Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

US inflation data for October and November reveals sticky price pressures, dampening hopes for an immediate Federal Reserve rate cut as the PCE index climbs to 2.8%.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US inflation data for October and November reveals sticky price pressures, dampening hopes for an immediate Federal Reserve rate cut as the PCE index climbs to 2.8%.

The Japanese Yen faces renewed pressure as the Bank of Japan cuts bond purchases, exposing the currency to global yield differentials and fiscal anxieties ahead of Friday's rate decision.

Risk sentiment has improved as fears of an immediate transatlantic trade war recede, boosting the Pound and Silver while traders digest Trump's claims of a framework agreement regarding Greenland.

The US economy posted a stunning 4.4% growth rate in Q3 while jobless claims remain historically low, reinforcing the Federal Reserve's likely decision to hold rates steady next week despite sticky inflation signals.

The ECB minutes reveal a central bank keeping rates steady amid resilient growth and sticky service inflation, effectively taking near-term rate cuts off the table.

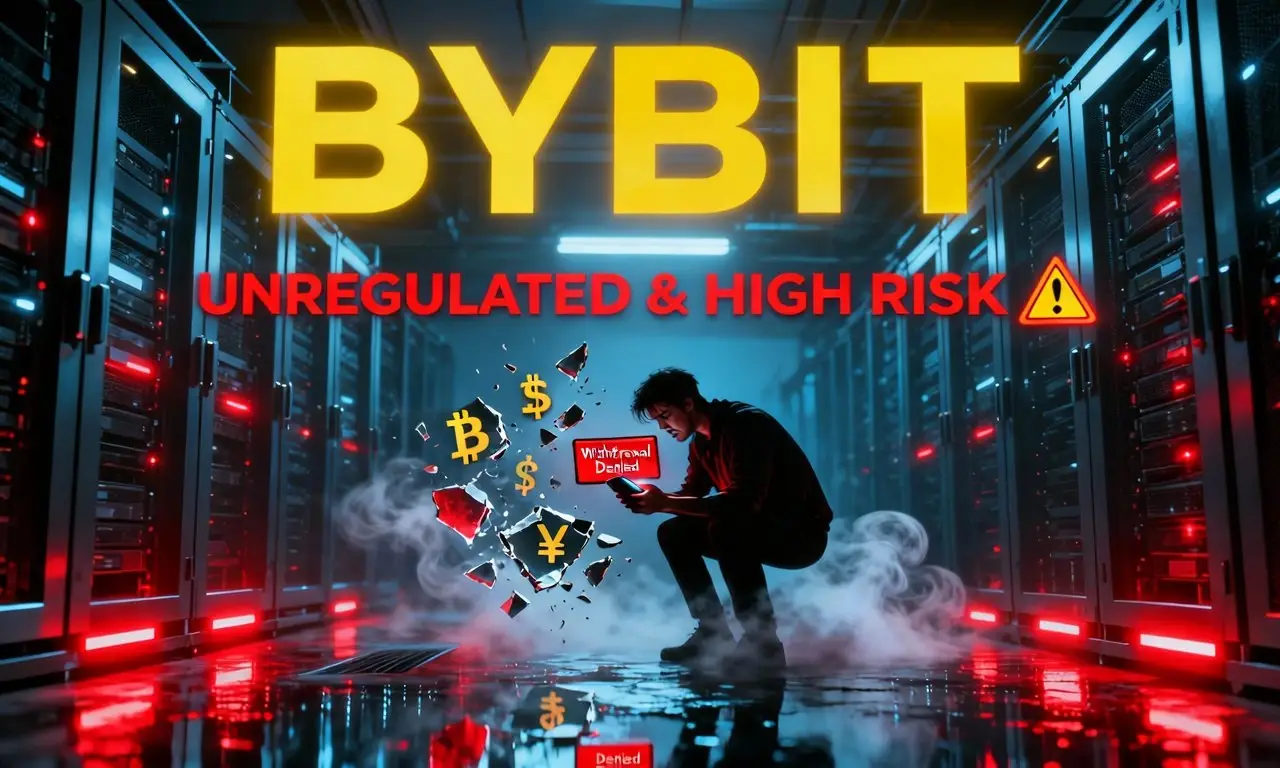

While BYBIT holds a high influence rank, its low WikiFX score of 2.43 and lack of valid regulation raise significant safety concerns. Recent trader complaints regarding missing crypto deposits and unpaid rebates suggest a high-risk environment for investors.

Crude oil prices plummet as the US calls for a massive production ramp-up, diverging sharply from Gold prices which remain elevated near record highs due to lingering institutional risks.

