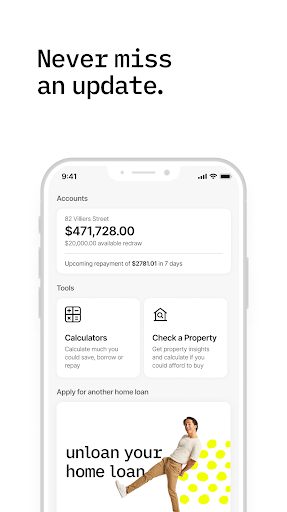

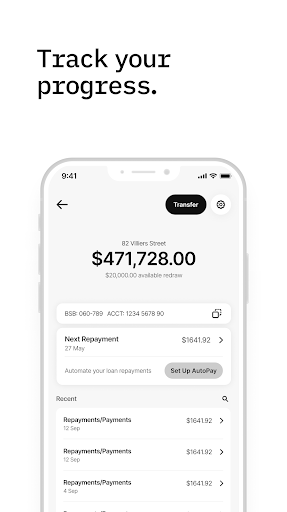

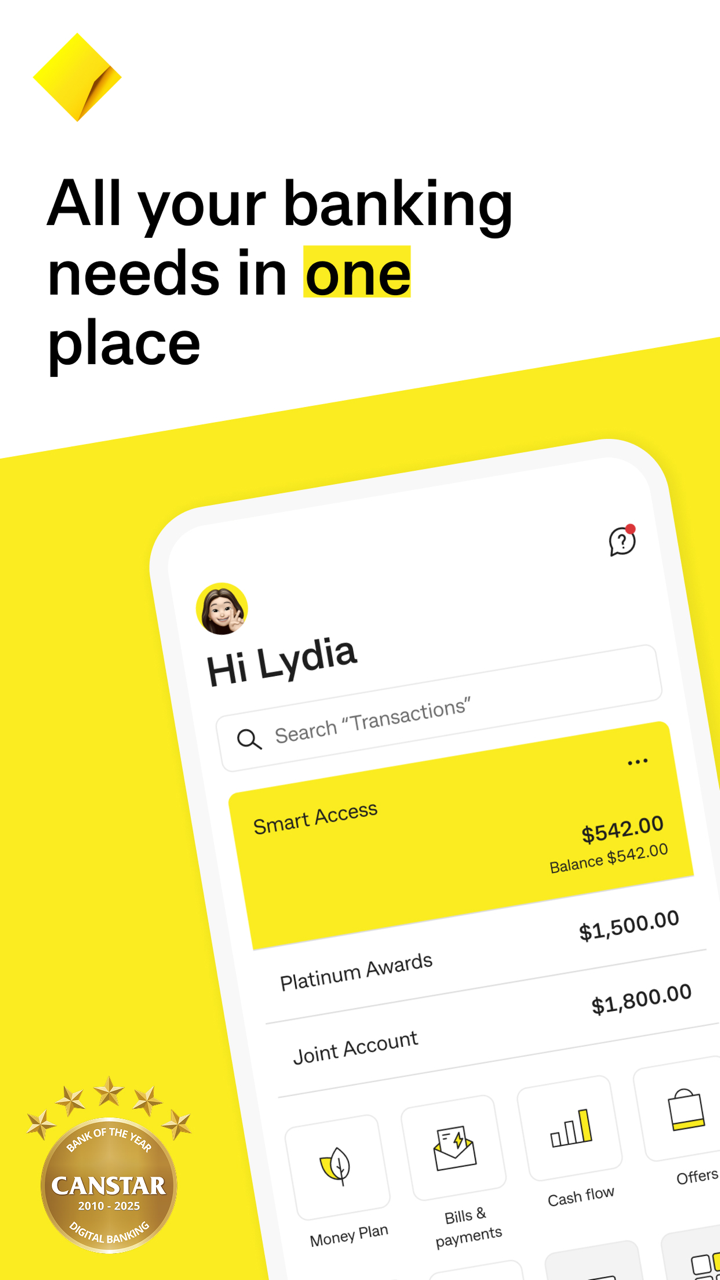

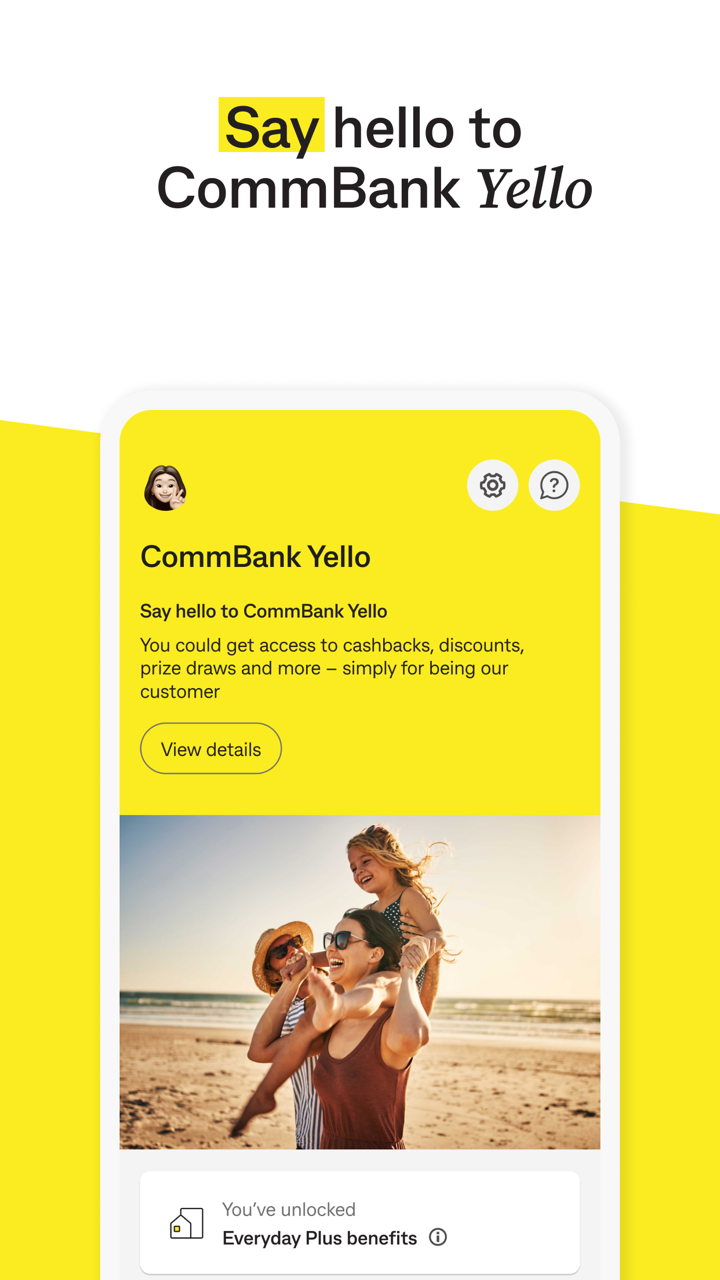

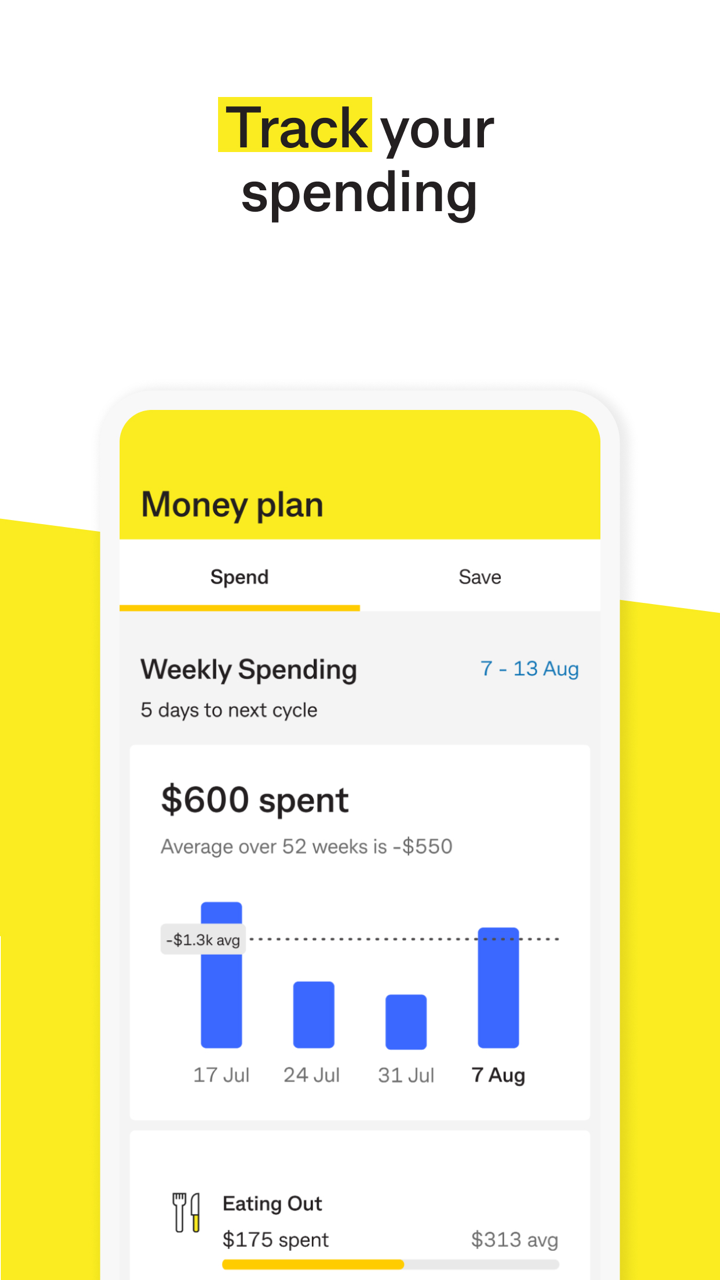

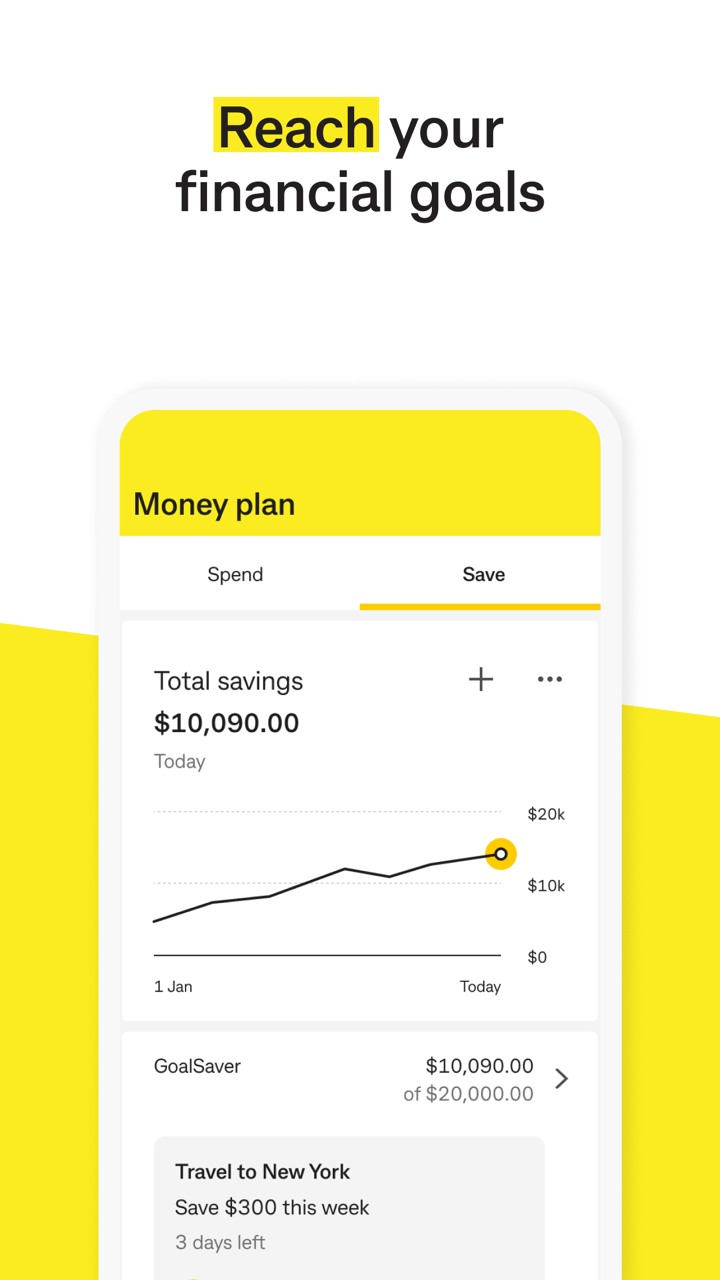

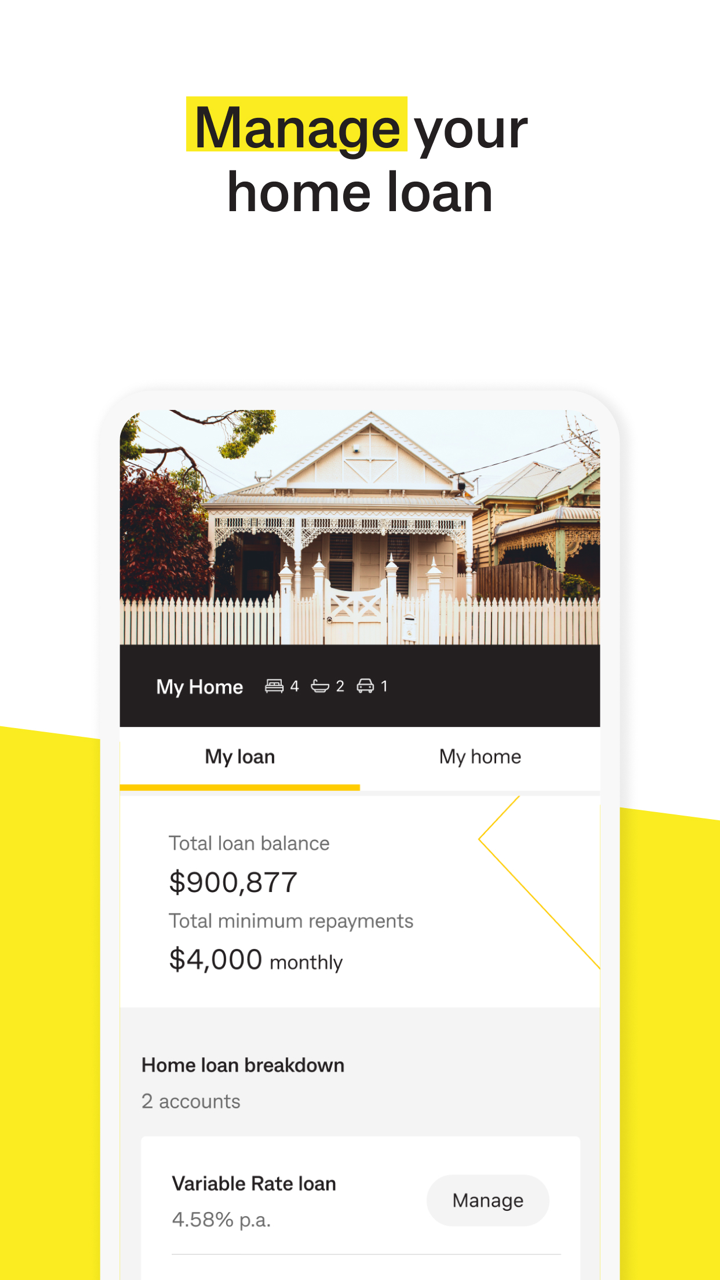

