Unternehmensprofil

| Fidelity Überprüfungszusammenfassung | |

| Gegründet | 1969 |

| Registriertes Land/Region | USA |

| Regulierung | SFC |

| Produkte & Dienstleistungen | Weltweite Investmentfonds, MPF & ORSO Rentenpläne, thematische und Multi-Asset-Investitionslösungen |

| Demo-Konto | ❌ |

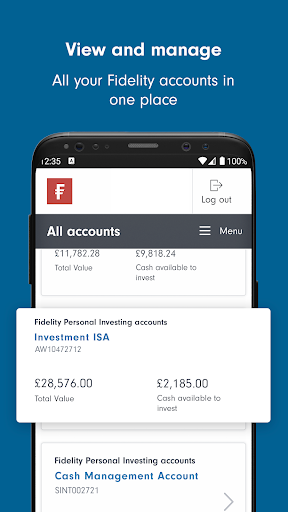

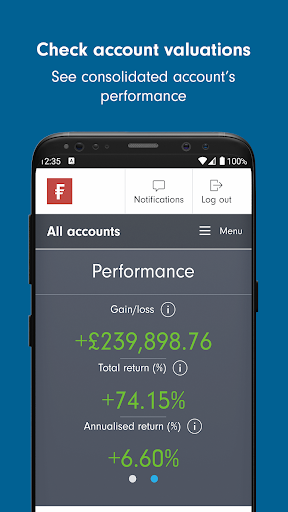

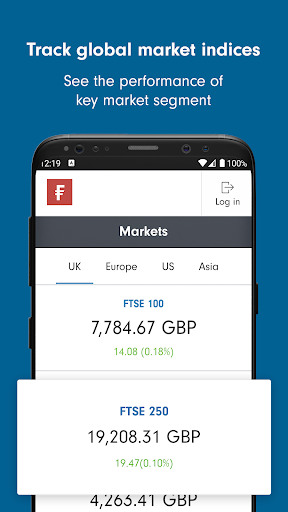

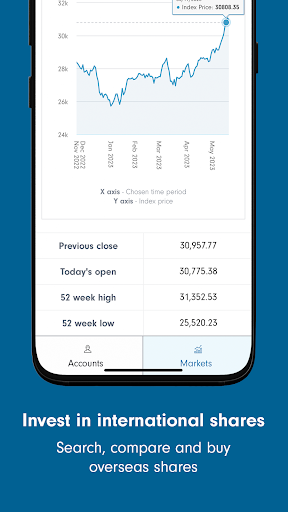

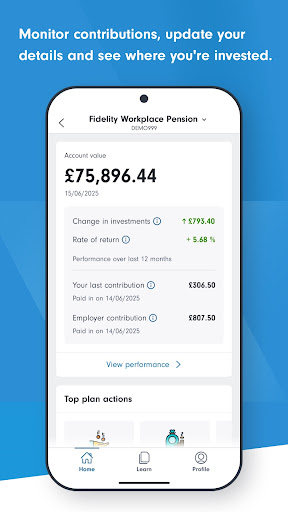

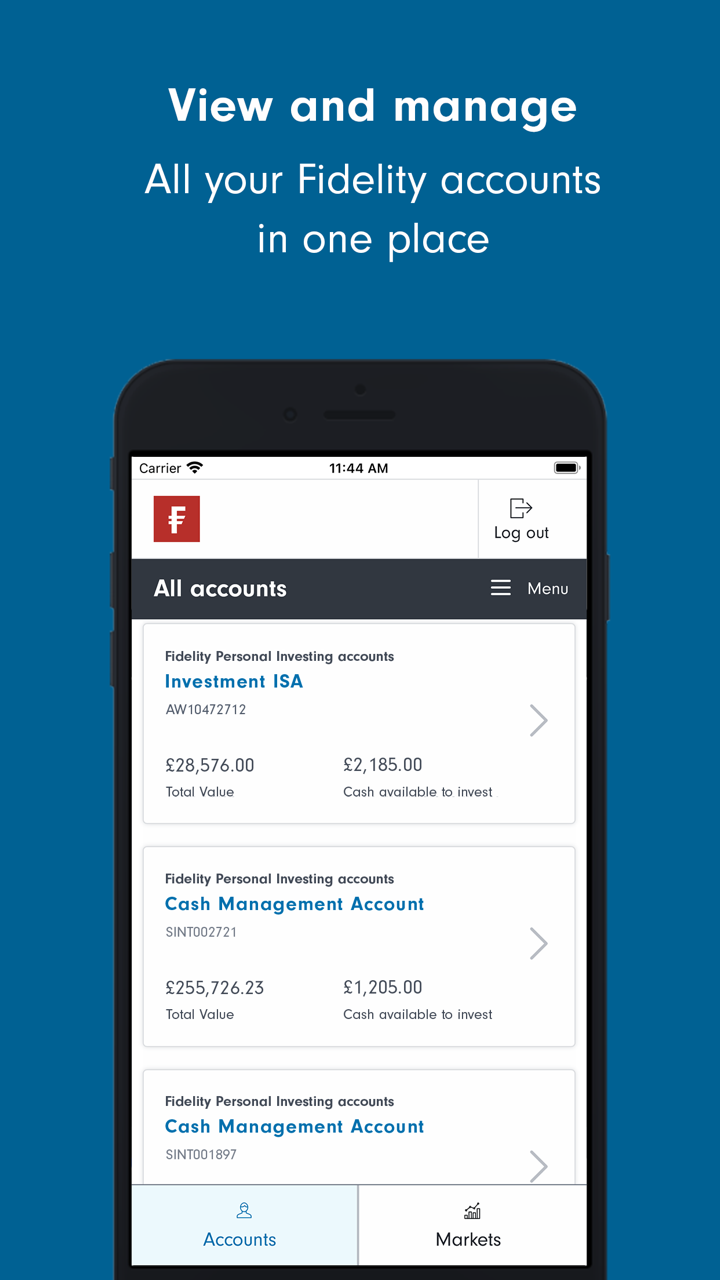

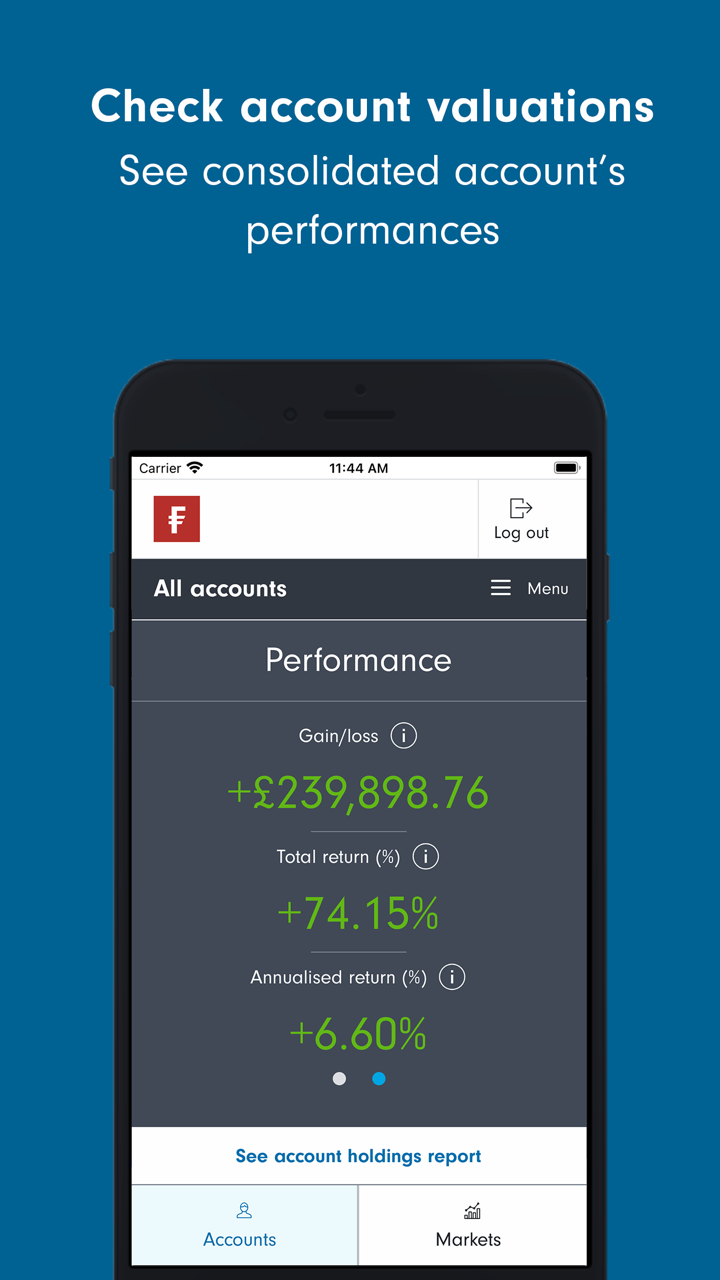

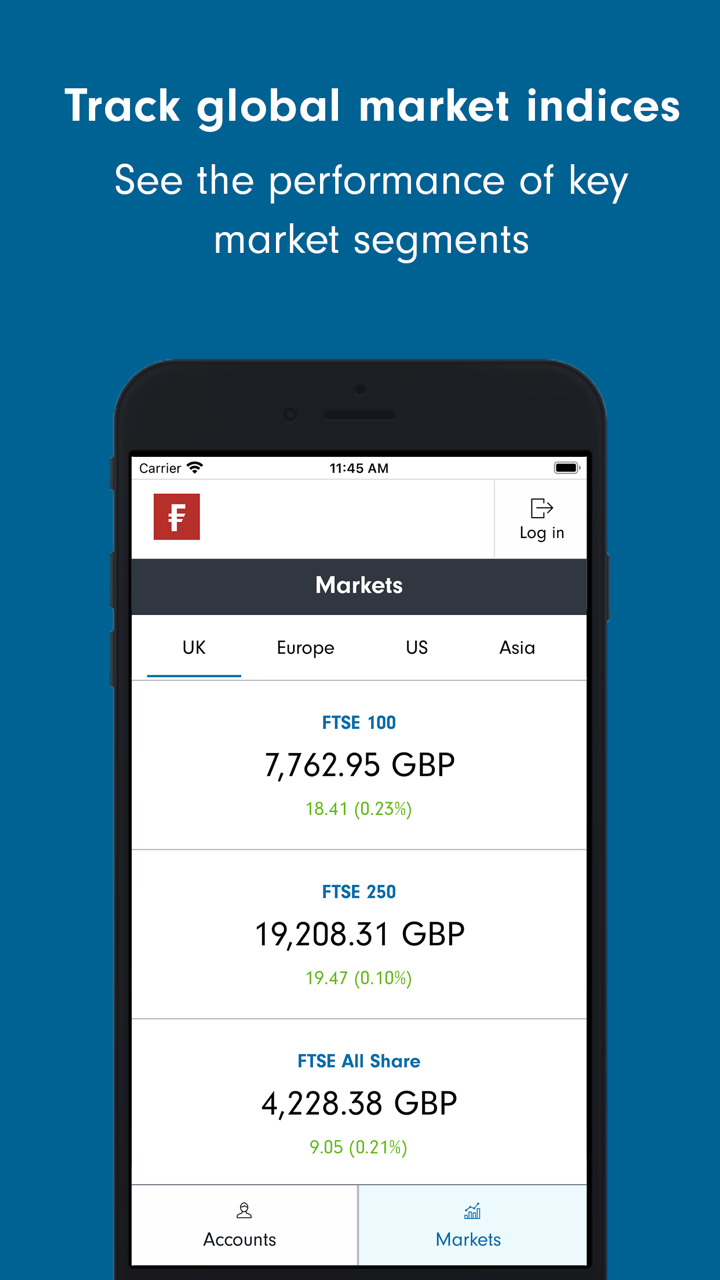

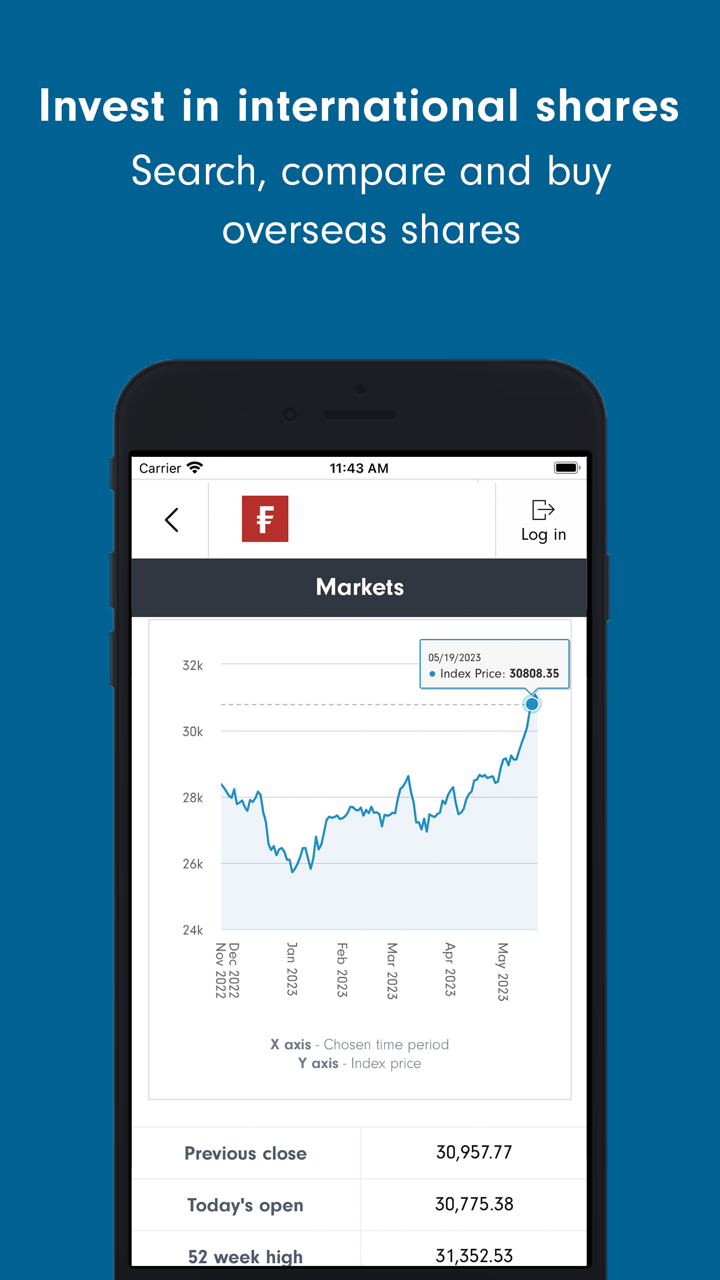

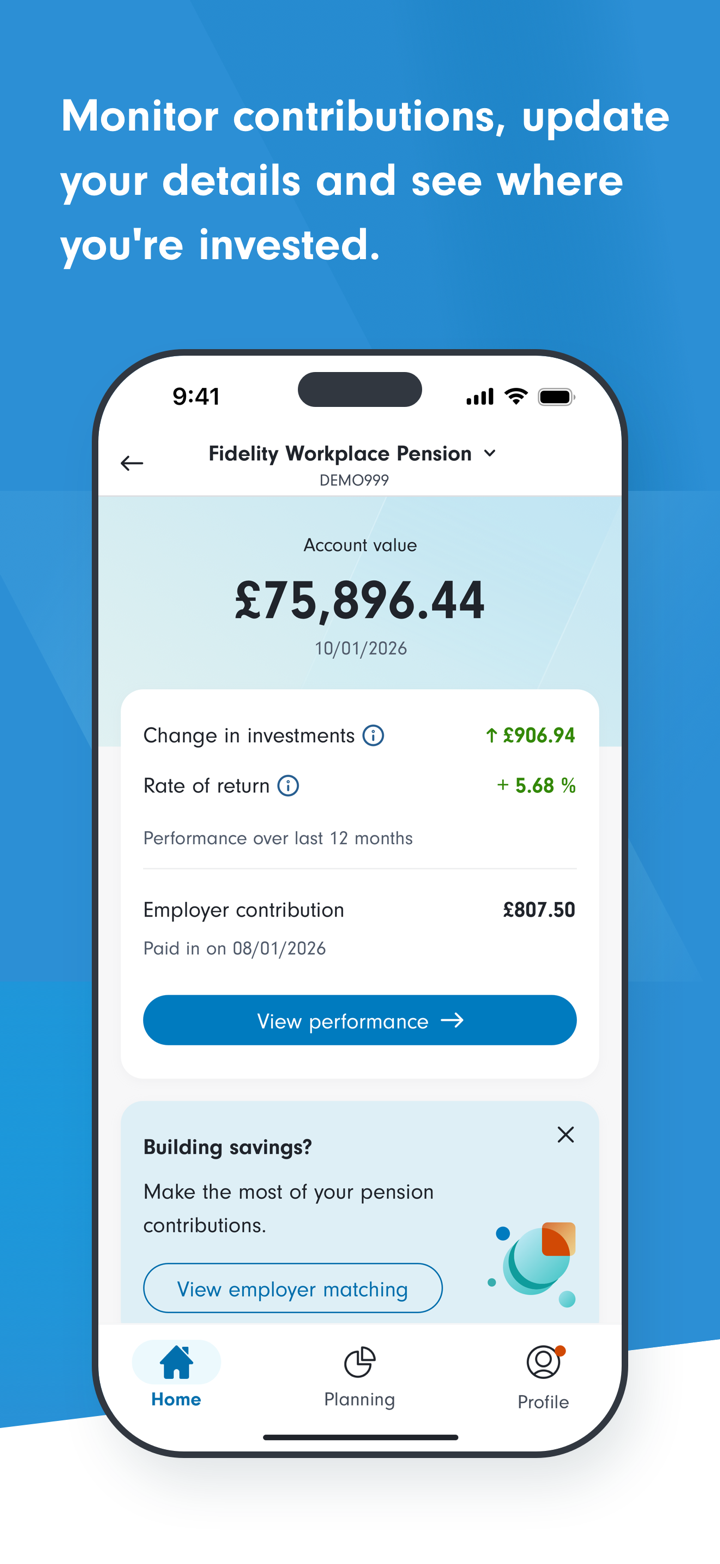

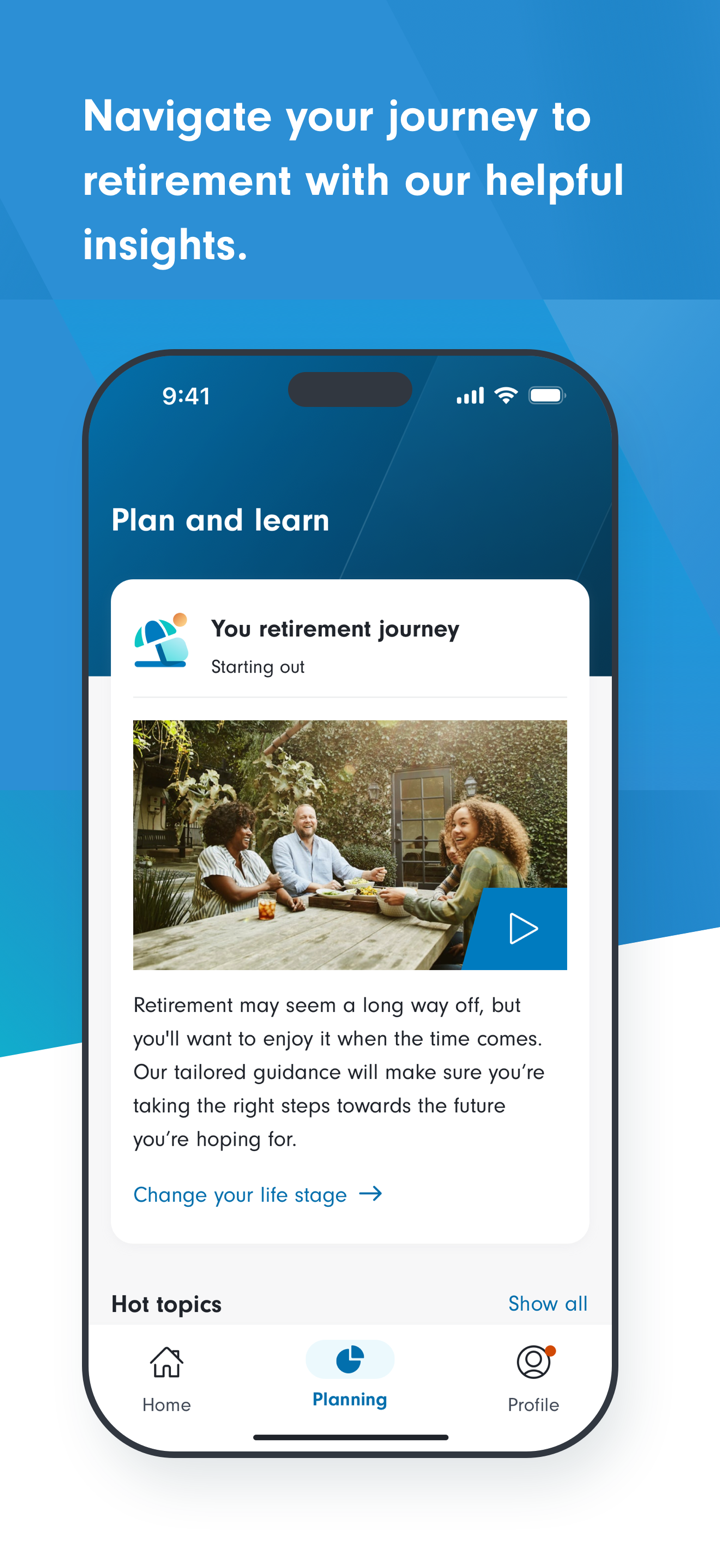

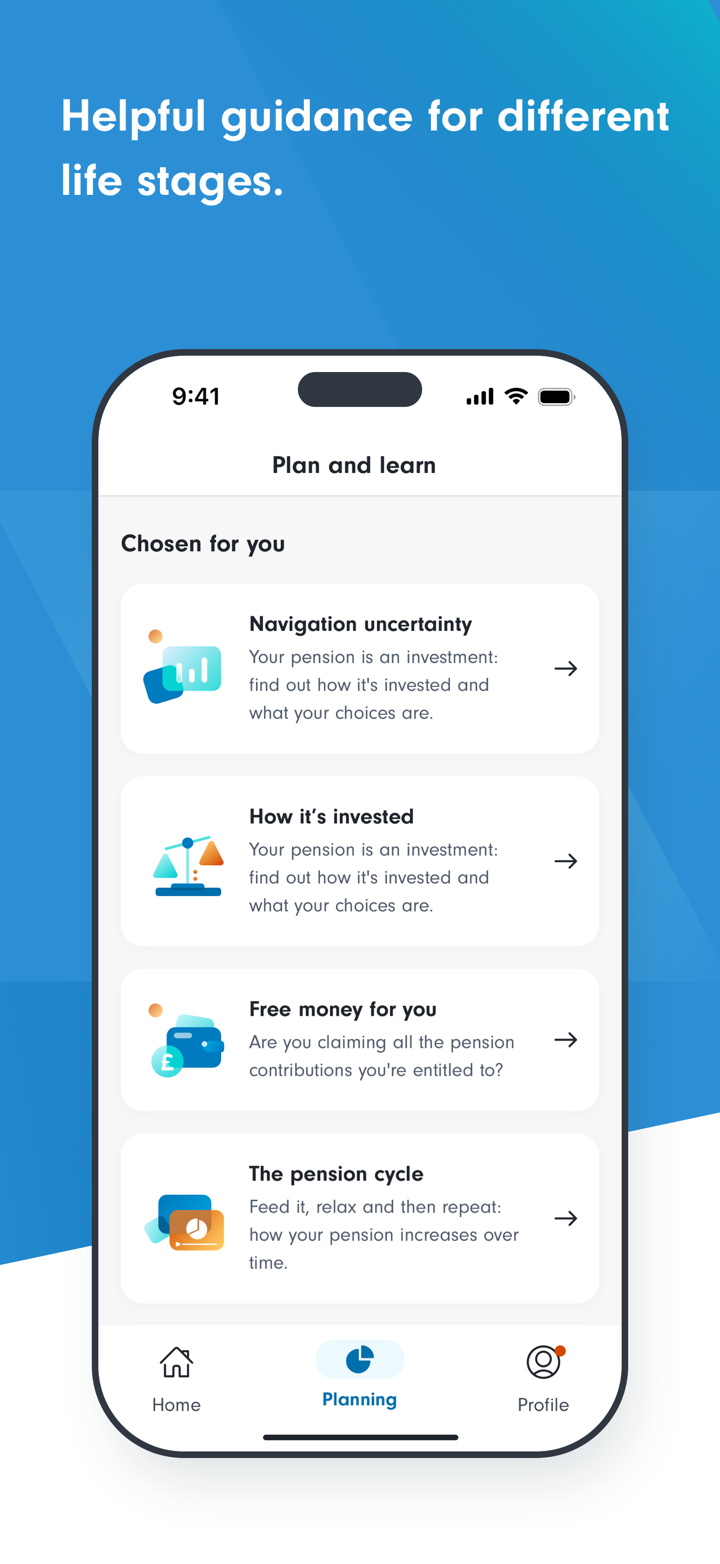

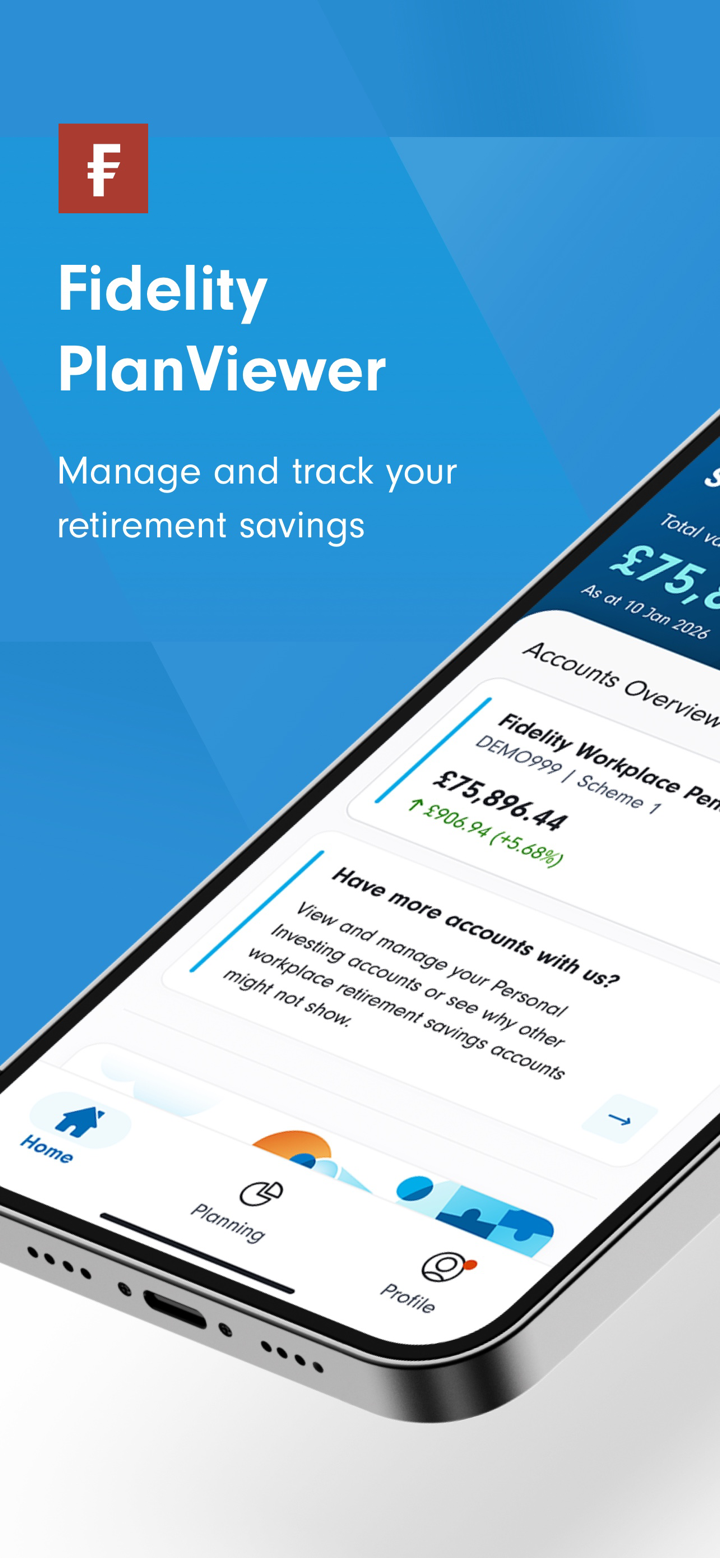

| Handelsplattform | Fidelity Online, Fidelity Mobile App |

| Mindesteinzahlung | HK$1.000/Monat (Monatlicher Investitionsplan) |

| Kundensupport | Telefon: (852) 2629 2629 |

