Abstract:Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

The Quick Answer: A Serious Warning

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, “Is NaFa Markets legit?”, the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

Our Final Decision

Our detailed investigation shows that NaFa Markets has many clear signs of being a fake operation. We strongly recommend that all traders and investors avoid this platform completely. Our decision is based on a pattern of lies and bad practices, including these important discoveries:

· False Claims About Rules: It falsely says it follows financial rules from an authority that has no power to give such permission - a major warning sign.

· Impossible Profit Promises: It advertises “guaranteed high returns,” a sales trick only used by pyramid schemes and fake investment programs, never by real brokers.

· Many User Complaints: A steady pattern of user reports shows major problems with withdrawing funds and no customer support, proving the fake business model.

Based on this proof, our advice is simple and clear: Stay away from NaFa Markets.

Breaking Down The Lies

To understand the danger NaFa Markets creates, we must look past its fancy website and check the real facts. Our analysis found a foundation built on false claims and tricks. This section explains the main evidence that proves its status as a NaFa Markets scam operation.

Warning Sign #1: Fake Rules and Licenses

A broker's license status is the foundation of whether it's trustworthy. NaFa Markets makes a specific claim: that it follows rules from the “Sharjah International Free Zone (SAIF Zone)” with license number 19514. This is a deliberate and serious lie.

It's important to understand the difference between a business license and a financial services license. A business registry, like the SAIF Zone, gives licenses for general business activities like importing/exporting or consulting. It provides a legal address and permission to run a business within that specific free zone. It has absolutely no power to watch over financial services, control forex trading, allow the holding of client money, or enforce client capital protection rules.

The real financial rule-makers in the United Arab Emirates (UAE) are the Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA). These are the only organizations that can legally allow and supervise a forex brokerage. Our checks confirm that NaFa Markets is not registered with or licensed by either the DFSA or the SCA. This means it is operating against the law and without any oversight.

Claiming to follow rules from a business registry is a trick used by fake brokers to appear trustworthy to those who don't know the difference. It is the most serious warning sign a broker can have.

Warning Sign #2: The “Guaranteed Money” Trap

NaFa Markets openly advertises a promise of “3% per month income.” This statement alone is clear proof of a scam. In the world of real finance and trading, there are no guaranteed returns. All investments carry market risks, and any company that promises a fixed, high rate of return is, by definition, not a real brokerage.

Real brokers provide access to markets, trade execution services, and trading platforms. Their earnings come from spreads or fees on trades. They never participate in or promise profits because they cannot control market outcomes.

The promise of fixed returns is the sign of a pyramid scheme. In such a setup, funds from new investors are used to pay “profits” to earlier investors. This creates an illusion of success that encourages more deposits. The scheme always collapses when new deposits can no longer cover the promised payouts, at which point the operators disappear with the remaining capital.

Warning Sign #3: The Fake Office

The registered address for NaFa Markets is listed as Q1-09-083/A, SAIF Zone, Sharjah. This address format is typical of a “Flexi-desk” or virtual office service. This is not a real headquarters with a compliance department, trading desk, and support staff. It is, basically, a mailbox and a shared desk used by countless other fake companies.

A company claiming to manage millions of dollars invested by clients would have a substantial, verifiable physical presence. The reliance on a virtual office shows that NaFa Markets has no real operational base, no accountable team, and can disappear without a trace. This lack of a physical location is a major warning sign for any financial institution.

The Copycat Trick

A common tactic among fake brokers is to choose a name that is intentionally similar to well-established, real financial firms. This “copycat” strategy is designed to confuse investors who may be doing quick, surface-level research. An investor might see positive information about the real company and mistakenly connect it with the scam platform. It is important to tell the difference between them.

Be Aware of These Names

Use this list to make sure you are not confusing the fake entity with real businesses:

· ❌ SCAM PLATFORM: NaFa Markets (website: nafamarkets.com) - This is the unregulated, fake entity discussed in this article. Avoid it completely.

· ✅ REAL COMPANY: NAFA Capital Advisors (India, nafacapital.com) - This is an unrelated and real asset management firm based in India. It has no connection to NaFa Markets.