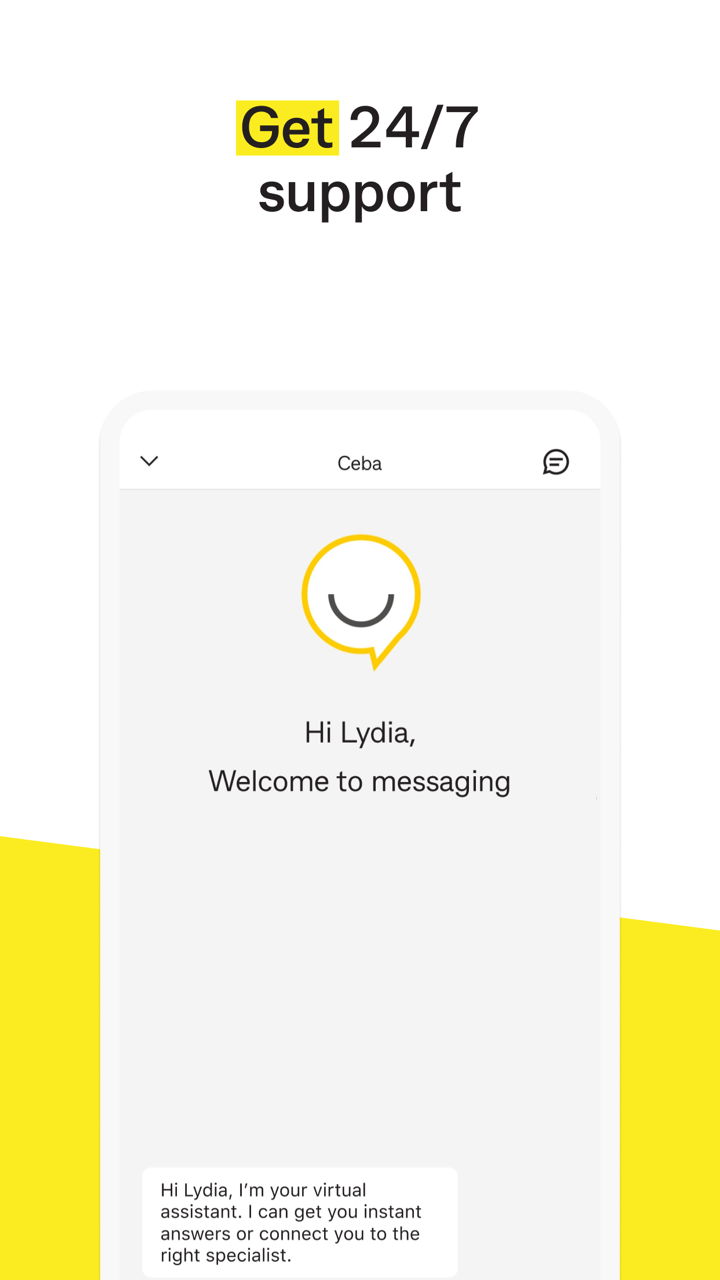

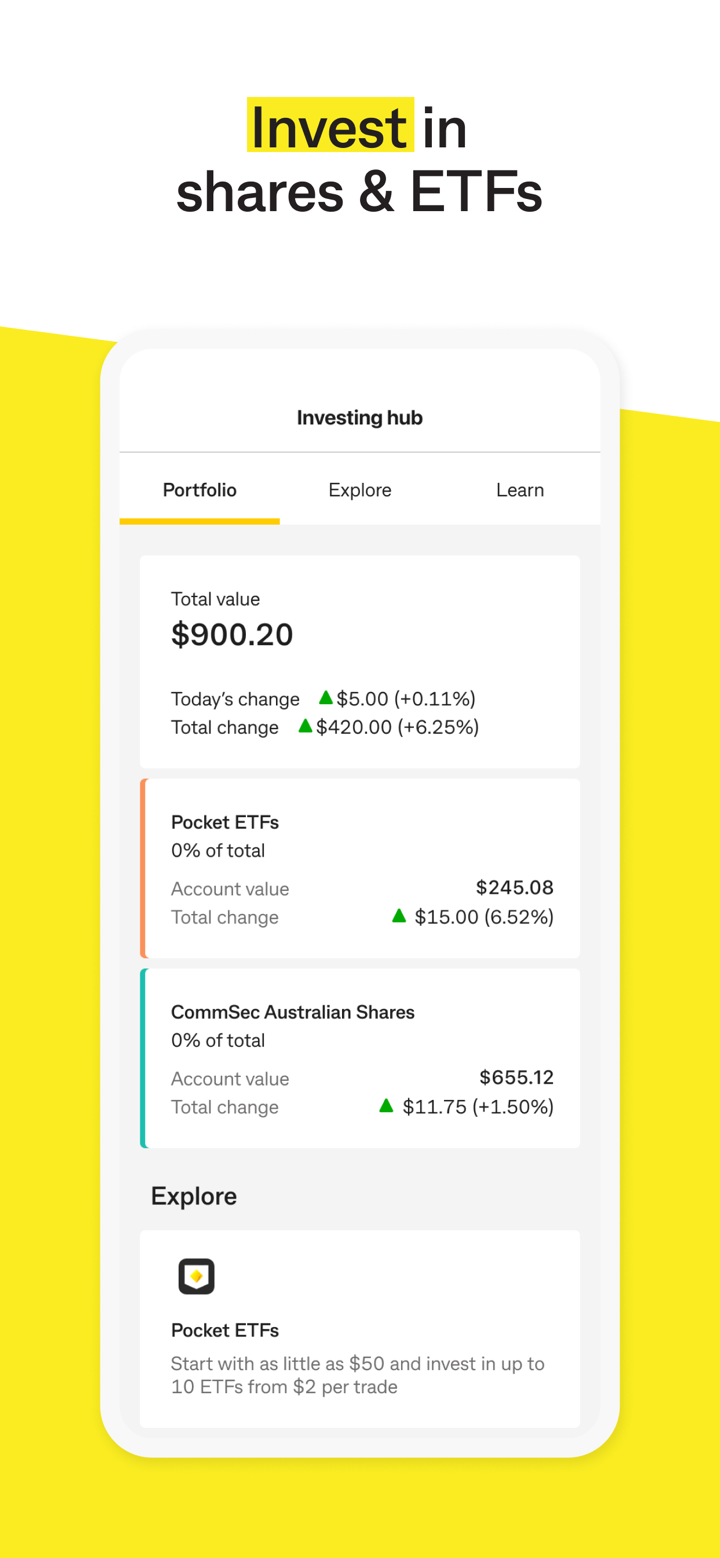

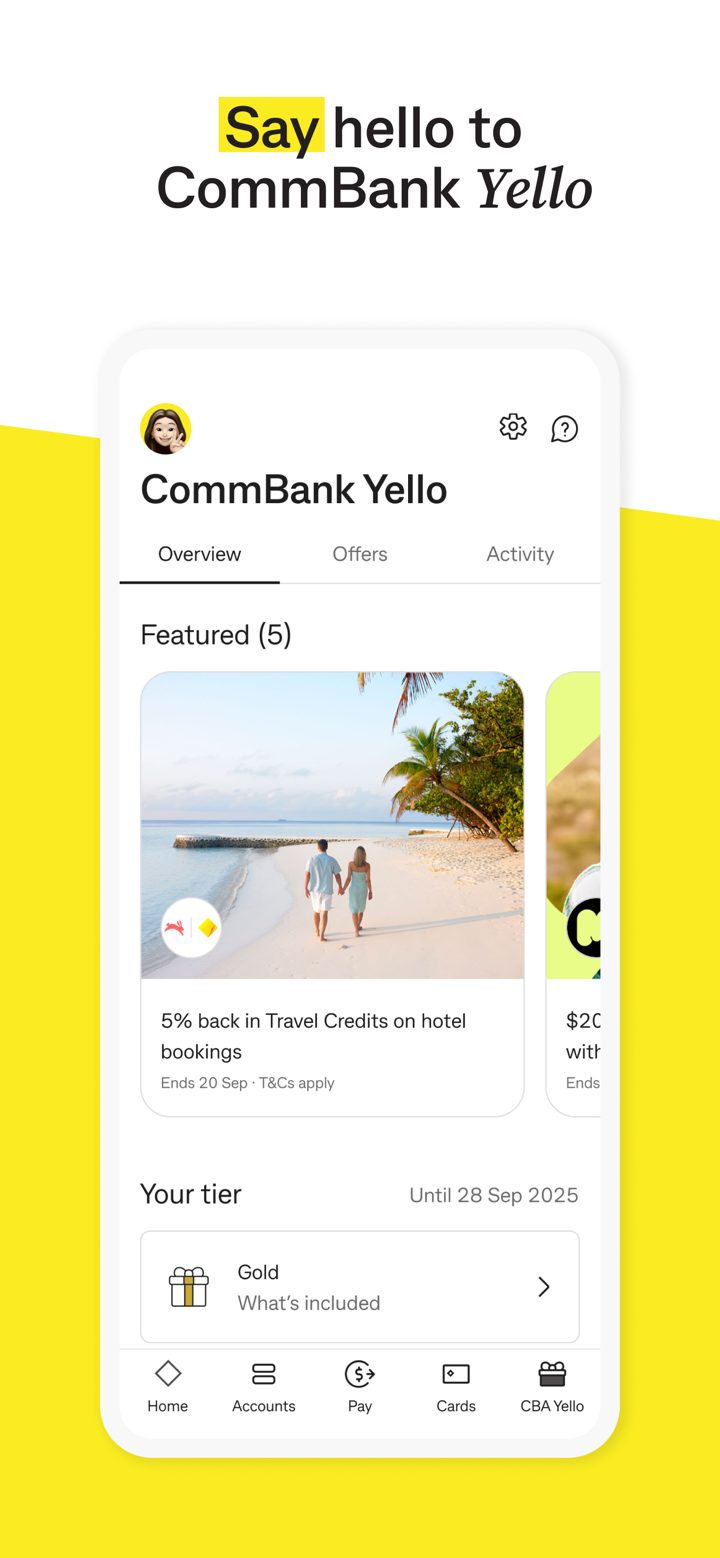

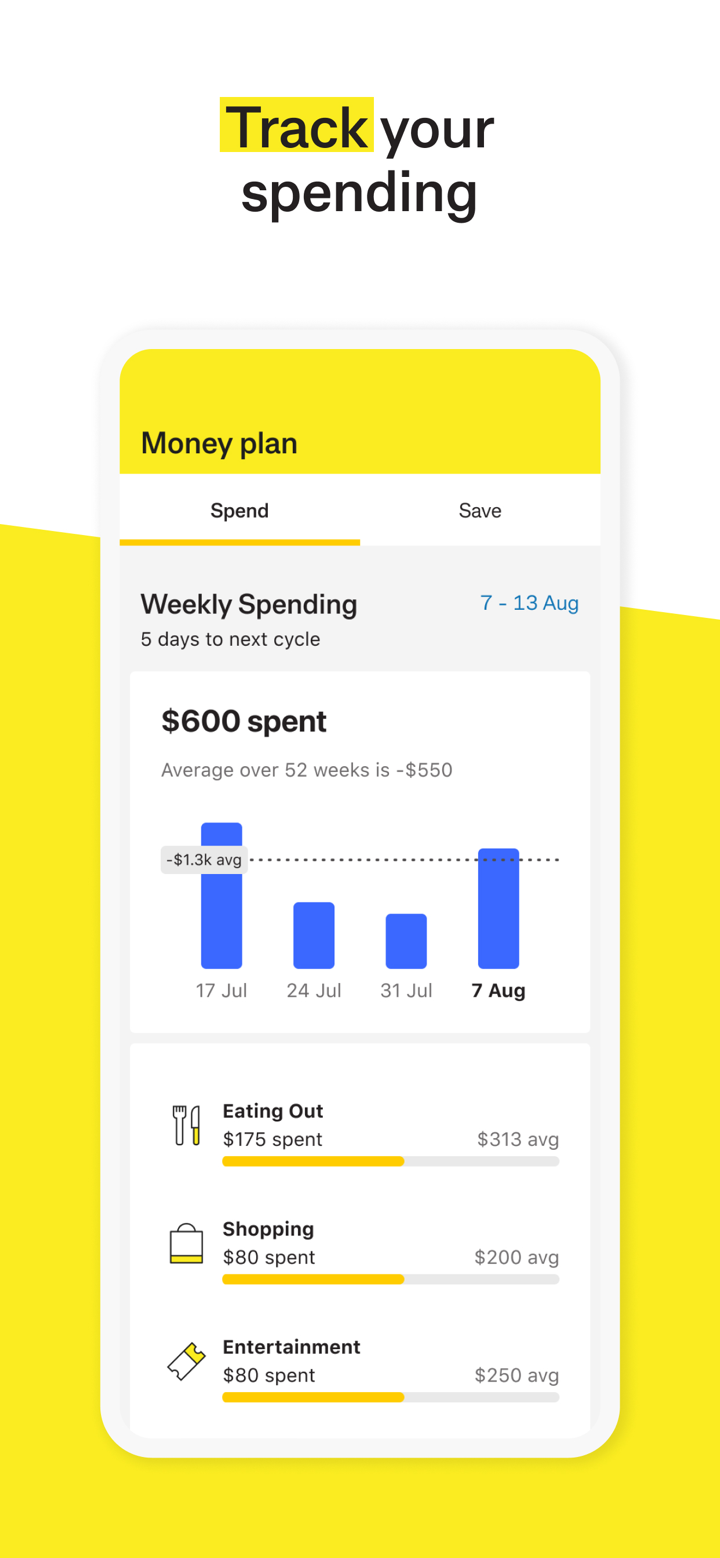

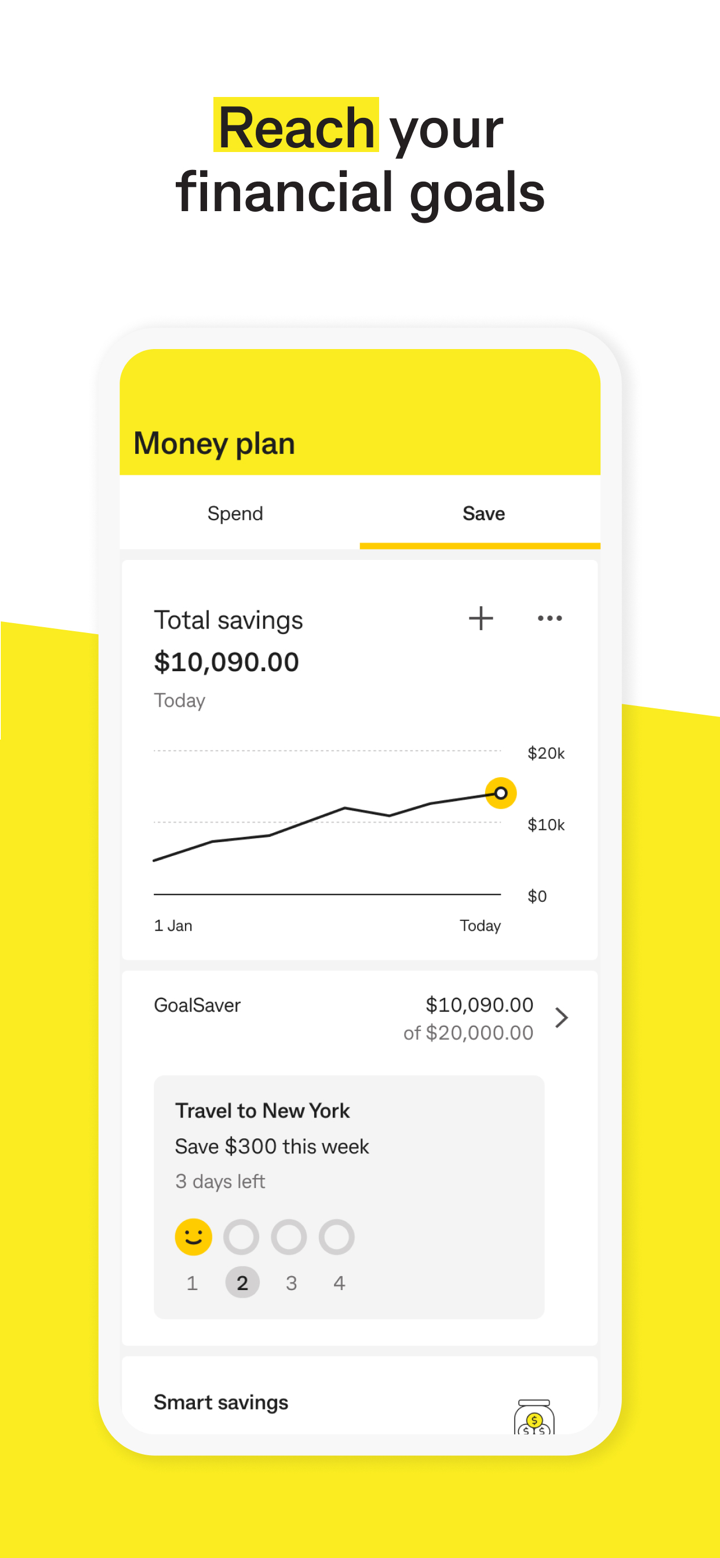

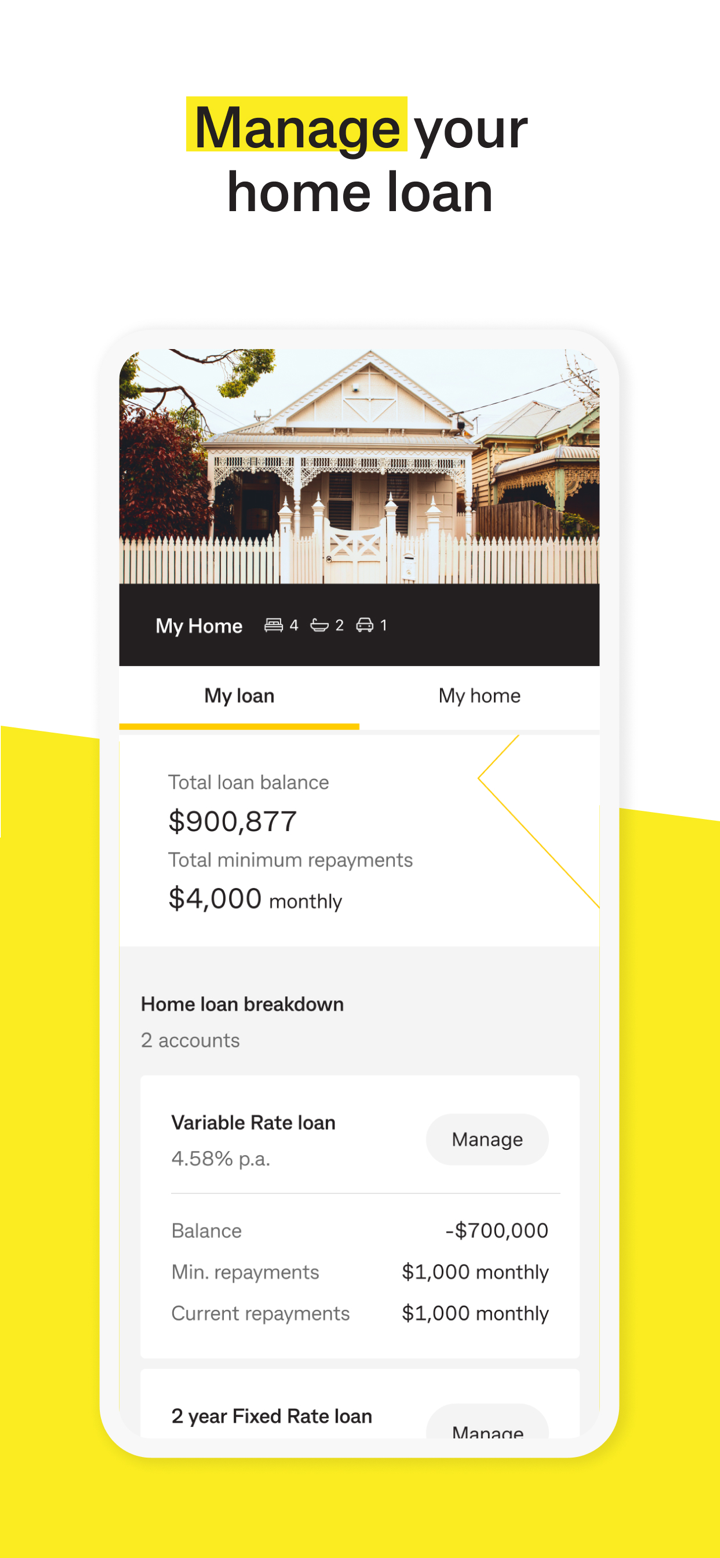

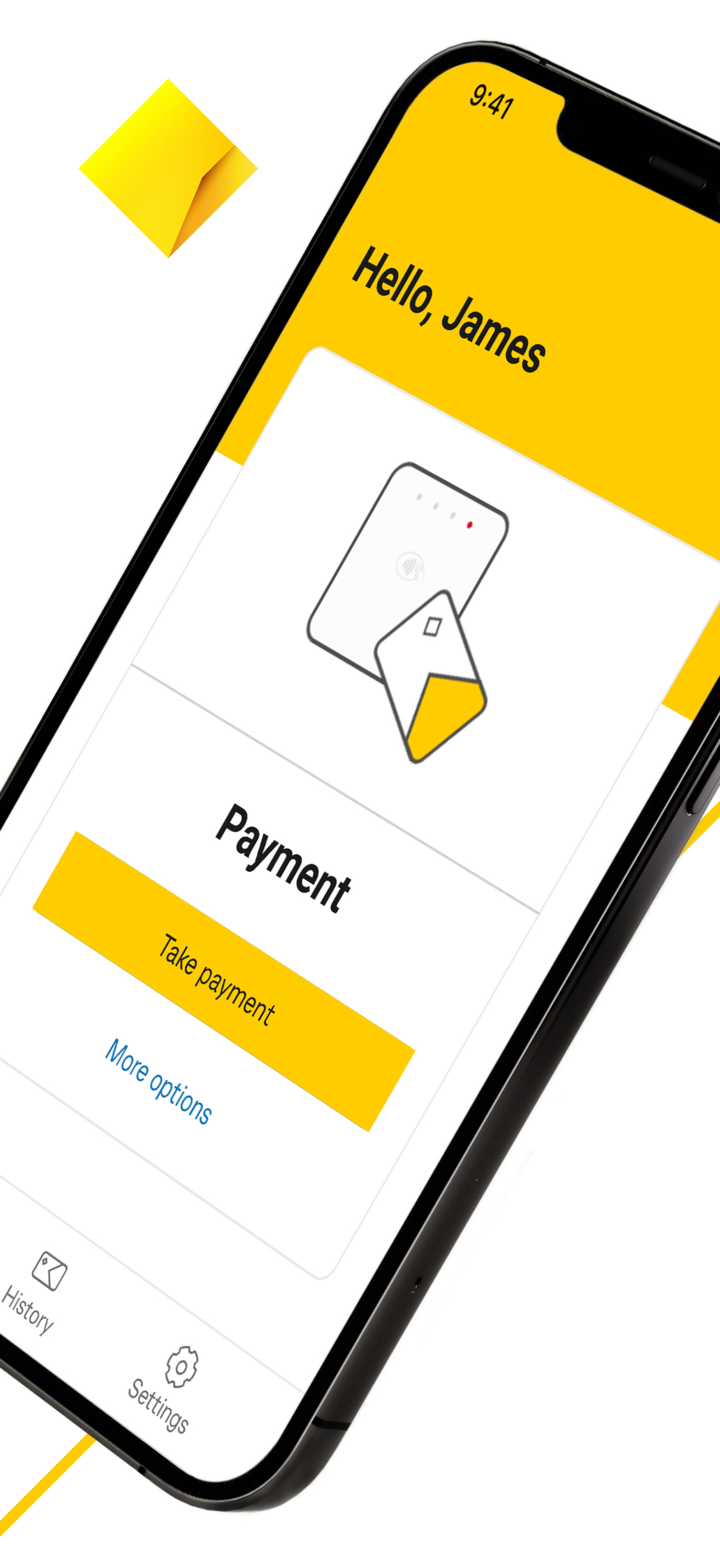

