Unternehmensprofil

| Shikoku Überprüfungszusammenfassung | |

| Gegründet | 2002 |

| Registriertes Land/Region | Japan |

| Regulierung | Reguliert von FSA (Japan) |

| Marktinstrumente | Investmentfonds, Aktien, Anleihen, Devisen, Rohstoffe |

| Demo-Konto | / |

| EUR/USD Spread | von 10 - 75 Sen |

| Handelsplattform | Web Trader |

| Kundensupport | Tel: 089-921-5200 |

| Adresse: Präfektur Ehime, Stadt Matsuyama, Sanbancho 5-10-1 | |

Shikoku Informationen

Shikoku ist ein in Japan ansässiger Broker, der 2002 gegründet wurde und von der FSA reguliert wird. Er bietet eine vielfältige Palette von Marktinstrumenten an, wie z.B.: Investmentfonds, Aktien, Anleihen, Devisen und Rohstoffe.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert von FSA | Begrenzte Kontaktmöglichkeiten |

| Verschiedene Handelswerte | Keine Unterstützung für MT4 und MT5 cTrader |

| Lange Betriebszeiten | Keine Demo-Konten verfügbar |

| Verschiedene Gebühren werden erhoben |

Ist Shikoku legitim?

Shikoku wird von der Finanzdienstleistungsagentur (FSA) reguliert, unter Shikoku, mit der Lizenznummer 四国財務局長(金商)第21号.

| Regulatorischer Status | Reguliert von | Lizenzierte Institution | Lizenztyp | Lizenznummer |

| Reguliert | Finanzdienstleistungsagentur (FSA) | Shikoku | Einzelhandels-Forex-Lizenz | 四国財務局長(金商)第21号 |

WikiFX Felduntersuchung

Das Feldforschungsteam von WikiFX besuchte die Adresse von Shikoku in Japan und fand das Büro vor Ort, was bedeutet, dass das Unternehmen mit einem physischen Büro betrieben wird.

Was kann ich bei Shikoku handeln?

