简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Abstract:One hundred and seventy. That is the number of complaints WikiFX has received against FBS in just the last three months. In the world of retail trading, a dozen complaints is a concern; 170 is a crime scene. While FBS flaunts a "Double A" influence rank and claims to be a user-friendly broker established in 2017, the data paints a picture of a digital casino where the house doesn't just rely on probability—it reportedly alters the game board.

One hundred and seventy. That is the number of complaints WikiFX has received against FBS in just the last three months. In the world of retail trading, a dozen complaints is a concern; 170 is a crime scene. While FBS flaunts a “Double A” influence rank and claims to be a user-friendly broker established in 2017, the data paints a picture of a digital casino where the house doesn't just rely on probability—it reportedly alters the game board.

From “ghost candles” that trigger stop losses to a terrifying accounting adjustment users call “Balance Fixed,” the evidence suggests that for many clients, the biggest risk isn't the market—it's the broker itself.

The Regulatory Reality: Licenses vs. The Watchlist

FBS presents itself as a multi-licensed entity. On paper, this is true. They hold licenses in Cyprus and Australia. However, a broker's safety is often defined by where they aren't welcome. The table below details the full regulatory scope provided in our database, including a critical warning from Malaysian authorities.

Official Regulatory Audit

| Regulator | License Type | Country | Status | License No. |

|---|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Straight Through Processing (STP) | Cyprus | Regulated | 331/17 |

| Australia Securities & Investment Commission (ASIC) | Market Making (MM) | Australia | Regulated | 426359 |

| Securities Commission Malaysia (SCM) | Unauthorized | Malaysia | Investor Alert List | N/A |

Note: The SCM warning specifically flags FBS for carrying out capital market activities without a license.

The “Balance Fixed” Phenomenon: Vanishing Profits

The most alarming trend in the recent data is a term that keeps appearing in victim reports: “Balance Fixed.” This isn't a market term; it appears to be an internal administrative action used to wipe account gains.

