Buod ng kumpanya

| China-Derivatives FuturesBuod ng Pagsusuri | |

| Itinatag | 1996 |

| Rehistradong Bansa/Rehiyon | China |

| Regulasyon | CFFEX |

| Mga Produkto at Serbisyo | Futures, Brokerage, Investment, Consulting, Asset Management, Fund |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Platform ng Paggawa ng Kalakalan | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, at TradeBlazer |

| Minimum na Deposit | / |

| Suporta sa Customer | Live Chat |

| Email: office@cdfco.com.cn | |

| Telepono: 400-688-1117 | |

| Address: Zhongyan Futures Co., Ltd., 7th Floor, Building B, Jinchang'an Building, No. 82 Dongsi Fourth Ring Road, Chaoyang District, Beijing | |

China-Derivatives Futures Impormasyon

Itinatag noong 1996, ang China-Derivatives Futures Co., Ltd. ay isang reguladong entidad sa ilalim ng pangangasiwa ng China Financial Futures Exchange (CFFEX). Gayunpaman, naglilingkod lamang ito sa mga kliyente sa loob ng China at kilalang pangunahing player sa domestic derivatives market. Ito ay isang kumprehensibong kumpanyang pinahihintulutan ng China Securities Regulatory Commission (CSRC) na nakaspecialize sa domestic commodity futures brokerage, financial futures brokerage, futures trading consulting, asset management, at public offering ng securities investment fund sales.

Mga Benepisyo at Kons

| Benepisyo | Kons | |

| Regulado ng CFFEX | Nakaspecialize sa futures trading | |

| Suportado ang demo trading | ||

| Iba't ibang mga plataporma ng kalakalan | ||

| Mahabang kasaysayan ng operasyon |

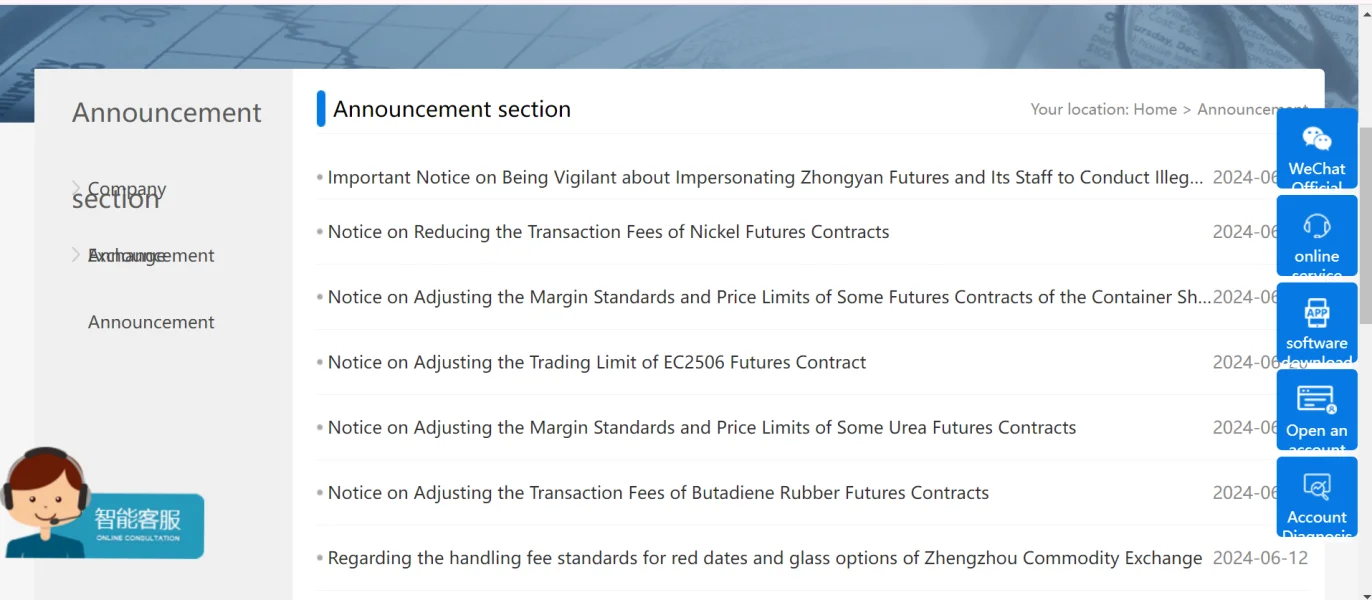

Tunay ba ang China-Derivatives Futures ?

