Company Summary

General Information & Regulation

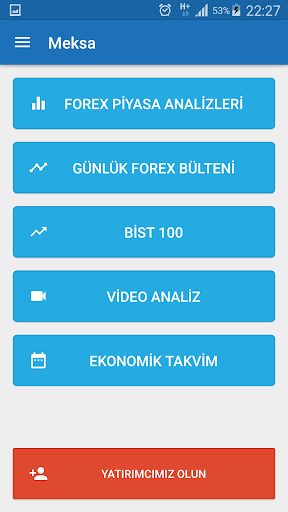

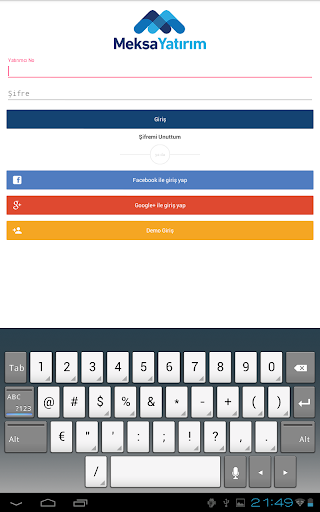

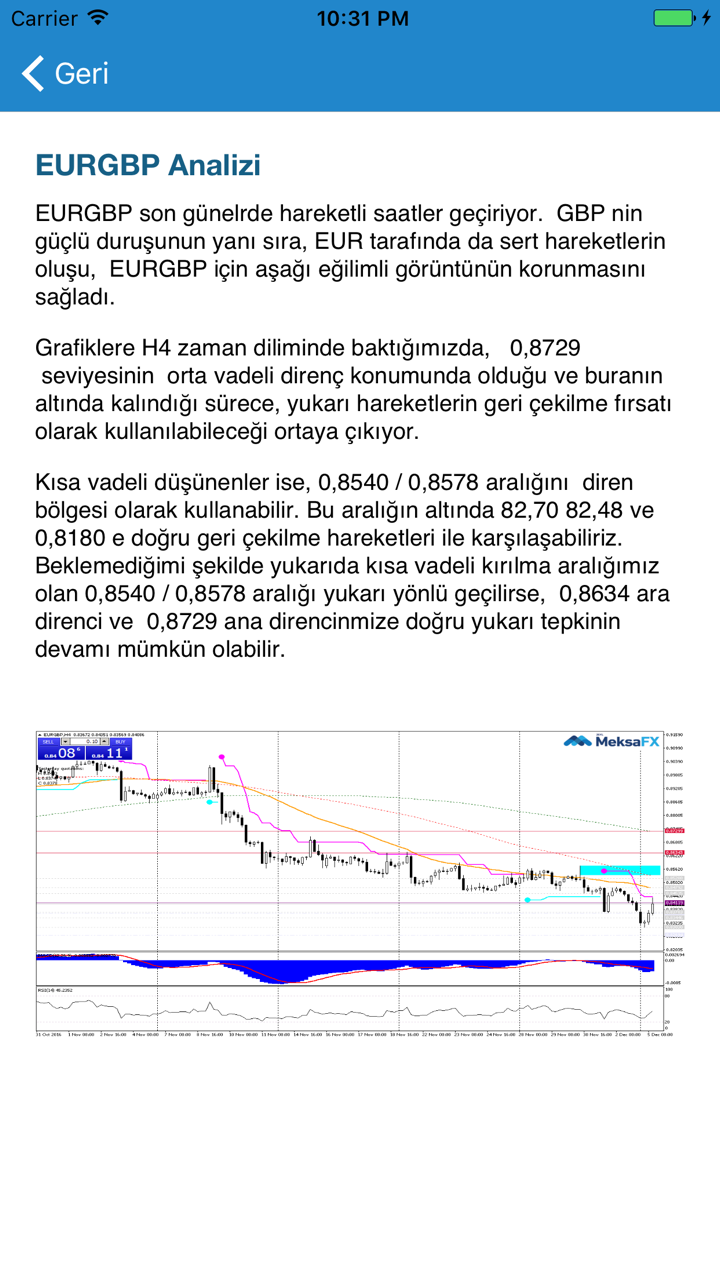

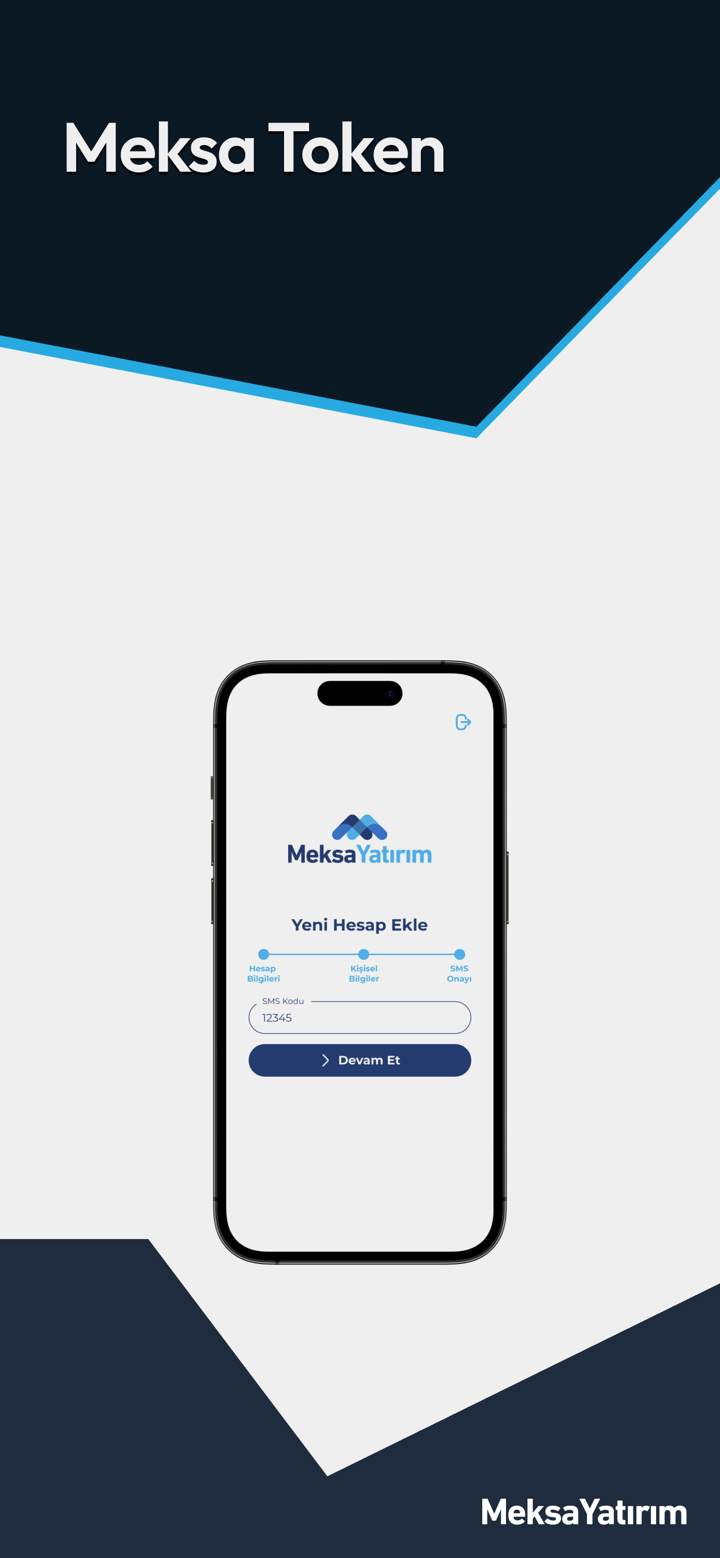

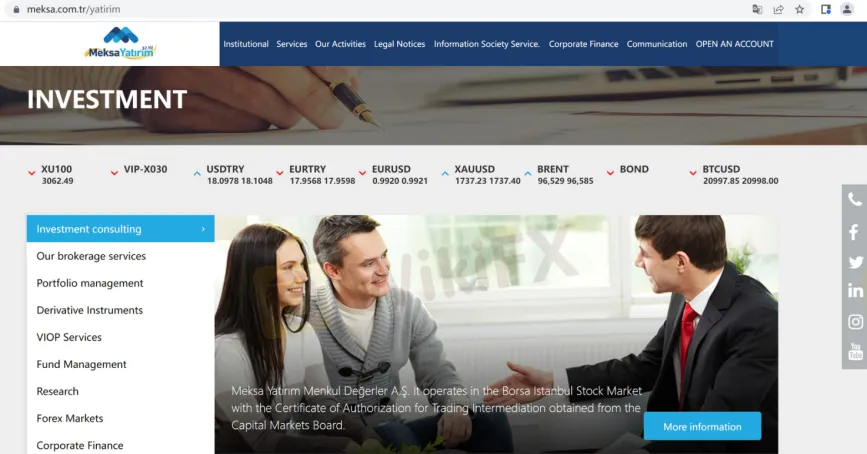

MEKSA, a trading name of Meksa Yatırım Menkul Değerler A.Ş, is allegedly a financial brokerage company established on June 28, 1990, and registered in Turkey. The broker says it operates in the Borsa Istanbul Stock Market with the Certificate of Authorization for Trading Intermediation obtained from the Capital Markets Board, claiming to provide its individual and corporate customers with various financial services. Here is the home page of this brokers official site:

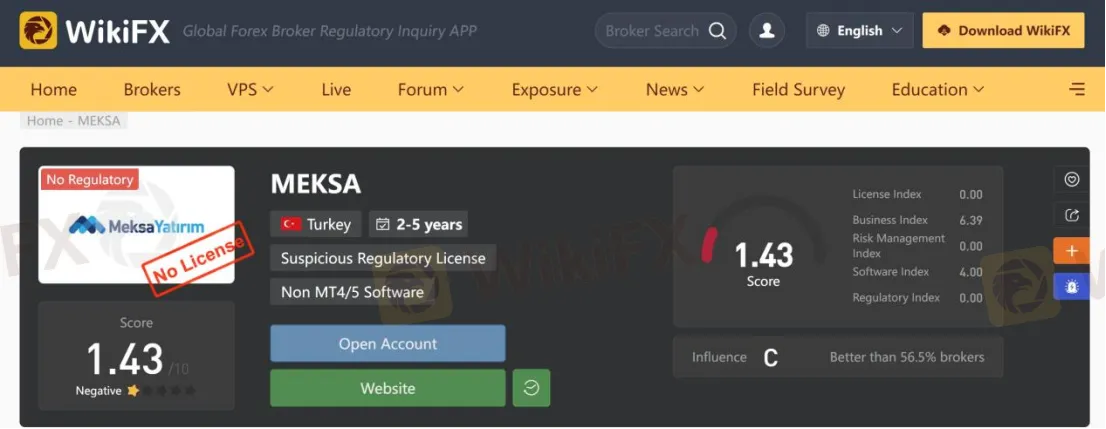

As for regulation, it has been verified that MEKSA does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.43/10. Please be aware of the risk.

Negative Reviews

A trader shared his terrible trading experience in the MEKSA platform at WikiFX. He said that MEKSA is a scam broker and he didnt get the promised 50% deposit when the date arrived. It is necessary for traders to read reviews left by some users before choosing forex brokers, in case they are defrauded by scams.