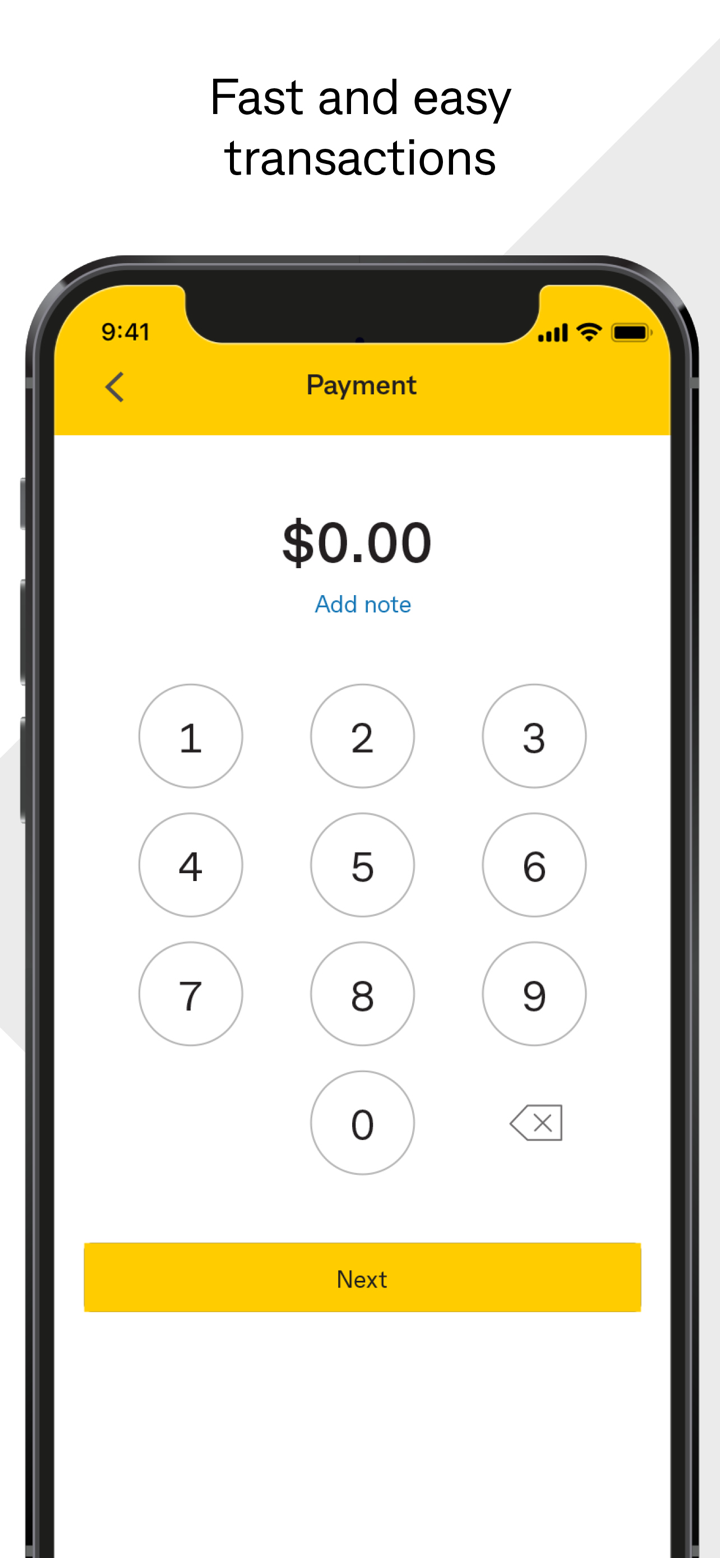

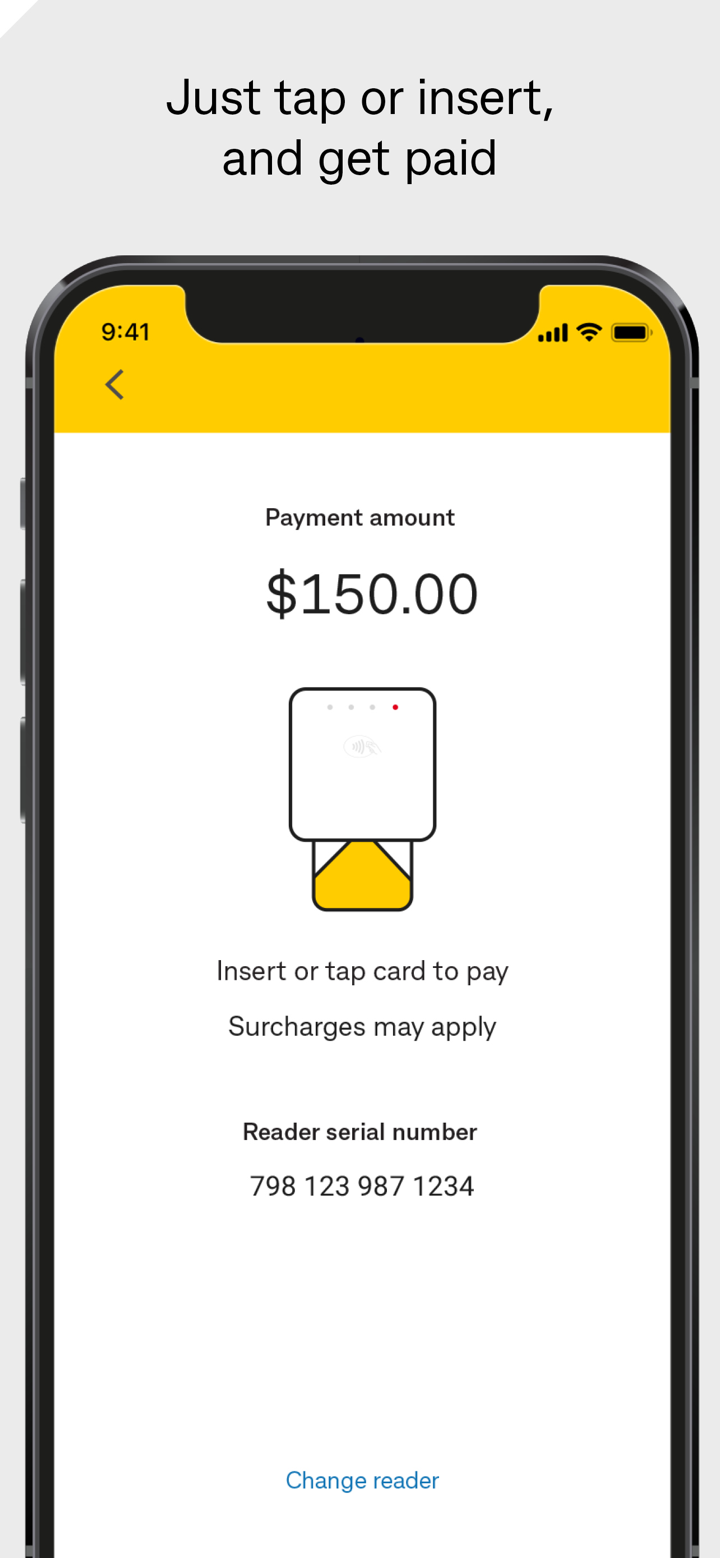

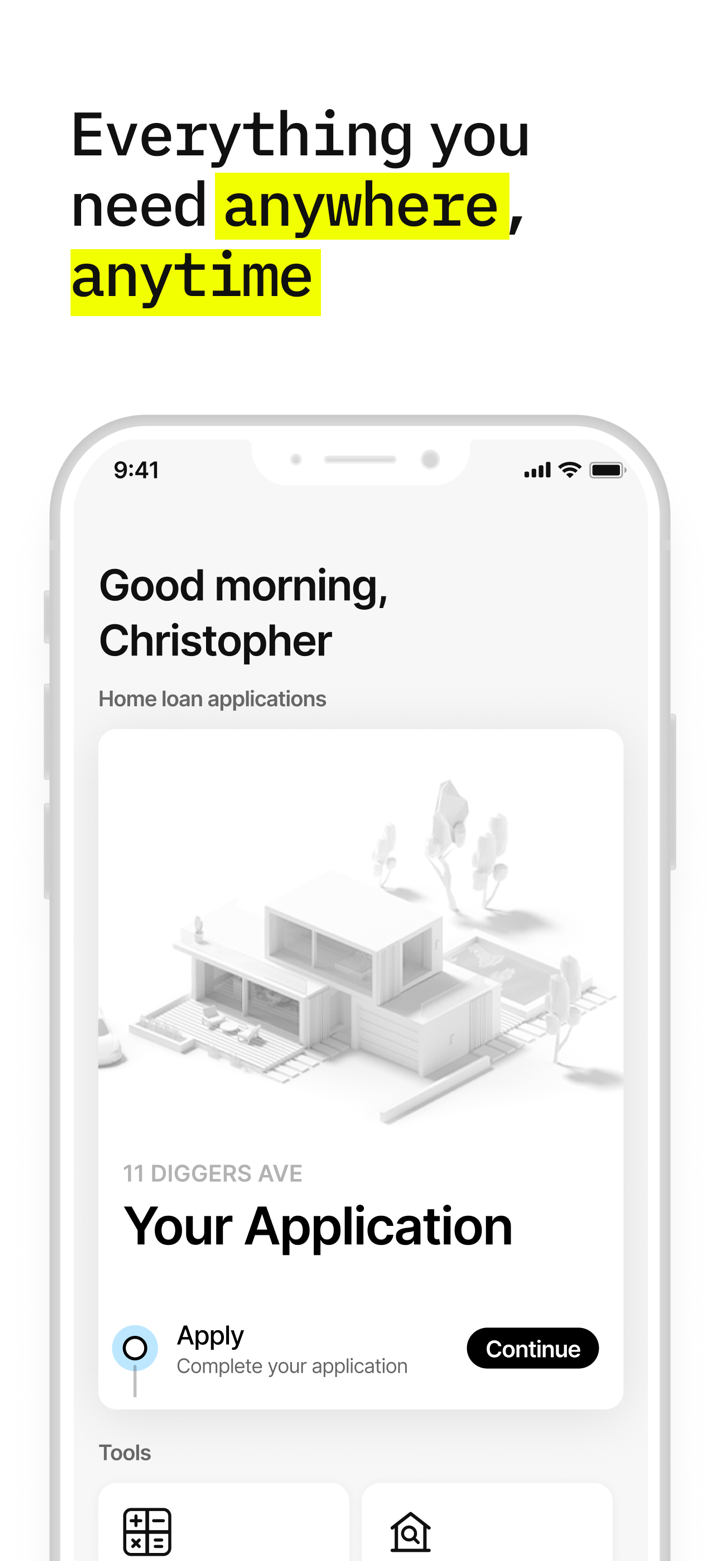

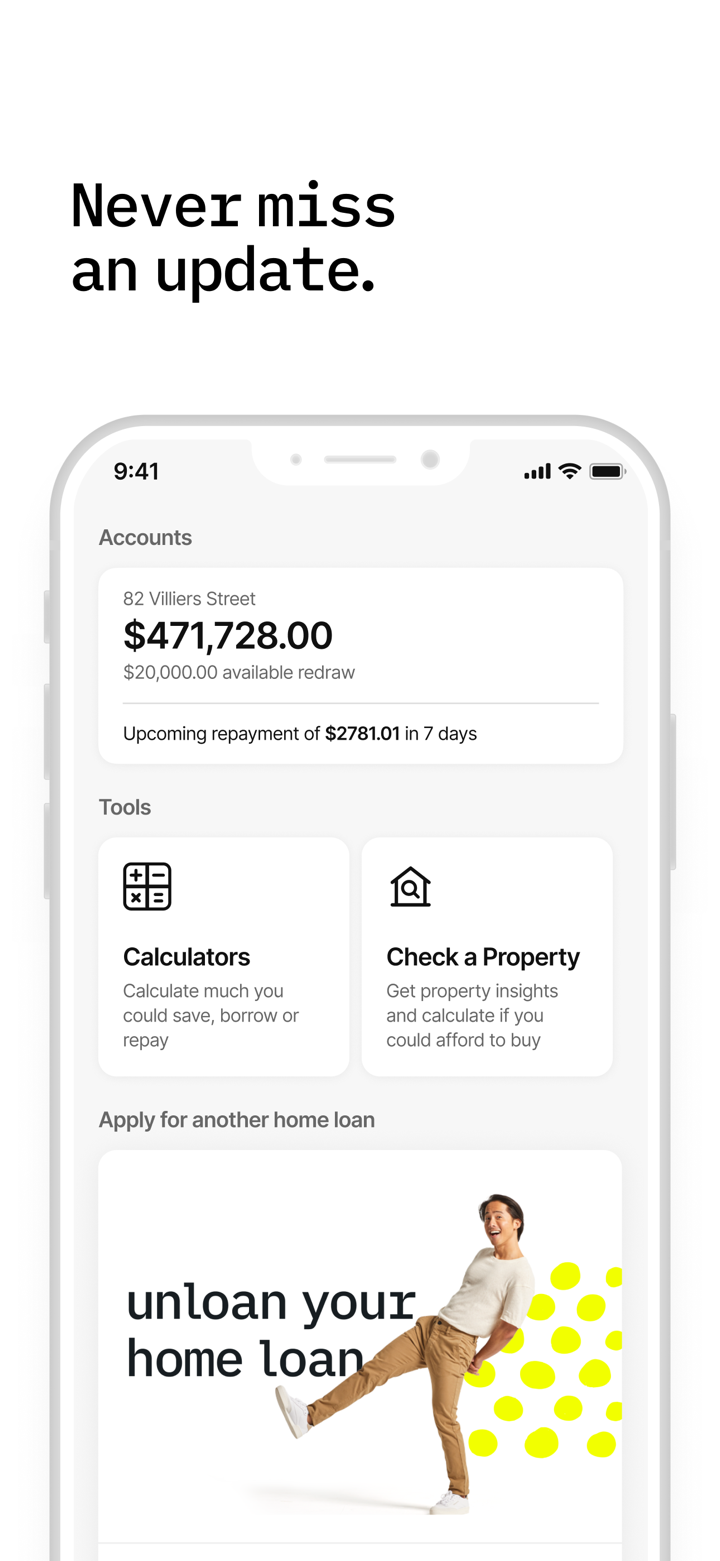

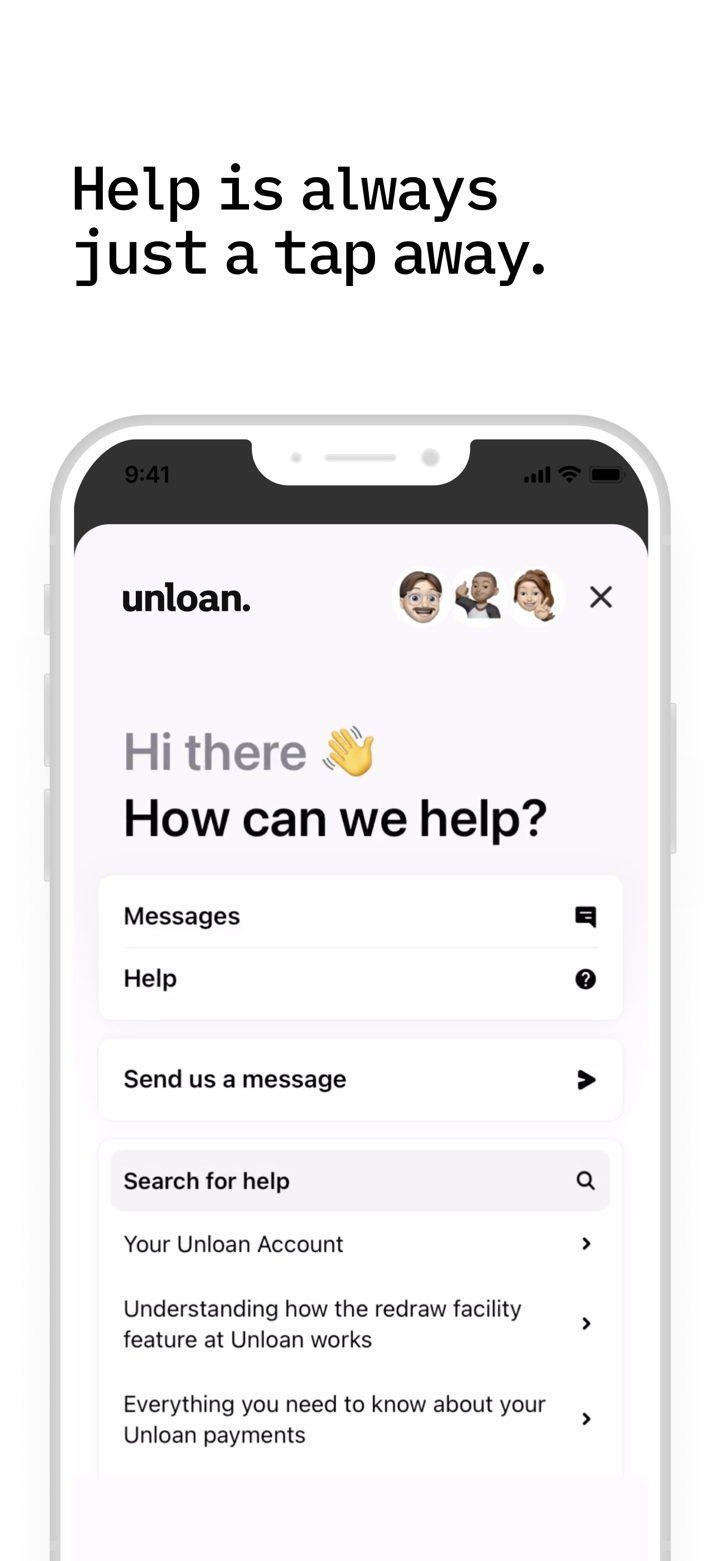

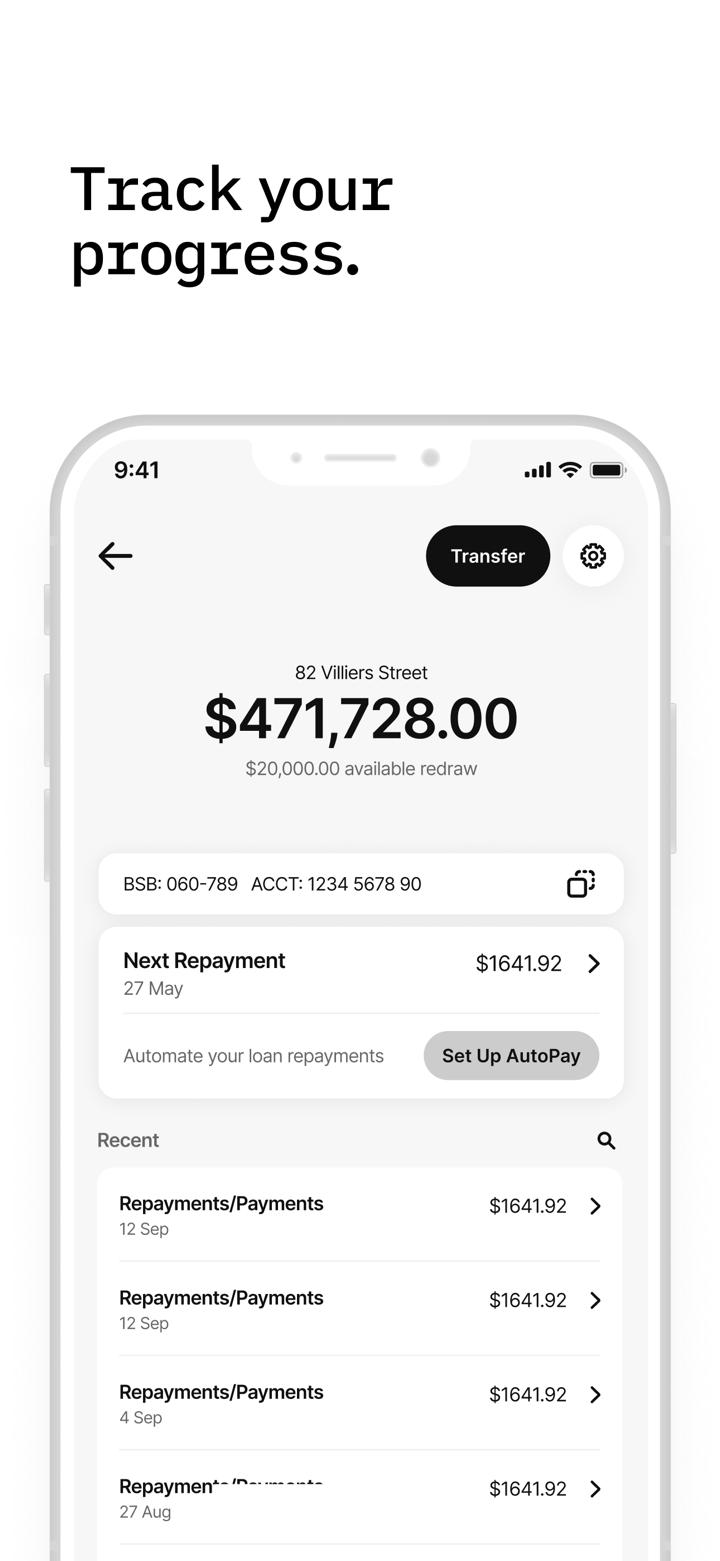

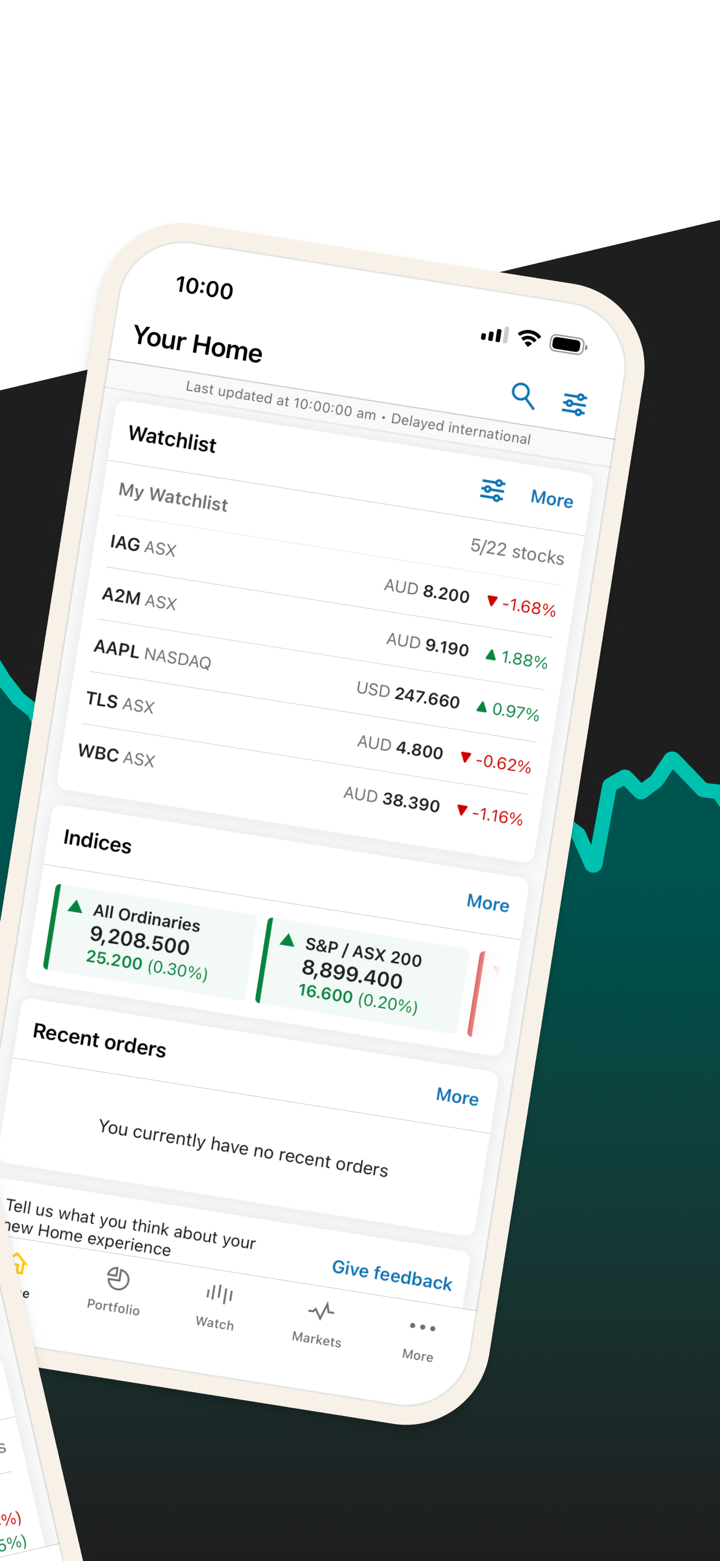

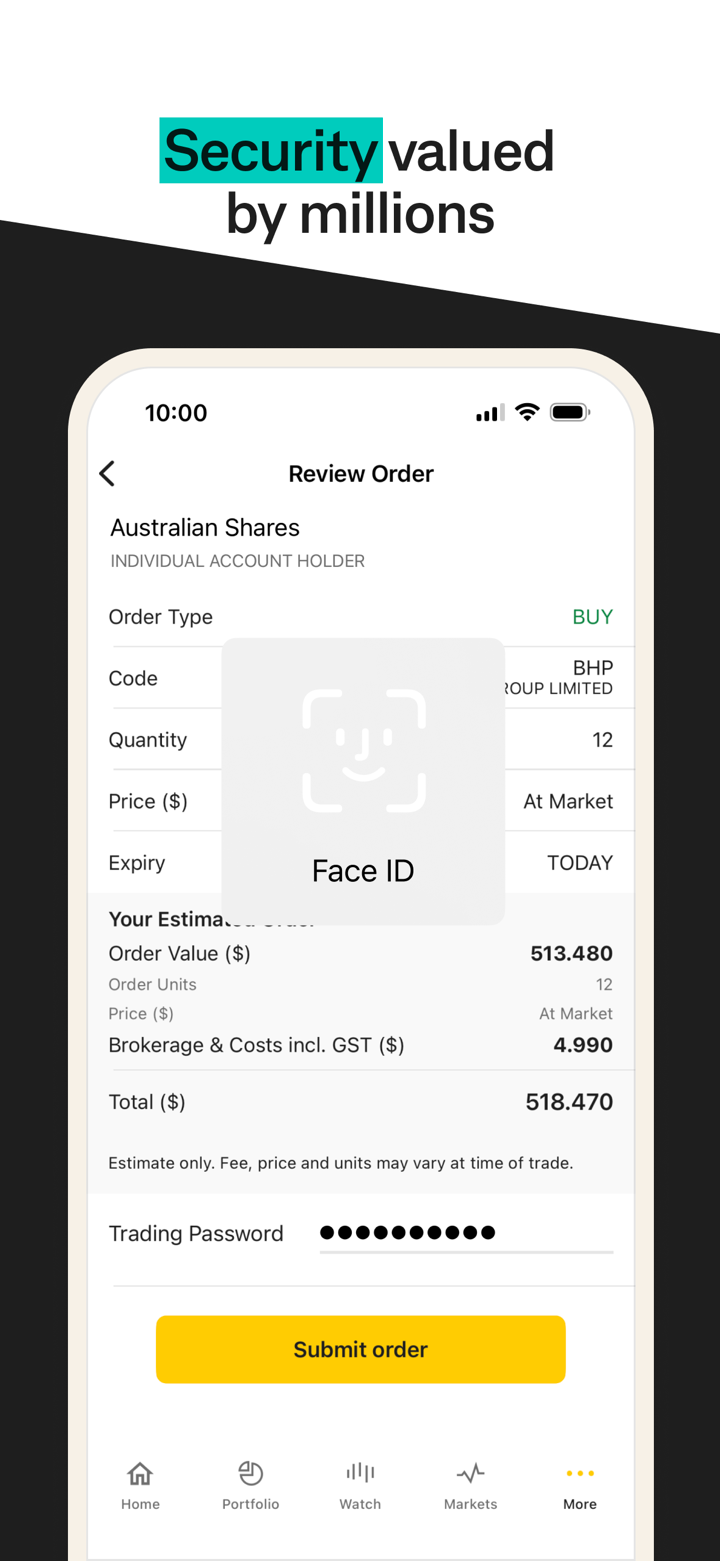

