WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A broker may appear legitimate at first glance, yet still operate beyond the limits of its regulatory permissions. Every year, traders lose money not because of bad strategies, but because they trusted a broker without fully understanding its regulatory standing. Today, WikiFX turns its spotlight on CBCX, a broker licensed in two different jurisdictions. Keep reading to learn more about this broker

In the fast-moving world of online trading, danger often hides in plain sight, including behind official-looking licences, persuasive marketing, and polished websites. A broker may appear legitimate at first glance, yet still operate beyond the limits of its regulatory permissions. Every year, traders lose money not because of bad strategies, but because they trusted a broker without fully understanding its regulatory standing.

Today, WikiFX turns its spotlight on CBCX, a broker licensed in two different jurisdictions. On the surface, it appears to be a regulated and stable trading platform. But beneath that polished image, there are critical details every trader should examine before investing.

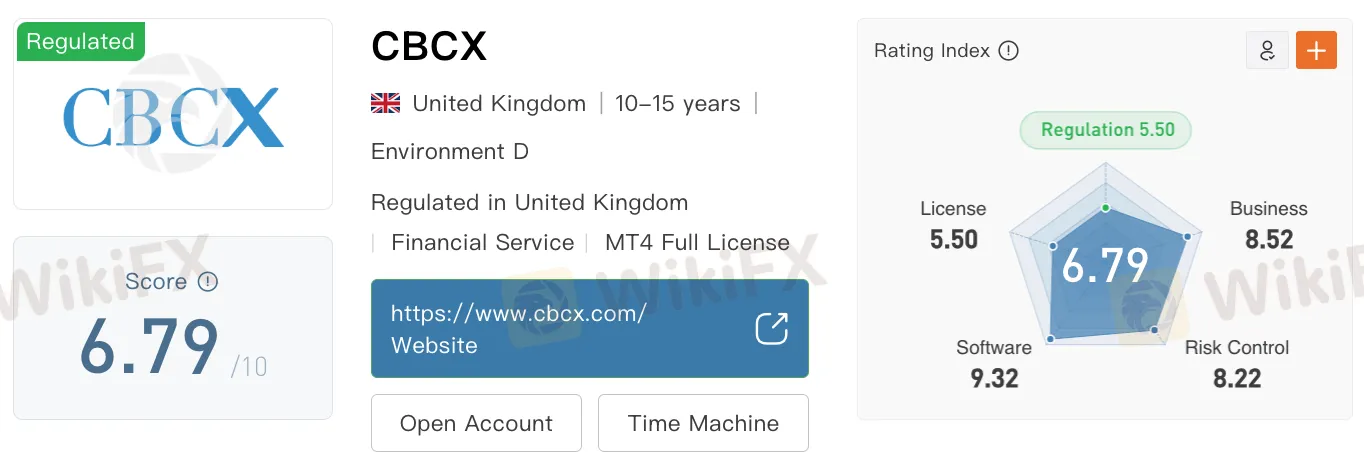

According to WikiFX, CBCX holds a WikiScore of 6.79 out of 10, which is a rating that suggests a generally stable regulatory framework and active operations. However, it also signals areas worth closer scrutiny, particularly since the broker operates across multiple jurisdictions with varying levels of regulatory coverage.

One of CBCXs strongest credentials comes from the Financial Conduct Authority (FCA) in the United Kingdom, under licence number 572911. The FCA is widely regarded as one of the toughest and most respected regulators in the world. Any firm under its supervision must comply with strict rules on transparency, client fund segregation, and fair market practices. An FCA licence is often a strong mark of credibility, but only when the broker operates fully within the rules.

CBCX also holds a registration with the Financial Sector Conduct Authority (FSCA) in South Africa, under licence number 49700. The FSCA oversees market conduct across financial institutions and ensures customers are treated fairly. While that sounds reassuring, here‘s where the red flag appears: CBCX’s FSCA registration is categorised as a non-forex financial services licence. This means that although the broker is officially listed with the FSCA, it may be offering services outside the permissions granted by that licence.

For traders, this is a crucial point. A broker providing products not fully covered by its regulatory permissions is operating in risky territory, and if something goes wrong, those activities may fall outside the regulators protection. Many traders mistake “having a licence” for a blanket guarantee of safety, but the scope of that licence matters just as much as its existence.

This is why professional traders never skip due diligence, and why they use WikiFX before committing a single dollar. WikiFX‘s database lets you instantly verify a broker’s licensing status, check the scope of its permissions, identify regulatory warnings, and read real trader reviews. All of this is free on the WikiFX website and mobile app. Fully utilize WikiFXs free tools to spot risks before they become costly mistakes.

In online trading, it‘s not enough to know whether a broker is licensed. You must know how it’s licensed, where it‘s licensed, and what that licence actually covers. Whether it’s CBCX or any other platform, taking five minutes to check them on WikiFX could be the difference between safe investing and financial regret.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.