Profil perusahaan

| China-Derivatives FuturesRingkasan Ulasan | |

| Didirikan | 1996 |

| Negara/Daerah Terdaftar | China |

| Regulasi | CFFEX |

| Produk & Layanan | Futures, Brokerage, Investasi, Konsultasi, Manajemen Aset, Dana |

| Akun Demo | ✅ |

| Leverage | / |

| Spread | / |

| Platform Perdagangan | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, dan TradeBlazer |

| Deposit Minimum | / |

| Dukungan Pelanggan | Obrolan Langsung |

| Email: office@cdfco.com.cn | |

| Telepon: 400-688-1117 | |

| Alamat: Zhongyan Futures Co., Ltd., Lantai 7, Gedung B, Jinchang'an Building, No. 82 Dongsi Fourth Ring Road, Distrik Chaoyang, Beijing | |

China-Derivatives Futures Informasi

Didirikan pada tahun 1996, China-Derivatives Futures Co., Ltd. adalah entitas yang diatur di bawah pengawasan China Financial Futures Exchange (CFFEX). Namun, perusahaan ini hanya melayani klien di dalam China dan merupakan pemain utama di pasar derivatif domestik. Ini adalah perusahaan keuangan komprehensif yang disetujui oleh China Securities Regulatory Commission (CSRC) yang mengkhususkan diri dalam pialang komoditas futures domestik, pialang futures keuangan, konsultasi perdagangan futures, manajemen aset, dan penawaran umum penjualan dana investasi sekuritas.

Kelebihan & Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh CFFEX | Kurang transparan |

| Spesialis dalam perdagangan futures | |

| Dukungan perdagangan demo | |

| Berbagai platform perdagangan | |

| Sejarah operasi panjang |

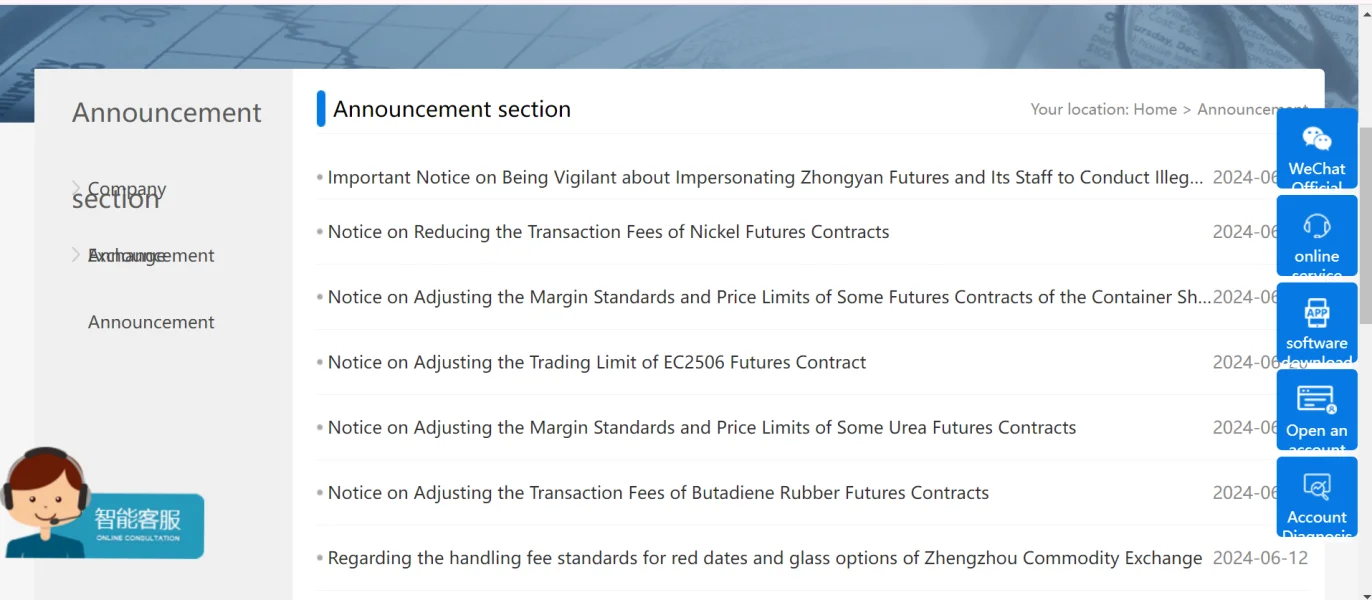

Apakah China-Derivatives Futures Legal?

China-Derivatives Futures diatur oleh CFFEX dengan nomor lisensi 0197.

| Negara yang Diatur | Otoritas yang Diatur | Status Regulasi | Entitas yang Diatur | Tipe Lisensi | Nomor Lisensi |

| China | China Financial Futures Exchange (CFFEX) | Diatur | China Commodity Futures Co., Ltd. | Lisensi Futures | 0197 |

Produk & Layanan

China-Derivatives Futures berfokus terutama pada perdagangan futures, dan juga menawarkan berbagai layanan investasi yang komprehensif, seperti pialang, investasi, konsultasi, manajemen aset, dan dana.