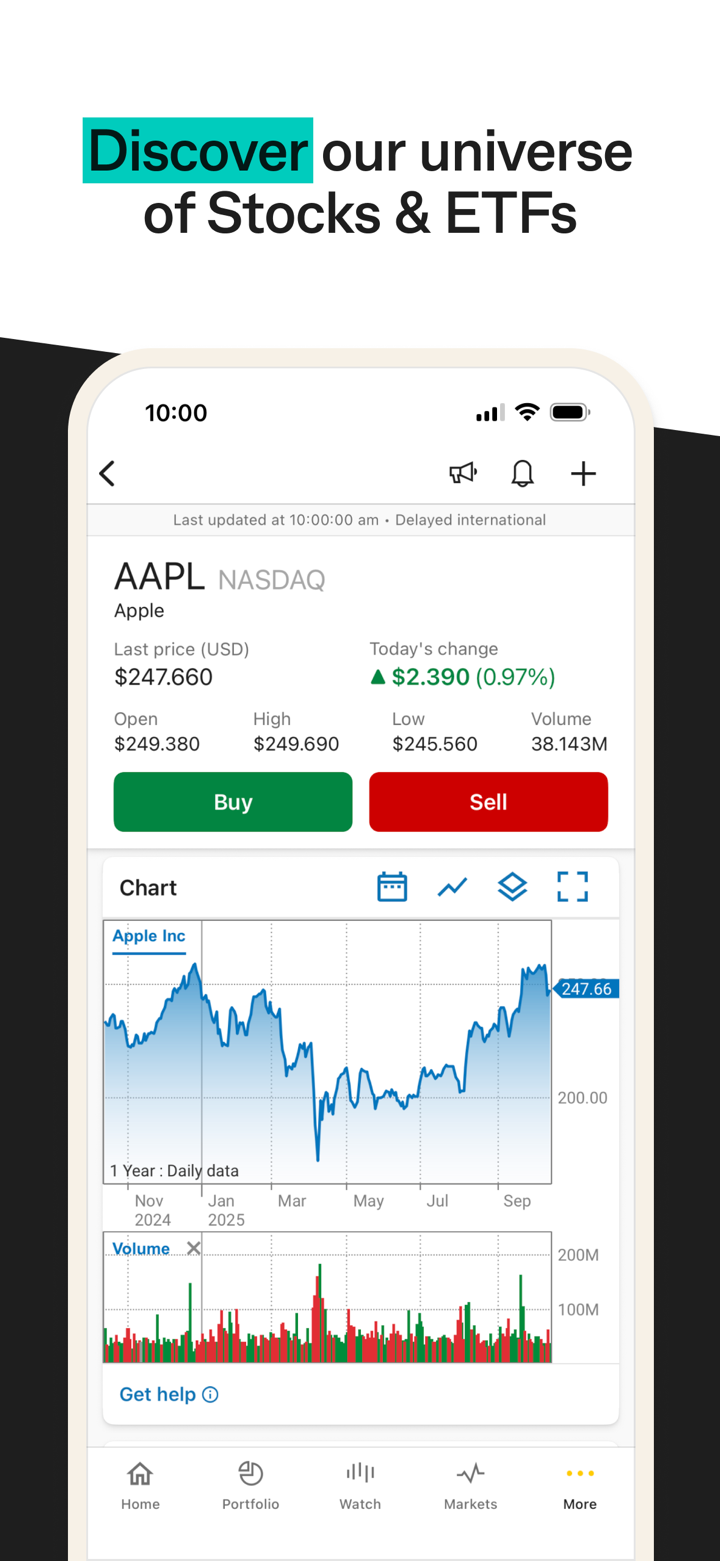

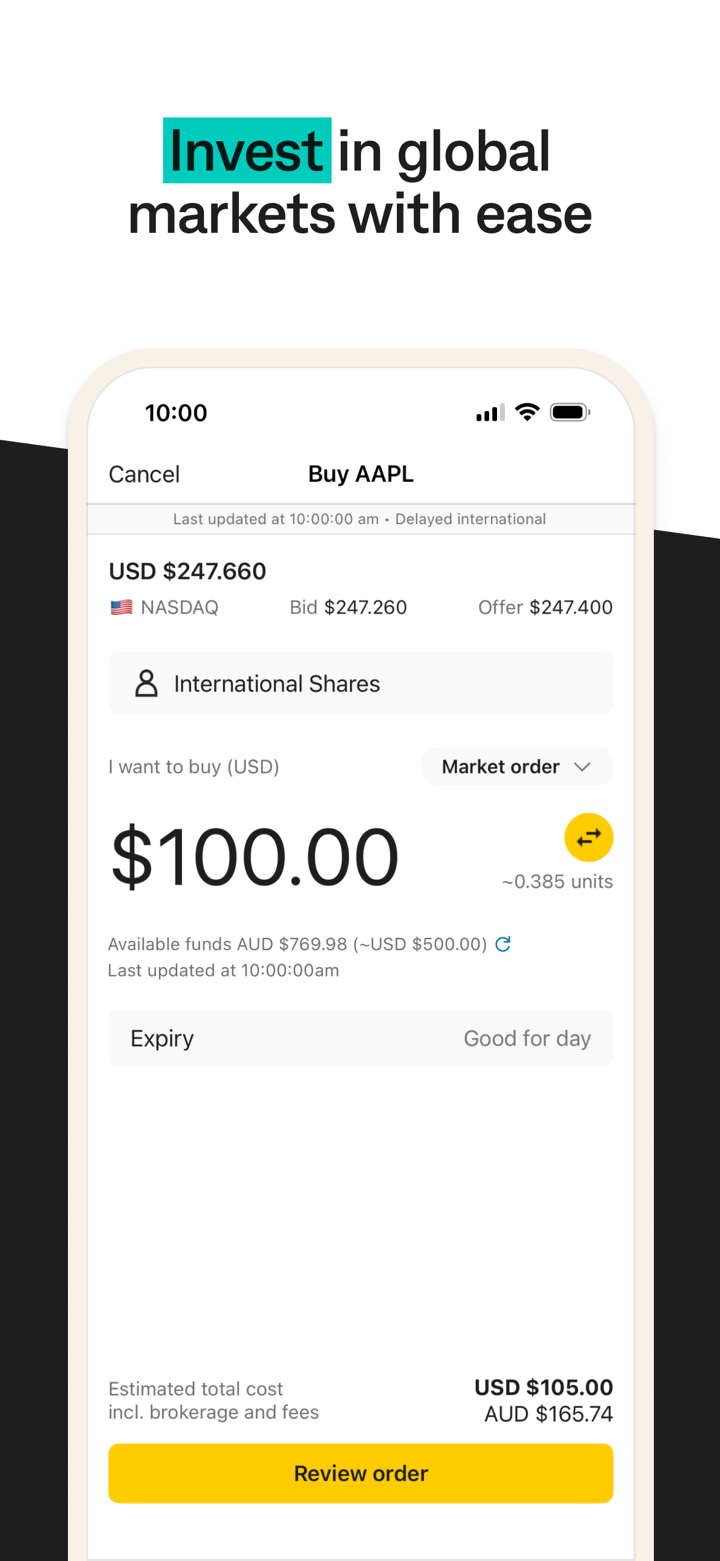

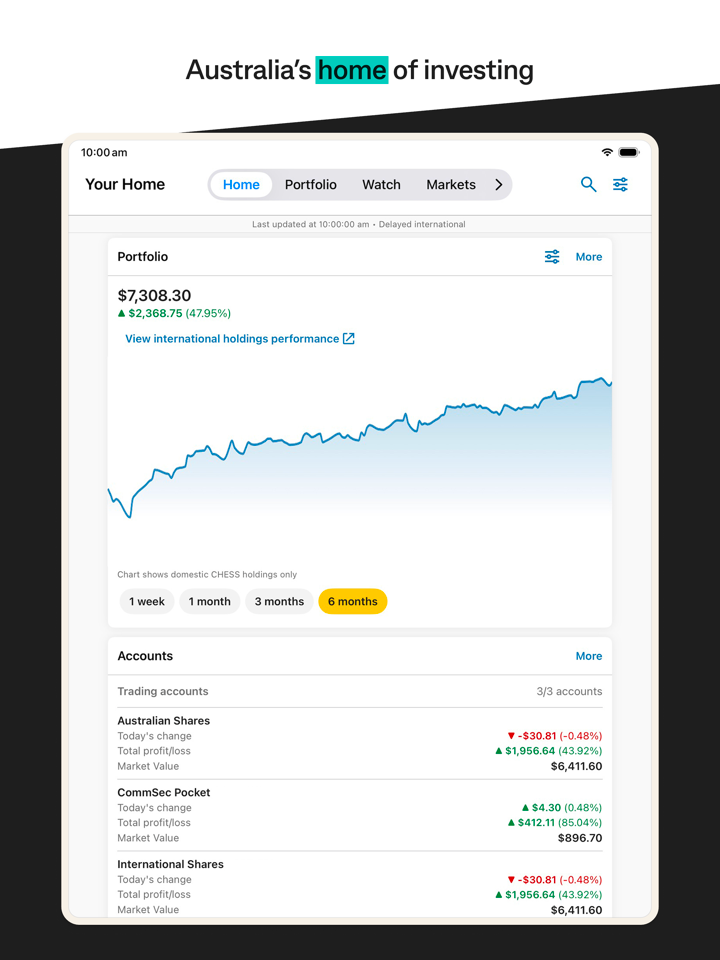

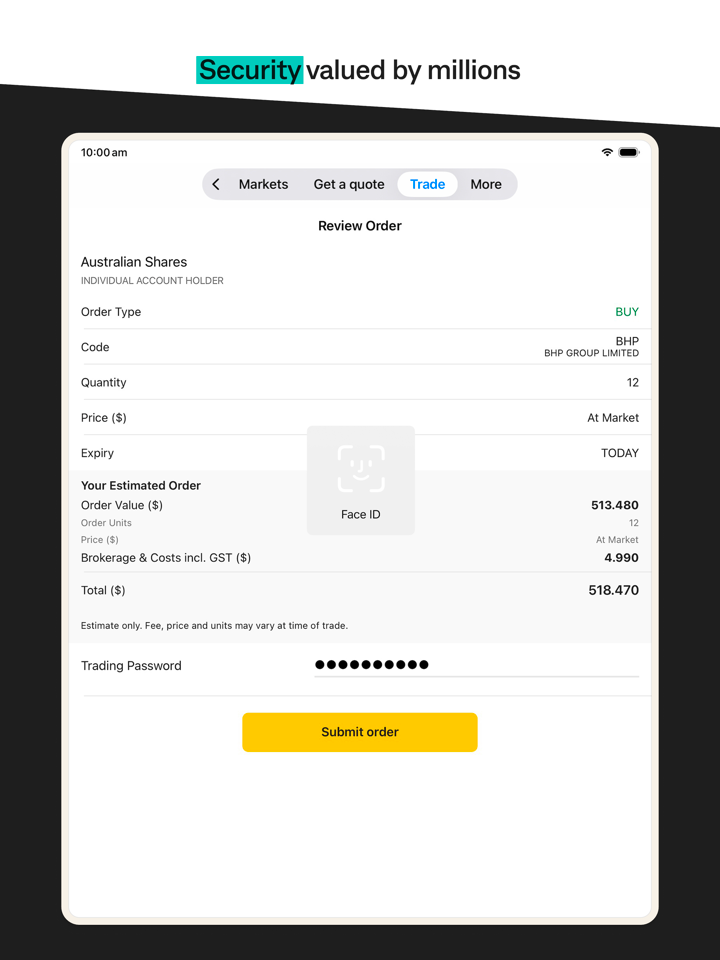

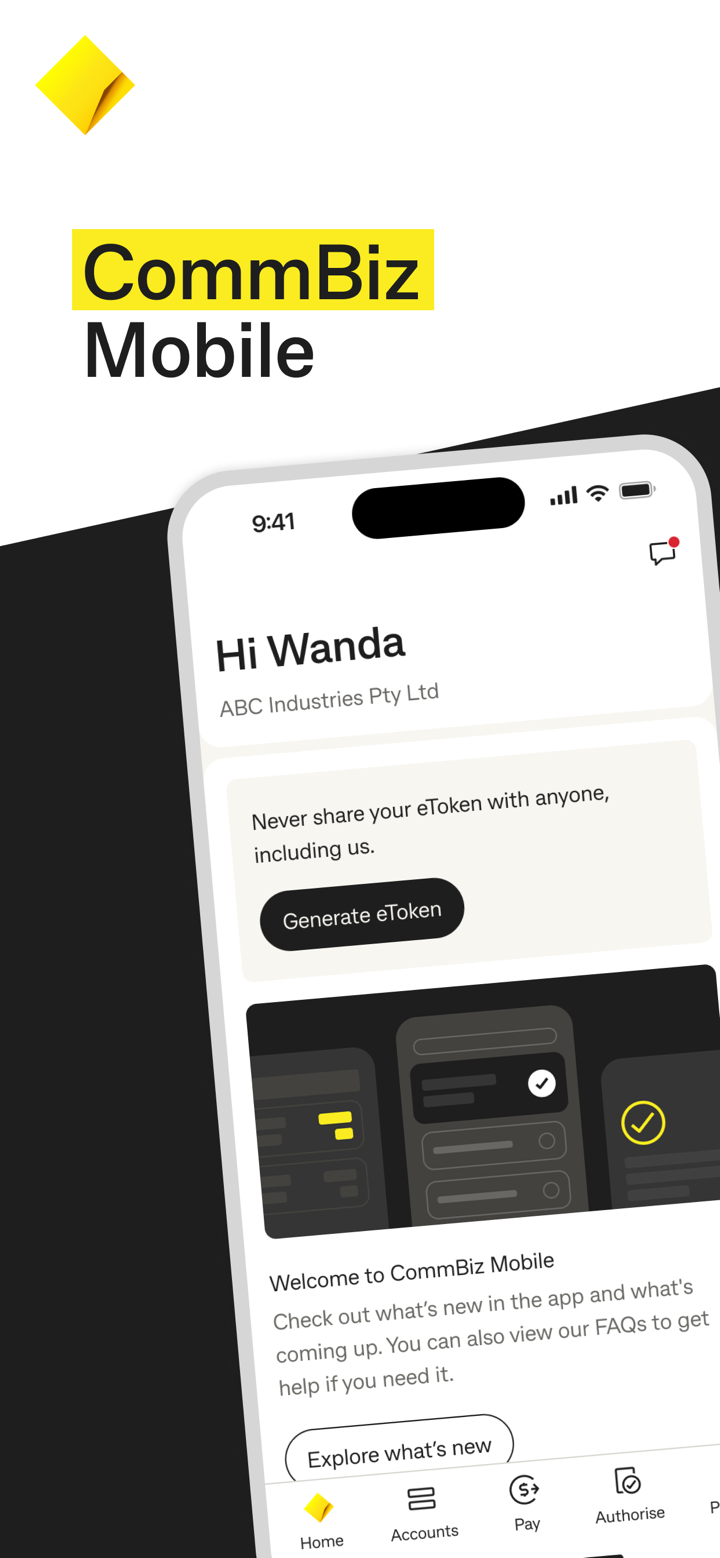

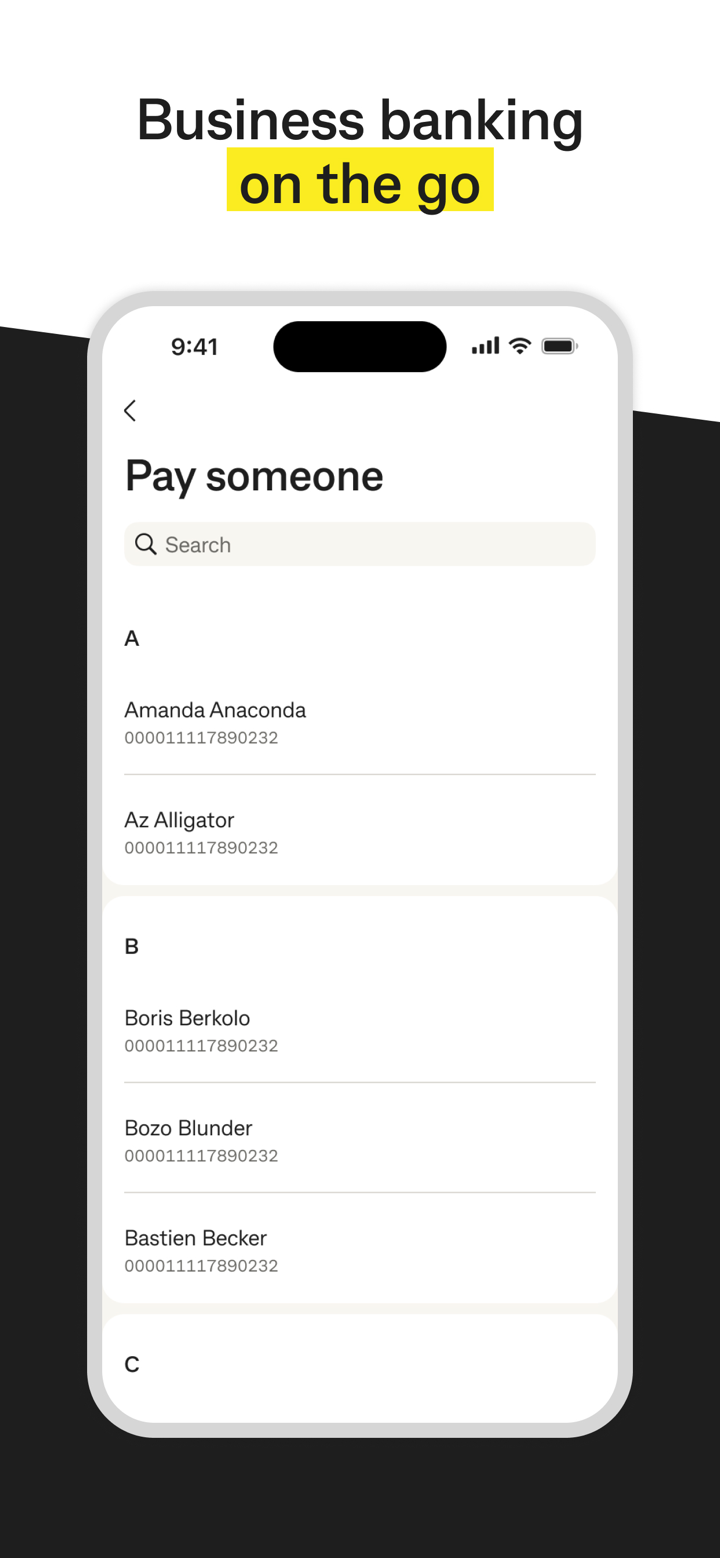

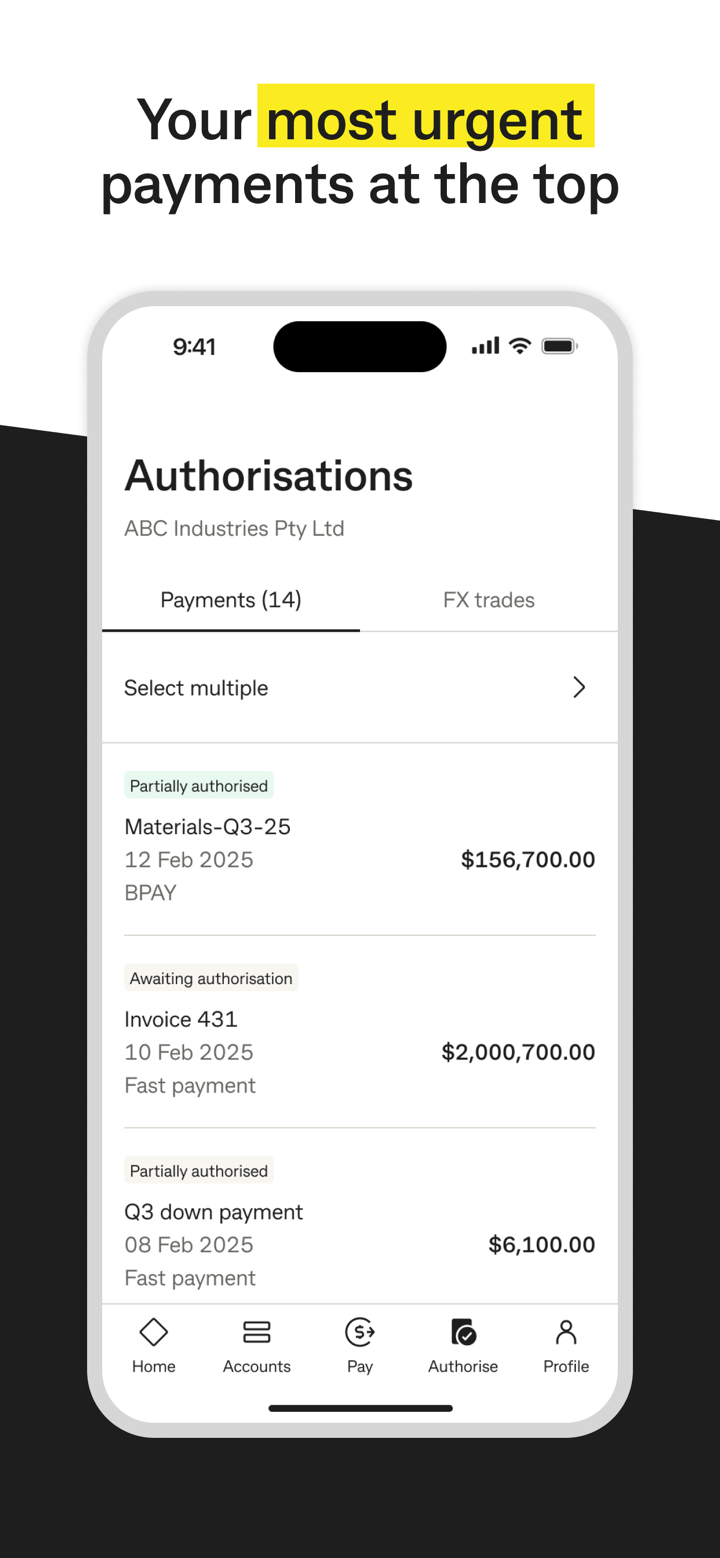