Services

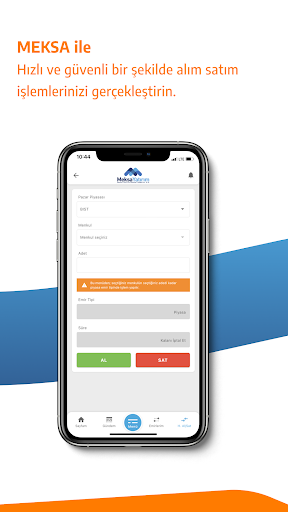

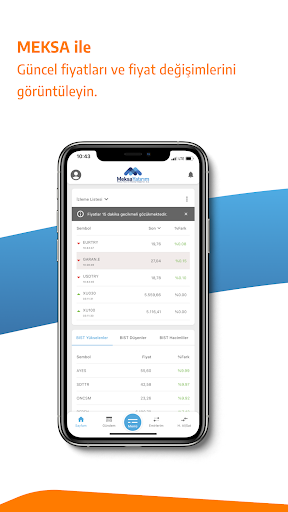

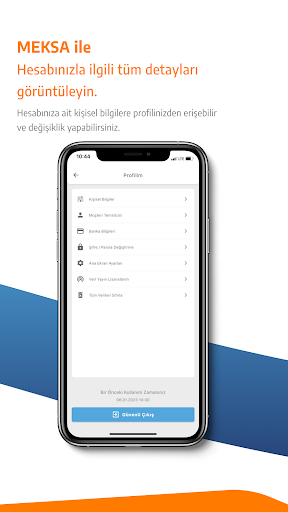

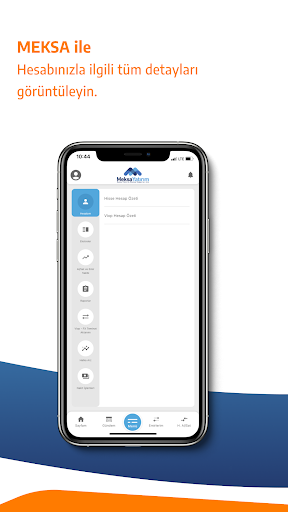

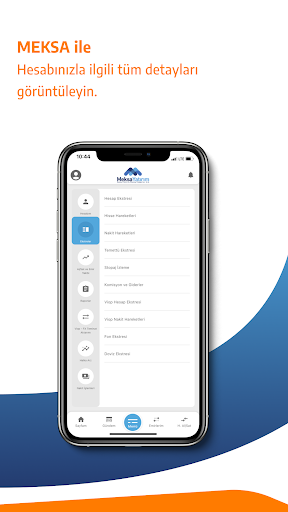

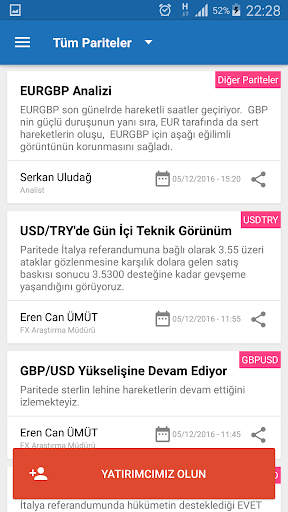