| Produk & Layanan | Didukung |

| Futures | ✔ |

| Dana | ✔ |

| Pialang | ✔ |

| Investasi | ✔ |

| Konsultasi | ✔ |

| Manajemen Aset | ✔ |

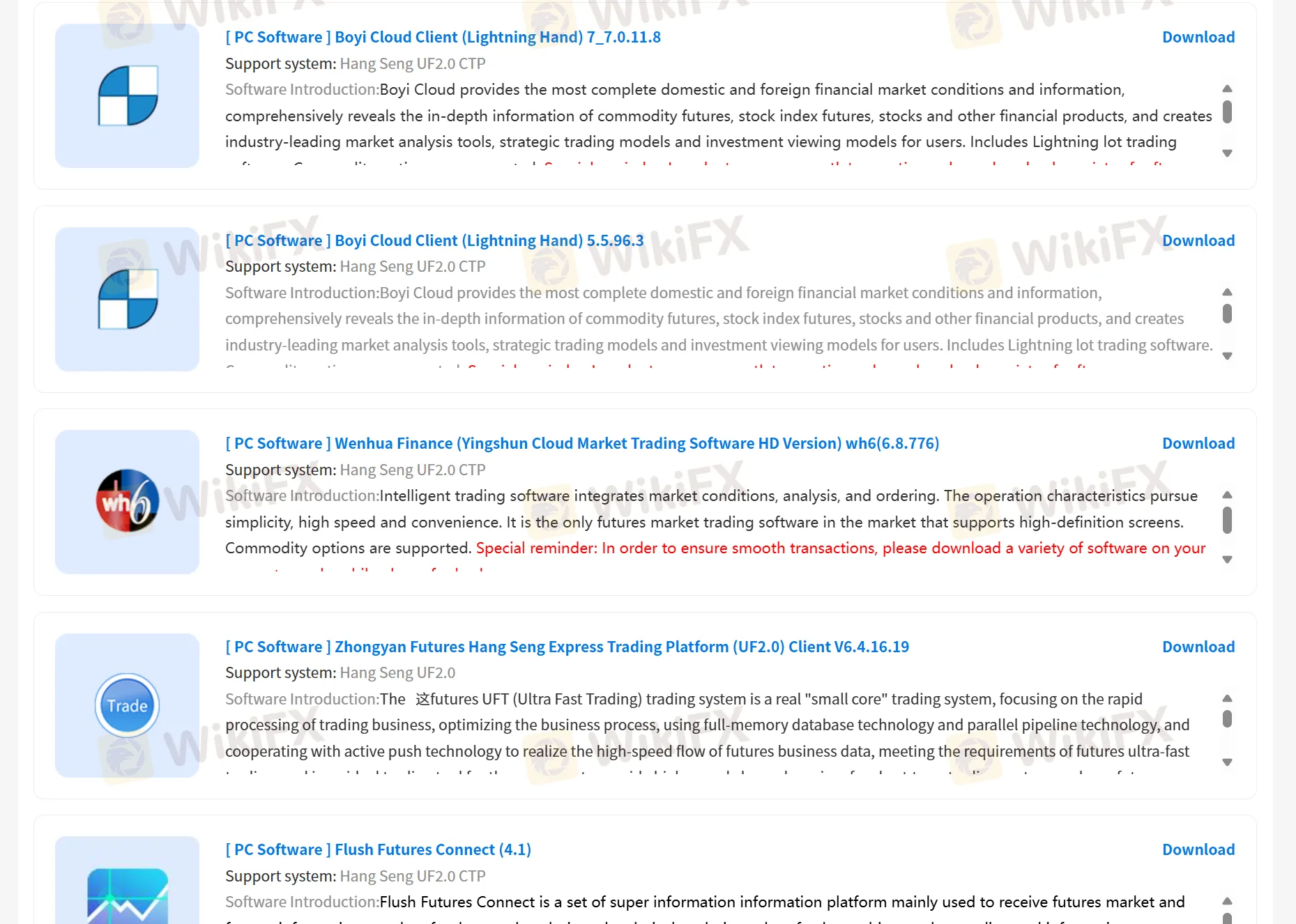

Platform Perdagangan

China Derivatives Futures mendukung perdagangan melalui platform-platform properti, China-Derivatives Futures App, dan Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, dan TradeBlazer. Selain itu, juga memberikan kesempatan kepada pelanggan untuk mensimulasikan perdagangan.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| China-Derivatives Futures App | ✔ | PC, Mobile | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

扶众法援

Hong Kong

Pada bulan Maret ini, saya menerima permintaan pertemanan, yang saya pikir mungkin adalah teman baik. Kemudian saya ditarik ke dalam kelompok persiapan, di mana anggota menunjukkan tangkapan layar keuntungan. Saya tergerak dan diamati untuk sementara waktu. Kemudian, saya juga terdaftar dan mengikuti instruksi guru. Guru meminta saya untuk membawa setoran menjadi 500 ribu sebagai ambang batas, mengklaim bahwa guru profesional dapat beroperasi untuk saya. Ada untung dan rugi. Ketika hanya ada 100 ribu yang tersisa, saya mencoba mengajukan permohonan penarikan. Tetapi saluran pendanaan tidak tersedia atas dasar risiko keberadaan. Guru terus menangkis dan memperhatikan saya bahwa setoran / penarikan mungkin ditunda. Penarikan tidak tersedia selama satu minggu.

Paparan

Cris Men

Ekuador

saya tidak pernah memiliki masalah dengan penarikan atau semacamnya

Baik

Maximilian 111

Nigeria

Saya melakukan perdagangan komoditas di sini sepanjang waktu. Ini menawarkan biaya transparan, dan layanan pelanggan yang luar biasa, yang selalu menjadi pilihan saya yang solid.

Baik

Vegas

Kolombia

China-Derivatives Futures co,.LTD. Menyediakan berbagai aplikasi perdagangan, dalam hal kesalahan perdagangan, sangat intim. Dan perusahaan ini memiliki badan regulasi resmi, informasi perdagangan terbuka dan transparan, saya sangat tenang.

Baik