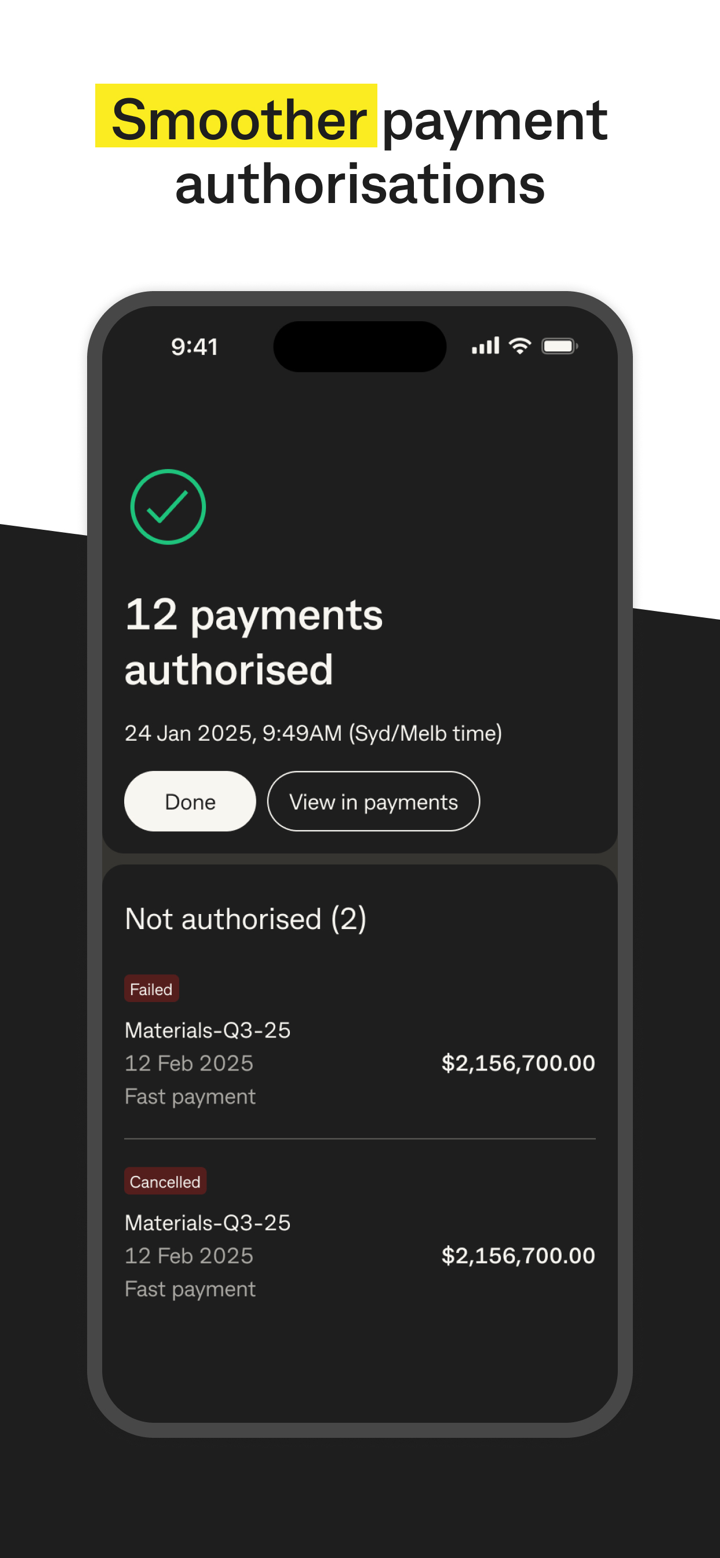

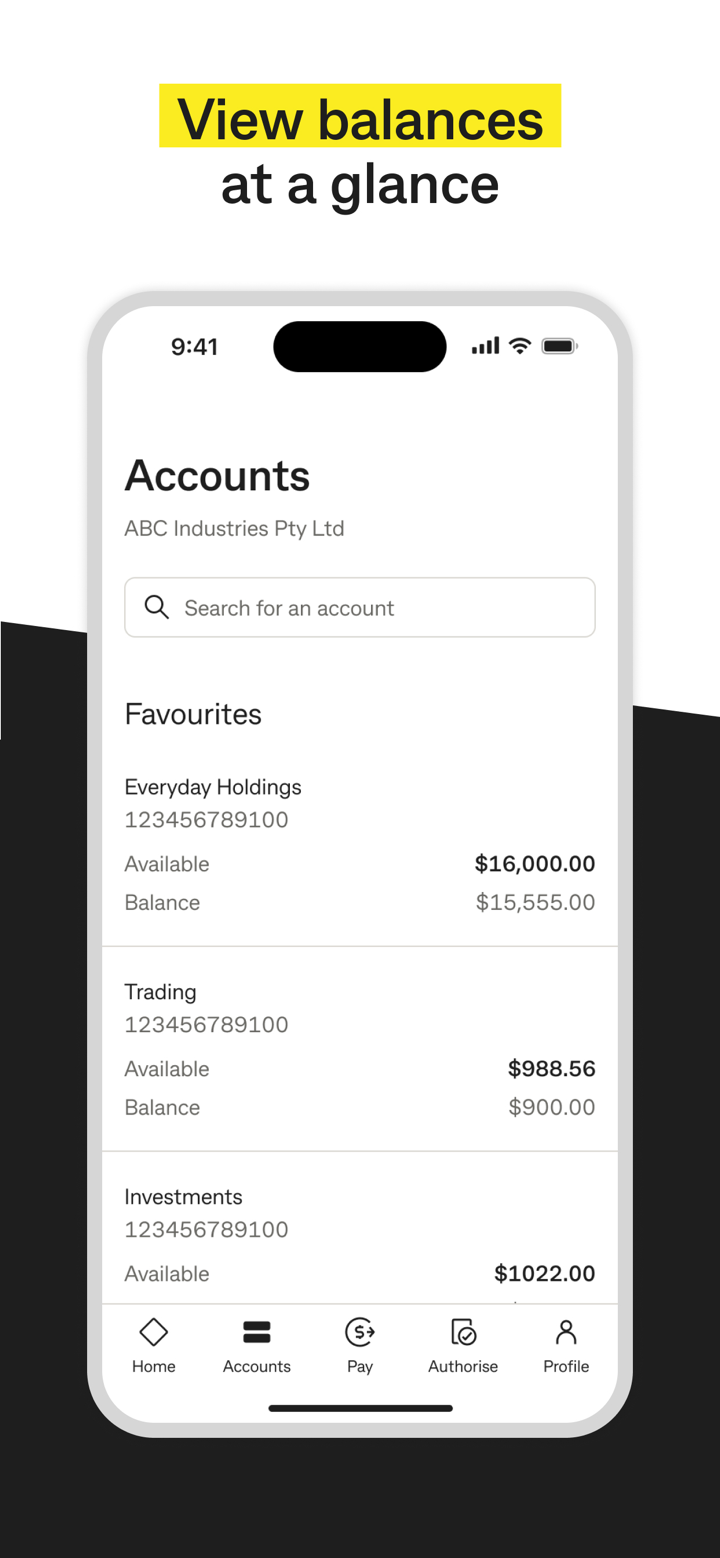

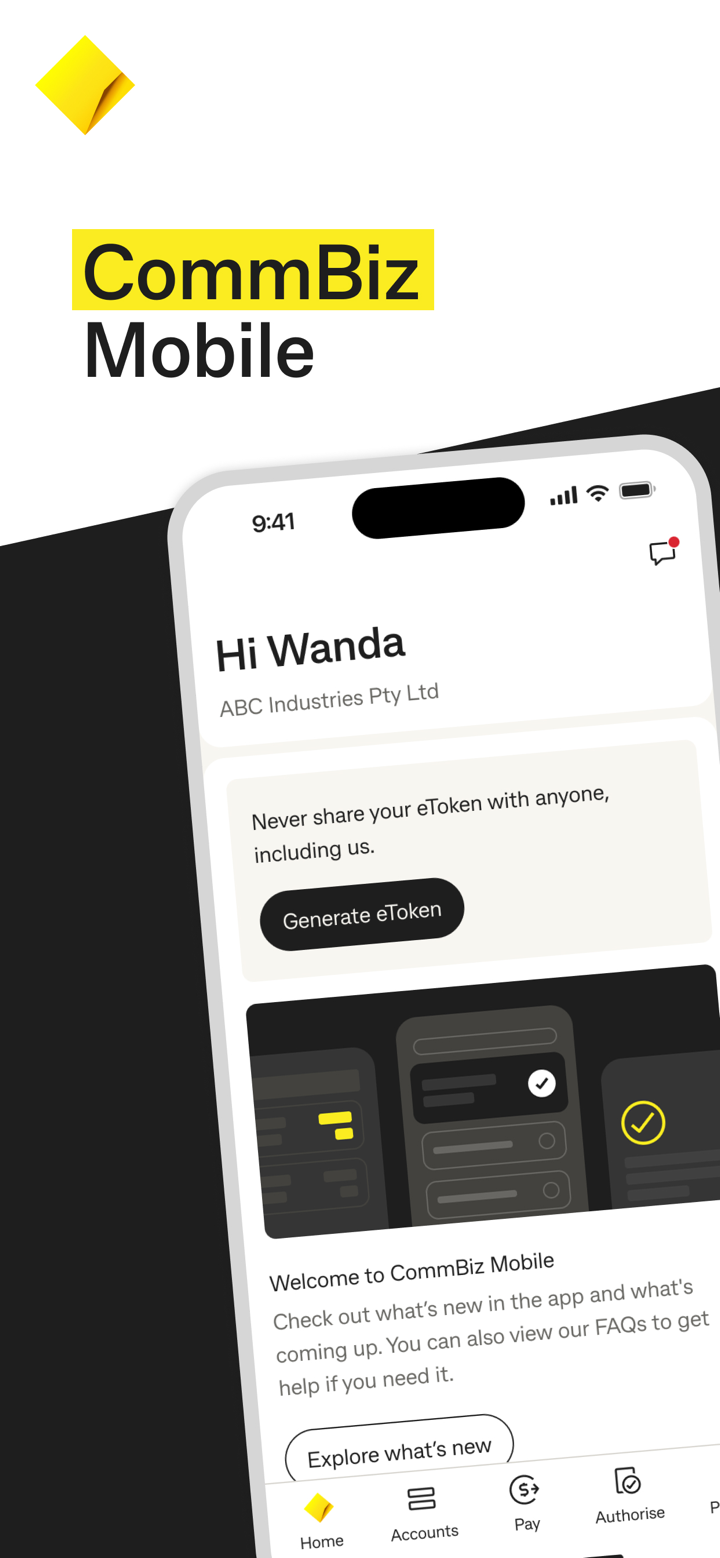

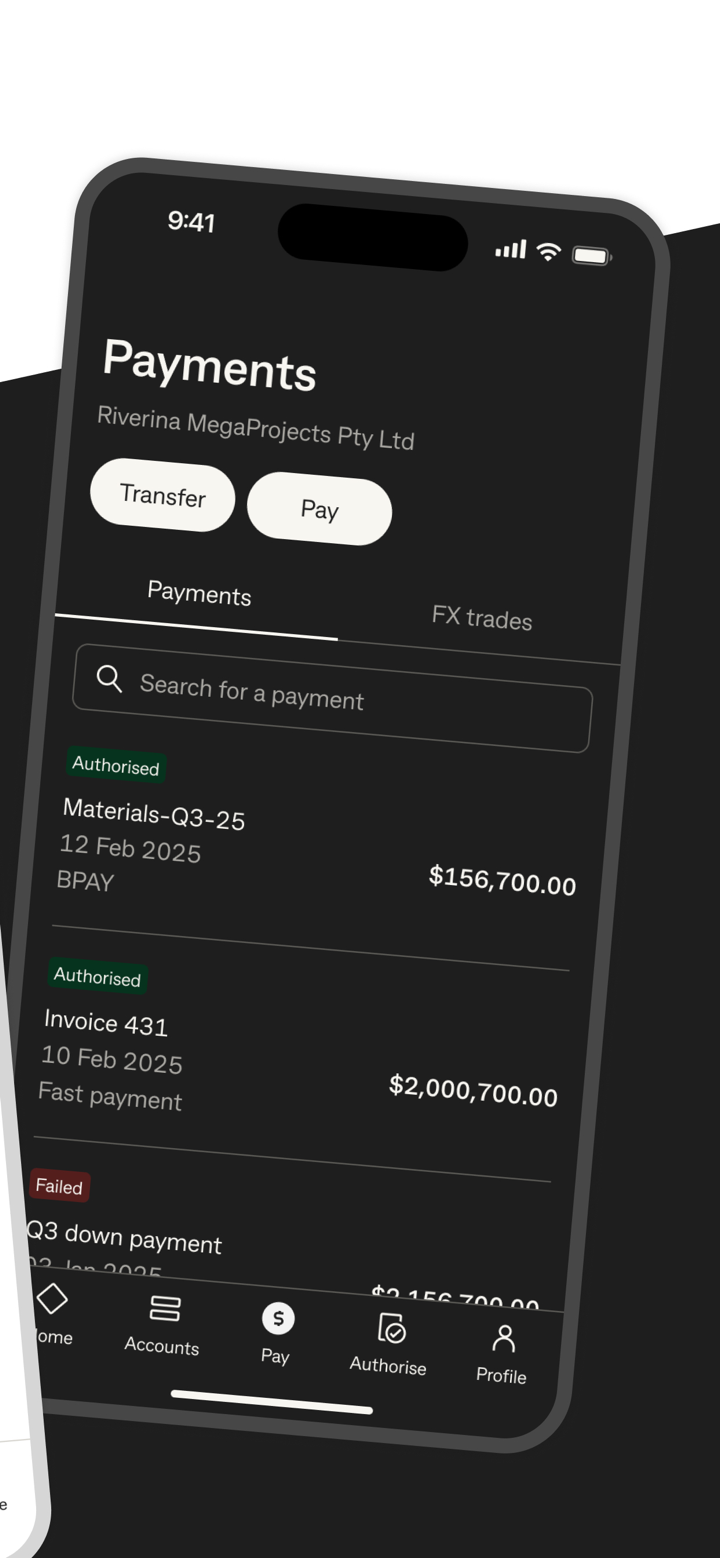

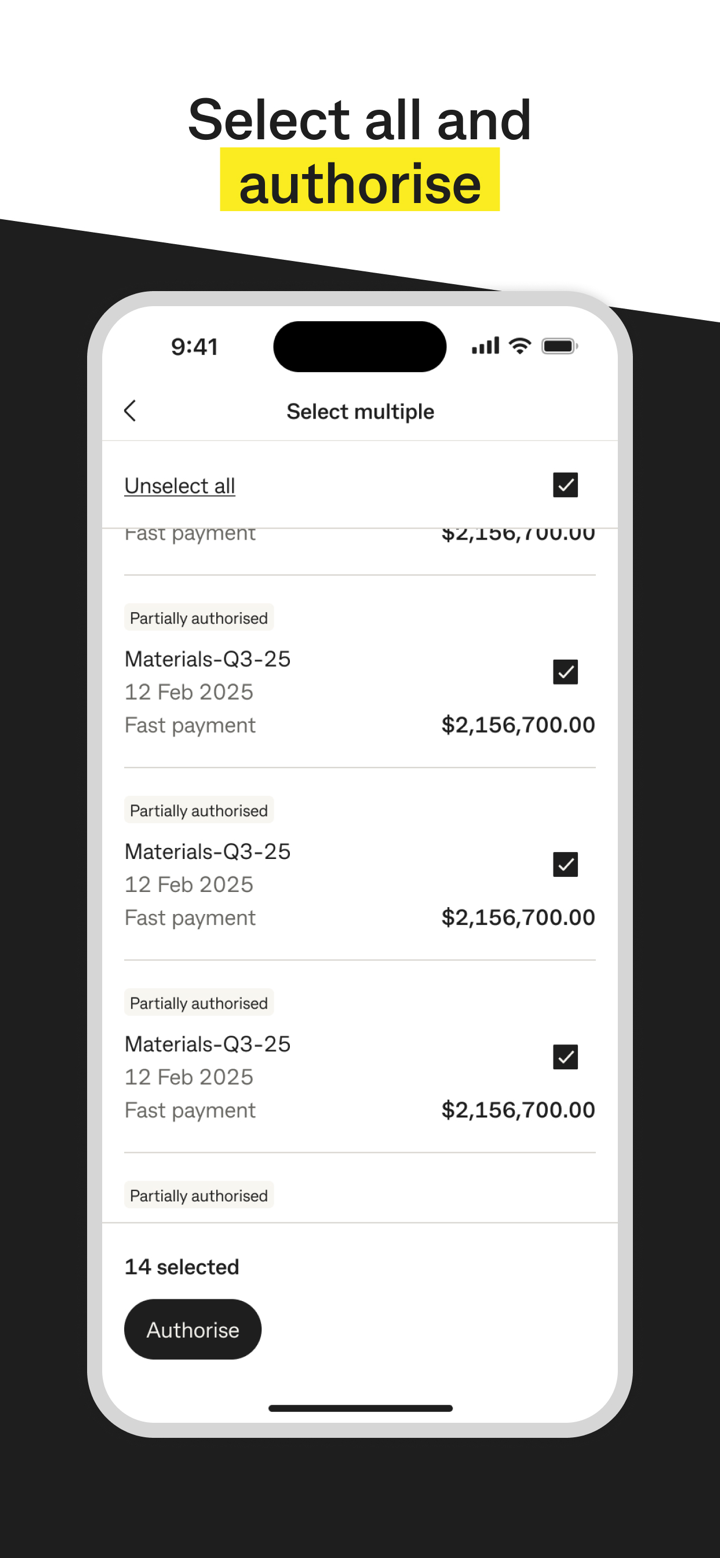

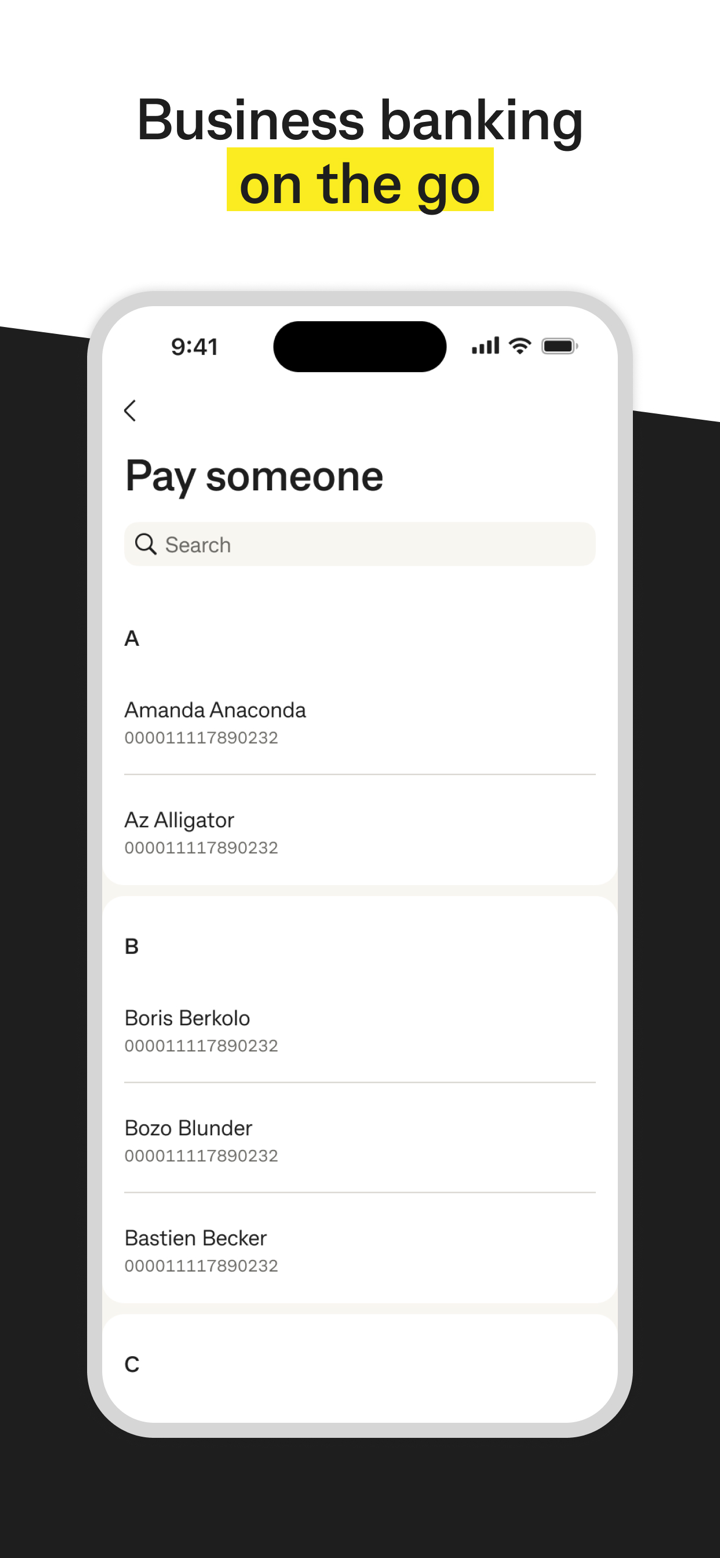

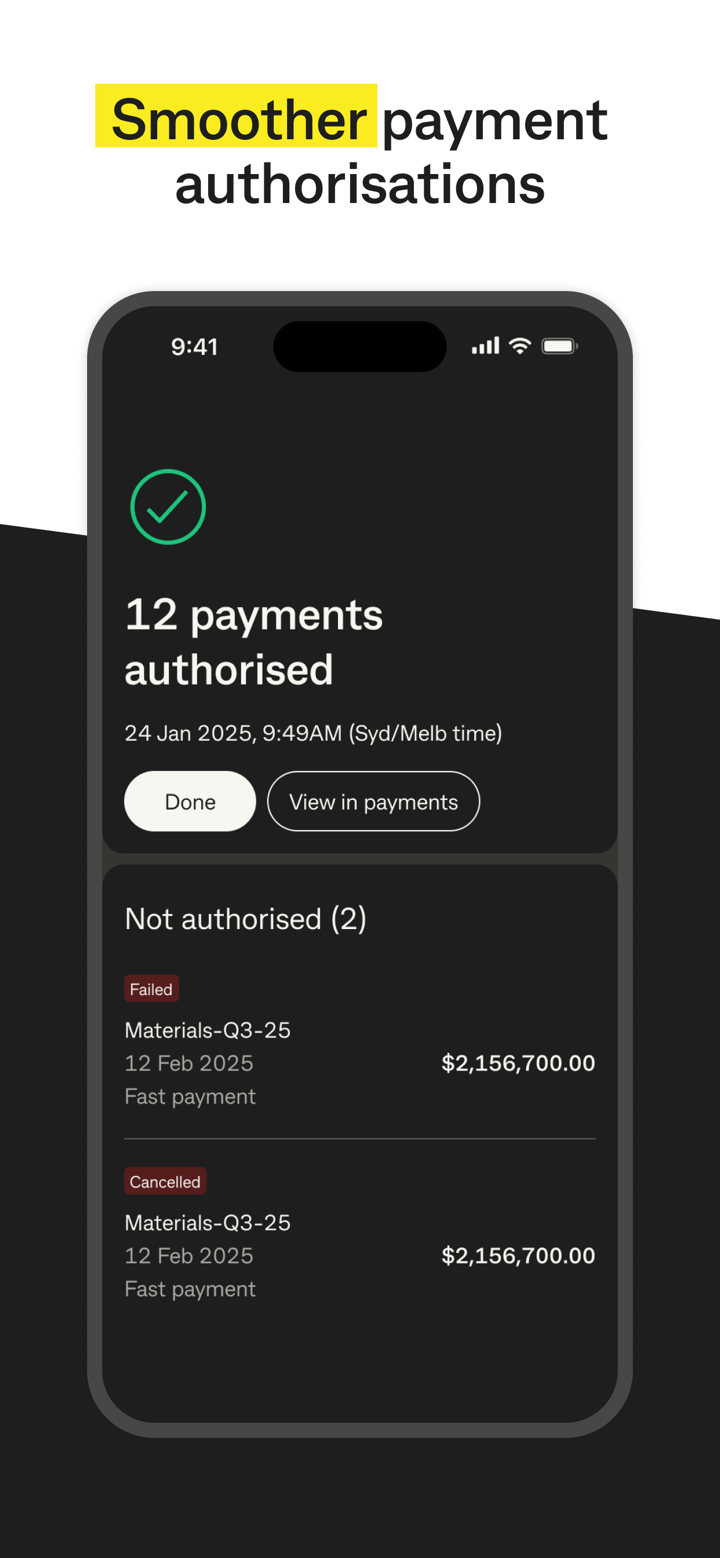