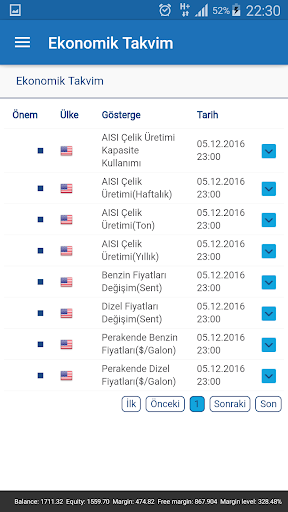

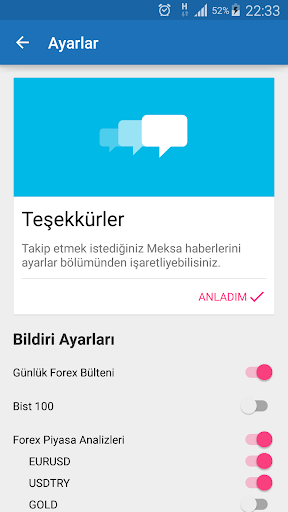

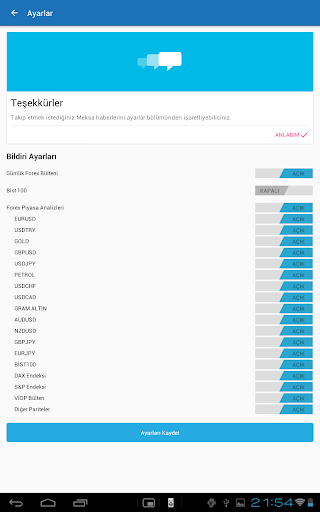

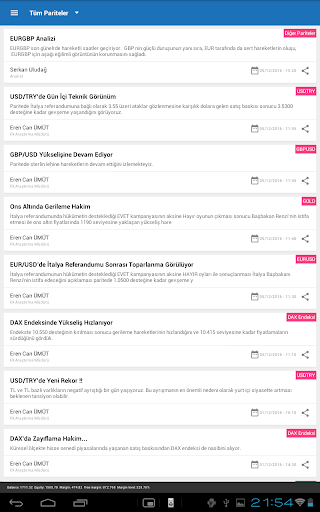

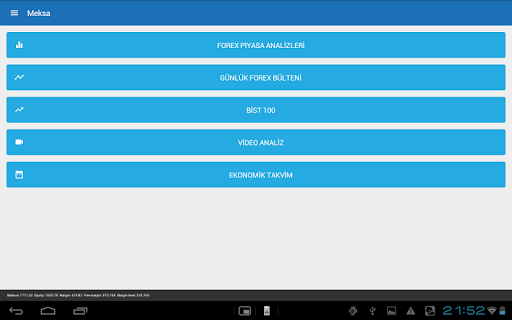

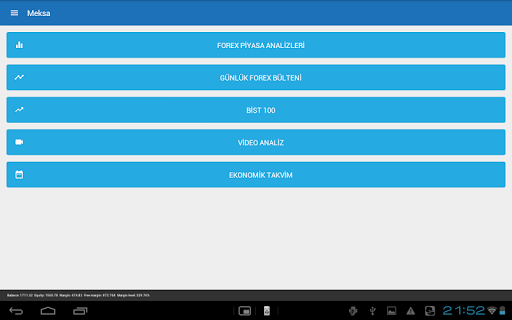

