مقدمة عن الشركة

المعلومات العامة واللوائح

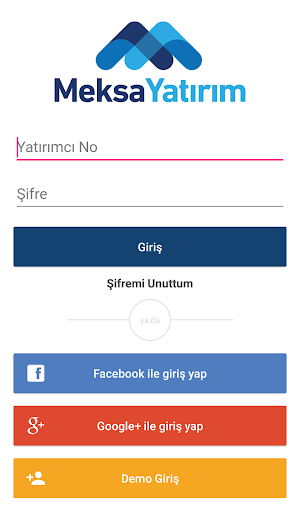

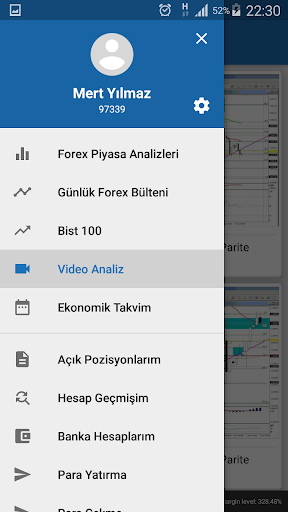

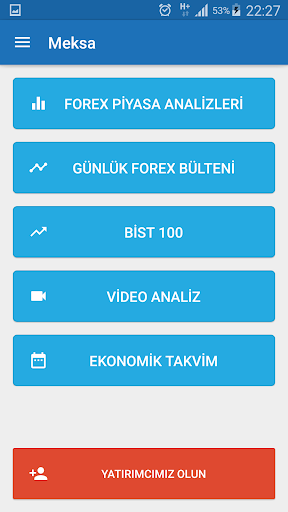

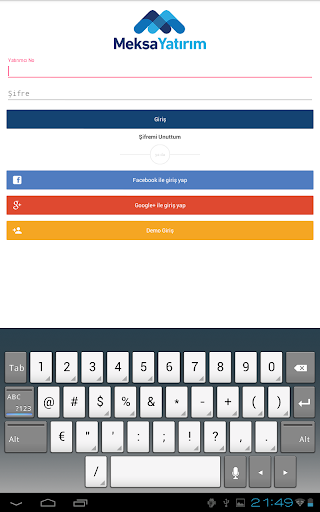

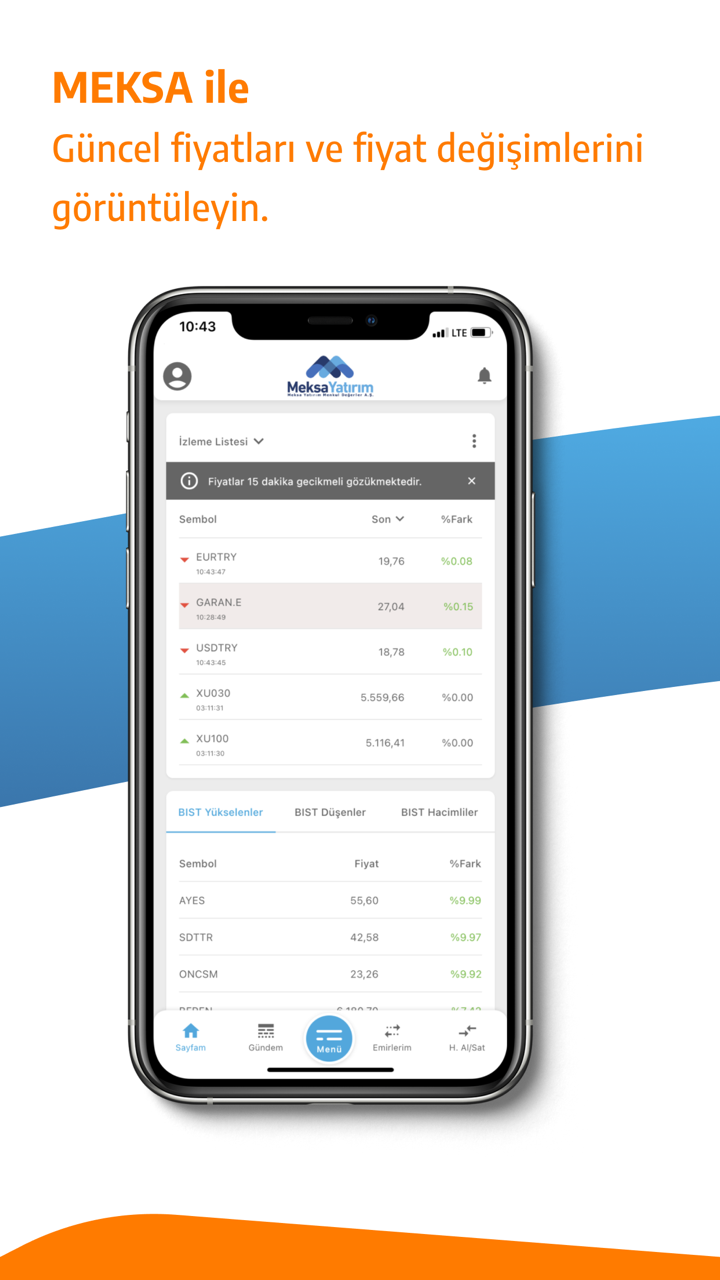

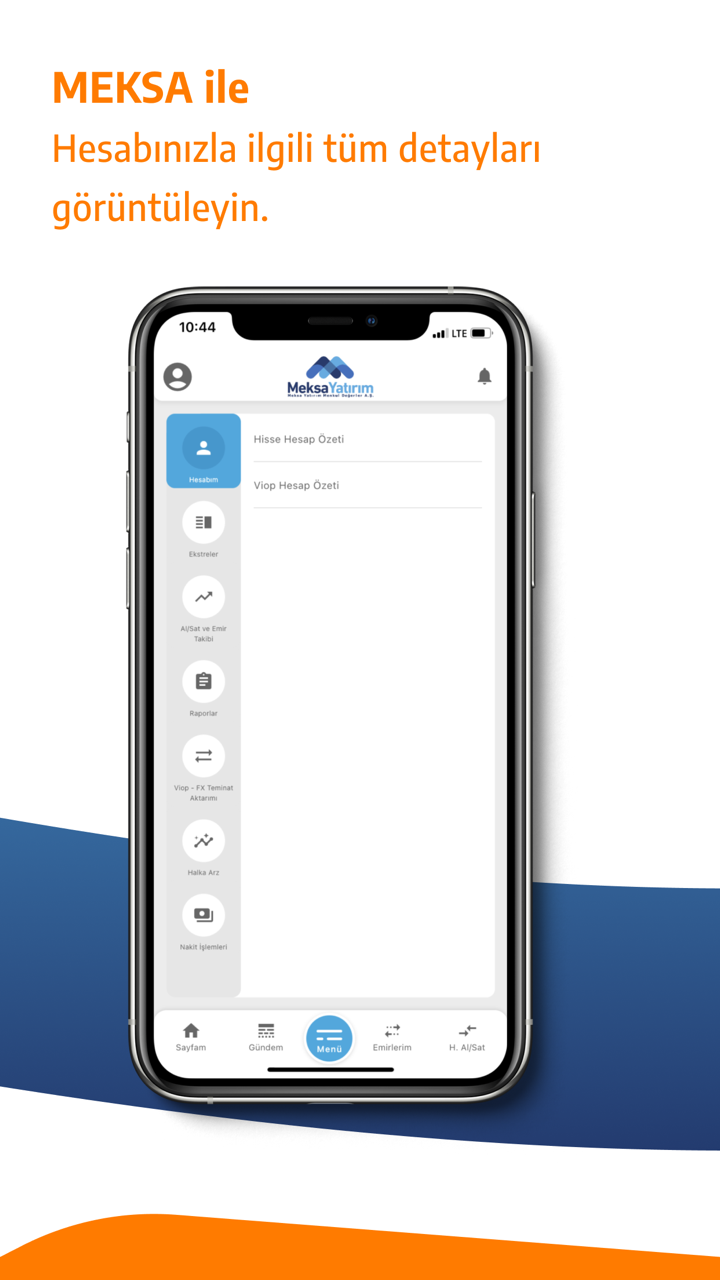

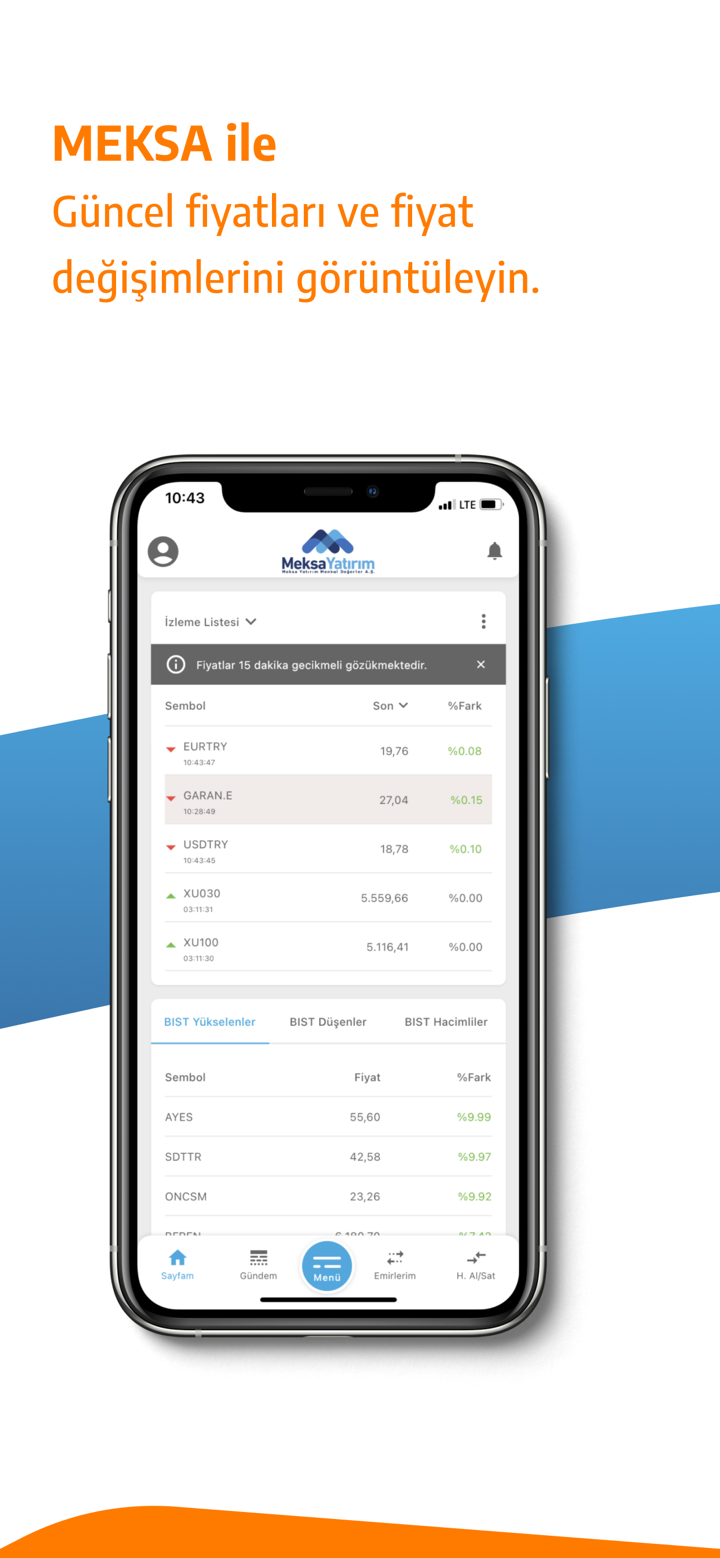

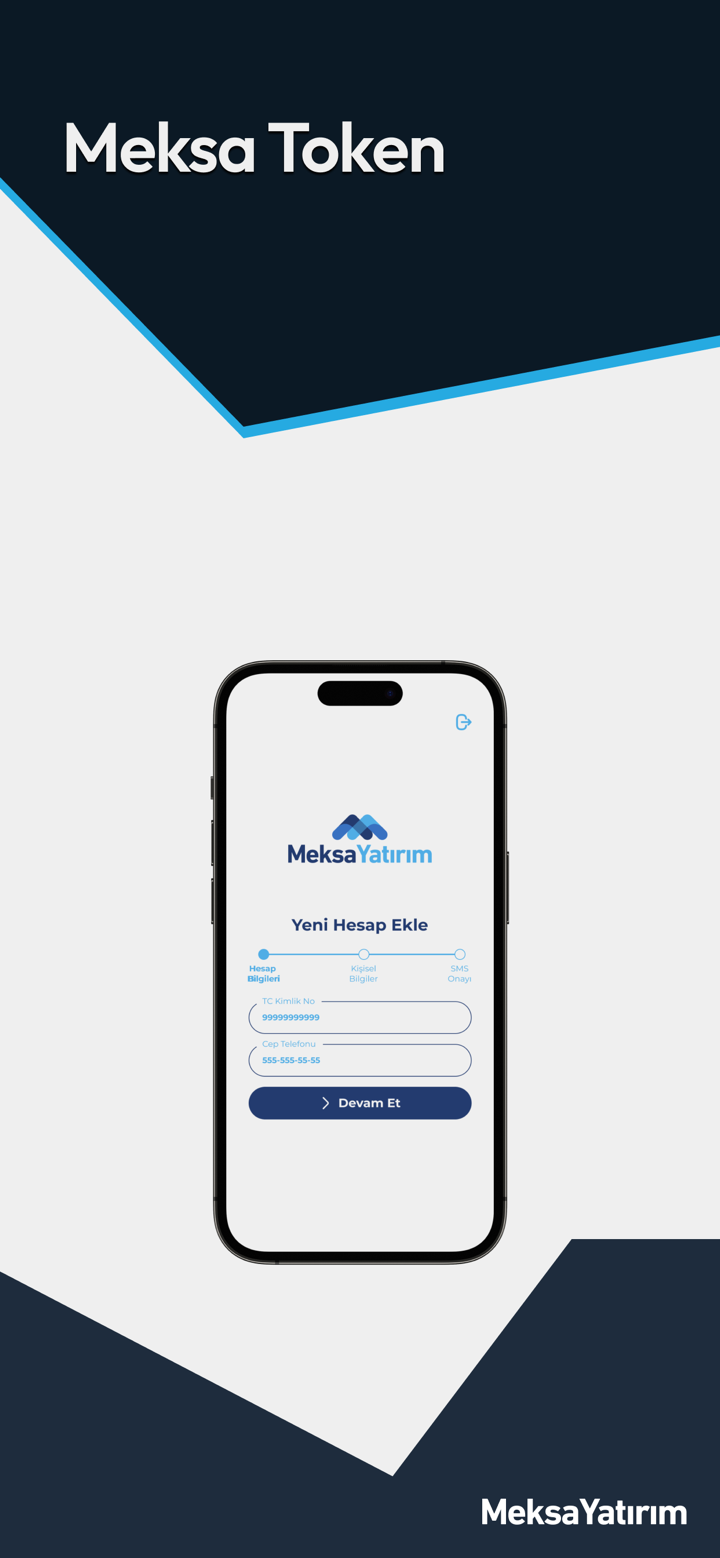

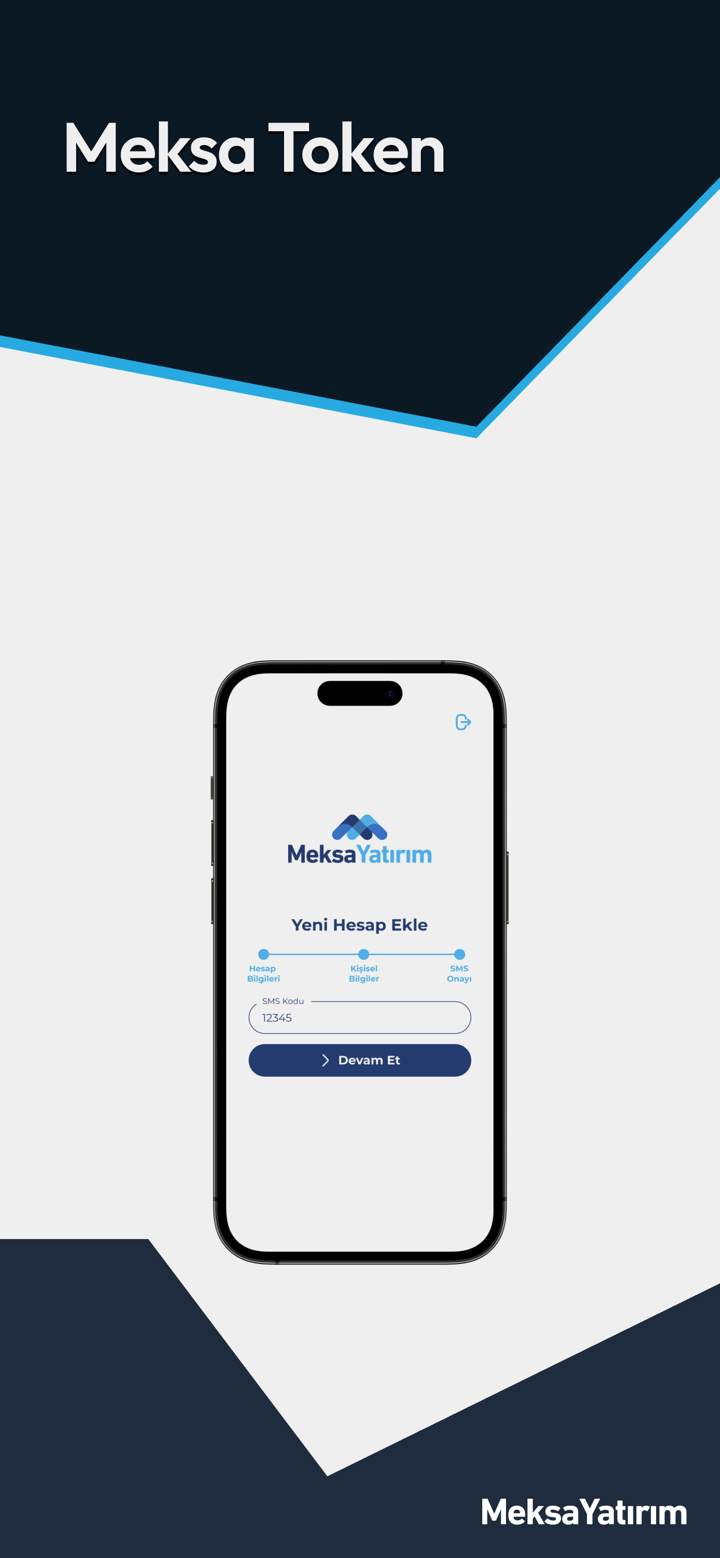

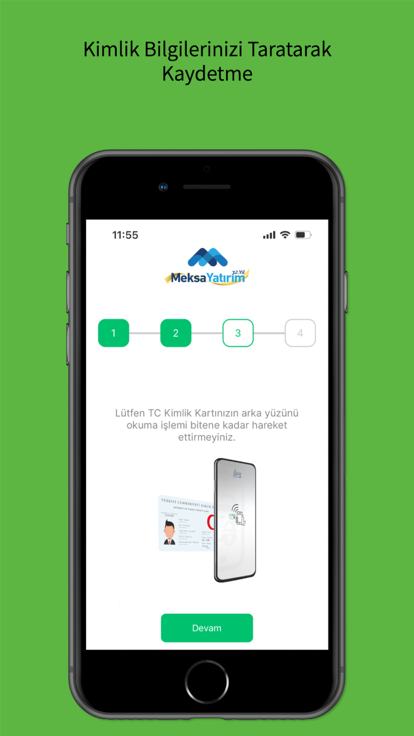

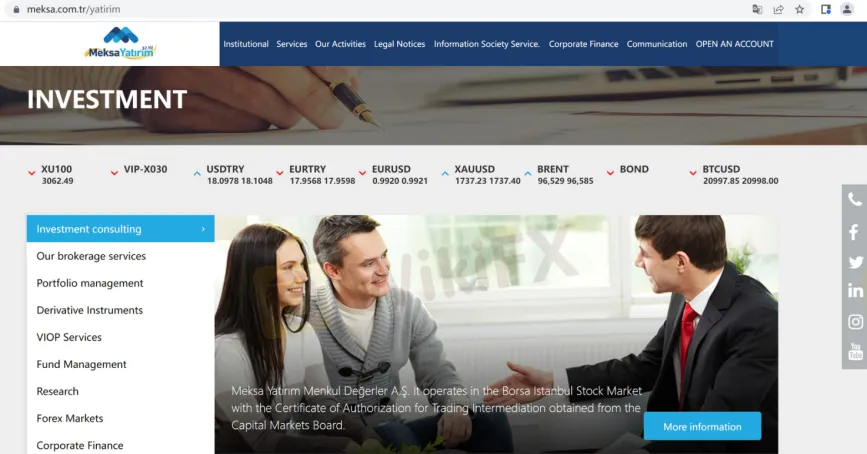

MEKSA، الاسم التجاري Meksa Yatırım Menkul Değerler A.Ş ، يُزعم أنها شركة وساطة مالية تأسست في 28 يونيو 1990 ، ومسجلة في تركيا. يقول الوسيط إنه يعمل في سوق الأوراق المالية في بورصة اسطنبول بشهادة تفويض لوساطة التداول التي تم الحصول عليها من مجلس أسواق رأس المال ، مدعيا تزويد عملائه من الأفراد والشركات بخدمات مالية مختلفة. هنا الصفحة الرئيسية لهذا الموقع الرسمي للوسطاء:

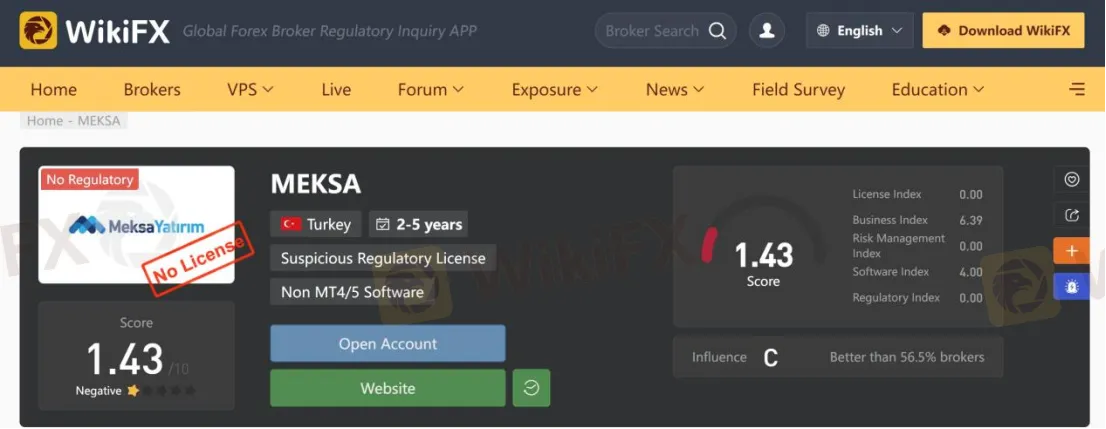

أما بالنسبة للتنظيم ، فقد تم التحقق من ذلك MEKSA لا تندرج تحت أي لوائح سارية المفعول. هذا هو السبب في أن وضعه التنظيمي على wikifx مُدرج على أنه "بدون ترخيص" ويحصل على درجة منخفضة نسبيًا تبلغ 1.43 / 10. من فضلك كن على علم بالمخاطر.

المراجعات السلبية

شارك أحد المتداولين تجربته التجارية الرهيبة في MEKSA منصة في wikifx. هو قال ذلك MEKSA وسيط احتيال ولم يحصل على وديعة 50٪ الموعودة عند وصول التاريخ. من الضروري للمتداولين قراءة المراجعات التي تركها بعض المستخدمين قبل اختيار وسطاء الفوركس ، في حالة الاحتيال عليهم بواسطة عمليات الاحتيال.

خدمات

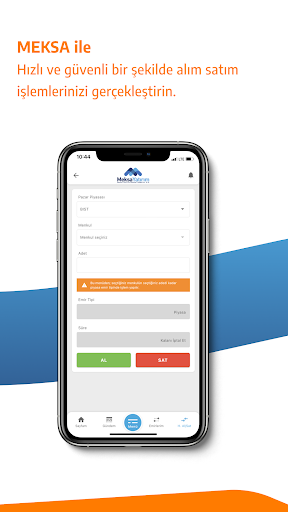

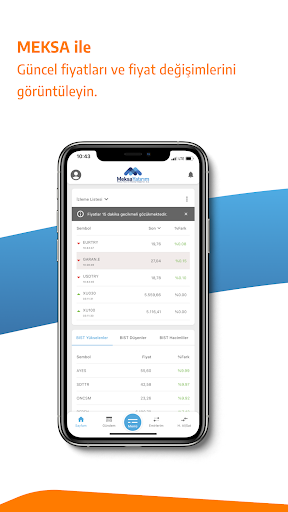

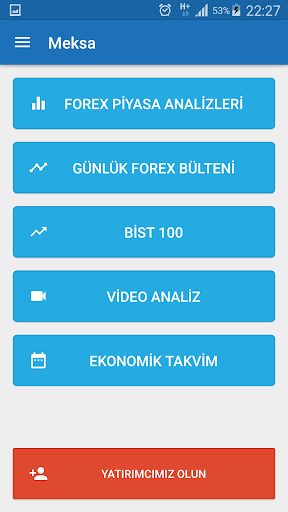

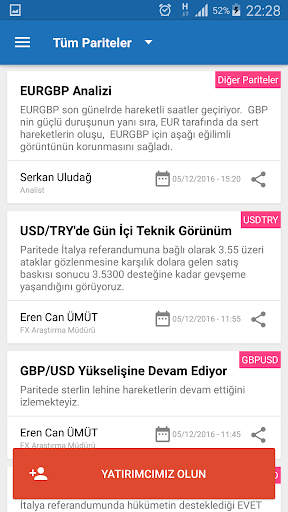

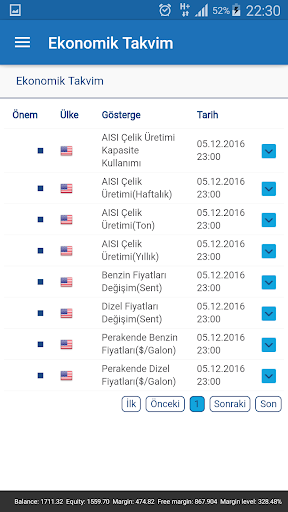

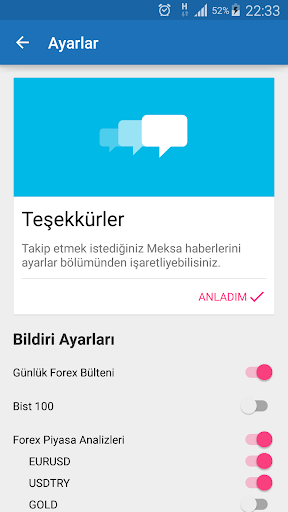

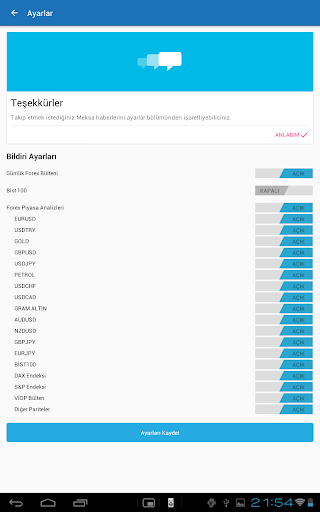

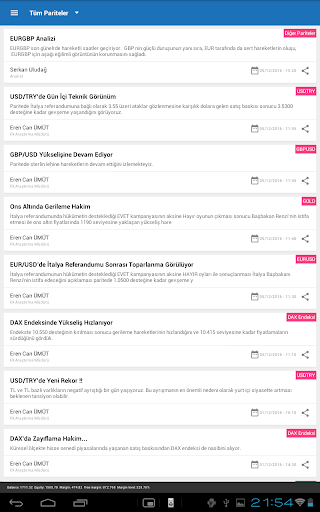

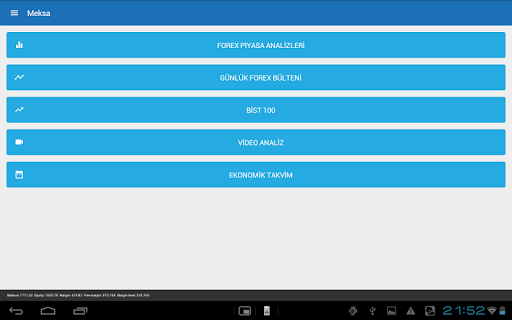

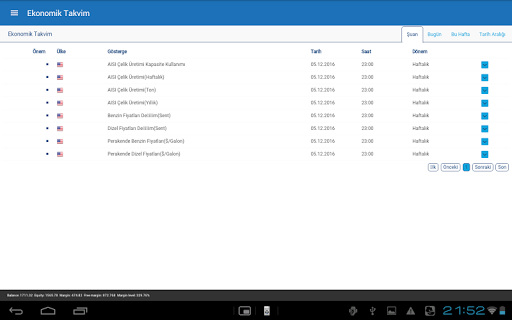

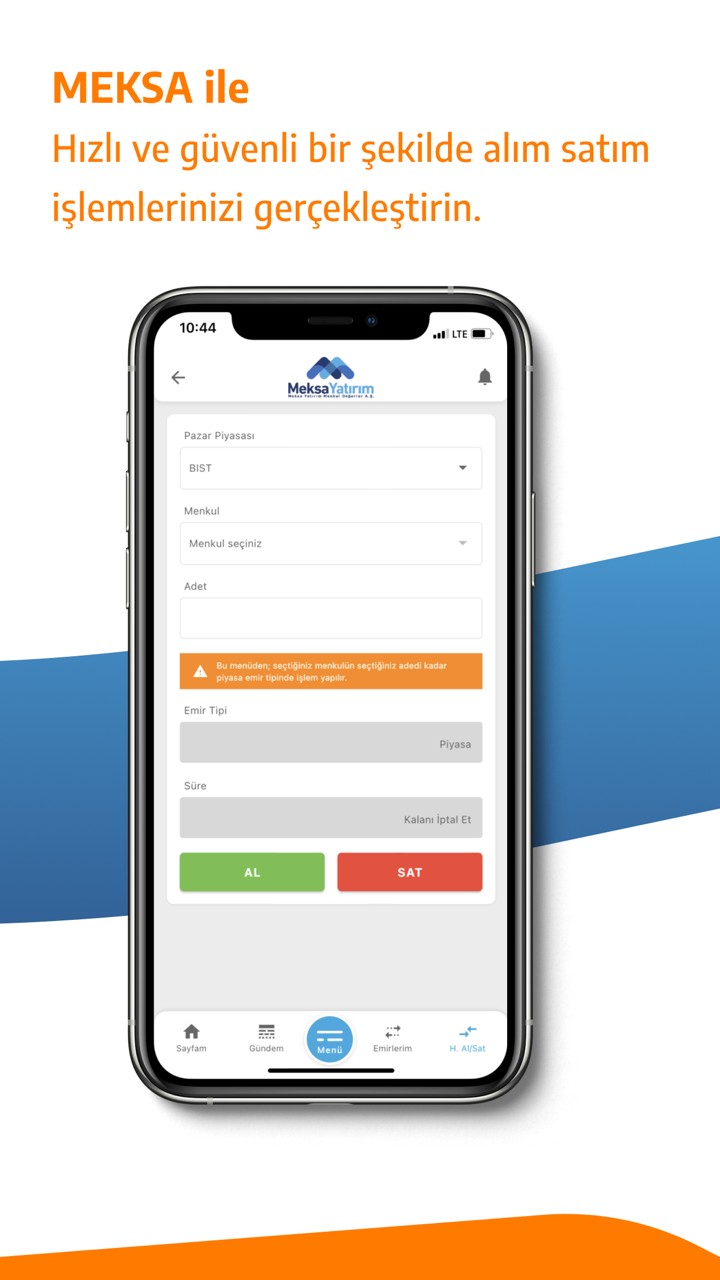

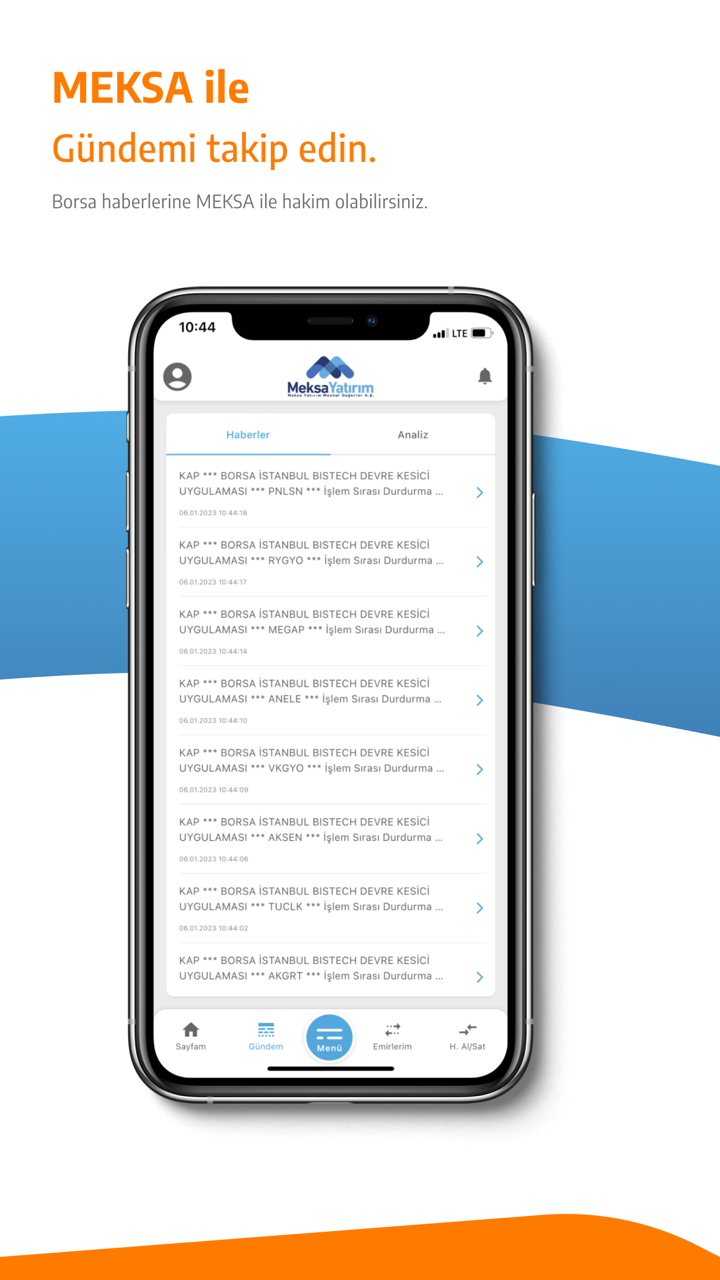

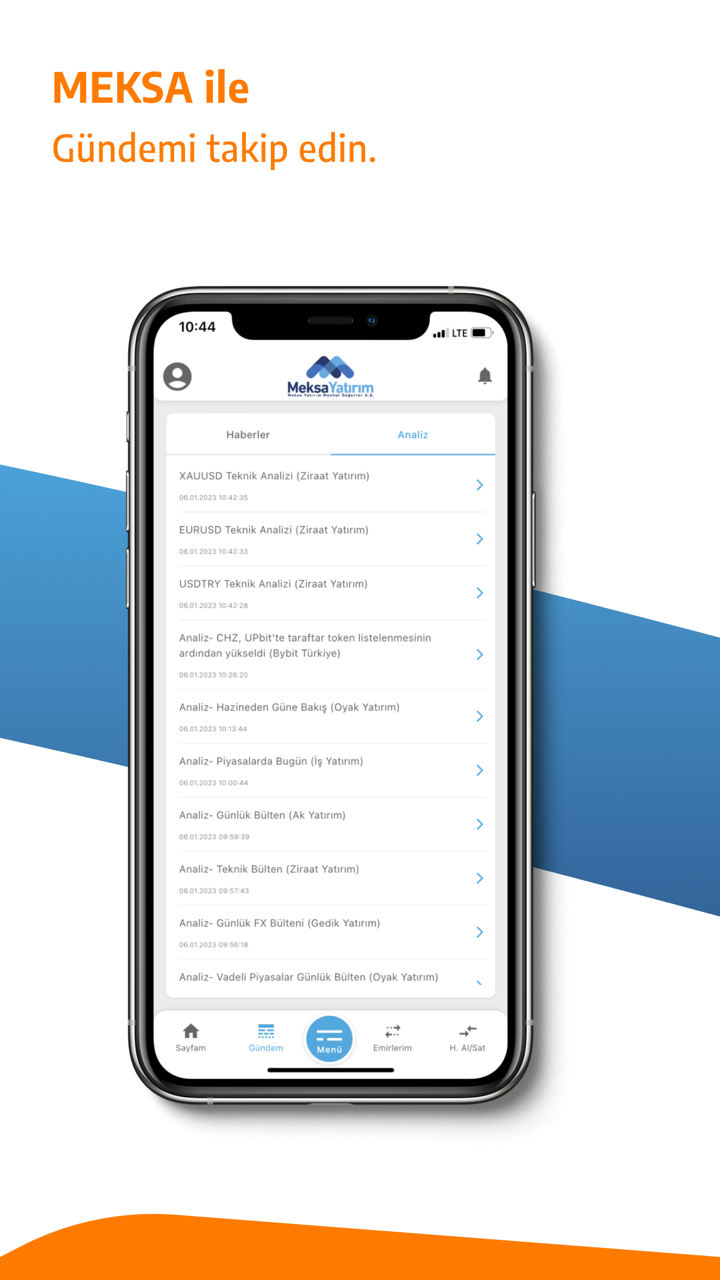

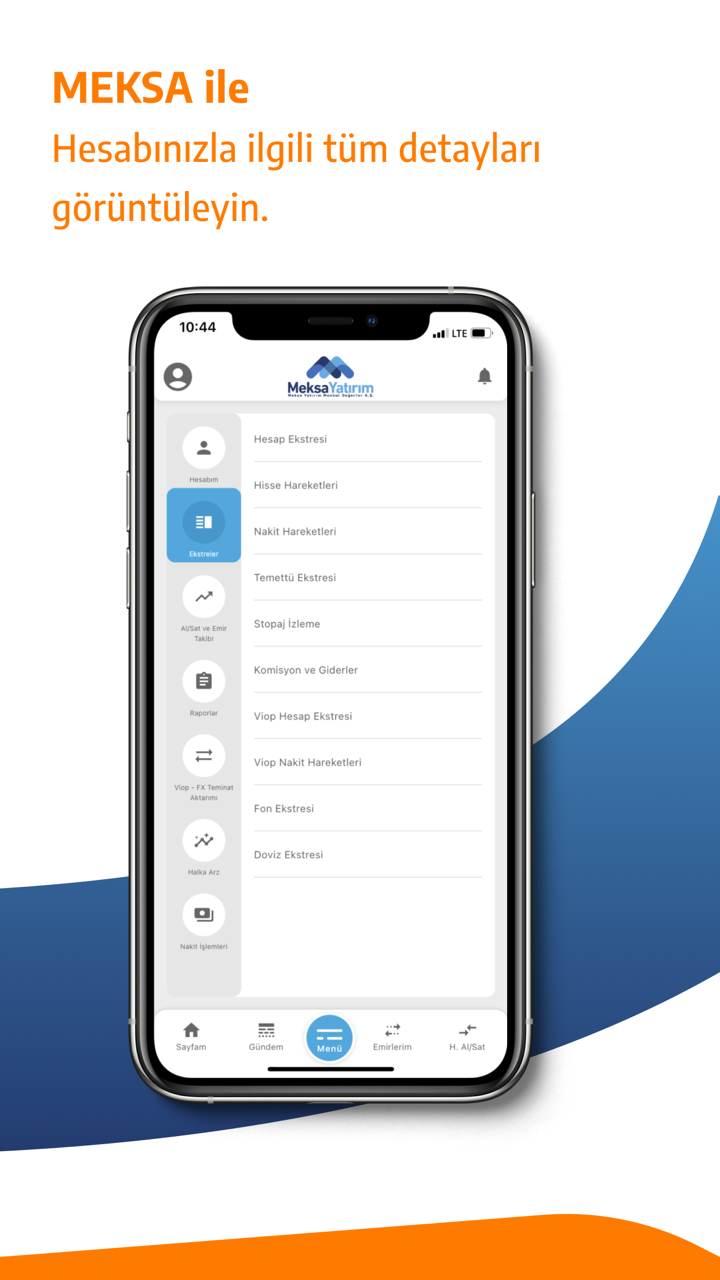

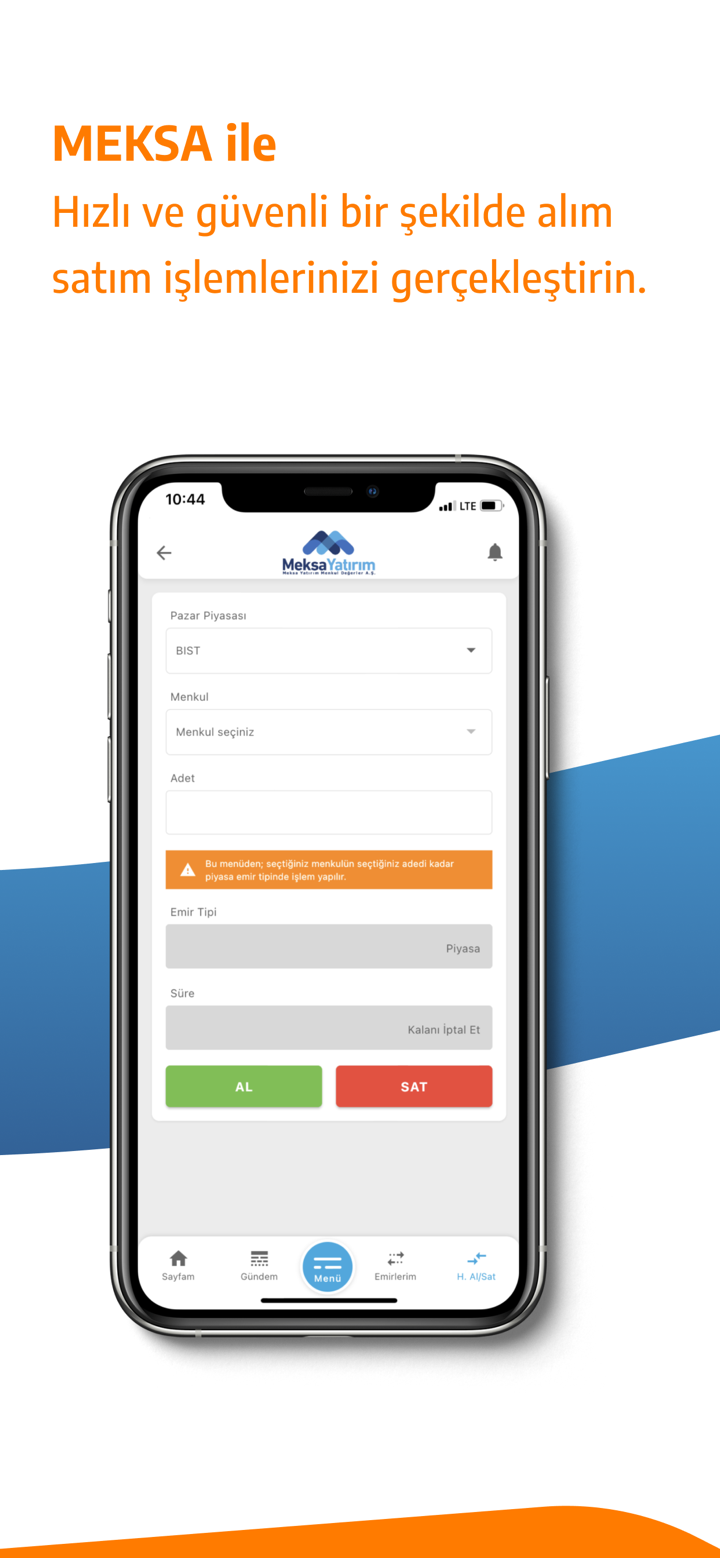

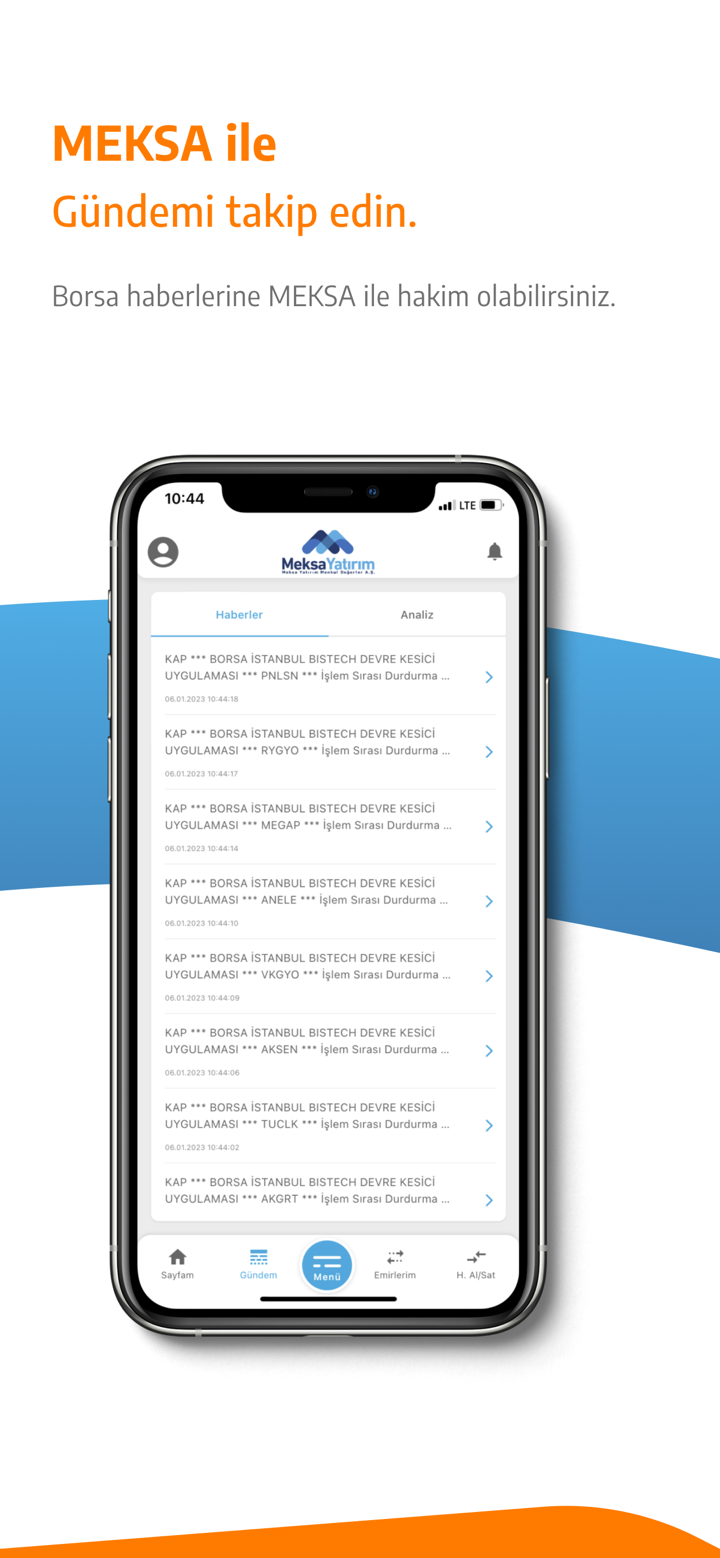

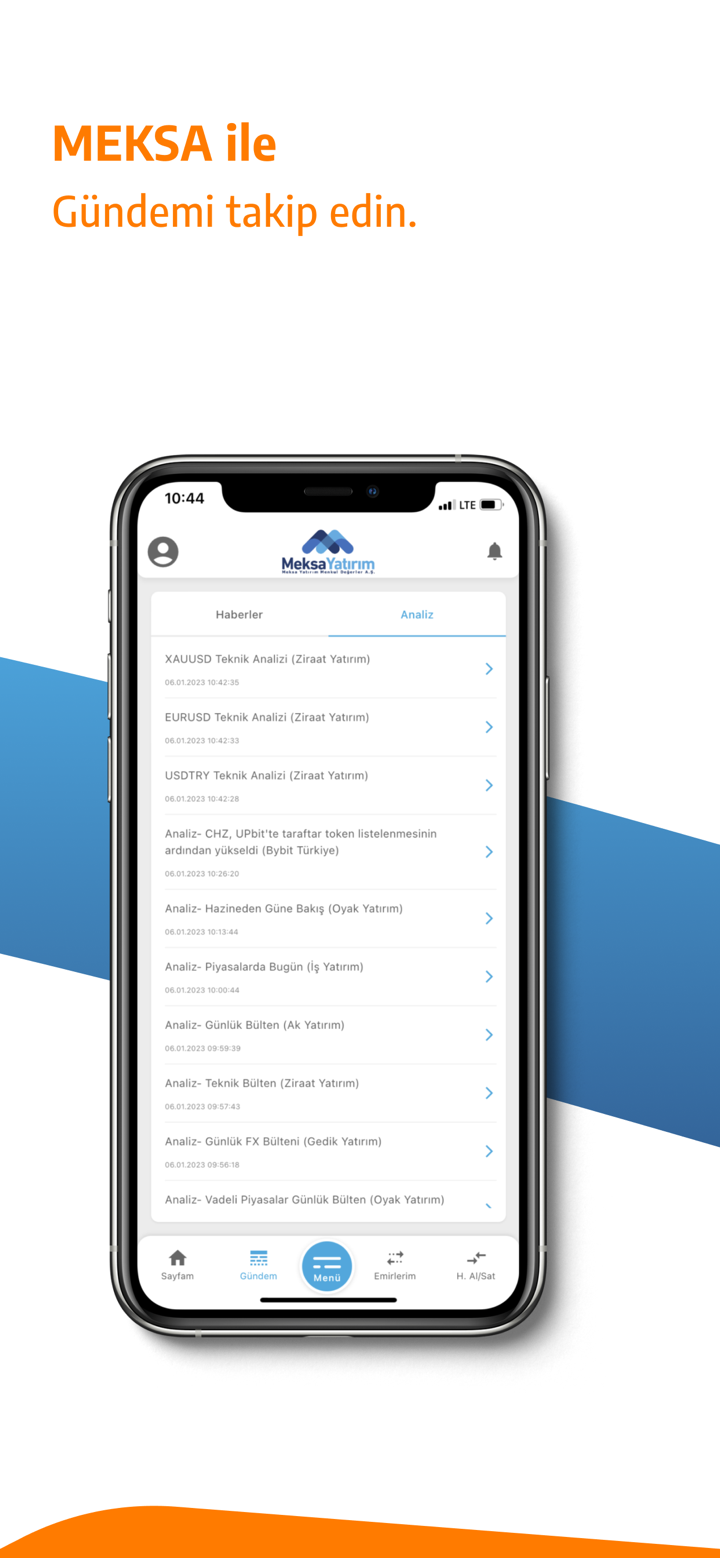

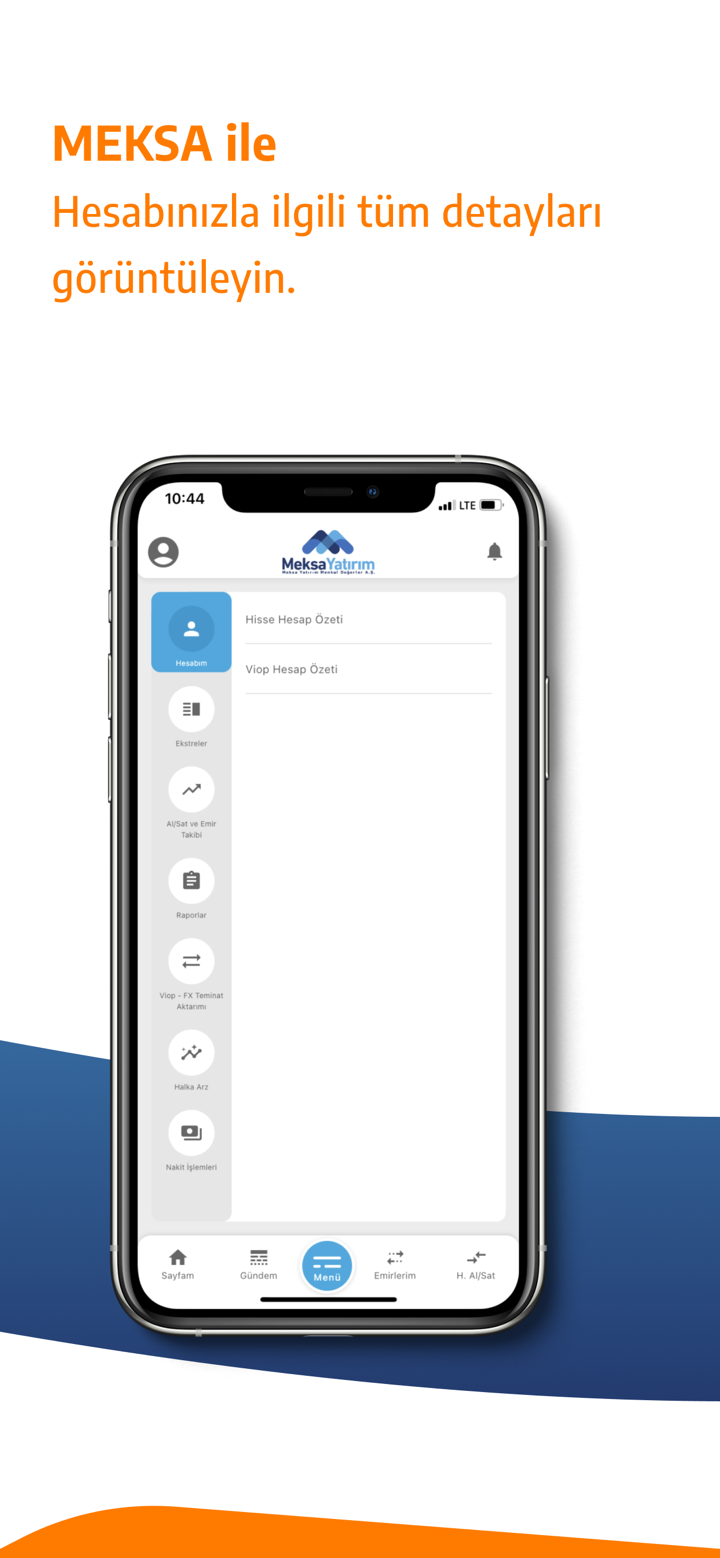

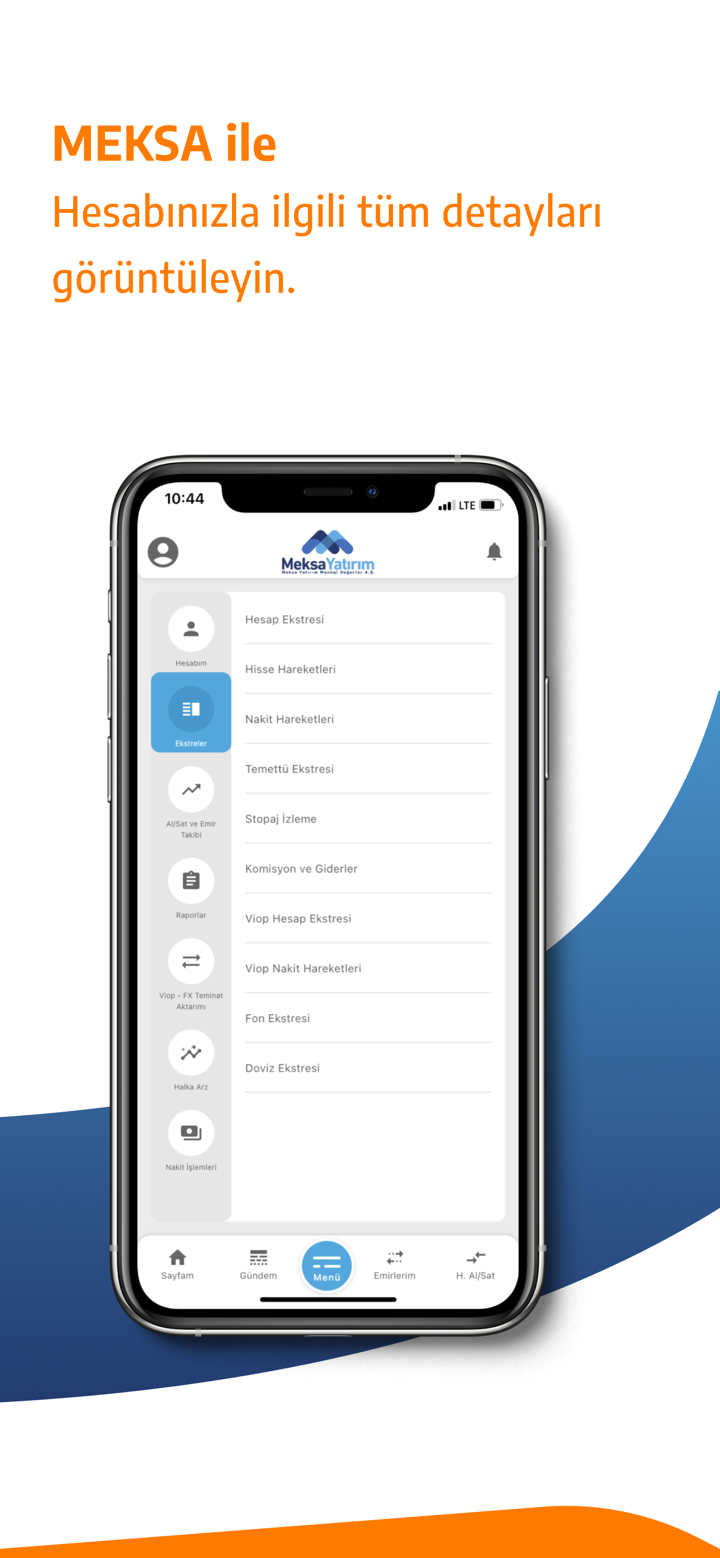

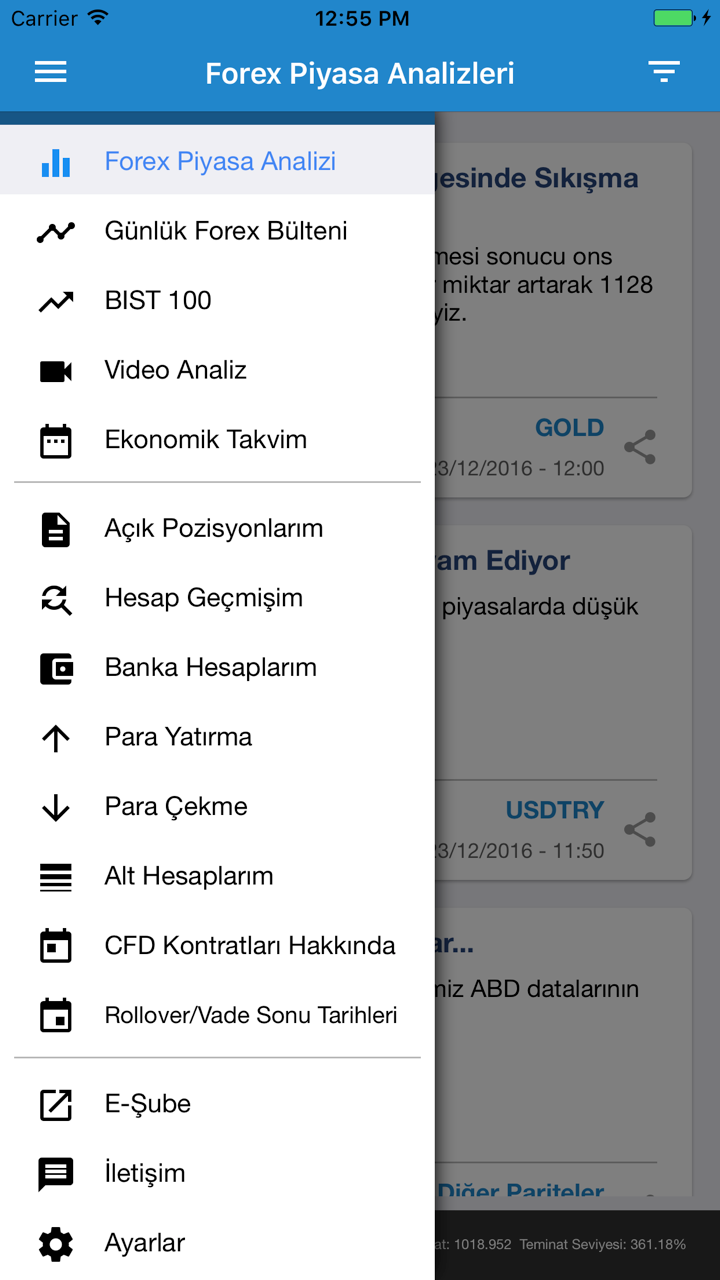

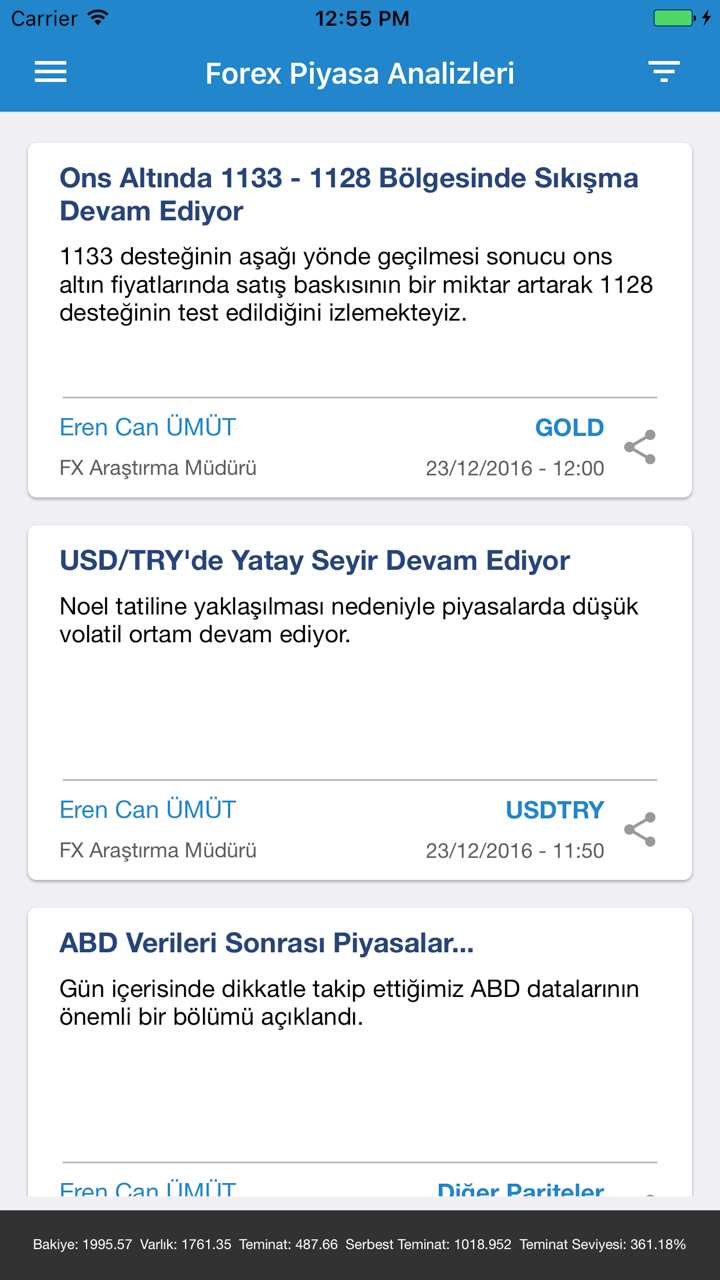

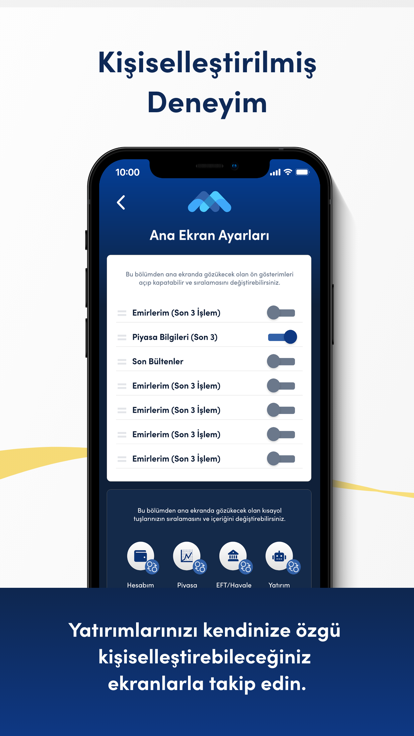

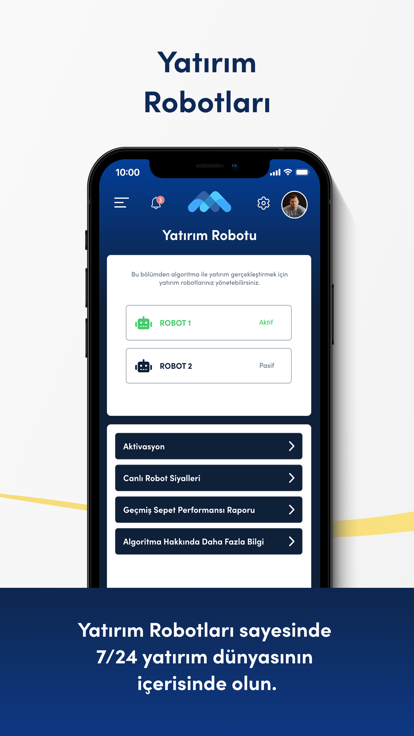

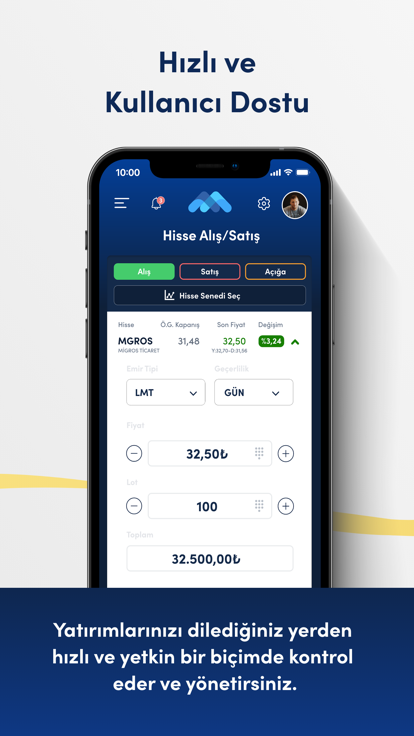

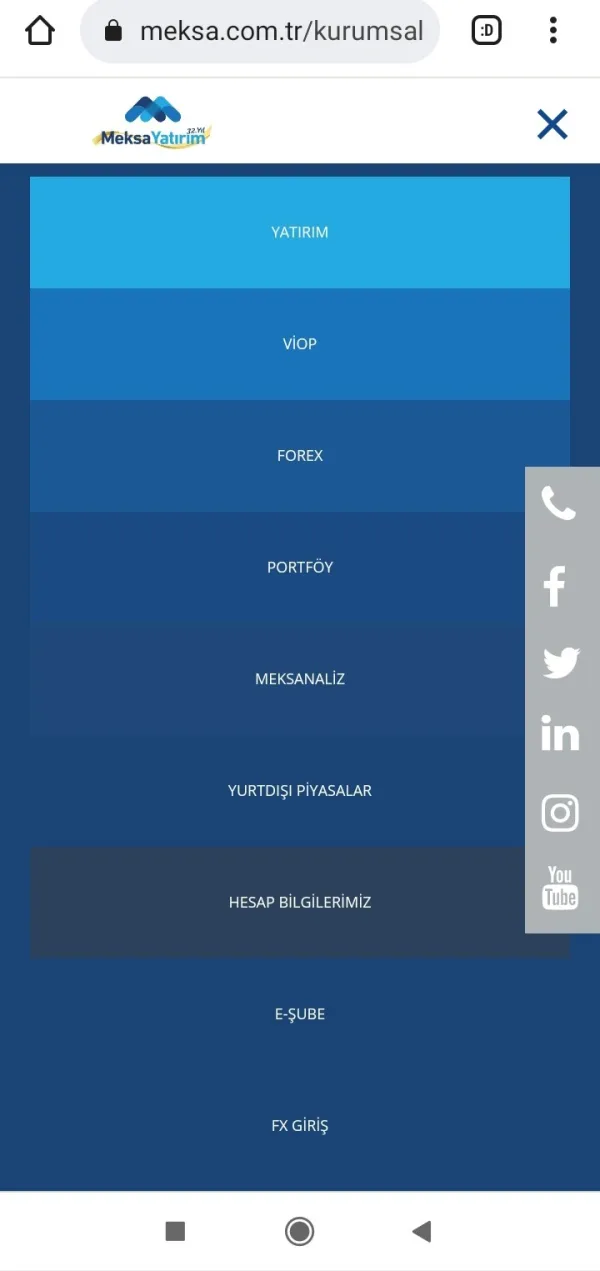

MEKSAتعلن أنها تقدم مجموعة متنوعة من الخدمات ، والتي تشمل الاستشارات الاستثمارية ، وخدمات الوساطة ، وإدارة المحافظ ، وأدوات المشتقات ، وخدمات viop ، وإدارة الصناديق ، والبحوث ، وأسواق الفوركس ، وتمويل الشركات.

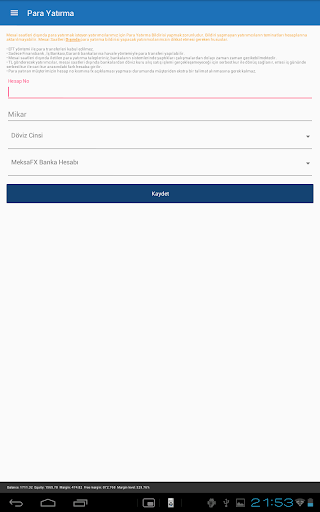

الإيداع والسحب

الحد الأدنى لمبلغ الإيداع لتحقيق استثمارات الفوركس بداخله MEKSA يقال أنه 50000 ليرة تركية بواسطة cmb. ومع ذلك ، لم يكشف الوسيط عن أي معلومات حول طرق الإيداع والسحب المقبولة.

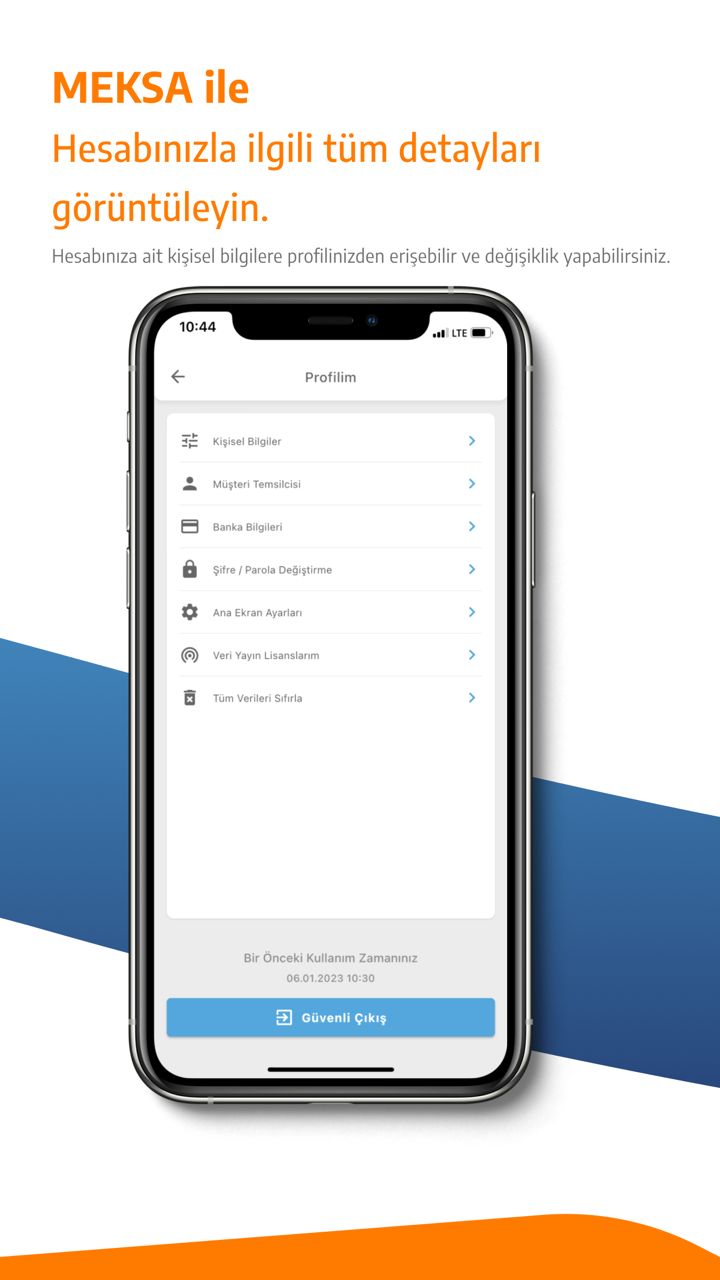

دعم العملاء

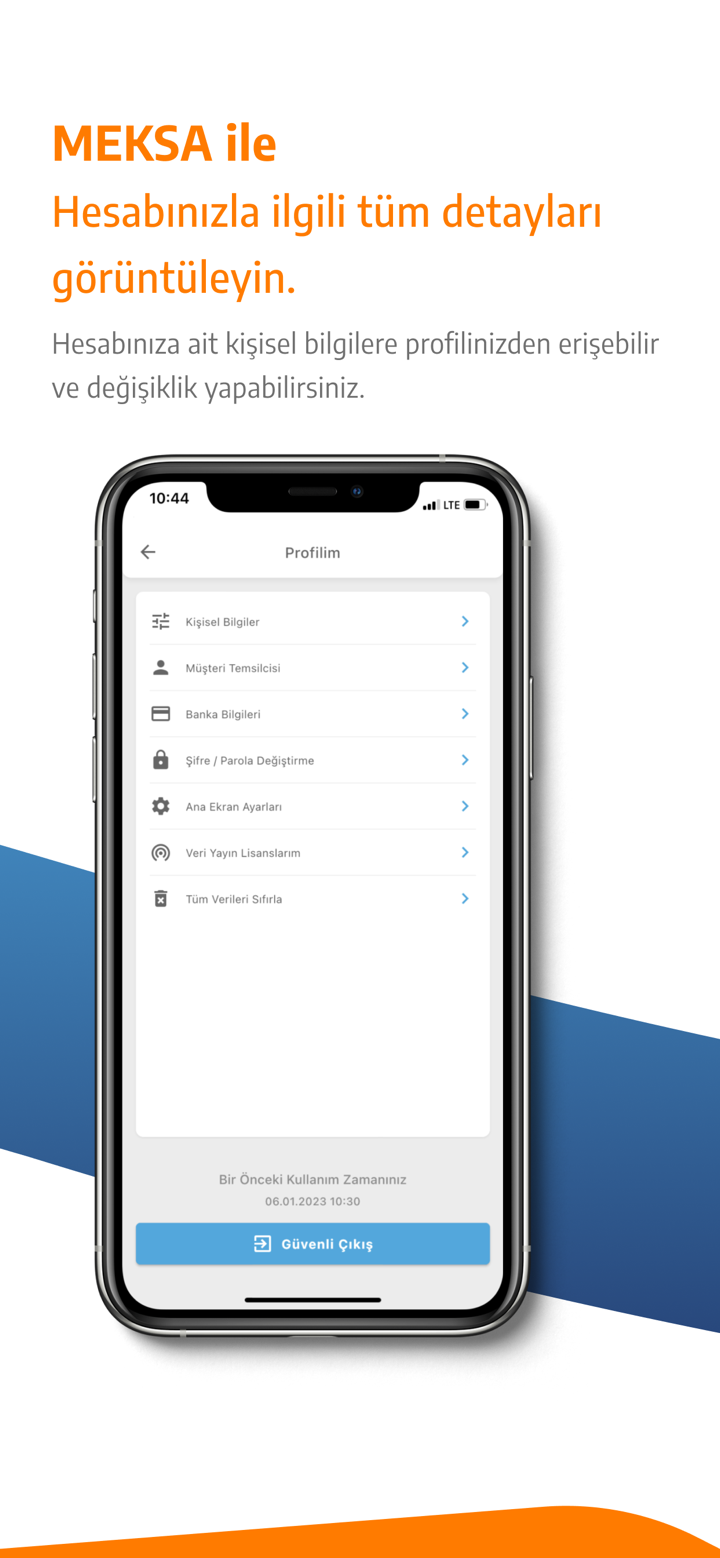

MEKSAيمكن الوصول إلى دعم العملاء عبر الهاتف: 02166813400 ، فاكس: +90 (216) 6930570 ، +90 (216) 6930571 ، +90 (216) 6930572 ، البريد الإلكتروني: destek @ MEKSA fx.com أو إرسال رسائل عبر الإنترنت للتواصل. يمكنك أيضًا متابعة هذا الوسيط على منصات التواصل الاجتماعي مثل twitter و facebook و instagram و youtube و LinkedIn. عنوان الشركة: şehit teğmen ali yılmaz sok. güven sazak plaza a blok no: 13 kat: 3-4 34810 kavacık - Beykoz / istanbul.

تحذير من المخاطر

ينطوي التداول عبر الإنترنت على درجة عالية من المخاطرة وقد تخسر كل رأس المال المستثمر. انها ليست مناسبة لجميع المتداولين أو المستثمرين. يرجى التأكد من فهمك للمخاطر التي تنطوي عليها ولاحظ أن المعلومات الواردة في هذه المقالة هي لأغراض المعلومات العامة فقط.