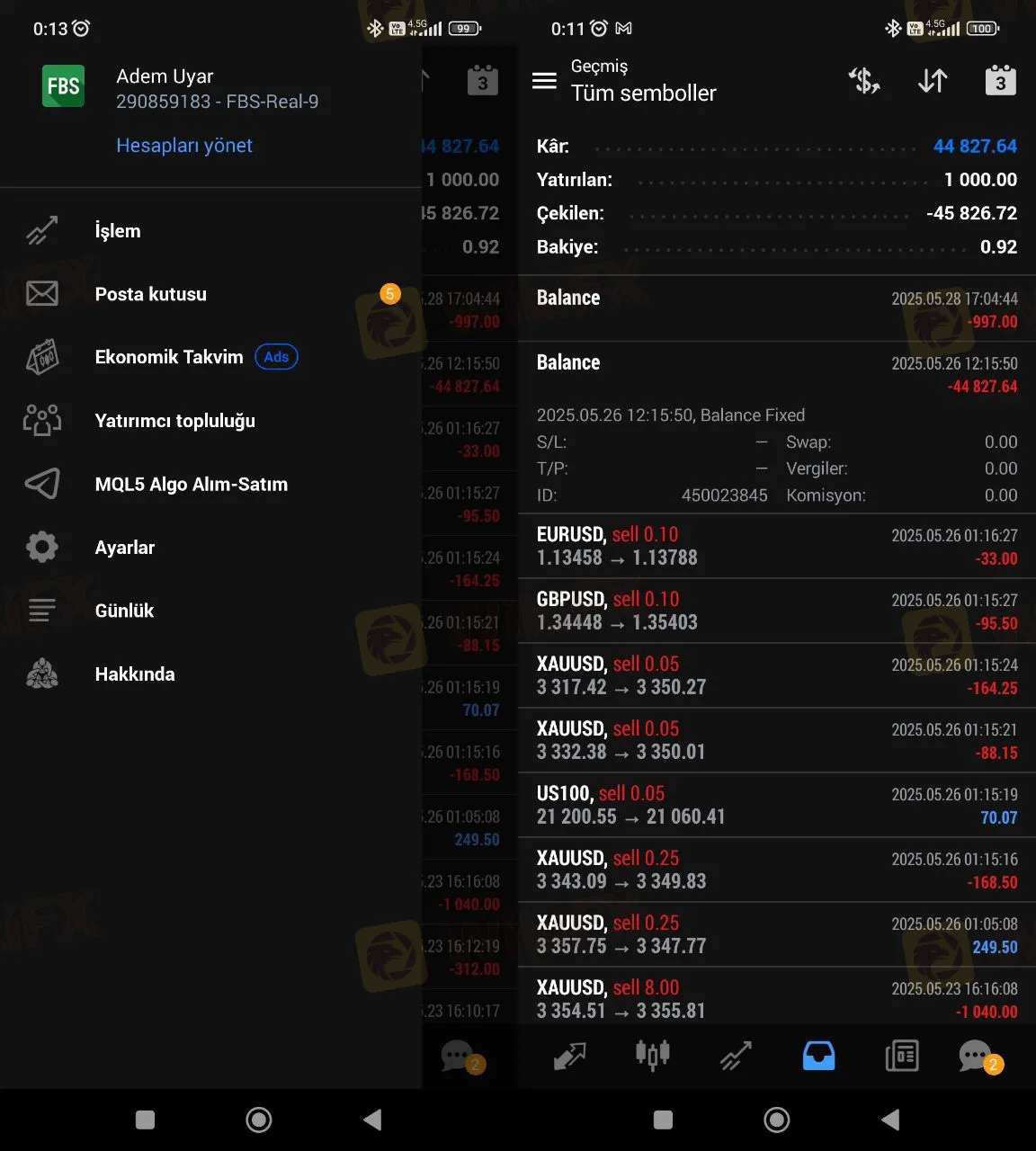

In Case 40, a user from Turkey reported a staggering loss. After generating $44,827 in profits, the user claims FBS simply erased the money under the label “Balance Fixed.” No bad trades, no market crash—just a manual adjustment reducing the balance to zero.