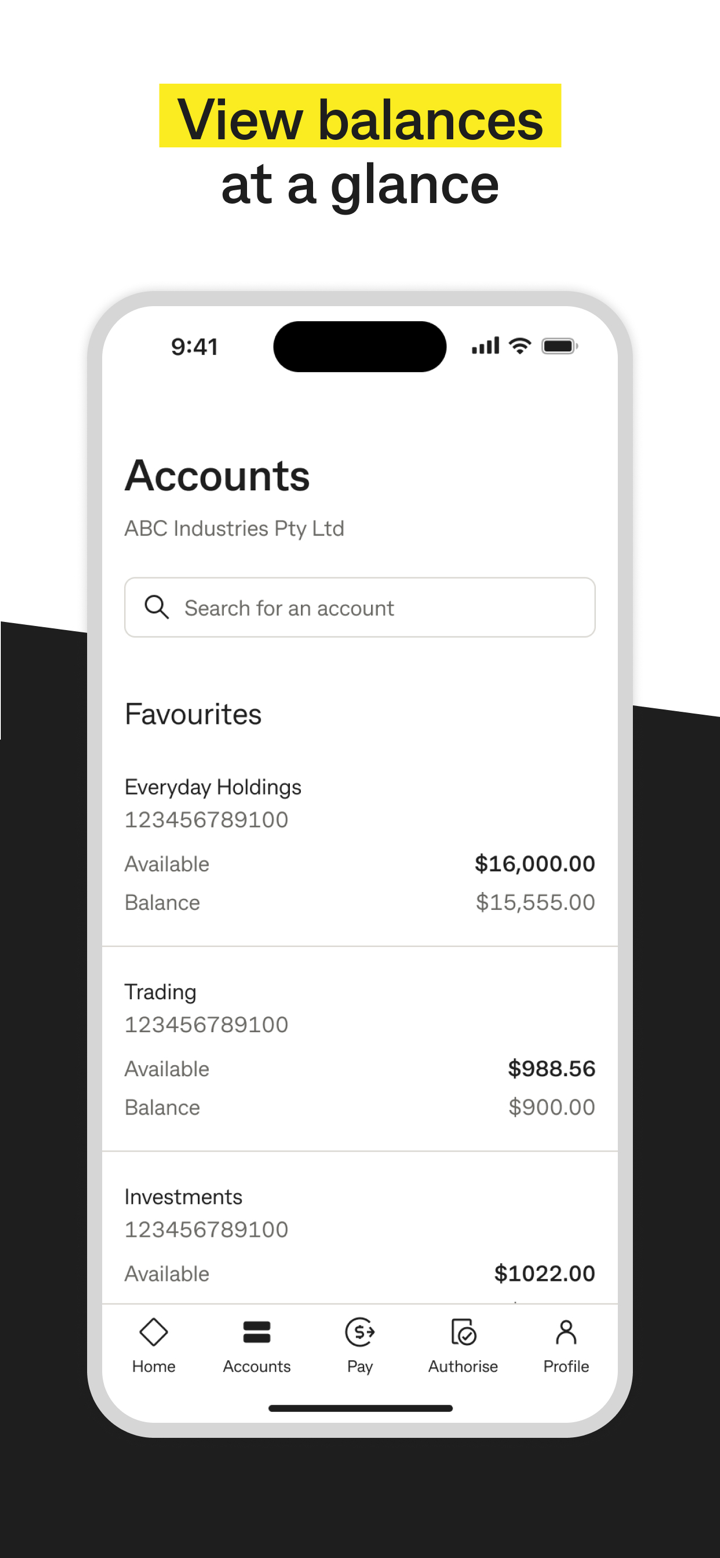

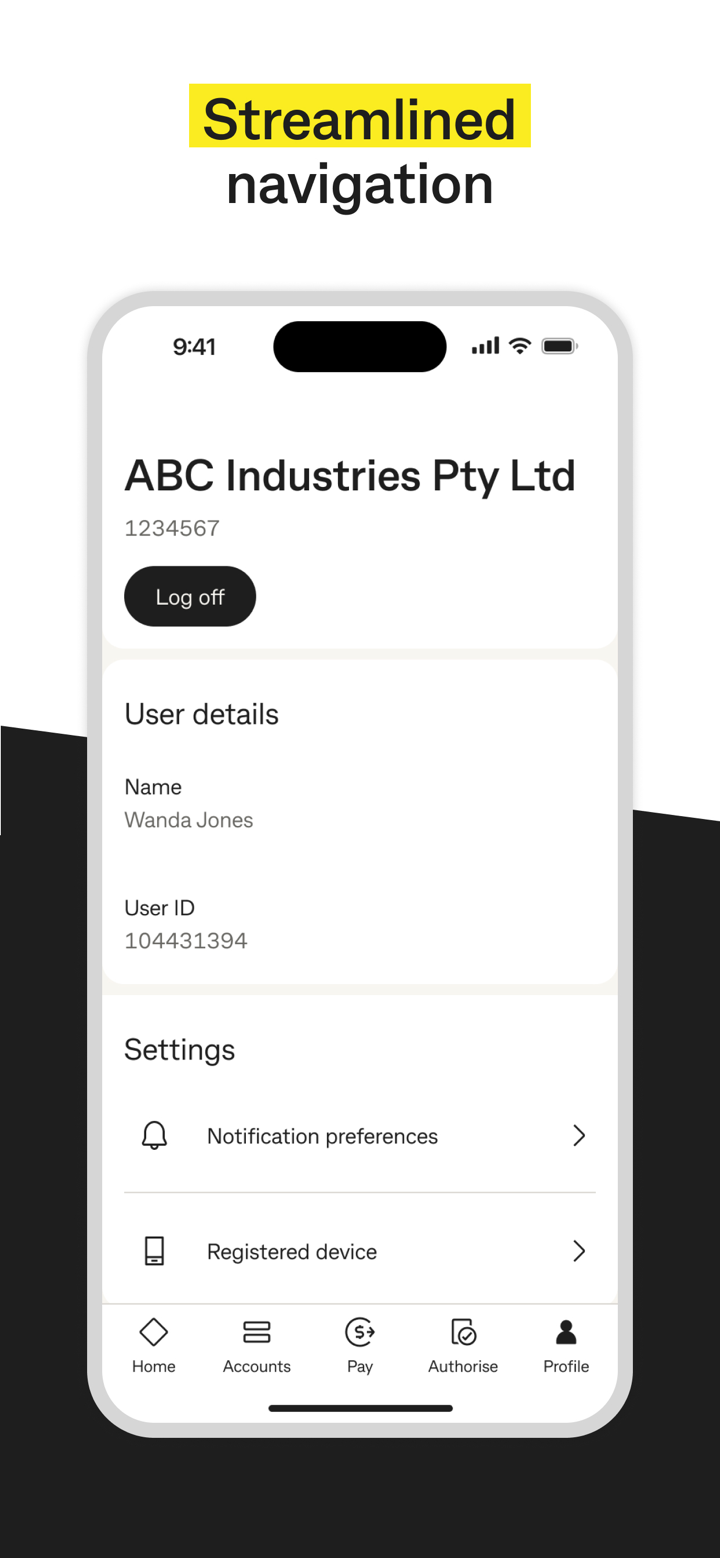

La Commonwealth Bank offre servizi bancari online tramite NetBank. NetBank consente ai clienti di trasferire fondi, gestire conti, accedere ad attività e passività e anche gestire risparmi e obiettivi di risparmio.