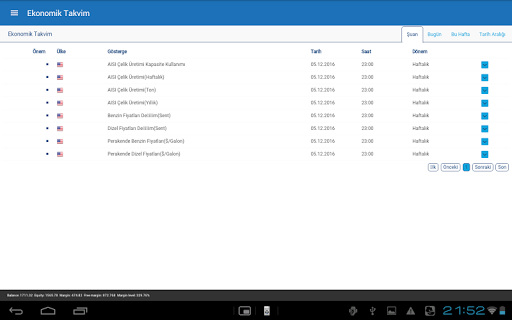

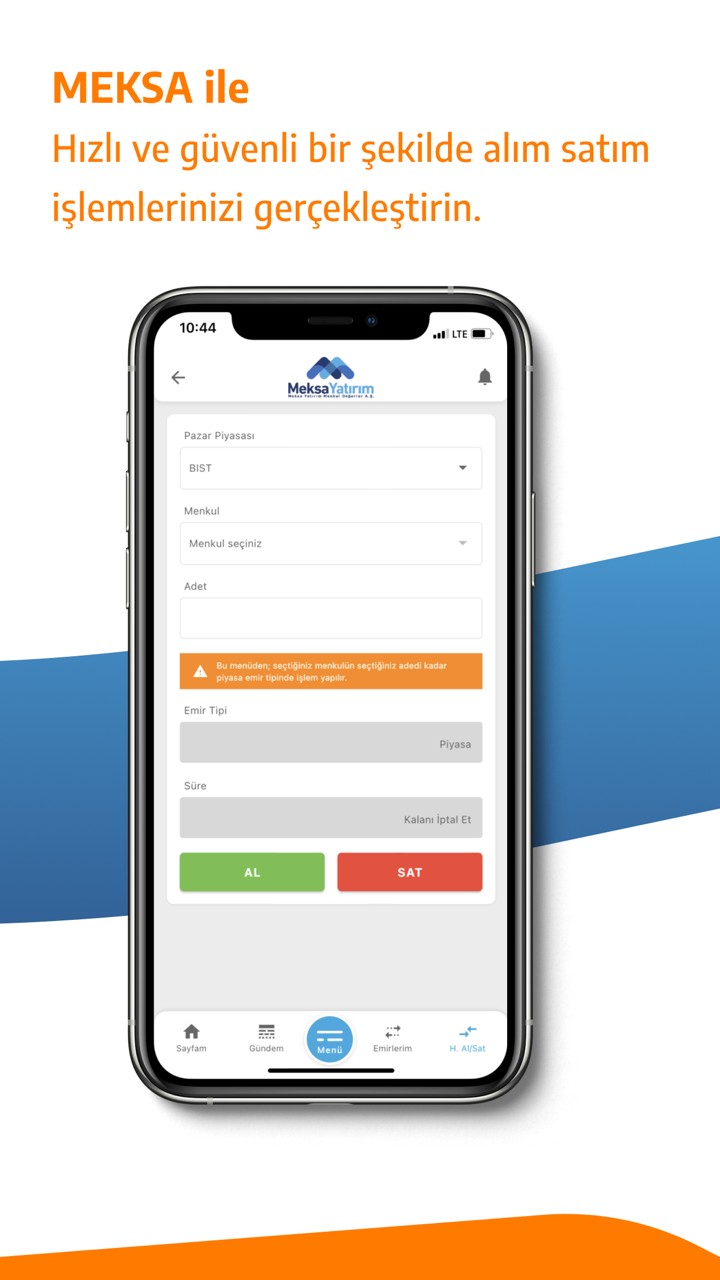

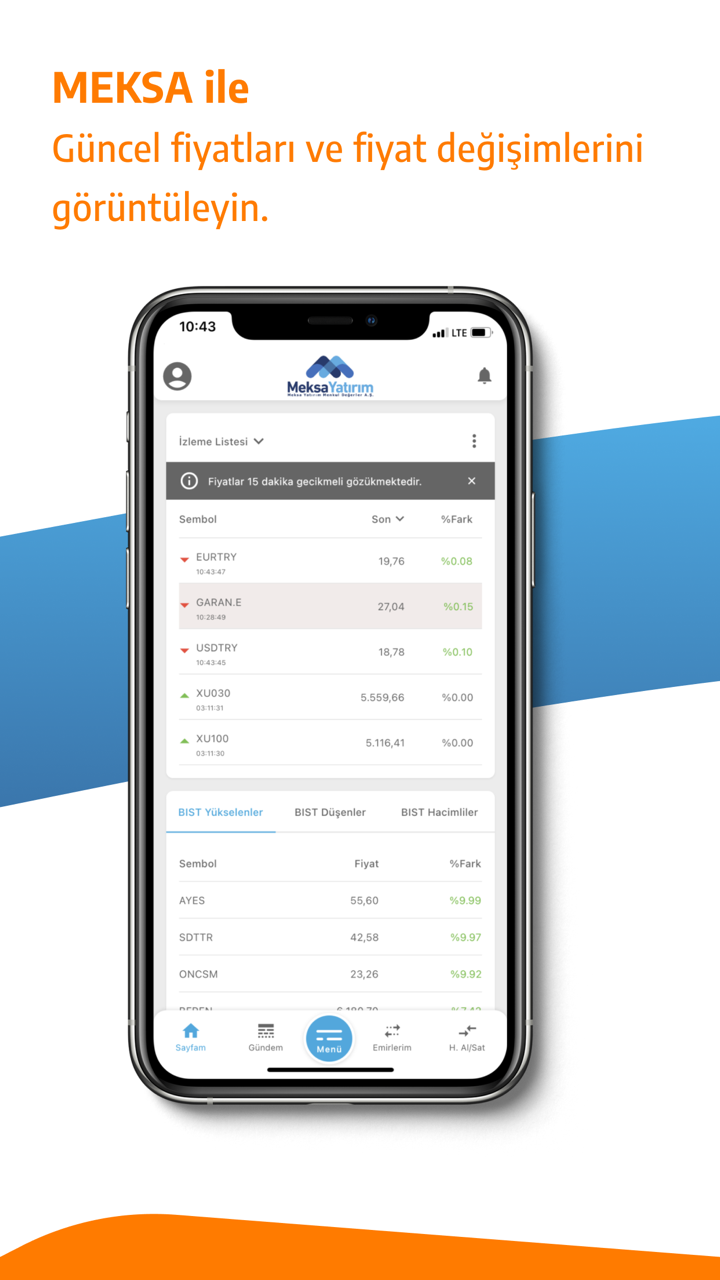

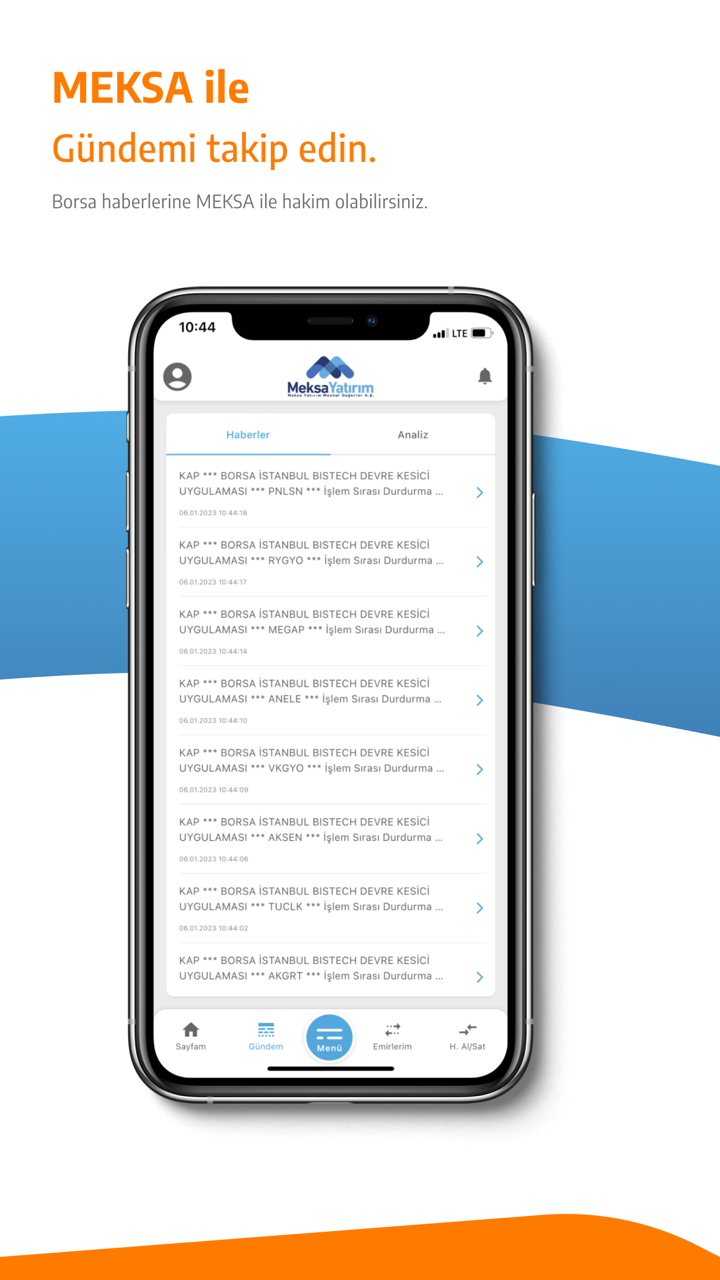

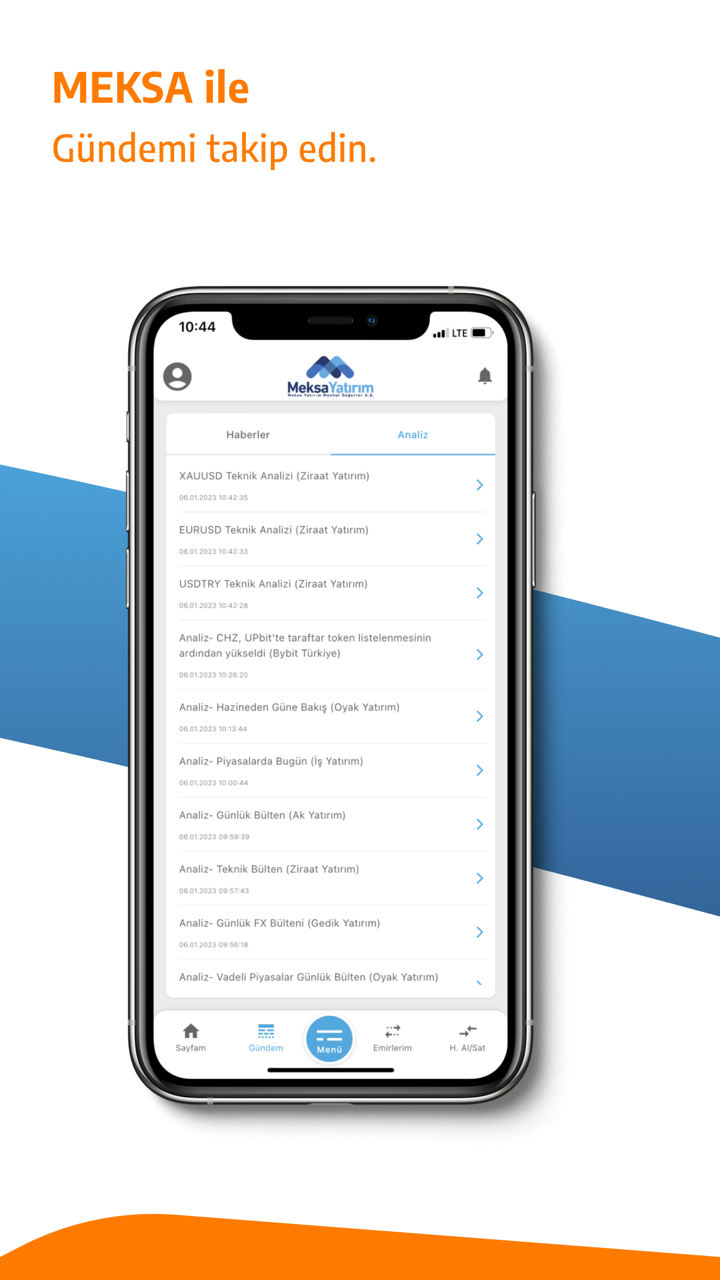

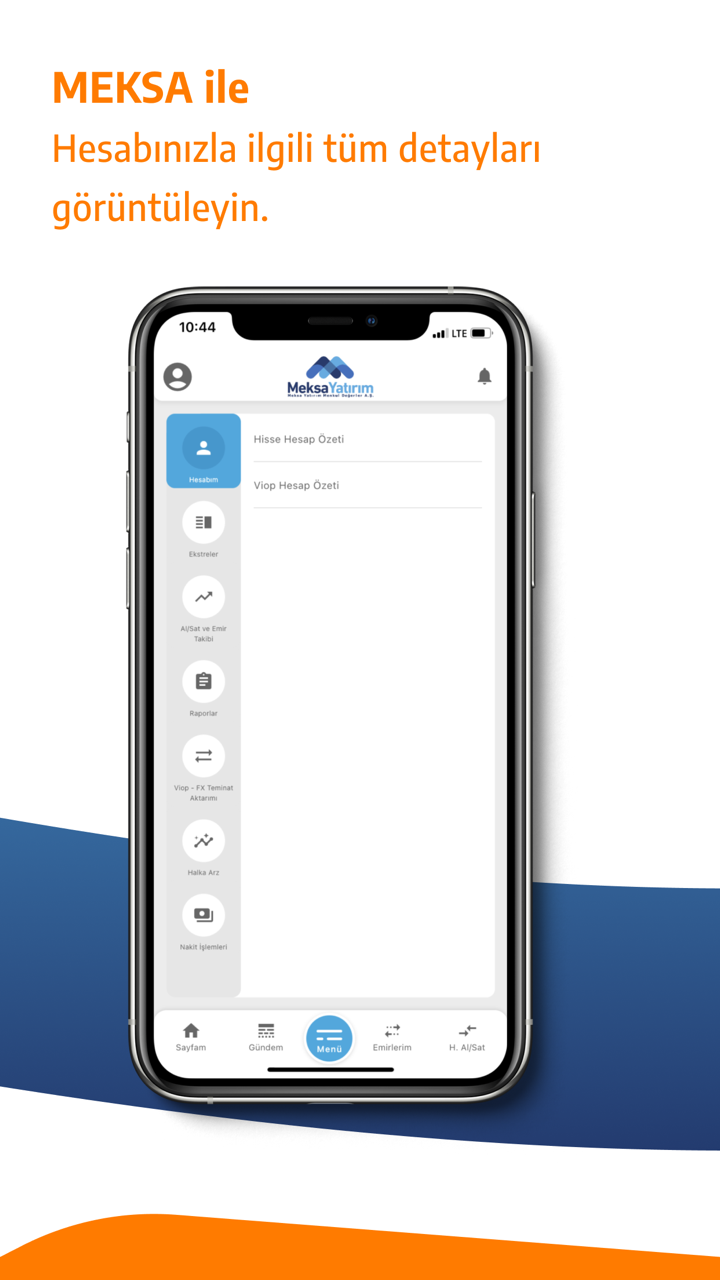

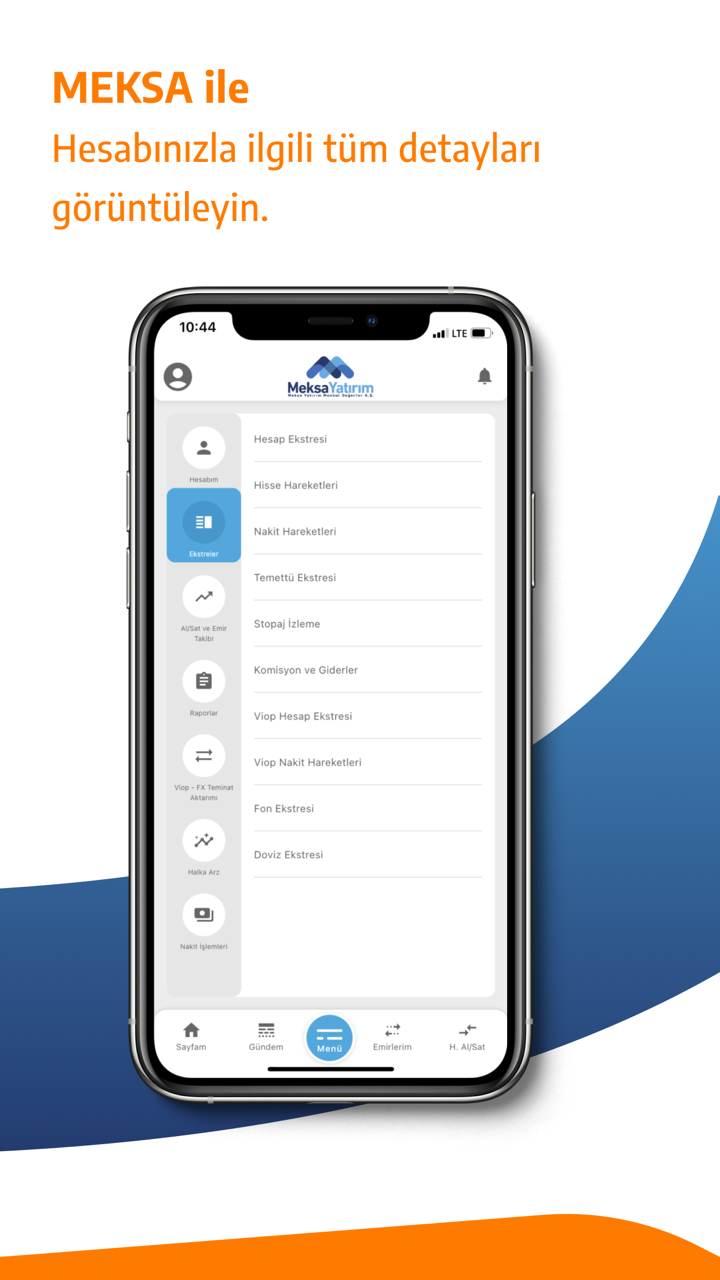

