Abstract:If you're new to forex trading or looking to sharpen your skills, learning how to read forex charts is one of the most important steps toward becoming a successful trader. Forex charts are the foundation of technical analysis and provide a visual representation of currency pair price movements over time. Understanding these charts can help you identify trends, spot entry and exit points, and make better-informed trading decisions.

If you're new to forex trading or looking to sharpen your skills, learning how to read forex charts is one of the most important steps toward becoming a successful trader. Forex charts are the foundation of technical analysis and provide a visual representation of currency pair price movements over time. Understanding these charts can help you identify trends, spot entry and exit points, and make better-informed trading decisions.

What Are Forex Charts?

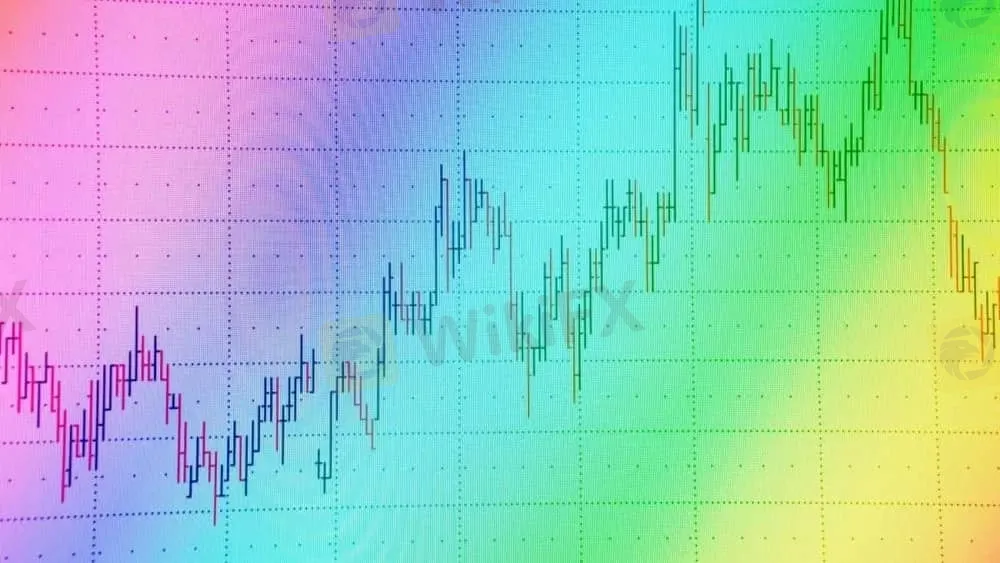

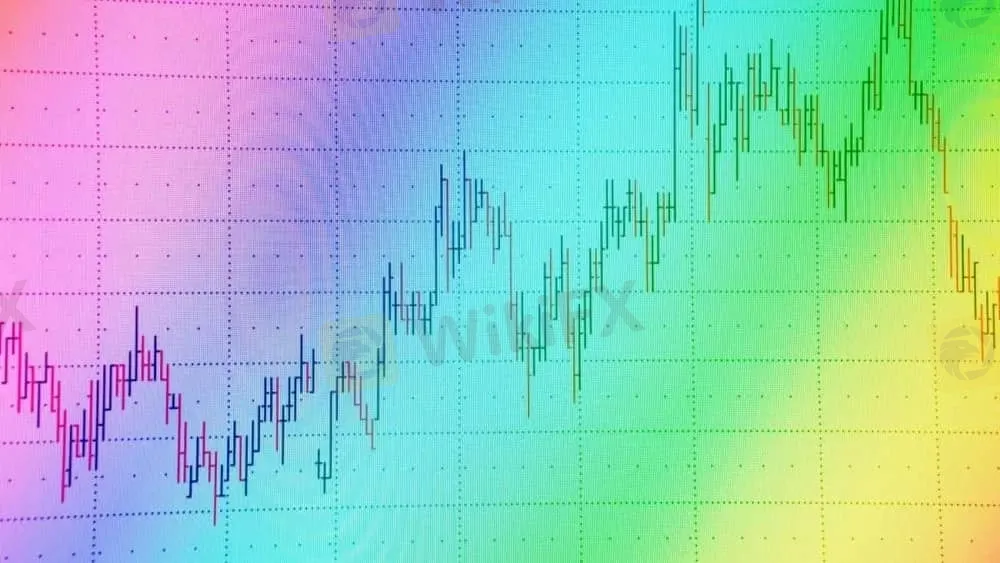

Forex charts are graphical displays of historical and real-time price data for currency pairs. They show how the exchange rate between two currencies has moved over a selected period, such as minutes, hours, days, or weeks. Most forex charts include time on the horizontal axis and price on the vertical axis.

When you read forex charts, you're essentially analyzing price behavior to predict future movements.

Types of Forex Charts

Before you can read forex charts like a pro, it's essential to know the three most common types:

1. Line Chart

A line chart connects the closing prices of a currency pair over time. Its simple and easy to follow but lacks detail compared to other chart types.

2. Bar Chart

A bar chart gives you more information, such as the open, high, low, and close (OHLC) prices for each time period. This makes it easier to analyze market volatility.

3. Candlestick Chart

Candlestick charts are the most popular among forex traders. Each candlestick represents the price action during a specific time frame. The body of the candle shows the open and close prices, while the wicks (shadows) show the highs and lows. Once you learn to read forex charts in candlestick form, you can spot patterns that signal potential price reversals or continuations.

Key Elements to Focus On

To read forex charts effectively, focus on these key elements:

• Trend Direction: Identify whether the market is in an uptrend, downtrend, or moving sideways.

• Support and Resistance: These are key price levels where the market tends to reverse or pause.

• Chart Patterns: Look for patterns like head and shoulders, triangles, and flags, which can signal potential market moves.

• Indicators: Tools like moving averages, RSI, and MACD can help confirm what you see on the chart.

Tips to Read Forex Charts Like a Pro

1. Start with Higher Time Frames: Analyze the daily or 4-hour chart first before zooming into shorter time frames.

2. Keep It Simple: Avoid cluttering your chart with too many indicators.

3. Practice Regularly: Use demo accounts to build confidence in reading charts.

4. Follow the News: Economic news impacts currency prices. Always consider fundamentals along with technical analysis.

Conclusion

Learning to read forex charts is a skill that takes time, but it‘s absolutely essential for anyone serious about forex trading. By understanding chart types, identifying trends, and recognizing key patterns, you can make smarter trading decisions and avoid costly mistakes. Keep practicing, stay disciplined, and soon you’ll be able to read forex charts like a pro.