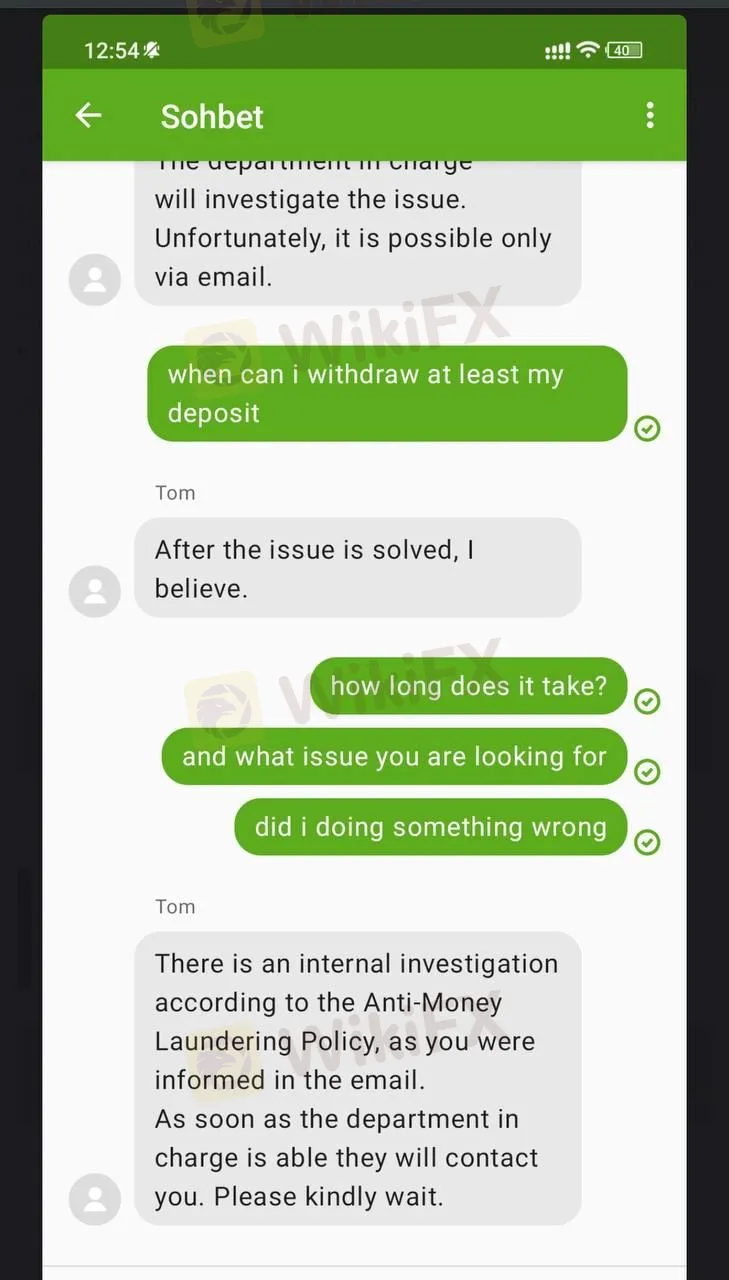

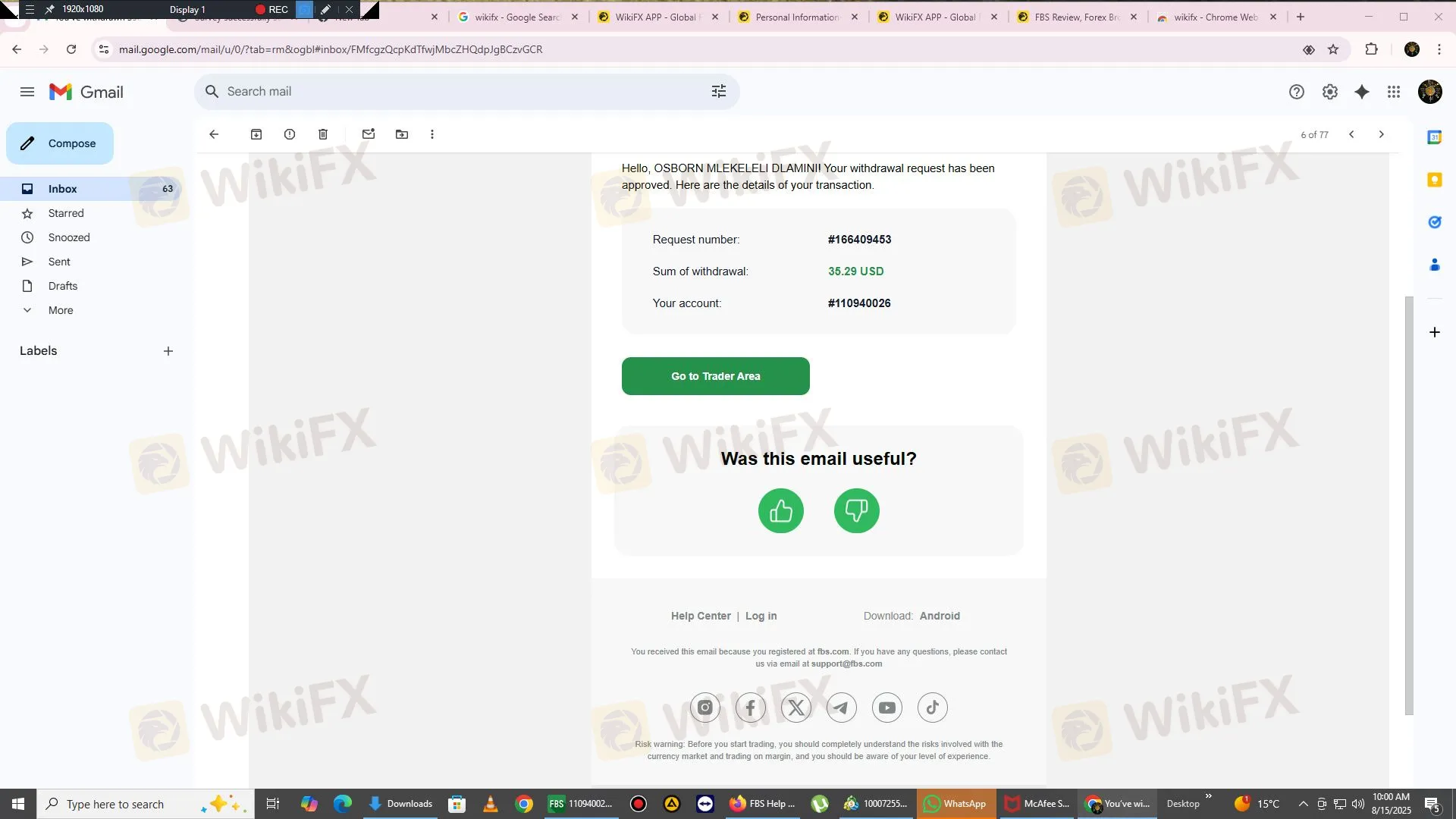

This is not an isolated incident. Case 14 details an Indian trader who deposited $248 and grew it to over $1,000. FBS blocked the account for “AML checks,” demanded invasive documentation (including video selfies and crypto transaction paths), and then executed a “Balance Fixed operation,” removing $1,099.65. The trader was left with nothing but a generic email instruction to wait.

