Abstract:Deriv faces rising scam allegations such as withdrawal issues, account freezes, and leverage changes—know the risks before trading.

Introduction

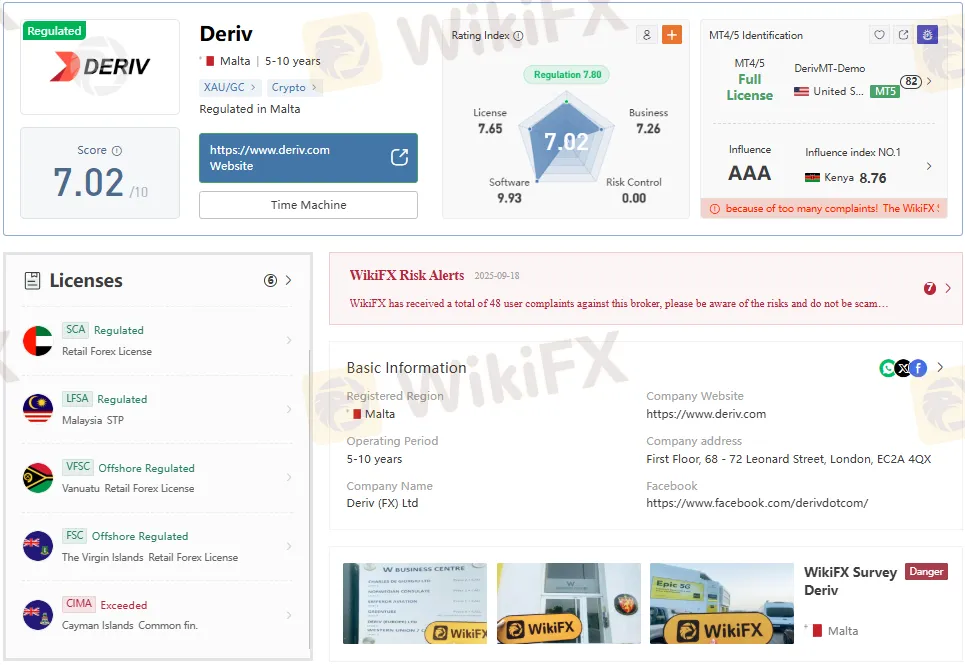

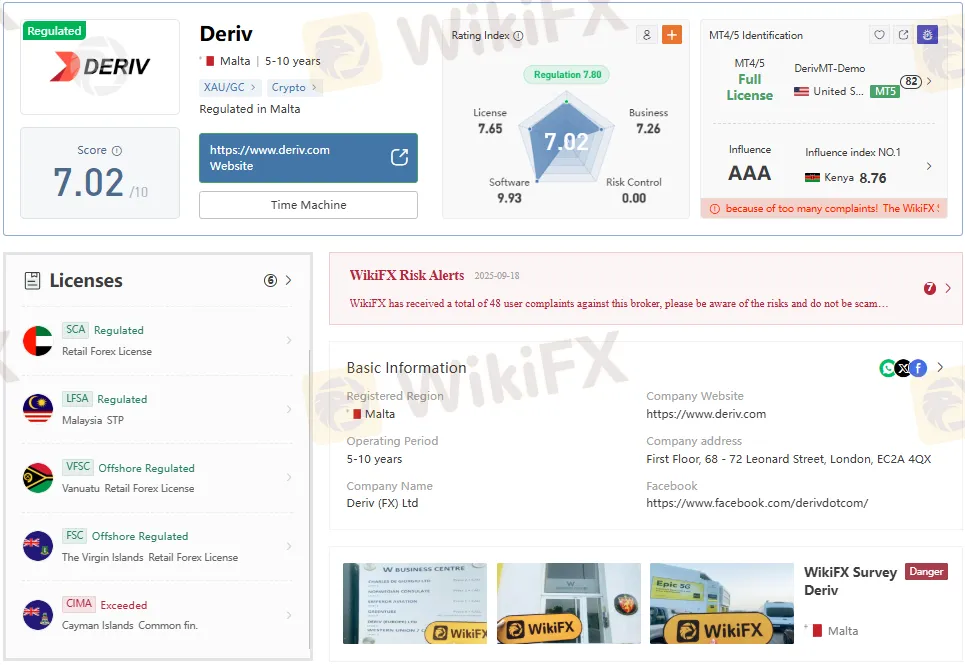

Deriv, the Malta-registered trading platform established in 1996, confronts escalating fraud allegations and user complaints throughout 2025. Recent investigations reveal substantial risks for traders worldwide, with WikiFX documenting 48 user complaints and 18 formal allegations specifically targeting withdrawal difficulties, sudden leverage adjustments, and account manipulation practices. The platform's regulatory framework appears compromised, featuring suspicious clone licenses alongside legitimate Malta Financial Services Authority (MFSA) oversight, creating uncertainty about actual trader protections.

