公司簡介

| 大昌期貨 檢討摘要 | |

| 成立時間 | 5-10 年 |

| 註冊國家/地區 | 中國 |

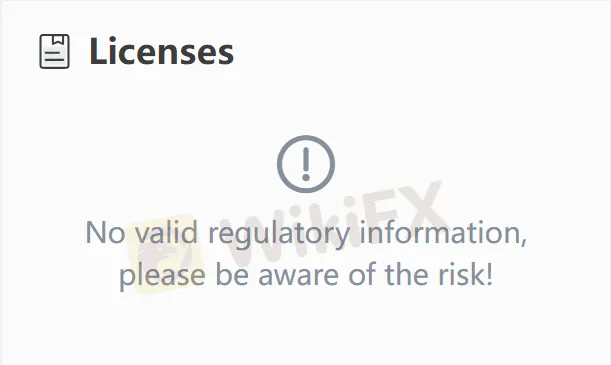

| 監管 | 未受監管 |

| 產品和服務 | 期貨 |

| 客戶支援 | (02)2960-1066 |

| 期貨客戶服務熱線:(02) 2960-6889 | |

| dcnf@twinsun.com.tw | |

| 傳真:(02)2965-7707 | |

大昌期貨 資訊

大昌期貨,即大昌期貨,為客戶提供全面的期貨交易服務。其業務範圍涵蓋國內和國際期貨交易,專業的期貨顧問為客戶量身定制交易策略,如“擺盪交易”和“日內交易”。然而,目前很難獲得清晰的信息表明其在官方網站上受到相關權威機構的監管。

優點和缺點

| 優點 | 缺點 |

| 多元化的金融服務 | 未受監管 |

| 全國業務布局 | 需要改進的創新 |

| 服務差異性不足 |

大昌期貨 是否合法?

在官方網站上沒有任何信息表明大昌期貨受到監管。建議投資者優先選擇受監管監督的期貨公司。

大昌期貨 提供哪些服務?

大昌期貨 主要提供國內外與期貨相關的業務。此外,期貨顧問為客戶量身定制“擺盪交易”和“日內交易”策略。與現貨商品相對,期貨是指雙方事先同意在未來特定日期(交割日期)按預先協議的價格買入或賣出一定數量的特定商品或金融資產的標準化合約。這些合約在專門的期貨交易所內交易。

大昌期貨 費用

大昌期貨 的官方網站沒有提供費用信息。投資者可能關心是否存在隱藏費用。建議他們在進行投資前與客戶服務聯繫,了解不同業務的費用信息。