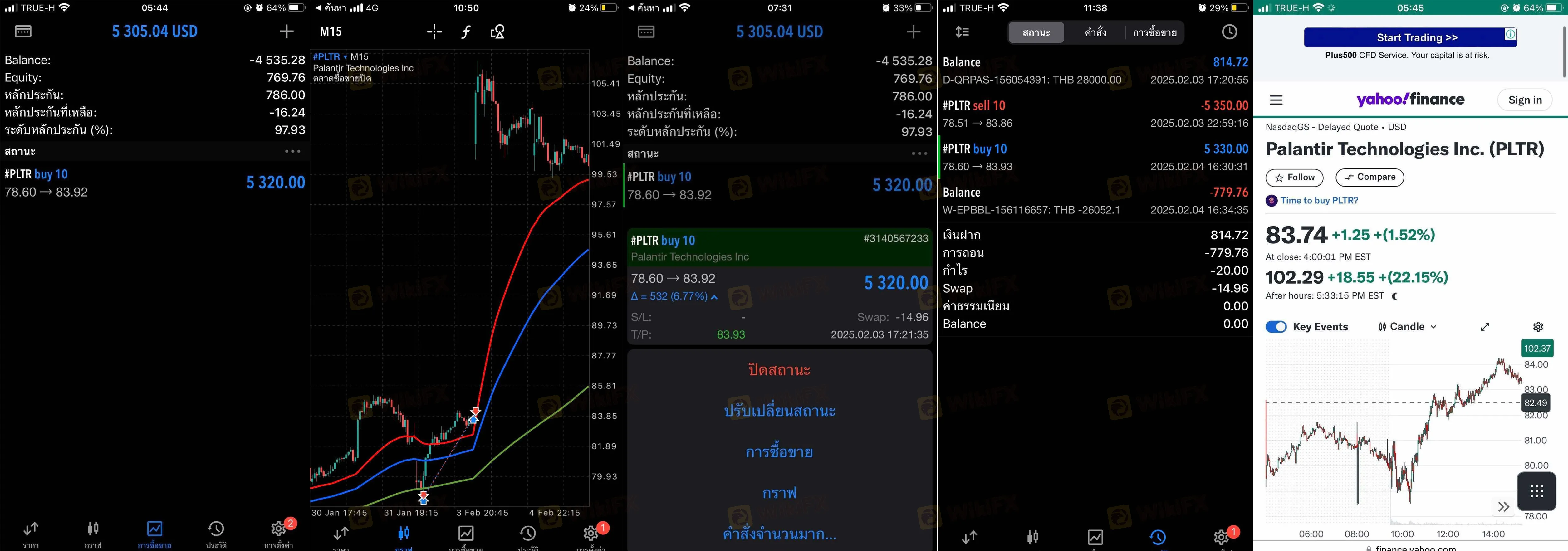

Case 18 echoes this, where a trader made $1,148 on a GBP/USD trade during the US CPI announcement. Hours later, FBS applied a “Balance Fixed” adjustment, clawing back $586.42. When a broker can retroactively decide which profits you get to keep, you aren't trading; you are begging.