| E-Mail: hkenquiry@fil.com | |

Fidelity Informationen

Gegründet im Jahr 1969, ist Fidelity ein Finanzunternehmen unter der Regulierung der SFC, das internationale Investmentlösungen anbietet. Es bietet keine Devisen- oder Differenzkontrakte an, sondern konzentriert sich stattdessen auf Investmentfonds, Rentenpläne (MPF/ORSO) und thematische Strategien.

Vor- und Nachteile

| Vorteile | Nachteile |

| SFC reguliert | Kein Demo- oder islamisches (swap-freies) Konto |

| Breite Auswahl an Investmentfonds und Rentenlösungen | Relativ hohe Gebühren |

| Staffelgebührenstruktur zugunsten von Investoren mit hohen Kontoständen | |

| Lange Betriebszeiten | |

| Verschiedene Kontotypen |

Ist Fidelity legitim?

Ja, Fidelity ist reguliert. Es ist von der Securities and Futures Commission (SFC) von Hongkong mit einer Lizenz für den Handel mit Futures-Kontrakten autorisiert. Die Lizenznummer lautet AAG408.

Produkte und Dienstleistungen

Fidelity bietet weltweite Investmentfonds, Rentenpläne (MPF & ORSO) und thematische Investitionen an, um die finanziellen Ziele der Anleger zu erreichen. Sie bieten Einkommensgenerierung, nachhaltige Investitionen und Multi-Asset-Strategien.

| Produkte & Dienstleistungen | Merkmale |

| Investmentfonds | Globale Fonds in verschiedenen Währungen und Anlageklassen |

| Thematische Investitionen | Langfristige Investitionen basierend auf globalen Trends und Innovations-Themen |

| Multi-Asset-Lösungen | Diversifizierte Portfolios, die verschiedene Anlagearten kombinieren |

| Nachhaltige Investitionen | Fokussiert auf ESG und verantwortungsbewusste Anlagestrategien |

| MPF (Mandatory Provident Fund) | Rentenfonds, die auf unterschiedliche Risiko- und Einkommensprofile zugeschnitten sind |

| ORSO (Occupational Retirement Schemes Ordinance) | Vom Arbeitgeber gesponserte Renten-Investitionspläne |

| Einkommensstrategien | Globale Einkommensschwerpunkt-Investmentoptionen |

| Asien-Fokussierte Investitionen | Fonds, die Wachstumschancen in asiatischen Märkten anvisieren |

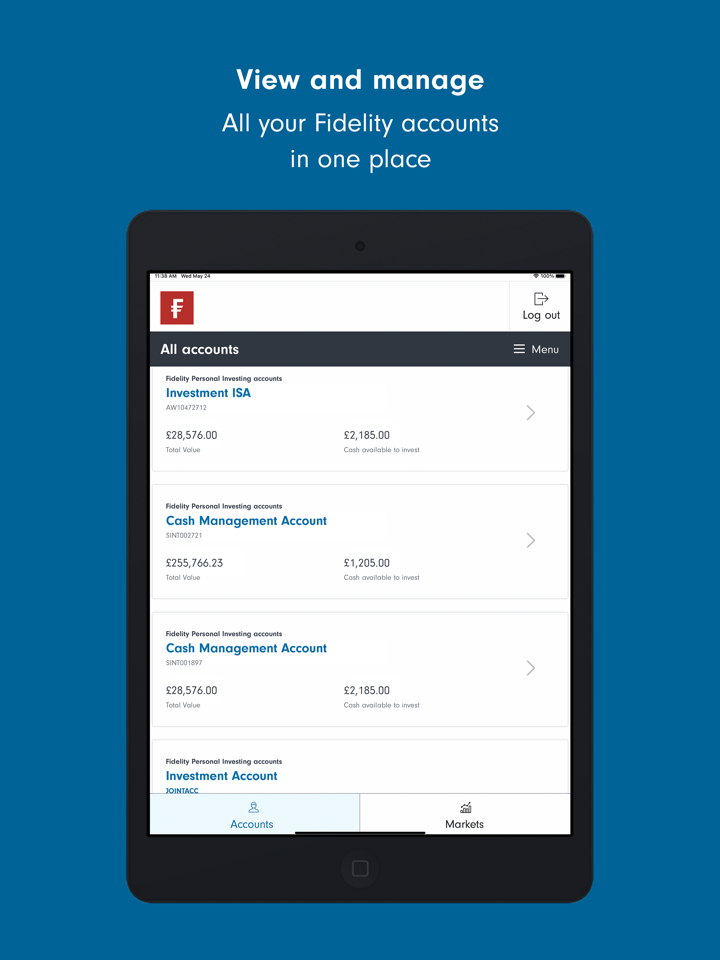

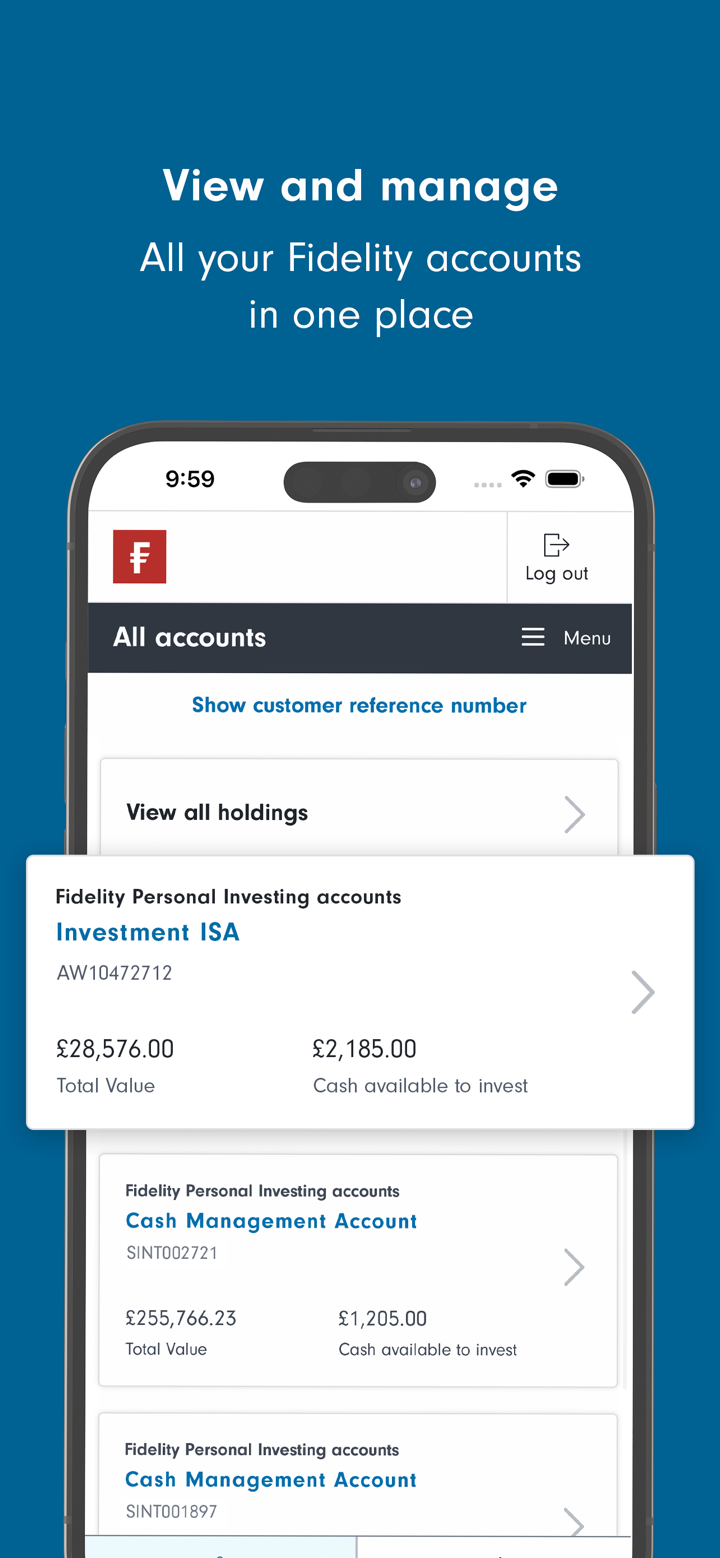

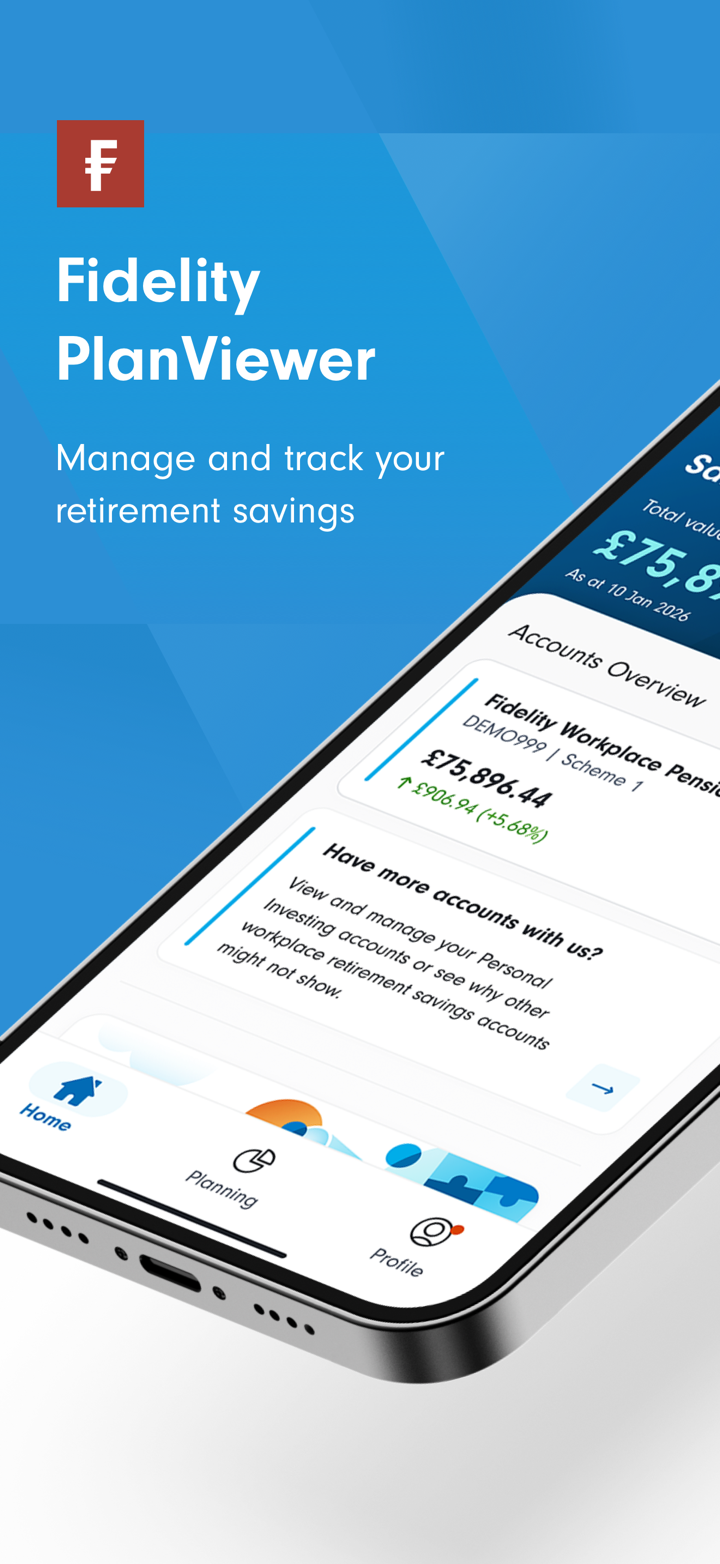

Kontotyp

Fidelity bietet vier Arten von Live-Konten an: Persönliche Anleger, MPF/ORSO-Mitglieder, Vermittler und institutionelle Anleger. Es gibt keine Demo- oder islamischen (swap-freien) Konten.

| Kontotyp | Geeignet für |

| Privatanleger | Einzelpersonen, die ihre eigenen Investitionen verwalten |

| MPF / ORSO-Konten | Mitarbeiter und Arbeitgeber unter Hongkonger Rentensystemen |

| Vermittler | Berater, Vermögensverwalter, Finanzberater |

| Institutionelle Anleger | Institutionen wie Renten, Unternehmen und Family Offices |

Fidelity Gebühren

Fidelitys Gebühren folgen einer gestaffelten Struktur - größere Anlagebeträge genießen niedrigere Gebühren, während kleinere Investitionen höhere Gebühren haben. Insgesamt ist die Kostenstruktur gemäß Branchenstandards moderat bis hoch.

| Investitionsmethode | Gebührentyp | Investitionsbilanz (USD) | Geldmittel | Anleihenfonds | Aktien- und andere Fonds |

| Einmalige Investition | Ausgabeaufschlag | ≥ 1.000.000 | 0,00% | 0,30% | 0,60% |

| 500.000 - <1.000.000 | 0,45% | 0,90% | |||

| 250.000 - <500.000 | 0,60% | 1,20% | |||

| 100.000 - <250.000 | 0,75% | 1,50% | |||

| 50.000 - <100.000 | 1,05% | 2,10% | |||

| <50.000 | 1,50% | 3,00% | |||

| Umschaltgebühr | ≥ 1.000.000 | 0,10% | - | ||

| 500.000 - <1.000.000 | 0,15% | - | |||

| 250.000 - <500.000 | 0,20% | - | |||

| 100.000 - <250.000 | 0,25% | - | |||

| 50.000 - <100.000 | 0,35% | - | |||

| <50.000 | 0,50% | - | |||

| Monatlicher Anlageplan | Ausgabeaufschlag | <HK$20.000/Monat | 1,00% | - | - |

| ≥HK$20.000/Monat | 0,00% | - | - |

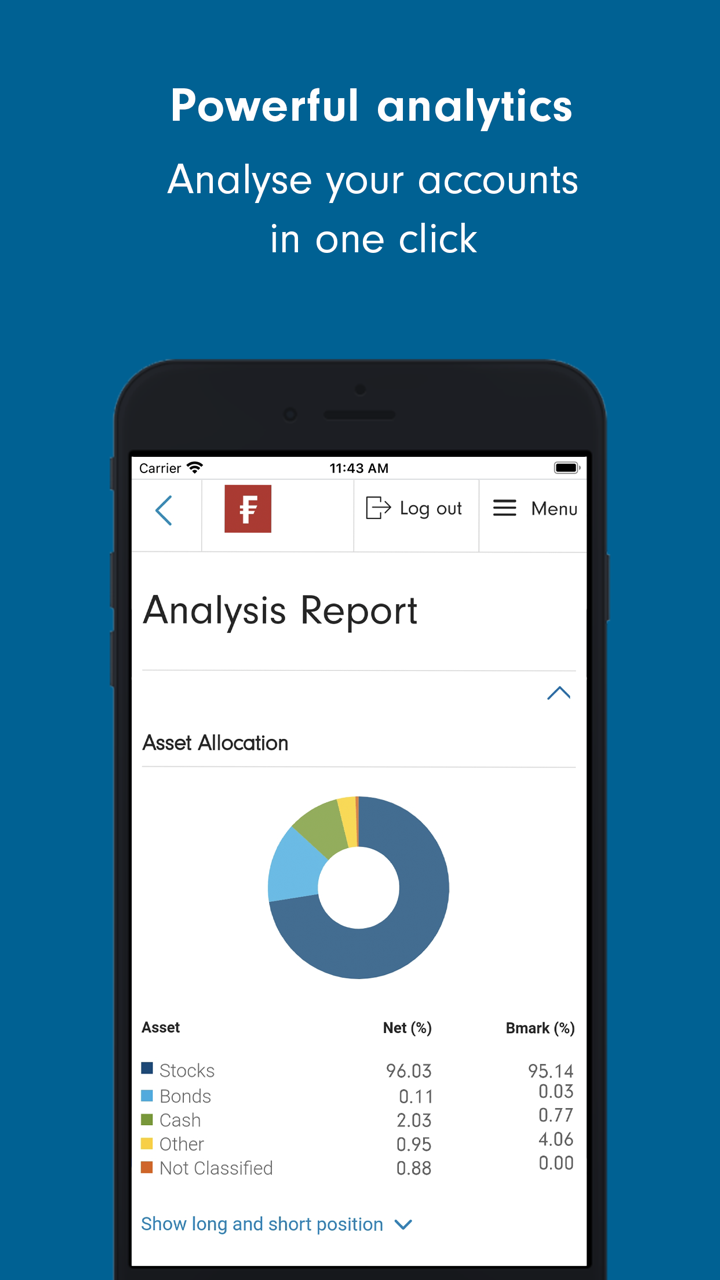

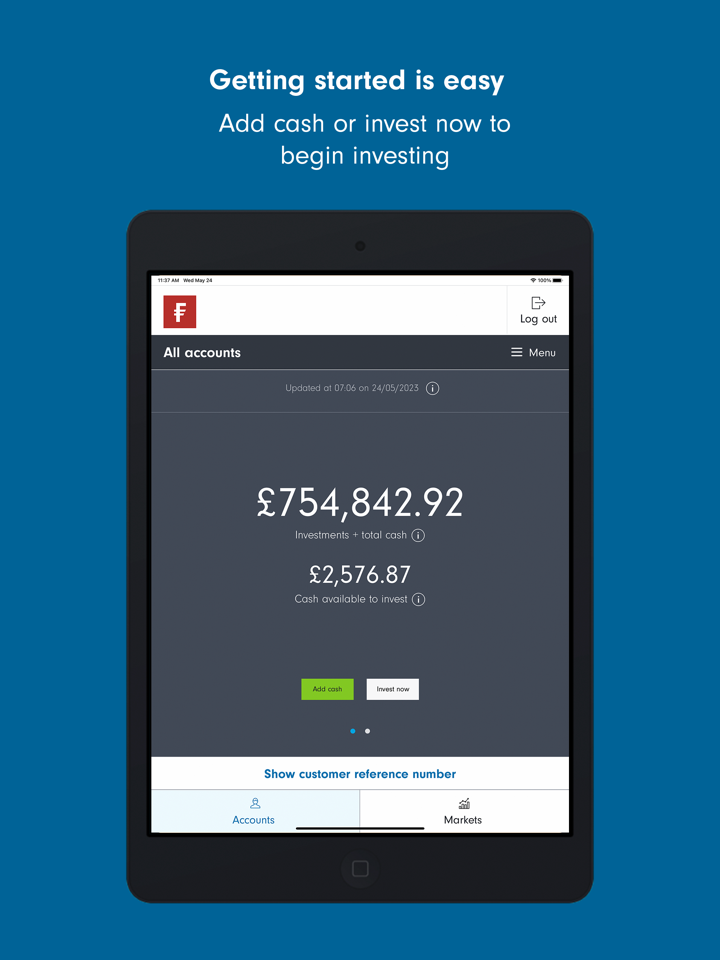

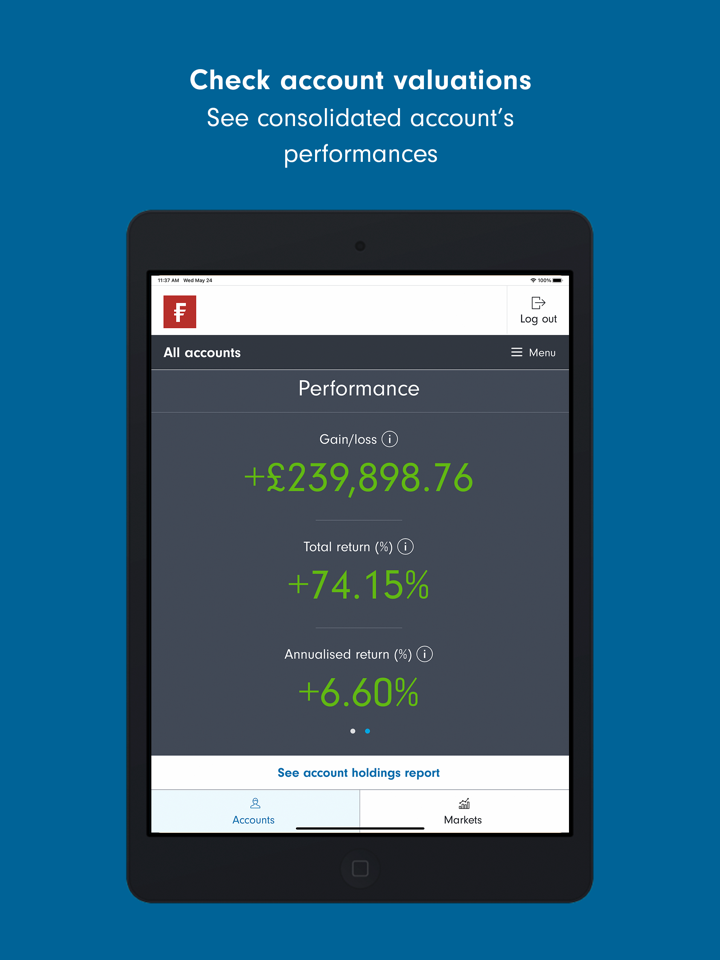

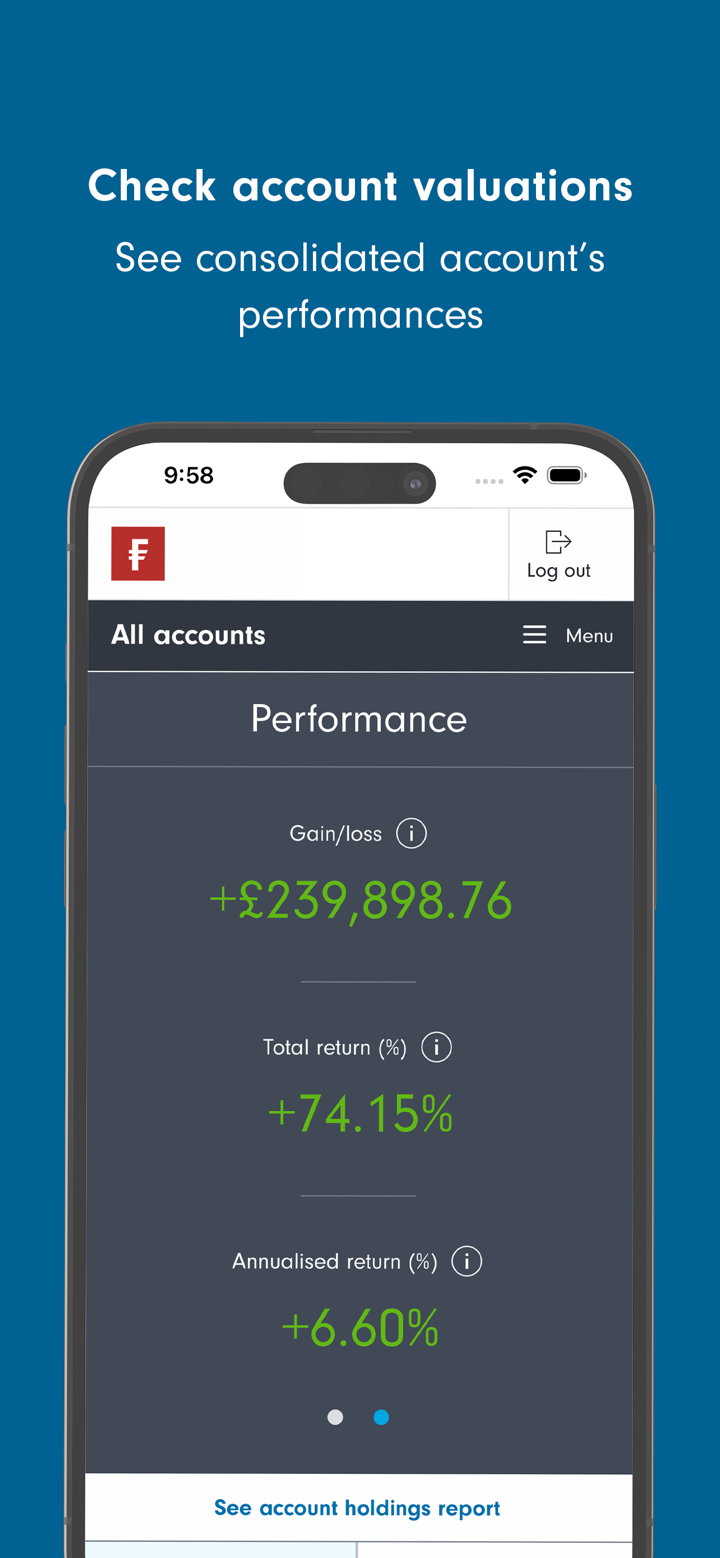

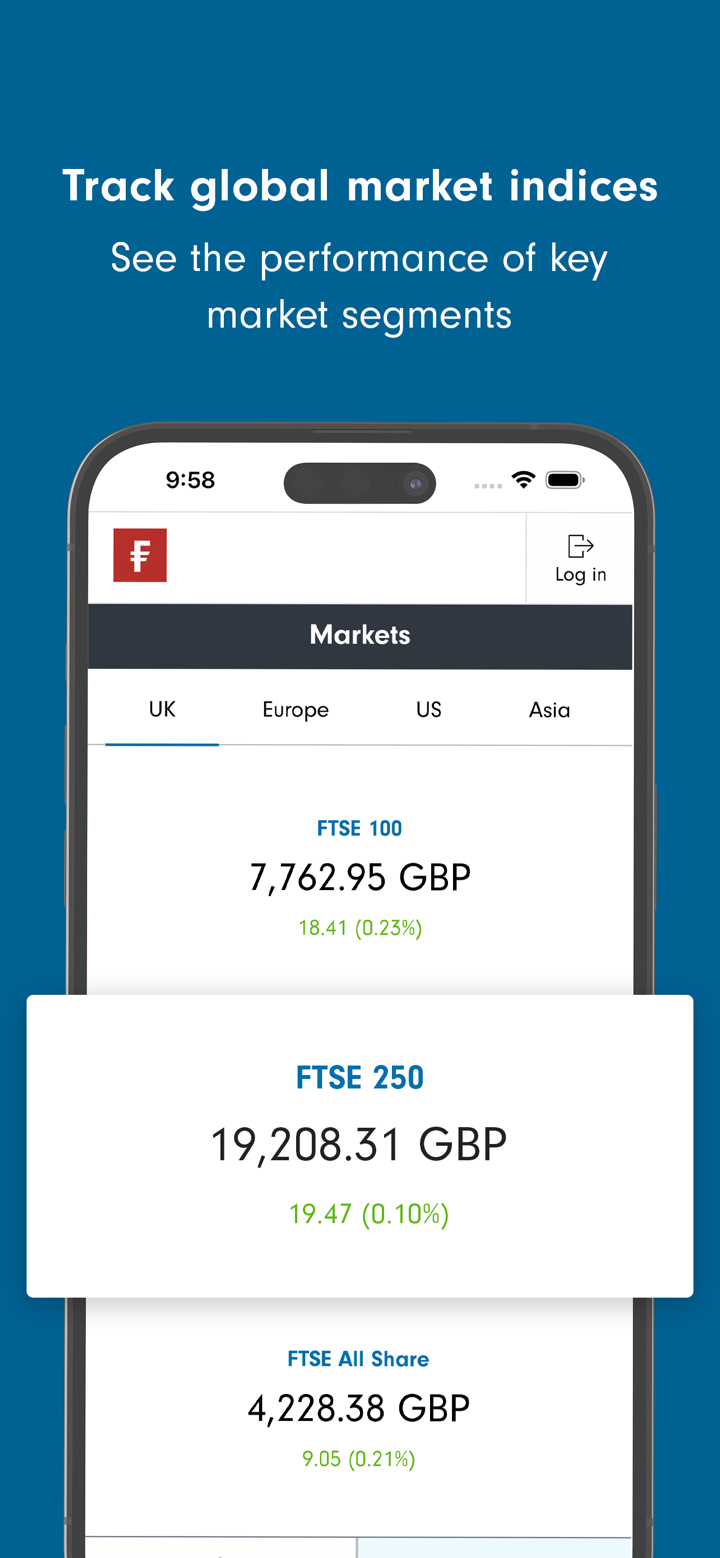

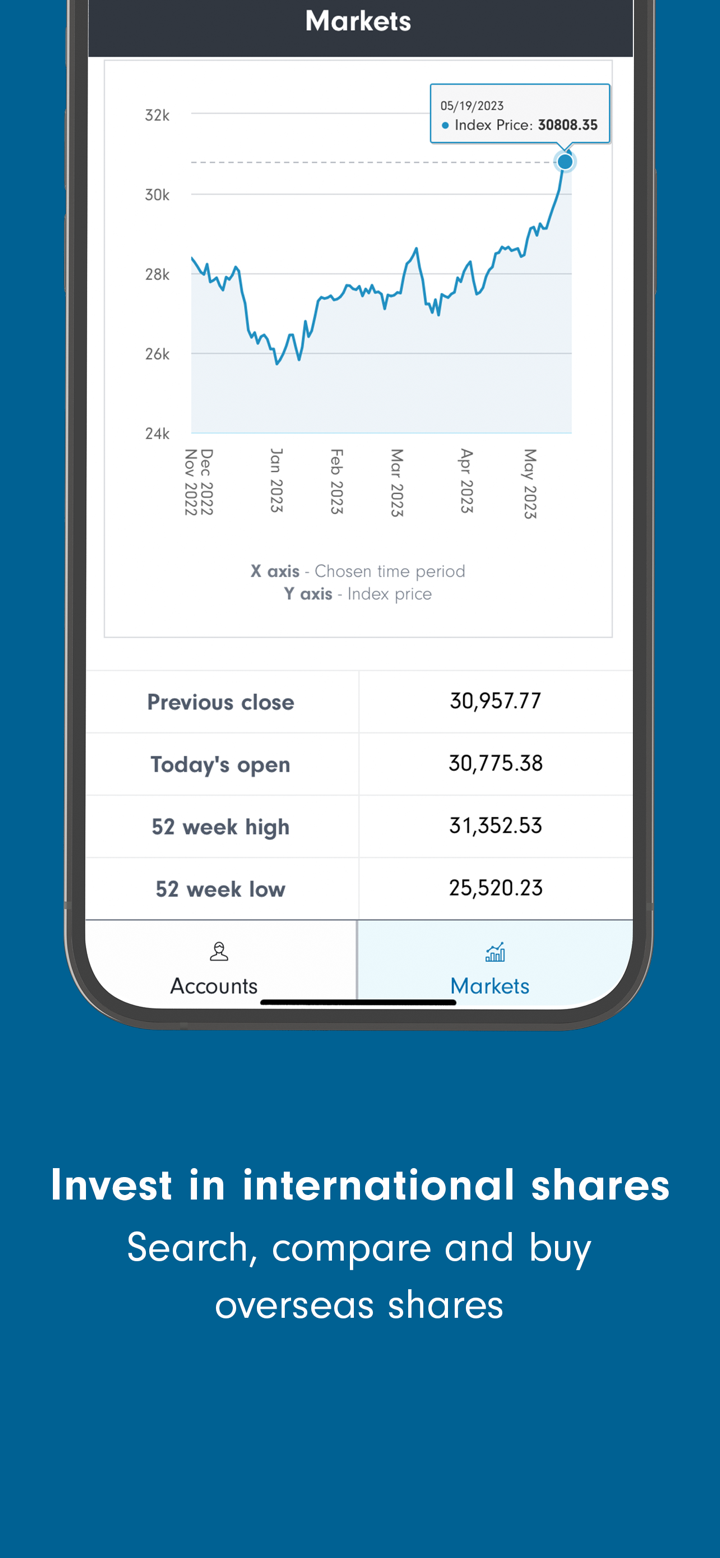

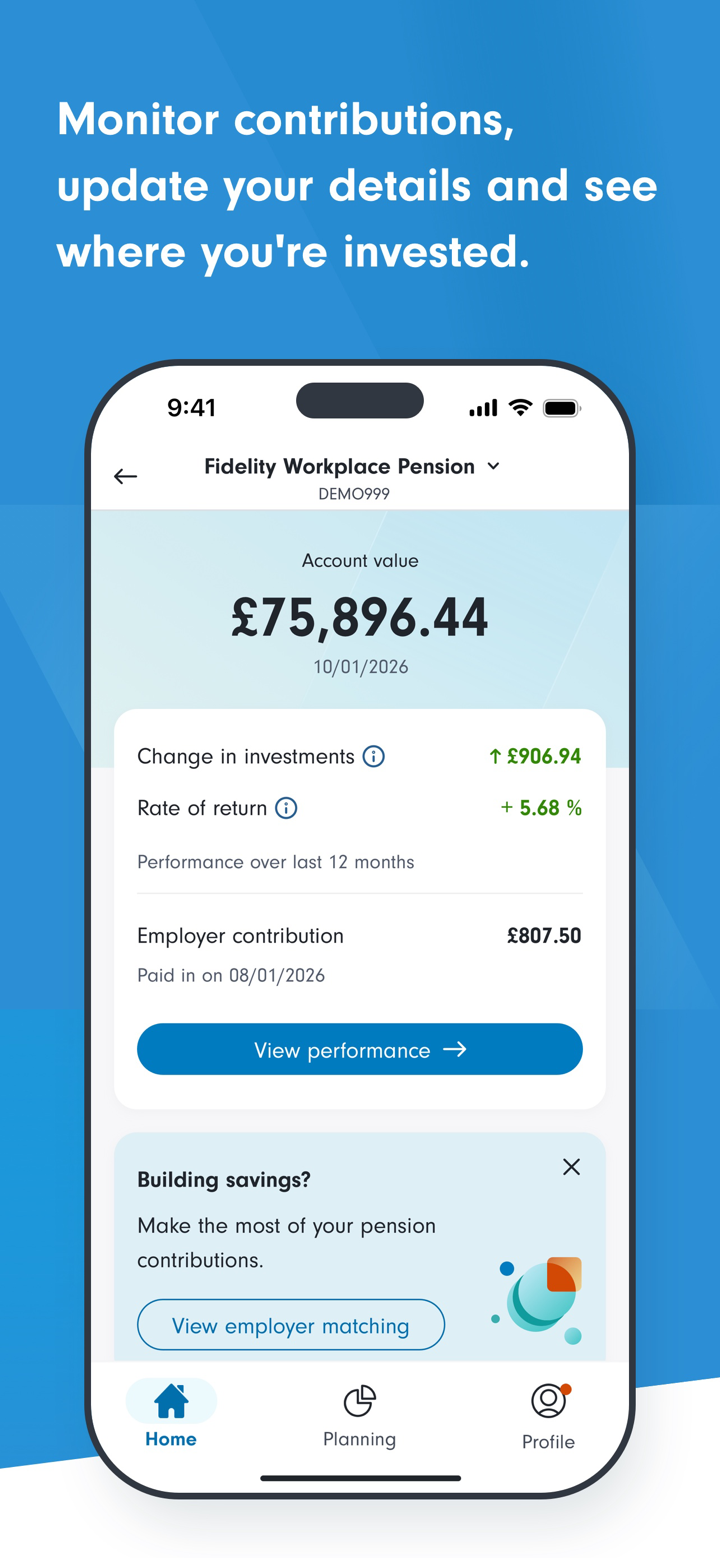

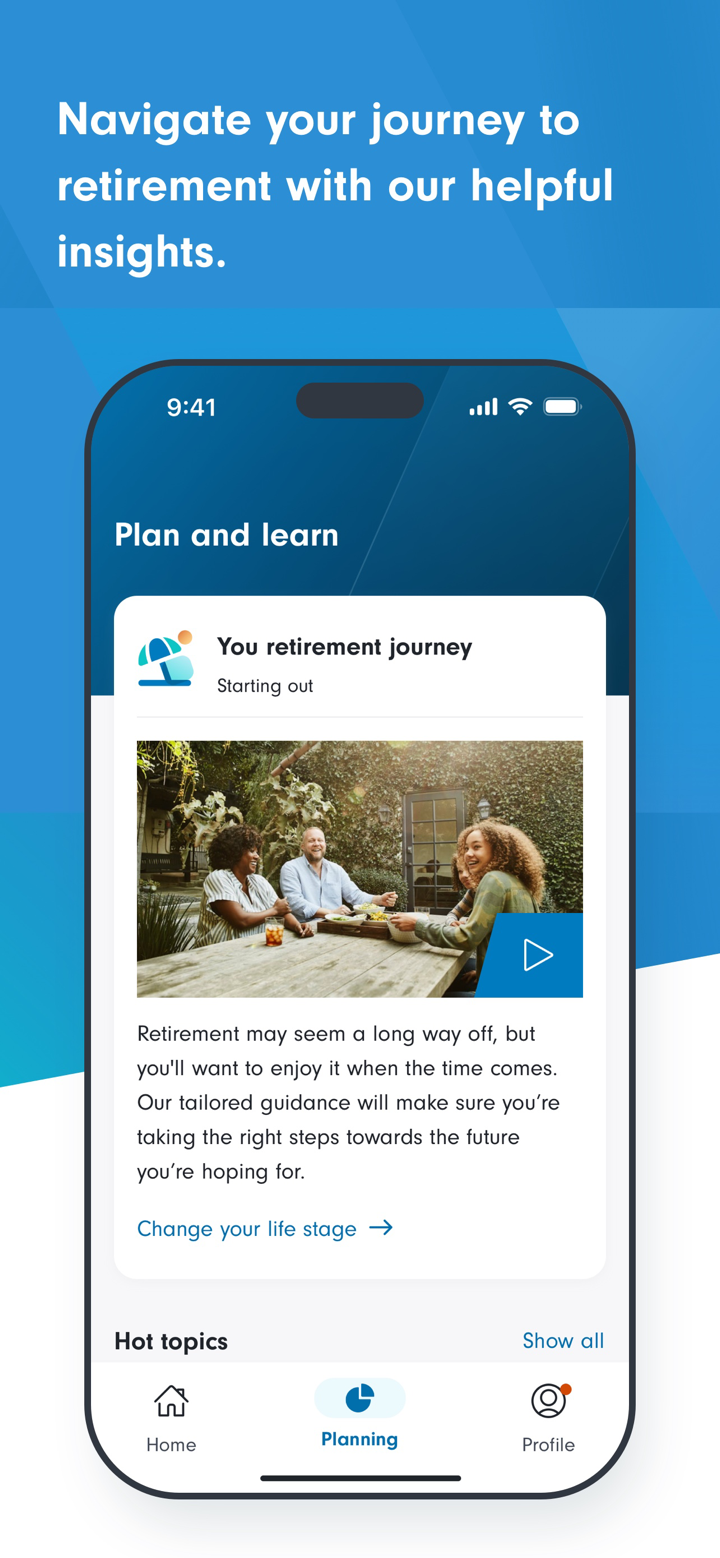

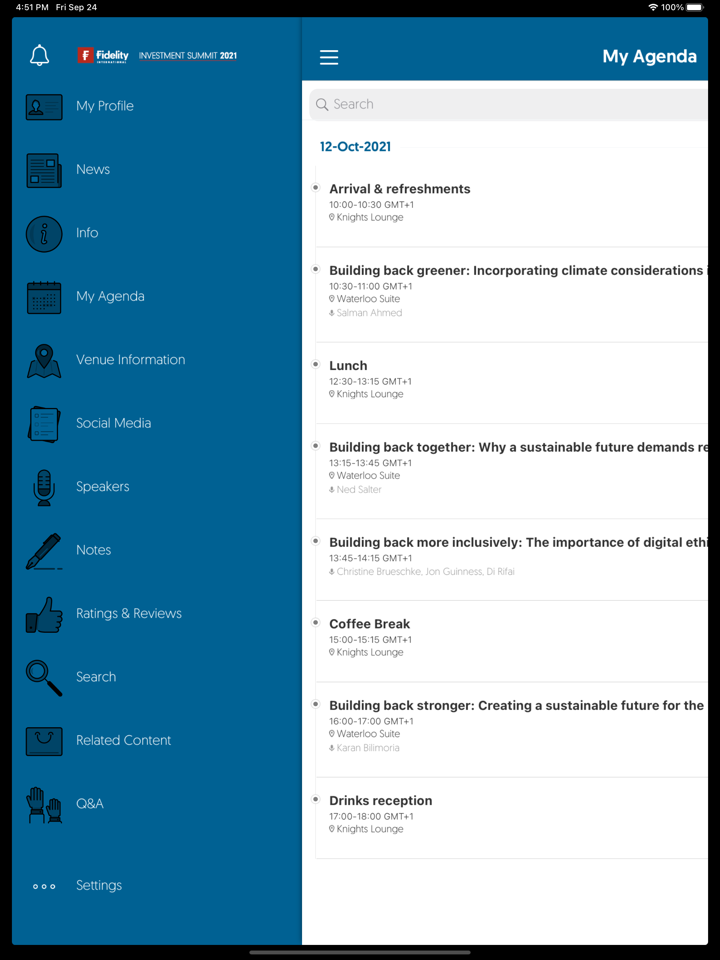

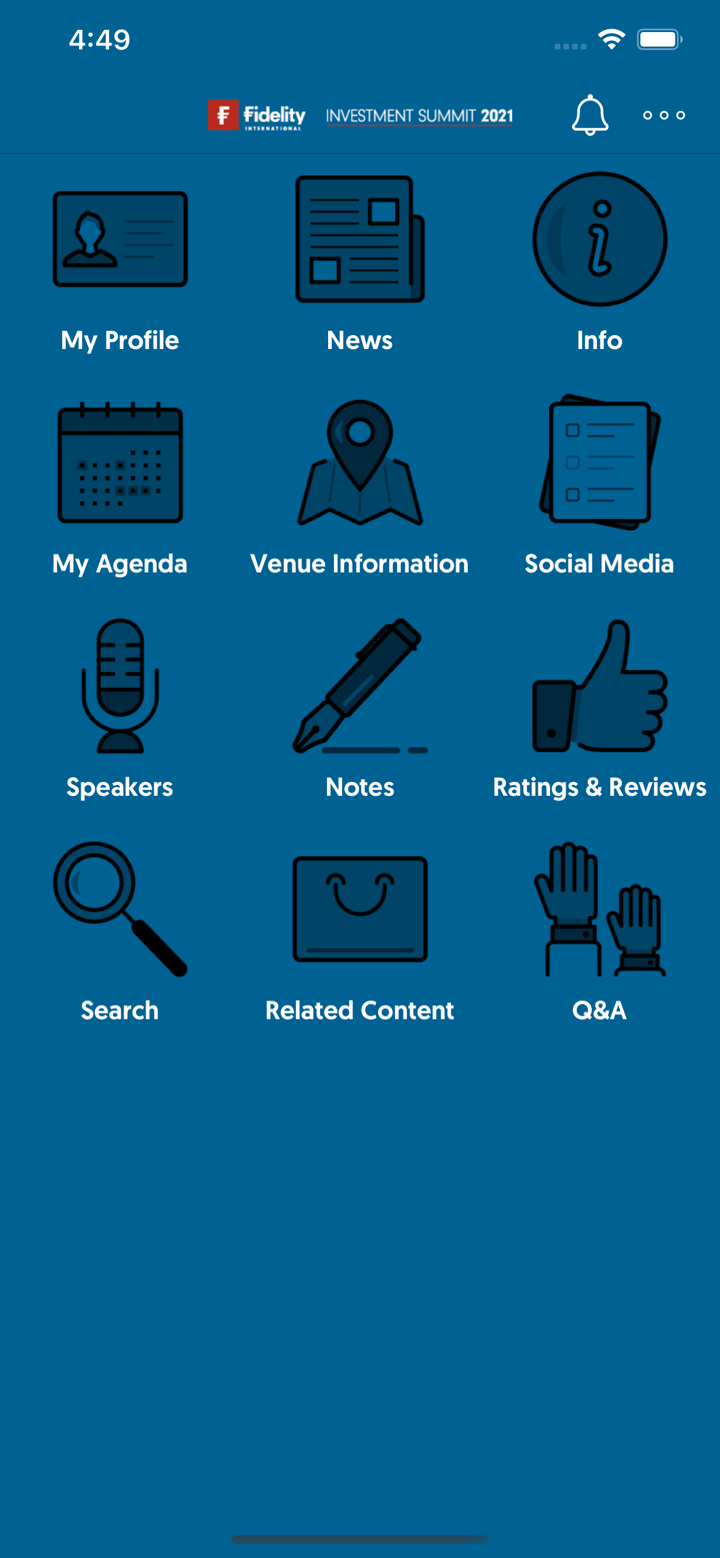

Handelsplattform

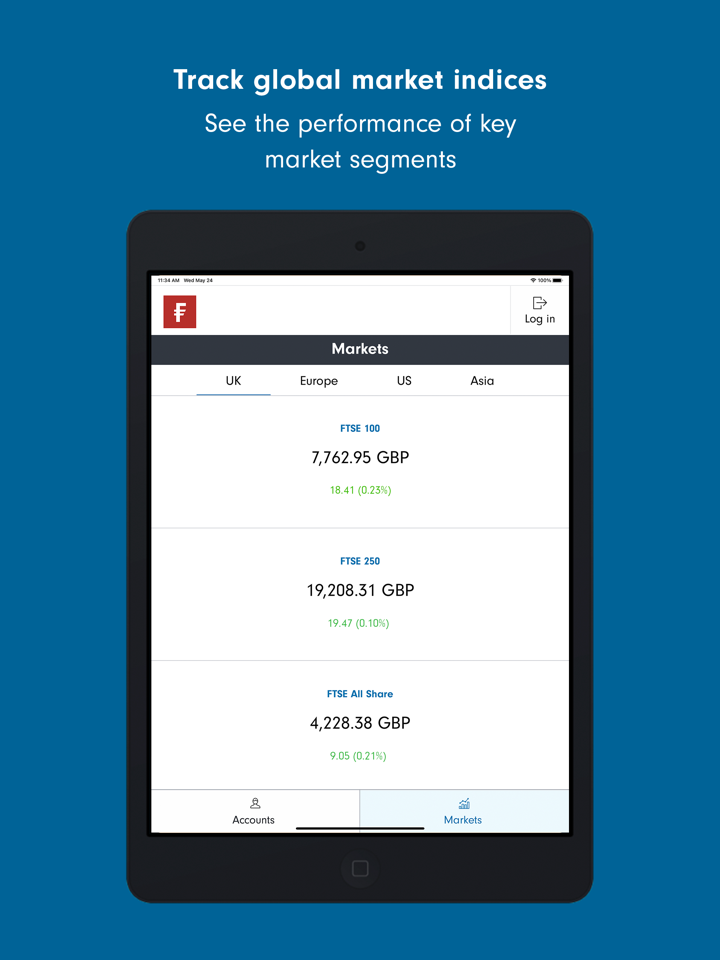

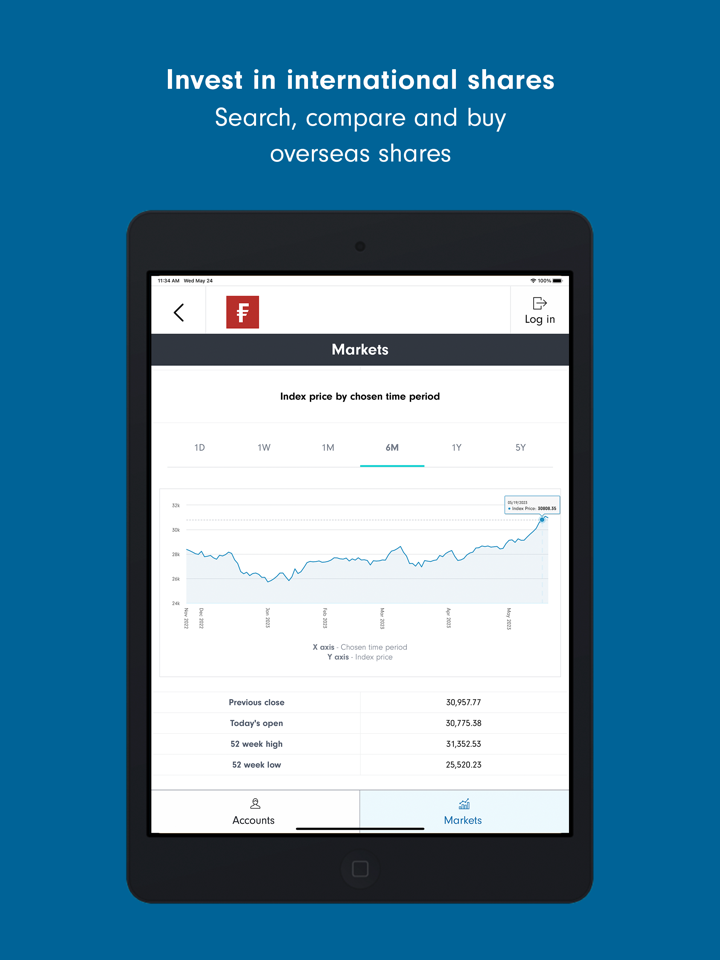

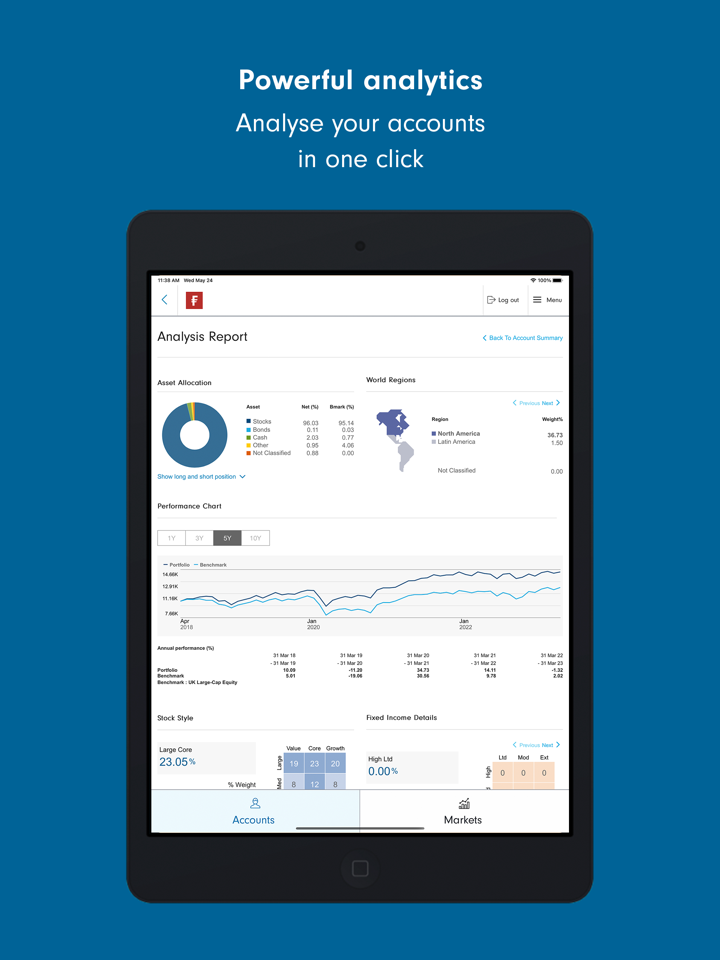

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

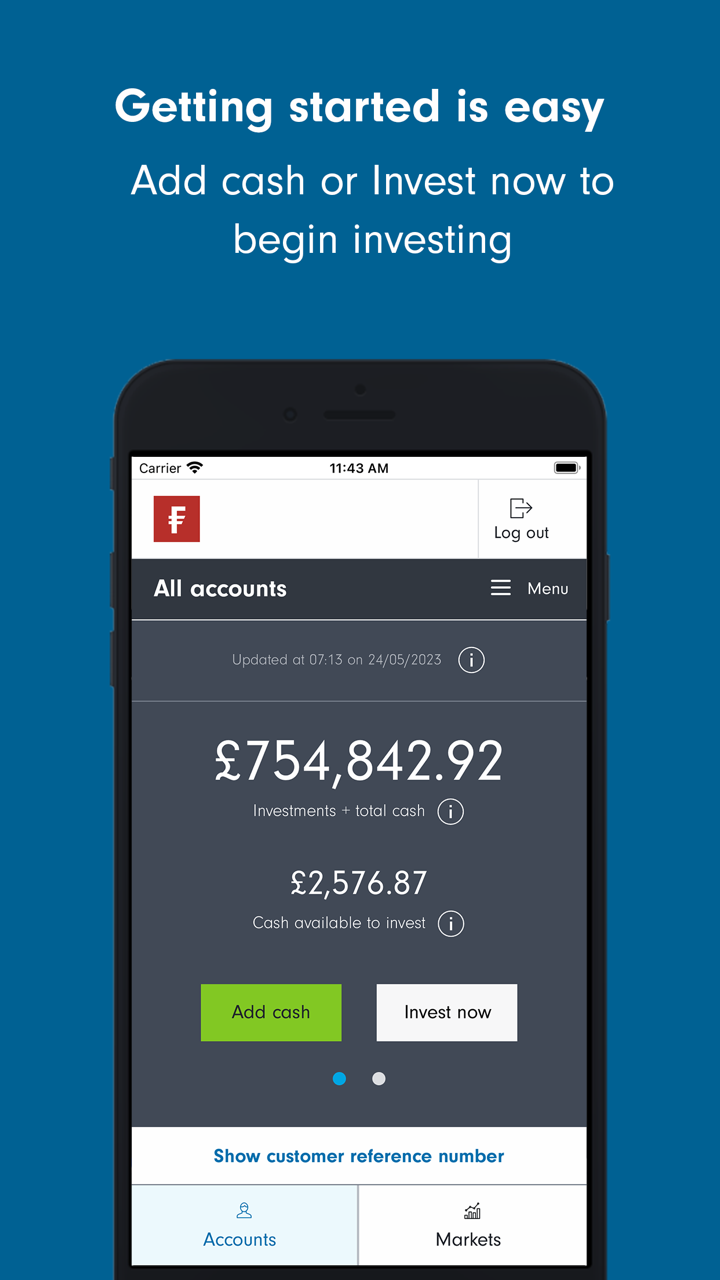

| Fidelity Online | ✔ | Web (PC, Mac) | Langfristige Anleger, die ihre Portfolios online verwalten |

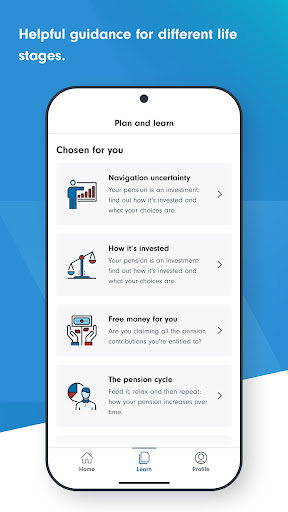

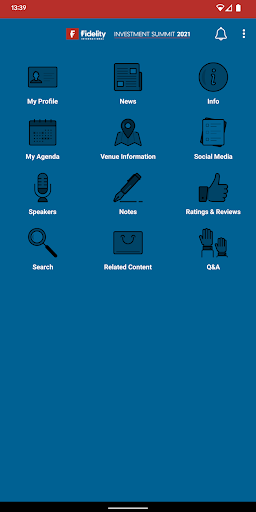

| Fidelity Mobile App | ✔ | iOS, Android | Anleger, die unterwegs auf ihre Portfolios zugreifen müssen |

Ein- und Auszahlung

Fidelity erhebt keine zusätzlichen Gebühren für Standard-Einzahlungs- oder Auszahlungsmethoden. Es können jedoch Bank- oder Zwischenkosten anfallen, abhängig von der verwendeten Methode. Die Mindesteinzahlung beträgt HK$1.000 pro Fonds pro Monat für monatliche Anlagepläne; für Einmalanlagen ist keine spezifische Mindestanforderung angegeben.

| Zahlungsmethode | Mindestbetrag | Gebühren | Bearbeitungszeit |

| Telegrafische Überweisung | / | Bank-/Zwischenkosten | Nach Erhalt der geklärten Mittel |

| HSBC-Rechnungszahlung (Internetbanking) | / | ❌ (außer Agenturgebühren) | Unverzüglich |

| Bankwechsel / Bankscheck | / | Agenturbankgebühren | |

| HSBC / Hang Seng Same-Day-Lastschrift | / | ❌ (unzureichende Mittel können Bankgebühren verursachen) | |

| Personenscheck (HK geklärt) | HK$1.000.000 oder weniger | ❌ | |

| Personenscheck (nicht in HK geklärt) | / | Es können Inkassogebühren anfallen | Nach Freigabe |