· ✅ REAL COMPANY: NBP Funds (Pakistan, formerly NAFA Funds) - This is another unrelated and real asset management company based in Pakistan. It has no connection to NaFa Markets.

The name similarity is not a coincidence. It is a planned move to ride on the reputation of others and trick investors into a false sense of security. Always double-check the website URL and regulatory details to make sure you are dealing with the correct company.

The Victim's Experience

For those who have already put money with NaFa Markets, their experience often follows a predictable and heartbreaking pattern. This journey is designed to take the maximum capital from a victim before disappearing. Recognizing these steps can help you understand what is happening and why you must stop dealing with the scammers immediately.

A Predictable 4-Step Pattern

1. The Good Times Phase: Initial Profits

After opening an account and making an initial deposit, your first few trades will likely appear to be incredibly successful. You will see your account balance grow daily on its trading platform. This is not real trading. The platform is often a manipulated or fake MT4/MT5 terminal where the scammer controls the price feed and the outcomes. These initial “profits” are completely made up to build your trust and make you believe its system works.

2. The Sales Push: Encouraged to Invest More

Once you are convinced of your success, an “account manager,” “senior advisor,” or “teacher” will contact you. They will praise your trading skills and tell you that you have a rare talent. This is followed by a high-pressure sales push. They will pressure you to deposit significantly more to qualify for a “VIP account,” access “higher returns,” or participate in a “guaranteed profit bonus.” They create a sense of urgency, telling you the opportunity is limited.

3. The Block: Trying to Withdraw

The illusion breaks the moment you try to withdraw funds. Whether you attempt to take out your initial capital or the “profits” you've accumulated, the request will be delayed, ignored, or outright denied. The friendly account manager who was calling you daily will suddenly become unreachable. This is the point where the trap is revealed.

4. The Final Squeeze: The “Fee” to Unlock Money

When you finally get a response, you will be told that you cannot withdraw your funds until you pay an additional fee. The excuses are always variations of the same script:

· *“You must first pay a 20% tax on your profits to the government.”*

· *“Your account has been frozen for a security check; a verification fee is required to unlock it.”*

· *“The third-party payment channel requires a clearance fee before processing the withdrawal.”*

· *“You need to increase your account balance to a certain level to meet the withdrawal minimum.”*

This is the final stage of the scam. Any funds you send will also be stolen. A real, regulated broker will never ask you to pay in order to withdraw your own funds. All real taxes and fees are taken directly from the withdrawal amount, not paid upfront.

Your Emergency Action Plan

Your next steps depend on whether or not you have already sent money to NaFa Markets. It is important to act quickly and decisively.

Situation 1: You Have NOT Deposited

If you have been in contact with NaFa Markets but have not yet deposited, you are fortunate! Your course of action is simple and immediate.

1. Stop all communication. Do not respond to the brokers emails, phone calls, or social media messages.

2. Block their contact details. Add its phone numbers, email addresses, and social media profiles to your block list.

3. Do not provide any personal documents. Never send the broker copies of your ID, passport, or utility bills. This information can be used for identity theft.

4. Consider it a lesson learned. Use this experience to understand the importance of careful research before investing.

Situation 2: You HAVE Already Deposited

If you have already invested in NaFa Markets, do not panic. While the situation is serious, taking immediate and careful action can sometimes help reduce the damage.

1. STOP ALL TRADING AND DEPOSITS. Do not invest another cent. Refuse all requests from your “account manager” to add more capital for any reason.

2. DO NOT PAY ANY FEES. Under no circumstances should you pay any “taxes,” “security deposits,” or “unlocking fees.” This is a bottomless pit designed to take more capital from you. You will never get your funds back by paying more.

3. GATHER ALL EVIDENCE. Take screenshots of everything: your account dashboard showing your balance, transaction histories, and all chat conversations (WhatsApp, Telegram, etc.) and emails with the company's representatives.

4. CONTACT YOUR BANK OR PAYMENT PROVIDER. Immediately call the fraud department of your bank or credit card company. Report the transactions as fraudulent and request a chargeback. Explain that the company is an unregulated entity that has provided a fake service and is refusing to return your money. Time is important, as chargeback windows are limited.