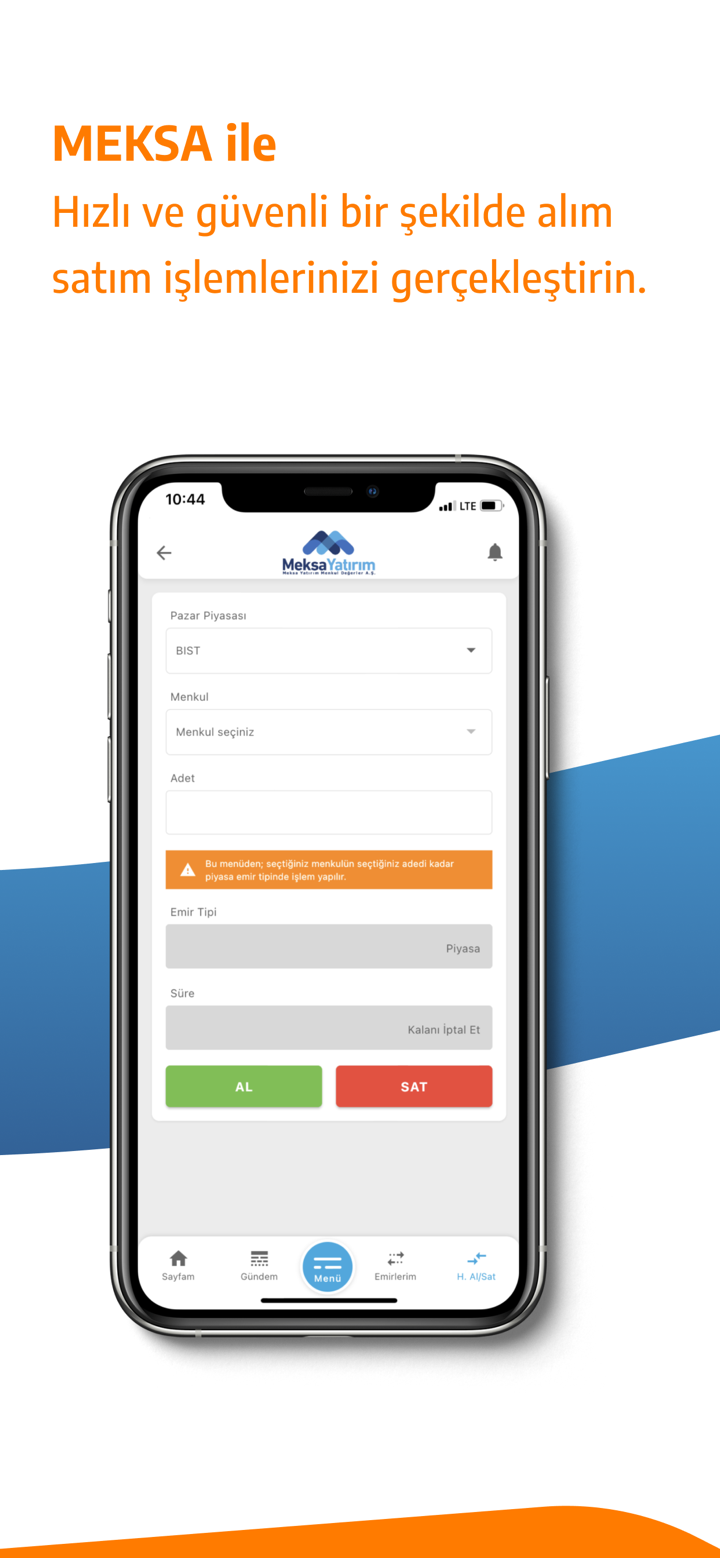

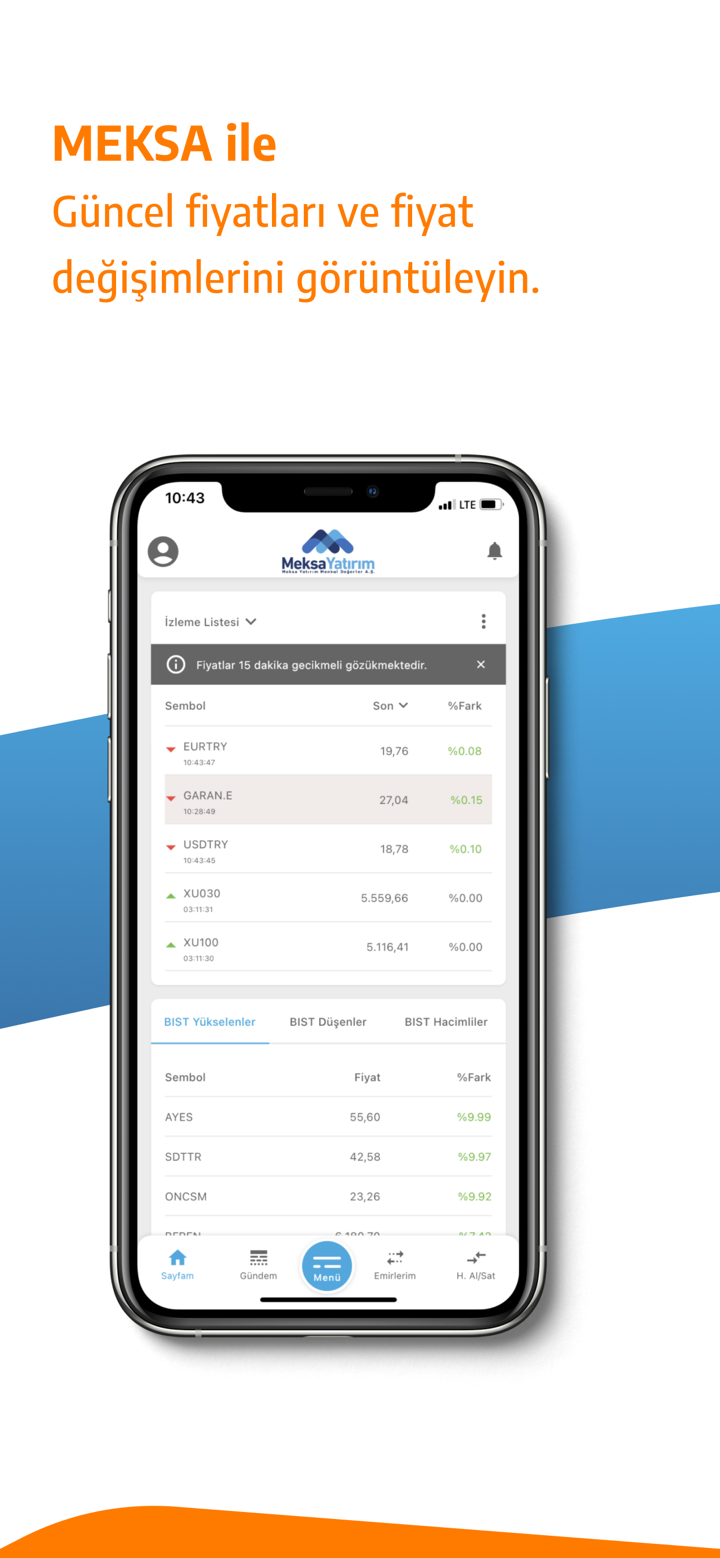

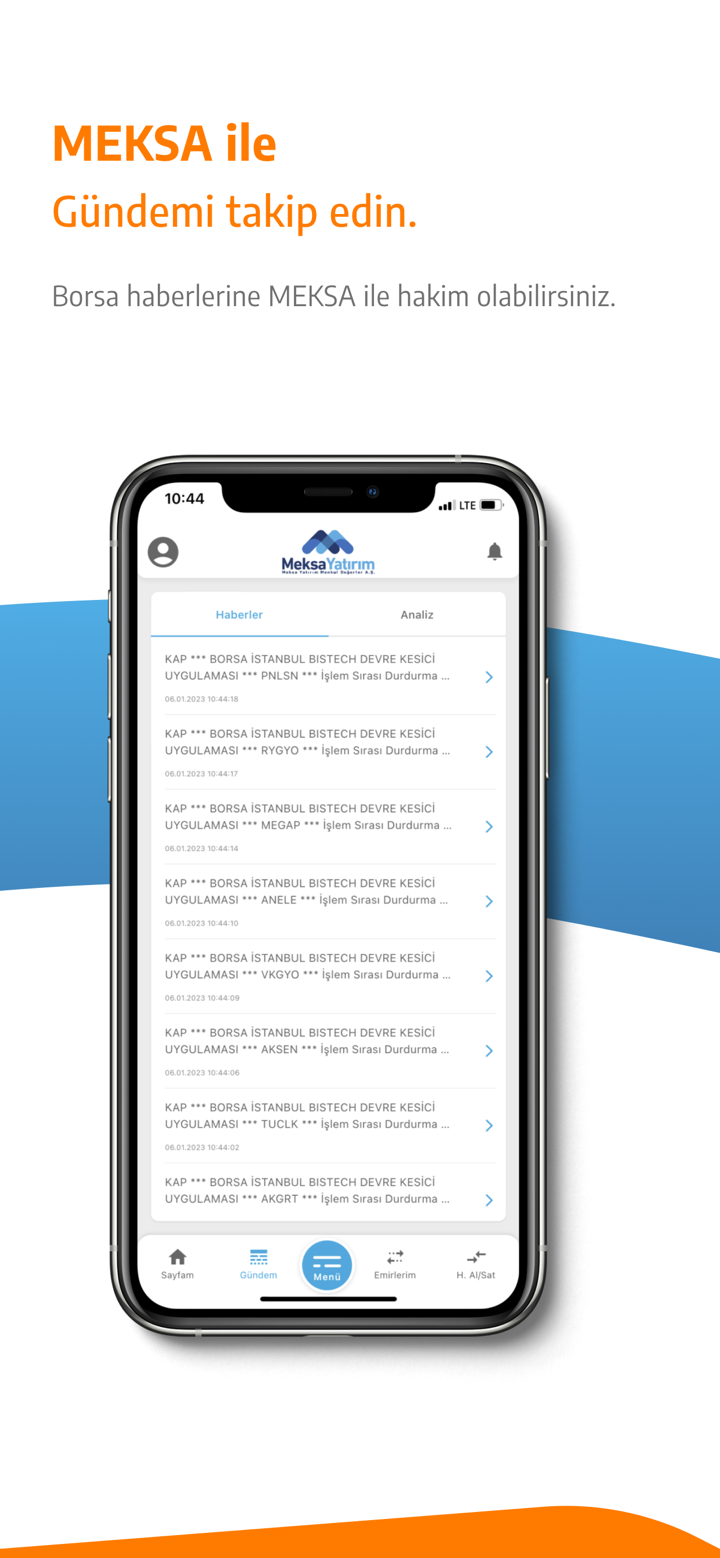

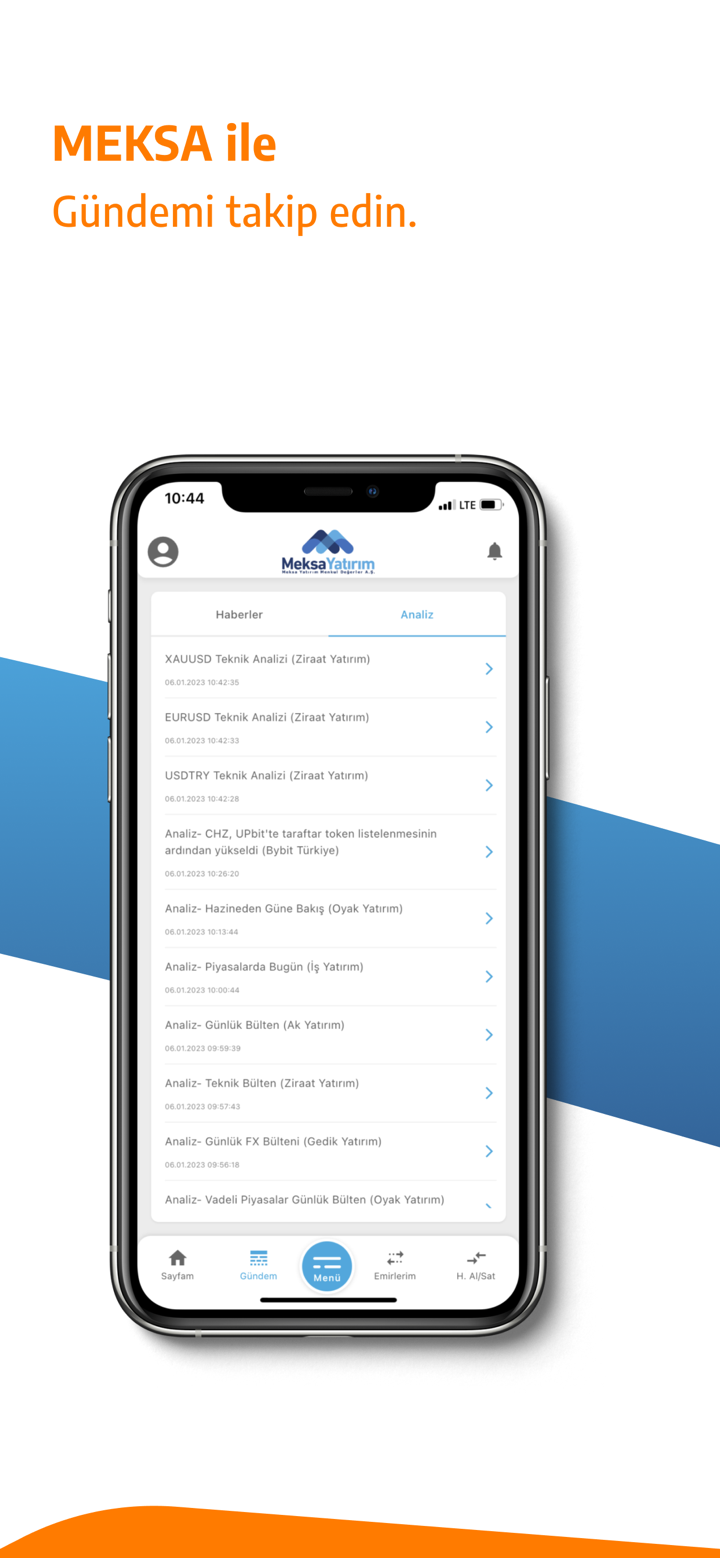

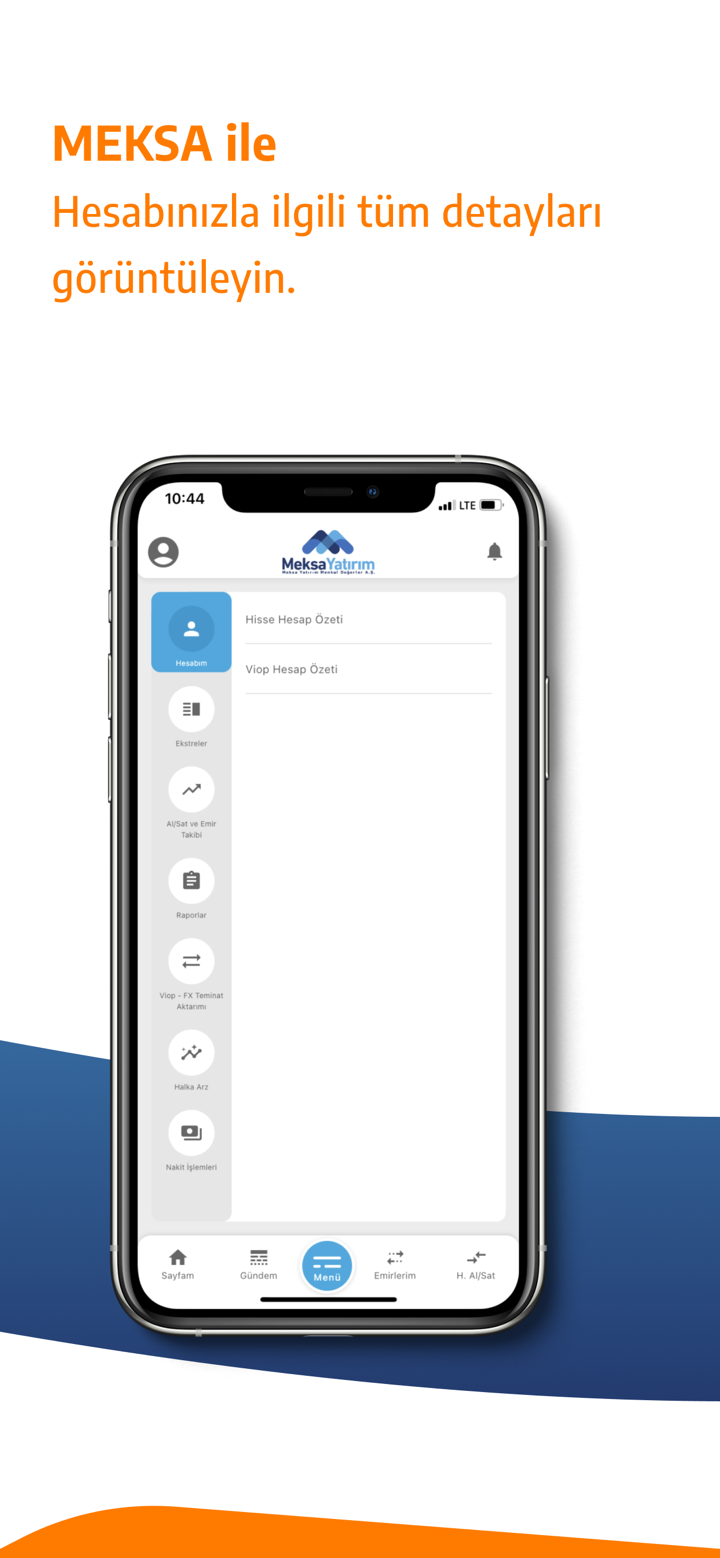

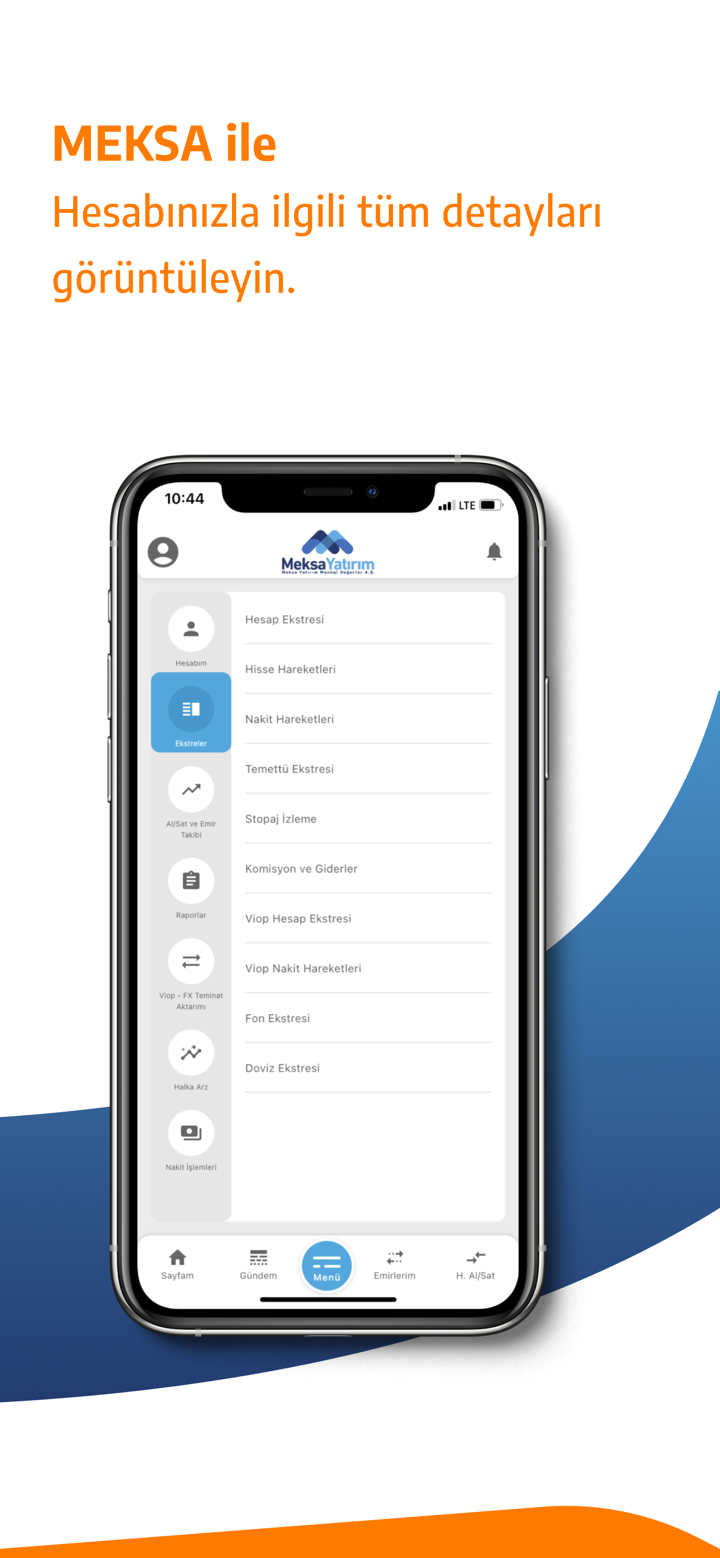