Ghost Candles and Price Manipulation

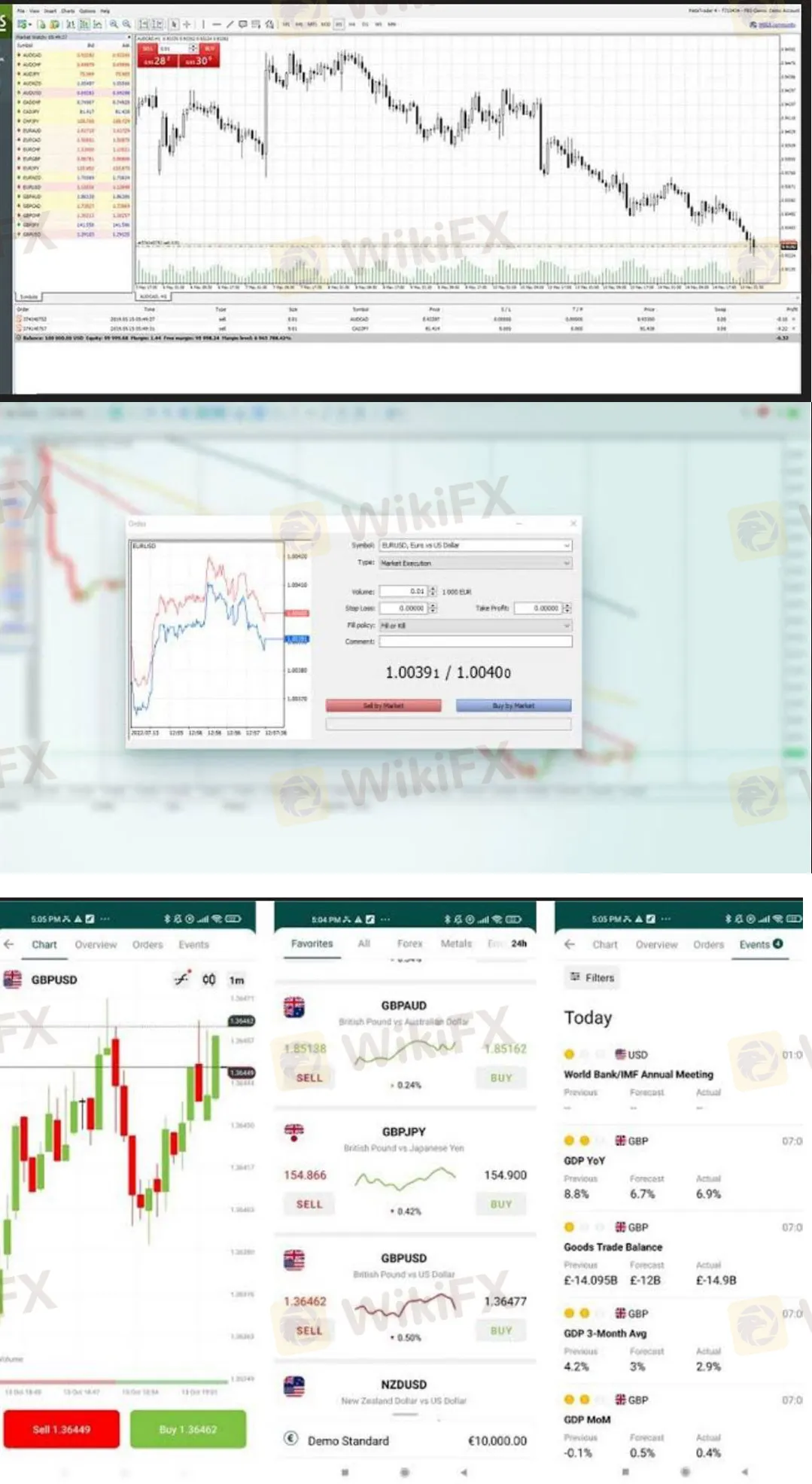

Experienced traders accept slippage as a cost of doing business. What they do not accept is fiction. Multiple reports indicate that FBS charts display price movements that do not exist on the global market, often triggering liquidations before the price “returns” to normal.