5. REPORT TO AUTHORITIES. File a report with your local police and your country's national cybercrime reporting agency. While local law enforcement may have limited power to pursue an international scam, filing a report creates an official record that can be useful for your bank's investigation.

Smart Protection: How to Check Any Broker

The painful experience with NaFa Markets serves as a powerful lesson: you can never trust a broker's claims without checking. The only way to protect your capital is to perform independent verification before investing. Adopting this simple habit will protect you from the vast majority of online investment scams.

A Simple 3-Step Verification Habit

Before you even consider opening an account, make this three-step process your non-negotiable routine.

· Step 1: Verify Rules Independently

Do not rely on the “About Us” or “Regulation” page of a broker's website. A broker's regulatory status is public information, but searching through different official registries can be complex. Instead of hunting through multiple government websites, you can use a comprehensive verification tool. A platform, such as WikiFX, brings together regulatory data from around the globe, allowing you to instantly see if a broker is truly licensed by a reputable authority or is using fake credentials like NaFa Markets.

· Step 2: Check User Reviews and History

Scam brokers often flood the internet with fake positive reviews to bury the negative ones. You need a trusted source that gathers real user experiences, with a particular focus on complaints about withdrawals. Before considering any broker, checking its profile on a service, such as WikiFX, can expose a pattern of withdrawal problems, poor support, or other red flags raised by actual users. This provides a real-world view of the company's behavior.

· Step 3: Make Verification Your First Step.

Make this your unbreakable rule: before providing an email address, phone number, or any personal information, perform your check. Visit WikiFX, type in the broker's name, and spend two minutes reviewing the full report. This simple, two-minute habit is the single most effective protection you have against fake operations such as NaFa Markets. It separates professional brokers from sophisticated thieves.

Final Decision: Not a Real Partner

The evidence is overwhelming and clear: NaFa Markets operates as a fake entity. It is not a real broker or a safe trading partner.

The Bottom Line

The combination of fake regulatory claims, the classic pyramid scheme promise of guaranteed profits, and a business model that ends in blocking withdrawals and demanding fake fees confirms its fake nature beyond any reasonable doubt. The risk of investing with NaFa Markets is not one of market changes; it is the certainty of financial loss through a calculated scam.

Our recommendation is absolute: do not deal with NaFa Markets under any circumstances. Always protect your capital by performing thorough, independent research on any financial service. Before investing, take two minutes to verify the broker's claims on a trusted, independent platform such as WikiFX. This simple step is your best defense.