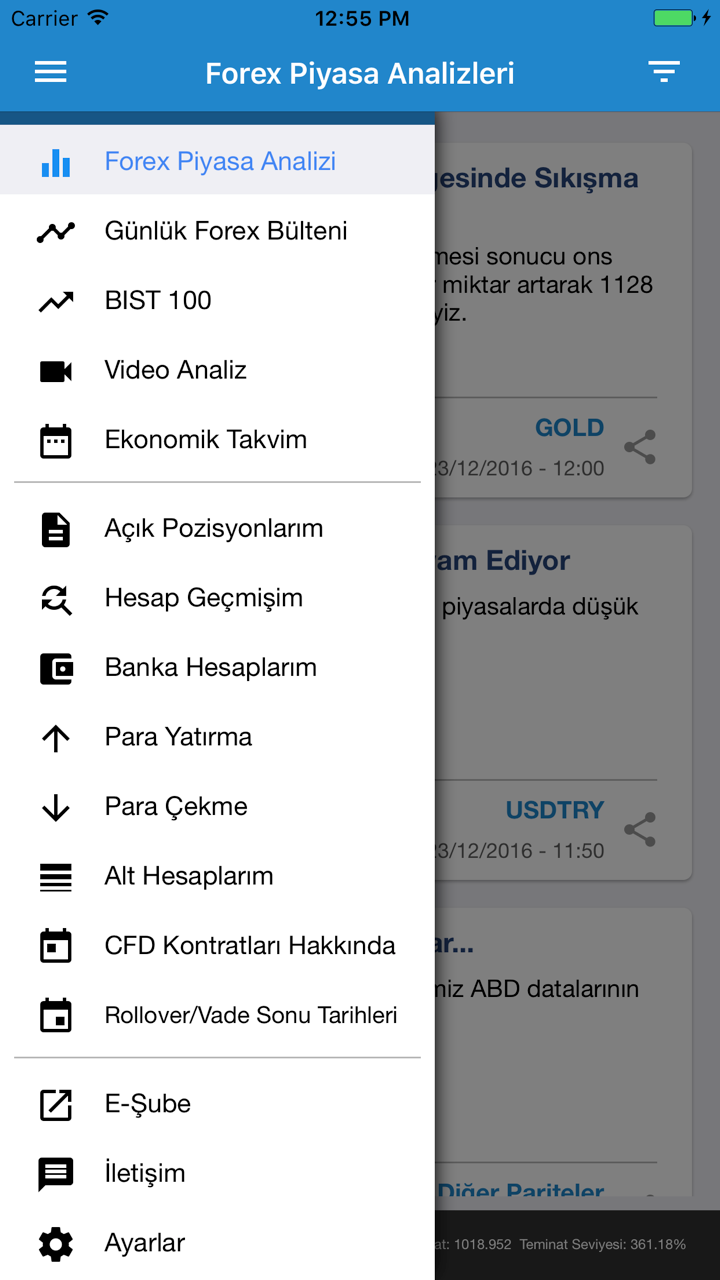

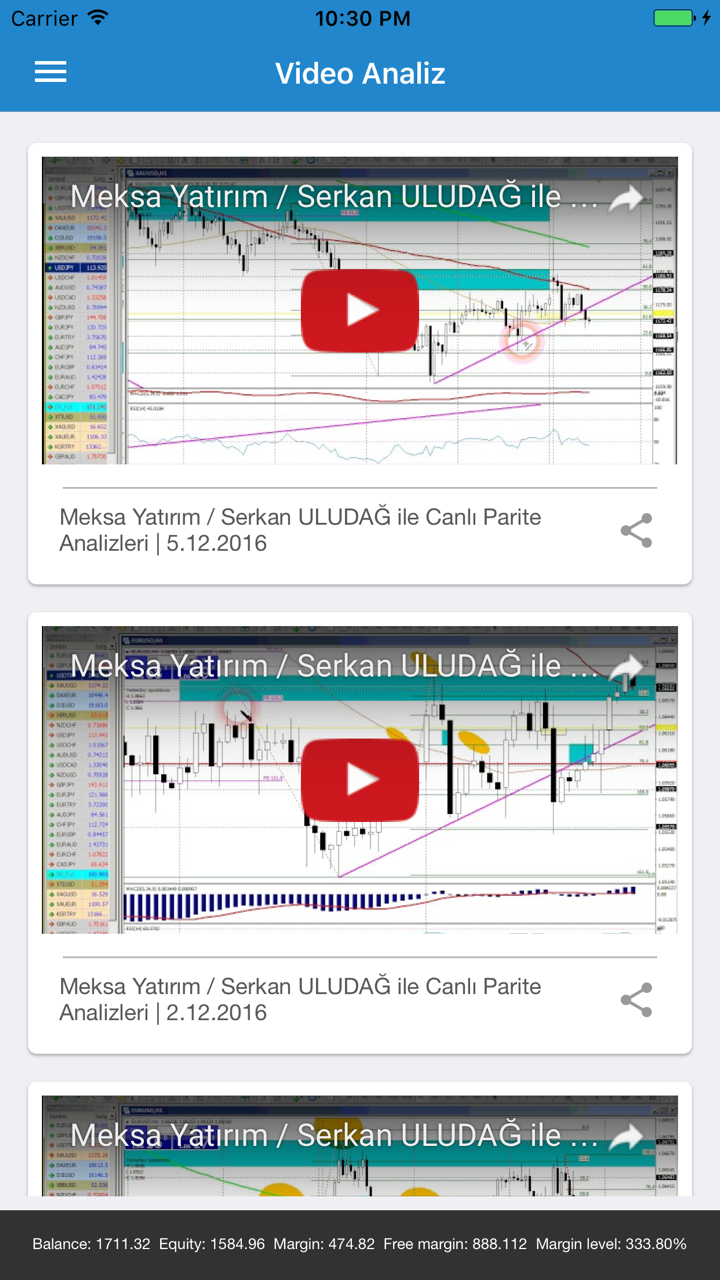

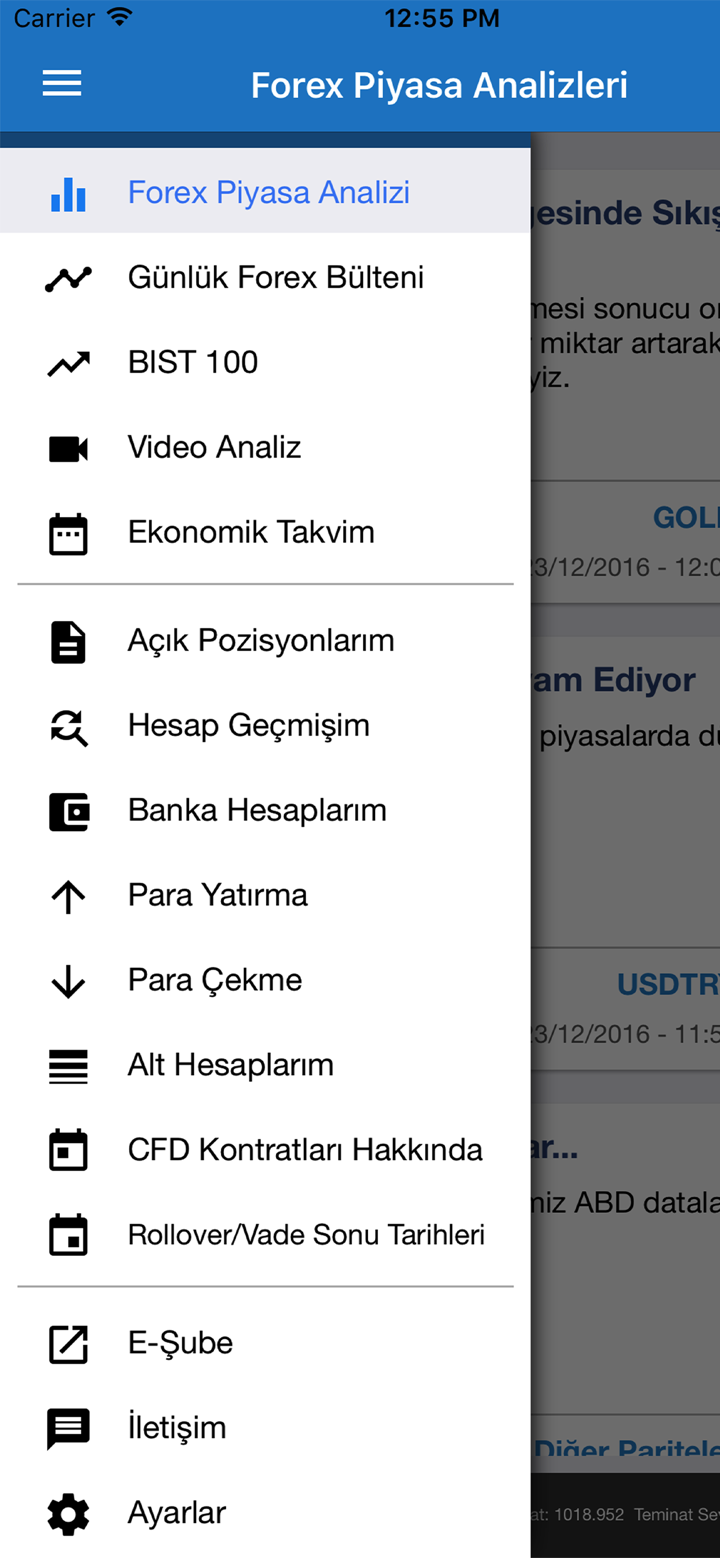

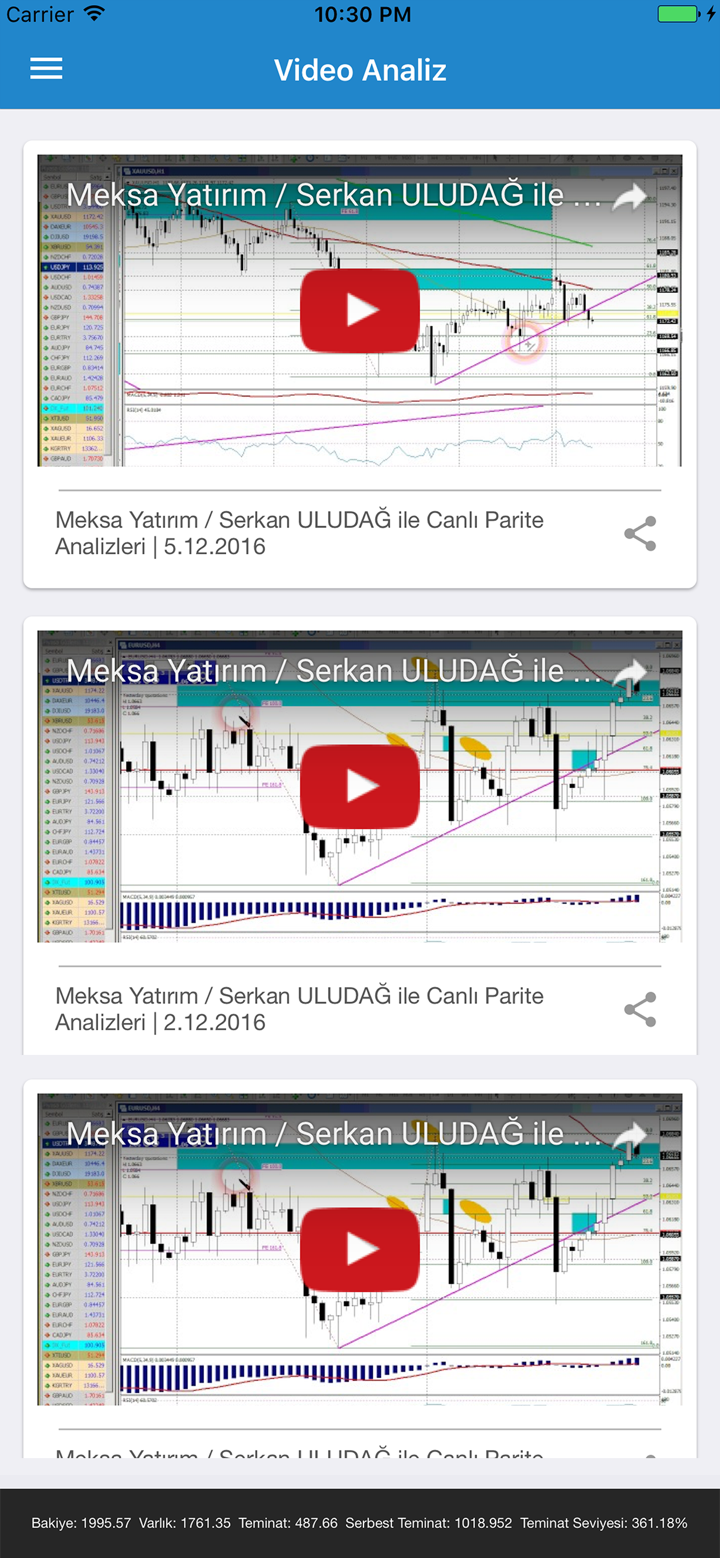

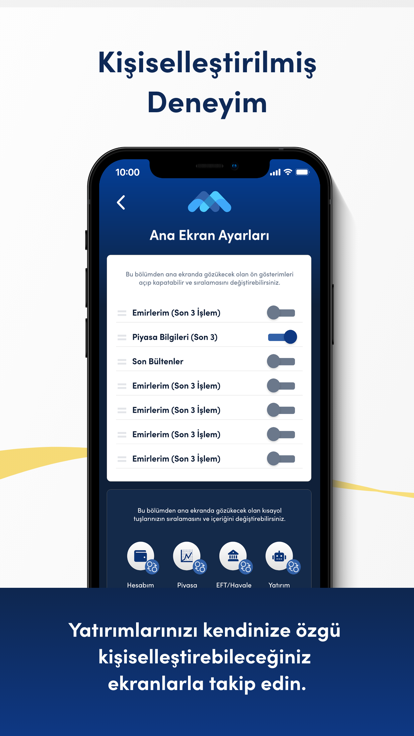

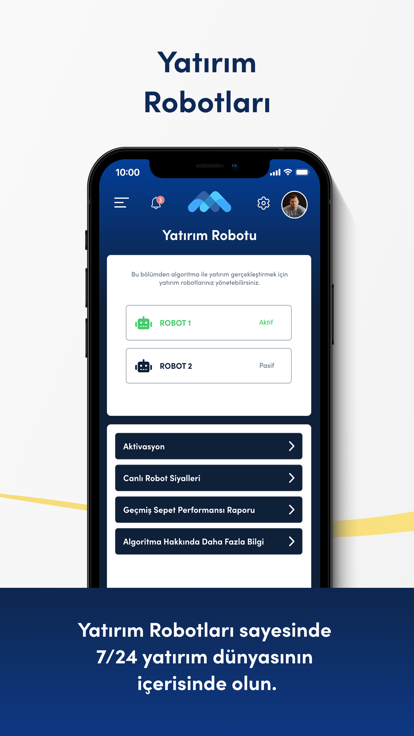

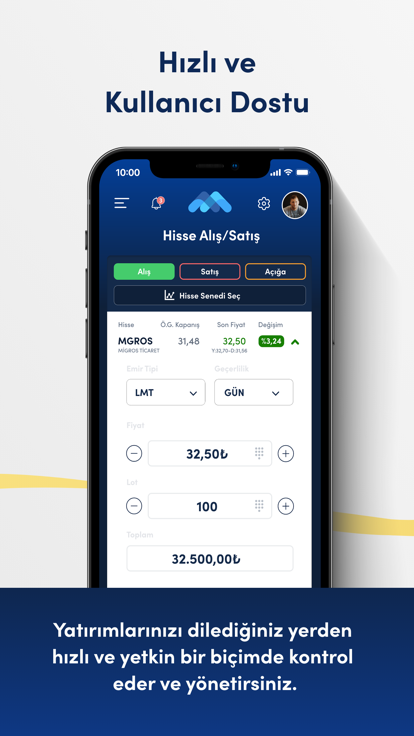

MEKSA advertises that it offers a diverse range of services, which include investment consulting, brokerage services, portfolio management, derivative instruments, VIOP services, fund management, research, forex markets and corporate finance.