Ang China-Derivatives Futures ay regulado ng CFFEX sa ilalim ng lisensyang 0197.

| Regulado na Bansa | Otoridad ng Regulasyon | Status ng Regulasyon | Reguladong Entidad | Uri ng Lisensya | Numero ng Lisensya |

| China | China Financial Futures Exchange (CFFEX) | Regulado | China Commodity Futures Co., Ltd. | Lisensya sa Futures | 0197 |

Mga Produkto at Serbisyo

China-Derivatives Futures ay pangunahing nakatuon sa kalakalan ng hinaharap, at nag-aalok din ito ng kumpletong hanay ng mga serbisyong pang-invest, tulad ng brokerage, investment, consulting, asset management, at pondo.

| Mga Produkto at Serbisyo | Supported |

| Hinaharap | ✔ |

| Pondo | ✔ |

| Brokerage | ✔ |

| Investment | ✔ |

| Consulting | ✔ |

| Asset Management | ✔ |

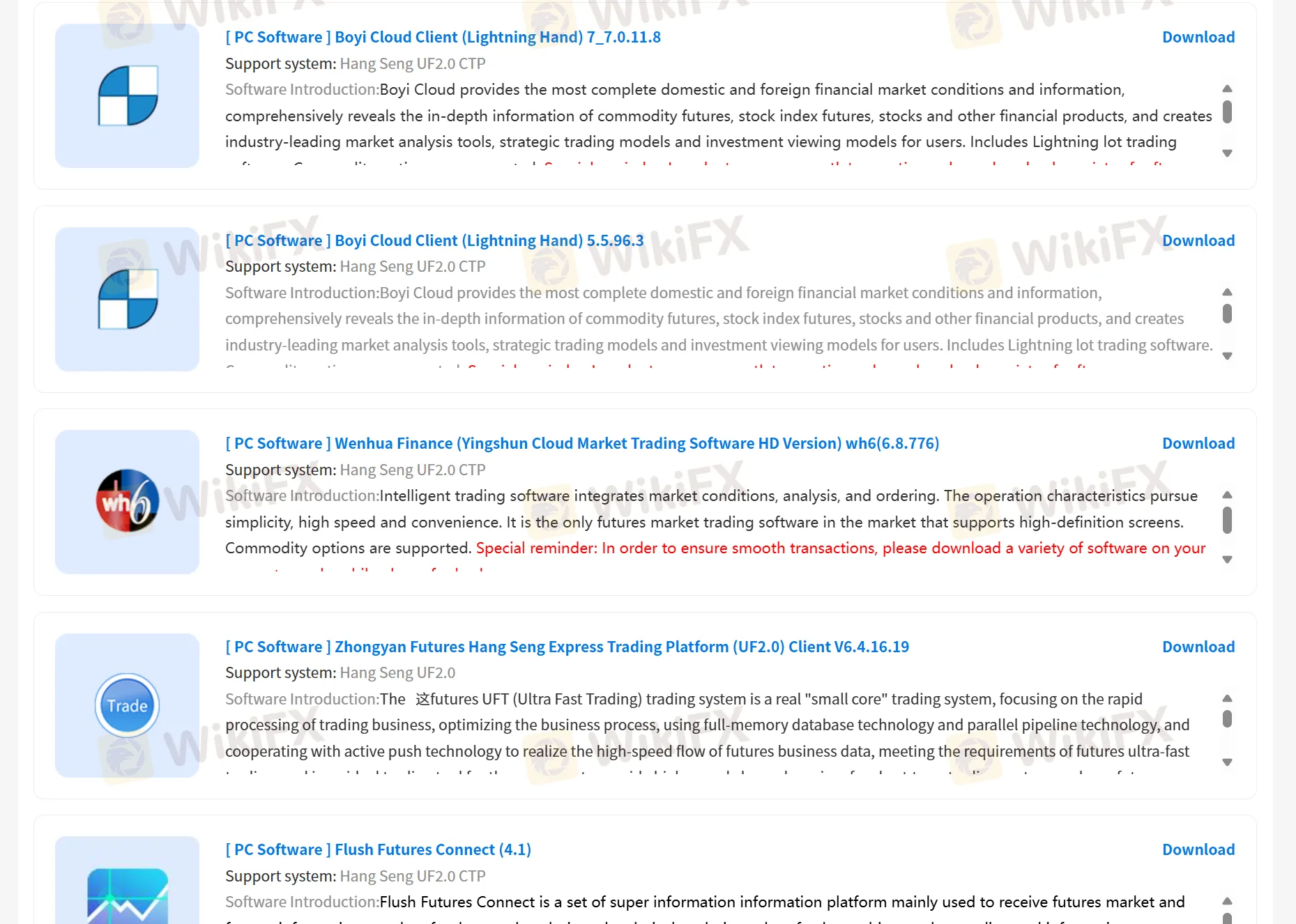

Plataforma ng Kalakalan

Ang China Derivatives Futures ay sumusuporta sa kalakalan sa pamamagitan ng mga platform na sariling pag-aari, China-Derivatives Futures App, at Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, at TradeBlazer. Bukod dito, nagbibigay din ito ng mga pagkakataon para sa mga customer na mag-simula ng kalakalan.

| Plataforma ng Kalakalan | Supported | Available Devices | Suitable for |

| China-Derivatives Futures App | ✔ | PC, Mobile | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

扶众法援

Hong Kong

