公司簡介

| HACHIJUNI 評論摘要 | |

| 成立年份 | 2006 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

| 產品和服務 | 股票、投資信託、債券 |

| 模擬帳戶 | / |

| 交易平台 | 線上交易系統 |

| 最低存款 | ¥1,000 |

| 客戶支援 | 電話:0120-70-3782 |

HACHIJUNI 資訊

Hachijuni Securities成立於2006年,是一家總部位於日本的金融服務公司,受日本金融廳(FSA)監管。公司提供多種產品,包括股票、投資信託和債券,並強調定制面對面服務,但價格較網上經紀商收取的價格更高。

優缺點

| 優點 | 缺點 |

| 受FSA監管 | 費用較高,尤其是面對面交易 |

| 無存款/提款費 | 轉賬服務僅限於Hachijuni Bank |

| 個性化客戶服務 | 最低存款額較高 |

HACHIJUNI 是否合法?

是的,HACHIJUNI(八十二証券株式会社)是正當的。日本金融廳(FSA)根據零售外匯牌照對其進行監管,官方牌照號碼為関東財務局長(金商)第21号。

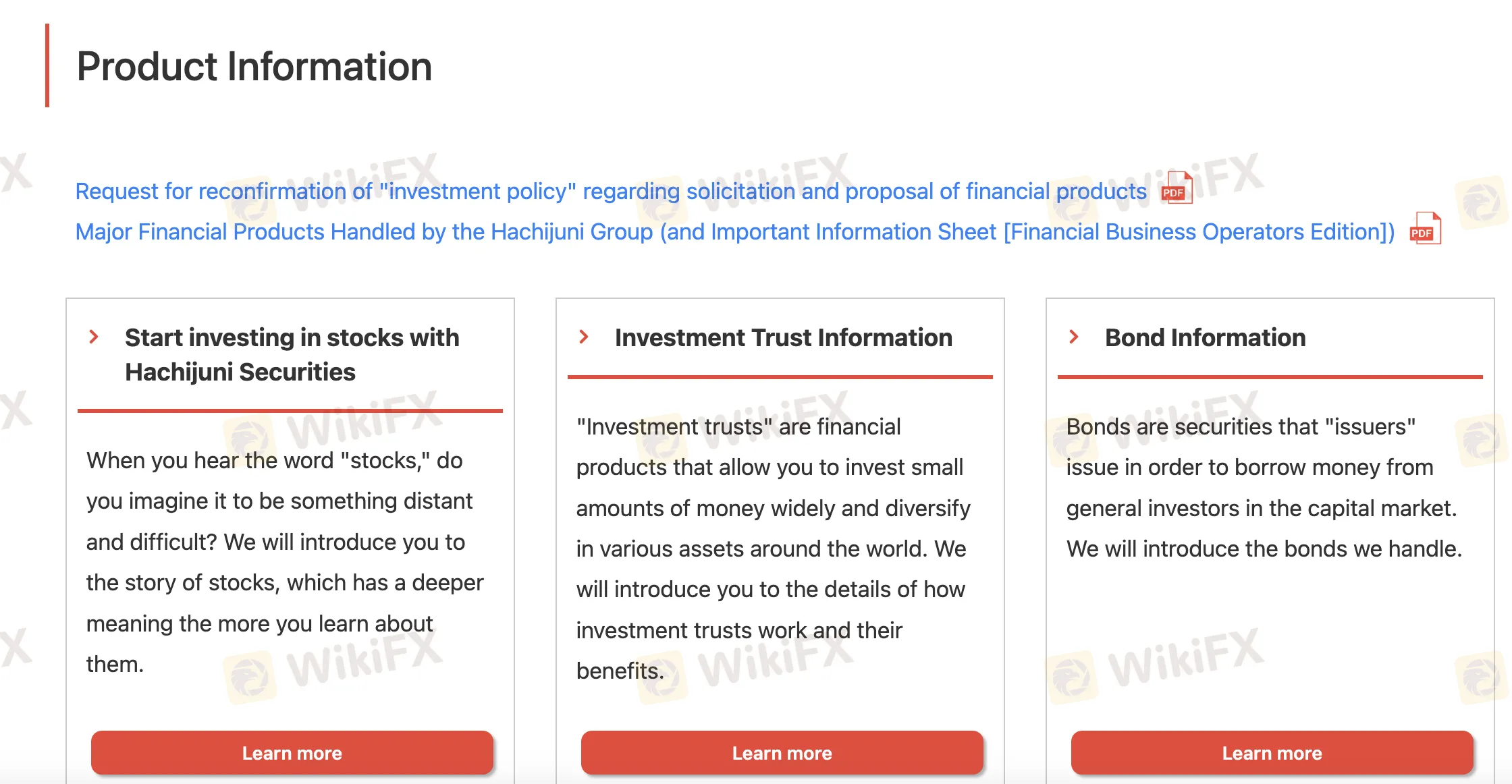

我可以在Hachijuni上交易什麼?

Hachijuni Securities為新手和經驗豐富的投資者提供多種不同的金融產品,包括股票、投資信託和債券。

| 交易工具 | 支援 |

| 股票 | ✓ |

| 投資信託 | ✓ |

| 債券 | ✓ |

| 外匯 | × |

| 大宗商品 | × |

| 指數 | × |

| 加密貨幣 | × |

| 期權 | × |

| ETFs | × |

HACHIJUNI 費用

HACHIJUNI的費用高於全球互聯網交易業務的標準,特別是面對面股票交易和管理外國資產帳戶。這使其成為傳統或本地投資者的更好選擇,而不是那些試圖節省金錢的網上交易者。