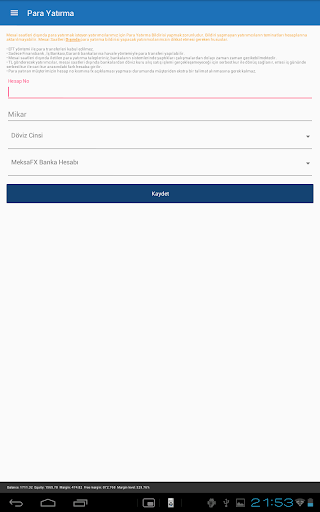

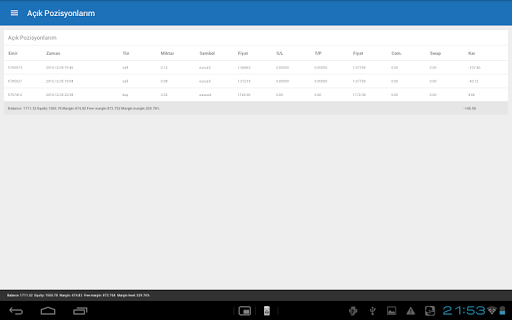

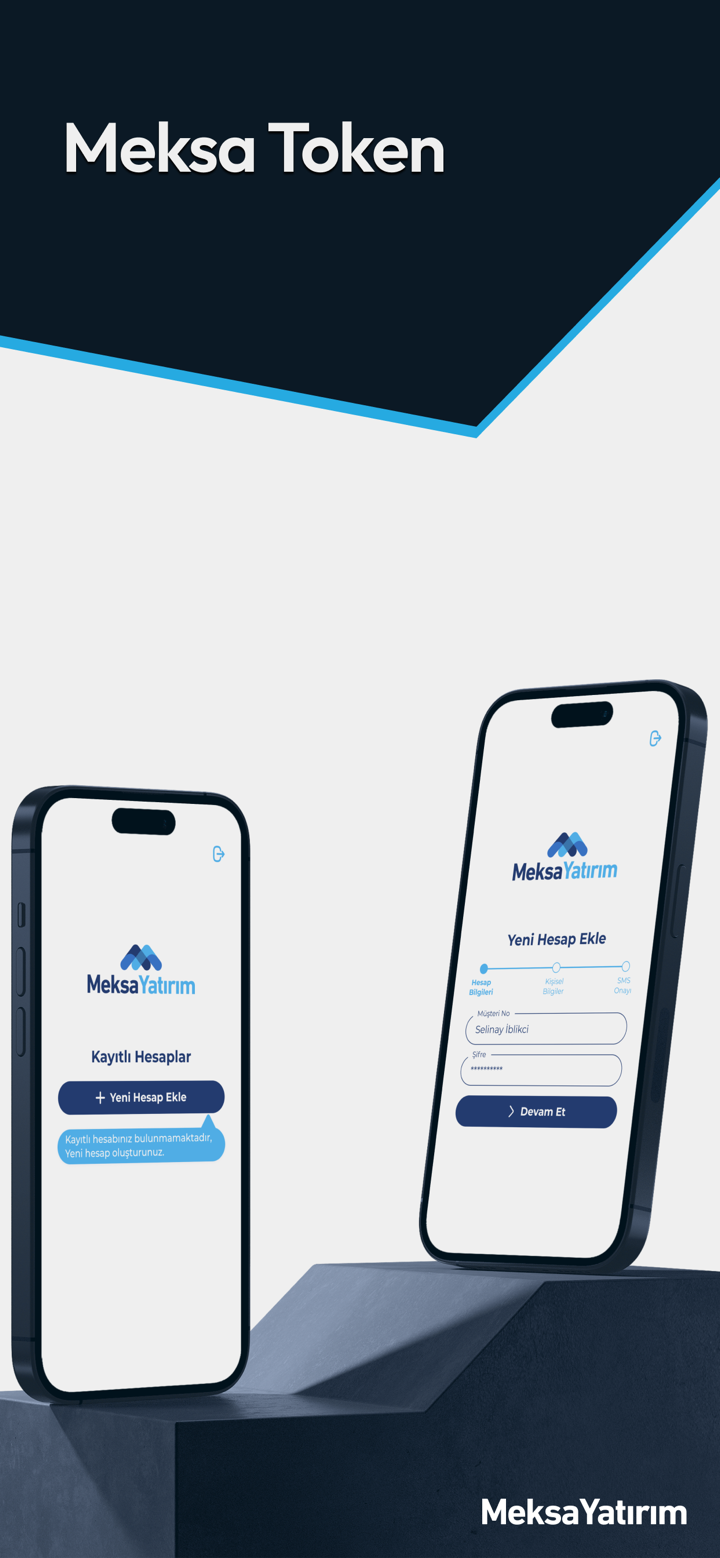

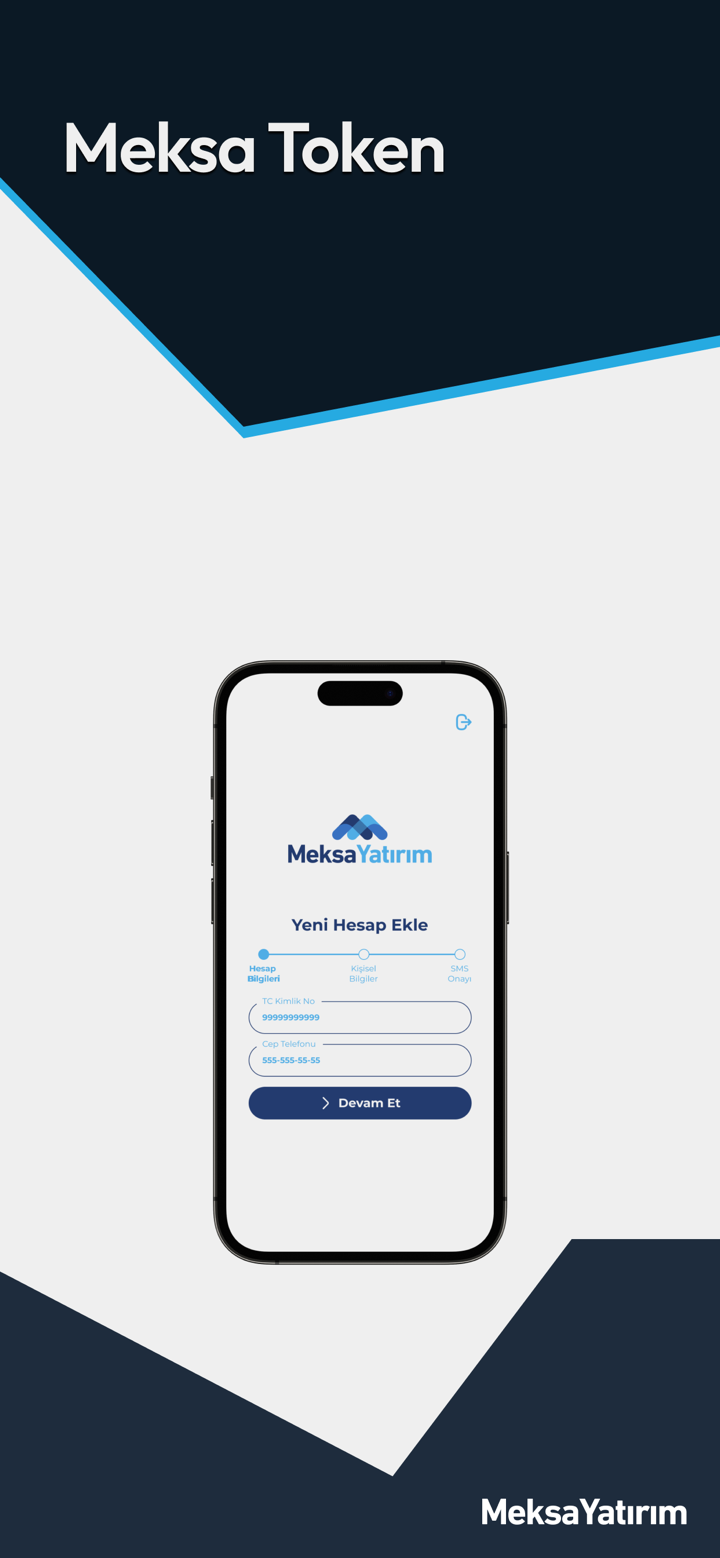

Deposit & Withdrawal

The minimum deposit amount to realize the forex investments within MEKSA is said to be 50,000 TL by the CMB. However, the broker didnt reveal any information about the acceptable deposit and withdrawal methods.

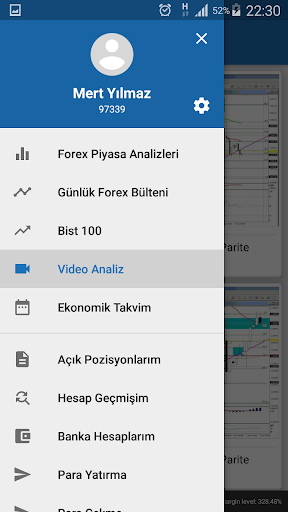

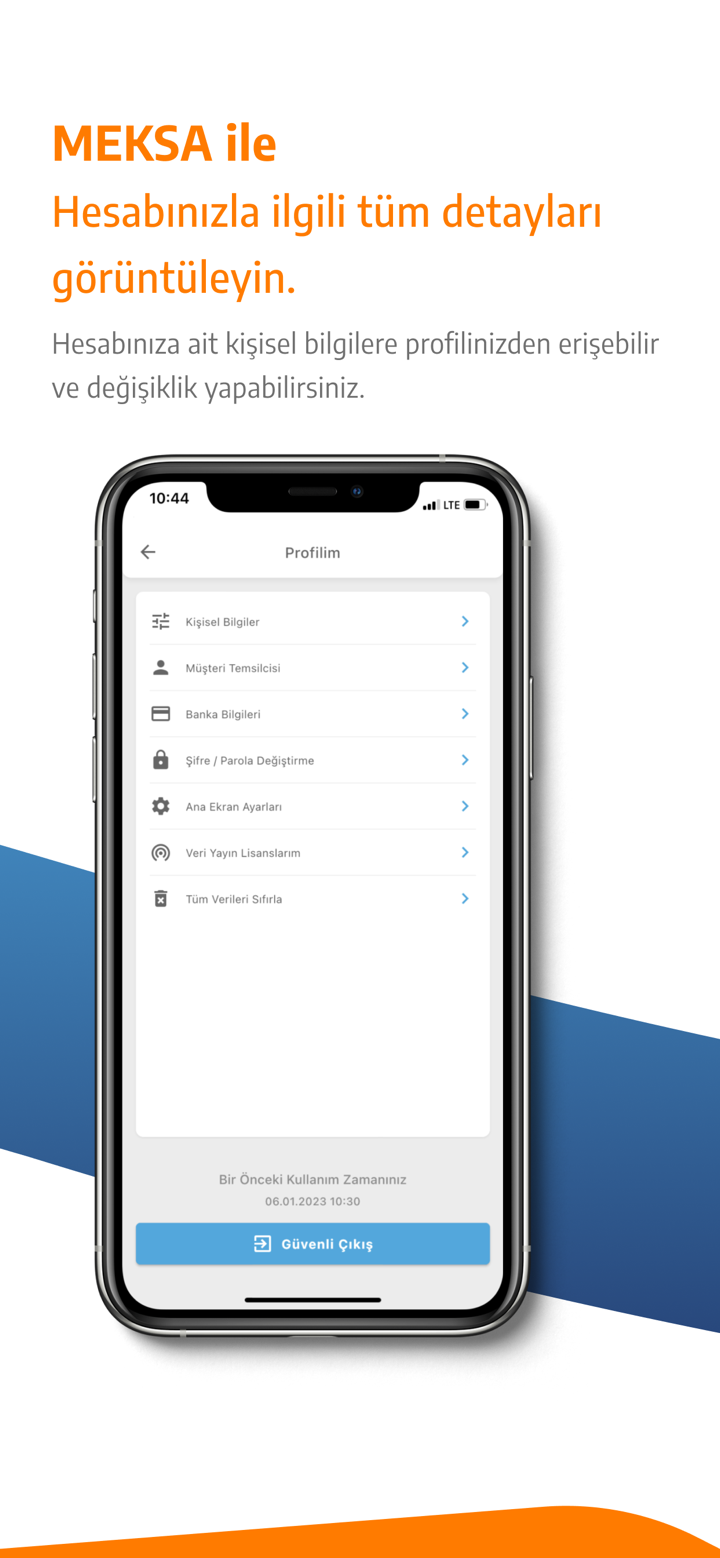

Customer Support

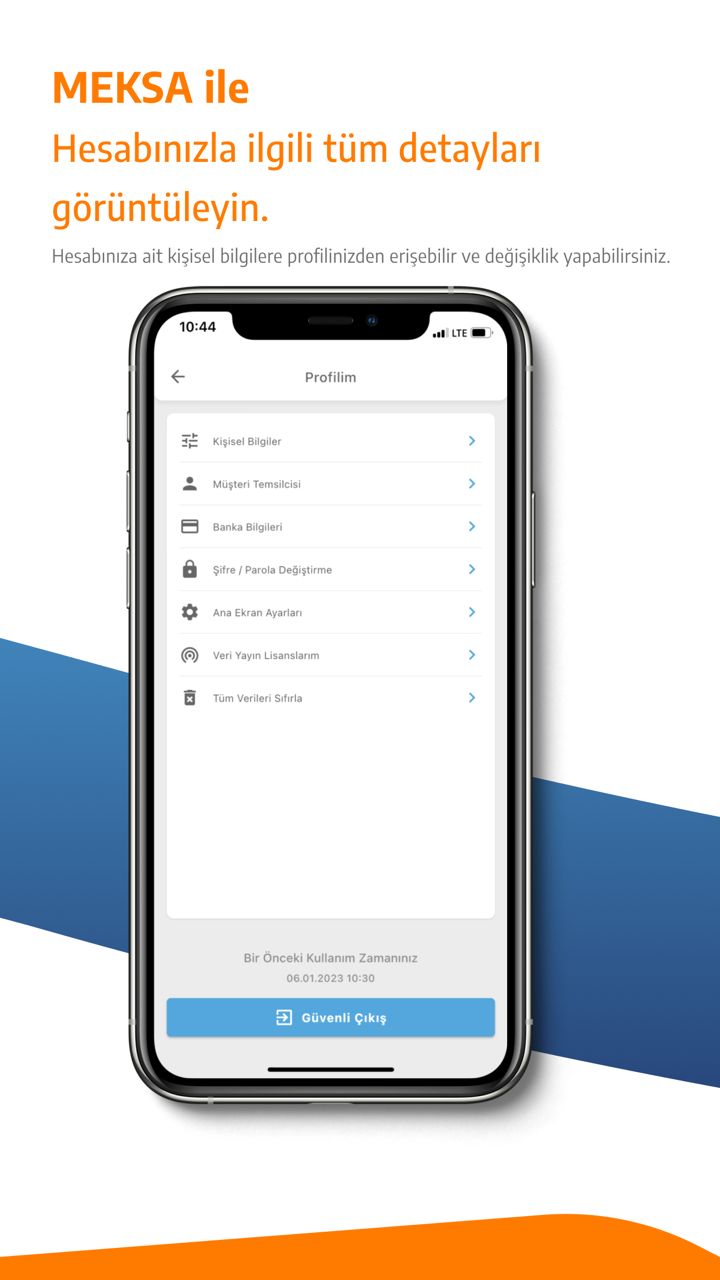

MEKSAs customer support can be reached by telephone: 02166813400, Fax: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, email: destek@meksafx.com or send messages online to get in touch. You can also follow this broker on social media platforms such as Twitter, Facebook, Instagram, YouTube and LinkedIn. Company address: Şehit Teğmen Ali Yılmaz Sok. Güven Sazak Plaza A Blok No:13 Kat: 3-4 34810 Kavacık - Beykoz / İSTANBUL.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.