| Handelsinstrumente | Unterstützt |

| Investmentfonds | ✔ |

| Aktien | ✔ |

| Anleihen | ✔ |

| Devisen | ✔ |

| Waren | ✔ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

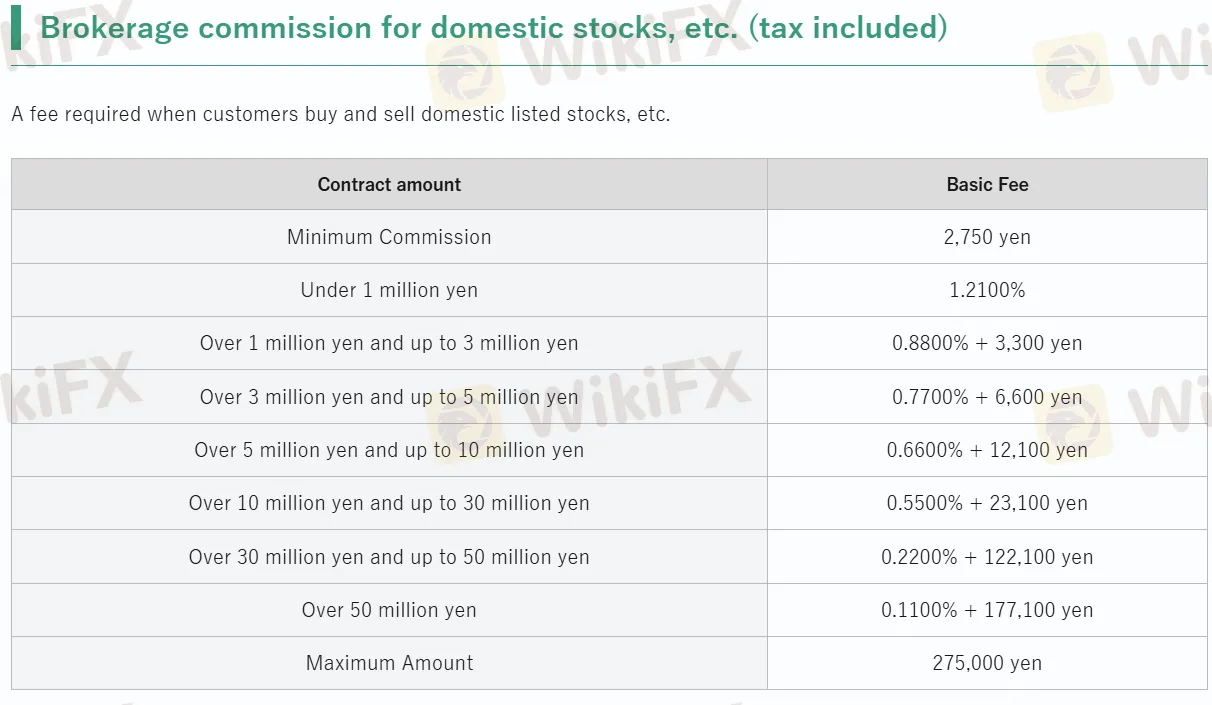

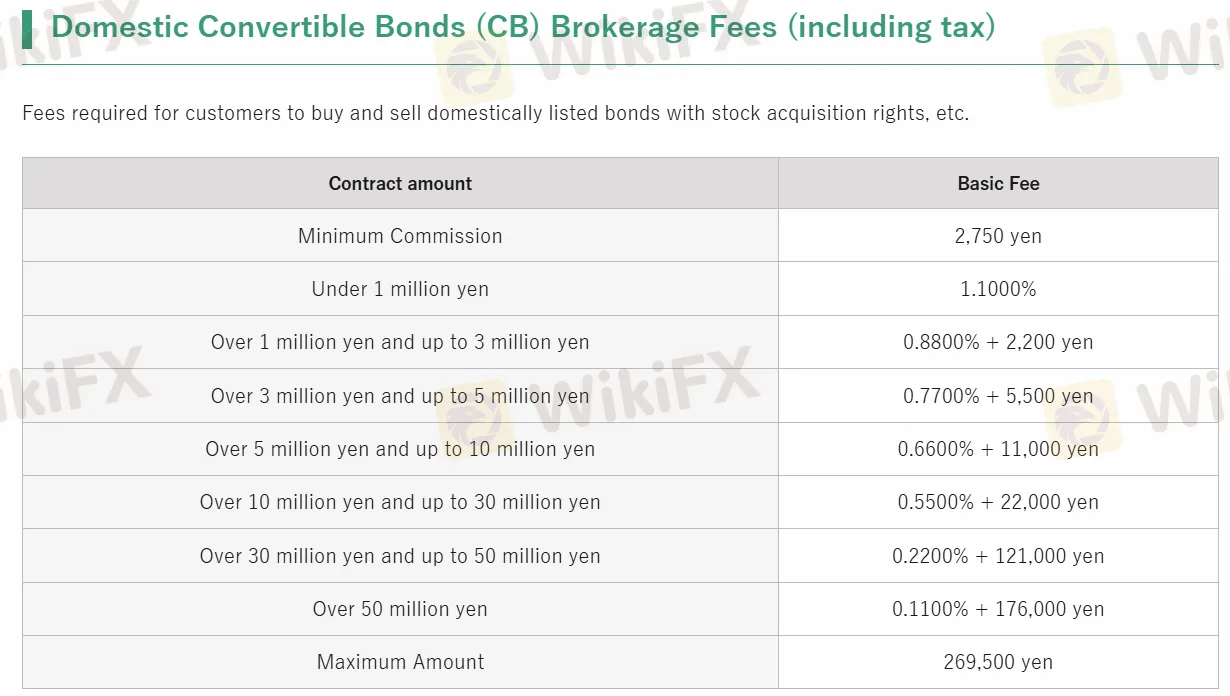

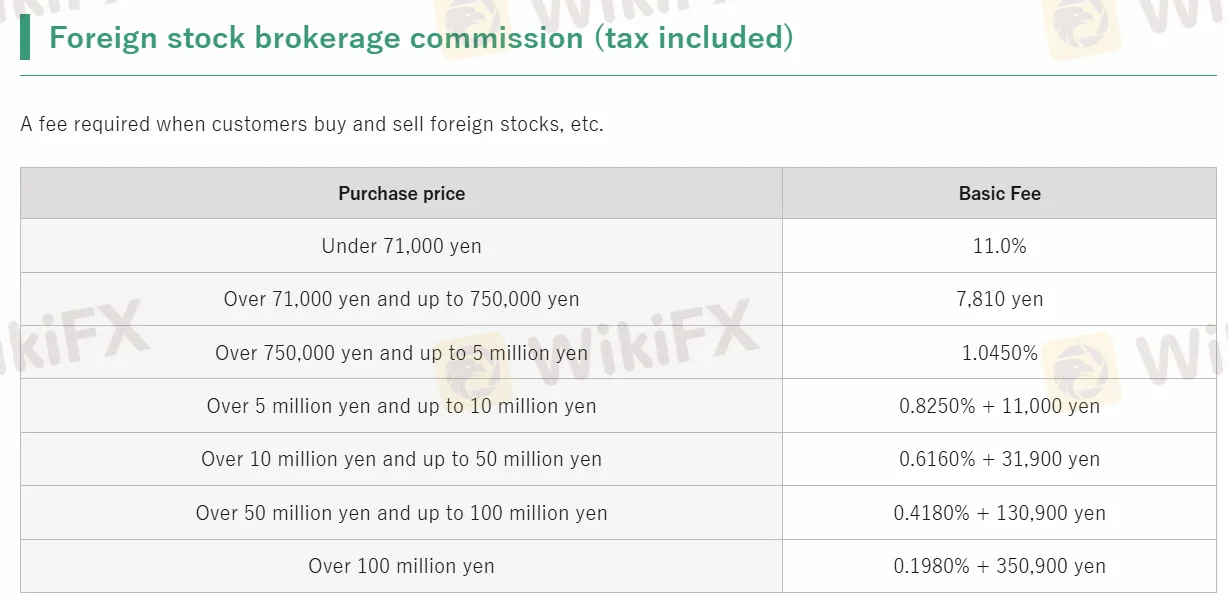

Shikoku Gebühren

| Art der Dienstleistung | Grundgebühr |

| Inländische Aktienmaklergebühr | JPY 2.750 - 275.000 |

| Inländische Wandelanleihenhandelsgebühr | JPY 2.750 - 269.500 |

| Ausländische Aktienmaklergebühr | 0,1980% - 11% |

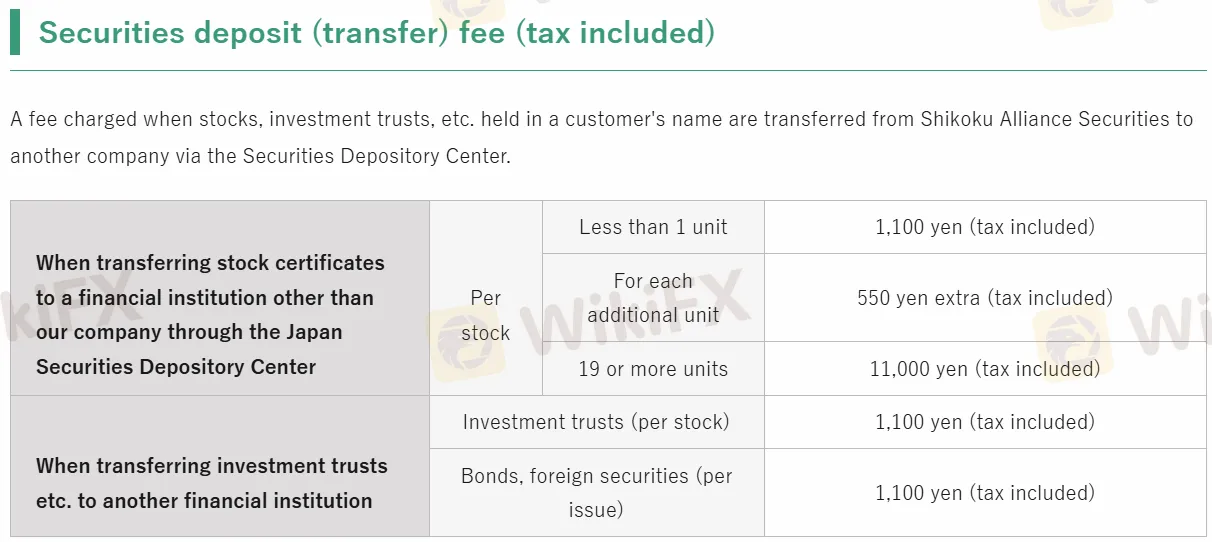

| Wertpapierdepots | JPY 550 - 11.000 |

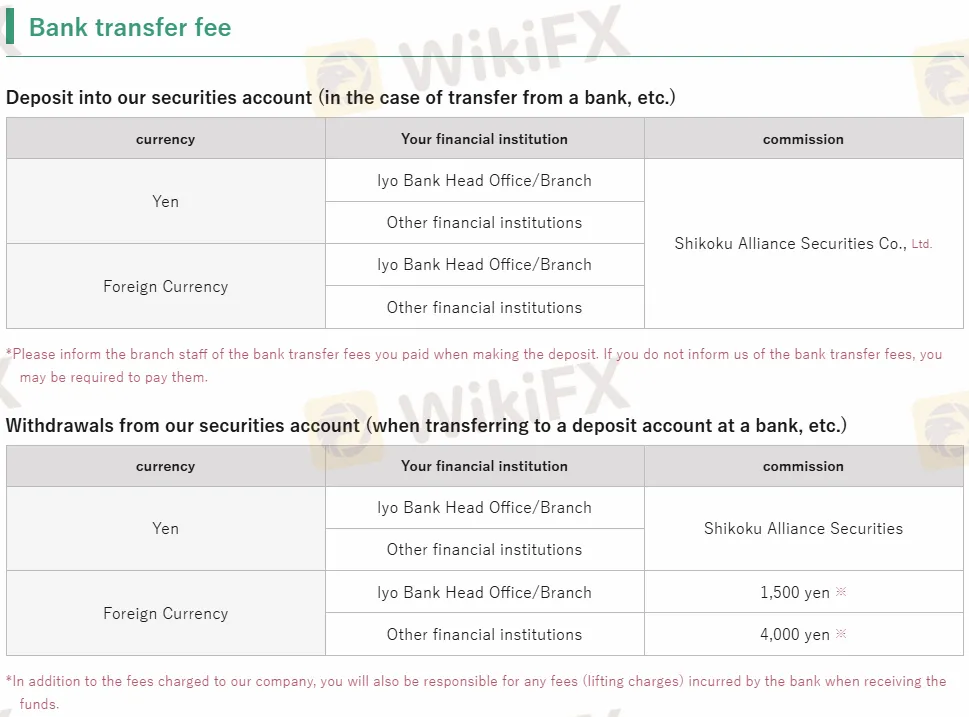

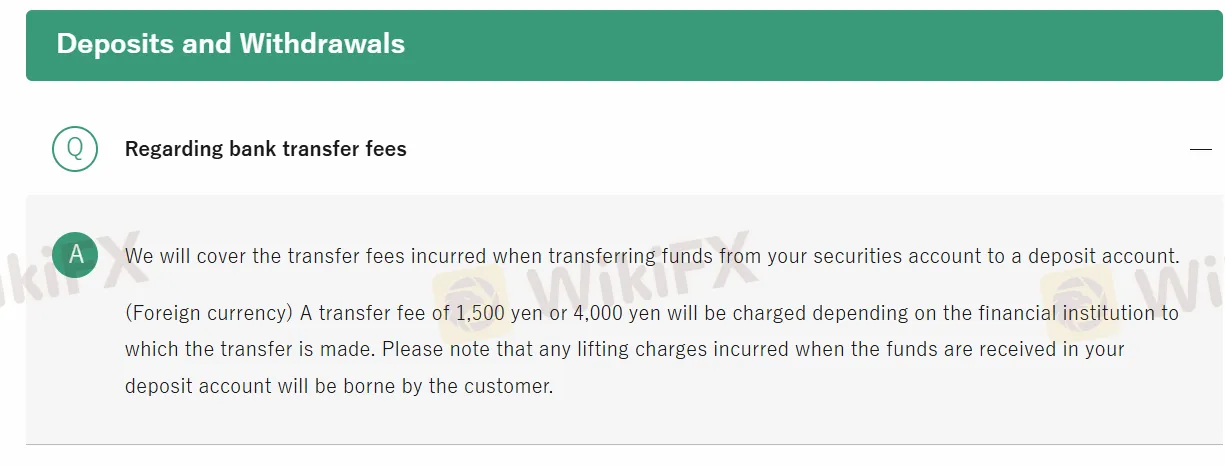

| Banküberweisungsgebühr | JPY 0 - 4.000 |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Web Trader | ✔ | Web | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Händler |

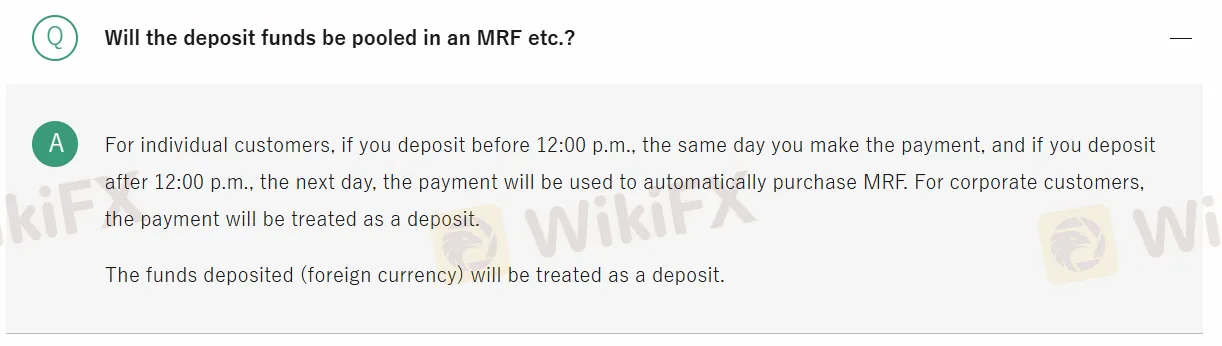

Ein- und Auszahlung

| Mindestbetrag | Banküberweisungsgebühr | Bearbeitungszeit | |

| Einzahlung | / | JPY 0 - 4.000 | Unter 24 Stunden |

| Auszahlung | / | / |