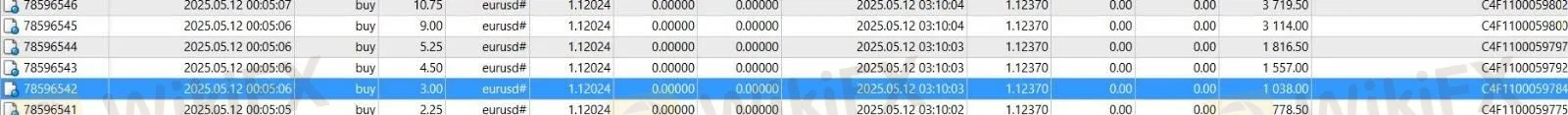

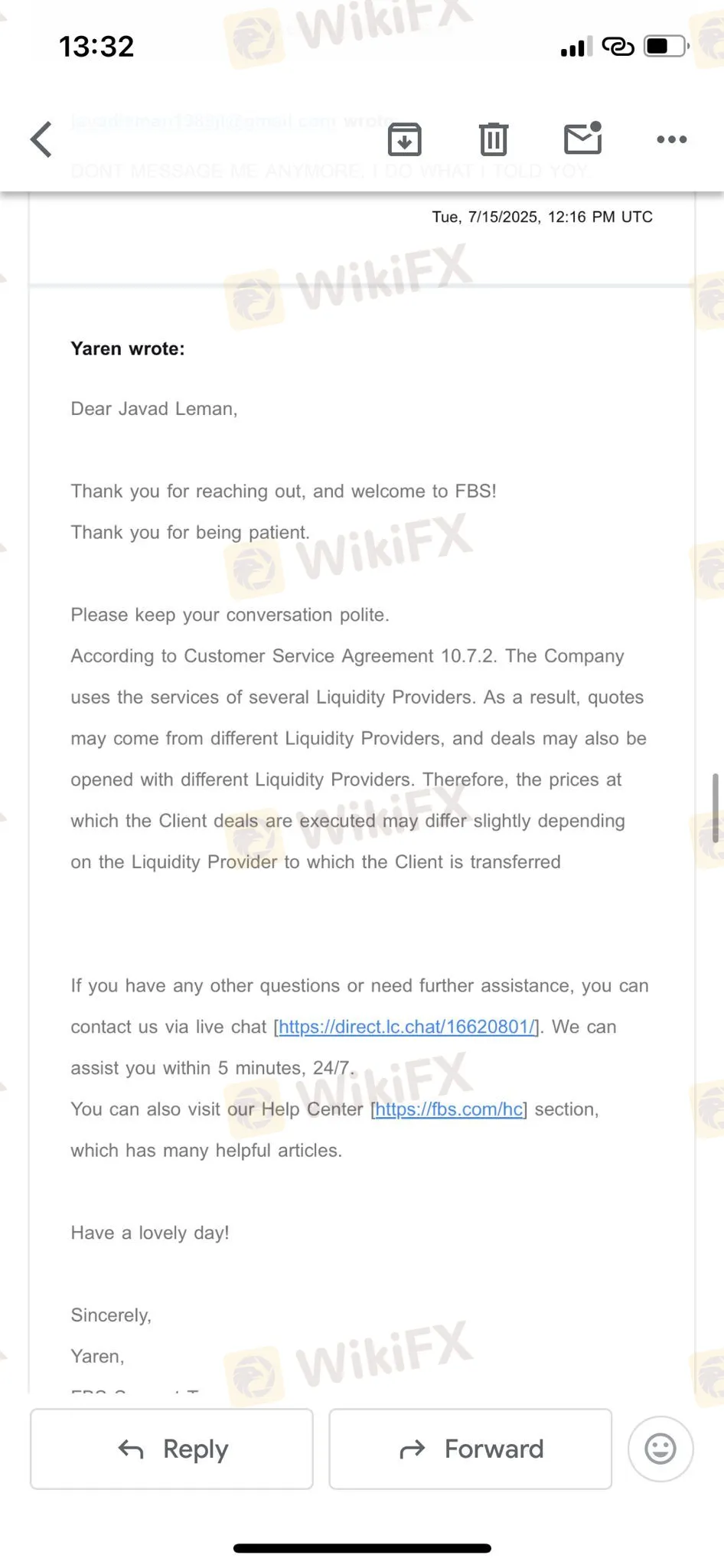

Case 1 provides a “smoking gun.” A trader with a substantial balance placed orders on EURUSD. FBS executed these orders at 1.1240, while the global market opening price was 1.11850. This 400-point discrepancy resulted in an immediate $30,000 loss. The trader cross-referenced with accounts at XM and FXOpen, where the prices were accurate. FBS's defense? “We use different Liquidity Providers.” A 400-point difference on a major pair like EURUSD is not a liquidity difference; it is an anomaly that only benefitted the broker.

Case 20 is equally damning. A user holding a Buy position on XAGUSD (Silver) had their trade closed because FBS claimed the price dropped to $18.667. Cross-referencing with other platforms confirms that Silver never touched the $18 range that day. The users entire balance was wiped out based on a price point that seemingly existed only on FBS servers.

Further evidence in Case 52 shows a trader suffering a $17,600 loss because FBS allegedly set a “Take Profit” order on their behalf without consent.

The Withdrawal Blockade

If you survive the “Balance Fixed” wipes and dodge the ghost candles, you still have to get your money out. The data is flooded with reports of obstructed withdrawals.