| 合約價格範圍 | 佣金(面對面,含稅) |

| 100萬日元以下 | 合約價格的1.265%(最低2,750日元) |

| 1百萬–1.5百萬日元 | 0.990% + 2,750日元 |

| 1.5百萬–2.5百萬日元 | 0.935% + 3,575日元 |

| 2.5百萬–3百萬日元 | 0.913% + 4,125日元 |

| 3百萬–5百萬日元 | 0.880% + 5,115日元 |

| 5百萬–1千萬日元 | 0.715% + 13,365日元 |

| 1千萬–2千萬日元 | 0.495% + 35,365日元 |

| 2千萬–3千萬日元 | 0.440% + 46,365日元 |

| 3千萬–4千萬日元 | 0.330% + 79,365日元 |

| 4千萬–5千萬日元 | 0.275% + 101,365日元 |

| 超過5千萬日元 | 固定242,000日元 |

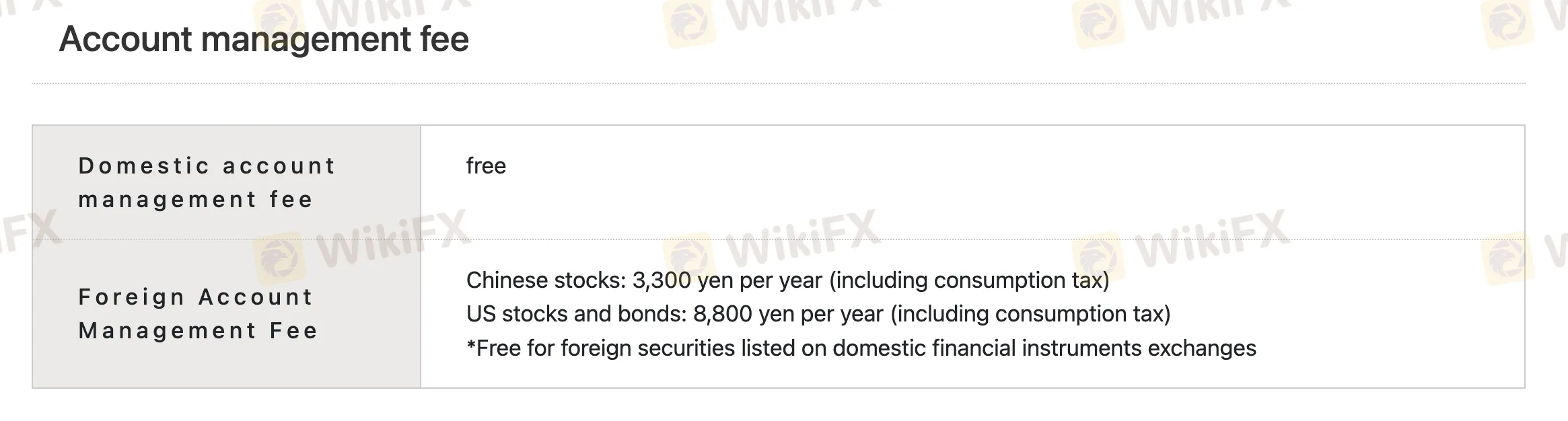

非交易費用

| 費用類型 | 金額 |

| 國內帳戶費用 | 0 |

| 外國帳戶費用 | 中國股票:每年3,300日元 |

| 美國股票和債券:每年8,800日元(部分資產免費) | |

| 股份轉讓(<1單位) | 每股1,100日元 |

| 股份轉讓(>1單位) | 每單位550日元(每股最高11,000日元) |

| 副本、證書 | 每份1,100日元(帳戶簿、結餘證明、賣賬單等) |

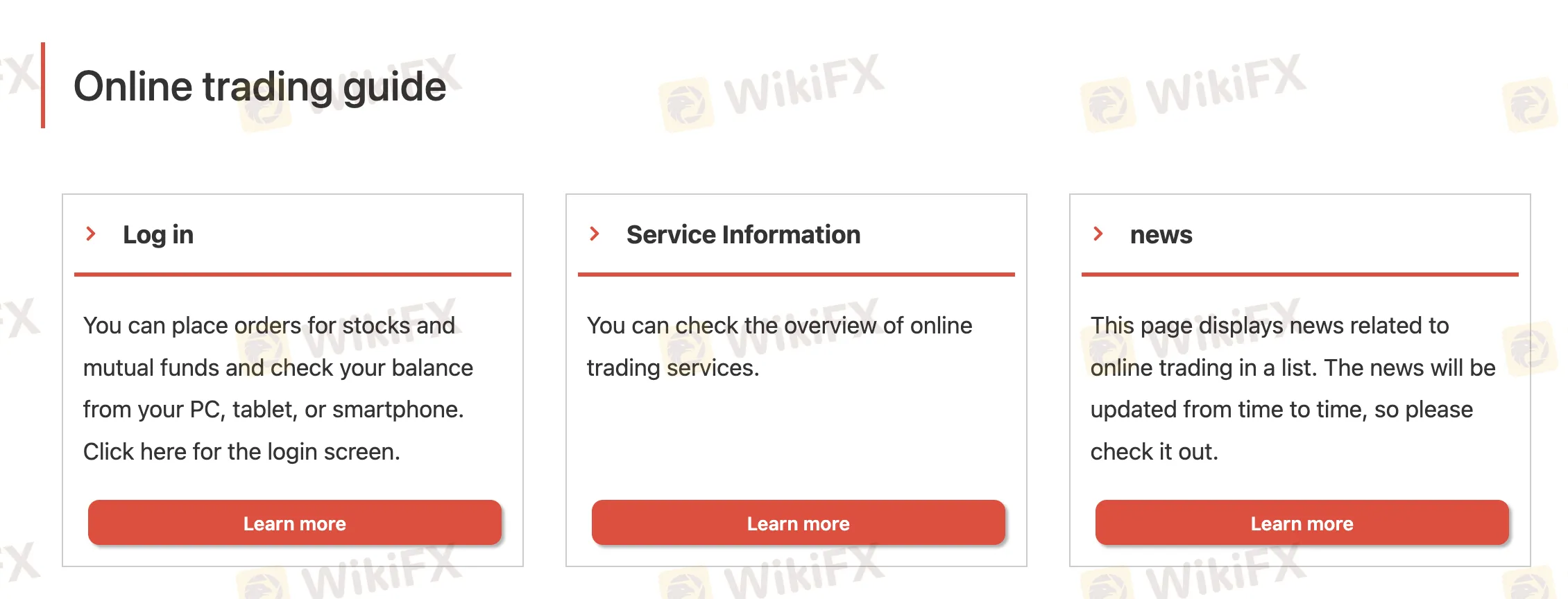

交易平台

| 交易平台 | 支援 | 可用設備 |

| 網上交易系統 | ✔ | 電腦、平板電腦、智能手機 |

存款和提款

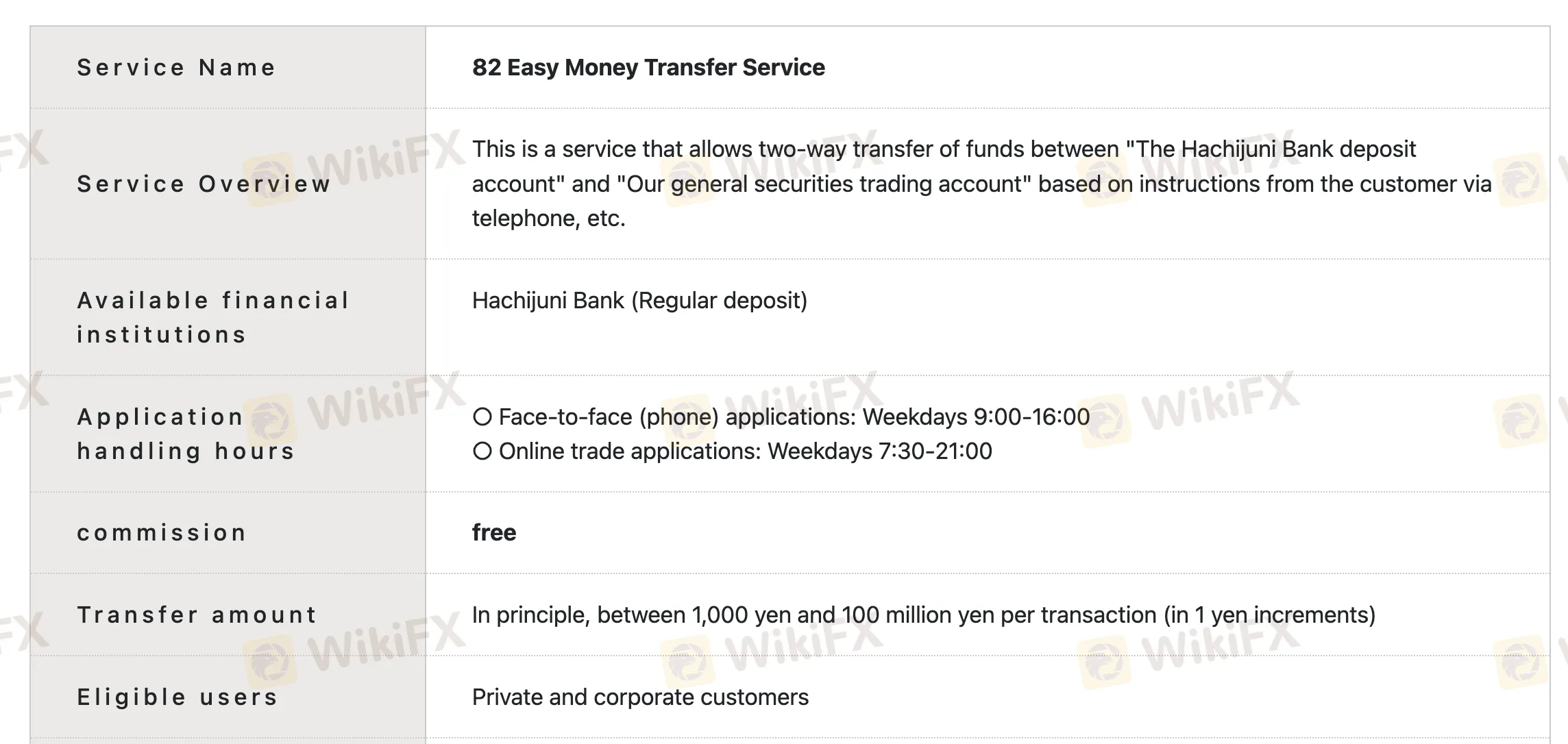

Hachijuni Securities不收取存款或提款費用,所有轉帳和匯款費用均由公司支付。 “82易錢轉帳服務”的最低存款金額通常為每筆1,000日元。

| 支付選項 | 最低金額 | 費用 | 處理時間 |

| 82易錢轉帳(銀行↔證券) | 每筆1,000日元–1億日元 | 0 | 電話:週日至週五 9:00–16:00; |

| 網上:週日至週五 7:30–21:00 |