within

Kolumbien

Bisher denke ich, dass Shikoku ein qualifiziertes Unternehmen ist, wenn Sie es brauchen, denke ich, dass es Ihre Wahl sein kann! Verschiedene Handelsbedingungen sind angemessen, und das Wichtigste ist, dass es sich nicht um ein illegales Unternehmen handelt, es wird Ihr Geld nicht betrügen.

Positive

文章

Hongkong

Ich bin es gewohnt, das Vertrauen von Shikoku zu investieren, meine Erfahrung ist großartig! Obwohl so viele neue Broker auftauchen, wähle ich auf jeden Fall lieber den erfahrenen.

Positive

FX1015868943

Hongkong

Jemand sagte, Shikoku sei eine gute Plattform, um in verschiedene Aktiengeschäfte zu investieren. Ist jemand bereit, mir zu sagen, wie hoch die Gebühren sind? Ich habe eine Anfrage gesendet, aber niemand antwortet mir...

Neutral

FX1022619685

Hongkong

Das Design der Website ist nicht das, was ich bevorzuge, und es ist schwierig zu finden, worauf Sie sich konzentrieren möchten. Hat das jemand gefunden? Es könnte für japanische Investoren besser geeignet sein. Für mich würde ich einige Makler finden, damit ich mich wohl fühle…

Neutral