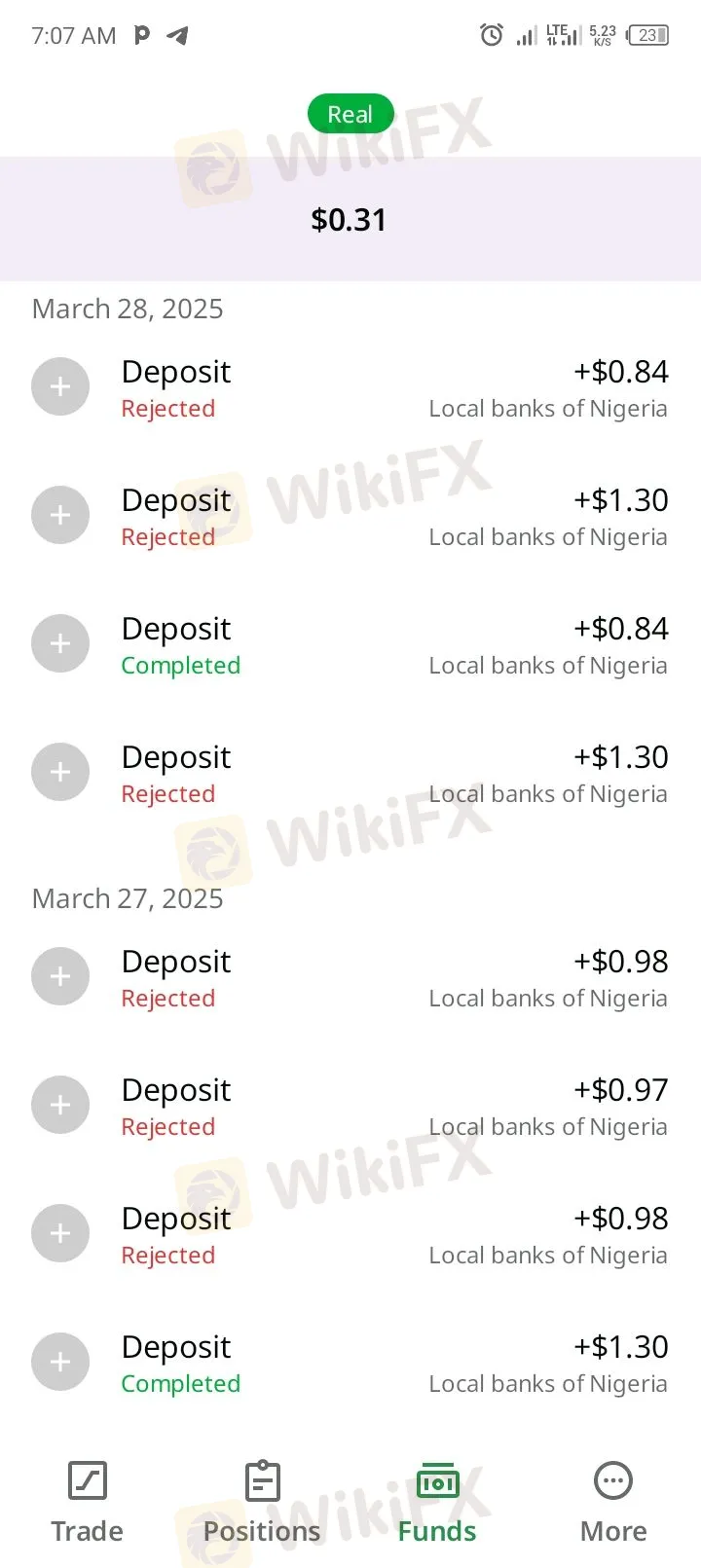

Case 49 highlights a dystopian scenario where a user from Nigeria tried to deposit funds six times. FBS rejected the deposits on their end, yet the money was still deducted from the user's bank account. The funds are now in limbo.

In Case 7, a user from Israel describes a classic “churn and burn” tactic: “The moment I started making growth, everything changed. Withdrawals became impossible.” Deposits are scrutinized, and successful traders are suddenly flagged for “verification” loops providing an excuse to freeze funds indefinitely.

Case 11 reports receiving fake notifications claiming “your amount has been approved,” yet the bank account remains empty. The support team's response was described as arrogant and unhelpful.

WikiFX Risk Warning

The information provided above is based strictly on the regulatory conflict and user complaints found in the WikiFX database. Forex trading involves significant risk, and the ability to withdraw funds is paramount. FBS has been flagged for authorization issues by the Securities Commission Malaysia and faces a high volume of complaints regarding price manipulation and profit removal.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator