Abstract:In online trading, danger rarely arrives with flashing red lights. More often, it hides behind a sleek, professional-looking platform with just one click away from taking your deposit and disappearing into the digital shadows. Today, the broker under WikiFX’s spotlight is Capital.com. Keep reading to discover whether it’s truly as safe as it seems.

In online trading, danger doesn‘t always announce itself with flashing red lights. Sometimes, it hides behind a sleek, professional-looking platform with just one click away from taking your deposit and vanishing into the digital shadows. Every year, countless traders learn the hard way that the broker they trusted wasn’t as safe as it seemed. The difference between protecting your capital and losing it often comes down to one crucial decision: choosing the right broker.

One name making waves in trading circles is Capital.com. Its discussed in forums, advertised across social media, and praised in trading communities. But is the hype deserved? Is Capital.com truly a safe place for traders or just another polished façade waiting to crack under pressure? The answer lies in its regulatory backbone and in whether traders know how to verify it.

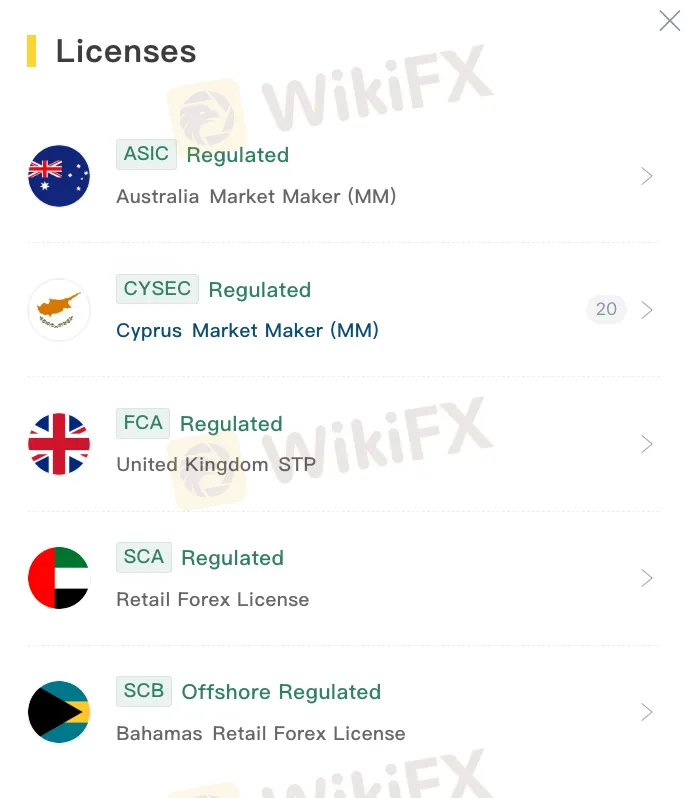

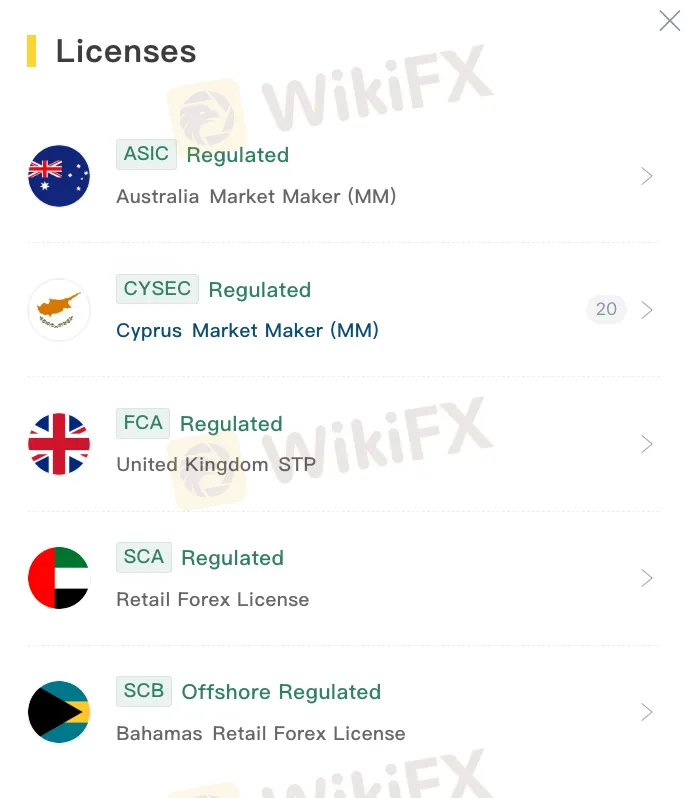

Capital.com wears its regulatory credentials proudly. The broker holds five active licences from some of the world‘s most reputable financial watchdogs, including the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC). These arent just decorative titles; each regulator enforces strict rules designed to protect client funds and keep operations transparent.

One of the most notable is its ASIC licence, number 513393. ASIC is known globally as one of the toughest financial regulators, ensuring companies treat clients fairly, follow strict operational standards, and safeguard customer funds. Passing ASICs scrutiny is a strong signal of credibility.

Capital.com is also regulated by CySEC, under licence number 319/17. CySEC operates within the MiFID II framework, which standardises investor protection and transparency rules across the European Economic Area. For traders, this means a high level of protection when dealing with a CySEC-authorised broker.

In the UK, Capital.com operates under licence number 793714 from the FCA. The FCA is widely regarded as one of the strictest regulators in the world, requiring brokers to operate transparently, keep client funds separate from company funds, and meet stringent financial stability requirements. Traders with an FCA-licensed broker can feel confident theyre dealing with a company that plays by the rules.

The broker has also expanded into the Middle East, securing a licence from the Securities and Commodities Authority (SCA) in the United Arab Emirates, under licence number 20200000176. The SCA enforces international compliance standards, ensuring financial firms in the UAE operate with integrity and transparency, which is a key safeguard in this fast-growing market.

Lastly, Capital.com holds a licence from the Securities Commission of the Bahamas, with registration number SIA-F245. While the Bahamas has historically been seen as an offshore hub, its financial laws have tightened in recent years to improve investor protection and combat misconduct. This shows Capital.coms commitment to building a truly global regulatory footprint.

This network of licences paints a picture of a broker committed to compliance, but here‘s where traders must stay alert: regulation alone doesn’t guarantee safety. Brokers can change, rules can shift, and even reputable firms can run into problems. Too many traders skip due diligence, relying solely on first impressions or marketing claims. That‘s a dangerous gamble, and it’s exactly how people lose their hard-earned money.

This is why professional traders turn to WikiFX before investing a single dollar. WikiFX lets you instantly verify a brokers licensing status, review any regulatory warnings, and read real trader feedback - all for free! In seconds, you can uncover hidden risks, spot red flags, and confirm whether a broker truly operates under the licences it claims.

In online trading, information isn‘t just power, but ultimate protection. Skipping this step is like driving at night without headlights: you might make it a short distance, but disaster is inevitable. Whether you’re considering Capital.com or any other broker, take five minutes to check them on WikiFX. That single action could save you from costly mistakes as well as give you the confidence to trade knowing exactly who youre dealing with.