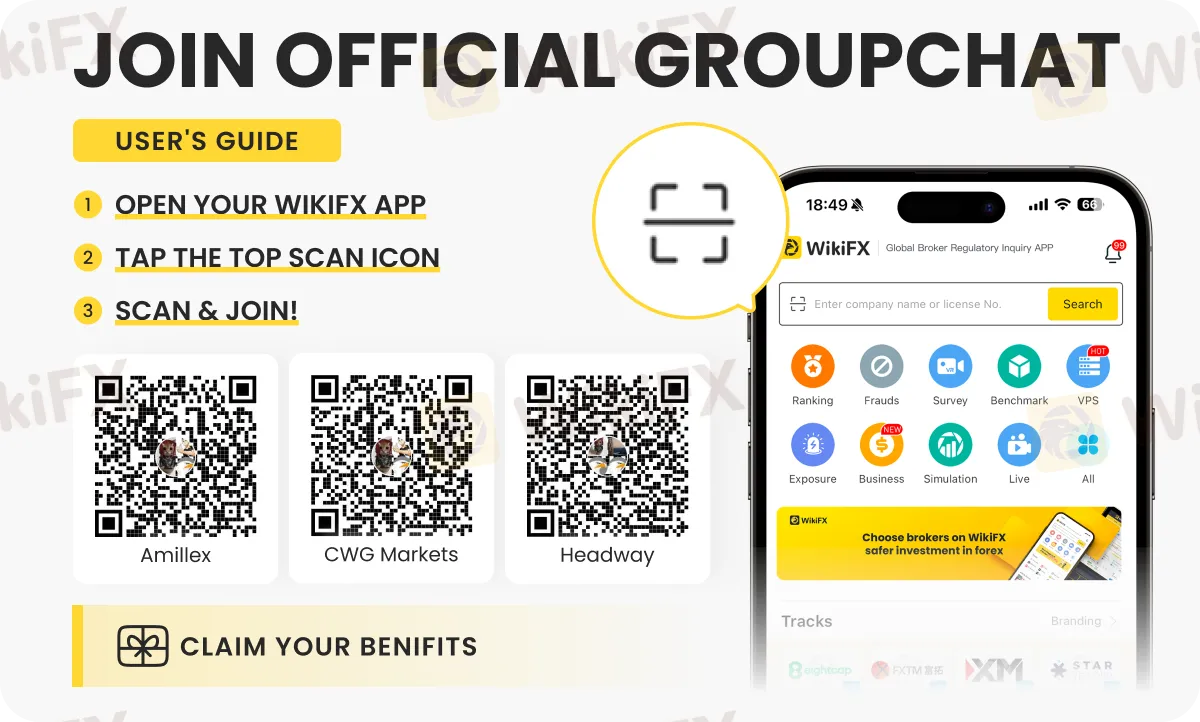

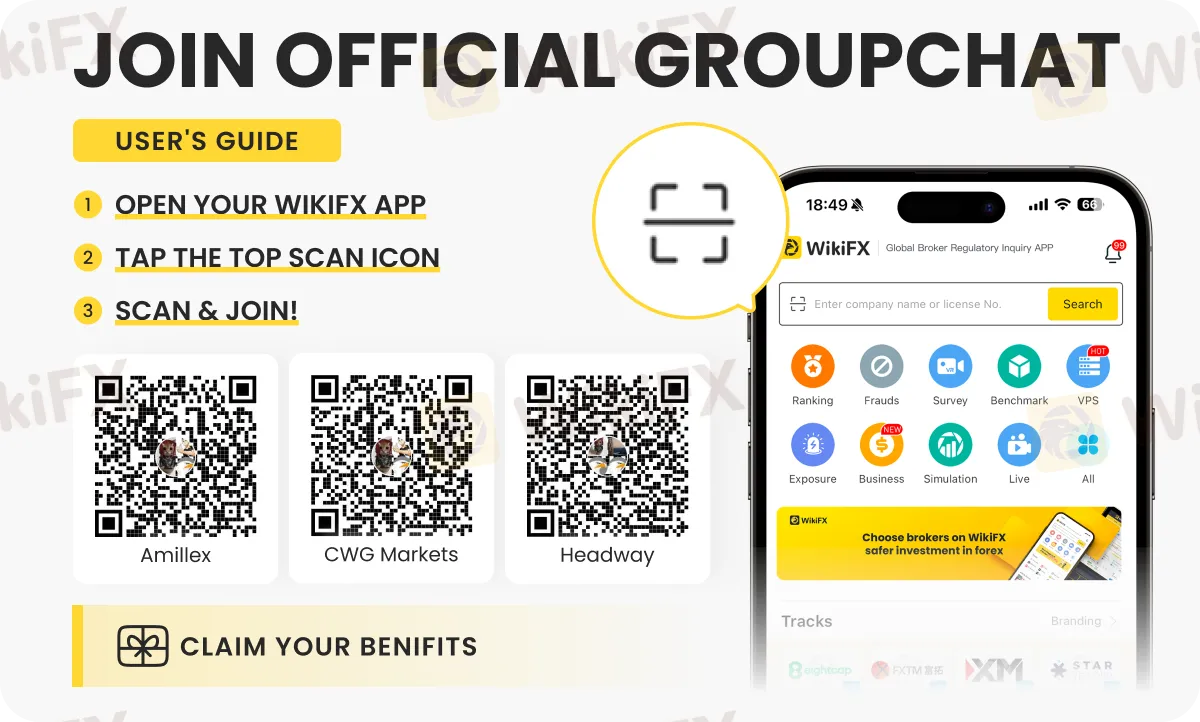

Watch your forex portfolio grow despite the markets ups and downs with insightful updates on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s by following the instructions shown below.