Current Complaint Landscape

The accumulating evidence against Deriv presents a troubling pattern of trader exploitation throughout 2025. WikiFX Risk Alerts documented comprehensive complaints ranging from withdrawal blockages to unauthorized account modifications, establishing a clear trajectory of problematic business practices. Indonesian traders report particularly severe incidents, with accounts holding millions of rupiahs frozen under “suspected unusual trading” pretenses despite consistent profitability histories.

Recent exposure cases demonstrate Deriv's systematic approach to preventing large withdrawals while maintaining normal processing for smaller amounts. Traders consistently report initial deposits and minor withdrawals proceeding smoothly, creating false confidence before encountering restrictions during significant fund recovery attempts. This calculated methodology suggests deliberate operational strategies rather than isolated technical difficulties.

Regulatory Concerns and License Issues

Deriv operates under a complex multi-jurisdictional structure that complicates trader protection and regulatory oversight. The platform maintains registrations across Malta, Gibraltar, and Vanuatu, with different regional users corresponding to separate entities that create jurisdictional confusion during dispute resolution. Most concerning, the Vanuatu VFSC license provides minimal regulation with virtually no fund segregation requirements or compensation schemes.

The Malta MFSA regulation provides some legitimacy, but traders frequently discover their accounts operate under offshore entities with weaker protections. Additionally, reports indicate VFSC and FSA licenses may be unverified or potentially cloned, raising questions about the platform's actual regulatory compliance. Independent verification attempts have failed to locate Deriv's stated Malta office address, further undermining regulatory credibility.

Withdrawal Processing Problems

Systematic withdrawal difficulties represent the most frequently reported issue among Deriv users across multiple platforms. Documented cases reveal calculated delays ranging from weeks to months, particularly affecting larger withdrawal requests exceeding typical trading profits. The platform implements increasingly complex verification procedures that often result in rejected documentation and extended review periods.

False advertising regarding payment processor capabilities compounds withdrawal problems significantly. Deriv promoted Sticpay as supporting $10,000 daily withdrawals, but actual limits restricted users to $1,000 per day, creating unexpected barriers for fund recovery. When traders provide official bank documentation explaining regional banking restrictions, Deriv frequently becomes unresponsive rather than implementing alternative solutions.

Customer support responses follow predictable patterns of requesting additional documentation, implementing secondary verification processes, or citing technical difficulties. Indonesian traders report submission of bank statements spanning six months, utility bills, and multiple identity documents, yet continue experiencing rejection notices citing incomplete information. These extensive requirements far exceed standard Know Your Customer (KYC) compliance protocols, suggesting deliberate obstruction tactics.

Trading Platform Manipulation Claims

Multiple independent sources document suspicious trading platform behavior affecting order execution and pricing accuracy. Synthetic indices, which Deriv controls entirely without external market influence, demonstrate unexplained price movements that consistently disadvantage traders during profitable positions. Users report sudden spikes triggering stop-loss orders despite favorable market trends, along with execution delays resulting in unfavorable pricing.

Chart inconsistencies present additional manipulation concerns, with Deriv price data failing to match historical information available through external sources. Traders monitoring multiple platforms simultaneously observe significant spread differences, with Deriv consistently showing less favorable pricing compared to competing brokers. These discrepancies suggest backend manipulation designed to reduce trader profitability systematically.

Order execution problems escalate during high-impact news events and volatile trading periods. Indian traders document instances where preset stop-loss levels at 1.2600 executed at 1.2450, creating 150-pip slippage that resulted in substantial unexpected losses. Such extreme execution deviations indicate either severe technical inadequacies or intentional manipulation during critical trading moments.

Leverage Manipulation Incidents

Recent exposure cases reveal Deriv's practice of unilaterally adjusting trader leverage during active positions, causing forced liquidations. Multiple documented incidents show traders opening positions at advertised leverage ratios, only to receive sudden notifications of leverage reductions that trigger margin calls. These adjustments occur without prior warning and typically happen during overnight hours when traders cannot respond immediately.

Indonesian traders report particularly severe leverage manipulation incidents where positions opened at 1:200 leverage suddenly became subject to 1:50 ratios. The timing of these adjustments coincides with favorable market movements that would generate profits, suggesting calculated intervention to prevent trader success. Platform advertisements continue promoting higher leverage availability while actual trading conditions impose much lower ratios.

Indian market participants document similar experiences with USD/INR trading, where advertised 1:1000 leverage becomes adjusted to 1:50 during active positions. These sudden changes create impossible margin requirements that force liquidation regardless of actual market performance. The systematic nature of these adjustments across different geographical regions indicates coordinated policy implementation rather than technical errors.