Abstract:Indian investor Maryam Khan, 35, was scammed out of nearly ₹35 Lakh in a fraudulent stock investment scheme orchestrated by individuals impersonating the legitimate financial firm Zerodha. The scam began when Khan came across a Facebook Reel on July 4 promoting fake investment opportunities. After contacting the WhatsApp number listed in the ad,

How a Fake Zerodha Offer Cost One Investor ₹3.5 Lakh

Indian investor Maryam Khan, 35, was scammed out of nearly ₹35 Lakh in a fraudulent stock investment scheme orchestrated by individuals impersonating the legitimate financial firm Zerodha. The scam began when Khan came across a Facebook Reel on July 4 promoting fake investment opportunities. After contacting the WhatsApp number listed in the ad, she was approached by a woman named Shruti Sindhawani, who convinced her to join a WhatsApp group and download an app called Lumien Max, allegedly a Demat account platform. Initially, Khan transferred ₹25,000 and received fake profit updates along with a bogus “Zerodha winning certificate,” which encouraged her to invest a total of ₹3,487,000.

Trouble began when Khan attempted to withdraw her funds. The scammer sent a counterfeit SEBI letter demanding a 15% tax payment, followed by a request for an additional 20% brokerage fee. It was at this point that Khan realized she had been duped. These scams highlight the growing threat of financial fraud on social media platforms in India.

Drawbacks of Investing with Zerodha

1. No Stock Tips or Investment Advice from Zerodha

The absence of stock tips, research reports, or investment recommendations from Zerodha can be seen as a drawback for many beginner or less-experienced investors. Without in-house research or expert guidance, users are left to rely entirely on their own knowledge, third-party sources, or external advisory services, which may not always be reliable or tailored to their needs. For new investors especially, the lack of curated insights can make decision-making more difficult and increase the chances of making uninformed or risky trades. In contrast, many full-service brokers provide research-backed recommendations, helping clients navigate market complexities. Therefore, while Zerodha promotes independent investing, its hands-off approach may feel overwhelming or insufficient for those looking for more structured guidance and support.

2. Hidden Charges

Zerodha, while known for its low-cost trading model, does have some additional charges that users should be aware of. For instance, using the Call and Trade feature incurs an extra fee of ₹50 per call. Similarly, if a trader fails to manually square off MIS (Margin Intraday Square off), BO (Bracket Order), or CO (Cover Order) positions, Zerodha charges ₹50 per executed order. Although digital contract notes are provided via email at no cost, requesting physical copies comes with a ₹20 fee per contract, along with applicable courier charges.

3. No Monthly Unlimited Trading Plans Offered

Zerodha does not provide any monthly unlimited trading plans, which means traders cannot pay a fixed monthly fee for unlimited trades. Instead, the platform follows a pay-per-trade pricing model, where brokerage is charged per transaction. This can be less cost-effective for high-frequency traders who execute numerous trades daily, as their cumulative brokerage fees may end up being higher compared to platforms offering flat-rate trading plans.

Do Not Miss These Important Articles- www.wikifx.com/en/newsdetail/202508131404894152.html

www.wikifx.com/en/newsdetail/202508135634249682.html

4 . No Lifetime Free AMC for Demat Accounts

Zerodha does not offer a lifetime free Annual Maintenance Charge (AMC) for its demat accounts. Users are required to pay AMC every year to maintain their demat accounts, which can be a recurring cost, especially for long-term investors who may not trade frequently. Unlike some brokers that waive AMC charges for life as part of promotional offers, Zerodha continues to apply this annual fee, which may be a downside for cost-conscious investors.