Ngayong Marso, nakatanggap ako ng isang kahilingan sa kaibigan, na sa palagay ko ay maaaring maging kaibigan ito sa stock. Pagkatapos ay hinila ako sa isang grupo ng paghahanda, kung saan nagpakita ang mga miyembro ng mga screenshot ng kita. Napalingon ako at naobserbahan sandali. Kalaunan, nakarehistro din ako at sumunod sa tagubilin ng guro. Hiniling sa akin ng guro na dalhin ang deposito sa 500,000 bilang isang threshold, na inaangkin na ang mga propesyonal na guro ay maaaring gumana para sa akin. May mga nadagdag at pagkalugi. Kapag mayroon pang 100 libong naiwan, sinubukan kong mag-aplay para sa pag-alis. Ngunit hindi magagamit ang channel ng pagpopondo sa pagkakaroon ng peligro. Ang guro ay patuloy na nag-fending at napansin ako na maaaring ipagpaliban ang deposito / pag-alis. Ang pag-alis ay hindi magagamit para sa isang linggo.

Paglalahad

Cris Men

Ecuador

hindi pa ako nagkaroon ng mga problema sa pag-withdraw o anumang katulad nito

Positibo

Maximilian 111

Nigeria

Ako ay nagtitinda ng mga komoditi dito sa palaging. Nag-aalok ito ng transparenteng mga bayarin, at mahusay na serbisyo sa customer, na laging ang aking matibay na pagpipilian.

Positibo

Vegas

Colombia

Ang China-Derivatives Futures co,.LTD. ay nagbibigay ng iba't ibang mga app para sa pag-trade, sa kaso ng mga pagkakamali sa pag-trade, napakamakabuluhan. At ang kumpanya ay may opisyal na regulasyon ng katawan, ang impormasyon sa pag-trade ay bukas at transparente, lubos akong nababahala.

Positibo