Market relief washes over global assets as President Trump suspends tariff threats against Europe, yet underlying tensions persist as Nordic pension funds liquidate U.S. Treasury holdings citing fiscal sustainability concerns.

Solid employment numbers in Australia and sticky inflation data in New Zealand are fueling hawkish bets for the Antipodean currencies, sparking technical breakouts.

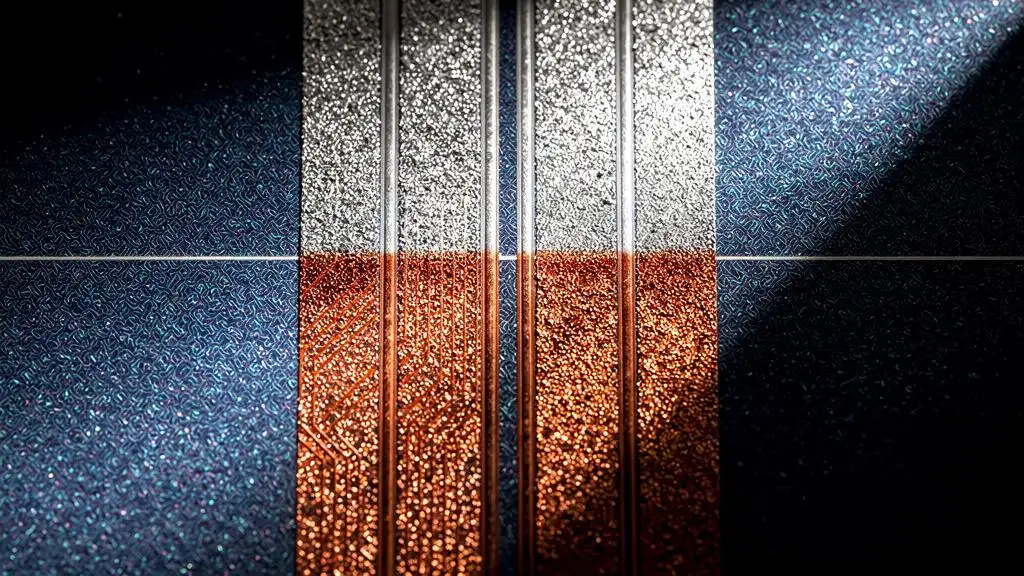

Silver prices have surged to record highs over $94/oz, driving a structural shift in the solar industry as manufacturers aggressively substitute copper for silver to survive crippling costs.

Geopolitical risk premiums are eroding as President Trump softens his rhetoric toward Europe and Russia-Ukraine peace talks gain momentum, stalling the Dollar's rally.

US Natural Gas futures have surged 50% in two days, poised for a 34-year record weekly gain due to severe cold weather forecasts. The rally threatens to reignite inflation fears and disrupt LNG exports to Europe and Asia.

Major Nordic pension funds have begun liquidating their US Treasury holdings, citing unsustainable US debt levels and political unpredictability. This strategic shift by "real money" investors signals a deepening crisis of confidence in the US dollar's role as a safe haven.

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

A Tan Sri was among two individuals detained by the MACC over an alleged RM300 million investment scam in Kuala Lumpur. Authorities say the unapproved schemes promised high returns and caused millions in losses nationwide, prompting renewed warnings for the public to verify investments and avoid offers that seem too good to be true.

INZO is a regulatory mirage, hiding behind a bottom-tier offshore license while systematically trapping trader capital through arbitrary leverage changes and impossible withdrawal hurdles. With a dismal WikiFX score of 2.32 and a flood of fraud allegations, this broker has successfully turned trading into a one-way street for your money.

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

Has Capitalix imposed a fine on your trading inactivity? Did you still lose your capital despite paying the fine amount? Have you had multiple instances of fund scams at Capitalix? Does your forex trading account balance often become negative? Failed to receive a response to the Capitalix withdrawal application? Did you face a prolonged drawdown issue on the broker’s trading platform? You are not alone! Many traders have reported these issues on broker review platforms such as WikiFX. We have uncovered all these alleged trading activities in this Capitalix review article. Take a look!

UFX Partners, a UK-based forex broker, has been flagged by many traders as a scam forex broker. Frequent reports of profit deletions, withdrawal blocks, and alleged fund scams are trending on several broker review platforms. Some traders reportedly lost all of their life savings due to the broker’s illegitimate trading activities. In this UFX Partners review article, we have highlighted numerous allegations against the broker. Read on!