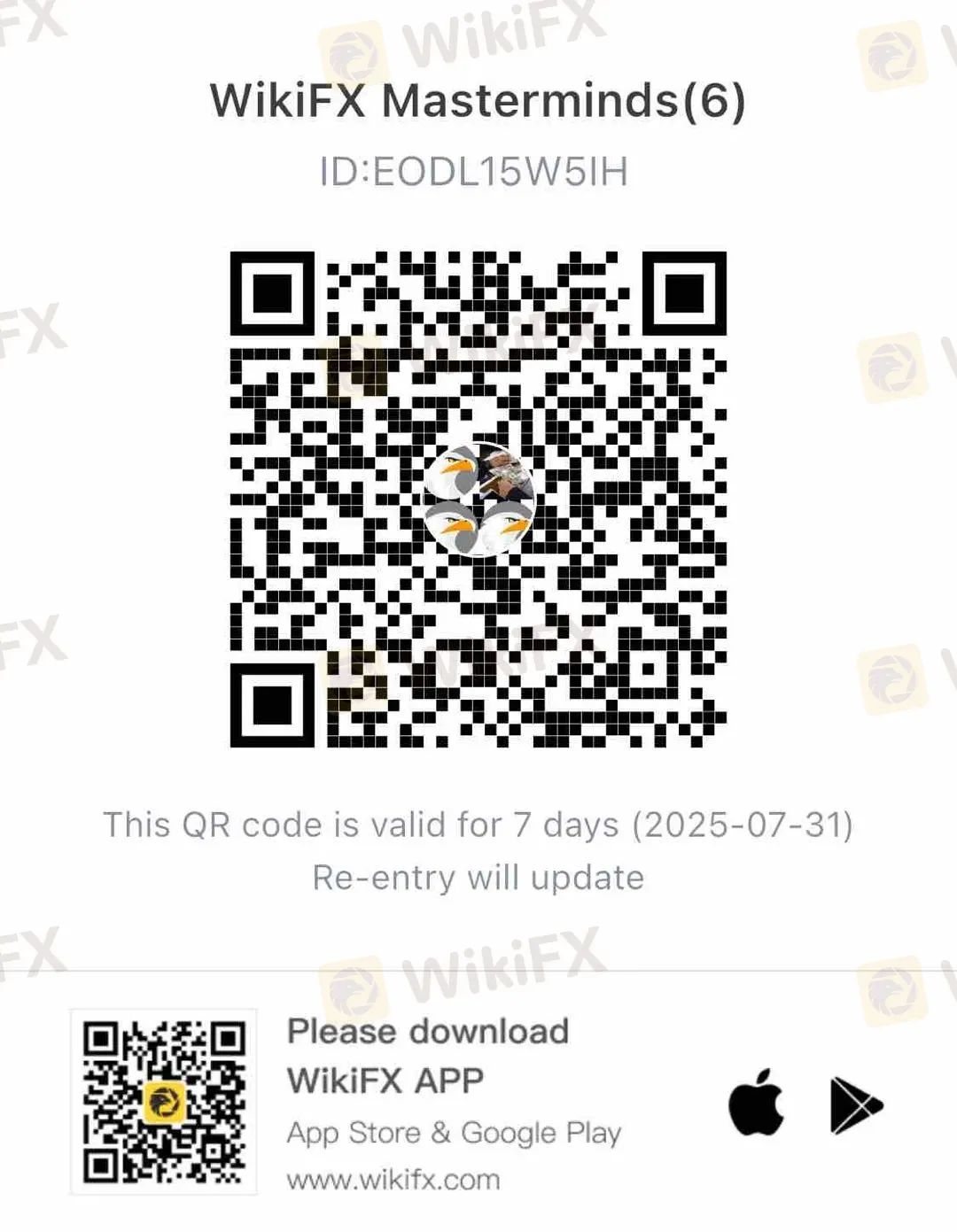

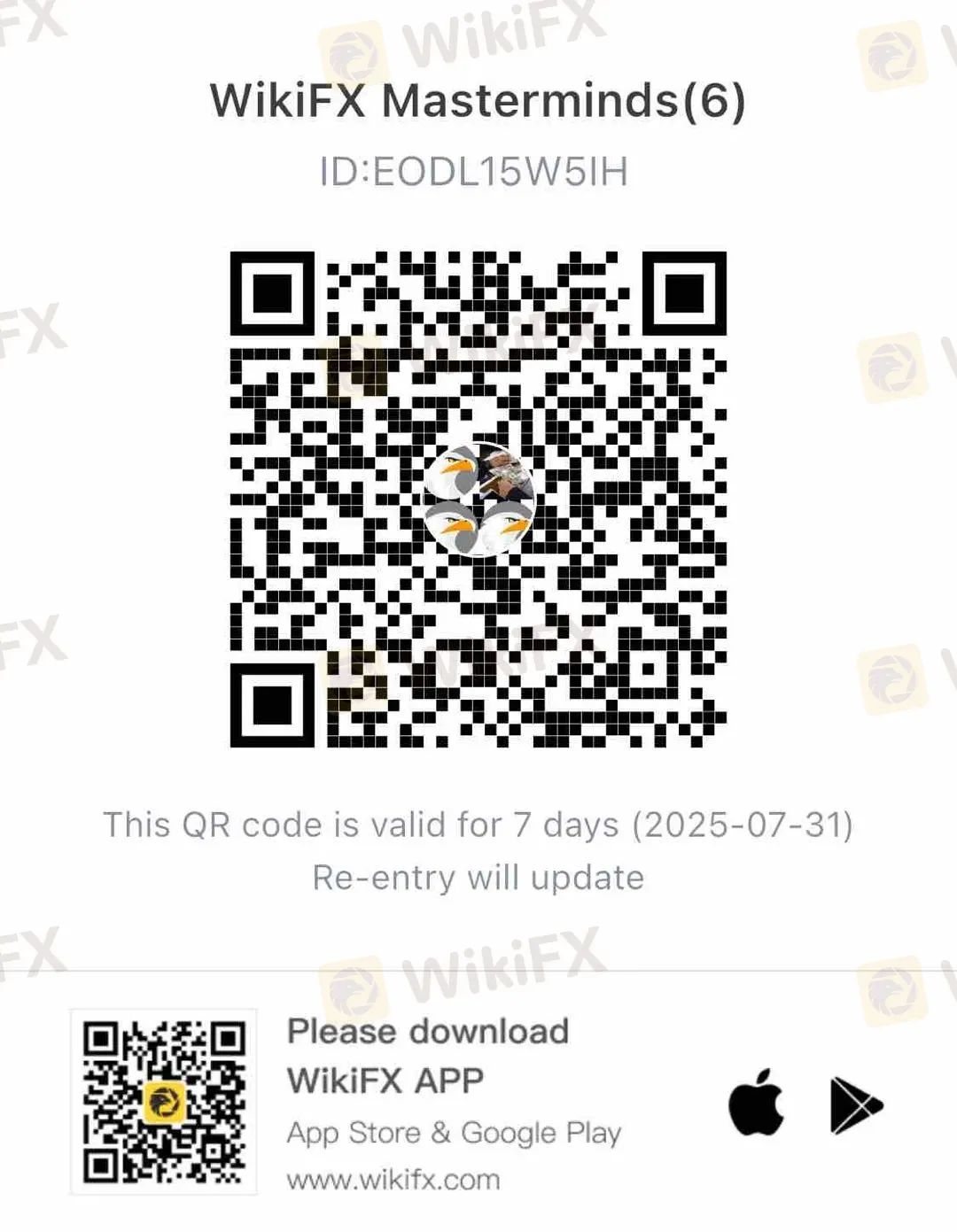

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!