[64] NetBank è offerto anche con un'app mobile disponibile per iOS e Android.

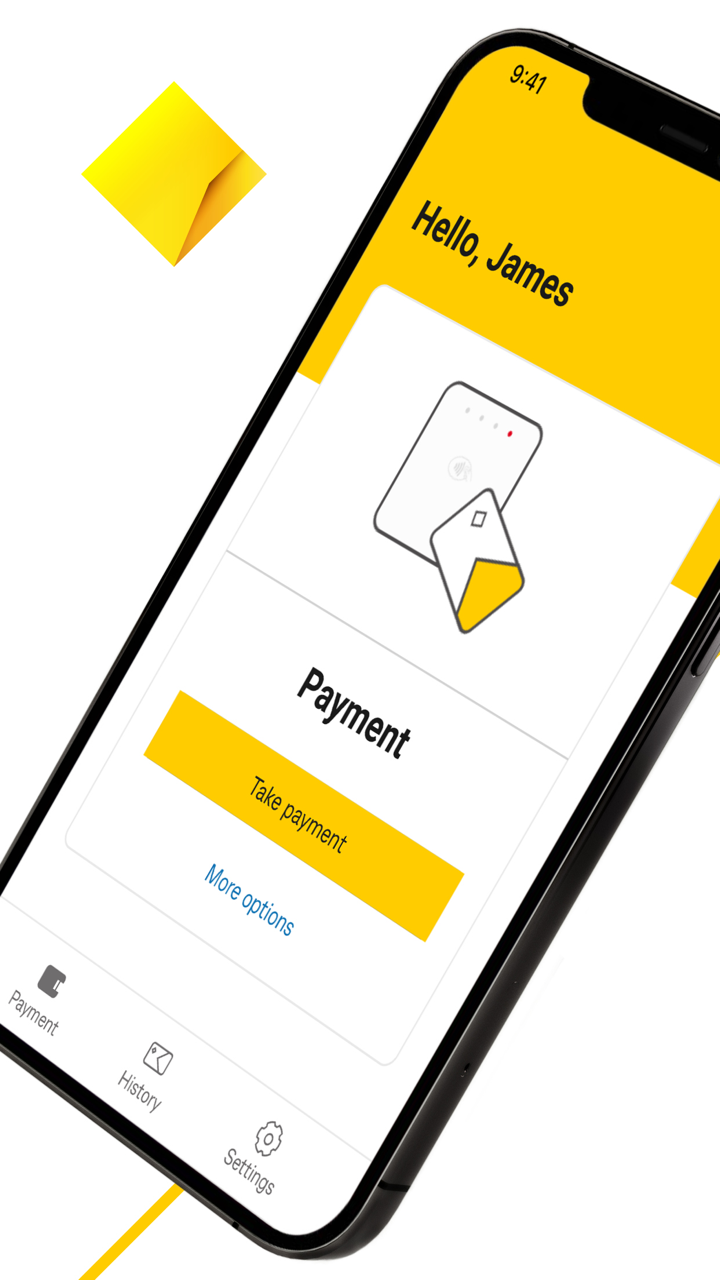

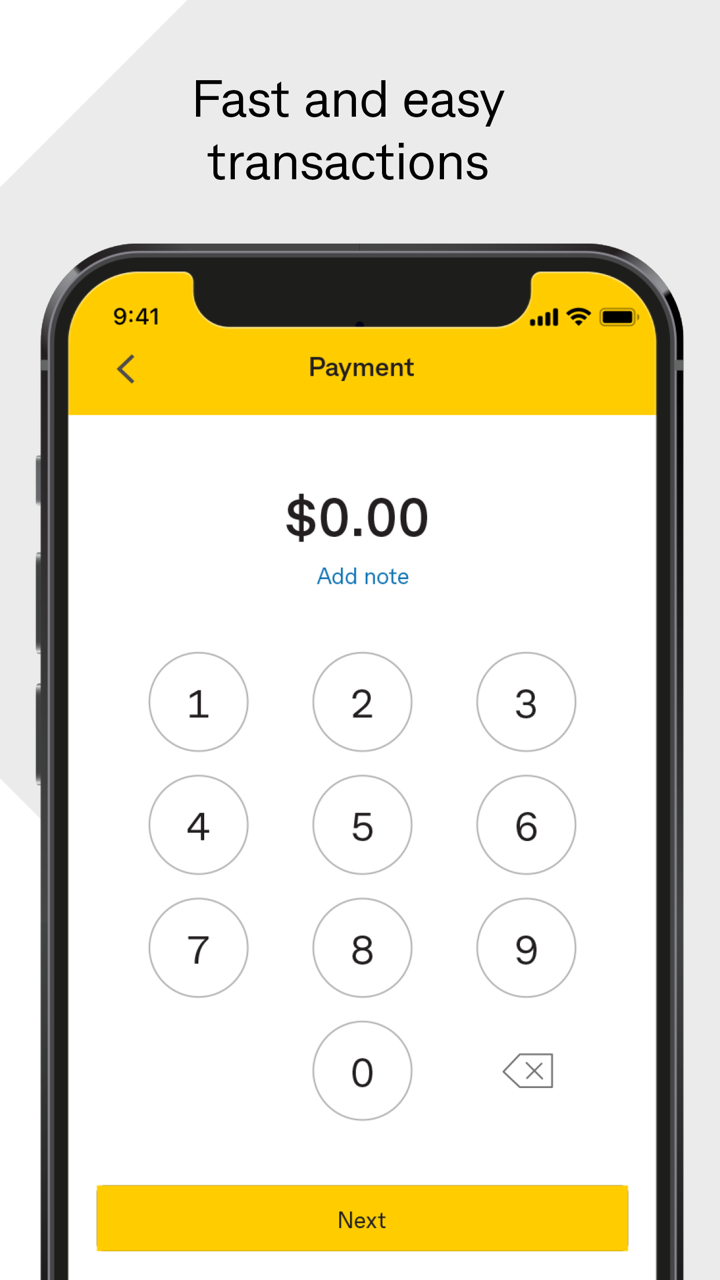

Albero

Beem It è un'applicazione mobile di pagamento istantaneo scaricabile gratuitamente di proprietà di Commonwealth Bank, NAB e Westpac successivamente venduta a Eftpos Australia. Offre un servizio di trasferimento di pagamento istantaneo tra gli utenti registrati dell'app indipendentemente dalla banca con cui si trovano. Le caratteristiche principali dell'app includono opzioni per pagare, trasferire, richiedere e dividere denaro.[65]